Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT of 1934 |

For the Fiscal Year Ended December 31, 2010

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission File No. 1-13652

First West Virginia Bancorp, Inc.

(Exact name of registrant as specified in its charter)

| West Virginia | 55-6051901 | |

| (State or other jurisdiction incorporation or organization) |

(I.R.S. Employer Identification No.) |

1701 Warwood Avenue

Wheeling, West Virginia 26003

(Address of principal executive offices)

Registrant’s telephone number, including area code: (304) 277-1100

Securities to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

| Common Stock $5.00 Par Value | NYSE AMEX |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

¨ Yes x No

Indicate by check mark whether the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act.

¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such report(s), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regional S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ¨ Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check-mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large Accelerated filer ¨ Accelerated filer ¨ Non-Accelerated filer ¨ Smaller Reporting Company x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).¨ Yes x No

The aggregate market value of the voting stock held by non-affiliates of the registrant, calculated by reference to the closing sale price of First West Virginia Bancorp’s common stock on the NYSE Amex on June 30, 2010, was $18,102,469. (Registrant has assumed that all of its executive officers and directors are affiliates. Such assumption shall not be deemed to be conclusive for any other purpose):

Table of Contents

The number of shares outstanding less treasury shares of the issuer’s common stock as of March 25, 2011:

Common Stock, $5.00 Par Value 1,652,814 shares

| DOCUMENTS INCORPORATED BY REFERENCE | ||

| Documents |

Part of Form 10-K into which Document is incorporated | |

| Portions of the Annual Report to Shareholders of First West Virginia Bancorp, Inc. for the year ended December 31, 2010. | Part II, Items 5, 6, 7, 7A, 8 and 9A; Part III, Item 13; Part IV, Item 15 | |

| Portions of First West Virginia Bancorp, Inc.’s Proxy statement for the 2011 Annual Meeting of Shareholders. | Part III, Items 10, 11, 12, 13 and 14 | |

2

Table of Contents

3

Table of Contents

First West Virginia Bancorp, Inc. (the “Company”) may from time to time make written or oral “forward-looking statements”, including statements contained in the Company’s filings with the securities and exchange commission (including this Annual Report on Form 10-K and the Exhibits thereto), in its report to shareholders and in other communications by the Company, which are made in good faith by the Company pursuant to the “safe harbor” provisions of the private securities litigation reform act of 1995.

These forward-looking statements involve risks and uncertainties, such as statements of the Company’s plans, objectives, expectations, estimates and intentions that are subject to change based on various important factors (some of which are beyond the Company’s control). The following factors, among others, could cause the Company’s financial performance to differ materially from the plans, objectives, expectations, estimates and intentions expressed in such forward-looking statements: the strength of the United States economy in general and the strength of the local economies in which the Company conducts operations; the effects of, and changes in, trade, monetary and fiscal policies and laws, including interest rate policies of the Board of Governors of the Federal Reserve System, inflation, changes in real estate values in the Company’s primary lending areas, market and monetary fluctuations; the impact of changes in financial services’ laws and regulations (including laws concerning taxes, banking, securities and insurance); technological changes; acquisitions; changes in consumer spending and savings habits; and the success of the Company at managing the risks involved in the foregoing.

The Company cautions that the foregoing list of important factors is not exclusive. The Company does not undertake to update any forward-looking statement, whether written or oral, that may be made from time to time by or on behalf of the Company.

General

First West Virginia Bancorp, Inc. (the “ Company”), was organized as a West Virginia business corporation on July 1, 1973 at the request of the Boards of Directors of the Bank of Warwood, N.A. and Community Savings Bank, N.A. for the purpose of becoming a bank holding company, under the Bank Holding Company Act of 1956, as amended. On December 30, 1974 the shareholders of those banks voted to become constituent banks of the Company, which reorganization was subsequently accomplished in accordance with regulatory procedure, and the Company thus became the first bank holding company in the state of West Virginia. Those banks later merged on June 30, 1984 under the name “First West Virginia Bank, N.A.” In November, 1995, the subsidiary banks of the Holding Company adopted the common name of “Progressive Bank, N.A.”

At December 31, 2010, First West Virginia Bancorp, Inc. had one wholly-owned banking subsidiary, Progressive Bank, N.A. in Wheeling, West Virginia.

Progressive Bank, N. A. is a community bank serving all of Ohio, Brooke, Marshall, Upshur, Lewis and Wetzel counties in the state of West Virginia, and a portion of the west bank of the Ohio River, located in the State of Ohio. Progressive Bank, N.A. operates three full-service offices in Ohio County, Wheeling, West Virginia, one full-service office in Brooke County, Wellsburg, West Virginia, one full-service office in Marshall County, Moundsville, West Virginia, one full-service office in Wetzel County, New Martinsville, West Virginia, one full-service office in Upshur County, Buckhannon, West Virginia, one full-service office in Lewis County, Weston, West Virginia, and one full-service office in Bellaire, Ohio. Progressive Bank, N.A. had total assets of approximately $277.4 million as of December 31, 2010.

Total Company assets as of December 31, 2010, which include the assets of its operating subsidiary bank, were $278.0 million. The authorized capital of the Company consists of 2,000,000 shares of capital stock, par value of $5.00 per share, of which 1,662,814 shares, less 10,000 treasury shares, were issued and outstanding as of December 31, 2010 to 271 registered shareholders. Shareholders’ equity at that date was $31,101,186.

4

Table of Contents

General Description of Business

First West Virginia Bancorp, Inc. is dependent upon its subsidiary for cash necessary to pay expenses, and dividends to its stockholders. The Company functions primarily as the holder of the capital stock of its wholly-owned subsidiary bank.

Progressive Bank, National Association, the sole subsidiary bank of the Company, is engaged in the business of banking and provides a broad range of consumer and commercial banking products and services to individuals, businesses, professionals and governments. The services and products have been designed in such a manner as to appeal to area consumers and businesses. The loan portfolio consists primarily of loans secured by real estate to consumers and businesses. The bank also engages in commercial loans and general consumer loans to individuals. The subsidiary bank offers a wide range of both personal and commercial types of deposit accounts and services as a means of gathering funds. Types of deposit accounts and services available include non-interest bearing demand checking, interest bearing checking (NOW accounts), savings, money market, certificates of deposit, individual retirement accounts, and Christmas Club accounts. The customer base for deposits is primarily retail in nature. The majority of the bank’s lending is concentrated in the upper Ohio Valley of northern West Virginia and adjacent areas of Ohio and Pennsylvania.

First West Virginia Bancorp, Inc.’s business is not seasonal. As of December 31, 2010, the subsidiary bank was not engaged in any operation in foreign countries and transactions with customers in foreign countries is not material.

Employees

As of December 31, 2010, the Company had 5 part-time employees. As of December 31, 2010, the subsidiary bank of the Holding Company had a total of 96 full-time employees and 7 part-time employees. The Bank provides a number of benefits for its full-time employees, including health and life insurance, 401-K plan, workers’ compensation and paid vacations. No employees are union participants or subject to a collective bargaining agreement.

Competition

Competition involving the Company is generally felt at the subsidiary level. All phases of the banks’ business are highly competitive. The subsidiary bank encounters competition from commercial banks and other financial institutions. The subsidiary bank also competes with other insurance companies, small loan companies, credit unions with respect to lending activities and also in attracting a variety of deposit related instruments.

Supervision and Regulation

The Company and its subsidiary bank are subject to certain statutes and regulations. The following is a summary of certain statutes and regulations that affect the Company and its subsidiary. This summary is qualified in its entirety by such statutes and regulations.

