Attached files

| file | filename |

|---|---|

| EX-21.01 - LIST OF SUBSIDIARIES - DEXCOM INC | dex2101.htm |

| EX-23.01 - CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM - DEXCOM INC | dex2301.htm |

| EX-31.02 - CERTIFICATION OF CFO - DEXCOM INC | dex3102.htm |

| EX-32.02 - CERTIFICATION OF CFO - DEXCOM INC | dex3202.htm |

| EX-32.01 - CERTIFICATION OF CEO - DEXCOM INC | dex3201.htm |

| EX-31.01 - CERTIFICATION OF CEO - DEXCOM INC | dex3101.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2010

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 000-51222

DEXCOM, INC.

(Exact name of Registrant as Specified in its Charter)

| Delaware | 33-0857544 | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) | |

| 6340 Sequence Drive San Diego, California |

92121 | |

| (Address of Principal Executive offices) | (Zip Code) | |

Registrant’s Telephone Number, including area code: (858) 200-0200

Securities registered pursuant to Section 12(b) of the Exchange Act:

| Title of Each Class |

Name of Each Exchange on Which Registered | |

| Common Stock, $0.001 Par Value Per Share | The NASDAQ Stock Market LLC (Nasdaq Global Market) | |

| Preferred Stock Purchase Rights | The NASDAQ Stock Market LLC (Nasdaq Global Market) |

Securities registered pursuant to Section 12(g) of the Exchange Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes x No ¨

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act.

Yes ¨ No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Rule 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definite proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “Smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one)

Large accelerated Filer ¨ Accelerated Filer x Non-accelerated Filer ¨ Smaller reporting company ¨

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No x

As of June 30, 2010, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was approximately $657,285,311 based on the closing sales price as reported on the NASDAQ Global Market.

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

| Class |

Outstanding at February 28, 2011 | |

| Common stock, $0.001 par value per share | 62,208,159 shares |

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the documents listed below have been incorporated by reference into the indicated parts of this report, as specified in the responses to the item numbers involved.

Designated portions of the Proxy Statement relating to the 2011 Annual Meeting of the Stockholders (the “Proxy Statement”): Part III (Items 9, 10, 11, 12, and 13). Except with respect to information specifically incorporated by reference in the Form 10-K, the Proxy Statement is not deemed to be filed as part hereof.

Table of Contents

Table of Contents

| Page Number |

||||||

| PART I |

||||||

| ITEM 1. |

1 | |||||

| ITEM 1A. |

23 | |||||

| ITEM 1B. |

43 | |||||

| ITEM 2. |

43 | |||||

| ITEM 3. |

43 | |||||

| PART II |

||||||

| ITEM 5. |

45 | |||||

| ITEM 6. |

46 | |||||

| ITEM 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

47 | ||||

| ITEM 7A. |

59 | |||||

| ITEM 8. |

60 | |||||

| ITEM 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

61 | ||||

| ITEM 9A. |

61 | |||||

| ITEM 9B. |

62 | |||||

| PART III |

||||||

| ITEM 10. |

63 | |||||

| ITEM 11. |

63 | |||||

| ITEM 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholders Matters |

63 | ||||

| ITEM 13. |

Certain Relationships and Related Transactions, and Director Independence |

63 | ||||

| ITEM 14. |

63 | |||||

| PART IV |

||||||

| ITEM 15. |

64 | |||||

Table of Contents

PART I

Except for historical financial information contained herein, the matters discussed in this Form 10-K may be considered forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and subject to the safe harbor created by the Securities Litigation Reform Act of 1995. Such statements include declarations regarding our intent, belief, or current expectations and those of our management. Prospective investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve a number of risks, uncertainties and other factors, some of which are beyond our control; actual results could differ materially from those indicated by such forward-looking statements. Important factors that could cause actual results to differ materially from those indicated by such forward-looking statements include, but are not limited to: (i) that the information is of a preliminary nature and may be subject to further adjustment; (ii) those risks and uncertainties identified under “Risk Factors;” and (iii) the other risks detailed from time-to-time in our reports and registration statements filed with the Securities and Exchange Commission, or SEC. Except as required by law, we undertake no obligation to revise or update publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

| ITEM 1. | BUSINESS |

Overview

We are a medical device company focused on the design, development and commercialization of continuous glucose monitoring systems for ambulatory use by people with diabetes and for use by healthcare providers in the hospital for the treatment of both diabetic and non-diabetic patients.

Ambulatory Product Line: SEVEN® PLUS

We received approval from the Food and Drug Administration, or FDA, and commercialized our first product in 2006. In 2007, we received approval and began commercializing our second generation system, the SEVEN, and on February 13, 2009, we received approval for our third generation system, the SEVEN PLUS, which is designed for up to seven days of continuous use, and we began commercializing this product in the first quarter of 2009. We no longer market or provide support for the SEVEN system. There are various differences between the SEVEN and the SEVEN PLUS. As compared to the SEVEN, the SEVEN PLUS incorporates additional user interface and algorithm enhancements that are intended to make its glucose monitoring function more accurate and customizable. The approval of the SEVEN PLUS by the FDA allows for the use of the SEVEN PLUS by adults with diabetes to detect trends and track glucose patterns, to aid in the detection of hypoglycemia and hyperglycemia and to facilitate acute and long-term therapy adjustments.

In-Hospital Product Line: GlucoClear®

To address the in-hospital patient population, we entered into an exclusive agreement with Edwards Lifesciences LLC, or Edwards, to develop jointly and market a specific product platform for the in-hospital glucose monitoring market, with an initial focus on the development of an intravenous sensor specifically for the critical care market. On October 30, 2009, we received CE Mark approval for our first generation blood-based in-vivo automated glucose monitoring system, which we have branded the GlucoClear, for use by healthcare providers in the hospital, and are continuing to seek approval for this system from the FDA. In partnership with Edwards, we initiated a very limited launch of the GlucoClear system in Europe in 2009.

Background

From inception to 2006, we devoted substantially all of our resources to start-up activities, raising capital and research and development, including product design, testing, manufacturing and clinical trials. Since 2006,

1

Table of Contents

we have devoted considerable resources to the commercialization of our ambulatory continuous glucose monitoring systems, including the SEVEN PLUS, as well as the continued research and clinical development of our technology platform.

The International Diabetes Federation, or IDF, estimates that 285 million people around the world have diabetes, and the Centers for Disease Control, or CDC, estimates that diabetes affects 25.8 million people in the United States. IDF estimates that by 2030, the worldwide incidence of people suffering from diabetes will reach 438.0 million. The increased prevalence of diabetes is believed to be the result of an aging population, unhealthy diets and increasingly sedentary lifestyles. According to the CDC, diabetes was the seventh leading cause of death by disease in the United States during 2007, and complications related to diabetes include heart disease, limb amputations, loss of kidney function and blindness.

According to a CDC spokesman cited in a New York Times article, one in every three children born in the United States in 2001 was expected to become diabetic in their lifetimes, and every day in the United States, on average, there would be 4,100 people diagnosed with diabetes, 230 people undergoing amputations as a result of diabetes, 120 people who enter end-stage kidney disease programs and 55 people who lose their vision.

