Attached files

| file | filename |

|---|---|

| EX-31.1 - U.S. China Mining Group, Inc. | ex31_1.htm |

| EX-31.2 - U.S. China Mining Group, Inc. | ex31_2.htm |

| EX-32.1 - U.S. China Mining Group, Inc. | ex32_1.htm |

| EX-32.2 - U.S. China Mining Group, Inc. | ex32_2.htm |

| EX-23 - CONSENT OF JOHN T. BOYD COMPANY, INDEPENDENT GEOLOGISTS - U.S. China Mining Group, Inc. | ex23.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2010

OR

|

x

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from to

Commission file number: 333-66994

U.S. CHINA MINING GROUP INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

43-1932733

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

|

17890 Castleton Street, Suite 112

|

||

|

City of Industry, California

|

91748

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number: (626) 581-8878

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No x

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained herein, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

¨

|

Accelerated filer

|

¨

|

||

|

Non-accelerated filer

|

¨

|

Smaller reporting company

|

x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter: $28,961,666 computed by reference to $4.90 as of June 30, 2010, which is less than $75 million.

Number of shares of common stock outstanding as of March 29, 2011: 18,902,582

|

PART I

|

||

|

1

|

||

|

21

|

||

|

30

|

||

|

30

|

||

|

31

|

||

|

31

|

||

|

PART II

|

||

|

31

|

||

|

32

|

||

|

32

|

||

|

40

|

||

|

40

|

||

|

40

|

||

|

41

|

||

|

PART III

|

||

|

41

|

||

|

44

|

||

|

49

|

||

|

50

|

||

|

51

|

||

|

PART IV

|

||

|

51

|

||

| SIGNATURES | 55 |

CAUTION REGARDING FORWARD-LOOKING INFORMATION

This Annual Report on Form 10-K for the year ended December 31, 2010 (“Annual Report”) contains forward-looking statements. All forward-looking statements are inherently uncertain as they are based on current expectations and assumptions concerning future events or future performance of the Company. Readers are cautioned not to place undue reliance on these forward-looking statements, which are only predictions and speak only as of the date hereof. Forward-looking statements usually contain the words “estimate,” “anticipate,” “believe,” “expect,” or similar expressions, and are subject to numerous known and unknown risks and uncertainties. In evaluating such statements, prospective investors should carefully review various risks and uncertainties identified in this Annual Report, including the matters set forth under the captions “Risk Factors” and in the Company’s other filings with the Securities and Exchange Commission (“SEC”). These risks and uncertainties could cause the Company’s actual results to differ materially from those indicated in the forward-looking statements. The Company undertakes no obligation to update or publicly announce revisions to any forward-looking statements to reflect future events or developments.

Although forward-looking statements in this Annual Report reflect the good faith judgment of our management, such statements can only be based on facts and factors currently known by us. Consequently, forward-looking statements are inherently subject to risks and uncertainties, and actual results and outcomes may differ materially from the results and outcomes discussed in or anticipated by the forward-looking statements. Factors that could cause or contribute to such differences in results and outcomes include, without limitation, those specifically addressed under the heading “Risks Relating to Our Business” below, as well as those discussed elsewhere in this Annual Report. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this Annual Report. We file reports with the SEC. You can read and copy any materials we file with the SEC at the SEC’s Public Reference Room, 100 F. Street, NE, Washington, D.C. 20549 on official business days during the hours of 10 a.m. to 3 p.m. You can obtain additional information about the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains an Internet site (www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, including the Company.

We undertake no obligation to revise or update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this Annual Report. Readers are urged to carefully review and consider the various disclosures made throughout the entirety of this Annual Report, which attempt to advise interested parties of the risks and factors that may affect our business, financial condition, results of operations and prospects.

PART I

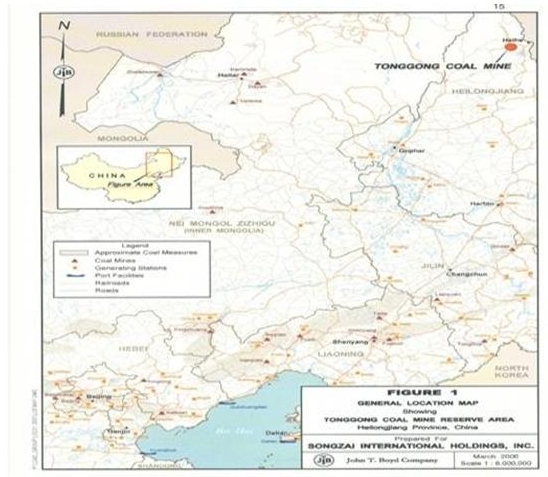

Overview

U.S. China Mining Group, Inc. (sometimes referred to in this annual report as the “Company”, “we” or “our”) is engaged in coal production by exploring, assembling, assessing, permitting, developing and mining coal properties in the People’s Republic of China (“PRC” or “China”). After obtaining permits from the Heilongjiang Province National Land and Resources Administration Bureau and the Heilongjiang Coal Production Safety Bureau, we extract coal, and then sell most of the coal on a metric ton (“ton”) basis for cash on delivery. Through the end of March 2008, our business consisted of the operations of Tong Gong coal mine through our subsidiary, Heilongjiang Tong Gong Mining Co., Ltd. (“Tong Gong”), in northern PRC. The mine is located approximately 175 kilometers southwest of the city of Heihe in the Heilongjiang Province.

On December 31, 2007, we entered into an agreement to acquire two mining companies in the PRC, Heilongjiang Xing An Group Hong Yuan Coal Mining Co., Ltd. (“Hong Yuan”) and Heilongjiang Xing An Group Sheng Yu Mining Co., Ltd. (“Sheng Yu”, and with Hong Yuan collectively referred to as “Xing An” or the “Xing An Companies”). The Xing An Companies operate two coal mines, the Hong Yuan and Sheng Yu mines, located in the city of Mohe in Heilongjiang Province. We completed our acquisition of the Xing An Companies on April 4, 2008, after which our business now consists of the operations of Tong Gong coal mine and the two Xing An coal mines.

History and Development of the Company

The Company was incorporated in the State of Nevada on June 7, 2001, under the name “Heritage Companies, Inc.”, and initially engaged in the on-line gift cards and related products business. The Company operated this business through October 2004 when it was discontinued.

On September 29, 2003, we executed a plan of exchange, between and among the Company and Rohit Patel, our former chairman, on the one hand, and Harbin Yong Heng Ke Ji Fa Zhan You Xian Ze Ren Gong Si, a PRC limited liability company (“Yong Heng”), and its shareholders (the “Yong Heng Shareholders”) on the other hand. At the closing of the transactions pursuant to the plan of exchange, the Yong Heng Shareholders exchanged all their shares of capital stock in Yong Heng for 67,000,000 shares of common stock of the Company, or 98.4% of the Company’s then outstanding common stock. Concurrently, Mr. Patel returned all of his shares of the Company’s common stock, 1,188,088 shares, to the Company for cancellation for a payment of $450,000. Upon completion of the share exchange transaction, Yong Heng became a wholly-owned subsidiary of the Company. On November 5, 2003, we changed our name from “Heritage Companies, Inc.” to “Songzai International Holding Group, Inc.” On July 1, 2010, we changed our name to “U.S. China Mining Group, Inc.”

