Attached files

| file | filename |

|---|---|

| EX-23 - EXHIBIT 23 - COLDWATER CREEK INC | a2202988zex-23.htm |

| EX-32 - EXHIBIT 32 - COLDWATER CREEK INC | a2202988zex-32.htm |

| EX-21 - EXHIBIT 21 - COLDWATER CREEK INC | a2202988zex-21.htm |

| EX-31.1 - EXHIBIT 31.1 - COLDWATER CREEK INC | a2202988zex-31_1.htm |

| EX-10.14 - EXHIBIT 10.14 - COLDWATER CREEK INC | a2202988zex-10_14.htm |

| EX-10.2.1 - EXHIBIT 10.2.1 - COLDWATER CREEK INC | a2202988zex-10_21.htm |

| EX-31.2 - EXHIBIT 31.2 - COLDWATER CREEK INC | a2202988zex-31_2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended January 29, 2011

Commission File Number 0-21915

COLDWATER CREEK INC.

(Exact name of registrant as specified in its charter)

| DELAWARE (State or other jurisdiction of incorporation or organization) |

82-0419266 (I.R.S. Employer Identification No.) |

ONE COLDWATER CREEK DRIVE, SANDPOINT, IDAHO 83864

(Address of principal executive offices)

(208) 263-2266

(Registrant's telephone number)

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class

|

Name of Each Exchange on Which Registered

|

|

|---|---|---|

| Common Stock $0.01 par value | NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES o NO ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES o NO ý

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act

of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the

past 90 days.

YES ý NO o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES o NO o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act (Check one):

| Large accelerated filer o | Accelerated filer ý | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

YES o NO ý

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant on July 30, 2010, the last business day of the registrant's most recently completed second fiscal quarter, based on the last reported trading price of the registrant's common stock on the NASDAQ was approximately $231,028,234

There were 92,503,103 shares of the registrant's $0.01 par value common stock outstanding on March 22, 2011.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's proxy statement to be filed with the Commission pursuant to Regulation 14A not later than 120 days after the end of the fiscal year covered by this Form are incorporated by reference into Part III of this Form 10-K.

Coldwater Creek Inc.

Annual Report on Form 10-K

For the Fiscal Year Ended January 29, 2011

Table of Contents

"We", "us", "our", "Company" and "Coldwater Creek", unless the context otherwise requires, means Coldwater Creek Inc. and its wholly-owned subsidiaries.

2

The following discussion contains various statements regarding our current strategies, financial position, results of operations, cash flows, operating and financial trends and uncertainties, as well as certain forward-looking statements regarding our future expectations. When used in this discussion, words such as "anticipate," "believe," "estimate," "expect," "could," "may," "will," "should," "plan," "predict," "potential," and similar expressions are intended to identify such forward-looking statements. Our forward-looking statements are based on our current expectations and are subject to numerous risks and uncertainties. As such, our actual future results, performance or achievements may differ materially from the results expressed in, or implied by, our forward-looking statements. Please refer to our "Risk Factors" in this Annual Report on Form 10-K. We assume no future obligation to update our forward-looking statements or to provide periodic updates or guidance.

General

Coldwater Creek Inc. is a specialty retailer of women's apparel, accessories, jewelry and gift items. Founded in 1984 as a catalog company, today we are a multi-channel specialty retailer. Our proprietary merchandise assortment reflects a sophisticated yet relaxed and casual lifestyle. A commitment to providing superior customer service is manifest in all aspects of our business. Our mission is to become one of the premier specialty retailers for women 35 years of age and older with average annual household incomes in excess of $75,000 by offering our customers a compelling merchandise assortment with superior customer service through all our sales channels.

References to a fiscal year refer to the calendar year in which the fiscal year commences. Our fiscal year ends on the Saturday nearest January 31st. This reporting schedule is followed by many national retail companies. This floating fiscal year end typically results in 13-week fiscal quarters and a 52-week fiscal year, but occasionally will contain an additional week resulting in a 14-week fiscal fourth quarter and a 53-week fiscal year.

Our Multi-Channel Approach

Since the opening of our first premium retail store in November 1999, we have gradually evolved from a direct marketer to a multi-channel specialty retailer. Our merchandise is offered through two distinct operating segments, retail and direct. Our retail segment includes premium retail stores and merchandise clearance outlet stores along with our day spa locations. Our direct segment encompasses our direct-to-consumer business through e-commerce and phone and mail operations. Our catalogs are prominently displayed in each premium retail store to encourage customers to continue shopping with us even after they have left our stores. This multi-channel approach also allows us to cross-promote our brand and provides customers with convenient access to our merchandise, regardless of their preferred shopping method. As part of our commitment to superior customer service, we accept returns virtually at any time and for any reason through any channel regardless of the initial point of purchase.

Information regarding segment performance is included in "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations," of this Annual Report on Form 10-K. Additionally, selected financial data for our segments is presented in Note 16 to our consolidated financial statements.

Retail Segment

As of January 29, 2011, we operated 373 premium retail stores throughout the United States. Our premium retail stores average approximately 5,900 square feet in size per store. Approximately 42 percent of these stores are located in traditional malls, 53 percent in lifestyle centers and 5 percent

3

in street locations. During fiscal 2010 we opened 19 new stores and closed 2 stores. Approval of new store locations or changes in existing store leases is conducted upon presentation of a collaborative analysis involving our real estate, business intelligence and finance departments. Our real estate department uses its experience and current market knowledge to identify potential locations based upon an overall market plan. Our business intelligence department then analyzes each location by extracting data and information from our own extensive customer database and combining it with external demographic information. Our finance department analyzes, among other things, a store's historical and projected performance trends such as store earnings and cash flows. This comprehensive analysis includes such information as projected sales, average consumer age and income level, buying habits and the retail location of competitors within the same trade area.

We also operated 39 merchandise clearance outlet stores at the end of fiscal 2010. Our outlet stores average approximately 6,900 square feet in size per store. We conduct periodic seasonal sales events in our premium retail stores and excess merchandise is cleared through our merchandise clearance outlet stores. In October 2010, we began using a full-time sales section within our premium retail stores to clear excess merchandise. Although we currently use outlets exclusively to manage overstocked premium merchandise, we will begin testing product made solely for this channel in fiscal 2011.

We also operate our Coldwater Creek ~ The Spa concept in nine locations. These day spas offer a complete menu of spa treatments, including massages, facials, body treatments, manicures and pedicures. In addition to spa treatments, the day spas carry an assortment of relevant apparel as well as lines of personal care products for women. Our day spas are staffed with experienced professionals in all treatment areas. We currently have no plans to expand our day spa operations.

Direct Segment

Our direct segment consists of sales generated through our e-commerce web site and from orders taken from customers over the phone and though the mail. Our direct segment began with the mailing of our first catalog in 1985 and was expanded in 1999 to include our e-commerce business. We use our e-commerce web site, www.coldwatercreek.com, to cost-effectively expand our customer base and provide another convenient shopping alternative for customers. The web site features the entire full-price merchandise offering found in our catalogs. It also serves as an efficient promotional vehicle for the disposition of excess inventory.

Marketing

As a direct-to-consumer retailer we have been able to create an extensive proprietary database of customer information including customer demographics, purchasing history, and geographic proximity to an existing or planned premium retail store. We believe our ability to effectively design and manage our marketing and promotional programs is enhanced by this rich source of information, allowing us to adjust the frequency, timing and content of each marketing program to maximize its benefits.

