Attached files

| file | filename |

|---|---|

| EX-5.1 - Gulf United Energy, Inc. | ex5-1.htm |

| EX-23.1 - Gulf United Energy, Inc. | ex23-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Gulf United Energy, Inc.

(Exact name of registrant as specified in its charter)

|

Nevada

|

1090

|

20-5893642

|

|

(State or other jurisdiction of incorporation or organization)

|

(Primary Standard Industrial Classification Code Number)

|

(I. R. S. Employer Identification Number)

|

P.O. Box 22165

Houston, Texas 77227-2165 (713) 942-6575

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

John B. Connally III

Chief Executive Officer

P.O. Box 22165

Houston, Texas 77227-2165 (713) 942-6575

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With copy to:

Thomas C. Pritchard, Esq.

Brewer & Pritchard, P.C.

Three Riverway, Suite 1800

Houston, Texas 77056

Tel: (713) 209-2950

Fax: (713) 659-5302

As soon as practicable after this Registration Statement becomes effective

(Approximate date of commencement of proposed sale to the public)

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filed, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filed” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer o

|

Accelerated filer o

|

|

Non-accelerated filer o (Do not check if a smaller reporting company)

|

Smaller reporting company x

|

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of

Securities to Be Registered

|

Amount

Being Registered

|

Proposed Maximum

Offering Price

Per Share(1)

|

Proposed Maximum

Aggregate

Offering Price

|

Amount of

Registration

Fee

|

|

Common Stock, par value $0.001

|

95,288,726

|

$0.50

|

$47,644,393

|

$5,531.51

|

|

Common Stock, par value $0.001, underlying Warrants

|

1,000,000

|

$0.30

|

$300,000

|

$34.83

|

|

TOTAL(2)

|

96,288,726

|

$47,944,363

|

$5,566.34

|

|

(1)

|

Estimated solely for the purpose of computing amount of the registration fee pursuant to Rule 457(c) promulgated under the Securities Act of 1933, except for the shares issuable upon exercise of warrants, which is pursuant to Rule 457(g).

|

|

(2)

|

Pursuant to Rule 416 under the Securities Act of 1933, the Registrant is also registering such additional indeterminate number of shares as may become necessary to adjust the number of shares as a result of a stock split, stock dividend or similar adjustment of its outstanding common stock.

|

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be amended. The selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION

Prospectus dated March 18, 2011.

PROSPECTUS

GULF UNITED ENERGY, INC.

96,288,726 Shares of Common Stock

This prospectus relates to the sale of up to 96,288,726 shares of our common stock, which includes an aggregate of 1,000,000 shares of common stock issuable upon the exercise of outstanding five-year common stock purchase warrants exercisable at $0.30 per share (the “Warrants”). The market for the common stock is limited, sporadic and volatile. Our common stock is listed for quotation on the Pink Sheets OTCQB published by OTC Markets Group, Inc. under the symbol “GLFE.” The last bid price of our common stock March 16, 2011 was $0.40 per share.

The selling stockholders are offering these shares of common stock. The selling stockholders may sell all or a portion of these shares from time to time in market transactions through any market on which our common stock is then traded, in negotiated transactions or otherwise, and at prices and on terms that will be determined by the then prevailing market price or at negotiated prices directly or through a broker or brokers, who may act as agent or as principal or by a combination of such methods of sale. The selling stockholders will receive all proceeds from the sale of the common stock. We will, however, receive the sale price of any common stock we sell to the selling stockholder upon exercise of the Warrants. We expect to use the proceeds received from the exercise of the Warrants, if any, for general working capital purposes. For additional information on the methods of sale, you should refer to the section entitled “Plan of Distribution.”

This investment involves a high degree of risk. You should purchase shares only if you can afford a complete loss of your investment. You should read this prospectus in its entirety and carefully consider the risk factors beginning on page 7 of this prospectus and the financial data and related notes incorporated by reference before deciding to invest in the shares.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus ______, 2011

TABLE OF CONTENTS

|

Prospectus Summary

|

3

|

|

Risk Factors

|

7

|

|

Special Note Regarding Forward-Looking Statements

|

17

|

|

Use of Proceeds

|

18

|

|

Selling Security Holders

|

19

|

|

Plan of Distribution

|

23

|

|

Description of Securities to be Registered and Our Capital Stock

|

25

|

|

Business

|

27

|

|

Management's Discussion and Analysis Of Financial Condition and Results of Operations

|

33

|

|

Determination of Offering Price

|

37

|

|

Market Price Information and Dividend Policy

|

38

|

|

Management

|

39

|

|

Security Ownership of Certain Beneficial Owners and Management

|

43

|

|

Disclosure of Commission Position on Indemnification for Securities Act Liabilities

|

44

|

|

Experts

|

44

|

|

Legal Matters

|

44

|

|

Where You Can Find More Information

|

44

|

|

Index To Financial Statements

|

F-1

|

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with information that is different. This prospectus is not an offer to sell, nor is it seeking an offer to buy, these securities in any jurisdiction where the offer or sale of these securities is not permitted. You should assume that the information contained in this prospectus is accurate as of the date on the front of this prospectus only. Our business, financial condition, results of operations and prospects may have changed since that date. This prospectus will be updated as required by law.

PROSPECTUS SUMMARY

The following summary highlights selected information contained in this prospectus. This summary does not contain all the information you should consider before investing in the securities. Before making an investment decision, you should read the entire prospectus carefully, including the “Risk Factors” section, the financial statements and the notes to the financial statements. In this prospectus, unless the context requires otherwise, references to the “Company,” “we,” “our” or “us” refer to Gulf United Energy, Inc.

GULF UNITED ENERGY, INC.

We are an international, early-stage oil and gas exploration company. We have initially concentrated our efforts in Colombia and Peru, where we believe we have attractive oil and gas interests. Our strategy is to develop a portfolio of non-operated oil and gas assets, primarily focused in South America, by balancing an inventory of near-term drilling projects with oil and gas development activities requiring extended lead times.

Our current asset portfolio includes participation in two hydrocarbon exploration blocks operated by SK Energy Co. Ltd. (“SK Energy”). SK Energy is a subsidiary of SK Group, one of South Korea’s top five industrial conglomerates. SK Energy is Korea’s largest petroleum refiner and is currently active in 34 blocks in 19 countries.

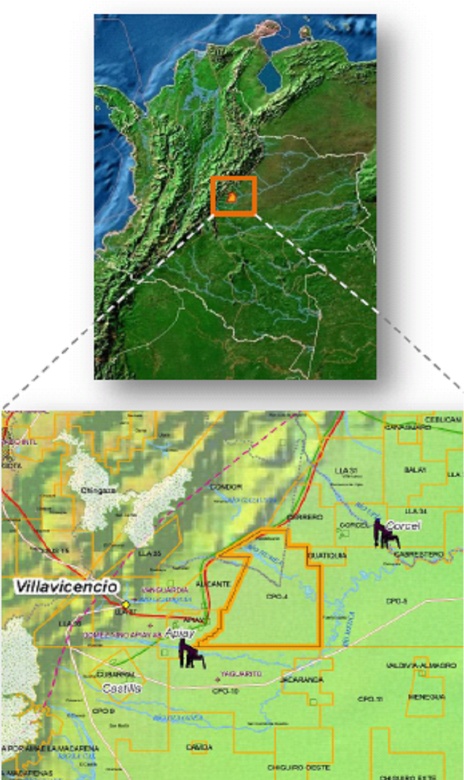

In Colombia, we have acquired, subject to regulatory approval, a 12.5% working interest in the 345,592 acre CPO-4 block in the Llanos Basin. Block CPO-4 is near existing production and immediately adjacent to and on trend with the Guatiquia block operated by Petrominerales Ltd. (TSX:PMG). Block CPO-4 is the near-term focus of the Company and SK Energy, with drilling expected to commence in the second quarter of calendar year 2011.

