Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2010

OR

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 001-33824

Kennedy-Wilson Holdings, Inc.

(Exact Name of Registrant as Specified in Its Charter)

Delaware | 26-0508760 | |

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) | |

9701 Wilshire Blvd., Suite 700 Beverly Hills, CA | 90212 | |

(Address of Principal Executive Offices) | (Zip Code) | |

(310) 887-6400

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

______________________________________________________________________

Title of Each Class | Name of Each Exchange on which Registered | |

Common Stock, $.0001 par value | NYSE |

Securities registered pursuant to Section 12(g) of the Act: None

______________________________________________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act:

Large accelerated filer | o | Accelerated filer | x | ||||

Non-accelerated filer | o | (Do not check if a smaller reporting company) | Smaller reporting company | o | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

Based on the last sale at the close of business on June 30, 2010, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was approximately $154,130,736.90.

The number of shares of common stock outstanding as of March 1, 2011 was 40,179,906.

DOCUMENTS INCORPORATED BY REFERENCE

Part III of this report incorporates certain information by reference from the registrant’s proxy statement for the annual meeting of stockholders to be held on or around June 24, 2010, which proxy statement will be filed no later than 120 days after the close of the registrant’s fiscal year ended December 31, 2010.

TABLE OF CONTENTS

Page | ||||

PART I | ||||

Item 1. | ||||

Item 1A. | ||||

Item 1B. | ||||

Item 2. | ||||

Item 3. | ||||

Item 4. | ||||

PART II | ||||

Item 5. | ||||

Item 6. | ||||

Item 7. | ||||

Item 7A. | ||||

Item 8. | ||||

Item 9. | ||||

Item 9A. | ||||

Item 9B. | ||||

PART III | ||||

Item 10. | ||||

Item 11. | ||||

Item 12. | ||||

Item 13. | ||||

Item 14. | ||||

PART IV | ||||

Item 15. | ||||

FORWARD-LOOKING STATEMENTS

Statements made by us in this report and in other reports and statements released by us that are not historical facts constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward-looking statements are necessarily estimates reflecting the judgment of our senior management based on our current estimates, expectations, forecasts and projections and include comments that express our current opinions about trends and factors that may impact future operating results. Disclosures that use words such as “believe,” “anticipate,” “estimate,” “intend,” “could,” “plan,” “expect,” “project” or the negative of these, as well as similar expressions, are intended to identify forward-looking statements.

Forward-looking statements are not guarantees of future performance, rely on a number of assumptions concerning future events, many of which are outside of our control, and involve known and unknown risks and uncertainties that could cause our actual results, performance or achievement, or industry results, to differ materially from any future results, performance or achievements, expressed or implied by such forward-looking statements. Although we believe that our plans, intentions, expectations, strategies and prospects as reflected in or suggested by those forward-looking statements are reasonable, we do not guarantee that the transactions and events described will happen as described (or that they will happen at all). For a further discussion of these and other factors that could impact our future results, performance or transactions, please carefully read “Risk Factors” in Part I, Item 1A below.

• | disruptions in general economic and business conditions, particularly in geographies where our business may be concentrated; |

• | the continued volatility and disruption of the capital and credit markets, higher interest rates, higher loan costs, less desirable loan terms and a reduction in the availability of mortgage loans and mezzanine financing, all of which could increase costs and could limit our ability to acquire additional real estate assets; |

• | continued high levels of, or increases in, unemployment and general slowdowns in commercial activity; |

• | our leverage and ability to refinance existing indebtedness or incur additional indebtedness; |

• | an increase in our debt service obligations; |

• | our ability to generate a sufficient amount of cash from operations to satisfy working capital requirements and to service our existing and future indebtedness; |

• | our ability to achieve improvements in operating efficiency; |

• | foreign currency fluctuations; |

• | adverse changes in the securities markets; |

• | our ability to retain our senior management and attract and retain qualified and experienced employees; |

• | our ability to attract new user and investor clients; |

• | our ability to retain major clients and renew related contracts; |

• | trends in use of large, full-service commercial real estate providers; |

• | changes in tax laws in the United States or Japan that reduce or eliminate deductions or other tax benefits we receive; |

• | future acquisitions may not be available at favorable prices or upon advantageous terms and conditions; and |

• | costs relating to the acquisition of assets we may acquire could be higher than anticipated. |

Any such forward-looking statements, whether made in this report or elsewhere, should be considered in the context of the various disclosures made by us about our businesses including, without limitation, the risk factors discussed below. Except as required under the federal securities laws and the rules and regulations of the U.S. Securities and Exchange Commission (the “SEC”), we do not have any intention or obligation to update publicly any forward-looking statements, whether as a result of new information, future events, changes in assumptions, or otherwise. For further discussion of these and other factors that could impact our future results, performance or transactions, please carefully read "Risk Factors" in Part I, Item 1A below.

PART I

Item 1. Business

Company Overview

Founded in 1977, Kennedy-Wilson Holdings, Inc. (which may be referred to, together with its subsidiaries, as “company,” “we,” “us,” and “our”) is an international real estate investment and services firm. We have grown from a real estate auction business into a vertically-integrated real estate operating company with approximately 300 professionals in 22 offices throughout the U.S. and Japan. We have over $7 billion of assets under management totaling over 40 million square feet of properties throughout the United States ("U.S.") and Japan, including ownership in 11,971 multifamily apartment units.

We are a holding company whose primary business operations are conducted through its wholly owned subsidiary, Kennedy-Wilson, Inc., or "Kennedy Wilson". Kennedy-Wilson Holdings, Inc. was incorporated in Delaware on July 9, 2007, under the name “Prospect Acquisition Corp.” On November 13, 2009, KW Merger Sub Corp., a wholly owned subsidiary of Prospect Acquisition Corp., merged with Kennedy Wilson, resulting in Kennedy Wilson becoming a wholly owned subsidiary of Prospect Acquisition Corp. Promptly after the merger, we changed the company name to “Kennedy-Wilson Holdings, Inc,” which is now listed on the New York Stock Exchange ("NYSE"). We refer to this transaction as the "Merger" throughout this document.

Business Segments

We are defined by two core business segments: KW Investments and KW Services. KW Investments invests our capital and our equity partners capital in multifamily, residential and office properties as well as loans secured by real estate. KW Services provides a full array of real estate-related services to investors and lenders, with a strong focus on financial institution-based clients.

KW Investments

We invest our capital and our equity partners capital in real estate assets through joint ventures, separate accounts, commingled funds, and wholly-owned. We are typically the general partner in these investment vehicles with ownership interests ranging from approximately 5%-50%. Our equity partners include financial institutions, foundations, endowments, high net worth individuals and other institutional investors. In many cases we get a promoted interest in the profits of our investments beyond our ownership percentage.