According to the American Diabetes Association, or ADA, one in every ten health care dollars was spent on treating diabetes in 2007, and the direct medical costs and indirect expenditures attributable to diabetes in the United States were an estimated $174 billion, an increase of $42 billion since 2002. Of the $174 billion in overall expenses, the ADA estimated that approximately $89 billion were costs associated with chronic complications and excess general medical costs, $27 billion were costs associated with diabetes care and $58 billion were indirect medical costs. The ADA also found that average medical expenditures among people with diagnosed diabetes were 2.3 times higher than for people without diabetes.

We believe continuous glucose monitoring has the potential to enable more people with diabetes to achieve and sustain tight glycemic control. The Diabetes Control and Complications Trial (DCCT) demonstrated that improving blood glucose control lowers the risk of developing diabetes related complications by up to 50%. The study also demonstrated that people with Type 1 diabetes achieved sustained benefits with intensive management. Yet, according to an article published in the Journal of the American Medical Association (JAMA) in 2004, less than 50% of diabetes patients were meeting ADA standards for glucose control (A1c), and only 37% of people with diabetes were achieving their glycemic targets. The CDC estimated that as of 2006, 63.4% of all adults with diabetes were monitoring their blood glucose levels on a daily basis, and that 86.7% of insulin-requiring patients with diabetes monitored daily.

Various clinical studies also demonstrate the benefits of continuous glucose monitoring and that continuous glucose monitoring is equally effective in patients who administer insulin through multiple daily injections or through use of continuous subcutaneous insulin infusion pumps. Results of a Juvenile Diabetes Research Foundation (JDRF) study published in the New England Journal of Medicine in 2008, and the extension phase of the study, published in Diabetes Care in 2009, demonstrated that continuous glucose monitoring improved A1c levels and reduced incidence of hypoglycemia for patients over the age of 25 and for all patients of all ages who utilized continuous glucose monitoring regularly.

Our initial target market in the United States consists of an estimated 30% of people with Type 1 diabetes who utilize insulin pump therapy and an estimated 50% of people with Type 1 diabetes who utilize multiple daily insulin injections. Our broader target market in the United States consists of our initial target market plus an estimated 20% of people with Type 1 diabetes using conventional insulin therapy and the 27% of people with Type 2 diabetes who require insulin. Although our initial focus is within the United States, our CE Mark approval also enables us to commercialize our system in those European, Asian and Latin American countries that recognize the CE Mark.

2

Table of Contents

Close Concerns, Inc., a healthcare information firm exclusively focused on diabetes and obesity, founded dQ&A Market Research Inc., a market research business with over 3,000 panel members that participate in diabetes related surveys. A dQ&A Panel Summary Report from February 2011 estimated that our share of the continuous glucose monitoring system market in the United States was at 48%. The report analyzed responses from 382 panel members who were asked what brand and model of continuous glucose monitoring system they used.

We have built a direct sales organization to call on endocrinologists, physicians and diabetes educators who can educate and influence patient adoption of continuous glucose monitoring. We believe that focusing efforts on these participants is important given the instrumental role they each play in the decision-making process for diabetes therapy. To complement our direct sales efforts, we also employ clinical specialists who educate and provide clinical support in the field, and we have entered into a limited number of distribution arrangements that allow distributors to sell our products. Although we plan to modestly increase the size of the sales organization in 2011, we believe our direct, highly-specialized and focused sales organization is sufficient for us to support our sales efforts.

We are leveraging our technology platform to enhance the capabilities of our current products and to develop additional continuous glucose monitoring products. In January 2008, we entered into two separate development agreements, one with Animas Corporation, or Animas, a subsidiary of Johnson & Johnson, and one with Insulet Corporation, or Insulet, to integrate our technology into the insulin pump product offerings of the respective partner, enabling the partner’s insulin pump to receive glucose readings from our transmitter and display this information on the pump’s screen. In addition, we are continuing to seek approval for our next generation ambulatory system, and are responding to FDA’s requests for additional data in support of that application. We expect our next generation system will further improve sensor reliability, stability and accuracy over the useful life of the sensor, and will be suited for large scale manufacturing. We also intend to seek approval for a pediatric indication (patients under 18 years of age) and a pregnancy indication (patients who develop gestational diabetes) for our product platform in the future. Further, as described above, we are developing in collaboration with Edwards the GlucoClear, which is a blood-based in-vivo automated glucose monitoring system for use by healthcare providers in the hospital. Our development timelines are highly dependent on our ability to achieve clinical endpoints and regulatory requirements and to overcome technology challenges, and our development timelines may be delayed due to extended regulatory approval timelines, scheduling issues with patients and investigators, requests from institutional review boards, sensor performance and manufacturing supply constraints, among other factors. In addition, support of these clinical trials requires significant resources from employees involved in the production of our products, including research and development, manufacturing, quality assurance, and clinical and regulatory personnel. Even if our development and clinical trial efforts are successful, the FDA may not approve our products, and if approved, we may not achieve acceptance in the marketplace by physicians and patients.

As a medical device company, reimbursement from Medicare and private third-party healthcare payors is an important element of our success. Although the Centers for Medicare and Medicaid, or CMS, released 2008 Alpha-Numeric Healthcare Common Procedure Coding System (“HCPCS”) codes applicable to each of the three components of our continuous glucose monitoring systems, to date, our approved products are not reimbursed by virtue of a national coverage decision by Medicare. It is not known when, if ever, Medicare will adopt a national coverage decision with respect to continuous glucose monitoring devices. Until any such coverage decision is adopted by Medicare, reimbursement of our products will generally be limited to those patients covered by third-party payors that have adopted coverage policies for continuous glucose monitoring devices. As of March 2011, the seven largest private third-party payors, in terms of the number of covered lives, have issued coverage policies for the category of continuous glucose monitoring devices. In addition, we have negotiated contracted rates with six of those third-party payors for the purchase of our SEVEN PLUS system by their members. Many of these coverage policies are restrictive in nature and require the patient to comply with extensive documentation and other requirements to demonstrate medical necessity under the policy. In addition, patients

3

Table of Contents

who are insured by payors that do not offer coverage for our devices will have to bear the financial cost of the products. We currently employ in-house reimbursement expertise to assist patients in obtaining reimbursement from private third-party payors. We also maintain a field-based reimbursement team charged with calling on third-party private payors to obtain coverage decisions and contracts. We have had formal meetings and have increased our efforts to create and liberalize coverage policies with third-party payors and expect to continue to do so in 2011. However, unless government and other third-party payors provide adequate coverage and reimbursement for our products, patients may not use them on a widespread basis.

We plan to develop future generations of technologies focused on improved performance and convenience and that will enable intelligent insulin administration. Our next generation of technologies are not yet FDA approved, but in the near term, we are seeking regulatory approval for a next generation sensor platform using advanced manufacturing processes that are more scalable and reliable. Over the longer term, we plan to develop networked platforms with open architecture, connectivity and transmitters capable of communicating with other devices.

