Attached files

| file | filename |

|---|---|

| EX-31.1 - CERTIFICATION PURSUANT TO SECTION 302 OF SARBANES OXLEY ACT OF 2002 - GSP-2, INC. | f10k2010ex31i_gsp2.htm |

| EX-32.1 - CERTIFICATION PURSUANT TO SECTION 906 OF SARBANES OXLEY ACT OF 2002 - GSP-2, INC. | f10k2010ex32i_gsp2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

x ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2010

o TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___________to ___________

Commission File No. 000-27195

GSP-2, INC.

(Name of small business issuer in its charter)

|

Nevada

|

27-3120288

|

|

|

(State or other jurisdiction of

|

(IRS Employer Identification No.)

|

|

|

incorporation or organization)

|

||

|

Gongzhuling State Agriculture Science and Technology Park, location of 998 kilometers, Line 102,

Gongzhuling city, Jilin province, China

|

||

|

(Address of principal executive offices)

|

(Zip Code)

|

+86-434-627-8415

(Registrant’s telephone number, including area code)

Securities registered under Section 12(b) of the Exchange Act:

|

Title of each class registered:

|

Name of each exchange on which registered:

|

|

|

None

|

None

|

Securities registered under Section 12(g) of the Exchange Act:

Common Stock, $0.001 par value

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yeso Nox

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yeso Nox

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yeso Noo

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yesx Noo

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference Part III of this Form 10-K or any amendment to this Form 10-K. [x]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

o

|

Accelerated filer

|

o

|

|

Non-accelerated filer

|

o

|

Smaller reporting company

|

x

|

|

(Do not check if a smaller reporting company)

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes x No o

As of March 25, 2011, the registrant had 13,800,000 shares of its common stock outstanding.

Documents Incorporated by Reference: None.

TABLE OF CONTENTS

|

PAGE

|

||

|

PART I

|

||

|

ITEM 1.

|

Business

|

2 |

|

ITEM 1A.

|

Risk Factors

|

7 |

|

ITEM 2.

|

Properties

|

8 |

|

ITEM 3.

|

Legal Proceedings

|

8 |

|

ITEM 4.

|

Removed and Reserved

|

8 |

|

PART II

|

||

|

ITEM 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

8 |

|

ITEM 6.

|

Selected Financial Data

|

9 |

|

ITEM 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operation

|

9 |

|

ITEM 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

10 |

|

ITEM 8.

|

Financial Statements and Supplementary Data

|

F- |

|

PART III

|

||

|

ITEM 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

11 |

|

ITEM 9A.

|

Controls and Procedures

|

11 |

|

ITEM 10.

|

Directors, Executive Officers and Corporate Governance

|

12 |

|

ITEM 11.

|

Executive Compensation

|

13 |

|

ITEM 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

14 |

|

ITEM 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

14 |

|

ITEM 14.

|

Principal Accounting Fees and Services

|

15 |

|

PART IV

|

||

|

ITEM 15.

|

Exhibits, Financial Statement Schedules

|

16 |

|

SIGNATURES

|

17 | |

Unless specifically noted otherwise, this Annual Report on Form 10-K (this “Report”) reflects the business and operations of GSP-2, Inc., a Nevada corporation, prior to the reverse acquisition of Shiny Gold Limited, a British Virgin Islands company (“Shiny Gold”), which was completed on February 11, 2011 (the “Share Exchange”). For a more complete discussion of the Share Exchange and the business and operations of Shiny Gold, please see our Current Report on Form 8-K filed with the Securities and Exchange Commission (the “SEC”) on February 11, 2011.

USE OF CERTAIN DEFINED TERMS

Except as otherwise indicated by the context, references in this Report to “we,” “us,” “our,” “our Company,” or “the Company” are to the combined business of GSP-2, Inc. and its consolidated subsidiaries. In addition, unless the context otherwise requires and for the purposes of this Report only:

|

●

|

“GSP-2” refers to GSP-2, Inc., a Nevada company;

|

|

●

|

“Exchange Act” refers to the Securities Exchange Act of 1934, as amended;

|

|

●

|

“Heng Chang HK” refers to Heng Chang HK Produce (HK) Investments, Ltd., a Hong Kong company;

|

|

●

|

“Hengchang Agriculture” refers to Jilin Hengchang Agriculture Development Co., Ltd., a PRC company;

|

|

●

|

“Hengchang Business Consultants” refers to Siping Hengchang Business Consultants Co., Ltd., a PRC company;

|

|

●

|

“Hengjiu” refers to Jilin Hengjiu Grain Purchase and Storage Co., Ltd., a PRC company;

|

|

●

|

“Operating Companies” refers to Hengchang Agriculture and Hengjiu;

|

|

●

|

“PRC” refers to the People’s Republic of China; and

|

|

●

|

“Securities Act” refers to the Securities Act of 1933, as amended; and

|

|

●

|

“Shiny Gold” refers to Shiny Gold Holdings Limited, a British Virgin Islands company.

|

FORWARD-LOOKING STATEMENTS

Certain information included in this Report or in other materials we have filed or will file with the SEC (as well as information included in oral statements or other written statements made or to be made by us) contains or may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934. You can identify these statements by the fact that they do not relate to matters of strictly historical or factual nature and generally discuss or relate to estimates or other expectations regarding future events. They contain words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “may,” “can,” “could,” “might,” “should” and other words or phrases of similar meaning in connection with any discussion of future operating or financial performance. Such statements may include, but are not limited to, information related to: anticipated operating results; consumer demand; financial resources and condition; changes in revenues; changes in profitability; changes in margins; changes in accounting treatment; cost of revenues; selling, general and administrative expenses; interest expense; growth and expansion; anticipated income or benefits to be realized from our investments in unconsolidated entities; the ability to produce the liquidity and capital necessary to expand and take advantage of opportunities; legal proceedings and claims.

From time to time, forward-looking statements also are included in other periodic reports on Forms 10-Q and 8-K, in press releases, in presentations, on our website and in other materials released to the public. Any or all of the forward-looking statements included in this Report and in any other reports or public statements made by us are not guarantees of future performance and may turn out to be inaccurate. This can occur as a result of incorrect assumptions or as a consequence of known or unknown risks and uncertainties. Many factors mentioned in this Report or in other reports or public statements made by us, such as government regulation and the competitive environment, will be important in determining our future performance. Consequently, actual results may differ materially from those that might be anticipated from our forward-looking statements.

Forward-looking statements speak only as of the date they are made. We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise.

1

PART I

|

ITEM 1.

|

BUSINESS.

|

We were incorporated in the State of Nevada on December 31, 2009 as a blank check development stage company formed for the purpose of acquiring an operating business, through a merger, stock exchange, asset acquisition or similar business combination. Prior to the reverse acquisition of Shiny Gold on February 11, 2011, we made no efforts to identify a possible business combination and had not previously conducted negotiations or entered into a letter of intent concerning any target business.

