Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Wendy's Co | form8-k_2010q4slides.htm |

Fourth Quarter and

Full-Year 2010 Earnings Call

Full-Year 2010 Earnings Call

March 3, 2011

Opening

Comments

Comments

John Barker

SVP and Chief Communications Officer

3

Agenda

4

Forward-Looking Statements and Regulation G

This presentation, and certain information that management may discuss in connection with this

presentation, may contain statements that are not historical facts, including, importantly,

information concerning possible or assumed future results of our operations. Those statements

constitute “forward-looking statements” within the meaning of the Private Securities Litigation

Reform Act of 1995 (the “Reform Act”). For all our forward-looking statements, we claim the

protection of the safe harbor for forward-looking statements contained in the Reform Act.

presentation, may contain statements that are not historical facts, including, importantly,

information concerning possible or assumed future results of our operations. Those statements

constitute “forward-looking statements” within the meaning of the Private Securities Litigation

Reform Act of 1995 (the “Reform Act”). For all our forward-looking statements, we claim the

protection of the safe harbor for forward-looking statements contained in the Reform Act.

Many important factors could affect our future results and could cause those results to differ

materially from those expressed in or implied by our forward-looking statements. Such factors,

all of which are difficult or impossible to predict accurately, and many of which are beyond our

control, include but are not limited to those identified under the caption “Forward-Looking

Statements” in our most recent earnings press release and in the “Special Note Regarding

Forward-Looking Statements and Projections” and “Risk Factors” sections of our most recent

Form 10-K and subsequent Form 10-Qs.

materially from those expressed in or implied by our forward-looking statements. Such factors,

all of which are difficult or impossible to predict accurately, and many of which are beyond our

control, include but are not limited to those identified under the caption “Forward-Looking

Statements” in our most recent earnings press release and in the “Special Note Regarding

Forward-Looking Statements and Projections” and “Risk Factors” sections of our most recent

Form 10-K and subsequent Form 10-Qs.

In addition, this presentation and certain information management may discuss in connection

with this presentation reference non-GAAP financial measures, such as earnings before interest,

taxes, depreciation and amortization, or EBITDA. Reconciliations of non-GAAP financial measures

to the most directly comparable GAAP financial measure are in the Appendix to this

presentation, and are included in the earnings release and posted on the Investor Relations

section of our website.

with this presentation reference non-GAAP financial measures, such as earnings before interest,

taxes, depreciation and amortization, or EBITDA. Reconciliations of non-GAAP financial measures

to the most directly comparable GAAP financial measure are in the Appendix to this

presentation, and are included in the earnings release and posted on the Investor Relations

section of our website.

