Attached files

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

Annual Report Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

For the Fiscal Year Ended December 31, 2010

Commission file number 0-4538

Cybex International, Inc.

(Exact name of registrant as specified in its charter)

| New York | 11-1731581 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 10 Trotter Drive, Medway, Massachusetts | 02053 | |

| (Address of principal executive office) | (Zip Code) | |

| Registrant’s telephone number, including area code | (508) 533-4300 | |

| Securities registered pursuant to Section 12(b) of the Act: | ||

| Title of Each Class |

Name of each exchange on which registered | |

| Common Stock, $.10 Par Value | NASDAQ Global Market | |

Securities registered pursuant to Section 12(g) of the Act:

NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulations S-T (§232.405 of this chapter) during the preceding 12 months (or for shorter period that the registrant was required to submit and post such files). Yes [ ] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “accelerated filer,” “large accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer [ ] Accelerated filer [ ] Non-accelerated filer [ ] Smaller reporting company [X]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

The aggregate market value of the common stock held by non-affiliates of the registrant as of June 26, 2010 was $12,687,353.

The number of shares outstanding of the registrant’s class of common stock, as of March 31, 2011

Common Stock, $.10 Par Value — 17,120,383 shares

DOCUMENTS INCORPORATED BY REFERENCE

The information required by Part III (Items 10, 11, 12, 13 and 14) is incorporated by reference from the registrant’s definitive proxy statement for its Annual Meeting of Stockholders, to be filed with the Commission pursuant to Regulation 14A, or if such proxy statement is not filed with the Commission on or before 120 days after the end of the fiscal year covered by this Report, such information will be included in an amendment to this Report filed no later than the end of such 120-day period.

PART I

| ITEM 1. | BUSINESS |

General

Cybex International, Inc. (the “Company” or “Cybex”), a New York corporation, is a manufacturer of exercise equipment and develops, manufactures and markets strength and cardiovascular fitness equipment products for the commercial and, to a lesser extent, consumer markets. The Company operates in one business segment.

Products

The Company develops, manufactures and markets high performance, professional quality exercise equipment products for the commercial market and, to a lesser extent, the premium segment of the consumer market. These products can generally be grouped into two major categories: cardiovascular products and strength systems.

The Company’s products are of professional quality and are believed to be among the best in the category in which they compete, featuring high performance and durability suitable for utilization in health clubs or by professional athletes. Accordingly, the majority of the Company’s products are premium priced.

The contribution to net sales of the Company’s product lines over the past three years is as follows (dollars in millions):

| 2010 | 2009 | 2008 | ||||||||||||||||||||||

| Net Sales | Percent | Net Sales | Percent | Net Sales | Percent | |||||||||||||||||||

| Cardiovascular products |

$ | 69.4 | 56 | % | $ | 66.7 | 55 | % | $ | 76.8 | 52 | % | ||||||||||||

| Strength systems |

41.0 | 33 | 42.0 | 35 | 58.2 | 39 | ||||||||||||||||||

| Parts |

5.7 | 5 | 5.3 | 4 | 4.8 | 3 | ||||||||||||||||||

| Freight and other sales (1) |

6.9 | 6 | 6.5 | 6 | 8.1 | 6 | ||||||||||||||||||

| $ | 123.0 | 100 | % | $ | 120.5 | 100 | % | $ | 147.9 | 100 | % | |||||||||||||

| (1) | Reflects shipping and handling fees and costs included on customer invoices. |

“Cybex”, “Eagle”, “VR3” and “Arc Trainer” are registered trademarks of Cybex, and “Big Iron,” “Bravo”, “Cyclone-S”, “CX-445T”, “FT-360”, “FT-450”, “Home Arc”, “Jungle Gym”, “LCX-425T”, “MG525”, “Pro3”, “Safety Sentry”, and “VR1” are trademarks of Cybex.

Cardiovascular Products. The Company’s cardiovascular equipment is designed to provide aerobic conditioning by elevating the heart rate, increasing lung capacity, endurance and circulation, and burning body fat. The Company’s cardiovascular products include cross trainers, treadmills, bikes and steppers. All of the Company’s cardiovascular products incorporate computerized electronics which control the unit and provide feedback to the user. All of the cardiovascular products, except the Home Arc, can be equipped with optional TV monitors that feature controls integrated into the control console, with an incremental list price of approximately $1,600.

Cross Trainers. Cybex Arc Trainer is a product designed to provide the user with more and varied training potential. It provides motions that vary from gliding to climbing. Its brake design provides resistance up to 900 Watts in the commercial version to meet the demands ranging from the casual user to the athlete. The 750AT and 750A Arc Trainers use a control console that is based on the 750T treadmill console, facilitating cross-use of these products. The 750AT Total Body Arc Trainer retains all of the functionality of the original Arc Trainer and adds upper body motion to provide for total body training. The Company also produces the 425A Arc Trainer for the light commercial and high-end consumer markets and the 360A Arc Trainer for the consumer market. The Arc Trainers’ list prices range from $3,495 to $7,995.

2

Treadmills. The Company has four treadmill models, the 750T, Pro3, CX-445T, and LCX-425T. The LCX-425T is a high-end consumer and light commercial product while the other models are for the commercial market. Each treadmill model is motorized and incorporates computerized electronics controlling speed, incline, display functions and preset exercise programs. The electronics also provide displays to indicate speed, elevation, distance, time, pace and a variety of other data. All of the treadmills include a complete diagnostic suite that can be accessed through the display, which is useful in the maintenance of the product. The CX-445T, Pro3 and 750T also include an innovative safety feature known as Safety Sentry which causes the treadmill to stop once it detects inactivity with the user. All treadmills are equipped with contact heart rate monitoring and deck suspension system and include wireless heart rate monitoring capabilities. The CX-445T and Pro3 are scheduled for phase out in early 2011. The Company anticipates introducing two new treadmills in early 2011, the 625T and 770T. The Company’s treadmills have list prices ranging from $4,795 to $7,895.

Bikes. The Company has two bikes, the 750C Upright Cycle and 750R Recumbent Cycle. These bikes feature improved ergonomics including a walk-through design on the recumbent model as well as improved ease of use and an exceptionally broad resistance range with multiple resistance modes. These products are designed to allow any users to receive the maximum benefit in minimum time. The console design is based on that of the 750T, 750A and 750AT to provide a common method of operation. The list price of the upright bike is $3,495 and the recumbent bike is $3,695.

Steppers. The Company has one model of stepper targeting the commercial marketplace. The Cyclone-S Stepper features the family display common to the Pro3 as well as an advanced ergonomic handrail design, contact and Polar heart rate monitoring and patented drive system. The list price of the Cyclone-S is $3,395.

Strength Training Products. Strength training equipment provides a physical workout by exercising the musculo-skeletal system. The Company’s strength training equipment uses weights for resistance. This product line includes selectorized single station equipment, jungle gyms, modular multi-station units, the MG525 multi-gym, functional trainers, plate-loaded equipment and free-weight equipment.

Selectorized Equipment. Selectorized single station equipment incorporates stacked weights, permitting the user to select different weight levels for a given exercise by inserting a pin at the appropriate weight level. Each selectorized product is designed for a specific muscle group with each product line utilizing a different technology targeted to facility and user type.

The Company’s selectorized equipment is sold under the trademarks “VR1”, “VR3” and “Eagle.” The VR1 line represents a value-engineered line suitable for smaller general-purpose facilities and as an entry line in larger facilities. This 20 piece line was introduced in 2007 as a replacement for the VR line. Eight new dual function machines intended for use in smaller facilities were added in 2008 and 2009. The VR3 line is a 23 piece line designed for exceptional ease of use in fitness facilities. Eagle represents the Company’s premier line and features a complete scope of use; it features ease-of-use as well as patented and patent pending technologies to meet the needs of performance oriented individuals and facilities. The Company currently sells 74 selectorized equipment products under the above lines with list prices between $2,725 and $7,295.