On September 23, 2004, we acquired a 75% equity interest in Tong Gong, a PRC limited liability company and the operator of Tong Gong coal mine, pursuant to a purchase and sales agreement, dated April 5, 2004. To acquire 75% of Tong Gong’s registered capital of 33,200,000 Renminbi (“RMB”) (approximately $4,009,662), we issued 400,000 shares of our convertible preferred stock, which at the time of issuance was convertible into 40,000,000 shares of our common stock at the ratio of 1:100. The convertible preferred stock is part of a class of 8,000,000 shares of so-called “blank check” preferred stock that was authorized on July 16, 2004. On December 19, 2006, the conversion ratio was amended to 1:10 such that the 400,000 shares of convertible preferred stock were convertible into 4,000,000 shares of common stock. Effective January 7, 2008, however, the conversion ratio for the preferred stock changed to a 1-for-1 as a result of the 10-to-1 reverse stock split of our issued and outstanding shares of common stock which was effective on that date. We acquired the 75% equity interest in Tong Gong from Mr. Hongwen Li, our current President and Chief Executive Officer. In addition to the 75% equity interest of Tong Gong, we acquired the net profit rights attached to the remaining 25% equity interest of Tong Gong, which was held by Harbin Green Ring Biological Degradation Products Developing Co., Ltd. (“Harbin Green”), a PRC limited liability company( “LLC”) under the control of Mr. Li. In November 2004, Harbin Green assigned the entire 25% equity interest to us, as a result of which we now beneficially own 100% of the equity interests in Tong Gong.

In October 2004, we terminated our on-line gift cards and related products business activity by discontinuing the operations of our Yong Heng subsidiary, which had not earned any revenue since the quarter ended September 30, 2004. On December 28, 2005, we sold the Yong Heng subsidiary to a third party for $241,000, and we recorded a gain of $107,798 on the sale.

On December 31, 2007, we entered into a stock purchase agreement with the Xing An Companies and their owners: Heilongjiang Xing An Mining Development Group Co., Ltd., a PRC limited liability company, Mingshu Gong, Yunjia Yue, Yunpeng Yue and Guoqing Yue (collectively the “Xing An Shareholders”). Pursuant to the terms of the stock purchase agreement, we acquired 90% of the registered capital, representing 90% of the outstanding equity interests, of the Xing An Companies from the Xing An Shareholders.

On January 7, 2008, we amended our Articles of Incorporation to effect a 10-to-1 reverse stock split and a proportional decrease of our authorized number of shares of common stock (the “Amendment”) by filing a Certificate of Change with the Secretary of State of Nevada pursuant to Nevada Revised Statutes Section 78.209. The Amendment had been previously authorized by our Board of Directors on December 21, 2007. Pursuant to the Amendment, each ten shares of our common stock, par value $0.001 per share, issued and outstanding immediately prior to the record date of January 7, 2008 was automatically reclassified as and converted into one share of our common stock, par value $0.001 per share. No fractional shares were issued. Further, our total number of authorized shares of common stock was decreased from 1,000,000,000 to 100,000,000 shares.

On April 4, 2008, we completed the acquisition of the Xing An Companies and, pursuant to the terms of the stock purchase agreement, the Xing An Shareholders received 8,000,000 shares of our common stock and $30 million, which is treated as a dividend pursuant to the accounting treatment applied to the transaction. Concurrently, we entered into an escrow agreement with the Xing An Companies, the Xing An Shareholders and U.S. Bank National Association as escrow agent, pursuant to which the 8,000,000 common shares were placed in escrow as security for certain indemnification obligations of the Xing An Shareholders in connection with this transaction, which escrow has since expired by its own terms. Additionally, we entered into a trust agreement with the Xing An Shareholders and Anping Cang as trustee, pursuant to which all of the beneficial interests to the 10% of the registered capital in the Xing An Companies still held by the Xing An Shareholders have been placed in trust for our benefit. In connection with the completion of our acquisition, both Hong Yuan and Sheng Yu were issued a Certificate of Approval by the Heilongjiang Office of the State Administration for Industry and Commerce, classifying these companies as Sino-foreign enterprises and listing the Company as owner of 90% of their respective registered capitals. Our acquisition of 90%, rather than 100%, of the Xing An Companies was dictated by PRC regulations applicable at the time of the transaction, which limit foreign ownership of mining-related companies to a maximum of 90%.

Hong Yuan was originally organized as a LLC under the laws of the PRC on August 18, 2003, and was issued a Certificate of Approval for Establishment of Enterprises with Foreign Investment (No. 2300002414) on March 24, 2008 by the Heilongjiang provincial government. Hong Yuan’s registered address is Xilinji Town, Mohe County, Daxing’an Mountain District, Heilongjiang Province.

Sheng Yu was originally organized as a LLC under the laws of the PRC on July 28, 2003, and was issued a Certificate of Approval for Establishment of Enterprises with Foreign Investment (No. 2300002415) on March 24, 2008 by the Heilongjiang provincial government. Sheng Yu’s registered address is Cross Area between Zhenxing Road and Zhonghua Road, Xilinji Town, Mohe County, Daxing’an Mountain District, Heilongjiang Province.

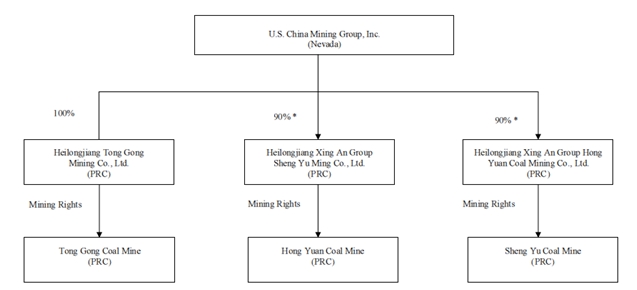

Current Corporate Structure

Our current organizational structure is as follows (the percentages depict the current equity interests):

* The remaining 10% was placed in trust for the benefit of the Company.

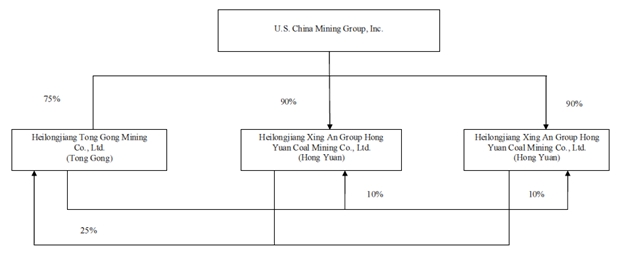

Reorganization of Subsidiaries

We recently reviewed our corporate structure and determined that, in order to assure full compliance with current PRC law and regulation, the non-controlling equity interests in our subsidiaries should in each case be held by the other subsidiaries and not by us or in trust. Consequently, the 25% equity interest in Tong Gong, which had previously been structured as an assignment to us, will instead be assigned to and held by the Xing An Companies and the 10% equity interest in the Xing An Companies will be held by Tong Gong and not by us in a trust. We anticipate that this change in structure will be completed by April 30, 2011. Thereafter, our corporate structure will be as follows (the percentages depict the equity interests):

The Coal Mines

Tong Gong Coal Mine

Tong Gong coal mine is located in the western slope of the Xiaoxinganling Mountains in the Heilongjiang Province in Northeastern China.

Initial exploration of Tong Gong coal mine dates back to 1958-1959 when geological surveys were performed by teams from the PRC Provincial Geology and Mineral Bureau. A regional geologic survey was conducted between 1972 and 1974 to determine coal bearing stratigraphy. An exploratory drilling program was undertaken in 1986 and continued through 1991. The mine was originally established in 1995 under the name Jinchang coal mine, and produced coal from 1996 through 1998. Tong Gong purchased the mining rights to the coal mine in June 2004 from Mr. Hongwen Li and rehabilitated the coal mine for production, renaming it Tong Gong coal mine in the process.

Tong Gong coal mine is an underground coal mine located in the western slope of the Xiaoxinganling Mountain in northern PRC. The mine is accessible by both railway and public roads. The coal reserves are located in the middle of the Heibaoshan-Muer coal basin, as secondary sedimentary basin. Several faults occur in, and define the coal fields with throws ranging from 20 meters to 270 meters. Coal bearing strata in the mine area are contained in the Jiufengshan Group. There are two coal seams in the mine area. The first seam is the stratigraphically lowest seam and is 2 meters to 5 meters thick and typically contains two to three partings. The other seam overlies the first seam and is thin and split and is generally not considered to be mineable. Reserves in the mine are only considered from the first seam.