Business

Highlights

Highlights

Roland Smith

President & Chief Executive Officer

6

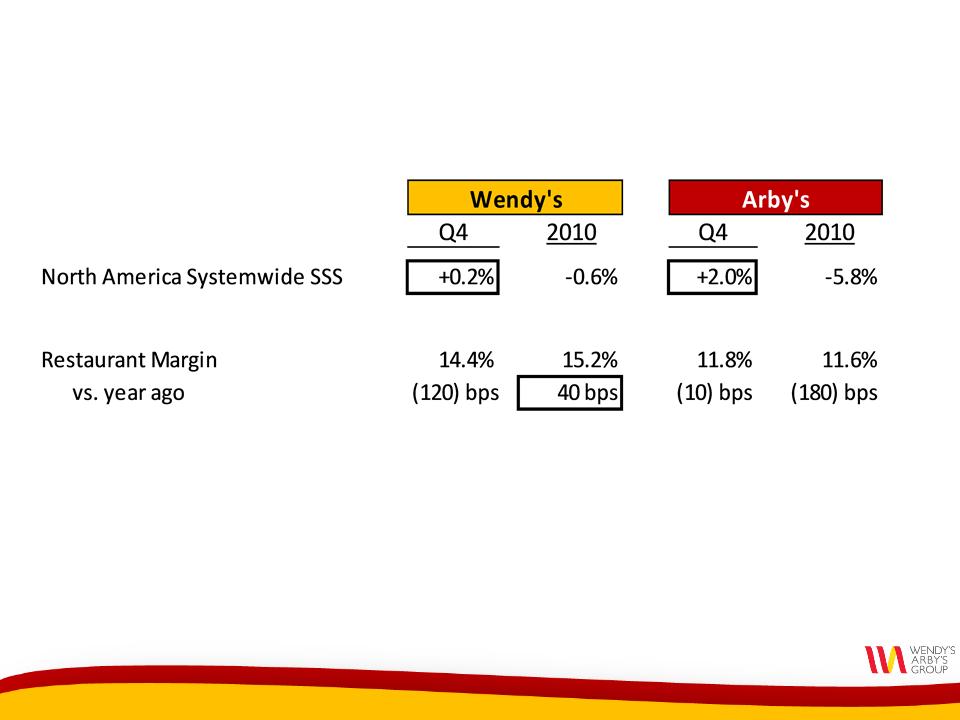

Key Results by Brand - Q4 and Full-Year 2010

*

*Restaurant Margin adjusted to exclude breakfast impact of 0.4% in Q4 and 0.4% for full-year 2010.

*

7

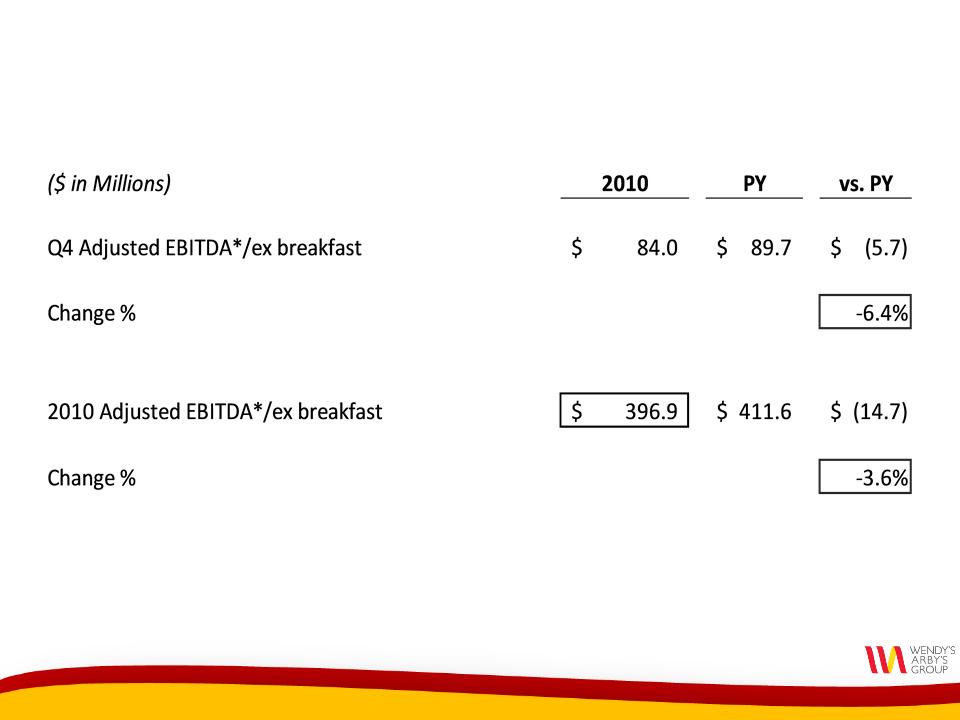

Q4 and Full-Year 2010 Results

*See Appendix for adjustments, which include: PY results adjusted to exclude 53rd week of $13.6 million.

