Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - TPC Group Inc. | d8k.htm |

Investor Conference Call

Quarter Ended December 31, 2010

March 4, 2011

Exhibit 99.1 |

2

SEC Disclosure Information

»

Forward Looking Statements -

Some of our comments today may include forward-

looking statements about our expectations for the future. These statements include

assumptions, expectations, predictions, intentions or beliefs about future

events. Although

we

believe

that

such

statements

are

based

on

reasonable

assumptions,

no

assurance can be given that such statements will prove to have been correct, and

we do not plan to update any forward-looking statements if our

expectations change. More information about the risks and

uncertainties relating to TPC Group and the forward- looking statements

may be found in our SEC filings. »

Non-GAAP Financial Measures -

Some of our comments today will reference

Adjusted EBITDA, which is a non-GAAP financial measure. Provided herein

is a reconciliation,

for

each

period

presented,

of

Adjusted

EBITDA

to

Net

Income,

which

is

the most directly comparable GAAP measure reported in our financial statements.

See Slide # 3 for a discussion covering our revision of previously reported

Adjusted EBITDA for the quarter ended December 31, 2010.

|

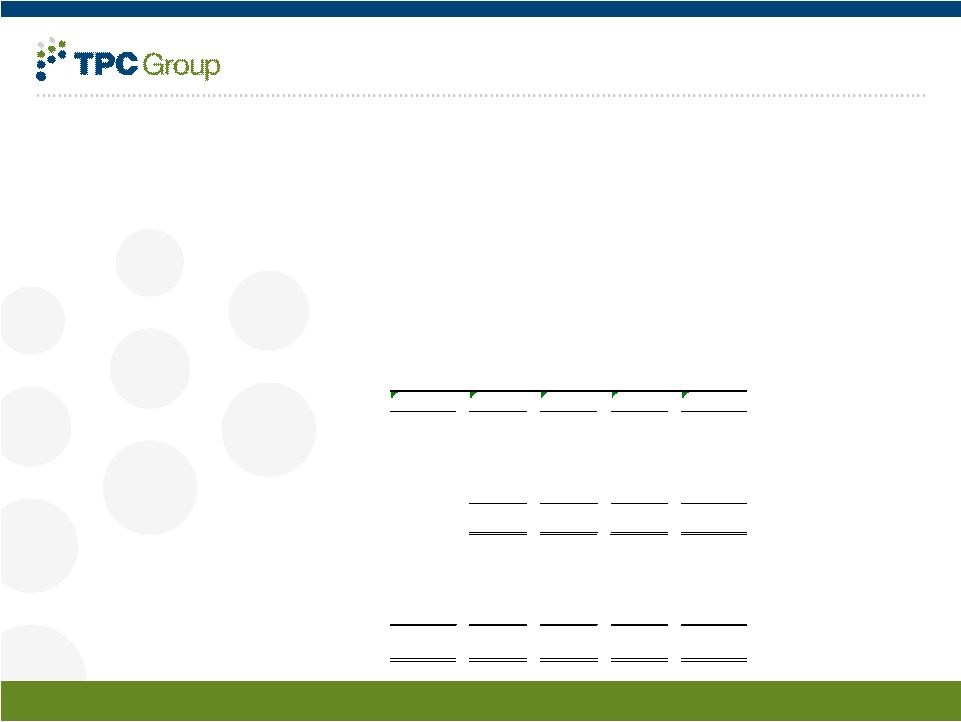

3

SEC Disclosure Information

ADJUSTED EBITDA –

REVISION OF PREVIOUSLY REPORTED AMOUNTS

We

calculate

Adjusted

EBITDA

as

earnings

before

interest,

taxes,

depreciation

and

amortization

(EBITDA),

which

is

then

adjusted

to

remove

or

add

back

certain

items.

These

items

are

identified

below

in

the

reconciliation

of

Adjusted

EBITDA

to

Net

Income

(Loss)

on

Slide

12.

Net

Income

(Loss)

is

the

GAAP

measure

most

directly

comparable

to

Adjusted

EBITDA.

As

shown

in

the

table

below,

we

have

revised

previously

reported

Adjusted

EBITDA

for

the

C4

Processing

segment

for

the

quarter

ended

December

31,

2009

to

remove

the

effect

of

the

business

interruption

insurance

recovery

of

$17.1

million.

We

have

concluded

that

removal

of

this

item,

which

we

consider

to

be

non-recurring

in

nature,

enhances

the

period-to-period

comparability

of

our

operating

results

and

is

more

useful

to

securities

analysts,

investors

and

other

interested

parties

in

their

understanding

of

our

operating

performance.