Market Opportunity

Diabetes

Diabetes is a chronic, life-threatening disease for which there is no known cure. The disease is caused by the body’s inability to produce or effectively utilize the hormone insulin. This inability prevents the body from adequately regulating blood glucose levels. Glucose, the primary source of energy for cells, must be maintained at certain concentrations in the blood in order to permit optimal cell function and health. Normally, the pancreas provides control of blood glucose levels by secreting the hormone insulin to decrease blood glucose levels when concentrations are too high. In people with diabetes, the body does not produce sufficient levels of insulin, or fails to utilize insulin effectively, causing blood glucose levels to rise above normal. This condition is called hyperglycemia and often results in chronic long-term complications such as heart disease, limb amputations, loss of kidney function and blindness. When blood glucose levels are high, patients often administer insulin in an effort to decrease blood glucose levels. Unfortunately, insulin administration can drive blood glucose levels below the normal range, resulting in hypoglycemia. In cases of severe hypoglycemia, diabetes patients risk acute complications, such as loss of consciousness or death. Due to the drastic nature of acute complications associated with hypoglycemia, many patients are reluctant to reduce blood glucose levels. Consequently, these patients often remain in a hyperglycemic state, increasing their odds of developing long-term chronic complications.

Diabetes is typically classified into two major groups: Type 1 and Type 2. We estimate that there are approximately 1.3 million Type 1 diabetes patients in the United States. Type 1 diabetes usually develops during childhood and is characterized by an absence of insulin, resulting from destruction of the insulin producing cells of the pancreas. Individuals with Type 1 diabetes must rely on frequent insulin injections in order to regulate and maintain blood glucose levels. We estimate that there are approximately 24.5 million people with Type 2 diabetes in the United States, which results when the body is unable to produce sufficient amounts of insulin or becomes insulin resistant. Depending on the severity of Type 2 diabetes, individuals may require diet and nutrition management, exercise, oral medications or insulin injections to regulate blood glucose levels. We estimate that approximately 3.6 million Type 2 patients must use insulin to manage their diabetes.

There are various subgroups of diabetic patients, including in-hospital patients, who present significant management challenges. According to the ADA, diabetes related hospitalizations totaled 24.3 million days in 2007, an increase of 7.4 million days from 2002. Additionally, studies show that many non-diabetic hospital patients suffer episodes of hyperglycemia. According to a Diabetes Care article, as of 1998, as many as 1.5 million hospitalized patients had significant hyperglycemia without a history of diabetes. A November 2001 article in the New England Journal of Medicine summarized a study of over 1,500 hospitalized patients, of which only 13% were diabetic, which concluded that intensive insulin therapy to maintain blood glucose levels within a target range reduced mortality among critically ill patients in the surgical intensive care unit and improved patient outcomes.

4

Table of Contents

According to the National Diabetes Education Program, about 75% of all newly diagnosed cases of Type 1 diabetes in the United States occur in juveniles younger than 18 years of age. In addition, Type 2 diabetes is occurring with increasing frequency in young people. The increase in prevalence is related to an increase in obesity amongst children. As of 2002, approximately 16% of children and teens were overweight, about double the number two decades before.

Importance of Glucose Monitoring

Blood glucose levels can be affected by many factors, including the carbohydrate and fat content of meals, exercise, stress, illness or impending illness, hormonal releases, variability in insulin absorption and changes in the effects of insulin in the body. Given the many factors that affect blood glucose levels, maintaining glucose within a normal range is difficult, resulting in frequent and unpredictable excursions above or below normal blood glucose levels. Patients manage their blood glucose levels by administering insulin or ingesting carbohydrates throughout the day in order to maintain blood glucose within normal ranges. Patients frequently overcorrect and fluctuate between hyperglycemic and hypoglycemic states, often multiple times during the same day. As a result, many patients with diabetes are routinely outside the normal blood glucose range. Patients are often unaware that their glucose levels are either too high or too low, and their inability to completely control blood glucose levels and the associated serious complications can be frustrating and, at times, overwhelming.

In an attempt to maintain blood glucose levels within the normal range, patients with diabetes must first measure their blood glucose levels. Often after measuring their blood glucose levels, patients make therapeutic adjustments. As adjustments are made, additional blood glucose measurements may be necessary to gauge the individual’s response to the adjustments. More frequent testing of blood glucose levels provides patients with information that can be used to better understand and manage their diabetes. The ADA recommends that patients test their blood glucose levels at least three or four times per day.

Clinical outcomes data support the notion that an important component of effective diabetes management is frequent monitoring of blood glucose levels. The landmark 1993 Diabetes Control and Complications Trial, or DCCT, consisting of patients with Type 1 diabetes, and the 1998 UK Prospective Diabetes Study, consisting of patients with Type 2 diabetes, demonstrated that patients who intensely managed blood glucose levels delayed the onset and slowed the progression of diabetes-related complications. In the DCCT, a major component of intensive management was monitoring blood glucose levels at least four times per day using conventional single-point blood glucose meters. The DCCT demonstrated that intensive management reduced the risk of complications by 76% for eye disease, 60% for nerve disease and 50% for kidney disease. However, the DCCT also found that intensive management led to a three-fold increase in the frequency of hypoglycemic events. In the December 2005 edition of the New England Journal of Medicine, the authors of a peer-reviewed study concluded that intensive diabetes therapy has long-term beneficial effects on the risk of cardiovascular disease in patients with Type 1 diabetes. The study showed that intensive diabetes therapy reduced the risk of cardiovascular disease by 42% and the risk of non-fatal heart attack, stroke or death from cardiovascular disease by 57%.

Limitations of Existing Glucose Monitoring Products

Single-point finger stick devices are the most prevalent devices for glucose monitoring. These devices require taking a blood sample with a finger stick, placing a drop of blood on a test strip and inserting the strip into a glucose meter that yields a single point in time blood glucose measurement. We believe that these devices suffer from several limitations, including:

| • | Limited Information. Even if patients test several times each day, each measurement represents a single blood glucose value at a single point in time. Given the many factors that can affect blood glucose levels, excursions above and below the normal range often occur between these discrete measurement points in time. Because patients only have single-point data, they do not gain sufficient information to indicate the direction or rate of change in their blood glucose levels. Without the ability |

5

Table of Contents

| to determine whether their blood glucose level is rising, falling or holding constant, and the rate at which their blood glucose level is changing, the patient’s ability to effectively manage and maintain blood glucose levels within normal ranges is severely limited. In addition, patients cannot test themselves during sleep, when the risk of hypoglycemia is significantly increased. |

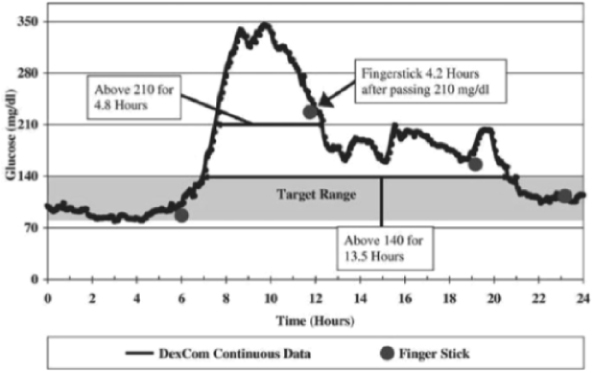

The following graph shows the limited information provided by four single-point measurements during a single day using a traditional single-point finger stick device, compared to the data provided by our continuous sensor. The data presented in the graph is from a clinical trial we completed in 2003 with a continuous glucose monitoring system, where the patient was blinded to the continuous glucose data. The continuous data indicates that, even with four finger sticks in one day, the patient’s blood glucose levels were above the target range of 80-140 mg/dl, or milligrams per deciliter, for a period of 13.5 hours.