Acquisition of Shiny Gold Limited

On February 11, 2011, we completed the reverse acquisition of Shiny Gold through the Share Exchange whereby we acquired all of the issued and outstanding ordinary shares of Shiny Gold in exchange for 12,800,000 shares of our common stock, par value $0.001 per share, which shares constituted approximately 92.8% of our issued and outstanding shares, as of and immediately after the consummation of the Share Exchange. As a result of the Share Exchange, Shiny Gold became our wholly owned subsidiary and the former shareholders of Shiny Gold became our controlling stockholders. The share exchange transaction with Shiny Gold was treated as a reverse acquisition, with Shiny Gold as the acquirer and the Company as the acquired party.

Upon the closing of the Share Exchange, Peter Goldstein resigned from all offices that he held effective immediately. In addition, Mr. Goldstein resigned from his position as our sole director. Also upon the closing of the reverse acquisition, our Board of Directors appointed Yushan Wei to fill the vacancy created by the resignation of Mr. Goldstein. In addition, our Board of Directors appointed Yushan Wei to serve as our President and Chief Executive Officer and Yufeng Wei as our Chief Operating Officer.

Current Operations

As a result of the Share Exchange, the Company is now a China-based agriculture company which engages in research and genetic development of corn seed, cultivation, production, purchasing, storage, and distribution of corn and other agriculture products. The Company sells high quality agricultural products as raw materials for commercial livestock feeding and other renewable energy uses. We plan to change our name to more accurately reflect our new business operations.

We believe that we have developed a unique model for the Chinese agricultural industry. As Chinese governmental policies place more restrictions on the people of China to reduce the size of their families, there are less people to farm the agricultural crops. The Company’s business model is designed to vertically integrate and manage integral aspects of the agricultural process as a producer, processor, marketer and distributor of agricultural products. The Company engages in research, and genetic development of the seed used for growing corn. The Company sells the corn seed to a major local seed distributor that in turn sells to the local provincial farmers, and provides a full service facility for the farmer when the corn is fully grown and harvested. The Company’s state of the art facilities purchase, separate, store and distribute the corn products for the farmers. The Company also intends to plant and harvest its own land through land use rights that they intend to acquire with the proceeds from a future financing. The Company serves its well established customer base in the Jilin province with its 180 employees. With additional funding, the Company anticipates the acquisition of additional land rights, farming equipment, storage facilities, and additional distribution facilities.

Corporate Structure

We own all of the ordinary shares of Shiny Gold. Shiny Gold was formed under the laws of the British Virgin Islands on May 20, 2010. Shiny Gold owns all of the share capital of Heng Chang HK. Heng Chang HK owns all of the share capital of Hengchang Business Consultants, a wholly foreign owned enterprise located in the PRC. On February 10, 2011, Hengchang Business Consultants entered into a series of agreements (the “Contractual Arrangements”) with each of Hengchang Agriculture and Hengjiu (together, the “Operating Companies”) and their respective shareholders. Other than the parties thereto, the material terms and conditions of the Contractual Arrangements entered into with Hengchang Agriculture and the terms and conditions of the Contractual Arrangements with Hengjiu are the same. The following is a summary of each of the Contractual Arrangements:

2

|

●

|

Exclusive Business Cooperation Agreement. Pursuant to the Exclusive Business Cooperation Agreement between the Operating Companies and Hengchang Business Consultants, Hengchang Business Consultants provides the Operating Companies with exclusive technical, consulting and other services in relation to the principal business of the Operating Companies. In consideration, the Operating Companies pay Hengchang Business Consultants fees equal to 100% of the Operating Companies’ net income, subject to certain adjustments.

|

|

●

|

Shareholders’ Equity Interest Pledge Agreement. Pursuant to the Shareholders’ Equity Interest Pledge Agreement between Hengchang Business Consultants, the Operating Companies and the shareholders of the Operating Companies, the Operating Companies’ shareholders agreed to pledge all of their current and future equity interests in the Operating Companies as security for payment of the consulting and service fees by the Operating Companies under the Exclusive Business Cooperation Agreement.

|

|

●

|

Exclusive Option Agreement. Under the Exclusive Option Agreement between Hengchang Business Consultants, the Operating Companies and the shareholders of the Operating Companies, the Operating Companies shareholders granted to Hengchang Business Consultants an irrevocable and exclusive right to purchase, or designate one or more persons to purchase all or part of the equity interest held by the shareholders in the Operating Companies to the extent that such purchase does not violate any PRC law or regulations then in effect. Hengchang Business Consultants and the Operating Companies shareholders shall enter into further agreements based on the circumstances of the exercise of the option, including price.

|

|

●

|

Power of Attorney. Under the Power of Attorney executed by the shareholders of the Operating Companies, the Operating Companies’ shareholders irrevocably and exclusively appointed Hengchang Business Consultants as their exclusive agent with respect to all matters concerning the shareholders, including but not limited to: 1) attending the Operating Companies’ shareholder meetings; 2) exercising all of the shareholders’ rights and voting rights; and 3) designating and appointing on behalf of the shareholders the legal representative, executive director and other senior management members of the Operating Companies.

|

Shiny Gold controls and receives the economic benefits of the Operating Companies’ business operations through the Contractual Arrangements, but does not own any equity interests in the Operating Companies. In addition, as a result of the Contractual Arrangements, the Operating Companies are deemed to be Shiny Gold’s variable interest entities and, accordingly, Shiny Gold consolidates the Operating Companies’ results, assets and liabilities into its financial statements.

3

The corporate structure of the Company as a result of the Share Exchange is as follows:

Our Industry

China’s economy has grown rapidly in recent years making China one of the fastest growing economies in the world. China’s agricultural industry has also grown significantly, driven by the growth of the overall economy. According to the China Statistical Abstract, the increase in China’s agricultural production is the result of an increase in the consumption of food products such as crops and meat proteins for human and animal nutrition, as well as food products for industrial uses such as fuels and materials. However, while domestic productions have grown, it has not kept pace with consumption resulting in imports of many agricultural products such as corn.

Despite its recent rapid growth, the agricultural industry in China remains at an early stage of modernization, with significant manual labor and less usage of advanced machinery and irrigation than that of developed economies. In an effort to modernize and promote development of the agricultural industry in China, the Chinese government has provided substantial financial support to agricultural and related business through low interest loans, preferential tax treatments, financial subsidies and other measures. In the mean time, Chinese farmers are increasingly using improved production techniques and products, including hybrid seeds.

