Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - Tim Hortons Inc. | d8k.htm |

Table of Contents

Exhibit 99.1

| TIM HORTONS INC. | ||

| 874 Sinclair Road (Canada) | 4150 Tuller Road, Unit 236 (United States) | |

| Oakville, Ontario, Canada, L6K 2Y1 | Dublin, Ohio, 43017, U.S.A. | |

| (905) 845-6511 | (614) 791-4200 |

NOTICE OF ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS

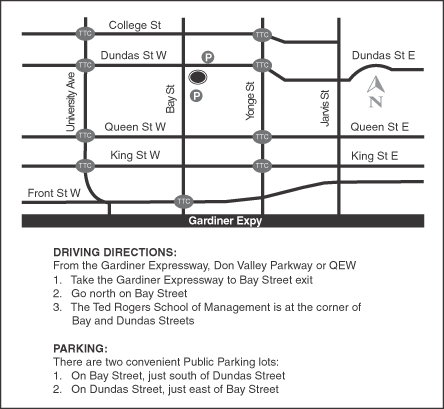

You are cordially invited to attend, and notice is hereby given that, the Annual and Special Meeting of Shareholders of Tim Hortons Inc. will be held at the School of Hospitality and Tourism Management, Ted Rogers School of Management, Ryerson University, 7th Floor Auditorium, 55 Dundas Street West, Toronto, Ontario, on Friday, May 13, 2011, at 10:30 a.m., Eastern Daylight Savings Time (EDST), for the following purposes:

| (a) | to receive our consolidated financial statements, and the independent auditor’s report thereon, for the fiscal year ended January 2, 2011; |

| (b) | to elect eleven directors, as named and described in the accompanying management proxy circular; |

| (c) | to reappoint PricewaterhouseCoopers LLP as our independent auditor (and, for the purposes of U.S. securities laws, our independent registered public accounting firm) for the fiscal year ending January 1, 2012; |

| (d) | to adopt the Tim Hortons Inc. Direct Share Purchase and Dividend Reinvestment Plan; and, |

| (e) | to transact such further or other business or matters as may properly come before the meeting. |

These matters are more fully described in the management proxy circular accompanying this notice. Any action on the items of business described above may be considered at the meeting or at any adjournment or postponement thereof. Please note that our proxy materials are also available through the Internet at www.envisionreports.com/THI2011 and at our website at www.timhortons-invest.com. In the interest of convenience to you and of minimizing the environmental impact associated with printing and mailing our proxy materials and annual reports in the future, you may indicate your preference for receiving all future materials electronically, in the manner provided for on the enclosed proxy card or, for beneficial holders, on the voting instruction form.

Shareholders of record attending the meeting should be prepared to present government-issued picture identification for admission. Shareholders owning common shares through a broker, bank, or other record holder should be prepared to present government-issued picture identification and evidence of share ownership as of March 15, 2011, such as an account statement, or a voting instruction form issued by the broker, bank or other record holder, for admission. Check-in at the meeting will begin at 9:30 a.m., EDST, and you should plan to allow ample time for check-in procedures. Seating will be limited and admission is on a first-come, first-served basis. Cameras, cell phones, recording equipment, and other electronic devices will not be permitted. If you would like to attend in person, we request that you indicate your plans in this respect as prompted if you vote electronically through the Internet, or on your proxy card or voting instruction form, as applicable.

As owners of Tim Hortons, your vote is very important, regardless of the number of shares you own. Whether or not you are able to join us in person, it is important that your shares be represented. Voting promptly will aid in reducing the expense of additional proxy solicitation. As such, we request that you vote as soon as possible by telephone, electronically, or in writing by following the instructions noted on the proxy card or, for beneficial shareholders, the voting instruction form, included with this notice. Your proxy card or voting instruction form, as applicable, must be received by our transfer agent before 11:59 p.m., EDST, on the day before the meeting (i.e., May 12, 2011). If you received a voting instruction form, you hold your shares through an intermediary and must provide your instructions as specified in the voting instruction form in sufficient time for the intermediary to act on them prior to that deadline. Voting your shares electronically through the Internet or by telephone does not affect your right to vote in person if you attend the meeting. For specific information regarding voting of your common shares, please refer to the section entitled “General Information About the 2011 Tim Hortons Inc. Annual and Special Meeting of Shareholders” in the accompanying proxy circular.

Thank you for your continued interest in Tim Hortons.

| Jill E. Aebker Deputy General Counsel and Secretary |

Oakville, Ontario, Canada

March 25, 2011

Table of Contents

i

Table of Contents

EXPLANATORY NOTES REGARDING THE CONTENT AND FORMAT OF THIS DOCUMENT

Tim Hortons Inc., a corporation incorporated under the Canada Business Corporations Act, qualifies as a foreign private issuer in the U.S. for purposes of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Although as a foreign private issuer, we are no longer required to do so, we currently continue to file annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K with the Securities and Exchange Commission (the “SEC”), instead of filing the reports available to foreign private issuers. All of our periodic and current reports are available through the Canadian System for Electronic Document Analysis and Retrieval (“SEDAR”), at www.sedar.com, and on the SEC website, at www.sec.gov.

As a Canadian corporation and foreign private issuer in the U.S. that is not subject to the requirements of Section 14(a) of the Exchange Act or Regulation 14A, our management proxy circular (the “proxy circular”) and related materials have been prepared in accordance with Canadian corporate and securities law requirements. As a result, for example, our officers and directors are required to file reports of equity ownership and changes in equity ownership with the Canadian Securities Administrators and do not file such reports under Section 16 of the Exchange Act.

As a foreign private issuer in the U.S., we are not required to disclose executive compensation according to the requirements of Regulation S-K that apply to U.S. domestic issuers, and we are otherwise not required to adhere to the U.S. requirements relative to certain other proxy disclosures and requirements. As set forth above, our proxy disclosures will be in compliance with Canadian requirements, which are, in most respects, substantially similar to the U.S. rules. We do generally attempt to comply with the spirit of the U.S. proxy rules when possible and to the extent that they do not conflict, in whole or in part, with required Canadian corporate or securities requirements or disclosure, with the exception that we have determined to monitor and follow the development of say on pay practices in Canada and, therefore, will not adopt the U.S. say on pay advisory vote on executive compensation in 2011 under the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010.

A copy of our Annual Report on Form 10-K for the year ended January 2, 2011 (“Form 10-K”), including the 2010 financial statements and management’s discussion and analysis, is being delivered: (i) contemporaneously with this proxy circular to registered shareholders, except those who asked not to receive it; and (ii) separately, to beneficial shareholders who requested a copy. The printed Form 10-K, as well as the Form 10-K which is available at www.envisionreports.com/THI2011 and at www.timhortons-invest.com, will not have attached to it all of the exhibits filed with or incorporated by reference into the Form 10-K filed with the SEC and with the Canadian Securities Administrators. You may review and print the Form 10-K and all exhibits from the SEC’s website at www.sec.gov or from the website of the Canadian Securities Administrators at www.sedar.com. In addition, we will send a complete copy of the Form 10-K (including all exhibits, if specifically requested), to any shareholder (without charge) upon written request addressed to: Investor Relations Department, Tim Hortons Inc., 874 Sinclair Road, Oakville, Ontario, Canada, L6K 2Y1.

In this proxy circular, we refer to Tim Hortons Inc., the Canada Business Corporations Act corporation whose shares you own (together with its subsidiaries, where applicable), as “Tim Hortons.” Additionally, we sometimes refer to Tim Hortons as “we,” “us,” “our,” “our corporation,” or “the corporation.” References to “GAAP” mean generally accepted accounting principles in the U.S.