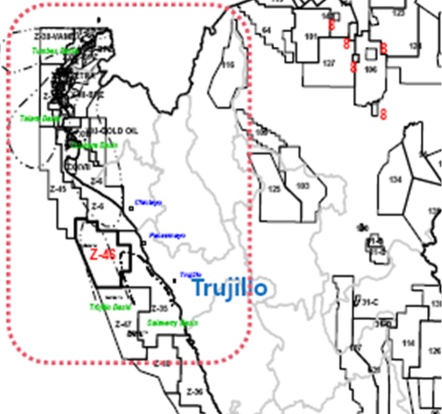

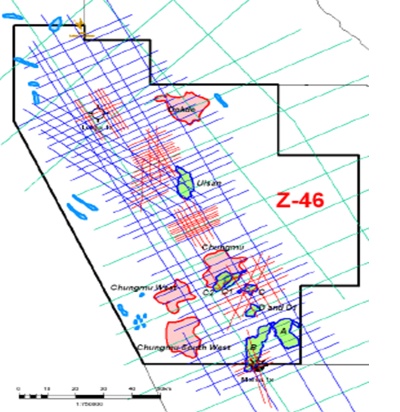

In Peru, we have acquired, subject to regulatory approval, a 40% working interest in the 2,803,411 acre Z-46 offshore block in the Trujillo Basin. Recent re-processed 2-D seismic data suggests a submarine fan deposition on the block and multiple leads have been identified. Two wells previously drilled on the block by Repsol reported oil, indicating an active hydrocarbon system. The Company and SK Energy began the acquisition of additional infill 2-D seismic data in December 2010.

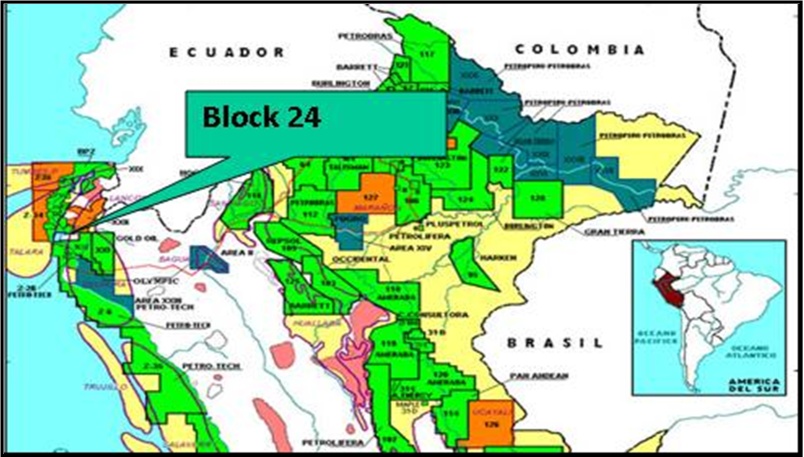

Also in Peru, we have acquired, subject to regulatory approval, a 5% participating interest in Block XXIV, an approximately 276,137 gross acre concession, and a 2% participating interest in the Peru Technical Evaluation Area (the “Peru TEA”). The Peru TEA consists of four contiguous blocks totaling approximately 40 million gross acres onshore on the western flank of the Andes Mountains. Block XXIV and Peru TEA are both operated by Upland Oil & Gas, LLC (“Upland”). Two exploratory wells have been drilled on Block XXIV and both wells are considered dry holes. There are no current plans to drill additional wells or to rework existing wells in the short term on Block XXIV, although future drilling has been planned on this concession by Upland. Similarly, there are no current plans to develop the Peru TEA.

We expect to engage in additional investment opportunities in oil and gas exploration and development as our resources permit. The scope of our activities in this regard may include, but may not be limited to, the acquisition or assignment of rights to develop exploratory acreage under concessions with government authorities and other private or public exploration and production companies, the purchase of oil and gas producing properties, farm-in and farmout opportunities (i.e., the assumption or assignment of obligations to fund the cost of drilling and development).

We may turn to opportunities in other countries if we deem the relevant considerations merit our investment. We plan to focus on early-stage exploration of hydrocarbons through a variety of transactions aimed at building a resource base. An integral part of our strategy is to build a competent and professional management and operations team to enable us to successfully carry out our business plan.

-3-

Our Properties

The following is a brief summary of our properties:

|

Property

|

Gross Acres

|

Net Acres

|

Working Interest(1)

|

Operator

|

Estimated Calendar Year 2011 Capital Expenditures

(in millions)

|

|

Colombia Property

|

|||||

|

Block CPO-4

|

345,592

|

43,200

|

12.5%

|

SK Energy

|

$12.0

|

|

Peru Properties

|

|||||

|

Block Z-46

|

2,803,411

|

1,121,411

|

40.0%

|

SK Energy

|

$6.0

|

|

Block XXIV

|

276,137

|

13,807

|

5.0%

|

Upland

|

< $0.5

|

|

TEA Area I, II, III, IV

|

40,321,163

|

806,423

|

2.0%

|

Upland

|

< $0.5

|

_______________

(1) The assignment of the working interests in Block Z-46, Block XXIV, and the Peru TEA are subject to the approval of PeruPetro S.A, and the assignment of our interest in Block CPO-4 is subject to the approval of the National Hydrocarbon Agency of Colombia and the Republic of Korea. See “Business – Our Exploration Projects” for a discussion of our farmout agreements.

Block CPO-4. Block CPO-4 is located in the Llanos Basin of Colombia. Block CPO-4 consists of 345,592 gross acres (43,200 net) and is located approximately 70 miles southeast of Bogotá. This block is operated by SK Energy. Gulf United and our Block CPO-4 partners have reprocessed 1,350 kilometers of 2-D seismic data and 530 square kilometers of 3-D seismic data shot on the northern portion of acreage. We are currently interpreting this seismic data. Drilling on Block CPO-4 is expected to commence during the second quarter of calendar year 2011 and will target oil objectives in the Mirador, Guadalupe, and Une sandstone formations. The zones are included in the Cretaceous and Eocene Interval. No independent engineering estimates have been prepared at this time.

Block Z-46. Block Z-46 is located in the Trujillo Basin offshore Peru. Block Z-46 consists of 2,803,411 gross acres (1,121,411 net) and is located in northern Peru. Water depths on the block range from 50 meters to 1,000 meters. This block is operated by SK Energy. Gulf United and our Block Z-46 partner have reprocessed 5,600 kilometers of 2-D seismic data. On December 31, 2010, we began acquiring an additional 2,904 kilometers of infill 2-D seismic data focused in the southern portion of the block where several 2-D defined Tertiary prospects are stacked with 2-D defined Paleozoic prospects. Based on the results of the new 2-D seismic data, we plan to acquire 3-D seismic data in early calendar year 2012 to be used in the selection of drilling locations. No independent engineering estimates have been prepared at this time.