Tong Gong coal mine, including the land on which the mine is located and on which most of our mining facilities are located as well as the underlying coal and other minerals, is owned by the PRC. Therefore, the exact amount of coal that we can extract from the mine is based on mining rights issued by the Heilongjiang Department of Land and Resources. Each mining right is issued pursuant to a reserves appraisal report submitted by government authorized mining engineers, and the mining right is issued upon approval of such appraisal report by the Heilongjiang Department of Land and Resources. The amount of coal underlying the mining rights represents the amount that we have paid for and may legally extract, assuming adequate economically viable reserves, under applicable PRC law and regulations.

We currently have in-place resources for the Tong Gong coal mine as follows:

|

Grant date

of the mining rights

|

In Place Resources

to which Mining

Rights Relate

(in metric tons) (1)

|

Due date for payment

of the mining rights

|

|

|

12/30/2004

|

4,649,700

|

---

|

|

|

9/30/2007

|

1,500,000

|

9/30/2017

|

|

|

Total

|

6,149,700

|

||

(1) The Company’s mining rights are based on appraisals of in place resources conducted by the appropriate PRC authorities and are expressed as a maximum number of metric tons of coal in each mine which the Company is entitled to extract under the related mining rights. Rights to legally extract coal do not guarantee reserves or the amount that may be economically extracted.

Our expected mining recovery is about 65-70% of the in-place resources, and our process / screening recoveries are about 95-97% of the run-of-mine output (the amount resulting from the mining recovery amount). Thus, we have the legal rights to extract coal based on 6,149,700 metric tons (“tons”) of in-place resources from Tong Gong coal mine, provided that the coal underlying the mining rights is fully paid for by a certain period of time. Having rights to legally extract stated amount of coal does not guarantee reserves or the amount that may be economically extracted. For mining rights granted prior to September 1, 2006, we are generally required to make full payment within five years unless specific good cause exists for extension. Effective September 1, 2006, under the authority of the Heilongjiang Geology and Mineral Exploration Office, the due date is ten years from the grant date for mining rights granted on or after September 1, 2006. The price is determined on a per ton basis, and is subject to change based on the prevailing market price as determined by the Heilongjiang Department of Land and Resources. As of December 31, 2010, we have paid for 5,383,495 tons out of the 6,149,700 tons to which we have mining rights.

The amount of coal underlying our mining rights is determined based on PRC standards, which differ from those of Guide 7 of the Securities Act Industry Guide (“SEC Industry Guide 7”). As such, coal that is deemed extractable in China, where we operate, may not be deemed proven or probable reserves under SEC Industry Guide 7. Because our coal is mined and sold entirely in China, we believe it is helpful to understanding our business for us to provide the measurements of coal reserves used by the Company in its operations and evaluations. The amount of coal underlying our mining rights in Tong Gong are based on PRC guidelines and presents a different valuation of our mining reserves from Tong Gong mine’s proven and probable reserves, as such terms are defined in SEC Industry Guide 7. Specifically:

Proven (Measured) Reserves are reserves for which (a) quantity is computed from dimensions revealed in outcrops, trenches, workings, or drill holes; grade and/or quality are computed from the results of detailed sampling and (b) the sites for inspection, sampling, and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth and mineral content of reserves are well-established.

Probable (Indicated) Reserves are reserves for which quantity and grade and/or quality are computed from information similar to that used for proven (measured) reserves, but the sites for inspection, sampling, and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven reserves, is high enough to assume continuity between points of observation.

We commissioned John T. Boyd Company, an independent mining and geological consulting firm (“JTB”) to assess Tong Gong coal mine in accordance with SEC Industry Guide 7. Based on the JTB report dated March 31, 2006, Tong Gong coal mine had proven product (salable) reserves of 1.36 million tons and probable product (salable) reserves of 0.17 million tons as of December 31, 2005. Based on such reserves, the JTB report also estimates the mine service life at 10 years. At the Company’s request, JTB also prepared a report (dated March 25, 2011), which provided information and estimates as of December 31, 2010. Tong Gong coal mine’s proven and probable product (salable) reserves as reported by JTB presented here comply with SEC Industry Guide 7. They are based upon and do not reflect reserves as described in the PRC appraisal on which our mining rights are based and which establishes the amount of coal we are entitled to extract pursuant to those rights. At December 31, 2010, the estimated product reserves for Tong Gong under Industry Guide 7 was approximately 0.49 million tons, of which all was proven product reserves.

In deriving its estimated reserve amounts, JTB in its report as of December 31, 2010 used assumed recoveries for mining and processing/screening utilized in its estimates for Tong Gong coal mine as follows: mining recovery - 55% area recovery; vertical recovery - 100% of coal column; coal processing recovery - 100% of coal in the run-of-mine output; and parting / OSD removal - 80% removal of the parting / OSD material in the run-of-mine output. These factors are different from those used in the PRC by firms providing appraisals for reserves on which mining rights, including ours, are based.

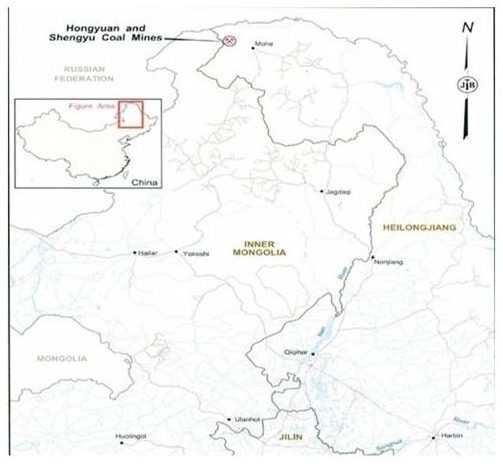

Hong Yuan and Sheng Yu Coal Mines

Hong Yuan and Sheng Yu coal mines (collectively “Xing An coal mines”) are adjacent underground mines. Both mines contain four principal coal seams – No. 3, No. 4, No. 5 and No. 6 – ranging from 1.7 to 4.0 meters in thickness.

Due to the significant costs of coal transport, the location of a coal mine can significantly affect its profitability and competitiveness. We believe the Xing An mines are well-situated given their existing access to both railway and public roads, as well as the demand for coal in Heilongjiang Province driven by the region’s rapid economic growth, and the substantial costs involved in transporting coal to this region from major coal-producing provinces such as Shaanxi Province, Shanxi Province and the Inner Mongolia Autonomous Region.

Xing An coal mines are located in the Daxinganling Mountain Range in Northeastern China, just outside of the city of Mohe which is less than two miles from the Russian border:

As with the Tong Gong coal mine, neither we nor our subsidiaries own the Hong Yuan and Sheng Yu coal mines. Our mining rights for Hong Yuan and Sheng Yu describe in-place resources, as follows:

|

Grant date

of the mining rights

|

In Place Resources

to which Mining Rights Relate

(in metric tons) (1)

|

Due date for payment

of the mining rights

|

||||

|

4/1/2005

|

816,300 |

12/30/2010*

|

||||

|

10/15/2005

|

13,520,700 |

9/30/2010*

|

||||

|

3/1/2007

|

5,444,800 |

3/1/2017*

|

||||

|

Total

|

19,781,800 | |||||

*fully paid as of December 31, 2010

(1) The Company’s mining rights are based on appraisals of in place resources conducted by the appropriate PRC authorities and are expressed as a maximum number of metric tons of coal in each mine which the Company is entitled to extract under the related mining rights. Rights to legally extract coal do not guarantee reserves or the amount that may be economically extracted.

