Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - NORTH VALLEY BANCORP | nvb_8k.htm |

Exhibit 99.183

North Valley Bancorp

NASDAQ: NOVB

SANDLER O’NEILL & PARTNERS

West Coast Financial Services Conference

March 8, 2011

Michael Cushman

President & CEO

Disclaimer Disclosure

This presentation contains certain forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those stated herein. For a discussion of factors that could cause actual results to differ, please refer to the Company’s periodic reports filed with the Securities and Exchange Commission, including its annual report on Form 10-K for the year ended December 31, 2009 (and in particular, the discussion of risk factors within that report) which should be considered when evaluating the business prospects of the Company.

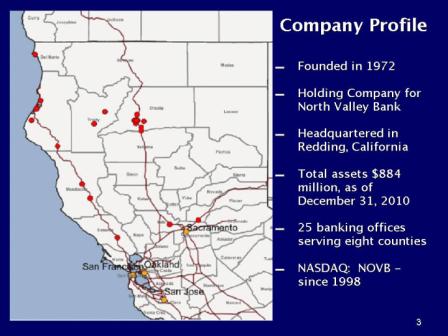

Company Profile

▬ Founded in 1972

▬ Holding Company for North Valley Bank

▬ Headquartered in Redding, California

▬ Total assets $884 million, as of December 31, 2010

▬ 25 banking offices serving eight counties

▬ NASDAQ: NOVB - since 1998

2010 Overview

▬ Successful $40 million capital raise – strong capital ratios

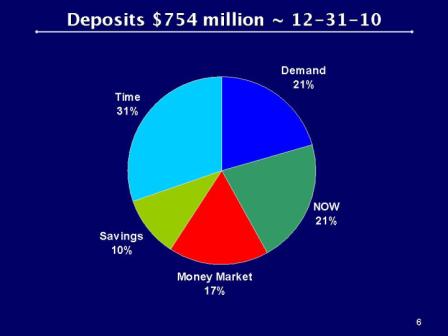

▬ Strong Core Deposits - $754MM.

▬ Reduced our Cost of Funds to 85 bps.

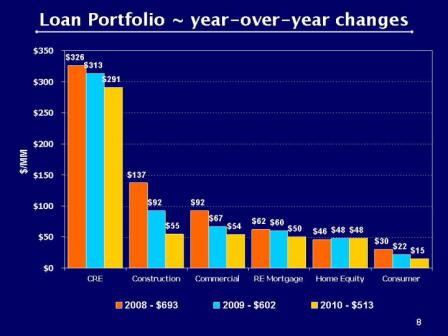

▬ Reduced Construction portfolio to $55 million from a high of $230 million in 2007.

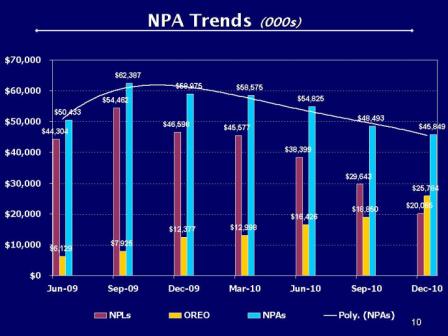

▬ Reduced NPLs by $26.5MM and NPAs by $13.1MM.

▬ Maintained strong liquidity position.

▬ Returned to profitability in the 4th Quarter.

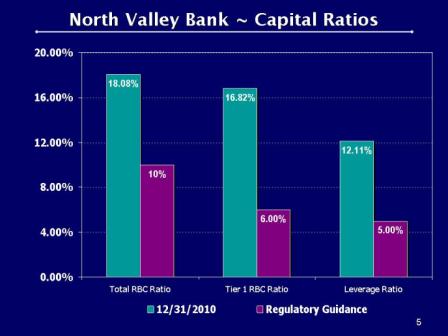

North Valley Bank ~ Capital Ratios

12/31/2010 Regulatory Guidance

Deposits $754 million ~ 12-31-10

Loan Portfolio $513 million ~ 12-31-10

Loan Portfolio ~ year-over-year changes

2008 - $693 2009 - $602 2010 - $513

Loan Portfolio Overview: CRE Portfolio

Loans by Type - $291 million at 12/31/10

NPA Trends (000s)

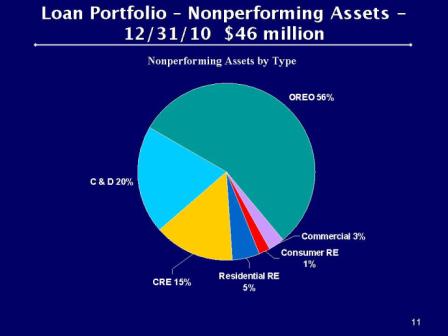

Loan Portfolio – Nonperforming Assets -12/31/10 $46 million

Nonperforming Assets by Type

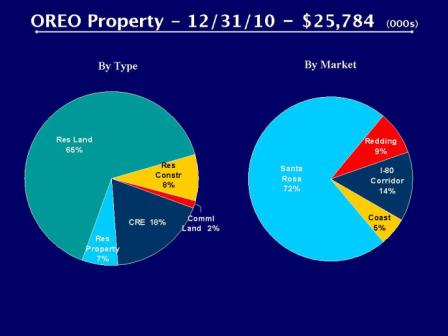

OREO Property - 12/31/10 - $25,784 (000s)

|

By Type

|

By Market

|

2011 Plan

▬ Reduce NPAs

▬ Loan Production

Owner-Occupied CRE

Government Guaranteed Lending

Expand RE Mortgage Group

▬ Improve Efficiency

▬ Strategically Focused

Thank You…