Attached files

| file | filename |

|---|---|

| 8-K - TRI VALLEY CORP 8-K 3-16-2011 - TRI VALLEY CORP | tv317118k.htm |

Exhibit 99.1

Tri-Valley Corporation

Maston Cunningham, President & CEO

NYSE Amex: TIV

March 2011

Safe Harbor Disclosure:

This presentation contains forward-looking statements that

involve risks and uncertainties. Actual results, events and

performance could vary materially from those contemplated by

these forward-looking statements which include such words and

phrases as exploratory, wildcat, prospect, speculates, unproved,

prospective, very large, expect, potential, etc. Among the factors

that could cause actual results, events and performance to differ

materially are risks and uncertainties discussed in "Item IA. Risk

Factors" and "Item 7. Management's Discussion and Analysis of

Financial Condition" contained in the company's Annual Report

on SEC Form 10-K for the year ended December 31, 2009, and

similar information contained in the company’s Quarterly Report

on SEC Form 10Q for the quarter ended September 30, 2010.

involve risks and uncertainties. Actual results, events and

performance could vary materially from those contemplated by

these forward-looking statements which include such words and

phrases as exploratory, wildcat, prospect, speculates, unproved,

prospective, very large, expect, potential, etc. Among the factors

that could cause actual results, events and performance to differ

materially are risks and uncertainties discussed in "Item IA. Risk

Factors" and "Item 7. Management's Discussion and Analysis of

Financial Condition" contained in the company's Annual Report

on SEC Form 10-K for the year ended December 31, 2009, and

similar information contained in the company’s Quarterly Report

on SEC Form 10Q for the quarter ended September 30, 2010.

2

Tri-Valley is…

• A significantly different company from a year ago

• Focused on California heavy oil production with nearly

10 MMB of net 3P reserves, and over 3 MMB of net

contingent resources

contingent resources

• Positioned to become the largest oil sands producer in

California

California

• Executing a plan to monetize two large Alaskan exploration

stage gold projects (porphyry and intrusion related

systems)

stage gold projects (porphyry and intrusion related

systems)