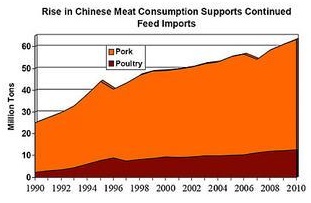

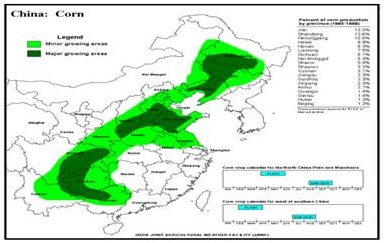

China is the world’s second largest corn producer after the United States. Coincident with the growth of its economy and the agricultural industry, corn production in China has grown at a rate more than twice the growth rate of the United States. Corn is used primarily as animal feed particularly for chickens and pigs as well as food for human consumption. According to the China National Grain and Oil Information Center, almost three quarters of Chinas total corn production was used to produce animal feed and 20% was used to produce ethanol, and the other 5% was used for human consumption.

4

The increasing demand for corn in China has been partially driven by the increasing demand for animal feed, which in turn has been driven by the significant growth in meat consumption as a result of the recent rapid growth in per capita disposable income in China. For more than two decades, China was one of the world’s largest net corn exporting countries. However, due to the rapid increase on domestic demand for corn in China, China now exports significantly less corn than it used to and its imports of corn have increased considerably.

We believe production of, and demand for, corn are likely to continue to rise as Chinas economy further develops, driven by increasing demands across all major uses of corn. Given limitations on land available for corn production, we believe use of hybrid corn seeds that can produce corn with characteristics such as high yielding drought or pest resistant or high oil content is also likely to continue to increase. As competition for suitable land in China for other crops continues while demand for corn increases, Chinese farmers may be inclined to utilize better production methods to increase yields and improve the quality and attributes of their corn products. We believe that the relatively low corn consumption per capita in China coupled with the rapid increase in domestic demand for corn demonstrates significant potential for China’s corn market to further grow.

Our Products

The chart below provides selected summary information about our corn and corn seed products:

|

Name

|

Promoting Area

|

Growth Area

|

|

Defeng (Hongyu) 29

|

Jilin Province

|

Mid-Late maturity

|

|

Defeng 77

|

Jilin Province

|

Late maturity

|

|

Defeng 108

|

Jilin Province

|

Late maturity

|

We generated the majority of our revenue from sales of corn. Defeng seed varieties have been widely planted in three northeastern provinces. The seeds are also being planted in certain areas in inner Mongolia. Defeng 29 and Defeng 77 corn seeds combined accounted for 22% of annual sales volume in 2010.

5

Research & Development

We believe that our future success depends on our ability to provide high quality and advanced products to our customers. We place strong emphasis on research and development to enhance the quality and competitiveness of our products. We conduct research and development through both our in-house research and development team and in cooperation with Jilin Academy of Agricultural Sciences, Tonghua City Academy of Agricultural Sciences and other research institutions.

Our own research team consists of research professionals and staff; among which are national corn and sorghum seed experts and senior technicians. Our research and development professionals have a primary and specialized focus in the agricultural biotechnology fields.

Quality Control

We believe our product quality standards are generally higher than the national industry standards in China.

Intellectual Property

Many elements of our proprietary information, such as production processes, technologies, know-how and data are not patentable in China. We rely primarily on a combination of trade secrets, trademarks, and confidentiality agreements with employees and third parties to protect our intellectual property.

Corn Seed

We have proprietary planting rights to five types of seed corns. New crop seeds must pass examination and approval by national or provincial governmental authorities before they are marketed and distributed. The examination and approval committees usually consist of professionals and experts from the agricultural and forestry governmental agencies. Defeng 10,77,101,108 and Defeng (Hongyu) 29 have passed the examination and approval from the Jilin Crop Variety Examination and Approval Committee. Once they pass the test and verification, these types of corn may be marketed and distributed.

Growth Strategy

The Company anticipates growing its business through acquisition of additional land use rights, cultivation of that land, and modernization of farming techniques. The Company expects to begin cultivating and farming 10,300 plus acres in 2011. This will produce approximately 42,000 tons of corn. The Company’s state of the art facilities are set up to separate, store and distribute the corn products for the Company and the local farmers. This unique operating process facilitates the sales of the seed and fertilizer all the way through to the distribution and sales of the harvested corn and soybeans. Additional growth strategy for the Company is in their acquisition of land use rights. The Company anticipates acquiring upwards of 50,000 additional land use acreage rights. With the Company reaching its ultimate ability to control the cultivation and harvesting of more than 50,000 acres of corn, it will more than double its current volume, and with the increase in efficiency will continue to drive the profits of the Company.

6

Marketing and Customer Support

Our product marketing and our customer support are closely linked. The company supplies over 100,000 farmers in the Jilin, Liaoning and Heilongjiang provinces. In these provinces, where usually there is one agent assigned to each province, the Company has assigned 120 agents to the Jilin province, 42 in Liaoning, and 86 in Heilongjiang province.

Competition

The agricultural industry in China is highly fragmented, largely regional and competitive. We do expect future competition; however, there is no immediate or direct competitor with the Company, as the Company is the largest seller in the Gongzhulin province. Additionally, starting in 2010, there has been a shortage of corn supply globally and the supply in the PRC is very tight. The Company does not have any concern in being able to sell all of their crop inventories.

Competitive Advantages

We believe that the following strengths have contributed to our current market position:

|

●

|

We have expanded the production capacity in the corn seed segment by obtaining access to additional farmland across major geographic regions in China. We currently have access to approximately 3,800 acres of farmland in the Jilin province for corn seed production.

|

|

●

|

We produce four types of proprietary corn seed products with one or more of the following special characteristics: high yield, disease resistance; drought resistance; high starch content; and stress tolerance. We are developing more varieties of corn seeds with these characteristics, as well as seeds for corn with high oil content and pest resistant corn.

|

|

●

|

Our core production base is strategically located in the Jilin province in the northern region of China, which is one of the largest corn seed production areas in China and is highly suited to growing corn and corn seeds due to its geographical and climate conditions.

|

|

●

|

The Company’s state of the art facilities separate, store and distribute the corn products for the farmers. This unique operating process facilitates the sales of the seed all the way through to the distribution and sales of the harvested corn. The Company has negotiated contracts with the government for sales of the harvested corn products. The Company owns its own railroad tracks that allow it to load up to 29 carts of corn at one time. Each cart holds approximately 60 to 70 tons of corn. As the Company’s main customers are the local governments, they ensure that the Company is able to get the rail time needed to ship the products on time.

|

|

●

|

Our quality management for the production of our corn seed involves rigorous quality control and inspection procedures. For corn seed production, we carefully select parent seeds before growing seeds on a mass scale. During the entire production process, we continually provide technical guidance to the village collectives and seed production companies that are contracted to grow our seeds, and we supervise the production and harvest process.

|

|

ITEM 1A.

|

RISK FACTORS.

|

Not required for smaller reporting companies.

|

ITEM 1B.

|

UNRESOLVED STAFF COMMENTS.

|

None.

7

|

ITEM 2.

|

PROPERTIES.

|

Prior to the Share Exchange, we neither rented nor owned any properties. We utilized the office space and equipment of our previous management at no cost. Previous management estimated such amounts to be immaterial.