The Company

The Company is a registered bank holding company under the Bank Holding Company Act of 1956, as amended, (“BHC Act”) and as such is subject to regulation by the Federal Reserve Board (“FRB”). The BHC Act requires every bank holding company to obtain the prior approval of the FRB before acquiring substantially all the assets of any bank or bank holding company or ownership or control of any voting shares of any bank or bank holding company, if, after such acquisition, it would own or control, directly or indirectly, more than five percent (5%) of the voting shares of such bank or bank holding company.

In approving acquisitions by bank holding companies of companies engaged in banking-related activities, the FRB considers whether the performance of any such activity by a subsidiary of the holding company reasonably can be expected to produce benefits to the public, such as greater convenience, increased competition, or gains in efficiency, which outweigh possible adverse effects, such as over concentration of resources, decrease of competition, conflicts of interest, or unsound banking practices.

As a bank holding company, the Company is required to file with the FRB reports and any other information regarding its business operations that is required pursuant to the BHC Act. The FRB also makes examinations of the Company.

5

Table of Contents

The Company is also deemed an “affiliate” of its subsidiary bank under the Federal Reserve Act which imposes certain restrictions on loans between the Company and its subsidiary bank, investments by the subsidiary in the stock of the Company, or the taking of stock of the Company by the subsidiary as collateral for loans to any borrower, or purchases by the subsidiary of certain assets from the Company, and the payment of dividends by the subsidiary to the Company.

FRB approval is required before the Company may begin to engage in any permitted non-banking activity. The FRB is empowered to differentiate between activities which are initiated by the Company or its subsidiary and activities commenced by acquisition of a going concern.

Being a West Virginia corporation, the Company is also subject to the corporate laws of the State of West Virginia as set forth in the West Virginia Corporation Act and to register with the Office of the Commissioner of Banking of West Virginia and file reports as requested. The Commissioner has the power to examine the Company and its subsidiary.

The Bank

The operations of the Company’s subsidiary bank, being a national bank, is subject to the regulations of a number of regulatory agencies including the regulations of a number of regulatory authorities including the Office of the Comptroller of the Currency (the “OCC”), the FRB and the West Virginia Department of Banking. Representatives of the OCC regulate and conduct examinations of the subsidiary bank. The subsidiary bank is required to furnish regular reports to the OCC and the Federal Deposit Insurance Corporation. The Comptroller of the Currency has the authority to prevent national banks from engaging in an unsafe or unsound bank practice and may remove officers or directors. It may be noted that the subsidiary bank of a bank holding company is subject to certain restrictions imposed by the banking laws on extensions of credit to the Company or its subsidiary.

Capital Requirements

The FRB and the OCC require banks and holding companies to maintain minimum capital ratios.

The FRB has promulgated “risk-adjusted” capital guidelines for bank holding companies. The OCC and FDIC have adopted substantially similar risk-based capital guidelines with respect to the Bank. These ratios involve a mathematical process of assigning various risk weights to different classes of assets, then evaluating the sum of the risk-weighted balance sheet structure against the Company’s capital base. The rules set the minimum guidelines for the ratio of capital to risk-weighted assets (including certain off-balance sheet activities, such as standby letters of credit) at 8%. At least half of the total capital is to be composed of common equity, retained earnings, and a limited amount of perpetual preferred stock less certain goodwill items (“Tier 1 Capital”). The remainder may consist of a limited amount of subordinated debt, other preferred stock, or a limited amount of loan loss reserves.

In addition, the federal banking regulatory agencies have adopted leverage capital guidelines for banks and bank holding companies. Under these guidelines, banks and bank holding companies must maintain a minimum ratio of three percent (3%) Tier 1 Capital to total assets. The Federal Reserve Board has indicated, however, that banking organizations that are experiencing or anticipating significant growth, are expected to maintain capital ratios well in excess of the minimum levels.

Regulatory authorities may increase such minimum regulatory capital requirements for all banks and bank holding companies, as well as specific individual banks or bank holding companies. Mandated increases in the minimum required capital ratios could adversely affect the Company and the Bank, including their ability to pay dividends.

As of December 31, 2010, the most recent notifications from the Office of the Comptroller of the Currency categorized the bank as well capitalized under the regulatory framework for prompt corrective action. There are no conditions or events since that notification that management believes has changed the capital category.

Additional Regulation

The Bank is also subject to federal regulation as to such matters as required reserves, limitation as to the nature and amount of its loans and investments, regulatory approval of any merger or consolidation, issuance or retirement of their own securities, limitations upon the payment of dividends and other aspects of banking operations. In addition, the activities and operations of the Bank are subject to a number of additional detailed, complex and sometimes overlapping federal and state laws and regulations. These include state usury and consumer credit laws , the Federal Truth-in-Lending Act and Regulation Z, the

6

Table of Contents

Federal Equal Credit Opportunity Act and Regulation B, the Fair Credit Reporting Act, the Truth in Savings Act, the Community Reinvestment Act, anti-redlining legislation and antitrust laws.

Financial Services Modernization Act of 1999

Under the Gramm-Leach-Bliley Act (better known as the Financial Services Modernization Act of 1999), bank holding companies are entitled to become financial holding companies and thereby affiliate with securities firms and insurance companies and engage in other activities that are financial in nature. A bank holding company may become a financial holding company if each of its subsidiary banks is well capitalized under the Federal Deposit Insurance Corporation Act of 1991 prompt corrective action provisions, is well managed, and has at least a satisfactory rating under the Community Reinvestment Act by filing a declaration that the bank holding company wishes to become a financial holding company. No regulatory approval will be required for a financial holding company to acquire a company, other than a bank or savings association, engaged in activities that are financial in nature or incidental to activities that are financial in nature, as determined by the Federal Reserve Board.

The Financial Services Modernization Act defines “financial in nature” to include”

| 1. | securities underwriting, dealing and market making; |

| 2. | sponsoring mutual funds and investment companies; |

| 3. | insurance underwriting and agency; |

| 4. | merchant bank activities and activities that the Federal Reserve Board has determined to be closely relating to banking. |

In addition, a financial holding company may not acquire a company that is engaged in activities that are financial in nature unless each of the subsidiary banks of the financial holding company has a Community Reinvestment Act rating of satisfactory or better. The Company has not registered to become a financial holding company.

The United States Congress has periodically considered and adopted legislation, such as the Gramm-Leach-Bliley Act, which has resulted in further deregulation of both banks and other financial institutions, including mutual funds, securities brokerage firms and investment banking firms. No assurance can be given as to whether any additional legislation will be adopted or as to the effect such legislation would have on the business of the Bank or the Company.

FDICIA

The Federal Deposit Insurance Company Improvement Act of 1991 (“FDICIA”), and the regulations promulgated under FDICIA, among other things, established five capital categories for insured depository institutions-well capitalized, adequately capitalized, undercapitalized, significantly undercapitalized and critically undercapitalized-and requires U.S. federal bank regulatory agencies to implement systems for “prompt corrective action” for insured depository institutions that do no meet minimum capital requirements based on these categories. Unless a bank is well capitalized, it is subject to restrictions on its ability to offer brokered deposits and on certain other aspects of its operations. An undercapitalized bank must develop a capital restoration plan and its parent bank holding company must guarantee the bank’s compliance with the plan up to the lesser of 5% of the banks or thrift’s assets at the time it became undercapitalized and the amount needed to comply with the plan. As of December 31, 2010, the Company’s banking subsidiary was well capitalized pursuant to these prompt corrective action guidelines.

