Attached files

| file | filename |

|---|---|

| EX-23.1 - EXHIBIT 23.1 - TRI VALLEY CORP | tv231ex.htm |

| EX-10.4 - EXHIBIT 10.4 - TRI VALLEY CORP | tv104ex.htm |

| EX-31.2 - EXHIBIT 31.2 - TRI VALLEY CORP | tv312ex.htm |

| EX-31.1 - EXHIBIT 31.1 - TRI VALLEY CORP | tv311ex.htm |

| EX-10.3 - EXHIBIT 10.3 - TRI VALLEY CORP | tv103ex.htm |

| EX-99.1 - EXHIBIT 99.1 - TRI VALLEY CORP | tv991ex.htm |

| EX-32.2 - EXHIBIT 32.2 - TRI VALLEY CORP | tv322ex.htm |

| EX-23.3 - EXHIBIT 23.3 - TRI VALLEY CORP | tv233ex.htm |

| EX-99.2 - EXHIBIT 99.2 - TRI VALLEY CORP | tv992ex.htm |

| EX-32.1 - EXHIBIT 32.1 - TRI VALLEY CORP | tv321ex.htm |

| EX-23.2 - EXHIBIT 23.2 - TRI VALLEY CORP | tv232ex.htm |

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the Fiscal Year Ended December 31, 2009

|

Commission File No. 001-31852

|

TRI-VALLEY CORPORATION

(Exact Name of Registrant as Specified in its Charter)

|

Delaware

|

94-1585250

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

4550 California Avenue, Suite 600, Bakersfield, California 93309

(Address of Principal Executive Offices)

Registrant's Telephone Number Including Area Code: (661) 864-0500

Securities Registered Pursuant to Section 12(b) of the Act:

|

Title of each class

|

Name of exchange on which registered

|

|

Common Stock, $0.001 par value

|

NYSE Amex, LLC

|

Securities Registered Pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act

Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o Nox

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such requirement for the past 90 days.

Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o Nox

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulations S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

Large accelerated filer o Accelerated filer x Non-accelerated filer o Smaller reporting company o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yeso Nox

As of March 22, 2010, 33,398,904 shares of common stock were outstanding.

The aggregate market value of the common shares of Tri-Valley Corporation held by non-affiliates on the last day of the registrant’s most recently completed second fiscal quarter was approximately $24 million.

DOCUMENTS INCORPORATED BY REFERENCE: None

TABLE OF CONTENTS

|

PART I

|

||

|

ITEM 1

|

Business

|

1

|

|

Competition

|

2

|

|

|

Governmental Regulation

|

2

|

|

|

Environmental Regulation

|

2

|

|

|

Employees

|

3

|

|

|

Available Information

|

3

|

|

|

ITEM 1A

|

Risk Factors

|

4

|

|

ITEM 1B

|

Unresolved Staff Comments

|

6

|

|

ITEM 2

|

Properties

|

7

|

|

Oil and Gas

|

7

|

|

|

Minerals

|

12

|

|

|

ITEM 3

|

Legal Proceedings

|

14

|

|

PART II

|

||

|

ITEM 5

|

Market Price of the Registrant's Common Stock and Related Security Holder Matters

|

15

|

|

Performance Graph

|

15

|

|

|

Equity Compensation Plan Information

|

16

|

|

|

ITEM 6

|

Selected Historical Financial Data

|

17

|

|

ITEM 7

|

Management's Discussion and Analysis of Financial Condition and Results of Operations

|

17

|

|

Notice Regarding Forward-Looking Statements

|

17

|

|

|

Overview

|

17

|

|

|

Critical Accounting Policies

|

18

|

|

|

Other Significant Accounting Polices

|

19

|

|

|

Accounting for Oil and Gas Producing Activities

|

20

|

|

|

Rig Operations

|

20

|

|

|

Mining Activity

|

20

|

|

|

Results of Operations

|

21

|

|

|

Financial Condition

|

23

|

|

|

Operating Activities

|

24

|

|

|

Investing Activities

|

24

|

|

|

Financing Activities

|

24

|

|

|

Liquidity and Capital Resources

|

24

|

|

|

ITEM 7A

|

Quantitative and Qualitative Disclosures About Market Risk

|

24

|

|

ITEM 8

|

Financial Statements

|

25

|

|

ITEM 9A

|

Controls and Procedures

|

58

|

|

Evaluation of Disclosure Controls

|

58

|

|

|

Management’s Report on Internal Control over Financial Reporting

|

58

|

|

|

Changes in Internal Control

|

59

|

|

|

Remediation of Material Weaknesses in Internal Control over Financial Reporting

|

59

|

|

|

PART III

|

||

|

ITEM 10

|

Directors and Executive Officers

|

62

|

|

ITEM 11

|

Executive Compensation

|

67

|

|

Compensation Discussion and Analysis

|

67

|

|

|

Personnel and Compensation Committee Report

|

71

|

|

|

Summary Compensation Table

|

72

|

|

|

Employment Agreement with Our Chief Executive Officer

|

72

|

|

|

Aggregated 2009 Option Exercises and Year-End Values

|

73

|

|

|

Option Grants During the Fiscal Year Ended December 31, 2009 to Named Executive Officers

|

74

|

|

|

Outstanding Equity Awards Table to Named Executive Officers and Directors

|

75

|

|

|

Compensation of Directors

|

76

|

|

|

ITEM 12

|

Security Ownership of Certain Beneficial Owners and Management

|

77

|

|

ITEM 13

|

Certain Relationships and Related Transactions

|

78

|

|

ITEM 14

|

Principal Accounting Fees and Services

|

78

|

|

ITEM 15

|

Exhibits and Financial Statement Schedules

|

79

|

|

SIGNATURES

|

80

|

|

ii

PART I

ITEM 1. BUSINESS

Tri-Valley Corporation (“Tri-Valley”, “TVC”, or “the Company”) is a Delaware corporation which currently conducts its operations through five wholly-owned subsidiaries. TVC’s principal offices are located at 4550 California Avenue, Suite 600, Bakersfield, California 93309; telephone (661) 864-0500.

GENERAL

The Company's five subsidiaries are:

|

|

•

|

Tri-Valley Oil & Gas Co. (“TVOG”)—conducts our hydrocarbon (crude oil and natural gas) business. TVOG derives its revenue from crude oil and natural gas drilling.

|

|

|

•

|

Select Resources Corporation, Inc. (“Select”)—conducts our precious metals and industrial minerals business. Select holds and develops three major mineral assets in the State of Alaska.

|

|

|

•

|

Great Valley Production Services, LLC (“GVPS”)—conducts our oil production services, well work over services, and the business of refurbishment of oilfield equipment.

|

|

|

•

|

Great Valley Drilling Company, LLC (“GVDC”)—formed to operate an oil drilling rig in the State of Nevada.

|

|

|

•

|

Tri-Valley Power Corporation—is inactive at the present time.

|

|

Tri-Valley's businesses are organized into four operating segments:

|

|

|

-

|

Oil and Gas Operations—This segment represents our oil and gas business. Further, during 2009, this segment generated 74% of the Company’s revenues from operations.

|

|

-

|

Rig Operations—This segment consists of drilling rig operations and also includes income from the rental and sale of oil field equipment.

|

|

-

|

Minerals—This segment represents our precious metal and industrial mineral prospects. In the past, it has generated revenues from pilot-scale mining projects and subcontracting exploration and business development projects. This segment holds title to land or leases in the State of Alaska. There was no significant precious metals activity in 2009.

|

|

-

|

Drilling and Development—This segment includes revenue received from crude oil and natural gas drilling and development operations performed for joint venture partners.

|

For additional information regarding Tri-Valley's current developments and segments, please see PART II, ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION and Note 16 to the Consolidated Financial Statements.

