Attached files

| file | filename |

|---|---|

| EX-21.1 - SUBSIDIARIES - Go Silver Toprich, Inc. | f10k2010ex21i_sinogreen.htm |

| EX-32.1 - CERTIFICATION - Go Silver Toprich, Inc. | f10k2010ex32i_sinogreen.htm |

| EX-31.1 - CERTIFICATION - Go Silver Toprich, Inc. | f10k2010ex31i_sinogreen.htm |

| EX-31.2 - CERTIFICATION - Go Silver Toprich, Inc. | f10k2010ex31ii_sinogreen.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: December 31, 2010

o TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to ____________

Commission File Number: 000-53208

SINO GREEN LAND CORPORATION

(Exact name of registrant as specified in its charter)

|

Nevada

|

54-0484915

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification Number)

|

|

|

6/F No.947,Qiao Xing Road, Shi Qiao Town

Pan Yu District, Guang Zhou

People’s Republic of China

|

|

(Address of principal executive office and zip code)

|

|

86-20-84890337

|

|

(Registrant’s telephone number, including area code)

|

|

N/A

|

|

(Former name, former address and former fiscal year, if changed since last report)

|

|

Securities registered pursuant to Section 12(b) of the Act: None

|

|

Securities registered pursuant to Section 12(g) of the Act: Common Stock, par value $0.001 per share

|

|

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

|

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

|

||||

|

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

|

||||

|

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

|

||||

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

||||

|

Large accelerated filer o

|

Accelerated filer o

|

Non-accelerated filer o

|

Smaller reporting company x

|

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

|

||||

|

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of March 30, 2010 was $34,162,068.

|

||||

|

There were 213,512,924 shares of common stock outstanding as of March 30, 2011.

|

||||

|

DOCUMENTS INCORPORATED BY REFERENCE:

|

||||

|

Information required by Part III is incorporated by reference from the Company’s definitive proxy statement or information statement which will be filed with the Securities and Exchange Commission within 120 days of December 31, 2010.

|

||||

SINO GREEN LAND CORPORATION

FORM 10-K

For the Fiscal Year Ended December 31, 2010

TABLE OF CONTENTS

|

Page

|

|

|

Part I

|

|

|

Item 1. Business

|

2 |

|

Item 1A. Risk Factors

|

13 |

|

Item 1B. Unresolved Staff Comments

|

25 |

|

Item 2. Properties

|

25 |

|

Item 3. Legal Proceedings

|

26 |

|

Item 4. (Removed and Reserved)

|

26 |

|

Part II

|

|

|

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

26 |

|

Item 6. Selected Financial Data

|

27 |

|

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

27 |

|

Item 7A. Quantative and Qualitative Disclosures About Market Risk

|

38 |

|

Item 8. Financial Statements and Supplementary Data

|

38 |

|

Item 9. Changes in and Disagreements With Accountants on Accounting and Financial Disclosure

|

39 |

|

Item 9A. Controls and Procedures

|

39 |

|

Item 9B. Other Information

|

40 |

|

Part III

|

|

|

Item 10. Directors, Executive Officers and Corporate Governance

|

40 |

|

Item 11. Executive Compensation

|

40 |

|

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

40 |

|

Item 13. Certain Relationships and Related Transactions, and Director Independence

|

40 |

|

Item 14. Principal Accounting Fees and Services

|

40 |

|

Part IV

|

|

|

Item 15. Exhibits, Financial Statement Schedules

|

41 |

INFORMATION CONCERNING THE COMPANY

References to “we,” “us,” “our” and similar words refer to the Sino Green Land Corporation and its subsidiaries and Guangzhou Greenland, a variable interest entity whose financial statements are consolidated with ours, unless the context indicates otherwise. Prior to the reverse acquisition, which is described in Item 1, these terms refer to Organic Region, its subsidiaries and Guangzhou Greenland, unless the context indicates otherwise.

Our business is conducted in China, using RMB, the currency of China, and our financial statements are presented in United States dollars, which is the functional currency of the parent company, Sino Green Land Corporation. In this annual report, we refer to assets, obligations, commitments and liabilities in our financial statements in United States dollars. These dollar references are based on the exchange rate of RMB (or, if applicable, another currency) to United States dollars, determined as of a specific date or period. Changes in the exchange rate will affect the amount of our obligations and the value of our assets in terms of United States dollars. Similarly, the compensation of our officers may reflect an increase or decrease in the amount of our obligations (expressed in dollars).

Statements in this annual report may be “forward-looking statements.” Forward-looking statements include, but are not limited to, statements that express our intentions, beliefs, expectations, strategies, predictions or any other statements relating to our future activities or other future events or conditions. These statements are based on current expectations, estimates and projections about our business based, in part, on assumptions made by management. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. Therefore, actual outcomes and results may, and are likely to, differ materially from what is expressed or forecasted in the forward-looking statements due to numerous factors, including those described above and those risks discussed from time to time in this annual report, including the risks described under “Item 1A. Risk Factors,” and “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this annual report. In addition, such statements could be affected by risks and uncertainties related to weather and natural disasters, our ability to conduct business in the PRC, product demand, including the demand for fruit and vegetable products, our ability to develop and maintain good relations with local cooperative suppliers, our ability to raise any financing which we may require for our operations, including financing for our green produce hub, competition, our ability to develop our proposed distribution hub, including entering into agreement with vendors and collecting fees from the vendors and developing a line of products for sale by us at the distribution center, government regulations and requirements, including any imposition of price controls, pricing and development difficulties, our ability to make acquisitions and successfully integrate those acquisitions with our business, as well as general industry and market conditions and growth rates, and general economic conditions. Any forward-looking statements speak only as of the date on which they are made, and we do not undertake any obligation to update any forward-looking statement to reflect events or circumstances after the date of this annual report.

1

PART I

Item 1. Business

Summary

Through our Chinese operating subsidiaries, we are primarily engaged in the wholesale distribution, marketing and sales of high-value fruits and vegetables at two main wholesale markets in Guangdong Province and North China. To date, almost all of our revenues have been generated by sales of Fuji apples, which accounted approximately 83% of our revenues in 2010 and approximately 85% of our revenues in 2009, and emperor bananas and tangerine oranges. We purchase our products directly from farming cooperative groups on plantations in three Chinese provinces of Shaanxi, Guangdong, and Guangxi and we distribute our products to other regions almost exclusively through the wholesale markets. At these markets our customers include trading agents who purchase fruit from us and sell to their own customers. Although we make some direct sales, these sales are not significant. We also provide the farming cooperatives with varying degrees of farming, harvesting and marketing services. We have recently introduced a line of vegetable products, which we prepare for shipping and distribution to end users.

Our proposed distribution hub consists of two buildings, which have a total of approximately 600,000 square feet of floor space, and a 130,000 square foot cold storage facility, all in the Guangdong Yuncheng wholesale market in Guangzhou, which we plan to use for the distribution of foods which we believe are high-quality foods. We plan to use the cold storage facility for storage of our apples. We believe that our hub will be the first hub in the PRC to provide wholesale and retail customers with the ability to purchase a wide variety of high quality foods in one location. All of the buildings, which were leased, have been constructed, although the two buildings in the distribution hub still require interior construction and decoration as well as equipment before we can use them. We paid for the construction of one of the buildings and the cold storage facility. We issued our common stock in February 2011 as payment for the construction of the other building.