As a result of the Share Exchange, our principal executive offices are now located in the Gongzhuling State Agricultural Technology Park. The Company operates the separation, storage and distribution processes along with the business offices on approximately 42 acres of land. The Company has 9 storage warehouses that can have a total capacity of 260,000 tons of product. All storage facilities are covered with cooling and air circulating systems, and are equipped with electronic grain temperature inspection systems. The Company also has approximately ¼ mile of rail tracks for distribution purposes that can hold 29 train cars, each which holds upwards of 60 to 70 tons of corn.

|

ITEM 3.

|

LEGAL PROCEEDINGS.

|

Prior to the Share Exchange, there were no pending legal proceedings to which the Company was a party or in which any former director, officer or affiliate of the Company, any owner of record or beneficially of more than 5% of any class of voting securities of the Company, or security holder was a party adverse to the Company or had a material interest adverse to the Company.

From time to time, we may become involved in various lawsuits and legal proceedings which arise in the ordinary course of business. However, litigation is subject to inherent uncertainties and an adverse result in these or other matters may arise from time to time that may harm our business. We are currently not aware of any such legal proceedings or claims that we believe will have a material adverse affect on our business, financial condition or operating results.

|

ITEM 4.

|

(REMOVED AND RESERVED).

|

PART II

|

ITEM 5.

|

MARKET FOR REGISTRANTS COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

|

Market Information

No established public market exists for our common stock.

Holders

As of the date of this Report, there are approximately 14 holders of record of our common stock. This number does not include shares held by brokerage clearing houses, depositories or others in unregistered form.

Dividends

We have never declared or paid a cash dividend. Any future decisions regarding dividends will be made by our Board of Directors. We currently intend to retain and use any future earnings for the development and expansion of our business and do not anticipate paying any cash dividends in the foreseeable future. Our Board of Directors has complete discretion on whether to pay dividends. Even if our Board of Directors decides to pay dividends, the form, frequency and amount will depend upon our future operations and earnings, capital requirements and surplus, general financial condition, contractual restrictions and other factors that the Board of Directors may deem relevant.

Securities Authorized for Issuance under Equity Compensation Plans

We do not have in effect any compensation plans under which our equity securities are authorized for issuance.

8

|

ITEM 6.

|

SELECTED FINANCIAL DATA.

|

|

|

We are not required to provide the information required by this Item because we are a smaller reporting company.

|

|

ITEM 7.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITIONS AND RESULTS OF OPERATIONS.

|

The following discussion relates to the financial condition and results of operations of the Company as of, and for the years ended, December 31, 2009 and 2010 and does not reflect the potential impact of the Share Exchange. The following discussion should be read in conjunction with the Consolidated Financial Statements and Notes thereto appearing elsewhere in this Report.

Overview

We were incorporated in the State of Nevada on December 31, 2009 as a blank check development stage company formed for the purpose of acquiring an operating business, through a merger, stock exchange, asset acquisition or similar business combination. Prior to the reverse acquisition of Shiny Gold on February 11, 2011, we made no efforts to identify a possible business combination and had not previously conducted negotiations or entered into a letter of intent concerning any target business.

On February 11, 2011, we completed the reverse acquisition of Shiny Gold through the Share Exchange whereby we acquired all of the issued and outstanding ordinary shares of Shiny Gold in exchange for 12,800,000 shares of our common stock, par value $0.001 per share, which shares constituted approximately 92.8% of our issued and outstanding shares, as of and immediately after the consummation of the Share Exchange. As a result of the Share Exchange, Shiny Gold became our wholly owned subsidiary and the former shareholders of Shiny Gold became our controlling stockholders. The share exchange transaction with Shiny Gold was treated as a reverse acquisition, with Shiny Gold as the acquirer and the Company as the acquired party.

Upon the closing of the Share Exchange, Peter Goldstein resigned from all offices that he held effective immediately. In addition, Mr. Goldstein resigned from his position as our sole director. Also upon the closing of the reverse acquisition, our Board of Directors appointed Yushan Wei to fill the vacancy created by the resignation of Mr. Goldstein. In addition, our Board of Directors appointed Yushan Wei to serve as our President and Chief Executive Officer and Yufeng Wei as our Chief Operating Officer.

As a result of the Share Exchange, the Company is now a China-based agriculture company which engages in research and genetic development of corn seed, cultivation, production, purchasing, storage, and distribution of corn and other agriculture products. The Company sells high quality agricultural products as raw materials for commercial livestock feeding and other renewable energy uses. We plan to change our name to more accurately reflect our new business operations.

Results of Operations

Because we did not have any business operations in fiscal 2010, we have not had any revenues during the period of inception through December 31, 2010. Total expenses for the period from inception to December 31, 2010 were $12,114. These expenses constituted professional, administrative and filing fees.

Liquidity and Capital Resources

As of December 31, 2010, we had no in cash available and had liabilities of $11,114. We were a development stage company and generated no revenue as of December 31, 2010.

Off Balance Sheet Arrangements

None.

9

Critical Accounting Policies

Use of Estimates

In preparing financial statements in conformity with generally accepted accounting principles, management is required to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and revenues and expenses during the reported period. Actual results could differ from those estimates.

Loss Per Share

Basic and diluted net loss per common share is computed based upon the weighted average common shares outstanding as defined by FASB Accounting Standards Codification Topic 260, “Earnings Per Share.” As of December 31, 2010 and 2009, there were no common share equivalents outstanding.

Income Taxes

The Company accounts for income taxes under FASB Codification Topic 740-10-25 (“ASC 740-10-25”). Under ASC 740-10-25, deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. Under ASC 740-10-25, the effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date.

Fair Value of Financial Instruments

The carrying amounts reported in the balance sheets for accounts payable approximate fair value based on the short-term maturity of these instruments.

|

ITEM 7A.

|

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

|

|

|

We are not required to provide the information required by this Item because we are a smaller reporting company.

|

10

GSP -2, INC.

(A DEVELOPMENT STAGE COMPANY)

CONTENTS

|

PAGE

|

F-2

|

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

|

|

PAGE

|

F-3

|

BALANCE SHEETS AS OF DECEMBER 31, 2010 AND DECEMBER 31, 2009

|

|

PAGE

|

F-4

|

STATEMENTS OF OPERATIONS FOR THE YEAR ENDED DECEMBER 31, 2010, THE ONE DAY PERIOD ENDED DECEMBER 31, 2009 AND THE PERIOD FROM DECEMBER 31, 2009 (INCEPTION) TO DECEMBER 31, 2010

|

|

PAGE

|

F-5

|

STATEMENT OF CHANGES IN STOCKHOLDERS’ DEFICIENCY FOR THE PERIOD FROM DECEMBER 31, 2009 (INCEPTION) TO DECEMBER 31, 2010

|

|

PAGE

|

F-6

|

STATEMENTS OF CASH FLOWS FOR THE YEAR ENDED DECEMBER 31, 2010, THE ONE DAY PERIOD ENDED DECEMBER 31, 2009 AND THE PERIOD FROM DECEMBER 31, 2009 (INCEPTION) TO DECEMBER 31, 2010

|

|

PAGES

|

F-7-F-10

|

NOTES TO FINANCIAL STATEMENTS

|

F-1

|

Webb & Company, P.A.

|

|

Certified Public Accountants

|

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors of:

GSP-2, Inc.