Single Day Continuous Data

| • | Inconvenience. The process of measuring blood glucose levels with single-point finger stick devices can cause significant disruption in the daily activities of people with diabetes and their families. Patients using single-point finger stick devices must stop whatever they are doing several times per day, self-inflict a painful prick and draw blood to measure blood glucose levels. To do so, patients must always carry a fully-supplied kit that may include a spring-loaded needle, or lancet, disposable test strips, cleansing wipes, and the meter, and then safely dispose of the used supplies. This process is inconvenient and may cause uneasiness in social situations. |

| • | Difficulty of Use. To obtain a sample with single-point finger stick devices, patients generally prick one of their fingertips or, occasionally, a forearm with a lancet. Patients then squeeze the area to produce the blood sample and another prick may be required if a sufficient volume of blood is not obtained the first time. The blood sample is then placed on a disposable test strip that is inserted into a blood glucose meter. This task can be difficult for patients with decreased tactile sensation and visual acuity, which are common complications of diabetes. |

6

Table of Contents

| • | Pain. Although the fingertips are rich in blood flow and provide a good site to obtain a blood sample, they are also densely populated with highly sensitive nerve endings. This makes the lancing and subsequent manipulation of the finger to draw blood painful. The pain and discomfort are compounded by the fact that fingers offer limited surface area, so tests are often performed on areas that are sore from prior tests. Patients may also suffer pain when the finger prick site is disturbed during regular activities. |

We believe a market opportunity exists for a glucose monitoring system that provides continuous glucose information, including trends, and that is convenient and easy to use. Several companies have attempted to address the limitations of single-point finger stick devices by developing continuous glucose monitoring systems. To date, in addition to DexCom, we are aware of three other companies, Cygnus, Medtronic and Abbott, that have received approval from the FDA to market continuous glucose monitors. We believe that one of the products, originally developed and marketed by Cygnus, is no longer actively marketed. In addition, we believe others are developing invasive and non-invasive continuous glucose monitoring systems, including Bayer Corporation. Except for our SEVEN and SEVEN PLUS, we believe that none of the products that have received FDA approval are labeled for more than five days of use. We also believe that none of the products that have received FDA approval are labeled for use as a replacement for single-point finger stick devices.

The DexCom Solution

Our SEVEN PLUS system offers the following advantages to patients with diabetes:

| • | Improved Outcomes. Data published in a peer-reviewed article based on our approval support trial for our first system demonstrated that patients using the system showed statistically significant improvements in maintaining their glucose levels within the target range when compared to patients relying solely on single-point finger stick measurements. Additional peer-review published data from our approval support trial for the SEVEN demonstrated that patients with access to seven days of continuous glucose data statistically improved glucose control by further increasing their time spent with glucose levels in the target range, thereby reducing time spent in both hyperglycemic and hypoglycemic ranges. Peer-review published data from our repeated use trial demonstrated a statistically significant reduction in hemoglobin A1c levels, a measure of the average amount of glucose in the blood over the prior three months, in patients using our system compared to patients relying solely on single-point finger stick measurements. Finally, results of a major multicenter clinical trial funded by the Juvenile Diabetes Research Foundation demonstrated that patients with Type 1 diabetes who used continuous glucose monitoring devices to help manage their disease experienced significant improvements in glucose control. |

| • | Access to Real-Time Values, Trend Information and Alerts. At the push of a button, patients can view their current glucose value, along with a graphical display of one-, three-, six-, twelve- or twenty-four-hour trend information. Without continuous monitoring, the patient is often unaware if his or her glucose is rising, declining or remaining constant. Access to continuous real-time glucose measurements provides patients with information that may aid in attaining better glucose control. Additionally, our SEVEN PLUS alerts patients when their glucose levels approach inappropriately high or low levels so that they may intervene. |

| • | Intuitive Patient Interface. We have developed a patient interface that we believe is intuitive and easy to use. Our receiver’s ergonomic design includes user-friendly buttons, an easy-to-read display, simple navigation tools, audible alerts and graphical display of trend information. |

| • | Convenience and Comfort. Our SEVEN PLUS provides patients with the benefits of continuous monitoring, without having to perform finger stick tests for every measurement. Additionally, the disposable sensor electrode that is inserted under the skin is a very thin wire, minimizing potential discomfort associated with inserting or wearing the disposable sensor. The external portion of the sensor, including the transmitter, is small, has a low profile and is designed to be easily worn under |

7

Table of Contents

| clothing. The wireless receiver is the size of a small cell phone and can be carried discreetly in a pocket or purse. We believe that convenience is an important factor in achieving widespread adoption of a continuous glucose monitoring system. |

While we believe the SEVEN PLUS offers these advantages, patients may not perceive the benefits of continuous glucose monitoring and may be unwilling to change their current treatment regimens. Furthermore, we do not expect that our SEVEN PLUS will appeal to all types of patients with diabetes. The SEVEN PLUS prompts a patient to insert a disposable sensor electrode under their skin at least every seven days, although we are aware of reports from the field that some patients have been able to use sensors for periods longer than seven days. Patients could find this process to be uncomfortable or inconvenient. Patients may be unwilling to insert a disposable sensor in their body, especially if their current diabetes management involves no more than two finger sticks per day. Additionally, the SEVEN PLUS is not approved as a replacement device for single-point finger stick devices, must be calibrated initially using measurements from two single-point finger stick tests, and thereafter at least every 12 hours using single-point finger stick tests, and may be more costly to use.

Our Strategy

Our objective is to become the leading provider of continuous glucose monitoring systems and related products to enable people with diabetes to more effectively and conveniently manage their disease. We also seek to develop and commercialize products that integrate our continuous glucose monitoring technologies into the insulin pump delivery systems of Animas and Insulet, respectively. In addition, we seek to design, develop and commercialize, in collaboration with Edwards, the GlucoClear, which is a blood-based in-vivo automated glucose monitoring system for use by healthcare providers in the hospital for the treatment of both diabetic and non-diabetic patients. To achieve these objectives, we are pursuing the following business strategies:

| • | Establish our technology platform as the leading approach to continuous glucose monitoring and leverage our development expertise to rapidly bring products to market. We have developed proprietary core technology and expertise that provides a broad platform for the development of innovative products for continuous glucose monitoring. We received approval from the FDA and commercialized our first product in 2006. In 2007, we received approval and began commercializing our second generation system, the SEVEN, and on February 13, 2009, we received approval for our third generation system, the SEVEN PLUS, which is designed for up to seven days of continuous use, and we began commercializing this product in the first quarter of 2009. We plan to continue to invest in the development of our technology platform and to obtain additional FDA approvals for our continuous glucose monitoring systems for both the ambulatory and in-hospital markets as well as for our integrated insulin pump delivery systems. We expect to continue to provide performance improvements and introduce new products to establish and maintain a leadership position in the market. In the future, we may develop our technology to support applications beyond glucose sensing. |

| • | Drive the adoption of our ambulatory products through a direct sales and marketing effort. We have a small direct field sales force, which we plan to modestly expand in 2011, to call on endocrinologists, physicians and diabetes educators who can educate and influence patient adoption of continuous glucose monitoring. We believe that focusing efforts on these participants is important given the instrumental role they each play in the decision-making process for diabetes therapy. To complement our sales efforts, we employ clinical specialists who will educate and provide clinical support to patients, and have entered into distribution arrangements that allow distributors to sell our SEVEN PLUS. We currently sell the SEVEN PLUS only in the United States and in portions of Europe and Israel, but plan to expand our sales elsewhere in the future. |

| • | Drive additional adoption through technology integration partnerships. We have development agreements with Animas and Insulet to develop products that will integrate our ambulatory product technology into the Animas conventional insulin pump and the Insulet OmniPod System PDM, as applicable, enabling the partner’s insulin pump to receive glucose readings from our transmitter and |