Through December 31, 2010, we had paid approximately $14.2 million in cash toward the exterior as well as some of the interior construction of this hub using cash generated by our operations and from funds which we raised in late 2009 and 2010. Pursuant to the terms of our lease for the hub, the landlord had the obligation to construct the facility, but we were required to advance funds to the landlord for the construction. We anticipate that the total investment to launch this business will be $32.4 million, which includes construction costs of approximately $27.4 million, with approximately $3 million for auxiliary facilities, such as refrigerated trucking capabilities and air conditioning, and $2 million for initial inventory of new premium imported products. The construction costs includes the approximately $8.4 million which was paid through the issuance of common stock in February 2011.

Commencing in the first quarter of 2010, we began to export food products, with our initial export sales being made to Australia. To date, revenue from exports has not constituted more than a nominal portion of our revenue.

Organization

We are a Nevada corporation, organized under the name Henry County Plywood Corporation, in March 2008, as the successor to a Virginia corporation of the same name which was organized in May 1948. We changed our corporate name to Sino Green Land Corporation on March 23, 2009.

We are the sole shareholder of Organic Region Group Limited (“Organic Region”), a British Virgin Islands company organized on January 30, 2003. Organic Region is the sole shareholder of Zhuhai Organic Region Modern Agriculture Ltd., a wholly foreign-owned entity, known as a WFOE, Guangzhou Organic Region Agriculture Ltd., a WFOE, Fuji Sunrise International Enterprises Limited, a British Virgin Islands company, Southern International Develop Limited, a British Virgin Islands company, and HK Organic Region Limited, a Hong Kong company. In addition, Organic Region entered into exclusive arrangements with Guangzhou Greenland Co. Ltd., an individual business entity owned by Mr. Xiong Luo, our chief executive officer, president and a director who gave Organic Region the ability to substantially influence Guangzhou Greenland’s daily operations and financial affairs, appoint its senior executives and approve all matters requiring shareholder approval. As a result, we consolidated the financial results of Guangzhou Greenland as variable interest entity pursuant to ASC 810, which was formerly classified as Financial Interpretation No. 46R, “Consolidation of Variable Interest Entities,” in our financial statements.

2

The following chart reflects our organizational structure as of the date of this annual report.

The following table describes our corporate structure:

|

Name of Entity

|

Relationship to Us

|

Nature of Business

|

|

Sino Green Land Corporation

|

N.A.

|

Holding company

|

|

Organic Region Group Limited

|

100% owned by us

|

Holding company

|

|

Zhuhai Organic Region Modern Agriculture Ltd.

|

100% owned by Organic Region

|

Plantation and export

|

|

Guangzhou Organic Region Agriculture Ltd.

|

100% owned by Organic Region

|

Cleaning and preparing vegetables for distribution and distribution of vegetables

|

|

Fuji Sunrise International Enterprises Limited

|

100% owned by Organic Region

|

Presently inactive, with plans for apple distribution

|

|

Southern International Develop Limited

|

100% owned by Organic Region

|

Leaseholder for green food distribution center presently under construction

|

|

HK Organic Region Limited

|

100% owned by Organic Region

|

Proposed import and export operations

|

|

Guangzhou Greenland Co., Ltd.

|

100% owned by our chief executive officer and treated as a variable interest entity controlled by us

|

Wholesale sale of fruit, and the source of substantially all of our revenue.

|

|

Guangzhou Metro Green Trading Limited

|

100% owned by Southern International Develop Limited

|

Premium foods distribution

|

3

Reverse Acquisition

On January 15, 2009, we acquired Organic Region pursuant to a share exchange agreement with Organic Region, its shareholders and its wholly owned subsidiaries. Pursuant to the share exchange agreement, the Organic Region shareholders transferred all of the shares of the capital stock of Organic Region, in exchange for 81,648,554 shares of our common stock, which constituted 98% of our issued and outstanding capital stock on a fully-diluted basis as of and immediately after the consummation of the transactions contemplated by the share exchange agreement. The exchange was treated as a recapitalization that gave effect to the share exchange agreement. Under generally accepted accounting principles, our acquisition of Organic Region is considered to be capital transactions in substance, rather than a business combination. That is, the acquisition is equivalent to the acquisition by Organic Region of us, with the issuance of stock by Organic Region for the net monetary assets of us (then known as Henry County Plywood Corporation). This transaction is accompanied by a recapitalization, and is accounted for as a change in capital structure. Accordingly, the accounting for the acquisition is identical to that resulting from a reverse acquisition. Under reverse takeover accounting, our historical financial statements are those of Organic Region, its subsidiaries and variable interest entity, which is treated as the acquiring party for accounting purposes. The financial statements reflect the recapitalization of the shareholders’ equity as if the transactions occurred as of the beginning of the first period presented. Thus, the 81,648,554 shares issued in the reverse acquisition are considered outstanding for all periods presented. In connection with the reverse acquisition, we changed our fiscal year to the calendar year to reflect the fiscal year of Organic Region.

As part of, and contemporaneously with, the reverse acquisition, on January 15, 2009, we entered into a redemption agreement with our then majority shareholders, pursuant to which we issued our non-interest bearing convertible promissory notes in the total principal amount of $500,000 to purchase 1,666,298 shares of common stock owned by these shareholders, and we cancelled the acquired shares. We paid the notes in two installments of principal in the amount of $250,000 on March 31, 2009 and April 27, 2009. We have no further obligation to our former majority shareholders.

At the time of the reverse acquisition, we were a shell company with no operations and our sole purpose was to locate and consummate a merger or acquisition with a private entity. As a result of the reverse acquisition, our business has become the business conducted by Organic Region.

Our corporate headquarters are located at 6/F No. 947, Qiao Xing Road, Shi Qiao Town, Pan Yu District, Guangzhou, People’s Republic of China. Our telephone number is 86-20-84890337. Our website is http://www.sinogreenland.com. Information on our website or any other website does not constitute a part of this annual report.

Our Industry and Market Trends

Background

The rapid economic expansion experienced in China in the recent decade brought more income to Chinese consumers and enabled higher consumer spending. We see this trend through the rising number of supermarkets operating in China and their total sales. Studies have shown that as the living standard of an urban population increases, consumers consume more fruits on a per capital basis. A recent USDA Economic Research study, Consumer Demand for Fruit and Vegetables: the U.S. Example, by Susan L. Pollack, concluded that fruit and vegetable consumption in high income countries was more than two and one-half times that of low income countries. This report is available at http://www.ers.usda.gov/publications/wrs011/wrs011h.pdf. The latest USDA data shows China’s urban per capita consumption of fruits and melons at 54kg in 2008 and 60kg in 2007. This information is available at http://www.ers.usda.gov/data/china/NationalResults.aspx?DataType=2&DataItem=104&StrDatatype=Urban+per+capita+consumption&ReportType=0. However, this amount is still low compared to the level of fruit consumption of 123kg/yr in the United States. We believe that there is still much room for growth of fruit consumption in China.