Our investment philosophy is based on three core fundamentals:

• | significant proprietary deal flow from an established network of industry relationships, particularly with financial institutions; |

• | focus on a systematic research process with a disciplined approach to investing; and |

• | superior in-house operating execution. |

Our primary investment markets include California, Washington, Hawaii and Japan, which we have identified as areas with dense populations, high barriers to entry, scarcity of land and supply constraints. We typically focus on the following opportunities:

• | real estate owners or lenders seeking liquidity; |

• | under-managed or under-leased assets; and |

• | repositioning opportunities. |

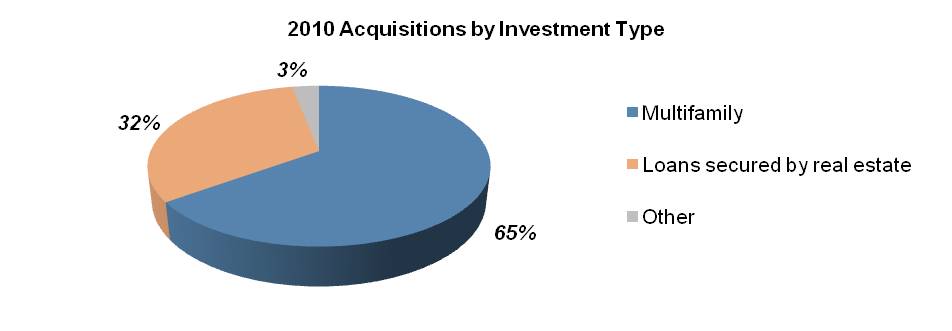

In 2010, we and our equity partners acquired $2.025 billion of real estate assets. Eighty-five percent of these acquisitions were sourced directly from financial institutions. Our 2010 acquisition activity consisted of the following investment types listed in the first table below:

1

Since 1999, we and our equity partners have invested in 201 transactions, deploying over $6.4 billion of capital, including $2.3 billion of equity. Of the transactions, 93 have been realized and generated an internal rate of return or "IRR" of 43% and a 1.7x equity multiple. Our equity partners and our current portfolio consists of 108 investments totaling over $3.4 billion of capital, including $1.2 billion of equity.

The following table describes our investment account, which includes the following financial statement captions below, and is derived from our consolidated balance sheet for the year ended December 31, 2010:

Dollars in millions | ||||

Investment in joint ventures | $ | 266.9 | ||

Real estate | 82.7 | |||

Mortgage debt | (35.2 | ) | ||

Notes receivable | 24.1 | |||

Loan pool participations | 25.2 | |||

$ | 363.7 | |||

The following table breaks down our investment account information derived from our consolidated balance sheet by investment type and geographic location:

Dollars in millions | |||||||||||||||||||||||

Multifamily | Loans Secured by Real Estate | Residential (1) | Office | Other | Total | ||||||||||||||||||

California | $ | 67.4 | $ | 63.7 | $ | 3.8 | $ | 18.3 | $ | — | $ | 153.2 | |||||||||||

Japan | 108.3 | — | — | 6.1 | — | 114.4 | |||||||||||||||||

Hawaii | — | 10.7 | 46.9 | — | — | 57.6 | |||||||||||||||||

Washington | 21.0 | 2.9 | 2.3 | 1.5 | — | 27.7 | |||||||||||||||||

Other | 2.7 | 4.9 | 0.3 | 0.8 | 2.1 | 10.8 | |||||||||||||||||

Total | $ | 199.4 | $ | 82.2 | $ | 53.3 | $ | 26.7 | $ | 2.1 | $ | 363.7 | |||||||||||

—————

(1) Includes for-sale residential, condominiums and residential land.

KW Services

KW Services offers a comprehensive line of real estate services for the full lifecycle of real estate ownership and investment to clients that include financial institutions, developers, builders and government agencies. KW Services has three business lines: auction and conventional sales, property services and investment management. These three business lines generate revenue for us through commissions and fees.

Since our inception, we have sold more than $10 billion of real estate through our auction platform and are considered one of the leaders in auction marketing, conducting live and online auctions. The auction group executes accelerated marketing

2

programs for all types of residential and commercial real estate. In 2010, we auctioned and conventionally sold over 40 projects in three countries and 18 states including California, Washington, Hawaii, Oregon, Texas, Nevada, Florida, Georgia, and North Carolina.

We manage over 40 million square feet of properties for institutional clients and individual investors in the U.S. and Japan, including 11,971 apartment units owned by us. With 22 offices throughout the U.S. and Japan, including five regional hubs, we have the capabilities and resources to provide property services to real estate owners as well as the experience as a real estate investor to understand client concerns.

Through our investment management business, we provide acquisition, asset management and disposition services to our equity partners as well as to third parties.

Additionally, KW Services plays a critical role in supporting the company's investment strategy by providing local market intelligence and real-time data for evaluating and valuing investments, generating proprietary transaction flow and creating value through efficient implementation of asset management or repositioning strategies.

Industry Overview

United States

We believe that the recent economic, capital and credit markets events have and will continue to create tremendous buying opportunities as properties may be purchased at significant discounts to historical cost. Many asset dispositions will result from:

▪ | highly leveraged property owners who will have loans maturing in 2011 and 2012 but will be unable to refinance; |

▪ | asset and loan sales directly from financial institutions; and |

▪ | companies reducing real estate portfolios to raise cash and shore up their balance sheets |

As sellers continue to be under pressure to move assets off of their balance sheets, we believe that our strong sourcing relationships will position us to acquire properties at steep discounts. Sellers will look to firms that they have relationships with and that can execute quickly and discreetly.

Over the past several years, many U.S. real estate markets have experienced a downturn in occupancy and property values. Unlike the last cycle, this recent downturn was driven by the lack of liquidity and the tightening of the credit markets rather than by an oversupply of new products. We believe that underlying real estate fundamentals have remained solid, particularly in major metropolitan and downtown areas where supply constraints exist.

Japan

It is expected that Japan, while still subject to the same market forces affecting economies across the globe, will likely experience a shorter economic downturn than that experienced in other industrialized economies because the Japanese banking system remains strong relative to its peers. We believe that the Japan's economy is in a better position to weather current economic conditions because, over the past decade, Japanese households have saved money and companies have steeply reduced their debt levels as a percentage of GDP. In the current credit environment, as in the U.S., highly-leveraged investors in Japan have been forced to reduce their debt.

Japan's current demographic trends include an influx of migration to major cities, creating strong demand for housing. Our research shows that real estate fundamentals have remained strong in greater Tokyo's residential market, and, in particular, in Tokyo's three major wards: Minato-ku, Shibuya-ku, and Setagaya-ku. With diminishing supply of new inventory due to stricter building regulations imposed in 2007, rents for quality assets are expected to remain strong while vacancy rates remain stable. We expect that properties in the greater Tokyo area that are newer and of higher quality will remain target assets for acquisition by many institutional investors.