Marketing

We sell all of our crude oil production to Santa Maria Refining Company and to Kern Oil & Refining Co.; and all of our natural gas production to DMJ Gas Marketing Consultants, LLC; and California Energy Exchange Corporation.

1

Executive Management Changes

Mr. Maston N. Cunningham joined the Company on January 15, 2009, as Vice President of Corporate Development. He was subsequently promoted to President and Chief Operating Officer in May 2009. In January 2010, the Company announced that Mr. Cunningham would succeed Mr. F. Lynn Blystone as Chief Executive Officer on or before March 31, 2010.

On March 5, 2010, Mr. F. Lynn Blystone retired from his positions as Chief Executive Officer and Chairman of the Board of Directors of the Company. Mr. G. Thomas Gamble, Director and Vice Chairman of the Board of Directors, was elected Chairman of the Board of Directors of the Company, replacing Mr. Blystone as Chairman; Mr. Cunningham was elected Chief Executive Officer and President of the Company, replacing Mr. Blystone as Chief Executive Officer.

On October 1, 2009, Mr. John E. Durbin joined the Company as Chief Financial Officer, succeeding Mr. Arthur M. Evans. On March 5, 2010, Mr. Durbin was elected Chief Financial Officer and Treasurer.

On October 1, 2009, Mr. Arthur M. Evans was named Chief Compliance Officer for Tri-Valley Corporation. Mr. Evans left the Company on February 25, 2010, when the Company’s compliance function was outsourced to legal counsel.

COMPETITION

The crude oil and natural gas businesses are highly competitive. Competition is particularly intense to acquire desirable producing properties, to acquire crude oil and natural gas exploration prospects or properties with known reserves, suitable for enhanced development and production efforts, and to hire qualified and experienced human resources. Our competitors include the major integrated energy companies, as well as numerous independent oil and gas companies, individual proprietors, and drilling programs. Many of these competitors possess and employ financial and human resources substantially greater than ours. Our competitors may also have a superior capability for evaluating, bidding, and acquiring desirable producing properties and exploration prospects.

We also face significant competition in our precious metals and minerals business. Competition is particularly intense to acquire mineral prospects and deposits suitable for exploration and development, to acquire reserves, and to hire qualified and experienced human resources. Our competitors in mineral property exploration, acquisition, development, and production include the major mining companies in addition to numerous intermediate and junior mining companies, mineral property investors and individual proprietors.

GOVERNMENTAL REGULATION

Petroleum exploration, development, storage, and sales activities are extensively regulated at both the federal and state levels in the United States. Likewise, the same is true for the exploration, development, and operation of minerals and precious metals properties. Legislation affecting our businesses is under ongoing review for amendment or expansion, frequently increasing the related regulatory burden. Numerous departments and agencies, both federal and state, are authorized by statute to issue, and have issued, rules and regulations affecting the crude oil, natural gas, minerals, and precious metals industries. Compliance with these rules and regulations is often difficult and costly, and there are substantial penalties for noncompliance. State statutes and regulations require permits for drilling operations, drilling bonds, and reports concerning operations. Our operations are also subject to numerous laws and regulations governing plugging and abandonment, the discharge of materials into the environment, or otherwise relating to environmental protection. The heavy regulatory burden on our businesses increases the cost of doing business and, consequently, affects our profitability. Given the uncertainty of the regulatory environment, we cannot predict the impact of governmental regulation on our financial condition or operating results.

ENVIRONMENTAL REGULATION

Our crude oil and natural gas operations are subject to risks of fire, explosions, blow-outs, pipe failure, abnormally-pressured formations, and environmental hazards such as oil spills, natural gas leaks, ruptures, or discharges of toxic gases, the occurrence of any of which could result in substantial losses due to injury or loss of life, severe damage to, or destruction of property, natural resources, and equipment, pollution or other environmental damage, clean-up responsibilities, regulatory investigation and penalties, and suspension of operations. We have contracted a credentialed specialist in health, safety, environmental, and permitting functions, and, in accordance with customary

2

industry practice, we maintain insurance against these kinds of risks. Our insurance coverage may not cover all losses in the event of a drilling or production catastrophe.

Crude oil and natural gas operations can result in liability under federal, state, and local environmental regulations for activities involving, among other things, water pollution and hazardous waste transport, storage, and disposal. Such liability can attach not only to the operator of record of the well, but also to other parties that may be deemed to be current or prior operators or owners of the wells or the equipment involved. Numerous governmental agencies issue rules and regulations to implement and enforce such laws, which are often difficult and costly to comply with and which carry substantial administrative, civil, and criminal penalties and, in some cases, injunctive relief for failure to comply. Some laws, rules, and regulations relating to the protection of the environment may, in certain circumstances, impose "strict liability" for environmental contamination. These laws can render a person or company liable for environmental and natural resource damages, cleanup costs, and, in the case of oil spills, consequential damages without regard to negligence or fault. Other laws, rules, and regulations may require the rate of oil and gas production to be below the economically optimal rate or may even prohibit exploration or production activities in environmentally sensitive areas. In addition, these laws often require some form of remedial action, such as closure of inactive pits and plugging of abandoned wells, to prevent pollution from former or suspended operations.

Compliance with environmental requirements, including financial assurance requirements and the costs associated with the cleanup of any spill, could have a material adverse effect on our capital expenditures or earnings. These laws and regulations have not had a material effect on the Company to date. Nevertheless, environmental laws and changes in environmental laws have the potential to adversely affect operations. At this time, we have no plans to make any material capital expenditures for environmental control facilities.

Our precious metals and minerals exploration and property development activities in Alaska are subject to various federal and state laws and regulations governing the protection of the environment. These laws and regulations are continually changing, are generally becoming more restrictive, and have the potential to adversely affect our minerals exploration and property development activities.

EMPLOYEES

We had a total of thirty-two employees on March 26, 2010.

AVAILABLE INFORMATION

We file annual and quarterly reports, proxy statements, and other information with the Securities and Exchange Commission (“the SEC”) using the SEC's EDGAR system. The SEC maintains a website on the Internet at http://www.sec.gov that contains all of the Company’s filings. These filings may be downloaded free of charge. One may also read and/or copy any of our SEC filings in its Public Reference Room at 100 F Street, NE, Washington, DC 20549. Our common stock is listed on the NYSE Amex, LLC, under the ticker symbol “TIV”. Please contact the SEC at 1-800-SEC-0330 for further information about their Public Reference Room. Tri-Valley Corporation’s website may be accessed at http://www.tri-valleycorp.com.

We furnish our shareholders with a copy of our Annual Report on Form 10-K which contains audited financial statements and such other reports as we, from time to time, may deem appropriate or as may be required by law. We use the calendar year as our fiscal year.

3

ITEM 1A. RISK FACTORS

You should carefully consider the following risk factors in addition to the other information included in this Annual Report on Form 10-K. Each of these risk factors could adversely affect our business, operating results, and financial condition, as well as, adversely affect the value of an investment in our common stock.

Changing global and local commodity pricing strongly impacts the Company’s operating results.