Our expected mining recovery is about 65-70% of the in-place resources, and our process / screening recoveries is about 95-97% of the run-of-mine output. Thus, we may extract coal based on 19,781,800 tons of in-place resources from Xing An coal mines, provided the coal underlying the mining rights is paid for by a certain period of time. As of December 31, 2010, we paid for all mining rights at the Xing An coal mines based on PRC reserve guidelines.

As with Tong Gong coal mine, we also commissioned JTB to assess both Xing An coal mines in accordance with SEC Industry Guide 7. Based on the JTB report dated April 15, 2008, as of June 30, 2007, Hong Yuan coal mine had proven product (salable) reserves of 2.53 million tons and probable product (salable) reserves of 2.81 million tons, and Sheng Yu had proven product (salable) reserves of 0.81 million tons and probable product (salable) reserves of 2.73 million tons. The Xing An coal mines’ proven and probable product (salable) reserves as reported by JTB presented here comply with SEC Industry Guide 7. They are based upon and do not reflect reserves as described in the PRC appraisal on which our mining rights are based and which establishes the amount of coal we are entitled to extract pursuant to those rights. The JTB report (dated March 25, 2011) provides updated information and estimates. At December 31, 2010, the estimated product reserves for Hong Yuan and Sheng Yu under Industry Guide 7 was approximately 8.21 million tons, of which 5.38 million tons was probable product reserves and 2.83 million tons was proven product reserves.

The JTB report as of December 31, 2010 employed assumed recoveries for mining and processing/screening in developing estimates for Hong Yuan coal mine as follows: mining recovery - 60% area recovery; vertical recovery - 100% of first 2.5 meters of coal column, 65% recovery of coal column greater than 2.5 meters thickness; coal processing recovery - 90% of coal in the run-of-mine output for seams 4, 5 and 6, 80% of coal in the run-of-mine output for No. 3 seam; and parting / OSD removal - 97% removal of the parting / OSD material in the run-of-mine output.

The JTB report as of December 31, 2010 employed assumed recoveries for mining and processing/screening in developing estimates for Sheng Yu coal mine as follows: mining recovery - 60% area recovery; vertical recovery - 100% of coal column; coal processing recovery - 90% of coal in the run-of-mine output for seams 4, 5 and 6, 80% of coal in the run-of-mine output for No. 3 seam; and parting / OSD removal - 97% removal of the parting / OSD material in the run-of-mine output.

Our Mining Operations

In addition to our mining rights, each of which caps the amount of coal we legally can extract from a specific mine, we operate these coal mines pursuant to the following permits:

|

Permit

|

Issuing Authority

|

Purpose of Permit

|

||

|

Resource mining permit

|

Heilongjiang Province National Land and Resources Administration Bureau

|

Specifies the coordinates of the mining area, the mine’s annual production capacity, and production life

|

||

|

Coal production right permit

|

Heilongjiang Province Coal Production Safety Bureau

|

Official coal production permit; specifies the coordinate of the mining area, the mine’s annual production capacity, production life

|

According to our resource mining permit for Tong Gong, the coal mine’s design capacity is estimated at 180,000 tons per annum based on mine operating conditions. Additionally, the resource mining permit estimates the mine’s resources at 6.14 million tons according to PRC standard for resource estimate that includes the coal resources in the specified mining area, which differs from the formulation based on current drilled hole under SEC Industry Guide 7. Our resource mining permits for Hong Yuan and Sheng Yu estimates those mines’ annual capacity at 450,000 tons and 150,000 tons, respectively, and an in-place estimate of their reserves at 10,775,000 tons and 9,006,000 tons, respectively.

In January 2008, our application to increase Tong Gong’s annual production amount was approved, and our coal production right permit presently authorizes us to mine 180,000 tons of coal per year, up from 150,000 tons, in a 1.1193 square kilometer area, which comprises the entire area of Tong Gong coal mine. The effective period of our coal production right permit for Tong Gong is from March 25, 2007 through June 30, 2016. Subject to certain geographic limitations, we are authorized to extract an aggregate of 600,000 tons of coal per year from the Hong Yuan and Sheng Yu mines, according to an extended coal production right permit covering both mines, which is effective from April 2010 to April 2020. The coal production right permits can be extended as necessary; however, any material change in or revocation of these permits by the Heilongjiang Province Coal Production Safety Bureau could materially and adversely affect our operations and financial condition.

Mining Tong Gong Coal Mine

Coal extracted from Tong Gong coal mine is for both industrial and home use. Steam coal is trucked to a nearby railroad cargo station, which is approximately 500 meters from the mine. The 500 meter road from the coal mine to the railroad cargo station is being improved to reduce trucking time.

The “longwall” coal mining method employed at Tong Gong coal mine, typical for the Chinese coal mining industry, uses longwall panels and retreating face methods to produce approximately 80% to 90% of the mine’s output. Incline development and longwall gate entries account for the remaining output. The general mine layout is a series of longwall panels extending from the left and right of three parallel inclines. The inclines currently extend for approximately 300 meters following the coal seam, and may be further extended up to 1,000 meters covering the entire length of the seam. The main incline houses compressed air lines, telephone and signal lines, high voltage cable and rail for hoisting operations. A service incline houses surface water supplies for fire fighting and underground water discharge lines. A secondary parallel intake incline adjacent to the main incline assists in ventilation. Longwall panels extend from the inclines to the reserve boundaries defined by property limits or geological features. The entire main block reserve area is currently recovered from the present inclines and planned extensions.

The longwall technique in use at the mine is semi-mechanized sublevel caving. It consists of a single hydraulic support with a 40-kilowatt motor powered by a small capacity advanced fuel cell. Drilling and blasting methods are used to break up the coal face and sublevel caving recovers the remaining coal. As the face line retreats along the strike of a seam, the roof strata collapses and allows the coal face to operate under manageable stresses. Sublevel caving techniques are widely used in the PRC.

All raw coal is hand loaded and transported down the face line by a chain conveyor or by coal cars. Rock material is used for floor ballast with the excess sent to the surface for disposal. The mine is equipped with a 2-meter diameter hoist that is capable of hoisting eight coal cars, each with a 1-ton capacity. Two air compressors are provided for underground air tool use. Diesel locomotives, 3- and 5-ton capacity, are used for underground haulage. We receive our electrical power from state-controlled power lines as well as local power lines. Power is supplied to underground workings through a high voltage cable.

Normal water inflow into the mine is controlled by three multistage centrifugal pumping units and dual discharge lines. During high water periods all three pumps can be utilized. The mine’s ventilation system includes an exhaust fan on the surface of the main incline. Auxiliary fans are used as needed. The present mine fan is capable of satisfying projected ventilation demands.

Tong Gong’s annual production volumes from 2005 to 2010, and the weighted average selling price per ton for each year, are as follows:

|

Year

|

Annual Production

(Tons )

|

Weighted Average

Price Per Ton

(RMB)

|

|

2005

|

129,448

|

RMB 176

|

|

2006

|

176,844*

|

RMB 174

|

|

2007

|

351,946*

|

RMB 198

|

|

2008

|

372,229*

|

RMB 231

|

|

2009

|

350,000*

|

RMB 332

|

|

2010

|

200,506*

|

RMB 360

|

Mining Xing An Coal Mines

Current mining operations at Xing An coal mines take advantage of the region’s weather conditions. For approximately 100 days from October to April, the frigid weather causes permafrost at these mines, enabling coal to be extracted by dynamite mining. Additionally, the permafrost eliminates the need for any shaft support. Thus, mining operations are ongoing during the entire 100-day period, with three shifts of eight hours each per day. To extract coal, controlled explosive charges are placed into holes that are drilled into a coal seam. After the explosives separate coal from the seam, a backhoe loader scoops the coal up from the ground and into a waiting haul truck with 8-ton capacity. Once the truck is loaded, it is driven to the surface where the coal is emptied on to a sorting machine. The sorting machine sorts the coal into three sizes and separates out rock through centrifugal action.

