Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT ON FORM 8-K - DELTA AIR LINES, INC. | delta_8k-032211.htm |

Exhibit 99.1

Delta: Building a Better Airline

J.P. Morgan Aviation, Transportation & Defense Conference

March 22, 2011

1

1

Safe Harbor

This presentation contains various projections and other forward-looking statements which

represent Delta’s estimates or expectations regarding future events. All forward-looking

statements involve a number of assumptions, risks and uncertainties, many of which are

beyond Delta’s control, that could cause the actual results to differ materially from the

projected results. Factors which could cause such differences include, without limitation,

business, economic, competitive, industry, regulatory, market and financial uncertainties

and contingencies, as well as the “Risk Factors” discussed in Delta’s Form 10-K for the year

ended December 31, 2010. Caution should be taken not to place undue reliance on Delta’s

forward-looking statements, which represent Delta’s views only as of the date of this

presentation, and which Delta has no current intention to update.

represent Delta’s estimates or expectations regarding future events. All forward-looking

statements involve a number of assumptions, risks and uncertainties, many of which are

beyond Delta’s control, that could cause the actual results to differ materially from the

projected results. Factors which could cause such differences include, without limitation,

business, economic, competitive, industry, regulatory, market and financial uncertainties

and contingencies, as well as the “Risk Factors” discussed in Delta’s Form 10-K for the year

ended December 31, 2010. Caution should be taken not to place undue reliance on Delta’s

forward-looking statements, which represent Delta’s views only as of the date of this

presentation, and which Delta has no current intention to update.

In this presentation, we will discuss certain non-GAAP financial measures. You can find the

reconciliations of those measures to comparable GAAP measures on our website at

delta.com.

reconciliations of those measures to comparable GAAP measures on our website at

delta.com.

2

2

Delta: Building a Better Airline

Higher revenues plus solid cost performance

drove $2.5 billion year-over-year improvement

in profitability for 2010

drove $2.5 billion year-over-year improvement

in profitability for 2010

Strong free cash flow

generation

generation

Solid financial foundation and low cost structure,

coupled with improved risk profile, positions

Delta to effectively address impact of high fuel

prices and events in Japan

coupled with improved risk profile, positions

Delta to effectively address impact of high fuel

prices and events in Japan

A successful 2010

Despite recent run-up in fuel prices, strong

operating cash flows with limited capital

requirements allow for sustainable free cash

flow generation

operating cash flows with limited capital

requirements allow for sustainable free cash

flow generation

Positioned to succeed in the

long-term

long-term

3

3

2010 Results Show Delta’s Solid Foundation….

2010 Operating Income ($M)

Note: All results exclude special items.

Delta’s industry-leading results are among the best in its history

In 2010, Delta:

• Improved pre-tax income by more

than $2.5 billion over 2009

than $2.5 billion over 2009

• Generated a 10% return on

invested capital

invested capital

• Increased unit revenues by 13%

• Maintained consolidated ex-fuel

unit costs at 2009 levels

unit costs at 2009 levels

• Reduced adjusted net debt by $2

billion to $15 billion

billion to $15 billion

• Successfully completed merger

integration

integration

EBIT

Margin

Margin

8.4%

5.6%

8.8%

1.8%

6.7%

9.6%

7.3%

4

…But Industry Faces Dramatic Rise in Fuel Prices

Today’s market prices reflect 2011 fuel price range of $3.05 - $3.10 per gallon

May - September

$2.02 - $2.11

$2.02 - $2.11

May 2010

Dec 2011

Prices to drive Delta’s fuel expense up by $3 billion, or 35%, over 2010

June - December

$3.13 - $3.18

$3.13 - $3.18

5

5

5

Higher Fuel Prices Driving Reduced Earnings

$325M

Capital Expenditures

Up 10 - 11%

Consolidated unit cost

March quarter 2011

Operating margin

(2 - 3%)

Fuel price

$2.90

Total unrestricted liquidity

$5.4 billion

March quarter 2011 vs.