Deposit Insurance and Assessments

The deposits of the Company’s banking subsidiary are insured up to regulatory limits by the FDIC, and, accordingly, are subject to deposit insurance assessments based on the Federal Deposit Insurance Reform Act of 2005, as adopted and took effect on April 21, 2006.

The Federal Deposit Insurance Company Improvement Act of 1991 (“FDICIA”) requires federal bank regulatory authorities to take “prompt corrective action” with respect to banks that do not meet minimum capital requirements. For these purposes, FDICIA establishes five capital tiers: well capitalized, adequately capitalized, undercapitalized, significantly undercapitalized, and critically undercapitalized.

7

Table of Contents

As an FDIC-insured institution, the Bank is required to pay deposit insurance premium assessments to the FDIC. The amount each institution pays for FDIC deposit insurance coverage is determined in accordance with a risk-based assessment system under which all insured depository institutions are placed into one of nine categories and assessed insurance premiums based upon their level of capital and supervisory evaluation. Institutions classified as well capitalized (as defined by the FDIC) and considered healthy pay the lowest premium while institutions that are less than adequately capitalized (as defined by the FDIC) and considered substantial supervisory concerns pay the highest premium. Because the Bank is presently “well capitalized” it pays the minimum deposit insurance premiums.

The Emergency Economic Stabilization Act 2008 increased the deposit insurance coverage from $100,000 to $250,000 per depositor. The basic deposit insurance limit of $100,000 was set to return on January 1, 2010, however, at this time, the date has been extended to December 13, 2013.

The FDIC may terminate the deposit insurance of any insured depository institution if the FDIC determines, after a hearing, that the institution has engaged or is engaging in unsafe or unsound practices, is in an unsafe or unsound condition to continue operations or has violated any applicable law, regulation, order, or any condition imposed in writing by, or written agreement with, the FDIC. The FDIC may also suspend deposit insurance temporarily during the hearing process for a permanent termination of insurance if the institution has no tangible capital. Management of the Company is not aware of any activity or condition that could result in termination of the deposit insurance of the Bank.

Depositor Preference Statute

In the “liquidation or other resolution” of an institution by any receiver, U.S. federal legislation provides that deposits and certain claims for administrative expenses and employee compensation against the insured depository institution would be afforded a priority over general unsecured claims against that institution, including federal funds and letters of credit.

Recent Legislation

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (“Dodd-Frank Act”) signed by the President on July 21, 2010 posed a significant impact on financial regulations. Certain provisions such as the permanent increase in deposit insurance coverage had an immediate effective date. Provisions regarding rules for interchanges fees on electronic debit transactions must be effective by July 21, 2011. Other provisions which, though intended to provide regulatory relief to community banks, may require time and further analysis to evaluate the actual consequences. Implementation of the Dodd-Frank Act provisions, which are conservatively estimated at more than 5,000 pages of new or expanded regulations for banks, will result in new rulemaking by the federal regulatory agencies over the next several years. Fully implementing the new and expanded regulation will involve ensuring compliance with extensive new disclosure and reporting requirements. The Dodd-Frank Act created an independent regulatory body, the Bureau of Consumer Financial Protection (“Bureau”), with authority and responsibility to set rules and regulations for most consumer protection laws applicable to all banks, large and small. The Bureau adds another regulator to scrutinize and police financial activities. Transfer to the Bureau of all consumer financial protection functions for designated laws by the other federal agencies must be completed no later than July 21, 2011. The Bureau has responsibility for mortgage reform and enforcement, as well as broad new powers over consumer financial activities which could impact what consumer financial services would be available and how they are provided. The following consumer protection laws are the designated laws that will fall under the Bureau’s rulemaking authority: the Alternative Mortgage Transactions Parity Act of 1928, the Consumer Leasing Act of 1976, the Electronic Fund Transfer Act, the Equal Credit Opportunity Act, the Fair Credit Billing Act, the Fair Credit Reporting Act subject to certain exclusions, the Fair Debt Collection Practices Act, the Home Owners Protection Act, certain privacy provisions of the Gramm-Leach-Bliley Act, the Home Mortgage Disclosure Act (HMDA), the Home Ownership and Equity Protection Act of 1994, the Real Estate Settlement Procedures Act (RESPA), the S.A.F.E. Mortgage Licensing Act of 2008 (SAFE Act), and the Truth in Lending Act. Review and revision of current financial regulations in conjunction with added new financial service regulations will heighten the regulatory compliance burden and increase litigation risk for the banking industry.

Also, in response to recent unprecedented financial market turmoil, the Emergency Economic Stabilization Act of 2008 (“EESA”) was enacted in 2008. EESA authorized the U.S. Treasury Department to provide up to $700 billion in funding for the financial services industry. Pursuant to the EESA, the Treasury was initially authorized to use $350 billion for the Troubled Asset Relief Program (“TARP”). Of this amount, Treasury allocated $250 billion to the TARP Capital Purchase Program. On January 15, 2009, the second $350 billion of TARP monies was released to the Treasury. The Secretary’s authority under TARP expired on December 31, 2009. The Company previously determined to not Participate

8

Table of Contents

in the TARP Capital Purchase Program.

In addition to the Dodd-Frank Act and EESA, there is significant potential for new federal regulations relating to lending, funding practices, and liquidity and capital standards, and the bank regulatory agencies are expected to be very aggressive in responding to concerns and trends identified in examinations. These increased governmental actions may increase our costs and limit our ability to pursue certain business opportunities.

Monetary Policies

The earnings of the Company are dependent upon the earnings of its wholly-owned subsidiary bank. The earnings of the subsidiary bank is affected by the policies of regulatory authorities, including the Comptroller of the Currency, the Board of Governors of the Federal Reserve System and the Federal Deposit Insurance Corporation. The policies and regulations of the regulatory agencies have had and will continue to have a significant effect on deposits, loans and investment growth, as well as the rate of interest earned and paid, and therefore will affect the earnings of the subsidiary bank and the Company in the future, although the degree of such impact cannot accurately be predicted.

Consumer Laws and Regulations

In addition to the banking laws and regulations discussed above, bank subsidiaries are also subject to certain consumer laws and regulations that are designed to protect consumers in transactions with banks. Among the more prominenet of such laws and regulations are the Truth in Lending Act, the Truth in Savings Act, the electronic funds Transfer Act, the Expedited Funds Availability Act, the Equal Credit Opportunity Act, the Fair credit Reporting act, and the Fair Housing Act. These laws and regulations mandate certain disclosure requirements and regulate the manner in which financial institutions must deal with customers when taking deposits or making loans to such customers. Bank subsidiaries must comply with the applicable provisions of these consumer protection laws and regulations as part of their ongoing customer relations.

Sarbanes-Oxley Act of 2002

On July 30, 2002, the Sarbanes-Oxley Act of 2002 (“SOA”) was enacted, which addresses, among other issues, corporate governance, auditing and accounting, executive compensation, and enhanced and timely disclosure of corporate information. Effective August 29, 2002, as directed by Section 302(a) of SOA, our Chief Executive Officer and Chief Financial Officer are each required to certify that the Company’s Quarterly and Annual reports do not contain any untrue statement of a material fact. The rules have several requirements, including requiring these officers certify that: they are responsible for establishing, maintaining and regularly evaluating the effectiveness of our internal controls; they have made certain disclosures to our auditors and the audit committee of the Board of Directors about internal controls; and they have included information in the Company’s Quarterly and Annual reports about their evaluation and whether there have been significant changes in our internal controls or in other factors that could significantly affect internal controls subsequent to the evaluation.