• Building oil production volume and revenue in 2011

• Significantly reducing operating costs

• Focused on generating cash flow from operations

• Led by an experienced, proven management team

3

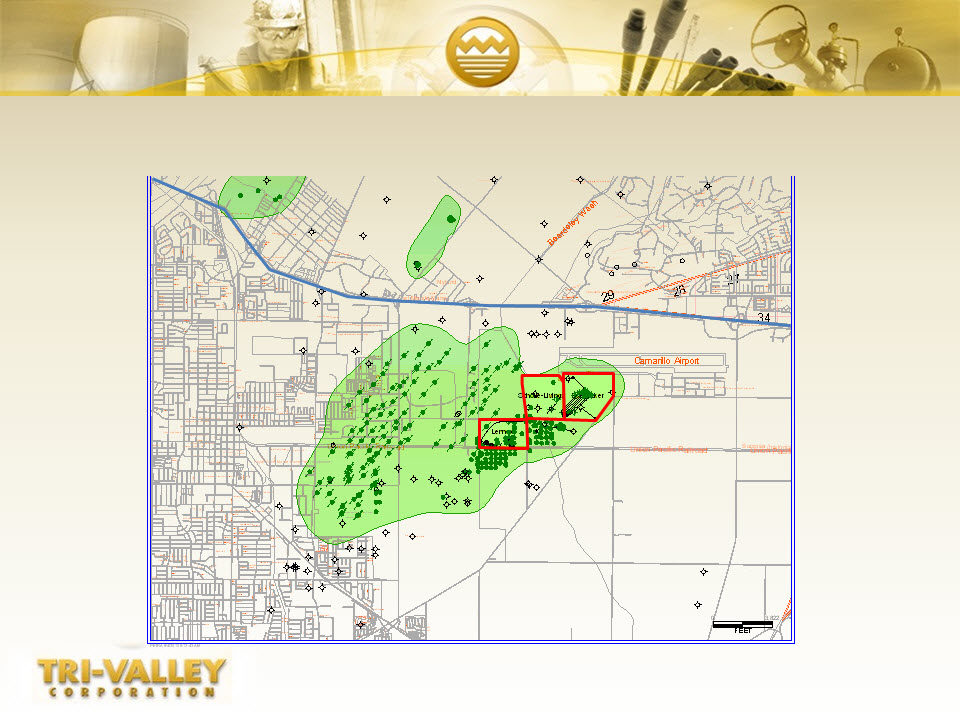

Pleasant Valley - Oxnard, CA

4

Pleasant Valley - Oxnard, CA

5

Oxnard Field

Hwy 126

Pleasant Valley - Leases

6

Lennox

Scholle-

Livingston

Livingston

Hunsucker

Title Under Litigation

Pleasant Valley - Oxnard, CA

• An “unconventional” heavy oil project to exploit 128 MMB

OOIP from the Upper Vaca Tar Sands from properties

located in the Oxnard Oilfield

OOIP from the Upper Vaca Tar Sands from properties

located in the Oxnard Oilfield

