Attached files

| file | filename |

|---|---|

| EX-21 - FutureFuel Corp. | ex21.htm |

| EX-14 - FutureFuel Corp. | ex14.htm |

| EX-32 - FutureFuel Corp. | ex32.htm |

| EX-23 - FutureFuel Corp. | ex23.htm |

| EX-11 - FutureFuel Corp. | ex11.htm |

| EX-31.A - FutureFuel Corp. | ex31pa.htm |

| EX-31.B - FutureFuel Corp. | ex31pb.htm |

| EX-10.12 - FutureFuel Corp. | ex10p12.htm |

| EX-10.15 - FutureFuel Corp. | ex10p15.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

√

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2010

|

|

or

|

|

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____________ to ______________

|

Commission file number: 0-52577

FUTUREFUEL CORP.

(Exact Name of Registrant as Specified in Its Charter)

|

Delaware

|

20-3340900

|

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

(I.R.S. Employer

Identification No.)

|

8235 Forsyth Blvd., Suite 400

Clayton, Missouri 63105

(Address of Principal Executive Offices, including Zip Code)

(805) 565-9800

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Name of each exchange on which registered

|

|

|

Common stock, par value $0.0001

|

New York Stock Exchange

|

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No √

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes No √

Note—Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Exchange Act from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes √ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer

|

|

Accelerated filer

|

√ | |

|

Non-accelerated filer

|

|

Smaller reporting company

|

|

(Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes No √

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter. $80,580,688

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date: 39,983,849

Table of Contents

General Development of the Business

The Company

FutureFuel Corp. (including our wholly-owned subsidiaries, the “Company” or “we”, “our” or “us”) is a Delaware corporation incorporated on August 12, 2005 under the name “Viceroy Acquisition Corporation”. We were formed to serve as a vehicle for the acquisition by way of an asset acquisition, merger, capital stock exchange, share purchase, or similar transaction of one or more operating businesses in the oil and gas industry. On July 12, 2006, we completed an offering of 22,500,000 units, each unit consisting of one share of our common stock and one warrant to acquire one share of our common stock. These units were issued at $8.00 per unit. On July 21, 2006, we entered into an acquisition agreement with Eastman Chemical Company to acquire its wholly-owned subsidiary, Eastman SE, Inc., a chemical manufacturer which had just launched a biobased products platform. Our shareholders approved the acquisition of Eastman SE, Inc. on October 27, 2006. On October 31, 2006, the acquisition of Eastman SE, Inc. was consummated (effective after the close of business on that day) and Eastman SE, Inc. became our wholly-owned subsidiary. In connection with such closing, we changed our name to FutureFuel Corp. and Eastman SE, Inc. changed its name to FutureFuel Chemical Company.

Our shares of common stock are quoted on the Over-the-Counter Bulletin Board (“OTC Bulletin Board”). The OTC Bulletin Board is an electronic trading service offered by the National Association of Security Dealers that shows real-time quotes, last sale prices, and volume information for over-the-counter equity securities.

On July 12, 2010, all outstanding unexercised warrants to purchase our common stock expired. Our warrants were not listed or quoted on any established exchange.

We declared a special cash dividend on February 3, 2011 of $0.10 per share on our common stock, with a record date of March 1, 2011 and payable on March 15, 2011.

On February 10, 2011, we filed with the United States Securities and Exchange Commission (“SEC”) a Form S-3 Registration Statement commonly referred to as a “shelf registration” whereby we registered shares of our common stock, preferred stock, warrants, rights, and units which we might issue in the future in an aggregate amount not to exceed $50 million. This registration statement was amended on March 4, 2011 and became effective on March 10, 2011.

On March 8, 2011, the New York Stock Exchange (“NYSE”) approved the listing of our common stock for trading on the exchange, and on March 9, 2011 we filed with the SEC a Form 8-A Registration Statement under the Securities and Exchange Act of 1934, as amended (the “Exchange Act”) with respect to our common stock. We anticipate that trading of our common stock on the NYSE will commence on March 23, 2011 under the symbol “FF”.

FutureFuel Chemical Company

FutureFuel Chemical Company is a Delaware corporation incorporated on September 1, 2005 under the name Eastman SE, Inc. It owns approximately 2,200 acres of land six miles southeast of Batesville in north central Arkansas fronting the White River. Approximately 500 acres of the site are occupied with batch and continuous manufacturing facilities, laboratories, and associated infrastructure, including on-site liquid waste treatment. The plant is staffed by approximately 500 non-union full-time employees. FutureFuel Chemical Company manufacturers diversified chemical products and biobased products comprised of biofuels and biobased specialty chemical products.

In the chemicals segment, the 2010 demand for our core existing product lines remained in line with our expectations. We also completed plant modifications and additions in 2010 to enable the processing of several new product lines. We continue to focus on building and maintaining our reputation as a technology-driven competitive chemical producer. We have retained a strong emphasis on cost control and efficiency improvements that, we

1

believe, will enable us to take advantage of growth opportunities that exist as a result of conditions in the worldwide chemical industry.

With respect to our biofuels segment, in 2009 we completed a project to increase our production capacity to 59 million gallons of biodiesel per year through the addition of a new continuous processing line. We initiated commercial production from this new line in May 2009. By the end of the second quarter of 2009, daily production volumes from the new processing line were demonstrated at approximately 80% of nameplate capacity. This production line was designed to produce biodiesel from feedstock with low fatty acids. We believe we successfully demonstrated our ability to keep this continuous processing line at or near capacity for sustained periods of time as well as our ability to procure and logistically handle large quantities of feedstock with low fatty acids. However, with the expiration of the $1.00 federal blender’s credit at the end of 2009 (see the discussion below), we determined that feedstocks with low fatty acids were too costly to consistently produce biodiesel with positive margins. Accordingly, in 2010, we redesigned our continuous line to produce biodiesel from feedstock with high fatty acids. We are still in the process of debugging this redesigned line.

There currently is uncertainty as to whether we will produce biodiesel in the future. This uncertainty results from: (i) changes in feedstock prices relative to biodiesel prices; (ii) the continuance of the $1.00 per gallon federal blender’s tax credit, which credit terminates on December 31, 2011; and (iii) the permanency of government mandates. See “Risk Factors” beginning at page 16 below.

Financial Information about Segments

Unless otherwise noted, the financial data presented herein represents our consolidated operations for the twelve-month periods ended December 31, 2010, December 31, 2009, and December 31, 2008. The following table sets forth: (i) our consolidated revenues from external customers for the years ended December 31, 2010, 2009, and 2008; (ii) our consolidated net income for the years ended December 31, 2010, 2009, and 2008; and (iii) our total assets at December 31, 2010, 2009, and 2008.

(Dollars in thousands)

|

Period

|

Revenues

from External Customers

|

Net Income

|

Total Assets

|

|||||||||

|

Year ended December 31, 2010

|

$ | 219,183 | $ | 23,094 | $ | 343,156 | ||||||

|

Year ended December 31, 2009

|

$ | 196,711 | $ | 16,992 | $ | 246,007 | ||||||

|

Year ended December 31, 2008

|

$ | 198,330 | $ | 22,675 | $ | 238,126 | ||||||

We have two business reporting “segments” as defined by U.S. generally accepted accounting principles: chemicals and biofuels. We are not able to allocate net income and total assets between these two business segments. However, revenues from external customers and gross margins can be allocated between the two business segments as set forth in the following table.