Block XXIV. Block XXIV is located in the Sechura/Talara Basin in Peru. Block XXIV consists of 276,137 gross acres (13,807 net) of which approximately 80,000 are offshore and 196,000 are onshore. The offshore portion of the block is highly prospective. There are currently no expenditures planned on Block XXIV.

TEA I, II, III, IV. Technical Evaluation Areas I, II, III, and IV of the Peru TEA are contiguous blocks that together comprise 40,321,163 gross acres (806,423 net). The Peru TEA’s run south on the western flank of the Andes Mountains from the border with Ecuador to near Lima. This greenfield opportunity will require geological evaluation, including the acquisition of aeromagnetic survey and 2-D seismic data, before we evaluate drilling opportunities.

For a full discussion of our exploration projects, including maps setting forth the locations of each project, please see the section of this prospects entitled “Business – Our Exploration Projects” beginning on page 28.

Recent Developments

In February 2011, we sold to accredited investors 83,388,726 shares of our common stock in a private placement at a purchase price of $0.30 per share, yielding aggregate gross proceeds to us of $25,016,618. At the closing of the February 2011 financing, we issued warrants to Pritchard Capital Partners, LLC, as placement agent (“Pritchard”) to purchase up to 1 million shares of Company common stock exercisable at $0.30 per share. The Warrants may be exercised on a cashless or “net exercise” basis. We are registering hereby the resale of the 83,388,726 shares of common stock sold in the February 2011 financing and the 1 million shares of common stock underlying the Warrants. We used the proceeds from this financing as follows: (i) $1.9 million was paid towards commissions, legal fees, and other offering expenses, (ii) $7,464,102 was used towards the repayment of outstanding debt, (iii) $3,402,300 was paid pursuant to existing contractual arrangements under farmout agreements, and (iv) approximately $333,000 has been used for general working capital purposes.

-4-

In January 2011, the Company’s board of directors expanded its membership from one to three directors and appointed John N. Seitz and Thomas G. Loeffler to fill the vacancies created by the increase in the number of board seats. As a result of the appointments, our board of directors is now comprised of three members, being John B. Connally III, who serves as Chairman and is our President and Chief Executive Officer, and Messrs. Seitz and Loeffler. Messrs. Seitz and Loeffler are both “independent directors,” as such term is defined under independence standards used by both the NASDAQ Stock Market and NYSE Amex rules. In connection with their appointments, each of Messrs. Seitz and Loeffler were issued 2 million shares of Company common stock.

Between December 2010 and January 2011, we sold to accredited investors 12,750,000 shares of our common stock in a private placement at a purchase price of $0.20 per share, yielding aggregate gross proceeds to us of $2,550,000. We are registering hereby the resale of 11,900,000 of these shares.

In December 2010, we borrowed $3.8 million through the issuance of debentures and issued 1 million shares of our common stock to accredited investors for gross proceeds of $200,000. The debentures were paid in full in February 2011.

In December 2010, we entered into consulting agreements with John Eddie Williams, Jr. and Reese Minerals Ltd. The consulting agreements have a term of one (1) year. Each consultant was granted 20 million shares of common stock as compensation under the consulting agreements.

In December 2010, we added additional members to our senior management team. Jim Ford serves as the Company’s Executive Vice President, Business Development and Operations; Ernest B. Miller IV serves as the Company’s Executive Vice President, Corporate Development and Administration; and James C. Fluker III serves as the Company’s Vice President, Exploration. Each of Messrs. Ford, Miller, and Fluker have entered into employment agreements with the Company, under which they will serve in their respective capacities for one year.

-5-

About This Offering

|

Common stock offered by selling stockholders

|

96,288,726 shares, consisting of (i) 95,288,726 shares of common stock and (ii) 1,000,000 shares of common stock underlying the Warrants.

|

|

Shares outstanding prior to the offering

|

454,667,726 shares(1) as of March 15, 2011

|

|

Shares to be outstanding after the offering

|

454,667,726 shares (1)

|

|

Use of proceeds

|

We will not receive any proceeds from the sale of the common stock. However, we will receive the sale price of any common stock we sell to a selling stockholder upon exercise of the Warrants (assuming the Warrants are not exercised on a cashless basis). We expect to use the proceeds received from the exercise of the Warrants, if any, for general working capital purposes.

|

|

Risk Factors

|

The securities offered hereby involve a high degree of risk. See “Risk Factors.”

|

|

Stock symbol

|

GLFE

|

_____________

|

(1)

|

Does not include shares of common stock issuable upon exercise of the Warrants. Please see our “Description of Securities to Be Registered and Our Capital Stock” section on page 25 for a complete description of these securities.

|

Summary Financial Data

The following summary of our financial information has been derived from our audited financial statements for the fiscal years ended August 31, 2010 and 2009 and from our unaudited financial statements for the quarter ended November 30, 2010.

|

As of and for the Year Ended

August 31,

|

||||||||

|

2010

|

2009

|

|||||||

|

Statement of Operations Data:

|

||||||||

|

Revenue

|

$ | -- | $ | -- | ||||

|

Net Loss

|

(2,315,199 | ) | (1,353,766 | ) | ||||

|

Net Loss per Share

|

(0.02 | ) | (0.05 | ) | ||||

|

Balance Sheet Data:

|

||||||||

|

Total Assets

|

$ | 7,705,549 | $ | 941,856 | ||||

|

Total Current Liabilities

|

4,787,782 | 2,282,225 | ||||||

|

Total Long Term Obligations

|

-- | -- | ||||||

|

Total Stockholders’ Equity (Deficit)

|

2,917,767 | (1,340,369 | ) | |||||

|

As of and for the Quarter Ended

November 30,

|

||||||||

|

2010

|

2009

|

|||||||

|

Statement of Operations Data:

|

||||||||

|

Revenue

|

$ | -- | $ | -- | ||||

|

Net Loss

|

(942,855 | ) | (65,538 | ) | ||||

|

Net Loss per Share

|

(0.003 | ) | (0.002 | ) | ||||

|

Balance Sheet Data:

|

||||||||

|

Total Assets

|

$ | 7,906,408 | $ | 1,060,556 | ||||

|

Total Current Liabilities

|

4,829,764 | 2,346,463 | ||||||

|

Total Long Term Obligations

|

-- | -- | ||||||

|

Total Stockholders’ Equity (Deficit)

|

3,076,644 | (1,285,907 | ) | |||||

-6-

RISK FACTORS

This investment has a high degree of risk. Before you invest you should carefully consider the risks and uncertainties described below and the other information in this prospectus. If any of the following risks actually occur, our business, operating results and financial condition could be harmed and the value of our stock could go down. This means you could lose all or a part of your investment.

Risks Related to Our Business and Financial Condition

We are an international, early-stage oil and gas exploration and production company with no operating history with which to evaluate our business. We may never attain profitability.

We are an international, early-stage oil and gas exploration and production company. As an early-stage company with limited operating history, it is difficult for potential investors to evaluate our business. Our proposed operations are therefore subject to all of the risks inherent in the expense, difficulty, complications and delays frequently encountered in connection with the development of any new business, as well as those risks that are specific to the oil and gas industry and to that industry in South America, in particular. Investors should evaluate us in light of the delays, expenses, problems and uncertainties frequently encountered by companies developing markets for new products, services and technologies. We may never overcome these obstacles.