Modular Units. The Jungle Gym provides facilities with a multi-station, configurable design for essential movements. The pricing of the Jungle Gym depends on configuration. The list price of a typical Jungle Gym is $12,135.

Multi-gym. The Company introduced the MG525 in early 2010, replacing an earlier model. The multi-gym uses considerably less space than multiple selectorized single station equipment. It contains three weight stacks to meet the needs of the vertical commercial market, especially hotels, corporate fitness centers and other small-scale locations. This product has a list price of $5,995.

3

Functional Trainers. The FT-360 was phased out in late 2010. The Bravo (originally the FT-450) was introduced in late 2008 as a successor to the FT-360. The Bravo extends the capabilities of functional training through the ability to vary the width of the cables and to add stabilization in a progressive manner. The Company has added four additional configurations targeted to rehabilitation and sports performance markets. These products have a list price ranging from $6,195 to $7,395.

Plate Loaded Equipment. The Company manufactures and distributes a wide range of strength equipment which mimics many of the movements found on its selectorized machines but are manually loaded with weights. These are simple products which allow varying levels of weight to be manually loaded. In 2009, the Company introduced eight updated models while phasing out earlier products. The Company currently offers 18 plate-loaded products, ranging in price from $1,425 to $4,065.

Free-Weight Equipment. The Company also sells free-weight benches and racks and complements them with OEM supplied dumbbells, barbells and plates. In 2010, the Company added the Big Iron line of free-weight products targeted at collegiate and professional athletic performance training. The Company offers 31 items of free-weight equipment with list prices ranging from $425 to $5,895.

Customers and Distribution

The Company markets its products to commercial customers and to individuals interested in purchasing premium quality equipment for use in the home. A commercial customer is defined as any purchaser who does not intend the product for home use. Management estimates that consumer sales represent less than 10% of 2010 net sales. Typical commercial customers are health clubs, hotels, resorts, spas, educational institutions, sports teams, sports medicine clinics, military installations, golf clubs, corporate fitness and community centers. Sales to Cutler-Owens International Ltd., an independent authorized dealer, represented 13.0%, 13.6% and 12.3% of the Company’s net sales for 2010, 2009 and 2008, respectively. Sales to Planet Fitness Equipment, LLC represented 12.4%, 10.6%, and 10.2% of the Company’s net sales for 2010, 2009, and 2008, respectively. Sales to Snap Fitness, Inc. or its franchisees represented 4.1%, 7.4% and 12.9% of the Company’s net sales for 2010, 2009 and 2008, respectively. No other customer accounted for more than 10% of the Company’s net sales for 2010, 2009 or 2008.

The Company distributes its products through independent authorized dealers, its own sales force, international distributors and its e-commerce web site (www.cybexinternational.com). The Company services its products through independent authorized dealers, international distributors, a network of independent service providers and its own service personnel.

Independent authorized dealers operate independent stores specializing in fitness-related products and promote home and commercial sales of the Company’s products. The operations of the independent dealers are primarily local or regional in nature. In North America, the Company publishes dealer performance standards which are designed to assure that the Company brand is properly positioned in the marketplace. In order to qualify as an authorized dealer, the dealer must, among other things, market and sell Cybex products in a defined territory, achieve sales objectives, have qualified sales personnel, and receive on-going product and sales training. As of March 1, 2011, the Company has approximately 63 active dealers with 116 locations in North America. The Company’s domestic sales force services this dealer network and sells direct in regions not covered by a dealer and in specialty markets, such as the military/government, fire departments, golf clubs or universities. The domestic sales team is comprised of 39 positions including territory managers or reps, regional or national account managers, Assistant Vice Presidents, and a Senior Vice President.

The national account team focuses on major market segments such as health clubs and gyms, hotels, resorts, the U.S. government and organizations such as YMCAs, as well as third party consultants which purchase on behalf of such national accounts. The Company has approximately 25 national accounts.

4

Sales outside of North America accounted for approximately 31%, 29% and 28% of the Company’s net sales for 2010, 2009 and 2008, respectively. The international sales force consists of 14 positions including a Senior Vice President, a Vice President of Europe Business Development, regional sales managers, country sales managers, a director of International Training, a Director of Communications, an operations coordinator and a European Group Sales Administrator. The Company, through its wholly-owned subsidiary, Cybex UK, directly markets and sells Cybex products in the United Kingdom. Cybex UK has 14 employees. The Company utilizes independent distributors for the balance of its international sales. There are approximately 67 independent distributors in 74 countries currently representing Cybex. The Company enters into international distributor agreements with these distributors which define territories, performance standards and volume requirements.

Additional information concerning the Company’s international sales and assets located in foreign countries is located in Note 2 to the Company’s consolidated financial statements.

The Company markets certain products by advertising in publications which appeal to individuals within its targeted demographic profiles. In addition, the Company advertises in trade publications and participates in industry trade shows. The Company has retained Greg Norman to engage in marketing of the Company’s products, specifically to the golf club market.

The Company offers leasing and other financing options for its commercial customers. The Company arranges financing for its dealers and direct sale customers through various third party lenders for which it may receive a fee. Management believes that these activities produce incremental sales of the Company’s products.

Warranties

All products are warranted for one year of labor and up to ten years for structural frames. Warranty periods for parts range from one to ten years depending on the part and type of equipment. The Company also provides extended warranties on its cardiovascular products. Warranty expense for the years ended December 31, 2010, 2009 and 2008 was $3,547,000, $4,940,000 and $4,361,000, respectively.

Competition

The market in which the Company operates is highly competitive. Numerous companies manufacture, sell or distribute exercise equipment. The Company currently competes primarily in the premium-performance, professional quality equipment segment of the market. The Company’s competitors vary according to product line and include companies with greater name recognition and more extensive financial and other resources than the Company.

Important competitive factors include price, product quality and performance, diversity of features, warranties and customer service. The Company follows a policy of premium quality and differentiated features which results in products having suggested retail prices at or above those of its competitors in most cases. The Company currently focuses on the segment of the market which values quality and is willing to pay a premium for products with performance advantages over the competition. Management believes that its reputation for producing products of high quality and dependability with differentiated features constitutes a competitive advantage.

Product Development

Research and development expense for the years ended December 31, 2010, 2009 and 2008 was $5,569,000, $4,545,000 and $6,603,000, respectively. At December 31, 2010, the Company had the equivalent of 38 employees engaged in ongoing research and development programs. The Company’s development efforts focus on improving existing products and developing new products, with the goal of producing user-friendly, ergonomically and biomechanically correct, durable exercise equipment with competitive features. Product development is a cross functional effort of sales, marketing, product management, engineering and manufacturing, led by the Company’s Senior Vice President of Research and Development.

5

Manufacturing and Supply

The Company maintains two vertically integrated manufacturing facilities equipped to perform fabrication, machining, welding, grinding, assembly and finishing of its products.

The Company manufactures treadmill and bike cardiovascular products in its facility located in Medway, Massachusetts and manufactures the cross trainers and strength equipment in its facility located in Owatonna, Minnesota. Raw materials and purchased components are comprised primarily of steel, aluminum, wooden decks, electric motors, molded or extruded plastics, milled products, circuit boards for computerized controls, video monitors and upholstery. These materials are assembled, fabricated, machined, welded, powder coated and upholstered to create finished products.

The Company’s stepper, multi-gym, and Home Arc products are manufactured for the Company in Taiwan.

