Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2010

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________ to __________

Commission File Number: 333-141676

Aftermarket Enterprises, Inc.

(Exact name of registrant as specified in charter)

| Nevada | 20-5354797 | |

| State or other jurisdiction of incorporation or organization | (I.R.S. Employer I.D. No.) |

| 933 S. 4th Street, Unit A, Grover Beach, California | 93433 | |

| (Address of principal executive offices) | (Zip Code) |

Issuer's telephone number, including area code: (805) 457-6999

Securities registered pursuant to section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

| None | N/A | |

Securities registered pursuant to section 12(g) of the Act:

| Common Stock, $0.001 par value | ||

| (Title of class) |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act Yes x No o

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.Yes x No o

1

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No x

Indicate by check mark if disclosure of delinquent filers in response to Item 405 of Regulation S-B is not contained herein, and not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-KSB or any amendment to this Form 10-KSB. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated filer | o | Accelerated filer | o | |

| Non-accelerated filer | o | (Do not check if a smaller reporting company) | Smaller reporting company | x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked prices of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter: The Registrant’s shares trade on the OTCBB. The shares trade very sporadically and the bid price on any given day may not be indicative of the actual price a stockholder could receive for their shares.

As of March 28, 2011, the Registrant had 3,076,996 shares of common stock issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

List hereunder the following documents if incorporated by reference and the part of the Form 10-K (e.g., part I, part II, etc.) into which the document is incorporated: (1) Any annual report to security holders; (2) Any proxy or other information statement; and (3) Any prospectus filed pursuant to rule 424(b) or (c) under the Securities Act of 1933: NONE

2

PART I

ITEM 1. BUSINESS

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This periodic report contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 with respect to the financial condition, results of operations, business strategies, operating efficiencies or synergies, competitive positions, growth opportunities for existing products, plans and objectives of management. Statements in this periodic report that are not historical facts are hereby identified as “forward-looking statements”.

BUSINESS

Aftermarket Enterprises was incorporated in August 2006 in the state of Nevada. We were formed with the intention of acquiring all of the assets and operations of Aftermarket Express, Inc. which operates a web site called www.EverythingSUV.com and related automotive accessories sales business. The web site www.EverythingSUV.com was formed in 2002 to sell automotive accessories over the internet. In September 2006, we acquired Aftermarket Express, Inc. which is now our wholly owned subsidiary.

Through our website, www.EverythingSUV.com, we sell automotive accessories to owners of sport utility vehicles. We maintain relationships with approximately two dozen manufacturers and distributors who ship our orders directly to our customers, enabling us to avoid the need to carry any inventory for more than 99% of the products we currently sell.

We receive and process all of our orders electronically. Once the order is received from the website, the customer’s credit card is authorized for the total cost of the sale, including shipping and handling. Upon successful authorization of the credit card, the order is sent to the appropriate supplier via fax or email. Upon confirmation that the order has been shipped by the supplier, the customer’s credit card is charged for the full value of the sale. Since we do not maintain an inventory, credit cards are not charged until shipment to assure the manufacture has the item in stock for immediate shipment. If the item is not available for immediate shipment, electronic communication is sent to the customer informing them of any delays.

In the event, although infrequent, that a customer chooses to return an item, we promptly refund the charge to their credit card upon notification from the supplier that the item has been received back from the customer.

Market Overview

The industry that we are active in is referred to as the “Specialty Automotive Equipment Industry,” and the companies manufacturing products and/or providing services in our industry are called “specialty automotive equipment companies.” They can be grouped into one of three major functional segments:

- Specialty Accessories and Appearance Products

- Racing and Performance

- Wheels, Tires and Suspension Components

We sell primarily products from the Specialty Accessories and Appearance Products segment and we currently cater specifically to the owners/drivers of sport utility vehicles. The Specialty Accessories and Appearance Products market segment includes interior trim and accessories such as floor mats and dashboard trim kits, brush bars, exterior side steps, cargo area liners, bug deflectors, restyling and appearance products, specialty waxes and chemicals, graphics and decals, sunroofs and others.

3

We believe most consumers approach modifying their vehicles from one of four basic perspectives:

|

-

|

Maintaining the vehicles value

|

|

-

|

Matching the vehicle to their lifestyle

|

|

-

|

Improving the utility value of the vehicle

|

|

-

|

Personalizing their vehicle just to make it more unique

|

Business Strategy

Aftermarket currently operates out of an office in Grover Beach, California which contains computers and other office equipment necessary for the operation of the company. Management believes that this location will suffice to accommodate the operation of the company for at least the next twelve months.

Our business strategy is to focus on superior customer service, constantly striving to provide the most current products available in the marketplace. In addition, we will attempt to consistently increase website traffic, to expand into market segments that appear to be available to us, capitalize on existing opportunities to cross promote and strive to maximize the dollar value of each customer. We will continue to consider and explore various ways to increase revenues and profits, including considering the sale of other product lines inside and outside of the automotive industry.

We strive to update our website as quickly as possible whenever new products are released. We buy 61% of our products from three suppliers. Surco, Inc. supplies 26% of our products, WAAG Los Angeles supplies 22% of our products and Keystone Automotive Operations, Inc. supplies 13% of our products. Surco and Keystone are general distributors that supply us with a wide range of products. There are other general distributors active in our industry that we also purchase products from. If either Surco or Keystone were to go out of business, refused to ship products to our customers or our relationship with them was otherwise damaged, we believe we could procure the products we need from other general distributors. WAAG is a specialty manufacturer of brush bars and grill guards for trucks and sport utility vehicles. If WAAG were to go out of business, refused to ship products to our customers or our relationship with them was otherwise damaged we would attempt to provide our customers with an alternative brand of brush bars and/or grill guards. However, if these suppliers went out of business, if our relationships with them were damaged or if they became unwilling to ship our orders directly to our customers and we were unable to utilize other suppliers for the products they supply, our business could be damaged.

Marketing and Promotion

We utilize search engine optimization activities, email marketing, linking agreements and key vendor relationships to drive our business. Our marketing strategy is designed to increase customer traffic to our website, drive awareness of products and services we offer, promote repeat purchases and develop incremental product revenue opportunities.