Our operating results depend heavily upon our ability to market our crude oil and natural gas production at favorable prices. The factors influencing the prices of the commodities we sell are beyond our control, including changes in consumption patterns, global and local economic conditions, production disruptions, OPEC actions, and other factors that impact supply and demand for oil and gas. Lower crude oil and natural gas prices may reduce the amount of these commodities we can economically develop and produce, and, in turn, may have a material, adverse effect on the carrying value of our assets, reserves, and operating results.

Any material change in the factors and assumptions underlying our estimates of crude oil and natural gas reserves could impair the quantity and value of those reserves.

Our proved crude oil and natural gas reserves depend on estimates that include reservoir characteristics and recoverability, as well as capital and operating costs. Any changes in the factors and assumptions underlying our estimates of these items could result in a material, negative impact to the volume of reserves reported.

Unless we successfully add to our existing proved reserves, our future crude oil and natural gas production will decline, resulting in an adverse impact to our business.

The rate of production from crude oil and natural gas properties generally declines as reserves are depleted. Except to the extent that we perform successful exploration, development, or acquisition activities, or through engineering studies, identify additional or secondary recovery reserves, our proved reserves will decline as we produce crude oil and natural gas. Likewise, if we are not successful in replacing the crude oil and natural gas we produce with good prospects for future production, our business will experience reduced cash flow and results of operations. As our rates of production have been relatively low, our risk of reserve depletion is, likewise, low for the immediate future. We have a current need for development capital. Without such capital, our ability to increase production will be hindered.

Crude oil and natural gas drilling and production activities are subject to numerous mechanical and environmental risks that could reduce production.

In addition to the risk that no commercially productive crude oil or natural gas reservoirs may be found, our operations may be curtailed, delayed, or canceled. Title problems, weather conditions, compliance with governmental regulations, mechanical difficulties, and shortages or delays in the delivery of drilling rigs and other equipment may limit our ability to develop, produce, or market our reserves.

Drilling for crude oil and natural gas may result in losses, not only as a result of drilling dry wells but also from wells that are productive but produce insufficient net revenues to be profitable on a full-cost basis. Likewise, our properties may be susceptible to hydrocarbon drainage from production by other operators on adjacent properties.

Our business operating risks include, but are not limited to, the risks of fire, explosions, blow-outs, pipe failure, abnormally-pressured formations; as well as environmental hazards, such as oil spills, natural gas leaks, ruptures, or discharges of toxic gases, the occurrence of any of which could result in substantial losses. In accordance with customary industry practice, we maintain insurance against these kinds of risks, but our level of insurance may not cover all losses in the event of a drilling or production catastrophe. Insurance is not available for all operational risks, such as risks that we will drill a dry hole, fail in an attempt to complete a well, or have problems maintaining production from existing wells.

Crude oil and natural gas operations can result in liability under federal, state, and local environmental regulations for activities involving, among other things, water pollution and hazardous waste transport, storage, and disposal. Such liability can attach to the operator of record of the well and also to other parties that may be deemed to be current or prior operators or owners of the wells or the equipment involved. Thus, environmental laws could subject us to liabilities for environmental damages even where we are not the operator who caused the environmental damage.

4

Future governmental and environmental regulations may increase our costs of production, impact or limit our current business plans, and reduce demand for our products.

As explained in detail in PART I, ITEM 1. GOVERNMENTAL REGULATION and in ITEM 1. ENVIRONMENTAL REGULATION, United States exploration for the production and sale of crude oil and natural gas is extensively regulated at both the federal and state levels. Our oil and gas business is subject to numerous laws and regulations relating to the protection of the environment. These laws and regulations continue to increase in both number and complexity and affect our operations. Any change in such laws, rules, regulations, or interpretations, may have a material, adverse effect on our revenues, operating income, and cash flow.

Additionally, we could be adversely affected by potential legislation that seeks to control or reduce emissions of “greenhouse gases” or use of fossil fuels, the adoption of which may increase our costs to find, develop, and produce crude oil and natural gas in the future.

Currently pending lawsuits threaten to limit potential development of a significant and valuable heavy oil project.

There are currently two legal actions pending against us that may result in the termination of leases to properties in our Pleasant Valley Project. Please see PART I, ITEM 3. LEGAL PROCEEDINGS. Drilling and production operations have not yet commenced on one of these leases, and operations on the other leases are currently suspended, pending the installation of an improved electric distribution system that is required by a local regulatory body. We believe that the leases have significant potential for development, but if the lessors are successful in terminating the oil and gas leases, our potential for future development in the Pleasant Valley Field will be significantly impaired. We are vigorously pursuing and defending these lawsuits, as we believe that we have valid claims and defenses. The litigation involves two of our three leases in the Pleasant Valley Field.

Our drilling rig operations have not had significant consistent revenue.

Although our drilling rig operations began in 2006, to date, we have not realized an economic rig utilization rate. Demand continues to be very weak, and we have idled our sole drilling rig. We have no employees devoted to this business. Future drilling rig operations may not be profitable due to the entry of new, lower-cost competitors and continued weak demand.

Our minerals business has not yet realized significant revenue and is not presently profitable.

Select Resources Corporation, Inc., was formed in late 2004 to manage our precious metals and industrial minerals properties in Alaska. The precious metal properties will require additional investment to discover and delineate sufficient mineral resources to justify any future commercial development. The calcium carbonate industrial minerals property could be returned to commercial production if sufficient purchase commitments are secured. To date, we have realized no significant revenue and cannot predict when, if ever, we may see significant returns from our precious metal and mineral investments.

The value of our minerals business depends on numerous factors not under our control.

The economic value of our minerals business may be adversely affected by changes in commodity prices for gold and calcium carbonate, increases in production and/or capital costs, and increased environmental or permitting requirements by federal and state governments. If our mineral properties commence production, our operating results and cash flow may be impaired by reductions in forecast grade or tonnage of the deposits, dilution of the mineral content of the ore, reduction in recovery rates, and a reduction in reserves, as well as unforeseen delays in the development of our projects. Finally, new competitors able to operate at lower costs may enter the industry.

The value of our minerals business may be adversely affected by risks and hazards associated with the mining industry that may not be fully covered by insurance.

Our minerals business is subject to a number of risks and hazards including, but not limited to, environmental hazards, industrial accidents, unusual or unexpected geologic formations, and unanticipated hydrologic conditions, including flooding and periodic interruptions caused by inclement or hazardous weather conditions.

We have contracted a credentialed specialist in health, safety, environmental, and permitting functions. For some of these risks, we maintain insurance to protect against these losses at levels consistent with our historical experience,

5

industry practice, and circumstances surrounding each identified risk. Insurance against environmental risks is generally either unavailable or, we believe, unaffordable; and, therefore, we do not maintain environmental insurance. Occurrence of events for which we are not insured may impair the value of our minerals business.

Risks Involved in Our Business Generally

Forward Looking Statements

Some of the information in this Annual Report Form 10-K contains forward-looking statements that involve substantial risks and uncertainties. You can identify these statements by forward-looking words, such as “may,” “will,” “expect,” “anticipate,” “believe,” “estimate”, and “continue,” or similar words. You should read statements that contain these words carefully because they:

• discuss our future expectations

• contain projections of our future results of operations or of our financial condition

• state other “forward-looking” information.

We believe it is important to communicate our expectations. However, there may be events in the future that we are not able to accurately predict and/or over which we have no control. The risk factors listed in this section, other risk factors about which we may not be aware, as well as, any cautionary language in this report, provide examples of risks, uncertainties, and events that may cause our actual results to differ materially from the expectations we describe in our forward-looking statements. You should be aware that the occurrence of the events described in these risk factors could have an adverse effect on our business, results of operations, and financial condition.