We have a limited operating history with significant losses and expect losses to continue for the foreseeable future.

We have incurred annual operating losses since our inception. As a result, at November 30, 2010, we had an accumulated deficit of $5,311,698. We have no revenue and do not anticipate receiving revenue in the near future. We expect that our operating expenses will increase as we develop our projects. We expect continued losses in fiscal 2011, and thereafter, until our projects generate profits and positive cash flow, if any.

We have a limited cash and liquidity position and will need to raise approximately $6 million to fund existing contractual obligations and estimated working capital needs in calendar year 2011.

At November 30, 2010, the Company had current assets of $191,153 and a working capital deficit of $4,638,611. Subsequent to November 30, 2010 we raised approximately $27.7 million in equity and $3.8 million in debt through private placements. We expect to deploy the remaining proceeds from our financings to fund existing contractual obligations and estimated working capital needs through December 2011, which are as follows:

|

·

|

$13.8 million under existing farmout agreements ($4.3 million relating to Block Z-46 and $9.5 million relating to Block CPO-4, which amounts are payable throughout calendar year 2011, but mostly in the 2nd calendar quarter);

|

|

·

|

$1.9 million under existing credit facilities (due in the second half of calendar year 2011);

|

|

·

|

$1.1 million under employment and consulting agreements; and

|

|

·

|

$1.0 million for working capital purposes.

|

We will need to raise at least $6 million of net proceeds beginning in July 2011 to fund our remaining calendar year 2011 contractual commitments and working capital needs. Inability to obtain capital on a timely basis may damage our credibility with industry participants if we cannot fund previously closed transactions.

We may not be successful in locating suitable financing transactions in the time period required or at all, and we may not obtain the capital we require by other means. Future financings may be dilutive to our stockholders, as we will most likely issue additional shares of our common stock or other equity to investors in future financing transactions, the terms of which may include preferences, superior voting rights, and the issuance of warrants or other derivative securities. In addition, debt and possible mezzanine financing may involve a pledge of assets and may be senior to equity holders.

We have historically financed our operations through best efforts private debt and equity financing. We do not have any credit facilities available with financial institutions, stockholders or third party investors, and will continue to rely on best efforts financings. There is no assurance that we can raise additional debt or equity capital from external sources. The Company has no control over the amount of funds that it may receive in financings and the time frame in which they may be received. Failure to raise additional capital during calendar year 2011 on favorable terms, or at all, will have a material adverse effect on our operations, could result in the loss of our interests in our exploration projects, and will likely cause us to curtail or cease operations.

-7-

We will need to raise additional capital in calendar year 2012. If we are unable to raise additional capital in 2012, we may be unable to meet our capital requirements in the future, causing us to curtail future growth plans or cut back our operations.

In addition to the amounts required in calendar year 2011, we will need to raise at least $17 million in calendar year 2012 in order to satisfy our obligations under existing contractual commitments and for general working capital purposes. We may need to raise in excess of that amount to meet various objectives including, but not limited to:

|

·

|

complying with funding obligations under new contractual commitments;

|

|

·

|

pursuing growth opportunities, including more rapid expansion;

|

|

·

|

making investments to improve our infrastructure;

|

|

·

|

hiring and retaining qualified management and key employees;

|

|

·

|

responding to competitive pressures;

|

|

·

|

complying with licensing, registration and other requirements;

|

|

·

|

maintaining compliance with applicable laws; and

|

|

·

|

maintaining adequate funds for working capital purposes.

|

We plan to pursue sources of such capital through various financing transactions or arrangements, including joint venturing of projects, debt financing, equity financing or other means. We may not be successful in locating suitable financing transactions in the time period required or at all, and we may not obtain the capital we require by other means. Future financings may be dilutive to our stockholders, as we will most likely issue additional shares of our common stock or other equity to investors in future financing transactions, the terms of which may include preferences, superior voting rights, and the issuance of warrants or other derivative securities. In addition, debt and possible mezzanine financing may involve a pledge of assets and may be senior to equity holders.

We will incur substantial costs in pursuing future capital financing, including investment banking fees, legal fees, accounting fees, securities law compliance fees, printing and distribution expenses and other costs. We will also be required to recognize non-cash expenses in connection with certain securities we may issue, such as convertible notes and warrants, which will adversely impact our results of operations.

We have historically financed our operations through best efforts private debt and equity financing. We do not have any credit facilities available with financial institutions, stockholders or third party investors, and will continue to rely on best efforts financings. There is no assurance that we can raise additional debt or equity capital from external sources. The Company has no control over the amount of funds that it may receive in financings and the time frame in which they may be received. Failure to raise additional capital, on favorable terms or at all, will have a material adverse effect on our operations, could result in the loss of our interests in our exploration projects, and will likely cause us to curtail or cease operations.

We may not receive approval of the assignments of rights to us in our oil and gas properties in which we have invested and are continuing to invest, and, as a result, we may not be able to legally protect our rights under our agreements with the operators of the applicable properties.

The assignment to the Company of the interest in Block CPO-4 is subject to the approval of both the ANH and the Republic of Korea. If such approval is not received from ANH and the Republic of Korea by July 31, 2011, the farmout agreement provides that the parties will meet within thirty days after such date to discuss possible amendments to the farmout agreement to avoid the need for the approval. If the Company and SK Energy are unable to agree upon the amendment, the farmout agreement will be terminated, the Company’s interest in Block CPO-4 will be deemed re-assigned back to SK Energy, and the Company will have the right to have returned any amounts paid under the farmout, without interest.

The assignment to the Company of the interest in Block Z-46 is subject to the approval of PeruPetro S.A. If such approval is not received from PeruPetro S.A. by November 30, 2011, the farmout agreement provides that the parties will meet within thirty days after such date to discuss possible amendments to the farmout agreement to avoid the need for the approval. If the Company and SK Energy are unable to agree upon the amendment, the farmout agreement will be terminated, the Company’s interest in Block Z-46 will be deemed re-assigned back to SK, and the Company will have the right to have returned any amounts paid under the farmout, without interest.

The assignment to the Company of the interests in Block XXIV and the Peru TEA are also subject to the approval of PeruPetro S.A. and certain governmental agencies of the Republic of Peru. Until such time as the approvals are received, Upland is holding the Block XXIV and Peru TEA interests in escrow.

-8-

We have begun the process of obtaining the necessary approvals described above. While we believe that we will be successful in obtaining the necessary approvals, if we do not receive such approvals or are not able to work out a favorable alternative arrangements with the parties to our agreements, then we may not be able to legally protect or enforce our rights to the affected oil and gas interests. As we do not currently have recordable title to any of our oil and gas interests, our business would be materially adversely affected if we are unable to protect or enforce our rights to maintain our rights to our oil and gas interests. Moreover, while we believe that we would have rights to receive or be refunded all amounts paid under our agreements, there is no assurance that our operating partners would have readily available funds from which to reimburse our advances.

We may be unable to access the capital markets to obtain additional capital that we will require to implement our business plan in calendar years 2011 and 2012, which would restrict our ability to grow.