All dollar amounts included in this proxy circular are in Canadian dollars, unless otherwise expressly stated to be in U.S. dollars or another currency.

All information in this proxy circular is being provided effective as of March 25, 2011, unless otherwise indicated.

All references to our website contained herein do not constitute incorporation by reference for information contained on the website and such information should not be considered part of this document.

1

Table of Contents

GENERAL INFORMATION ABOUT THE 2011 TIM HORTONS INC. ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS

The following questions and answers are intended to address commonly asked questions regarding shareholder meeting matters. These questions and answers may not address all matters that may be important to you. Please refer to the more detailed information contained elsewhere in this proxy circular.

Questions and Answers Regarding Annual and Special Meeting Matters

Why am I receiving these proxy materials?

These proxy materials have been mailed to you, or made available to you through electronic means in accordance with your prior instruction, on or about March 25, 2011, in connection with the solicitation by management of proxies for use at the meeting. These materials are available on the Internet at www.envisionreports.com/ THI2011 and on our investor website at www.timhortons-invest.com. Under applicable Canadian requirements, we must provide printed copies of proxy materials to shareholders, unless they consent to receive materials by electronic delivery. As a result, shareholders are encouraged to indicate their preference for receiving future materials from us electronically by following the instructions for doing so on the proxy card or, in the case of beneficial holders, the voting instruction form, mailed with this proxy circular. Doing so will allow us to save considerably on printing and mailing costs and to further our environmental objectives through the prudent use of resources.

Our meeting will take place at the School of Hospitality and Tourism Management, Ted Rogers School of Management, Ryerson University, 7th Floor Auditorium, 55 Dundas Street West, Toronto, Ontario, on Friday, May 13, 2011, at 10:30 a.m., EDST. Our shareholders are invited to attend the meeting and are requested to vote on the proposals described in this proxy circular.

Only shareholders of record at the close of business on March 15, 2011 will be entitled to notice of, to attend and to vote at the meeting or any adjournment(s) or postponement(s) thereof. A list of shareholders of Tim Hortons Inc. will be maintained and open for examination by any of our shareholders, for any purpose germane to the meeting, during regular business hours at our principal executive offices.

What is included in these proxy materials?

These proxy materials include:

| • | Our proxy circular for (and notice of) the meeting; and, |

| • | Our proxy card or, for beneficial shareholders, a voting instruction form, for submitting your vote in writing to us or your broker, as the case may be, in the event you choose not to take advantage of electronic or telephonic voting. |

The Form 10-K is being delivered:

| • | contemporaneously with these proxy materials to registered shareholders, except those who asked not to receive it; and |

| • | separately from these proxy materials to beneficial shareholders who requested a copy. |

What meeting procedures are available electronically?

We have implemented electronic procedures that provide you with the ability to:

| • | View our proxy materials for the meeting through the Internet at www.envisionreports.com/THI2011 and at our investor website at www.timhortons-invest.com; |

| • | For shareholders of record, cast your votes on the proposals before the shareholders at the meeting at www.investorvote.com; and, |

| • | For shareholders of record, instruct us to send our future proxy materials to you electronically by e-mail, also at www.investorvote.com. |

2

Table of Contents

Choosing to receive your future proxy materials by e-mail will reduce the impact of our annual shareholders’ meetings on the environment and will also save us the cost of printing and mailing documents to you. If you choose to receive future proxy materials by e-mail, you will receive an e-mail notifying you of next year’s meeting, which will contain a link to the Internet site where the proxy materials will be posted and, if separate from the site where the proxy materials are posted, a link to the site where you may register your vote. Your election to receive proxy materials by e-mail will remain in effect until you affirmatively terminate it.

What proposals will be voted on at the meeting?

There are three proposals that will be voted on at the meeting:

| • | The election to the Board of Directors of eleven individuals, as named and described in this proxy circular, each for a term of one year; |

| • | The reappointment of PricewaterhouseCoopers LLP as our independent auditor (and, for the purposes of U.S. securities laws, our independent registered public accounting firm) for the fiscal year ending January 1, 2012; and, |

| • | The adoption of the Tim Hortons Inc. Direct Share Purchase and Dividend Reinvestment Plan (the “DSPP”). |

What is our Board of Directors’ voting recommendation?

Our Board recommends that you vote your shares “FOR” the election of each of the eleven nominees as named and described in this proxy circular, our Audit Committee and Board recommend that you vote your shares “FOR” the reappointment of PricewaterhouseCoopers LLP as our independent auditor for the fiscal year ending January 1, 2012, and our Board recommends you vote your shares “FOR” the adoption of the DSPP.

Who may vote at the meeting?

If you owned common shares at the close of business on March 15, 2011 (the “Record Date”), then you may attend and vote at the meeting. At the close of business on the Record Date, we had 166,335,179 common shares issued and outstanding, of which 166,057,097 shares are entitled to vote at the meeting. There are 278,082 common shares currently held by The TDL RSU Employee Benefit Plan Trust, and these shares are not entitled to vote at the meeting. As of the Record Date, our directors and executive officers and their affiliates beneficially owned, in the aggregate, approximately 656,397 common shares, representing beneficial ownership of less than 1% of the outstanding common shares as of that date. You are entitled to one vote for each common share held. There are no cumulative voting rights in the election of our directors.

What is the difference between holding shares as a shareholder of record and as a beneficial owner of shares held in street name?

Shareholders of Record. If your shares are registered directly in your name with our transfer agent, Computershare Trust Company of Canada (“Computershare”), you are considered a shareholder of record with respect to those common shares, and the proxy materials were sent directly to you by us.

Beneficial Owners of Shares Held in Street Name. If your common shares are held in an account at a brokerage firm, bank, or other similar organization, then you are the beneficial owner of common shares held in “street name,” or in the general account of the broker or other organization. Proxy materials are generally forwarded to beneficial holders by the brokerage firm, bank or other organization through which the shares are held.

If I am a shareholder of Tim Hortons, how do I vote?

Shareholders of Record. All registered shareholders may vote electronically by accessing the Internet site at www.investorvote.com or by telephone by using the toll-free telephone number stated on the proxy card.

3

Table of Contents

Registered shareholders also have the option to vote by mail, in which case such shareholders will need to complete the enclosed proxy card, sign, and return it in the prepaid envelope provided. Registered shareholders may also vote in person at the meeting or hand deliver the proxy card at the meeting. If you vote electronically through the Internet, or by telephone, you do not have to return your proxy card.

Beneficial Owners of Shares Held in Street Name. Beneficial shareholders may vote electronically or by telephone by following the instructions provided by their bank or broker, or by mail by returning the completed voting instruction form in the prepaid envelope provided. If you are a beneficial shareholder and you wish to vote in person at the meeting, you may do so by acting in accordance with either of the two following procedures, depending upon whether your intermediary is registered with Broadridge Investor Communication Solutions Canada (“Broadridge”):

| • | If your intermediary is registered with Broadridge, complete your voting instruction form by inserting your own name in the blank space provided, but leave all of the “for,” “withhold,” and “against” boxes blank. You should then return your voting instruction form, following the instructions provided, in sufficient time for your intermediary to act upon it. If you have done so and your instructions have been received by Computershare from your intermediary by 11:59 p.m., EDST, on the day before the meeting (i.e., May 12, 2011), then when you appear at the meeting in person you will be allowed to vote the shares covered by the voting instruction form; or, |

| • | If your intermediary is not registered with Broadridge, complete your voting instruction form by inserting your own name in the blank space provided, and indicate on the voting instruction form that you wish to receive a legal form of proxy. After you return your voting instruction form, you should receive the legal form of proxy from your broker, bank, or other organization. Please note that you must then send the legal form of proxy to our transfer agent, Computershare, and it must be received by Computershare by 11:59 p.m., EDST, on the day before the meeting (i.e., May 12, 2011). If you have requested a legal form of proxy but do not send it back to Computershare in time for Computershare to receive it before this deadline, you will not be able to vote your shares in person at the meeting. |

The shares represented by the proxy will be voted or withheld from voting in accordance with your instructions.

