Attached files

| file | filename |

|---|---|

| 8-K - 1st United Bancorp, Inc. | i00111_1stunited-8k.htm |

| EX-12.1 - 1st United Bancorp, Inc. | i00111_ex12-1.htm |

| EX-99.1 - 1st United Bancorp, Inc. | i00111_ex99-1.htm |

Follow-On Common Stock Offering

NASDAQ: FUBC

March 2011

Forward-Looking Statements

2

This presentation includes forward-looking statements, including statements about future results. These statements are

subject to uncertainties and risks, including but not limited to

our ability to integrate the business and operations of

companies and banks that we have acquired, and those that we may acquire in the future; the failure to achieve

expected gains, revenue growth, and/or expense savings from future acquisitions; our

need and our ability to incur

additional debt or equity financing; the strength of the United States economy in general and the strength of the local

economies in which we conduct operations; the accuracy of our financial statement estimates and assumptions,

including the estimate of our loan loss provision; the effects of harsh weather conditions, including hurricanes, and

man-made disasters; inflation, interest rate, market, and monetary fluctuations; the effects of our lack of a diversified

loan

portfolio, including the risks of geographic and industry concentrations; the frequency and magnitude of

foreclosure of our loans; legislative and regulatory changes, including the Dodd-Frank Act; our ability to comply with

the extensive laws and regulations

to which we are subject; the willingness of clients to accept third-party products and

services rather than our products and services and vice versa; changes in securities and real estate markets; increased

competition and its effect on pricing; technological

changes; changes in monetary and fiscal policies of the U.S.

Government; the effects of security breaches and computer viruses that may affect our computer systems; changes in

consumer spending and saving habits; growth and profitability of our noninterest

income; changes in accounting

principles, policies, practices or guidelines; anti-takeover provisions under federal and state law as well as our Articles

of Incorporation and our Bylaws; and our ability to manage the risks involved in the foregoing.

These factors, as well as additional factors, can be found in our periodic and other filings with the SEC, which are

available at the SEC’s internet site (http://www.sec.gov). Actual

results may differ materially from projections and

could be affected by a variety of factors, including factors beyond our control. Forward-looking statements in this

presentation speak only as of the date of these materials, and we assume

no obligation to update forward-looking

statements or the reasons why actual results could differ.

Rule 433 Legend

3

This presentation is for informational purposes only and does not constitute an offer to sell securities. The Company

has filed a preliminary prospectus supplement and a registration statement

(including a base prospectus) with the

Securities and Exchange Commission (“SEC”) for the offering to which this communication relates. Before you invest,

you should read the preliminary prospectus supplement and the base prospectus, and other

documents the Company

has filed with the SEC for more complete information about the Company and this offering. You may get these

documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, copies of the preliminary

prospectus

supplement and the base prospectus may also be obtained from the Company or any underwriter

participating in the offering if you request it by calling (866) 699-6332.

Offering Terms

4

Issuer:

1st United Bancorp, Inc.

Trading Symbol:

FUBC (NASDAQ Global Market)

Security Offered:

Common Stock

Offering Size:

Approximately 5 million shares

Over-Allotment Option:

15%

Use of Proceeds:

Funding of our future growth strategy

Book-Running Manager:

Stifel Nicolaus Weisel

Co-Manager:

Raymond James

5

Investment Merits

Largest healthy publicly held community banking franchise in

Southeast Florida

Strong and conservative balance sheet

41% of loan portfolio covered by FDIC loss share protection

Exceptional core deposit base (26% non-interest bearing)

Low cost of deposits (0.86% in 4Q 2010)

Good organic and strategic in-market growth opportunities

Experienced with FDIC-assisted transactions and open bank

acquisitions

Proven Florida management team with extensive experience and

track record of creating shareholder value

Business Overview

6

15th

largest Florida headquartered financial institution by assets

$1.27 billion in assets

$1.06 billion in deposits

26% non-interest bearing deposits

Serving South Florida banking markets since 2003

15 hub banking centers in Florida

12 hub offices in the attractive Miami-Fort Lauderdale-Pompano Beach-Homestead MSA

Business Banking Focus with Strong Asset Quality

A focus on the commercial banking segment

NPAs/Assets of 2.21% versus Florida peer average of 6.26% (excluding TDRs) (1)

Construction and development loans comprise only 3.9% of total loans

Robust capital position:

(1)

Florida peers consist of Florida-chartered commercial banks with assets between $500 million and $2 billion.

