Attached files

Copyright

©2011 drugstore.com, inc. All rights reserved Confidential

Exhibit 99.2 |

| Copyright

©2011 drugstore.com, inc. All rights reserved Confidential

Additional Information

Additional Information about the Transaction

The

information

in

this

presentation

is

not,

and

is

not

intended

to

be,

a

solicitation

of

proxies

or

an

offer

of

securities.

drugstore

plans

to

file

with

the

SEC

and

mail

to

its

stockholders

a

Proxy

Statement

in

connection

with

the

transaction.

The

Proxy

Statement

will

contain

important

information

about

Walgreens,

drugstore,

the transaction and related matters. Investors and security holders are urged to read the Proxy

Statement carefully when it is available.

Investors and security holders will be able to obtain free copies of the Proxy

Statement and other documents filed with the SEC by drugstore through the web site maintained

by the SEC at www.sec.gov and by contacting drugstore Investor Relations at (212)

331-8424. In addition, investors and security holders will be able to obtain

free copies of the documents filed with the SEC on on drugstore’s website at

www.drugstore.com. Participants in the Acquisition of drugstore

drugstore.com and its directors and officers and certain other members of management and

employees may be deemed to be participants in the solicitation of proxies from its

stockholders in connection with the Transaction. Information regarding these persons

who may, under the rules of the SEC, be considered participants in the solicitation of

drugstore’s stockholders in connection with the proposed transaction will be set forth in the Proxy

Statement described above when it is filed with the SEC. Additional information regarding

drugstore’s executive officers and directors is included in drugstore’s

definitive proxy statement, which was filed with the SEC on April 30, 2010.

You

can

obtain

free

copies

of

this

document

from

drugstore

using

the

contact

information

above. |

| Copyright

©2011 drugstore.com, inc. All rights reserved Confidential

Forward-Looking Statements

Forward-Looking Statements

Information set forth in this material contains forward-looking statements, which involve

a number of risks and uncertainties. These statements include those regarding the

closing of the transaction, the integration process and the potential benefits of the

acquisition. These statements are not guarantees of future performance and are

subject to risks, uncertainties and assumptions that could cause actual results to vary

materially from those indicated, including: the ability

to

obtain

regulatory

approvals

of

the

transaction

on

the

proposed

terms

and

schedule; the

failure of drugstore’s stockholders to approve the transaction; the risk that the

businesses will not be integrated successfully; the risk that the cost savings and any

other synergies from the transaction may not be fully realized or may take longer to

realize than expected; disruption from the transaction making it more difficult to

maintain relationships with customers, employees or suppliers; competition and its

effect on pricing, spending, third-party relationships and revenues; and other

factors described in Walgreens Annual Report on Form 10-K for the year ended August

31, 2010, drugstore.com’s Annual Report on Form 10-K for the year ended January 2,

2011 and their respective subsequent SEC filings, which risks and uncertainties are

incorporated herein by reference. You are cautioned not to place undue reliance on

these forward-looking statements, which

speak

only

as

of

the

date

of

this

press

release.

Except

to

the

extent

required

by

law,

Walgreens and drugstore.com disclaim any obligation to update any forward-looking

statements after the distribution of this material, whether as a result of new

information, future events, changes in assumptions, or otherwise.