The annual production volumes from 2005 to 2010, and the weighted average selling price per ton, are as follows:

|

Year

|

Annual Production

(Tons )

|

Weighted Average

Price Per Ton

(RMB)

|

|

2005

|

299,760

|

RMB 200

|

|

2006

|

694,502*

|

RMB 196

|

|

2007

|

712,690*

|

RMB 228

|

|

2008

|

743,280*

|

RMB 238

|

|

2009

|

569,718

|

RMB 337

|

|

2010

|

512,350

|

RMB 299

|

* while our production volumes in 2006, 2007, 2008, 2009 and 2010 exceeded the amount specified on our coal production permits, such practice is common in Heilongjiang Province, and was accepted by the relevant authorities because the mining rights for the extracted coal and taxes from sales of such coal were paid.

Brokered Coal

In addition to mining coal, we also broker coal from small independent mines operating in the areas surrounding the mines that we operate. Because operators of these small mines often lack the means to transport coal from the mines, they have no market for their coal other than selling it to us at competitive prices. The brokered coal enables our subsidiaries to fulfill their respective sales obligations. Tong Gong currently brokers approximately 280,000 tons of coal annually at approximately 14% mark down of the costs of the coal that it mines. Xing An, on the other hand, brokers approximately 512,800 tons of coal annually at approximately the same costs as the coal that the company mines.

Our Products

There are four types of coal: lignite, sub-bituminous, bituminous and anthracite. Each has characteristics that make it more or less suitable for different end uses. In general, coal of all geological composition is characterized by end use as either “steam coal” or “metallurgical coal.” Steam coal is used by electricity generators and by industrial facilities to produce steam, electricity or both. Metallurgical coal is refined into coking coal, which is used in the production of steel. Heat value and sulfur content, the two most important coal characteristics, determine the best end use of particular types of coal. The heat value of coal is commonly measured in British thermal unit (Btu) per pound of coal. Sulfur content can vary from seam to seam and sometimes within each seam. Coal combustion produces sulfur dioxide, the amount of which varies depending on the chemical composition and the concentration of sulfur in the coal. Also, ash is the inorganic residue remaining after the combustion of coal. As with sulfur content, ash content varies from seam to seam. Ash content is an important characteristic of coal because electric generating plants must handle and dispose of ash following combustion. Moisture content of coal varies by the type of coal, the region where it is mined and the location of coal within a seam. In general, high moisture content decreases the heat value and increases the weight of the coal, thereby making it more expensive to transport. Moisture content in coal, as sold, can range from approximately 5% to 30% of the coal’s weight. When some types of coal are super-heated in the absence of oxygen, they form a hard, dry, caking form of coal called “coke.” Steel production uses coke as a fuel and reducing agent to smelt iron ore in a blast furnace.

The following information comes from the JTB reports that we commissioned and is prepared in accordance with SEC Industry Guide 7. As indicated above, however, this information is not based upon and does not reflect the reserves as described in the PRC appraisal on which our mining rights are based and which establish the amount of coal that we can legally extract pursuant to the mining rights issued to our subsidiaries.

Tong Gong’s Coal

As reported in the JTB report dated March 25, 2011, the coal from Tong Gong coal mine has the following characteristics:

|

Recoverable

Reserves

(million

tons ) (1)

|

Amount

Assigned to

Existing

Facilities (2)

|

Type of Coal

|

Btu per

Pound

|

Sulfur

Content

(%)

|

Ash

Content

(%)

|

Moisture

(%)

|

|

|

Proven

(Measured) (3)

|

0.49

|

0.49

|

Steam coal

|

10,080

|

0.5

|

14

|

6

|

|

Probable

(Indicated) (3)

|

--

|

--

|

Steam coal

|

10.080

|

0.5

|

14

|

6

|

|

Total

|

0.49

|

0.49

|

|

(1)

|

Amount is as of December 31, 2010, based on the JTB report dated March 25, 2011.

|

|

(2)

|

Existing infrastructure and equipment allows these reserves to be mined at current production levels.

|

|

(3)

|

A drill hole spacing of 500 meters is used for proven reserves, and a drill hole spacing of 1,000 meters is used for probable reserves.

|

Xing An’s Coal

Based on the JTB report dated March 25, 2011, the coal from Hong Yuan coal mine has the following characteristics:

|

Recoverable

Reserves

(million

tons ) (1)

|

Amount

Assigned to

Existing

Facilities (2)

|

Type of

Coal

|

Btu per

Pound

|

Sulfur

Content

(%)

|

Ash

Content

(%)

|

Moisture

(%)

|

|

|

Proven

(Measured) (3)

|

2.15

|

2.15

|

Steam coal

|

6,660-9,000

|

0.5-0.7

|

19-35

|

10

|

|

Probable

(Indicated) (3)

|

2.68

|

2.68

|

Steam coal

|

6,660-9,000

|

0.5-0.7

|

19-35

|

10

|

|

Total

|

4.83

|

4.83

|

Based on the JTB report dated March 25, 2011, the coal from Sheng Yu coal mine has the following characteristics:

|

Recoverable

Reserves

(million

tons ) (1)

|

Amount

Assigned to

Existing

Facilities (2)

|

Type of

Coal

|

Btu per

Pound

|

Sulfur

Content

(%)

|

Ash

Content

(%)

|

Moisture

(%)

|

|

|

Proven

(Measured) (3)

|

0.68

|

0.68

|

Steam coal

|

6,660-9,000

|

0.5-0.7

|

19-35

|

10

|

|

Probable

(Indicated) (3)

|

2.70

|

2.70

|

Steam coal

|

6,660-9,000

|

0.5-0.7

|

19-35

|

10

|

|

Total

|

3.38

|

3.38

|

|

(1)

|

Amount is as of December 31, 2010, based on the JTB report dated March 25, 2011.

|

|

(2)

|

Existing infrastructure and equipment allow these reserves to be mined at current production levels.

|

|

|

(3)

|

A drill hole spacing of 500 meters is used for proven reserves, and a drill hole spacing of 1,000 meters is used for probable reserves.

|

Our Customers

Because of their differing properties, Tong Gong’s coal and Xing An’s coal are sold to different types of customers. Tong Gong’s coal is primarily sold to power plants, cement factories, wholesalers and individuals for home heating. Xing An’s coal, on the other hand, is primarily sold to power plants, metallurgical mills and fuel trading companies.

For the year ended December 31, 2010, three customers collectively accounted for approximately 79% of our consolidated revenue:

|

·

|

Heilongjiang QiQiHaEr Huadian Power Plants Co., Ltd., accounted for 60% of our total sales in 2010;

|

|

·

|

Heilongjiang Beihai Logistics Company, accounted for 19% of our total sales in 2010;

|

|

·

|

Changchun Rail Transportation Co., Ltd., accounted for 10% of our total sales in 2010;

|

We sell our coal on a per ton basis directly to our customers. Coal is generally sold to major customers by purchase order signed prior to the beginning of each mining season. These purchase orders generally specify the quantities and timing of purchases planned over a time period generally no longer than one year. The balance of the sales comes from purchase orders issued by the same customers that have additional requirements for coal during the year, or from smaller customers. Net coal sales represent the invoiced value of coal sold and are net of sales taxes, transportation costs and various miscellaneous fees relating to sales if the invoiced value includes transportation costs to the customers. While the price of coal did not change significantly between 2005 and 2006, there was a significant increase in 2007 through 2010 driven by market demands. Under such conditions, most customers in 2010 paid in advance of delivery, and we require the remaining customers to pay against delivery of coal. As a result, we carried only approximately $212,000 in accounts receivable at December 31, 2010. Our sales personnel conduct routine customer visits and customer satisfaction surveys. We have established long-term business relationships with our major customers, and our management believes that these relationships are stable. Once our coal is extracted, it is typically picked up immediately by, or loaded immediately for delivery to, customers so we do not currently maintain an inventory of extracted coal. Coal extracted from Tong Gong coal mine is trucked approximately 500 meters to the nearest rail siding and sold f.o.b. railcar. Coal extracted from Xing An coal mines is trucked approximately 60 kilometers to a stockyard adjacent to the nearest rail siding and sold f.o.b. railcar.