(2)

See appendix for non-GAAP reconciliation of tangible common equity / tangible assets.

Regulatory Capital Ratios

2010

2009

Tier 1 Ratio

21.62%

23.23%

Risk Based Capital Ratio

23.71

25.45

Leverage Ratio

11.78

12.54

Tang Common Equity/ Tang Assets

(2)

10.31

12.69

Branch Footprint

7

1st United Branches

Headquarters & Main Office

One North Federal Highway

Boca Raton, FL 33432

MSA: Miami-Fort Lauderdale-Pompano Beach-Homestead, FL

Address

City

Zip

1

One N Federal Hwy

Boca Raton

33432

2

5854 S Flamingo Rd

Cooper City

33330

3

2855 N University Dr

Coral Springs

33065

4

8484 NW 36th St

Doral

33166

5

633 S Federal Hwy

Fort Lauderdale

33301

6

2800 E Oakland Park Blvd

Fort Lauderdale

33306

7

1001 Brickell Bay Dr

Miami

33131

8

3400 Coral Way

Miami

33145

9

15801 Biscayne Blvd

North Miami Beach

33160

10

741 US Hwy 1

North Palm Beach

33408

11

335 S County Rd

Palm Beach

33480

12

307 Evernia St

West Palm Beach

33401

MSA: Palm Bay-Melbourne-Titusville, FL

Address

City

Zip

13

1020 Buttonwood St

Barefoot Bay

32976

MSA: Sebastian-Vero Beach, FL

Address

City

Zip

14

1020 US Hwy 1

Sebastian

32958

15

1717 Indian River Blvd

Vero Beach

32960

Attractive Market Demographics

8

Operates 15 banking offices in Florida, 12 of which are in the demographically

attractive Miami-Fort Lauderdale-Pompano Beach-Homestead MSA

Core markets are expected to exhibit strong growth in the coming years

Source: SNL Financial, the Office of Economic and Demographic Research of the Florida Legislature and the US Census Bureau

* Figures are weighted by deposits in each county shown, except total population which is the summation of each county.

County

Total

Population

2010

Population

Change 2000 -

2010 (%)

Projected

Change 2010 -

2015 (%)

Median HH

Income 2010

HH Income

Change 2000 -

2010 (%)

Projected HH

Income

Change 2010 -

2015 (%)

Miami-Dade, FL

2,463,726

9.34

2.34

46,323

$

28.69

14.67

Palm Beach, FL

1,294,546

14.44

1.88

58,922

30.76

14.44

Broward, FL

1,754,788

8.12

(0.36)

54,548

30.21

14.00

Indian River, FL

143,385

26.95

9.74

50,479

27.37

11.32

Brevard, FL

558,359

17.25

3.34

51,144

27.53

12.08

Weighted Average Franchise *

6,214,804

11.41

2.26

50,658

$

29.28

14.32

Florida

18,917,612

18.37

4.25

49,910

$

28.49

12.27

National

311,212,863

10.59

3.85

54,442

$

29.12

12.39

Evolution of the Company

9

Current Management

team raised $10 million

in capital and formed

1st

United in order to buy

Advantage Bankshares,

a troubled institution

with approximately $49

million in assets and a

branch in North Palm

Beach.

Acquired First Western

Bank with $31 million in

assets and one branch

located in Cooper City

(western Broward

County). Served

as a

strategic entry point into

Broward County with an

enviable deposit mix

comprised of 50% DDA.

Announced the merger

with Equitable Financial

Group, which had

approximately $180

million in assets and 5

branches in Broward

and Miami-Dade

Counties. Filled

out

base franchise in

Broward and provided

an entry point into

Miami-Dade.

Acquired the banking

center network (6

branches, 3 retained),

substantially all the

deposits ($88 million),

and much of the loan

portfolio ($38 million)

of Citrus Bank,

N.A. in

a P&A transaction.

Sold $6.6 million of

preferred stock in a

private offering. Also

raised $10.4 million

through a Rights

Offering of common

stock.

On March 13, 2009,

issued and sold $10

million of preferred

stock to Treasury as part

of the TARP program.

Raised $21 million of

common equity in

February.

Assets and deposits at

year end of $246.6

million and $186.0

million, respectively.

Raised $26.6 million

of common equity in

January. Assets and

deposits at year end of

$332.2 million and

$240.2 million,

respectively.

On 12/11/09, acquired

Republic Federal

Bank, N.A. through a

FDIC-assisted

transaction ($297

million in assets, $350

million in deposits).

