Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - AgEagle Aerial Systems Inc. | d8k.htm |

| EX-99.1 - PRESS RELEASE - AgEagle Aerial Systems Inc. | dex991.htm |

| EX-99.3 - INVESTOR PRESENTATION - AgEagle Aerial Systems Inc. | dex993.htm |

Key Market

Statistics Key Market Statistics

Stock Symbol

ENRJ

Headquarters

San Antonio, TX

Share Price

$0.90

Shares Outstanding

72.3 Million (Diluted)

Market Capitalization

$65 Million (Diluted)

Cash

$3.5 Million

Marketable Securities

$1.9 Million

Bank Debt

$6.1 Million

A Pure-Play Domestic

A Pure-Play Domestic

Onshore Oil Company

Onshore Oil Company

Eastern Kansas

EnerJex owns leases covering approximately 13,000 net acres

in Eastern Kansas and produces oil from shallow formations

ranging in depth from 500-2,000 feet. EnerJex’s historical

drilling success has exceeded 95% and its oil production is

characterized by low decline rates with production lasting up

to 40 years or more, providing repeatability and long life cash

flow. The Company has identified more than 1,000 additional

drilling prospects on its existing leases, some of which will be

drilled deeper than the primary target to explore additional

zones that may be productive and have yet to be tested.

South Texas

EnerJex owns leases covering approximately 9,100 gross acres

in South Texas focused in two separate oil projects. The

Company’s El Toro Project is an undisclosed oil resource play

in which EnerJex has leased 7,100 gross acres and completed 9

vertical wells spanning a distance of approximately 8 miles, all

of which encountered oil in the target reservoir. Numerous

attractive offset drilling locations have been established and

the project area holds the potential for hundreds of oil wells.

The Company’s Lonesome Dove Project consists of 2,000 gross

acres located in Lee County adjacent to the prolific Giddings

Field which has produced 380 million barrels of oil and 2.1

trillion cubic feet of natural gas primarily from the Austin Chalk

formation. EnerJex is targeting oil from the Austin Chalk and

Taylor Sand formations.

Asset Overview

Asset Overview

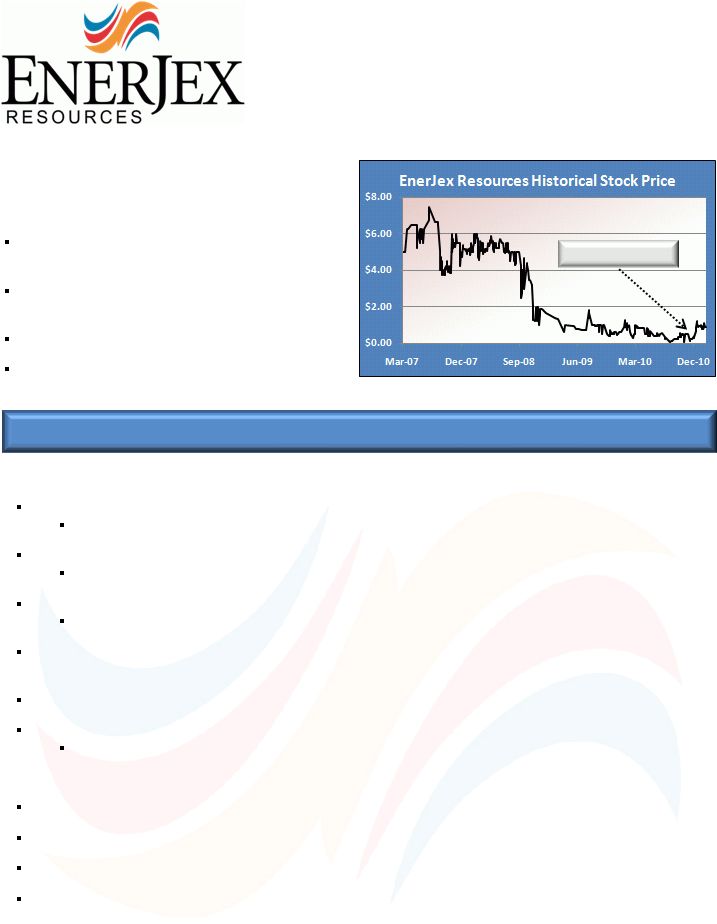

EnerJex Resources, Inc. (ENRJ) is a pure-play

domestic onshore oil company with assets located

in Eastern Kansas and South Texas. The Company’s

primary business is to explore, develop, produce,

and acquire oil properties onshore in the United

States. EnerJex presently owns a majority interest

in approximately 500 producing oil wells and has

identified more than 1,000 additional drilling

prospects on its existing leases.