Our current capital is not sufficient to enable us to execute our business plan. Because we are an early-stage company with limited resources, we may not be able to compete in the capital markets with much larger, established companies that have ready access to capital. Our ability to obtain needed financing may be impaired by conditions in the capital markets (both generally and in the oil and gas industry in particular), our status as a new enterprise without a demonstrated operating history, the location of our prospective oil and natural gas properties in developing countries and prices of oil and natural gas on the commodities markets (which will impact the amount of asset-based financing available to us) and/or the loss of key management. Further, if oil and/or natural gas prices on the commodities markets decrease, then our potential revenues, if any, will decrease, and such decreased future revenues may increase our requirements for capital. Some of the contractual arrangements governing our operations may require us to maintain minimum capital, and we may lose our contract rights if we do not have the required minimum capital. If the amount of capital we are able to raise from financing activities is not sufficient we may be required to curtail or cease our operations.

The ongoing worldwide financial and credit crisis may continue indefinitely. Because of severely reduced market liquidity, we may not be able to raise additional capital when we need it. Because the future of our business depends on the completion of one or more investment transactions for additional capital, we may not be able to complete such transactions. As a result, we may be forced to curtail our current business activities or cease operations entirely.

Our senior management team is relatively new to our company and may not be able to develop and execute a successful new business strategy.

Although our senior management team is experienced in the oil and gas industry, they are each relatively new to the Company which itself is new to this business. Our management is in the process of developing and executing a business strategy for the Company. If our management is not able to develop a business strategy which we can execute in a successful manner, our business could fail and/or we could lose all of our current and future capital. Our business is speculative and dependent upon the implementation of our business plan and our ability to enter into agreements with third parties for the rights to exploit potential oil and gas reserves on terms that will be commercially viable for us.

Because our continuation as a going concern is in doubt, we will be forced to cease business operations unless we can raise sufficient funds to satisfy our working capital needs.

We have incurred losses since our inception resulting in an accumulated deficit of $5,311,698 at November 30, 2010. Further losses are anticipated in developing our business. As a result, as of August 31, 2010, our auditors have expressed substantial doubt about our ability to continue as a going concern. Between December 2010 and January 2011, we sold 12,750,000 shares of our common stock in a private placement for gross proceeds of $2,550,000. In February 2011, we sold 83,388,726 shares of our common stock in a private placement for gross proceeds of $25,016,618. As a result of our recent financings, we believe that we have a sufficient amount of cash on hand to satisfy a portion of our contractual obligations and working capital needs in calendar year 2011. We will, however, need to raise additional funds in calendar years 2011 and 2012. If we cannot raise funds to meet our obligations, we will become further insolvent and may be required to cease business operations.

Our lack of diversification increases the risk of an investment in our common stock.

Our business will focus on the oil and gas industry in a limited number of properties, initially in Peru and Colombia. Larger companies have the ability to manage their risk by diversification. However, we lack diversification, in terms of both the nature and geographic scope of our business. As a result, factors affecting our industry, or the regions in which we operate, will likely impact us more acutely than if our business was diversified.

Strategic relationships upon which we rely are subject to change, which may diminish our ability to conduct our operations.

Our ability to successfully bid on and acquire properties, to discover resources, to participate in drilling opportunities and to identify and enter into commercial arrangements with customers, depends on developing and maintaining close working relationships with industry participants and on our ability to select and evaluate suitable properties. Further, we must consummate transactions in a highly competitive environment. These realities are subject to change and may impair our ability to grow.

-9-

To develop our business, we will endeavor to use the business relationships of our management and to enter into strategic relationships, which may take the form of joint ventures with other private parties or with local government bodies or contractual arrangements with other oil and gas companies, including those that supply equipment and other resources that we use in our business. We may not be able to establish these strategic relationships, or if established, we may not be able to maintain them. In addition, the dynamics of our relationships with strategic partners may require that we incur expenses or undertake activities we would not otherwise incur or undertake in order to fulfill our obligations to these partners or maintain our relationships. If our strategic relationships are not established or maintained, our business prospects may be limited, which could diminish our ability to conduct our operations.

Our strategic partners may change ownership or senior management, and this may negatively affect our business relationships with these partners and our results of operations.

Our strategic partners may change ownership or senior management and this may negatively affect our business relationships with these partners and our results of operations. It is possible that the change of ownership of any of our current or future strategic partners could have a negative impact on our relationship with them and we could lose our investment and suffer considerable losses if any of them choose to discontinue the relationship or their involvement in a particular project or their operations in Peru or Colombia.

Our strategic partners may not be able to timely deploy capital or may not be able to raise the capital necessary to conduct exploratory and production activities.

Our strategic partners will require significant capital resources to pursue the current exploration and production plan. While SK Energy appears to be well-capitalized, it may not be able to timely deploy the capital necessary to conduct exploratory and production activities for a variety of reasons, all of which are outside of our control. Moreover, while we believe Upland, the operator on Block XXIV, has the financial strength to raise sufficient capital, we have no assurance that this is the case. Failure by either party to deploy capital for the projects in which we participate will have a material adverse effect on our business.

Competition in obtaining rights to explore and develop oil and gas reserves and to market our production may impair our business.

The oil and gas industry is extremely competitive. Present levels of competition for oil and gas resources in South America, and particularly in Colombia, are high. Significant amounts of capital are being raised worldwide and directed towards the South American markets, and more and more companies are pursuing the same opportunities. Other oil and gas companies with greater resources will compete with us by bidding for exploration and production licenses and other properties and services we will need to operate our business. Additionally, other companies may compete with us in obtaining capital from investors. Competitors include larger, foreign-owned companies, which may have access to greater financial and other resources than we, may be more successful in the recruitment and retention of qualified employees and may conduct their own refining and petroleum marketing operations, giving them a competitive advantage. In addition, actual or potential competitors may be strengthened through the acquisition of additional assets and interests. Because of some or all of these factors, we may not be able to compete.

We may not be able to effectively manage our growth, which may harm our profitability.

Our strategy envisions building and expanding our business. If we fail to effectively manage our growth, our financial results will be adversely affected. Growth may place a strain on our management systems and resources. We must continue to refine and expand our business development capabilities, our systems and processes and our access to financing sources. As we grow, we must continue to hire, train, supervise and manage new employees. We cannot assure you that we will be able to:

|

·

|

expand our systems effectively or efficiently or in a timely manner;

|

|

·

|

optimally allocate our human resources; or

|

|

·

|

identify and hire qualified employees or retain valued employees.

|

If we are unable to manage our growth and our operations, our financial results could be adversely affected, which will diminish our profitability.

Our business may suffer if we do not attract and retain talented personnel.

Our success will depend in large measure on the abilities, expertise, judgment, discretion, integrity and good faith of our management and other personnel in conducting our business. We are in the process of building our management team. The loss of any of our executive officers or our inability to attract qualified board members could adversely impact our business. We may also experience difficulties in certain jurisdictions in our efforts to obtain suitably qualified staff and to retain staff who are willing to work in that jurisdiction. While we do not currently carry “key man” life insurance on our key employees, we have entered into employment agreements with each of our management team.

-10-

Our success depends on the ability of our management and employees to interpret market and geological data correctly and to interpret and respond to economic market and other conditions in order to locate and adopt appropriate investment opportunities, monitor such investments and ultimately, if required, successfully divest such investments. Further, our future personnel may not continue their association or employment with us, and we may not be able to find replacement personnel with comparable skills. If we are unable to attract and retain key personnel, our business may be adversely affected.