Ability to Operate as a Going Concern: If we are unable to obtain additional funding, our business will be materially impaired.

The Company remains dependent on capital formation for funding its operating and general and administrative requirements for 2010. Availability of capital is dependent on many external factors, such as the current economic climate and interest rates, among others, and may not be available to the Company when needed. Important sources for capital in the past have been investment in the TVC OPUS 1 Drilling Program, L.P. and the private placement of our restricted common stock. Although we have been successful in the past at attracting sufficient capital, we do not have certainty that additional financing will be available when needed on acceptable terms. Insufficient financing may prevent or limit us from implementing our business strategy.

Our cash balance as of December 31, 2009, was $0.3 million. Current liabilities were $12.3 million on that date. It should be noted, however, that Accounts Payable to Joint Venture Partners comprised $5.0 million of the $12.3 million in total current liabilities and were offset by $6.5 million in Accounts Receivable from Joint Venture Partners in total current assets on that date. See Note 11 to our consolidated financial statements for the years ended December 31, 2009, and 2008, for additional discussion. In light of this and other factors, our independent accountant has included a going concern qualification in its report on our financial statements for the year ended December 31, 2009, noting that our ability to continue as a going concern is dependent on additional sources of capital and the success of our business strategy. See Note 15 to our consolidated financial statements for the years ended December 31, 2009, and 2008.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None

6

ITEM 2. PROPERTIES

Our principal properties consist of proven and unproven crude oil and natural gas properties; mining claims on unproven precious metals properties; and a fee interest in an industrial minerals property.

OIL AND GAS

The following properties are operated by the Company and have been funded in part by the TVC OPUS 1 Drilling Program, L.P.:

Pleasant Valley: This property is located in Ventura County, California, in the Oxnard Oil Field where we are in the early stages of developing and producing heavy oil from the Upper Vaca Tar Formation. The California State Department of Oil and Gas and Geothermal Resources has published estimates that the Upper Vaca Tar has over 400 million barrels of original oil in place (OOIP), of which we and our partners control about 128 million barrels of OOIP attributable to Pleasant Valley as estimated by an independent reserves engineering firm in October 2009. During 2007, we drilled a total of seven horizontal wells and installed temporary production facilities; and in 2008, we commenced cyclic steaming operations. During 2009, production was curtailed periodically to accommodate installation of larger diameter flow lines, production manifolds, and artificial lift equipment on three of the seven wells; and to test steam injection parameters on individual wells. Smaller diameter tubing was also installed in all seven wells to achieve better steam distribution.

Our plans for 2010 include the drilling of a horizontal injector well that will be paired with an existing horizontal producing well to test Steam-Assisted-Gravity-Drainage (SAGD) technology for future deployment to fully develop and produce the Upper Vaca Tar. We also plan this year to convert a vertical well to a water disposal well to eliminate the cost of offsite water disposal once regulatory approval of our application is received.

Temblor Valley West/South Belridge Field: The South Belridge Properties are located in Kern County, California, west of Bakersfield, and include a total of 56 wells; six producing, one active injection well, and 49 idle wells. Five wells were drilled in 2007, and these wells extended the known oil-bearing formations to the west by over a half mile. Oil production on the Property comes from the Etchegoin Formation. Attempts in prior years to increase production by cyclic steaming of the Lower Diatomite Formation and a pilot waterflood of the Etchegoin Formation proved unsuccessful. We are currently evaluating other options for these Properties, including possible divestiture.

Temblor Valley East/Edison Field: This property is located in Kern County, California, east of Bakersfield and consists of the Shield and Arms Lease which includes two producing wells, one injection well, and three idle wells. The two producing wells were completed in the Olcese Formation and are produced by beam pump. We are currently evaluating other options for this Property, including possible divestiture.

Moffat Ranch: This gas field is located in the southern area of the “California Gas Country” in Madera County in central California. The gas field consists of one producing well and three idle wells. In late 2007, Tri-Valley drilled the deepest wellbore penetration in the field to below 10,000 feet to evaluate more than 14 potential producing horizons. Two of these potential gas zones were evaluated for productive potential in 2007, and one was successfully tested at over one million cubic feet per day. In 2008, attempts to restore the three idle wells to production were unsuccessful. We have plans to rework one of our idle wells in the second quarter of 2010.

Ekho: The Ekho No. 1 exploratory well, located north of Bakersfield in Kern County, California, was originally drilled by the Company to 19,088 feet in 2000 and encountered hydrocarbons in tight formations in the lower zones of the well. In 2005, we hydraulically fractured the Vedder Zone between 18,018 and 18,525 feet, injecting approximately 5,000 barrels of fluid which carried approximately 118,000 pounds of bauxite propping material. While successful mechanically, the fracturing operation did not result in producing hydrocarbons at commercial rates from the Vedder Zone. This well still has multiple targets which can be evaluated in the future, and we will continue to look for new technologies that could allow the Vedder Zone to produce commercially.

Sunrise Natural Gas Project: This project is located just north of Bakersfield, California, in the City of Delano and consists of one vertical well and one horizontal well that were drilled by the Company in 2000 and 2003, respectively, and which encountered “tight” natural gas in the McClure Shale at approximately 8,200 feet. We believe the McClure Shale may hold up to three trillion cubic feet of natural gas in the mapped area of closure. In 2005, we hydraulically fractured 1,000 feet of the 3,000 foot horizontal portion of a well bore in the tight McClure Shale utilizing gelled diesel that carried in approximately 138,000 pounds of sand. Again, while mechanically successful like the Ekho Project, the fracturing operation did not result in the well producing hydrocarbons from the McClure Shale at commercial rates. We will continue to review all available technologies to bring the Sunrise Natural Gas Project potential to commercial realization given the volume of natural gas in place in the tight reservoir.

7

In addition, Tri-Valley currently operates the following properties:

Rio Vista Field: The Rio Vista Field is located in Solano County, in northern California, and we operate four producing gas wells and two idle wells on two separate leases in this field. These two separate leases are the Hanson and the Webb Tract.

Dutch Slough Field: The Dutch Slough Field is located in Contra Costa County in northern California, where we operate one producing gas well and two idle wells on the Martin-Severin Lease in this field.

Edison Field (Race Track Hill Area): The Edison Field Property is located east of Bakersfield, California, and contains seven idle wells that offset a successful cyclic steaming operation in the Santa Margarita Formation. We have obtained 29 individual well drilling permits for this property and plan to reactivate production on this lease in 2010 with cyclic steaming operations in the second quarter of the year. We also plan to drill up to 20 new wells beginning in the third quarter of 2010. This property, when fully developed, has the potential to produce approximately 3.7 million barrels of oil for Tri-Valley’s interest, based upon an independent engineering report completed in January 2010.

Proved Reserves

We have retained the services of Mr. Leland B. Cecil, P.E., an independent petroleum engineer based in Bakersfield, California, and AJM Petroleum Consultants of Calgary, Alberta, Canada, to estimate the Company’s net share of Proved and Prospective Reserves at December 31, 2009. Proved Reserve estimates are classified as either Developed or Undeveloped Reserves. Prospective Reserves are differentiated as Probable Reserves and Possible Reserves. The estimates were prepared according to the guidelines established by the U.S. Securities and Exchange Commission (“the SEC”) and the Financial Accounting Standards Board (“FASB”) for valuation of crude oil and natural gas reserves.