On 12/17/10,

acquired The Bank

of Miami, N.A.

through a FDIC-

assisted transaction

($378 million in

assets, $255

million in

deposits).

Raised $80.5

million through an

initial public

offering of

common stock.

2003

2004

2005

2006

2007

2008

2009

2010

Experienced Management Team

10

Rudy E. Schupp

Chief Executive Officer

37 Years Experience

CEO Since July 2003

President and CEO of 1st

United Bank

Warren S. Orlando

Chairman

37 Years Experience

Chairman Since July

2003

John Marino

President

27 Years Experience

President Since July 2003

COO and CFO of 1st

United Bank

Chief Lending Officer

23Years Experience

EVP/Chief Lending

Officer since 2007; prior

served as SVP, Team

Leader Business Banking

Wade A. Jacobson

Experienced Acquirer and Integrator

11

Transaction History

Source: Company filings.

At Acquisition

Acquisition

Date

($ Millions)

Acquired Bank

Headquarters

Type

Announced

Integrated

Assets

Deposits

First Western Bank

Cooper City, FL

Whole Bank

4/04

7/04

$35.7

$26.7

Equitable Bank

Fort Lauderdale, FL

Whole Bank

2/08

5/08

222.2

136.0

Citrus Bank, N.A.

Vero Beach, FL

Divestiture

8/08

8/08

92.5

87.5

Republic Federal Bank, N.A.

Miami, FL

FDIC

12/09

5/10

296.7

350.0

The Bank of Miami, N.A.

Miami, FL

FDIC

12/10

4/11

378.3

254.5

12

Growth Through FDIC-Assisted Transactions

On December 11, 2009, Republic

Federal Bank, National Association,

Miami, Florida, was closed by the OCC,

which appointed the FDIC as receiver.

1st United’s winning bid was comprised

of an

asset discount of ($37.7mm). All

of the deposits of Republic Federal

Bank, N.A. were assumed at a premium

of 1.2%.

The FDIC will reimburse FUBC for

80% of charge-offs up to $36

million and 95% thereafter on loans

and other real estate acquired.

Transaction Overview

Key Transaction Metrics

Republic Federal Bank, NA Transaction

At Announcement

($000’s)

Net earning loans acquired

184,729

Net investments acquired

33,637

Net deposits acquired

349,647

Excess of assets acquired over liabilities assumed

(137,465)

Cash received from the FDIC

158,000

Total Gain Recorded

20,535

13

Growth Through FDIC-Assisted Transactions

The Bank of Miami Transaction

On December 17, 2010, The Bank of

Miami, National Association, Coral

Gables, Florida, was closed by the OCC,

which appointed the FDIC as receiver.

1st United’s winning bid was comprised

of an

asset discount of ($38mm) and a

0% deposit premium.

The FDIC will reimburse FUBC for

80% of charge-offs on loans and

other real estate acquired.

Transaction Overview

Key Transaction Metrics

At Announcement

($000’s)

Net earning loans acquired

203,185

Net investments acquired

29,060

Net deposits acquired

254,538

Excess of assets acquired over liabilities assumed

50,841

Cash paid to FDIC

39,800

Total gain recorded

11,041

Total branches

None - All

closed effective

4/30/11

Conversion/Integration

4/30/2011

1st United Ranks 15th Among Florida Headquartered Institutions

14

Source: SNL Financial. Top tier regulatory data as of 12/31/10.

* Excludes TDRs.

Florida-Based Institutions Ranked by Assets ($000)

Rank

Institution

Assets

($000)

NPAs/

Assets (%)*

1

EverBank

$12,008,751

2.84%

2

BankUnited

10,884,701

2.13

3

BankAtlantic

4,469,172

7.87

4

Ocean Bankshares, Inc.

3,648,590

11.98

5

Capital City Bank Group, Inc.

2,602,464

4.75

6

Bond Street Holdings, Inc.

2,460,843

1.10

7

CenterState Banks, Inc.

2,063,319

4.19

8

Seacoast Banking Corporation of Florida

2,016,381

4.73

9

USAmeriBancorp Inc.

1,869,422

2.40

10

Lydian Private Bank

1,764,703

4.98

11

U.S. Century Bank

1,681,051

12.88

12

Gibraltar Private Bank & Trust Co.

1,649,657

3.90

13

Great Florida Bank

1,556,082

11.18

14

CNLBancshares, Inc.

1,452,910

5.75

15

1st United Bancorp, Inc.

1,267,751

2.21

16

Villages Bancorporation, Inc.

