Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE, DATED FEBRUARY 24, 2011 - SIFCO INDUSTRIES INC | dex991.htm |

| 8-K - CURRENT REPORT - SIFCO INDUSTRIES INC | d8k.htm |

Investor Presentation

Wall Street Analyst Forum

March 1, 2011

Exhibit 99.2 |

1

Copyright 2011 SIFCO Industries, Inc.

This

presentation

contains

forward–looking

statements,

as

defined

by

the

Private

Securities

Litigation

Reform

Act

of

1995

(the

“Act”).

As

a

general

matter,

forward-looking

statements

relate

to

anticipated

trends

and

expectations

rather

than

historical

matters.

Although

they

reflect

the

company’s

current

expectations,

these

statements

involve

a

number

of

risks,

uncertainties,

and

assumptions

relating

to

the

company’s

operations

and

business

environment

that

are

difficult

to

predict

and

may

be

beyond

the

control

of

the

company.

Such

uncertainties

and

factors

may

cause

actual

results

to

differ

materially

from

those

expressed

or

implied

by

forward-looking

statements.

More

information

on

the

risks

and

uncertainties

relating

to

the

forward-looking

statements

can

be

found

within

the

company’s

most

recent

periodic

reports

filed

with

the

Securities

and

Exchange

Commission,

which

are

available

on

the

company’s

Investor

Relations

website

at

www.sifco.com

or

the

SEC’s

website

at

www.sec.gov.

The

forward-looking

statements

contained

herein

represent

the

company’s

judgment

as

of

the

date

of

this

presentation

and

it

cautions

readers

not

to

place

undue

reliance

on

such

statements.

The

Company

undertakes

no

obligation

to

publicly

release

any

forward-looking

information

to

reflect

anticipated

or

unanticipated

events

or

circumstances

after

the

date

of

this

document.

Forward-Looking Statements |

2

Copyright 2011 SIFCO Industries, Inc.

Discussion Outline

Introductions

Overview of SIFCO Industries, Inc.

Market Segments

Business Strategy

Financial Summary |

3

Copyright 2011 SIFCO Industries, Inc.

SIFCO Industries Management

Michael S. Lipscomb -

President & Chief Executive Officer

Frank A. Cappello –

Chief Financial Officer, VP –

Finance

James P. Woidke –

Chief Operating Officer, EVP |

4

Copyright 2011 SIFCO Industries, Inc.

Discussion Outline

Introductions

Overview of SIFCO Industries, Inc.

Market Segments

Business Strategy

Financial Summary |

5

Copyright 2011 SIFCO Industries, Inc.

SIFCO Industries, Inc.

SIFCO Industries is engaged in the production and sale of a variety of

metalworking processes, services and products primarily to the specific

design requirements of our customers.

Operations:

Two Forging Plants

Aerospace Turbine Component Repair Facility

Multiple Selective Plating Operations

Products:

Forged components,

machined forged parts,

remanufactured components for aero turbine engines, and

selective

plating

products

and

contract

services

for

low

volume,

refurbishment

and

OEM

applications |

6

Copyright 2011 SIFCO Industries, Inc.