The Company single sources its stepper, multi-gym and Home Arc products and certain raw materials and component parts, including drive motors, belts, running decks, molded plastic components, electronics and video monitors, where it believes that sole sourcing is beneficial for reasons such as quality control and reliability of the vendor or cost. The Company attempts to reduce the risk of sole source suppliers by maintaining varying levels of inventory. However, the loss of a significant supplier, or delays or disruptions in the delivery of components or materials, or increases in material costs, could have a material adverse effect on the Company’s operations.

The Company manufacturers most of its strength training equipment on a “build-to-order” basis which responds to specific sales orders. The Company manufactures its other products based upon projected sales in addition to a “build to order” basis.

Backlog

Backlog historically has not been a significant factor in the Company’s business.

Patents and Trademarks

The Company owns, licenses or has applied for various patents with respect to its products and has also registered or applied for a number of trademarks. While these patents and trademarks are of value, management does not believe that it is dependent, to any material extent, upon patent or trademark protection.

Insurance

The Company’s product liability insurance currently provides an aggregate of $10,000,000 of annual coverage on a claims made basis ($5,000,000 annual coverage for claims made prior to December 1, 2008). These policies include a deductible of $250,000 on claims made after December 1, 2008 with an annual aggregate deductible of $1,000,000 (for claims made prior to December 1, 2008, a $100,000 deductible with an annual aggregate deductible of $750,000). Reserves for self insured retention, including claims incurred but not yet reported, are included in accrued liabilities on the consolidated balance sheet.

Governmental Regulation

The Company’s products are not subject to material governmental regulation.

The Company’s operations are subject to federal, state and local laws and regulations relating to the environment. The Company regularly monitors and reviews its operations and practices for compliance with these laws and regulations, and management believes that it is in material compliance with such environmental

6

laws and regulations. Despite these compliance efforts, some risk of liability is inherent in the operation of the business of the Company, as it is with other companies engaged in similar businesses, and there can be no assurance that the Company will not incur material costs in the future for environmental compliance.

Employees

On March 1, 2011, the Company employed 552 persons on a full-time basis. None of the Company’s employees are represented by a union. The Company considers its relations with its employees to be good.

Available Information

The Company files reports electronically with the Securities and Exchange Commission. Forms 8-K, 10-Q, 10-K, Proxy Statements and other information can be viewed at http://www.sec.gov. This information can also be viewed without charge at the Company’s own website at http://www.cybexinternational.com. The internet website address for Cybex is included in this report for identification purposes. The information contained therein or connected thereto are not intended to be incorporated into this Annual Report on Form 10-K.

| ITEM 1A. | RISK FACTORS |

The risk factors identified in the cautionary statements below could cause our actual results to differ materially from those suggested in the forward-looking statements appearing elsewhere in this Annual Report on Form 10-K. However, these risk factors are not exhaustive and new risks may also emerge from time to time. It is not possible for management to predict all risk factors or to assess the impact of all risk factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Accordingly, forward-looking statements should not be relied upon as a prediction of actual results.

We are subject to a product liability jury verdict substantially in excess of our insurance coverage and beyond our capacity to pay. On December 7, 2010, the jury in the Barnhard v Cybex International, Inc. product liability suit returned a $66 million verdict, apportioned 75% to Cybex, 20% to a non-affiliated co-defendant and 5% to the plaintiff. Under New York law, Cybex would be responsible for payment of 95% of any judgment entered on this verdict and may then seek to collect 20% of such judgment from the co-defendant. Our available insurance coverage for this matter as of December 31, 2010 was approximately $2,900,000. See Item 3, Part 1 below and Note 14 of the Notes to the Consolidated Financial Statements included herein for a more detailed description of this matter. We intend to vigorously pursue all available options to seek a reversal or reduction of the verdict and any judgment that is ultimately entered on the verdict. However, any appeals we make in this matter may be denied. In addition, we may be required to post a bond in a significant amount, up to the full amount of the judgment, in order to obtain a stay of enforcement of the judgment during the pendency of our appeals, and there is no assurance that we will have the financial ability to obtain such a bond. We do not have the resources to a satisfy our obligations if the plaintiff is ultimately able, either due to our inability to post a bond or the failure of our appeals, to enforce a judgment in this matter unless the judgment is substantially reduced from the jury verdict. Even if we have the financial ability to obtain a bond or to pay a reduced judgment, such events could have a material adverse effect on our business prospects, liquidity, financial condition and cash flows. The uncertainties of this matter may also negatively affect the willingness of others, including our customers, vendors and lenders, to do business with us. The above factors have caused our independent registered public accountants to include an explanatory paragraph in their opinion on our consolidated financial statements included herein stating that this matter raises substantial doubt about our ability to continue as a going concern.

Failure to comply with our credit facilities could have a material adverse effect upon us. We failed to meet certain financial covenants contained in our credit facilities at March 28 and June 27, 2009. We obtained waivers from each lender for the quarters then ended, and we also renegotiated our financial covenants with our lenders.

7

In March, 2011, our financial covenants were further amended and we are currently in compliance with our credit facilities. A failure to remain in compliance with our credit facilities could result in a number of consequences, such as our lenders requiring all indebtedness to be paid or our revolving lender refusing to extend further revolving loans, which could have a material adverse effect on our business, prospects or financial condition.

Our revolving credit facility matures on July 1, 2011. Our revolving credit facility matures on July 1, 2011, prior to which time we anticipate it will be extended or refinanced. However, there is no assurance that such extension or refinancing will be available or, if available, that it will be on favorable terms. If we are unable to extend or refinance the revolving credit facility, we would not have available to us working capital loans. While we have not utilized the revolving credit facility for working capital financing since 2009, the failure to have revolving credit availability could result in insufficient sources of liquidity to meet our obligations.

We have incurred losses. We incurred net losses in the last three fiscal years. In 2008 we recorded a goodwill impairment charge of $11,247,000, resulting in a net loss for the year. An approximate 19% decline in our 2009 net sales compared to the prior year was a substantial contributor to our 2009 net loss. In 2010, we incurred $45,991,000 in pre-tax litigation charges, related to the product liability jury award discussed above, and a $12,665,000 incremental tax provision, primarily due to the valuation allowance recorded against deferred tax assets as a result of the uncertainty of realization caused by the litigation charge, resulting in a net loss of $58,237,000 for the year. If we are unable to maintain our profitability and we incur losses in the future, such losses could have a material adverse effect on our business prospects, liquidity, financial condition and cash flows.

General economic conditions affect our results. Demand for our products is affected by economic conditions and consumer confidence. In times of economic uncertainty, our customers, particularly commercial customers such as fitness clubs, may become cautious in making expansion and other investments and may reduce their capital expenditures for items such as the fitness equipment offered by us. In addition, economic conditions could make it more difficult for us to collect amounts as they become due to us. While our net sales in 2010 were 2% above prior year results, net sales for 2009 and 2010 were approximately 19% and 17%, respectively, below 2008 net sales. We believe that this sales decline largely reflected our customers’ caution in making capital investment decisions due to economic conditions, both generally and in the fitness industry. If these economic conditions persist or further deteriorate, our ability to generate future revenues and earnings and our business prospects, liquidity and financial condition could be materially adversely affected.

We depend upon our ability to successfully develop, market and sell new or improved products. Our continued growth and ability to remain competitive will substantially depend upon our development of new or improved products. A failure to develop new or improved products on a timely basis, or which are accepted in the marketplace, or which produce appropriate sales or profit margins, could adversely affect our ability to generate future revenues and earnings and have a negative impact on our business prospects, liquidity and financial condition.

Increases in raw material costs, or the unavailability of raw materials or components, could adversely affect us. Increases in our cost of raw materials could have a material effect on our profitability. We currently source our Home Arc, multi-gym and stepper and certain raw materials and component parts (e.g., drive motors, belts, running decks, molded plastic components and electronics) from single suppliers. Current economic conditions may make it more likely that our suppliers are unable to deliver supplies which we require on a timely basis or at all. The loss of a significant supplier, or delays or disruptions in the delivery of raw materials or components, could adversely affect our ability to generate future revenues and earnings and have a material adverse effect on our business and financial results.