1,225,465

3.17

17

BAC Florida Bank

1,121,363

3.26

18

Crews Banking Corporation

1,112,684

3.31

19

Florida Capital Group, Inc.

979,768

9.24

20

Tampa Banking Company

971,896

4.17

15

(1) 1st United branch count includes three The Bank of Miami branches that the Company has announced will be closed.

Source: SNL Financial. Deposit data as of 6/30/10.

Significant Market Share Opportunity

Miami-Fort Lauderdale-Pompano Beach-Homestead, FL

Rank

Institution

Branches

Deposits

($000)

Market

Share

1

Wells Fargo & Co. (CA)

211

$27,355,250

17.44%

2

Bank of America Corp. (NC)

205

23,077,582

14.71

3

SunTrust Banks Inc. (GA)

104

11,244,059

7.17

4

Citigroup Inc. (NY)

51

10,099,406

6.44

5

JPMorgan Chase & Co. (NY)

131

7,633,564

4.87

6

BankUnited Inc. (FL)

56

5,713,880

3.64

7

Regions Financial Corp. (AL)

81

4,795,124

3.06

8

HSBC

17

4,468,988

2.85

9

Mercantil Servicios

16

4,156,338

2.65

10

BB&T Corp. (NC)

64

3,904,899

2.49

24

1st United Bancorp Inc. (FL)

(1)

15

1,176,984

0.75

Total For Institutions In Market

1,619

$156,882,263

Florida

Rank

Institution

Branches

Deposits

($000)

Market

Share

1

Bank of America Corp. (NC)

650

$74,790,144

18.56%

2

Wells Fargo & Co. (CA)

677

66,147,778

16.41

3

SunTrust Banks Inc. (GA)

553

41,542,894

10.31

4

Regions Financial Corp. (AL)

399

19,153,073

4.75

5

BB&T Corp. (NC)

273

14,690,037

3.65

6

JPMorgan Chase & Co. (NY)

254

10,488,619

2.60

7

Citigroup Inc. (NY)

52

10,108,589

2.51

8

EverBank Financial (FL)

15

9,040,029

2.24

9

Fifth Third Bancorp (OH)

166

8,080,779

2.01

10

Toronto-Dominion Bank

163

7,602,035

1.89

39

1st United Bancorp Inc. (FL)

(1)

18

1,264,448

0.31

Total For Institutions In Market

5,630

$403,009,539

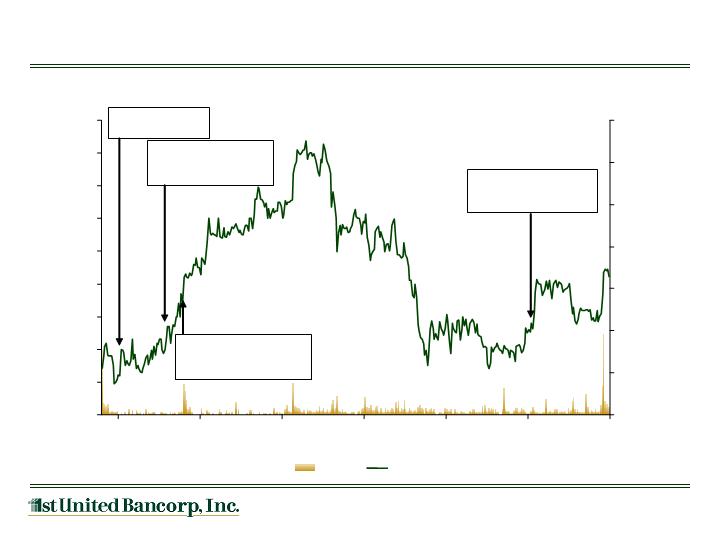

The 18 Months Since Our IPO Have Been Transformational

16

Volume

(000s)

Price

0

500

1,000

1,500

2,000

2,500

3,000

3,500

3/10/2011

12/13/2010

9/17/2010

6/23/2010

3/29/2010

12/30/2009

10/5/2009

$5.00

$5.50

$6.00

$6.50

$7.00

$7.50

$8.00

$8.50

$9.00

$9.50

Volume

Price

Redeemed all TARP

preferred stock and

warrants for $10.5 million

Raised $80.5 million

in equity capital.