4

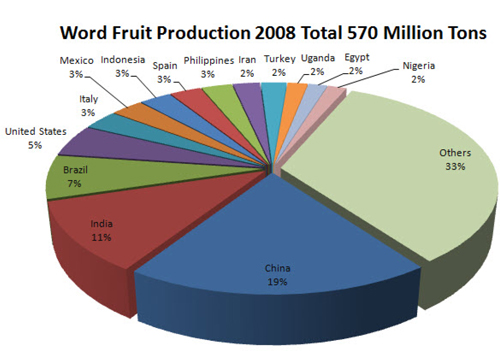

In terms of the absolute size of the market, a 2008 National Bureau of Statistics of China report on the world fresh food market estimated that China’s total fruit production was 107.8 million tons in 2008, representing approximately 19% of an estimated global production of 570 million metric tons for that year. Of China’s production volume, China exported only about 1.9 million tons, so the vast majority of its production was consumed domestically. This information is available at http://www.stats.gov.cn/tjsj/qtsj/gjsj/2009/t20100413_402634129.htm. Thus, the vast majority of China’s fruit production was consumed domestically.

Industry Structure

Prior to 1984, the fruit industry in China was subject to state controlled pricing and distribution. Although fruit production developed rapidly and features varied categories and configurations, the PRC’s fruit production structure still lagged far behind other industries in the following three aspects:

|

·

|

Apples, oranges and pears accounted for a large proportion of total domestic fruit production (at approximately 63.5%), but lacked high-end and rare categories.

|

|

·

|

The domestic fruit harvest period was clustered in the fall months; oranges mature mainly in November and December and a few categories of fruits matured before October. The supply of fruits was therefore too concentrated during a short period.

|

|

·

|

Fruit storage methods only allowed for the storage of less than 30% of total fruit production and mechanical processing methods could only store 10% of total production.

|

In 1984, the PRC government began to implement a system of reforms in the industry which transformed the industry from a fully state oriented structure to a market oriented structure, from state oriented pricing to market oriented pricing, and from state controlled distribution to multi -channel distribution. These changes not only greatly mobilized and enthused fruit farmers and promoted the development of fruit production, they also increased the income of farmers and resulted in more variation in the vegetables available to residents.

These reforms led to the development of planting and storage technologies which enabled consumers to purchase their fruits all year round and in small amounts, rather than purchase all their demand at one time and only when fruits were in season. The reforms also led to the introduction of multiple transportation channels and the opening up of new markets across China. As a result, consumers have access to fruits from all regions in China and are no longer limited to locally produced fruits.

5

In addition, the improvement of people’s living standards in the PRC has led to more attention being paid to the link between healthy foods and long lives. This trend has stimulated the consumption of substances that promote health, including fresh fruits and vegetables, and the transition of fresh fruits in China from a luxury to a necessity. We expect that this increase in demand is leading to good prospects for the whole fruit and vegetable industry.

Our Growth Strategy

Our long-term growth plans include both the expansion of our present distribution business and the development and implementation of our proposed distribution hub, which is described under “Proposed Distribution Hub.”

As a company that seeks to market premium specialty fruit, we believe we are well positioned to capitalize on future industry growth in China. We believe that our produce can be treated as premium fruit because we have been successfully marketing our produce at premium prices because of the overall quality of our produce. We are dedicated to providing healthy and high nutritional premium specialty fruit and vegetables. We intend to implement the following strategic plans to take advantage of industry opportunities and our competitive strengths:

|

·

|

Strengthen and expand our supply sources. We believe that a steady supply of premium specialty fruits is crucial to our future success. Currently, we have built strong relationships with three plantation bases in Shaanxi, Guangdong, and Guangxi Provinces. We intend to further strengthen our existing cooperative relationships with our plantation bases and plan to expand our supply sources by securing more first priority purchase rights with suppliers across China. Thus, in order to expand, we need to purchase the long-term leases, which have a significant up-front cost.

|

|

·

|

Expand our distribution network to increase the prevalence of our products nationwide. Our current sales depend heavily on our regional distributors and their network. To support our rapid growth in sales, we plan to further expand our distribution network by leveraging our steady and expanding supply sources and capture the higher margin business of sales to retail stores and super markets.

|

|

·

|

Expand the fruits that we sell to satisfy different customer preferences. We currently focus on apples, bananas and oranges because they are the best selling fruits in the world. However, we constantly evaluate our product line and seek to adapt to changing market conditions by updating our products to fulfill market needs. Currently, we are testing a few new fruits, such as pears.

|

Proposed Distribution Hub

Our proposed distribution hub consists of two buildings, which have a total of approximately 600,000 square feet of floor space, and a 130,000 square foot cold storage facility, all in the Guangdong Yuncheng wholesale market in Guangzhou, which we plan to use for the distribution of foods which we believe are high-quality foods. We plan to use the cold storage facility for storage of our apples. We believe that our hub will be the first hub in the PRC to provide wholesale and retail customers with the ability to purchase a wide variety of high quality foods in one location. All of the buildings have been constructed, although the two buildings in the distribution hub still require interior construction and decoration as well as equipment before we can use them. We paid for the construction of all three buildings, although payment for one of the buildings was made in shares of our common stock. At our distribution hub:

|

·

|

We will provide space for produces to sell their products to the public, for which we will receive a rental fee based on the space used and a management fee based on the producers’ revenues. We anticipate that most of our revenue from the distribution hub will be generated by these fees from other vendors.

|

|

·

|

We will sell imported products, primarily organic products, which we consider to be premium products, which we will purchase in the international market and sell at the distribution hub. We do not anticipate that we will sell our present produce at the distribution hub.

|

In determining which foods are to be sold in our distribution hub, we will seek to provide space to producers who are:

|

·

|

Members of the China Green Foods Association, who sell more than 17,000 green food items. Green foods are foods that are not organic but which meet standards set by the China Ministry of Agriculture.

|

|

·

|

Producers of organic foods, which have been certified as organic by an independent laboratory which we will designate. Organic foods are foods which are produced without the use of pesticides or other chemicals.

|

6

|

·

|

Producers of food which is labeled as “pollution-free” in compliance with applicable government regulations after being tested at an independent laboratory which we will designate. The government sets forth specific technical requirements relating to the production and content of the foods, which standards limiting content of harmful substances and approves the use of the “pollution-free” mark.

|

Through December 31, 2010, we had paid approximately $14.2 million toward the exterior as well as some interior construction of this hub using cash generated by our operations and from funds which we raised in late 2009 and 2010. Pursuant to the terms of our lease for the hub, the landlord had the obligation to construct the facility, but we were required to advance funds to the landlord for the construction. The construction of the exterior of the building has been completed, and we expect to complete the interior and commence operations at the hub by September 2011, although we can give no assurance that we will be able to commence operations by that date. We anticipate that the total investment to launch this business will be $32.4million, which includes construction costs of approximately $27.4 million, with approximately $3 million for auxiliary facilities, such as refrigerated trucking capabilities and air conditioning, and $2 million for initial inventory of new premium imported products. The construction costs includes the approximately $8.4 million which was paid through the issuance of common stock in 2011. The construction of the exterior of the buildings has been completed, and we expect to complete the interior and commence operations at the hub by September 2011.