Our

calculation

of

Adjusted

EBITDA

may

be

different

from

the

calculation

used

by

other

companies;

therefore,

it

may

not

be

comparable

to

other

companies.

12/31/10

9/30/10

6/30/10

3/31/10

12/31/09

Adjusted EBITDA - as previously reported ($mm)

C4 Processing

23.8

$

26.1

$

14.7

$

29.4

$

Performance Products

14.6

17.2

11.4

4.5

Corporate

(5.3)

(7.8)

(7.0)

(6.7)

33.1

$

35.5

$

19.1

$

27.2

$

Adjusted EBITDA - current definition ($mm)

C4 Processing

15.7

$

23.8

$

26.1

$

14.7

$

12.3

$

Performance Products

9.2

14.6

17.2

11.4

4.5

Corporate

(5.9)

(5.3)

(7.8)

(7.0)

(6.7)

19.0

$

33.1

$

35.5

$

19.1

$

10.2

$

Quarter Ended

(Unaudited) |

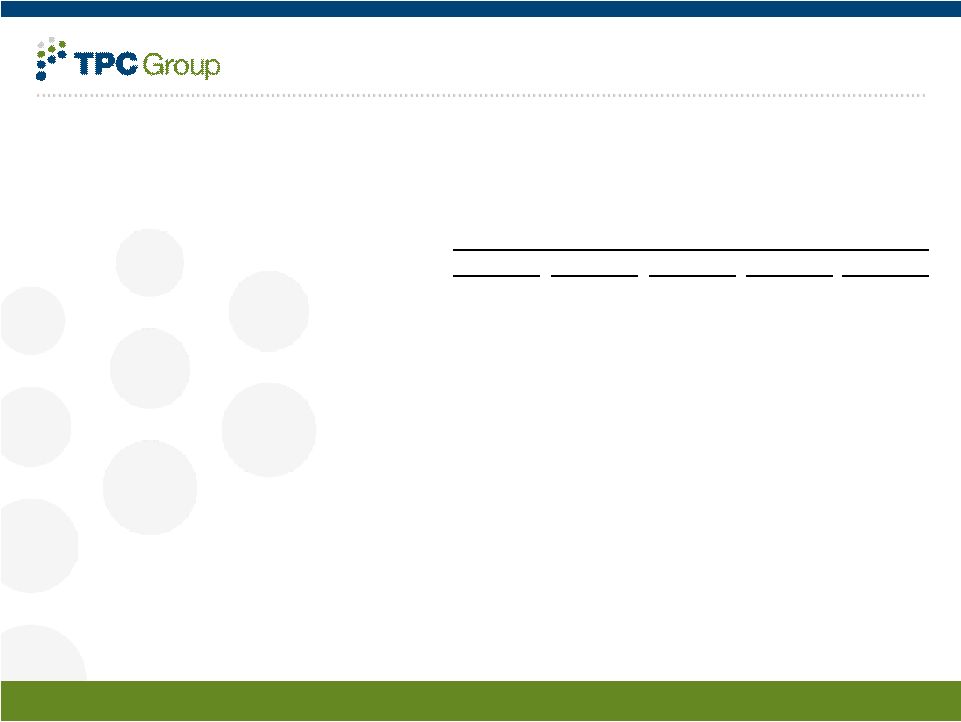

4

2010 Calendar Accomplishments

»

January

•

Public company listing

»

May

•

Initiated trading on the NASDAQ

•

Amended / extended Asset Based Revolver, $175 million

»

October

•

Issued $350 million of long-term debt at 8.25%, due 2017

•

Repaid $270 million term loan indebtedness

»

November

•

Initiated Dutch Auction Tender for $130 million of public shares

»

December

•

Repurchased 2+ million shares = 12% of current shares outstanding

•

Closed the calendar 2010 year with $107 million of Adjusted EBITDA

|

5

12/31/10

9/30/10

6/30/10

3/31/10

12/31/09

Revenue

486.1

$

499.4

$

531.8

$

400.7

$

415.8

$

Gross Profit (revenues less cost of sales)

59.2

71.3

77.8

59.7

49.0

Operating Income

8.4

22.5

24.4

8.8

16.4

Interest Income (Expense) and Other

(10.7)

(2.8)

(2.1)

(2.0)

(2.0)

Income Tax (Expense) / Benefit

1.6

(6.9)

(7.9)

(2.7)

(6.0)

Net Income

(0.7)

$

12.8

$

14.4

$

4.1

$

8.4

$

Earnings per Share (Diluted)

(0.04)

0.70

0.80

0.23

0.47

Quarter Ended

(Unaudited)

Dollars in millions

except EPS

*

See

slide

3

for

discussion

of

Adjusted

EBITDA

and

slide

12

for

a

reconciliation

of

Adjusted

EBITDA

to

Net

Income

for

all

periods

presented

.