Acquired $378 million

assets of the Bank of

Miami, N.A. from the FDIC

Acquired $297 million

assets of Republic Federal

Bank, N.A. from the FDIC

17

In less than 18 months, 1st United has amassed:

$360 million of net new earning assets, $355 million of which enjoy a benign credit profile

as they are under FDIC loss share protection

$30 million of bargain purchase gain

$517 million of new deposits, with an overall non-interest bearing segment of 26.4% with

the addition of only three banking centers

A banking network in Miami-Dade County, Florida’s largest banking market, and assembled

an enviable International deposit division

Significant risk defenses with an expansive Credit and Risk Management division, a stout

BSA division with a newly formed International division and a full loss share management

department

Elevated earning engines through this dramatic increase in earning assets

Significant franchise value

Made possible by the Fall 2009 IPO, which raised $80.5 million

1st United has growth and franchise development momentum

shared by just a few

institutions in the State of Florida

Capital is necessary to sustain this momentum

Why Are We Considering Raising Capital?

18

Opportunity: Troubled Florida Institutions are in Abundance

(1) Excludes merger targets.

Source: SNL Financial. Regulatory financial data as of 12/31/10. FDIC enforcement actions are for this cycle as of 3/4/11.

Asset Stratification of FL Institutions with Texas Ratios > 100%

Total Assets: $17.4B

Among Florida Institutions with Assets < $2B

(1)

:

Statewide

Texas Ratios

> 100%

NPAs/ Assets

> 7.0%

Tier 1

Leverage

Ratio < 6.0%

FDIC

Enforcement

Actions

52

92

34

47

8

17

11

6

10

0

2

4

6

8

10

12

14

16

18

< $100MM

$100 - $200MM

$200 - $300MM

$300 - $400MM

> $400MM

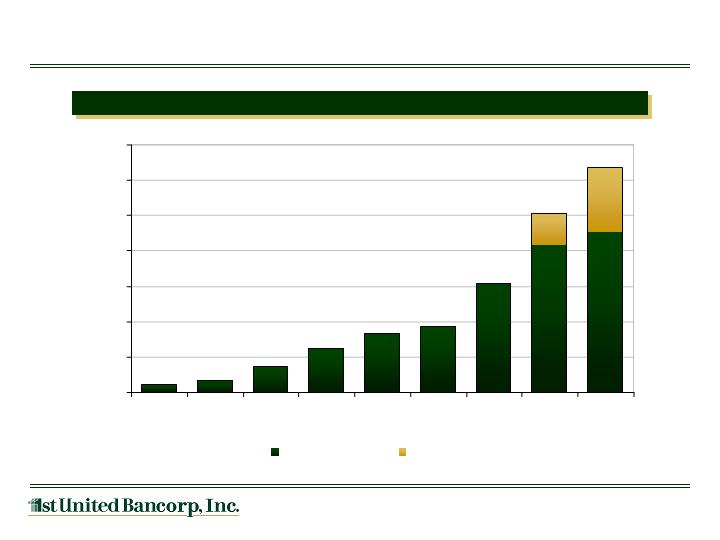

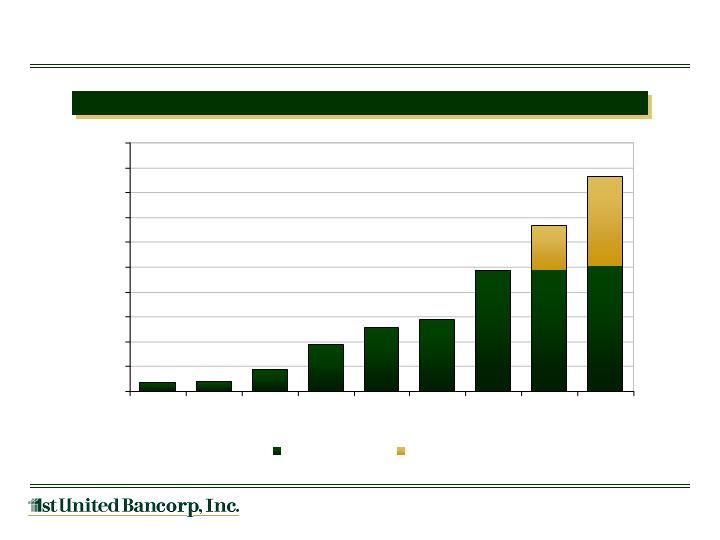

Quality Growth

Total Assets ($000)

Total Deposits ($000)

Equitable

Citrus

First

Western

Republic

Federal

19

Advantage

The Bank

of Miami

$0

$200,000

$400,000

$600,000

$800,000

$1,000,000

$1,200,000

$1,400,000

2004

2005

2006

2007

2008

2009

2010

$0

$100,000

$200,000

$300,000

$400,000

$500,000

$600,000

$700,000

$800,000

$900,000

$1,000,000

$1,100,000

$1,200,000

2004

2005

2006

2007

2008

2009

2010

Interest Bearing

Non-Interest Bearing

Strong Track Record of Growth

Total Assets ($MM)

20

Source: SNL Financial.