The Company’s operating results may fluctuate significantly from quarter to quarter, and fluctuations in operating results could cause the stock price to decline.

The Company's operating results may vary significantly from quarter to quarter due to a number of factors. In future quarters, operating and drilling results (including any dry holes drilled) may be below the expectations of public market analysts or investors, and the price of our common stock may decline. Currently, the Company does not have a source of revenue, and it is doubtful that the Company will generate any revenues in the foreseeable future. In addition, drilling results may fluctuate based on conditions outside of our control, and there is no guarantee that our drilling programs will meet projections, forecasts or the expectations of market analysts or our investors.

Any change to government regulation/administrative practices may have a negative impact on our ability to operate and profitability.

The laws, regulations, policies or current administrative practices of any government body, organization or regulatory agency in Peru or Colombia or any other jurisdiction where we might conduct our business activities, may be changed, applied or interpreted in a manner which will fundamentally alter the ability of the Company to carry on our business. The actions, policies or regulations, or changes thereto, of any government body or regulatory agency or other special interest groups, may have a detrimental effect on us. Any or all of these situations may have a negative impact on our ability to operate profitably or at all.

Risks Related to Our Industry and Regional Focus

Current volatile market conditions and significant fluctuations in energy prices may continue indefinitely, negatively affecting our business prospects and viability.

Commodities and capital markets have been under great stress and volatility during the past few years in part due to the credit crisis affecting lenders and borrowers on a worldwide basis. As a result of this crisis, crude oil prices tumbled from over one hundred forty dollars ($140) per barrel in mid 2008 to less than forty dollars ($40) per barrel in early 2009, causing companies to re-evaluate existing strategies. While crude oil prices have recovered significantly, we are watching the situation and are adjusting our strategy to reflect these market conditions. We will not be immune to lower commodities prices which could cause more restrictive credit market conditions. Our ability to enter into or profit from our existing exploration and production projects may be compromised, and in a continuing environment of lower crude oil and natural gas prices, our future results of operations and market value will be affected negatively.

Our exploration for oil and natural gas is risky and may not be commercially successful, impairing our ability to generate revenues.

Oil and natural gas exploration involves a high degree of risk. These risks are more acute in the early stages of exploration. Our expenditures on exploration may not result in discoveries of oil or natural gas in commercially- viable quantities. It is difficult to project the costs of implementing an exploratory drilling program due to the inherent uncertainties of drilling in unknown formations, the costs associated with encountering various drilling conditions, such as over pressured zones and tools lost in the hole, and changes in drilling plans and locations as a result of prior exploratory wells or additional seismic data and interpretations thereof. If exploration costs exceed our estimates, or if our exploration efforts do not produce viable reserves, our exploration efforts will not be commercially successful, which will adversely impact our ability to generate any revenues and our business strategy.

The potential profitability of oil and gas ventures in South America depends upon factors beyond our control.

The potential profitability of oil and gas properties in South America is dependent upon many factors beyond our control. For instance, world prices and markets for oil and gas are unpredictable, highly volatile, potentially subject to governmental fixing, pegging, controls or any combination of these and other factors which respond to changes in domestic, international, political, social, and economic environments. In addition, due to worldwide economic uncertainty and greater competition among market participants, the difficulty of obtaining and the cost of funds for production and other expenses have increased. These and future changes are impossible to predict and may materially affect our financial performance.

-11-

Oil and gas operations are subject to comprehensive regulation which may cause substantial delays or require capital outlays in excess of those anticipated, causing an adverse effect on the Company.

Oil and gas operations are subject to national and local laws relating to the protection of the environment, including laws regulating removal of natural resources from the ground and the discharge of materials into the environment. Oil and gas operations are also subject to national and local laws and regulations which seek to maintain health and safety standards by regulating the design and use of drilling methods and equipment. Environmental standards imposed by national or local authorities may be changed and any such changes may have material adverse effects on our activities. Moreover, compliance with such laws may cause substantial delays or require capital outlays in excess of those anticipated, thus causing an adverse effect on us. Additionally, we may be subject to liability for pollution or other environmental damages which we may elect not to insure against due to prohibitive premium costs and other reasons. To date, we have not been required to spend any significant amounts on compliance with environmental regulations. However, we may be required to expend substantial sums in the future and this may affect our ability to develop, expand or maintain our operations.

We are dependent upon third party operators of our oil and gas properties.

Under the terms of the operating agreements related to our oil and gas properties, third parties act as the operator of our oil and gas wells and control the drilling and operating activities to be conducted on our properties. Therefore, we have limited control over certain decisions related to activities on our properties, which could affect our results of operations. Decisions over which we have limited control include:

|

·

|

the timing and amount of capital expenditures;

|

|

·

|

the timing of initiating the drilling and re-completing of wells;

|

|

·

|

the extent of operating costs; and

|

|

·

|

the level of ongoing production.

|

The nature of oil and gas exploration makes the estimates of costs uncertain, and our operations may be adversely affected if we underestimate or have underestimated such costs.

It is difficult to project the costs of implementing an exploratory drilling program. Complicating factors include the inherent uncertainties of drilling in unknown formations, the costs associated with encountering various drilling conditions, such as over-pressured zones and tools lost in the hole, and changes in drilling plans and locations as a result of prior exploratory wells or additional seismic data and interpretations thereof. If we underestimate the costs of such programs, we may be required to seek additional funding, shift resources from other operations or abandon such programs.

We may not be able to develop oil and gas reserves on an economically-viable basis.

To the extent that we succeed in discovering oil and/or natural gas reserves, we cannot assure that these reserves will be capable of production levels we project or in sufficient quantities to be commercially viable. On a long-term basis, our viability depends on our ability to find, develop and commercially produce oil and gas reserves. Our future reserves, if any, will depend not only on our ability to develop then-existing properties, but also on our ability to identify and acquire additional suitable producing properties or prospects, to find markets for the oil and natural gas we develop and to effectively distribute our production into our markets.

Future oil and gas exploration may involve unprofitable efforts, not only from dry wells, but from wells that are productive but do not produce sufficient net revenues to return a profit after drilling, operating and other costs. Completion of a well does not assure a profit on the investment or recovery of drilling, completion and operating costs. In addition, drilling hazards or environmental damage could greatly increase the cost of operations and various field operating conditions may adversely affect the production from successful wells. These conditions include delays in obtaining governmental approvals or consents, shut-downs of wells resulting from extreme weather conditions, problems in storage and distribution and adverse geological and mechanical conditions. While we will endeavor to effectively manage these conditions, we cannot be assured of doing so optimally, and we will not be able to eliminate them completely in any case. Therefore, these conditions could diminish our future revenue and result in the impairment of our oil and natural gas interests.

A shortage of drilling rigs and other equipment and geophysical service crews could hamper our ability to exploit any oil and gas resources we may acquire.

Because of the increased oil and gas exploration activities in South America, competition for available drilling rigs and related services and equipment has increased significantly, and these rigs and related items have become substantially more expensive and harder to obtain. We may not be able to procure the necessary drilling rigs and related services and equipment or the cost of such items may be prohibitive. Our ability to comply with future license obligations or otherwise generate revenues from the production of operating oil and gas wells could be hampered as a result of this, and our business could suffer. Additionally, a shortage of crews available to shoot and process seismic activity could cause us to breach our obligations.