March quarter 2010

March quarter 2010

Passenger unit revenue

Up 7 - 8%

Consolidated ex-fuel unit cost

Up 2 - 3%

System capacity

Up 4 - 5%

Domestic

Up 1 - 2%

International

Up 12 - 13%

Note: Excludes special items Fuel price is net of hedge impact, and includes taxes, transportation, and option premiums

March quarter fuel price creates over $600 million higher expense

6

• Strong revenue environment, combined with

industry fare actions, driving higher yields

industry fare actions, driving higher yields

Higher Revenues

Reduce Capacity

Fleet Efficiency

Hedge Portfolio

• Retire 120 of our least efficient aircraft over next 18

months, including DC9-50 and Saab turbo-prop

fleets, and 60 50-seat regional jets

months, including DC9-50 and Saab turbo-prop

fleets, and 60 50-seat regional jets

• Reducing 2H capacity by 4 points versus plan, with

a focus on entities where revenue has not kept pace

with fuel

a focus on entities where revenue has not kept pace

with fuel

• Reshaping hedge portfolio and locking in

hedge gains

hedge gains

Using revenues and capacity reductions to address higher fuel expense

Adapting Quickly To The New Fuel Environment

7

Revenues in all entities except transatlantic keeping pace with fuel increase

March Quarter 2011 YOY Change

|

Entity

|

Unit Revenue

|

Unit Cost

|

|

Domestic

|

Up 9 - 10%

|

Up 9 - 10%

|

|

Latin

|

Up 15 - 16%

|

Up 13 - 14%

|

|

Pacific

|

Up 11 - 12% *

|

Up 11 - 12%

|

|

Atlantic

|

Down 2 - 3%

|

Up 11 - 12%

|

|

System

|

Up 7 - 8%

|

Up 10 - 11%

|

* Prior to impact of events in Japan

Successfully Passing Fuel Cost through Revenue

8

Targeted reductions where revenue not keeping pace with costs

2H11 YOY Capacity Change

|

|

Original

Plan |

Revised

Plan |

Change |

|

Domestic

|

2%

|

(3%)

|

(5 pts)

|

|

Atlantic

|

(1%)

|

(4%)

|

(3 pts)

|

|

Latin

|

7%

|

6%

|

(1 pt)

|

|

Pacific

|

13%

|

5%

|

(8 pts)

|

|

System

|

2%

|

(2%)

|

(4 pts)

|

Capacity Actions

• Pulldown of 15-20% Japan

capacity through May,

including suspension of

Haneda

capacity through May,

including suspension of

Haneda

• Reducing Memphis hub

departures by 25%

departures by 25%

• Reduction of capacity in

underperforming Transatlantic

markets, in conjunction with JV

partners

underperforming Transatlantic

markets, in conjunction with JV

partners

Reducing 2H11 Schedule by Four Points

9

Preliminary estimates range 2011 net impact at $250 - $400 million

The situation in Japan continues to evolve….

Other Actions

• $1 million donation of cash and in-kind

support for disaster relief

support for disaster relief

• Dedicated Delta-Red Cross website to

receive donations from employees and

customers

receive donations from employees and

customers

• Standing offer of complimentary cargo

and passenger space for the American

Red Cross

and passenger space for the American

Red Cross

• Working with USAid and other

organizations to provide charter service

for evacuations and supplies

organizations to provide charter service

for evacuations and supplies

Delta Response to Japan Events

Capacity Response

• Reduce Japan capacity by 15-20%

through May to reflect likely decrease

in short-term demand

through May to reflect likely decrease

in short-term demand

• Suspend service to Haneda

• Pull back on capacity between Narita

and the beaches

and the beaches

• Selectively upgauge Asia over-flights

and increase charter operations

and increase charter operations

10

10

Targeting Incremental Revenue of $1 Billion by 2013

Technology, product investments underway to unlock untapped revenue streams

Deliver a Consistent, Quality Experience for Customers

• Improved seat experience with flat-beds, Economy

Comfort and more domestic first class seats

Comfort and more domestic first class seats

• State of the art facilities in JFK and Atlanta

• Customer service is a key differentiator

Offer New Products and Services Customers Value

• Seat-related products (e.g. Economy Comfort)

• SkyPriority recognizes our highest-value customers

• Ancillary products to improve the travel experience (e.g.,

hotels, SkyClub passes, Wi-Fi)

hotels, SkyClub passes, Wi-Fi)