Competition

We compete with a range of local and national real estate firms, individual investors and other corporations. Because of our unique mix of investment and service businesses, we compete with brokerage and property management companies as well as companies that invest in real estate and real estate secured loans. Our investment business competes with real estate investment partnerships, real estate investments trusts, other investment companies and regional investors and developers, especially those that invest in the western United States, Hawaii and Japan. We compete with them on the basis of our relationships with the sellers and our ability to close an investment transaction in a short time period at competitive pricing. The real estate services business is both highly fragmented and competitive. We compete with real estate brokerage and auction companies on the basis of our relationship with property owners, quality of service, and commissions charged. We compete

3

with property management and leasing firms also on the basis of our relationship with clients, the range and quality of services provided, and fees and commissions charged.

Competitive Advantages

We believe that the company has a unique platform from which to execute our investment and services strategy. The combination of a service business (including auctions) and an investment platform provides significant competitive advantages over other real estate buyers operating stand-alone or investment-focused firms and may allow us to generate superior risk-adjusted returns. Our investment strategy focuses on investments that offer significant appreciation potential through intensive property management, leasing, repositioning, redevelopment and the opportunistic use of capital. We differentiate ourselves from other firms in the industry with our full service, investment oriented structure. Whereas most other firms use an investment platform to obtain additional service business revenue, we use our service platform to enhance the investment process and ensure the alignment of interests with our investors.

Our competitive advantages include:

• | Transaction experience: Our Executive Committee has more than 125 years of combined real estate experience and has been working and investing together on average for over 15 years. Members of the Executive Committee have collectively acquired, developed and managed in excess of $15 billion of real estate investments in the U.S. and Japan through various economic cycles at our company and throughout their careers. |

• | Extensive relationship and sourcing network: We leverage our services business in order to source off-market deals. In addition, the Executive Committee and our acquisition team have transacted deals in nearly every major metropolitan market on the West Coast of the U.S., as well as in Japan. Their local presence and reputation in these markets have enabled them to cultivate key relationships with major holders of property inventory, in particular financial institutions, throughout the real estate community. |

• | Structuring expertise and speed of execution: Prior acquisitions completed by us have taken a variety of forms including direct property investments, joint ventures, exchanges involving stock or operating partnership units, participating loans and investments in performing and non-performing mortgages with the objective of long-term ownership. We believe we have developed a reputation of being able to quickly execute, as well as originate and creatively structure acquisitions, dispositions and financing transactions. |

• | Vertically-integrated platform for operational enhancement: We have approximately 300 employees in both KW Investments and KW Services, with 22 regional offices throughout the U.S. and Japan. This geographically diversified business model is aimed at weathering real estate cycles. We have a hands-on approach to real estate investing and possess the local expertise in property management, leasing, construction management, development and investment sales, which we believe enable us to invest successfully in selected submarkets. |

• | Risk protection and investment discipline: We underwrite our investments based upon a thorough examination of property economics and a critical understanding of market dynamics and risk management strategies. We conduct an in-depth sensitivity analysis on each of our acquisitions. This analysis applies various economic scenarios that include changes to rental rates, absorption periods, operating expenses, interest rates, exit values and holding periods. We use this analysis to develop our disciplined acquisition strategies. |

Transaction based results

A significant portion of our cash flow is tied to transaction activity, which can affect an investor’s ability to compare our financial condition and results of operations on a quarter-by-quarter basis. Historically, this seasonality has caused our revenue, operating income, net income and cash flows from operating activities to be tied to transaction activity, which is not necessarily concentrated in any one quarter.

Employees

As of December 31, 2010, we had approximately 300 professionals in 22 offices throughout the U.S. and Japan. We believe that we have been able to attract and maintain high quality employees. There are no employees subject to collective bargaining agreements. In addition, we believe we have a good relationship with our employees.

Item 1A. Risk Factors

Our results of operations and financial condition can be adversely affected by numerous risks. You should carefully

4

consider the risk factors detailed below in conjunction with the other information contained in this report. If any of the following risks actually occur, our business, financial condition, operating results, cash flows and/or future prospects could be materially adversely affected.

Risks Related to Our Business

The success of our business is significantly related to general economic conditions and the real estate industry and, accordingly, our business could be harmed by an economic slowdown and downturn in real estate asset values, property sales and leasing activities.

Our business is closely tied to general economic conditions in the real estate industry. As a result, our economic performance, the value of our real estate and real estate secured notes, and our ability to implement our business strategies may be affected by changes in national and local economic conditions. The condition of the real estate markets in which we operate tends to be cyclical and related to the condition of the economy in the U.S. and Japan as a whole and to the perceptions of investors of the overall economic outlook. Rising interest rates, declining employment levels, declining demand for real estate, declining real estate values or periods of general economic slowdown or recession or the perception that any of these events may occur have negatively impacted the real estate market in the past may in the future negatively affect our performance. In addition, the economic condition of each local market where we operate may be dependent on one or more industries. Our ability to change our portfolio promptly in response to economic or other conditions is limited. Certain significant expenditures, such as debt service costs, real estate taxes, and operating and maintenance costs are generally not reduced when market conditions are poor. These factors would impede us from responding quickly to changes in the performance of our investments and could adversely impact our business, financial condition and results of operations. We have experienced in past years and expect in the future to be negatively impacted by, periods of economic slowdown or recession, and corresponding declines in the demand for real estate and related services, within the markets in which we operate. The previous recession and the downturn in the real estate market have resulted in and/or may result in:

• | a general decline in rents due to defaulting tenants or less favorable terms for renewed or new leases; |

• | fewer purchases and sales of properties by clients, resulting in a decrease in property management fees and brokerage commissions; |

• | a decline in actual and projected sale prices of our properties resulting in lower returns on the properties in which we have invested; |

• | higher interest rates, higher loan costs, less desirable loan terms and a reduction in the availability of mortgage loans and mezzanine financing, all of which could increase costs and could limit our ability to acquire additional real estate assets; and |

• | a decrease in the availability of lines of credit and other sources of capital used to purchase real estate investments and distressed notes. |

If the economic and market conditions that prevailed in 2008 and 2009 were to return, our business performance and profitability could deteriorate. If this were to occur, we could fail to comply with certain financial covenants in our revolving credit agreement which would force us to seek an amendment with our lenders. No assurance can be given that we would be able to obtain any necessary waivers or amendments on satisfactory terms, if at all. In addition, in an extreme deterioration of our business, we could have insufficient liquidity to meet our debt service obligations when they come due in future years.

Adverse developments in the credit markets may harm our business, results of operations and financial condition.

Disruptions in the credit markets may adversely affect our business of providing advisory services to owners, investors and occupiers of real estate in connection with the leasing, disposition and acquisition of property. If our clients are unable to procure credit on favorable terms, there may be fewer completed leasing transactions, dispositions and acquisitions of property. In addition, if purchasers of real estate are not able to procure favorable financing resulting in the lack of disposition opportunities for our funds and projects, our services businesses will generate lower incentive fees and we may also experience losses of co-invested equity capital if the disruption causes a permanent decline in the value of investments made.

