Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CNO Financial Group, Inc. | form8k.htm |

Supplemental Information

March 30, 2011

March 30, 2011

Exhibit 99.1

CNO Financial Group

2

Forward-Looking Statements

Cautionary Statement Regarding Forward-Looking Statements. Our statements, trend analyses and other information contained in this

press release relative to markets for CNO Financial’s products and trends in CNO Financial’s operations or financial results, as well as other

statements, contain forward-looking statements within the meaning of the federal securities laws and the Private Securities Litigation Reform

Act of 1995. Forward-looking statements typically are identified by the use of terms such as “anticipate,” “believe,” “plan,” “estimate,” “expect,”

“project,” “intend,” “may,” “will,” “would,” “contemplate,” “possible,” “attempt,” “seek,” “should,” “could,” “goal,” “target,” “on track,” “comfortable

with,” “optimistic” and similar words, although some forward-looking statements are expressed differently. You should consider statements that

contain these words carefully because they describe our expectations, plans, strategies and goals and our beliefs concerning future business

conditions, our results of operations, financial position, and our business outlook or they state other ‘‘forward-looking’’ information based on

currently available information. Assumptions and other important factors that could cause our actual results to differ materially from those

anticipated in our forward-looking statements include, among other things: (i) changes in or sustained low interest rates causing a reduction in

investment income, the margins of our fixed annuity and life insurance businesses and demand for our products; (ii) general economic, market

and political conditions, including the performance and fluctuations of the financial markets which may affect our ability to raise capital or

refinance existing indebtedness and the cost of doing so; (iii) the ultimate outcome of lawsuits filed against us and other legal and regulatory

proceedings to which we are subject; (iv) our ability to make changes to certain non-guaranteed elements of our life insurance products; (v) our

ability to obtain adequate and timely rate increases on our health products, including our long-term care business; (vi) the receipt of any

required regulatory approvals for dividend and surplus debenture interest payments from our insurance subsidiaries; (vii) mortality, morbidity,

the increased cost and usage of health care services, persistency, the adequacy of our previous reserve estimates and other factors which may

affect the profitability of our insurance products; (viii) changes in our assumptions related to deferred acquisition costs or the present value of

future profits; (ix) the recoverability of our deferred tax assets and the effect of potential ownership changes and tax rate changes on their

value; (x) our assumption that the positions we take on our tax return filings, including our position that our 7.0% convertible senior debentures

due 2016 will not be treated as stock for purposes of Section 382 of the Internal Revenue Code of 1986, as amended, and will not trigger an

ownership change, will not be successfully challenged by the Internal Revenue Service; (xi) changes in accounting principles and the

interpretation thereof; (xii) our ability to continue to satisfy the financial ratio and balance requirements and other covenants of our debt

agreements; (xiii) our ability to achieve anticipated expense reductions and levels of operational efficiencies including improvements in claims

adjudication and continued automation and rationalization of operating systems, (xiv) performance and valuation of our investments, including

the impact of realized losses (including other-than-temporary impairment charges); (xv) our ability to identify products and markets in which we

can compete effectively against competitors with greater market share, higher ratings, greater financial resources and stronger brand

recognition; (xvi) our ability to generate sufficient liquidity to meet our debt service obligations and other cash needs; (xvii) our ability to maintain

effective controls over financial reporting; (xviii) our ability to continue to recruit and retain productive agents and distribution partners and

customer response to new products, distribution channels and marketing initiatives; (xix) our ability to achieve eventual upgrades of the

financial strength ratings of CNO Financial and our insurance company subsidiaries as well as the impact of our ratings on our business, our

ability to access capital and the cost of capital; (xx) the risk factors or uncertainties listed from time to time in our filings with the Securities and

Exchange Commission; (xxi) regulatory changes or actions, including those relating to regulation of the financial affairs of our insurance

companies, such as the payment of dividends and surplus debenture interest to us, regulation of financial services affecting (among other

things) bank sales and underwriting of insurance products, regulation of the sale, underwriting and pricing of products, and health care

regulation affecting health insurance products; and (xxii) changes in the Federal income tax laws and regulations which may affect or eliminate

the relative tax advantages of some of our products. Other factors and assumptions not identified above are also relevant to the forward-

looking statements, and if they prove incorrect, could also cause actual results to differ materially from those projected. All forward-looking

statements are expressly qualified in their entirety by the foregoing cautionary statements. Our forward-looking statements speak only as of the

date made. We assume no obligation to update or to publicly announce the results of any revisions to any of the forward-looking statements to

reflect actual results, future events or developments, changes in assumptions or changes in other factors affecting the forward-looking

statements.

press release relative to markets for CNO Financial’s products and trends in CNO Financial’s operations or financial results, as well as other

statements, contain forward-looking statements within the meaning of the federal securities laws and the Private Securities Litigation Reform

Act of 1995. Forward-looking statements typically are identified by the use of terms such as “anticipate,” “believe,” “plan,” “estimate,” “expect,”

“project,” “intend,” “may,” “will,” “would,” “contemplate,” “possible,” “attempt,” “seek,” “should,” “could,” “goal,” “target,” “on track,” “comfortable

with,” “optimistic” and similar words, although some forward-looking statements are expressed differently. You should consider statements that

contain these words carefully because they describe our expectations, plans, strategies and goals and our beliefs concerning future business

conditions, our results of operations, financial position, and our business outlook or they state other ‘‘forward-looking’’ information based on

currently available information. Assumptions and other important factors that could cause our actual results to differ materially from those

anticipated in our forward-looking statements include, among other things: (i) changes in or sustained low interest rates causing a reduction in

investment income, the margins of our fixed annuity and life insurance businesses and demand for our products; (ii) general economic, market

and political conditions, including the performance and fluctuations of the financial markets which may affect our ability to raise capital or

refinance existing indebtedness and the cost of doing so; (iii) the ultimate outcome of lawsuits filed against us and other legal and regulatory

proceedings to which we are subject; (iv) our ability to make changes to certain non-guaranteed elements of our life insurance products; (v) our

ability to obtain adequate and timely rate increases on our health products, including our long-term care business; (vi) the receipt of any

required regulatory approvals for dividend and surplus debenture interest payments from our insurance subsidiaries; (vii) mortality, morbidity,

the increased cost and usage of health care services, persistency, the adequacy of our previous reserve estimates and other factors which may

affect the profitability of our insurance products; (viii) changes in our assumptions related to deferred acquisition costs or the present value of

future profits; (ix) the recoverability of our deferred tax assets and the effect of potential ownership changes and tax rate changes on their

value; (x) our assumption that the positions we take on our tax return filings, including our position that our 7.0% convertible senior debentures

due 2016 will not be treated as stock for purposes of Section 382 of the Internal Revenue Code of 1986, as amended, and will not trigger an

ownership change, will not be successfully challenged by the Internal Revenue Service; (xi) changes in accounting principles and the

interpretation thereof; (xii) our ability to continue to satisfy the financial ratio and balance requirements and other covenants of our debt

agreements; (xiii) our ability to achieve anticipated expense reductions and levels of operational efficiencies including improvements in claims

adjudication and continued automation and rationalization of operating systems, (xiv) performance and valuation of our investments, including

the impact of realized losses (including other-than-temporary impairment charges); (xv) our ability to identify products and markets in which we

can compete effectively against competitors with greater market share, higher ratings, greater financial resources and stronger brand

recognition; (xvi) our ability to generate sufficient liquidity to meet our debt service obligations and other cash needs; (xvii) our ability to maintain

effective controls over financial reporting; (xviii) our ability to continue to recruit and retain productive agents and distribution partners and

customer response to new products, distribution channels and marketing initiatives; (xix) our ability to achieve eventual upgrades of the

financial strength ratings of CNO Financial and our insurance company subsidiaries as well as the impact of our ratings on our business, our

ability to access capital and the cost of capital; (xx) the risk factors or uncertainties listed from time to time in our filings with the Securities and