1600 N.E. Loop 410, Suite 104

|

San Antonio, TX 78209 |

TEL

210.451.5545 |

WWW.ENERJEXRESOURCES.COM

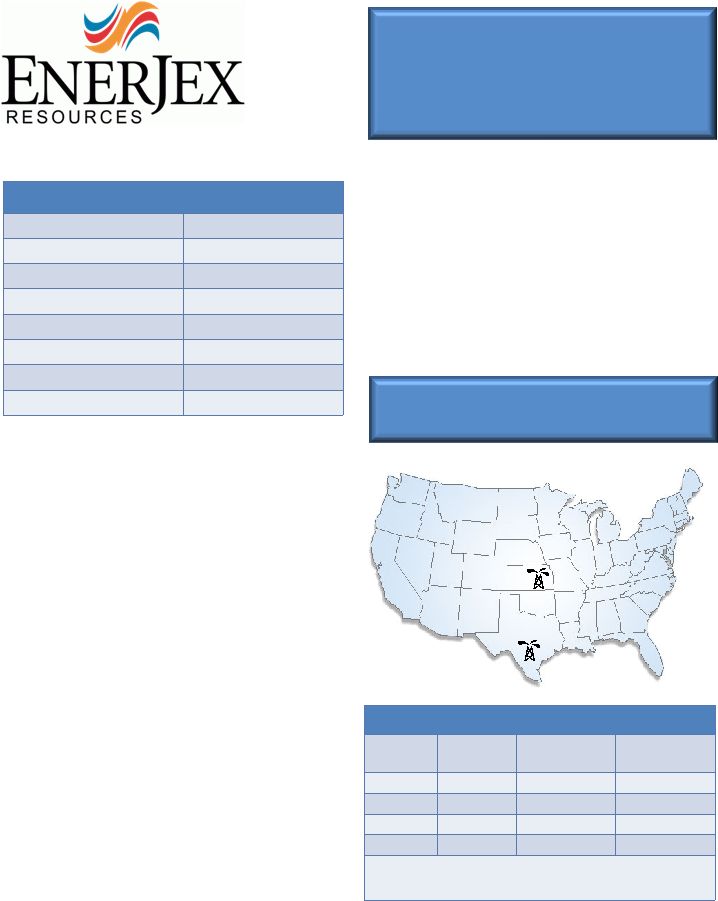

Eastern Kansas Oil Reserves

Eastern Kansas Oil Reserves

Reserve

Category

Barrels

of Oil

Future Net

Cash Flow

PV-10 Value

Proven

3,275,584

$159,150,266

$61,599,496

Probable

1,192,410

$54,343,560

$18,188,302

Possible

1,873,630

$84,579,739

$21,417,864

Total

6,431,623

$297,073,565

$101,205,662

March 4, 2011

Exhibit 99.2

Based on EnerJex’s 9/30/10 reserve report assuming NYMEX strip pricing as

of 11/30/10 and J&J Operating’s (Acquired by EnerJex) reserve report as of

12/1/10 assuming NYMEX strip pricing as of 11/19/10.

Company Profile |

Recent

Accomplishments Acquired operating equipment for $230,000 and brought operations

in-house.

Expected annual cost savings of at least $500,000.

Favorably restructured Joint Development Agreement related to one of EnerJex’s largest

assets in Eastern Kansas. Significantly increased the Company’s oil reserves and

associated value. Reestablished oil production on numerous leases that had been

neglected and required maintenance work. Expected to add 25+ barrels of daily oil

production at minimal cost. Sold non-core assets for $1.4 million and secured

$650,000 of project financing to begin development of a non-core Eastern Kansas oil

field in which EnerJex will retain a 30% interest. Added meaningful new oil hedges in

strong price environment and eliminated low price vintage hedges. Began active drilling

program on multiple oil leases in Eastern Kansas. Completed more than 10 wells year to

date with a 100% success rate and multiple rigs are actively drilling. Go Forward

Plan Aggressively increase oil production and reserves in Eastern Kansas.

Significantly reduce operating expenses and increase cash flow.

Leverage stable cash flow base to further develop high-impact El Toro Project in South

Texas. Advance stock listing to NYSE-AMEX or NASDAQ

1600 N.E. Loop 410, Suite 104

|

San Antonio, TX 78209 |

TEL

210.451.5545 |

WWW.ENERJEXRESOURCES.COM

Transformation

EnerJex was transformed through a comprehensive

transaction that closed on December 31, 2010:

Management and the board of directors were

completely reconstituted.

100% of the senior secured debentures were

converted into common equity at $0.80 per share.

$25 million of acquisitions in exchange for stock.

$5 million raised through common equity offering.

ENERJEX IS FOCUSED 100% ON CREATING PER-SHARE VALUE FOR STOCKHOLDERS

Transformation |