In 2008 and 2009, the credit markets experienced a disruption of unprecedented magnitude. This disruption reduced the availability and significantly increased the cost of most sources of funding. In some cases, these sources were eliminated. While the credit market has shown signs of improving since the second half of 2009, liquidity remains constrained and it is impossible to predict when the market will return to normalcy. This uncertainty may lead market participants to continue to act more conservatively, which may amplify decreases in demand and pricing in the markets we serve.

We could lose part or all of our investment in the real estate assets we have interests in, which could have a material

5

adverse effect on our financial condition and results of operations.

There is the inherent possibility in all of our real estate investments that we could lose all or part of our investment. Real estate investments are generally illiquid, which may affect our ability to change our portfolio in response to changes in economic and other conditions. Moreover, regarding our investment in real estate, we may not be able to unilaterally decide the timing of the disposition of an investment, and as a result, may not control when and whether any gain will be realized or loss avoided. The value of our investments can also be diminished by:

• | civil unrest, acts of war and terrorism and acts of God, including earthquakes, hurricanes and other natural disasters (which may result in uninsured or underinsured losses); |

• | the impact of present or future legislation in the U.S. or in Japan (including environmental regulation, changes in laws concerning foreign ownership of property, changes in real estate tax rates, changes in zoning laws and laws requiring upgrades for disabled persons) and the cost of compliance with these types of legislation; and |

• | liabilities relating to claims to the extent insurance is not available or is inadequate. |

We may be unsuccessful in renovating the properties we acquire resulting in investment losses.

Part of our investment strategy is to locate and acquire real estate assets that we believe are undervalued and to improve them to increase their resale value. We face risks arising from the acquisition of properties not yet fully developed or in need of substantial renovation or redevelopment, particularly the risk that we overestimate the value of the property and the risk that the cost or time to complete the renovation or redevelopment will exceed the budgeted amount. Such delays or cost overruns may arise from:

• | shortages of materials or skilled labor; |

• | a change in the scope of the original project; |

• | the difficulty in obtaining necessary zoning, land-use, environmental, building, occupancy and other governmental permits and authorization; |

• | the discovery of structural or other latent defects in the property once construction has commenced; and |

• | delays in obtaining tenants. |

Any failure to complete a redevelopment project in a timely manner and within budget or to sell or lease the project after completion could have a material adverse effect upon our business, results of operation and financial condition.

We may not recover part or any of our investment in the mezzanine loans we make or acquire due to a number of factors including the fact that such loans are subordinate to the interests of senior lenders.

We have made and expect to continue to make or acquire mezzanine loans, which are loans that are secured by real property, but are subject to the interests of lenders who are senior to us. These mezzanine loans are considered to involve a high degree of risk compared to other types of loans secured by real property. This is due to a variety of factors, including that a foreclosure by the holder of the senior loan could result in its mezzanine loan becoming uncollectible. Accordingly, we may not recover the full amount, or any, of our investment in mezzanine loans. In addition, mezzanine loans may have higher loan to value ratios than conventional term loans.

Our operations in Japan subject us to additional social, political and economic risks associated with conducting business in foreign countries, which may materially adversely effect our business and results of operations.

One of our strategies for the future is to continue our operations in Japan. The scope of our international operations may lead to more volatile financial results and difficulties in managing our businesses. This volatility and difficulty could be caused by, among other things, the following:

• | restrictions and problems relating to the repatriation of profits; |

• | difficulties and costs of staffing and managing international operations; |

• | the burden of complying with multiple and potentially conflicting laws; |

• | laws restricting foreign companies from conducting business and unexpected changes in regulatory requirements; |

• | the impact of different business cycles and economic instability; |

• | political instability and civil unrest; |

• | greater difficulty in perfecting our security interests, collecting accounts receivable, foreclosing on security and protecting our interests as a creditor in bankruptcies in certain geographic regions; |

6

• | potentially adverse tax consequences; |

• | share ownership restrictions on foreign operations; |

• | Japanese property and income taxes, tax withholdings and tariffs; and |

• | geographic, time zone, language and cultural differences between personnel in different areas of the world. |

Our joint venture activities subject us to unique third-party risks, including risks that other participants may become bankrupt or take action contrary to our best interests.

We have utilized joint ventures for large commercial investments and real estate developments. We plan to continue to acquire interests in additional limited and general partnerships, joint ventures and other enterprises, collectively referred to herein as “joint ventures”, formed to own or develop real property or interests in real property or note pools. It is our strategy in Japan to invest primarily through joint ventures. We have acquired and may acquire minority interests in joint ventures and we may also acquire interests as a passive investor without rights to actively participate in management of the joint ventures. Investments in joint ventures involve additional risks, including the possibility that the other participants may become bankrupt or have economic or other business interests or goals which are inconsistent with ours, that we will not have the right or power to direct the management and policies of the joint ventures and that other participants may take action contrary to our instructions or requests and against our policies and objectives. Should a participant in a material joint venture act contrary to our interest, it could have a material adverse effect upon our business, results of operations and financial condition. Moreover, we cannot be certain that we will continue these investments, or that we can identify suitable joint venture partners and form new joint ventures in the future.

We purchase distressed loans and loan portfolios that have a higher risk of default and delinquencies than newly originated loans and as a result, we may lose part or all of our investment in such loans and loan portfolios.

We may purchase loans and loan portfolios that are unsecured or secured by real or personal property. These loans and loan portfolios are generally non-performing or sub-performing, and often are in default at the time of purchase. In general, the distressed loans and loan portfolios we acquire are highly speculative investments and have a greater than normal risk of future defaults and delinquencies as compared to newly originated loans. Returns on loan investments depend on the borrower’s ability to make required payments or, in the event of default, our security interests, if any, and our ability to foreclose and liquidate whatever property that secure the loans and loan portfolios. We cannot be sure that we will be able to collect on a defaulted loan or foreclose on security successfully or in a timely fashion. There may also be instances when we are able to acquire title to an underlying property and sell it, but not make a profit on its investment.

We may not be successful in competing with companies in the real estate services and investment industry, some of which may have substantially greater resources than we do.

Real estate investment and services businesses are highly competitive. Our principal competitors include both large multinational companies and national and regional firms, such as Jones Lang LaSalle, Inc. and CB Richard Ellis, Inc. Many of our competitors have greater financial resources and a broader global presence than we do. We compete with companies in the U.S., and, to a limited extent, in Japan, with respect to:

• | selling commercial and residential properties on behalf of customers through brokerage and auction services; |

• | leasing and property management, including construction and engineering services; |

• | purchasing commercial and residential properties, as well as undeveloped land for our own account; and |

• | acquiring secured and unsecured loans. |

Our services operations must compete with a growing number of national firms seeking to expand market share. There can be no assurance that we will be able to continue to compete effectively, maintain current fee levels or arrangements, continue to purchase investment property profitably or avoid increased competition.

If we are unable to maintain or develop new client relationships, our service business and financial condition could be substantially impaired.

We are highly dependent on long-term client relationships and on revenues received for services with third-party owners and related parties. A considerable amount of our revenues are derived from fees related to our service business.