We expect that the food items sold in the distribution hub will include fruits and vegetables, rice and other grains, meat, eggs and oil. Some of these foods will be certified as green foods by the Green Food Development Center. Green food is a Chinese certification program for food. The China Green Food Development Center, an agency of the Ministry of Agriculture, is responsible for establishing the green food standards and granting the green food certification.

In general, in order for a food product to obtain green food certification, it must meet four conditions.

|

·

|

It must be grown in a good ecological environment. The quality of the soil, air and water must meet the environmental requirements for the area in which the foods are grown.

|

|

·

|

The production process for green foods must comply with the green food production technical standards, relating to such matters as pesticides, fertilizers, veterinary drugs, feed and food additives.

|

|

·

|

The food products must be tested by an authorized testing organization. The physical and chemical (heavy metals, pesticide residues and veterinary drug residues and microbiological indices must meet the green food product standards.

|

|

·

|

The packing of the green food product, including the use of the green food logo, must meet the requirements for green food packaging.

|

Information on the Green Food Development Center is available at http://www.greenfood.org.cn/sites/GREENFOOD/; however, information on that website is not provided by us and does not constitute a part of this annual report.

In developing this business we will require agreements with each vendor. We anticipate that we will enter into agreements with each supplier which provide for the vendor to pays us a rental for the right to occupy space in the distribution hub and a management fee for management services. We anticipate that we will be paid both a fixed fee and a variable fee based on the vendor’s revenues. Thus, we anticipate that most of our revenue from our proposed distribution hub will be generated by the fees paid by the vendors who sell products at our distribution hub, with a significant percentage of our revenues from the distribution hub being based on the revenue of the vendors who occupy space at the distribution hub.

We will be seeking to import and sell at our distribution hub a line of imported food products which we think can be sold at premium prices. We anticipate that that most of the products we sell will be organic products, but may also include other products that are consistent with the quality of products that are being offered at the distribution hub. We anticipate that our initial cash requirement for inventory will be approximately $2 million and that we will normally have an inventory of approximately $4 million.

Our Present Products

Our main products are Fuji apples, which accounted for 83% of our revenue in the year ended December 31, 2010, emperor bananas and tangerine oranges, which are high-quality variations of bananas and oranges. We are also engaged, to a lesser extent, in the wholesale distribution of a variety of vegetables, including tomatoes, cauliflower, cucumber, lettuce, spinach, leek, celery, peppers, Chinese cabbage, carrots, loofah, pumpkin, bitter gourd, white gourd, gherkin and yams.

7

Fuji Apples – Fuji apples, which comprised 82.8%% of our sales in 2010 and 85.2% of our sales in 2009, are very popular in China because of their crispness and taste. They are also treated as a high-end product. The output for the Fuji apple in China was about 18 million tons in 2008. Fuji apples have a long storage period and are easy to transport. At December 31, 2010, we leased more than 16,200 acres of Fuji apple plantations. During 2010, our 16,200 acre Fuji apple plantation base in Yan’an, Shaanxi Province, had an output of approximately 116,071 tons.

Emperor Bananas – The emperor banana derives its name from its appealing outer appearance and delicious taste. It is considered to be a premium item in China and is priced about two to two and a half times the price for normal bananas. The emperor banana originated in Thailand and is new to China. Historically, Wanqingsha Town in Nansha District in Guangzhou, Guangdong Province has been a major area for growing traditional bananas. In 2003, banana production drastically declined due to the spread of the “Panama Virus,” which stunted the growth and cultivation of traditional bananas. To address this agricultural problem, we launched a collaborative effort with Nansha’s local government to find alternative fruits to grow in Nansha district. Pilot projects for Hawaiian papaya, Taiwan pearl guava and Thai emperor banana were pursued. Of the three fruits tested, the Emperor banana from Thailand proved to be the most economically viable fruit to cultivate. Aside from the Emperor banana’s compatibility with Nansha’s agricultural landscape and local farming knowledge, we believe that emperor bananas can generate a gross margin which is 100% to 250% higher than that of traditional bananas. We have developed a special method for cultivating seedlings for this species in our research laboratories. Our seedlings mature and are ready for planting in approximately three months and are harvested between seven and nine months later. We believe that our Guangzhou plantation is now one of the only two Chinese growers of emperor bananas. During 2010, our farmers produced 16,280 tons of these bananas on 2,864 acres of land.

Tangerine Orange – Tangerine orange trees are created by grafting the Japanese tangerine tree onto an orange tree stem when both are one year old. The resulting tree contains a number of desirable characteristics. Its juice is sweeter than tangerine and it has a meatier body than regular oranges. Tangerine oranges can be stored for approximately 90 days, which is a relatively long storage period and makes the fruit well suited for transportation. Our tangerine orange plantation is roughly 1,300 acres in size and is located in Liuzhou in Guangxi Province. Our tangerine orange output in 2010 was more than 8,300 tons.

Our Plantations

We currently lease three main plantations: the Luochuan Apple Plantation Base in Yan’an, Shaanxi Province; the NanshaWanqingsha emperor banana plantation base in Guangzhou, Guangdong Province and the Rong’an tangerine orange plantation base in Liuzhou, Guangxi Province.

We are a party to 25-year land lease agreements with farming cooperatives. Pursuant to these agreements we lease the land from farming cooperatives and then grant farming rights back to the farming cooperatives. In exchange, we have first priority on purchasing the farming cooperatives’ production at prevailing wholesale prices. We do not receive any rentals from the cooperatives. Rather, these agreements provide us with an annual supply of produce. We believe that our cooperative relationships with farming cooperatives allows us to reduce our financial and operating risks and avoid the substantial capital required to maintain and finance agricultural production while making a significant contribution to regional development. Our land lease agreements provide for us to pay, at the inception of the lease term, the full amount due under the lease, which is amortized over the term of the lease.

Sales

Almost all of our products are sold by us at the Guangdong Yun Cheng Wholesale Market and the Beijing XinFadi Agricultural Products Wholesale Market, two major markets for the sale of agricultural products in their respective areas, where we lease space to sell our produce. We derived more than 99% of our revenue from these two markets in 2010 and 2009.

Quality Control

In 2006, we passed the ISO9001:2000 quality management system. We have also established our own quality control system for all our fresh fruits and vegetables, and we have adopted what we consider a very high quality standard. We seek to control our inventory levels in the wholesale centers to balance our inventory against market need and minimize spoilage rates as well as our stock holding and handling costs.

8

For the tangerine oranges and emperor bananas, our field quality control teams check and inspect all products before they are delivered to the wholesale markets and to our customers. In addition, our own quality control team in Shaanxi Province monitors all shipments of Fuji apples and with a view to making sure that the fruit in each truck load complies with our standards.

We also provide technical assistance to the farmers to help improve the quality of the produce.

Our Suppliers and Supply Arrangements

Fuji Apples

We currently obtain all of our Fuji apples from farming cooperatives that work on 16,200 acres of apple plantation bases located in Luochuan County, Yan’an, Shaanxi Province. Our average annual production output is between 80,000 to 100,000 tons. Since 1947, various varieties of apples have been successfully cultivated in Luochuan County and, in 2000, Luochuan County was designated as the apple growing region in China. To date, approximately 60 varieties of apples are being grown in Luochuan County on a total plantation area of close to 100,000 acres, with 76% of this area being dedicated to Fuji apple production. In 2010, total apple production in Luochuan County was estimated at about 800,000 tons.