What happens if I do not give specific voting instructions?

Shareholders of Record. If you are a shareholder of record and you indicate when voting on the Internet or by telephone that you wish to vote as recommended by our Board of Directors, or, if you sign and return a proxy card without giving specific voting instructions, then the proxyholders appointed by our Board of Directors will vote your shares in the manner recommended by our Board on all matters presented in this proxy circular and as the proxyholders may determine in their discretion with respect to any other matters as may be properly presented for a vote at the meeting.

Beneficial Owners of Shares Held in Street Name. If the organization that holds your shares does not have discretionary authority to vote on a particular matter and does not receive instructions from you on how to vote your shares on such matter, or otherwise elects not to vote your shares in the absence of your direction on a matter for which it has discretionary authority, the organization that holds your shares will inform our Inspector of Election (or, Scrutineer) that it does not have the authority (or otherwise declines) to vote on such matter with respect to your shares. This is generally referred to as a “broker non-vote.” We encourage you to provide voting instructions to the organization that holds your shares by carefully following the instructions provided in the voting instruction form. See “How are abstentions and broker non-votes treated?” below for additional information.

Who can act as a proxy?

The persons named as proxyholders in the accompanying proxy card are officers of the corporation. A shareholder has the right to appoint a person as nominee to attend and act for and on such shareholder’s behalf at the meeting other than the management nominees named in the accompanying proxy card, and such person need not be a

4

Table of Contents

shareholder of the corporation. This right may be exercised by inserting in the blank space on the enclosed proxy card the name of the person the shareholder wishes to appoint as proxyholder, or by completing, signing, and submitting a separate proxy card (in proper form) naming such person as proxyholder.

The accompanying proxy card confers discretionary authority upon the persons named therein with respect to any amendments or variations to matters identified in the Notice of Meeting accompanying this proxy circular and with respect to such other business or matters which may properly come before the meeting or any adjournment(s) or postponement(s) thereof. As of the date of this proxy circular, we are not aware of any such amendments or variations or any other matters to be addressed at the meeting.

What is the quorum requirement for the meeting?

The presence, in person or by proxy, at the opening of the shareholders’ meeting of the holders of common shares representing not less than 25% of the outstanding common shares entitled to vote at the meeting on the Record Date constitutes a quorum. For purposes of determining whether there is a quorum, abstentions and broker non-votes are treated as shares that are present. See below under “How are abstentions and broker non-votes treated?”

What is the voting requirement to approve each of the proposals?

The voting requirements with respect to each of the proposals are as follows:

| Proposal 1—Election of directors | Each director must be elected by a plurality of the votes cast. Shareholders may vote for individual nominees, as we do not have slate voting. | |

| Proposal 2—Reappointment of our independent auditor | To be approved by shareholders, this proposal must receive the affirmative vote of a majority of the votes cast. | |

| Proposal 3—Adoption of the Tim Hortons Inc. Direct Share Purchase and Dividend Reinvestment Plan | To be approved by shareholders, this proposal must receive the affirmative vote of a majority of the votes cast. | |

There is no substantial interest, direct or indirect, of any director, executive officer, or associate of any of the foregoing in any of the proposals before the shareholders at the meeting.

How are abstentions and broker non-votes treated?

Abstentions and broker non-votes are counted for purposes of determining whether a quorum is present. For the purpose of determining whether the shareholders have approved a matter, abstentions and broker non-votes will have no effect on the outcome of the vote. It is critical that you cast your vote if you want it to count. As a result of restrictions under the Canada Business Corporations Act and recent changes governing members of the New York Stock Exchange, your bank or broker will not be able to vote your uninstructed shares on a discretionary basis. If you are a shareholder of record and you do not cast your vote, no votes will be cast on your behalf on any of the items of business at the meeting.

May I change my vote after I have voted?

If you are a shareholder of record, you may revoke your proxy and change your vote at any time before the final vote at the meeting. You may vote again on a later date on the Internet or by telephone (only your latest Internet or telephone proxy submitted prior to the meeting will be counted), or by signing and returning a new proxy card with a later date no later than 11:59 p.m., EDST, on the day before the meeting (i.e., May 12, 2011), or by attending the meeting and voting in person. However, your attendance at the meeting will not automatically revoke your proxy unless you vote again at

5

Table of Contents

the meeting or specifically request in writing that your prior proxy be revoked. The Internet and telephone procedures for voting and for revoking or changing a vote are designed to authenticate shareholders’ identities, to allow shareholders to give their voting instructions, and to confirm that shareholders’ instructions have been properly recorded.

A beneficial holder of shares in street name may revoke a voting instruction form that has been given to an intermediary at any time by written notice to the intermediary or to the service company that the intermediary uses, in sufficient time for the intermediary to act on it. In addition, a beneficial holder may change his or her vote by attending the meeting and voting in person, provided the beneficial holder has followed one of the procedures outlined above under “If I am a shareholder of Tim Hortons, how do I vote?”

Is my vote confidential?

Proxy instructions, ballots, and voting tabulations that identify individual shareholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within our corporation or to third parties, except:

| • | As necessary to meet applicable legal requirements; |

| • | To allow for the tabulation and certification of votes; and, |

| • | To facilitate a successful proxy solicitation. |

Occasionally, shareholders provide written comments on their proxy cards, which may be forwarded to management and/or our Board of Directors.

Where can I find the voting results of the meeting?

The preliminary voting results will be announced at the meeting. The final voting results will be tallied by the Inspector of Election and reported promptly, and in any event within four business days of the meeting (or, if not then available, on such later date as they become available), in a current report on Form 8-K that will be accessible at www.sec.gov and www.sedar.com.

Who is soliciting my proxy?

Proxies are being solicited by and on behalf of management of Tim Hortons Inc.

Who is paying for the cost of this proxy solicitation?

We are paying the costs of the solicitation of proxies for our shareholders of record and beneficial owners of shares held in street name. These costs include certain fees and expenses associated with:

| • | Forwarding printed proxy materials by mail to shareholders; and, |

| • | Obtaining beneficial owners’ voting instructions from banks, brokers, and other organizations that are the record owners. |

In addition to soliciting proxies by mail and electronically, our Board members, officers and certain employees, or our transfer agent, may solicit proxies on our behalf, personally or by telephone, or, we may ask a proxy solicitor to solicit proxies on our behalf by telephone, electronically or otherwise. We expect the cost of a private proxy solicitor would be approximately $35,000. Arrangements also may be made with brokerage houses and other custodians, nominees, and fiduciaries for the forwarding of solicitation materials to the beneficial owners of our shares held by those persons, and the corporation will reimburse such organizations for reasonable expenses incurred by them in connection with the forwarding of solicitation materials to beneficial holders.

Shareholders that vote through the Internet should understand that there may be costs associated with electronic access, such as usage charges from Internet access providers and telephone companies that will be borne by the shareholder in order for the shareholder to connect to or access the Internet site.

6

Table of Contents

Where are our principal executive offices located, and what is our main telephone number?

Our principal executive offices in Canada are located at 874 Sinclair Road, Oakville, Ontario, Canada, L6K 2Y1; our main telephone number in Canada is (905) 845-6511.