Proved Reserves are those quantities of crude oil and natural gas, which, by analysis of geoscience and engineering data, can be estimated with reasonable certainty to be economically producible from a given date forward, from known reservoirs, and under existing economic conditions, operating methods, and government regulations, prior to the time at which contracts providing the right to operate expire, unless evidence indicates that renewal is reasonably certain, regardless of whether deterministic or probabilistic methods are use for the estimation. Projects to extract the hydrocarbons must have commenced, or the operator must be reasonably certain it will commence the projects within a reasonable time. Proved Reserves are further classified as either Developed or Undeveloped. Proved Developed Reserves are Proved Reserves that can be expected to be recovered through existing wells with existing equipment and operating methods or in which the cost of the required equipment is relatively minor compared to the cost of a new well, and through installed extraction equipment and infrastructure operational at the time of the reserves estimate if the extraction is by means not involving a well. Proved Undeveloped Reserves are Proved Reserves that are expected to be recovered from new wells on undrilled acreage, or from existing wells where a relatively major expenditure is required for recompletion.

Prospective Reserves are differentiated according to reservoir characteristics and exhibited recovery from efforts analogous to the subject properties. Probable Reserves are those additional reserves that are less certain to be recovered than Proved Reserves but which, together with Proved Reserves, are as likely as not to be recovered. Probable reserves may be assigned to areas of a reservoir adjacent to Proved Reserves where data control or interpretations of available data are less certain, even if the interpreted reservoir continuity of structure or productivity does not meet the reasonable certainty criterion. Likewise, Probable Reserves may be assigned to areas that are structurally higher than the proved area if these areas are in communication with the proved reservoir. Finally, Possible Reserves are those additional reserves that are less certain to be recovered than Probable Reserves. Possible Reserves may be assigned to areas of a reservoir adjacent to Probable Reserves where data control and interpretations of available data are progressively less certain. Frequently, this will be in areas where geoscience and engineering data are unable to define clearly the area and vertical limits of commercial production from the reservoir by a defined project. Possible Reserves also include incremental quantities associated with a greater percentage recovery of the hydrocarbons in place than the recovery quantities assumed for Probable Reserves.

Engineering estimates of the quantities of proved reserves are inherently imprecise and represent only approximate amounts because of the judgments involved in developing such information.

8

Our estimated future net recoverable crude oil and natural gas reserves as of December 31, 2009, 2008, and 2007, were as follows:

|

Year Ending

|

BBL

|

MCF

|

||

|

Crude Oil

|

Natural Gas

|

|||

|

December 31, 2009

|

Developed

|

282,271

|

395,252

|

|

|

Undeveloped

|

2,738,439

|

0

|

||

|

Net Proved

|

3,020,710

|

395,252

|

||

|

Probable

|

760,000

|

0

|

||

|

Possible

|

6,045,425

|

42,008

|

||

|

Net Prospective

|

6,805,425

|

42,008

|

||

|

December 31, 2008

|

Developed

|

0

|

695,931

|

|

|

Undeveloped

|

0

|

0

|

||

|

Net Proved

|

0

|

695,931

|

||

|

Probable

|

0

|

0

|

||

|

Possible

|

0

|

0

|

||

|

Net Prospective

|

0

|

0

|

||

|

December 31, 2007

|

Developed

|

372,048

|

791,128

|

|

|

Undeveloped

|

0

|

0

|

||

|

Net Proved

|

372,048

|

791,128

|

||

|

Probable

|

0

|

0

|

||

|

Possible

|

0

|

0

|

||

|

Net Prospective

|

0

|

0

|

||

|

December 31, 2006

|

Developed

|

275,452

|

787,017

|

|

|

Undeveloped

|

0

|

0

|

||

|

Net Proved

|

275,452

|

787,017

|

||

|

Probable

|

0

|

0

|

||

|

Possible

|

0

|

0

|

||

|

Net Prospective

|

0

|

0

|

||

Economics for determined reserves in 2009 were formulated from market conditions that existed during the twelve months of the year. Product sale prices were calculated from applicable prices posted on the first day of the calendar months. Operating expenses were normalized for a twelve month moving average. No consideration was given to potential future inflation of either product sale prices or costs relative to future operation. The present value of projected future net income was calculated at an annual discount rate of 10%. On this basis, future net revenue to be derived from our Proved Developed and Undeveloped crude oil and natural gas reserves was $44.2 million at December 31, 2009.

Using year-end 2008 crude oil and natural gas prices and prevailing levels of lease operating expenses, the estimated present value of the future net revenue to be derived from our proved developed and undeveloped crude oil and natural gas reserves, discounted at 10%, was $1.7 million at December 31, 2008, and $12.3 million at December 31, 2007. The precipitous drop in crude oil reported reserves from the end of 2007 to the end of 2008 was due to the

9

collapse of crude oil prices in the second half of 2008. This resulted in the proved producing reserves on our producing oil wells at the time to be written down to zero in the reserve report.

On December 31, 2008, the SEC issued Release No. 33-8995 amending its oil and natural gas reporting requirements for oil and natural gas producing companies. The effective date of the new accounting and disclosure requirements is for annual reports filed for fiscal years ending on or after December 31, 2009. Among other things Release No. 33-8995:

|

·

|

Revises a number of definitions relating to proved oil and natural gas reserves to make them consistent with the Petroleum Resource Management System, which includes certain non-traditional resources in proved reserves.

|

|

·

|

Permits the use of new technologies for determining proved oil and natural gas reserves.

|

|

·

|

Requires the use of average prices for the trailing twelve-month period in the estimation of oil and natural gas reserve quantities and for companies using the full cost method of accounting, in computing the Ceiling Limitation, in place of a single day price as of the end of the fiscal year.

|

|

·

|

Permits the disclosure in filings with the SEC of probable and possible reserves and reserves sensitivity to changes in prices.

|

|

·

|

Requires additional disclosures (outside of the financial statements) regarding the status of undeveloped reserves and changes in status of these from period to period.

|

|

·

|

Requires a discussion of the internal controls in place to assure objectivity in the reserve estimation process and disclosure of the technical qualifications of the technical person having primarily responsibility for preparing the reserve estimates.

|

Companies are not permitted to use the new SEC requirements for fiscal years ending prior to December 31, 2009. We have evaluated the effect that adoption of the final rule will have on our financial statements and oil and natural gas reserve estimates and disclosures. Based on a review by our independent petroleum engineer, we believe that, if the new requirements had been in effect for our fiscal 2008, our reported natural gas and crude oil reserves would have been substantially higher than those reported under the currently applied SEC standards. Notably, the use of trailing twelve month average prices instead of year end prices would have dramatically increased the value of our reserves. In fiscal 2008, the prices we received for oil production varied from a high of $123.13 per barrel to a low of $26.15 per barrel, with the year end price on which reserves were calculated being $30.13 per barrel.

The unaudited supplemental information attached to the consolidated financial statements provides more information on crude oil and natural gas reserves and estimated values.