Competition

The environment for our products and services is intensely competitive. Our current and potential competitors include: (1) brick and mortar retailers, catalog retailers, publishers, vendors, distributors and manufacturers of our products, many of which possess significant brand awareness, sales volume, and customer bases, and some of which currently sell, or may sell, products or services through the Internet, mail order, or direct marketing; (2) other online e-commerce sites; (3) a number of indirect competitors, including media companies, Web portals, comparison shopping websites, and Web search engines, either directly or in collaboration with other retailers; and (4) companies that provide e-commerce services, including website development; third-party fulfillment and customer-service. We believe that the principal competitive factors in our market segments include selection, price, availability, convenience, information, discovery, brand recognition, personalized services, accessibility, customer service, reliability, speed of fulfillment, ease of use, and ability to adapt to changing conditions, as well as our customers’ overall experience and trust in transactions with us. We believe by bringing an assortment of various products onto one web site geared to a niche market we can compete effectively with the larger all encompassing sites. However, due to the number of competitors we will constantly face and with price pressures from such competitors, we will have to be able to operate on small margins. Other companies also may enter into business combinations or alliances that strengthen their competitive positions.

4

Intellectual Property

We currently own no intellectual property.

Seasonality

Our business is affected by seasonality, which historically has resulted in higher sales volume during our fourth quarter.

Employees

The Company has no employees. Orders are processed by our President with support from a single independent contractor on an as needed basis.

ITEM 2. PROPERTIES

The Company owns no properties and utilizes office space located at 433 S. 4th Street, Unit A, Grover Beach, California, which it rents on a month to month basis. This arrangement is expected to continue until and unless such time as the Company becomes involved in a business venture which necessitates its relocation or grows to the extent it requires more space than is currently available. The Company has no agreements with respect to the maintenance or future acquisition of the office facilities.

ITEM 3. LEGAL PROCEEDINGS

None.

ITEM 4. (REMOVED AND RESERVED)

5

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

The Company's Common Stock is quoted on the OTC Bulletin Board, under the symbol “AFTM”.

| Quarter Ended | High Bid | Low Bid | ||||||

| December 2010 | $ 5.00 | .01 | ||||||

| September 2010 | $ 5.00 | .01 | ||||||

| June 2010 | $ 5.00 | .01 | ||||||

| March 2010 | $ 5.00 | .01 | ||||||

Since its inception, the Company has not paid any dividends on its Common Stock, and the Company does not anticipate that it will pay dividends in the foreseeable future. At March 28, 2010, the Company had approximately 53 stockholders of record. As of March 28, 2011, the Company had 3,076,996 shares of its Common Stock issued and outstanding.

Recent Sales of Unregistered Securities

There were no securities sold in the Fiscal Year Ending 2010.

On September 28, 2010, the Company issued 300,000 shares of stock valued at $9,000 to its CEO/President, Adam Anthony as a management bonus.

ITEM 6 SELECTED FINANCIAL DATA

Summary of Financial Information

We had a net loss of $11,573 for the year ended December 31, 2010. At December 31, 2010, we had cash and cash equivalents of $3,502 and working capital deficit of $14,351.

The following table shows selected summarized financial data for the Company at the dates and for the periods indicated. The data should be read in conjunction with the financial statements and notes included herein beginning on page F-1.

STATEMENT OF OPERATIONS DATA:

|

For the Year Ended

December 31, 2010

|

For the Year Ended

December 31, 2009

|

|||||||

|

Revenues

|

$ | 96,020 | $ | 95,675 | ||||

|

Cost of Goods Sold

|

61,400 | 73,964 | ||||||

|

General and Administrative Expenses

|

45,867 | 44,867 | ||||||

|

Net Loss

|

(11,573 | ) | (23,156 | ) | ||||

|

Basic Income (Loss) per Share

|

.00 | .01 | ||||||

|

Diluted Income (Loss) per Share

|

.00 | .01 | ||||||

|

Weighted Average Number of Shares Outstanding

|

2,851,996 | 2,776,996 | ||||||

|

Weighted Average Number of Fully Diluted Shares Outstanding

|

2,851,996 | 2,776,996 | ||||||

|

BALANCE SHEET DATA:

|

||||||||

|

December 31, 2010

|

December 31, 2009

|

|||||||

|

Total Current Assets

|

$ | 6,161 | $ | 6,771 | ||||

|

Total Assets

|

6,161 | 6,771 | ||||||

|

Total Current Liabilities

|

20,512 | 18,549 | ||||||

|

Working Capital

|

(14,351 | ) | (11,778 | ) | ||||

|

Stockholders’ Equity (Deficit)

|

(14,351 | ) | (11,778 | ) | ||||

6

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Overview

Although we have reduced our expenses to better reflect anticipated revenue, we are in need of additional capital to grow the Company and expand into new product lines. At this time, we are dependent on the continued financial support of our officer and director to fund any short falls. As market conditions improve, we would like to expand into offering additional automobile products and drop ship items in the automobile area. “Drop ship” items are products which we sell through our website, but which are shipped directly to the customer from the manufacturer. Upon receipt the order, we send a purchase order to the manufacturer and the manufacturer “drop ships” the product to the customer. 100% of the products we sell are “drop ship” items.

Currently, we continue to find that consumers are reluctant to spend disposable income on automobile accessories and as such, our suppliers have reduced their product offering, further hampering our ability to offer product. We are hopeful as the economy continues to improve that suppliers will expand their product offering and consumers will start to spend more of their disposable income. Until conditions improve, we will continue to operate at a loss or break even. Additionally, our ability to expand and generate additional revenue sources will be hampered.

In the meantime, we are adding products to our online store and focusing promotional efforts on products that are commonly purchased and readily available, such as floor mats, cargoliners and roof racks. In addition, we are seeking out vendors that are manufacturing accessories for newer model years and attempting to establish relationships with them. If we are unable to source manufacturers that are making accessories for current model year vehicles, and if current vendors don’t continue to add items to their product offering for current model years, we will be unable to provide shoppers with products and our revenues will suffer. We believe that by focusing on products offered by vendors who are keeping up with current model years and by adding new vendors in areas where old vendors are not keeping up with current model years, our product offering will remain relevant and in demand and we can stabilize revenue. We hope by focusing on specific product offerings and establishing promotions for them, we can increase revenue in the future. In addition, we are currently establishing “upsell” product offerings in our online store in hopes that we can increase the revenue potential of each customer. “Upsell” products are items that are offered to the consumer after they have chosen an item for purchase, but before they have completed their order. For example, if a customer is ordering a roof rack, they would be offered a cargo net as an “upsell” product. The term “upsell” refers to an effort to increase the value of each order.