Invest in Technology To Sustain Innovation

• Revamped eCommerce platforms enable revenue

innovation

innovation

• Improved revenue management from stronger pricing

tools

tools

JFK Terminal 4

11

% of Fuel Consumption Hedged

Responding to dislocation of WTI to jet fuel

Avg Jet Equivalent Cap $2.91 $2.89 $2.95 $2.84

Avg Jet Equivalent Floor $2.74 $2.62 $2.54 $2.62

Repositioning Fuel Hedge Portfolio

• Converted nearly all WTI hedge

positions to Brent crude or

heating oil

positions to Brent crude or

heating oil

• Current mark to market value of

$500 million with $360 million in

locked-in gains

$500 million with $360 million in

locked-in gains

• Utilizing cashless collar

structures to provide for

downside participation

structures to provide for

downside participation

12

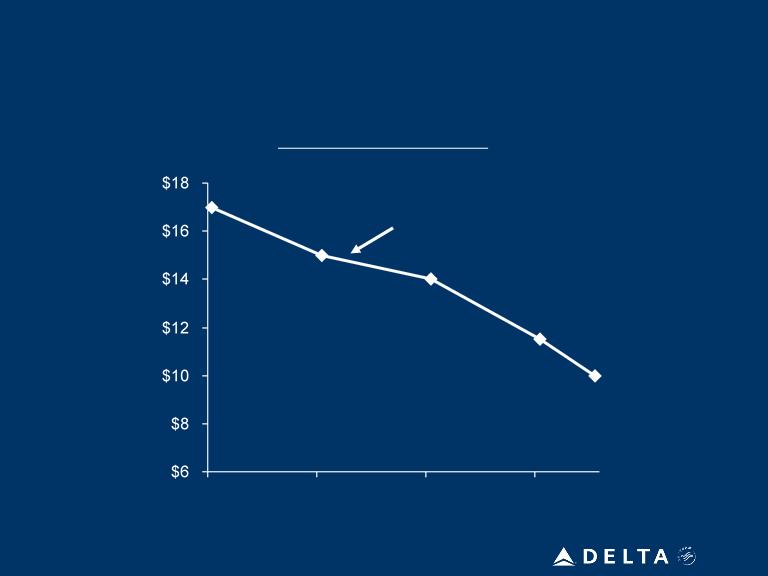

Commitment to Debt Reduction Remains Intact

Adjusted Net Debt

12/31/09

Mid-2013

High fuel will shift timing of achieving $10 billion adjusted net debt target

3/31/11

$14.6 billion

$14.6 billion

$17 billion

$10 billion

13

Scheduled Debt Maturities ($B)

Proactively Managing Near-Term Debt Maturities

$1.6

$2.1

$2.5 *

EETC

Other debt / capital leases

Exit facility

Amex

• Strong liquidity position will be maintained

by a combination of financing and

refinancing activities in addition to solid

free cash flow generation

by a combination of financing and

refinancing activities in addition to solid

free cash flow generation

• Taking advantage of market opportunities

to proactively address future maturities

and reduce cost of debt

to proactively address future maturities

and reduce cost of debt

• $200 million of 2011 EETC bullet maturity

has already been refinanced, with an

additional 26 aircraft becoming available

for future refinancing

has already been refinanced, with an

additional 26 aircraft becoming available

for future refinancing

• $1.2B of revolver commitments in hand to

refinance the 2012 exit facility

refinance the 2012 exit facility

Plan in place to maintain minimum $5 billion in liquidity

* Does not include $900 million in revolver expiration

14

Commitment To $1.3 Billion Annual CapEx

Annual Capital Spending Levels (billions)

Prudent capital management enables sustainable annual free cash flows

14

2008 2009 2010 2011 2012 2013 2014+

$2.2 $1.3 $1.3 $1.25 $1.2 $1.4 $1.3

Merger

Integration

International

Product &

Facilities

Product &

Facilities

Domestic

Narrowbody

Replacement

Narrowbody

Replacement

15

15

Path To Improving Shareholder Returns

10 - 12% operating margin

$5 billion EBITDAR

Minimize capital reinvestment

requirements

requirements

Use cash to delever the balance

sheet

sheet

Generate sustainable 10%+ return on invested capital

16

|

Non-GAAP Financial Measures

|

||||||||||

|

We sometimes use information that is derived from our Condensed Consolidated Financial Statements, but that is not presented in accordance with accounting principles generally accepted in the U.S. (“GAAP”). Certain of this information is considered “non-GAAP financial measures” under the U.S. Securities and Exchange Commission rules. The non-GAAP financial measures should be considered in addition to results prepared in accordance with GAAP, but should not be considered a substitute for or superior to GAAP results.

|

||||||||||

|

Delta is unable to reconcile certain forward-looking projections to GAAP as the nature or amount of special items cannot be estimated at this time.

|

||||||||||

|

Delta excludes special items because management believes the exclusion of these items is helpful to investors to evaluate the company’s recurring operational performance.

|

||||||||||

|

Delta presents net investing activities because management believes this metric is helpful to investors to evaluate the company’s investing activities.