About SIFCO Industries -

Milestones

1913

Steel Improvement Company is founded and

subsequently merged with Forest City Electric to form

Steel Improvement & Forge Company -

-

SIFCO

1930

Initial supplier to emerging aircraft industry

1957

SIFCO becomes a public company

SIF listed on AMEX

T&W Forge acquired in December

1968

2010

1968-98

Enters turbine component repair business and grows

with multiple facilities

2006

Exits large aero turbine component repair business

|

7

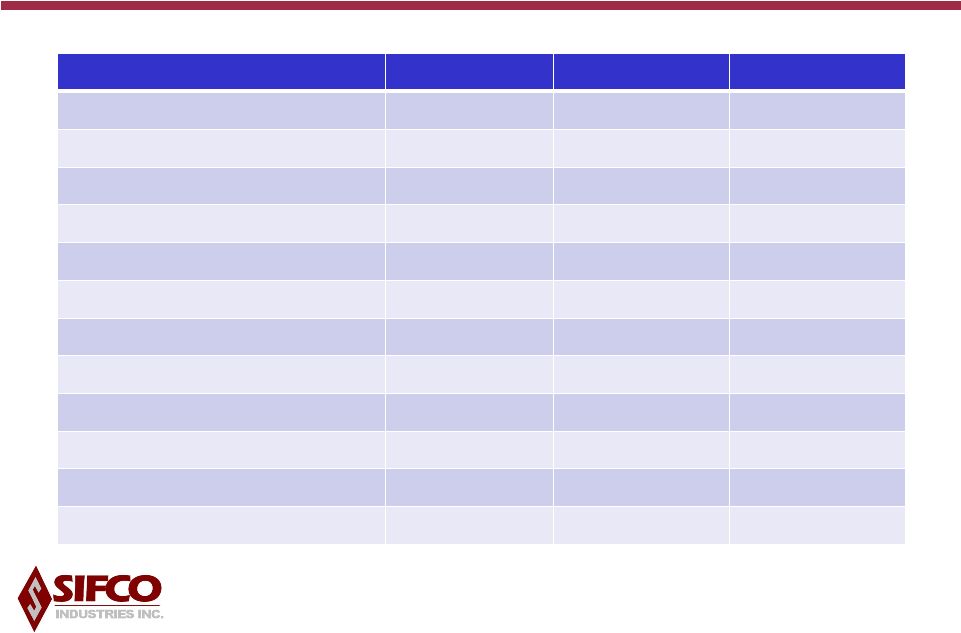

SIFCO Industries, Inc.

Division

Description

FY 2010

Net Sales

FY2010

Backlog

Locations

Forged

Components

Group

ASC Group

Repair Group

Manufacturer of forged

OEM and aftermarket

aerospace and IGT

components

$78.4 million *

(79% of Net Sales)

$89.9 million

Cleveland, OH

Alliance, OH

Develops, manufactures

and sells selective plating

products and provides

contract services for low

volume repair,

refurbishment and OEM

applications

$12.2 million

(12% of Net Sales)

N/A

Cleveland, OH

Houston, TX

East Windsor, CT

Norfolk, VA

Bromsgrove, UK

Paris, France

Rattvik, Sweden

Repair and

remanufacture of small

aerospace turbine

engine components

$8.9 million

(9% of Net Sales)

$2.3 million

Minneapolis, MN

* Pro-forma results reflect

T&W Forge as if it was

included in SIFCO’s operations

during 100% of FY 2010. |

8

Copyright 2011 SIFCO Industries, Inc.