(Dollars in thousands)

|

Period

|

Revenues

from

Chemical Segment

|

Revenues

from

Biofuels Segment

|

Total Revenues

from

External Customers

|

Gross

Margin

from Chemical Segment

|

Gross

Margin

from

Biofuels Segment

|

Gross

Margin

|

||||||||||||||||||

|

Year ended December 31, 2010

|

$ | 178,280 | $ | 40,903 | $ | 219,183 | $ | 41,433 | $ | (149 | ) | $ | 41,284 | |||||||||||

|

Year ended December 31, 2009

|

$ | 143,759 | $ | 52,952 | $ | 196,711 | $ | 33,007 | $ | 1,430 | $ | 34,437 | ||||||||||||

|

Year ended December 31, 2008

|

$ | 155,553 | $ | 42,777 | $ | 198,330 | $ | 32,738 | $ | 7,679 | $ | 40,417 | ||||||||||||

See note 21 to our consolidated financial statements contained in “Item 8. Financial Statements and Supplementary Data” for adjustments to segment gross margins to arrive at net income.

2

Narrative Description of the Business

Principal Executive Offices

Our principal executive offices are located at 8235 Forsyth Blvd., 4th Floor, Clayton, Missouri 63105. Our telephone number is (805) 565-9800. FutureFuel Chemical Company’s principal executive offices are located at 2800 Gap Road, Highway 394 South, Batesville, Arkansas 72501-9680. Its telephone number at such office is (870) 698-1811.

The Company

We completed the offering described above on July 12, 2006 and acquired FutureFuel Chemical Company at the close of business on October 31, 2006. On July 11, 2008, our common stock began to be quoted on the OTC Bulletin Board under the symbol “FTFL”. All of our warrants outstanding as of December 31, 2009 have either: (i) been exercised by the holder thereof; (ii) been purchased by us and canceled; or (iii) expired effective July 12, 2010; and are no longer outstanding. Our warrants were not listed or quoted on any national exchange or any other price quotation system.

We own approximately 2,200 acres of land six miles southeast of Batesville in north central Arkansas fronting the White River. Approximately 500 acres of the site are occupied with batch and continuous manufacturing facilities, laboratories, and associated infrastructure, including on-site liquid waste treatment. The plant is staffed by approximately 500 non-union full-time employees. Land and support infrastructure are available to support expansion and business growth. In March 2009, we acquired a granary in Marianna, Arkansas.

For the year ended December 31, 2010, approximately 78% of site revenue was derived from manufacturing specialty chemicals for specific customers (“custom manufacturing”) with 4% of revenues being derived from multi-customer specialty chemicals (“performance chemicals”) and 18% from biofuels. Custom manufacturing involves producing unique products for individual customers, generally under long-term contracts. The plant’s custom manufacturing product portfolio includes a bleach activator for a major detergent manufacturer, a proprietary herbicide and intermediates for a major life sciences company, and chlorinated polyolefin adhesion promoters and antioxidant precursors for a major chemical company. The performance chemicals product portfolio includes polymer (nylon) modifiers and several small-volume specialty chemicals for diverse applications.

We are committed to growing our chemical and biofuels businesses. We also intend to pursue commercialization of other products, including building block chemicals. In pursuing this strategy, we will continue to establish a name identity in the biofuels business, leverage our technical capabilities and quality certifications, secure local and regional markets, and expand marketing efforts to fleets and regional/national customers. These items are discussed in greater detail below.

Biofuels Business Segment

Overview of the Segment

Our biofuels segment was established in early 2005 as an initiative of the site management team to leverage technical and operational expertise as well as available manufacturing capacity to pursue business growth opportunities in addition to the legacy specialty chemicals business. The biofuels segment had revenue of $40,903,000 for the year ended December 31, 2010, $52,952,000 for the year ended December 31, 2009, and $42,777,000 for the year ended December 31, 2008.

Biofuel Products

Our biofuels business segment currently targets biodiesel. In addition, we sell petrodiesel in blends with our biodiesel and, from time to time, with no biodiesel added. Our biofuels segment also includes the operation of a granary in central Arkansas that we acquired in March 2009. The infrastructure and location of the granary provide an advantaged position related to several expansion projects we are evaluating within our biofuels segment. We can provide no assurance that any of these expansion projects will come to fruition. Until such time as we elect to pursue one or more of these expansion projects, we intend to continue purchasing grain from farmers in central

3

Arkansas and reselling that grain to buyers at major agricultural centers for export out of our region. Finally, we are a shipper of refined petroleum products on a common carrier pipeline and, from time-to-time, we buy and sell petroleum products to maintain our active shipper status on this pipeline.

Biodiesel is a renewable energy consisting of mono-alkyl esters of fatty acids. The mono-alkyl esters are typically produced from vegetable oil, fat, or grease feedstocks. Biodiesel is used primarily as a blend with petrodiesel (usually 2% (B2) to 20% (B20) by volume). A major advantage of biodiesel is that it can be used in most existing diesel engines and fuel injection equipment in blends up to 20% with no material impact to engine performance. Biodiesel has about 93% of the energy content of petrodiesel on a per gallon basis, and a cetane number between 50 and 60. Biodiesel’s chemical composition translates to better engine performance and lubrication; however, its lower energy content may result in a slight decrease in fuel economy. As an additional benefit, biodiesel is the only alternative fuel to meet all testing requirements of the Clean Air Act and, in 1998, Congress approved the use of biodiesel as an Energy Policy Act compliance strategy (which allows federal, state, and public fleets covered by this Act to meet their alternative fuel vehicle purchase requirements simply by buying biodiesel and burning it in new or existing diesel vehicles in at least a 20% blend). Finally, biodiesel also benefits from favorable properties compared to petrodiesel (e.g., negligible sulfur content and lower particulate matter and greenhouse gas emissions). See Status and Issues for Biodiesel in the United States, National Renewable Energy Laboratory, Robert L. McCormick, Teresa Alleman, Aaron Williams, Yoshio Coy, Andrew Hudgins, and Wendy Dafoe, October 2009 and Pew Center on Global Climate Change, http://www.pewclimate.org/technology/factsheet/biodiesel.

Biodiesel commercialization was achieved at our Batesville plant in October 2005. Technical and operational competency developed as a supplier of specialty chemicals enabled the development of a flexible manufacturing process which can utilize the broadest possible range of feedstock oils, including soy oil, cottonseed oil, palm oil, pork lard, poultry fat, and beef tallow. The Batesville plant produces B100. B20 is currently used in the facility’s diesel fleet and is available for retail sale at the site. In the second quarter of 2009, we began offering B100, biodiesel blended with petrodiesel (B2, B5, B10, and B20 grades), and petrodiesel at our leased storage facility in Little Rock, Arkansas. In addition, we deliver blended product to a small group of customers within our region.

Biodiesel Production

Biodiesel can be made from renewable sources such as: (i) crude and refined virgin vegetable oils; (ii) crude and refined animal fats; and (iii) used cooking oils and trap grease. The choice of feedstock is determined primarily by the price and availability of each feedstock variety, yield loss of lower quality feedstock, and the capabilities of the producer’s biodiesel production facility. In the United States, the majority of biodiesel historically has been made from domestically produced soybean oil. See Pew Center on Global Climate Change, http://www.pewclimate.org/technology/factsheet/biodiesel. However, this reliance on soybean oil has constrained biodiesel production in the United States due to its higher cost and competition with food demands. As such, the biodiesel feedstock market in the United States is in a transition from this increasingly expensive first-generation soy feedstock to alternative second-generation lower-cost, non-food feedstocks such as used vegetable oil, tallow, and algae. See http://www.emerging-markets.com/biodiesel/default.asp.