Securities Laws and Compliance

As of February 13, 1995, the Company’s common stock was registered with the Securities and Exchange commission (“SEC”) under the Securities Exchange Act of 1934, as amended (“1934 Act”). This registration requires ongoing compliance with the 1934 Act and its periodic filing requirements as well as a wide range of Federal and State securities laws. These requirements include, but are not limited to, the filing of annual, quarterly and other reports with the SEC, certain requirements as to the solicitation of proxies from shareholders as well as other proxy rules, and compliance with the reporting requirements and “short-swing” profit rules imposed by Section 16 of the 1934 Act.

Available Information

The public may read and copy any materials that are filed with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, D.C. 20549, on official business days during the hours of 10:00

9

Table of Contents

a.m. to 3:00 p.m. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site, (http://www.sec.gov), that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC.

The Company presently has an internet website, (http://www.firstwvbancorp.com). Copies of the annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished to the SEC are available on the internet website and are also available free of charge upon request.

Statistical Information

The statistical information noted below is provided pursuant to Guide 3, Statistical Disclosure by Bank Holding Companies. Page references are to the Annual Report to Shareholders for the year ended December 31, 2010, and such pages are incorporated herein by reference.

| Page | ||||||||

| 1. | Distribution of Assets, Liabilities and Stockholders’ equity; | |||||||

| Interest Rates and Interest Differential | ||||||||

| a. | Average Balance Sheets | 30 | ||||||

| b. | Analysis of Net Interest Earnings | 31 | ||||||

| c. | Rate Volume Analysis of Changes in Interest Income and Expense |

32 | ||||||

| 2. | Investment Portfolio | |||||||||||||||

| a. | Book Value of Investments Book values of investment securities at December 31, 2010 and 2009 are as follows (in thousands): |

|||||||||||||||

| December 31, | ||||||||||||||||

| 2010 | 2009 | |||||||||||||||

| Securities held-to-maturity: |

||||||||||||||||

| Obligations of states and political subdivisions |

$ | — | $ | — | ||||||||||||

| Total held-to-maturity |

— | — | ||||||||||||||

| Securities available for sale: |

||||||||||||||||

| U.S. Treasury securities and obligations of U.S. Government corporations and agencies |

$ | 35,698 | $ | 26,434 | ||||||||||||

| Obligations of states and political subdivisions |

34,291 | 29,041 | ||||||||||||||

| Mortgage-backed securities |

62,950 | 60,283 | ||||||||||||||

| Equity securities |

230 | 239 | ||||||||||||||

| Total available-for-sale |

133,169 | 115,997 | ||||||||||||||

| Total |

$ | 133,169 | $ | 115,997 | ||||||||||||

10

Table of Contents

Statistical Information – continued

| Page | ||||||||||||||||

| b. | Maturity Schedule of Investments | 34 | ||||||||||||||

| c. | Securities of Issuers Exceeding 10% of Stockholders’ Equity | N/A | ||||||||||||||

| The Corporation does not have any securities of Issuers, other than U.S. Government agencies and corporations, which exceed 10% of Stockholders’ Equity. | ||||||||||||||||

| 3. | Loan Portfolio | |||||||||||||||

| a. | Types of Loans | 13 | ||||||||||||||

| b. | Maturities and Sensitivities of Loans to Changes in | |||||||||||||||

| Interest Rates | 35 | |||||||||||||||

| c. | Risk Elements | 36 | ||||||||||||||

| Nonaccrual, Past Due and Restructured Loans | 13-16 and 36 | |||||||||||||||

| Potential problem loans | 13-16 and 36 | |||||||||||||||

| Foreign outstandings | N/A | |||||||||||||||

| Loan concentrations | 19 | |||||||||||||||

| d. | Other Interest Bearing Assets | N/A | ||||||||||||||

| 4. | Summary of Loan Loss Experience | 16-18,37,38 | ||||||||||||||

| 5. | Deposits | |||||||||||||||

| a. | Breakdown of Deposits by Categories, | |||||||||||||||

| Average Balance and Average Rate Paid | 30 | |||||||||||||||

| b. | Other Deposit categories |

N/A | ||||||||||||||

| c. | Foreign depositors with deposits in domestic offices | N/A | ||||||||||||||

| d. | Maturity Schedule of Time Certificates of | |||||||||||||||

| Deposit and Other Time Deposits of $100,000 or more | 18 | |||||||||||||||

| e. | Maturity Schedule of Foreign Time Certificates of | |||||||||||||||

| Deposit and Other Time Deposits of $100,000 or more | N/A | |||||||||||||||

| 6. | Return on Equity and Assets | 28 | ||||||||||||||

| 7. | Short-Term Borrowings | 19,38 | ||||||||||||||

Not applicable to Smaller Reporting Companies.

Item 1B Unresolved Staff Comments

Not Applicable

11

Table of Contents

The Company and its subsidiary bank, Progressive Bank, N.A., owned and/or leased property as of December 31, 2010 as described below.

Progressive Bank, N.A. presently owns the land and building at 1701 Warwood Avenue, Wheeling, West Virginia where the bank’s Warwood offices are located. The two-story building has approximately 15,500 square feet in total area. The office has three drive-in facilities adjacent to the rear of the building and customer parking to the north side of the building. A lot on North Seventeenth Street, southwest of the building, is used for employee parking. A two-story home located at 1709 Warwood Avenue was purchased in 1985 for the purpose of providing rental income and additional employee parking. Progressive Bank, N.A. also owns a lot adjacent to the bank for future expansion.

Progressive Bank, N.A. also owns the building and approximately 50% of the land at 875 National Road, Wheeling, West Virginia at which the Woodsdale branch is located. The Woodsdale branch expanded its one-story building to a total of approximately 6,050 square feet in area in 1994. This expansion was accomplished by the purchase of approximately 6,600 square feet of land located immediately west of the existing bank office property in 1993. The office has a four lane drive-in facility at the rear of the building and one drive-in automatic teller machine in the front of the building. The remaining portion of the land is leased to the bank until 2013 with 1 ten-year option to renew.

Progressive Bank, N.A. has a lease agreement to rent property for use as a banking premises known as the “Bethlehem branch office.” The Bethlehem branch office is located at 1090 East Bethlehem Boulevard, Wheeling, West Virginia. The office is a one story building with approximately 3400 square feet of area and has four drive-in lanes. The lease is for a five year term commencing February 1, 2002, with eight successive five year options to renew.

Progressive Bank, N.A. also owns the Wellsburg branch office located at 744 Charles Street, Wellsburg, West Virginia. This office is a 3 story building with over 8,400 square feet of total area. This office includes an on-premises drive-in facility.

Progressive Bank, N.A. owns the building and land located at 809 Lafayette Avenue, Moundsville, West Virginia. The office is a two-story building with approximately 7,430 square feet of total area. This office also has a three lane drive in facility.

Progressive Bank, N.A. owns the New Martinsville branch office located at 425 Third Street, New Martinsville, West Virginia. The office is a single story brick branch bank facility with approximately 3,642 square foot of area. This office also has a two lane drive-in at the rear of the facility.

Progressive Bank, N.A. owns the building and land for the Bellaire branch office located at 426 34th Street, Bellaire, Ohio, including its drive-in facilities at the rear of the building. The bank office is housed in a one-story building, which includes office space in its basement for a total of 4,500 square feet of office area. The bank also owns a lot adjacent to the parking lot.