Exchange Commission; (xxi) regulatory changes or actions, including those relating to regulation of the financial affairs of our insurance

companies, such as the payment of dividends and surplus debenture interest to us, regulation of financial services affecting (among other

things) bank sales and underwriting of insurance products, regulation of the sale, underwriting and pricing of products, and health care

regulation affecting health insurance products; and (xxii) changes in the Federal income tax laws and regulations which may affect or eliminate

the relative tax advantages of some of our products. Other factors and assumptions not identified above are also relevant to the forward-

looking statements, and if they prove incorrect, could also cause actual results to differ materially from those projected. All forward-looking

statements are expressly qualified in their entirety by the foregoing cautionary statements. Our forward-looking statements speak only as of the

date made. We assume no obligation to update or to publicly announce the results of any revisions to any of the forward-looking statements to

reflect actual results, future events or developments, changes in assumptions or changes in other factors affecting the forward-looking

statements.

CNO Overview

CNO Financial Group

4

The Company: CNO Financial Group

§ Focused on serving the protection needs of the fast-growing but

underserved middle income and senior markets

underserved middle income and senior markets

§ Products include supplemental health, Medicare supplement, life,

annuity and long-term care

annuity and long-term care

§ Products sold through efficient, growing distribution channels:

– Bankers Life: strong career agent franchise

– Colonial Penn: direct distribution platform

– Washington National: wholly-owned distributor (PMA) and independent

agents

agents

§ Centralized services operation to add value to all units

§ Over 3.9 million policies in force

CNO Financial Group

5

Broad Distribution Reach

• Focused on middle-income senior

market with Medicare supplement,

life, annuity, LTC, Medicare Part D

and Medicare Advantage products

market with Medicare supplement,

life, annuity, LTC, Medicare Part D

and Medicare Advantage products

• “Kitchen-table” sales model

through over 5,000 career agents

and sales managers; growing

agents at 4.5% annually for past

six years

through over 5,000 career agents

and sales managers; growing

agents at 4.5% annually for past

six years

• 150+ branches nationwide

• Focused on middle-income working

Americans in Worksite and

Individual markets with

supplemental health and life

insurance products

Americans in Worksite and

Individual markets with

supplemental health and life

insurance products

• Serving approximately 1 million

policyholders and over 20,000

groups e.g. small business,

education, government, and

healthcare

policyholders and over 20,000

groups e.g. small business,

education, government, and

healthcare

• Distribution through over 2,000

independent agents in 2 sales

channels; PMA (a wholly-owned

distributor) and WNIC Independent.

independent agents in 2 sales

channels; PMA (a wholly-owned

distributor) and WNIC Independent.

• Focused on lower middle-income

retirees with simple, low-cost life

insurance products

retirees with simple, low-cost life

insurance products

• Direct response model with media

and mail-based lead generation

with robust telemarketing support

and mail-based lead generation

with robust telemarketing support

Career

Direct

PMA/Independent

CNO Financial Group

6

Value Through Growth and Execution

The Opportunity: Rapidly Growing, Underserved Market

§ Our focus is meeting the needs of fast-growing senior market

§ Attractive demographics: Baby Boomers reaching retirement age

– The first of Boomer population become Medicare-eligible this year

– Americans turning 65 will grow by nearly 4% annually over next decade

– In ten years, population 65 years old and older will increase by 50%

– Financial downturn underscored importance of risk management and

guaranteed products

guaranteed products

We know this market better than anyone, pursue it full-time, and represent

a pure play in the attractive senior middle income market

a pure play in the attractive senior middle income market

CNO Financial Group

7

CNO Financial Group

8

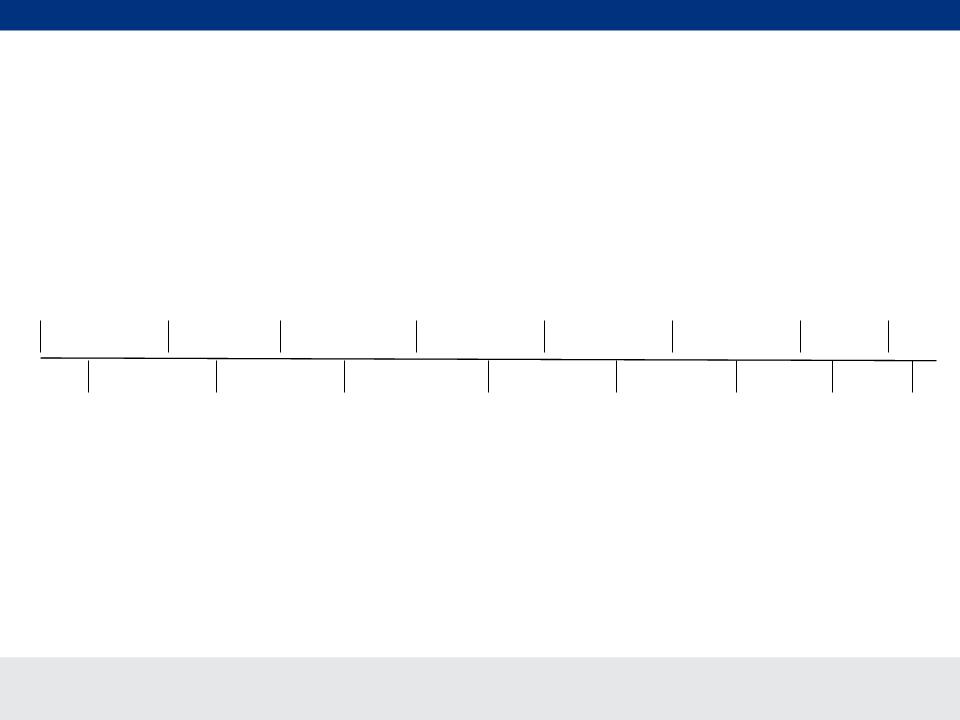

Q4 2008

Separation

of Closed

Block LTC

business

of Closed

Block LTC

business

Q4 2006

VNB

introduced

VNB

introduced

2007/2008

CIG sales &

marketing

rightsizing -

$6 million

annual

expense

reduction

marketing

rightsizing -

$6 million

annual

expense

reduction

2008

Excess Chicago

space vacated -

$5 million

annual expense

save

space vacated -

$5 million

annual expense

save

Q4 2007

Recapture of

Colonial Penn

Life Block

Colonial Penn

Life Block

Q3 2007

Sale of $3

billion

annuity block

billion

annuity block

Q3 2007

Completed

consolidation

of shared

services in

Carmel, Sale of

excess space in

Carmel

consolidation

of shared

services in

Carmel, Sale of

excess space in

Carmel

Q1 2009

Renegotiated

credit facility

to loosen

covenants

credit facility

to loosen

covenants

Q1 2007

Expanded

Annual

Incentive Plan

participation;

increased

weight on

shareholder

value

Annual

Incentive Plan

participation;

increased

weight on

shareholder

value

Q3 2009

Reinsurance

of CIG Life

policies to

Wilton Re

of CIG Life

policies to

Wilton Re

Q4 2010

Refinanced

$650 million

of debt

$650 million

of debt

Q4 2009

Reinsurance of

Bankers Life

policies to

Wilton Re

Bankers Life

policies to

Wilton Re

Q4 2009

Refinanced

convertible

debentures

putable in Sept

2010; issued

new equity;

paid down Sr.