The majority of our property management agreements are cancelable prior to their expiration by the client for any reason on as little as 30 to 60 days’ notice. These contracts also may not be renewed when their respective terms expire. If we fail to maintain existing relationships, fail to develop and maintain new client relationships or otherwise lose a substantial number of

7

management agreements, we could experience a material adverse change in our business, financial condition and results of operations.

Decreases in the performance of the properties we manage are likely to result in a decline in the amount of property management fees and leasing commissions we generate.

Our property management fees are generally structured as a percentage of the revenues generated by the properties that we manage. Similarly, our leasing commissions typically are based on the value of the lease commitments. As a result, our revenues are adversely affected by decreases in the performance of the properties we manage and declines in rental value. Property performance will depend upon, among other things, our ability to control operating expenses (some of which are beyond our control), and financial conditions generally and in the specific areas where properties are located and the condition of the real estate market generally. If the performance or rental values of the properties we manage decline, the management fees and leasing commissions we derive from such properties could be materially adversely affected.

Our leasing activities are contingent upon various factors including tenant occupancy and rental rates, which if adversely affected, could cause our operating results to suffer.

A significant portion of our property management business involves facilitating the leasing of commercial space. In certain areas of operation, there may be inadequate commercial space to meet demand and there is a potential for a decline in the number of overall lease and brokerage transactions. In areas where the supply of commercial space exceeds demand, we may not be able to renew leases or obtain new tenants for our owned and managed rental properties as leases expire. Moreover, the terms of new leases and renewals (including renovation costs or costs of concessions to tenants) may be less favorable than current leases. Our revenues may be adversely affected by the failure to promptly find tenants for substantial amounts of vacant space, if rental rates on new or renewal leases are significantly lower than expected, or if reserves for costs of re-leasing prove inadequate. We cannot be sure that we can continue to lease properties for our clients and for our own account in a profitable manner.

Our ability to lease properties also depends on:

• | the attractiveness of the properties to tenants; |

• | competition from other available space; |

• | our ability to provide for adequate maintenance and insurance and to pay increased operating expenses which may not be passed through to tenants; |

• | the availability of capital to periodically renovate, repair and maintain the properties, as well as for other operating expenses; and |

• | the existence of potential tenants desiring to lease the properties. |

If we are unable to identify, acquire and integrate suitable acquisition targets, our future growth will be impeded.

Acquisitions and expansion have been, and will continue to be, a significant component of our growth strategy for the future. While maintaining our existing business lines, we intend to continue to pursue a sustained growth strategy by increasing revenues from existing clients, expanding the breadth of our service offerings, seeking selective co-investment opportunities and pursuing strategic acquisitions.

Our ability to manage our growth will require us to effectively integrate new acquisitions into our existing operations while managing development of principal properties. We expect that significant growth in several business lines occurring simultaneously will place substantial demands on our managerial, administrative, operational and financial resources. We cannot be sure that we will be able to successfully manage all factors necessary for a successful expansion of our business. Moreover, our strategy of growth depends on the existence of and our ability to identify attractive and synergistic acquisition targets. The unavailability of suitable acquisition targets, or our inability to find them, may result in a decline in business, financial condition and results of operations.

Our business is highly dependent upon the economy and real estate market in California which has recently experienced a significant downturn and is vulnerable to future decline.

We have a high concentration of our business activities in California. Consequently, our business, results of operations and financial condition are dependent upon general trends in California's economy and real estate market. California's economy has experienced a significant downturn in the recent recession and a sustained decline in the value of California real estate. Real estate market declines in California have become so severe that the market value of a number of properties securing loans has become significantly less than the outstanding balances of those loans. Real estate market declines may negatively affect

8

our ability to sell property at a profit. In addition, California historically has been vulnerable to certain natural disaster risks, such as earthquakes, floods, wild fires and erosion-caused mudslides. The existence of adverse economic conditions or the occurrence of natural disasters in California could have a material adverse effect on our business, financial condition and results of operations.

We own real estate properties located in Hawaii, which subjects us to unique risks relating to, among other things, the current recession in Hawaii, Hawaii’s economic dependence on fluctuating tourism, the isolated location of Hawaii and the potential for natural disasters.

We conduct operations and own properties in Hawaii. Consequently, our business, results of operations and financial condition are dependent upon and affected by general trends in Hawaii's economy and real estate market. Hawaii's economy has experienced a significant downturn in the current recession and a sustained decline in the value of Hawaiian real estate. Real estate market declines may negatively affect our ability to sell property at a profit. In addition, Hawaii’s economy is largely dependent upon tourism, which is subject to fluctuation and has recently experienced a significant drop. Hawaii historically has also been vulnerable to certain natural disaster risks, such as tsunamis, hurricanes and earthquakes, which could cause damage to properties owned by us or property values to decline in general. Hawaii’s remote and isolated location also may create additional operational costs and expenses, which could have a material adverse impact on our financial results.

Our auction services business has historically been countercyclical and, as a result, our operating results may be adversely affected when general economic conditions are improving.

Our results of operations are dependent on the performance of our auction services group, which historically has been countercyclical. Our auction services group has recently experienced an increase in revenues due to, among other things, the substantial increase in the number of foreclosures stemming from the current economic crisis. Improvements in general economic conditions may cause auction service revenues to decrease, which could cause a material adverse impact on our results of operations.

If we fail to comply with laws and regulations applicable to us in our role as a real estate broker, property/facility manager or developer, we may incur significant financial penalties.

We are subject to numerous federal, state, local and non-U.S. laws and regulations specific to the services we perform in our business, as well as laws of broader applicability, such as tax, securities and employment laws. Brokerage of real estate sales and leasing transactions and the provision of property management and valuation services require us to maintain applicable licenses in each U.S. state and certain non-U.S. jurisdictions in which we perform these services. If we fail to maintain our licenses or conduct these activities without a license, or violate any of the regulations covering our licenses, we may be required to pay fines (including treble damages in certain states) or return commissions received or have our licenses suspended or revoked.

We have certain obligations in connection with our real estate brokerage services which could subject us to liability in the event litigation is initiated against us for an alleged breach of any such obligation.

As a licensed real estate broker, we and our licensed employees are subject to certain statutory due diligence, disclosure and standard-of-care obligations. Failure to fulfill these obligations could subject us or our employees to litigation from parties who purchased, sold or leased properties they brokered or managed. In addition, we may become subject to claims by participants in real estate sales claiming that we did not fulfill our statutory obligations as a broker.

We may become subject to claims for construction defects or other similar actions in connection with the performance of our property management services.

In our property management capacity, we hire and supervise third-party contractors to provide construction and engineering services for our properties. While our role is limited to that of a supervisor, we cannot be sure that we will not be subjected to claims for construction defects or other similar actions. Adverse outcomes of property management litigation could have a material adverse effect on our business, financial condition and results of operations.

Our properties may subject us to potential environmental liability.