We seek to present a consistent brand image throughout all of our marketing and promotion activities. Our merchandise is offered through one core catalog title: Coldwater Creek. The Coldwater Creek catalog is the primary branding and marketing vehicle designed to generate sales in all of our sales channels. We continue to evaluate our Coldwater Creek catalog to ensure that we are reaching the greatest number of customers in the most effective and efficient manner possible. We also use national magazine advertising and postcards targeting specific markets to drive traffic to all channels, while promoting overall brand awareness.

Customers are driven to our web site primarily by our catalogs, e-mail campaigns and online advertising. In addition, we participate in cost-per-click search and revenue share-based affiliate

4

programs whereby numerous popular Internet search engines and consumer web sites provide direct access to our web site.

We also offer customer loyalty programs such as onecreek and our co-branded credit card program. The onecreek program benefits include sneak peeks at upcoming trends and new merchandise, onecreek customer service specialists, exclusive onecreek savings and promotions, free shipping on returns, and a special birthday gift. The co-branded credit card program is operated through a third party. Customers who participate in our credit card reward program earn points on purchases made with the credit card at Coldwater Creek and at other businesses where the card is accepted. Cardholders who accumulate the requisite number of points are issued a coupon that is valid towards the purchase of our merchandise. In addition to earning points, all participants in the co-branded credit card program receive exclusive offers throughout the year. These offers have included special discounts, invitations to our shopping events, and periodic opportunities to earn double and triple points.

Merchandise Design and Procurement

We design and develop the majority of our apparel either in-house or through collaboration with independent designers. To ensure our designers stay abreast of trends in styles and fabrics, we operate a design center in New York City. Our New York design team merges the latest fashion trends with our customers' preferences to build an overall vision that guides the design and development of our seasonal merchandise assortment.

Our product development team translates the overall vision for each season into various product designs, fabrics and prints, indicating the construction and exact specifications for each item. Our team seeks inspiration from their extensive travels, fashion shows, and our direct sourcing team, which provides new fabrics and novelty prints along with product samples from various manufacturers. Our direct sourcing team also assists in identifying the appropriate manufacturers to supply each item and in negotiating price and delivery terms.

Once our merchandise assortment is selected, our inventory planning team determines the quantities of each item to purchase in order to meet anticipated demand. This determination is made through the analysis of information such as historical sales, planned merchandise presentation, scheduled store openings, and sales and margin projections. This process culminates in the issuance of various purchase orders. Coordinating with the direct sourcing department, quality assurance and quality compliance personnel monitor the production process to verify the merchandise is produced to exact specifications and within the designated timeline.

We alter the composition, magnitude and timing of merchandise offerings based upon an understanding of prevailing consumer demand, preferences and trends. The timing of merchandise offerings may be further impacted by, among other factors, the performance of various third parties on which we are dependent. Additionally, the net sales we realize from a particular merchandise offering may impact more than one fiscal quarter and year and the amount and pattern of the sales realization may differ from that realized by a similar merchandise offering in a prior fiscal quarter or year. We continually review inventory to identify excess and slow moving merchandise and clear this merchandise through markdown and other promotional offerings. We also dispose of excess and slow moving inventory internally through our full-time sales section within our premium retail stores, outlets and website, and we have on occasion used a third party liquidator.

Our apparel is purchased through both domestic importers who procure the merchandise on our behalf and international manufacturers through our direct sourcing program. During fiscal 2010, we had approximately 290 active vendors and our largest individual vendor represented less than 9 percent of our merchandise purchases. We have sourcing offices in Hong Kong and India to assist with product

5

development and production management, as well as monitoring compliance with our code of conduct and monitoring program discussed further below.

For fiscal 2010, we were the importer of record for approximately 60 percent of our total apparel purchases. We believe direct sourcing provides us with more control over the production, quality and transportation logistics of our apparel and results in faster speed to market and lower merchandise costs. Domestic importers will remain, however, a crucial component of our overall sourcing strategy, providing unique industry and marketplace knowledge along with product design and development capabilities.

We are committed to sourcing our products in a responsible manner, respecting both the countries in which we have a business presence and the business partners that manufacture our products. We have a code of conduct and monitoring program that applies to all factories contracted in the production of merchandise for Coldwater Creek. Within this code, we recognize that local customs and laws vary from one region of the world to another; however, we strongly believe the issues of business ethics, human rights, health, safety and environmental stewardship transcend geographical boundaries. The intention of this code is to communicate our expectations to each of our business partners.

Distribution Facility and Customer Contact Centers

We lease a 960,000 square-foot facility in Mineral Wells, West Virginia which houses our distribution operations and one of our customer contact centers. We also operate a customer contact center located in Coeur d'Alene, Idaho. Our single distribution facility fulfills merchandise needs for our retail locations and merchandise sold through our direct channel. We believe that our distribution facility is adequate to provide the capacity required for the foreseeable future.

Seasonality

Our quarterly results and cash flows can fluctuate significantly depending on a number of factors including the particular seasonal fashion lines and customer response to our merchandise offerings, shifts in the timing of certain holidays, including Valentine's Day, Easter, Mother's Day, Thanksgiving and Christmas, and weather related influences.

Competition

The women's retail apparel market is highly competitive. Competitors range from specialty apparel retail companies such as Chico's, Talbots, Christopher & Banks and Ann Taylor, to small single channel catalog, e-commerce and retail store companies. We also compete with national department store chains such as Macy's, Nordstrom, Dillard's and JC Penney, along with discount retailers that offer women's apparel and accessories, such as Kohl's and Target.

We believe that we compete principally on the basis of our high-quality, distinctive merchandise selection and exceptional customer service. We also believe that an integrated, multi-channel sales strategy enhances our ability to compete in the marketplace by providing convenient access to our merchandise, regardless of our customer's preferred shopping method.

Employees

As of January 29, 2011, we had 2,832 full-time employees and 6,366 part-time employees. During our peak selling season, which includes the months of November and December, we utilize a substantial number of temporary employees. None of our employees are covered by collective bargaining agreements.

6

Trademarks

Our registered trademarks include Coldwater Creek®, Coldwater Creek The Spa® and the stylized Coldwater Creek logo. We believe that our registered and common law trademarks have significant value and are instrumental to our ability to market and sustain demand for our merchandise and brand.

Available Information

We are subject to the reporting requirements of the Securities Exchange Act of 1934, as amended (the Exchange Act), and therefore file periodic reports and other information with the Securities and Exchange Commission (SEC). These reports may be obtained by visiting the Public Reference Room of the SEC at 100 F Street, NE, Washington, D.C. 20549, or by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains an Internet web site at www.sec.gov that contains reports, proxy information statements and other information regarding issuers that file electronically.

Our filings under the Exchange Act, including annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments to these reports, are also available free of charge on the investor relations portion of our web site at www.coldwatercreek.com. These reports are available as soon as reasonably practicable after such material is electronically filed with or furnished to the SEC. The reference to our web site address does not constitute incorporation by reference of the information contained on the web site, and the information contained on the web site is not part of this document.