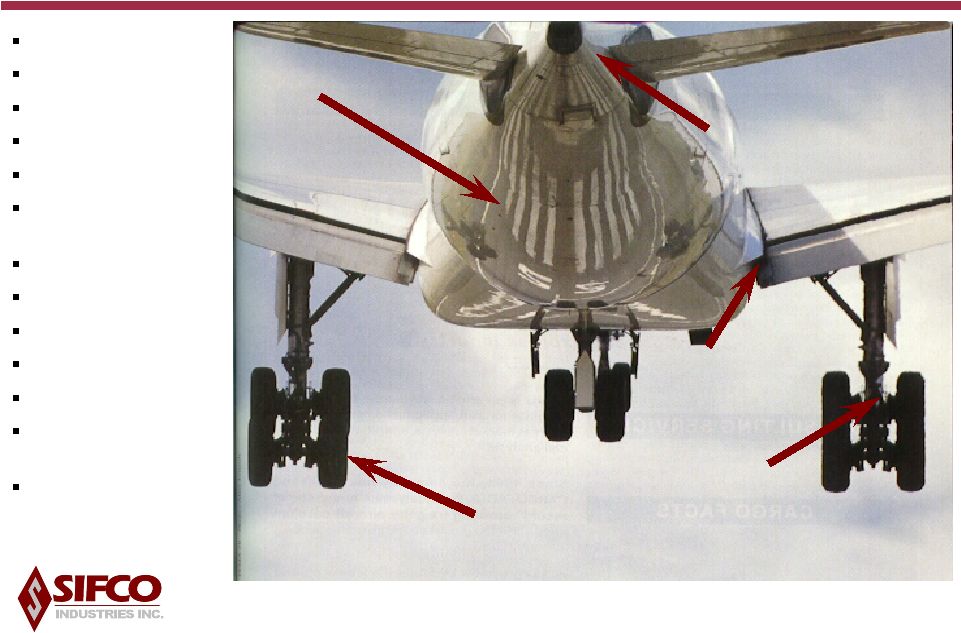

Aircraft Applications

APU Parts &

Mounts

Airframe Parts

Landing Gears

Wheels & Brakes

Wing Supports

Airbus

Allison

Aircraft Braking

Boeing

Cessna

BF Goodrich

Aerospace

Hamilton-Sundstrand

Northrop Grumman

Lockheed Martin

Messier-Dowty

Parker-Hannifin

Pratt & Whitney

Aircraft

Rolls-Royce |

9

Copyright 2011 SIFCO Industries, Inc.

Rotor Hubs

Transmission Gears

Spindles

Engine Parts

Helicopter Applications

Agusta Aerospace

Bell Helicopter

Boeing Helicopter

Pratt & Whitney

Canada

Rolls-Royce

Sikorsky Aircraft

Turbomeca

Pitch Housing |

10

Copyright 2011 SIFCO Industries, Inc.

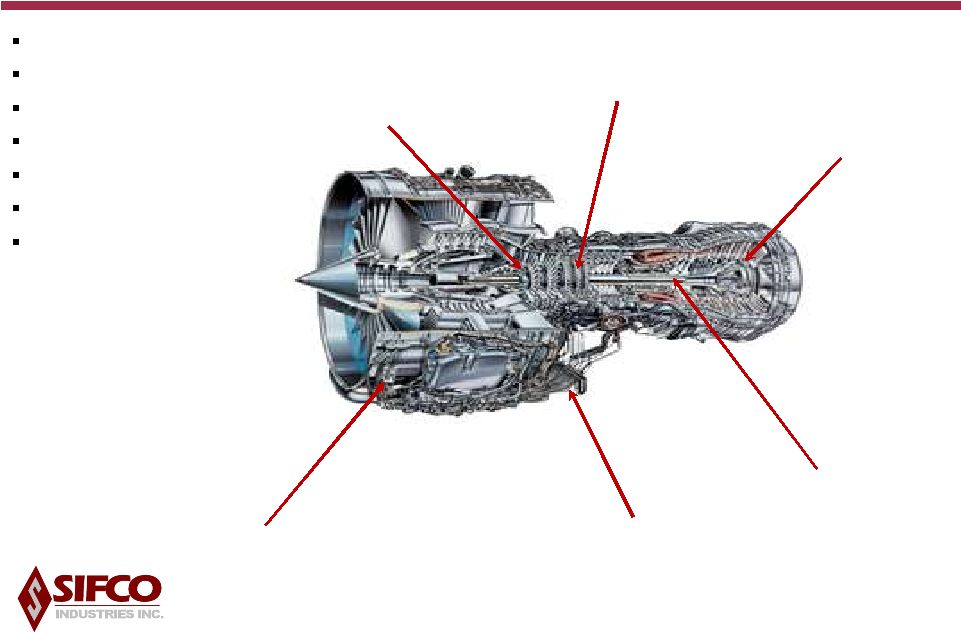

Engine Applications

Rolls-Royce

Hamilton Sundstrand

General Electric

Pratt & Whitney

MTU

Avio

Honeywell

Engine Mounts

Compressor Discs

Bearing Components

Drive Shafts

Hot Section Components

Internal Drive Gears |

11

Copyright 2011 SIFCO Industries, Inc.

Stators/Vanes

Airfoils/Blades

Industrial Gas Turbine Applications

GE –

Energy

Siemens

Alstom Power

T-Fairings |

12

Copyright 2011 SIFCO Industries, Inc.

Discussion Outline

Introductions

Overview of SIFCO Industries, Inc.

Market Segments

Business Strategy

Financial Summary |

13

Copyright 2011 SIFCO Industries, Inc.

Market Segments

Blue-Chip Customer Base |

14

Copyright 2011 SIFCO Industries, Inc.