• Oxnard Oilfield, discovered in 1937, has 400 MMB OOIP in

the Upper Vaca Tar as estimated by the CA Dept. of Oil &

Gas

the Upper Vaca Tar as estimated by the CA Dept. of Oil &

Gas

• Upper Vaca Tar is analogous to the Canadian Athabasca

Oil Sands

Oil Sands

7

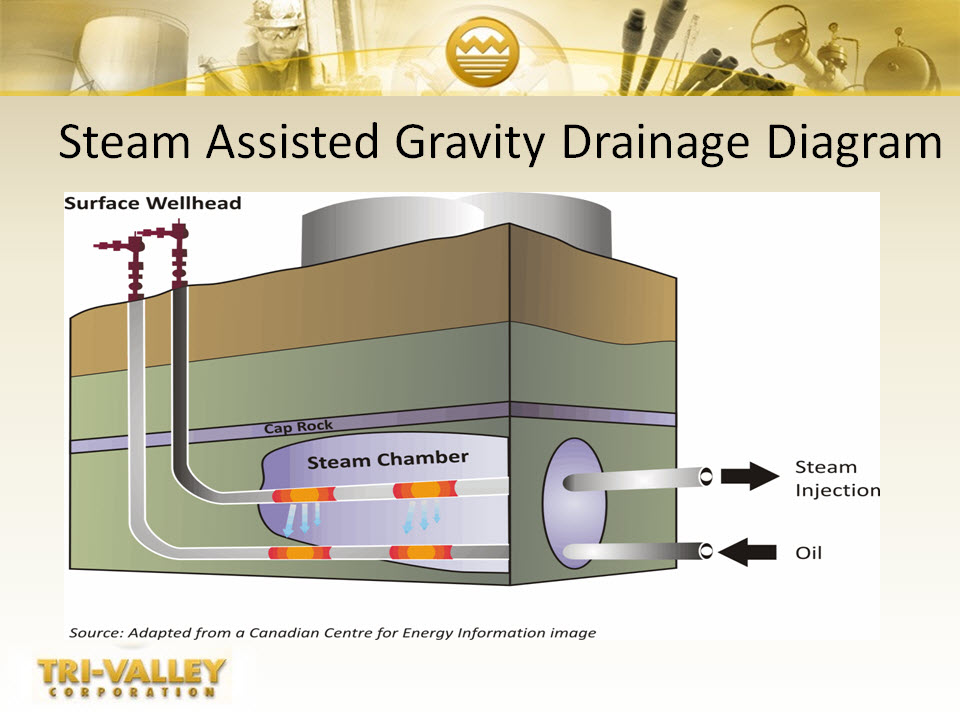

Pleasant Valley - Oxnard, CA

• TIV is the first operator to produce heavy oil from horizontal

wells drilled into the Upper Vaca Tar Formation

wells drilled into the Upper Vaca Tar Formation

• Maximum recovery up to 60% of OOIP will require

deployment of latest Canadian technologies, such as Steam-

Assisted, Gravity-Drainage (SAGD)

deployment of latest Canadian technologies, such as Steam-

Assisted, Gravity-Drainage (SAGD)

