Attached files

| file | filename |

|---|---|

| 8-K/A - FORM 8-K/A - Cybergy Holdings, Inc. | form8ka.htm |

| EX-99.3 - EXHIBIT 99.3 - Cybergy Holdings, Inc. | exhibit99-3.htm |

EXHIBIT 99.2

LANGUAGE KEY ASIA LTD. AND SUBSIDIARIES

FINANCIAL STATEMENTS

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors

Language Key Asia Ltd.

We have audited the accompanying Consolidated Balance Sheets of Language Key Asia Ltd. and its Subsidiaries (collectively, the “Company”) as of December 31, 2010 and 2009, and the related Consolidated Statements of Operations and Comprehensive Income, Consolidated Statements of Shareholders’ Equity, and Consolidated Statements of Cash Flows for the years then ended. These consolidated financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these consolidated financial statements based on our audits.

We conducted our audits in accordance with standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatements. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the consolidated financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall consolidated financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the consolidated financial position of the Company as of December 31, 2010 and 2009 and the consolidated results of their operations and their cash flows for the years then ended in conformity with accounting principles generally accepted in the United States of America.

/s/MaloneBailey, LLP

www.malone-bailey.com

Houston,

Texas

March 29, 2011

Language Key Asia Ltd. and Subsidiaries

Consolidated Balance Sheets

(Stated in US dollars)

| December 31, 2010 | December 31, 2009 | |||||

| ASSETS | ||||||

| Current Assets | ||||||

| Cash and cash equivalents | $ | 246,089 | $ | 207,566 | ||

| Accounts receivable | 199,287 | 153,904 | ||||

| Unbilled revenue | 188,785 | 77,825 | ||||

| Other receivables | 12,433 | 11,547 | ||||

| Corporate tax recoverable | 10,295 | 9,676 | ||||

| Prepaid expenses | 2,747 | - | ||||

| Due from related parties | 41,907 | 4,794 | ||||

| Total Current Assets | 701,543 | 465,312 | ||||

| Property and equipment, net | 37,019 | 22,819 | ||||

| Other assets | 30,285 | 18,115 | ||||

| TOTAL ASSETS | $ | 768,847 | $ | 506,246 | ||

| LIABILITIES & SHAREHOLDERS’ EQUITY | ||||||

| Current Liabilities | ||||||

| Deferred revenue | 203,970 | 218,926 | ||||

| Accrued liabilities | 32,910 | 9,489 | ||||

| Tax payable | 60,997 | 35,421 | ||||

| Other payable | 107,137 | 4,542 | ||||

| Due to related parties | 233,697 | 78,842 | ||||

| Wages payable | 78,468 | 39,406 | ||||

| Total Current Liabilities | 717,179 | 386,626 | ||||

| TOTAL LIABILITIES | $ | 717,179 | $ | 386,626 |

| SHAREHOLDERS’ EQUITY | ||||||

| Ordinary A Shares, $1.00 par

value, 1,000,000 authorized, 325,710 shares and 301,282 issued and outstanding at December 31, 2010 and 2009 |

$ | 325,710 | $ | 301,282 | ||

| Ordinary B Shares, $0.1 par

value, 10,000,000 authorized, none issued and outstanding at December 31, 2010 and 2009 |

- | - | ||||

| Preferred Shares, $0.01 par

value, 100,000,000 authorized, none issued and outstanding at December 31, 2010 and 2009 |

- | - | ||||

| Subscription receivable | (100,000 | ) | (100,000 | ) | ||

| Retained deficit | (219,972 | ) | (118,039 | ) | ||

| Accumulated other comprehensive income | 45,930 | 36,377 | ||||

| TOTAL SHAREHOLDERS’ EQUITY | 51,668 | 119,620 | ||||

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | $ | 768,847 | $ | 506,246 |

The accompanying notes are an integrated part of these consolidated financial statements

Language Key Asia Ltd. and Subsidiaries

Consolidated Statements of Operations and Comprehensive Income

(Stated in US dollars)

| For the years ended December 31, | ||||||

| 2010 | 2009 | |||||

| Sales revenue | $ | 1,901,396 | $ | 1,478,424 | ||

| Cost of goods sold | 927,428 | 674,441 | ||||

| Gross profit | 973,968 | 803,983 | ||||

| Operating expenses | ||||||

| Selling expenses | 14,681 | - | ||||

| General and administrative expenses | 1,179,343 | 789,744 | ||||

| Total operating expenses | 1,194,024 | 789,744 | ||||

| Income (loss) from operations | (220,056 | ) | 14,239 | |||

| Other income | 154,590 | 23,708 | ||||

| Interest expense | (565 | ) | (554 | ) | ||

| Income (loss) before income tax | (66,031 | ) | 37,393 | |||

| Income Tax Expense | 35,902 | 14,738 | ||||

| Net Income (loss) | $ | (101,933 | ) | $ | 22,655 | |

| Other comprehensive income (loss) | ||||||

| Foreign currency translation adjustments | 9,553 | 9,329 | ||||

| Total Comprehensive Income (loss) | $ | (92,380 | ) | $ | 31,984 | |

The accompanying notes are an integrated part of these consolidated financial statements

Language Key Asia Ltd. and Subsidiaries

Consolidated Statement of

Shareholders’ Equity

(Stated in US dollars)

| Accumulated | ||||||||||||||||||

| Ordinary A Shares | Other | Total | ||||||||||||||||

| Comprehensive | Subscription | Retained | Shareholder's | |||||||||||||||

| Shares | Amount | Income | Receivable | Deficit | Equity | |||||||||||||

| Balance as of December 31, 2008 | 301,282 | $ | 301,282 | $ | 27,048 | $ | - | (140,694 | ) | $ | 187,636 | |||||||

| Net income for the year | - | - | - | - | 22,655 | 22,655 | ||||||||||||

| Share subscription Receivable | - | - | - | (100,000 | ) | - | (100,000 | ) | ||||||||||

| Foreign currency translation adjustment | - | - | 9,329 | - | - | 9,329 | ||||||||||||

| Balance as of December 31, 2009 | 301,282 | $ | 301,282 | $ | 36,377 | $ | (100,000 | ) | (118,039 | ) | $ | 119,620 | ||||||

| Net income for the year | - | - | - | - | (101,933 | ) | (101,933 | ) | ||||||||||

| Shares issued for consulting fees | 24,428 | 24,428 | - | - | - | 24,428 | ||||||||||||

| Foreign currency translation adjustment | - | - | 9,553 | - | - | 9,553 | ||||||||||||

| Balance as of December 31, 2010 | 325,710 | $ | 325,710 | $ | 45,930 | $ | (100,000 | ) | (219,972 | ) | $ | 51,668 | ||||||