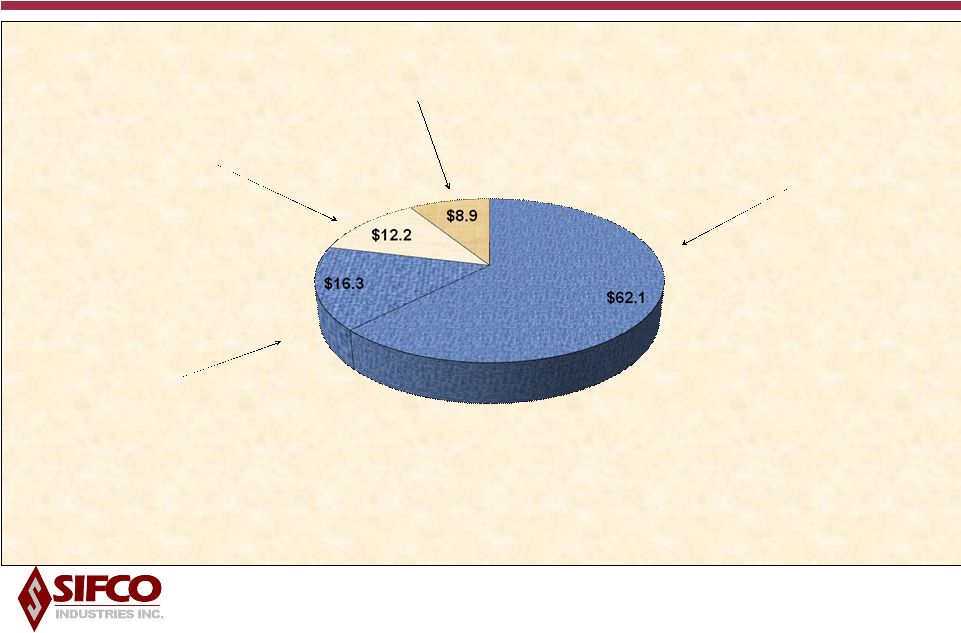

FY 2010 Revenues:

$99.6 million *

SIFCO Forge 62%

T&W Forge 16%

Applied Surface Concepts 12%

Turbine Component Repair 10%

* Pro-forma results reflect T&W Forge as if it was

included in SIFCO’s operations during 100% of FY

2010. All figures are in millions ($)

|

15

Copyright 2011 SIFCO Industries, Inc.

Market Segments

Aerospace

Flight-critical components and services found on

variety of commercial airliners, business and

military jets, and helicopters.

Energy

Engineered forged components to leading industrial

gas turbine (IGT) manufacturers. Provider of

selective plating product and services to oil and

gas customers throughout the world.

Two primary market segments:

*

Aerospace -

75%

* Energy -

17%

* Other -

8%

World-wide provider of highly-engineered components and services

to both the Aerospace and Energy markets. High-Growth End

Markets |

16

Copyright 2011 SIFCO Industries, Inc.

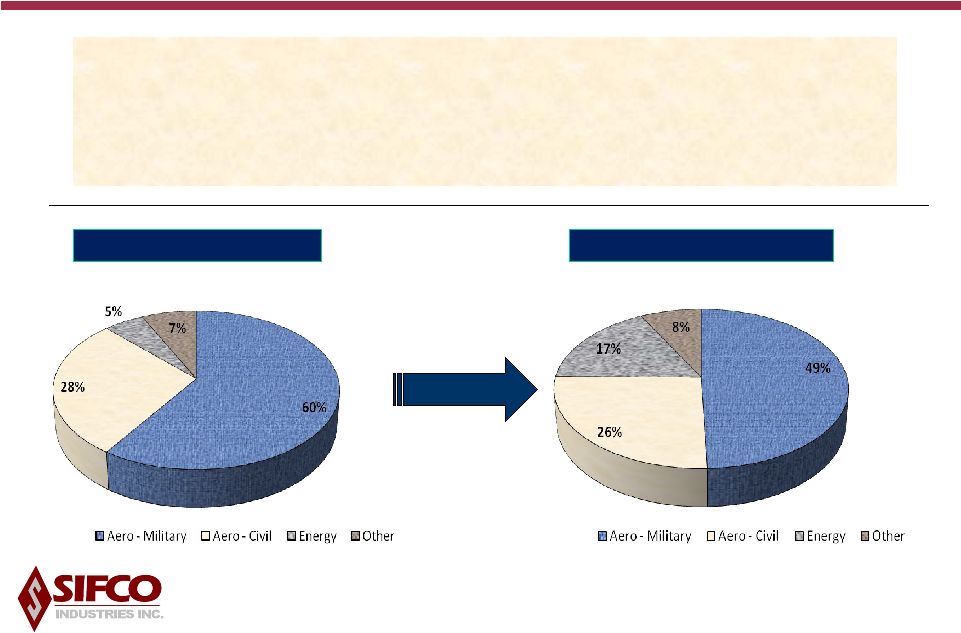

Revenue by Market Segment

Major Market Segments:

* Aerospace -75%

*Energy –

17%

*Other –

8%

Military

IGT

Civil

Oil & Gas

Pre-T&W Forge

Acquisition

Post-T&W Forge Acquisition |

17

Copyright 2011 SIFCO Industries, Inc.

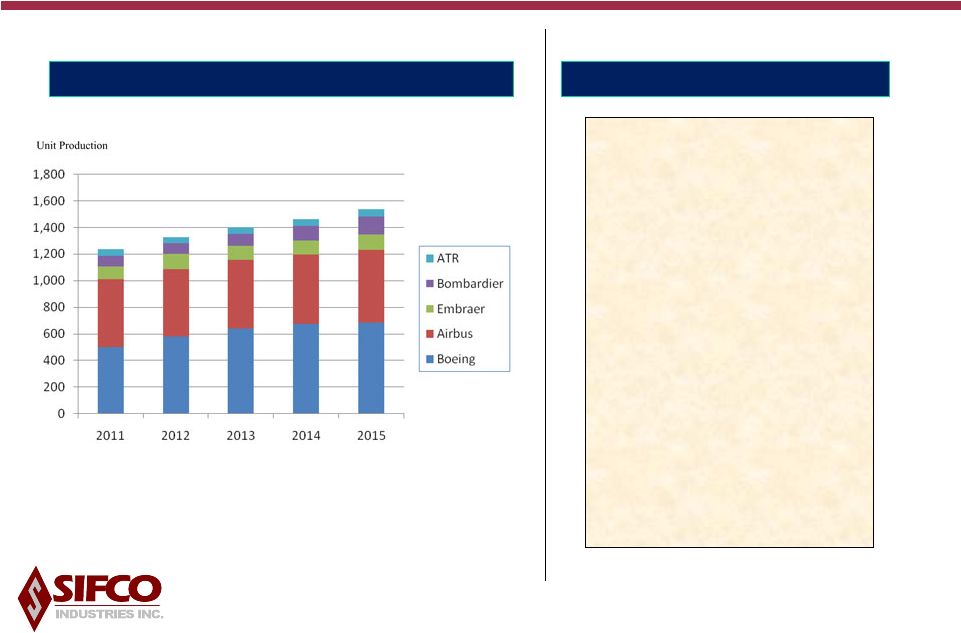

Market Segments

World Commercial Transport Production

Boeing

737

(27),

747

(62)

757

(23),

767(40)

777

(18),

787(13)

Airbus

A319/A320

(7)

A330/A340

(18)

A380

(1)

Embraer

145

(21)

170/190

(7)

Active SIFCO Platforms

( ) represents number of active part numbers

Source: Forecast International |

18

Copyright 2011 SIFCO Industries, Inc.