• SAGD Pilot is planned for second half of 2011

• TIV Ownership: 25.00% Working Interest (WI) and 18.75%

Net Revenue Interest (NRI) + small ORRI’s

Net Revenue Interest (NRI) + small ORRI’s

8

9

Steam Assisted Gravity Drainage Diagram

10

Recovery Factor

75%

65%

70%

20 to 60%

250’

100°F

Vaca Tar Sands vs. Canada’s Oil Sands

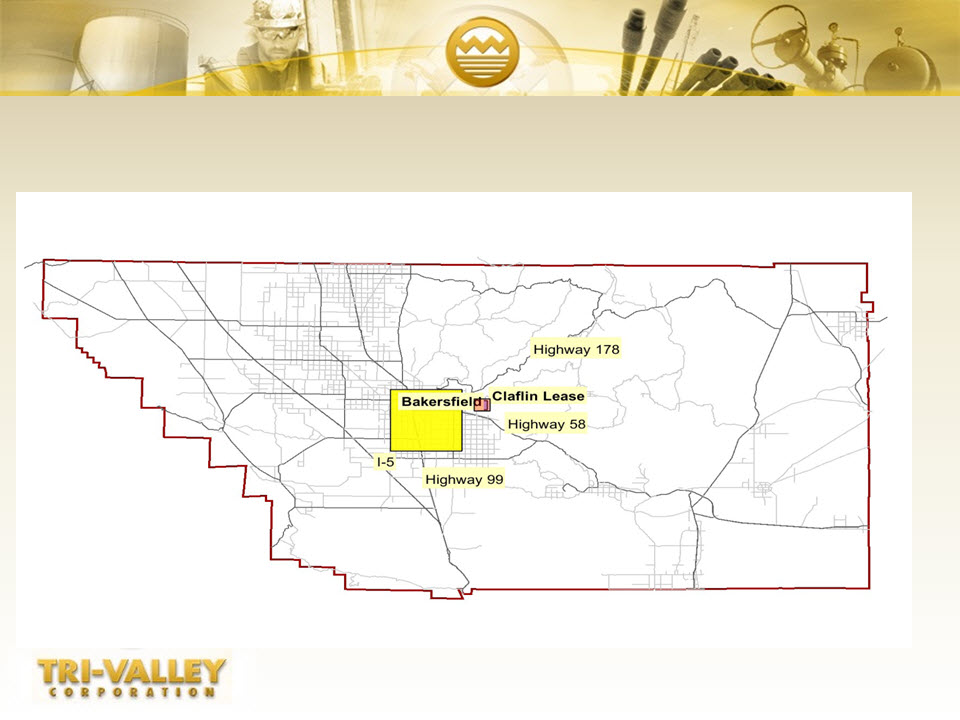

Claflin - Bakersfield, CA

11

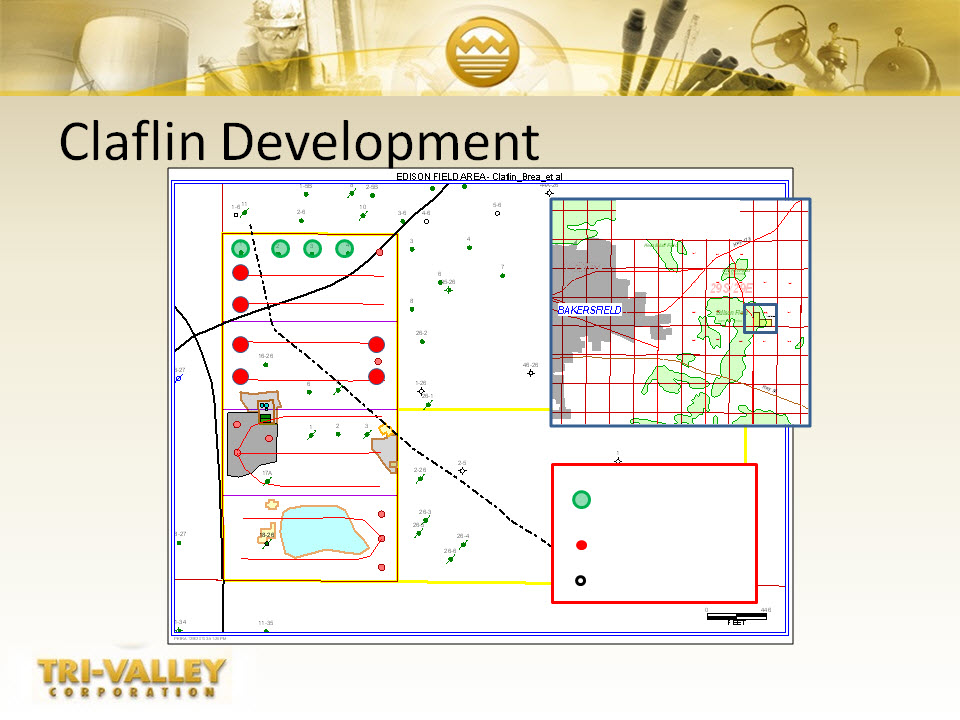

Claflin

• 2.0 MMB net proved reserves (SEC); 16° API gravity

• 22 Wells to be drilled and equipped during 2011

• Exit rate at year-end 2011 estimated at 800 BOPD

• Peak production is estimated at 1,200 BOPD in 2012

• $8.9 Million of average annual net operating profit for

first three years

first three years

• TIV Ownership: 100% Working Interest (WI) and

87.5% Net Revenue Interest (NRI)

87.5% Net Revenue Interest (NRI)