Plan of Operation.

We have an established web store presence and supplier relationships in the aftermarket SUV accessories marketplace. This presence was obtained through the purchase of the website and related business of Aftermarket Express, Inc. Currently, our product line focuses on the SUV marketplace.

7

We offer a wide variety of SUV accessories through our online store are adding products to offering and focusing promotional efforts on products that are commonly purchased and readily available, such as floor mats, cargoliners and roof racks. In addition, we are seeking out vendors that are manufacturing accessories for newer model years and attempting to establish relationships with them. If we are unable to source manufacturers that are making accessories for current model year vehicles, and if current vendors don’t continue to add items to their product offering for current model years, we will be unable to provide shoppers with products and our revenues will suffer. We believe that by focusing on products offered by vendors who are keeping up with current model years and by adding new vendors in areas where old vendors are not keeping up with current model years, our product offering will remain relevant and in demand and we can stabilize revenue. We hope by focusing on specific product offerings and establishing promotions for them, we can increase revenue in the future. In addition, we are currently establishing “upsell” product offerings in our online store in hopes that we can increase the revenue potential of each customer. The term “upsell” refers to an effort to increase the value of each order. “Upsell” products are items that are offered to the consumer after they have chosen an item for purchase, but before they have completed their order. For example, if a customer is ordering a roof rack, they would be offered a cargo net as an “upsell” product in an effort to increase the value of to the Company of that particular order.

We will continue to consider and explore various ways to increase revenues and profits, including considering the sale of other product lines inside and outside of the automotive industry.

LIQUIDITY AND CAPITAL RESOURCES

As of December 31, 2010, we had a working capital deficit of $14,351. We are hopeful that we can increase sales sufficient to cover our operating expenses. However, depending on how our business performs over the next several months, we may have to seek additional capital in the future.

Our primary source of liquidity in the past has been cash provided by our stock offering, debt instruments and operating activities. Our working capital needs over the next 12 months consist primarily of marketing, legal and audit expenses. We are hopeful that with changes made to the business we will be able to meet our ongoing needs. If our efforts to increase sales are not successful, we will have to obtain additional financing. Presently, we do not feel bank financing is feasible and believe we would have to rely on loans from existing shareholders and management or further equity offerings. At this time there exist no commitments from any parties to provide further financing.

RESULTS OF OPERATIONS

We continued to lose money during the year ended December 31, 2010, with a net loss of $11,573, compared to a loss of $23,156 for the year ended December 31, 2009. We had sales of $96,020 and $95,675 for the years ended December 31, 2010 and December 31, 2009, respectively. Without additional revenue, we will continue to suffer losses as our sales are currently not high enough to cover our operating expenses. In response to the deteriorating market that has resulted from the current economic conditions and surge in oil and fuel prices, we have cut our general and administrative expenses such that we are currently producing an operating profit when legal and audit expenses are extracted. We would expect employee costs to increase in the future as we expand operations and require additional personnel. Currently, our president, Adam Anthony, is not taking a salary which is helping to reduce employee expenses. For the year ended December 31, 2010, our legal and professional fees were $17,289 which were primarily associated with the audit, legal and filing fees. We expect legal and accounting fees will continue for the foreseeable future and we expect them to remain at current levels. We are currently not engaged in any fee based marketing or advertising activities.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENATRY DATA

The financial statements of the Company are set forth immediately following the signature page to this Form 10-K.

8

ITEM 8. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

The Company has had no disagreements with its certified public accountants with respect to accounting practices or procedures or financial disclosure.

ITEM 9A(T). CONTROLS AND PROCEDURES

Evaluation of Disclosure Controls and Procedures

Our management, which consists of one person and with the assistance of an outside CPA firm, evaluated the effectiveness of our disclosure controls and procedures as of the end of the period covered by this report. Based on that evaluation, our President and CFO concluded that our disclosure controls and procedures as of the end of the period covered by this report were effective such that the information required to be disclosed by us in reports filed under the Exchange Act is (i) recorded, processed, summarized and reported within the time periods specified in the SEC’s rules and forms and (ii) accumulated and communicated to our management, including our President and CFO, as appropriate to allow timely decisions regarding disclosure. A controls system cannot provide absolute assurance, however, that the objectives of the controls system are met, and no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, within a company have been detected.

Management’s Annual Report on Internal Control over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial reporting (as defined in Rule 13a-15(f) under the Exchange Act). Our internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with accounting principles generally accepted in the United States.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Therefore, even those systems determined to be effective can provide only reasonable assurance of achieving their control objectives.

Our management, with the participation of the President and CFO, evaluated the effectiveness of our internal control over financial reporting as of December 31, 2010. Based on this evaluation, our management, with the participation of the President and CFO, concluded that, as of December 31, 2010, our internal control over financial reporting was effective. As we grow our business we will be actively looking at how to segregate our duties to provide better controls.

This annual report does not include an attestation report of the Company’s registered public accounting firm regarding internal control over financial reporting. Management’s report was not subject to attestation by the Company’s registered public accounting firm pursuant to temporary rules of the Security and Exchange Commission that permit the Company to provide only management’s report in this annual report.

Changes in internal control over financial reporting

There have been no changes in internal control over financial reporting that occurred during our last fiscal year that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

ITEM 9B. OTHER INFORMATION

None

9

PART III

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

The following table identifies our sole director and executive officer:

|

Principal Occupation for Past Five Years and

|

||

|

Name

|

Age

|

Current Public Directorships or Trusteeships

|

|

Adam Anthony

|

45

|

Mr. Anthony currently serves as our sole officer in the position of president and director. Additionally, Mr. Anthony since April 2006 has served as the VP Corporate Finance, Ascendiant Capital Group, LLC which is a business consulting company located in Irvine, California. From April 2004 through April 2006, Mr. Anthony was the executive vice-president of mergers, acquisitions and corporate affairs for PracticeXpert, Inc. of Calabasas, California which engaged in the provision of medical billing and practice management services to physicians. From April 2003 through April 2004, Mr. Anthony was a business consultant for PracticeXpert, Inc. Prior to joining PracticeXpert, Inc., from January 2001 to April 2003, Mr. Anthony was the CEO of Thaon Communications of Los Angeles California which was primarily involved in the placement of direct response advertising and the marketing of various general consumer products via infomercials. Mr. Anthony received his bachelor’s degree in business administration from Saginaw Valley State University in University Center, Michigan. Mr. Anthony is not an officer or director of any other public companies.

|

Mr. Anthony was employed by Thaon Communications who’s wholly owned subsidiary PTS TV, Inc. filed for chapter 7 bankruptcy protection. At the time of the filing, Mr. Anthony was also acting as the CEO of the subsidiary in addition to his responsibilities for Thaon Communications. The bankruptcy was filed in December 2002 and discharged in February 2005.