Progressive Bank, N.A. owns the building and the land for its full-service banking facility in Buckhannon, West Virginia. The Buckhannon office is a one story building with approximately 1,760 square feet of office area. The office has a three lane drive-in facility located at the rear of the building.

Progressive Bank, N.A. has a lease agreement for the building for its Weston branch office. The Weston branch office is located at #10 Market Square Shopping Center, Weston, West Virginia. This lease is for a period of two years commencing April 1, 2006, with two successive two year options to renew followed by two successive five year renewal options.

Progressive Bank, N.A. has a lease agreement to rent property for use as a corporate office. The Corporate office is located at 590 National Road, Wheeling, West Virginia. The lease is for a seven year term commencing December 1, 2009, with three successive five year options to renew.

Progressive Bank, N.A. owns a tract of real estate of approximately 1.64 acres situated on the waters of Finks run and West Virginia State Route 20, in Buckhannon, West Virginia. The property was purchased and is being held for future banking office expansion.

Progressive Bank, N.A. also owns a tract of land with a building thereon fronting on South Locust Street in the City of Buckhannon, WV. The property was purchased and is being held for future banking office expansion.

The Company does not have any encumbrances or capital leases on its personal property.

The nature of the business of the Company’s subsidiary generates a certain amount of litigation involving matters arising in the ordinary course of business. The Company is unaware of any litigation other than ordinary routine litigation incidental to the business of the Company, to which it or its subsidiary is a party or of which any of their property is subject.

12

Table of Contents

Item 5 Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

On February 13, 1995, the Company’s common stock was filed and became effective under section 12(g) of the Securities and Exchange Act of 1934. On February 21, 1995, the Company was approved for listing its securities on the American Stock Exchange’s Emerging Company Marketplace and began trading under the symbol FWV.EC on March 8, 1995. The Company subsequently filed Form 8A to register its common stock under Section 12(b) of the Securities Exchange Act of 1934 which became effective on March 1, 1995. On June 16, 1995, the Company was approved for listing its securities on the American Stock Exchange primary list and began trading under the symbol FWV on June 20, 1995.

As of December 31, 2010, the Company had 271 registered shareholders of record who collectively held 1,652,814 of the 2,000,000 authorized shares of the Company, par value $5.00 per share. The Company held 10,000 treasury shares.

The following table sets forth the high and low sales prices of the common stock of the Company for each quarter in 2010 and 2009.

|

First Quarter |

Second Quarter |

Third Quarter |

Fourth Quarter |

|||||||||||||||

| 2010 | High | $ | 17.48 | $ | 16.26 | $ | 16.76 | $ | 17.49 | |||||||||

| Low | $ | 11.50 | $ | 13.23 | $ | 13.26 | $ | 13.65 | ||||||||||

| 2009 | High | $ | 12.85 | $ | 12.64 | $ | 12.61 | $ | 12.80 | |||||||||

| Low | $ | 8.42 | $ | 10.65 | $ | 10.06 | $ | 10.94 | ||||||||||

Dividends

The ability of the Company to pay dividends will depend on the earnings of its subsidiary bank and its financial condition, as well as other factors such as market conditions, interest rates and regulatory requirements. Therefore, no assurances may be given as to the continuation of the Company’s ability to pay dividends or maintain its present level of earnings. See Note 17 of the Notes to Consolidated Financial Statements appearing at Page 22 of the Annual Report to Shareholders for the year ended December 31, 2010, included in this report as Exhibit 13.1, and incorporated herein by reference, for a discussion on the limitations on dividends.

The Company has paid regular quarterly cash dividends since it became a bank holding company in 1975. Total dividends declared and paid by the Company in 2010, 2009 and 2008 were $.73, $.73, and $.71, respectively, per share each year.

The following table sets forth annual dividend, net income and ratio of dividends to net income of the Company for 2010, 2009 and 2008.

| DIVIDEND HISTORY OF COMPANY |

||||||||||||

| (per share) | ||||||||||||

| Dividend | Net Income | Ratio - Dividends to Net Income |

||||||||||

| 2010 |

$ | .73 | $ | 1.42 | 51.4% | |||||||

| 2009 |

$ | .73 | $ | 1.39 | 52.5% | |||||||

| 2008 |

$ | .71 | $ | 1.33 | 53.4% | |||||||

The common stock of the Company is not subject to any redemption provisions or restrictions on alienability. The common stock is entitled to share pro rata in dividends and in distributions in the event of dissolution or liquidation. There are no options, warrants, privileges or other rights with respect to Company stock at the present time, nor are any such rights proposed to be issued.

13

Table of Contents

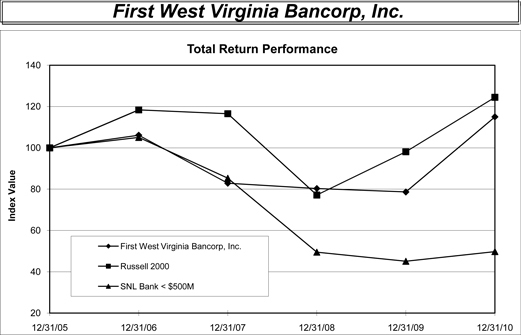

Performance Graph

| Period Ending | ||||||||||||||||||||||||

| Index |

12/31/05 | 12/31/06 | 12/31/07 | 12/31/08 | 12/31/09 | 12/31/10 | ||||||||||||||||||

| First West Virginia Bancorp, Inc. |

100.00 | 106.12 | 82.89 | 80.32 | 78.65 | 114.99 | ||||||||||||||||||

| Russell 2000 |

100.00 | 118.37 | 116.51 | 77.15 | 98.11 | 124.46 | ||||||||||||||||||

| SNL Bank < $500M |

100.00 | 105.05 | 85.30 | 49.51 | 45.10 | 49.78 | ||||||||||||||||||

Set forth above is a line graph prepared by SNL Securities L.C. (“SNL”), which compares the percentage change in the cumulative total shareholder return on the Company’s common stock against the cumulative total shareholder return on stocks included on the SNL Index for banks with assets under $500 million and the Russell 2000 Index for the period December 31, 2005 through December 31, 2010. An initial investment of $100.00 (Index value equals $100.00) and ongoing dividend reinvestment is assumed throughout.

Item 6 Selected Financial Data

Selected Financial Data on page 28 of the Annual Report to Shareholders of First West Virginia Bancorp, Inc. for the year ended December 31, 2010, included in this report as Exhibit 13.1, is incorporated herein by reference.

Item 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations

Management’s Discussion and Analysis of Financial Condition and Results of Operations on Pages 29 through 40 of the Annual Report to Shareholders of First West Virginia Bancorp, Inc. for the year ended December 31, 2010, included in this report as Exhibit 13.1, is incorporated herein by reference.

Item 7A Quantitative and Qualitative Disclosures About Market Risk

The information required by Item 7A is noted in part in Management’s Discussion and Analysis of Financial Condition and Results of Operations – Interest Rate Risk on pages 39 through 40 of the Annual Report to Shareholders of First West Virginia Bancorp, Inc. for the year ended December 31, 2010, included in this report as Exhibit 13.1, is incorporated herein by reference.

14

Table of Contents

Item 8 Financial Statements and Supplementary Data

The report of independent registered public accounting firm and consolidated financial statements, included on pages 2 through 27 of the Annual Report to Shareholders of First West Virginia Bancorp, Inc. for the year ended December 31, 2010, included in this report as Exhibit 13.1, are incorporated herein by reference.