• TIV has acquired the Brea lease, a similar adjoining

property to develop in 2012

property to develop in 2012

12

13

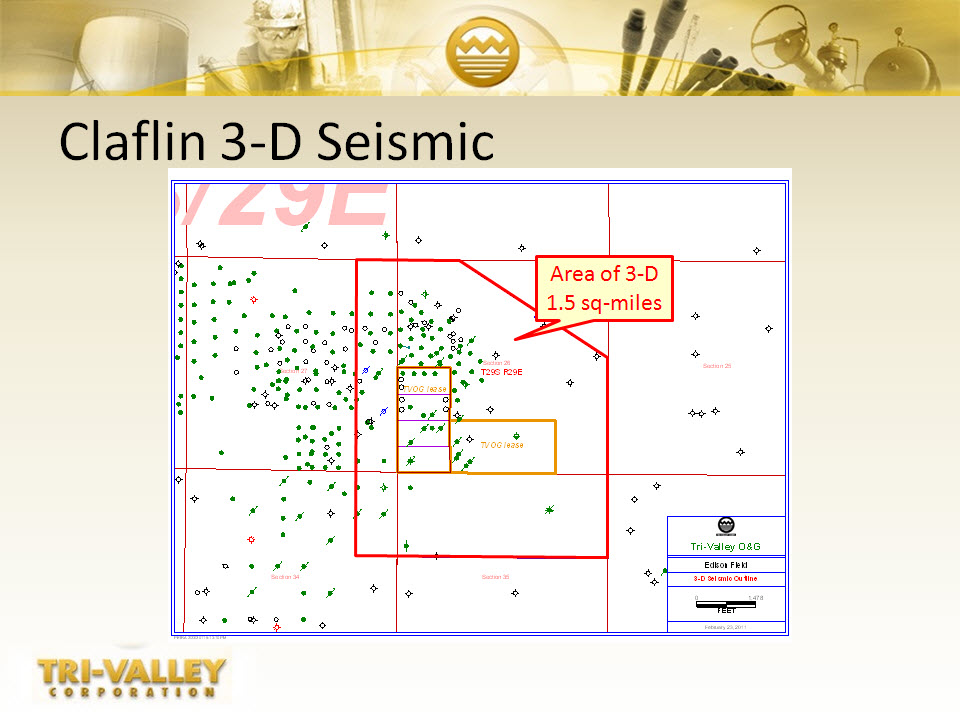

Claflin 3-D Seismic Area of 3-D 1.5 sq-miles

14

Initial 6

Wells

Wells

Index Map

Producing wells

New Development

Wells

Future Wells

Claflin Development

Significant Cost Reductions

• Reduced annualized G&A costs over $1 Million

• Salary and Benefit Expense reduced 18% for 2011:

• Eliminated five positions

• Outsourced IT

• Reduced other contract services

• Potential to reduce Pleasant Valley production costs per

barrel by 20% with increased volumes and other cost

reductions in 2011

barrel by 20% with increased volumes and other cost

reductions in 2011

• Potential to reduce Claflin production costs per barrel by

50% with increased volumes from new wells in 2011

50% with increased volumes from new wells in 2011

15

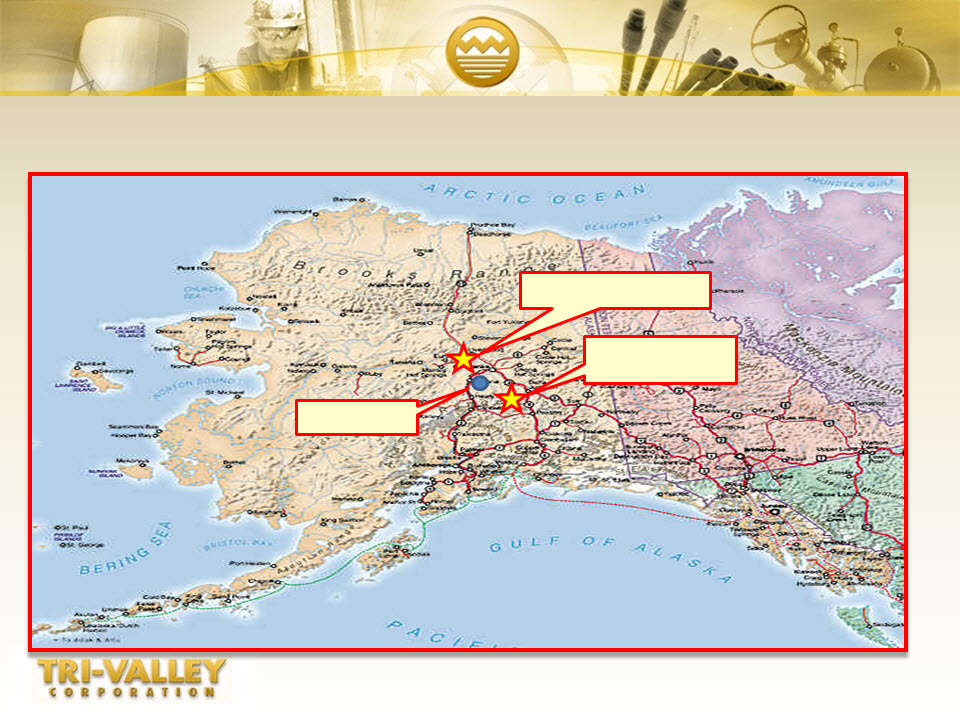

Alaska Mineral Properties

Fairbanks

Richardson

Shorty Creek

16

Shorty Creek

• Shorty Creek is a potential world-class porphyry deposit

• Contiguous to ITH’s Livengood property containing 13.3

Million oz of gold resource at 0.5 grams/ton cut-off (heap

leach quality)