$833

$906

$180

$362

$47

$67

$143

$247

$332

$376

$618

$1,013

$1,268

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

2002

2003

2004

2005

2006

2007

2008

2009

2010

Non-covered Assets

Covered Assets

Gross Loans ($MM)

21

Strong Track Record of Growth

Source: SNL Financial. Gross loans include loans held for sale.

$487

$506

$180

$355

$38

$40

$90

$191

$257

$287

$487

$667

$861

$0

$100

$200

$300

$400

$500

$600

$700

$800

$900

$1,000

2002

2003

2004

2005

2006

2007

2008

2009

2010

Non-covered Loans

Covered Loans

Total Deposits ($MM)

22

Strong Track Record of Growth

Source: SNL Financial.

$78

$128

$157

$213

$335

$609

$783

$84

$101

$194

$281

$60

$58

$42

$55

$112

$186

$240

$272

$436

$803

$1,065

$0

$200

$400

$600

$800

$1,000

$1,200

2002

2003

2004

2005

2006

2007

2008

2009

2010

Interest Bearing

Noninterest Bearing

Net Interest Margin (%)

23

Steady Net Interest Margin

Source: SNL Financial, Company disclosure.

3.78%

3.70%

3.71%

3.49%

4.23%

4.12%

3.94%

4.06%

3.0%

3.2%

3.4%

3.6%

3.8%

4.0%

4.2%

4.4%

1Q 2009

2Q 2009

3Q 2009

4Q 2009

1Q 2010

2Q 2010

3Q 2010

4Q 2010

24

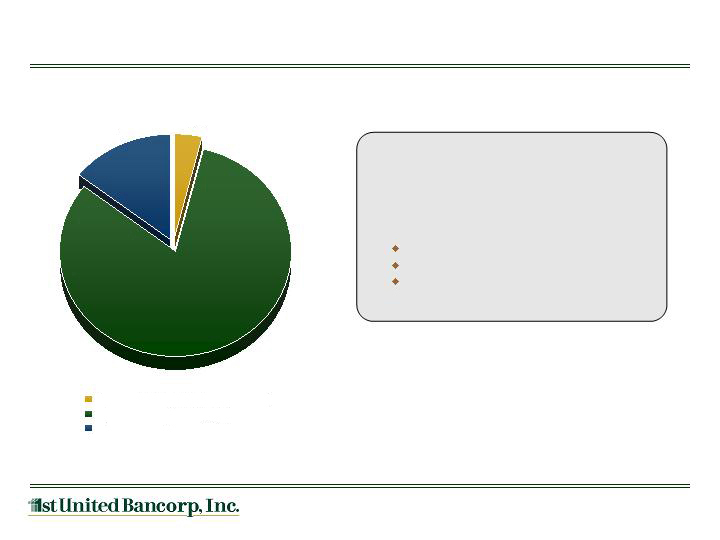

Investment Portfolio (12/31/10)

Investment portfolio managed to:

1. Minimize interest rate risk

2. Maintain sufficient liquidity

3. Maximize return

As of December 31, 2010:

No municipal bond exposure

Primarily longer-dated MBS securities

Substantially all of the portfolio is backed

by the U.S. Treasury or federal agencies

(1) Substantially all mortgage-backed securities in the portfolio are FNMA and FHLMC backed.

Source: SNL Financial. Data as of December 31, 2010.

3.9%

81.7%

14.4%

U.S. Treasury & Federal Agencies

Mortgage-Backed Securities (1)

Agency CMO’s

25

41% of Total Loans Covered by Loss Share

Agreements

Substantially all loans originated in primary

market area

Well-Diversified Loan Portfolio (12/31/10)

Loans by Category ($ in thousands)

Source: Company filings. Data as of December 31, 2010.

Residential

26.4%

Commercial

19.4%

Commercial RE

48.7%

Construction &

Development

3.9%

Consumer &

Other

1.6%

Loan Type

Total

Loans

Total

Percent of

Portfolio

Residential

859

227,500

$

26.4%

Commercial

631

166,686

19.4

Commercial RE

447

419,602

48.7

Construction & Development

45

33,444

3.9

Consumer & Other

200

13,645

1.6

Total (12/31/10)

2,182

860,877

$

100.0%

26

Comments

45% of total CRE portfolio is owner-occupied.