Credit Facility

convertible

debentures

putable in Sept

2010; issued

new equity;

paid down Sr.

Credit Facility

Q4 2009

Renegotiated

Senior Credit

Facility to

loosen

covenants

Senior Credit

Facility to

loosen

covenants

Q4 2009

Achieved

RBC in

excess of

300%

RBC in

excess of

300%

Q1 2011

Pre-paid

$50

million on

Senior

Credit

Facility

$50

million on

Senior

Credit

Facility

CNO - Timeline of Management Actions

CNO Financial Group

9

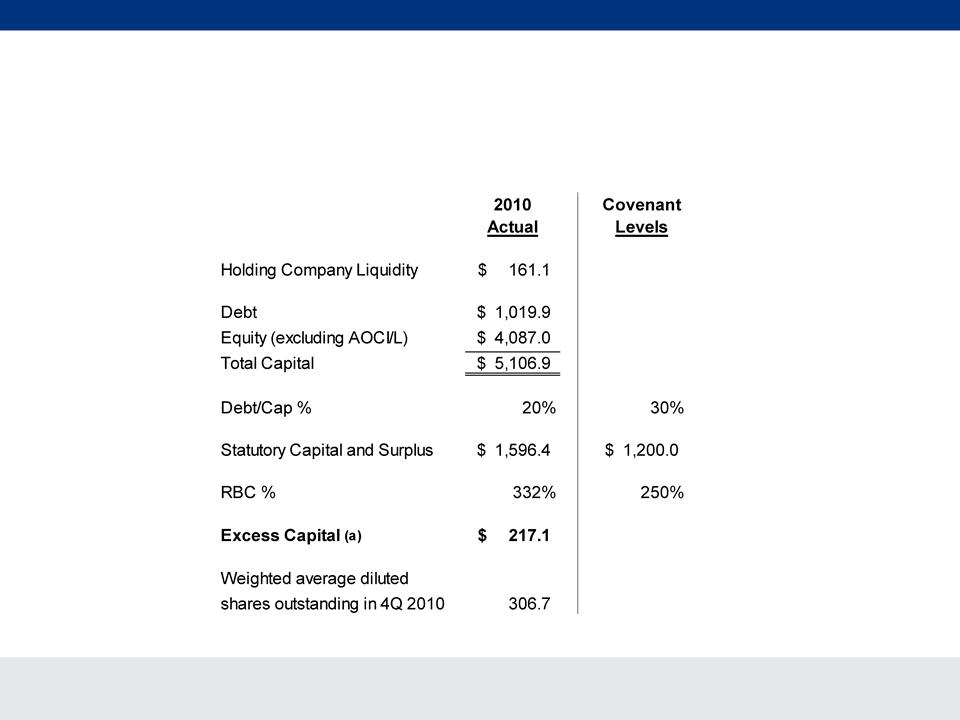

We are projecting to build on our excess capital position in the near-term while

maintaining significant cushion relative to debt covenants

maintaining significant cushion relative to debt covenants

(a) Capital in excess of that needed to maintain 300% RBC level and $100 million liquidity at the holding company

Current Capitalization

CNO Financial Group

10

Excess Capital Utilization Opportunities

§ Debt Repayment

§ Share Buybacks

§ Common Stock Dividends

§ Accelerate Distribution Growth

§ Selective Acquisitions

§ Build Holding Company Investment Portfolio

CNO Financial Group

11

Summary

§ Strategic focus on burgeoning senior middle-market—unique “pure

play”

play”

§ Attractive growth and profit potential driven by demographics and

execution

execution

§ Considerable progress financially and operationally

§ Well capitalized and well managed

§ Value of tax paying status not yet fully realized in stock price

§ Strong performance momentum—8 consecutive quarters of

profitable results

profitable results

Washington National Business Review

CNO Financial Group

13

Independent agent distribution

Two sales channels: PMA (wholly-owned) and WNIC Independent

Supplemental Health and Life products

Washington National is a leading provider of supplemental health and life

insurance for middle-income Americans in the Worksite and Individual

markets, serving approximately 1 million policyholders and over 20,000

groups through more than 2,000 independent agents.

insurance for middle-income Americans in the Worksite and Individual

markets, serving approximately 1 million policyholders and over 20,000

groups through more than 2,000 independent agents.

Washington National

Distribution:

Product Focus:

Market Focus and Distribution Approach

CNO Financial Group

14

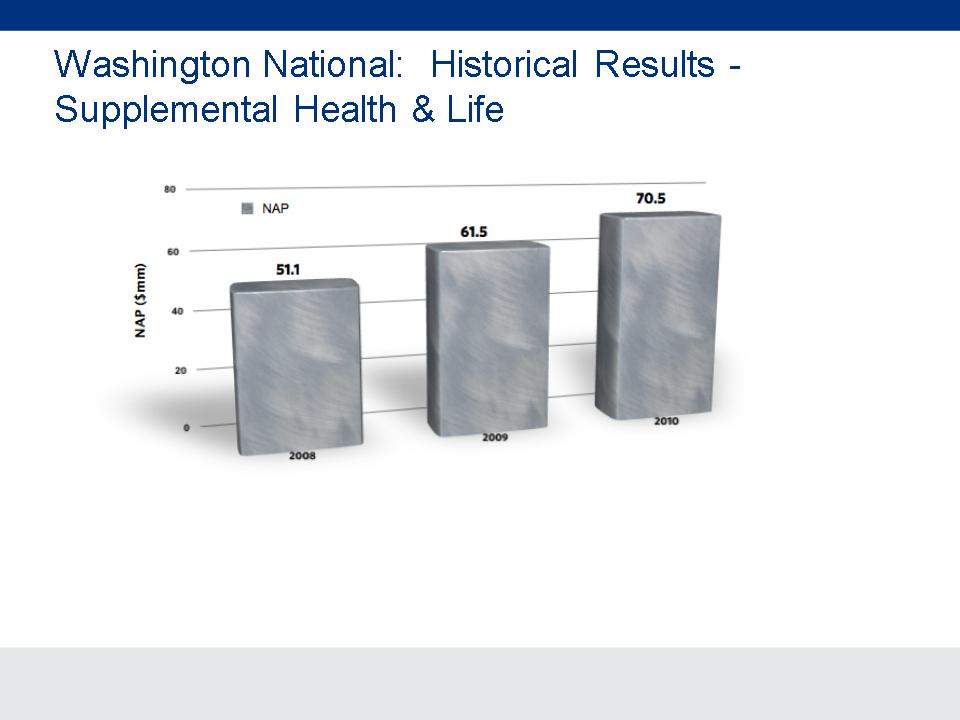

§ Washington National sales of core products have increased 37.9% since 2008

Washington National

CNO Financial Group

15

Washington National

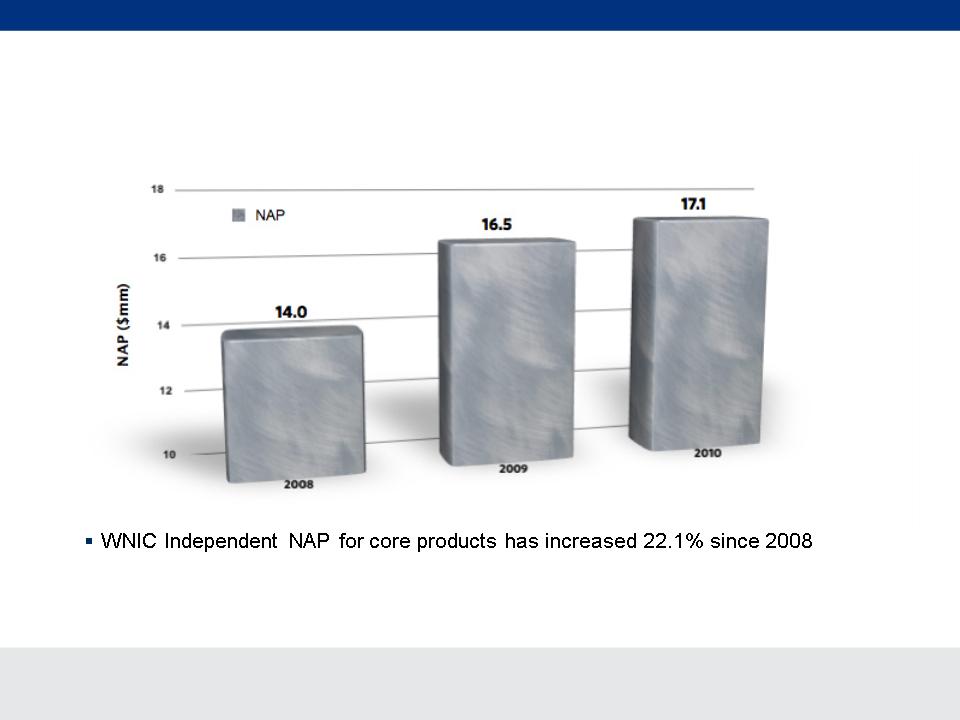

WNIC Independent: Historical Results -

Supplemental Health & Life

Supplemental Health & Life

CNO Financial Group

16

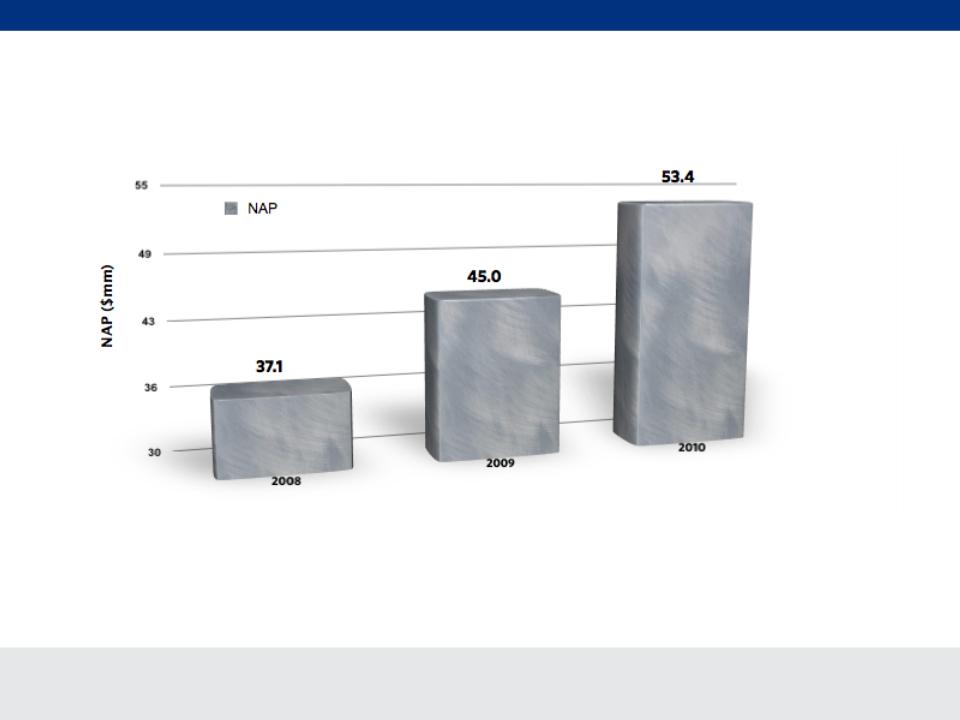

§ PMA sales of core products have increased 43.9% since 2008

Washington National

PMA: Historical Results - Supplemental Health & Life

CNO Financial Group

17

Washington National

Distribution Growth Priorities

§ Continue generating double-digit growth in supplemental health and

voluntary worksite sales

voluntary worksite sales

§ Grow WNIC Independent - independent distribution

§ Grow PMA - wholly-owned distributor

– Recruiting

– Expanding geographic coverage

– Adding district and regional leaders, and improving talent through training

and monitoring

and monitoring

§ Pursue “Other Distribution” opportunities

Investments

CNO Financial Group

19

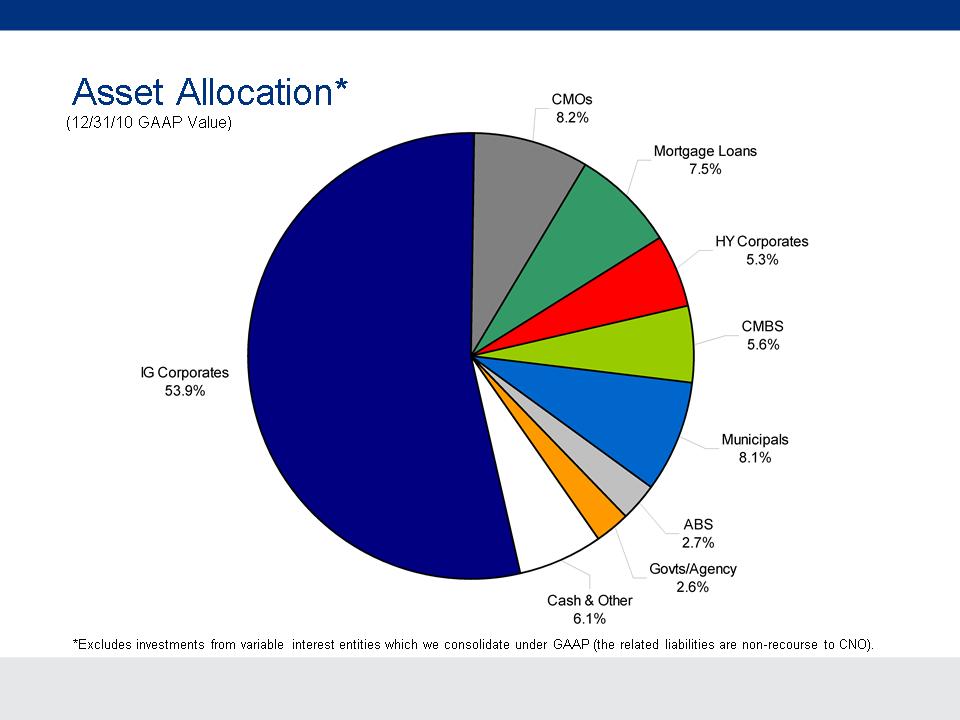

Investments

§ Our long-term corporate goal is stable and predictable investment performance meeting