Net

Income

(Loss)

is

the

GAAP

measure

most

directly

comparable

to

Adjusted

EBITDA. |

2011

Capex Guidance (in millions)

2011 Base maintenance

$ 15

2011 New Lab

7

2011 Discretionary ROI

8

Engineering for Dehydro 1

5

2011 Capex Plan

$ 35

Potential Projects

Low Range

High Range

Dehydro 1 add’t spend

0

-

10

Dehydro 2 engineering

0

-

5

Total

$ 35

-

$ 50

6 |

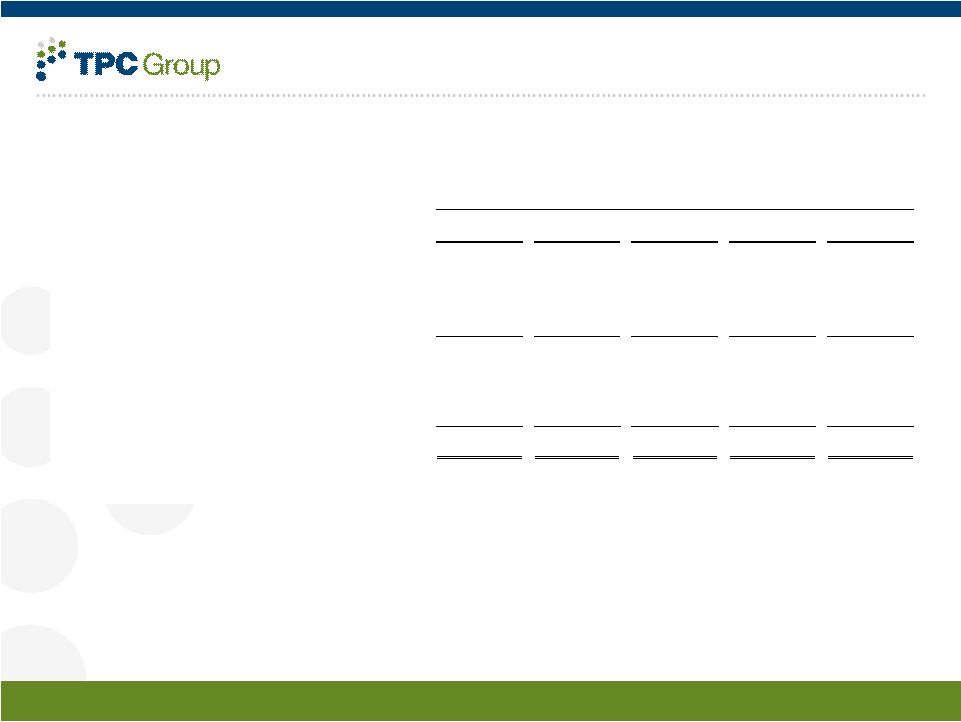

7

12/31/10

9/30/10

6/30/10

3/31/10

12/31/09

Revenue ($mm)

394.6

$

397.9

$

424.5

$

299.7

$

337.4

$

Gross Profit ($mm)

40.2

47.3

51.4

39.3

35.2

Adj. EBITDA ($mm)*

15.7

23.8

26.1

14.7

12.3

Volume (mm lbs)

597.2

587.1

644.7

531.0

680.6

Gross Profit/lb

0.07

$

0.08

$

0.08

$

0.07

$

0.05

$

Adj. EBITDA/lb

0.03

0.04

0.04

0.03

0.02

12/31/10

9/30/10

6/30/10

3/31/10

12/31/09

Revenue ($mm)

91.5

$

101.5

$

107.3

$

101.0

$

78.4

$

Gross Profit ($mm)

19.0

24.0

26.4

20.4

13.8

Adj. EBITDA ($mm)*

9.2

14.6

17.2

11.4

4.5

Volume (mm lbs)

141.0

161.6

158.0

153.7

140.8

Gross Profit/lb

0.13

$

0.15

$

0.17

$

0.13

$

0.10

$

Adj. EBITDA/lb

0.07

0.09

0.11

0.07

0.03

12/31/10

9/30/10

6/30/10

3/31/10

12/31/09

Revenue ($mm)

486.1

$

499.4

$

531.8

$

400.7

$

415.8

$

Gross Profit ($mm)

59.2

71.3

77.8

59.7

49.0

Adj. EBITDA ($mm)*

24.9

38.4

43.3

26.1

16.8

Volume (mm lbs)

738.2

748.7

802.7

684.7

821.4

Gross Profit/lb

0.08

$

0.10

$

0.10

$

0.09

$

0.06

$

Adj. EBITDA/lb

0.03

0.05

0.05

0.04

0.02

C4 Processing

Performance Products

Total Operating Segments (excludes Corporate)

Quarter Ended

Quarter Ended

Quarter Ended

*

See

slide

3

for

discussion

of

Adjusted

EBITDA

and

slide

12

for

a

reconciliation

of

Adjusted

EBITDA

to

Net

Income

for

all

periods

presented

.