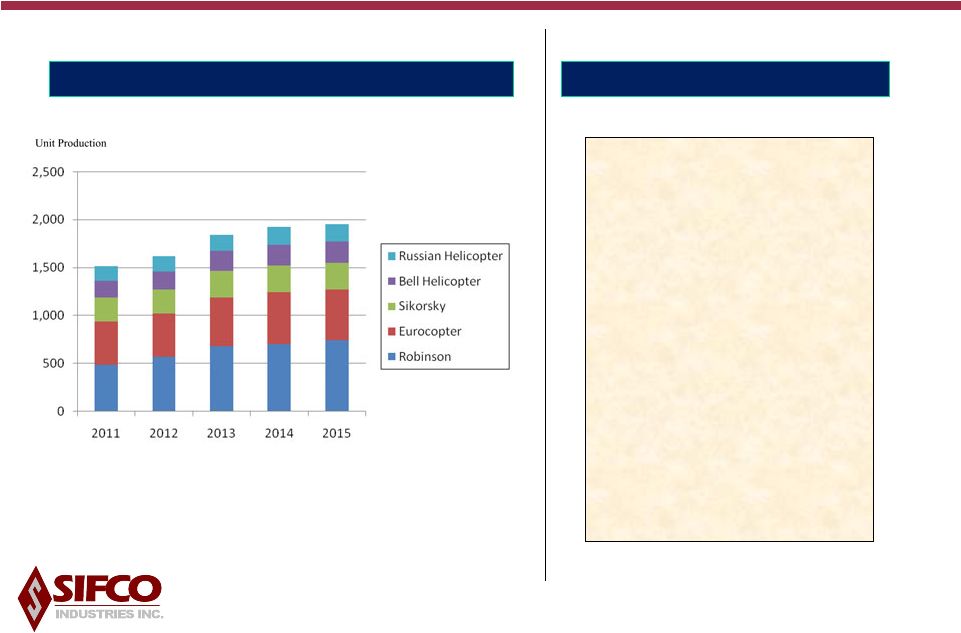

Market Segments

World Civil Rotary-Wing Production

Sikorsky

S76

(21)

S92

(33)

Bell Helicopter

206

(7)

212

(5)

214

(24)

222

(16)

412

(12)

429

(2)

449 (8)

609

(6)

Active SIFCO Platforms

( ) represents number of active part numbers

Source: Forecast International |

19

Copyright 2011 SIFCO Industries, Inc.

Market Segments

Sikorsky

o

Blackhawk (UH-60/S-70)

1,015

64

o

Seahawk (SH/MH-60)

429

64

o

CH-53K

50

22

•

(200 total planned for Marines) *

Bell / Boeing

o

V-22 Tiltrotor

311

24

Boeing

o

CH-47

292

31

o

F-18

Hornet

234

(thru

2016)

47

Lockheed Martin

o

F-16

166

(thru

2017)

51

o

F35 Joint Strike Fighter

924

71

Major Military Platforms

Active SIFCO

Part Numbers

* Source: Forecast International

Est. Production Units

2010-2019 * |

20

Copyright 2011 SIFCO Industries, Inc.

Discussion Outline

Introductions

Overview of SIFCO Industries, Inc.

Market Segments

Business Strategy

Financial Summary |

21

Copyright 2011 SIFCO Industries, Inc.

Clear Business Strategy

Focus on long-term, consistent growth

Invest in technology that yields a competitive advantage

Drive Operational Excellence

Grow through disciplined, strategic acquisitions and/or capital

investment |

22

Copyright 2011 SIFCO Industries, Inc.

Invest in Technology That Yields a Competitive Advantage

New

35,000

lb.

Hammer

Cell

-

$6.5

million

Satisfy

current/new

customers’

need

for

larger

components

o

In-service date: January, 2010

o

Cell includes:

o

35,000 lb. steam hammer

o

Three hydraulic presses

o

State-of-the-art rotary furnace

o

New

hammer

cell

doubled

the

capability

of

Cleveland

Forge

facility

o

Part weight from 500 lbs. to 1,000 lb. max.

o

Received GE order for large IGT blade in 2/11.

New

Chemical

Etching

Line

-

$110K

New

capability

to

serve

new

customer

–

Siemens

o

In-service date: December, 2010

o

Line etches cast blades for Siemens IGT units. |

23

Copyright 2011 SIFCO Industries, Inc.

Drive Operational Excellence

A critical strategy in remaining competitive is to drive Operational

Excellence at all divisions.

More

importantly, differentiate ourselves from the competition!

Three main areas of focus:

Long-term sustained Continuous Improvement

SMART

Lean

TOC

Six Sigma

Reliability Centered Maintenance

100% Customer Satisfaction

Focus is on being

customer-centered

100% on-time delivery is the expectation

Organization Development

Enhance succession planning –

right people for the right positions

Look for “strategic additions”

-

personnel

Preferred Supplier Status |

24

Copyright 2011 SIFCO Industries, Inc.

Grow through Disciplined, Strategic Acquisitions and/or Capital Investment

Renewed Focus to Grow the Business

Major effort to strengthen the Portfolio

Growth will come from the following:

New Products

•

Complimentary or value-added opportunities

Enhanced Capabilities

Market Expansion

•

Entry into new markets and/or development of new customers

|

25

Copyright 2011 SIFCO Industries, Inc.