corporate return objectives for our new and in-force products

corporate return objectives for our new and in-force products

§ Our current tactical priority: generating satisfactory investment income within acceptable

risk parameters

risk parameters

§ We invest predominantly in liquid fixed income securities

§ Our portfolio is actively managed

§ Our portfolio has performed to our expectations, reflecting yield, credit loss dilution and

migration trends consistent with the credit cycle

migration trends consistent with the credit cycle

§ We have well-developed risk controls including intensive fundamental research,

conservative asset allocation and credit policies, enterprise-level asset liability

management, disciplined hedging, and closely-monitored compliance

conservative asset allocation and credit policies, enterprise-level asset liability

management, disciplined hedging, and closely-monitored compliance

§ Our hedging activities supporting our indexed products have produced favorable results

(predominately static hedging)

(predominately static hedging)

§ Total return strategy to invest holding company excess capital

CNO Financial Group

20

CNO Financial Group

21

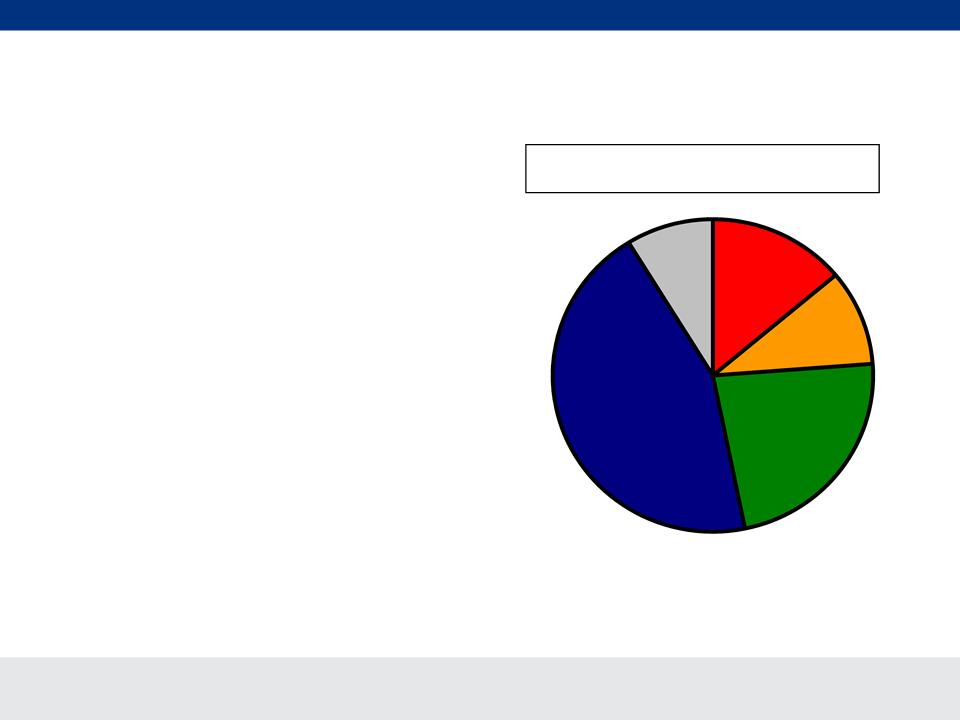

Investment Quality*

§ 91% investment grade

Fixed Maturities, available for sale, by Rating

at 12/31/10 (Market Value)

at 12/31/10 (Market Value)

|

% of Bonds which are Investment Grade:

|

12/31/09

93%

|

3/31/10

93%

|

6/30/10

92%

|

9/30/10

92%

|

12/31/10

91%

|

*Excludes investments from variable interest entities which we consolidate under GAAP (the related liabilities are non-recourse to CNO).

AAA

14%

AA

10%

A

23%

BBB

44%

<BBB

9%

CNO Financial Group

22

Earned Yield/Net Investment Income

§ Full year 2010 portfolio yield increase due

primarily to new money investments at yields

consistently exceeding portfolio rate

primarily to new money investments at yields

consistently exceeding portfolio rate

§ Increase in investment income also benefited

from growth in average assets

from growth in average assets

§ 4Q10 decline in earned yield due primarily to

expansion of FHLB loans

expansion of FHLB loans

Ø Floating rate

Ø Matched

|

New Money Rate:

|

5.15%

|

6.21%

|

6.26%

|

6.00%

|

5.96%

|

($ millions)

|

Earned Yield:

|

5.63%

|

5.76%

|

5.83%

|

5.86%

|

5.77%

|

|

|

4Q09

|

1Q10

|

2Q10

|

3Q10

|

4Q10

|

CNO Financial Group

23

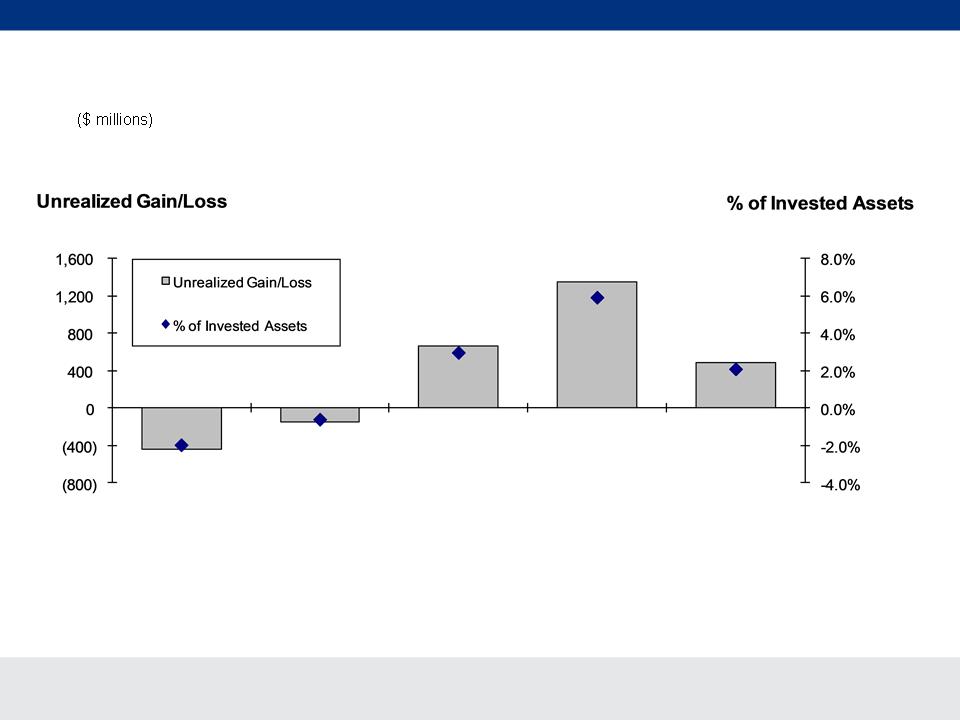

Unrealized Gain/Loss*

*Includes debt and equity securities classified as available for sale. Excludes investments from variable interest

entities which we consolidate under GAAP.

entities which we consolidate under GAAP.