The accompanying notes are an integrated part of these consolidated financial statements

Language Key Asia Ltd. and Subsidiaries

Consolidated Statements of Cash Flows

(Stated in US dollars)

| For the years ended December 31, | ||||||

| 2010 | 2009 | |||||

| CASH FLOWS FROM OPERATING ACTIVITIES | ||||||

| Net income (loss) | $ | (101,933 | ) | $ | 22,655 | |

| Adjustments to reconcile net income (loss)

to net cash (used in) provided by operating activities: |

||||||

| Depreciation expense | 7,862 | 6,363 | ||||

| Shares for consulting service provided | 24,428 | - | ||||

| Changes in operating assets and liabilities: | ||||||

| Accounts receivable | (41,772 | ) | (9,503 | ) | ||

| Unbilled revenue | (107,385 | ) | 38,364 | |||

| Other receivables | (464 | ) | (2,469 | ) | ||

| Prepaid expenses | (2,751 | ) | - | |||

| Other asset | (11,838 | ) | (1,585 | ) | ||

| Accounts payable | - | (15,680 | ) | |||

| Deferred revenue | (20,780 | ) | 37,881 | |||

| Accrued liabilities | 23,301 | (4,654 | ) | |||

| Taxes payable | 23,418 | 32,178 | ||||

| Other Payable | 101,902 | (720 | ) | |||

| Wage payable | 36,990 | (19,129 | ) | |||

| CASH (USED IN) PROVIDED BY OPERATING ACTIVITIES | (69,022 | ) | 83,701 | |||

| CASH FLOWS FROM INVESTING ACTIVITIES | ||||||

| Purchase of property and equipment | (21,731 | ) | (6,965 | ) | ||

| Advances/loans to related parties | (37,150 | ) | (414 | ) | ||

| CASH USED IN INVESTING ACTIVITIES | (58,881 | ) | (7,379 | ) | ||

| CASH FLOWS FROM FINANCING ACTIVITIES | ||||||

| Repayment of related party loans | - | (7,381 | ) | |||

| Proceeds from related parties | 155,286 | 8,615 | ||||

| CASH PROVIDED BY FINANCING ACTIVITIES | 155,286 | 1,234 | ||||

| Effect of exchange rate changes on cash and cash equivalents | 11,140 | 10,055 | ||||

| NET INCREASE IN CASH | 38,523 | 87,611 | ||||

| CASH AND CASH EQUIVALENTS AT BEGINNING OF YEAR | $ | 207,566 | $ | 119,955 | ||

| CASH AND CASH EQUIVALENTS AT END OF YEAR | $ | 246,089 | $ | 207,566 | ||

| Supplementary Disclosures for Cash Flow Information: | ||||||

| Income taxes paid | $ | 14,617 | $ | - |

The accompanying notes are an integrated part of these consolidated financial statements

LANGUAGE KEY ASIA LTD. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1 - BUSINESS, BASIS OF PRESENTATION AND SIGNIFICANT ACCOUNTING POLICIES

Organization

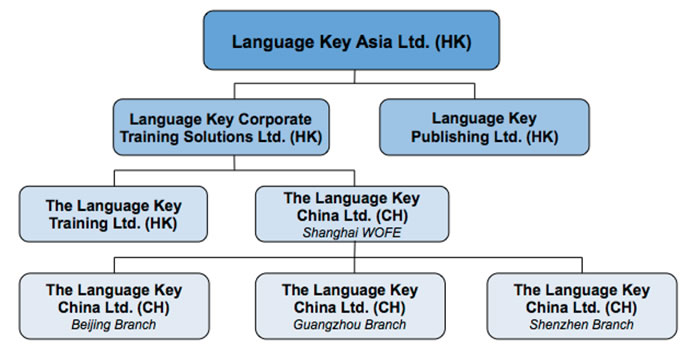

Language Key Asia Ltd. (the “Company”) was incorporated in Hong Kong on October 13, 2010. The Company was established with $3,000,000 in authorized capital, and currently has two classes of Ordinary shares (Class A and Class B), as well as one class of Preferred shares. The Company was established to centralize the administrative, governance, management, and financing for the Language Key Group of companies (“LK Group”), all of which are wholly-owned by the Company, which consists of Language Key Corporate Training Solutions Ltd. (a Hong Kong corporation, and formerly The Language Key China Ltd., established on August 21, 2002, “LKCTS”), The Language Key Training Ltd. (a Hong Kong corporation established on March 21, 2003, “LKTR”), and The Language Key China Ltd. (a Wholly Owned Foreign Enterprise registered in Shanghai, China established on October 11, 2002, “LKCH”), and Language Key Publishing Ltd. (established on January 11, 2011, “LKPUB”).

The Company was further established to enable the efficient acquisition of the LK Group by Mount Knowledge Holdings Inc. (“MKHD”), a U.S publicly traded (OTCBB: MKHD) Nevada corporation and to be the vehicle into which to receive equity capital contributions from MKHD. On December 31, 2010, the shareholders of the Company executed a share exchange agreement with MKHD and Mount Knowledge Asia Ltd. (“MKA”), a wholly owned Hong Kong regional holding company established by MKHD on November 15, 2010, to hold the 100% ownership interest of Language Key Asia Ltd after the acquisition.

The LK Group provides custom-tailored Business English and Communications Skills courses, Soft Skills workshops, Executive Coaching and other related services to public and private sector clients, including government entities in Hong Kong and Mainland China and Fortune 500 corporations. The Company also debuted its new E-Learning Platform (“ECO-Learning”), developed in conjunction with MKHD, at the Salvo Global Learning and Development Conference in Singapore in February 2011, and is preparing to commence User Acceptance Testing of ECO-Learning in April 2011 with a selected group of organizations that include current and prospective clients in Hong Kong, Mainland China, Singapore, Malaysia, and South Korea. In addition, early stage discussions are taking place with potential software resellers in Taiwan, Malaysia, Singapore, the Indian subcontinent, and the Middle East. The Company currently plans to officially launch ECO-Learning in the second quarter of 2011, following the completion of User Acceptance Testing.