8

Table of Contents

| display this information on the pump’s screen. We believe patients who have adopted continuous subcutaneous insulin infusion, or CSII, are patients who more aggressively manage their diabetes and may be more inclined to utilize our continuous glucose monitoring systems. |

| • | Seek broad coverage policies and reimbursement for our products. Our approved products are not reimbursed by virtue of a national coverage decision by Medicare. As of March 2011, the seven largest private third-party payors, in terms of the number of covered lives, have issued coverage policies for the category of continuous glucose monitoring devices. Many of these coverage policies, however, are restrictive in nature and require the patient to comply with extensive documentation and other requirements to demonstrate medical necessity under the policy. We have negotiated contracted rates with six of those third-party payors for the purchase of our products by their members. We currently employ in-house reimbursement expertise to assist patients in obtaining reimbursement from private third-party healthcare payors. We also maintain a field-based reimbursement team charged with calling on third-party private payors to obtain coverage decisions and contracts. |

| • | Expand the use of our products to other patient care settings and patient demographics. Our ambulatory products are approved for use at home and in health care facilities by adults (18 years and older) with diabetes. We believe our sensor technology may be beneficial to pediatric diabetes patients and intend to seek approval for use in patients under the age of 18 in the future. We also believe there is an unmet medical need for continuous glucose monitoring in the hospital setting. According to the ADA, diabetes related hospitalizations totaled 24.3 million days in 2007, an increase of 7.4 million days from 2002. In addition, studies show that many non-diabetic hospital patients suffer episodes of hyperglycemia. As of 1998, as many as 1.5 million hospitalized patients in the United States had significant hyperglycemia without a history of diabetes. A study of over 1,500 hospitalized patients, of which only 13% had a history of diabetes, concluded that intensive insulin therapy to maintain blood glucose levels reduced mortality among critically ill patients in the surgical intensive care unit and improved patient outcomes. To address this patient population, we entered into an exclusive agreement with Edwards to develop jointly and market a specific product platform for the in-hospital glucose monitoring market, with an initial focus on the development of an intravenous sensor specifically for the critical care market. |

| • | Provide a high level of customer support, service and education. We support our sales and marketing efforts with a customer service program that includes customer training and support. We provide direct technical support by telephone 24 hours a day to patients, endocrinologists, physicians and diabetes educators to promote safe and successful use of our products. |

| • | Pursue the highest safety and quality levels for our products. We have established an organization that is highly focused on product quality and patient safety. We have developed in-house engineering, quality assurance, clinical and regulatory expertise, and data analysis capabilities. Additionally, we seek to continue to establish credible and open relationships with regulatory bodies, physician opinion leaders and scientific experts. These capabilities and relationships will assist us in designing products that we believe will meet or exceed expectations for reliable, safe performance. |

Our Technology Platform

The development of a continuous glucose monitor requires successful coordination and execution of a wide variety of technology disciplines, including biomaterials, membrane systems, electrochemistry, low power microelectronics, telemetry, software, algorithms, implant tools and sealed protective housings. We have developed in-house expertise in each of these disciplines. We believe we have a broad technology platform that will support the development of multiple products for glucose monitoring.

Sensor Technology

The key enabling technologies for our sensors include biomaterials, membrane systems, electrochemistry and low power microelectronics. Our membrane technology consists of multiple polymer layers configured to

9

Table of Contents

selectively allow the appropriate mix of glucose and oxygen to travel through the membrane and react with a glucose specific enzyme to create an extremely low level electrical signal, measured in pico-amperes. This electrical signal is then translated into glucose values. We believe that the capability to measure very low levels of an electrical signal and to accurately translate those measurements into glucose values is also a unique and distinguishing feature of our technology. We have also developed technology to allow sensitive electronics to be packaged in a small, fully-contained, lightweight sealed unit which minimizes inconvenience and discomfort for the patient.

Receiver and Transmitter Technology

Our ambulatory glucose monitoring systems use radiofrequency telemetry to wirelessly transmit information from the transmitter, which sits in a pod atop the sensor, to our receiver. We have developed the technology for reliable transmission and reception and have consistently demonstrated a high rate of successful transmissions from sensor to receiver in our clinical trials. Our receiver then processes and displays real-time and trended glucose values, and provides alerts. We have used our extensive database of continuous glucose data from our clinical trials to create software and algorithms for the display of data to patients.

In March 2009, the Federal Communications Commission, or FCC, established a bifurcated Medical Implant Communications System, or MICS, band which requires device manufacturers whose products will operate in the main MICS band to either manufacture their devices using listen-before-transmit technology, or to transmit on a side band outside the main MICS band at lower power. Although the SEVEN PLUS does not comply with existing MICS band listen-before-transmit requirements, the FCC granted a waiver to allow us to continue marketing and operating our SEVEN PLUS through March 2013, which we believe will provide adequate time to design an alternative method of wireless communication.

Other Technology Applications

We have gained our technology expertise by learning to design implants that can withstand the rigors of functioning within the human body for extended periods of time. In addition to the foreign body response, we have overcome other problems related to operating within the human body, such as device sealing, miniaturization, durability and sensor geometry. We believe that, over time, the expertise gained in overcoming these problems may support the development of additional products beyond glucose monitoring.

Our Products

Ambulatory Product Line: SEVEN PLUS

We received approval from the FDA and commercialized our first product in 2006. In 2007, we received approval and began commercializing our second generation system, the SEVEN, and on February 13, 2009, we received approval for our third generation system, the SEVEN PLUS, which is designed for up to seven days of continuous use, and we began commercializing this product in the first quarter of 2009. We no longer market or provide support for the SEVEN system. There are various differences between the SEVEN and the SEVEN PLUS. As compared to the SEVEN, the SEVEN PLUS incorporates additional user interface and algorithm enhancements that are intended to make its glucose monitoring function more accurate and customizable. The approval of the SEVEN PLUS by the FDA allows for the use of the SEVEN PLUS by adults with diabetes to detect trends and track glucose patterns, to aid in the detection of hypoglycemia and hyperglycemia and to facilitate acute and long-term therapy adjustments. The SEVEN PLUS must be prescribed by a physician and includes a disposable sensor, a transmitter and a small handheld receiver. The SEVEN PLUS is indicated for use as an adjunctive device to complement, not replace, information obtained from standard home blood glucose monitoring devices and must be calibrated periodically using a standard home blood glucose monitor. The sensor is inserted by the patient and is intended to be used continuously for up to seven days after which it is removed by the patient and may be replaced by a new sensor. Our transmitter and receiver are reusable. In 2008, we

10

Table of Contents

received CE Mark approval for the SEVEN system, and on September 30, 2009, we received CE Mark approval for the SEVEN PLUS, enabling commercialization of the SEVEN PLUS system in the European Union and the countries in Asia and Latin America that recognize the CE Mark. We initiated a limited commercial launch in the European Union and Israel in 2008 and 2009 and have focused our international sales efforts on a portion of European countries.