Executive Officers of the Registrant

The table below sets forth the name, current age and current position of our executive officers as of March 22, 2011:

Name

|

Age | Positions Held | |||

|---|---|---|---|---|---|

| Dennis C. Pence | 61 | Chairman of the Board of Directors, President and Chief Executive Officer | |||

| Jill Brown Dean | 54 | President, Chief Merchandising Officer | |||

| Jerome Jessup | 50 | President, Chief Creative Officer | |||

| James A. Bell | 43 | Senior Vice President, Chief Financial Officer | |||

| John E. Hayes III | 48 | Senior Vice President, General Counsel | |||

Executive Officers

Dennis C. Pence co-founded Coldwater Creek in 1984, and has served as a Director since our incorporation in 1988, serving as the Board's Chairman since July 1999 and as its Vice-Chairman prior to that. Mr. Pence has served as our Chief Executive Officer since September 2009, and previously from September 2002 through October 2007 and from 1984 through December 2000. Mr. Pence has also served as our President since September 2009 and from 1984 through 2000. From June 2002 to September 2002, he provided us with his executive management services. From January 2002 to June 2002, Mr. Pence served as our interim Chief Financial Officer and Treasurer. From January 2001 to January 2002, Mr. Pence was semi-retired. Mr. Pence has also served as Chairman of the Board's Executive Committee since its formation in May 2000, a member of the Succession Planning and Management Development committee since November 2007, and as Secretary from July 1998 to February 2009. From April 1999 to December 2000, he was also the President of our Internet Commerce Division. Prior to co-founding Coldwater Creek, Mr. Pence was employed by Sony Corp. of America, a subsidiary of Sony Corporation, a publicly held manufacturer of audio, video, communication, and information technology products, from 1975 to 1983, where his final position was National Marketing Manager—Consumer Video Products.

7

Jill Brown Dean joined us as President and Chief Merchandising Officer in February 2011. Prior to joining Coldwater Creek, Ms. Dean served as President of the Limited Too division of Tween Brands from October 2006 to April 2008. Prior to that, Ms. Dean spent 18 years with Limited Brands, serving as Executive Vice President, General Manager for Victoria's Secret flagship stores from July 2003 to October 2006, as well as President and Chief Executive Officer of Lane Bryant from June 1994 to October 2001. Ms. Dean began her career at Limited Brands in merchandising for the Express division.

Jerome Jessup was appointed President and Chief Creative Officer in February 2011, having joined the Company in August 2009 as Executive Vice President, Creative Director. Prior to joining Coldwater Creek, Mr. Jessup ran his own fashion collection and consulting practice for four years. Prior to that, he was the Senior Executive Vice President of Design and Merchandising for Ann Taylor. Mr. Jessup also spent ten years with The Gap, Inc., leading the design and product development functions for Banana Republic, as well as for The Gap, GapKids, babyGap and GapBody divisions.

James A. Bell has served as Senior Vice President and Chief Financial Officer since April 2010. Upon joining the Company, Mr. Bell served as Divisional Vice President of Financial Planning from September 2009 until December 2009. From December 2009 to April 2010, Mr. Bell served as Vice President of Financial Planning. Prior to joining Coldwater Creek, Mr. Bell served from April 2007 to June 2009 as Senior Vice President, Finance and Planning for Harry and David Holdings, Inc. From October 2002 to April 2007, Mr. Bell was Senior Director, Finance at The Gap, Inc. Prior to his role at Gap, Mr. Bell served in various senior finance roles at SmartPipes, Inc., a software company and in Piper Jaffray's Investment Banking group. Prior to his role at Piper Jaffray, Mr. Bell served in the U.S. Navy for nine years on active duty as a Naval Flight Officer.

John E. Hayes III joined us as Senior Vice President, General Counsel in February 2009 and served as the Company's interim Chief Financial Officer from November 2009 to April 2010, as well as our Human Resources executive from November 2009 to the present. Prior to joining Coldwater Creek, Mr. Hayes was engaged for 17 years in private law practice, most recently as a partner with Hogan & Hartson, LLP, from March 2003 to February 2009. While in private practice, Mr. Hayes served as our outside corporate and securities law counsel from 1999 until joining us. Prior to his legal career, Mr. Hayes practiced as an accountant with KPMG LLP.

8

In addition to the other information set forth in this report, you should carefully consider the following risk factors which could materially affect our business, financial condition or future results of operations. The risks described below are not the only risks we face. Additional risks and uncertainties not currently known or that are currently deemed immaterial may also adversely affect our business, financial condition, or future results of operations.

We must successfully gauge fashion trends and changing consumer preferences.

Forecasting consumer demand for our merchandise is difficult given the nature of changing fashion trends and consumer preferences, which can vary by season and from one geographic region to another and be affected by general economic conditions that are difficult to predict. The global specialty retail business fluctuates according to changes in consumer preferences dictated, in part, by fashion and season. In addition, our merchandise assortment differs in each seasonal flow and at any given time our assortment may not resonate with our customer base. On average, we begin the design process for apparel nine to ten months before merchandise is available to consumers, and we typically begin to make purchase commitments four to eight months in advance. These lead times make it difficult for us to respond quickly to changes in demand for our products. To the extent we misjudge the market for our merchandise or the products suitable for local markets, our sales will be adversely affected and the markdowns required to move the resulting excess inventory will adversely affect our results of operations.

We are working to improve our merchandise assortment to provide fashionable looks and current styles interpreted appropriately for our customer. Creating product with a new creative aesthetic designed for our core and target customer demographic increases our design risk. If our new design aesthetic and merchandise assortments do not resonate with our core and target customer demographic, our sales, gross margins and results of operations may be adversely affected.

Our inventory levels and merchandise assortments fluctuate seasonally, and at certain times of the year, such as during the holiday season, we maintain higher inventory levels and are particularly susceptible to risks related to demand for our merchandise. If the demand for our merchandise were to be lower than expected, causing us to hold excess inventory, we would be forced to further discount merchandise, which reduces our gross margins, results of operations and operating cash flows. If we were to carry low levels of inventory and demand is stronger than we anticipate, we may not be able to reorder merchandise on a timely basis to meet demand, which may adversely affect sales and customer satisfaction.

Economic conditions have impacted consumer spending and may adversely affect our financial position and results of operations.

Consumer spending patterns are highly sensitive to the economic climate and overall consumer confidence. Consumer spending continues to be impacted by the high levels of unemployment, declines in home values, restrictions on the availability of credit, volatile energy and food costs, and other negative economic conditions, nationally and regionally. We continue to be affected by challenging macroeconomic conditions which are evidenced in our business by a highly competitive retail selling environment and low retail store traffic. We believe these conditions will continue into fiscal 2011 and for the foreseeable future. If consumer spending on apparel and accessories continues to decline and demand for our products decreases further, we may be forced to further discount our merchandise or sell it at a loss, which would adversely affect revenues, gross margins, earnings and operating cash flows. In addition, higher costs for transportation, raw materials, labor, insurance and healthcare, and other negative economic factors may adversely affect our cost of sales and operating expenses.

9

We may be unable to maintain the value of our brand.

Our success is driven by the value of the Coldwater Creek brand. Maintaining, promoting and positioning our brand will depend largely on the success of our design, merchandise assortment, and marketing efforts and our ability to provide a consistent, high quality customer experience. Our brand could also be adversely affected by negative publicity targeting our public image and reputation. Deterioration of the value of our brand may adversely affect our business and results of operations.

Our credit facility contains borrowing base and other provisions that may restrict our ability to access it.

The distress in the financial markets has resulted in extreme volatility in securities prices and diminished liquidity and credit availability, which may adversely affect our liquidity. Additionally, lower than expected sales that negatively impact our cash flows could require us to borrow under our credit facility. Although we currently do not have any borrowings under our $70 million secured credit facility, we currently use it for letters of credit which reduces the amount available for borrowings. The actual amount of credit that is available from time to time under our credit facility is limited to a borrowing base amount that is determined according to, among other things, a percentage of the value of eligible inventory plus a percentage of the value of eligible credit card receivables, as reduced by certain reserve amounts that may be determined at the discretion of the lender. Consequently, it is possible that, should we need to access our credit facility, it may not be available in full. Additionally, our credit facility contains covenants related to capital expenditure levels and minimum inventory book value, and other customary matters. Our failure to comply with the covenants, terms and conditions of our credit facility could cause the facility not to be available to us. Tightening of the credit markets could make it difficult for us to enter into agreements for new indebtedness or obtain funding through the issuance of our securities.