(A Development Stage Company)

We have audited the accompanying balance sheets of GSP-2, Inc. (A Development Stage Company) (the "Company") as of December 31, 2010 and 2009 and the related statements of operations, changes in stockholders' deficiency and cash flows for the year ended December 31, 2010, the one day period ended December 31, 2009, and the period December 31, 2009 (Inception) to December 31, 2010. These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly in all material respects, the financial position of GSP-2, Inc. (A Development Stage Company) as of December 31, 2010 and 2009 and the results of its operations and its cash flows for the year ended December 31, 2010, the one day period ended December 31, 2009 and the period December 31, 2009 (Inception) to December 31, 2010 in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern as discussed in Note 4 to the financial statements, the Company has a net loss of $12,414 from Inception, a working capital and a stockholders' deficiency of $11,114 as of December 31, 2010. These factors raise substantial doubt about the Company's ability to continue as a going concern. Management's plans concerning these matters are also described in Note 4. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ Webb & Company, P.A.

WEBB & COMPANY, P.A.

Certified Public Accountants

Boynton Beach, Florida

March 30, 2011

|

1500 Gateway Boulevard, Suite 202 • Boynton Beach, FL 33426

|

|

Telephone: (561) 752-1721 • Fax: (561) 734-8562

|

|

www.cpawebb.com

|

F-2

|

GSP -2, Inc.

|

||||||||

|

(A Development Stage Company)

|

||||||||

|

Condensed Balance Sheets

|

||||||||

|

For the period from

|

||||||||

|

December 31, 2009

|

||||||||

|

As of

|

(Inception) to | |||||||

|

December 31, 2010

|

December 31, 2010

|

|||||||

|

ASSETS

|

||||||||

|

Total Assets

|

$ | - | $ | - | ||||

|

LIABILITIES AND STOCKHOLDERS' DEFICIENCY

|

||||||||

|

Current Liabilities

|

||||||||

|

Accounts Payable

|

$ | 11,114 | $ | 830 | ||||

|

Total Liabilities

|

11,114 | 830 | ||||||

|

Commitments and Contingencies

|

- | - | ||||||

|

Stockholders' Deficiency

|

||||||||

|

Preferred stock, $0.001 par value; 10,000,000 shares authorized,

|

||||||||

|

none issued and outstanding

|

- | - | ||||||

|

Common stock, $0.001 par value; 100,000,000 shares authorized, 1,000,000

|

1,000 | 1,000 | ||||||

|

and 1,000,000 issued and outstanding, respectively

|

||||||||

|

Additional paid-in capital

|

- | - | ||||||

|

Deficit accumulated during the development stage

|

(12,114 | ) | (1,830 | ) | ||||

|

Total Stockholders' Deficiency

|

(11,114 | ) | (830 | ) | ||||

|

Total Liabilities and Stockholders' Deficiency

|

$ | - | - | |||||

See Accompanying Notes to Condensed Financial Statements

F-3

|

GSP -2, Inc.

|

||||||||||||

|

(A Development Stage Company)

|

||||||||||||

|

Condensed Statements of Operations

|

||||||||||||

|

For the period from

|

||||||||||||

|

For the

|

For the

|

December 31, 2009

|

||||||||||

|

three months ended

|

twelve months ended

|

(Inception) to | ||||||||||

|

December 31, 2010

|

December 31, 2010

|

December 31, 2010

|

||||||||||

|

Operating Expenses

|

||||||||||||

|

Professional fees

|

$ | 5,985 | $ | 10,284 | $ | 11,114 | ||||||

|

Stock compensation

|

- | - | 1,000 | |||||||||

|

Total Operating Expenses

|

5,985 | 10,284 | 12,114 | |||||||||

|

LOSS FROM OPERATIONS BEFORE INCOME TAXES

|

(5,985 | ) | (10,284 | ) | (12,114 | ) | ||||||

|

Provision for Income Taxes

|

- | - | - | |||||||||

|

NET LOSS

|

$ | (5,985 | ) | $ | (10,284 | ) | $ | (12,114 | ) | |||

|

Net Loss Per Share - Basic and Diluted

|

(0.01 | ) | (0.01 | ) | ||||||||

|

Weighted average number of shares outstanding

|

1,000,000 | 1,000,000 | ||||||||||

|

during the period - Basic and Diluted

|

||||||||||||

See Accompanying Notes to Condensed Financial Statements

F-4

|

GSP -2, Inc.

|

||||||||||||||||||||||||||||

|

(A Development Stage Company)

|

||||||||||||||||||||||||||||

|

Condensed Statement of Changes in Stockholders' Deficiency

|

||||||||||||||||||||||||||||

|

For the period from December 31, 2009 (Inception) to December 31, 2010

|

||||||||||||||||||||||||||||

|

Deficit

|

||||||||||||||||||||||||||||

|

Preferred Stock

|

Common stock

|

Additional

|

accumulated during

|

Total

|

||||||||||||||||||||||||

|

paid-in

|

development

|

Stockholders'

|

||||||||||||||||||||||||||

|

Shares

|

Amount

|

Shares

|

Amount

|

capital

|

stage

|

Deficiency

|

||||||||||||||||||||||

|

Common stock issued for services to founder ($0.001/share)

|

- | $ | - | 1,000,000 | $ | 1,000 | $ | - | $ | - | $ | 1,000 | ||||||||||||||||

|

Net loss for the one day period ended December 31, 2009

|

- | - | - | - | - | (1,830 | ) | (1,830 | ) | |||||||||||||||||||

|

Balance, December 31, 2009

|

- | - | 1,000,000 | 1,000 | - | (1,830 | ) | (830 | ) | |||||||||||||||||||

|

Net loss for the Twelve month period ended December 31, 2010

|

- | - | - | - | - | (10,284 | ) | (10,284 | ) | |||||||||||||||||||

|

Balance, December 31, 2010

|

- | $ | - | 1,000,000 | $ | 1,000 | $ | - | $ | (12,114 | ) | $ | (11,114 | ) | ||||||||||||||