-12-

Decommissioning costs are unknown and may be substantial; unplanned costs could divert resources from other projects.

We may become responsible for costs associated with abandoning and reclaiming wells, facilities and pipelines which we may use for production of oil and gas reserves. Abandonment and reclamation of these facilities and the costs associated therewith is often referred to as “decommissioning.” We have not yet established a cash reserve account for use in the future. If decommissioning is required before economic depletion of our future properties or if our estimates of the costs of decommissioning exceed the value of the reserves remaining at any particular time to cover such decommissioning costs, we may have to draw on funds from other sources to satisfy such costs. The use of other funds to satisfy such decommissioning costs could impair our ability to focus capital investment in other areas of our business.

Our inability to obtain necessary facilities could hamper our operations.

Oil and natural gas exploration and development activities are dependent on the availability of drilling and related equipment, transportation, power and technical support in the particular areas where these activities will be conducted, and our access to these facilities may be limited. To the extent that we conduct our activities in remote areas, needed facilities may not be proximate to our operations, which will increase our expenses. Demand for such limited equipment and other facilities or access restrictions may affect the availability of such equipment to us and may delay exploration and development activities. The quality and reliability of necessary facilities may also be unpredictable, and we may be required to make efforts to standardize our facilities, which may entail unanticipated costs and delays. Shortages and/or the unavailability of necessary equipment or other facilities will impair our activities, either by delaying our activities, increasing our costs or otherwise.

Environmental risks may adversely affect our business.

All phases of the oil and natural gas business present environmental risks and hazards and are subject to environmental regulation pursuant to a variety of international conventions and federal, provincial and municipal laws and regulations. Environmental legislation provides for, among other things, restrictions and prohibitions on spills, releases or emissions of various substances produced in association with oil and gas operations. The legislation also requires that wells and facility sites be operated, maintained, abandoned and reclaimed to the satisfaction of applicable regulatory authorities. Compliance with such legislation can require significant expenditures, and a breach may result in the imposition of fines and penalties, some of which may be material. Environmental legislation is evolving in a manner we expect may result in stricter standards and enforcement, larger fines and liability and potentially increased capital expenditures and operating costs. The discharge of oil, natural gas or other pollutants into the air, soil or water may give rise to liabilities to foreign governments and third parties and may require us to incur costs to remedy such discharge. The application of environmental laws to our business may cause us to curtail our production or increase the costs of our production, development or exploration activities.

Managing local community relations where we and our partners operate could be problematic.

We or our operating partners may be required to present our operational plans to local communities or indigenous populations living in the area of a proposed project before project activities can be initiated. Additionally, working with local communities will be an essential part of our work program for the development of any of our exploration and production projects in the region. If we or our partners fail to manage any of these community relationships appropriately, our operations could be delayed or interrupted and we or our partners could lose rights to operate in these areas, resulting in a negative impact on our business, our reputation and our share price.

Our insurance may be inadequate to cover liabilities we may incur.

Our involvement in the exploration for, and development of, oil and natural gas properties may result in our becoming subject to liability for pollution, blow-outs, property damage, personal injury or other hazards. Although we intend to obtain insurance in accordance with industry standards to address such risks, such insurance has limitations on liability that may not be sufficient to cover the full extent of such liabilities. In addition, such risks may not, in all circumstances be insurable or, in certain circumstances, we may choose not to obtain insurance to protect against specific risks due to the high premiums associated with such insurance or for other reasons. The payment of such uninsured liabilities would reduce the funds available to us. If we suffer a significant event or occurrence that is not fully insured, or if the insurer of such event is not solvent, or denies coverage, we could be required to divert funds from capital investment or other uses towards covering our liability for such events.

-13-

Our business is subject to local legal, political and economic factors which are beyond our control, which could impair our ability to build and expand our operations or operate profitably.

We expect to operate our business in Peru, Colombia and possibly other countries. There are risks that economic and political conditions will change in a manner adverse to our interests. These risks include, but are not limited to, terrorism, military repression, interference with private contract rights (such as privatization), extreme fluctuations in currency exchange rates, high rates of inflation, exchange controls and other laws or policies affecting environmental issues (including land use and water use), workplace safety, foreign investment, foreign trade, investment or taxation, as well as restrictions imposed on the oil and natural gas industry, such as restrictions on production, price controls and export controls. Any changes in oil and gas or investment and tax regulations and policies or a shift in political attitudes in countries in which we intend to operate are beyond our control and may significantly hamper our ability to build and expand our operations or operate our business at a profit. For example, changes in laws in the jurisdiction in which we operate or expand into with the effect of favoring local enterprises, changes in political views regarding the exploitation of natural resources and economic pressures may make it more difficult for us to negotiate agreements on favorable terms, obtain required licenses, comply with regulations or effectively adapt to adverse economic changes, such as increased taxes, higher costs, inflationary pressure and currency fluctuations.

Insurgent and criminal activities in the territories in which we operate, or the perception that such activities are likely, may disrupt our operations, hamper our ability to hire and keep qualified personnel and impair our access to sources of capital.

Colombia has been the site of South America’s largest and longest political and military insurgency and has experienced uncontrolled criminal activity relating to drug trafficking. While the situation has improved in recent years, there can be no guarantee that the situation will improve further or that it will not deteriorate in Colombia or any other territories in which we may operate. Insurgent or criminal activities (including kidnapping and terrorism) in any of the territories in which we operate, or the perception that such activities are likely, may disrupt our operations in that country, hamper our ability to hire and keep qualified personnel and hinder or shut off our access to sources of capital. Any such changes are beyond our control and may adversely affect our business.

Local legal and regulatory systems in which we operate may create uncertainty regarding our rights and operating activities, which may harm our ability to do business.

We are a company organized under the laws of the State of Nevada and are subject to United States laws and regulations. The jurisdictions in which we intend to operate our exploration, development and production activities may have different or less developed legal systems than the United States, which may result in risks such as:

|

·

|

effective legal redress in the courts of such jurisdictions, whether in respect of a breach of law or regulation, or, in an ownership dispute, being more difficult to obtain;

|

|

·

|

a higher degree of discretion on the part of governmental authorities;

|

|

·

|

a lack of judicial or administrative guidance on interpreting applicable rules and regulations;

|

|

·

|

inconsistencies or conflicts between and within various laws, regulations, decrees, orders and resolutions; and

|

|

·

|

relative inexperience of the judiciary and courts in such matters.

|

In certain jurisdictions the commitment of local business people, government officials and agencies and the judicial system to abide by legal requirements and negotiated agreements may be more uncertain, creating particular concerns with respect to licenses and agreements for business. These licenses and agreements may be susceptible to revision or cancellation and legal redress may be uncertain or delayed. Property right transfers, joint ventures, licenses, license applications or other legal arrangements pursuant to which we operate may be adversely affected by the actions of government authorities and the effectiveness of and enforcement of our rights under such arrangements in these jurisdictions may be impaired.

Our business will suffer if our strategic partners cannot obtain or maintain necessary licenses.

Our operations will require licenses, permits and in some cases renewals of licenses and permits from various governmental authorities. Our ability to obtain, sustain or renew such licenses and permits on acceptable terms is subject to changes in regulations and policies and to the discretion of the applicable governments, among other factors. Our inability to obtain, or our loss of or denial of extension to any of these licenses or permits could hamper our ability to produce revenues from our operations.