We are subject to product liability claims that may exceed our insurance coverage. As a manufacturer of fitness products, we are inherently subject to the hazards and uncertainties of product liability litigation. We have maintained, and expect to continue to maintain, product liability insurance, and we include reserves for self

8

insured retention in accrued liabilities in our consolidated balance sheets. While we believe that our current insurance coverage is adequate, we may be subject to product liability claims which assert damages materially in excess of the limits of our insurance coverage. In December 2010, a significant jury verdict was rendered in a product liability suit, discussed above, which substantially exceeds our available insurance coverage. It is possible that the Company could be subject to other product liability judgments or settlements which materially exceed the available insurance coverage and related reserves.

We have been involved in a number of other litigation matters and expect legal claims in the future. In recent years we have been involved in a number of other litigation matters, including with respect to intellectual property rights and contractual disputes. We expect that we will continue to be involved in litigation in the ordinary course of business. While we maintain reserves for estimated litigation costs and losses, one or more adverse determinations or excessive costs in litigation affecting us could have a material adverse effect on our business prospects, liquidity, financial condition and cash flows.

Our failure or inability to protect our intellectual property from misappropriation or competition could adversely affect our business prospects. Our intellectual property aids us in competing in the exercise equipment industry. Despite our efforts to protect our intellectual property rights, such as through patent, trade secret and trademark protection, unauthorized parties may try to copy our products, or obtain and use information that we regard as proprietary. In addition, the laws of some foreign countries may not protect our rights to as great an extent as U.S. law. Furthermore, the patents and trademarks which we have obtained or may seek in the future may not be of a sufficient scope or strength to provide meaningful economic or competitive value. Our rights and the additional steps we have taken to protect our intellectual property may not be adequate to deter misappropriation, and we also remain subject to the risk that our competitors or others will independently develop non-infringing products substantially equivalent or superior to our products. We also may not be able to prevent others from claiming that our products violate their proprietary rights. If we are unable to protect our intellectual property, or if we are sued for infringing another party’s intellectual property, our business, financial condition, results of operation or cash flows could be materially adversely affected.

We principally use two facilities to produce our products and a material business disruption at either facility could significantly impact our business. Most of our products are manufactured or assembled in two vertically integrated facilities located in Massachusetts and Minnesota. These facilities house all our manufacturing operations and our executive offices. We take precautions to safeguard our facilities, including obtaining insurance, maintaining safety protocols and using off-site storage of computer data. However, a natural disaster, such as an earthquake, fire or flood, or an act of terrorism or vandalism, could cause substantial disruption to our operations, damage or destroy our manufacturing equipment, information systems or inventory and cause us to incur substantial additional expenses. The insurance we maintain against disasters may not cover or otherwise be adequate to meet our losses in any particular case. Any disaster which prevents operations in either of our facilities for any extended period may result in decreased revenues and increased costs and could significantly harm our operating results, financial condition, cash flows and prospects.

The loss of a major customer could adversely affect us. In 2010 sales to one independent authorized dealer represented 13.0% of our net sales and sales to an end user customer represented 12.4% of net sales. These customers represented 9.5% and 6.7%, respectively, of our accounts receivable as of December 31, 2010. The concentration of customers may increase our overall exposure to credit risk. The loss or significant reduction in the business of a major customer, or a major customer experiencing financial difficulty, could significantly harm our operating results, financial condition, cash flows and prospects.

We rely on third party dealers and distributors to sell and service a significant portion of our products. In 2010, more than half of our total net sales were to our independent authorized dealers in North America and to independent distributors internationally. These third party dealers and distributors may terminate their relationships with us, or fail to commit the necessary resources to sell or service our products to the level of our

9

expectations. If current or future third party dealers or distributors do not perform adequately, or if we fail to maintain our existing relationships with them or fail to recruit and retain dealers or distributors in particular markets or geographic areas, our revenues may be adversely affected and our operating results could suffer.

Our major stockholders may exercise effective control over us. John Aglialoro, Joan Carter and UM Holdings Ltd., who are related parties, collectively own approximately 49.5% of our outstanding common stock. Such stockholders may have the ability to significantly influence (i) the election of our Board of Directors, and thus our future direction and (ii) the outcome of all other matters submitted to our stockholders, including mergers, consolidations and the sale of all or substantially all of our assets.

We face strong competition. The fitness equipment industry is highly competitive. Numerous companies manufacture, sell or distribute exercise equipment. Our competitors include companies with strong name recognition and more extensive financial and other resources than us.

We carry debt. We carry long-term debt. This leverage may have several important consequences, including the need to meet debt service requirements and vulnerability to changes in interest rates. This leverage may also limit our ability to raise additional capital, withstand adverse economic or business conditions and competitive pressures, and take advantage of significant business opportunities that may arise.

Warranty claims may exceed the related reserves. We warrant our products for varying periods of up to ten years. While we maintain reserves for warranty claims, it could have a material adverse effect on our business prospects, liquidity, financial condition and cash flows if warranty claims were to materially exceed anticipated levels.

We may have a liability related to the arrangement of third party financing. We offer to our customers leasing and other financing of products by third party providers, for which we may receive a fee. While most of these financings are without recourse, in certain cases we may offer a guaranty or other recourse provisions. At December 31, 2010, our maximum contingent liability under all recourse provisions was approximately $5,691,000. While we maintain a reserve for estimated losses under these recourse provisions, it could have a material adverse effect on our business prospects, liquidity, financial condition and cash flows if actual losses were to materially exceed the related reserve.

We are currently not in compliance with, and may be unable to regain or maintain compliance with, NASDAQ’s continued listing requirements. On January 21, 2011, we received notification from the NASDAQ Stock Market (“NASDAQ”) that we no longer meet the NASDAQ’s continued listing requirement because our common stock traded below $1.00 per share for 30 consecutive business days. The notification of non-compliance has no immediate effect on the listing or trading of our securities on the NASDAQ Global Market. To regain compliance, the closing bid price of our common stock must meet or exceed $1.00 per share for at least 10 consecutive business days prior to July 20, 2011. In addition to NASDAQ’s $1.00 minimum bid price rule, there are a number of other continued listing requirements that we must satisfy in order to maintain our listing on NASDAQ, and there is no assurance we will regain and maintain compliance with the NASDAQ continued listing standards. The delisting of our common stock from trading on NASDAQ could have a significant negative effect on the market for, and liquidity and value of, our common stock.

Unfavorable international political or economic changes and/or currency fluctuations could negatively impact us. Approximately 31% and 29% of our sales in 2010 and 2009, respectively, were derived from outside North America. Political or economic changes and/or currency fluctuations in countries in which we do business could negatively impact our business and financial results, including decreases in our revenues and profitability.

We may not be able to attract and retain key employees and the loss of any member of our senior management could negatively affect our business. We compete for the services of qualified personnel. Our future success will depend upon, to a significant degree, the performance and contribution of the members of senior

10

management and upon our ability to attract, motivate and retain other highly qualified employees with technical, management, marketing, sales, product development, creative and other skills. Although we do have employment agreements with our executive officers, there can be no assurance that such officers will continue to perform under those contracts. Our business, financial condition and results of operations could be materially and adversely affected if we lost the services of members of our senior management team or key technical or creative employees or if we failed to attract additional highly qualified employees.

Future issuances of preferred stock may adversely affect the holders of our common stock. Our Board has the ability to issue, without approval by the common stockholders, shares of one or more series of preferred stock, with the new series having such rights and preferences as the Board may determine in its sole discretion. Any series of preferred stock may have rights, including cumulative dividend, liquidation and conversion rights, senior to our common stock, which could adversely affect the holders of the common stock, as well as the economic value of the common stock.