Under various federal, state and local laws, ordinances and regulations, a current or previous owner or operator of real estate may be liable for the cleanup of hazardous or toxic substances and may be liable to a governmental entity or to third parties for property damage and for investigation and clean-up costs incurred by governmental entities or third parties in connection with the contamination. Such laws typically impose liability without regard to whether the owner or operator knew of, or was responsible for, the presence of the hazardous or toxic substances, even when the contaminants were associated with

9

previous owners or operators. The costs of investigation, remediation or removal of hazardous or toxic substances may be substantial, and the presence of those substances, or the failure to properly remediate those substances, may adversely affect the owner’s or operator’s ability to sell or rent the affected property or to borrow using the property as collateral. The presence of contamination at a property can impair the value of the property even if the contamination is migrating onto the property from an adjoining property. Additionally, the owner of a site may be subject to claims by parties who have no relation to the property based on damages and costs resulting from environmental contamination emanating from the site.

In connection with the direct or indirect ownership, operation, management and development of real properties, we may be considered an owner or operator of those properties or as having arranged for the disposal or treatment of hazardous or toxic substances. Therefore, we may be potentially liable for removal or remediation costs.

Certain federal, state and local laws, regulations and ordinances also govern the removal, encapsulation or disturbance of asbestos-containing materials during construction, remodeling, renovation or demolition of a building. Such laws may impose liability for release of asbestos-containing materials, and third parties may seek recovery from owners or operators of real properties for personal injuries associated with asbestos-containing materials. We may be potentially liable for those costs for properties that we own. In the past, we have been required to remove asbestos from certain buildings that we own. There can be no assurance that in the future we will not be required to remove asbestos from our buildings or incur other substantial costs of environmental remediation.

Before consummating the acquisition of a particular piece of property, it is our policy to retain independent environmental consultants to conduct a thorough environmental review of the property to check for contaminants, including performing a Phase I environmental review. These assessments have included, among other things, a visual inspection of the properties and the surrounding area and a review of relevant federal, state and historical documents. To date, the assessments we have had done have not revealed any environmental liability that we believe would have a material adverse effect on our business, assets or results of operations as a whole, nor are we aware of any material environmental liability of the types described. Nevertheless, it is possible that the assessments we commissioned do not reveal all environmental liabilities or that there are material environmental liabilities of which we are currently unaware. There can be no assurance that future laws, ordinances or regulations will not impose any material environmental liability or that the current environmental condition of our properties will not be affected by tenants, by the condition of land or operations in the vicinity of those properties, or by unrelated third parties. We have not been notified by any governmental authority, and are not otherwise aware of any material noncompliance, liability or claim relating to hazardous or toxic substances in connection with any of our properties. There can be no assurance that federal, state and local agencies or private plaintiffs will not bring these types of actions in the future, or that those actions, if adversely resolved, would not have a material adverse effect on our business, financial condition and results of operations.

We may incur unanticipated expenses relating to laws benefiting disabled persons.

The Americans with Disabilities Act, or the ADA, generally requires that public accommodations such as hotels and office buildings be accessible to disabled people. We believe that our properties are in substantial compliance with the ADA and that we will not be required to make substantial capital expenditures to address the requirements of the ADA. If, however, our properties are not in compliance with the ADA, the U.S. federal government could fine us or private litigants could sue us for money damages. If we are required to make substantial alterations to one or more of our properties, our results of operations could be materially adversely affected.

We may incur significant costs complying with laws, regulations and covenants that are applicable to our properties and operations.

The properties in our portfolio and our operations are subject to various covenants and federal, state and local laws and regulatory requirements, including permits and licensing requirements. Such laws and regulations, including municipal or local ordinances, zoning restrictions and restrictive covenants imposed by community developers may restrict our use of our properties and may require us to obtain approval from local officials or community standards organizations at any time with respect to our properties, including prior to acquiring a property or when undertaking renovations of any of our existing properties. Among other things, these restrictions may relate to fire and safety, seismic, asbestos-cleanup or hazardous material abatement requirements. There can be no assurance that existing laws and regulations will not adversely affect us or the timing or cost of any future acquisitions or renovations, or that additional regulations will not be adopted that increase such delays or result in additional costs. Our failure to obtain required permits, licenses and zoning relief or to comply with applicable laws could have a material adverse effect on our business, financial condition and results of operations.

Our property insurance coverages are limited and any uninsured losses could cause us to lose part or all of our investment in our insured properties.

10

We carry comprehensive general liability coverage and umbrella coverage on all of our properties with limits of liability which we deem adequate and appropriate under the circumstances (subject to deductibles) to insure against liability claims and provide for the cost of legal defense. There are, however, certain types of extraordinary losses that may be either uninsurable, or that are not generally insured because it is not economically feasible to insure against those losses. Should any uninsured loss occur, we could lose our investment in, and anticipated revenues from, a property, which loss or losses could have a material adverse effect on our operations. Currently, we also insure some of our properties for loss caused by earthquake in levels we deem appropriate and, where we believe necessary, for loss caused by flood. We cannot be sure that the occurrence of an earthquake, flood or other natural disaster will not have a materially adverse effect on our business, financial condition and results of operations.

Risks Related to Our Company

If we are unable to raise additional debt and equity capital, our results of operations could suffer.

We depend upon third-party equity and debt financings to acquire properties through our investment business, which is a key driver of future growth. We estimate that in the next 12 to 18 months our acquisition plan will require between approximately $650 million and $1.0 billion in third-party equity and between approximately $1.3 billion and $1.5 billion in third-party debt. We expect to obtain debt financing from seller financing, the assumption of existing loans, government agencies and financial institutions. We expect to obtain equity financing from equity partners, which include pension funds, family offices, financial institutions, endowments and money managers. Our access to capital funding is uncertain. Our inability to raise additional capital on terms reasonably acceptable to us could jeopardize the future success of our business.

The loss of one or more key personnel could have a material adverse effect on our operations.

Our continued success is dependent to a significant degree upon the efforts of our senior executives, who have each been essential to our business. The departure of all or any of our executives for whatever reason or the inability of all or any of them to continue to serve in their present capacities or our inability to attract and retain other qualified personnel could have a material adverse effect upon our business, financial condition and results of operations. Our executives have built highly regarded reputations in the real estate industry. Our executives attract business opportunities and assist both in negotiations with lenders and potential joint venture partners and in the representation of large and institutional clients. If we lost their services, our relationships with lenders, joint ventures and clients would diminish significantly.

In addition, certain of our officers have strong regional reputations and they aid in attracting and identifying opportunities and negotiating for us and on behalf of our clients. In particular, we view the establishment and maintenance of strong relationships through certain officers as critical to our success in the Japanese market. As we continue to grow, our success will be largely dependent upon our ability to attract and retain qualified personnel in all areas of business. We cannot be sure that we will be able to continue to hire and retain a sufficient number of qualified personnel to support or keep pace with our planned growth.

The loss of our chief executive officer ("CEO") could have a material adverse effect on our operations.