See Accompanying Notes to Condensed Financial Statements

F-5

|

(A Development Stage Company)

|

||||||||||||

|

Condensed Statements of Cash Flows

|

||||||||||||

|

For the

|

||||||||||||

|

|

For the

|

For the

|

period from

|

|||||||||

| three month | twelve month | December 31, 2009 | ||||||||||

|

period ended

|

period ended

|

(Inception) to

|

||||||||||

|

December 31, 2010

|

December 31, 2010

|

December 31, 2010

|

||||||||||

|

Cash Flows From Operating Activities:

|

||||||||||||

|

Net Loss

|

$ | (5,985 | ) | $ | (10,284 | ) | $ | (12,114 | ) | |||

|

Adjustments to reconcile net loss to net cash used in operations

|

||||||||||||

|

Common stock issued for services

|

- | 1,000 | 1,000 | |||||||||

|

Changes in operating assets and liabilities:

|

||||||||||||

|

Increase in accounts payable and accrued expenses

|

5,985 | 9,284 | 11,114 | |||||||||

|

Net Cash Used In Operating Activities

|

- | - | - | |||||||||

|

Cash Flows From Investing Activities:

|

- | - | - | |||||||||

|

Cash Flows From Financing Activities:

|

- | - | - | |||||||||

|

Net Increase in Cash

|

- | - | - | |||||||||

|

Cash at Beginning of Period

|

- | - | - | |||||||||

|

Cash at End of Period

|

$ | - | $ | - | $ | - | ||||||

|

Supplemental disclosure of cash flow information:

|

||||||||||||

|

Cash paid for interest

|

$ | - | $ | - | $ | - | ||||||

|

Cash paid for taxes

|

$ | - | $ | - | $ | - | ||||||

See Accompanying Notes to Condensed Financial Statements

F-6

GSP - 2, INC.

(A DEVELOPMENT STAGE COMPANY)

NOTES TO FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2010 and 2009

|

NOTE 1

|

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES AND ORGANIZATION

|

(A) Organization

GSP-2, Inc. (a development stage company) (the "Company") was incorporated under the laws of the State of Nevada on December 31, 2009. The Company was organized to provide business services and financing to emerging growth entities.

The Company was formed to engage in any lawful corporate undertaking, including, but not limited to, selected mergers and acquisitions. It has been in the developmental stage since inception and has no operations to date. It will attempt to locate and negotiate with a business entity for the combination of that target company with us. The combination will normally take the form of a merger, stock- for-stock exchange or stock-for-assets exchange. In most instances, the target company will wish to structure the business combination to be within the definition of a tax-free reorganization under Section 351 or Section 368 of the Internal Revenue Code of 1986, as amended. No assurances can be given that it will be successful in locating or negotiating with any target company.

Activities during the development stage include developing the business plan and raising capital.

(B) Use of Estimates

In preparing financial statements in conformity with generally accepted accounting principles, management is required to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and revenues and expenses during the reported period. Actual results could differ from those estimates.

(C) Cash and Cash Equivalents

The Company considers all highly liquid temporary cash investments with an original maturity of three months or less to be cash equivalents. As of December 31, 2010 and December 31, 2009, the Company had no cash equivalents.

(D) Loss Per Share

Basic and diluted net loss per common share is computed based upon the weighted average common shares outstanding as defined by FASB Accounting Standards Codification Topic 260, “Earnings Per Share.” As of December 31, 2010 and 2009, there were no common share equivalents outstanding.

F-7

GSP - 2, INC.

(A DEVELOPMENT STAGE COMPANY)

NOTES TO FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2010 and 2009

(E) Income Taxes

The Company accounts for income taxes under FASB Codification Topic 740-10-25 (“ASC 740-10-25”). Under ASC 740-10-25, deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. Under ASC 740-10-25, the effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date.

|

2010

|

2009

|

|||||||

|

Expected income tax recovery (expense) at the statutory

|

$ | (3,497 | ) | $ | (622 | ) | ||

|

rate of 34%

|

||||||||

|

Tax effect of expenses that are not deductible for income tax

|

- | 340 | ||||||

|

purposes (net of other amounts deductible for tax purposes)

|

||||||||

|

Change in valuation allowance

|

3,497 | 282 | ||||||

|

Provision for income taxes

|

$ | - | $ | - | ||||

|

The components of deferred income taxes are as follows:

|

||||||||

| 2010 | 2009 | |||||||

|

Deferred income tax asset:

|

||||||||

|

Net operating loss carryforwards

|

$ | 3,779 | $ | 282 | ||||

|

Valuation allowance

|

(3,799 | ) | (282 | ) | ||||

|

Deferred income taxes

|

$ | - | $ | - | ||||

As of December 31, 2010, the Company has a net operating loss carryforward of approximately $11,100 available to offset future taxable income through 2030. The increase in the valuation allowance at December 31, 2010 was $3,497.

(F) Business Segments

The Company operates in one segment and therefore segment information is not presented.

F-8

GSP - 2, INC.

(A DEVELOPMENT STAGE COMPANY)

NOTES TO FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2010 and 2009

(G) Revenue Recognition

The Company will recognize revenue on arrangements in accordance with FASB ASC No. 605, “Revenue Recognition”. In all cases, revenue is recognized only when the price is fixed and determinable, persuasive evidence of an arrangement exists, the service is performed and collectability of the resulting receivable is reasonably assured.

(H)Fair Value of Financial Instruments

The carrying amounts reported in the balance sheets for accounts payable approximate fair value based on the short-term maturity of these instruments.

|

NOTE 2

|

STOCKHOLDERS’ DEFICIENCY

|

Stock Issued for Services

On December 31, 2009, the Company issued 1,000,000 shares of common stock to its founder having a fair value of $1,000 ($0.001/share) in exchange for services provided (See Note 3).

|

NOTE 3

|

RELATED PARTY TRANSACTION

|

On December 31, 2009, the Company issued 1,000,000 shares of common stock to its founder having a fair value of $1,000 ($0.001/share) in exchange for services provided (See Note 2).

|

NOTE 4

|

GOING CONCERN

|

As reflected in the accompanying financial statements, the Company is in the development stage with limited operations. The Company has a net loss of $12,114 from inception and has a working capital and stockholders’ deficiency of $11,114 at December 31, 2010. This raises substantial doubt about its ability to continue as a going concern. The ability of the Company to continue as a going concern is dependent on the Company’s ability to obtain funding from its principal stockholder and implement its business plan. The financial statements do not include any adjustments that might be necessary if the Company is unable to continue as a going concern.

Management believes that actions presently being taken to obtain additional stockholder loans and implement its strategic plans provide the opportunity for the Company to continue as a going concern.

F-9

GSP - 2, INC.

(A DEVELOPMENT STAGE COMPANY)

NOTES TO FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2010 and 2009

|

NOTE 5

|

SUBSEQUENT EVENT

|

On February 11, 2011 the Company, entered into a plan of reorganization with Shiny Gold Holdings LTD (“Shiny Gold”). The Company issued 12,800,000 shares of common stock for 100% of the outstanding shares of Shiny Gold. As a result of the transaction, shareholders of Shiny Gold owned 92.8% of the combined entity upon completion of the transaction. The transaction will be recorded as a reverse merger and recapitalization wherein GSP-2, (the shell), is the legal acquirer and whereas Shiny Gold, (the operating company), is the accounting acquirer.