We have incurred substantial financial commitments and fixed costs related to our retail stores that we will not be able to recover if our stores are not successful.

The success of an individual store location depends largely on the success of the lifestyle center or shopping mall where the store is located, and may be influenced by changing customer demographic and consumer spending patterns. These factors cannot be predicted with complete accuracy. Because we are required to make long-term financial commitments when leasing retail store locations, and to incur substantial fixed costs for each store's design, leasehold improvements, fixtures and management information systems, it would be costly for us to close a store that does not prove successful. The current economic environment may also adversely affect the ability of developers or landlords to meet commitments to us to pay for certain tenant improvement costs we incur in connection with building out new retail store locations.

The testing of our retail stores' long-lived assets for impairment requires us to make significant estimates about our future performance and cash flows that are inherently uncertain. These estimates can be affected by numerous factors, including changes in economic conditions, our operations, and competitive conditions in the industry. These factors, or changes in actual performance compared with estimates of our future performance, may affect the timing and the fair value estimates used in our testing of long-lived assets, which may result in impairment charges.

We are subject to potentially adverse outcomes in litigation matters.

We are, from time to time, involved in various legal proceedings incidental to the conduct of our business. Actions which may be filed against us include commercial, intellectual property infringement, customer and employment claims, including class action lawsuits alleging that we have violated federal and state wage and hour and other laws. These issues arise primarily in the ordinary course of business but could raise complex factual and legal issues, which are subject to multiple risks and uncertainties

10

and could require significant management time and costs to defend. We believe that our current litigation issues will not have a material adverse effect on our results of operations or financial condition. However, our assessment of current litigation could change in light of the discovery of facts not presently known to us with respect to pending legal actions, or adverse determinations by judges, juries or other finders of fact. Moreover, additional litigation that is not currently pending may adversely affect our results of operations or financial condition.

Our results of operations fluctuate and may be negatively impacted by seasonal influences.

Our net sales, results of operations, liquidity and cash flows have fluctuated, and will continue to fluctuate, on a quarterly basis, as well as on an annual basis, as a result of a number of factors, including, but not limited to, the following:

- •

- the composition, size and timing of various merchandise offerings;

- •

- the timing and number of premium retail store openings and closings;

- •

- the timing and number of promotions;

- •

- the timing and number of catalog mailings;

- •

- the ability to accurately estimate and accrue for merchandise returns and the costs of obsolete inventory disposition;

- •

- the timing of merchandise shipping and receiving, including any delays resulting from labor strikes or slowdowns, adverse

weather conditions, health epidemics or national security measures; and

- •

- shifts in the timing of important holiday selling seasons relative to our fiscal quarters, including Valentine's Day, Easter, Mother's Day, Thanksgiving and Christmas, and the day of the week on which certain important holidays fall.

Our results continue to depend materially on sales and profits from the November and December holiday shopping season. In anticipation of traditionally increased holiday sales activity, we incur certain significant incremental expenses, including the hiring of a substantial number of temporary employees to supplement the existing workforce. If, for any reason, we were to realize lower-than-expected sales or profits during the November and December holiday selling season, as we did in fiscal 2010, 2009 and 2008, our financial condition, results of operations, including related gross margins, and cash flows for the entire fiscal year may be adversely affected.

We may be unable to manage the complexities of our multi-channel business model, which could harm our results of operations.

The complexity of our multi-channel business model requires a level of expertise to successfully manage operations. As we continue to tightly control expenses, we may experience an increase in demands on our managerial, operational and administrative resources, as well as our control environment. If we do not manage these demands, we may not realize the full benefits of our multi-channel business model, which may adversely affect our results of operations.

We are subject to significant risks associated with our management information systems.

We have a number of complex management information systems that are critical to our operations, including systems such as accounting, human resources, inventory purchasing and management, financial planning, direct segment order processing, and retail segment point-of-sale systems. Installing new systems or maintaining and upgrading existing systems carries substantial risk, including potential loss of data or information, cost overruns, implementation delays, disruption of operations, lower

11

customer satisfaction resulting in lost customers, inability to deliver merchandise to our stores or our customers and our potential inability to meet reporting requirements, any of which would harm our business and may adversely affect our results of operations.

We depend on key vendors for timely and effective sourcing and delivery of our merchandise. If these vendors are unable to timely fill orders or meet quality standards, we may lose customer sales and our reputation may suffer.

We may experience difficulties in obtaining sufficient manufacturing capacity from our vendors. We generally maintain non-exclusive relationships with multiple vendors that manufacture our merchandise. However, we have no contractual assurances of continued supply, pricing or access to new products, and any vendor could discontinue selling to us at any time. Moreover, a key vendor may become unable to supply our inventory needs due to capacity constraints, financial instability, or other factors beyond our control, or we could decide to stop using a vendor due to quality or other issues. If we were required to change vendors or if a key vendor were unable to supply desired merchandise in sufficient quantities on acceptable terms, particularly in light of current global economic conditions, we could experience delays in filling customer orders or delivering inventory to stores until alternative supply arrangements were secured. These delays could result in lost sales and a decline in customer satisfaction. The inability of key vendors to access credit and liquidity, or the insolvency of key vendors, could lead to their failure to deliver our merchandise, which would result in lost sales and lower customer satisfaction. It is also possible that the inability of our vendors to access credit will cause them to extend less favorable terms to us, which could adversely affect our cash flows, margins and financial condition, as well as limit the availability under our credit facility. Additionally, delays by our vendors in supplying our inventory needs could cause us to incur more expensive air freight charges, which may adversely affect our margins.

Our reliance on foreign vendors subjects us to uncertainties that could impact our costs to source merchandise, delay or prevent merchandise shipments, or harm our business reputation.

We continue to source apparel directly from foreign vendors, particularly those located in Asia, India and Central America. We were the importer of record for approximately 60 percent of our total apparel purchases during fiscal 2010. Irrespective of our direct sourcing from foreign vendors, substantially all of our merchandise, including that which we buy from domestic vendors, is manufactured overseas. This exposes us to risks and uncertainties which could substantially impact our ability to realize any perceived cost savings. These risks include, among other things:

- •

- burdens associated with doing business overseas, including the imposition of, or increases in, tariffs or import duties,

or import/export controls or regulations, as well as credit assurances we are required to provide to foreign vendors;

- •

- declines in the relative value of the U.S. dollar to foreign currencies;

- •

- volatile fuel, energy and raw material costs, such as recent increases in the cost of cotton;

- •

- failure of vendors to adhere to our quality assurance standards, code of conduct and other environmental, labor, health,

and safety standards for the benefit of workers;

- •

- financial instability of a vendor or vendors, including their potential inability to obtain credit to manufacture the

merchandise they produce for us;

- •

- the potential inability of our vendors to meet our production needs due to raw material or labor shortages;

12

- •

- changing, uncertain or negative economic conditions, political uncertainties or unrest, or epidemics or other health or

weather-related events in foreign countries resulting in the disruption of trade from exporting countries; and

- •

- restrictions on the transfer of funds or transportation delays or interruptions.

We face substantial competition from other retailers in the women's apparel industry.