As of the date of this filing, the Company employs approximately 52 full-time employees in Hong Kong, Shanghai, Beijing, and Guangzhou, China.

As all of the companies in the LK Group are under common control, this structure has been accounted for as a reorganization of entities under common control and the financial statements have been prepared as if the reorganization had occurred retroactively.

Prior to its acquisition by MKA and MKHD, the LK Group underwent a significant corporate restructuring.

On November 1, 2010, shortly after its formation, the Company acquired LKCTS, a Hong Kong corporation with identical shareholders and shareholdings as the Company in a one-for-one (1:1) share exchange. At the date of the share exchange, LKCTS was the direct parent company of LKTR, a Hong Kong corporation, as well as LKCH, a Shanghai-registered Wholly-Owned Foreign Enterprise (“WOFE”). Following the share exchange, the Company became the surviving parent company for all of the LK Group’s operations.

During the year ended December 31, 2010, the fiscal year for LKTR was changed from April 30 to December 31 in order to conform to the year-end reporting period for all other companies in the LK Group.

As of December 31, 2010, in addition to its Shanghai headquarters, LKCH had Beijing (November 10, 2006), Shenzhen (established July 15, 2008), and Guangzhou (established December 3, 2010). LKCH was established in 2004 with $140,000 in registered capital, but successfully increased its registered capital by an additional $150,000 on December 23, 2010.

On September 3, 2010, the name of The Language Key China Ltd., a Hong Kong corporation, and the direct parent company for the WOFE, was changed to Language Key Corporate Training Solutions Ltd. This name change was effected to better reflect the regional scope of the company, given that it had operations in both Hong Kong and Mainland China.

On August 24, 2010, The Language Key China Ltd., a Hong Kong corporation (renamed Language Key Corporate Training Solutions Ltd. on September 3, 2010) acquired LKTR, a Hong Kong corporation, in a one-for-one (1:1) share exchange with The Language Key Training Ltd., a British Virgin Islands corporation with identical shareholders and shareholdings as LKTR and The Language Key China Ltd. The result of the transaction was that both of the LK Group’s operating companies, LKTR and LKCH, were centralized under a single, direct parent company, which enabled a more integrated approach to management and decision-making. Following this share exchange, on September 2, 2010, LKTR executed a corporate resolution whereby one of its Directors, who was also a shareholder, resigned from its Board of Directors, and Dirk Haddow, the CEO of the Company remained as the sole Director. On September 2, 2010, also following the share exchange, The Language Key China Ltd. executed a corporate resolution whereby two of its Directors, who were also shareholders, resigned from its Board of Directors, and Dirk Haddow, the CEO of the Company remained as the sole Director.

As of March 28, 2011, the corporate structure of the LK Group was as follows:

Basic of Presentation

The accompanying consolidated financial statements have been prepared in accordance with U.S, Generally Accepted Accounting Principles (“US GAAP”). The Company’s functional currencies are the Chinese Renminbi (“RMB¥”) and Hong Kong dollar (“HKD$”); however the accompanying financial statements have been translated and presented in United States Dollars (“USD$”).

Consolidation

The accompanying consolidated financial statements include the accounts of the Company and its wholly owned subsidiaries. Intercompany balances and transactions have been eliminated in preparing the accompanying consolidated financial statements.

Use of Estimates

The preparation of financial statements, in conformity with generally accepted accounting principles, requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting year. Because of the use of estimates inherent in the financial reporting process, actual results could differ from those estimates.

Financial Instruments and Concentration of Risk

The fair value of financial instruments, which consist of cash, accounts receivable, other receivables, accrued liabilities and other payable, were estimated to approximate their carrying values due to the immediate or relatively short maturity of these instruments. Unless otherwise noted, it is management’s opinion that this Company is not exposed to significant interest or credit risks arising from these financial instruments.

Cash and Cash Equivalents

Cash is comprised of cash on hand and demand deposits. Cash equivalents include short-term highly liquid investments with original maturities of three months or less that are readily convertible to known amounts of cash and which are subject to an insignificant risk of change in value. At December 31, 2010 and 2009, the Company had $246,089 and $207,566 in cash equivalents, respectively.

Accounts Receivable

The Company records an Account Receivable when it issues an invoice for a particular training contract. Accounts Receivable is reduced by the collection of payments from clients for such invoices. Invoices issued prior to the start of a training course, and therefore in advance of the recognition of any revenue associated with that training course, are classified on the Company’s balance sheet as Deferred Revenues. The Company currently does not maintain an Allowance for Doubtful Accounts due to its good collections history with its clients.

Property and Equipment

Property and equipment are stated at historical cost less accumulated depreciation. Depreciation on property and equipment is calculated on the straight-line method over the estimated useful lives of the assets as set out below:

| Residual Value | Estimated Useful Life | |

| Office furniture and equipment | 5% | 5 years |

| Vehicles | 5% | 5 years |

Income Taxes

The Company has adopted the Accounting Standards Codification (ASC) subtopic 740-10. ASC 740-10 requires the use of the asset and liability method of accounting of income taxes. Under the asset and liability method of ASC 740-10, deferred tax assets and liabilities are recognized for the future tax consequences attributable to temporary differences between the financial statements carrying amounts of existing assets and liabilities and their respective tax basis. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled.

The Company provides deferred taxes for the estimated future tax effects attributable to temporary differences and carry forwards when realization is more likely than not. If it is more likely than not that some portion or all of a deferred tax asset will not be realized, a valuation allowance is recognized.

Other Taxes

The Company generates its income in China where Business Tax, Income Tax, City Construction and Development Tax, and Education Surcharge taxes are applicable.

Foreign Currency Translation

While the Company presents its consolidated financial results and accompanying notes in U.S. dollar terms, its functional currency for its operations in the The People’s Republic of China (“PRC”) is the Chinese Renminbi, and its functional currency for its operations in Hong Kong is the Hong Kong dollar. Transactions in Renminbi and Hong Kong dollars are translated into U.S. dollars as follows:

| i) |

monetary items at the exchange rate prevailing at the balance sheet date; | |

| ii) |

non-monetary items at the historical exchange rate; | |

| iii) |

revenue and expense at the average rate in effect during the applicable accounting period. |

Translation adjustments resulting from this process are recorded in Stockholders’ Equity as a component of Accumulated Other Comprehensive Income (Loss). Gains and losses arising on translation or settlement of foreign currency denominated transactions or balances are recorded in the Consolidated Statements of Operations.