A variety of factors may discourage potential take-over attempts. John Aglialoro, Joan Carter and UM Holdings Ltd., who are related parties, collectively own approximately 49.5% of our outstanding common stock. In addition, our Certificate of Incorporation requires an affirmative super-majority stockholder vote before we can enter into certain defined business combinations, except for combinations that meet certain specified conditions; provides for staggered three-year terms for members of the Board of Directors; and authorizes the Board of Directors to issue preferred stock in one or more series and to fix the rights, preferences, privileges and restrictions of such preferred stock without any further vote or action by our stockholders. Each of these factors could have the effect of discouraging potential take-over attempts and may make attempts by stockholders to change our management more difficult.

In the event we are unable to satisfy regulatory requirements relating to internal control over financial reporting, or if these internal controls are not effective, our business and financial results may suffer. Effective internal controls are necessary for us to provide reasonable assurance with respect to our financial reports and to effectively prevent fraud. If we cannot provide reasonable assurance with respect to our financial reports and effectively prevent fraud, our business and operating results could be harmed. Pursuant to the Sarbanes-Oxley Act of 2002, we are required to furnish a report by management on internal control over financial reporting, including management’s assessment of the effectiveness of such control. Internal control over financial reporting may not prevent or detect misstatements because of its inherent limitations, including the possibility of human error, the circumvention or overriding of controls, or fraud. Therefore, even effective internal controls can provide only reasonable assurance with respect to the preparation and fair presentation of financial statements. In addition, projections of any evaluation of the effectiveness of internal control over financial reporting to future periods are subject to the risk that the control may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate. If we fail to maintain the adequacy of our internal controls, including any failure to implement required new or improved controls, or if we experience difficulties in their implementation, our business and operating results could be harmed, we could fail to meet our reporting obligations, and there could also be a material adverse effect on our stock price.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

| ITEM 2. | PROPERTIES |

The Company occupies approximately 120,000 square feet of space in Medway, Massachusetts and approximately 340,000 square feet of space in Owatonna, Minnesota for administrative offices, manufacturing, assembly and warehousing. Both facilities are owned by the Company. The Company also utilizes outside warehousing.

11

Cybex UK, the Company’s wholly-owned United Kingdom subsidiary, leases approximately 728 square feet of space in Measham, England. This space is utilized for the subsidiary’s direct sales and service efforts in the United Kingdom, which serves Cybex’s operations throughout Europe.

The Company’s manufacturing facilities are equipped to perform fabrication, machining, welding, grinding, assembly and powder coating of its products. These facilities are well maintained and kept in good repair. Management believes that the Company’s facilities are adequate for its operations for the foreseeable future.

Additional information concerning the financing of the Company’s facilities are described in Notes 7 and 14 to the Company’s consolidated financial statements.

| ITEM 3. | LEGAL PROCEEDINGS |

Product Liability

As a manufacturer of fitness products, the Company is inherently subject to the hazards and uncertainties of product liability litigation. The Company has maintained, and expects to continue to maintain, product liability insurance, and it includes reserves for self insured retention in accrued liabilities in the consolidated balance sheets. While the Company believes that its insurance coverage is adequate in light of the risks of product liability claims and awards, the Company may be subject to product liability claims which assert damages materially in excess of the limits of its insurance coverage. In December 2010, a jury verdict in the Barnhard v Cybex International, Inc. product liability suit, discussed below, apportioned a significant amount of liability to the Company, which substantially exceeds the Company’s available insurance coverage. It is possible that the Company could be subject to other product liability judgments or settlements which materially exceed the available insurance coverage and related reserves.

Litigation and Contingencies

Barnhard v. Cybex International, Inc., et al.

This product liability litigation was commenced in 2005 in the Supreme Court, Eighth District, State of New York. The plaintiff, who was rendered a quadriplegic after she pulled a Cybex weight machine over onto herself, asserted that Cybex was at fault for the accident due to the design of the machine and a failure to warn. On December 7, 2010, the jury returned a $66 million verdict, apportioned 75% to Cybex, 20% to co-defendant Amherst Orthopedic Physical Therapy, P.C. and 5% to the plaintiff. Under New York law, Cybex would be responsible for payment of 95% of any judgment entered on this verdict and may then seek to collect 20% of such judgment from the co-defendant.

In January 2011 the Company filed post-trial motions, seeking, alternatively, judgment in its favor as a matter of law, a new trial and a reduction of the verdict. In February 2011, the trial court denied these motions, and the Company thereafter filed an appeal from this post-trial order with the Appellate Division, Fourth Judicial Department. At the date of this Report, no judgment has been entered on the verdict. Interest does not begin to accrue on this judgment until after it has been entered. The Company intends to vigorously pursue all available options to seek a reversal or reduction of the verdict and any judgment that is ultimately entered.

United Leasing, Inc. v. Cybex International, Inc., et al.

The Company on February 25, 2009 was served with an Amended Complaint which added the Company and its wholly owned subsidiary, Cybex Capital Corp. (collectively with the Company referred to herein as Cybex), as additional defendants in this action originally venued in the Circuit Court for Williamson County, State of Tennessee. The plaintiff, United Leasing, Inc., provided a series of lease financings for the sale of Cybex equipment to a purchaser/lessee which has since entered bankruptcy, many of which sales were made by an independent dealer, also a defendant in the action. The plaintiff alleged that it was induced to finance in excess of

12

the purchase price for certain of the equipment based primarily upon alleged rebates to the purchaser/lessee made by the independent dealer. Cybex Capital assisted in the lease financing and the plaintiff asserted that Cybex participated in the alleged scheme and was liable for any resulting damages.

During March 2009, this action was removed to the United States District Court for the Middle District of Tennessee, and Cybex filed an Answer denying all material allegations of the Amended Complaint, other than admitting limited guarantees of certain of the leases at issue had been provided.

In January 2011, the parties entered into a settlement agreement. Pursuant to this settlement, Cybex paid to the plaintiff the sum of $937,500, the parties provided cross-releases of all claims and the litigation has been dismissed with prejudice.

The Company is involved in certain other legal actions, contingencies and claims arising in the ordinary course of business. In the opinion of management, the ultimate disposition of these other matters will not have a material adverse effect on the Company’s financial position, results of operations or cash flows. Legal fees related to those matters are charged to expense as incurred.

| ITEM 4. | RESERVED |

SPECIAL ITEM. EXECUTIVE OFFICERS OF REGISTRANT

Officers are elected by the Board of Directors and serve at the pleasure of the Board. The executive officers of the Company as of March 15, 2011 were as follows:

| Name |

Age | Position | ||||

| John Aglialoro |

67 | Chairman and Chief Executive Officer | ||||

| Arthur W. Hicks, Jr. |

52 | President, Chief Operating Officer and Chief Financial Officer | ||||

| Edward Kurzontkowski |

47 | Senior Vice President of Manufacturing | ||||

| Raymond Giannelli |

57 | Senior Vice President of Research and Development | ||||

| Edward J. Pryts |

50 | Senior Vice President of Sales—North America | ||||

| John P. Young |

48 | Senior Vice President of Sales—International | ||||

Mr. Aglialoro has served as Cybex’s Chief Executive Officer since 2000. Mr. Aglialoro is also the Chairman of UM Holdings Ltd., which he co-founded in 1973. UM Holdings Ltd. is the Company’s principal stockholder. He served as a Director and Chairman of Trotter Inc. (“Trotter”) from 1983 until Trotter’s merger with Cybex in 1997, from which time he has served as the Chairman of the Company’s Board of Directors.