Impact of T&W Forge Acquisition

T&W Forge Acquisition, completed 12/10/10, provides the following:

Further Leveraging and Expansion of Core Forging Platform

•

Equipment between both forge operations is complimentary

•

Cleveland facility has increased capability for larger components due to recent

installation of 35K hammer cell

Just awarded new large component for GE 7FA.05 platform

•

Expect market penetration due to strong customer relationships

SIFCO Forge : Rolls Royce

T&W Forge:

GE Energy

Diversification into Power Generation Market

•

Forged Components Group has primarily been focused on aerospace

•

Energy now represents 17% of business

Immediately Accretive to EPS

•

Provides synergistic opportunities to enhance profitability

Consistent with Overall Business Strategy |

26

Copyright 2011 SIFCO Industries, Inc.

Recent Program Awards

Rolls Royce

5-year LTA valued at $85 million. (2011-2016)

Contract

covers

compressor

discs,

shafts

and

various

transmission

gears

for

the

Lockheed

Martin

C-130,

Bell/Boeing

V-22

Osprey,

Embraer

ERJ

and

the

Lockheed

Martin

F-35

Joint

Strike

Fighter (JSF).

Sikorsky

Multi-Year (MY) 7 award valued at $29 million.

(2011-2012) Award is for supply of rotor and tail rotor transmission

gears, rotor head structural components and landing gear. Components

are associated with the family of Blackhawk military helicopters (UH-

60/S-70).

Awarded multiple part numbers on new heavy-lift CH-53K

helicopter still in development. Estimated annual volume is $2 million

with 2018 in-service date. |

27

Copyright 2011 SIFCO Industries, Inc.

Recent Program Awards

Hamilton Sundstrand

10-year LTA valued at $35 million. (2010-2020)

Various

impellors,

shafts,

diffusers

and

auxiliary

power

unit

(APU)

discs

for

multiple

commercial

and

military

aircraft.

Select

aircraft

include

the

Boeing

737/747/777,

Airbus

A320/A340/A380,

Embraer

ERJ,

Boeing C-130, Bell/Boeing V-22 Osprey, Boeing

F-15, Lockheed Martin F-16.

10-year LTA valued at $25 million. (2011-2021)

Award is to supply multiple transmission gears and shafts as well as pump

actuators, valves and gears. These components are associated with the

Boeing 787 and the Lockheed Martin F-35 Joint Strike Fighter

(JSF). Embraer

Two-year LTA valued at $3.5 million. (2011-2012)

LTA covers landing gear components for the ERJ 170/190 aircraft as well as

the Sikorsky S-92. |

28

Copyright 2011 SIFCO Industries, Inc.

Discussion Outline

Introductions

Overview of SIFCO Industries, Inc.

Market Segments

Business Strategy

Financial Summary |

29

Copyright 2011 SIFCO Industries, Inc.

FY 2010 Financial Highlights

Posted strong operating results in a challenging economic environment:

o

FY2010

Pro-forma

net

sales

increased

6%

to

$99.6

million

1

•

Primary driver was acquisition of TWF

o

FY2010 Pro-forma EBITDA (FIFO basis) increased 14% to $14.4 million.

1

o

EPS improved to $1.31 from $1.00 on Pro-forma basis.

1

Continued strong management of balance sheet

o

Successful working capital management efforts maintained very strong current ratio

of 3.9. o

Cash

and

ST

investments

increased

to

$21.6

million

–

essentially

no

debt.

New $30 million revolving credit facility negotiated in December, 2010 in conjunction

with TWF acquisition.

o

$11.7

million

borrowed

to

fund

acquisition

–

currently

at

$7.7

million.

1

Pro-forma results reflect T&W Forge as if it was included in

SIFCO’s operations during 100% of FY 2010. |

30

Copyright 2011 SIFCO Industries, Inc.

FY 2010 Financial Highlights

$6.7 million reinvested in the equipment/facilities to enhance capabilities:

o

Completed

installation

of

new

35K

hammer

cell

-

$3.8

million

in

FY2010

o

Completed

installation

of

new

ERP

software

system

-

$

0.6

million

in

FY2010

Special dividend increased 50% from $0.10/share to $0.15/share.