Comprehensive Income

The Company has adopted ASC220, Reporting Comprehensive Income, which establishes standards for reporting and displaying comprehensive income, its components, and accumulated balances in a full-set of general-purpose financial statements. The Company’s accumulated other comprehensive income represents the accumulated balance of foreign currency translation adjustments.

Revenue Recognition

The Company and its subsidiaries recognize revenues from training sales equally over the duration of training contracts. Revenues recognized for training courses that commence prior to an invoice being issued are classified on the Company’s balance sheet as Unbilled Revenues.

Related parties

A party is considered to be related to the Company if the party directly or indirectly or through one or more intermediaries, controls, is controlled by, or is under common control with the Company. Related parties also include principal owners of the Company, its management, members of the immediate families of principal owners of the Company and its management and other parties with which the Company may deal if one party controls or can significantly influence the management or operating policies of the other to an extent that one of the transacting parties might be prevented from fully pursuing its own separate interests. A party which can significantly influence the management or operating policies of the transacting parties or if it has an ownership interest in one of the transacting parties and can significantly influence the other to an extent that one or more of the transacting parties might be prevented from fully pursuing its own separate interests is also a related party.

Recently Issued Accounting Pronouncements

The Company does not expect the adoption of any recently issued accounting pronouncements to have a significant impact on its financial position, results of operations or cash flows.

NOTE 2 – ACCOUNTS RECEIVABLE

As of December 31, 2010 and 2009, accounts receivable consisted of the following:

| December 31, | December 31, | |||||

| 2010 | 2009 | |||||

| Accounts receivable | $ | 199,287 | $ | 153,904 | ||

| Allowance for doubtful accounts | - | - | ||||

| Accounts receivable | $ | 199,287 | $ | 153,904 |

NOTE 3 – UNBILLED REVENUE

Unbilled revenue consisted of the following:

| December 31, | December 31, | |||||

| 2010 | 2009 | |||||

| Unbilled revenue | $ | 188,785 | $ | 77,825 |

NOTE 4 – PROPERTY AND EQUIPMENT, NET

Property and equipment consisted of the following:

| December 31, | December 31, | |||||

| 2010 | 2009 | |||||

| Office Equipment, Furniture, and Fixtures | $ | 65,966 | $ | 43,690 | ||

| Accumulated depreciation | (28,947 | ) | (20,871 | ) | ||

| Total property and equipment, net | $ | 37,019 | $ | 22,819 |

Depreciation expenses consisted of the following:

| For the years ended December 31, | ||||||

| 2010 | 2009 | |||||

| Depreciation expense | $ | 7,862 | $ | 6,363 | ||

NOTE 5 – DEFERRED REVENUE

Deferred revenue consisted of the following:

| December 31, | December 31, | |||||

| 2010 | 2009 | |||||

| Deferred revenue | $ | 203,970 | $ | 218,926 |

NOTE 6 - STOCKHOLDERS’ EQUITY

As of December 31, 2010, the Company’s authorized shares consisted of the following:

| a) |

1,000,000 shares of Class A Common Stock, par value $1.00 (325,710 shares issued and outstanding as of December 31, 2010) | |

| b) |

10,000,000 shares of Class B Common Stock, par value $0.10 (zero shares issued and outstanding as of December 31, 2010) | |

| c) |

100,000,000 Preferred shares, par value $0.01 (zero shares issued and outstanding as of December 31, 2010) |

Common stock

On December 14, 2010, the Company granted 24,428 shares of Ordinary A stock, at par value $1.00 per share, to Jeff Tennenbaum, a consultant of the Company, as compensation for consulting services provided (the “Consulting Shares”), for a total consideration of $24,428.

NOTE 7 - RELATED PARTY TRANSACTIONS

Related party transactions were in the normal course of operations and were measured at the exchange amount which is the amount of consideration established and agreed to by the related parties.

The related parties consist of the following:

| (1) |

Mount Knowledge Holdings Inc. (“MKHD”), publicly reporting parent company of the Company |

| (2) |

Mount Knowledge Asia Ltd. (“MKA”), regional parent company of the Company |

| (3) |

The Language Key China Ltd. Guangzhou (“LKGZ”), branch office of the Company’s China subsidiary that was incorporated in December 2010 but whose accounting books were opened in January 2011 |

| (4) |

Foxglove Enterprises International Ltd. (“Foxglove”), former owner of the “Language Key” trademark, which is controlled by a relative of one of the Former Company shareholders. |

| (5) |

Mr. Dirk Haddow, current CEO of the Company |

| (6) |

Mr. Jeff Tennenbaum, current CFO of the Company |

| (7) |

Mr. Mark Wood, former shareholder of the Company |

| (8) |

Mr. Chris Durcan, former shareholder of the Company |

| (9) |

Former Company Shareholders; (a) Dirk Haddow, (b) Mark Wood, and (c) Chris Durcan |

| (10) |

The Language Key Training Ltd. (“LKBVI”), a British Virgin Islands corporation that was a Former affiliate of one of the Company’s subsidiaries that was owned by the Former Company Shareholders |

Due from related parties consists of the following:

| December 31, | December 31, | |||||

| 2010 | 2009 | |||||

| The Language Key China Ltd. Guangzhou | $ | 36,915 | $ | - | ||

| Mount Knowledge Asia Ltd | 4,992 | - | ||||

| Mr. Chris Durcan | - | 4,794 | ||||

| Total due from Related Parties | $ | 41,907 | $ | 4,794 |

Due to related parties consists of the following:

| December 31, | December 31, | |||||

| 2010 | 2009 | |||||

| Mount Knowledge Holdings Inc | $ | 225,000 | $ | - | ||

| Mr. Jeff Tennenbaum | 8,697 | - | ||||

| Foxglove | - | 46,164 | ||||

| Former Company Shareholders | - | 9,413 | ||||

| Mr. Dirk Haddow | - | 19.149 | ||||

| Mr. Mark Wood | - | 4,116 | ||||

| Totals | $ | 233,697 | $ | 78,842 |

As of December 31, 2010 and 2009, the Company had outstanding amounts due to Related Parties in the amounts of $233,697 and $78,842, respectively. At December 31, 2010 and 2009, the Company also had outstanding amounts Due from Related Parties in the amounts of $41,907 and $4,794, respectively.

During the year ended December 31, 2009, amounts due to Related Parties primarily consisted of amounts due to Company' s shareholders as of that date, and amounts due to a related party, of which the beneficiaries were the Company' s shareholders as of that date, for the right to use the " Language Key" trademark in Hong Kong.