Mr. Hicks is the Company’s President, Chief Operating Officer and Chief Financial Officer. Mr. Hicks has served the Company as President since 2008, as Chief Operating Officer since 2006 and as Chief Financial Officer since 2002. He also held the title Executive Vice President from 2006 until his appointment as President. Prior to 2006, he served Cybex through a service agreement between the Company and UM Holdings Ltd., where he was employed as Chief Financial Officer since 1988. He was a director of Trotter from 1994 to 1997 and has served as a director of Cybex since 1997.

Mr. Kurzontkowski has served as the Company’s Senior Vice President of Manufacturing since 2008. He joined Trotter in 1981 and has served the Company in a variety of capacities, including Executive Vice President of Operations from 2002 to 2003 and Senior Vice President of Manufacturing and Engineering from 2003 to 2008.

Mr. Giannelli has served as the Company’s Senior Vice President of Research and Development since 2003. He first joined Cybex in 1975 and served in various positions including Vice President of Research and Development. In 1991, Mr. Giannelli left Cybex and joined Trotter as the Vice President of Research and

13

Development and continued to maintain that position after the merger of Trotter with Cybex. Mr. Giannelli left Cybex in 1999 and returned in 2001 to assist in Cybex’s research and development effort as the Chairman of the Cybex Institute.

Mr. Pryts has served as the Company’s Senior Vice President of Sales—North America since 2007. Mr. Pryts first joined Trotter in 1993 and has served the Company in a variety of capacities, including Vice President of Sales—North America from 2002 to 2006 and Vice President of Domestic Sales from 2000 to 2002.

Mr. Young has served as the Company’s Senior Vice President of Sales—International since January 2007. He first joined Cybex in 1999 and has served in several capacities, including Vice President of International Sales from 2001 to 2006.

14

PART II

| ITEM 5. | MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

The Company’s common shares are traded on the NASDAQ Global Market under the symbol CYBI.

The following table shows the high and low market prices as reported by NASDAQ:

| 2010 | 2009 | |||||||||||||||

| Calendar |

High | Low | High | Low | ||||||||||||

| First Quarter |

$ | 1.62 | $ | 1.17 | $ | 1.93 | $ | 0.81 | ||||||||

| Second Quarter |

1.72 | 1.17 | 1.49 | 0.95 | ||||||||||||

| Third Quarter |

1.80 | 1.34 | 2.55 | 0.86 | ||||||||||||

| Fourth Quarter |

1.65 | 0.57 | 1.89 | 1.15 | ||||||||||||

As of March 15, 2011, there were approximately 436 common stockholders of record. This figure does not include stockholders with shares held under beneficial ownership in nominee name.

Under the Company’s credit agreements, the Company currently does not have the ability to pay dividends. The present policy of the Company is to retain any future earnings to provide funds for the operation and expansion of its business.

The following table summarizes securities authorized for issuance under equity compensation plans at December 31, 2010:

Equity Compensation Plan Information

| Plan category |

Number of securities to be issued upon exercise of outstanding options, warrants and rights |

Weighted-average exercise price of outstanding options, warrants and rights |

Number of securities remaining available for future issuance under equity compensation plans |

|||||||||

| Equity compensation plans approved by |

791,125 | $ | 2.17 | 565,000 | (1) | |||||||

| Equity compensation plans not approved by |

— | — | — | |||||||||

| Total |

791,125 | $ | 2.17 | 565,000 | ||||||||

| (1) | Consists of 565,000 shares available for issuance under the Company’s 2005 Omnibus Incentive Plan. See Note 10 to the Company’s consolidated financial statements for a description of this plan. |

15

Performance Graph

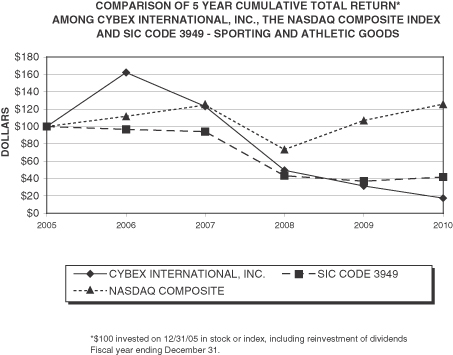

The following graph compares the five-year cumulative total return (change in stock price plus reinvested dividends) on the Company’s common stock with the total returns of the NASDAQ Market Value Index, a broad market index covering stocks listed on the NASDAQ, and the companies in the Sporting and Athletic Goods Industry (SIC Code 3949), a group encompassing 17 companies (the “SIC Code Index”). The performance graph is deemed furnished and not filed with the Securities and Exchange Commission.

Comparison of 5-Year Cumulative Total Return Among

Cybex International, Inc., NASDAQ Market Index,

and SIC Code Index (1)

| 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | |||||||||||||||||||

| Cybex International, Inc. |

$ | 100.00 | $ | 162.16 | $ | 123.24 | $ | 49.73 | $ | 31.62 | $ | 17.84 | ||||||||||||

| NASDAQ Market Index |

100.00 | 111.74 | 124.67 | 73.77 | 107.12 | 125.93 | ||||||||||||||||||

| SIC CODE 3949-Sporting and Athletic Goods |

100.00 | 96.77 | 94.36 | 43.38 | 37.35 | 42.06 | ||||||||||||||||||

| (1) | Assumes $100 invested on December 31, 2005 and dividends are reinvested. Source: Research Data Group, Inc. |

16

| ITEM 6. | SELECTED FINANCIAL DATA |

The following information has been extracted from the Company’s consolidated financial statements for the five years ended December 31, 2010. This selected consolidated financial data should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the Company’s consolidated financial statements and notes thereto included elsewhere in this report.

| Year Ended December 31 | ||||||||||||||||||||

| 2010 | 2009 | 2008 | 2007 | 2006 | ||||||||||||||||

| (in thousands, except per share data) | ||||||||||||||||||||

| Statement of Operations Data: |

||||||||||||||||||||

| Net sales |

$ | 122,961 | $ | 120,474 | $ | 147,929 | $ | 146,503 | $ | 126,924 | ||||||||||

| Cost of sales |

78,114 | 84,466 | 99,940 | 95,683 | 80,241 | |||||||||||||||

| Gross profit |

44,847 | 36,008 | 47,989 | 50,820 | 46,683 | |||||||||||||||

| Selling, general and administrative expenses |

42,072 | 37,680 | 42,321 | 42,224 | 36,757 | |||||||||||||||

| Litigation charge |

45,991 | (a) | — | — | — | — | ||||||||||||||

| Goodwill impairment charge |

— | — | 11,247 | (c) | — | — | ||||||||||||||

| Operating income (loss) |

(43,216 | ) | (1,672 | ) | (5,579 | ) | 8,596 | 9,926 | ||||||||||||

| Interest expense, net |

(1,260 | ) | (1,274 | ) | (1,176 | ) | (963 | ) | (1,839 | ) | ||||||||||

| Income (loss) before income taxes |

(44,476 | ) | (2,946 | ) | (6,755 | ) | 7,633 | 8,087 | ||||||||||||

| Income tax expense (benefit) |

13,761 | (b) | (509 | ) | 2,333 | (2,121 | )(d) | (11,967 | )(e) | |||||||||||

| Net income (loss) |

$ | (58,237 | ) | $ | (2,437 | ) | $ | (9,088 | ) | $ | 9,754 | $ | 20,054 | |||||||

| Basic earnings (loss) per share |

$ | (3.40 | ) | $ | (0.14 | ) | $ | (0.52 | ) | $ | .56 | $ | 1.22 | |||||||

| Diluted earnings (loss) per share |

$ | (3.40 | ) | $ | (0.14 | ) | $ | (0.52 | ) | $ | .55 | $ | 1.18 | |||||||

| (a) | Consists of a $45,991 charge relating to the unfavorable jury verdict in the Barnhard product liability suit. |