Net

Income

(Loss)

is

the

GAAP

measure

most

directly

comparable

to

Adjusted

EBITDA.

Selected Operating Results (unaudited) |

2011

Outlook (in millions except tax rate, all

approximate) General and administrative expense

$ 30

Depreciation and amortization

40

Interest expense, net

32

Effective tax rate

36%

8 |

Supplemental Data

9 |

12/31/10

9/30/10

6/30/10

3/31/10

12/31/09

End of Qtr BD Contract Price ($/lb) (1)

0.86

0.93

0.92

0.76

0.65

Unleaded Gasoline Qtr Avg - USGC ($/gal) (2)

2.18

2.00

2.11

2.06

1.91

US Ethylene Industry Capacity Utilization (%) (3)

88.0

92.3

87.6

85.5

87.3

US BD Production (mm lbs) (3)

813

838

820

795

831

(1) Source: CMAI

(2) Source: Platts

(3) Source: Hodson

Quarter Ended

10

Selected Market Data |

11

Selected Financial Data

12/31/10

9/30/10

6/30/10

3/31/10

12/31/09

Sales Volumes (mm lbs) (1)

738.2

748.7

802.7

684.7

821.4

Sales Revenue ($mm)

486.1

499.4

531.8

400.7

415.8

Adjusted EBITDA ($mm)

C4 Processing

15.7

23.8

26.1

14.7

12.3

Performance Products

9.2

14.6

17.2

11.4

4.5

Corporate

(5.9)

(5.3)

(7.8)

(7.0)

(6.7)

Adjusted EBITDA (2)

19.0

33.1

35.5

19.1

10.2

Adjusted EBITDA per pound

0.03

0.04

0.04

0.03

0.01

Operating Segment Adjusted EBITDA per pound (3)

0.03

0.05

0.05

0.04

0.02

(1) Does not include tolling volume.

(2) See footnote on previous slide.

(3) Adjusted EBITDA for the C4 Processing and Performance Products

operating segments - i.e. total Adjusted EBITDA less Corporate.

Quarter Ended

(Unaudited) |

12

Reconciliation of Adjusted EBITDA to Net Income

(*)

Adjusted

EBITDA

is

presented

and

discussed

herein

because

management

believes

it

enhances

understanding

by

investors

and

lenders

of

the

Company’s

financial

performance.

Adjusted

EBITDA

is

not

a

measure

computed

in

accordance

with

GAAP.

Accordingly

it

does

not

represent

cash

flow

from

operations,

nor

is

it

intended

to

be

presented

herein

as

a

substitute

for

operating

income

or

net

income

as

indicators

of

the

Company’s

operating

performance.

Adjusted

EBITDA

is

the

primary

performance

measurement

used

by

senior

management

and

our

Board

of

Directors

to

evaluate

operating

results

of,

and

to

allocate

capital

resources

between,

our

business

segments.

We

calculate

Adjusted

EBITDA

as

earnings

before

interest,

taxes,

depreciation

and

amortization

(EBITDA),

which

is

then

adjusted

to

remove

or

add

back

certain

items..

These

items

are

identified

above

in

the

Reconciliation

of

Adjusted

EBITDA

to

Net

Income

(Loss),

the

GAAP

measure

most

directly

comparable

to

Adjusted

EBITDA.

Our

calculation

of

Adjusted

EBITDA

may

be

different

from

calculations used by other companies; therefore, it may not be comparable to other

companies. 12/31/10

9/30/10

6/30/10

3/31/10

12/31/09

Net income (loss)

(0.7)

$

12.8

$

14.4

$

4.1

$

8.4

$

Income tax expense

(1.6)

6.9

7.9

2.7

6.0

Interest expense, net

11.1

3.2

4.0

3.5

3.8

Depreciation and amortization

9.9

9.9

9.8

9.8

9.9

EBITDA

18.7

32.8

36.1

20.1

28.1

Non-cash stock based compensation

0.3

0.3

0.5

-

0.3

Unrealized gain on derivatives

-

-

(1.1)

(1.0)

(1.2)

BI insurance recoveries

-

-

-

-

(17.1)

Adjusted EBITDA (*)

19.0

$

33.1

$

35.5

$

19.1

$

10.1

$

Quarter Ended

(Unaudited, in millions) |