Million oz of gold resource at 0.5 grams/ton cut-off (heap

leach quality)

• Asarco had multiple intercepts during 1988-89 program

• Drilled 20 holes, eight had gold intercepts ranging from 0.53 grams

gold /ton up to 4.5 grams gold/ton

gold /ton up to 4.5 grams gold/ton

• Six anomalies have been identified for further exploration

work in the 2010 NI 43-101 Report evaluation, which

indicates a large porphyry copper, gold, and molybdenum

system up to eight miles in diameter

work in the 2010 NI 43-101 Report evaluation, which

indicates a large porphyry copper, gold, and molybdenum

system up to eight miles in diameter

17

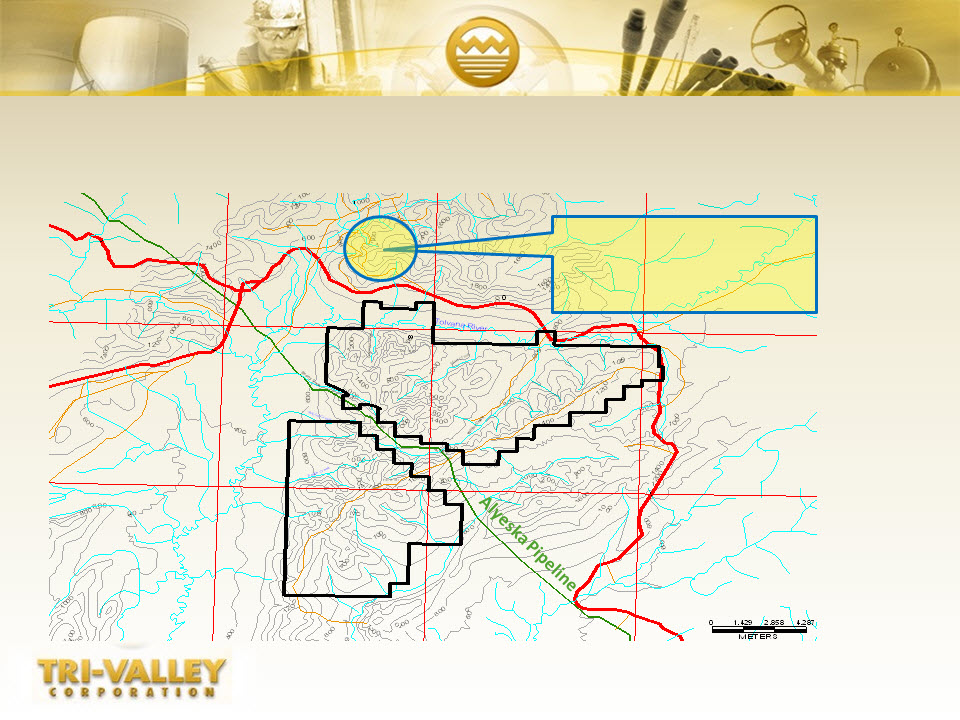

Shorty Creek

Shorty Creek Claims

52 Sq. Miles

International Tower Hill

13.3 million oz gold

at 0.50 grams/ton

Elliot Hwy

18

Shorty Creek Exploration

• Drilling and other exploration work on the six

anomalies identified in the NI 43-101 Report

may ultimately require $10-15 Million in new

investment

anomalies identified in the NI 43-101 Report

may ultimately require $10-15 Million in new

investment

• Ideal joint venture opportunity for a major or

mid-tier gold or copper producer to earn a

majority interest

mid-tier gold or copper producer to earn a

majority interest

19

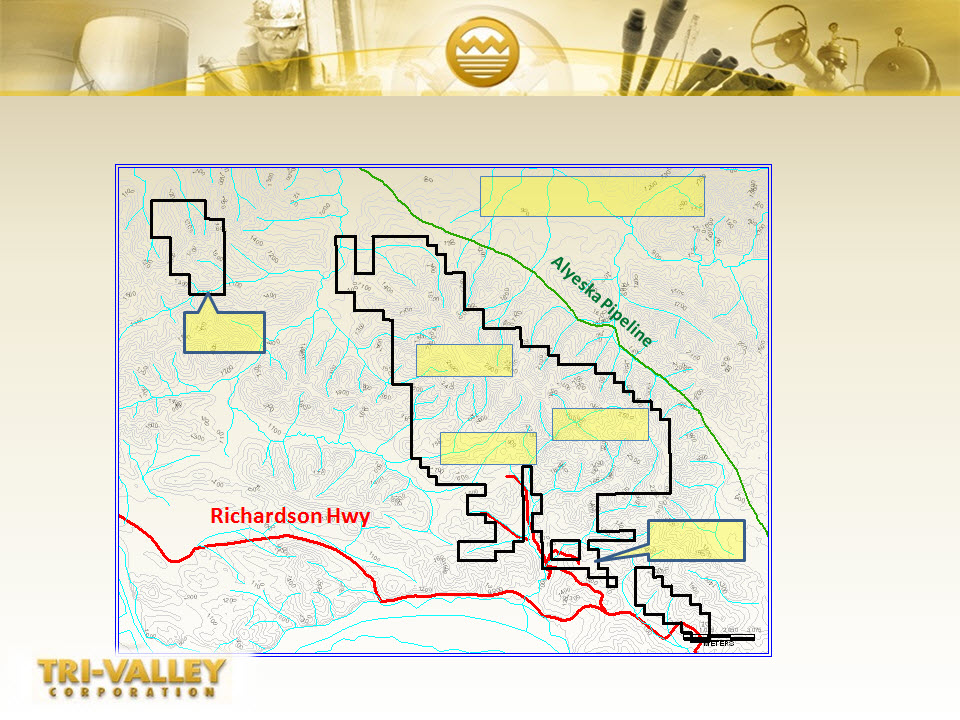

Richardson

• Have identified six anomalies with surface geochem sampling,