We face substantial competition from retailers for elements in our merchandise lines, and net sales may decline or grow more slowly if we are unable to differentiate our merchandise and shopping experience from those of other retailers. In addition, the retail apparel industry has experienced significant price deflation over the past several years largely due to the downward pressure on retail prices caused by discount retailers and, more recently, by declining consumer spending, resulting in increased promotional and competitive activity. We expect this price deflation to continue as a result of the recent expiration of quota restrictions on the importing of apparel into the United States from foreign countries that are members of the World Trade Organization. This price deflation may make it more difficult for us to maintain gross margins and to compete with retailers that have greater purchasing power than we have.

Consumer concerns about purchasing items via the Internet as well as external or internal infrastructure system failures could negatively impact our e-commerce sales or cause us to incur additional costs.

Our business is vulnerable to consumer privacy concerns relating to purchasing items over the Internet, security breaches, and failures of Internet infrastructure and communications systems. If consumer confidence in making purchases over the Internet declines as a result of privacy or other concerns, our e-commerce net sales may be adversely affected. We may be required to incur increased costs to address or remedy any system failures or security breaches or any actual or perceived consumer privacy concerns.

We may be unable to efficiently fill customer orders in our direct channel, which could harm customer satisfaction.

If we are unable to efficiently process and fill customer orders, customers may cancel or refuse to accept orders, and customer satisfaction could be harmed. We are subject to, among other things:

- •

- failures in the efficient and uninterrupted operation of our customer contact centers or our sole distribution center in

Mineral Wells, West Virginia, including system failures caused by telecommunications systems providers and order volumes that exceed our present telephone or Internet system capabilities;

- •

- delays or failures in the performance of third parties, such as vendors who supply our merchandise, shipping companies and

the U.S. postal and customs services, including delays associated with labor disputes, labor union activity, inclement weather, natural disasters, health epidemics and possible acts of terrorism; and

- •

- disruptions or slowdowns in our order processing or fulfillment systems resulting from increased security measures implemented by U.S. customs, or from homeland security measures, telephone or Internet down times, system failures, computer viruses, electrical outages, mechanical problems, human error or accidents, fire, natural disasters or comparable events.

13

We have a liberal merchandise return policy and we may experience a greater number of returns than we anticipate.

As part of our commitment to superior customer service, we accept returns virtually at any time and for any reason through any channel regardless of initial point of purchase. We make allowances in our financial statements for anticipated merchandise returns based on historical return rates and future expectations. These allowances may be exceeded, however, by actual merchandise returns as a result of many factors, including changes in the merchandise mix, size and fit, actual or perceived quality, differences between the actual product and its presentation in catalogs or on the web site, timeliness of delivery, competitive offerings and consumer preferences or confidence. Any significant increase in merchandise returns that exceed our estimates would result in adjustments to revenue and to cost of sales and may adversely affect our financial condition, results of operations and cash flows.

We may be unable to manage significant increases in the costs associated with the catalog business.

We incur substantial costs associated with catalog mailings, including paper, postage, merchandise acquisition and human resource costs associated with catalog layout and design, production and circulation and increased inventories. Significant increases in U.S. Postal Service rates and the cost of telecommunications services, paper and catalog production could significantly increase catalog production costs and result in lower profits for the catalog business. Most of our catalog-related costs are incurred prior to mailing, and as such we are not able to adjust the costs of a particular catalog mailing to reflect the actual subsequent performance of the catalog. Moreover, customer response rates have been volatile in recent years, particularly for mailings to prospective customers. Because the catalog business accounts for a significant portion of total net sales, any performance shortcomings experienced by the catalog business may adversely affect our overall business, financial condition, results of operations and cash flows.

Our success is dependent upon key personnel and our ability to attract and retain qualified employees.

Our future success depends largely on the contributions and abilities of key executives and other employees. The loss of any of our key employees may adversely affect our business. Furthermore, the current economic conditions or the location of our corporate headquarters in Sandpoint, Idaho, may make it more difficult or costly to attract qualified employees for key positions. We have made significant changes at all levels of our merchandising and creative teams, including both internal promotions and new hires. We believe that we now have the key people in place to enable us to reinvigorate our product assortment and reposition our brand. However, there can be no assurance that these key employees will be successful in executing our initiatives.

Our multi-channel business model may expose us to assessments for unpaid taxes.

Our multi-channel business model subjects us to state and local taxes in numerous jurisdictions, including state income, franchise, and sales and use tax. We collect these taxes in any jurisdiction in which we have a physical presence. While we believe we have appropriately paid or accrued for all taxes based on our interpretation of applicable law, tax laws are complex and interpretations differ from state to state. In the past, some taxing jurisdictions have assessed additional taxes and penalties on us, asserting either an error in our calculation or an interpretation of the law that differed from our own. It is possible that taxing authorities may make additional assessments in the future. In addition to taxes, penalties and interest, these assessments could cause us to incur legal fees associated with resolving disputes with taxing authorities.

Additionally, changes in state and local tax laws, such as temporary changes associated with "tax holidays" and other programs, require us to make continual changes to our collection and reporting systems that may relate to only one taxing jurisdiction. If we fail to update our collection and reporting

14

systems in response to these changes, any over collection or under collection of sales taxes could subject us to interest and penalties, as well as private lawsuits and damage to our reputation.

The majority of our cash and cash equivalents are concentrated with one financial institution.

We maintain the majority of our cash and cash equivalents with one major financial institution in the United States, in the form of demand deposits, money market accounts and other short-term investments. Deposits in this institution may exceed the amounts of insurance provided on such deposits. With the current financial environment and the instability of financial institutions, we cannot be assured that we will not experience losses on our deposits.

The stock price has fluctuated and may continue to fluctuate widely.

The market price for our common stock has fluctuated and has been and will continue to be significantly affected by, among other factors, quarterly operating results, changes in any earnings estimates publicly announced by us or by analysts, customer response to merchandise offerings, the size of catalog mailings, the timing of retail store openings or of important holiday seasons relative to our fiscal periods, seasonal effects on sales and various factors affecting the economy in general. In addition, stock markets generally have experienced a high level of price and volume volatility and market prices for the stock of many companies including ours, have experienced wide price fluctuations not necessarily related to their operating performance. The reported high and low sale prices of our common stock were $8.75 per share and $2.71 per share, respectively, during fiscal 2010. The fluctuation of the market price of our common stock may have a negative impact on our liquidity and access to capital. In addition, price volatility of our common stock may expose us to stockholder litigation which may adversely affect our financial condition, results of operations and cash flows.

Our largest stockholders may exert influence over our business regardless of the opposition of other stockholders or the desire of other stockholders to pursue an alternate course of action.

Dennis Pence, our Chairman of the Board of Directors, President, CEO and co-founder, may be deemed to beneficially own directly and indirectly, approximately 14.3 percent of our outstanding common stock as of March 22, 2011. Ann Pence, our co-founder, may be deemed to beneficially own, directly and indirectly, approximately 19.6 percent of our outstanding common stock as of March 22, 2011. Either Dennis Pence or Ann Pence acting independently, would have significant influence over, and should they act together, could effectively control the outcome of, any matters submitted to stockholders, including the election of directors and approval of business combinations, and could delay, deter or prevent a change of control of the Company, which may adversely affect the market price of our common stock. The interests of these stockholders may not always coincide with the interests of other stockholders.

Provisions in the charter documents and Delaware law may inhibit a takeover and discourage, delay or prevent stockholders from replacing or removing current directors or management.