F-10

|

ITEM 9.

|

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE.

|

|

|

None.

|

|

ITEM 9A.

|

CONTROLS AND PROCEDURES.

|

Evaluation of Disclosure Controls and Procedures

Our principal executive officer and principal financial officer, after evaluating the effectiveness of our disclosure controls and procedures (as defined in paragraph (e) of Rules 13a-15 and 15d-15 under the Securities Exchange Act of 1934) as of the end of the period covered by this Report, have concluded, that, based on such evaluation, our disclosure controls and procedures were effective to ensure that information required to be disclosed by us in the reports that we file or submit under the Securities Exchange Act of 1934 is recorded, processed, summarized and reported, within the time periods specified in the SEC’s rules and forms and is accumulated and communicated to management, including the Chief Executive Officer and Chief Financial Officer, or persons performing similar functions, as appropriate to allow timely decisions regarding required disclosure, particularly during the period in which this Report was being prepared.

11

Changes in Internal Control Over Financial Reporting

There were no changes in our internal control over financial reporting, identified in connection with the evaluation of such internal control that occurred during the fourth quarter of our last fiscal year that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

This Report does not include a report of management’s assessment regarding internal control over financial reporting or an attestation report of the Company’s registered public accounting firm due to a transition period established by rules of the SEC for newly public companies.

PART III

|

ITEM 10.

|

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE.

|

The following sets forth information about our directors and executive officers as of the date of this Report:

|

Name

|

Age

|

Position

|

||

|

Yushan Wei

|

45 |

Chairman of the Board of Directors, President and Chief Executive Officer

|

||

|

Yufeng Wei

|

43 |

Chief Operating Officer

|

Mr. Yushan Wei was appointed as our President and Chief Executive Officer on February 11, 2011 and became the Chairman of our Board of Directors upon the closing of the Share Exchange. Mr. Wei has extensive experience in the grain and seeds industry. Mr. Wei established Jinling Woods Co., Limited at Gongzhuling City in 1996. In 2004, he co-established Hengchang Agriculture and has since served as its President and Chief Executive Officer. Under his management, the grain reserve capacity of Hengchang Agriculture has grown from less than 100,000 tons to almost 300,000 tons. Mr. Wei graduated from Inner Mongolia Medical College in 1988.

Mr. Yufeng Wei was appointed as our Chief Operating Officer on February 11, 2011. Mr. Wei has over 20 years experience in the agriculture industry. From July 1990 to June 1996, Mr. Wei served as the director of Wuzhou Xinmin Granary in Guangxi Zhuang Autonomous Region of China. From June 1996 to March 1999, he served as the Chairman and General Manager of Guangxi Wuzhou Lenong Co., Ltd. From March 1999 to December 2003, Mr. Wei was working at the Wuzhou Branch of the grain reserves of the central people’s government as the vice director. In January 2004, Mr. Wei co-established Hengchang Agriculture and has since served as its Chief Operating Officer, in which capacity he has been assisting the Chief Executive Officer on the management, client development, strategic planning, and related substantial issues for the company. Mr. Wei graduated from Nanjing University of Agriculture and Economics in 1990 with a bachelor’s degree on grain reserves.

Family Relationships

Yushan Wei and Yufeng Wei are brothers. There are no other family relationships among any of our officers or directors.

Section 16(a) Beneficial Ownership Reporting Compliance

Under the securities laws of the United States, the Company’s directors, its executive officers, and any persons holding more than ten percent of the Company’s common stock are required to report their initial ownership of the Company’s common stock and any subsequent changes in that ownership to the SEC. Specific due dates for these reports have been established, and the Company is required to disclose in this Report any failure to file by these dates. Based solely upon a review of such reports, we believe that these filing requirements were satisfied on a timely basis.

12

Code of Ethics

We have not adopted a code of ethics that applies to our principal executive officer, principal financial officer, principal accounting officer, or persons performing similar functions, because of the small number of persons involved in the management of the Company.

Board Committees

Our Board of Directors has no separate committees and our Board of Directors acts as the audit committee and the compensation committee. We do not have an audit committee financial expert serving on our Board of Directors.

|

ITEM 11.

|

EXECUTIVE COMPENSATION.

|

The following sets forth information with respect to the compensation awarded or paid to Peter Goldstein, our former President, for all services rendered by him in all capacities to us in fiscal 2010 and 2009. Mr. Goldstein was our sole named executive officer for fiscal 2010 and 2009. On February 11, 2011 and in connection with the Share Exchange, Mr. Goldstein resigned as an executive officer of the Company and Yushan Wei was appointed as our President and Chief Executive Officer and Yufeng Wei was appointed as our Chief Operating Officer.

Summary Compensation Table

The following table sets forth information regarding each element of compensation that we pay or award to Mr. Goldstein for fiscal 2010 and 2009.

|

Name and

Principal Position

|

Year

|

Salary($)

|

All Other

Compensation ($)

|

Total($)

|

|||||||||

|

Peter Goldstein (1)

|

2010

|

$ | 0 | $ | 0 | $ | 0 | ||||||

|

Former President

|

2009

|

$ | 0 | $ | 1,000 | $ | 1,000 | ||||||

|

(1)

|

The Company was incorporated on December 31, 2009 and paid $1,000 in stock to Mr. Goldstein as compensation in fiscal 2009. The Company did not pay any compensation to Mr. Goldstein in fiscal 2010.

|

Outstanding Equity Awards at Fiscal Year-End Table

We had no outstanding equity awards as of the end of fiscal 2010.

Employment Agreements

We did not have an employment agreement with Mr. Goldstein.

Compensation of Directors

We had no non-management directors in fiscal 2010 or fiscal 2009. Management directors are not compensated for their service as directors. The compensation received by our management directors for their services as employees of the Company is shown in the “Summary Compensation Table” of this Report above.

Compensation Committee Interlocks and Insider Participation

Our Board of Directors does not have a compensation committee and the entire Board of Directors performs the functions of a compensation committee.

No member of our Board of Directors has a relationship that would constitute an interlocking relationship with our executive officers or directors or another entity.

13

|

ITEM 12.