At December 31, 2010, the amounts due to the Company' s shareholders were waived by their mutual consent and recognized as non-operating income in 2010.

At December 31, 2010, the amounts due to a related party for the right to use the " Language Key" trademark in Hong Kong totalled $65,776, payable to the Company' s majority shareholders as of such date. Following the Company' s acquisition by MKHD, this amount was secured by a Promissory Note in the amount of $65,776, and reclassified on the balance sheet from being a Related Party Transaction to an Other Payable. This Note bears no interest, and is to be repaid in 12 monthly instalments. As of December 31, 2010, no payments had been made against the Promissory Note, however, subsequent to year-end, total payments of $12,790 were made and as of March 28, 2011, the balance of the Promissory Note was $52,986.

Also during the year ended December 31, 2009, pursuant to an agreement that was in place from 2008 until March 31, 2009, the Former Company Shareholders, through LKBVI, had a Licensing Agreement with its subsidiary at that date, The Language Key Training Ltd. (" LKTR" ), a Hong Kong corporation, such that LKBVI would earn a Licensing Fee equal to 15% of LKTR' s prior month' s revenues for the use of training courses and materials owned by LKBVI. The Licensing Fee was paid monthly until March 2009, after which time it ceased to be in effect. For the period during the year ended December 31, 2009 that the Licensing Agreement was in effect, Licensing Fees in the amount of $24,849 were paid by LKTR to LKBVI. Further, on August 24, 2010, pursuant to the Company' s corporate restructuring as outlined in Note 1, LKTR was acquired by one of the Company' s subsidiaries, LKCTS, in a one-for-one (1:1) share exchange with LKBVI, thereby ending LKBVI' s affiliation with LKTR.

During the year ended December 31, 2010, the Company received a total of $255,000 in cash advances from MKHD. Of this amount, $30,000 was used to reimburse the Company for legal and corporate restructuring expenses that the Company bore on MKHD' s behalf and the remaining $225,000 were cash advances to enable the Company to increase staff, invest in software content development, and increase general operations in advance of finalizing the acquisition of the Company by MKHD. At the time that these funds were received by the Company, MKHD had no controlling interest in the Company. However, during this same period in which funds were received by the Company, the Company and MKHD were in long-term acquisition negotiations. At December 31, 2010, the loan balance outstanding to MKHD was $225,000, which comprises the vast majority of the outstanding related party transactions to date. The combined cash advancements (loans) are non-interest bearing and have no set maturity date, however, the Company anticipates repaying these funds during 2011 and/or reclassifying of these amounts due to MKHD as equity.

During the year ended December 31, 2009, the amounts Due from Related Parties primarily consisted entirely of amounts due from a former shareholder. During the year ended December 31, 2010, this amount was forgiven and subsequently written off.

At December 31, 2010, the amounts due from Related Parties consisted of funds due from MKA, a subsidiary of MKHD, for expenses paid by the Company relating to the incorporation, registration, and establishment a of bank account for MKA, as well as funds due from the LKCH' s Guangzhou branch, which, while it was incorporated in December 2010, did not have opened bank accounts until January 2011. As March 28, 2011, the amounts due from the Guangzhou branch would be eliminated in LKCH, and therefore within the Company' s consolidated financial statements.

NOTE 8 - INCOME TAXES

The Company is incorporated in Hong Kong, and is subject to tax on income or capital gain under the current laws of the Hong Kong. The Company' s other subsidiaries are subject to income tax as described below.

Hong Kong

Taxation in the income statement represents the provision for Hong Kong profits tax for the period. Hong Kong profits tax is calculated at 16.5% of the estimated assessable profit for the period.

The charge for current income tax is based on the results for the period as adjusted for items that are non-assessable or disallowed. Income tax is calculated using tax rates that have been enacted or substantively enacted by the end of the reporting period.

Deferred tax is provided, using the liability method, on all temporary differences at the end of the reporting period between the tax bases of assets and liabilities and their carrying amounts in the financial statements. However, if the deferred tax arises from initial recognition of an asset or liability in a transaction other than a business combination that at the time of the transaction affects neither the accounting profit nor taxable profit or loss, it is not accounted for.

The deferred tax liabilities and assets are measured at the tax rates that are expected to apply to the period when the asset is recovered or the liability is settled, based on tax rates and tax laws that have been enacted or substantively enacted at the end of the reporting period. Deferred tax assets are recognized to the extent that it is probable that future taxable profit will be available against which the deductible temporary differences, tax losses and credits can be utilized.

The People' s Republic of China (PRC)

Prior to January 1, 2008, the Company was governed by the previous Income Tax Law (the " Previous Tax Law" ) of China. Under the Previous Tax Law, the Company' s PRC subsidiary, The Language Key China Ltd. was entitled various preferential tax treatments.

On March 16, 2007, the National People' s Congress passed the new Enterprise Income Tax law (the " new EIT law" ) which imposes a single income tax rate of 25% for most domestic enterprises and foreign investment enterprises. The new EIT law was effective as of January 1, 2008. The new EIT law provides a five-year transition period from its effective date for those enterprises which were established before March 16, 2007 and which were entitled to a preferential lower tax rate under the then effective tax laws or regulations, as well as grandfathering tax holidays.

The new EIT Law also provides that an enterprise established under the laws of foreign countries or regions but whose " de facto management body" is located in the PRC be treated as a resident enterprise for PRC tax purposes and consequently be subject to the PRC income tax at the rate of 25% for its worldwide income. The Implementing Rules of the new EIT Law merely defines the location of the " de facto management body" as " the place where the exercising, in substance, of the overall management and control of the production and business operation, personnel, accounting, properties, etc., of a non-PRC company is located." On April 22, 2009, the PRC State Administration of Taxation further issued a notice entitled " Notice Regarding Recognizing Offshore-Established Enterprises Controlled by PRC Shareholders as Resident Enterprises Based on Their Place of Effective Management." Under this notice, a foreign company controlled by a PRC company or a group of PRC companies shall be deemed as a PRC resident enterprise, if (i) the senior management and the core management departments in charge of its daily operations mainly function in the PRC; (ii) its financial decisions and human resource decisions are subject to decisions or approvals of persons or institutions in the PRC; (iii) its major assets, accounting books, company seals, minutes and files of board meetings and shareholders' meetings are located or kept in the PRC; and (iv) more than half of the directors or senior management personnel with voting rights reside in the PRC. Based on a review of surrounding facts and circumstances, the Company does not believe that it is likely that its operations outside of the PRC should be considered a resident enterprise for PRC tax purposes. However, due to limited guidance and implementation history of the new EIT Law, should the Company be treated as a resident enterprise for PRC tax purposes, the Company will be subject to PRC tax on worldwide income at a uniform tax rate of 25% retroactive to January 1, 2008.