66,000 shares repurchased at an average price of $10.60.

o

The six-month repurchase period expired in December, 2010.

|

31

Copyright 2011 SIFCO Industries, Inc.

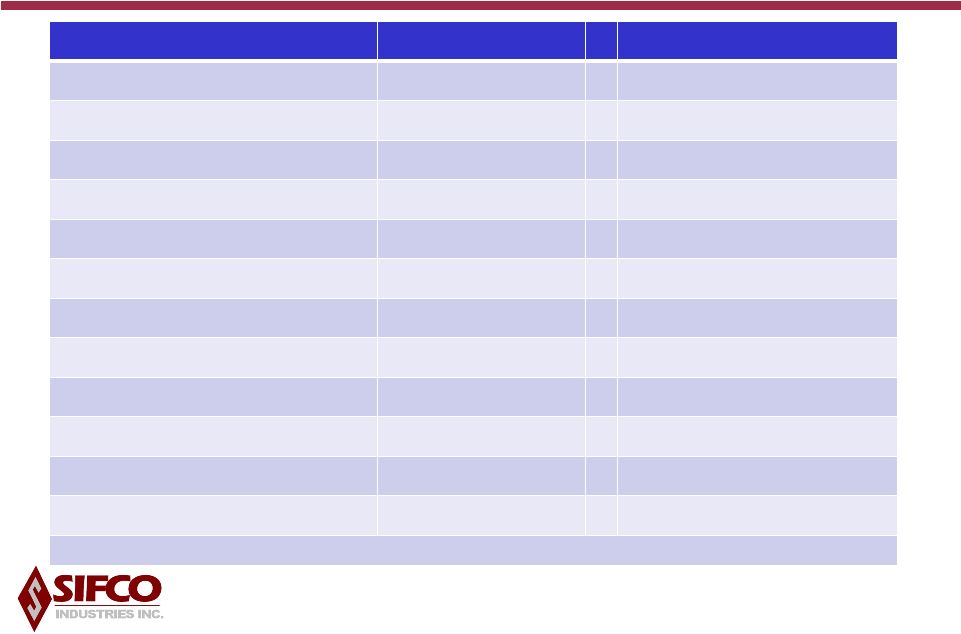

FY2010 Financial Results

FY 2010 Actual

FY 2010 Pro Forma*

Net Sales

$83,270

$99,619

Gross Profit

$19,741

$24,183

23.7%

24.3%

Net Income

$5,362

$7,017

EPS

$1.00

$1.32

EBITDA (LIFO basis)

$10,303

$14,228

+/-

LIFO expense (income)

$175

$175

EBITDA (FIFO basis)

$10,478

$14,403

* Pro-forma results reflect T&W Forge as if it was included in SIFCO’s

operations during 100% of FY 2010 |

32

Copyright 2011 SIFCO Industries, Inc.

Historical Financial Results

FY 2007

FY 2008

FY 2009

Net Sales

$87,255

$101,391

$93,888

Gross Profit

$21,420

$22,230

$23,941

24.5%

21.9%

25.5%

Net Income

$6,728

$5,830

$8,035

EPS

$1.27

$1.09

$1.51

EBITDA (LIFO basis)

$11,865

$10,428

$14,203

+/-

LIFO expense (income)

$331

$1,712

$(1,583)

EBITDA (FIFO basis)

$12,196

$12,140

$12,620 |

33

Copyright 2011 SIFCO Industries, Inc.

Overall Historical Backlog

Backlog is primarily driven by Forged Components Group

-

-

steady growth over last 4 quarters |

34

Copyright 2011 SIFCO Industries, Inc.

Firmly Established Relationships with Diverse, Blue-Chip Customer Base

Significant Backlog & Revenue Visibility

Capacity to Expand Profitably

Experienced Management Team

High-Growth End Markets

Platform for Future Acquisitions & Expansions

Investment Highlights |

35

Copyright 2011 SIFCO Industries, Inc.

Contact Information

SIFCO Industries, Inc.

970

E.

64

th

St.

Cleveland, Ohio 44103

Frank Cappello

VP-Finance and Chief Financial Officer

(216) 432-6278

WWW.SIFCO.COM |