Summarized Quarterly Financial Information

A summary of selected quarterly financial information follows:

| 2010 | First Quarter |

Second Quarter |

Third Quarter |

Fourth Quarter |

||||||||||||

| Total interest income |

$ | 2,997,289 | $ | 3,025,943 | $ | 2,943,635 | $ | 2,891,028 | ||||||||

| Total interest expense |

871,185 | 783,922 | 738,435 | 661,960 | ||||||||||||

| Net interest income |

2,126,104 | 2,242,021 | 2,205,200 | 2,229,068 | ||||||||||||

| Provision for loan losses |

30,000 | 30,000 | 30,000 | 130,000 | ||||||||||||

| Investment securities gain (loss) |

— | 253,267 | 308,095 | 3,912 | ||||||||||||

| Total other income |

294,915 | 323,699 | 487,379 | 305,315 | ||||||||||||

| Total other expenses |

1,897,110 | 1,932,889 | 1,922,485 | 1,970,414 | ||||||||||||

| Income before income taxes |

493,909 | 856,098 | 1,048,189 | 437,881 | ||||||||||||

| Net income |

460,651 | 668,034 | 786,938 | 423,658 | ||||||||||||

| Net income per share

|

0.28 | 0.40 | 0.48 | 0.26 | ||||||||||||

| 2009 | First Quarter |

Second Quarter |

Third Quarter |

Fourth Quarter |

||||||||||||

| Total interest income |

$ | 3,304,098 | $ | 3,254,038 | $ | 3,193,845 | $ | 3,161,861 | ||||||||

| Total interest expense |

1,193,530 | 1,105,757 | 1,054,974 | 973,838 | ||||||||||||

| Net interest income |

2,110,568 | 2,148,281 | 2,138,871 | 2,188,023 | ||||||||||||

| Provision for loan losses |

— | 10,000 | 30,000 | 143,942 | ||||||||||||

| Investment securities gain (loss) |

(7,393 | ) | 185,945 | (21,429 | ) | 31,394 | ||||||||||

| Total other income |

296,901 | 302,979 | 341,091 | 661,515 | ||||||||||||

| Total other expenses |

1,737,025 | 1,938,040 | 1,900,933 | 2,016,083 | ||||||||||||

| Income before income taxes |

663,051 | 689,165 | 527,600 | 720,907 | ||||||||||||

| Net income |

523,594 | 546,225 | 468,248 | 766,919 | ||||||||||||

| Net income per share

|

0.32 | 0.33 | 0.28 | 0.46 | ||||||||||||

| 2008 | First Quarter |

Second Quarter |

Third Quarter |

Fourth Quarter |

||||||||||||

| Total interest income |

$ | 3,482,786 | $ | 3,329,189 | $ | 3,366,841 | $ | 3,335,265 | ||||||||

| Total interest expense |

1,352,940 | 1,297,528 | 1,329,848 | 1,294,900 | ||||||||||||

| Net interest income |

2,129,846 | 2,031,661 | 2,036,993 | 2,040,365 | ||||||||||||

| Provision for loan losses |

— | — | — | — | ||||||||||||

| Investment securities gain (loss) |

112,501 | (511 | ) | (2,081 | ) | — | ||||||||||

| Total other income |

347,984 | 334,061 | 355,438 | 340,516 | ||||||||||||

| Total other expenses |

1,762,484 | 1,723,293 | 1,734,713 | 1,788,280 | ||||||||||||

| Income before income taxes |

827,847 | 641,918 | 655,637 | 592,601 | ||||||||||||

| Net income |

636,341 | 511,217 | 521,905 | 536,048 | ||||||||||||

| Net income per share

|

0.38 | 0.31 | 0.32 | 0.32 | ||||||||||||

Item 9 Changes In and Disagreements with Accountants on Accounting and Financial Disclosure

None

15

Table of Contents

Item 9A Controls and Procedures

Evaluation of Disclosure Controls and Procedures

The Company’s management has performed its evaluation of the effectiveness of the design and operation of the Company’s disclosure controls and procedures pursuant to Exchange Act Rule 13a-15(e). Based upon that evaluation, the Chief Executive Officer and the Chief Financial Officer have concluded that the Company’s disclosure controls and procedures are effective, as of the end of the period covered by this report, in timely alerting them to material information as required to be included in the Company’s periodic Securities Exchange Commission filings.

Internal Control Over Financial Reporting

This annual report does not include an attestation report of the Company’s registered public accounting firm regarding internal control over financial reporting. Management’s report was not subject to attestation by the Company’s registered public accounting firm pursuant to the rules of the Securities and Exchange Commission that permit the Company to provide only management’s report in this annual report.

There were no changes in the Company’s internal control over financial reporting that occurred during the Company’s fiscal quarter ended December 31, 2010 that has materially affected, or is reasonably likely to materially affect the Company’s internal control over financial reporting.

Management’s Report on Internal Control Over Financial Reporting

The Company’s management is responsible for the preparation and fair presentation of the consolidated financial statements and the related financial information included in this annual report. The financial statements and the information related to those statements have been prepared in conformity with accounting principles generally accepted in the United States of America and reflect management’s judgments and estimates concerning effects of events and transactions that are accounted for or disclosed.

The Company’s management is also responsible for establishing and maintaining adequate internal control over financial reporting. The Company’s internal control over financial reporting includes those policies and procedures that pertain to the Company’s ability to record, process, summarize and report reliable financial data. Management recognizes that there are inherent limitations in the effectiveness of any internal control over financial reporting, including the possibility of human error and the circumvention or overriding of internal control. Accordingly, even effective internal control over financial reporting can provide only reasonable assurance with respect to financial statement preparation. Further, because of changes in conditions, the effectiveness of internal control over financial reporting may vary over time.

In order to ensure that the Company’s internal control over financial reporting is effective, management is required to evaluate, with the participation of the Company’s principal executive and principal financial officers, the effectiveness of the Company’s internal control over financial reporting as of the end of each fiscal year and did so most recently for its financial reporting as of December 31, 2010. Management’s assessment of the effectiveness of the Company’s internal control over financial reporting was based on criteria for effective internal control over financial reporting described in Internal Control Integrated Framework issued by the Committee of Sponsoring Organizations (COSO) of the Treadway Commission. Based on this assessment, management has concluded that the internal control over financial reporting was effective as of December 31, 2010. This annual report does not include an attestation report of the Company’s registered public accounting firm regarding internal control over financial reporting. Management’s report was not subject to attestation by the Company’s registered public accounting firm pursuant to the rules of the Securities and Exchange Commission that permit the Company to provide only management’s report in this annual report.

The Board of Directors, acting through its Audit Committee, is responsible for the oversight of the Company’s accounting policies, financial reporting and internal control. The Audit Committee of the Board of Directors is comprised entirely of outside directors who are independent of management. The Audit Committee is responsible for the appointment and compensation of the independent auditor and approves decisions regarding the appointment or removal of the Company’s Internal Auditor. It meets periodically with management, the independent auditors and the internal auditors to ensure that they are carrying out their responsibilities. The Audit Committee is also responsible for performing an oversight role by reviewing and monitoring the financial, accounting and auditing procedures of the Company in addition to reviewing the Company’s financial reports. The independent auditors and the internal auditor have full and unlimited access to the Audit Committee, with or without management, to discuss the adequacy of internal control over financial reporting, and any other matter which they believe should be brought to the attention of the Audit Committee.