limited core drilling, and some previous mining

limited core drilling, and some previous mining

• All of the anomalies are associated with the Intrusion Related

Gold Deposit Model

Gold Deposit Model

• NI 43-101 study is in progress and is to be completed by

March 31, 2011

March 31, 2011

• Drilling and other Exploration work on identified anomalies

may require $10-15 MM in new investment

may require $10-15 MM in new investment

• Also a joint venture opportunity for a major or mid-tier gold

producer to earn a majority interest

producer to earn a majority interest

20

Richardson

21

Richardson Hwy

44 Sq. Mi. of Claims

Shamrock

Bald Knob

Democrat

Hilltop

May’s Pit

Experienced Management Team

Maston Cunningham - President and CEO

• Joined TIV in 2009; became CEO in March 2010

• 22 years with Occidental Petroleum, includes 15 years abroad

• President & GM of Oxy’s subsidiary in Ecuador

John Durbin - CFO

• 30-year career in senior financial positions with Conoco and DuPont

• Extensive international experience

Michael Stark - VP of Exploration

• 12 years with Ivanhoe Energy; most recently as VP of Exploration and Land

• 20 years with Occidental Petroleum, includes 9 years abroad

Jim Kromer - VP of Operations

• 44 years experience in drilling, production, engineering, and operations

• Conoco, Exxon, Amerada Hess, Omni Exploration, Damson Oil, Ely, Stream Energy, Matris