Our farming cooperatives arranges for the packaging and transportation of their harvested apples to our wholesale centers. To market effectively, we require an efficient logistical process in loading, unloading, transporting and delivering fruit from the plantation base to the wholesale centers. On a weekly basis, we coordinate with the Luochuan plantation base to schedule deliveries to either Yun Cheng or XinFadi wholesale centers. In addition, our sales and distribution team monitors our Fuji apple inventories with the primary objective of controlling inventory levels in the wholesale centers to balance our inventory level against what we perceive as the market need in order to minimize spoilage and reduce stock holding and handling costs.

We are a party to 25-year land lease agreements with farming cooperatives. Pursuant to these agreements we lease the land from farming cooperatives and then grant farming rights back to the farming cooperatives. In exchange, we have first priority on purchasing the farming cooperatives’ production at prevailing wholesale prices. We do not receive any rentals from the cooperatives. Rather, these agreements provide us with an annual supply of produce. We believe that our cooperative relationships with farming cooperatives allows us to reduce our financial and operating risks and avoid the substantial capital required to maintain and finance agricultural production while making a significant contribution to regional development. Our land lease agreements provide for us to pay, at the inception of the lease term, the full amount due under the lease, which is amortized over the term of the lease.

Emperor Bananas

Our emperor bananas are grown in Wanqingsha Town, Nansha District, Guangzhou in Guangdong Province. The emperor banana is a premium product, but like the traditional banana, it is highly perishable and needs to be brought to market and sold generally within three to four weeks after harvest. We coordinate with the emperor banana plantation base to facilitate deliveries and effectively manage inventories in the same manner that we do for wholesale Fuji apples.

We are negotiating with the Nansha local government to obtain the right to expand the acreages on which emperor bananas are grown and to develop this land. We intend to develop this parcel in phases. However, we cannot assure you that we will be able to obtain the rights to the land or to develop additional land. In 2007, we started our first phase of emperor banana cultivation covering 330 acres. In 2008, our farming cooperatives cultivated an additional 2,500 acres. We have also assisted our cooperatives to establish a seedling facility whose goal was to produce 1,000,000 seedlings by the end of 2009. Our cooperatives reached this goal.

We intend to seek to replicate this business model for emperor bananas in the Nansha district. We are coordinating with Nansha’s farming cooperative to increase the membership of our farming cooperative and encourage them to participate in our emperor banana cultivation program. We regularly conduct emperor banana cultivation seminars and educate farmers with a view to persuading them to join our cooperative arrangement. We transfer the seedlings we produce in our facilities to the farmers, which they can cultivate and sell back to us when the fruit matures. We believe that our agricultural practices contribute to the quality of the emperor bananas that we distribute.

9

Tangerine Oranges

We purchase our tangerine oranges pursuant to a 25-year lease agreement with the Rongan Wan Shanhong Fruit Company, which owns a 1,300-acre tangerine orange plantation base. Annual output for the Rongan Wan Shanhong Fruit Company reached approximately 7,500 tons in 2009 and 8,300 tons in 2010.

The following table provides the size of the plantations on which our fruits are harvested, the type of fruit produced and the tons produced for the year ended December 31, 2010:

|

Plantation

|

Acres

|

Product

|

Tons

|

|

KuibaiTown,Luochuan County, Shaanxi Province

|

7,428

|

Apples

|

59,114

|

|

LaomiaoTown,Luochuan County, Shaanxi Province

|

3,778

|

Apples

|

30,950

|

|

ShiquanTown,Luochuan County, Shaanxi Province

|

2,500

|

Apples

|

21,094

|

|

Yangshu Town, Luochuan County, Shaanxi Province

|

2,500

|

Apples

|

4,911

|

|

Wanqingsha Town, Nansha District, Guangzhou in Guangdong Province

|

2,864

|

Bananas

|

16,280

|

|

Liuzhou, Guangxi Province

|

1,283

|

Oranges

|

8,380

|

Marketing, Sales and Distribution

To date, all of our products have been sold to a limited number of regions in the PRC. Our goal is to expand our domestic distribution network and distribute our products to other regions in the PRC and to export our products to foreign countries, including Indonesia, Hong Kong SAR, Macao and Australia. We have entered into an agreement with a distributor in Australia pursuant to which we have begun to sell green foods to this distributor, although our sales to this distributor have not been significant.

Fuji Apples

We distribute our Fuji apples in the Guangdong Yun Cheng Wholesale Market and the Beijing XinFadi Agricultural Products Wholesale Market. The Guangdong Yun Cheng Wholesale Market is one of the major wholesale centers for apples and tangerine oranges in Southern China, with an annual apple volume of more than 1.8 million tons. This wholesale market serves an area of approximately 43 million people within a 200 kilometer radius. In 2010, our annual turnover in the Yun Cheng wholesale market was approximately 69,700 tons, representing approximately 60% of our total apple production. We believe that we are the largest apple wholesaler in Yun Cheng, accounting for a 3% of Yun Cheng’s annual apple turnover in 2010. The second largest apple seller at Yung Cheng has less than1% of Yun Cheng’s total annual turnover.

The Beijing XinFadi Agricultural Products Wholesale Market is one of the largest agricultural wholesale centers in China with an annual apple turnover of approximately 3.5 million tons. This wholesale market covers a market of approximately 24 million people within a 200 kilometer radius. In 2010, we sold approximately 46,350 tons of apples in XinFadi, representing approximately 1.3% of XinFadi’s total annual turnover in apples.

Emperor Bananas and Tangerine Oranges

We distribute our emperor bananas and our tangerine oranges to wholesale centers such as the Guangdong Yun Cheng Wholesale Market in Southern China and the Beijing XinFadi Agricultural Products Wholesale Market in Northern China.

Vegetables

We distribute various vegetables in different seasons – tomato, cauliflower, cucumber, lettuce, spinach, leek, celery, peppers, Chinese cabbage, carrot, loofah, pumpkin, bitter gourd, white gourd, gherkin and yams.We plan to supply vegetables directly to supermarket chains. At present, sales of vegetables represent less than 1% of our revenue.

Competition

As a result of land reforms during the past 20 years, orchards in China are generally small and the average farmer only owns between 0.4 to 0.5 acres of land. As a result, there are very few large marketing and distribution enterprises in the Chinese fruit industry. In general, apples in China are sold through small fruit brokers who buy apples from farmers for cash. The brokers sort and pack the fruit and resell it at fresh fruit markets or package it for delivery to processors.

Although statistics are not available, we do not believe that there are any distributors of Fuji apples, emperor bananas or tangerine oranges that handle more overall annual tonnage than we do. We also believe that our emphasis on premium products set us apart from other distributors of apples, bananas and oranges, although other companies market premium products, including Fuji and other premium quality apples. In the Chinese market, we believe that only the Yan’an Apple Group and the Qixia Apple Group, which are state-owned enterprises, are our closest competitors.