|

Copyright

©2011 drugstore.com, inc. All rights reserved Confidential

Our Strategy

Our strategy has been consistent –

•

Be the Online Leader in Health, Beauty and Wellness

•

Provide our customers a great experience allowing them to shop

whenever, wherever and however they want to shop

•

Offer convenience and service, with a wide assortment, including

hard-to-find items

But, the world has changed –

•

Competition is increasing

•

Consolidation is occurring in our industry

•

Offline retailers are quickly moving online

So…..We Have Had a Growing Belief That We Should Partner or

Combine With a Leading Multi-Channel or Offline Retailer

1 |

Copyright

©2011 drugstore.com, inc. All rights reserved Confidential

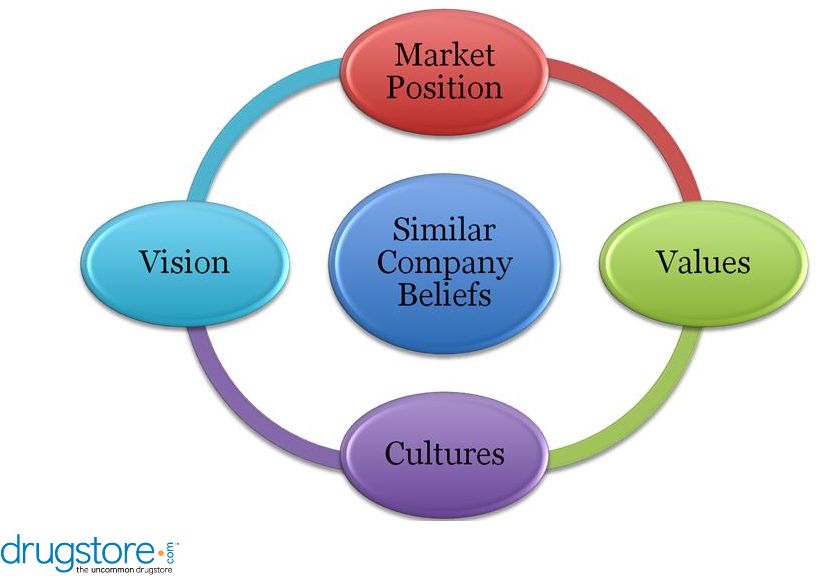

Our ideal partner….

2 |

Copyright

©2011 drugstore.com, inc. All rights reserved Confidential

Walgreens –

Largest and Most Trusted

Drugstore

Named one of Fortune magazine’s Most Admired Companies in America for 17th

consecutive year

Walgreens recently donated $150K to American Red Cross and is matching up to

$100K of employee donations to help in the recent Japanese

earthquake Goal: Be America’s most trusted and convenient provider of

consumer goods and services and pharmacy, health and wellness

solutions In 2010, Sales surpassed $67B,

Net Income over $2B

Operates 7,500 stores with

244,000 total employees

Nearly 75% of American’s live

within 5 miles of a Walgreens

store

3 |

Copyright

©2011 drugstore.com, inc. All rights reserved Confidential

Structure and Consideration

4

•

Cash purchase of DSCM shares in

connection with the merger of DSCM with a

Walgreens subsidiary

Structure

•

$3.80 per share

•

Total purchase price equal to approx $429M

Per Share

Price

•

All unvested options/SSARs and RSUs and vested

options/SSARs with an exercise price of $3.80 or

higher will be “rolled over”

to Walgreens equity

•

Vested, in the money options/SSARs and vested,

but unsettled RSUs will be paid out in cash

•

All RSAs (vested and unvested) will be paid out in

cash

Treatment of

Stock Options

& Equity |

Copyright

©2011 drugstore.com, inc. All rights reserved Confidential

Significant Benefits to Drugstore!!

Allows us to offer a multi-channel experience

Let’s us combine with an industry leader whose

value and vision is consistent with our own

Allows us to invest more in our business

Gives us scale

Offers additional career opportunities

5 |

Copyright

©2011 drugstore.com, inc. All rights reserved Confidential

Walgreens End-State Vision will be

Executed in a Planned and Phased Manner

Keep all existing Walgreens and DSCM online

channels

Combine the strengths of Walgreens.com and

DSCM platforms to enhance overall product

assortment and customer experience

Create the ability to easily ship to stores, pick up in

stores and offer home delivery leveraging our store

network

Combine Walgreens leading mobile capability with

DSCM’s online retail capabilities

6 |

Copyright

©2011 drugstore.com, inc. All rights reserved Confidential

Our Guiding Principles for Transition

7 |

Copyright

©2011 drugstore.com, inc. All rights reserved Confidential

What it Means for You?

This transaction is about growth and investment

Walgreens recognizes that each of our companies has

been successful because of its employees. Therefore, it

is a high priority for Walgreens to:

Focus on team member retention

Identify and cultivate talent from both organizations

Acquisition complements Walgreens existing

eCommerce talent base

Few job reductions expected

Will maintain separate locations, Seattle will be a

Center of Excellence

The approach to compensation and benefits is to

maintain a substantially similar offering to what our

employees currently receive:

Walgreens benefit programs are

o

Externally competitive

o

Internally equitable

o

Recognize both individual and team contributions to success

8 |

Copyright

©2011 drugstore.com, inc. All rights reserved Confidential

Over the Next Few Weeks…

Until the transaction closes, Walgreens and DSCM must operate business

as separate companies

Together we will outline a clear integration roadmap with the key

milestones

An integration planning task force will be formed and will be composed of

both Walgreens and DSCM representatives to ensure that we leverage the

best of both organizations and minimize disruption

We ask for your support in continuing to meet our commitments to

our

customers, vendors, business partners, communities, stockholders

and to

each other

This is a two-way street. We encourage you to ask questions and

provide your input throughout this journey as we build a leading

eCommerce business together

Please direct your questions, expectations and concerns to your

manager and/or HR representative………….or your CEO!!!

9 |