Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - TRANSATLANTIC PETROLEUM LTD. | d8k.htm |

Exhibit 99.1

TransAtlantic Petroleum Ltd.

Provides Year End 2010 Operations Update and Reserves Summary

FOR IMMEDIATE RELEASE

Hamilton, Bermuda (March 17, 2011) – TransAtlantic Petroleum Ltd. (TSX: TNP)(NYSE-AMEX: TAT) is pleased to provide an operational update for the year ended December 31, 2010.

Form 10-K for the Year Ended December 31, 2010

On March 16, 2011, we filed a Form 12b-25, giving us an additional fifteen days to file our Annual Report on Form 10-K for the year ended December 31, 2010. We filed the Form 12b-25 because we need additional time to complete the financial statements to be contained in the Form 10-K. We expect to file the Form 10-K within the period described under Rule 12b-25.

Selected Production Highlights

Net oil and gas production, after royalty, for the fourth quarter of 2010 increased 171% to approximately 344,000 barrels of oil equivalent (“boe”) compared to approximately 127,000 boe for the fourth quarter of 2009. For the fourth quarter of 2010, net oil production, after royalty, in the Company’s Selmo oil field increased 45% to approximately 180,000 barrels of oil from approximately 124,000 barrels of oil in the fourth quarter of 2009. For 2010, net oil and gas production, after royalty, increased 133% to approximately 974,000 boe compared to approximately 417,000 boe in 2009. The increase in 2010 was the result of a full year of production in the Selmo oil field, additional production in the Arpatepe oil field and new production in the Thrace Basin gas fields.

For the fourth quarter of 2010, the Company’s average realized oil price was approximately $92.00 per barrel, and the Company’s average realized natural gas price was approximately $8.00 per thousand cubic feet (“Mcf”).

Summary of Net Reserves

DeGolyer and MacNaughton evaluated the Company’s reserves as of December 31, 2010 in accordance with the reserves definitions of Rule 4-10(a) (1)-(32) of Regulation S-X of the Securities and Exchange Commission (“SEC”) and in accordance with National Instrument 51-101 (“NI 51-101”) and the Canadian Oil and Gas Evaluators Handbook (“COGEH”). DeGoyler and MacNaughton evaluated reserves at the Company’s Selmo oil field, Arpatepe oil field, Bakuk license, and Thrace Basin gas fields, all of which are located in Turkey.

NI 51-101 Case Reserves Summary

The following is a summary of the Company’s estimated net proved, probable, and possible reserves at December 31, 2010 compared to total estimated net proved, probable, and possible reserves at December 31, 2009:

| Oil & Sales Gas TransAtlantic |

Oil & Sales Gas TransAtlantic |

|||||||||||||||||||

| Net (Mbbl) |

Net (MMcf) |

Net (MBoe)(1) |

||||||||||||||||||

| 2010 | 2010 | 2009 | % Change |

|||||||||||||||||

| Proved Developed |

5,596 | 16,566 | 8,357 | 6,464 | 29 | % | ||||||||||||||

| Proved Undeveloped |

7,349 | 5,582 | 8,279 | 5,210 | 59 | % | ||||||||||||||

| Total Proved (1P) |

12,945 | 22,148 | 16,636 | 11,674 | 43 | % | ||||||||||||||

| Probable |

5,339 | 38,316 | 11,725 | 12,265 | (4 | %) | ||||||||||||||

| Total Proved + Probable (2P) |

18,284 | 60,464 | 28,361 | 23,939 | 18 | % | ||||||||||||||

| Possible |

12,803 | 174,130 | 41,825 | 14,458 | 189 | % | ||||||||||||||

| Total Proved + Probable + Possible(2) (3P) |

31,087 | 234,594 | 70,186 | 38,397 | 83 | % | ||||||||||||||

| (1) | Boe is not included in the Degolyer and MacNaughton report and is derived by the Company by converting natural gas to oil in the ratio of six thousand cubic feet (mcf) of natural gas to one barrel (bbl) of oil. Boe may be misleading, particularly if used in isolation. A boe conversion ratio of 6 mcf to 1 bbl is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. |

| (2) | Under NI 51-101, possible reserves are those additional reserves that are less certain to be recovered than probable reserves. There is a 10% probability that the quantities actually recovered will equal or exceed the sum of proved plus probable plus possible reserves. |

SEC Case Reserves Summary

The following is a summary of the Company’s estimated net proved, probable, and possible reserves at December 31, 2010:

| Reserves | Proved Developed |

Total Proved |

Proved plus Probable |

Proved plus Probable plus Possible |

||||||||||||

| Oil and Condensate, Mbbl |

5,588 | 12,936 | 18,277 | 31,080 | ||||||||||||

| Gas, Mmcf |

16,560 | 22,425 | 60,737 | 234,863 | ||||||||||||

| Total Oil and Gas, Mboe |

8,346 | 16,674 | 28,400 | 70,224 | ||||||||||||

| Future Net Revenue, U.S. $ |

429,788 | 817,138 | 1,407,181 | 3,228,267 | ||||||||||||

Note: The Company did not evaluate probable and possible reserves evaluated in accordance with SEC guidelines at December 31, 2009, so no comparison is made to that time period. Mboe is not included in the DeGolyer and MacNaughton report and was derived by the Company by converting natural gas to oil in the ratio of six mcf of natural gas to one bbl of oil. Future net revenue was calculated using $79.00 per bbl and $7.77 per mcf.