0% of the CRE portfolio is construction

Diversified Commercial Real Estate Composition

December 31, 2010

24%

16%

15%

12%

5%

5%

7%

9%

1%

4%

2%

Office

Warehouse/Industrial

Other

Retail

Gas Stations

Land

Mixed Use

Multi-Family

Restaurant

Hotel/Motel

Church

27

Funding Mix 12/31/10

Deposit Mix 12/31/10

92% Core Deposits

(1) At December 31, 2010, time deposits of approximately $70 million were

wholesale

deposits acquired from The Bank of Miami which we anticipate

not renewing

Funding Composition

Well-Positioned for Higher Short-Term Rates

Interest Bearing

Deposits

72%

Fed Funds &

Repos

1%

Other

1%

Noninterest

Bearing Deposits

26%

Demand Deposits

26%

NOW Accounts

11%

Time Deposits (1)

36%

Savings Deposits

4%

Money Market

Deposits

23%

28

Allowance for Loan Losses / Loans (%)

Net Charge-Offs / Avg. Loans (%)

NPAs/Assets at December 31, 2010 of 2.21%

Strong Credit Quality

1.51%

1.99%

1.19%

0.72%

0.84%

0.99%

1.48%

2.56%

2.73%

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

2004

2005

2006

2007

2008

2009

2010

Reserves/Loans

Reserves/Non-Covered Loans

2.01

1.14

0.21

0.08

-0.03

-0.10

-0.27

-0.50

0.00

0.50

1.00

1.50

2.00

2.50

2004

2005

2006

2007

2008

2009

2010

29

Classified and Nonperforming Assets

(dollars in thousands)

(1) All non-performing loans are included in the substandard classification.

12/31/09

3/31/10

6/30/10

9/30/10

12/31/10

Uncovered Non-Performing Assets

$15,699

$20,103

$28,762

$24,385

$20,819

Substandard Loans

(1)

57,241

66,507

65,385

56,947

53,944

Special Mention Loans

24,371

14,300

17,300

28,700

22,567

Total

$81,612

$80,807

$82,685

$85,647

$76,511

Non-Performing Loans

30

(1) Excludes loans covered under loss share agreements with the FDIC. Also excludes TDR’s which are all

performing in accordance with

the restructured terms and for which the average yield is 4.8%.

As of December 31, 2010

Dollars in Thousands

%

Number of

Nonaccrual

NAL % of

60-89

Outstanding

Covered

Nonaccrual

Loan

Outstanding

Days Past

Loan Type

Loan Balance

Loans

Loans

Balance

1

Balance

1

Due Balance

Residential

$227,500

52%

11

$7,700

3.4%

$116

Commercial Real Estate

456,615

42%

10

8,381

1.8%

2,635

Construction & Land Development

33,444

20%

3

1,759

5.3%

0

Commercial & Industrial

129,673

27%

6

241

0.2%

185

Other

13,645

34%

1

289

2.1%

0

Total

$860,877

41%

31

$18,370

2.1%

$2,936

12/31/2009

$667,003

27%

27

$15,010

2.3%

8,882

31

Other Real Estate (12/31/10)

(dollars in thousands)

Assets Not Subject to

Loss Share

Agreements

Assets Subject to

Loss Share

Agreements

Total

Commercial Real Estate

$

2,147

$

5,461

$

7,608

Residential

302

1,175

1,477

Total

$

2,449

$

6,636

$

9,085

Robust Capital Position with Growth Capacity

32

(As of December 31, 2010)

With the proposed offering, assuming a minimum TCE ratio of 8.00%, 1st

United

would have the capacity to add approximately $675 million of incremental assets.

(1) See appendix for non-GAAP reconciliation of tangible equity and tangible assets.

* Assumes a $30mm offering, a 5.00% underwriting discount and estimated fixed expenses of $250,000.

($ in 000’s)

Well-Capitalized

12/31/2010

Pro Forma

Capital Ratios

Requirement

As Reported

Offering

Leverage

5.00%

11.80%

14.27%

*

Tier 1 Risk-Based

6.00%

21.62%

26.24%

*

Total Risk-Based

10.00%

23.71%

28.31%

*

TCE / Assets

10.31%

12.34%

Current Tangible Equity

(1)

$125,753

Net Offering Proceeds

28,250

*

Pro Forma Tangible Equity

$154,003

Current Tangible Assets

(1)

$1,219,455

Net Offering Proceeds

28,250

8.00%

8.50%

9.00%

Pro Forma Tangible Assets

$1,247,705

$677,333

$564,095

$463,439

Note: Does not contemplate any goodwill or bargain

purchase gain which may result from a transaction.