Except as indicated below, to the knowledge of management, during the past five years, no present or former director, or executive officer of the Company:

(1) filed a petition under the federal bankruptcy laws or any state insolvency law, nor had a receiver, fiscal agent or similar officer appointed by a court for the business or property of such person, or any partnership in which he was a general partner at or within two years before the time of such filing, or any corporation or business association of which he was an executive officer at or within two years before the time of such filing;

(2) was convicted in a criminal proceeding or named subject of a pending criminal proceeding (excluding traffic violations and other minor offenses);

(3) was the subject of any order, judgment or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining him from or otherwise limiting, the following activities:

(i) acting as a futures commission merchant, introducing broker, commodity trading advisor, commodity pool operator, floor broker, leverage transaction merchant, associated person of any of the foregoing, or as an investment advisor, underwriter, broker or dealer in securities, or as an affiliate person, director or employee of any investment company, or engaging in or continuing any conduct or practice in connection with such activity;

(ii) engaging in any type of business practice; or

(iii) engaging in any activity in connection with the purchase or sale of any security or commodity or in connection with any violation of federal or state securities laws or federal commodities laws;

(4) was the subject of any order, judgment, or decree, not subsequently reversed, suspended, or vacated, of any federal or state authority barring, suspending, or otherwise limiting for more than 60 days the right of such person to engage in any activity described above under this Item, or to be associated with persons engaged in any such activity;

(5) was found by a court of competent jurisdiction in a civil action or by the Securities and Exchange Commission to have violated any federal or state securities law, and the judgment in such civil action or finding by the Securities and Exchange Commission has not been subsequently reversed, suspended, or vacated.

(6) was found by a court of competent jurisdiction in a civil action or by the Commodity Futures Trading Commission to have violated any federal commodities law, and the judgment in such civil action or finding by the Commodity Futures Trading Commission has not been subsequently reversed, suspended or vacated.

10

COMPLIANCE WITH SECTION 16(A) OF THE EXCHANGE ACT

The Company is not aware of any other late reports filed by officers, directors and ten percent stockholders.

ITEM 11. EXECUTIVE COMPENSATION

SUMMARY COMPENSATION TABLE

The following table sets forth, for the fiscal years indicated, all compensation awarded to, earned by or paid to Aftermarket's chief executive officer and each of the other executive officers that were serving as executive officers at December 31, 2010 (collectively refered to as the "Named Executives"). No other executive officer serving during 2010 received compensation greater than $100,000.

Summary Compensation Table

|

Name and

Principal Position

|

Year

|

Salary

|

Bonus

|

Stock

Awards

|

Option

Awards

|

Non-Equity

Incentive Plan

Compensation

|

All

Other Compensation

|

Total

|

||||||||

|

Adam

|

2009

|

--

|

--

|

--

|

--

|

--

|

--

|

--

|

||||||||

|

Anthony, CEO

|

2010

|

--

|

--

|

$9,000

|

--

|

--

|

--

|

--

|

Option/SAR Grants in Last Fiscal Year

There were no stock option or SAR Grants during the fiscal year 2010

Stock Option Exercise

None of the named executives exercised any options to purchase shares of common stock in fiscal 2010.

Long-Term Incentive Plan (“LTIP”)

There were no awards granted during the fiscal year 2010 under a long-term incentive plan.

Board of Directors Compensation

Each director may be paid his expenses, if any, of attendance at each meeting of the board of directors, and may be paid a stated salary as director or a fixed sum for attendance at each meeting of the board or directors or both. No such payment shall preclude any director from serving the corporation in any other capacity and receiving compensation therefore. We did not compensate our directors for service on the Board of Directors during fiscal 2010.

No other compensation arrangements exist between Aftermarket and our sole director.

11

Employment Contracts and Termination of Employment and Change-in-Control Arrangements

Aftermarket does not have any employment contracts with our executive officers. No other compensatory plan or arrangements exist between Aftermarket and our executive officers that results or will result from the resignation, retirement or any other termination of such executive officer’s employment with Aftermarket or from a change-in-control of the Company.

Report on Repricing of Options/SARs

We did not adjust or amend the exercise price of stock options or SARs previously awarded to any executive officers during fiscal 2010.

Report on Executive Compensation

The Board of Directors determines the compensation of Aftermarket’s executive officer and president and sets policies for and reviews with the chief executive officer and president the compensation awarded to the other principal executives, if any. The compensation policies utilized by the Board of Directors are intended to enable Aftermarket to attract, retain and motivate executive officers to meet our goals using appropriate combinations of base salary and incentive compensation in the form of stock options. Generally, compensation decisions are based on contractual commitments, if any, as well as corporate performance, the level of individual responsibility of the particular executive and individual performance. During the fiscal year ended 2010, Aftermarket's chief executive officer was Adam Anthony. There were no other executive officers for Aftermarket during the fiscal year 2010.

Board of Directors Interlocks and Insider Participation in Compensation Decisions

No such interlocks existed or such decisions were made during fiscal year 2010.

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

The following table sets forth, as of March 28, 2011, the names, addresses and number of shares of common stock beneficially owned by all persons known to the management of Aftermarket to be beneficial owners of more than 5% of the outstanding shares of common stock, and the names and number of shares beneficially owned by our director of Aftermarket and our sole executive officer and director of Aftermarket (except as indicated, each beneficial owner listed exercises sole voting power and sole dispositive power over the shares beneficially owned).