8

Update on Arby’s

• Announced on January 20th that we are exploring

strategic alternatives for Arby’s, including a sale

strategic alternatives for Arby’s, including a sale

• Re-launch of the brand with national advertising

began on February 27th

began on February 27th

2010 Results and

2011 Outlook

2011 Outlook

Steve Hare

Chief Financial Officer

10

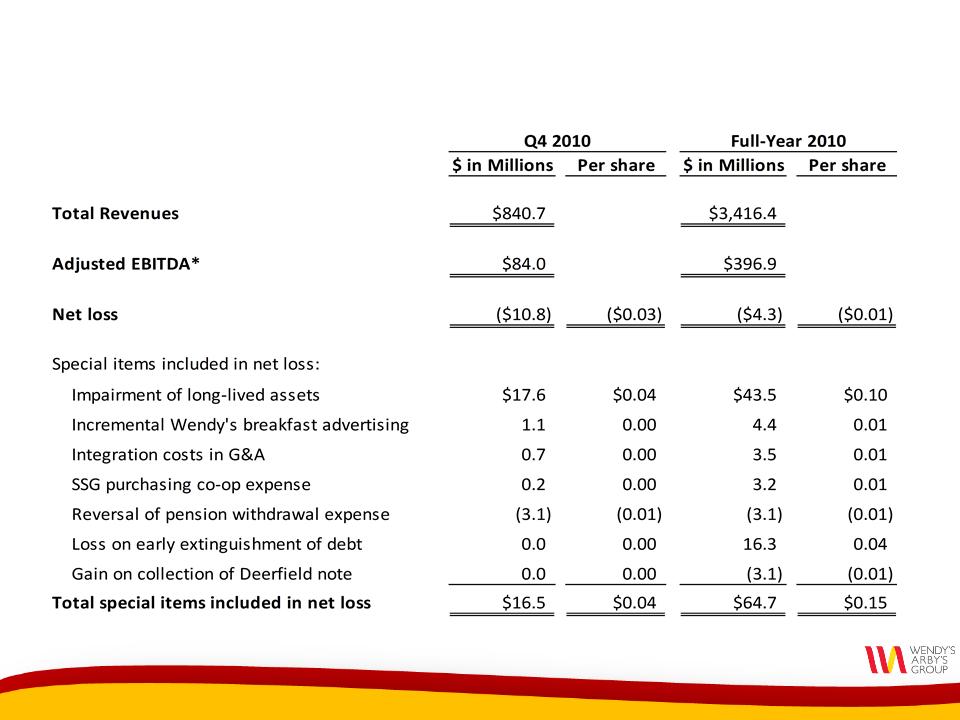

Fourth Quarter and Full-Year 2010 Results

*See Appendix.