The following table sets forth the net quantities of natural gas and crude oil that we produced during:

|

Year Ended December 31,

|

|||

|

2009

|

2008

|

2007

|

|

|

Natural Gas (MCF)

|

32,076

|

102,070

|

45,928

|

|

Crude Oil (BBL)

|

21,092

|

26,299

|

7,006

|

10

The following table sets forth our average sales price and average production (lifting) cost per unit of crude oil and natural gas produced during:

|

Year Ended December 31,

|

||||||||||||||||||||||||

|

2009

|

2008

|

2007

|

||||||||||||||||||||||

|

Gas (MCF)

|

Oil (BBL)

|

Gas (MCF)

|

Oil (BBL)

|

Gas (MCF)

|

Oil (BBL)

|

|||||||||||||||||||

|

Sales Price

|

$ | 3.55 | $ | 35.74 | $ | 8.07 | $ | 90.10 | $ | 7.15 | $ | 58.23 | ||||||||||||

|

Production Costs

|

$ | 2.91 | $ | 69.68 | $ | 1.67 | $ | 37.45 | $ | 1.55 | $ | 16.28 | ||||||||||||

|

Net Profit

|

$ | 0.64 | $ | (33.94 | ) | $ | 6.40 | $ | 52.65 | $ | 5.60 | $ | 41.95 | |||||||||||

|

As of December 31, 2009, we had the following gross and net position in wells and developed acreage:

|

|

Wells (1)

|

Acres (2)

|

|||||

|

Gross

|

Net

|

Gross

|

Net

|

|||

|

79

|

22.81

|

3,730

|

1,044

|

All of our producing wells and acres where the Company has a working interest are located within California.

|

(1)

|

"Gross" wells represent the total number of producing wells in which we have a working interest. "Net" wells represent the number of gross producing wells multiplied by the percentages of the working interests which we own. "Net wells" recognizes only those wells in which we hold an earned working interest. Working interests earned at payout have not been included.

|

|

(2)

|

"Gross" acres represent the total acres in which we have a working interest. "Net" acres represent the aggregate of the working interests which we own in the gross acres.

|

The following table sets forth the number of productive and dry exploratory and development wells which we drilled during:

|

Year Ended December 31,

|

|||

|

2009

|

2008

|

2007

|

|

|

Exploratory

|

|||

|

Producing

|

-0-

|

-0-

|

-0-

|

|

Dry

|

-0-

|

-0-

|

-0-

|

|

Total

|

-0-

|

-0-

|

-0-

|

|

Development

|

|||

|

Producing

|

-0-

|

-6-

|

-5-

|

|

Dry

|

-0-

|

-0-

|

-0-

|

|

Total

|

-0-

|

-6-

|

-5-

|

The following table sets forth information regarding undeveloped oil and gas acreage in which we had an interest on December 31, 2009:

|

State

|

Gross Acres

|

Net Acres

|

||

|

California

|

22,465

|

19,373

|

||

11

Our undeveloped acreage is held pursuant to leases from landowners. Such leases have varying dates of execution and generally expire one to five years after the date of the lease without drilling or unitization into an offsetting producing well. In the next three years, the following lease gross acreage expires:

|

Expires in 2010

|

7,268 acres

|

|

Expires in 2011

|

1,089 acres

|

|

Expires in 2012

|

8,678 acres

|

MINERALS

Our wholly-owned subsidiary, Select Resources Corporation, Inc., holds and maintains two precious metal properties and an industrial minerals property in the State of Alaska. The Richardson and Shorty Creek precious metal properties are exploration stage gold properties which require additional capital to fully evaluate their gold and minerals potential. There is no assurance that a commercially-viable mineral deposit exists on either of these precious metal properties. Current economic conditions point towards continued strength for precious metal prices, and we plan to maintain a strong focus on these properties.

Our industrial minerals property, the Admiral Calder Quarry (“Calder”), contains over 25 million tons of high grade minable resource in place according to our independent engineering estimates and was partially developed and produced for a short time by the previous owner. Select acquired Calder in 2005 but has neither mined nor sold any product from the property.

Shorty Creek: In January 2005, we acquired the Shorty Creek property (“Shorty”) which is located in the Tolovana District about 60 miles northwest of Fairbanks, Alaska, along the paved, all-weather Elliot Highway that is the principal route used to access the North Slope petroleum production areas. Shorty has been described by a state geologist of Alaska as perhaps the best drill–ready gold exploration project in the state; and it directly offsets, and is on trend with, International Tower Hill’s ongoing exploration drilling program at its Livengood Gold Project which has so far defined 12.5 million ounces of gold (indicated and inferred).

Shorty Creek is a gold or possible polymetalic exploration project where we have conducted previous campaigns of exploration work that included geochemical sampling and drilling which have identified anomalous concentrations of gold, copper, molybdenum, and their pathfinder elements.

In 2005 we carried out geophysical and satellite interpretation programs over a large portion of Shorty Creek and a multi-element soil auger geochemical program extending over one of four distinctive aeromagnetic anomalies, covering an area approximately of one mile, resulting in the identification of five precious metal and base metal anomalies. This same year we acquired mineral rights to 178 State of Alaska mining claims through staking and lease arrangements from Gold Range Ltd., covering approximately 17 square miles. In 2009, additional property was acquired through contractors, essentially doubling Shorty’s property position to about 40 square miles, and was based on geophysics and third-party gold geochemistry.

Also in 2009, we acquired regional geochemistry data from the State of Alaska and an interpretation of that data by the University of Alaska which significantly enhanced the potential of Shorty Creek. The State’s geochemistry data was collected over a 1,000 square mile area that includes Shorty Creek. From this data, the University determined that the highest two-and-one-quarter percent (2.25%) concentrations of precious and base metals are clustered in a 45 square mile area and about eighty-five percent (85%) of this cluster lies within the boundaries of the Shorty Creek prospect.

To date, we have not identified proven or probable mineral reserves on Shorty Creek. Based on archived data, including the State of Alaska geochemistry data and the University of Alaska study, significant mineralization has been identified on the property; and if determined to be of adequate size, quality, and spatial distribution, the final extent of this mineralization could prove to be economic in the future. Further exploration is required before a final evaluation as to the economic and technical feasibility can be determined. To that end, we have contracted Avalon Development Corporation to prepare an NI 43-101 (Canadian form) report for Shorty Creek which should be completed in the second quarter of 2010 and continue to pursue options for funding additional exploration work on the property.

12

The following table sets forth the information regarding the acreage position of the Shorty Creek claim block as of December 31, 2009:

|

Gross Acres

|

Net Acres

|

|

24,440

|

24,440

|

Richardson: The Richardson Property (“Richardson”) is located in the Richardson District, one of the most prospective and underexplored gold exploration districts in east-central Alaska. Our claims are located near the all-weather paved Richardson Highway, about seventy miles southeast of Fairbanks, Alaska, and just south of the nearby Trans-Alaska Pipeline corridor that provides access to our claims from the north. We acquired the bulk of the Richardson property in 1987, and it covers 29,640 acres of land, all of which is owned by the State of Alaska.

The Richardson Project is an early-stage gold exploration project with past placer production and pilot-size lode gold production. Geophysical and geochemical signatures are consistent with intrusion-related gold systems. Nine highly prospective zones have been identified in previous exploration programs carried out by the Company and previous owners.

In late 2005, we initiated geophysical and satellite interpretation programs over the entire Richardson Property and a multi-element soil auger geochemical program, extending along approximately 4.5-miles of the Richardson Lineament that appears to extend 12 to 15 miles in length. The survey found six precious metal and other element anomalies. We also conducted 3,050 feet of diamond drilling in the Democrat Mine area which indicated gold and silver mineralization.

To date, we have no proven or probable mineral reserves on Richardson and have contracted with Avalon Development Corporation to produce an NI 43-101 report (Canadian form) that will be prepared in 2010 after completion of a similar report for Shorty Creek.