For purposes of this table, information as to the beneficial ownership of shares of common stock is determined in accordance with the rules of the Securities and Exchange Commission and includes general voting power and/or investment power with respect to securities. Except as otherwise indicated, all shares of our common stock are beneficially owned, and sole investment and voting power is held, by the person named. For purposes of this table, a person or group of persons is deemed to have "beneficial ownership" of any shares of common stock, which such person has the right to acquire within 60 days after the date hereof. The inclusion herein of such shares listed beneficially owned does not constitute an admission of beneficial ownership.

12

All percentages are calculated based upon a total number of 3,076,996 shares of common stock outstanding as of March 28, 2011, plus, in the case of the individual or entity for which the calculation is made, that number of options or warrants owned by such individual or entity that are currently exercisable or exercisable within 60 days.

|

Amount and Nature of

|

Percentage of Outstanding

|

|||

|

Name and Address of Beneficial Owner

|

Beneficial Owner

|

Common stock

|

||

|

Principal Shareholders

|

||||

|

Ascendiant Capital Group, LLC (1)

18881 Von Karman Avenue, 16th Floor

Irvine, CA 92612

|

1,133,301

|

36.83%

|

||

|

Jeffrey W. Holmes

P.O. Box 11207

Zephyr Cove, NV 89448

|

444,151

|

14.43%

|

||

|

Adam Anthony

2703 Anacapa

Irvine, CA 92602

|

500,000

|

16.25%

|

||

|

Officers and Directors

|

||||

|

Adam Anthony

2703 Anacapa

Irvine, CA 92602

|

500,000

|

16.25%

|

||

|

Director and executive officer of the

|

||||

|

Company (1 individuals)

|

500,000

|

16.25%

|

___________________________

(1) Ascendiant Capital Group, LLC is controlled and owned by Bradley Wilhite and Mark Bergendahl.

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE

Transactions with Management and Others.

On August 7, 2008, Ascendiant Capital Group, a shareholder, purchased 250,000 shares of stock for $.12 per share as part of our offering. In total, 44 investors, including Ascendiant, purchased 1,054,544 shares of our common stock at $.12 per share for a total of $126,485 in cash. None of the purchasers except Ascendiant were affiliated with us at the time of purchase.

On August 22, 2008, we repaid a loan to Ascendiant Capital Group, a shareholder, in the amount of $14,663.56 consisting of $14,000 of principal and $663.56 of accrued interest. The Note originated on February 29, 2008 and accrued interest at a rate of 10% annually. This paid in full any and all debts the Company had to Ascendiant.

On August 22, 2008, we repaid a loan to Jeff Holmes, a shareholder, in the amount of $7,331.78 consisting of $7,000 of principal and $331.78 of accrued interest. The Note originated on February 29, 2008 and accrued interest at a rate of 10% annually. This paid in full any and all debts the Company had to Mr. Holmes.

On November 19, 2009 we borrowed $3,000 from our President, Adam Anthony. The Note is interest free and is payable upon demand.

On December 7, 2009 we borrowed $10,000 from our President, Adam Anthony. The Note is interest free and is payable upon demand.

Independence of Management

There were no material transactions, or series of similar transactions, since the beginning of the Company's last fiscal year, or any currently proposed transactions, or series of similar transactions, to which the Company was or is to be a party, in which the amount involved exceeds $60,000 and in which any director or executive officer, or any security holder who is known to the Company to own of record or beneficially more than 5% of any class of the Company's common stock, or any member of the immediate family of any of the foregoing persons, has an interest.

Transactions with Promoters

There have been no transactions between the Company and promoters during the last fiscal year.

13

ITEM 14. PRINCIPAL ACCOUNTANT FEES AND SERVICES

1) Audit Fees - The aggregate fees incurred for each of the last two fiscal years for professional services rendered by our principal accountant for the audit of our annual financial statements and review of our quarterly financial statements is approximately $7,800 and $11,250 for each of the years ending December 31, 2009 and 2010.

2) Audit-Related Fees. $1,440 and $1,257.

3) Tax Fees. $1,000 and $25

4) All Other Fees. $0.

5) Not applicable.

6) Not Applicable.

ITEM 15. EXHIBITS, FINANCIAL STATEMENT SCHEDULES.

(a)(1)FINANCIAL STATEMENTS. The following financial statements are included in this report:

| Title of Document | Page |

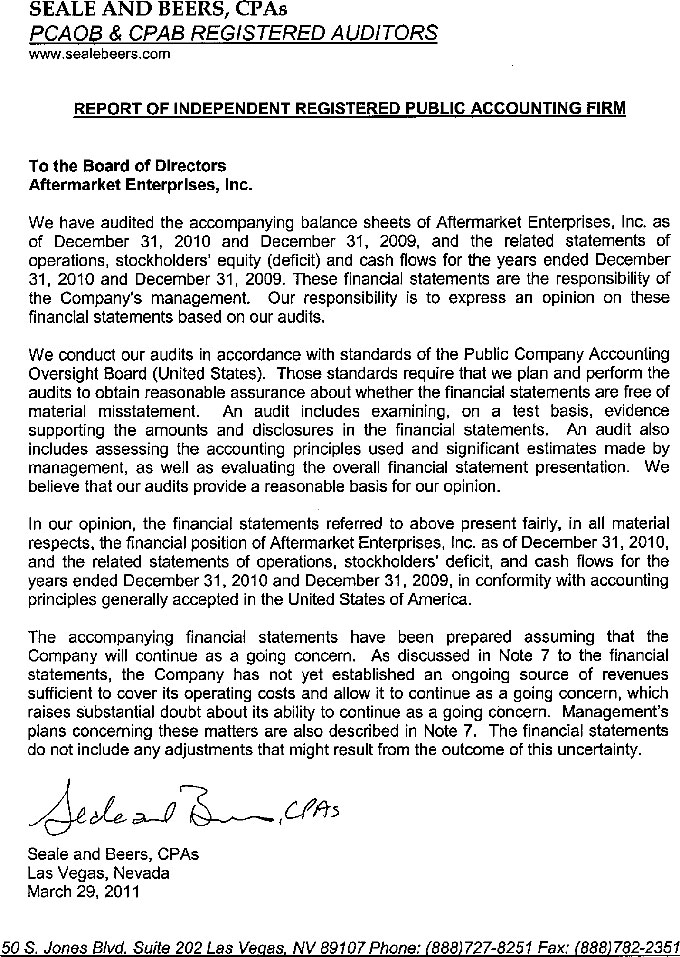

| Report of Independent Registered Public Accounting Firm | F-1 |

| Balance Sheets | F-2 |

| Statements of Operations | F-3 |

| Statements of Stockholders’ Deficit | F-4 |

| Statements of Cash Flows | F-5 |

| Notes to Financial Statements | F-6 |

(a)(2)FINANCIAL STATEMENT SCHEDULES. The following financial statement schedules are included as part of this report:

None.