11

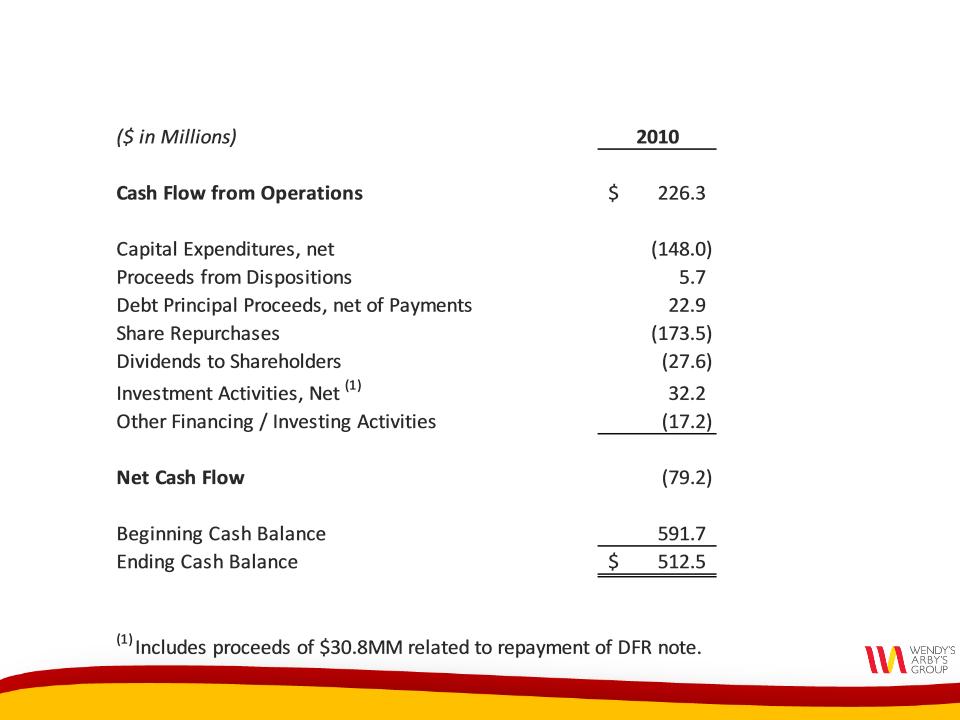

Cash Flow 2010

12

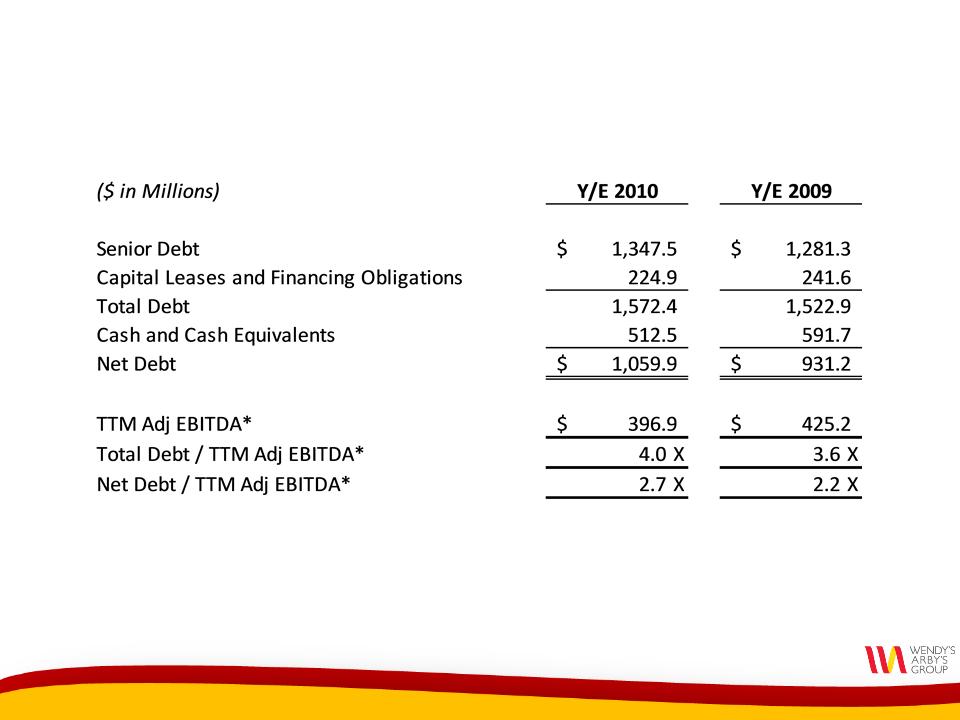

Consolidated Debt

*See Appendix.