Product Pricing

Coal prices are generally determined by market price or are based on contractual terms. However, the price for certain thermal coal used for power generation is determined among coal suppliers and power plant buyers in accordance with the pricing guidance published by the PRC Government.

We set pricing by taking into account: (i) prices in the relevant local coal markets (inclusive of transportation costs); (ii) grade and quality of the coal; and (iii) relationships with customers. Most of the transportation costs are borne by the customers. The average price for raw coal from Tong Gong in 2010 was RMB 360 per ton, which is RMB 28 higher than the average price of RMB 332 in 2009. The average price for raw coal from Xing An in 2010 was RMB 299 per ton in 2010, which was RMB 38 less than the average price of RMB 337 per ton in 2009. This decrease was due to the shutting down of the Xing An mines for the retrofit projects, which resulted in partial production for the Xing An mines. Lower coal production resulted in a higher percentage of sales to the local power plants, with which we usually signed yearly contracts at lower margin prices and the retrofit construction had an impact on our production such that we were producing lower quality coal, which sold at lower prices.

Product Delivery

All of our major customers are located in Northeastern China, primarily in the provinces of Heilongjiang and Jilin. Coal is transported to these customers principally by railways. We delivered about 1,804,000 tons of our raw coal to our customers by railways in 2008, about 1,323,845 tons in 2009 and about 1,460,152 tons in 2010.

Sources and Availability of Raw Materials and the Principal Suppliers

We purchase certain materials in connection with our coal mining operations, including: (i) tires for mining equipment and vehicles; (ii) lift cylinders; and (iii) iron boards. Because these materials are readily available, we do not purchase them exclusively from any one supplier for our Tong Gong operation. Xing An, however, does source tires and lift cylinders principally from Mohe County Yongsheng Metal Products Shop, and iron boards principally from Mohe Shuangli Steel Store. The price of these materials is set at market rates or determined through negotiations. We believe we have established stable cooperative relationships with the suppliers that we deal with to ensure a reliable supply of the materials required for our mining operations.

Research and Development

We had no research and development expenses in 2010 and in 2009. We currently have no plans for any research and development activities and do not anticipate any material research and development costs.

Intellectual Properties and Licenses

We have no material patents, licenses or other intellectual property.

Competition

In the area where we operate Tong Gong coal mine, there are two other coal mines which directly compete with us: No. 151 coal mine and Fu Hong coal mine. No. 151 coal mine has an annual production capacity of 400,000 tons and Fu Hong coal mine has an annual production capacity of 200,000 tons. However, because demand for coal currently outpaces supply, we do not face any meaningful competition for the sale of our coal from Tong Gong. In the area where we operate Xing An coal mines, on the other hand, competition is comprised of small mining operations that often lack transportation capabilities to deliver their coal to the nearest train depot.

Growth Strategy

We intend to grow our business by acquisition and by increased production in our existing mines. Our goal over the next several years is to reach a level of mining and selling substantially more tonnage at higher prices. In December 2009, we began a program to upgrade one of our mines to increase efficiency, safety and boost production at the site. This mine will be transitioning from room-and-pillar mining to long-wall mining process, which will enable year round production. In November 2010, we started to launch coal sorting business that consists of sourcing raw coal from producer in neighbor areas and then cleaning and sorting the raw coal on site to yield better market price. We also will achieve our growth by acquiring properties holding reserves of coal of high heat content. We seek to identify targets in which the heat content of the coal is higher than the heat content of coal from our present mines and we can therefore sell this coal at higher prices per ton than we presently obtain, although we will also consider acquisitions of thermal coal mines (with relatively lower heat content) in circumstances in which the price is appropriate to the available return on investment.

We anticipate that some of these acquisitions will be of existing mines and some will be of undeveloped properties. In all cases, they will be properties with established reserves. Our 5-year goal is to have 200 million tons of reserves and to be mining approximately 5 million tons per year.

We will finance these acquisitions, as well as the improvements necessary to existing mines and the development of mines on undeveloped properties, by using internally generated cash, as well as cash raised by issuing equity securities. We do not anticipate using debt financing.

We anticipate that these acquisitions will be in China and in the United States. We expect to export coal mined in the United States to China and to sell it to our customers there. Because we expect to increase the amount of coal that has higher heat content, we also expect that our customer base will reflect an increase in the number of steel manufacturers and others for whom high heat content coal is essential.

On May 19, 2010, the Company entered into an Asset Purchase Agreement (the "Asset Purchase Agreement") to acquire the Erdos City Dongsheng District Liujiaqu Coal Mine ("Liujiaqu Coal Mine") located in the Inner Mongolia region of the PRC. The transaction of the acquisition of Liujiaqu Coal Mine had not been completed as of the filing of this annual report. The parties are reviewing the potential impact on the transaction of new municipal policy and requirements of Erdos City and have not scheduled a date for completion of the transaction.

On January 20, 2011, the Company signed an advance agreement with an individual owner of a coal mine located in Guizhou China. Pursuant to the agreement, through March 4, 2011, the Company has advanced a refundable RMB 30 million (approximately $4,525,000, the maximum amount provided under the agreement) to an escrow account to be used for improvements to this mine. In addition, the Company intends to undertake the acquisition of the mine from the individual owner if the owner can complete the necessary restructuring of the mine as appropriate for acquisition and the new mining company after the restructuring has received all government required permits for normal production. If the potential acquisition goes forward, the escrow amount will be treated as partial consideration. If not, the amount will be reimbursed to the Company.

Regulatory Overview

Coal Law

On August 29, 1996, the PRC Government promulgated the People’s Republic of China Coal Law (the “Coal Law”), which became effective on December 1, 1996. The Coal Law sets forth requirements for all coal mines, including state-owned mines and privately owned mines, mainly providing for resource exploitation planning, approval of new mines, the issuance of mining and safety production permits, implementation of safety standards, processing of coal, business management, protection of mine areas from destructive exploitation, and safety protection for miners and administrative supervision.

According to the Coal Law, entities seeking to establish mining enterprises must apply to the relevant government office and obtain all necessary approvals. Upon obtaining such approvals, the entities concerned will be granted a mining permit from the Ministry of Land and Resources. Thereafter, an entity must obtain a coal production permit and a coal operation permit and other related quality permits in order to commence coal production and sell coal products in the PRC. The PRC Government is in the process of amending the Coal Law, in response to concerns over the lack of a well-coordinated development plan for mining, which contributed to a significant amount of waste of valuable coal resources. The lack of effective penalty provisions or the lenient enforcement of existing provisions in the Coal Law has been cited as another important reason for the current rulemaking effort.

Mining activities in the PRC are also subject to the People’s Republic of China Mineral Resources Law (“Mineral Resources Law”), promulgated by the PRC Government on March 19, 1986 and amended on August 29, 1996. The Mineral Resources Law regulates matters relating to the planning or engaging in the exploration, exploitation and mining of mineral resources. According to the Mineral Resources Law all mineral resources, including coal, are owned by the state. Except under limited circumstances, any enterprise planning to engage in the exploration, exploitation and mining of mineral resources must first apply for and obtain exploration rights and mining rights before commencing the relevant activities. The Mineral Resources Law prohibits the transfer of exploration and exploitation rights in general unless the transfer falls within certain specified circumstances.