Operations Update

“We expect to achieve a production rate from our properties in Turkey of at least 10,000 boe per day by the end of 2011,” said Malone Mitchell, the Company’s Chairman. He added, “All of our actions are directed toward this near-term goal, at which point we will largely be able to fund our capital expenditure program out of cash flow.” For 2011, the Company anticipates non-acquisition capital expenditures of between $125 million and $150 million, with the overwhelming majority directed towards Turkey.

Turkey Operations – Thrace Basin

More than half of the Company’s capital expenditures in 2011 are planned for properties in the Thrace Basin. The capital will be expended in the expectation of considerably growing gas production from the current base of approximately 10.0 million net cubic feet per day (“Mmcfpd”). The program for 2011 will focus on developing shallow gas prospects and reserves (conventional gas) and fracture stimulating the deeper pay (unconventional gas). The Company expects net gas production at year end of approximately 35 to 40 Mmcfpd.

On the Company’s northern licenses (3839 and 4037) production growth is expected from receipt of a wholesale gas license, which will permit sales from wells that are currently shut-in, and the drilling of 15 to 20 wells on structures identified on recently processed 3D seismic data.

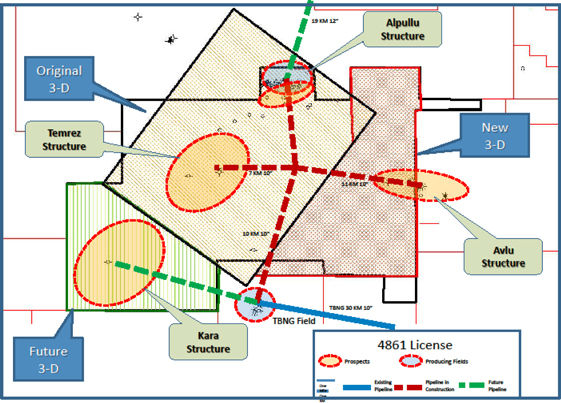

On the Company’s central licenses, considerable production growth is expected from the Alpullu gas field and the adjoining exploration license, where the Company plans to drill between five and eight wells to further develop the Alpullu field and test structures on the exploration license. The Alpullu field is currently producing at a constrained rate through a small pipeline to the north. The Company is currently constructing a pipeline to the south, which would connect the field to the gas distribution system operated by Thrace Basin Natural Gas. The Company plans to build gathering lines to connect the structures to the east and west of the new pipeline.

The Company plans to be quite active on the southern licenses that it expects to acquire upon the acquisition of Thrace Basin Natural Gas, currently expected to close in the second quarter of

2011. The Company expects to drill approximately 20 wells on these licenses in 2011, targeting shallow conventional targets, and re-enter and fracture stimulate approximately eight wells in the Mezardere formation, which is behind pipe.

Turkey Operations – Southeastern Turkey

Selmo Oil Field

In January 2011, the Company began conducting a series of small fracture stimulations and gelled acid jobs on wells in the Selmo oil field. As a result of those operations, daily average production increased from approximately 2,400 bopd at year end 2010 to an average of 2,766 bopd for the month of February 2011, reaching a peak production of over 3,000 bopd. Current production from the field is approximately 3,000 bopd. The Company plans to drill and complete at least 24 wells in the field during 2011. As a result of the planned drilling activity, the Company expects production to grow to approximately 4,000 bopd. “In addition to the active drilling program, we are also reviewing all current and lower rate wells as candidates for fracture stimulated or gelled acid stimulation, as our results to date have been very good,” said Gary Mize, the Company’s President. A summary of the results from the fracture and gelled acid stimulations in Selmo follows:

| Oil Production Rate, BPD | ||||||||

| Well |

Operation |

Before |

After |

Current | ||||

| S-57 |

Fracture stimulation | 0 | 120 | 20 | ||||

| S-45ST |

Fracture stimulation | 7 | 170 | 120 | ||||

| S-62 |

Fracture stimulation | 82 | 250 | 155 | ||||

| S-50A |

Fracture stimulation | 0 | 25 | 0 | ||||

| S-56 |

Gelled acid | 0 (new drill) | 260 | 257 | ||||

| S-2 |

Gelled acid | 0 | 300 | 275 | ||||

| S-60 |

Gelled acid | 0 (new drill) | 300 | 63 | ||||

| S-71 |

Gelled acid | 0 (new drill) | 366 | just online | ||||

Paleozoic Trend

Last year the Company acquired 252 square kilometers of 3D seismic data around the Arpatepe field area on License 3118, in which the Company holds a 50% working interest. Last week, the Company received brute stack processing of the data and expects

to receive final migrated data by the end of March 2011. “This is the highest priority 3D seismic data we are working with right now. We are pleased with the leads we see on the brute stack data,” said Mr. Mize. The Company expects to drill three exploration wells and two development wells at Arpatepe in 2011. In addition, plans have been approved to put the Arpatepe-1 well on pump, which is still flowing, but at declining rates. The Company anticipates that the pump should increase production from the well by about 300 bopd gross. The Company expects its year end 2011 net production from License 3118 will be approximately 600 bopd.

Syrian Trend – Bakuk

The Company and its partner have completed and tested the Bakuk Camurlu Pipeline, a 23 kilometer, six-inch pipeline that runs from the Bakuk-101 gas discovery well to the south. Limited gas sales are anticipated to commence by the end of March 2011 and build gradually over the coming months. The Company has a 50% working interest on the Bakuk license and is evaluating prospect proposals for a well on the South Bakuk area, where the Company acquired 3D seismic data last year. In addition, the Company is working with its partner to plan another well to further delineate the Bakuk-101 discovery. That well could help justify the construction of a larger pipeline approximately 50 miles to the north, which would access markets with greater demand for gas. If that pipeline were constructed it would not come into service until 2012.

Bulgaria and Romania Operations

The Company is planning wells in Bulgaria to appraise the Deventci R-1 gas discovery and to test the Etropole shale. In Romania, the Company plans to drill a well to test the Silurian aged shale. The wells are likely to be drilled in succession, beginning in late Spring.

Morocco Operations

The Company has drilled the GRB-1 well to a total depth of 8,120 feet (2,475 meters) and expects to reach total depth in the next few days. The GRB-1 well is located near the Atlantic coast approximately 30 kilometers south of Tangiers and 3.5 kilometers from the Maghreb-Europe gas pipeline.

The GRB-1 well was the first well drilled on the Asilah exploration permits and has targeted Tertiary age reservoirs. The Company plans to test numerous intervals that had gas shows while drilling.

The GRB-1 well was drilled using the Company’s Viking I-8 rig. Upon completion of testing, the rig will move to the Tselfat exploration permit and drill the planned TKN-1 well on the Tekna Jurassic oil prospect, 3.5 kilometers north of the Haricha oil field.

The HR-33bis appraisal well, drilled in the Haricha oil field by the Company in 2009, tested 100 bfpd with 50% water cut from Jurassic and Tertiary age reservoirs at a subsea depth of approximately 2,802 feet (854metres). The field had an estimated 15 million barrels of oil originally in place, and oil production ceased in 1972 after production of approximately 2.8 million barrels of oil. The HR-33bis location was recently enlarged, and specialized testing equipment was installed. An extended well test will start soon to give a more complete estimation of the remaining reserves and determine the feasibility of field redevelopment.

Annual Shareholder’s Meeting

The Company plans to hold its annual shareholder’s meeting on June 27, 2010 in Istanbul, Turkey. Details of the meeting will be made available on the Company’s website, www.transatlanticpetroleum.com.

Upcoming Conference Schedule

Management will be providing a presentation at the Howard Weil 39th Annual Energy Conference in New Orleans on March 31, 2011 at 10:35 a.m. Eastern time. A copy of the Company’s presentation will be available on March 29, 2011 on the Company’s website. Management will also be providing a presentation at the IPAA OGIS Conference in New York on April 13, 2011 at 11:45 a.m. Eastern time. The Company’s presentation at the conference will be available via webcast. In addition, the Company is planning an analyst day to be held on April 12, 2011 at 3:00 p.m. Eastern time in New York City at the Hilton New York. The event will be available via webcast, the details of which will be available on the Company’s website.

Conference Call

The Company will host a conference call to discuss this release on Thursday, March 17, 2011 at 8:30 a.m. Eastern, 7:30 a.m. Central. To access the conference call, please contact the conference call operator at 877-878-2762, or 678-809-1005 for international calls, approximately 10 minutes prior to the scheduled start time, and ask for the TransAtlantic conference call. The pass code is 49645270. A replay will be available until 11:59 p.m. Eastern on March 23, 2011. The number for the replay is 800-642-1687, or 706-645-9291 for international calls, and the pass code is 49645270.