In 2009, we completed a project to increase our production capacity to 59 million gallons of biodiesel per year through the addition of a new continuous processing line. We initiated commercial production from this new line in May 2009. By the end of the second quarter of 2009, daily production volumes from the new processing line were demonstrated at approximately 80% of nameplate capacity. This production line was designed to produce biodiesel from feedstock with low fatty acids. We believe we successfully demonstrated our ability to keep this continuous processing line at or near capacity for sustained periods of time as well as our ability to procure and logistically handle large quantities of feedstock with low fatty acids. However, with the expiration of the $1.00 federal blender’s credit at the end of 2009 (see the discussion below), we determined that feedstocks with low fatty acids were too costly to consistently produce biodiesel with positive margins. Accordingly, we redesigned our continuous line to produce biodiesel from feedstock with high fatty acids. We are still in the process of debugging this redesigned line.

Legislative Incentives

Historically, the acceptance of biodiesel in the United States has been driven to a great degree by legislative initiatives. For example, agencies of the United States government, including the Department of Energy, the

4

Environmental Protection Agency, the Internal Revenue Service, and the Department of Agriculture, as well as many states, offer biodiesel incentives or have mandates for the use of biodiesel, or both. There are other governmental incentives that do not directly reduce the net cost of producing or blending biodiesel but that drive the demand for biodiesel. For example, tax credits are available under the Internal Revenue Code for investment in qualifying refueling property, the Environmental Protection Agency will pay 50-100% of the cost for schools to upgrade and/or replace their buses, and programs administered by the Department of Energy indirectly require government fleet operators to purchase substantial amounts of biodiesel. The principal federal incentives that we believe have the greatest positive effect on our business are discussed below.

The Energy Policy Act of 1992 requires government fleet operators to use a certain percentage of alternatively fueled vehicles. The Act established a goal of replacing 10% of motor fuels with non-petroleum alternatives by 2000, increasing to 30% by the year 2010. Currently, 75% of all new light-duty federal vehicles purchased are required to have alternative fuel capability to set an example for the private automotive and fuel industries.

Under the Energy Conservation Reauthorization Act of 1998, vehicle fleets that are required to purchase alternatively fueled vehicles can generate credit toward this requirement by purchasing and using biodiesel in a conventional vehicle. Since there are few cost-effective options for purchasing heavy-duty alternatively fueled vehicles, federal and state fleet providers can meet up to 50% of their heavy-duty alternatively fueled vehicle purchase requirements with biodiesel. The biodiesel fuel credit allows fleets to purchase and use 450 gallons of biodiesel in vehicles in excess of 8,500 pounds gross vehicle weight instead of alternatively fueled vehicles. Fleets must purchase and use the equivalent of 450 gallons of pure biodiesel in a minimum of a 20% blend to earn one credit. Covered fleets earn one vehicle credit for every light-duty alternatively fueled vehicle they acquire annually beyond their base vehicle acquisition requirements. Credits can be banked or sold.

Congress passed a biodiesel tax incentive, structured as a federal excise tax credit, as part of the American Jobs Creation Act of 2004. The credit amounted to one cent for each percentage point of vegetable oil or animal fat biodiesel that was blended with petrodiesel (and one-half cent for each percentage point of recycled oils and other non-agricultural biodiesel). For example, blenders that blended B20 made from soy, canola, and other vegetable oils and animal fats received a 20¢ per gallon excise tax credit, while biodiesel made from recycled restaurant oils (yellow grease) received half of this credit. The tax incentive generally was taken by petroleum distributors and was substantially passed on to the consumer. It was designed to lower the cost of biodiesel to consumers in both taxable and tax-exempt markets. The tax credit was scheduled to expire at the end of 2006, but was extended in the Energy Policy Act of 2005 to the end of 2008 and then to December 31, 2009 through the Emergency Economic Stabilization Act of 2008.

Congress enacted the Energy Policy Act of 2005 in August 2005 and included a number of provisions intended to spur the production and use of biodiesel. In particular, the Act’s provisions include biodiesel as part of the minimum volume of renewable fuels (the renewable fuels standard or “RFS”), in the nationwide gasoline and diesel pool, with the Environmental Protection Agency being directed to determine the share to be allocated to biodiesel and other details through its rulemaking process. More specifically, the RFS requires a specific amount of renewable fuel to be used each year in the nationwide gasoline and diesel pool. The volume increases each year, from 4 billion gallons per year in 2006 to 7.5 billion gallons per year in 2012. The Act requires the Environmental Protection Agency, beginning in 2006, to publish by November 30th of each year, “renewable fuel obligations” that will be applicable to refiners, blenders, and importers in the contiguous 48 states. The renewable fuel obligations are required to be expressed in terms of a volume percentage of gasoline sold or introduced into commerce and consist of a single applicable percentage that will apply to all categories of refiners, blenders, and importers. The renewable fuel obligations are to be based on estimates that the Energy Information Association provides to the Environmental Protection Agency on the volumes of gasoline it expects will be sold or introduced into commerce. The Environmental Protection Agency released the final rules to implement the RFS on April 10, 2007. Under those rules, the RFS compliance period did not begin until September 1, 2007. The applicable volume of renewable fuel under this program was 4.7 billion gallons for 2007, 5.4 billion gallons for 2008, 11.1 billion gallons for 2009, and 12.95 billion gallon for 2010, increasing to 36 billion gallons per year by 2022. Beginning in 2010, a certain percentage of renewable fuel blended into transportation fuels must be cellulosic biofuel, biomass-based diesel (biodiesel), and/or advanced biofuel.

The Energy Policy Act of 2005 also created a new tax credit for small agri-biodiesel producers with production capacity not in excess of 60 million gallons, of 10¢ per gallon for the first 15 million gallons of agri-biodiesel sold.

5

Our 2010 biodiesel production capacity did not exceed 60 million gallons and thus we qualified for this credit. We expect that our 2011 biodiesel production capacity will not exceed 60 million gallons and that we will qualify for this credit in 2011.

On December 19, 2007, the Energy Independence and Security Act of 2007 was enacted which, among other things, expanded the RFS (also referred to as “RFS2”). In contrast to the Energy Policy Act of 2005, this bill provided an RFS carve-out applicable specifically to biodiesel; the RFS requirement of the Energy Policy Act of 2005 had mostly been filled by ethanol. Beginning January 1, 2009, the 2007 Act mandates that 500 million gallons of biomass-based diesel (biodiesel) be used per year. On November 21, 2008, the USEPA announced that the 2009 RFS2 for refiners, importers, and blenders was 10.21%. The 2008 RFS was 7.76%. The 2009 RFS2 represents 11.1 billion gallons of renewable fuel and includes 500 million gallons of biodiesel and renewable diesel. The mandate under the 2007 Act increases each year and reaches 1 billion gallons per year in 2012. Beyond 2012, the mandate is to be determined by the Environmental Protection Agency administrator in coordination with the secretaries of energy and agriculture, but with a minimum of that mandated in 2012, thus a 1 billion gallons per year floor. On November 23, 2010, the Environmental Protection Agency finalized the 2011 RFS2 biodiesel volume at 800 million gallons.