(a)(3)EXHIBITS. The following exhibits are included as part of this report:

| SEC | ||||||

| Exhibit | Reference | |||||

| Number | Number | Location | ||||

| tem 3 | Articles of Incorporation and Bylaws | |||||

| 3.01 | 3 | Articles of Incorporation | Incorporated by reference* | |||

| 3.02 | 3 | Bylaws | Incorporated by reference* | |||

| Item 4 | Instruments Defining the Rights of Security Holders |

| 4.01 | 4 | Specimen Stock Certificate | Incorporated by reference* | |||

| 21 | 21 |

Subsidiaries of Registrant |

This filing | |||

| 23 | 23 |

Consent of Auditor

|

This filing | |||

| 31.01 | 31 | CEO certification | This Filing | |||

| 31.02 | 31 | CFO certification | This Filing | |||

| 32.01 | 32 | CEO certification | This Filing | |||

| 32.02 | 32 | CFO certification | This Filing |

* Incorporated by reference from the Company's registration statement on Form S-1 filed with the Commission, SEC file no. 333-141676.

14

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, this report has been signed below by the following persons on behalf of the Registrant and in the capacities and on the dates indicated:

| Aftermarket Enterprises, Inc. | |||

|

Date: March 28, 2011

|

By:

|

/s/ Adam Anthony | |

| Adam Anthony, President, Director, Principal | |||

| Accounting Officer (Principal Executive | |||

| Officer) | |||

In accordance with the Securities Exchange Act of 1934, this report has been signed by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

|

Signature

|

Title

|

Date

|

||

|

/s/Adam Anthony .

|

|

|

||

|

Adam Anthony

|

Director | March 28, 2011 |

15

16

AFTERMARKET ENTERPRISES, INC.

CONSOLIDATED BALANCE SHEETS

|

December 31, 2010

|

December 31, 2009

|

|||||||

|

ASSETS

|

||||||||

|

Current Assets

|

||||||||

|

Cash

|

3,502 | 6,771 | ||||||

|

Accounts Receivable

|

2,659 | |||||||

|

Total Current Assets

|

6,161 | 6,771 | ||||||

|

TOTAL ASSETS

|

6,161 | 6,771 | ||||||

|

LIABILITIES

|

||||||||

|

Current Liabilities

|

||||||||

|

Accounts Payable

|

3,674 | 2,319 | ||||||

|

Accrued Liabilities

|

2,459 | 3,005 | ||||||

|

Loan Payable, Related Party

|

13,000 | 13,000 | ||||||

|

Sales tax payable

|

1,379 | - | ||||||

|

Deferred Revenue

|

- | 225 | ||||||

|

Total Current Liabilities

|

20,512 | 18,549 | ||||||

|

STOCKHOLDERS' EQUITY (DEFICIT)

|

||||||||

|

Preferred Stock: ($0.001 par value, 10,000,000 shares authorized; no shares issued and outstanding)

|

||||||||

|

Common Stock: ($0.001 par value, 90,000,000 shares authorized; 3,076,996 issued and outstanding)

|

3,078 | 2,777 | ||||||

|

Additional Paid-in Capital

|

196,553 | 187,853 | ||||||

|

Accumulated Deficit

|

(213,981 | ) | (202,408 | ) | ||||

|

Total Stockholder's Equity (Deficit)

|

(14,351 | ) | (11,778 | ) | ||||

|

Total Liabilities and Stockholders' Equity (Deficit)

|

6,161 | 6,771 | ||||||

The accompanying notes are an integral part of these financial statements.

17

AFTERMARKET ENTERPRISES, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

|

Twelve Months Ended

|

||||||||

|

12/31/10

|

12/31/09

|

|||||||

|

Revenues

|

||||||||

|

Sales (net of returns)

|

96,020 | 95,675 | ||||||

|

Cost of Goods Sold

|

61,400 | 73,964 | ||||||

|

Gross Profit

|

34,620 | 21,711 | ||||||

|

Expenses

|

||||||||

|

Amortization Expense

|

7,911 | |||||||

|

Credit Card Discount

|

4,312 | 4,432 | ||||||

|

Payroll Expense

|

- | - | ||||||

|

Professional Fees: Related Party

|

9,000 | - | ||||||

|

Other General & Administrative

|

31,755 | 31,642 | ||||||

| 45,067 | 43,985 | |||||||

|

Gain/(Loss) from Operations

|

(11,247 | ) | (22,274 | ) | ||||

|

Other income/expense:

|

- | - | ||||||

|

Interest Income

|

- | - | ||||||

|

Interest Expense

|

126 | (82 | ) | |||||

|

Penalties ans Settlements

|

200 | - | ||||||

| 326 | (82 | ) | ||||||

|

Provision for State Taxes

|

(800 | ) | (800 | ) | ||||

|

Net Profit/(Loss)

|

(11,573 | ) | (23,156 | ) | ||||

|

Net income/(loss) per common share

|

(0.00 | ) | (0.01 | ) | ||||

|

Weighted average number of common shares outstanding

|

2,851,996 | 2,776,996 | ||||||

The accompanying notes are an integral part of these financial statements.