We are principally subject to governmental supervision and regulation by the following agencies of the PRC Government:

|

·

|

the State Council, which is the highest level of the executive branch, is responsible for the examination and approval of major investment projects specified in the 2004 Catalogue of Investment Projects released by the PRC Government;

|

|

·

|

the National Development and Reform Commission, which formulates and implements major policies concerning China’s economic and social development, examines and approves investment projects exceeding certain capital expenditure amounts or in specified industry sectors, including examination and approval of foreign investment projects, oversees reform of state-owned enterprises and formulates industrial policies and investment guidelines for the natural resource industries, such as coal production. In addition, the NDRC administers coal export activities and export quotas jointly with the Ministry of Commerce. The NDRC is also responsible for the evaluation and implementation of the price-linking mechanism between the prices of coal and power;

|

|

·

|

the Ministry of Commerce of China (“MOFCOM”) and/or its local counterpart, which regulates foreign investment in China, such as review and approval of foreign invested companies in China and mergers and acquisitions of Chinese domestic enterprises by foreign investors;

|

|

·

|

the Ministry of Land and Resources of China (“MLR”) and/or its local counterpart, which has the authority to grant land use licenses and mining right permits, approves transfer and lease of mining rights, and reviews mining rights premium and reserve valuation;

|

|

·

|

the State Administration of Coal Mine Safety (“SACMS”) and/or its local counterpart, which is responsible for the implementation and supervision of the relevant safety laws and regulations applicable to coal mines and coal mining operations;

|

|

·

|

the Ministry of Environmental Protection of China (“MEP”) and/or its local counterpart, which supervises and controls environmental protection and monitors China’s environmental system;

|

|

·

|

the Ministry of Construction of China (“MOC”) and/or its local counterpart, which is responsible for the management of survey and design of construction projects, including but not limited to the survey and design of coal mines;

|

|

·

|

the National and State Tax Bureaus and/or their local counterparts, which are responsible for the federal and local income, VAT and other taxes;

|

|

·

|

the State Administration of Foreign Exchange of China (“SAFE”) and/or its local counterpart, which is responsible for the convertibility of RMB into foreign currencies, registration of foreign debt or loans of Chinese companies and, in certain cases, the remittance of currency out of the PRC, such as repayment of bank loans or dividends denominated in foreign currencies, and

|

|

·

|

the State Administration for Industry and Commerce of China (“SAIC”) and/or its local counterpart, which is responsible for review and approval of establishment of domestic and foreign invested companies in China and issuance of their business licenses.

|

The following is a brief summary of the principal laws, regulations, policies and administrative directives to which we are subject.

Pricing

Until 2002, the production and pricing of coal was largely subject to close control and supervision by the PRC Government, which centrally manages the production and pricing of coal. Previously, the price of coal was determined based on a government-devised pricing guideline, which set out the suggested prices for coal. However, to effectuate the transformation from planned economy to market economy practices, from January 1, 2002 China eliminated the state guidance price for coal and allowed prices for all types of coal to be determined in accordance with market demand. However, as the PRC Government continues to maintain control over the national railway system, which is the primary means for coal transportation in China, the PRC Government still may exert influence over the pricing of coal through its allocation of railway transportation capacity for coal.

In addition, under the Price Law of the PRC, promulgated December 29, 1997, effective May 1, 1998, in the event of an actual increase or potential increase in the prices of important products such as coal, the State Council and the provincial governments, autonomous regions and municipalities directly under the PRC Government may adopt intervention measures, such as restricting the ratio of price differentials or of profits, and imposing price limits, etc. In August 2004, the NDRC issued a notice setting forth temporary measures to be imposed on thermal coal prices for certain regions. In December 2004, the NDRC issued a notice setting forth guidelines for pricing of thermal coal sales in 2005. Under these guidelines, the coal suppliers and their customers may not negotiate for the sale of coal at prices exceeding the government suggested price range.

Similar to coal pricing, the production and supply of coal, which is dictated by the PRC Government’s annual state coal allocation plan, has been gradually liberalized and largely subject to market forces. Major domestic coal suppliers and coal purchasers attend the Annual National Coal Trading Convention to negotiate and discuss the price and quantity of coal to be supplied and purchased for the coming year through the signing of letters of intent and short and long-term supply contracts.

On December 18, 2006, the National Development and Reform Committee issued the Notice Relating to the Good Preparation for Inter Provincial Coal Production Transportation Works (Fa Gai Yun Xing [2006] No. 2867). According to the notice, in 2007, policies were to be implemented to encourage the reform of the market system for determining coal prices by allowing parties to determine prices through discussions in accordance with market demand, and to encourage price determination based on quality. On December 27, 2006, the relevant government departments and units, such as the National Development and Reform Committee for railway operations, and the Transportation Department, convened a 2007 coal industry video and telephone conference. This symbolized the end of the Annual National Coal Trading Convention that has been in place for over 50 years. Under the State’s macroeconomic controls, the new mechanism for enterprises to freely determine prices through negotiations was put in place.

Fees and Taxes

There are various taxes and fees that are imposed upon coal producers in Heilongjiang Province, as well as statutory reserves which coal producers are required to set aside. Such taxes, fees and statutory reserves as applicable to Tong Gong at December 31, 2010 are as follows:

|

Item

|

|

Base

|

|

Rate

|

|

Corporate income tax

|

|

Taxable income

|

|

25.0%

|

|

VAT

|

|

Revenue from domestic sales

|

|

17.0%

|

|

City construction tax

|

|

Amount of VAT and business tax

|

|

Exempted by National

Government

|

|

Education surcharge

|

|

Amount of VAT and business tax

|

|

Exempted by National

Government

|

|

Anti-flood fee

|

Proceeds from the sale of coal

|

0.1%

|

||

|

Resource tax

|

|

Volume of raw coal produced

|

|

RMB 2.3 per ton

|

|

Compensation for the depletion of coal resources

|

|

Volume of raw coal produced

|

|

RMB 3.0 per ton

|

|

Mine maintenance fund

|

|

Volume of raw coal produced

|

|

RMB 8.7 per ton

|

Such taxes, fees and statutory reserves as applicable to Xing An at December 31, 2010 are as follows:

|

Item

|

|

Base

|

|

Rate

|

|

Corporate income tax

|

|

Taxable income

|

|

25.0%

|

|

VAT

|

|

Revenue from domestic sales

|

|

17.0%

|

|

City construction tax

|

|

Amount of VAT and business tax

|

|

Exempted by National

Government

|

|

Education surcharge

|

|

Amount of VAT and business tax

|

|

3.0%

|

|

Anti-flood fee

|

Proceeds from the sale of coal

|

0.1%

|

||

|

Resource tax

|

|

Aggregate volume of raw coal or coal products sold

|

|

RMB 2.3 per ton

|

|

Compensation for the depletion of coal resources

|

|

Proceeds from the sale of coal

|

|

1%

|

|

Mine maintenance fund

|

|

Volume of raw coal produced

|

|

RMB 8.7 per ton

|

|

Safety fund

|

|

Volume of raw coal produced

|

|

RMB 3.0 per ton

|

|

Environment fund, voluntary fund (Asset retirement obligation)

|

Volume of raw coal produced

|

RMB 1.0 per ton

|

Under the Mineral Resources Law, if mining results in damage to arable land, grasslands or forest areas, the mining enterprise must take effective measures to return the land to an arable state, plant trees or grass or take other measures. The Mineral Resources Law and other applicable laws and regulations also state that anyone who causes others to suffer loss in terms of production or in terms of living standards is held liable for the loss under the law and is required to compensate the persons affected and to remedy the situation. In addition, the Mineral Resources Law also provides for (i) regulations concerning labor safety and hygiene and (ii) environmental protection.