10

We face indirect competition from the publicly held companies Chaoda Modern Agriculture (Holdings) Limited and China Green Agriculture, Inc. Chaoda Modern Agriculture, a Hong-Kong listed company, primarily produces vegetables and, to a lesser extent, fruits, while China Green Agriculture, a Hong-Kong listed company, primarily produces fertilizers.

We believe that our success to date and potential for future growth can be attributed to a combination of our strengths, including the following:

|

·

|

Strong Supplier Relationships – We implement a cooperative (collaborative) supply chain model, under which we have total control of the production cycle of our high value fruits and of our resale at wholesale centers. Under the 25-year lease agreements, we acquire first priority purchase rights from what we believe are the best plantation bases, we provide farming cooperatives with technological support to enable them to produce high yields and we provide them with ready market for their produce through our multi-channel marketing network. We believe that our structure provides motivation to the farmers.

|

|

·

|

Recognition for the Way we Conduct Business – In 2007, we became qualified for bidding as a United Nations supplier, which means that we are recognized as subscribing to the UN Supplier Code of Conduct in the conduct of our business and operations. In 2006, we received both the ISO9001:2000 quality management system certificate.

|

|

·

|

Production Line Processing Technology – Our production line processing technology (for which we have applied for a patent in China) provides standardized procedures for inspection, grading, cleansing and packaging of our fruits and vegetables. We use this “deep cleansing” technology to provide healthy, fresh and high-quality produce with our Organic Region brand name. In 2006, our Organic Region brand was granted the National “3.15” China Famous Brand Authentication award, and in 2006, we received the Guangzhou Nansha District Agricultural Technology Breakthrough Support Prize Certificate for introducing emperor banana cultivation technology.

|

|

·

|

High Product Quality – Based on the market acceptance of our products as premium prices, we believe that our products are viewed as high quality products by our customers, and in the past three years we believe that we have established a reliable reputation in wholesale centers in China. We have chosen to focus on the premium fruits and vegetables. We do not compete in low-end markets. We believe that only by providing high quality and adhering to high-end market standards can we remain successful.

|

Research and Development

Our research and development programs concentrate on sustaining the productivity of our agricultural lands, product quality, value-added product development and packaging design. Agronomic research is directed toward sustaining and improving product yields and product quality by examining and improving agricultural practices in all phases of production (such as development of specifically adapted fruit varieties, land preparation, fertilization, cultural practices, pest and disease control, post-harvesting, handling, packing and shipping procedures). We also provide on-site technical services to our suppliers and we are also responsible for the implementation and monitoring of recommended agricultural practices. Our research and development expenses have not been significant for the years ended December 31, 2010 or 2009.

Intellectual Property

We have no patents or patent applications outside of China. Our application for a Chinese invention patent for “cleaning, freshening and sterilizing method and device for fruit and vegetable” (Application No. 2005100888659) is pending. This patent application right is held in the names of Mr. Xiong Luo and Mr. Anson Yiu Ming Fong, who transferred the application right to us for no consideration, pursuant to a patent transfer agreement, among Mr. Luo, Mr. Fong and the Company, dated January 10, 2009.

We also have 16 trademark applications pending, including our logo and the term organic region in both English and Chinese.

We also seek to protect our technological know-how through confidentiality agreements entered into with the employees in our production department. However, we cannot assure you that our patents, trademarks and confidentiality agreements will be adequate to protect our intellectual property rights.

11

Regulation

The food industry is subject to extensive regulation in China. The following summarizes the most significant PRC regulations governing our business in China.

Food Hygiene and Safety Laws and Regulations

As a distributor and producer of food products in China, we are subject to a number of PRC laws and regulations governing food safety and hygiene, including:

|

•

|

the PRC Product Quality Law;

|

|

•

|

the PRC Food Hygiene Law;

|

|

•

|

the Implementation Rules on the Administration and Supervision of Quality and Safety in Food Producing and Processing Enterprises (trail implementation);

|

|

•

|

the Regulation on the Administration of Production Licenses for Industrial Products;

|

|

•

|

the General Measure on Food Quality Safety Market Access Examination;

|

|

•

|

the General Standards for the Labeling of Prepackaged Foods;

|

|

•

|

the Standardization Law;

|

|

•

|

the Regulation on Hygiene Administration of Food Additive;

|

|

•

|

the Regulation on Administration of Bar Code of Merchandise; and

|

|

•

|

the PRC Metrology Law.

|

These laws and regulations set out safety and hygiene standards and requirements for various aspects of food production, such as the use of additives, production, packaging, handling, labeling and storage, as well as facilities and equipment. Failure to comply with these laws and regulations may result in confiscation of our products and proceeds from the sales of non-compliant products, destruction of our products and inventory, fines, suspension of production and operation, product recalls, revocation of licenses, and, in extreme cases, criminal liability.

We believe that our exposure to these risks is limited since our business model and our agreements with our suppliers provide a cushion which shields us from product liability exposure and we control food hygiene and food quality by implementing a strict quality control system and we believe that we comply in all material respects with these laws and regulations. To the extent that the government imposes additional laws or restrictions, we would have to comply with those laws as well. To the extent that we purchase foods from other suppliers for our green food distribution hub, we may be subject to liability exposure to the extent that our suppliers either do not comply with all applicable regulation or from impurities in foods we purchase from them.

Environmental Regulations

We are subject to various governmental regulations related to environmental protection. The major environmental regulations applicable to us include:

|

•

|

the Environmental Protection Law of the PRC;

|

|

•

|

the Law of PRC on the Prevention and Control of Water Pollution;

|

|

•

|

Implementation Rules of the Law of PRC on the Prevention and Control of Water Pollution;

|

|

•

|

the Law of PRC on the Prevention and Control of Air Pollution;

|

|

•

|

Implementation Rules of the Law of PRC on the Prevention and Control of Air Pollution;

|

|

•

|

the Law of PRC on the Prevention and Control of Solid Waste Pollution; and

|

|

•

|

the Law of PRC on the Prevention and Control of Noise Pollution.

|

12

We have obtained all permits and licenses required for production of our products and believe that we are in material compliance with all applicable laws and regulations.

Our packaging facilities are subject to various pollution control regulations with respect to noise, water and air pollution and the disposal of waste and hazardous materials. We are also subject to periodic inspections by local environmental protection authorities. We have received certifications from the relevant PRC government agencies in charge of environmental protection, indicating that our business operations are in material compliance with relevant PRC environmental laws and regulations.

Employees

As of March 15, 2010, we employed a total of 190 full-time employees. The following table sets forth the number of our employees by function.

|

Function

|

Number of Employees

|

|||

|

Senior management

|

9

|

|||

|

Human resource and administration.

|

21

|

|||

|

Production

|

34

|

|||

|

Procurement

|

15

|

|||

|

Marketing and sales

|

30

|

|||

|

Logistic

|

40

|

|||

|

Product development

|

5

|

|||

|

Quality control

|

11

|

|||

|

Accounting

|

16

|

|||

|

Import/export

|

2

|

|||

|

Advertising

|

5

|

|||

|

Information technology

|

2

|

|||

|

Total

|

190

|

|||

Our employees are not represented by a labor organization or covered by a collective bargaining agreement. We have not experienced any work stoppages. We believe that our employee relations are good.