Provisions in our Certificate of Incorporation and Bylaws may have the effect of delaying or preventing a merger with or acquisition of us, even where the stockholders may consider it to be favorable. These provisions could also prevent or hinder an attempt by stockholders to replace current directors and include:

- •

- providing for a classified Board of Directors with staggered, three-year terms;

- •

- prohibiting cumulative voting in the election of directors;

- •

- authorizing the Board to designate and issue "blank check" preferred stock;

- •

- limiting persons who can call special meetings of the Board of Directors or stockholders;

15

- •

- prohibiting stockholder action by written consent; and

- •

- establishing advance notice requirements for nominations for election to the Board of Directors or for proposing matters that can be acted on by stockholders at a stockholders meeting.

Because the Board of Directors appoints management, any inability to effect a change in the Board of Directors may also result in the entrenchment of management.

We are also subject to Section 203 of the Delaware General Corporation Law, which, subject to exceptions, prohibits a Delaware corporation from engaging in any business combination with an interested stockholder for a period of three years following the date that the stockholder became an interested stockholder. The preceding provisions of our Certificate of Incorporation and Bylaws, as well as Section 203 of the Delaware General Corporation Law, could discourage potential acquisition proposals, delay or prevent a change of control and prevent changes in our management.

The day spa concept may not be successful and may be abandoned at any time.

We operate the Coldwater Creek ~ The Spa concept in nine locations. To date, our day spas have had a negative impact on our earnings, as we experiment with marketing approaches and gather data regarding the spa business and, in particular, our spa customer. We have no plans to build additional day spas. There is no assurance that the day spa concept will ever be successful.

If we were to abandon the day spa concept, we would be required to write off any remaining net capitalized costs and may incur lease termination costs, which may adversely affect results of operations. Additionally, we may incur impairment charges related to our day spas if there were a continued deterioration in the spas' results of operations.

We may be unable to successfully grow our premium retail store base, which could result in lower long term revenue growth.

We continue to believe that retail expansion will be a key driver for our long term growth. However, due to our recent business performance, we have scaled back our store opening plans. During fiscal 2010, we opened 19 new premium retail stores and closed two, ending the year with 373 premium retail stores. We plan to limit new store openings in fiscal 2011 to five stores to which we have previously committed and to close between eight and 12 stores. However, there can be no assurance that these stores will be opened, will be opened in a timely manner, or, if opened, that these stores will be profitable. The ability to open retail stores depends on our ability to successfully:

- •

- identify or secure premium retail space;

- •

- negotiate site leases on favorable lease terms for the retail store locations we identify; and

- •

- prevent construction delays and cost overruns in connection with the build-out of new stores.

Any miscalculations or shortcomings we may make in the planning and control of our retail stores may adversely affect our financial position, results of operations and cash flows. In addition, current macroeconomic conditions could result in an inability on the part of real estate developers to obtain retail property in preferred locations.

We do not maintain a specific rollout plan beyond a one-year horizon. We continually reassess store rollout plans based on the overall retail environment, the performance of the retail business, our access to working capital and external financing and the availability of suitable store locations. For example, it is possible that in any year we will increase planned store openings, particularly if we experience strong retail sales and have access to the necessary working capital or external financing. Likewise, we would be inclined to further curtail our store rollout if we were to continue to experience

16

weak retail sales or if we did not have adequate working capital or access to financing, or as a part of a cost containment initiative.

We may be unable to protect our trademarks from infringement.

Our registered trademarks, which include Coldwater Creek®, Coldwater Creek The Spa® and the stylized Coldwater Creek logo, are important to our success. Even though we register and protect our trademarks and other intellectual property rights, there is no assurance that our actions will protect us from others infringing upon our trademarks and proprietary rights or seeking to block sales of our products as infringements of their trademarks and proprietary rights. If we cannot adequately protect our marks or prevent infringement of them, our business and results of operations may be adversely affected.

Item 1B. UNRESOLVED STAFF COMMENTS

None.

The general location, use and approximate size of our principal properties as of January 29, 2011 are as follows:

Facility

|

Address | Owned/ Leased |

Approximate Size | |||

|---|---|---|---|---|---|---|

Corporate Offices(a) |

Sandpoint, Idaho | Owned | 270,000 sq. ft. | |||

East Coast Operations Center, including Distribution and Customer Contact Center |

Mineral Wells, West Virginia |

Leased |

960,000 sq. ft. |

|||

Coeur d'Alene Customer Contact Center |

Coeur d'Alene, Idaho |

Leased |

69,000 sq. ft. |

|||

Foreign sourcing offices |

Hong Kong and Delhi, India |

Leased |

17,000 sq. ft. |

|||

New York Design Studio |

New York City, New York |

Leased |

20,000 sq. ft. |

|||

373 Premium Retail Stores(b) |

Various U.S. locations |

Leased |

2,186,000 sq. ft. |

|||

39 Outlet Stores(c) |

Various U.S. locations |

Leased |

270,000 sq. ft. |

|||

9 Day Spas(d) |

Various U.S. locations |

Leased |

49,000 sq. ft. |

- (a)

- Our

corporate offices include approximately 176,000 square feet of administrative office space and approximately 94,000 square feet occupied by our employee

fitness center, spa, virtual retail stores, photo studio, and employee training center.

- (b)

- Our

premium retail stores average approximately 5,900 square feet in size per store. The base term of our premium retail store leases is generally ten

years. Store count includes 372 premium retail stores and one flagship store located in Manhattan, New York.

- (c)

- Our

outlet stores average approximately 6,900 square feet in size per store. The base term of our outlet store leases is generally five years.

- (d)

- Our day spas average approximately 5,400 square feet in size per spa. The base term of our day spa leases is generally ten years.

We believe that our corporate offices, distribution center and customer contact centers will meet our operational needs for the foreseeable future.

17

We are, from time to time, involved in various legal proceedings incidental to the conduct of business. Actions filed against us from time to time include commercial, intellectual property infringement, customer and employment claims, including class action lawsuits alleging that we violated federal and state wage and hour and other laws. We believe that we have meritorious defenses to all lawsuits and legal proceedings currently pending against us. Though we will continue to vigorously defend such lawsuits and legal proceedings, we are unable to predict with certainty whether or not we will ultimately be successful.

On September 12, 2006, as amended on April 25, 2007, Brighton Collectibles, Inc. (Brighton) filed a complaint against us in the United States District Court for the Southern District of California. The complaint alleged, among other things, that we violated trade dress and copyright laws. On November 21, 2008, a jury found us liable to Brighton for copyright and trade dress infringement. In January 2009, the court entered a judgment in the total amount of $8.0 million, which includes damages of $2.7 million on the trade dress claim, $4.1 million in damages and profits on the copyright claim and $1.2 million in attorneys' fees. We have appealed the judgment as we believe there are legitimate grounds to overturn the judgment. Pending the appeal, the court entered a temporary stay of execution conditioned on us posting an $8.0 million bond, which has been posted. On December 12, 2008, as amended on September 17, 2009, Brighton filed another complaint against us in the United States District Court for the Southern District of California. This additional complaint alleges copyright infringement of three different Brighton designs and seeks to recover damages of approximately $0.7 million, plus attorneys' fees and costs. We are vigorously defending this matter. We believe it is without merit and we are asserting various defenses to the action. We believe that the amount of loss, if any, related to these legal proceedings is adequately reserved for or covered by insurance.

18

Item 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Price Range of Common Stock and Dividend Policy

Our common stock has been quoted on the NASDAQ Stock Market under the symbol "CWTR" since our initial public offering on January 29, 1997. On March 22, 2011, we had 6,471 stockholders of record and 92,503,103 shares of common stock, $0.01 par value per share, outstanding.