Exploration, and Delta Petroleum

Exploration, and Delta Petroleum

22

Key Accomplishments in 2010

• Closed a $5.0 million sale of common stock in a registered

direct offering with institutional investors in April 2010

direct offering with institutional investors in April 2010

• Completed artificial lift installations for all seven horizontal

oil wells producing at Oxnard

oil wells producing at Oxnard

• Implemented expanded 30-day steam cycles at Oxnard

• Re-activated production on four existing oil wells at Claflin

• Formed an Advisory Committee with partners who own or

control a majority interest of the TVC OPUS 1 Drilling

Program, L.P., to align interests with TIV for development

of Pleasant Valley oil sands project

control a majority interest of the TVC OPUS 1 Drilling

Program, L.P., to align interests with TIV for development

of Pleasant Valley oil sands project

23

Key Accomplishments in 2010

• Reorganized to focus on oil and gas production; developed

plan to monetize Alaskan properties:

plan to monetize Alaskan properties:

• Completed an NI 43-101 Report on Shorty Creek

• Opened virtual data room for Shorty Creek and Richardson

• Closed $2.5 MM sale of Admiral Calder calcium carbonate

property

property

• Built a reservoir model/simulator for PV oil sands project

• Hired a senior operations engineer with SAGD experience

for Pleasant Valley oil sands project

for Pleasant Valley oil sands project

• Cancelled warrants from April 2010 registered direct

offering to improve TIV’s capital structure

offering to improve TIV’s capital structure

24

Where We Are Going in 2011?

• Increase daily gross oil production from 300 to 1,000

barrels by year-end 2011

barrels by year-end 2011

• Increase production at Claflin and Pleasant Valley

• Initiate first SAGD oil sands production in California

• Drill up to 22 new wells at Claflin

• Reach agreement with OPUS partnership to better align

interests with TIV for Oxnard oil sands development

interests with TIV for Oxnard oil sands development

• Secure an earn-in agreement with an established industry

partner to prove up gold and other minerals on one of the

Alaskan properties

partner to prove up gold and other minerals on one of the

Alaskan properties

• Achieve breakeven cash flow from operations by year-end

25

TIV Valuation Metrics

Total Reserves 10.0

5.5 $110.3

$2.01

5.5 $110.3

$2.01

*NPV 10% Values on 2010 SEC Based Reserves

26

$MM $/share Market Cap: 3-15-11 Closing Price $26.4 $0.48 Risked Risk Adjusted Net Asset Valuation*: MMBO MMBO $MM $/share Proved Reserves: Claflin-Brea 2.1 2.1 $35.2 $0.64 Oxnard 1.0 1.0 $30.1 $0.55 Probable Reserves: Claflin-Brea 1.7 .9 $11.8 $0.21 Oxnard .7 .4 $10.7 $0.19 Possible Reserves: Oxnard 4.5 1.1 $22.5 $0.41 Total Reserves 10.0 5.5 $110.3 $2.01 *NPV 10% Values on 2010 SEC Based Reserves

TIV Valuation Metrics

• TIV’s current $26.4 MM Market Cap represents:

o 25% discount to Claflin-Brea Proved Reserves

o 60% discount to Total Proved Reserves

o 70% discount % to Total Proved & Probable Reserves

o 75% discount to Total Proved, Probable & Possible Reserves

• Market Cap does not appear to reflect any upside value for:

o Higher Current 2011 Oil Prices vs. 2010

o Monetization of Shorty Creek & Richardson Gold Projects

o Resolution of litigation related to one property at Oxnard (3.4 MMBO

net contingent resources)

net contingent resources)

27

BLM Oil and Gas Lease Auction

Tops $1.4 Million*

Tops $1.4 Million*

• Six oil and gas lease parcels in Kern County were

auctioned for a total of $1,479,093.50, including

administrative fees, by the Bureau of Land

Management’s Bakersfield Field Office Wednesday.

auctioned for a total of $1,479,093.50, including

administrative fees, by the Bureau of Land

Management’s Bakersfield Field Office Wednesday.

• Vintage Production California, Bakersfield, paid the

highest price per acre $2,000, and also paid the highest

total bid price for one parcel, $1,008,000.

highest price per acre $2,000, and also paid the highest

total bid price for one parcel, $1,008,000.

*Source: BLM News Release 3-10-2011

28