18

AFTERMARKET ENTERPRISES, INC.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY (DEFICIT)

December 31, 2010

|

Common Stock

|

Additional Paid-in Capital

|

Accumulated Deficit

|

Total Stockholders’ Equity (Deficit)

|

|||||||||||||||||

|

Shares

|

Amount

|

|||||||||||||||||||

|

December 31, 2007

|

1,592,452 | 1,592 | 58,653 | (73,001 | ) | (12,756 | ) | |||||||||||||

|

Stock issued for cash at $.12 per share on August 12, 2008

|

1,054,544 | 1,055 | 125,430 | 126,485 | ||||||||||||||||

|

Stock issued for consulting services at $.03 per share on October 1, 2008

|

130,000 | 130 | 3,770 | 3,900 | ||||||||||||||||

|

Net loss for year

|

- | - | - | (106,251 | ) | (106,251 | ) | |||||||||||||

|

Balance, December 31, 2008

|

2,776,996 | 2,777 | 187,853 | (179,252 | ) | 11,378 | ||||||||||||||

|

Net loss for year

|

(23,156 | ) | (23,156 | ) | ||||||||||||||||

|

Balance, December 31, 2009

|

2,776,996 | 2,777 | 187,853 | (202,408 | ) | (11,778 | ) | |||||||||||||

|

Stock issued for Professional Fees: Related Party @ $.03 per share on September 28, 2010 (management bonus - Adam Anthony)

|

300,000 | 300 | 8,700 | 9,000 | ||||||||||||||||

|

Net Loss for December 31,2010

|

(11,573 | ) | (11,573 | ) | ||||||||||||||||

|

Balance, December 31,2010

|

3,076,996 | 3,077 | 196,553 | (213,981 | ) | (14,351 | ) | |||||||||||||

The accompanying notes are an integral part of these financial statements

19

AFTERMARKET ENTERPRISES, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

|

12 months ended

|

12 months ended

|

|||||||

|

12/31/10

|

12/31/09

|

|||||||

|

Operating Activities

|

||||||||

|

Net Income/(loss)

|

$ | (11,573 | ) | $ | (23,156 | ) | ||

|

Prior period loss adjustment restated

|

||||||||

|

Adjustment for items not involving cash:

|

||||||||

|

Amortization expense

|

0 | 7,911 | ||||||

|

Deferred Revenue

|

0 | 225 | ||||||

|

Shares issued for Professional Services: Related Party

|

9,000 | 0 | ||||||

|

Change in non-cash working capital items:

|

(2,573 | ) | (15,021 | ) | ||||

|

|

||||||||

|

(Increase) decrease in other current assets

|

(2,659 | ) | 42 | |||||

|

Increase (decrease) in accounts payable

|

1,355 | (14,816 | ) | |||||

|

Increase (decrease) in accrued liabilities

|

(546 | ) | 592 | |||||

|

Increase (decrease) in loan payable, related party

|

0 | 0 | ||||||

|

Increase (decrease) in sales tax payable

|

1,379 | 0 | ||||||

|

Increase (decrease) in deferred revenue

|

(225 | ) | 0 | |||||

|

Cash provided by (used in) operating activities

|

(3,269 | ) | (29,203 | ) | ||||

|

Investing Activities

|

||||||||

|

None

|

- | - | ||||||

|

Cash used in investing activities

|

- | - | ||||||

|

Financing Activities

|

||||||||

|

Proceeds from loan(s) payable – related party

|

- | 13,000 | ||||||

|

Proceeds from sale of common stock

|

||||||||

|

Payment of loan(s) payable – related party

|

||||||||

|

Cash provided by financing activities

|

- | 13,000 | ||||||

|

Increase (decrease) in cash position

|

(3,269 | ) | (16,203 | ) | ||||

|

Cash position at beginning of period

|

6,771 | 22,974 | ||||||

|

Cash position at end of period

|

3,502 | 6,771 | ||||||

The accompanying notes are an integral part of these financial statements

20

Aftermarket Enterprises, Inc.

Notes to Consolidated Financial Statements

December 31, 2010

|

NOTE 1

|

ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

|

This summary of significant accounting policies of Aftermarket Enterprises, Inc. (the Company) is presented to assist in understanding the Company's financial statements. These accounting policies conform to accounting principles generally accepted in the United States of America and have been consistently applied in the preparation of the accompanying consolidated financial statements.

Business Activity

Aftermarket Enterprises, Inc. (the Company) is a Nevada corporation organized on August 4, 2006 to market and sell aftermarket automotive products through the Internet. On May 12, 2004, Everything SUV, LLC was organized to sell aftermarket automotive products for SUV’s through the Internet. On July 24, 2006, all rights, titles and interests to any and all memberships and ownership interests in Everything SUV, LLC were transferred to Aftermarket Express, Inc. The Company acquired all the outstanding shares of common stock of Aftermarket Express, Inc. on September 1, 2006 in a business combination. The Company has elected a fiscal year end of December 31st. All intercompany balances have been eliminated on consolidation.

Recently Issued Accounting Pronouncements

We have reviewed recent accounting pronouncements through the date of these financial statements and believe their implementation would not have a material impact on the Company’s accounting or financial reports.

Cash and Cash Equivalents

The Company considers all highly-liquid instruments with a maturity of three months or less to be cash equivalents. The Company had $3,502 in cash and cash equivalents at December 31, 2010.

Use of Estimates in the preparation of the financial statements

The preparation of the Company's financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the amounts reported in these financial statements and accompanying notes. Actual results could differ from those estimates.

Revenue Recognition

The Company recognizes revenue from product sales when the following four revenue recognition criteria are met: persuasive evidence of an arrangement exists, delivery has occurred or services have been rendered, the selling price is fixed or determinable, and collectability is reasonably assured. Product sales and shipping revenues are recorded when the products are shipped and title passes to customers. The customer’s credit card is authorized at the time the order is placed, thereby providing reasonable assurance of collectability. The credit card is then charged for the amount of the sale when the product is shipped from the supplier, with one exception. All custom orders for products which are manufactured specifically to fulfill the customers order are charged in full at the time the order is placed. If the custom order is subsequently canceled by the customer and the vendor has not incurred expense associated with the order and subsequently will not be invoicing us, we refund the customer’s money in full. If there is a charge from the vendor, we refund the customer’s money less the amount invoiced by the vendor. Our suppliers notify us via email when orders have been shipped and, with rare exceptions, all orders for merchandise that is in stock are shipped within 48 hours of the time of the order. Delivery to the customer is deemed to have occurred when the product is shipped from the supplier.

21

Return/Refund Policy

Customers may return/exchange their merchandise within 30 days of the sale unless the item is embroidered or otherwise customized, in which case all sales are final. Return shipping charges are the responsibility of the customer unless an error has been made on our part. The return of certain items may incur a restocking fee. If so, the customer is made aware at the time of the sale. Refunds for returned merchandise are processed promptly upon confirmation of receipt of the returned merchandise in like-new condition, less any applicable restocking and/or shipping charges. Our revenues and costs of goods sold are reported without making an allowance for returned merchandise due to the fact that our return rate is less than one half of one percent of gross revenue.