The following table sets forth the high and low sales price data for our common stock for the periods indicated:

| |

Price Range of Common Stock |

||||||

|---|---|---|---|---|---|---|---|

| |

High | Low | |||||

Fiscal 2010: |

|||||||

First Quarter |

$ | 8.75 | $ | 4.22 | |||

Second Quarter |

$ | 7.37 | $ | 3.13 | |||

Third Quarter |

$ | 5.89 | $ | 3.27 | |||

Fourth Quarter |

$ | 3.58 | $ | 2.71 | |||

Fiscal 2009: |

|||||||

First Quarter |

$ | 3.96 | $ | 1.42 | |||

Second Quarter |

$ | 7.48 | $ | 3.48 | |||

Third Quarter |

$ | 9.20 | $ | 5.62 | |||

Fourth Quarter |

$ | 6.43 | $ | 4.14 | |||

We have never paid a cash dividend on our common stock nor do we expect to declare a cash dividend in the foreseeable future. In addition, the payment of dividends is subject to certain restrictions under our Credit Agreement.

19

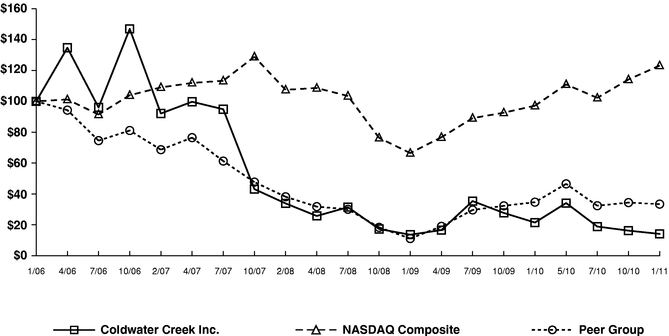

Performance Graph

The following graph compares the cumulative five-year total return to stockholders on Coldwater Creek Inc.'s common stock to the cumulative total returns of the NASDAQ Composite Index, and a customized peer group of the following four companies: AnnTaylor Stores Corp., Chico's FAS Inc., Christopher & Banks Corp. and Talbots Inc. The stock price performance shown below is not necessarily indicative of future performance.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

Among Coldwater Creek Inc., the NASDAQ Composite Index and a Peer Group

* $100 invested on 1/28/06 in stock or 1/31/06 in index, including reinvestment of dividends. Index calculated on month-end basis.

| |

1/06 | 4/06 | 7/06 | 10/06 | 2/07 | 4/07 | 7/07 | 10/07 | 2/08 | 4/08 | |||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Coldwater Creek Inc. |

$ | 100.00 | $ | 134.68 | $ | 96.00 | $ | 146.87 | $ | 92.10 | $ | 99.71 | $ | 94.85 | $ | 43.11 | $ | 33.86 | $ | 25.72 | |||||||||||

NASDAQ Composite |

$ | 100.00 | $ | 101.18 | $ | 91.44 | $ | 103.94 | $ | 109.00 | $ | 111.90 | $ | 113.32 | $ | 128.85 | $ | 107.45 | $ | 108.61 | |||||||||||

Peer Group |

$ | 100.00 | $ | 94.27 | $ | 74.53 | $ | 81.09 | $ | 68.65 | $ | 76.46 | $ | 61.30 | $ | 47.66 | $ | 38.16 | $ | 31.76 | |||||||||||

| 7/08 | 10/08 | 1/09 | 4/09 | 7/09 | 10/09 | 1/10 | 5/10 | 7/10 | 10/10 | 1/11 | ||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| $ | 31.41 | $ | 17.29 | $ | 13.58 | $ | 16.62 | $ | 35.36 | $ | 27.70 | $ | 21.48 | $ | 34.10 | $ | 18.88 | $ | 16.23 | $ | 14.11 | |||||||||||

| $ | 103.45 | $ | 76.32 | $ | 66.46 | $ | 76.73 | $ | 89.08 | $ | 92.62 | $ | 97.13 | $ | 110.92 | $ | 102.23 | $ | 114.12 | $ | 123.13 | |||||||||||

| $ | 30.05 | $ | 18.34 | $ | 11.11 | $ | 18.98 | $ | 29.62 | $ | 32.29 | $ | 34.67 | $ | 46.51 | $ | 32.35 | $ | 34.40 | $ | 33.40 | |||||||||||

The information required by this item concerning equity compensation plans is incorporated by reference to "Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters" of this Annual Report on Form 10-K.

20

Item 6. SELECTED FINANCIAL DATA

The following statements of operations and balance sheet data have been derived from our audited financial statements. The information presented below should be read in conjunction with Management's Discussion and Analysis of Financial Condition and Results of Operations and our consolidated financial statements and related notes included elsewhere herein. All information is presented in thousands except per share, average square feet per store and store count data.

| |

Fiscal Year Ended(a) | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

January 29, 2011 |

January 30, 2010(b) |

January 31, 2009 |

February 2, 2008 |

February 3, 2007(c) |

||||||||||||

| |

(52 weeks) |

(52 weeks) |

(52 weeks) |

(52 weeks) |

(53 weeks) |

||||||||||||

Statement of Operations Data: |

|||||||||||||||||

Net sales |

$ | 981,101 | $ | 1,038,581 | $ | 1,024,221 | $ | 1,151,472 | $ | 1,054,611 | |||||||

Gross profit |

$ | 307,285 | $ | 334,281 | $ | 350,560 | $ | 450,183 | $ | 471,007 | |||||||

Net income (loss) |

$ | (44,111 | ) | $ | (56,132 | ) | $ | (25,963 | ) | $ | (2,488 | ) | $ | 55,372 | |||

Net income (loss) per common share—Basic |

$ | (0.48 | ) | $ | (0.61 | ) | $ | (0.29 | ) | $ | (0.03 | ) | $ | 0.60 | |||

Net income (loss) per common share—Diluted |

$ | (0.48 | ) | $ | (0.61 | ) | $ | (0.29 | ) | $ | (0.03 | ) | $ | 0.59 | |||

Weighted average common shares outstanding—Basic |

92,316 | 91,597 | 91,037 | 92,801 | 92,616 | ||||||||||||

Weighted average common shares outstanding—Diluted |

92,316 | 91,597 | 91,037 | 92,801 | 94,485 | ||||||||||||

Cash dividends declared per common share |

$ | — | $ | — | $ | — | $ | — | $ | — | |||||||

Selected Segment Data: |

|||||||||||||||||

Net sales: |

|||||||||||||||||

Retail |

$ | 732,430 | $ | 782,429 | $ | 751,352 | $ | 775,082 | $ | 664,170 | |||||||

Direct |

$ | 248,671 | $ | 256,152 | $ | 272,869 | $ | 376,390 | $ | 390,441 | |||||||

Operating income: |

|||||||||||||||||

Retail |

$ | 27,083 | $ | 37,479 | $ | 30,396 | $ | 76,585 | $ | 107,566 | |||||||

Direct |

40,483 | 41,837 | 42,108 | 55,878 | 98,595 | ||||||||||||

Segment operating income |

67,566 | 79,316 | 72,504 | 132,463 | 206,161 | ||||||||||||

Unallocated corporate and other |

(110,945 | ) | (124,494 | ) | (118,716 | ) | (143,132 | ) | (122,266 | ) | |||||||

Income (loss) from operations |

$ | (43,379 | ) | $ | (45,178 | ) | $ | (46,212 | ) | $ | (10,669 | ) | $ | 83,895 | |||