13

• Pursuing strategic alternatives for Arby’s,

including a potential sale

including a potential sale

• Reducing corporate G&A to support single brand

2011: Transition Year

14

Benefits of Potential Sale of Arby’s

• Ability to focus resources on the Wendy’s brand

• Reduce corporate G&A to support a single brand

• Reduce capitalized lease obligations

• Reduce future capital expenditures

• Proceeds from sale would be available for

re-investment and return of capital to shareholders

re-investment and return of capital to shareholders

Sale expected to be accretive to net

income and free cash flow

income and free cash flow

15

Reduce G&A to Support Single Brand

• In 2010, approximately 1/3 of our $417 million G&A

expenses related to Arby’s

expenses related to Arby’s

• Arby’s G&A included direct G&A as well and

allocation of indirect support center G&A

allocation of indirect support center G&A

• Assuming a sale of Arby’s, direct and indirect G&A

related to Arby’s expected to transfer to the buyer or

be eliminated

related to Arby’s expected to transfer to the buyer or

be eliminated

16

2011 Outlook

• Expect $345-355 million of pro forma(1)

Company EBITDA

Company EBITDA

• Key Assumptions:

– Wendy’s same-store sales growth +1% to +3%

– Wendy’s company-operated restaurant margin(2)

improvement of 30 to 60 basis points

improvement of 30 to 60 basis points

• Commodities increasing 2-3%

– Capital expenditures of $145 million

(1) Assumes sale of Arby’s and related G&A reductions occurred as of the beginning of 2011.

(2) Includes breakfast expense in 2010 and 2011.

17

Uses of Capital 2011 and beyond

• Investments in Organic Growth & Operations

– Breakfast (new kitchen equipment, coffee program,

menuboards)

menuboards)

– Remodeling

– POS/restaurant technology

– New restaurant development - North America

– Expansion in international markets

• Common Stock Repurchase and Dividends

Wendy’s Initiatives

& Global Expansion

& Global Expansion

Roland Smith

President & Chief Executive Officer

19

Wendy’s Key 2011 Initiatives

• Reinforce “Real” Brand Positioning

• Introduce New Dave’s Hot ‘N Juicy Cheeseburger

• Launch New Products & Reinforce “My 99”

• Expand Breakfast Menu

• Deliver Operational Excellence

• Remodel Facilities

• Prepare for New Restaurant Growth

Drive Positive Same-Store Sales

20

21

• Fresh, never frozen, 100%

pure North American beef

pure North American beef

• 40% thicker patty

• Quality toppings

• Crinkle-cut pickle

• Red onion

• Toasted and buttered bun

Dave’s Hot ‘N Juicy

Cheeseburgers Feature:

Cheeseburgers Feature:

National Launch

2nd Half 2011

2nd Half 2011

22

Gold Hamburger Test Results

4 Week Base

1st Media Flight

2nd Media Flight

Dave’s Hot n’ Juicy Cheeseburgers

Test Market Average Unit Sales

(vs base)

(vs base)