|

||||||||||

|

Delta uses adjusted total debt, including aircraft rent, in addition to long-term adjusted debt and capital leases, to present estimated financial obligations. Delta reduces adjusted total debt by cash, cash equivalents and short-term investments, resulting in adjusted net debt, to present the amount of additional assets needed to satisfy the debt.

|

||||||||||

|

Delta presents return on invested capital (ROIC) as management believes it is helpful to investors in assessing the company's ability to generate returns using its invested capital. ROIC represents operating income excluding special items divided by the sum of average market value of equity and average adjusted net debt.

|

||||||||||

|

Delta presents free cash flow because management believes this metric is helpful to investors to evaluate the company’s ability to generate cash.

|

||||||||||

17

|

Pre-Tax Income

|

||||||||

|

Full Year

|

Full Year

|

|||||||

|

(in millions)

|

2010

|

2009

|

||||||

|

Pre-tax income (loss)

|

$ | 608 | $ | (1,581 | ) | |||

|

Items excluded:

|

||||||||

|

Restructuring and merger-related items

|

450 | 407 | ||||||

|

Loss on extinguishment of debt

|

391 | 83 | ||||||

|

Other

|

10 | - | ||||||

|

Pre-tax income (loss) excluding special items

|

$ | 1,459 | $ | (1,091 | ) | |||

18

|

Operating Income & Margin

|

||||

|

Full Year

|

||||

|

(in billions)

|

2010

|

|||

|

Operating income

|

$ | 2,217 | ||

|

Item excluded:

|

||||

|

Restructuring and merger-related items

|

450 | |||

|

Operating income excluding special items

|

$ | 2,667 | ||

|

Total operating revenue

|

$ | 31,755 | ||

|

Operating margin excluding special items

|

8.4 | % | ||

19

|

Total capital expenditures

|

||||||||

|

Full Year

|

Full Year

|

|||||||

|

(in billions)

|

2009

|

2008

|

||||||

|

Delta property and equipment additions (GAAP)

|

$ | 1.2 | $ | 1.5 | ||||

|

Northwest property and equipment additions (GAAP) for the period from January 1 to October 29, 2008

|

- | 1.1 | ||||||

|

Other

|

0.1 | (0.4 | ) | |||||

|

Total capital expenditures

|

$ | 1.3 | $ | 2.2 | ||||

20

|

Adjusted Net Debt & ROIC

|

||||||||||||||||

| (in billions) |

December 31, 2010

|

September 30, 2010

|

June 30, 2010

|

March 31, 2010

|

December 31, 2009

|

|||||||||||||||||||||||||||||||||||

|

Debt and capital lease obligations

|

$ | 15.3 | $ | 15.4 | $ | 15.8 | $ | 16.9 | $ | 17.2 | ||||||||||||||||||||||||||||||

|

Plus: unamortized discount, net from purchase accounting and fresh start reporting

|

0.6 | 0.7 | 1.0 | 1.1 | 1.1 | |||||||||||||||||||||||||||||||||||

|

Adjusted debt and capital lease obligations

|

$ | 15.9 | $ | 16.1 | $ | 16.8 | $ | 18.0 | $ | 18.3 | ||||||||||||||||||||||||||||||

|

Plus: 7x last twelve months' aircraft rent

|

2.7 | 3.0 | 3.2 | 3.3 | 3.4 | |||||||||||||||||||||||||||||||||||

|

Adjusted total debt

|

18.6 | 19.1 | 20.0 | 21.3 | 21.7 | |||||||||||||||||||||||||||||||||||

|

Less: cash, cash equivalents and short-term investments

|

(3.6 | ) | (3.9 | ) | (4.4 | ) | (4.9 | ) | (4.7 | ) | ||||||||||||||||||||||||||||||

|

Adjusted net debt

|

$ | 15.0 | $ | 15.2 | $ | 15.6 | $ | 16.4 | $ | 17.0 | ||||||||||||||||||||||||||||||

|

(in billions, except % return)

|

2010 | |||||||||||||||||||||||||||||||||||||||

|

Operating income

|

$ | 2.7 | ||||||||||||||||||||||||||||||||||||||

|

Market value of equity (assuming $12.60/ share)

|

$ | 10.6 | ||||||||||||||||||||||||||||||||||||||

|

Adjusted net debt

|

$ | 15.5 | ||||||||||||||||||||||||||||||||||||||

|

Total invested capital

|

$ | 26.1 | ||||||||||||||||||||||||||||||||||||||

|

Return on invested capital

|

10 | % | ||||||||||||||||||||||||||||||||||||||

21