The Emergency Economic Stabilization Act of 2008 extended the biodiesel tax credit through December 31, 2009 and qualified all biodiesel for a $1.00 per gallon tax credit, including biodiesel made from non-virgin feedstocks such as yellow grease. As noted above, prior legislation limited the tax credit for biodiesel manufactured from non-virgin feedstocks to $0.50 per gallon.

On February 17, 2009, the American Recovery and Reinvestment Act of 2009 was enacted which, among other things, appropriated monies to support various investments and offered incentives (such as tax credits, grant programs, and other funding) for projects related to alternative fuels, energy independence, and renewable energy technologies. For example, the Department of Energy was provided with $800 million for projects related to biomass, and $2 billion was made available for grants for manufacturing advanced battery systems and electric vehicle components to support domestic manufacturing of advanced lithium ion batteries and hybrid electric systems.

The $1.00 per gallon blender tax credit expired on December 31, 2009. However, in December 2010, the credit was reinstated retroactive to January 1, 2010 by the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010. The tax credit is now scheduled to expire on December 31, 2011. If this tax credit is not renewed, its expiration could have a material adverse effect on our biodiesel business. See “Risk Factors” beginning at page 16 below.

The federal government offers other programs, including those summarized in the table below.

|

Federal Agency that Administers/

Oversees

|

Type of Incentive

|

Who Receives Incentive

|

Commonly Known As

|

Summary

|

|

Internal Revenue Service

|

income tax credit

|

infrastructure providers

|

Alternative Fuel Infrastructure Credit

|

Provides a tax credit in an amount equal to 50% of the cost of any qualified non-residential alternatively fueled vehicle refueling property placed into service in the United States up to $50,000 in 2009 and 2010, subject to certain limits, and up to 30% of the cost, not to exceed $30,000, for equipment placed into service in 2011.

|

|

Environmental Protection Agency

|

grant program

|

school districts

|

Clean School Bus Program

|

Reduces operating costs and children’s exposure to harmful diesel exhaust by limiting bus idling, implementing pollution reduction technology, improving route logistics and switching to biodiesel. The Energy Bill of 2005

|

6

|

Federal Agency that Administers/

Oversees

|

Type of Incentive

|

Who Receives Incentive

|

Commonly Known As

|

Summary

|

|

utilizes this program to grant up to a 50% cost share (depending on the age and emissions of the original bus) to replace school buses with buses that operate on alternative fuel or low-sulfur diesel, or up to 100% for retrofit projects.

|

||||

|

grants/funding

|

cities, ports, and public entities

|

National Clean Diesel Campaign

|

Offers grants and funding to reduce pollution from diesel engines and adoption of clean technologies for agricultural and construction equipment and other projects.

|

|

|

grants/funding

|

state, local, and tribal agencies

|

Air Pollution Control Program

|

Assists project costs to implement plans for developing, improving, and maintaining prevention of air pollution and the national ambient air quality standards with emphasis on alternative fuels.

|

|

|

Department of Agriculture

|

grant program

|

agricultural producers and small businesses

|

Renewable Energy Systems and Energy Efficiency Improvements Grant

|

In 2005, the Department of Agriculture’s Office of Rural Development made available $22.8 million in competitive grant funds and guaranteed loans for the purchase of renewable energy systems and energy improvements for agricultural producers and small rural businesses. Eligible projects include biofuels, hydrogen and energy efficiency improvements, as well as solar, geothermal and wind.

|

|

Department of Agriculture/ Department of Energy

|

grant program

|

biobased fuels researchers

|

Biomass Research and Development Act of 2000

|

Funds research, development and demonstration biomass projects with respect to renewable energy resources from the agricultural and agro-forestry sectors. Biomass is defined as organic matter that is available on a renewable or recurring basis.

|

|

Department of Energy

|

grants/funding

|

municipalities and local agencies

|

Clean Cities

|

Supports local initiatives to reduce the use of petroleum in transportation with volunteer coalitions to promote alternative fuels

|

7

|

Federal Agency that Administers/

Oversees

|

Type of Incentive

|

Who Receives Incentive

|

Commonly Known As

|

Summary

|

|

Department of Transportation

|

grants/funding

|

states, municipalities, state DOTs, and transit agencies

|

Clean Fuels Grant program and Congestion Migration and Air Quality Improvement Program

|

Assists designated non-attainment areas for ozone and carbon monoxide in maintaining the national ambient air quality standards; promotes low-emission buses, equipment, alternative fuel stations and infrastructure, use of biodiesel, and cost-effective congestion mitigation activities to improve air quality.

|

Many states are following the federal government’s lead and are offering similar programs and incentives to spur biodiesel production and use. For example, Arkansas provides an income tax credit of 5% of the cost of the facilities and equipment used directly in the wholesale or retail distribution of biodiesel where the equipment has not been claimed in a previous tax year. In addition, Arkansas offers a tax refund of $0.50 for each gallon of biodiesel used by a supplier to produce a biodiesel/petrodiesel mixture of not more than 2% biodiesel. In April 2007, Arkansas passed legislation that provides for a $0.20 per gallon biodiesel producer credit and up to $50,000 in grants per site for biodiesel producers and distributors to install distribution infrastructure. The $0.20 per gallon Arkansas producer credit is capped at 10 million gallons of production, or $2 million, per defined time intervals. The first interval was January 1, 2007 through June 30, 2008. We submitted an application for the $0.20 per gallon biodiesel producer credit for production during this 18-month interval and received the $2 million credit in March 2008. The next funding interval was July 1, 2008 to June 30, 2009. We applied for funding under this program for biodiesel produced during this interval and received the $2 million credit in July 2009. No funding was available for this program in 2010, nor do we expect funding to be available in 2011. However, we intend to apply for the credit in future years when and as such credit is available.

Our review of state statutes reveals that virtually all states provide either user or producer incentives for biodiesel, several states provide both types of incentives, and approximately 37 states provide incentives to biodiesel producers to build facilities in their states, typically offering tax credits, grants, and other financial incentives. As we expand our business outside of Arkansas, we will evaluate these additional state incentives to determine if we qualify for them.

We will continue to identify and pursue other incentives to support our business. However, no assurances can be given that we will qualify for any such incentives or, if we do qualify, what the amount of such incentives will be.

ASTM D6751 Standard

For quality specification purposes, and to qualify for the blender’s tax credit, biodiesel must meet the requirements of ASTM D6751. This specification ensures that blends up to B20 are compatible with diesel engines and associated fuel system hardware. See Status and Issues for Biodiesel in the United States, National Renewable Energy Laboratory, Robert L. McCormick, Teresa Alleman, Aaron Williams, Yoshio Coy, Andrew Hudgins, and Wendy Dafoe, October 2009. All biodiesel manufactured at our Batesville plant is tested in on-site quality control laboratories and confirmed to meet the ASTM D6751 standard.

Renewable Identification Numbers

As noted above, the RFS mandates levels of various types of renewable fuels that are to be blended with U.S. gasoline and diesel fuel by U.S. refiners, blenders, and importers. Renewable Identification Numbers (“RINs”) are the mechanism for insuring that the prescribed levels of blending are reached. As ethanol and biodiesel is produced or imported, the producer or importer has the responsibility to assign a series of numbers (i.e., a RIN) to their product. Assignment is made according to guidelines established by the Environmental Protection Agency. Once the RIN is assigned to the fuel, it essentially becomes the renewable fuel credit. When biofuels change ownership to the refiners, importers, and blenders of the fuel, the RINs are also transferred. The RINs ultimately are separated from the renewable fuel generally at the time the renewable fuel is blended. The refiners, importers, and blenders

8

generally use the RINs to establish that they have blended their applicable percentage of renewable fuels during the applicable reporting period. However, once the RINs are separated from the underlying biofuels (e.g., by blending the underlying biodiesel with petrodiesel), they can also be sold separate and apart from the underlying biofuel.