+27%

23

Wendy’s New Products

and My 99 Everyday Value Menu

and My 99 Everyday Value Menu

Seasonal Salads

Seasonal Salads

Fish & Chips

Fish & Chips

Fresh Berry Frosty

Fresh Berry Frosty

Asiago

Asiago

Chicken Club

Chicken Club

24

Wendy’s Breakfast Opportunity

• Wendy’s is the only major QSR

hamburger chain with an opportunity

to introduce breakfast

hamburger chain with an opportunity

to introduce breakfast

• AUVs $1.4 million without breakfast

• Breakfast can add $140,000-$150,000

to AUVs in the near-term

to AUVs in the near-term

25

2011 Breakfast Expansion Timeline

Q4

2011

2011

Q2

2011

2011

Q3

2011

2011

Q1

2011

2011

2010

1,000

STORES

YE

2011

2011

CONVERT 300 OLD MENU

STORES

STORES

NEW

MENU

LAUNCH

MENU

LAUNCH

LOUISVILLE &

SAN ANTONIO

SAN ANTONIO

ADDITIONAL

MARKETS

MARKETS

• Kansas City

• Phoenix

• Pittsburgh

• Shreveport

26

Wendy’s Facility Remodels and New Designs

Next Generation Designs in process

100 Remodels planned for 2011

75 to be in new design

27

North America - Store Growth

~6,000 store base

1,000

new stores

new stores

28

8,000 store

opportunity

opportunity

8,000 store

opportunity

opportunity

29

Recent International Announcements

Philippines

•Expanding existing development agreement with Wenphil

– Adding 44 new restaurants for a total of 75 Wendy’s locations in

the country

the country

Japan

•New joint venture agreement with Higa Industries Co., Ltd

– Leading food importer and distributor

– Successful former Domino’s Pizza franchisee

– First Wendy’s restaurant scheduled to open in Tokyo in 2011, with

plans for rapid growth

plans for rapid growth

30

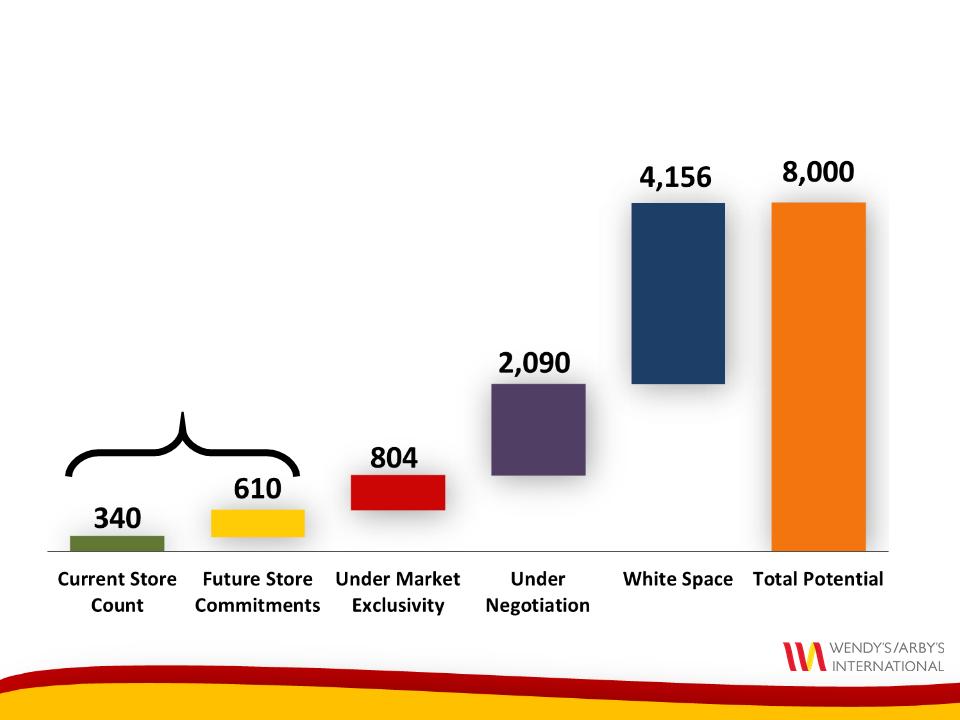

International* Development Pipeline

~1,000

*excludes Canada.

31

Growth Initiatives Summary

• Introduce exciting, new products

• Expand dayparts - especially breakfast

• Focus on operational excellence

• Modernize our facilities

• Pursue global expansion

Average annual EBITDA growth of 10-15%, beginning in 2012

32

Recent and Upcoming Events

• January 27

Investor Day

• March 9

Bank of America Merrill Lynch 2011

Consumer Conference

Consumer Conference

• March 14

Roth Capital Annual Orange County

Growth Stock Conference

Growth Stock Conference

• March 28

J.P. Morgan Gaming, Lodging,

Restaurant & Leisure Management

Access Forum 2011

Restaurant & Leisure Management

Access Forum 2011

•May 10

Q1 Earnings Release

Q&A

Appendix

35

36

|

(In Thousands)

|

Fourth Quarter

|

|

Twelve Months

|

||||

|

(Unaudited)

|

2010

(13 weeks)