We are required under PRC law to make contributions to the employee benefit plans at specified percentages of the after-tax profit. In addition, we are required by the PRC law to cover employees in China with various types of social benefits. We believe that we are in material compliance with the relevant PRC laws.

Executive Officers of the Registrant

The following table sets forth below is information concerning our executive officers.

|

Name

|

Age

|

Position

|

|

Xiong Luo

|

55

|

Chief executive officer and president

|

|

Yan Pan

|

43

|

Chief operating officer

|

|

Huasong Sheena Shen

|

38

|

Chief financial officer

|

Xiong Luo has been a chief executive officer and president since October 2010 and a director since February 2009. Mr. Luo served as our chief operating officer from January 15, 2009 until April 2010. Mr. Luo is also our corporate secretary, which is not an executive officer. He also served as chief operating officer of our BVI subsidiary, Organic Region, since 2006. Mr. Luo has also served as the general manager of our PRC operating subsidiaries, Zhuhai Organic and Guangzhou Organic, since 2004. Mr. Luo has more than 20 years’ experience in enterprise planning and operations. Prior to joining us, Mr. Luo served from 2001 to 2004, as general manager and managing director of China Environmental Protection Industry Ltd., from 1998 to 2001, as general manager of Beijing World Oasis Technology Limited; from 1997 to 1998, as general manager of Beijing Chunyi Industry Ltd., and from 1991 to 1997 as general manager of the Zhuhai Guanli plastic machinery plant. Mr. Luo graduated from Guangdong South China Agricultural University in 1985 with a B.A. Degree and holds seven patents, two of which are related to inventions.

Yan Pan has been our chief operating officer since May 1, 2010. Mr. Pan was a vice president of operations for us from July 2009 until April 2010. From 2007 to July 2009, Mr. Pan served as director of the luxury product business for Vasto, an Italian menswear brand owned by a Chinese family, where he oversaw brand positioning, product development, retail development and supplier management. From 2001 to 2007, Mr. Pan served as general manager of the Chinese operations of a Swedish outsourcing company, Outsource Supply Management, where he was responsible for overseeing client servicing, suppliers and overall strategic business development from 2001 to 2007. Mr. Pan holds a bachelor of arts degree from Dr. Sun Yat Sen University in China with a major in English literature, and he took courses for an MBA degree at Rutgers University.

Huasong Sheena Shen has been chief financial officer since October 2010. She served as vice president – finance from April 2010 until October 2010. From April 2007 until November 2009, Ms. Shen was managing partner of Great Wall Research LLC, a financial and accounting consulting firm which provided services to Chinese companies listed in the United States. From November 2006 until March 2007, Ms. Shen was chief financial officer of Masada Group Technologies Corporation, a technology company. From May 2000 until October 2006, Ms. Shen was employed by JP Morgan Chase in different capacities, with her final position being financial manager – global credit risk management operations from February 2005 until October 2006. Mr. Shen received her BS degree in accounting from Brigham Young University Hawaii and her MBA in finance from the University of Connecticut. Ms. Shen is a certified public accountant and a chartered financial analyst.

13

Item 1A. Risk Factors

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this annual report, before making an investment decision, and you should only consider an investment in our common stock if you can afford to sustain the loss of your entire investment. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

RISKS RELATED TO OUR BUSINESS

Because we restated our financial statements, investors may lack confidence in our ability to present financial information and the results of our operations and it may be difficult for us to raise funds for our operations.

On August 23, 2010, we concluded, after a review of the pertinent facts, that the previously issued financial statements contained in our annual report on Form 10-K for the year ended December 31, 2009 and our quarterly reports on Form 10-Q for the quarters ended March 31, 2010, September 30, 2009, June 30, 2009 and March 31, 2009, respectively, should not be relied upon for reasons set forth in Note 13 of Notes to Consolidated Financial Statements. This annual report reflects restated financial statements for the year ended December 31, 2009 because of our failure to account properly for the treatment of securities issued in financings during 2009 and 2008. As a result, our net income, as originally reported, was overstated by approximately $3.5 million for 2009. Our need to restate our financial statements reflects the inadequacy of our disclosure controls and our controls over financial reporting and may impair our ability to raise funds we require for our operations and may otherwise impair our operations and our relationships with our investors. Further, we cannot assure you that further restatements will not be required.

Because we have a deficiency in working capital, we will require funds for our operations, including our proposed distribution hub.

At December 31, 2010, we had a working capital deficiency of approximately $2.9 million, primarily as a result of higher accounts payable and accrued expenses and the an approximately $1.0 million derivative liability arising from our financings in 2008. We may require additional capital for our operations, and, in particular with respect to our distribution hub. Through December 31, 2010, we have made advances of approximately $14.2 million for the construction of our hub. We made this payment from cash generated by our operations and from funds which we raised from several small equity offerings in 2009 and 2010. We anticipate that the total cash investment to launch this business will be $32.4 million, and we have no present commitment for such funds. Because of our low stock price and the lack of an active trading market in our common stock, it may be difficult for us to raise funds on terms which are favorable to us, if at all. Our increases in revenue in 2010 compared with 2009 and 2009 compared with 2008 represented in large part from increased sales resulting from our purchase of long-term leases on which farming cooperatives can grow products for us to sell. The payment of the full amount of the leases, which was approximately $3.3 million in 2010 and $3.4 million in 2009, is due at the beginning of the lease. In order for us to expand our produce business in a manner which seeks to provide us with a continuing source of supply (subject to conditions which affect farming generally), we require capital to purchase the leasehold interests. Our failure to raise the necessary funds could impair our ability to expand our business.

Our operations are cash intensive, and our business could be adversely affected if we fail to maintain sufficient levels of working capital.

We spend a significant amount of cash on our operations, principally to procure fruits and vegetables as well as the purchase of long-term leases for farm land for which payment is required at the inception of the lease. Historically, our primary capital needs have been to fund our working capital requirements and our primary sources of funds have been cash generated from operations. If we fail to generate sufficient sales, we may not have sufficient liquidity to fund our operating costs and our business could be adversely affected. If available liquidity is not sufficient to meet our operating requirements, we plan consider pursuing financing arrangements or further reducing expenditures as necessary to meet our cash requirements. However, there is no assurance that, if required, we will be able to raise additional capital or reduce discretionary spending to provide the required liquidity. Currently, raising money in the capital markets for small capitalization companies is difficult and banking institutions have become stringent in their lending requirements. Accordingly, we cannot be sure of the availability or terms of any third party financing.

Since our proposed distribution hub is a new, cash intensive business in which we have no prior experience we may not be able to develop this business or operate this business profitably.