The new EIT Law also imposes a withholding income tax of 10% on dividends distributed by a foreign invested enterprise to its immediate holding company outside of China, if such immediate holding company is considered as a non-resident enterprise without any establishment or place within China or if the received dividends have no connection with the establishment or place of such immediate holding company within China, unless such immediate holding company’s jurisdiction of incorporation has a tax treaty with China that provides for a different withholding arrangement. Such withholding income tax was exempted under the previous income tax regulations.

The Company’s subsidiary, The Language Key China Ltd., as an enterprise established in Shanghai, PRC, was entitled to a preferential enterprise tax rate of 18% prevailing in Pudong Economic Zone for all years before 2008, and the following preferential rates started on January 1, 2008:

| Year | Tax Rate |

| 2008 | 18% |

| 2009 | 20% |

| 2010 | 22% |

| 2011 | 24% |

| 2012 and thereafter | 25% |

The provision for taxes on earnings consisted of:

| December 31, | December 31, | |||||

| 2010 | 2009 | |||||

| Hong Kong Enterprise Income Tax | $ | - | $ | - | ||

| PRC Enterprise Income Tax | 35,902 | 14,738 | ||||

| Income tax, net | $ | 35,902 | $ | 14,738 |

A reconciliation between the income tax computed at the U.S. statutory rate and the Company's provision for income tax in Hong Kong is as follows:

| December 31, | December 31, | |||||

| 2010 | 2009 | |||||

| U.S. Federal income tax statutory rate | 34.0% | 34.0% | ||||

| U.S. Federal income tax statutory rate | -34.0% | -34.0% | ||||

| Hong Kong Statutory rate | 16.5% | 16.5% | ||||

| Loss not subject to income tax | -16.5% | -16.5% | ||||

| Effective tax rate | 0.0% | 0.0% |

A reconciliation between the income tax computed at the U.S. statutory rate and the Company's provision for income tax in the PRC is as follows:

| December 31, | December 31, | |||||

| 2010 | 2009 | |||||

| U.S. Federal income tax statutory rate | 34.0% | 34.0% | ||||

| Foreign income not recognized | -34.0% | -34.0% | ||||

| PRC preferential enterprise income tax rate | 25.0% | 25.0% | ||||

| Tax holiday and relief granted to the Subsidiary | -3.0% | -5.0% | ||||

| Permanent differences related to entertainment expense and revenue recognition | 14.0% | 2.0% | ||||

| Loss carryforward | 0.0% | .-10.0% | ||||

| Effective tax rate | 36.0% | 12.0% |

Accounting for Uncertainty in Income Taxes

The Company adopted the provisions of Accounting for Uncertainty in Income Taxes on January 1, 2007. The provisions clarify the accounting for uncertainty in income taxes recognized in an enterprise’s financial statements in accordance with the standard “Accounting for Income Taxes,” and prescribes a recognition threshold and measurement process for financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. The provisions of Accounting for Uncertainty in Income Taxes also provides guidance on derecognition, classification, interest and penalties, accounting in interim periods, disclosure and transition.

The Company may from time to time be assessed interest or penalties by major tax jurisdictions. In the event it receives an assessment for interest and/or penalties, it will be classified in the financial statements as tax expense.

Based on the Company’s evaluation, the Company has concluded that there are no significant uncertain tax positions requiring recognition in its financial statements.

NOTE 9 - COMMITMENTS AND CONTINGENCIES

Lease Obligation

The Company has entered into multiple lease agreements for its office space. The Company’s rent expense for the years ending December 31, 2010 and 2009 was $141,005 and $92,378. As of December 31, 2010, the Company’s commitments for minimum lease payments under these un-revocable operating leases for the next five years are as follows:

| Year ending December 31, | Payments due | ||

| 2011 | $ | 76,850 | |

| 2012 | 32,708 | ||

| 2013 to 2015 | - | ||

| Total | $ | 109,558 |

Tax issues

The tax authority of the PRC Government conducts periodic and ad hoc tax filing reviews on business enterprises operating in the PRC after those enterprises had completed their relevant tax filings, hence the Company' s tax filings may not be finalized. It is therefore uncertain as to whether the PRC tax authority may take different views about the Company' s tax filings which may lead to additional tax liabilities.

One area in which the Company faces such uncertainty is with respect to China' s Circular on Strengthening the Administration of Enterprise Income Tax on Non-Resident Enterprises' Share Transfer Income (" Circular 698" ) that was released in December 2009 with retroactive effect from January 1, 2008.

The Chinese State Administration of Taxation (SAT) released a circular (Guoshuihan No. 698 - Circular 698) on December 10, 2009 that addresses the transfer of shares of Chinese resident companies by nonresident companies. Circular 698, which is effective retroactively to January 1, 2008, may have a significant impact on many companies that use offshore holding companies to invest in China. While Circular 698 does not apply to shareholders who are individuals, Language Key Corporate Training Solutions Ltd., the sole shareholder of The Language Key China Ltd., and a wholly-owned subsidiary of the Company, is a Hong Kong corporation. The PRC authority has the discretion to determine whether this enterprise shareholder is treated as a resident enterprise. If such shareholder is recognized as a non-resident enterprise, Circular 698 may be applicable to the Share Exchange Agreement due to the transfer of shares of the Company, which indirectly holds the equity interests of The Language Key China Ltd., to MKHD. Circular 698 provides that where a non-resident enterprise investor indirectly transfers the equity of a PRC resident enterprise, if the overseas intermediary holding company being transferred by the non-resident enterprise is established in a country/region where the effective tax rate is less than 12.5% or which does not tax the overseas income of its residents, the non-resident enterprise must submit the required documents to the PRC tax authority in charge of the PRC resident enterprise within 30 days after the equity transfer agreement is concluded. However, there is uncertainty as to the application of Circular 698. For example, while the term "indirectly transfer" is not defined, it is understood that the relevant PRC tax authorities have jurisdiction regarding requests for information over a wide range of foreign entities having no direct contact with China. Moreover, the relevant authority has not yet promulgated any formal provisions or formally declared or stated how to calculate the effective tax in the country or jurisdiction and to what extent and the process of the disclosure to the tax authority in charge of that Chinese resident enterprise.