|

|

2009

(14 weeks)

|

|

2010

(52 weeks)

|

|

2009

(53 weeks)

|

|

EBITDA

|

$ 85,824

|

|

$ 82,619

|

|

$ 384,037

|

|

$ 384,359

|

|

Depreciation and amortization

|

(44,724)

|

|

(46,882)

|

|

(182,172)

|

|

(190,251)

|

|

Impairment of long-lived assets

|

(28,053)

|

|

(51,024)

|

|

(69,477)

|

|

(82,132)

|

|

Operating profit (loss)

|

13,047

|

|

(15,287)

|

|

132,388

|

|

111,976

|

|

Interest expense

|

(32,694)

|

|

(37,037)

|

|

(137,229)

|

|

(126,708)

|

|

Loss on early extinguishment of debt

|

-

|

|

-

|

|

(26,197)

|

|

-

|

|

Investment income (expense), net

|

5

|

|

842

|

|

5,261

|

|

(3,008)

|

|

Other than temporary losses on investments

|

-

|

|

-

|

|

-

|

|

(3,916)

|

|

Other income, net

|

808

|

|

1,220

|

|

3,782

|

|

1,523

|

|

Loss before income taxes

|

(18,834)

|

|

(50,262)

|

|

(21,995)

|

|

(20,133)

|

|

Benefit from income taxes

|

8,076

|

|

35,544

|

|

17,670

|

|

23,649

|

|

Net (loss) income from continuing operations

|

$ (10,758)

|

|

$ (14,718)

|

|

$ (4,325)

|

|

$ 3,516

|

Wendy’s/Arby’s Group, Inc. and Subsidiaries

Calculation and Comparison of EBITDA and a Reconciliation of EBITDA to Net Income

|

(In Thousands)

|

Fourth Quarter

|

|

Twelve Months

|

||||

|

(Unaudited)

|

2010

(13 weeks)

|

|

2009

(14 weeks)

|

|

2010

(52 weeks)

|

|

2009

(53 weeks)

|

|

EBITDA

|

$ 85,824

|

|

$ 82,619

|

|

$ 384,037

|

|

$ 384,359

|

|

Plus:

Integration costs in general and administrative (G&A)

|

1,185

|

|

5,387

|

|

5,514

|

|

16,598

|

|

SSG purchasing co-op expenses in G&A

|

245

|

|

-

|

|

5,145

|

|

-

|

|

Incremental advertising for Wendy’s new breakfast

|

1,738

|

|

-

|

|

7,192

|

|

-

|

|

Reversal of pension withdrawal expense in cost of sales

|

(4,975)

|

|

-

|

|

(4,975)

|

|

-

|

|

Wendy’s purchasing co-op start-up costs in G&A

|

-

|

|

15,500

|

|

-

|

|

15,500

|

|

Facilities relocation and corporate restructuring

|

-

|

|

2,125

|

|

-

|

|

11,024

|

|

Pension withdrawal expense in cost of sales

|

-

|

|

4,975

|

|

-

|

|

4,975

|

|

Benefit from vacation policy standardization in G&A

|

-

|

|

(3,339)

|

|

-

|

|

(3,339)

|

|

Benefit from vacation policy standardization in cost of sales

|

-

|

|

(3,925)

|

|

-

|

|

(3,925)

|

|

Adjusted EBITDA

|

84,017

|

|

103,342

|

|

396,913

|

|

425,192

|

|

Less:

|

|

|

|

|

|

|

|

|

EBITDA effect of additional week in 2009

|

N.A.

|

|

(13,600)

|

|

N.A.

|

|

(13,600)

|

|

Normalized 52 weeks adjusted EBITDA

|

$ 84,017

|

|

$ 89,742

|

|

$ 396,913

|

|

$ 411,592

|

Reconciliation of EBITDA to Adjusted EBITDA

% Change in Adjusted EBITDA -6.4% -3.6%