In-Hospital Product Line: GlucoClear

To address the in-hospital patient population, we entered into an exclusive agreement with Edwards to develop jointly and market a specific product platform for the in-hospital glucose monitoring market, with an initial focus on the development of an intravenous sensor specifically for the critical care market. On October 30, 2009, we received CE Mark approval for our first generation GlucoClear, a blood-based in-vivo automated glucose monitoring system for use by healthcare providers in the hospital, and are continuing to seek approval for this system from the FDA. In partnership with Edwards, we initiated a very limited launch of the GlucoClear in Europe in 2009.

Products in Development

We are leveraging our technology platform to enhance the capabilities of our current products and to develop additional continuous glucose monitoring products. We are continuing to seek approval for our next generation ambulatory system, and are responding to FDA’s requests for additional data in support of that application. We expect our next generation system will further improve sensor reliability, comfort, stability and accuracy over the useful life of the sensor, and will be suited for large scale manufacturing. We also intend to seek approval for a pediatric indication (patients under 18 years of age) in the future.

In 2008, we entered into two separate development agreements, one with Animas, a subsidiary of Johnson & Johnson, and one with Insulet, to integrate our technology into the insulin pump product offerings of the respective partner, enabling the partner’s insulin pump to receive glucose readings from our transmitter and display this information on the pump’s screen.

Continuous Glucose Monitoring Disposable Sensor & Reusable Transmitter

Our sensor includes a tiny wire-like electrode coated with our sensing membrane system. This disposable sensor comes packaged with an integrated insertion device and is contained in a small plastic housing platform, or pod. The base of the pod has adhesive that attaches it to the skin. The sensor is intended to be easily and reliably inserted by the patient by exposing the adhesive, placing the pod against the surface of the skin of the abdomen and pushing down on the insertion device. The insertion device first extends a narrow gauge needle containing the sensor into the subcutaneous tissue and then retracts the needle, leaving behind the sensor in the tissue and the pod adhered to the skin. The patient then disposes of the insertion device and snaps the reusable transmitter to the pod. After a stabilization period of a few hours, the patient is required to calibrate the receiver with two measurements from a single-point finger stick device and the disposable sensor begins wirelessly transmitting the continuous glucose data at specific intervals to the handheld receiver. Patients are prompted by the receiver to calibrate the system twice per day with finger stick measurements throughout the seven day usage period to ensure reliable operation, which calibration may be accomplished by using any FDA approved blood glucose meter. Currently, the SEVEN PLUS is indicated for use as an adjunctive device to complement, not replace, information obtained from standard home blood glucose monitoring devices, although in the future we may seek replacement claim labeling from the FDA for the use of a future generation sensor as the sole basis for making therapeutic adjustments.

The disposable sensor contained in the SEVEN PLUS is intended to function for up to seven days after which it may be replaced. After seven days, the patient simply removes the pod and attached sensor from the skin

11

Table of Contents

and discards them while retaining the reusable transmitter. A new sensor and pod can then be inserted and used with the same receiver and transmitter for a subsequent seven day period. We are aware of reports from the field, however, that patients have been able to use sensors for periods longer than seven days.

Handheld Receiver

Our small handheld receiver is carried by the patient and wirelessly receives continuous glucose values from the sensor. Proprietary algorithms and software, developed from our extensive database of continuous glucose data from clinical trials, are programmed into the receiver to process the glucose data from the sensor and display it on a user-friendly graphical user interface. With a push of a button, the patient can access their current glucose value and one-, three-, six-, twelve- and twenty-four-hour trended data. Additionally, when glucose values are inappropriately high or low, the receiver provides an audible alert or vibrates. The receiver is a self-contained, durable unit with a rechargeable battery.

Sales and Marketing

We have built a direct sales organization to call on endocrinologists, physicians and diabetes educators who can educate and influence patient adoption of continuous glucose monitoring. We believe that focusing efforts on these participants is important given the instrumental role they each play in the decision-making process for diabetes therapy. To complement our direct sales efforts, we employ clinical specialists who help to educate patients on the benefits of continuous glucose monitoring and provide clinical support to endocrinologists, physicians and diabetes educators who prescribe our products. As of December 31, 2010, we employed approximately 56 direct sales personnel and clinical account specialists. We continue to improve our sales and marketing organization as necessary to support the commercialization of our products, and plan to modestly expand the size of the field sales force during 2011. We believe that referrals by physicians and diabetes educators, together with self-referrals by patients, have driven and will continue to drive adoption of our SEVEN PLUS. We directly market our products in the United States primarily to endocrinologists, physicians and diabetes educators. Although the number of diabetes patients is significant, the number of physicians and educators influencing these patients is relatively small. As of 2008, there were an estimated 4,000 clinical endocrinologists in the United States. As a result, we believe our direct, highly-specialized and focused sales organization is sufficient for us to support our sales efforts for the foreseeable future.

We use a variety of marketing tools to drive adoption, ensure continued usage and establish brand loyalty for our continuous glucose monitoring systems by:

| • | creating awareness of the benefits of continuous glucose monitoring and the advantages of our technology with endocrinologists, physicians, diabetes educators and patients; |

| • | providing strong and simple educational and training programs to healthcare providers and patients to ensure easy, safe and effective use of our systems; and |

| • | maintaining a readily-accessible telephone and web-based technical and customer support infrastructure, which includes clinicians, diabetes educators and reimbursement specialists, to help referring physicians, diabetes educators and patients as necessary. |

Our sales organization competes with the experienced and well-funded marketing and sales operations of our competitors. We have relatively limited experience developing and managing a direct sales organization and we may be unsuccessful in our attempt to manage and expand the sales force. Developing a direct sales organization is a difficult, expensive and time consuming process. To be successful we must:

| • | recruit and retain adequate numbers of effective sales personnel; |

| • | effectively train our sales personnel in the benefits of our products; |

12

Table of Contents

| • | establish and maintain successful sales, marketing, training and education programs that encourage endocrinologists, physicians and diabetes educators to recommend our products to their patients; and |

| • | manage geographically disbursed operations. |

Competition

The market for blood glucose monitoring devices is intensely competitive, subject to rapid change and significantly affected by new product introductions. Four companies, Roche Disetronic, a division of Roche Diagnostics; LifeScan, Inc., a division of Johnson & Johnson; the MediSense and TheraSense divisions of Abbott Laboratories; and Bayer Corporation, currently account for substantially all of the worldwide sales of self-monitored glucose testing systems. These competitors’ products use a meter and disposable test strips to test blood obtained by pricking the finger or, in some cases, the forearm. In addition, other companies are developing or marketing minimally invasive or noninvasive glucose testing devices and technologies that could compete with our devices. There are also a number of academic and other institutions involved in various phases of our industry’s technology development.