We generally create RINs when we produce biodiesel. Those RINs may be separated from the biodiesel at the time, if any, that we blend the biodiesel with petrodiesel. If we sell the biodiesel prior to blending, the RIN goes with the biodiesel. If we blend the biodiesel prior to selling it, we then sell the RINs with our blended biodiesel or we sell them separate from the biodiesel, dependent upon whether there is a market for the separated RINs and the prices at which they can be sold. However, no assurances can be given that a separate market for RINs will be sustained.

Future Strategy

Prior to 2009, the growth of the biodiesel industry had been significant. However, as the price of petrodiesel dropped in 2009, the relative cost of biodiesel increased due to rising prices of feedstocks (among other things), and the $1.00 producer credit terminated at the end of 2009 (with uncertainty about its reinstatement), the production of biodiesel in the United States decreased in 2009 and 2010. This trend may continue given challenging economic conditions and the leveling off of government requirements after 2012, as well as the uncertainty of the federal blender’s credit. See Pew Center on Global Climate Change, http://www.pewclimate.org/technology/factsheet/biodiesel. Researchers believe that the U.S. market will transition to larger plants, alternative feedstocks, and second generation technologies, resulting in a consolidation among smaller, first-generation producers accompanied by a series of mergers and acquisitions in the field. However, we believe that producers who are proactive in responding to these changes can benefit in this emerging market. These responses include: new and improved technologies; alternative feedstocks with higher yields; production scalability and flexibility options; supply chain, distribution, and co-location strategies; the sale of RINs separate from the underlying biodiesel; and innovative risk management strategies. See http://www.emerging-markets.com/biodiesel/default.asp.

Our future strategy for our biofuels segment is geared towards these responses. For example, in 2009, we commercialized two biobased solvents: FUTURESOL FAME and FUTURESOL Glysol, which we intend to market. In addition, we intend to expand our biodiesel capacity utilizing available facilities as market conditions dictate. All future capacity will be operated primarily in continuous processing mode to realize operating economies and optimum throughput. Existing and future processes will accommodate a wide range of feedstock oils, allowing optimization relative to supply and pricing. However, our continued production of biodiesel may be severely limited, or eliminated entirely, in the event Congress does not renew the $1.00 per gallon blenders tax credit past December 31, 2011. See “Risk Factors” beginning at page 16.

Customers and Markets

We currently market our biodiesel products by truck and rail directly to customers in the United States. Through the utilization of liquid bulk storage facilities and barge loading capabilities, we are positioned to market biodiesel throughout the United States for transportation and home heating fuel usage. For the twelve months ended December 31, 2010, 12 of our customers represented 80% of biofuels revenues (15% of total revenues) with the remaining 20% of biofuels revenues (5% of total revenues) spread across a large number of customers. Although the regional market is still being developed, we estimate that the regional direct market available to us at maturity will be at least 30 million gallons per year.

Competition

As of December 2010, there was a reported 2.73 billion gallons per year of biodiesel production capacity in the United States, although only approximately 545 million gallons of biodiesel were estimated to have been produced in 2009 (http://www.biodiesel.org.buyingbiodiesel/plants), and 280 million gallons of biodiesel were estimated to have been produced in 2010 (http://www.thebioenergysite.com/news/7153/international-bioenergy-days-2010-biodiesel-gets-burned). We compete with other producers of biodiesel, both locally, regionally, and nationally. There are four biodiesel plants in the state of Arkansas, but only our plant is currently operating. There are several operating facilities in surrounding states and announced biodiesel production facilities in surrounding states. We estimate that regional competitive producers had approximately 95 million gallons of capacity at the end of 2010. Our production and the national production of biodiesel were significantly reduced in 2010 for a number of reasons,

9

including uncertainty about the loss of the dollar tax credit, which has now been retroactively reinstated to January 1, 2010 (but which expires December 31, 2011). We anticipate that biodiesel production at our plant and nationally will likely increase in 2011 over 2010 with the renewal of the tax credit and the RFS2 mandate, although no assurances can be given that there will be such an increase.

In addition to biodiesel producers, we compete with new technologies that are being developed as alternatives to biodiesel. For example, biotech company LS9 Inc. announced that it is producing renewable diesel fuel from E. coli excrement. See http://www.biofuelsdigest.com/blog2/2010/01/28/jbei-ls9-reengineer-e-coli-to-produce-renewable-diesel-directly-from-biomass-cbp-arrives-in-the-drop-in-sphere/. UOP, a major supplier to the petrochemical refining industry, has also reported the development of technology for the conversion of natural oils and wastes to green diesel. See http://www.uop.com/renewables/10010.html. We cannot give any assurances that renewable diesel fuel, green diesel, or some other product produced by these competing technologies will not supplant biodiesel as an alternative to conventional petrodiesel.

Supply and Distribution

As a result of our feedstock-flexible process, we are able to source feedstock from a broad supplier base which includes pork, chicken, and beef rendering facilities from both national and regional suppliers. Soybean oil has been sourced from several national and regional producers. Cottonseed oil has been sourced from a regional cooperative. All feedstocks are currently supplied by either rail or truck. We believe that an adequate supply of feedstocks can be sourced to support anticipated production.

We intend that biodiesel and other biofuels will be sold from the plant site as well as shipped to liquid bulk storage facilities for further distribution. Sales from the plant site are made by railcar and tank truck. Biodiesel is being delivered to liquid bulk storage facilities by company-owned tank trucks and common carriers for distribution there and for further transportation by barge or tank truck.

Cyclicality and Seasonality

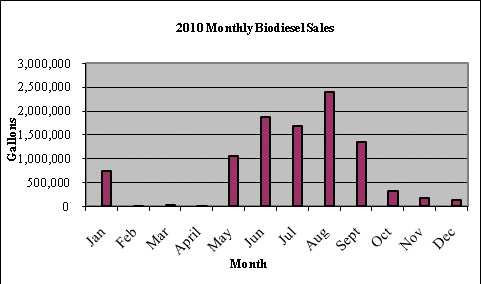

The following charts depict our monthly sales of biodiesel (in gallons) for 2009 and 2010.

|

|

Our sales of biodiesel have been limited in winter months. Non-seasonal business (primarily on-road transportation) has not been sufficient regionally to generate biodiesel sales at blends greater than B5 in winter months at the end of farming activity. Also, cold weather usage and storage properties which reduce biodiesel demand during winter months require resolution in order to fully exploit year-round demand opportunities.

Chemicals Business Segment

Overview of the Segment

Our chemicals segment manufactures diversified chemical products that are sold externally to third party customers. This segment comprises two components: “custom manufacturing” (manufacturing chemicals for specific customers); and “performance chemicals” (multi-customer specialty chemicals). The chemicals segment had

10

revenue of $178,280,000, $143,759,000, and $155,553,000 for the years ended December 31, 2010, 2009, and 2008, respectively.

Chemical Products

Custom manufacturing involves producing unique products for individual customers, generally under long-term contracts. Many of these products are produced under confidentiality agreements in order to protect intellectual property. This is a service-based business where customers value technical capabilities, responsiveness, and process improvement to continually improve costs and reliability. Our plant’s custom manufacturing product portfolio includes two large products or product families which are generally produced throughout the year: (i) a bleach activator for a major detergent and consumer products manufacturer; and (ii) a proprietary herbicide (and intermediates) for a major life sciences company. The portfolio also contains a number of smaller products which are produced intermittently in a “batch campaign” mode, for diverse customers and end markets.