Not Applicable

16

Table of Contents

Item 10 Directors, Executive Officers and Corporate Governance

The information required by Item 10 of FORM 10-K related to Directors of the Registrant appears under the captions “Item 2—Election of Directors” on pages 5-10, “Item 3—Election of Directors (in the Alternative to Item 2)” on pages 11-14, “Section 16(a) Beneficial Ownership Reporting Compliance” on page 27, and “Audit Committee” on pages 15-16, in the First West Virginia Bancorp, Inc.’s 2011 Proxy Statement dated March 28, 2011 for Annual Meeting of Stockholders to be held April 12, 2011, included in this report as Exhibit 99, is incorporated herein by reference.

The Company adopted a Code of Ethics for its Directors, Executive Officers and Employees. A copy of the Code of Ethics is included in this report as Exhibit 14.1 and is incorporated herein by reference.

There have been no changes to the procedures by which shareholders recommend nominees to the company’s Board of Directors that were disclosed in the Company’s Proxy Statement dated March 18, 2010 for the Annual Meeting of Stockholders held on April 13, 2010, included in the Company’s Form 10-K for the year ended December 31, 2009.

Executive Officers of the Registrant

The following table sets forth selected information about the principal officers of the Company.

TABLE

| Name | Age |

All Positions with Holding Company and Subsidiary(1) | ||

| Sylvan J. Dlesk |

72 | Chairman of the Board of the Holding Company since 2004; President & CEO of the Company since June 2006; Interim President and Chief Executive Officer of the Company from April 2005 to June 2006; Vice Chairman of the Board of the Holding Company 2000- 2004; President and CEO since June 2006; Interim President and Chief Executive Officer of Progressive Bank, N.A. from April 2005 to February 2006; Director of Holding Company and Director of Progressive Bank N.A. since 1988.

| ||

| Laura G. Inman |

70 | Vice Chairman of the Board of the Holding Company since 2004; Chairman of the Board of the Holding Company 1998-2004; Vice Chairman of the Board of the Holding Company 1995-1998; Senior Vice President of the Holding Company 1993-1995; Senior Vice President of Progressive Bank, N.A. from 1993-2001; Director of the Holding Company and Director of Progressive Bank, N.A. from 1993.

| ||

| Francie P. Reppy |

50 | Executive Vice President, Chief Administrative Officer, Chief Financial Officer and Treasurer of the Holding Company since 2005; Senior Vice President, Chief Financial Officer and Treasurer of the Holding Company 2004-2005; Senior Vice President and Chief Financial Officer of the Holding Company 2000-2004; Controller of the Holding Company 1992-2000; Executive Vice President, Chief Administrative Officer, and Chief Financial Officer since 2005; Senior Vice President, Chief Financial Officer and Cashier of Progressive Bank, N.A. 2004- 2005; Senior Vice President and Chief Financial Officer of Progressive Bank, N.A. 2000-2004; Controller of Progressive Bank, N.A. 1992-2000.

| ||

| Brad D. Winwood |

54 | Vice President, Chief Operating Officer and Investment Officer of the Holding company since 2010; Vice President of the Holding Company from 2008 to 2010; Senior Vice President, Chief Operating Officer and Investment Officer of of Progressive Bank, N.A. since 2010; Senior Vice President, Senior Accounting, Operations Officer and Investment Officer of Progressive Bank, N.A. from 2007 to 2010; Senior Vice President, Senior Accounting and Investment Officer of Progressive Bank, N.A. from 2005 to 2007; Vice President, Senior Accounting Officer of Progressive Bank, N.A. from 2003 to 2005; Vice President, of Progressive Bank, N.A. from 1993 to 2003.

| ||

17

Table of Contents

PART III

| (b) | Executive Officers of the Registrant- continued |

| Connie R. Tenney |

56 | Vice President of the Holding Company since 1996; Senior Vice President of Progressive Bank, N.A. 2003; President, Chief Executive Officer, Cashier and Secretary of Progressive Bank, N.A.- Buckhannon 1995-2003; Director of Progressive Bank, N.A. - Buckhannon 1990-2003; Executive Vice President, Cashier and Secretary of Progressive Bank, N.A.- Buckhannon 1990-1995; Cashier and Secretary 1986-1990

| ||||

Notes:

(1) With the exception of Connie R. Tenney, all the principal officers of the Company reside in or near Wheeling, West Virginia. Connie R. Tenney resides near Buckhannon, West Virginia.

Item 11 Executive Compensation

The information required by Item 11 of FORM 10-K related to Executive Compensation appears under the caption “Executive Officer and Director Compensation” on pages 20-26. in the First West Virginia Bancorp, Inc.’s 2011 Proxy Statement dated March 28, 2011 for Annual Meeting of Stockholders to be held April 12, 2011, included in this report as Exhibit 99, is incorporated herein by reference.

Item 12 Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

The information required by Item 12 of FORM 10-K appears under the captions “Security Ownership of Management” on pages 26-28 and “Principal Shareholders” on page 29-30 in the First West Virginia Bancorp, Inc.’s 2011 Proxy Statement dated March 28, 2011 for Annual Meeting of Stockholders to be held April 12, 2011, included in this report as Exhibit 99, is incorporated herein by reference.

Item 13 Certain Relationships and Related Transactions, and Director Independence

The information required by Item 13 of FORM 10-K appears under the captions “Transactions with Management and Others” on pages 29-30 and “Independence of Directors and Nominees” on pages 13-14 in the First West Virginia Bancorp, Inc.’s 2011 Proxy Statement dated March 28, 2011 for Annual Meeting of Stockholders to be held April 12, 2011, included in this report as Exhibit 99, is incorporated herein by reference and in Note 11 of the Notes to Consolidated Financial Statements appearing at Page 20 of the Annual Report to Shareholders for the year ended December 31, 2010, included in this report as Exhibit 13.1, and incorporated herein by reference.

The Company follows a written policy for the granting of loans to directors and executive officers. This policy is as follows: With the exception of the items specifically identified below, all loans to Board of Directors and Executive Officers will be reported to the subsidiary bank board in a timely manner. Credit extensions and terms for any of the above will be: (1) made on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions by the bank for those who are not recognized as any of the above mentioned individuals and (2) does not involve more than the normal risk of repayment of present other unfavorable features:

| 1. | Any executive officer, director, or principal shareholder requesting a loan is to submit a written application containing the purpose of the credit, and/or a financial statement depending upon the nature of the credit to the bank. |

| 2. | Loans to an Executive Officer are permitted in an aggregate amount that equals the higher of $25,000 or 2.5% of the bank’s capital. However, in no event shall the aggregate outstanding amount of these loans exceed $100,000.00. Executive Officers have been defined by the Board of Directors to include Chairman, President & CEO, Executive Vice President and COO, Senior V.P. & CFO. |

| 3. | Extensions of credit shall not be made to any of the bank’s Directors, or principal shareholders or to any related interest of that person in an amount that when aggregated with the amount of all other extensions of credit to that person and all related interests of that person exceeds the higher of $25,000 or 5% of the bank’s capital, and unimpaired surplus unless: |

| (1) | The extension of credit or line of credit has been approved in advance by a majority of the entire Board of Directors, and |