Foreign currency exchange rate fluctuations may affect our financial results.

We expect to sell any future oil and natural gas production under agreements that will be denominated in U.S. dollars and foreign currencies. Many of the operational and other expenses we incur will be paid in the local currency of the country where we perform our operations. As a result, fluctuations in the U.S. dollar against the local currencies in jurisdictions where we operate could result in unanticipated and material fluctuations in our financial results. Local operations may require funding that exceeds operating cash flows and there may be restrictions on expatriating proceeds and/or adverse tax consequences associated with such funding.

-14-

We may not be able to repatriate our earnings.

We will be conducting all of our operations in South America through subsidiaries of one or more wholly-owned, offshore subsidiaries established for this purpose. Therefore, we may be dependent on the cash flows of our offshore subsidiaries to meet our obligations. Our ability to receive such cash flows may be constrained by taxation levels in the jurisdictions where our subsidiaries operate and by the introduction of exchange controls or repatriation restrictions in the jurisdictions where we operate. There is no assurance that any exchange or repatriation restrictions will not be imposed in the future.

Risks Related to our Common Stock

The market price of our common stock is very volatile and the value of your investment is subject to sudden decreases.

The trading price for our common stock has been, and we expect it to continue to be, volatile. More specifically, the closing bid price of our stock has fluctuated between $0.04 per share and $0.55 per share since September 1, 2009. The price at which our common stock trades depends upon a number of factors that are beyond our control. The stock market has, from time to time, experienced extreme price and volume fluctuations. These broad market fluctuations may lower the market price of our common stock. Further, during periods of stock market price volatility, share prices of many companies have fluctuated in a manner not necessarily related to their operating performance; accordingly, our common stock may be subject to greater price volatility than the stock market as a whole.

There is not now, and there may never be, an active market for our common stock.

There currently is an extremely limited market for our common stock. Further, although our common stock is currently quoted on the Pink Sheets OTCQB, trading of our common stock is extremely sporadic. For example, several days may pass before any shares are traded. As a result, an investor may find it difficult to dispose of, or to obtain accurate quotations of the price of, our common stock. Accordingly, investors must assume they may have to bear the economic risk of an investment in our common stock for an indefinite period of time, and may lose their entire investment. There can be no assurance that a more active market for our common stock will develop, or if one should develop, there is no assurance that it will be sustained. This severely limits the liquidity of our common stock and would likely have a material adverse effect on the market price of our common stock and on our ability to raise additional capital.

We cannot assure that our common stock will become liquid or that it will be listed on a national securities exchange.

Until our common stock is listed on a national securities exchange such as the NASDAQ National Market or the NYSE Amex, we expect our common stock to remain eligible for quotation on the Pink Sheets OTCQB. If we fail to meet the criteria set forth in Securities and Exchange Commission (“SEC”) regulations, various requirements would be imposed by law on broker-dealers who sell our securities to persons other than established customers and accredited investors. Consequently, such regulations may deter broker-dealers from recommending or selling our common stock, which may further affect the liquidity of our common stock. This would also make it more difficult for us to raise capital.

Future sales of our common stock could lower our stock price.

We will sell additional shares of common stock in subsequent offerings with an offering price that may be greater or less than the current offering price. We may also issue additional shares of common stock or derivative securities convertible into shares of common stock to finance future acquisitions. We have granted to investors purchasing 12,750,000 shares of common stock in our December 2010 – January 2011 private placement certain anti-dilution rights. Such rights provide that if, prior to April 30, 2011, we sell shares of our common stock at a price below $0.20 per share, then immediately after such sale, the Company will issue to each investor who participated in the December 2010 – January 2011 private placement additional shares of common stock such that the aggregate number of shares acquired by any investor would be equal to the number of shares of common stock such investor could have purchased at the reduced purchase price. In connection with the closing of our February 2011 private placement, we issued the Warrants to purchase up to 1 million shares of our common stock. We cannot predict the size of future issuances of our common stock or the effect, if any, that future issuances and sales of shares of our common stock will have on the market price of our common stock. Sales of substantial amounts of our common stock, or the perception that such sales could occur, may adversely affect prevailing market prices for our common stock. Moreover, sales of our common stock by existing shareholders could also depress the price of our common stock.

-15-

Future sales of our common stock in the public market could lower our stock price.

This prospectus registers the resale of 96,288,726 shares of common stock, which includes 1 million shares of common stock issuable upon the exercise of outstanding five year common stock purchase warrants exercisable at $0.30 per share that will be eligible to be sold to the public. Sales of substantial amounts of our common stock, or the perception that such sales could occur, may adversely affect prevailing market prices for our common stock.

Our common stock is subject to the “penny stock” rules of the SEC and the trading market in our common stock is limited, which makes transactions in our common stock cumbersome and may reduce the value of an investment in the stock.

The SEC has adopted Rule 15g-9 which establishes the definition of a “penny stock,” for the purposes relevant to us, as any equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require:

|

·

|

that a broker or dealer approve a person’s account for transactions in penny stocks; and

|

|

·

|

the broker or dealer receives from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased.

|

In order to approve a person’s account for transactions in penny stocks, the broker or dealer must:

|

·

|

obtain financial information and investment experience objectives of the person; and

|

|

·

|

make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks.

|

The broker or dealer must also deliver to the potential investor, prior to any transaction in a penny stock, a disclosure schedule prescribed by the SEC relating to the penny stock market, which, in highlight form sets forth:

|

·

|

the basis on which the broker or dealer made the suitability determination; and

|

|

·

|

that the broker or dealer received a signed, written agreement from the investor prior to the transaction.

|

Generally, brokers may be less willing to execute transactions in securities subject to the “penny stock” rules. This may make it more difficult for investors to dispose of common stock and cause a decline in the market value of stock.

Disclosure also has to be made to the potential investor about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

The price of our common stock will remain volatile, which could lead to losses by investors and costly securities litigation.

The trading price of our common stock is likely to be highly volatile and could fluctuate in response to factors such as:

|

·

|

actual or anticipated variations in our operating results;

|

|

·

|

announcements of drilling developments by us, our strategic partners or our competitors;

|

|

·

|

announcements by us or our competitors of significant acquisitions, strategic partnerships, joint ventures or capital commitments;

|

|

·

|

adoption of new accounting standards affecting our Company’s industry;

|

|

·

|

additions or departures of key personnel;

|

|

·

|

sales of our common stock or other securities in the open market;

|

|

·

|

catastrophic equipment failures, such as blow-outs;

|

|

·

|

litigation; and

|

|

·

|

other events or factors, including the price of oil and gas, many of which are beyond our control.

|

The stock market is subject to significant price and volume fluctuations. In the past, following periods of volatility in the market price of a company’s securities, securities class action litigation has often been initiated against the company. Litigation initiated against us, whether or not successful, could result in substantial costs and diversion of our management’s attention and resources, which could harm our business and financial condition.

We do not anticipate dividends to be paid on our common stock.

Cash dividends have never been declared or paid on our common stock, and we do not anticipate such a declaration or payment for the foreseeable future. We cannot assure stockholders of a positive return on their investment when they sell their shares, nor can we assure that stockholders will not lose the entire amount of their investment in the Company.

-16-