Our principal executive offices in the U.S. are located at 4150 Tuller Road, Unit 236, Dublin, Ohio, 43017, U.S.A.; our main telephone number at our U.S. office is (614) 791-4200.

Voting Securities and Their Principal Holders

The following table sets forth information with respect to the shareholders known to us, based on our review of public filings as of March 11, 2011, to own beneficially, directly or indirectly, or exercise control or direction over, more than 5% of the issued and outstanding common shares of the corporation:

| Title of Class |

Name and Address of Beneficial Holder |

Amount and Nature of Beneficial Ownership* |

Percent of Class* | |||

| Common Shares |

FMR LLC and a joint filer (1) 82 Devonshire Street Boston, MA 02109 |

18,009,190 | 10.82% |

| * | Based on 166,475,179 common shares outstanding as of March 11, 2011 (including the 278,082 shares held by The TDL RSU Employee Benefit Plan Trust). |

| (1) | Information based solely on the Schedule 13G/A filed with the SEC on February 14, 2011 by FMR LLC (“FMR”). Fidelity Management & Research Company (“Fidelity”), 82 Devonshire Street, Boston, Massachusetts, 02109, is a wholly owned subsidiary of FMR and a registered investment advisor. Fidelity is the beneficial owner of 14,638,032 common shares as a result of acting as investment advisor to various registered investment companies (the “funds”). The ownership of one fund, Fidelity Contrafund, amounted to 11,653,332 common shares. |

| Edward C. Johnson 3d, Chairman of FMR, and FMR, through its control of Fidelity and the funds, each has sole power to dispose of the 14,638,032 common shares owned by the funds. Voting power for these common shares is held by the boards of trustees of the funds. Members of the family of Mr. Johnson own, directly or through trusts, securities representing 49% of the voting power of FMR and, as a result of a shareholders’ voting agreement, may be deemed, under the Investment Company Act of 1940, to form a controlling group with respect to FMR. |

| Strategic Advisers, Inc. (“Strategic”), 82 Devonshire Street, Boston, Massachusetts, 02109, a registered investment adviser, is a wholly owned subsidiary of FMR and, as such, FMR’s beneficial ownership includes 2,478 common shares beneficially owned through Strategic. |

| Pyramis Global Advisors, LLC (“PGALLC”), 900 Salem Street, Smithfield, Rhode Island, 02917, an indirect wholly owned subsidiary of FMR and a registered investment adviser, is the beneficial owner of 3,038,910 common shares as a result of its serving as investment advisor to institutional accounts, non-U.S. mutual funds, or investment companies registered under the Investment Company Act of 1940 owning such shares. Mr. Johnson and FMR, through its control of PGALLC, each has sole dispositive power over and sole power to vote or to direct the voting of the 3,038,910 common shares owned by the institutional accounts or funds advised by PGALLC. |

| Pyramis Global Advisors Trust Company (“PGATC”), 900 Salem Street, Smithfield, Rhode Island, 02917, an indirect wholly owned subsidiary of FMR and a bank as defined under Section 3(a)(6) of the Exchange Act, is the beneficial owner of 279,500 common shares as a result of its serving as investment manager of institutional accounts owning such shares. Mr. Johnson and FMR, through its control of PGATC, each has sole dispositive power over 279,500 common shares and sole power to vote or to direct the voting of 167,200 common shares owned by the institutional accounts managed by PGATC. |

| FIL Limited (“FIL”), Pembroke Hall, 42 Crow Lane, Hamilton, Bermuda, and various foreign-based subsidiaries provide investment advisory and management services to a number of non-U.S. investment companies and certain |

7

Table of Contents

| institutional investors. FIL is the beneficial owner of 50,270 common shares. Partnerships controlled predominantly by members of the family of Mr. Johnson, Chairman of FMR and FIL, or trusts for their benefit, own shares of FIL voting stock representing approximately 39% of the total votes which may be cast by all holders of FIL voting stock. FMR and FIL are separate and independent corporate entities, and their boards of directors are generally composed of different individuals. |

Security Ownership of Management

The following table sets forth, as of March 11, 2011, information with respect to common shares owned beneficially by each director, by each nominee for election as a director, by the executive officers named in the Summary Compensation Table set forth under “Executive and Director Compensation,” and by all of our directors and executive officers as a group:

| Title of Class |

Name and address of beneficial holder(1) |

Common Shares currently held(2) |

Common Shares that can be acquired within 60 days(3) |

Total beneficial ownership |

Percent of Class | |||||||||

| Common Shares |

Paul D. House | 169,468 | 73,092 | 242,560 | * | |||||||||

| Donald B. Schroeder |

73,187 | 121,313 | 194,500 | * | ||||||||||

| M. Shan Atkins |

1,000 | — | 1,000 | * | ||||||||||

| Michael J. Endres |

42,752 | (4) | — | 42,752 | * | |||||||||

| Moya M. Greene |

— | — | — | * | ||||||||||

| The Hon. Frank Iacobucci |

6,584 | — | 6,584 | * | ||||||||||

| John A. Lederer |

15,120 | — | 15,120 | * | ||||||||||

| David H. Lees |

6,601 | (5) | — | 6,601 | * | |||||||||

| Ronald W. Osborne |

3,000 | (6) | — | 3,000 | * | |||||||||

| Wayne C. Sales |

11,968 | — | 11,968 | * | ||||||||||

| Catherine L. Williams |

— | — | — | * | ||||||||||

| Cynthia J. Devine |

72,225 | 49,922 | 122,147 | * | ||||||||||

| David F. Clanachan |

49,079 | (7) | 49,922 | 99,001 | * | |||||||||

| William A. Moir |

100,406 | 49,922 | 150,328 | * | ||||||||||

| Roland M. Walton |

68,895 | 49,922 | 118,817 | * | ||||||||||

| All directors and executive officers as a group (19 persons) |

656,397 | 462,025 | 1,118,422 | * | ||||||||||

| * | Represents beneficial ownership of less than 1% of our outstanding common shares. |

| (1) | The business address for all of the directors and executive officers is Tim Hortons Inc., 874 Sinclair Road, Oakville, Ontario, Canada, L6K 2Y1, or Tim Hortons USA Inc., 4150 Tuller Road, Unit 236, Dublin, Ohio, 43017, U.S.A. |

| (2) | The amounts reflected in this column include common shares owned directly or indirectly for which there is voting and/or investment power, including shared voting and/or investment power. See immediately below under “Ownership of Deferred Stock Units by Directors” for a listing of the number of deferred stock units (“DSUs”) owned by each director as of March 11, 2011, which are not included in the table above. |

| (3) | Amounts reflected in this column include: (i) common shares issuable or deliverable to settle restricted stock units (including restricted stock units received automatically pursuant to settlement of dividend equivalent rights) held by executive officers under our 2006 Stock Incentive Plan (the “Stock Incentive Plan”), up to and including the May 2011 vesting of restricted stock units and dividend equivalent rights; and (ii) vested stock options with tandem stock appreciation rights issued under the Stock Incentive Plan held by executive officers, including those that vest in May 2011. We have included for this purpose the gross amount of shares deliverable, but actual shares received will be less as a result of the payment of applicable withholding tax. Additionally, as required, we have provided the number of stock options with tandem stock appreciation rights that may be acquired without reduction for the |

8

Table of Contents

| value of the exercise price. For additional information regarding outstanding restricted stock units and stock options with tandem stock appreciation rights held by executive officers, see “Incentive Plan Awards” and Notes (2) and (3) to the Summary Compensation Table under “Executive and Director Compensation.” |

| (4) | Includes 30,000 common shares held in two trusts over which Mr. Endres has voting and investment power. |

| (5) | Common shares are held jointly by Dr. Lees and his spouse with whom he shares voting and investment power. |

| (6) | Common shares are held jointly by Mr. Osborne and his spouse with whom he shares voting and investment power. |

| (7) | Certain of the common shares beneficially owned by Mr. Clanachan are held in accounts in respect of which he has shared voting and investment power with his spouse. |

For the purpose of this table, which contains information that is also included in our Form 10-K filing for the fiscal year ended January 2, 2011, the term “executive officer” has the meaning ascribed to it under Rule 405 promulgated under the Securities Act of 1933, as amended (the “1933 Act”), and National Instrument 51-102—Continuous Disclosure Obligations. The information with respect to beneficial ownership is based upon information furnished by each director or executive officer or information contained in insider reports made with the Canadian Securities Administrators.