The Company has sought the advice of PRC legal counsel regarding the application of and the risks associated with Circular 698. Circular 698, which provides parties with a short period of time to comply its requirements, indirectly taxes foreign companies on gains derived from the indirect sale of a Chinese company.

Based upon the advice of legal counsel, during January 2011, the Company retained an accounting and tax advisory firm (the " Advisory Firm" ) to assist in the preparation and submission of the necessary documents to the SAT for the purpose of applying to be recognized as a resident enterprise per the definition of Circular 698 following its acquisition by MKHD. Said designation would make the Company exempt from a 10% withholding tax on the equity transfer gains resulting from the sale of the Company and the pro-rata value of its China subsidiary, LKCH, relative to the overall transactional value of the acquisition.

Per the guidelines provided by the Advisory Firm, the Company completed the preparation of the documents required for submission to the SAT. Prior to the end of thirty (30) day submission deadline from the date of the acquisition, the Advisory Firm, acting as the official representative of the Company, met with a representative of the local SAT office of the in Pudong, Shanghai and was verbally informed by said representative that the Company was not required to file any documents on the completed acquisition. Despite the initial conclusion by the Advisory Firm and the local SAT office, the Company intends to proactively submit formal documents to the SAT in the second quarter of 2011 in order to remain in good standing with the PRC tax authority and to receive a written confirmation of the designation and exemption.

If the PRC tax authorities determine that Circular 698 applies to the Share Exchange Agreement and the Company needs to pay withholding taxes on the pro-rata equity transfer gains of LKCH, the taxes would equal the equity transfer gains applicable to LKCH multiplied by the applicable income tax rate determined by the PRC tax authorities, and pursuant to Circular 698, equity transfer gains will equal the balance of the equity transfer price after deducting the cost of equity investment in LKCH. The Company' s legal counsel had advised that the pertinent tax rate to be applied against such equity transfer gains would be 10%.

While the Company cannot be certain of how the PRC tax authorities will treat the matter because the consideration received by the Company' s former shareholders in the Share Exchange Agreement was exclusively in the form of the publicly traded common stock of MKHD, the Company can, based on certain assumptions, estimate the potential tax liability. On the closing date of the Share Exchange Agreement, the share price of MKHD was $0.20 per share. As the Company' s shareholders received 1,800,000 in exchange for one hundred (100%) percent of their equity in the Company, the dollar value of the consideration was $360,000. At the time of the Share Exchange Agreement, the registered capital of LKCH was $140,000. Therefore, if one hundred (100%) percent of the acquisition consideration received by the former shareholders of the Company were attributable to LKCH, then the equity transfer gain would be $220,000. Applying a ten (10%) percent withholding tax to this amount yields a tax liability of $22,000. However, the Company regards this estimated tax amount to be the upper limit of its potential tax liability because not all of the consideration received by its former shareholders in the Share Exchange Agreement was attributable to LKCH. In addition to LKCH, the Company has an operating subsidiary in Hong Kong (LKTR) which generates significant revenues and holds the rights to the " Language Key" trademark in the PRC. Therefore, the Company believes that a certain percentage of the consideration received by its former shareholders in the Share Exchange Agreement would be attributable to LKTR. However, due to the short history of the New EIT law and lack of applicable legal precedents, it remains unclear how the PRC tax authorities will determine the PRC resident enterprise tax treatment of the Company.

NOTE 10 - CONCENTRATIONS

Major Customers

For the years ended December 31, 2010 and 2009, the Company had one major customer which contributed 11.8% and 17.5% of its consolidated revenue, respectively.

NOTE 11 - OPERATING RISKS

Lack of Insurance

The Company could be exposed to liabilities or other claims for which the Company would have no insurance protection. The Company does not currently maintain any business interruption insurance, products liability insurance, or any other comprehensive insurance policy except for property insurance policies with limited coverage. As a result, the Company may incur uninsured liabilities and losses as a result of the conduct of its business. There can be no guarantee that the Company will be able to obtain additional insurance coverage in the future, and even if it can obtain additional coverage, the Company may not carry sufficient insurance coverage to satisfy potential claims. Should uninsured losses occur, any purchasers of the Company' s common stock could lose their entire investment.

Country Risk

The Company has significant operating risk in the PRC. The operating results of the Company may be adversely affected by changes in the political and social conditions in the PRC and by changes in Chinese government policies with respect to laws and regulations, anti-inflationary measures, currency conversion and remittance abroad, and rates and methods of taxation, among other things. The Company can give no assurance that those changes in political and other conditions will not result in have a material adverse effect upon the Company' s business and financial condition.

Exchange Risk

The Company cannot guarantee the relative Renminbi, Hong Kong dollar, and U.S. dollar exchange rates will remain steady, therefore the Company could post the same profit for two comparable periods and post higher or lower profit depending on the relative movements in the price of these currencies. The exchange rate could fluctuate depending on changes in the political and economic environments without notice.

Credit Risk

Financial instruments which potentially subject the Company to concentrations of credit risk consist of cash and accounts receivable. A significant portion of the Company' s cash balances are on deposit at financial institutions in the PRC, the currency of which is not free trading. Foreign exchange transactions are required to be conducted through institutions authorized by the Chinese government and there is no guarantee that Chinese currency can be converted to U.S. or other currencies.

NOTE 12 - SUBSEQUENT EVENTS

During the year ended December 31, 2010, the Company received a total of $255,000 in cash advances from MKHD, of which $30,000 was used to reimburse the Company for legal and corporate restructuring expenses, and the remaining $225,000 were cash advances to enable the Company to increase staff, invest in software content development, and increase general operations prior to the finalizing the acquisition of the Company by Mount Knowledge Holdings Inc. At the time that these funds were received by the Company, MKHD had no controlling interest in the Company. However, during this same period in which funds were received by the Company, the Company and MKHD were in long-term acquisition negotiations.

Share Exchange Agreement

On December 31, 2010, Dirk Haddow, Mark Wood, Chris Durcan, Jeff Tennenbaum, and Language Key Training Ltd. (" LKBVI" ), a British Virgin Islands Corporation owned and controlled by Dirk Haddow, Mark Wood and Chris Durcan (collectively, the "Sellers"), sold 325,710 Ordinary A Shares of the Company (the " LK " A" Shares" ), owned and held by the Sellers, in exchange for an aggregate of 1,800,000 shares of MKHD common stock in accordance with the terms and conditions of the executed Share Exchange Agreement on December 31, 2010.