18

Table of Contents

| (2) | The interested party has abstained from participating directly or indirectly in the vote. |

| (3) | All loans exceeding the aggregate of $500,000 must be approved according to steps 1 and 2. Payment of an overdraft of an executive officer or director is not permitted unless the funds are made in accordance with 1) a written, preauthorized, interest bearing extension of credit plan that specifies a method of repayment or, 2) a written preauthorized transfer of funds from another account of the account holder at the bank. This prohibition does not apply to payment of inadvertent overdrafts on an account in an aggregate amount of $1,000 or less provided 1) the account is not overdrawn for more than 5 business days, and 2) the bank assess the usual fee charged any other customer of the bank in similar circumstances. |

| 4. | There are no limits on loans to Executive Officers of the Bank when the loan is for the purpose of educating dependent children or to purchase, refinance (or improve) that Officer’s principal residence. These loans, of course, must comply with all other bank policy, may not be at preferential rates and must be approved by the Board of Directors if they exceed the limits outlined in item (3) above. Loans to executive officers will be made subject to the condition that the loan will, at the option of the bank, become due and payable at any time that the officer is indebted to this and other financial institutions in an aggregate amount greater than the amount specified in the preceding paragraph. |

| 5. | Any borrowing from a financial institution (this bank, other banks, savings and loans, etc.) by an executive officer of this bank, that is in excess of the established limits, shall be immediately reported to the President, who will then report these loans to the Board of Directors. This report to the President will be in writing and will include the lender’s name, the date and amount of each loan, the security (if any), and the purpose for which the proceeds have been or will be used. |

| 6. | In compliance with Regulation O, the total of all loans to Executive Officers, Directors, Principal Shareholders and their related interest of the bank, holding companies and subsidiaries of the holding company, cannot exceed the amount of the bank’s unimpaired capital and unimpaired surplus. This limit will be established by adding the total equity capital shown on the bank’s most recently filed consolidated report of condition and authorized subordinated notes and debentures, and the valuation reserve. |

The Company also requires all directors to report related interests and to abstain prior to approval of any extensions of credit which are subject to board approval. Board approval is required for loans secured by real estate in excess of $300,000, non-real estate secured loans in excess of $150,000 and unsecured loans in excess of $25,000 to any related borrower. This is evidenced by the director signing a form prior to the approval of such loans. This reporting requirement was at the direction of the Corporate Governance, Human Resource and Compensation Committee.

Fees for services to the Company that are provided by any Director are subject to approval by the Board of Directors of the Company or its subsidiary.

Item 14 Principal Accountant Fees and Services

The information required by Item 14 of FORM 10-K appears under the caption “Item 4—Ratification of Independent Registered Public Accounting Firm” on pages 30-31. in the First West Virginia Bancorp, Inc.’s 2011 Proxy Statement dated March 28, 2011 for Annual Meeting of Stockholders to be held April 12, 2011, included in this report as Exhibit 99, is incorporated herein by reference.

19

Table of Contents

Item 15 Exhibits and Financial Statement Schedules

Financial Statements Filed; Financial Statement Schedules

The following consolidated financial statements of First West Virginia Bancorp, Inc. and its subsidiary, included in the Annual Report to Shareholders for the year ended December 31, 2010, are incorporated by reference in Item 8:

| Exhibit 13.1 Page Number |

||||

| Report of Independent Registered Public Accounting Firm |

27 | |||

| Consolidated Balance Sheets (December 31, 2010 and December 31, 2009) |

2 | |||

| Consolidated Statements of Income (Years ended December 31, 2010, 2009 and 2008) |

3 | |||

| Consolidated Statements of Changes in Stockholders’ Equity (Years ended December 31, 2010, 2009 and 2008) |

4 | |||

| Consolidated Statements of Cash Flows (Years ended December 31, 2010, 2009 and 2008) |

5 | |||

| Notes to Consolidated Financial Statements (Years ended December 31, 2010, 2009 and 2008) |

6-26 | |||

The exhibits listed in the Exhibit Index on page 22 of this FORM 10-K are filed herewith or incorporated by reference.

20

Table of Contents

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| First West Virginia Bancorp, Inc. | ||

| (Registrant) | ||

| By: |

/s/ Sylvan J. Dlesk | |

| Sylvan J. Dlesk | ||

| Chairman/President and Chief Executive Officer/Director | ||

| Date: |

March 28, 2011 | |

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the Registrant and in the capacities and on the dates indicated.

| Signatures |

Title |

Date | ||

| /s/ Sylvan J. Dlesk Sylvan J. Dlesk |

Chairman, President and Chief Executive Officer, Director |

March 28, 2011 | ||

| /s/ Francie P. Reppy Francie P. Reppy |

Executive Vice President, Chief Administrative Officer Chief Financial Officer, Treasurer/ Director |

March 28, 2011 | ||

| /s/ Nada E. Beneke Nada E. Beneke |

Director | March 28, 2011 | ||

| /s/ Gary W. Glessner Gary W. Glessner |

Director | March 28, 2011 | ||

| /s/ Laura G. Inman Laura G. Inman |

Director | March 28, 2011 | ||

| /s/ R. Clark Morton R. Clark Morton |

Director | March 28, 2011 | ||

| /s/ William G. Petroplus William G. Petroplus |

Director | March 28, 2011 | ||

| /s/ Thomas L. Sable Thomas L. Sable |

Director | March 28, 2011 | ||

| /s/ Brad D. Winwood Brad D. Winwood |

Director | March 28, 2011 | ||

21

Table of Contents

The following exhibits are filed herewith and/or are incorporated herein by reference.

| Exhibit |

Description | |

| 3.1 | Certificate and Articles of Incorporation of First West Virginia Bancorp, Inc.* | |

| 3.2 | Bylaws of First West Virginia Bancorp, Inc.* | |

| 10.3 | Lease dated July 20, 1993 between Progressive Bank, N.A., formerly known as “First West Virginia Bank, N.A.”, and Angela I. Stauver.* | |

| 10.4 | Lease dated March 7, 2006 between Progressive Bank, N.A. and O. V. Smith & Sons of Big Chimney, Inc.* | |

| 10.5 | Lease dated May 12, 2001 between Progressive Bank, N.A. and Sylvan J. Dlesk and Rosalie J. Dlesk doing business as Dlesk Realty & Investment Company.* | |

| 10.7 | Lease dated December 1, 2009 between Progressive Bank, N.A. and Richard J. Dlesk, Sr. And Sharon G Neis-Dlesk.* | |

| 11.1 | Statement regarding computation of per share earnings. Filed herewith and incorporated herein by reference. | |

| 12.1 | Statement regarding computation of ratios. Filed herewith and incorporated herein by reference. | |

| 13.1 | Annual Report to Shareholders, as listed in Part II, Item 8. Filed herewith and incorporated herein by reference. | |

| 14.1 | Code of Ethics. Filed herewith and incorporated herein by reference. | |

| 21.1 | Subsidiaries of the Holding Company. Filed herewith and incorporated herein by reference. | |

| 23 | Consent of S.R. Snodgrass, A.C. Filed herewith and incorporated herein by reference. | |

| 31 | Rule 13a-14(a) / 15d/14(a) Certifications - Certification of Chief Executive Officer pursuant to section 302 of the Securities and Exchange Act of 1934. Filed herewith and incorporated herein by reference. | |

| 31.1 | Rule 13a-14(a) / 15d/14(a) Certifications - Certification of Chief Financial Officer pursuant to section 302 of the Securities and Exchange Act of 1934. Filed herewith and incorporated herein by reference. | |

| 32 | Certification pursuant to 18 U.S.C. §1350,as adopted pursuant to section 906 of the SARBANES-OXLEY ACT of 2002. Filed herewith and incorporated herein by reference. | |

| 99 | Proxy statement for the Annual Shareholders meeting to be held April 12, 2011. Incorporated herein by reference. | |

* Incorporated by reference in First West Virginia Bancorp, Inc.’s filing on Form 10-K dated March 31, 2010.

22