Performance chemicals comprise multi-customer products which are sold based upon specification and/or performance in the end-use application. This portfolio includes a family of polymer (nylon) modifiers and several small-volume specialty chemicals for diverse applications. In addition, we have recently been successful in growing our performance chemical business through new product development. New products include a family of acetal based solvents, including diethoxymethane, dimethoxymethane, dibutoxymethane, and glycerol formal, and phenol sulfonic acid, which build on our sulfonations technology.

Future Strategy

To build on and maintain our reputation as a technology-driven competitive chemical producer, we believe that we must continuously focus on cost control, operational efficiency, and capacity utilization to maximize earnings. The ability to utilize large scale batch and continuous production processes and a continuous focus on process improvements allow us to compete effectively in the custom manufacturing market and to remain cost competitive with, and for some products cost-advantaged over, our competitors. We intend to improve margins in this area of our business by careful management of product mix with regard to size of opportunity, timing to market, capital efficiency, and matching of opportunities to assets and capabilities.

We expect to derive significant growth in performance chemicals as a result of the application of new technologies to the conversion of biomass and waste carbon sources in order to produce a range of specialty chemical products. If we are successful in developing these products, they would represent a first generation of renewable chemicals that we believe would displace materials currently produced from fossil fuels. However, no assurances can be made that we will successfully develop such products or, if developed, that they will be accepted commercially.

Customers and Markets

Our chemical products are used in a variety of markets and end uses, including detergent, agrochemical, automotive, photographic imaging, coatings, nutrition, and polymer additives. These products are generally non-cyclical; however, the customers are often the “brand owners” and therefore control factors related to demand, such as market development strategy. In many cases, we may be unable to increase or maintain our level of sales revenue for these products.

All sales of the bleach activator are made to The Procter & Gamble Company pursuant to a multi-year supply agreement that was effective April 1, 2008. Sales of the bleach activator totaled $79,537,000, $73,466,000, and $83,995,000 for the years ended December 31, 2010, 2009, and 2008, respectively. Additionally, all sales of a proprietary herbicide and certain other intermediates used in the production of this herbicide are made to Arysta LifeScience North America Corporation pursuant to contracts which continue year-to-year unless terminated by notice given no later than 270 days prior to the end of the current term for the herbicide and not later than 18 months prior to the current term for the intermediates. No assurances can be given that these contracts will not be terminated. Sales of this herbicide and its intermediates totaled $36,509,000, $31,587,000, and $34,156,000 for the years ended December 31, 2010, 2009, and 2008, respectively. These two customers represented approximately 54%, 53%, and 60% of our revenues in 2010, 2009, and 2008, respectively.

11

Competition

Historically, there have been significant barriers to entry for competitors with respect to chemicals primarily due to the fact that the relevant technology and manufacturing capability has been held by a small number of companies. As technology and investment have increasingly moved outside of North America, competition from multi-national chemical manufacturers has intensified, primarily from India and China. We compete with these and other producers primarily based on price, customer service, technology, quality, and reliability. Our major competitors in this segment include large multi-national companies with specialty chemical business units, and smaller independent producers. The multi-national competitors are often disadvantaged by poor responsiveness and customer service, while the small producers often have limited technology and financial resources. We believe that we should be well positioned for growth due to the combination of our scale of operations, technical capabilities, and financial resources.

Supply and Distribution

Specialty chemicals are generally high unit value products sold in packaged, or low-volume bulk form, for which distribution is a relatively minor component of cost. Most products are sold FOB the Batesville site for distribution globally. Similarly, raw materials for these products are comparatively higher-value components that are sourced globally. An exception will be the biofuels co-products, which will be recovered from local processing and purified or further functionalized into other products at the site.

Cyclicality and Seasonality

Our chemical products typically are not cyclical but they are sensitive to global economic conditions. Supply and demand dynamics determine profitability at different stages of cycles and global economic conditions affect the length of each cycle. Despite some sensitivity to global economic conditions, many of the products in the chemical segment provide a stable foundation of earnings.

Backlog

The majority of our revenues are derived under custom manufacturing agreements with specific customers. These customers generally provide us with forecasts of demand on a monthly or quarterly basis. These forecasts are intended to enable us to optimize the efficiency of our production processes and generally are not firm sales orders. As such, we do not monitor or report backlog.

Intellectual Property

We consider our intellectual property portfolio to be a valuable corporate asset which we intend to expand and protect globally through a combination of trade secrets, confidentiality and non-disclosure agreements, patents, and copyrights. As a producer of a broad and diverse portfolio of chemicals, our intellectual property relates to a wide variety of products and processes acquired through the development and manufacture of over 300 specialty chemicals during the history of the site. Our primary strategy regarding our intellectual property portfolio will be to appropriately protect all innovations and know-how in order to provide our business segments with a technology-based competitive advantage wherever possible. In the chemicals business segment, custom manufacturing projects are primarily conducted within the framework of confidentiality agreements with each customer to ensure that intellectual property rights are defined and protected. In the biofuels business segment, innovations and process know-how will be vigorously protected as appropriate. As may be necessary, we will seek to license technology from third parties that complements our strategic business objectives. Neither our business as a whole nor any particular segment is materially dependent upon any one particular patent, copyright, or trade secret. As the laws of many foreign countries do not protect intellectual property to the same extent as the laws of the United States, we can make no assurance that we will be able to adequately protect all of our intellectual property assets.

12

Research and Development

We devote significant resources to our research and development programs which are primarily targeted towards two objectives:

|

|

·

|

innovating, developing, and improving biofuels processes, in particular biodiesel and other biofuels, including value-up technology and applications for co-products; and

|

|

|

·

|

developing and improving processes for custom manufacturing products and performance chemicals.

|

Our research and development capabilities comprise analytical chemistry competencies to assay and characterize raw materials and products, organic chemistry expertise applied across a breadth of reaction chemistries and materials, and process engineering capabilities for batch and continuous processing of both solid and liquid materials. We believe that these core competencies, established in support of the legacy chemical business, are applicable to building a technology-based position in biofuels and associated biobased specialty products.

Research and development expense incurred by us for the years ended December 31, 2010, 2009, and 2008 were $3,494,000, $4,165,000, and $3,951,000, respectively. Substantially all of such research and development expense related to the development of new products, services, and processes or the improvement of existing products, services, and processes.

Environmental Matters

Various aspects of our operations are subject to regulation by state and federal agencies. Biofuel and chemical operations are subject to numerous, stringent, and complex laws and regulations at the federal, state, and local levels governing the discharge of materials into the environment or otherwise relating to environmental protection. These laws and regulations may:

|

|

·

|

require acquisition of permits regarding discharges into the air and discharge of waste waters;

|

|

|

·

|

place restrictions on the handling and disposal of hazardous and other wastes; and

|

|

|

·

|

require capital expenditures to implement pollution control equipment.

|

Compliance with such laws and regulations can be costly and noncompliance can result in substantial civil and even criminal penalties. Some environmental laws impose strict liability for environmental contamination, rendering a person liable for environmental damages and cleanup costs without regard to negligence or fault. Moreover, public interest in the protection of the environment has increased substantially in recent years. Our operations could be adversely affected to the extent laws are enacted or other governmental action is taken that imposes environmental protection requirements that result in increased costs to the biofuels and/or chemical manufacturing industry in general. The following provides a general discussion of some of the significant environmental laws and regulations that impact our activities.