Assuming Minimum TCE Threshold:

Capacity for Incremental Assets

33

Net income of $2.160 million

Loan loss reserve stable at $13.1 million with 41% of loans and OREO as

covered assets with loss share protection

Loan loss reserve / non-performing loans ratio of 69.1%

Net interest margin increased to 4.06%

Increased loans to $860.7 million (acquisition of The Bank of Miami

accounted for $203 million of net new loans)

Organic loan growth in 2010 equated to $91 million ($67 million of fundings)

Increased total deposits to $1.064 billion with non-interest bearing deposits

representing 26.4% of deposits

Organic deposit growth of over $30 million in 2010

2010 Results & Developments

34

Earnings potential has significantly increased with the growth of the Bank,

including the acquisition of The Bank of Miami

2010 net income of over $2.1 million (pre-provision, pre-acquisition earnings of

over $8.2 million for 2010)

Q4 margin of 4.06% before additional operating leverage

from The Bank of

Miami transaction

Accretion of discount on loans acquired in FDIC-assisted transactions will enhance the

net interest margin over the next several quarters

On December 17, 2010, The Bank of Miami transaction added $203 million in

performing loans and approximately $29 million in investments with no new

branches and the addition of less than 40

employees

1st United has made significant investments in infrastructure

and technology,

including extensive asset resolution and loss share capabilities

Created a scalable platform with the ability to support significant growth

Earnings Growth at 1st United

Business Drivers

35

Maintain our top quartile net interest margin

Grow the best core deposit mix in Florida banking (non-

interest bearing deposits 26% at December 31, 2010)

A relentless focus on asset quality through inclusive, system-

wide orchestrated credit regime

Successful, opportunistic bank acquisition program

Attraction of talented bankers

Maintain focus on safety and soundness

1st United Opportunity

36

1.

Management team with extensive in-market experience and a track record of

performance and shareholder returns

2.

Company has experienced considerable growth recently through FDIC-assisted

acquisitions and is well-positioned to leverage its existing infrastructure to capitalize

on future opportunities

5.

Unique position as one of the few institutions in Florida with the financial profile

necessary to go on the offensive with regard to organic growth, traditional or FDIC-

assisted transactions

3.

Strong capital and liquidity position with favorable asset quality and a meaningful

percentage of the loan portfolio covered by FDIC loss share

4.

Despite near-term weakness in Florida, the long-term attractive demographic profile

has remained intact

7.

Attractive valuation to reflect franchise potential and earnings growth story:

- Trades at a stated Price/BV of 100% and Price/2011 Earnings of 50.2x *

* Based on a 10-day VWAP of $7.03 as of March 10, 2011 and median consensus equity research analyst estimate for 2011.

6.

Recent growth in core earnings expected to continue

Appendix

This presentation contains certain financial information determined by methods other than U.S.

GAAP. Management believes that these non-GAAP financial measures provide useful

supplemental

information. Non-GAAP financial measures are not standardized, and therefore it

may not be possible to compare these financial measures with other companies’ non-GAAP

financial measures that may have the same name or similar names.

Reconciliation tables relating to the non-GAAP financial measures used in this presentation are

displayed on the following page.

38

Non-GAAP Financial Reconciliation

(Dollar amounts in thousands, except per share amounts)

Reconciliation of Non-GAAP Financial Measures

As of and for the Years Ended December 31,

2010

2009

Total assets

1,267,752

$

1,013,441

$

Goodwill

(45,008)

(45,008)

Intangible assets, net

(3,289)

(3,045)

Tangible Assets

1,219,455

$

965,388

$

Shareholders’ equity

174,050

$

170,594

$

Goodwill

(45,008)

(45,008)

Intangible assets, net

(3,289)

(3,045)

Tangible shareholders’ equity

125,753

$

122,541

$

Book value per common share

7.02

$

6.88

$

Effect of intangible assets

(1.95)

(1.94)

Tangible book value per common share

5.07

$

4.94

$

Equity to total assets

13.73%

16.83%

Effect of intangible assets

(3.42)

(4.14)

Tangible equity/tangible assets

10.31%

12.69%

Common Stock Offering

March 2011