Advertising

The Company expenses advertising costs as incurred. There were no advertising costs incurred during the fiscal year ending December 31, 2009 or December 31, 2010.

Shipping and Handling Costs

Shipping and handling costs are included in cost of sales.

Earnings per share

The Company follows ASC Topic 260 to account for the earnings per share. Basic earning per common share (“EPS”) calculations are determined by dividing net income by the weighted average number of shares of common stock outstanding during the year. Diluted earning per common share calculations are determined by dividing net income by the weighted average number of common shares and dilutive common share equivalents outstanding. During periods when common stock equivalents, if any, are anti-dilutive they are not considered in the computation.

NOTE 2 BUSINESS ACQUISITIONS

On September 1, 2006, we acquired Aftermarket Express, Inc. which is now our wholly owned subsidiary. We purchased Aftermarket Express, Inc. from its stockholders for $31,300 paid in the form of $21,300 in cash and $10,000, interest free Promissory Note with a maturity date of November 29, 2006. The Promissory Note was paid in full on November 2, 2006.

NOTE 3 COMMITMENTS

None.

|

NOTE 4

|

RELATED PARTY TRANSACTIONS

|

As of December 31, 2009, the Company had received loans totaling $13,000 from the Company’s President, Adam Anthony. These loans are non-interest bearing and are due upon demand.

As of December 31, 2010, the Company had received loans totaling $13,000 from the Company’s President, Adam Anthony. These loans are non-interest bearing and are due upon demand.

On September 28, 2010, the Company issued 300,000 shares of stock to its CEO/President, Adam Anthony as a management bonus for services rendered during Q3, 2010. The Board has not made any determinations as to future stock issuances for management services.

NOTE 5 WEBSITE

We receive all of our revenues through our website. Once the order is received from the website, the customer’s credit card is authorized for the total cost of the sale, including shipping and handling. Upon successful authorization of the credit card, the order is sent to the appropriate supplier via email. Upon confirmation that the order has been shipped by the supplier, the customer’s credit card is charged for the full value of the sale. If the item is not available for immediate shipment, electronic communication is sent to the customer informing them of any delays.

The value of our website has been fully ammortized over time. The ammortization schedule is as follows:

| Year | Initial Value | Accumulated Ammortization | ||||||

| 2006 | $ | 35,610 | $ | 3,957 | ||||

| 2007 | 11,872 | |||||||

| 2008 | 11,872 | |||||||

| 2009 | 7,911 | |||||||

| 12/31/09 | $ | 35,610 | $ | 35,612 | * | |||

*the discrepancy between initial value and Accumulated Ammortization is attributable to rounding done for reporting purposes only.

NOTE 6 INCOME TAXES

The Company follows FASB ASB 740-10, “Income Taxes” for recording the provision for income taxes. Deferred tax assets and liabilities are computed based upon the difference between the financial statement and income tax basis of assets and liabilities using the enacted marginal tax rate applicable when the related asset or liability is expected to be realized or settled. Deferred income tax expenses or benefits are based on the changes in the asset or liability each period. If available evidence suggests that it is more likely than not that some portion or all of the deferred tax assets will not be realized, a valuation allowance is required to reduce the deferred tax assets to the amount that is more likely than not to be realized. Future changes in such valuation allowance are included in the provision for deferred income taxes in the period of change.

Deferred income taxes may arise from temporary differences resulting from income and expense items reported for financial accounting and tax purposes in different periods. Deferred taxes are classified as current or non-current, depending on the classification of assets and liabilities to which they relate. Deferred taxes arising from temporary differences that are not related to an asset or liability are classified as current or non-current depending on the periods in which the temporary differences are expected to reverse.

|

2010

|

2009

|

|||||||

|

Loss

|

$ | (11,573 | ) | $ | (23,156 | ) | ||

|

Deferred Tax Asset (30%)

|

$ | 3,472 | $ | 6,947 | ||||

|

Impairment of Deferred Tax Asset

|

$ | (3,472 | ) | $ | (6,947 | ) | ||

| Net Deferred Tax Asset | $ | 0 | $ | 0 | ||||

NOTE 7 GOING CONCERN

The Company's financial statements are prepared using generally accepted accounting principles in the United States of America applicable to a going concern which contemplates the realization of assets and liquidation of liabilities in the normal course of business. The Company has not yet established an ongoing source of revenues sufficient to cover its operating costs and allow it to continue as a going concern. The ability of the Company to continue as a going concern is dependent on the Company obtaining adequate capital to fund operating losses until it becomes profitable. If the Company is unable to obtain adequate capital, it could be forced to cease operations.

In order to continue as a going concern, the Company will need, among other things, additional capital resources. Management's plans to obtain such resources for the Company include (1) obtaining capital from management and significant shareholders sufficient to meet its minimal operating expenses, and (2) seeking out and completing a merger with an existing operating company. However, management cannot provide any assurances that the Company will be successful in accomplishing any of its plans.

The ability of the Company to continue as a going concern is dependent upon its ability to successfully accomplish the plans described in the preceding paragraph and eventually secure other sources of financing and attain profitable operations. The accompanying financial statements do not include any adjustments that might be necessary if the Company is unable to continue as a going concern.

NOTE 8 STOCKHOLDERS EQUITY

We have 100,000,000 shares of stock authorized for issuance, consisting of 10,000,000 preferred and 90,000,000 common.

Currently there are no shares of preferred stock issued or outstanding.

As of December 31, 2006, there were 1,100,000 shares of common stock issued and outstanding.

During the fiscal year 2007, 492,452 shares of common stock were issued in connection with the conversion of outstanding promissory notes into common stock.

As of December 31, 2007, there were 1,592,452 shares of common stock issued and outstanding.

During the fiscal year 2008, we issued 1,054,544 shares of common stock for cash of $126,485 and 130,000 shares for consulting services valued at $3,900.

As of December 31, 2009, there were 2,776,996 shares of common stock issued and outstanding.

During the fiscal year 2010, we issued 300,000 shares of common stock as a management bonus valued at $9,000. (see Note 4).

As of December 31, 2010, there were 3,076,996 shares of common stock issued and outstanding.

NOTE 9 SUBSEQUENT EVENTS

The Company has evaluated subsequent events from the balance sheet date through the issuance of these financial statements and has determined that there are no items to disclose.

22