The federal Comprehensive Environmental Response, Compensation and Liability Act (“CERCLA”), and analogous state laws, impose joint and several liability, without regard to fault or the legality of the original act, on certain classes of persons that contributed to the release of a hazardous substance into the environment. These persons include the owner and operator of the site where the release occurred, past owners and operators of the site, and companies that disposed or arranged for the disposal of hazardous substances found at the site. Responsible parties under CERCLA may be liable for the costs of cleaning up hazardous substances that have been released into the environment and for damages to natural resources. Additionally, it is not uncommon for third parties to assert claims for personal injury and property damage allegedly caused by the release of hazardous substances or other pollutants into the environment.

The federal Solid Waste Disposal Act, as amended by the Resource Conservation and Recovery Act (“RCRA”), is the principal federal statute governing the management of wastes, including the treatment, storage, and disposal of hazardous wastes. RCRA imposes stringent operating requirements, and liability for failure to meet such

13

requirements, on a person who is either a generator or transporter of hazardous waste or an owner or operator of a hazardous waste treatment, storage, or disposal facility. Many of the wastes generated in our manufacturing facility are governed by RCRA.

The federal Oil Pollution Act of 1990 (“OPA”) and regulations thereunder impose liability on responsible parties for damages resulting from oil spills into or upon navigable waters, adjoining shorelines, or in the exclusive economic zone of the United States. A responsible party includes the owner or operator of an onshore facility. OPA limits liability for onshore facilities to $350 million. These liability limits may not apply if a spill is caused by a party’s gross negligence or willful misconduct, the spill resulted from violation of a federal safety, construction, or operating regulation, or if a party fails to report a spill or to cooperate fully in a clean-up. Failure to comply with OPA’s requirements may subject a responsible party to civil, criminal, or administrative enforcement actions.

The federal Water Pollution Control Act (“Clean Water Act”) imposes restrictions and controls on the discharge of pollutants into navigable waters. These controls have become more stringent over the years, and it is possible that additional restrictions may be imposed in the future. Permits must be obtained to discharge pollutants into state and federal waters. The Clean Water Act provides for civil, criminal, and administrative penalties for discharges of oil and other pollutants, and imposes liability on parties responsible for those discharges for the costs of cleaning up any environmental damage caused by the release and for natural resource damages resulting from the release. Comparable state statutes impose liability and authorize penalties in the case of an unauthorized discharge of petroleum or its derivatives, or other pollutants, into state waters.

The federal Clean Air Act (“Clean Air Act”), and associated state laws and regulations, restrict the emission of air pollutants from many sources, including facilities involved in manufacturing chemicals and biofuels. New facilities are generally required to obtain permits before operations can commence, and new or existing facilities may be required to incur certain capital expenditures to install air pollution control equipment in connection with obtaining and maintaining operating permits and approvals. Federal and state regulatory agencies can impose administrative, civil, and criminal penalties for non-compliance with permits or other requirements of the Clean Air Act and associated state laws and regulations.

The federal Endangered Species Act, the federal Marine Mammal Protection Act, and similar federal and state wildlife protection laws prohibit or restrict activities that could adversely impact protected plant and animal species or habitats. Manufacturing activities could be prohibited or delayed in areas where such protected species or habitats may be located, or expensive mitigation may be required to accommodate such activities.

Our policy is to operate our plant and facilities in a manner that protects the environment and the health and safety of our employees and the public. We intend to continue to make expenditures for environmental protection and improvements in a timely manner consistent with our policies and with the technology available. In some cases, applicable environmental regulations such as those adopted under the Clean Air Act and RCRA, and related actions of regulatory agencies, determine the timing and amount of environmental costs incurred by us.

We establish reserves for closure/post-closure costs associated with the environmental and other assets we maintain. Environmental assets include waste management units such as incinerators, landfills, storage tanks, and boilers. When these types of assets are constructed or installed, a reserve is established for the future costs anticipated to be associated with the closure of the site based on the expected life of the environmental assets, the applicable regulatory closure requirements, and our environmental policies and practices. These expenses are charged into earnings over the estimated useful life of the assets. Currently, we estimate the useful life of each individual asset up to 35 years.

In addition to our general environmental policies and policies for asset retirement obligations and environmental reserves, we accrue environmental costs when it is probable that we have incurred a liability and the amount can be reasonably estimated. In some instances, the amount cannot be reasonably estimated due to insufficient data, particularly in the nature and timing of the future performance. In these cases, the liability is monitored until such time that sufficient data exists. With respect to a contaminated site, the amount accrued reflects our assumptions about remedial requirements at the site, the nature of the remedy, the outcome of discussions with regulatory agencies and other potentially responsible parties at multi-party sites, and the number and financial viability of other potentially responsible parties. Changes in the estimates on which the accruals are based, unanticipated government

14

enforcement action, or changes in health, safety, environmental, chemical control regulations, and testing requirements could result in higher or lower costs.

Our cash expenditures related to environmental protection and improvement were approximately $9,376,000, $9,923,000, and $11,507,000 for the years ended December 31, 2010, 2009, and 2008, respectively. These amounts pertain primarily to operating costs associated with environmental protection equipment and facilities, but also include expenditures for construction and development. We do not expect future environmental capital expenditures arising from requirements of environmental laws and regulations to materially increase our planned level of annual capital expenditures for environmental control facilities.

We believe that we have obtained in all material respects the necessary environmental permits and licenses to carry on our operations as presently conducted. We have reviewed environmental investigations of the properties owned by us and believe, on the basis of the results of the investigations carried out to date, that there are no material environmental issues which adversely impact us. In addition, under our acquisition agreement with Eastman Chemical Company, Eastman Chemical Company acquired environmental insurance with respect to environmental conditions at the Batesville plant existing as of the closing date and Eastman Chemical Company has agreed, subject to certain limitations, to indemnify FutureFuel Chemical Company with respect to such environmental conditions through October 31, 2011.

Management Team and Workforce

Our executive management team at the Batesville plant consists of four individuals with a combined 100 plus years of experience in the chemicals industry, comprising technical, operational, and business responsibilities. The members of the executive team also have international experience, including assignments in Europe and Asia. The operational and commercial management group at the Batesville site includes six additional degreed professionals with an average experience of over 20 years in the chemical industry.

The Batesville workforce comprises approximately 490 full-time employees (in addition to the ten senior managers), with a total of 75 degreed professionals, including 19 chemists (10 PhDs) and 40 engineers (including 10 licensed professional engineers and 21 chemical engineers). The site is non-unionized. Operations personnel are highly skilled as all site manufacturing and infrastructure is fully automated and computer-controlled. The workforce is substantially self-sufficient in the range of required operational skills and experience due to the lack of locally-available process industry infrastructure. Voluntary attrition at the site has averaged less than 1.6% annually since 2006.

Financial Information about Geographic Areas

Most of our sales are FOB the Batesville plant, although some FOB points are in other states or at foreign ports. While many of our chemicals are utilized to manufacture products that are shipped, further processed, and/or consumed throughout the world, the chemical products, with limited exceptions, generally leave the United States only after ownership has transferred from us to the customer. Rarely are we the exporter of record, never are we the importer of record into foreign countries, and we are not always aware of the exact quantities of our products that are moved into foreign markets by our customers. We do track the addresses of our customers for invoicing purposes and use this address to determine whether a particular sale is within or outside the United States. Our revenues for the last three fiscal years attributable to the United States and foreign countries (based upon the billing addresses of our customers) were as set forth in the following table.