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS.

|

The following table sets forth certain information as of March 25, 2011 with respect to the holdings of: (1) each person known to us to be the beneficial owner of more than 5% of our common stock; (2) each of our directors, nominees for director and named executive officers; and (3) all directors and executive officers as a group. To the best of our knowledge, each of the persons named in the table below as beneficially owning the shares set forth therein has sole voting power and sole investment power with respect to such shares, unless otherwise indicated. Unless otherwise specified, the address of each of the persons set forth below is in care of the Company, Gongzhuling State Agriculture Science and Technology Park, location of 998 kilometers, Line 102, Gongzhuling city, Jilin province, China.

|

Name of Beneficial Owner

|

Amount and Nature of Beneficial Ownership

|

Percent of

Common Stock

|

||

|

Yushan Wei

|

0

|

*

|

||

|

Yufeng Wei

|

0

|

*

|

||

|

All directors and executive officers as a group (2 persons)

|

0

|

*

|

||

|

|

||||

|

Peter Goldstein

650 Sweet Bay Avenue

Plantation, Florida 33324

|

1,000,000

|

7.25%

|

||

|

Ally Joy Investments Limited

|

9,246,208

|

67.00%

|

* Less than 1%

There are no arrangements which may at a subsequent date result in a change of control of the Company.

|

ITEM 13.

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE.

|

Transactions with Related Persons

The following includes a summary of transactions since the beginning of fiscal 2010, or any currently proposed transaction, in which we were or are to be a participant and the amount involved exceeded or exceeds $120,000 and in which any related person had or will have a direct or indirect material interest (other than compensation described in Item 11 of this Report). We believe the terms obtained or consideration that we paid or received, as applicable, in connection with the transactions described below were comparable to terms available or the amounts that would be paid or received, as applicable, in arm’s-length transactions.

Prior to the Share Exchange, there were no transactions since the beginning of fiscal 2010, or any currently proposed transaction, in which we were or are to be a participant and the amount involved exceeded or exceeds $120,000 and in which any related person prior to the Share Exchange had or will have a direct or indirect material interest.

As a result of the Share Exchange, the Company, through its subsidiaries and the Contractual Arrangements, controls Hengchang Agriculture and Hengjiu. From time to time, Yushan Wei, our newly appointed President and Chief Executive Officer and Chairman of our Board of Directors, has advanced funds to Hengchang Agriculture for working capital purposes. These advances are non-interest bearing, unsecured and payable on demand. As of December 31, 2010, the amount due to Mr. Wei by Hengchang Agriculture was $6,287,598.

14

Director Independence

We do not have any independent directors. Because our common stock is not currently listed on a national securities exchange, we have used the definition of “independence” of The NASDAQ Stock Market to make this determination. NASDAQ Listing Rule 5605(a)(2) provides that an “independent director” is a person other than an officer or employee of the company or any other individual having a relationship which, in the opinion of the Company’s Board of Directors, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. The NASDAQ listing rules provide that a director cannot be considered independent if:

|

●

|

the director is, or at any time during the past three years was, an employee of the company;

|

|

●

|

the director or a family member of the director accepted any compensation from the company in excess of $120,000 during any period of 12 consecutive months within the three years preceding the independence determination (subject to certain exclusions, including, among other things, compensation for board or board committee service);

|

|

●

|

a family member of the director is, or at any time during the past three years was, an executive officer of the company;

|

|

●

|

the director or a family member of the director is a partner in, controlling stockholder of, or an executive officer of an entity to which the company made, or from which the company received, payments in the current or any of the past three fiscal years that exceed 5% of the recipient’s consolidated gross revenue for that year or $200,000, whichever is greater (subject to certain exclusions);

|

|

●

|

the director or a family member of the director is employed as an executive officer of an entity where, at any time during the past three years, any of the executive officers of the company served on the compensation committee of such other entity; or

|

|

●

|

the director or a family member of the director is a current partner of the company’s outside auditor, or at any time during the past three years was a partner or employee of the company’s outside auditor, and who worked on the company’s audit.

|

Yushan Wei is not considered independent because he is an executive officer of the Company.

We do not currently have a separately designated audit, nominating or compensation committee.

|

ITEM 14.

|

PRINCIPAL ACCOUNTING FEES AND SERVICES.

|

Audit Fees

For the Company’s fiscal years ended December 31, 2010 and December 31, 2009, we were billed approximately $4,000 and $3,380, respectively, for professional services rendered for the audit and reviews of our financial statements.

Audit Related Fees

The Company did not incur any audit related fees, other than the fees discussed in Audit Fees, above, for services related to our audit for the fiscal years ended December 31, 2010 and December 31, 2009.

Tax Fees

For the Company’s fiscal years ended December 31, 2010 and December 31, 2009, we were not billed for professional services rendered for tax compliance, tax advice, and tax planning.

All Other Fees

The Company did not incur any other fees related to services rendered by our principal accountant for the fiscal years ended December 31, 2010 and December 31, 2009.

15

Pre-Approval of Services

We do not have an audit committee. As a result, our Board of Directors performs the duties of an audit committee. Our Board of Directors evaluates and approves in advance the scope and cost of the engagement of an auditor before the auditor renders the audit and non-audit services. We do not rely on pre-approval policies and procedures.

PART IV

|

ITEM 15.

|

EXHIBITS, FINANCIAL STATEMENT SCHEDULES.

|

(a) The following documents are filed as part of this report:

Financial Statements:

The condensed balance sheets of the Company as of December 31, 2010 and December 31, 2009, the related condensed statements of operations, changes in stockholders’ deficiency and cash flows for the years then ended, the footnotes thereto, and the report of Webb & Company, P.A., independent auditors, are filed herewith.

Exhibits:

The exhibits listed in the accompanying index to exhibits are filed or incorporated by reference as part of this Report.

(b) The following are exhibits to this Report and, if incorporated by reference, we have indicated the document previously filed with the SEC in which the exhibit was included.

|

Exhibit Number

|

Description

|

|

|

2.1

|

Share Exchange Agreement [incorporated by reference to Exhibit 2.1 of the Company’s Current Report on Form 10 filed with the SEC on February 11, 2011]

|

|

|

3.1

|

Articles of Incorporation [incorporated by reference to Exhibit 3.1 of the Company’s Amendment No.1 to Registration Statement on Form 10 filed with the SEC on September 14, 2010]

|

|

|

3.2

|

Bylaws [incorporated by reference to Exhibit 3.2 of the Company’s Amendment No.1 to Registration Statement on Form 10 filed with the SEC on September 14, 2010]

|

|

|

31.1

|

Certification of Chief Executive Officer and Chief Financial Officer pursuant to Rule 13a-14(a) of the Exchange Act.

|

|

| 32.1 |

Certification of Chief Executive Officer and Chief Financial Officer pursuant to Rule 13a-14(b) of the Exchange Act and Section 906 of the Sarbanes-Oxley Act of 2002.

|

16

SIGNATURES

In accordance with Section 13 or 15(d) of the Exchange Act, the registrant caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

GSP-2, INC.

|

||

|

|

||

|

By:

|

/s/ Yushan Wei

|

|

|

President

|

||

|

Dated:

|

March 31, 2011

|

|

Pursuant to the requirements of the Securities Exchange Act of 1934, this Report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

|

Name

|

Title

|

Date

|

|

|

/s/ Yushan Wei

|

President and Director

|

March 31, 2011

|

|

|

Yushan Wei

|

17