Ownership of Deferred Stock Units by Directors

The following table sets forth the number of DSUs held by our non-employee directors as of March 11, 2011. These DSUs are not included in the number of common shares beneficially owned by directors set forth in the table above. DSUs are notional units that track the value of our common shares, with the value determined upon a director’s separation from service with us and, ultimately, settled in cash. One DSU is equivalent in value to one common share, and DSUs carry dividend equivalent rights. We include DSUs in determining compliance with our stock ownership guidelines for directors. For additional information regarding outstanding DSUs held by directors, see “Executive and Director Compensation—Director Compensation.”

| Director |

Number of Deferred Stock Units |

|||

| M. Shan Atkins |

9,228 | |||

| Michael J. Endres |

12,899 | |||

| Moya M. Greene |

8,989 | |||

| The Hon. Frank Iacobucci |

22,671 | |||

| John A. Lederer |

15,031 | |||

| David H. Lees |

14,920 | |||

| Ronald W. Osborne |

7,868 | |||

| Wayne C. Sales |

14,601 | |||

| Catherine L. Williams |

7,143 | |||

9

Table of Contents

CORPORATE GOVERNANCE PRINCIPLES AND PRACTICES

The corporation has adopted certain principles and practices so that effective corporate governance is maintained and the Board functions independently of management.

Applicable Governance Requirements and Guidelines

The corporation is a Canadian reporting issuer and qualifies as a foreign private issuer for purposes of the Exchange Act. Our common shares are listed on the Toronto Stock Exchange (“TSX”) and the New York Stock Exchange (“NYSE”). As a result, the corporation is subject to, and complies with, a number of legislative and regulatory corporate governance requirements, policies and guidelines, including those of the TSX, the Canadian Securities Administrators, the NYSE, and the SEC. The corporation currently complies with the governance requirements of the NYSE applicable to U.S. domestic issuers listed on the NYSE. Pursuant to Section 303A.11 of the NYSE Listed Company Manual, foreign private issuers such as the corporation must disclose significant differences between their corporate governance practices and those required to be followed by U.S. issuers under the NYSE listing standards. Our corporate governance practices comply with the NYSE requirements applicable to U.S. domestic issuers and are in compliance with applicable rules adopted by the SEC to give effect to the provisions of the Sarbanes-Oxley Act of 2002. As mentioned above, we also comply with applicable Canadian corporate governance requirements.

In addition to compliance with governance requirements, our Board continuously monitors initiatives and trends in corporate governance with a view to evaluating and, where appropriate, implementing best practices. Our significant governance principles and practices, all of which are described below, are set forth in governance documentation available on our website at www.timhortons-invest.com. These include our Principles of Governance (our Board mandate), Governance Guidelines, committee mandates or charters, Standards of Business Practices (Code of Ethics), Directors’ Code of Conduct, and our Audit Committee Pre-Approval Policy. We will provide a copy of any of these governance documents to any person, without charge, who requests a copy in writing to our Secretary at Tim Hortons Inc., 874 Sinclair Road, Oakville, Ontario, Canada, L6K 2Y1.

Principles of Governance and Governance Guidelines

Principles of Governance

Our Board of Directors, which is comprised of a substantial majority of independent directors (9 of 11), has adopted Principles of Governance and Governance Guidelines. The Principles of Governance set forth, in general terms, the mandate, or role and general responsibilities, of the Board. The Principles of Governance outline that the Board’s overall goals are: to maximize long-term shareholder value and provide oversight and support such that the corporation conducts its business in a highly ethical manner; to create an environment that respects and values all employees; and, to promote corporate responsibility. The full text of the Principles of Governance are as follows:

Tim Hortons Board of Directors assumes accountability for the success of the enterprise by taking responsibility for the corporation’s failure and success. The Board’s overall goals are to maximize long-term shareholder value and provide oversight and support such that the corporation conducts its business in a highly ethical manner; to create an environment that respects and values all employees; and, to promote corporate responsibility.

Specifically, the Board’s responsibilities include:

| • | Approving a corporate philosophy and mission; |

| • | Selecting, monitoring, evaluating, compensating, and–if necessary–replacing the CEO and other senior executives, and overseeing management succession; |

| • | Providing guidance for, reviewing and approving management’s strategic and business plans, including developing in-depth knowledge of the businesses being served, understanding and questioning the |

10

Table of Contents

| assumptions upon which such plans are based, and reaching an independent judgment as to the probability that the plans can be realized, including but not limited to potential risk exposures in connection with such strategic plans and objectives; |

| • | Reviewing and approving the corporation’s financial objectives, plans, and actions, including significant capital allocations and expenditures and the corporation’s liquidity needs; |

| • | Reviewing the principal risk exposures of the corporation and, if applicable, reviewing mitigation plans in connection therewith during at least one Board meeting each year; |

| • | Reviewing and approving material transactions not in the ordinary course of business; |

| • | Monitoring corporate performance against the strategic and business plans, including overseeing the operating results on a regular basis to evaluate the extent to which the business is being properly managed, the business and liquidity are sufficiently stable, and management is prepared for contingencies in the corporation’s industry and the economy; |

| • | Requiring ethical behavior and compliance with laws and regulations, auditing and accounting principles, and the corporation’s own governing documents; and, |

| • | Performing such other functions as are prescribed by law or assigned to the Board in the corporation’s governing documents. |

The Board strives to be a strategic asset of the corporation. It must continuously monitor and confirm that it has the right people to address the right issues with the right information in a culture that fosters teamwork.

Tim Hortons Board–in a spirit of continuous improvement–will periodically assess its performance against governance “best practices” and hold itself accountable both as individual directors and as a Board for adhering to the highest standards of board professionalism and performance.

Governance Guidelines

The Governance Guidelines address Board structure, membership (including nominee qualifications), performance, management oversight, and other matters. The Governance Guidelines describe the three main Board committees (the Audit Committee, the Nominating and Corporate Governance Committee (the “Nominating Committee”), and the Human Resource and Compensation Committee (the “Compensation Committee”)), as well as the charters of each committee. Pursuant to the Governance Guidelines, the independent directors hold regular executive sessions (without management present) attendant to all Board and committee meetings, and schedule sessions with only the independent members of the Board as otherwise needed or desired. The Lead Director, The Hon. Frank Iacobucci, presides at executive sessions of the independent directors, except where the principal matters to be considered are within the scope of authority of one of the other committee chairs. Executive sessions comprised only of the independent directors were held at all but one of the Board’s 2010 meetings, and the meeting for which the executive session was not held was a special telephonic meeting.