(Dollars in thousands)

|

Period

|

United States

|

All Foreign

Countries

|

Total

|

|||||||||

|

Year ended December 31, 2010

|

$ | 201,496 | $ | 17,687 | $ | 219,183 | ||||||

|

Year ended December 31, 2009

|

$ | 179,505 | $ | 17,206 | $ | 196,711 | ||||||

|

Year ended December 31, 2008

|

$ | 164,963 | $ | 33,367 | $ | 198,330 | ||||||

For the years ended December 31, 2010, 2009, and 2008, revenues from Mexico accounted for 7%, 8%, and 11%, respectively, of total revenues. During 2008, FutureFuel Chemical Company sold significant quantities of biodiesel

15

to companies from Canada, during which time revenues from Canada became a material component of total revenues. Revenues from Canada accounted for 0%, 0%, and 5% of total revenues for each of the years ended December 31, 2010, 2009, and 2008, respectively. Other than Mexico and Canada, revenues from a single foreign country during 2010, 2009, and 2008 did not exceed 1% of our total revenues.

All of our long-lived assets are located in the United States.

Available Information

We file annual, quarterly, and other reports, proxy statements, and other information with the SEC. You may read and copy any materials that we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers such as us that file electronically with the SEC. You may access that site at http://www.sec.gov.

Such documents may also be viewed at our website at http://ir.futurefuelcorporation.com/sec.cfm.

We make available free of charge, through the “Investor Relations - SEC Filings” section of our Internet website (http://ir.futurefuelcorporation.com/sec.cfm), our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports, filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, as soon as reasonably practicable after electronically filing such material with, or furnishing it to, the SEC.

We also make available free of charge, through the “Investor Relations - Corporate Governance” section of our website (http://ir.futurefuelcorporation.com/governance.cfm), the corporate governance guidelines of our board of directors, the charters of each of the committees of our board of directors, and the code of business conduct and ethics for our directors, officers, and employees. Such materials will be made available in print upon the written request of any shareholder to FutureFuel Corp., 8235 Forsyth Blvd., 4th Floor, Clayton, Missouri 63105, Attention: Investor Relations.

An investment in us involves a high degree of risk and may result in the loss of all or part of your investment. You should consider carefully all of the information set out in this document and the risks attaching to an investment in us, including, in particular, the risks described below. The information below does not purport to be an exhaustive list and should be considered in conjunction with the contents of the rest of this document.

Risks Associated With Our Business Activities

The federal excise tax credit for biodiesel will expire on December 31, 2011 and Congress has not enacted legislation to extend this credit. If the credit is not renewed, our cost of producing biodiesel will be increased, which could have an adverse effect on our financial position.

In October 2004, Congress passed a biodiesel tax incentive, structured as a federal excise tax credit, as part of the American Jobs Creation Act of 2004. The credit amounted to one cent for each percentage point of vegetable oil or animal fat biodiesel that was blended with petrodiesel (and one-half cent for each percentage point of recycled oils and other non-agricultural biodiesel, subsequently amended and increased to one cent). For example, blenders that blended B20 made from soy, canola, and other vegetable oils and animal fats received a 20¢ per gallon excise tax credit. The tax incentive generally was taken by petroleum distributors and was passed on to the consumer. It was designed to lower the cost of biodiesel to consumers in both taxable and tax-exempt markets. The tax credit was scheduled to expire at the end of 2006, but was extended in the Energy Policy Act of 2005 to December 31, 2008 and most recently it was extended to December 31, 2011.

Congress has not enacted any legislation to extend this tax credit beyond December 31, 2011 and it expires at that time. If biodiesel feedstock costs do not decrease significantly relative to biodiesel prices, we could realize a

16

negative gross margin on biodiesel. As a result, we could cease producing biodiesel, which could have an adverse effect on our financial condition.

The industries in which we compete are highly competitive.

The biodiesel industry, as well as the chemical business, are highly competitive. There is competition within these industries and also with other industries in supplying the energy, fuel, and chemical needs of industry and individual consumers. We compete with other firms in the sale or purchase of various goods or services in many national and international markets. We compete with large national and multi-national companies that have longer operating histories, greater financial, technical, and other resources, and greater name recognition than we do. In addition, we compete with several smaller companies capable of competing effectively on a regional or local basis, and the number of these smaller companies is increasing. Our competitors may be able to respond more quickly to new or emerging technologies and services and changes in customer requirements. As a result of competition, we may lose market share or be unable to maintain or increase prices for our products and/or services or to acquire additional business opportunities, which could have a material adverse effect on our business, financial condition, results of operations, and cash flows. Although we will employ all methods of competition which are lawful and appropriate for such purposes, no assurances can be made that they will be successful. A key component of our competitive position, particularly given the expected commodity-based nature of many of our products, will be our ability to manage expenses successfully, which requires continuous management focus on reducing unit costs and improving efficiency. No assurances can be given that we will be able to successfully manage such expenses.

Our competitive position in the markets in which we participate is, in part, subject to external factors in addition to those that we can impact. Natural disasters, changes in laws or regulations, war or other outbreak of hostilities, or other political factors in any of the countries or regions in which we operate or do business, or in countries or regions that are key suppliers of strategic raw materials, could negatively impact our competitive position and our ability to maintain market share.

Production of biodiesel requires adequate supplies of cost-effective feedstocks. Our inability to acquire adequate volumes of feedstocks may adversely affect our anticipated results of operation and financial condition.

Reaching the federally mandated one billion gallons of biodiesel use by 2012, if met through soybean-based biodiesel alone, would require about 690 million bushels of soybeans, which is about 22% of the U.S. annual soybean crop. Analysts have cautioned that using more than 35% of the soybean crop for biodiesel would cause significant shocks in food and agricultural markets. To increase consumption beyond 1.5 billion gallons of soy-based biodiesel, the U.S. would need to depend on imports, continue increasing soybean yields, or develop other feedstocks and/or conversion processes. Although waste feedstocks are available for biodiesel production, the quantities of such wastes are limited (wastes generated in the U.S. would yield on an annual basis approximately 390 million gallons of biodiesel (150 million gallons from yellow grease and 240 million gallons from animal fats)). See Pew Center on Global Climate Change, http://www.pewclimate.org/technology/factsheet/biodiesel. There are several sources of additional feedstock that could be developed in the near-term (such as algae), but no assurances can be made that they will be developed or, if developed, that they will be available at a cost-effective price. Accordingly, as annual production of biodiesel in the United States increases, the availability of feedstocks could become scarce and/or prices of feedstocks could increase, either of which could adversely affect our results of operations and financial conditions.

Anti-subsidy and anti-dumping complaints have been filed with the European Commission concerning imports of biodiesel originating in the United States. The existence of such complaints, and an adverse decision by the European Commission, could reduce demand for biodiesel produced in the United States.

Anti-subsidy and anti-dumping complaints have been filed with the European Commission concerning imports of biodiesel originating in the United States. The European Commission initiated an investigation into these complaints on August 12, 2010 to determine whether anti-dumping and countervailing measures imposed by the European Commission on imports of biodiesel originating in the United States had been circumvented. This investigation is currently pending. Although we are not a target of such complaints and do not import biodiesel into the European community, the existence of such complaints, and an adverse decision by the European Commission,

17