| (b) | Includes an increase in the valuation allowance of $30,656 to fully offset deferred tax assets, primarily due to the uncertainty of realization of the Company’s deferred tax assets resulting from the product liability suit. The net incremental tax provision recorded as a result of the litigation charge was $12,665. |

| (c) | Consists of a non-cash non-tax deductible goodwill impairment charge of $11,247 triggered by declines in the Company’s stock price in the period. |

| (d) | Includes a benefit of $5,377 resulting from a reduction in the valuation allowance for deferred income taxes. |

| (e) | Includes a benefit of $15,361 resulting from a reduction in the valuation allowance for deferred income taxes. |

| December 31 | ||||||||||||||||||||

| 2010 | 2009 | 2008 | 2007 | 2006 | ||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| Balance Sheet Data: |

||||||||||||||||||||

| Working capital |

$ | (26,611 | ) | $ | 21,107 | $ | 20,929 | $ | 18,186 | $ | 14,061 | |||||||||

| Total assets |

85,414 | 88,635 | 91,301 | 98,129 | 73,377 | |||||||||||||||

| Long-term debt (including current portion) |

15,809 | 17,606 | 18,488 | 18,950 | 3,762 | |||||||||||||||

| Total stockholders’ equity (deficit) |

(15,010 | ) | 43,109 | 45,451 | 55,042 | 45,667 | ||||||||||||||

17

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

CAUTIONARY STATEMENT FOR FORWARD LOOKING INFORMATION

Statements included in this Management’s Discussion and Analysis of Financial Condition and Results of Operations may contain forward-looking statements. There are a number of risks and uncertainties that could cause actual results to differ materially from those anticipated by the statements made below. These include, but are not limited to, the resolution of litigation involving us, our ability to comply with the terms of our credit facilities, competitive factors, technological and product developments, market demand, and economic conditions. Further information on these and other factors which could affect our financial results can be found in our filings with the Securities and Exchange Commission, including Part I of this Annual Report on Form 10-K.

OVERVIEW AND OUTLOOK

We are a New York corporation that develops, manufacturers and markets high performance, professional quality exercise equipment products for the commercial market and, to a lesser extent, the premium segment of the consumer market.

We estimate that commercial sales represent more than 90% of our total net sales. Our financial performance can be affected when, in times of economic uncertainty, our commercial customers, particularly fitness clubs, become cautious in making expansion and other capital investments and reduce their expenditures for items such as the fitness equipment offered by us.

Our net sales began to decline commencing with the fourth quarter of 2008, with net sales in 2009 and 2010 approximately 19% and 17%, respectively, below 2008 net sales. We believe that this sales decline largely reflects our commercial customers, particularly fitness clubs, being cautious in making capital investments due to economic conditions, both generally and in the fitness industry.

Our sales began to recover in 2010, with 2010 net sales approximately 2% above 2009 net sales. This improvement in sales accelerated throughout the year, with sales in the second and third quarters of 2010 essentially flat compared to net sales for the corresponding 2009 periods and fourth quarter 2010 net sales almost 15% above fourth quarter 2009 results. While we believe that this trend may reflect improving economic and industry conditions as well as our marketing and new product initiatives, there is no assurance that the improved sales trend will continue. We also cannot be certain the extent that other factors, such as the product liability verdict discussed below or changes in economic conditions, will affect our financial performance.

We took various steps to reduce expenses in response to the decline in our sales. These steps included a first quarter 2009 work force reduction of about 5% and a wage reduction of 3% or 5% for all employees in effect from the second quarter 2009 to December 31, 2009. In addition, at the request of our outside Board members, a 5% reduction in director fees was in effect during the period of the employee wage reduction. We intend to monitor general economic conditions and our sales performance and, if warranted, may implement further cost saving measures.

On December 7, 2010, the jury in the Barnhard product liability suit returned a $66 million verdict, apportioned 75% to Cybex, 20% to a non-affiliated co-defendant, and 5% to the plaintiff. Under New York law, Cybex would be responsible for payment of 95% of any judgment entered on this verdict and may then seek to collect 20% of such judgment from the co-defendant. Our available insurance coverage for this matter as of December 31, 2010 was approximately $2,900,000. See Item 3, Part 1 of this Report and Note 14 of the Notes to the Consolidated Financial Statements included herein for a more detailed description of this matter. We intend to vigorously pursue all available options to seek a reversal or reduction of the verdict and any judgment that is ultimately entered on the verdict, and we will seek a stay of enforcement of any judgment during the appellate process. Such a stay may require the posting of a bond in a substantial amount, up to the full amount of the

18

judgment. While we will ask the Court to issue such a stay with a limited or no bonding requirement, there is no assurance we will be successful in this regard or that we will have the financial ability to secure a bond at a level required by the Court. The requirement to post a bond in a significant amount, even if at a level within our capacity to secure, could have a material adverse effect on our liquidity, financial condition and business prospects. If we are unable to obtain a required bond, the plaintiff would be able to immediately enforce the judgment before we are able to fully pursue our appeal. We do not have the capital resources or liquidity to satisfy our obligations if the plaintiff is ultimately able, either due to our inability to post a bond or the failure of our appeal, to enforce a judgment in this matter that has not been substantially reduced from the jury verdict.

The report of our independent registered public accountants on our consolidated financial statements contained in this Report on Form 10-K includes an explanatory paragraph stating that the Barnhard jury verdict raises substantial doubt about our ability to continue as a going concern. The consolidated financial statements that are included herein do not include any adjustments that might result from the outcome of this uncertainty.

We believe that we were not at fault in the accident that is the basis of the plaintiff’s claims and accordingly that this case was wrongly decided as to liability. In addition, we believe that the amount of damages awarded by the jury is grossly overstated. Our strategy to resolve the doubt about our ability to continue as a going concern is to vigorously contest the outcome of the Barnhard jury verdict through post trial proceedings and appeal, in order to obtain a reversal or substantial reduction of the award.

The foregoing statements are based on current expectations. These statements are forward-looking and actual results may differ materially. In particular, the uncertainties created by the jury verdict discussed above, and the continued uncertainties in U.S. and global economic conditions and in the fitness industry, make it particularly difficult to predict future events and may preclude us from achieving expected results.

RESULTS OF OPERATIONS

The following table sets forth selected items from the Consolidated Statements of Operations as a percentage of net sales:

| Year Ended December 31 | ||||||||||||

| 2010 | 2009 | 2008 | ||||||||||

| Net sales |

100 | % | 100 | % | 100 | % | ||||||

| Cost of sales |

64 | 70 | 68 | |||||||||

| Gross profit |

36 | 30 | 32 | |||||||||

| Selling, general and administrative expenses |

34 | 31 | 28 | |||||||||

| Litigation charge |

37 | — | — | |||||||||

| Goodwill impairment charge |

— | — | 8 | |||||||||

| Operating loss |

(35 | ) | (1 | ) | (4 | ) | ||||||

| Interest expense, net |

1 | 1 | 1 | |||||||||

| Loss before income taxes |

(36 | ) | (2 | ) | (5 | ) | ||||||

| Income tax expense (benefit) |

11 | — | 1 | |||||||||

| Net loss |

(47 | )% | (2 | )% | (6 | )% | ||||||

NET SALES

Our net sales increased $2,487,000, or 2%, to $122,961,000 in 2010 compared with a $27,455,000, or 19%, decrease in 2009 compared to 2008.

19

The increase in 2010 was attributable to increases in sales of cardiovascular products of $2,658,000, or 4% to $69,362,000 and increased freight, parts and other sales of $801,000, or 7% to $12,579,000, offset by decreases in sales of strength products of $972,000, or 2% to $41,020,000. We believe that the overall increase in sales is reflective of improving economic conditions as well as our marketing and new product initiatives.