Except in compelling circumstances, any director who, during two consecutive full calendar years, attended fewer than 75% of the total of (i) all Board meetings held during the period for which he or she has been a director (including regularly scheduled, special and telephonic meetings) and (ii) all meetings held by all committees on which he or she

served (during the periods that he or she served) shall be asked to tender his or her resignation to the Board, and the Board shall consider relevant facts and circumstances and determine whether to accept or decline such tendered resignation. The Board of Directors held a total of six meetings during 2010, both regularly scheduled and special. Each director attended at least 75% of the aggregate of the total number of meetings of the Board of Directors and Board committees held during the period for which such director served. The Governance Guidelines also provide that the directors are expected to attend the meeting of shareholders. All of the eleven directors included on the slate for reelection to the Board in 2010 attended the annual meeting of shareholders in 2010.

11

Table of Contents

With respect to our governance structure, the Governance Guidelines provide that if the Chair of the Board is not an independent director, the Chair of the Nominating Committee will serve as Lead Director and as a member of the Executive Committee. Mr. House, our former Chief Executive Officer (CEO) and a current executive officer, has served as our Executive Chairman since March 2008. He held the role of Chairman of the Board and CEO from February 2007 until March 2008. The Hon. Frank Iacobucci has served as our Lead Director since Mr. House became our Chairman in February 2007. The Governance Guidelines contain a general description of the responsibilities of the Executive Chairman and the Lead Director. See also “Governance Structure” below.

Majority Voting Policy for Election of Directors

In November 2010, we adopted a majority voting standard for the election of directors in uncontested elections, which is included in the Governance Guidelines. Under that policy, if a nominee does not receive the affirmative vote of at least the majority of votes cast, the director shall promptly tender his or her resignation for consideration by the Nominating Committee and the Board.

Code of Ethics (Standards of Business Practices) and Directors’ Code of Conduct

We have adopted a Code of Ethics, which we have designated as our Standards of Business Practices, that applies to all of our officers and employees, including our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. We also have an Ethics and Compliance Office. Our Chief Risk and Privacy Officer is responsible for overseeing compliance initiatives and programs, managing the investigation and resolution of reports of non-compliance and ethics issues, and reporting on such activities to the Audit Committee. In addition, we have an Ethics HotLine, and we discuss significant matters raised through this line with the Audit Committee, as needed. In addition, in the event a call to the Ethics HotLine relates to a matter involving an executive officer or a member of the Ethics and Compliance Office, that matter would by-pass the Ethics and Compliance Office and be referred directly to our Audit Committee Chair. As part of our decision to voluntarily comply with Form 8-K reporting requirements notwithstanding that the corporation is a foreign private issuer under U.S. securities laws, we intend to satisfy the disclosure requirement under Item 5.05 of Form 8-K regarding any amendment to, or waiver of, any provision (related to elements listed under Item 406(b) of Regulation S-K) of the Standards of Business Practices that applies to our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, by timely posting such information on our corporate and investor website at www.timhortons-invest.com, as required.

In order to augment the prohibitions against improper insider trading in our Standards of Business Practices, we also have separate insider trading and window trading policies for directors, restaurant-owner advisory board members, officers and employees who may from time to time be in possession of material, non-public information. Our insider trading and window trading policies allow for, and we have a separate policy governing, automatic trading plans entered into pursuant to Rule 10b5-1 under the Exchange Act and applicable provisions of Canadian securities laws.

We have also adopted a separate Directors’ Code of Conduct. This Code of Conduct emphasizes the importance of the Standards of Business Practices and reaffirms the Board’s commitment to certain key principles, including confidentiality, fair dealing, compliance with laws, and the reporting of illegal or unethical behavior.

In accordance with our Governance Guidelines and applicable NYSE and Canadian corporate governance rules, the Board of Directors has a Nominating Committee, an Audit Committee, and a Compensation Committee. The Board has also established an Executive Committee. The Executive Committee has been delegated all of the authority of the Board with respect to matters below an established dollar threshold, subject to certain exceptions and limitations. Committee membership is considered annually in May by the Nominating Committee and the Board. The charter for each of the three main committees sets forth the purpose and responsibilities of each respective committee, which are generally described below, as well as descriptions of the role of the Chair of each of the committees. Each committee is required to meet at least four times a year, and otherwise as needed.

12

Table of Contents

Nominating and Corporate Governance Committee

The current members of the Nominating Committee are The Hon. Frank Iacobucci (Chair), Ms. Atkins, and Messrs. Lederer, Lees, and Sales, each of whom satisfies the Independence Requirements and is, therefore, independent of the corporation. See below for a discussion of applicable “Independence Requirements” set forth under “Independence and Other Considerations for Director Service.” The Nominating Committee met seven times during 2010. Executive sessions comprised only of the independent directors who were members of the Nominating Committee were held at each of those 2010 meetings.

The Nominating Committee’s functions include: assisting the Board in reviewing and determining, annually, the appropriate governance structure for the corporation and the Board; overseeing the process for CEO succession planning, including reviewing such planning and related processes and facilitating the Board’s identification and evaluation of potential successors to the CEO; establishing the desired qualifications of directors and identifying and assessing potential nominees meeting those criteria; recommending to the Board nominees for election as directors by the shareholders, including any candidates nominated by shareholders; reviewing and making recommendations to the Board regarding the functions and responsibilities of the Chairman, CEO and Lead Director; reviewing independence considerations for existing and prospective Board members; and, developing plans regarding the size and composition of the Board and its committees. In addition, the Nominating Committee reviews the Principles of Governance and Governance Guidelines, makes recommendations to the Board with respect to other corporate governance principles applicable to us, annually reviews compliance with listing standards, oversees the annual self-evaluation of the Board and its committees, conducts an annual self-evaluation of the Nominating Committee, and monitors and recommends changes to the responsibilities of the Board’s committees, including determining proper oversight by the Board and its committees of risk assessment and mitigation under our enterprise risk management program. Governance structure and director-nominee considerations are described in greater detail below. In 2010, the Nominating Committee charter was amended to include the Nominating Committee’s oversight accountability, on behalf of the Board, for: sustainability, corporate responsibility and environmental and social issues, which will include the consideration of potential short- and long-term trends and impacts, as well as risks and opportunities to our business; and, corporate political contributions, under the corporation’s political contribution policy adopted in 2010. With respect to succession planning activities, see also “Human Resource and Compensation Committee,” below.

Director Orientation and Education

The Nominating Committee also oversees and maintains programs for initial orientation and ongoing education of our directors. The orientation and education program consists of three important parts: initial orientation sessions; continuing general knowledge; and, receipt of current information between meetings, each of which is described below. Upon joining our Board, each new director is provided with extensive Board manuals. The materials contained in the manuals, coupled with the other components of the orientation and education program, are intended to inform new directors regarding, among other matters, the role and responsibilities of the Board, its committees, and the directors; the nature and operation of the corporation’s business; financial reporting and internal controls; the significant risks facing the corporation; the corporation’s relationships with its key stakeholders, including shareholders, restaurant owners, and employees; and, the corporation’s strategic plans. The Nominating Committee annually reviews, and reports to the Board regarding, the effectiveness of the Board’s orientation and education program.

Initial Orientation Sessions. As soon as reasonably practicable after joining the Board, new directors participate in discussions with our Executive Chairman and Lead Director, as well as key members of our senior management including, among others, the CEO, CFO, General Counsel, Corporate Secretary, and Vice President of Investor Relations, in order to gain working knowledge in each of the key areas identified above. In addition, new directors are required to tour certain of the corporation’s manufacturing and distribution facilities to supplement this information with direct exposure to the operation of the business. Directors new to service on a public company board must also attend an appropriate external seminar within two years of their appointment, and those new to public company audit committee service must attend such a seminar within a reasonable period of time after their appointment, to further understand the roles, responsibilities, and liabilities associated with public company board service.