An enhanced webcast of the conference call and replay will be provided by Shareholder.com and will be available through the Company’s website. To access the conference call and replay, click on “Investors,” select “Events,” and click on “Webcast” found below the event listing.

About TransAtlantic

TransAtlantic Petroleum Ltd. is a vertically integrated, international energy company engaged in the acquisition, development, exploration, and production of crude oil and natural gas. The Company holds interests in developed and undeveloped oil and gas properties in Turkey, Morocco, Bulgaria, and Romania. The Company owns its own drilling rigs and oilfield service equipment, which it uses to develop its properties in Turkey and Morocco. In addition, the Company provides oilfield services and contract drilling services to third parties in Turkey.

Forward-Looking Statements

This news release contains statements regarding the acquisition of companies, the acquisition of a wholesale gas license, the acquisition and processing of seismic data, the drilling, testing, stimulation, completion and production of oil and gas wells, the construction of pipelines, the holding of an annual shareholders’ meeting, participation in conferences and analyst meetings, the timing of such acquisition of companies, acquisition of wholesale gas license, acquisition and processing of seismic data, drilling, testing, stimulation, completion and production of oil and gas wells, construction of pipelines, holding of an annual shareholders’ meeting, participation in conferences and analyst meetings, as well as other expectations, plans, goals, objectives, assumptions or information about future events, conditions, results of operations or performance that may constitute forward-looking statements or information under applicable securities legislation. Such forward-looking statements or information are based on a number of assumptions which may prove to be incorrect. In addition to other assumptions identified in this news release, assumptions have been made regarding, among other things, the ability of the Company to continue to develop and exploit attractive foreign initiatives.

Although the Company believes that the expectations reflected in such forward-looking statements or information are reasonable, undue reliance should not be placed on forward-looking statements because the Company can give no assurance that such expectations will prove to be correct. Forward-looking statements or information are based on current expectations, estimates and projections that involve a number of risks and uncertainties which could cause actual results to differ materially from those anticipated by the Company and described in the forward-looking statements or information. These risks and uncertainties include but are not limited to the continuing ability of the Company to operate effectively internationally, reliance on current oil and gas laws, rules and regulations, volatility of oil and gas prices, fluctuations in currency and interest rates, imprecision of resource estimates, the results of exploration, development and drilling, imprecision in estimates of future production capacity, changes in environmental and other regulations or the interpretation of such regulations, the ability to obtain necessary regulatory approvals, weather and general economic and business conditions. If one or more of these risks or uncertainties materialize (or the consequences of such a development changes), or should underlying assumptions prove incorrect, actual outcomes may vary materially from those forecasted or expected.

The forward-looking statements or information contained in this news release are made as of the date hereof and the Company undertakes no obligation to update publicly or revise any forward-looking statements or information, whether as a result of new information, future events or otherwise, unless so required by applicable securities laws.

Notes Regarding NI 51-101 Reserves Data and Other Oil and Gas Information

NI 51-101 imposes oil and gas disclosure standards for Canadian public companies engaged in oil and gas activities. The Company has provided certain of the reserves data and other oil and gas information included in this news release in accordance with NI 51-101 and COGEH and such information may differ from the corresponding information prepared in accordance with U.S. disclosure requirements.

Notes Regarding SEC Reserves Data and Other Oil and Gas Information

The Company uses in this news release the terms proved, probable and possible reserves. Proved reserves are reserves which, by analysis of geoscience and engineering data, can be estimated with reasonable certainty to be economically producible from a given date forward, from known reservoirs and under existing economic conditions, operating methods and government regulations prior to the time at which contracts providing the right to operate expire, unless evidence indicates that renewal is reasonably certain, regardless of whether deterministic or probabilistic methods are used for the estimation. The project to extract the hydrocarbons must have commenced, or the operator must be reasonably certain that it will commence the project within a reasonable time. Probable reserves are those additional reserves that are less certain to be recovered than proved reserves but which, together with proved reserves, are as likely as not to be recovered. Possible reserves are those additional reserves that are less certain to be recovered than probable reserves. Estimates of probable and possible reserves which may potentially be recoverable through additional drilling or recovery techniques are by nature more uncertain than estimates of proved reserves and accordingly are subject to substantially greater risk of not actually being realized by the Company.

(NO STOCK EXCHANGE, SECURITIES COMMISSION OR OTHER REGULATORY AUTHORITY HAS APPROVED OR DISAPPROVED THE INFORMATION CONTAINED HEREIN.)

| Contact: | ||

| Matt McCann | CEO | |

| Phone: | (214) 220-4323 | |

| Internet: | http://www.transatlanticpetroleum.com | |

| Address: | 5910 N. Central Expressway | |

| Suite 1755 | ||

| Dallas, Texas 75206 |