12/31/2009

3/31/2010

6/30/2010

9/30/2010

12/31/2010

CNO Financial Group

24

What we’re buying now…

§ Prime Jumbo RMBS

§ Selected Commercial Mortgage Loans

§ (Original rating) AAA/AA CMBS

§ First and Second Pay CLO’s

§ Taxable Municipal Bonds

CNO Financial Group

25

Asset Liability Management

§ Duration

– Interest rate risk is low

– Duration gap limits continually monitored/managed at statutory entity and line of business

levels

levels

– Significant product mix/distribution mitigating factors

• Diversification benefits from product portfolio

• Annuity products represent ~ 40% of liabilities (~ 90% have surrender penalty)

• Non-interest sensitive products represent ~ 60% liabilities

• Stable liability profile (smaller policies, owned distribution system)

§ Convexity - monitor as secondary indicator of interest rate risk

§ Volatility

– FAS 133 requires the separate valuation of the equity and interest rate components of our

Fixed Index Annuity products

Fixed Index Annuity products

– Our hedging activities related to both these components have been effective

– Hedge variance objectives and performance continually monitored and actively managed

(predominately static hedges)

(predominately static hedges)

We measure and manage our asset /liability exposure using 3 key variables

CNO Financial Group

26

Investments

§ CMBS, CRE loan, non-agency RMBS portfolios have been actively

managed “up in quality”

managed “up in quality”

§ We are generating sufficient yield to meet product spread

requirements

requirements

§ Asset/Liability match is tight and closely monitored

§ Investment risk carefully calibrated to capacity of overall enterprise

for capital volatility

for capital volatility

Bankers Life Business Review

CNO Financial Group

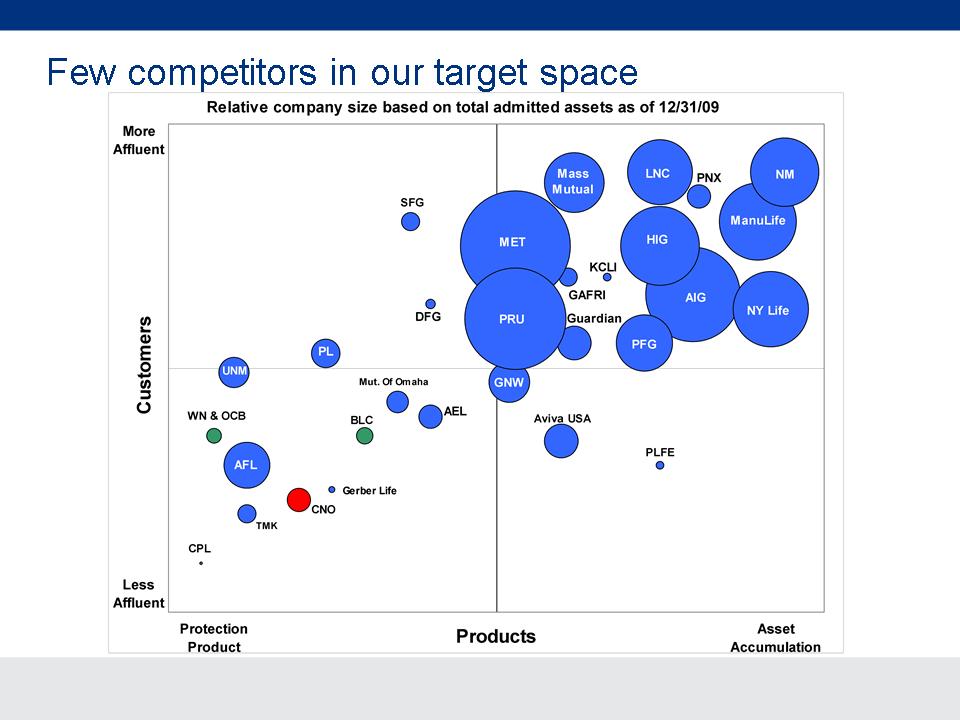

28

Strong, established company

§ Established in 1879, with over 125 years of experience

§ $12 billion in assets under management

§ 1.3 million policyholders

Focused on the Boomer and retiree middle market

§ Most insurance companies work in multiple markets, favor pre-retirement

market and tend to move up market as quickly as circumstances allow

market and tend to move up market as quickly as circumstances allow

§ While the fastest growing, least competitive, and most accessible and needs

aware, this market remains one of the most underserved in the U.S.

aware, this market remains one of the most underserved in the U.S.

Focused on career, exclusive distribution force

§ More than 5,000 producers in over 200 branch and satellite offices servicing

49 states

49 states

§ Most insurance companies work through multiple distribution channels

§ Many are moving away from dependence on career distribution due to both

cost and capability challenges

cost and capability challenges

Bankers Overview

Bankers Life

CNO Financial Group

29

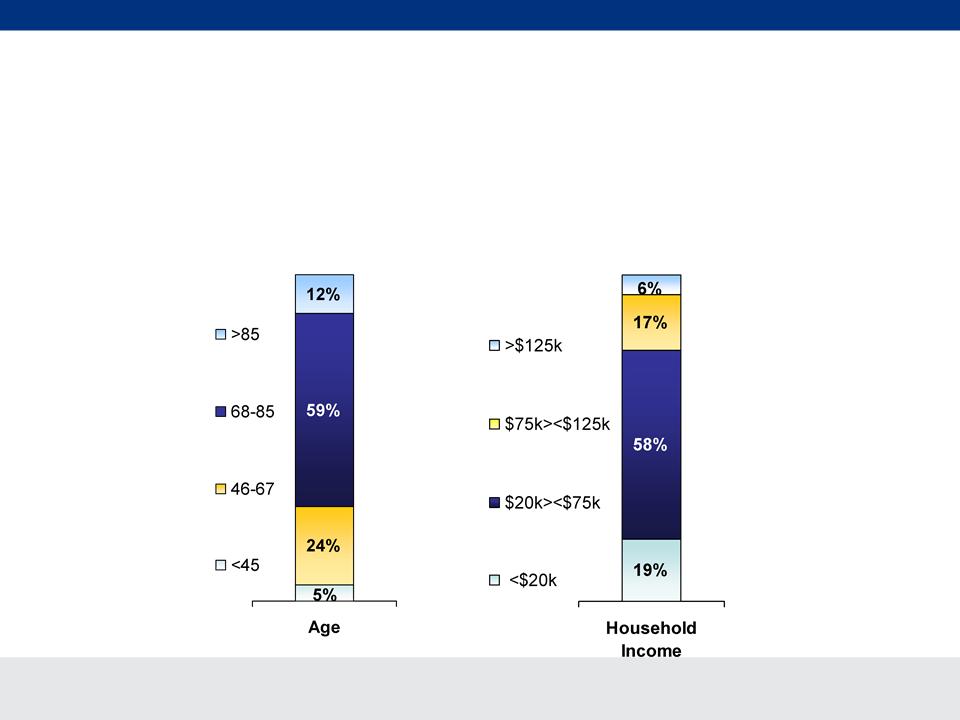

Everyday Americans

Share of Bankers Life and Casualty’s Customers

Bankers current customers reflect a large age and income demographic, unique

from the up-market focus of most life and annuity insurers

from the up-market focus of most life and annuity insurers

Bankers Life

CNO Financial Group

30

Center For a Secure Retirement

Launched in 2011:

n To educate consumers on

achieving financial security

during retirement

achieving financial security

during retirement

n Sponsor research studies to

aid consumers

aid consumers

n Generate online content that

(over time) will become highly-

ranked

(over time) will become highly-

ranked

Bankers Life

CNO Financial Group

31

§ Surveyed Americans age 55 to 75 in our target market (incomes between

$25,000 to $75,000), exploring confidence towards financial security

$25,000 to $75,000), exploring confidence towards financial security

§ 54% do not receive professional retirement guidance of any kind

§ 51% had not been contacted by any kind of retirement professional in the

past 12 months

past 12 months

§ Middle-income retirees have three misconceptions about professional

retirement advice:

retirement advice:

─ I can do it all on my own

─ I’m not wealthy enough

─ Professional advice is too expensive

§ 30% spend no time at all researching or investigating retirement planning

opportunities; two out of three (61%) spend less than one hour per month

opportunities; two out of three (61%) spend less than one hour per month

Inaugural Study:

Middle-Income Retirement Preparedness

Middle-Income Retirement Preparedness

Focus on simple product designs and basic needs

Bankers Life

CNO Financial Group

32

Bankers Product Suite

Legacy

Savings

Medicare

Long Term

Care

Care

Life

Insurance

Annuities

Investments

• Short-Term Care

• Home Care

• Comprehensive Care

• Whole Life

• Term Life

• Universal Life

• Fixed Annuities

• Indexed Annuities

• Immediate Annuities

• Mutual Funds*

• Variable

Annuities*

Annuities*

• Medicare Supplement

• Medicare Advantage*

• Medicare Part D*

*In-Sourced Products

Bankers has a broad products suite, tailored to its target market, leveraging third

parties to fill specialized capabilities

parties to fill specialized capabilities

Bankers Life

CNO Financial Group

33

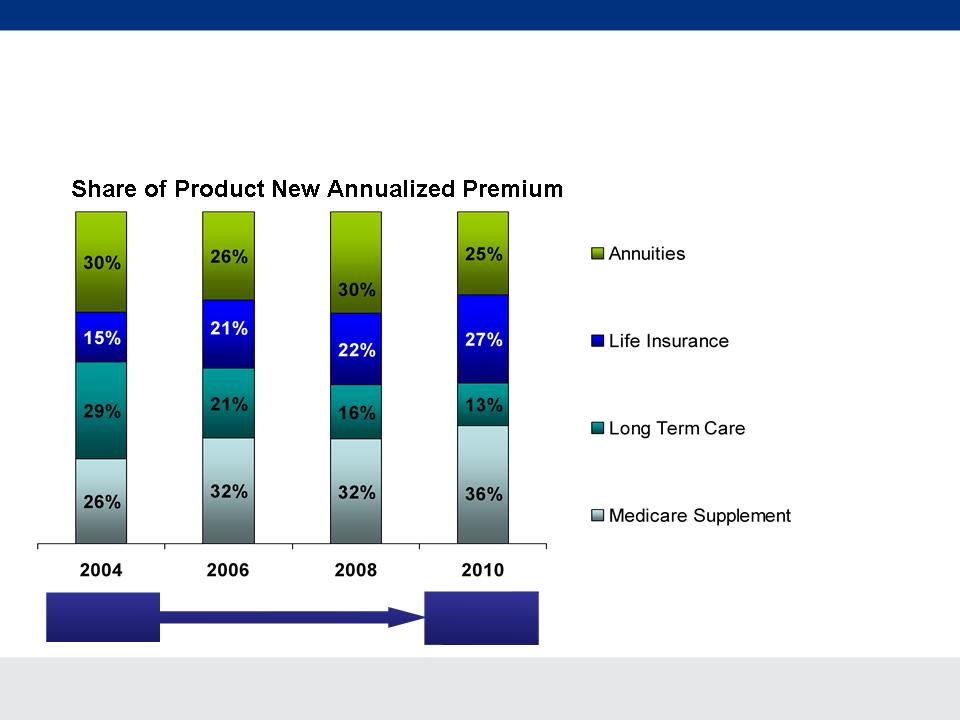

Diversified, Evolving Products

Bankers diversified product suite has adapted to changing consumer needs and

business climates

business climates

Total Medicare Sales (Millions)

$63.6

$102.2

Bankers Life

CNO Financial Group

34

Medicare Supplement Market

§ Several leading carriers using

Modernized Medigap plans to

grow share with aggressive pricing

Modernized Medigap plans to

grow share with aggressive pricing

§ Some carriers offering “no

questions asked” guaranteed

issue plans up to age 71

questions asked” guaranteed

issue plans up to age 71

§ New entrants attacking market

including major healthcare carriers

including major healthcare carriers

§ Expect greater competition as

regional carriers exit Medicare

Advantage market and distributors

move away from individual major

medical due to compressed

margins

regional carriers exit Medicare

Advantage market and distributors

move away from individual major

medical due to compressed

margins

Highlights

§ New application submissions of

Modernized plans flat to prior year, but

mix is shifting to lower premium cost-

sharing plans that are more competitive

in market

Modernized plans flat to prior year, but

mix is shifting to lower premium cost-

sharing plans that are more competitive

in market

§ Evaluating introducing more granular

rate structure (male/female,

preferred/tobacco) and tighter

underwriting to provide greater capacity

for further rate reductions if needed

rate structure (male/female,

preferred/tobacco) and tighter

underwriting to provide greater capacity

for further rate reductions if needed

Bankers Initiatives

Bankers Life

CNO Financial Group

35

Life Insurance Market

Highlights

Bankers Initiatives

§ Strong life insurance growth has been fueled

by a simple product design and streamlined

underwriting priced at a market premium given

distribution and underwriting model

by a simple product design and streamlined

underwriting priced at a market premium given

distribution and underwriting model

§ Focus on Boomer and retiree middle-income

needs for lower face amounts and fewer riders

which help meet consumer and agent needs

for higher take rates, simpler applications and

shorter cycle times

needs for lower face amounts and fewer riders

which help meet consumer and agent needs

for higher take rates, simpler applications and

shorter cycle times

§ Branch leadership involvement in new product

selection and design

selection and design

§ Products managed to value of new business

threshold - present value of future statutory

cash flows, net of cost of capital

threshold - present value of future statutory

cash flows, net of cost of capital

§ Limited use of reinsurance due to lower face

amounts and less capital intensive product

mix

amounts and less capital intensive product

mix

Bankers Life

§ Life insurance market rebounding from

2009 sales decline, with 3% growth in

recurring premium in 2010 (LIMRA)

2009 sales decline, with 3% growth in

recurring premium in 2010 (LIMRA)