13

Table of Contents

Continuing General Knowledge. General knowledge is conveyed to directors in meetings with, and in written or other materials provided by, members of senior management. In particular, directors: (i) receive comprehensive advance materials prior to each regularly scheduled and, if appropriate, special Board and committee meeting; (ii) are involved in setting the agendas for Board and committee meetings; (iii) attend annual or biennial strategic planning sessions; and (iv) have full access to our senior management both during the course of and in between meetings. In addition to the information regarding the business that is conveyed in the normal course as part of regular Board and committee meetings, the corporation also maintains an ongoing education program. This program consists of a minimum of two educational sessions per year, one led by internal members of senior management and one led by external subject matter experts. Topics for these sessions may include discussions of regulatory and compliance matters, governance matters, enterprise risk management or assessment, or, they may focus on certain aspects of the business for which senior management or any director believes additional education would be appropriate.

Receipt of Current Information. Senior management and the Board recognize the importance of keeping the Board adequately informed of events and business matters in between regularly scheduled meetings. In this regard, the Board receives consistent updates between Board meetings on key matters or events affecting our business from the CEO and other members of senior management. Directors are also encouraged to attend meetings and events involving restaurant owners and the Tim Horton Children’s Foundation that occur outside of our Board and committee meetings. In furtherance of keeping current regarding general matters relevant to Board and committee service, our directors are also encouraged to attend external educational seminars relevant to Board or committee service and share any meaningful information obtained from such seminars with other Board or committee members, as applicable, depending upon the subject matter. The Secretary’s office maintains a list of appropriate external educational seminars and makes the list available to directors on an ongoing basis.

Board and Committee Self-Evaluation

The annual Board and committee self-evaluation process was adopted by the Board based on the review and recommendation of the Nominating Committee. The annual process considers such matters as: participation and involvement of Board and committee members; oversight and effectiveness of the Board and its committees as to key functions; quality and adequacy of materials and information provided to the Board and committees, both for and between meetings; Board and committee composition; and, with respect to the committees, fulfillment of accountabilities delegated from the Board and outlined in the committee charters. Feedback is solicited from Board and committee members on these and other important areas through a set of detailed, multi-page questionnaires that are tailored to the Board and each committee, respectively. The questionnaires include specific questions, with scaled responses, as well as open-ended requests for written commentary in certain limited areas, including, if applicable, with respect to any response indicating that improvement is needed.

The Board questionnaire also has scaled questions designed to solicit responses related to the performance of individual directors, the Executive Chairman, and the Lead Director. Additionally, the questionnaire requires that each director provide written commentary on his or her assessment of the individual performance of other Board members, either on an individual or collective basis.

Board members submit completed Board and Nominating Committee questionnaires, including any commentary on the performance of individual Board members and/or the Executive Chairman, on an anonymous basis to Mr. Iacobucci. The completed questionnaires for the other committees are submitted on an anonymous basis to the committee chairs of the Compensation Committee and the Audit Committee, respectively. Directors are also informed as part of the process, in advance, that they may submit feedback regarding the Lead Director’s performance directly to the Corporate Secretary. Although questionnaires may be completed on an anonymous basis, Board and committee members are advised that they are free to identify themselves on their questionnaires should they wish to discuss any matter directly with Mr. Iacobucci, the respective committee chair, or, with respect to any matter involving the Lead Director, the Corporate Secretary.

For the Board and the Nominating Committee, Mr. Iacobucci presents the results of the self-evaluations at the succeeding Nominating Committee and Board meetings. The Board results are reviewed by the Nominating Committee

14

Table of Contents

to fulfill its oversight role to facilitate the evaluation process and so that any areas for improvement for the Board and/or any committee surfaced through the self-evaluations, including any suggestions for improvement in the self-evaluation process, are reviewed and, if appropriate, addressed. The Audit Committee and Compensation Committee chairs present the results to their respective committees and to the Board. The committee chairs follow up with Mr. Iacobucci and/or respective members of management, as appropriate, regarding any results or feedback to be reviewed and/or addressed, as applicable. Any feedback on the performance of individual Board members or the Executive Chairman is provided to such Board member or the Executive Chairman, as applicable, by Mr. Iacobucci. The Corporate Secretary would provide any feedback received by the Secretary regarding the Lead Director directly to the Lead Director.

The Nominating Committee reviews the Board and committee self-evaluation process annually. As a result of this review, the Nominating Committee may revise the form and content of the questionnaires and/or other aspects of the overall process to reflect changing circumstances, to include feedback from directors, or to incorporate modifications designed to improve the overall process.

As described above, since March 2008, the governance structure for the corporation has consisted of three key leadership roles, with Mr. House as Executive Chairman, Mr. Iacobucci as Lead Director, and Mr. Schroeder as CEO. Our Governance Guidelines contain a general discussion of the responsibilities of each of the Executive Chairman and Lead Director based on position descriptions for each role. The Lead Director’s accountabilities include providing independent leadership to the Board, and he works with the Executive Chairman to facilitate the proper functioning and effectiveness of the Board. Also included in the Lead Director’s responsibilities are: presiding at executive sessions of the independent directors, except where the principal matters to be considered are within the scope of authority of one of the other committee chairs; coordinating with the Executive Chairman and management to set the agenda for Board meetings; serving as a communication channel between the independent directors and the Executive Chairman and management; and, overseeing and reporting to the Board regarding the Board’s and Nominating Committee’s annual self-evaluation. The general duties and responsibilities of the Executive Chairman include: presiding at regular and special meetings of the Board and fostering a strong working relationship between the CEO and the Board; strategic planning and related activities, in coordination with key members of senior management; acting as an ambassador with key stakeholders, including restaurant owners, general industry and the community; and, such other duties as are assigned by the Board. As our President and CEO, Mr. Schroeder is accountable as the senior executive leader of the corporation for its overall operations, financial performance, and day-to-day activities. Mr. Schroeder brings to the CEO role extensive experience with the business and industry, with 20 years of service to the corporation in various executive-level positions.

The Board most recently reviewed the appropriateness of the current governance structure in February of 2011, which included a review of the position descriptions and accountabilities of each of the Executive Chairman, Lead Director, and CEO. As a result of this review, the Board determined that the existing governance structure continued to serve the corporation well as it leverages the unique skills and experience of the Executive Chairman, Lead Director, and CEO for the benefit of our corporation and shareholders. In addition, for 2011, the Board determined that Mr. House’s role would focus to a greater degree on Board leadership, strategic planning activities, and other functions that are more aligned with Mr. House’s status as a director, as opposed to senior management. In furtherance of this approach, the transitional relationship between the Executive Chairman and CEO roles effectively ended in 2010. With Mr. House continuing as our Executive Chairman, we are able to take advantage of his background and experience as a Board member of a public company in the quick service industry for many years (including, Wendy’s International, Inc. (“Wendy’s”)), and also allows us to continue to benefit from Mr. House’s extensive knowledge of our business in a senior leadership capacity through his roles as CEO (13 years), and other executive-level positions. Mr. House had a total of 23 years of service with our corporation prior to being appointed as our Executive Chairman. With respect to the Lead Director role, Mr. Iacobucci has extensive legal (including, as a Justice of the Supreme Court of Canada), corporate governance, and public company board skills and related leadership experience, with a reputation for excellence in these areas, that he also brings to service on our Board. He is often appointed by the Government of Canada and the province of Ontario to consider controversial and potentially divisive matters, given his well-established track record of solid and reasoned

15

Table of Contents

analysis and appropriate resolution of a myriad of complex issues. As our Lead Director and Chair of the Nominating Committee, Mr. Iacobucci oversees and leads the independent directors and makes recommendations to the Board with respect to the adoption and maintenance of sound governance principles and best practices. Our governance structure has allowed for Mr. Schroeder, and other members of senior management, to continue to benefit from access to the considerable and varied knowledge and experience of both Messrs. House and Iacobucci.