Our continued success is dependent to a significant degree upon the efforts of our CEO, who is essential to our business. The departure of CEO for whatever reason or the inability of our CEO to continue to serve in his present capacity could have a material adverse effect upon our business, financial condition and results of operations. Our CEO has built a highly regarded reputation in the real estate industry. Our CEO attracts business opportunities and assists both in negotiations with lenders and potential joint venture partners and in the representation of large and institutional clients. If we lost his services, our relationships with lenders, joint ventures and clients would diminish significantly.

Our revenues and earnings may be materially and adversely affected by fluctuations in foreign currency exchange rates due to our international operations.

Our revenues from non-U.S. operations have been primarily denominated in the local currency where the associated revenues were earned. Thus, we may experience significant fluctuations in revenues and earnings because of corresponding fluctuations in foreign currency exchange rates. To date, our foreign currency exposure has been limited to the Japanese Yen. Due to the constantly changing currency exposures to which we will be subject and the volatility of currency exchange rates, there can be no assurance that we will not experience currency losses in the future, nor can we predict the effect of exchange rate fluctuations upon future operating results. Our management may decide to use currency hedging instruments from time to time including foreign currency forward contracts, purchased currency options (where applicable) and foreign currency borrowings. The economic risks associated with these hedging instruments include unexpected fluctuations in inflation rates, which could impact cash flow relative to paying down debt, and unexpected changes in our underlying net asset position. There

11

can be no assurance that any hedging will be effective.

Our operating results are subject to significant volatility from quarter to quarter as a result of the varied timing and magnitude of our strategic acquisitions and dispositions.

We have experienced a fluctuation in our financial performance from quarter to quarter due in part to the significance of revenues from the sales of real estate on overall performance. The timing of purchases and sales of our real estate investments has varied, and will continue to vary, widely from quarter to quarter due to variability in market opportunities, changes in interest rates, and the overall demand for residential and commercial real estate, among other things. While these factors have contributed to our increased operating income and earnings in the fourth quarter in past years, there can be no assurance that we will continue to perform well in the fourth quarter.

In addition, the timing and magnitude of brokerage commissions paid to us may vary widely from quarter to quarter depending upon overall activity in the general real estate market and the nature of our brokerage assignments, among other things.

We have in the past and may continue in the future to incur significant amounts of debt to finance acquisitions, which could negatively affect our cash flows and subject our properties or other assets to the risk of foreclosure.

We have historically financed new acquisitions and property purchases with cash derived from secured and unsecured loans and lines of credit. For instance, we typically purchase real property with loans secured by a mortgage on the property acquired. We anticipate the continuation of this trend. We do not have a policy limiting the amount of debt that we may incur. Accordingly, our management and board of directors have discretion to increase the amount of our outstanding debt at any time. We could become more highly leveraged, resulting in an increase in debt service costs that could adversely affect results of operations and increase the risk of default on debt. We may incur additional debt from time to time to finance strategic acquisitions, investments, joint ventures or for other purposes, subject to the restrictions contained in the documents governing our indebtedness. If we incur additional debt, the risks associated with our leverage, including our ability to service our debt, would increase. If we are required to seek an amendment to our credit agreement, our debt service obligations may be substantially increased.

The majority of our debt bears interest at variable rates. As a result, we are subject to fluctuating interest rates that may impact, adversely or otherwise, results of operations and cash flows. We may be subject to risks normally associated with debt financing, including the risk that cash flow will be insufficient to make required payments of principal and interest, and the risk that existing indebtedness on our properties will not be able to be refinanced or our leverage could increase our vulnerability to general economic downturns and adverse competitive and industry conditions, placing us at a disadvantage compared to those of our competitors that are less leveraged, our debt service obligations could limit our flexibility in planning for, or reacting to, changes in our business and in the commercial real estate services industry; our failure to comply with the financial and other restrictive covenants in the documents governing our indebtedness could result in an event of default that, if not cured or waived, results in foreclosure on substantially all of our assets; and that the terms of available new financing will not be as favorable as the terms of existing indebtedness. If we are unable to satisfy the obligations owed to any lender with a lien on one of our properties, the lender could foreclose on the real property or other assets securing the loan and we would lose that property or asset. The loss of any property or asset to foreclosure could have a material adverse effect on our business, financial condition and results of operations.

From time to time, Moody's Investors Service, Inc. and Standard & Poor's Ratings Services, a division of The McGraw-Hill Companies, Inc., rate our significant outstanding debt. These ratings and any downgrades thereof may impact our ability to borrow under any new agreements in the future, as well as the interest rates and other terms of any future borrowings, and could also cause a decline in the market price of our common stock.

We cannot be certain that our earnings will be sufficient to allow us to pay principal and interest on our debt and meet our other obligations. If we do not have sufficient earnings, we may be required to seek to refinance all or part of our existing debt, sell assets, borrow more money or sell more securities, none of which we can guarantee that we will be able to do and which, if accomplished, may adversely impact our stock price.

Our debt obligations impose significant operating and financial restrictions, which may prevent us from pursuing certain business opportunities and taking certain actions.

Our debt obligations impose, and future debt obligations may impose, significant operating and financial restrictions on us. These restrictions limit or prohibit, among other things, our ability to:

• | incur additional indebtedness; |

• | repay indebtedness (including the notes) prior to stated maturities; |

12

• | pay dividends on, redeem or repurchase our stock or make other distributions; |

• | make acquisitions or investments; |

• | create or incur liens; |

• | transfer or sell certain assets or merge or consolidate with or into other companies; |

• | enter into certain transactions with affiliates; |

• | sell stock in our subsidiaries; |

• | restrict dividends, distributions or other payments from our subsidiaries; and |

• | otherwise conduct necessary corporate activities. |

In addition, our unsecured credit facility requires us to maintain compliance with specified financial covenants, including maximum balance sheet leverage and fixed charge coverage ratios. As of December 31, 2010, we are in compliance with these covenants.

These covenants could adversely affect our ability to finance our future operations or capital needs and pursue available business opportunities. A breach of any of these covenants could result in a default in respect of the related indebtedness. If a default occurs, the relevant lenders could elect to declare the indebtedness, together with accrued interest and other fees, to be immediately due and payable and proceed against any collateral securing that indebtedness.

We have guaranteed a number of loans in connection with various equity partnerships which may result in us being obligated to make substantial payments.

We have provided guarantees associated with loans secured by assets held in various joint venture partnerships. The maximum potential amount of future payments (undiscounted) we could be required to make under the guarantees was approximately $28 million at December 31, 2010. The guarantees expire by the year end of 2011 and our performance under the guarantees would be required to the extent there is a shortfall in liquidation between the principal amount of the loan and the net sales proceeds of the property. If we were to become obligated to perform on these guarantees, it could have an adverse effect on our financial condition.

We have a number of equity partnerships that are subject to obligations under certain “non-recourse carve out” guarantees that may be triggered in the future.