Several companies have attempted to address the limitations of single-point finger stick devices by developing continuous glucose monitoring systems. To date, in addition to DexCom, we are aware that three other companies, Cygnus, Medtronic, and Abbott, have received approval from the FDA for continuous glucose monitors. We believe that one of the products, originally developed and marketed by Cygnus, is no longer actively marketed. Except for our SEVEN and SEVEN PLUS, we believe that none of the products that have received FDA approval are labeled for more than five days of use. We also believe that none of the FDA approved products are labeled for use as a replacement for single-point finger stick devices.

A number of companies, including Bayer, are developing next generation real-time continuous glucose monitoring or sensing devices and technologies as well as several other companies that are developing non-invasive continuous glucose monitoring products to measure the patient’s glucose level. The majority of these non-invasive technologies do not pierce the skin, but instead typically analyze signatures reflected back from energy that has been directed into the patient’s skin, tissue or bodily fluids.

Many of our competitors are either publicly traded or are divisions of publicly-traded companies, and they enjoy several competitive advantages, including:

| • | significantly greater name recognition; |

| • | established relations with healthcare professionals, customers and third-party payors; |

| • | established distribution networks; |

| • | additional lines of products, and the ability to offer rebates or bundle products to offer higher discounts or incentives to gain a competitive advantage; |

| • | greater experience in conducting research and development, manufacturing, clinical trials, obtaining regulatory approval for products and marketing approved products; and |

| • | greater financial and human resources for product development, sales and marketing, and patent litigation. |

As a result, we cannot assure you that we will be able to compete effectively against these companies or their products.

We believe that the principal competitive factors in our market include:

| • | safe, reliable and high quality performance of products; |

13

Table of Contents

| • | cost of products and eligibility for reimbursement; |

| • | comfort and ease of use; |

| • | effective sales, marketing and distribution; |

| • | brand awareness and strong acceptance by healthcare professionals and patients; |

| • | customer service and support and comprehensive education for patients and diabetes care providers; |

| • | speed of product innovation and time to market; |

| • | regulatory expertise; and |

| • | technological leadership and superiority. |

Manufacturing

We currently manufacture our devices at our headquarters in San Diego, California. These facilities have more than 8,000 square feet of laboratory space and approximately 10,000 square feet of controlled environment rooms. In February 2010, our facility was subject to a post-approval inspection by the FDA. After the close of the inspection, the FDA investigator issued a Form 483 identifying several inspectional observations. Subsequent to the inspection, we also received a warning letter from the FDA requiring us to file medical device reports (MDRs) in accordance with the MDR regulations for complaints involving sensor wire fractures underneath a patient’s skin. The warning letter also recommended that we add certain warnings and precautions statements to the labeling, patient education brochures, and our company website regarding the appropriate use of the SEVEN PLUS system, including that they are not approved for use in children under age 18, pregnant women, or persons on dialysis. In response to the warning letter and the Form 483 inspectional observations, we have taken corrective action to address the observations to achieve substantial compliance with the FDA regulatory requirements applicable to a commercial medical device manufacturer. In October 2010, we were subject to a follow-up site inspection by the FDA, and upon completion of that inspection, we were notified by the inspector that there were no 483 inspectional observations. We also received written notification dated November 1, 2010 from the FDA that we adequately addressed all issues cited in the warning letter.

There are technical challenges to increasing manufacturing capacity, including equipment design and automation, material procurement, problems with production yields, and quality control and assurance. We have focused significant effort on continual improvement programs in our manufacturing operations intended to improve quality, yields and throughput. We have made progress in manufacturing to enable us to supply adequate amounts of product to support our commercialization efforts, however there can be no assurances that supply will not be constrained going forward. Additionally, the production of our continuous glucose monitoring systems must occur in a highly controlled and clean environment to minimize particles and other yield- and quality-limiting contaminants. Developing commercial-scale manufacturing facilities has and will continue to require the investment of substantial additional funds and the hiring and retaining of additional management, quality assurance, quality control and technical personnel who have the necessary manufacturing experience. Manufacturing is subject to numerous risks and uncertainties described in detail in “Risk Factors” below.

We manufacture our SEVEN PLUS with components supplied by outside vendors and with parts manufactured by us internally. Key components that we manufacture internally include our wire-based sensors for our SEVEN PLUS. The remaining components and assemblies are purchased from outside vendors. We then assemble, test, package and ship the finished SEVEN PLUS systems, which includes a reusable transmitter, a receiver, and disposable sensors.

We purchase certain components and materials from single sources due to quality considerations, costs or constraints resulting from regulatory requirements. Currently, those single sources are On Semiconductor Corp, which produces the application specific integrated circuits used in our transmitters; DSM PTG, Inc., which manufactures certain polymers used to synthesize our polymeric membranes for our sensors; Flextronics

14

Table of Contents

International Ltd., which assembles the printed circuit boards for our transmitters and receivers; and The Tech Group, which produces injection molded components. In some cases, agreements with these and other suppliers can be terminated by either party upon short notice. We may not be able to quickly establish additional or replacement suppliers for our single-source components, especially after our products are commercialized, in part because of the FDA approval process and because of the custom nature of the parts we designed. Any supply interruption from our vendors or failure to obtain alternate vendors for any of the components would limit our ability to manufacture our systems, and could have a material adverse effect on our business.

Third Party Reimbursement

As a medical device company, reimbursement from Medicare and private third-party healthcare payors is an important element of our success. Although CMS released 2008 Alpha-Numeric HCPCS codes applicable to each of the three components of our continuous glucose monitoring systems, to date, our approved products are not reimbursed by virtue of a national coverage decision by Medicare. As of March 2011, the seven largest private third-party payors, in terms of the number of covered lives, have issued coverage policies for the category of continuous glucose monitoring devices. In addition, we have negotiated contracted rates with six of those third-party payors for the purchase of our products by their members. Many of these coverage policies are restrictive in nature and require the patient to comply with documentation and other requirements to demonstrate medical necessity under the policy. In addition, patients who are insured by payors that do not offer coverage for our devices will have to bear the financial cost of the products. We currently employ in-house reimbursement expertise to assist patients in obtaining reimbursement from private third-party payors. We also maintain a field-based reimbursement team charged with calling on third-party private payors to obtain coverage decisions and contracts. We have had formal meetings and have increased our efforts to create coverage policies with third-party payors during 2010 and expect to continue to do so in 2011. However, unless government and other third-party payors provide adequate coverage and reimbursement for our products, patients may not use them.

Medicare, Medicaid, health maintenance organizations and other third-party payors are increasingly attempting to contain healthcare costs by limiting both coverage and the level of reimbursement of new medical devices, and, as a result, their coverage policies may be restrictive, or they may not cover or provide adequate payment for our products. In order to obtain reimbursement arrangements, we may have to agree to a net sales price lower than the net sales price we might charge in other sales channels. The continuing efforts of government and third-party payors to contain or reduce the costs of healthcare may limit our revenue. Our initial dependence on the commercial success of our SEVEN PLUS makes us particularly susceptible to any cost containment or reduction efforts. Accordingly, unless government and other third-party payors provide adequate coverage and reimbursement for our products, our financial performance may be harmed.