To date, substantially all of our revenue has been derived from the sale of Fuji apples, tangerine oranges and emperor bananas, which we purchase from farming cooperatives to which we lease the land on which the produce is grown. We are in the process of constructing a distribution hub in the Guangzhou Yuncheng wholesale market. This business is different from our present business and involved additional risks, including the following:

|

·

|

We will seek to enter into agreements with a wide range of vendors with which we will have no affiliation that will sell their produce in our distribution hub. We anticipate that most of our revenue from our proposed distribution hub will be generated from fees from the vendors who lease space at the distribution hub. A significant portion of the fees will be based on a percentage of the sales by the vendors at our distribution hub. Thus, our revenue from the distribution hub will be in large part dependent upon the success of the independent vendors in selling their products at the distribution hub and their providing us with an accurate determination of their revenue and making the required payment to us in a timely manner. The failure of the vendors to generate revenue, properly account for their revenue and make the required payments to us could impair our ability to operate the distribution hub profitably.

|

14

|

·

|

We will seek to sell products which are very different from the foods that we presently sell, which we expect may include imported organic products. We do not have experience in purchasing and selling any foods other than our fruits and vegetables, and we would need to hire employees, including managerial employees, with experience in importing organic foods and marketing the foods in the PRC. Our failure to hire and retain qualified personnel or to select the products for which there is a market and our failure to market and sell these products could impair our ability to generate profits from our business in the distribution hub.

|

|

·

|

We have two buildings with approximately 600,000 square feet of floor space for our distribution hub and a 130,000 square foot cold storage facility for our wholesale apples distribution business. We will incur significant expenses in completing and equipping the interior of the buildings. Although we plan to commence operations by September 2011, we may not be able to meet that timetable, and, if we are not able to obtain necessary financing, it is likely that we will not meet that schedule.

|

|

·

|

In order to manage a distribution center at which we anticipate a large number of independent and unrelated vendors will be selling a wide range of products, we would need to hire a significant number of employees with experience in managing a distribution center. Our failure to obtain and retain such key employees could impair our ability to generate a profit from the distribution center.

|

|

·

|

Although we plan to lease space to different vendors, with each vendor having responsibility for its own product line, we may be subject to liability for actions or conduct by the vendors even though we will have no control over their operations.

|

|

·

|

We will be required to maintain an inventory for each product that we market. Because all food products are perishable, if we do not project accurately both our requirements and the prices at which we can sell the products, we may have significant surpluses or shortages of products and we may pay prices which do not generate an adequate gross margin. Some of our proposed products must be sold very shortly after they are received, often on the same day that they are received, with the result that any unsold products are not salable. Our failure to estimate our requirements accurately could impair our ability to operate this business profitable.

|

|

·

|

Although we plan to have the products sold by vendors at our distribution hub tested before we enter into agreements with the vendors and to have spot tests of products being sold performed, we will not control the operations of the independent vendors at our distribution hub, and we may have difficulty enforcing quality control standards for our vendors. The failure of the vendors to deliver quality products, any product recalls affecting the vendors and public questions or concerns, whether or not justified, relating to the quality or purity of foods sold in our distribution market, could affect the reputation of the distribution hub, which could impair our ability to operate the center profitably.

|

|

·

|

We would need to develop and implement inventory control systems designed for a business which is different from and significantly larger than our present business. The failure to implement such a system could impair our ability to operate profitably.

|

|

·

|

Because we expect to purchase products from non-Chinese suppliers, over whom we have no control, we may have difficulty controlling and monitoring the quality of our products. The failure to deliver quality products could impair our ability to operate this business profitably.

|

|

·

|

Although we plan to develop a number of different product lines, our failure to develop only a small portion of these lines may impair our ability to operate the market as a whole profitably.

|

|

·

|

Both the cost of the construction of the distribution hub and the purchase of inventory require significant cash outlays, and we have no present commitment for the required cash. Our inability to obtain the necessary funding could impair our ability to develop the distribution hub.

|

|

·

|

If we are not successful in completing construction of the distribution hub or funding our purchase of an adequate inventory of a variety of funds which we plan to market for our own account or entering into agreements with vendors who would sell their products at our distribution hub, we may not be able to operate this business, in which event we would have to write off our significant investment in the project.

|

15

In connection with the proposed development of our distribution hub, we may sell directly to supermarkets and other retail outlets, which will present us with additional risks and financial requirements.

If we are successful in operating our distribution hub, we may then seek to expand our customer base to include supermarkets and other retail stores. In connection with this aspect of our proposed business, we will be subject to additional risks, including the foregoing:

|

·

|

We would need to develop and implement a marketing program to bring our produce to the attention of a new customer base. We presently sell almost exclusively at two wholesale markets, which does not require any significant marketing effort. Our wholesale customers purchase products at these markets for sale to their retail customer base. We would be seeking to sell directly to the retail customer base. If we are not successful in establishing a marketing program, we may not be able to operate this phase of our business profitably.

|

|

·

|

We presently deliver our produce to two wholesale markets at which we sell our produce, and wholesale companies purchase our produce and deliver it to their customers. If we sell directly to retail markets, we may have the obligation to deliver our produce to some of our retail customers, which will increase our costs.

|

|

·

|

Any delay in delivery of produce could affect the quality of the produce and could result in a rejection of a shipment if the customer questions the quality of our produce, if the customer had to obtain the produce from other sources or for any other reason.

|

Any financing we obtain may result in significant dilution to our shareholders.

We have no commitment from any bank or other financing source for our anticipated cash requirements, including those related to the completion of our proposed distribution hub or for any additional working capital which may be required in connection with the operation of the distribution hub and the proposed marketing effort directed at supermarkets and other retail outlets. If we raise funds through the sale of our equity securities, including convertible debt securities, it may be necessary for us to issue shares at a price which is below the current market price. Any such sale would result in significant dilution to our shareholders. We cannot assure you that financing will be available or that any terms which are available would not be unfavorable to us.

We may be unable to manage future rapid growth.

We have grown rapidly over the last few years and, if we implement our distribution hub business, the business growth could place a significant strain on our managerial, operational and financial resources. In addition to hiring a significant number of employees necessary to operate our expanded business, we will need to expand our management staff to adequate manage a large operation. If we are not able to implement management controls over this business, we may be unable to operate profitably. Our ability to manage future growth will depend on our ability to continue to implement and improve operational, financial and management information systems on a timely basis and to expand, train, motivate and manage our workforce. Our personnel, systems, procedures and controls may not be adequate to support our future growth. Our failure or inability to effectively manage our expansion may lead to increased costs, a decline in sales and reduced profitability.

Our business is subject to weather conditions, natural disasters and other conditions beyond our control which could affect our revenue, gross margins and net income.

Severe weather conditions and natural disasters, such as floods, droughts, frosts, earthquakes, plant disease or other pestilence, which are difficult to anticipate and cannot be controlled by us, may affect both the supply and the distribution of our products and otherwise disrupt our operations. Such disasters may affect the cost and supply of raw materials, including fruits and vegetables or result in reduced supplies of raw materials, lower recoveries of usable raw materials, higher costs of cold storage if harvests are accelerated and processing capacity is unavailable or interruptions in our production schedules if harvests are delayed. If our supplies of raw materials are reduced, we may not be able to find enough supplemental supply sources on favorable terms, if at all, which could impact our ability to supply product to our customers and adversely affect our business, financial condition and results of operations. Similarly, if our distribution network is not able to operate, we would not be able to sell our products. Further, to the extent that these factors affect the independent vendors at our proposed distribution hub, our ability to collect fees from these vendors may be materially impaired. We have no business interruption or similar insurance to provide protection from these and other business disruptions.

As a company which sells fresh food, our business can be impaired by product liability claims, recalls, adverse publicity or negative public perception regarding particular fruits we sell as consumers may avoid our products.

16