As a result of the completion of the transactions contemplated by MKHD on December 31, 2010, MKHD, through its wholly-owned subsidiary, Mount Knowledge Asia Ltd. (" MKA" ), owns 100% of the ordinary shares of the Company.

In addition to the Share Exchange Agreement, the following represents other terms and conditions of the acquisition:

Subscription Agreement

On December 31, 2010, MKHD and MKA, its wholly-owned subsidiary, entered into a subscription agreement (the " Subscription Agreement" ) with the Company for the purchase by the MKHD or MKAof 10,000,000 shares of Ordinary B stock of the Company for an aggregate purchase price of $1,000,000 (the " Purchase Price" ). Such shares were delivered at the closing and the Purchase Price is payable as follows:

- A payment in the amount of $75,000 is due and payable on or before December 31, 2010;

- A payment in the amount of $75,000 on or before January 15, 2011;

- A payment in the amount of $200,000 on or before February 15, 2011;

- A payment in the amount of $125,000 on or before March 15, 2011; and

- Seven (7) equal payments of $75,000 payable on first day of each month beginning on or before April 15, 2011.

If MKHD defaults on a payment, and fails to cure such default within sixty (60) days from the date of such default, the Company is entitled to liquidated damages in the amount of $500 per day for each and every day MKHD is in default after the sixtieth (60th) day until such default has been cured. If the default is not cured within ninety (90) days from the date of default, then MKHD shall forfeit the right to vote the shares subscribed for and received until the default has been cured. If the default is not cured, along with any other outstanding amounts owed to the Company, on or before the date in which the final payment is due and payable then the Company shall have the right to rescind the subscription and any and all shares of Ordinary B stock received by MKHD or MKA, as the case may be, shall be cancelled.

New Stock Issuance

On December 31, 2010, MKHD agreed to issue to the Company and/or its assigns at Closing a total of four hundred eighty thousand (480,000) shares of the Common Stock (the " MKHD Shares" ) of Mount Knowledge Holdings, Inc. at a par value ($0.001 per share), subject to a twelve (12) month sale restriction from the date of issuance (the " Additional Sale Restriction" ), for the purpose of providing certain employee stock incentives (signing bonus) for key management personnel of the Company.

License Revocation and Assignment

On December 31, 2010, Sellers shall cause the cancellation of the trademark licensing royalty agreement (the " Royalty Agreement" ) with Foxglove International Enterprises Ltd, a British Virgin Islands Corporation (the " Licensor" ) as set forth in the executed license revocation and release deed agreement dated December 31, 2010, (the " License Revocation and Release Deed Agreement" ), in exchange for a cash payment from the Company in the amount of Thirty-Three Thousand Four Hundred Eighty and No/100 Dollars (USD $33,480.00), due and payable to the Licensor on the Closing Date, including the assignment to the Company the full and unencumbered rights to the " Language Key" name, trademarks, service marks, and any other intellectual property rights owned by Licensor with no limitations and free and clear any claims against the Company, and/or its operation subsidiaries, now or in the future, as set forth in the executed assignment agreement dated December 31, 2010, (the " Assignment Deed Agreement" ), in exchange for a cash payment from the Company in the amount of Thirty-Three Thousand Four Hundred Eighty and No/100 Dollars (USD $33,480.00), due and payable to the Licensor on the Closing Date.

As of the date of this Current Report, no cash payments have been made with respect to the aforementioned deeds, and the Licensor currently holds a lien against the " Language Key" trademark. The terms of this lien provide that the Licensor shall receive interest at a rate of 1.5% per month on the unpaid balance of the $66,960 in aggregate payments due, retroactive to January 1, 2011. The Company intends to satisfy this obligation to the Licensor during April 2011.

Promissory Note (Payment of Royalties Owed)

On December 31, 2010, the Company executed a promissory note (the " Promissory Note" ) in the principal amount of $65,776 (the " Principal Amount" ) in favor of Foxglove International Enterprises Ltd. (" Foxglove" ) in satisfaction of certain royalty payments (the " Royalty Payments" ) owed by The Language Key Training, Ltd. (" LKTR" ), a Hong Kong company and an indirect, wholly owned subsidiary of the Company, to Foxglove for fiscal years 2008 and 2009.

The Principal Amount is payable in cash in twelve equal monthly installments. The Company may prepay, in whole or in part, the Principal Amount, without payment of any premium or penalty. In addition, the Company has a right to set-off and/or apply any and all amounts owed to it, its subsidiaries and affiliates by Foxglove, its subsidiaries and affiliates pursuant to any agreement or arrangement between the Company and Foxglove and/or their respective subsidiaries and affiliates, against any all amounts owed by the Company to Foxglove under the Promissory Note.

Licensing Agreement

On December 31, 2010, the Company and LK BVI entered into a licensing agreement pursuant to which the Company granted to LK BVI the right to use, rework and/or publish certain existing training content developed prior to December 31, 2010 owned and held by the Company for a term of 88 years.

A copy of the Original Definitive Agreement was filed as Exhibit 10.1 to MKHD’s Current Report on Form 8-K filed with the Securities and Exchange Commission (the “SEC”) on October 8, 2010. A copy of Amendment No. 1 was filed as Exhibit 10.1 to the MKHD’s Current Report on Form 8-K filed with the SEC on October 29, 2010. A copy of Amendment No. 2, was filed as Exhibit 10.1, Subscription Agreement as Exhibit 10.2, Share Exchange Agreement as Exhibit 10.3, Promissory Note as Exhibit 10.4 and Licensing Agreement as Exhibit 10.5, to MKHD’s Current Report on Form 8-K filed with the SEC on January 6, 2011.

Employee Loan

On March 7, 2011, LKCH, the Company’s subsidiary in Mainland China, received a loan from a Company employee in the amount of $30,492 (“Note”) for the purposes of providing working capital to LKCH in advance of future capital contributions from LKCTS, its Hong Kong parent company. The Note is a short-term non-interest bearing thirty (30) day demand note due and payable on or before March 31, 2011 (“Due Date”). If the Note is not repaid on or before the Due Date, then the principal amount of the Note accrues interest at a rate of 10% per annum until the Note is repaid in full.