The corporation believes that its leadership structure, discussed in detail above, supports the risk oversight function of the Board. The CEO and other members of senior management have responsibility for assessing and managing the corporation’s risk exposure, and the Board and its committees provide oversight in connection with those efforts. In addition, we believe that our Board leadership and governance structure further supports effective risk oversight because the role of the Executive Chairman brings additional expertise directly related to our business that is valuable to the Board and its committees in understanding the key risks and assessing management’s mitigation plans, as may be applicable. See also “Audit Committee—Enterprise Risk Management,” below.

Concurrent with the Board’s annual review of the governance structure and position descriptions of the Executive Chairman, Lead Director, and CEO, the Compensation Committee also reviewed the respective roles and accountabilities in connection with annual compensation determinations. As Mr. House’s role is now focused on functions that are more aligned with his status as a director, his compensation has decreased substantially, and Mr. Schroeder’s has increased over the same time period. See below under “Compensation Discussion and Analysis” for a complete description of CEO and Executive Chairman compensation. We have also included an overview of Mr. House’s compensation under “Director Compensation,” below, although neither Mr. House nor Mr. Schroeder receives any compensation for serving as a director of the corporation.

Independence and Other Considerations for Director Service

The Governance Guidelines express our Board’s goal that a substantial majority of our directors satisfy the independence requirements set forth in the Governance Guidelines (the “Independence Requirements”). The Independence Requirements incorporate the listing standards of the NYSE and the requirements of Canadian securities laws. The Governance Guidelines also set forth additional requirements, including that directors have no “business conflict” with the corporation. The Governance Guidelines further require that all members of the Audit Committee, the Compensation Committee, and the Nominating Committee satisfy the Independence Requirements. Each member of the Compensation Committee also must be a “non-employee director,” as such term is defined in Rule 16b-3 under the Exchange Act, and an “outside director,” as described under Section 162(m) of the Internal Revenue Code of 1986, as amended.

In making the affirmative determination, in February 2011, that all of our directors are independent in accordance with the Independence Requirements, except for Messrs. House and Schroeder, the Nominating Committee and the Board considered all relevant facts and circumstances, not merely from the standpoint of the director, but also from that of any person or organization with which the director has an affiliation or association.

The independence determinations of the Nominating Committee and the Board for the director-nominees set forth herein included consideration of the following:

| • | Michael J. Endres. Mr. Endres serves on the board of directors of Huntington Bancshares, Inc. (“Huntington”). Huntington, either directly, or indirectly through affiliates or subsidiaries, provides certain banking services to us in the United States. The Board concluded Mr. Endres is not affected by his service as a Huntington director because he is not involved in Huntington’s day-to-day banking activities and does not have any direct responsibility with respect to Huntington’s arrangements with us. Additionally, Mr. Endres has agreed to recuse himself from participating in meetings of the Huntington board of directors and our Board if such participation would, or is reasonably likely to, present a conflict of interest. |

| • | Moya M. Greene. Until her appointment as CEO of the Royal Mail in May 2010, Ms. Greene had been the President, Chief Executive Officer, and a member of the board of directors of Canada Post Corporation. That |

16

Table of Contents

| corporation and its affiliates have several agreements with us for mail and parcel delivery. We paid approximately $1.2 million under these agreements in 2010 (of which approximately $0.7 million was paid during the period from January to May). The Board concluded that Ms. Greene’s independence would not be affected by her prior position with Canada Post because the annual payments under the agreements were for essential services (mail and parcel delivery) and, further, insignificant in amount to Canada Post and us. The agreements were not of sufficient size to require direct consideration or approval by Ms. Greene in her capacity as either an executive officer or a director of Canada Post. |

| • | John A. Lederer. In 2010, Mr. Lederer became the President and Chief Executive Officer of U.S. Foodservice, Inc. (“U.S. Foodservice”), a food distribution enterprise which also supplies quick service restaurants in the U.S. The Board considered whether Mr. Lederer’s position with U.S. Foodservice would have an impact on his independence and, after review, the Board concluded that Mr. Lederer’s independence would not be affected by his relationship with U.S. Foodservice. Mr. Lederer has agreed to recuse himself from participating in meetings of the U.S. Foodservice board of directors and our Board if such participation would, or is reasonably likely to, present a conflict of interest. |

| • | Ronald W. Osborne. Mr. Osborne has been the Chairman of the board of directors of Postmedia Network Canada Corp. and its subsidiary Postmedia Network Inc. (collectively, “Postmedia”) since July 2010, is a member of the board of trustees of RioCan Real Estate Investment Trust (“RioCan”), is Chairman of the board of directors of Sun Life Financial Inc. (“Sun Life”), and until August 2010, was a member of the board of directors of Brookfield Renewable Power, Inc., a wholly owned subsidiary of Brookfield Asset Management (“Brookfield”). Postmedia’s operations consist of publishing properties formerly owned by Canwest Global Communications Corporation. As such, we may from time to time in the ordinary course purchase advertising space in one or more of the publications owned by Postmedia. RioCan is the lessor of various restaurant sites to the corporation’s subsidiaries. Sun Life provides the corporation with administration services for various retirement benefit plans and programs and also leases restaurant space in one downtown Toronto location to one of the corporation’s subsidiaries. The Board concluded that Mr. Osborne’s independence would not be affected by his directorships with Postmedia, RioCan or Sun Life, and was not affected during the time he was a director of Brookfield because, as a director, he is not or was not involved in the day-to-day operating activities of these companies and does not or did not have any direct responsibility with respect to the agreements between these companies and us. Additionally, Mr. Osborne has agreed to recuse himself from participating in meetings of the Postmedia, RioCan, or Sun Life boards and/or our Board if such participation would, or is reasonably likely to, present a conflict of interest. |

| • | Wayne C. Sales. In 2010, Mr. Sales became the Chairman of the Board of SuperValu Inc., a grocery retailer and distributor (“SuperValu”). The Board considered whether Mr. Sales’ position with SuperValu would have an impact on his independence and, after review, the Board concluded that Mr. Sales’ independence would not be affected by his relationship with SuperValu. Mr. Sales has agreed to recuse himself from participating in meetings of the SuperValu board of directors and our Board if such participation would, or is reasonably likely to, present a conflict of interest. |

| • | Catherine L. Williams. Ms. Williams is a member of the board of directors of Enbridge Inc. (“Enbridge”). Enbridge provides certain of the corporation’s subsidiaries with natural gas. The Board concluded that Ms. William’s independence would not be affected by her position with Enbridge because the annual payments to Enbridge were for essential utility services and, further, were not of sufficient size to require direct consideration or approval by Ms. Williams in her capacity as a director of Enbridge. As of March 4, 2011, our records indicate that the Alberta Investment Management Corporation (“AIMCO”), an Alberta crown corporation which manages pensions, endowments, and government funds, held 756,200 of our common shares, representing approximately 0.45% of the corporation’s outstanding common shares as of such date. Ms. Williams has been a member of the board of AIMCO since September 2009. The Board concluded that AIMCO’s minimal ownership of our common shares does not affect Ms. William’s independence. Ms. Williams has agreed to recuse herself from participating in meetings of our Board, Enbridge’s and/or AIMCO’s board of directors if such participation would, or is reasonably likely to, present a conflict of interest. |

17

Table of Contents