§ Market and geopolitical uncertainty

driving strong growth in guaranteed

whole and universal life products,

particularly among Boomers and

retirees

driving strong growth in guaranteed

whole and universal life products,

particularly among Boomers and

retirees

§ Product development focused on

increasingly complex products to meet

affluent customers’ needs

increasingly complex products to meet

affluent customers’ needs

CNO Financial Group

36

Annuity Market

§ Low Treasury rates and tight

spreads on corporate securities

have depressed new money rates

on annuities, but remain attractive

against comparable investments

such as bank CDs

spreads on corporate securities

have depressed new money rates

on annuities, but remain attractive

against comparable investments

such as bank CDs

§ Carriers have generally pulled

back on their guarantees, rates,

bonuses, and compensation -

some have even stopped selling

certain products

back on their guarantees, rates,

bonuses, and compensation -

some have even stopped selling

certain products

Highlights

§ Re-filed fixed interest annuities to reduce

guaranteed rates

guaranteed rates

§ Reduced bonus rate on most popular

product

product

§ Reduced commissions/override to

improve rates/margins

improve rates/margins

Bankers Initiatives

Bankers Life

CNO Financial Group

37

§ LTC is an important product that enables

Bankers Life to meet the needs of its customers

Bankers Life to meet the needs of its customers

§ Improved financial results over the past 2.5

years have been a result of rigorous claims

management and decisive inforce rate

management

years have been a result of rigorous claims

management and decisive inforce rate

management

§ Stringent underwriting and low exposure to high

risk product designs (e.g., “0” day elimination

period, “lifetime” benefits, high compound

inflation, etc)

risk product designs (e.g., “0” day elimination

period, “lifetime” benefits, high compound

inflation, etc)

§ New business priced for higher returns using

conservative lapse and interest rate

assumptions

conservative lapse and interest rate

assumptions

§ A portion of new business reinsured with major

carrier

carrier

§ Additional advanced training for LTC

“specialists”, mentor model and new collateral

and sales support material focused on

improving top line results

“specialists”, mentor model and new collateral

and sales support material focused on

improving top line results

Bankers Life

Highlights

Bankers Initiatives

§ Exit of many competitors, others

following with rate increases

following with rate increases

§ Viability of CLASS Act in question

§ Sluggish individual sales due to

price point, agent/broker

apprehension, and tighter

underwriting

price point, agent/broker

apprehension, and tighter

underwriting

LTC Market

CNO Financial Group

38

Distribution Strategy

§ Bankers “Franchise” model builds best practices across recruiting, lead generation, and

training to drive productivity, consistency and compliance

training to drive productivity, consistency and compliance

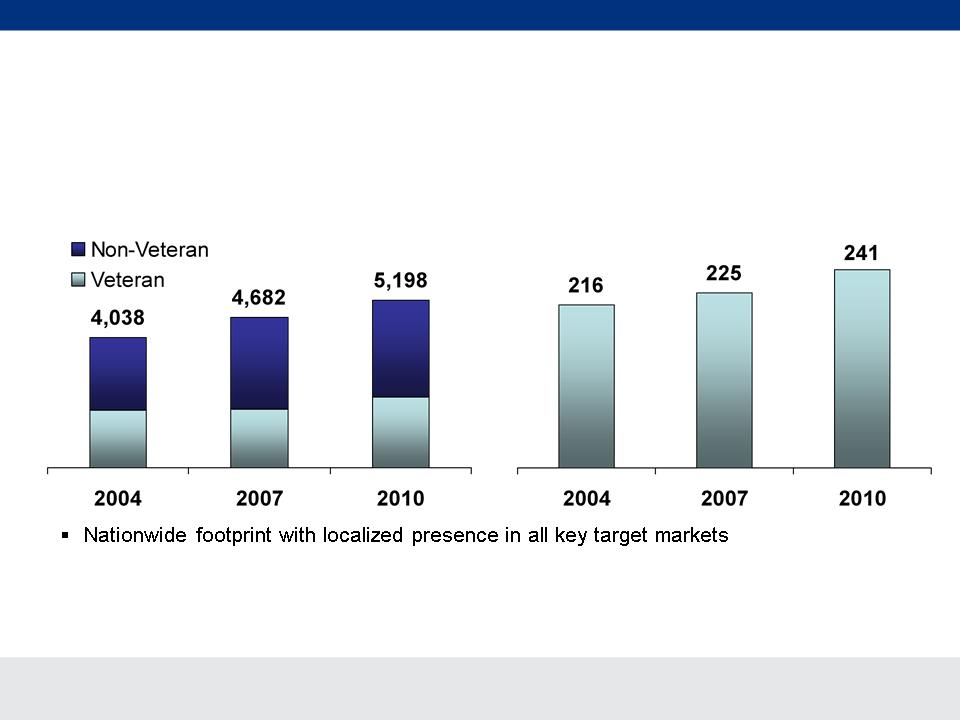

Average Producers

Over 5,000 producers meet consumers “at the kitchen table” employing a needs-

based selling approach

based selling approach

Branch and Satellite Offices

Bankers Life

CNO Financial Group

39

Keys to Distribution Success

§ Regional Directors focused on developing talent and relocating top

performers across region

performers across region

– Creates career path for up-and-comers who stay focused on growth

– As managers relocate, best practices and high-performance culture moves

with them

with them

§ Greater utilization of marketing programs

– High investment in lead generation programs

– Maximize centralized recruiting services

– Adapt quickly to new product introductions

Bankers Life

CNO Financial Group

40

The demographics of CNO’s target market are very attractive. As a result of the

baby boom, the number of Americans turning 65 each year will grow by nearly 4%

per year over the next decade.

baby boom, the number of Americans turning 65 each year will grow by nearly 4%

per year over the next decade.

The first of Boomer population become Medicare-eligible this year; In 10 years, the

number of people 65 years old and older will increase by 50%

number of people 65 years old and older will increase by 50%

Bankers Life

Growth Opportunities

§ There is a strong correlation between the number of target households within

20 miles of an office and the number of active agents that the office supports

20 miles of an office and the number of active agents that the office supports

– 80% of agents live within 20 miles of one our branches

– 75% of sales take place within 10 miles from an agent’s home

§ Using mapping software, we have identified additional locations that have

sufficient target households to support an office; these locations could

collectively support an incremental agent count through these office locations

sufficient target households to support an office; these locations could

collectively support an incremental agent count through these office locations

– Currently planning to add 15 new locations in 2011

CNO Financial Group

41

Longer Term - Growth Plan Executive Summary

§ Bankers near term goal is to grow sales 8-10% per year. We plan on achieving this

growth through similar increases in both the size and productivity of our agency

force

growth through similar increases in both the size and productivity of our agency

force

§ This level of growth is expected to be achieved through a combination of improved

productivity within our existing locations (same store sales) and expansion of our

reach through the addition of new locations

productivity within our existing locations (same store sales) and expansion of our

reach through the addition of new locations

§ Productivity can be enhanced by product line expansion including third party

offerings and focused cross sell marketing strategies

offerings and focused cross sell marketing strategies

§ The strong growth of the Northeast territory is instructive to our efforts to improve

existing office performance- their ability to successfully develop and relocate high

performers is now being mimicked across the nation

existing office performance- their ability to successfully develop and relocate high

performers is now being mimicked across the nation

§ Current household demographics suggest that existing offices can support

additional agents - talent development and migration will be key to getting us there

additional agents - talent development and migration will be key to getting us there

§ Additional agent growth can be achieved by opening up additional offices -

particularly satellites, which are inexpensive to open and have a two-year payback

particularly satellites, which are inexpensive to open and have a two-year payback

Bankers Life