In some foreign markets, pricing and profitability of medical devices are subject to government control. In the United States, we expect that there will continue to be federal and state proposals for similar controls. Also, the trends toward managed healthcare in the United States and proposed legislation intended to reduce the cost of government insurance programs could significantly influence the purchase of healthcare services and products and may result in lower prices for our products or the exclusion of our products from reimbursement programs.

Intellectual Property

Protection of our intellectual property is a strategic priority for our business. We rely on a combination of patent, copyright and other intellectual property laws, trade secrets, nondisclosure agreements and other measures to protect our proprietary rights. As of February 2011, we had obtained 57 issued U.S. patents, and had 255 additional U.S. patent applications pending. We believe it will take up to five years, and possibly longer, for these pending U.S. patent applications to result in issued patents. As of February 2011, we had 18 international applications filed under the Patent Cooperation Treaty, 3 granted European patents, 49 European patent applications pending, 10 Japanese patent applications pending, 12 registered U.S. trademarks, 6 pending U.S. trademark applications, 9 registered European trademarks, 2 pending European trademark applications, and 3 registered Japanese trademarks. Our patents begin expiring in 2017.

15

Table of Contents

Together, our patents and patent applications seek to protect aspects of our core membrane and sensor technologies, and our product concepts for continuous glucose monitoring. We believe that our patent position provides us with sufficient rights to develop, sell and protect our current and proposed commercial products. However, our patent applications may not result in issued patents, and any patents that have issued or might issue may not protect our intellectual property rights. Furthermore, our patents may not be upheld. Any patents issued to us may be challenged by third parties as being invalid or unenforceable, or third parties may independently develop similar or competing technology that avoids our patents. The steps we have taken may not prevent the misappropriation of our intellectual property, particularly in foreign countries where the laws may not protect our proprietary rights as fully as in the United States.

The medical device industry in general, and the glucose testing sector of this industry in particular, are characterized by the existence of a large number of patents and frequent litigation based on assertions of patent infringement. We are aware of numerous patents issued to third parties that may relate to aspects of our business, including the design and manufacture of continuous glucose monitoring sensors and membranes, as well as methods for continuous glucose monitoring. The owners of each of these patents could assert that the manufacture, use or sale of our continuous glucose monitoring systems infringes one or more claims of their patents. Each of these patents contains multiple claims, any one of which may be independently asserted against us. There may be patents of which we are presently unaware that may relate to aspects of our technology that could materially and adversely affect our business. In addition, because patent applications can take many years to issue, there may be currently pending applications that are unknown to us, which may later result in issued patents that may materially and adversely affect our business.

We are currently engaged in patent litigation with Abbott Diabetes Care, Inc., or Abbott, as further described in “Item 3. Legal Proceedings” of this Annual Report. In connection with this litigation each of Abbott’s seven patents that are the subject of the litigation have one or more associated reexamination requests in various stages at the U.S. Patent and Trademark Office, or the Patent Office. The court has granted a stay of litigation pending completion of the reexamination process. The Board of Patent Appeals and Interferences within the Patent Office has recently rendered decisions on the appeals related to the reexaminations of two of the patents. We believe these decisions are favorable to us; however, Abbott may still seek judicial review of the decisions. Four patents are currently undergoing reexamination at the Patent Office. Reexamination of another patent was completed in 2010 and we recently submitted a subsequent reexamination request.

In addition, since 2008, Abbott has copied claims from certain of our applications, and stated that it may seek to provoke an interference with certain of our pending applications in the Patent Office. If interference is declared and Abbott prevails in the interference, we would lose certain patent rights to the subject matter defined in the interference. Also since 2008, Abbott has filed reexamination requests seeking to invalidate fifteen of our patents. The fifteen reexamination requests are in various stages at the Patent Office. We have filed responses with the Patent Office seeking claim construction to differentiate certain claims from the prior art presented in the reexaminations, seeking to amend certain claims to overcome the prior art presented in the reexaminations, canceling claims and/or seeking to add new claims. It is possible that the Patent Office may determine that some or all of the claims of our patents subject to the reexamination are invalid.

Although it is our position that Abbott’s assertions of infringement have no merit, and that the potential interference and reexamination requests have no merit, the outcome of the litigation and interference or reexamination requests cannot be assessed currently with certainty. We may not successfully defend ourselves against the claims made by Abbott, and we may not prevail in the litigation. If Abbott were to successfully seek an injunction, it could force us to stop making, using, selling or offering to sell our products. The technology at issue in our litigation with Abbott is currently used in our products, including our SEVEN PLUS, which is our only ambulatory product that is approved for commercial sale, and the GlucoClear, our blood-based in-vivo automated glucose monitoring system for in-hospital use. If we were forced to stop selling these products either as a result of an unfavorable outcome in the litigation or in connection with the grant of an injunction, our business and prospects would suffer. In addition, defending against this action, including any injunction action,

16

Table of Contents

could have a number of harmful effects on our business regardless of the final outcome of such litigation. For example, we have incurred, and expect to continue to incur significant costs in defending the action.

Any adverse determination in litigation or interference proceedings to which we are or may become a party relating to patents could subject us to significant liabilities to third parties or require us to seek licenses from other third parties. Furthermore, if we are found to willfully infringe third-party patents, we could, in addition to other penalties, be required to pay treble damages and/or attorney fees for the prevailing party. Although patent and intellectual property disputes in the medical device area have often been settled through licensing or similar arrangements, costs associated with such arrangements may be substantial and would likely require ongoing royalties. We may be unable to obtain necessary licenses on satisfactory terms, if at all. If we do not obtain necessary licenses, we may not be able to redesign our products to avoid infringement and any redesign may not receive FDA approval in a timely manner. Adverse determinations in a judicial or administrative proceeding or failure to obtain necessary licenses could prevent us from manufacturing and selling our products, which would have a significant adverse impact on our business. We also rely on trade secrets, technical know-how and continuing innovation to develop and maintain our competitive position. We seek to protect our proprietary information and other intellectual property by generally requiring our employees, consultants, contractors, outside scientific collaborators and other advisors to execute non-disclosure and assignment of invention agreements on commencement of their employment or engagement. Agreements with our employees also forbid them from bringing the proprietary rights of third parties to us. We also generally require confidentiality or material transfer agreements from third parties that receive our confidential data or materials. We cannot provide any assurance that employees and third parties will abide by the confidentiality or assignment terms of these agreements. Despite measures taken to protect our intellectual property, unauthorized parties might copy aspects of our products or obtain and use information that we regard as proprietary.

Government Regulation

Our products are medical devices subject to extensive and ongoing regulation by the FDA and regulatory bodies in other countries. The Federal Food, Drug and Cosmetic Act, or FDCA, and the FDA’s implementing regulations govern product design and development, pre-clinical and clinical testing, pre-market clearance or approval, establishment registration and product listing, product manufacturing, product labeling, product storage, advertising and promotion, product sales, distribution, recalls and field actions, servicing and post-market clinical surveillance.

FDA Regulation