The following table sets forth the information regarding the acreage position of our Richardson, Alaska, claim block as of December 31, 2009:

|

Gross Acres

|

Net Acres

|

|

29,640

|

28,821

|

Industrial Minerals: Our industrial minerals project is the Admiral Calder calcium carbonate quarry (“Calder”) located in Alaska on the northwest end of Prince of Wales Island, approximately 150 air miles south of Juneau and 88 air miles northwest of Ketchikan. Independent estimates conclude that Calder may hold in excess of 25 million tons of high chemical grade, high brightness, and high whiteness calcium carbonate resource in place. By some authorities, Calder has the potential to be “a world class producer of calcium carbonate for several markets” (Harben and Lobdell, Peter Harben, Inc. 2005).

Select paid $3.0 million in 2005 to acquire Calder from Sealaska Corporation, which had invested approximately $20 million to partially delineate and develop the mineral deposit, including installations of mining materials handling equipment, marine loading facilities, and other infrastructure on the property. The quarry covers only 15 acres, but the entire property covers 572 acres of patented mining ground and includes all operating permits and tideland leases. Less than 10% of the acreage has been explored, and geologic mapping suggests substantially more resources exist on the property. The property has been in a “care and maintenance” mode since 2005 while we pursued additional capital, potential partners, and calcium carbonate product customers that would facilitate restarting quarry operations. Improved global economic conditions in the future should stimulate demand for calcium carbonate which is a key ingredient in over 1,200 products including paper and paints. Industrial minerals projects such as Calder must be competitive with other producers in terms of quality, volume, and CIF pricing to gain customers. Calder’s seaside location and marine loading facilities offer a distinct competitive advantage.

In 2009, Select continued negotiations with prospective buyers for calcium carbonate who had obtained product quality tests from outside parties. These tests confirmed the extremely high quality of the calcium carbonate in the size range of over ten microns and also better quantified the reduced whiteness and brightness for the two micron size fraction. In 2010, we are pursuing options to monetize Calder, including: 1) redevelopment of the quarry; 2) outright sale or lease; 3) joint venture; or a combination of these three options.

13

The following table sets forth the information regarding the acreage position of our Admiral Calder Property as of December 31, 2009:

|

Gross Acres

|

Net Acres

|

|

572

|

572

|

ITEM 3. LEGAL PROCEEDINGS

Other than ordinary routine litigation incidental to our business, certain additional material litigation follows:

Tri-Valley Corporation v. Hansen et al., No. 56-2009-00345844-CU-OR-VTA, Superior Court, Ventura County, California.

On May 29, 2009, we filed a quiet title action against the lessors of our Scholle-Livingston oil and gas lease. On July 2, 2009, the defendants filed a cross complaint. Our action seeks to quiet title to our oil and gas lease by affirming the validity of the lease, and the cross-complaint seeks to terminate the lease. Our present intention is to develop this lease as part of our Pleasant Valley Project. Although we have yet to commence drilling or production operations on this lease, we believe it has significant and valuable heavy oil deposits. The present status of the action is that the parties are in the process of discovery, with a trial date scheduled for May 24, 2010. We are vigorously pursuing this lawsuit as we believe that we have valid claims and defenses.

Lenox v. Tri-Valley Corporation, No. 56-2009-00358492-CU-OR-VTA, Superior Court, Ventura County, California

On September 25, 2009, the lessors of our Lenox and Snodgrass oil and gas leases filed a quiet title action against us. Our answer to the action was filed on November 6, 2009. The principal relief sought by lessors is for a declaration of quiet title by declaring a termination of our Lenox and Snodgrass oil and gas leases in our Pleasant Valley Project. Our present intention is to develop these leases as part of our Pleasant Valley Project which we believe has significant and valuable heavy oil deposits. We drilled one well and reworked several others on these leases. However, operations are currently suspended pending the installation of an improved electric distribution system that is required by a local regulatory body in order to address air emissions requirements. The present status of the action is that initial pleadings have been exchanged, and the process of discovery is the likely next step for the parties. However, at this time, neither party has propounded discovery on the other. We are vigorously defending this lawsuit as we believe that we have valid claims and defenses.

14

PART II

ITEM 5. MARKET PRICE FOR REGISTRANT’S COMMON EQUITY AND RELATED SECURITY HOLDER MATTERS

Our common stock trades on the NYSE Amex, LLC, under the ticker symbol “TIV”. The following table shows the high and low sales prices and high and low closing prices reported for the years ended December 31, 2009, and 2008:

| Sales Prices | Closing Prices | |||

| High | Low | High | Low | |

| 2009 | ||||

| Fourth Quarter | $3.80 | $1.58 | $3.51 | $1.63 |

| Third Quarter | $3.59 | $0.83 | $3.10 | $0.83 |

| Second Quarter | $1.56 | $0.93 | $1.38 | $0.93 |

| First Quarter | $1.95 | $0.97 | $1.95 | $1.01 |

| 2008 | ||||

| Fourth Quarter | $6.30 | $1.46 | $6.17 | $1.51 |

| Third Quarter | $8.59 | $6.00 | $8.14 | $6.15 |

| Second Quarter | $9.73 | $5.70 | $9.15 | $5.77 |

| First Quarter | $7.50 | $4.85 | $7.25 | $5.03 |

As of December 31, 2009, we estimated that approximately 4,500 shareholders in the United States and several foreign countries held our common stock.

We historically have paid no dividends, and at this time, we do not plan to pay any dividends in the immediate future. In 2009, trading volume exceeded 49 million shares.

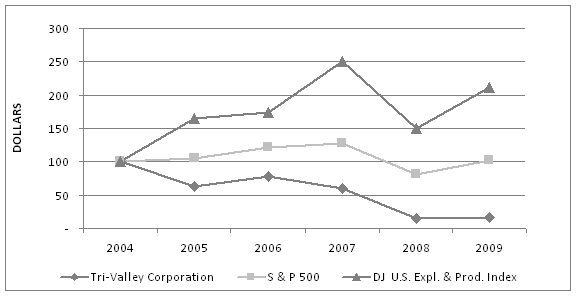

PERFORMANCE GRAPH

The following table compares the performance of Tri-Valley Corporation’s common stock with the performance of the Standard & Poor’s 500 Composite Stock Index and the Dow Jones U. S. Exploration and Production Index from December 31, 2004, through December 31, 2009. The table shows the performance of our common stock relative to two broad-based stock performance indices. The information is included for historical comparative purposes only and should not be considered indicative of future stock performance. The table and graph compare the yearly percentage change in the cumulative total stockholder return on $100 invested in our common stock with the cumulative total return of the two stock indices.