Most of our real estate properties within our equity partnerships are encumbered by traditional non-recourse debt obligations. In connection with most of these loans, however, we entered into certain “non-recourse carve out” guarantees, which provide for the loans to become partially or fully recourse against us if certain triggering events occur. Although these events are different for each guarantee, some of the common events include:

• | The special purpose property-owning subsidiary’s filing a voluntary petition for bankruptcy; |

• | The special purpose property-owning subsidiary’s failure to maintain its status as a special purpose entity; and |

• | Subject to certain conditions, the special purpose property-owning subsidiary’s failure to obtain lender’s written consent prior to any subordinate financing or other voluntary lien encumbering the associated property. |

In the event that any of these triggering events occur and the loans become partially or fully recourse against us, our business, financial condition, results of operations and common stock price could be materially adversely affected.

The deteriorating financial condition and/or results of operations of certain of our clients could adversely affect our business.

We could be adversely affected by the actions and deteriorating financial condition and results of operations of certain of our clients if that led to losses or defaults by one or more of them, which in turn, could have a material adverse effect on our results of operations and financial condition.

Any of our clients may experience a downturn in its business that may weaken its results of operations and financial condition. As a result, a client may fail to make payments when due, become insolvent or declare bankruptcy. Any client bankruptcy or insolvency, or the failure of any client to make payments when due, could result in material losses to our company. A client bankruptcy would delay or preclude full collection of amounts owed to us. Additionally, certain corporate services and property management client agreements require that we advance payroll and other vendor costs on behalf of clients. If such a client were to file bankruptcy or otherwise fail, we may not be able to obtain reimbursement for those costs or

13

for the severance obligations we would incur as a result of the loss of the client.

We may incur expenses associated with defending law suits filed by former holders of Kennedy-Wilson's stock.

On November 13, 2009, our wholly-owned subsidiary, KW Merger Sub Corp., merged with and into Kennedy-Wilson. Prior to the merger, a small percentage of Kennedy-Wilson’s outstanding common stock was owned by holders who were not known to our management. If one or more of these holders were to bring a claim alleging that members of Kennedy-Wilson, Inc.’s board of directors breached their fiduciary duties in connection with approving the merger, we would incur costs defending and/or settling such claim.

Risks Related to Ownership of Our Common Stock

Our directors and officers and their affiliates are significant stockholders, which makes it possible for them to have significant influence over the outcome of all matters submitted to stockholders for approval and which influence may be in conflict with our interests and the interests of our other stockholders.

As of March 10, 2011, our directors and executive officers and their respective affiliates owned an aggregate of approximately 48.6% of the outstanding shares of our common stock. These stockholders will have significant influence over the outcome of all matters submitted for stockholder approval, including the election of our directors and other corporate actions. In addition, such influence by one or more of these affiliates could have the effect of discouraging others from attempting to purchase or take us over and/or reducing the market price offered for our common stock in such an event.

We may issue additional equity securities which may dilute your interest in us.

In order to expand our business, we may consider offering and issuing additional equity or equity-based securities. Holders of our securities may experience a dilution in the net tangible book value per share held by them if this occurs. The number of shares that we may issue for cash without stockholder approval will be limited by the rules of the NYSE or other exchange on which our securities are listed. However, there are generally exceptions which allow companies to issue a limited number of equity securities without stockholder approval which would dilute your ownership.

The price of our common stock may be volatile.

The price of our common stock may be volatile due to factors such as:

• | changes in real estate prices; |

• | actual or anticipated fluctuations in our quarterly and annual results and those of our publicly held competitors; |

• | mergers and strategic alliances among any real estate companies; |

• | market conditions in the industry; |

• | changes in government regulation and taxes; |

• | shortfalls in our operating results from levels forecasted by securities analysts; |

• | investor sentiment toward the stock of real estate companies in general; |

• | announcements concerning us or our competitors; and |

• | the general state of the securities markets. |

Kennedy-Wilson, Inc. has not recently operated as a “reporting company.” Fulfilling our obligations as a “reporting company” going forward will be expensive and time consuming.

Kennedy-Wilson has not been a public reporting company since 2004 and since that time has not been required to document and assess the effectiveness of its internal control procedures in order to satisfy the requirements of Section 404 of the Sarbanes-Oxley Act of 2002. Although we have maintained disclosure controls and procedures and internal control over financial reporting as required under the federal securities laws with respect to our activities, Kennedy-Wilson has not been required to establish and maintain such disclosure controls and procedures and internal controls over financial reporting which are required with respect to a public company with substantial operations. Under the Sarbanes-Oxley Act of 2002 and the related rules and regulations of the SEC, our management has been required to implement additional corporate governance practices and to adhere to a variety of reporting requirements and accounting rules. Compliance with these obligations requires significant time and resources from our management, finance and accounting staff and has significantly increased our legal, insurance and financial compliance costs. As a result of the increased costs associated with being a “reporting company,” Kennedy-Wilson's operating income as a percentage of revenue is likely to be lower.

14

Our common stock may be delisted, which could limit your ability to trade our common stock and subject us to additional trading restrictions.

Our common stock is listed on the NYSE, a national securities exchange. We cannot assure you that our common stock will continue to be listed on the NYSE in the future. If the NYSE delists our common stock from trading on its exchange, we could face significant material adverse consequences, including:

• | a limited availability of market quotations for our common stock; |

• | a limited amount of news and analyst coverage for our company; |

• | a decreased ability for us to issue additional securities or obtain additional financing in the future; and |

• | limited liquidity for our stockholders due to thin trading. |

Our staggered board may entrench management and discourage unsolicited stockholder proposals that may be in the best interests of stockholders and certain anti-takeover provisions in our organizational documents may discourage a change in control.

Our second amended and restated certificate of incorporation provides for our board of directors to be divided into three classes, each of which generally serves for a term of three years with only one class of directors being elected in each year. As a result, at any annual meeting only a minority of the board of directors will be considered for election. Since this “staggered board” would prevent our stockholders from replacing a majority of our board of directors at any annual meeting, it may entrench management and discourage unsolicited stockholder proposals that may be in the best interests of stockholders. Additionally, certain provisions of our second amended and restated certificate of incorporation and our amended and restated bylaws may have an anti-takeover effect and may delay, defer or prevent a tender offer or takeover attempt that a stockholder might consider in its best interest, including those attempts that might result in a premium over the market price for the shares held by stockholders.

In addition, Section 203 of the Delaware General Corporation Law, may, under certain circumstances, make it more difficult for a person who would be an “interested stockholder,” which is defined generally as a person with 15% or more of a corporation’s outstanding voting stock, to effect a “business combination” with the corporation for a three-year period. A “business combination” is defined generally as mergers, consolidations and certain other transactions, including sales, leases or other dispositions of assets with an aggregate market value equal to 10% or more of the aggregate market value of the corporation.

These anti-takeover provisions could make it more difficult for a third party to acquire us, even if the third party’s offer may be considered beneficial by many stockholders. As a result, stockholders may be limited in their ability to obtain a premium for their shares.

Item 1B. Unresolved Staff Comments

None

Item 2. Properties