The decrease in 2009 was attributable to decreases in sales of cardiovascular products of $10,074,000, or 13% to $66,704,000, strength training products of $16,181,000, or 28% to $41,992,000 and freight, parts and other sales of $1,200,000, or 9% to $11,778,000. The sales decline was generally throughout our product offerings and we believe was reflective of economic conditions, generally and in the fitness industry.

Sales outside of North America represented 31%, 29% and 28% of consolidated net sales in 2010, 2009 and 2008, respectively.

GROSS MARGIN

Gross margin was 36.5% in 2010, compared with 29.9% in 2009 and 32.4% in 2008. Margins increased in 2010 due to higher selling prices (2.3%), favorable product mix (1.2%), lower warranty costs (1.2%), lower component costs (.9%), lower obsolescence expense (.9%) and lower manufacturing costs (.1%).

Margins decreased in 2009 due to higher material costs (2.3%) as a percentage of sales due primarily to higher steel costs and product and customer mix, higher warranty costs (1.2%), and higher overhead as a percentage of sales mainly due to lower volumes (.8%). These decreases in margin were partially offset by lower labor costs as a percentage of sales (1.1%) and improvements in freight billings compared to freight costs (.7%).

SELLING, GENERAL AND ADMINISTRATIVE EXPENSES

Selling, general and administrative expenses, including bad debt expense, increased by $4,392,000, or 12% in 2010 to $42,072,000 compared to a decrease of $4,641,000, or 11%, in 2009. As a percentage of net sales, these expenses were 34%, 31% and 28% in 2010, 2009 and 2008, respectively.

The 2010 increase in selling, general and administrative expenses was predominantly due to higher sales and marketing costs ($3,551,000) including initiatives directed to new markets, higher sales compensation and advertising costs.

The 2009 decrease in selling, general and administrative expenses was predominantly due to a decrease in domestic and international selling expenses ($2,879,000) and a decrease in product development costs ($2,058,000) and was the result of various cost reductions we effectuated during 2009 in response to economic conditions.

LITIGATION CHARGE

The litigation charge for the year ended December 31, 2010 relates to an unfavorable jury verdict in the Barnhard product liability suit. See Note 14 to the Company’s consolidated financial statements.

GOODWILL IMPAIRMENT CHARGE

At December 31, 2008, we tested our goodwill for impairment and performed the initial step of our impairment evaluation by comparing the fair market value of our single reporting unit, as determined using market capitalization, as adjusted for a control premium, to its carrying value. As the carrying amount exceeded the fair value, the second step of the impairment evaluation was performed to calculate impairment, and as a result a goodwill impairment charge of $11,247,000, the entire amount of the goodwill carrying value, was recorded effective December 31, 2008, with no corresponding tax benefit. The primary reason for the impairment charge was the reduction in our market capitalization resulting from the sustained decline of our stock price during the second half of 2008.

20

INTEREST EXPENSE, NET

Net interest expense decreased by $14,000, or 1%, in 2010 to $1,260,000 compared to an increase of $98,000, or 8%, in 2009. During 2010, interest expense decreased due to lower interest rates on the new equipment facility offset by higher interest earned in 2009 from a financing program. During 2009, interest expense increased due to a higher applicable interest rate resulting from debt modifications, offset by lower average borrowings.

INCOME TAXES

We recorded, as of December 31, 2010, an increase in the valuation allowance for deferred tax assets of $30,656,000 to fully offset our deferred tax assets of $32,158,000. A valuation allowance for deferred tax assets is recorded to the extent it cannot be determined that the realization of these assets is more likely than not. Due to the uncertainty created by an unfavorable product liability jury verdict (see Note 14 to the Company’s consolidated financial statements), we determined that a valuation allowance against the entire amount of our deferred tax assets as of December 31, 2010 is necessary. We recorded an income tax expense (benefit) of $13,761,000 (including the increase in the valuation allowance), ($509,000) and $2,333,000 for the years ended December 31, 2010, 2009, and 2008, respectively. The effective tax (benefit) rate was 72.3% in 2010 excluding the litigation charge and related tax expense, (17.3%) in 2009 and 51.9% in 2008 before the non-deductible goodwill impairment charge. The tax (benefit) rates in each year are affected by non-deductible foreign losses, and the percentage that these losses represent of our results for the year causes large fluctuations in our tax (benefit) rates. Actual cash outlays for taxes continue to be reduced by the available operating loss carryforwards and credits.

As of December 31, 2010, U.S. federal operating loss carryforwards of approximately $15,462,000 were available to us to offset future taxable income and, as of such date, we also had foreign net operating loss carryforwards of $5,871,000, federal alternative minimum tax credit carryforwards of $700,000 and federal research and development tax credit carryforwards of $352,000.

FINANCIAL CONDITION, LIQUIDITY AND CAPITAL RESOURCES

As of December 31, 2010, we had negative working capital of $26,611,000 compared to positive working capital of $21,107,000 at December 31, 2009. The net decrease in working capital is primarily due to the net liability accrued for the non-cash Barnhard litigation charge of $46,792,000, as well as the use of cash for capital expenditures and the reduction of long-term debt, partially offset by the net cash provided by operating activities in 2010.

For the year ended December 31, 2010, we generated $4,192,000 of cash from operating activities compared to $7,219,000 for the year ended December 31, 2009. The decrease in cash provided by operating activities in 2010 compared to 2009 is primarily due to increases in accounts receivable and inventories in 2010 compared to decreases in 2009, partially offset by net income excluding the litigation charge and related tax expense generated in 2010 compared to a net loss in 2009.

Cash used in investing activities of $2,240,000 in 2010 consisted of purchases of manufacturing tooling and equipment of $1,443,000, primarily for the manufacture of new products, and computer hardware and infrastructure of $797,000. Cash used in investing activities of $613,000 during 2009 consisted of purchases of manufacturing tooling and equipment of $312,000, primarily for the manufacture of new products, and computer hardware and infrastructure of $301,000. While 2011 capital expenditures are expected to be approximately $3,500,000, the timing and amount of these expenditures will depend on economic conditions, the results of our operations and our other cash needs.

21

For the year ended December 31, 2010, cash used in financing activities of $1,801,000 consisted primarily of $5,863,000 in repayment of the Wells Fargo Bank, NA (“Wells Fargo”) term loans and $933,000 of principal payments on the Citizens real estate loan, offset by $4,999,000 advanced under the Citizens equipment facility. For the year ended December 31, 2009, cash used in financing activities of $1,355,000 consisted primarily of net term loan payments of $882,000 and $451,000 for the purchase of treasury stock through a repurchase program.

We have credit facilities with RBS Citizens, National Association and RBS Asset Finance, Inc. (collectively, “Citizens”). Our Citizens Credit Agreement provides a revolving line of credit of up to the lesser of a ceiling or an amount determined by reference to a borrowing base. Our Citizens Loan Agreement provided for a $13,000,000 real estate loan which was advanced in 2007 to finance the acquisition of our Owatonna facility. Our Citizens equipment facility has provided $4,999,000 of equipment lease financing, the proceeds of which were used in June 2010 to retire equipment term loans and related obligations to Wells Fargo. The Citizens real estate loan and revolving line of credit are secured by substantially all of our assets. The Citizens equipment facility is secured by our equipment, is cross-collateralized by our accounts receivable and inventory and matures on July 1, 2015. The Citizens real estate loan matures on July 2, 2014. The Citizens revolving line of credit matures July 1, 2011. While there can be no assurance, we anticipate that the line will either be extended or replaced prior to that date.

At December 31, 2010, there were no outstanding revolving credit loans, a $11,223,000 real estate loan and $4,586,000 outstanding under the Citizens equipment facility. Availability under the revolving loan fluctuates daily. At the date of this Report, the availability under the revolving line of credit is $2,000,000.