Selected Operating Data: |

|||||||||||||||||

Total catalogs mailed |

83,125 | 91,365 | 85,950 | 128,551 | 118,690 | ||||||||||||

Average premium retail store size in square feet |

5,900 | 5,900 | 5,900 | 5,800 | 5,600 | ||||||||||||

Balance Sheet Data: |

|||||||||||||||||

Cash and cash equivalents |

$ | 51,613 | $ | 84,650 | $ | 81,230 | $ | 62,479 | $ | 148,680 | |||||||

Inventory |

$ | 156,481 | $ | 161,546 | $ | 135,376 | $ | 139,993 | $ | 126,953 | |||||||

Working capital |

$ | 81,846 | $ | 98,885 | $ | 92,989 | $ | 115,750 | $ | 173,319 | |||||||

Total assets |

$ | 506,723 | $ | 583,523 | $ | 628,627 | $ | 624,259 | $ | 580,475 | |||||||

Total long-term debt, including capital leases(d) |

$ | 12,241 | $ | 11,454 | $ | 13,316 | $ | 14,467 | $ | 1,008 | |||||||

Stockholders' equity |

$ | 193,009 | $ | 235,561 | $ | 282,496 | $ | 301,863 | $ | 317,456 | |||||||

Premium Retail Store Count: |

|||||||||||||||||

Beginning of the fiscal year(e) |

356 | 348 | 306 | 240 | 174 | ||||||||||||

Opened during the period |

19 | 8 | 42 | 66 | 65 | ||||||||||||

Closed during the period |

2 | — | — | — | — | ||||||||||||

End of the fiscal year |

373 | 356 | 348 | 306 | 239 | ||||||||||||

- (a)

- References

to a fiscal year refer to the calendar year in which the fiscal year commences. Our fiscal year end is the Saturday nearest

January 31st. This floating fiscal year end typically results in 13-week fiscal quarters and a 52-week fiscal year, but occasionally will contain an

additional week resulting in a 14-week fiscal fourth quarter and a 53-week fiscal year.

- (b)

- During fiscal 2009, we recorded a $24.4 million non-cash income tax charge, or $0.27 per share, related to a valuation allowance against net deferred tax assets. U.S. GAAP requires that we assess whether a valuation allowance should be established against our deferred tax assets based on the consideration of all available evidence using a "more likely than not" standard. In making such judgments, significant weight is given to evidence that can be objectively verified. A company's current or previous losses are given more weight than its projected future performance. Consequently, based on available evidence, in particular our three-year historical cumulative losses, we recorded a valuation allowance against our net deferred tax asset. The recording of a valuation allowance has no impact on cash and does not preclude us from utilizing the full amount of the deferred tax asset in future profitable periods.

21

- (c)

- Effective

January 29, 2006, we adopted the accounting standard related to Share-Based Payments using the modified prospective method. On

February 3, 2007, we adopted the accounting standard related to Employers' Accounting for Defined Benefit Pension and Other Postretirement Plans, resulting in a $3.2 million decrease in

stockholders' equity.

- (d)

- We

maintain a revolving line of credit up to $70.0 million, with subfacilities for the issuance of up to $70.0 million in letters of credit

and swingline advances of up to $10.0 million.

- (e)

- As of February 4, 2007, we reclassified our Jackson Hole, WY store from a resort to a premium store.

22

Item 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion contains various statements regarding our current initiatives, financial position, results of operations, cash flows, operating and financial trends and uncertainties, as well as certain forward-looking statements regarding our future expectations. When used in this discussion, words such as "anticipate," "believe," "estimate," "expect," "could," "may," "will," "should," "plan," "predict," "potential," and similar expressions are intended to identify such forward-looking statements. Our forward-looking statements are based on our current expectations and are subject to numerous risks and uncertainties. As such, our actual future results, performance or achievements may differ materially from the results expressed in, or implied by, our forward-looking statements. Please refer to our "Risk Factors" elsewhere in this Annual Report on Form 10-K for the fiscal year ended January 29, 2011. The forward-looking statements in this Annual Report are as of the date such report is filed with the SEC, and we assume no obligation to update our forward-looking statements or to provide periodic updates or guidance.

Overview

We encourage you to read this Management's Discussion and Analysis of Financial Condition and Results of Operations in conjunction with the accompanying consolidated financial statements and related notes. The fiscal years ended January 29, 2011 (fiscal 2010), January 30, 2010 (fiscal 2009) and January 31, 2009 (fiscal 2008) each consisted of 52 weeks.

Executive Summary

Net loss for fiscal 2010 was $44.1 million, or $0.48 per share, compared with a net loss of $56.1 million, or $0.61 per share, for fiscal 2009. Net loss for fiscal 2010 includes impairment charges of $3.9 million, or $0.04 per share. Net loss for fiscal 2009 included a $24.4 million non-cash income tax charge, or $0.27 per share, related to a valuation allowance against net deferred tax assets; a $3.8 million after-tax charge, or $0.04 per share, related to the separation from our former CEO; and a $0.6 million non-cash charge, or $0.01 per share, related to premium retail store asset impairments.

Net sales decreased to $981.1 million in fiscal 2010 compared to $1,038.6 million in fiscal 2009. This 5.5 percent decrease in net sales for the year was primarily driven by a decrease in comparable premium retail store sales1 of 8.5 percent in our retail segment and a decrease in our direct segment sales of 2.9 percent.

Gross profit for fiscal 2010 was $307.3 million, or 31.3 percent of net sales, compared with $334.3 million, or 32.2 percent of net sales, in fiscal 2009. The 90 basis point decline in gross profit margin was primarily due to deleveraging of occupancy expenses, offsetting a slight improvement in merchandise margins.

Selling, general and administrative expenses for fiscal 2010 were $346.7 million, or 35.3 percent of net sales, compared with $378.9 million, or 36.5 percent of net sales, for fiscal 2009. The decline in SG&A was primarily related to lower employee-related and marketing expenses and other fixed and variable costs.

- (1)

- We define comparable premium retail stores as those stores in which the gross square footage has not changed by more than 20 percent in the previous 16 months and which have been open for at least 16 consecutive months (provided that store has been considered comparable for the entire quarter) without closure for seven consecutive days or moving to a different temporary or permanent location. Due to the extensive promotions that occur as part of the opening of a premium store, we believe waiting sixteen months rather than twelve months to consider a store to be comparable provides a better view of the growth pattern of the premium retail store base. The calculation of comparable store sales varies across the retail industry and as a result, the calculations of other retail companies may not be consistent with our calculation.

23

We ended fiscal 2010 with $51.6 million in cash and cash equivalents, compared to $84.7 million at the prior year end. Working capital was $81.8 million at the end of fiscal 2010, compared to $98.9 million at the end of fiscal 2009. Premium retail inventory, including the retail inventory in our distribution center, decreased 15.3 percent per square foot compared to fiscal 2009. Total inventory decreased 3.1 percent to $156.5 million at the end fiscal 2010 from $161.5 million at the end of fiscal 2009.

Company Initiatives

We believe that the most important change we need to make in order to improve our sales and profitability is to offer our core and target customer an assortment that she finds more appealing. We recognize that our target customer's style orientation has changed over the last several years, and that our collections have not evolved to meet her needs.

We have talked extensively to our customer to better understand her needs and what she expects from Coldwater Creek. Our findings have consistently told us that, among other things, a) color is important to her and she is looking for colors that are seasonally appropriate, b) she finds the bold prints and patterns we have offered in the past too matronly, c) she looks to us for jackets in flattering silhouettes that give her shape and d) she wants versatility in her wardrobe.

We have made significant changes at all levels of our merchandising and creative teams to better address the needs of both our core and target customer demographic. Most recently, we announced that Jill Dean has joined us as President and Chief Merchandising Officer. In addition to a select number of internal promotions within our merchandising team, we have recently added two senior level merchants for both our retail and direct businesses.