All coal producers are subject to PRC environmental protection laws and regulations which currently impose fees for the discharge of waste substances, require the payment of fines for serious pollution and provide for the discretion of the PRC Government to close any facility which fails to comply with orders requiring it to cease or cure operations causing environmental damage. All environmental protection facilities must be inspected and certified by relevant governmental authorities as being in compliance with PRC environmental protection laws and regulations.

Domestic Trading of Coal

Pursuant to the Measures for the Regulation of Coal Operations promulgated by the NDRC on December 27, 2004, the state implemented a system to examine coal operation qualifications in respect of coal operations, including the wholesale and retail of raw coal and processed coal products, and the processing and distribution of coal for civilian use. Before an enterprise can engage in coal operations, it must obtain a coal operation qualification certificate. A coal production enterprise that deals in coal products which it did not itself produce and process is required to obtain coal operation qualifications. The enterprise is also prohibited from dealing in coal products produced and/or processed by a coal mine enterprise that does not have a coal production permit. An enterprise is also prohibited from selling coal products to a coal operation enterprise that does not have coal operation qualifications.

Although the PRC Government indirectly influences coal prices through its broad regulation of electricity prices and control over the allocation of national railway capacity, domestic coal prices have mainly been market-driven since 2002, when the PRC Government eliminated the price control measures for coal used in electric power generation. Prior to 2006, however, the PRC Government continued to implement temporary measures to prevent and control any unusual fluctuations in thermal coal prices. This, among other reasons, has caused thermal coal contract prices for major users to be generally lower than spot market prices during this period. On January 1, 2006, the NDRC announced the elimination of such temporary intervention practices on thermal coal price, thus completely removing control over thermal coal prices, including contract prices for major users.

Environmental Protection Laws and Regulations

Pursuant to the Environmental Protection Law, MEP is empowered to formulate national environmental quality and discharge standards and to monitor China’s environmental system at the national level for the purpose of preventing and eliminating environmental pollution and damage to ecosystems. Environmental protection bureaus at the county level and above are responsible for environmental protection within their areas of jurisdiction.

Environmental regulations require companies to file an environmental impact report with the relevant environmental authority for approval before undertaking the construction of a new production facility or any major expansion or renovation of an existing production facility. New facilities built pursuant to this approval are not permitted to operate until the relevant environmental authority has performed an inspection and has found that the facilities are in compliance with environmental standards.

Mining operations, including both open pit mines and underground mines, may result in disturbances of surface and underground land and cause water pollution, landslides and other types of environmental damage. To manage the adverse effects that the coal industry has on the environment, China promulgated a series of laws and regulations. Through these laws and regulations, China established national and local environmental protection legal frameworks and issued standards applicable to emission controls, discharges of wastes and pollutants to the environment, generation, handling, storage, transportation, treatment and disposal of waste materials by production facilities, land rehabilitation and reforestation.

The Environmental Protection Law, promulgated by the National People’s Congress December 26, 1989, is the cardinal law for environmental protection in China. The law establishes the basic principle for coordinated advancement of economic growth, social progress and environmental protection, and defines the rights and duties of governments at all levels. Local environmental protection bureaus may set stricter local standards than the national standards and enterprises are required to comply with the stricter of the two sets of standards. The Environmental Protection Law requires any entity operating a facility that produces pollutants or other hazards to incorporate environmental protection measures into its operations and to establish an environmental protection responsibility system, which must adopt effective measures to control and properly dispose of waste gases, waste water, waste residue, dust or other waste materials.

New construction, expansion or reconstruction projects and other installations that directly or indirectly discharge pollutants to the environment shall be subject to relevant state regulations governing environmental protection for such projects. Entities undertaking such projects must submit a pollutant discharge declaration statement detailing the amount, type, location and method of treatment to the competent authorities for examination. The authorities will allow the construction project operator to release a certain amount of pollutants into the environment and will issue a pollutant discharge license for that amount of discharge subject to the payment of discharge fees. The release of pollutants is subject to monitoring by the competent environmental protection authorities. If an entity discharges more than the amount permitted by the pollutant discharge license, the local environmental protection bureau can fine the entity up to several times the discharge fees payable by the offending entity for its allowable discharge, require the offending entity to close its operations, or take other measures to remedy the problem.

In the environmental impact statement of a construction project, the project operator shall make an assessment regarding the pollution and environmental hazards the project is likely to produce and its impact on the ecosystem, and measures for their prevention and control. The operator shall submit the statement according to the specified procedure to the competent environmental protection authority for examination and approval. The building of sewage outlets within any water conservancy projects, such as canals, irrigation channels and reservoirs, shall be subject to the consent of the competent authority in charge of water conservancy projects.

The facilities for the prevention and control of pollution must be designed, constructed and put into use or operation simultaneously with the main part of a construction project. Such facilities must be inspected by the competent environmental protection authority. If they do not conform to the specified requirements, the operator shall not be permitted to put the new facility into operation or use.

The rehabilitation of mining sites is another important issue the PRC Government has sought to address. Under the Law of Land Administration of the People’s Republic of China, promulgated June 15, 1986, and amended on August 28, 2004, and the Land Rehabilitation Regulations, issued by the State Council in 1988 and effective January 1, 1989, coal producers must undertake measures to restore the mining site to its original state within a prescribed time frame if mining activities result in damage to arable land, grassland or forest. The rehabilitated land must meet rehabilitation standards, as required by law from time to time, and may only be subsequently used upon examination and approval by the land authorities. A coal producers’ failure to comply with this requirement or its failure to return the mining site to its original state will result in the imposition of fines, rehabilitation fees and/or rejection of applications for land use rights by the local bureau of land and resources.

Emissions of waste water by coal mines and coking plants are regulated by the Law on Prevention and Control of Water Pollution of the PRC, promulgated by the Standing Committee of National People’s Congress in May 1984 and as amended in May 1996 and February 2008, which became effective in June 2008, and the Administrative Regulations on the Levy and Use of Discharge Fees, issued by the State Council in January 2003 and effective in July 2003. Any new construction projects, such as coal mines and coking plants, must submit an environmental impact statement, which shall include an assessment of the water pollution hazards the project is likely to produce and its impact on the ecosystem. The environmental impact statement must also contain measures to prevent and control the water pollution hazards. Every new production facility must be equipped with waste water processing facilities which must be put in use together with the production facilities. Construction projects that discharge pollutants into water shall pay a pollutant discharge fee in accordance with state regulations.

Violators of the Environmental Protection Law and various environmental regulations may be subject to warnings, payment of damages and fines. Any entity undertaking construction work or manufacturing activities before the pollution and waste control and processing facilities are inspected and approved by the environmental protection department may be ordered to suspend production or operations and may be fined. The violators of relevant environmental protection laws and regulations may be exposed to criminal liability if violations result in severe loss of property, personal injuries or death.

In addition to the PRC environmental laws and regulations, China is a signatory to the 1992 United Nations Framework Convention on Climate Change and the 1998 Kyoto Protocol, which propose emission targets to reduce greenhouse gas emissions. The Kyoto Protocol came into force on February 16, 2005. At present, the Kyoto Protocol has not set any specific emission targets for certain countries, including China.

Mineral Resources Laws and Regulations

Exploration, exploitation and mining operations must comply with the relevant provisions of the Mineral Resources Law and other relevant regulations, and are under the supervision of the Ministry of Land and Resources. Exploration and exploitation of mineral resources are also subject to examination and approval by the Ministry of Land and Resources and relevant local authorities. Upon approval, a mining permit is issued by the relevant administrative authorities, which are responsible for supervision and inspection of mining exploitation in their jurisdictions. The holders of mining rights are required to file annual reports with the relevant administrative authorities.