15

The stock performance graph assumes for comparison that the value of the Company’s common stock and of each index was $100 on December 31, 2004, and that all dividends were reinvested. Past performance is not necessarily an indicator of future results.

|

December 31,

|

||||||||||||||||||||||||

|

2004

|

2005

|

2006

|

2007

|

2008

|

2009

|

|||||||||||||||||||

|

Tri-Valley Corporation

|

$ | 100.0 | $ | 63.6 | $ | 77.6 | $ | 60.5 | $ | 14.7 | $ | 16.0 | ||||||||||||

|

S & P 500

|

$ | 100.0 | $ | 104.9 | $ | 121.5 | $ | 128.2 | $ | 80.7 | $ | 102.1 | ||||||||||||

|

DJ U.S. Expl. & Prod. Index

|

$ | 100.0 | $ | 165.0 | $ | 174.0 | $ | 250.0 | $ | 150.0 | $ | 211.0 | ||||||||||||

EQUITY COMPENSATION PLAN INFORMATION

The following table sets forth, for the Company's equity compensation plans, the number of options and restricted stock outstanding under such plans, the weighted-average exercise price of outstanding options, and the number of shares that remain available for issuance under such plans, as of December 31, 2009.

|

Total securities to be issued upon exercise of outstanding options or vesting of restricted stock

|

|||||||||

|

Plan category

|

Number

|

Weighted-average exercise price

|

Securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a))

|

||||||

|

(a)

|

(b)

|

(c)

|

|||||||

|

Equity compensation plans approved by security holders

|

2,490,500 | $3.93 | 1,349,350 | ||||||

|

Equity compensation plans not approved by security holders

|

0 | 0 | 0 | ||||||

|

Total

|

2,490,500 | $3.93 | 1,349,350 | ||||||

16

ITEM 6. SELECTED HISTORICAL FINANCIAL DATA

|

Income Statement Data

|

|||||

|

2009

|

2008

|

2007

|

2006

|

2005

|

|

|

Revenues

|

1,448,001

|

8,124,700

|

11,016,107

|

4,936,723

|

12,526,110

|

|

Operating Income (Loss)

|

(10,661,937)

|

(14,209,174)

|

(8,746,830)

|

(5,881,276)

|

(4,919,707)

|

|

Loss from Discontinued Operations

|

-

|

-

|

-

|

(4,774,840)

|

(4,810,364)

|

|

Gain on Sale of Discontinued Operations

|

-

|

-

|

-

|

9,715,604

|

|

|

Income (Loss) before Minority Interest

|

(10,661,937)

|

(14,478,178)

|

(8,746,830)

|

(940,512)

|

(9,730,071)

|

|

Minority Interest

|

-

|

(269,005)

|

(139,939)

|

(27,341)

|

|

|

Net Loss

|

(10,661,937)

|

(14,209,174)

|

(8,606,891)

|

(913,171)

|

(9,730,071)

|

|

Basic Earnings per Share:

|

|||||

|

Loss from Continuing Operations

|

(0.33)

|

(0.54)

|

(0.35)

|

(0.25)

|

(0.22)

|

|

Income (Loss) from Discontinued Operations, Net

|

-

|

-

|

-

|

0.21

|

(0.21)

|

|

Basic Earnings Per Share:

|

(0.33)

|

(0.54)

|

(0.35)

|

(0.04)

|

(0.43)

|

|

Balance Sheet Data

|

|||||

|

2009

|

2008

|

2007

|

2006

|

2005

|

|

|

Property, Plant and Equipment, net

|

8,180,405

|

9,921,501

|

16,232,653

|

12,076,043

|

13,635,981

|

|

Total Assets

|

15,532,330

|

17,470,721

|

25,254,895

|

28,654,125

|

19,738,730

|

|

Current Liabilities

|

12,324,563

|

5,154,323

|

10,296,665

|

9,046,945

|

7,637,645

|

|

Long Term Obligations

|

1,746,662

|

2,165,578

|

2,596,101

|

2,963,562

|

4,528,365

|

|

Minority Interest

|

-

|

3,334,596

|

249,945

|

5,410,746

|

-

|

|

Stockholder's Equity

|

1,461,105

|

6,816,225

|

12,112,184

|

11,232,872

|

7,572,720

|

No cash dividends have been declared.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

NOTICE REGARDING FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements. The words, "anticipate," "believe," "expect," "plan," "intend," "estimate," "project," "could," "may," "foresee," and similar expressions are intended to identify forward-looking statements. These statements include information regarding expected development of the Company's business, lending activities, relationship with customers, and development in the oil and gas industry. Should one or more of these risks or uncertainties occur, or should underlying assumptions prove incorrect, actual results may vary materially and adversely from those anticipated, believed, estimated, or otherwise indicated.

OVERVIEW

Prices for crude oil tend to be influenced by large, national state oil companies based upon global supply and demand, while natural gas prices seem to be more dependent on national and local conditions. We expect that natural gas prices will hold steady over the next two years. If, however, prices should fall, due to new regulatory measures or the discovery of new and easily producible reserves, our revenue from crude oil and natural gas sales would also fall.

We continue grading and prioritizing our proprietary geologic library, which contains over 700 leads and prospects, in the State of California for exploratory drilling. We use our library, seismic database, and other geoscientific data as resources for determining future opportunities for potential exploration.

We believe we have acquired an inventory of under-explored and under-exploited properties with the potential to yield significant returns upon development. Our future results will depend on our success in finding new reserves, in commercially developing those reserves, and in developing the reserves we currently have. There can be no assurance as to the revenue we ultimately derive from any new discoveries. We do not engage in hedging activities and do not use commodity futures or forward contracts for commodity price risk management.

CRITICAL ACCOUNTING POLICIES

We prepare Consolidated Financial Statements for inclusion in this Report in accordance with accounting principles that are generally accepted in the United States ("GAAP"). Note 2 to our Consolidated Financial Statements

17

(contained in Item 8 of this Annual Report) contains a comprehensive discussion of our significant accounting policies. Critical accounting policies are those that may have a material impact on our financial statements and also require management to exercise significant judgment due to a high degree of uncertainty at the time the estimate is made. Our senior management has discussed the development and selection of our accounting policies, related accounting estimates and disclosures with the Audit Committee of our Board of Directors.

Preparation of our Consolidated Financial Statements under GAAP requires management to make estimates and assumptions that affect reported assets, liabilities, revenues, expenses, and some narrative disclosures. The estimates that are most critical to our Consolidated Financial Statements involve oil and gas reserves and impairment of oil and gas properties.

Oil and Gas Reserves. Estimates of our proved crude oil and gas reserves included in this report are prepared in accordance with GAAP and SEC guidelines and were based on evaluations prepared by independent petroleum engineers with respect to our properties. The accuracy of a reserve report estimate is a function of:

- The quality and quantity of available data;

- The interpretation of that data;

- The accuracy of various mandated economic assumptions; and

- The judgment of the persons preparing the estimate.

Because these estimates depend on many assumptions, all of which may substantially differ from actual future results, reserve estimates will be different from the quantities of oil and gas that are ultimately recovered. In addition, results of drilling, testing and production after the date of an estimate may justify material revisions to the estimate.

It should not be assumed that the present value of future net cash flows included in this Report as of December 31, 2009, is the current market value of our estimated proved reserves. Changes in crude oil and gas prices can cause revisions in our estimates if the sales price on which reserves are based makes it uneconomical to continue producing the reserves based on our current production costs. In 2008 and 2007, our average and year-end price received for natural gas was significantly higher than our average production costs, and it appeared unlikely that natural gas prices would fall far enough to result in an impairment based on historic prices. However, a significant fall in the price of crude oil in 2008 caused a reduction in our crude oil reserves and resulted in recording an impairment expense as discussed below. Because of the 2008 impairment of crude oil reserves to a value of zero, no further reduction was possible.

Estimates of proved reserves materially impact depletion expense. If the estimates of proved reserves decline, the rate at which we record depletion expense will increase, reducing future net income. Such a decline may result from lower market prices, which may make it uneconomical to drill for and produce higher cost fields. In addition, a decline in proved reserve estimates may impact the outcome of our assessment of its crude oil and natural gas producing properties for impairment.