Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - QUESTCOR PHARMACEUTICALS INC | d8k.htm |

| EX-99.1 - PRESS RELEASE - QUESTCOR PHARMACEUTICALS INC | dex991.htm |

1

Exhibit 99.2 |

2

2

NASDAQ:

QCOR

NASDAQ:

QCOR

March 2011

March 2011 |

3

Safe Harbor Statement

Note: Except for the historical information contained herein, this press release contains

forward-looking statements that have been made pursuant to the Private Securities

Litigation Reform Act of 1995. These statements relate to future events or our future

financial performance. In some cases, you can identify forward-looking statements

by terminology such as “believes,” “continue,”

“could,”

“estimates,”

“expects,”

“growth,”

“may,”

“plans,”

“potential,”

“should,”

“substantial”

or “will”

or the negative of such terms and other

comparable terminology. These statements are only predictions. Actual events or results may

differ materially. Factors that could cause or contribute to such differences include,

but are not limited to, the following: Our reliance on Acthar for substantially all of

our net sales and profits; The complex nature of our manufacturing process and the

potential for supply disruptions or other business disruptions; The lack of patent

protection for Acthar; and the possible FDA approval and market introduction of competitive products;

Our ability to generate revenue from sales of Acthar

to treat on-label indications associated with NS, and our ability to develop

other

therapeutic uses for Acthar; Research and development risks, including risks associated with

Questcor's preliminary work in the area of

nephrotic

syndrome and our reliance on third-parties to conduct research and development and the

ability of research and development to generate successful results; Regulatory changes

or other policy actions by governmental authorities and other third parties as recently

adopted U.S. healthcare reform legislation is implemented; Our ability to receive high reimbursement levels from

third party payers; An increase in the proportion of our Acthar

unit sales comprised of Medicaid-eligible patients and government

entities; Our ability to estimate reserves required for Acthar

used by government entities and Medicaid-eligible patients and the

impact that unforeseen invoicing of historical Medicaid sales may have upon our results; Our

ability to operate within an industry that is highly regulated at both the Federal and

state level; Our ability to effectively manage our growth and our reliance on key personnel;

The impact to our business caused by economic conditions; Our ability to protect our

proprietary rights; Our ability to maintain effective controls over financial reporting;

The risk of product liability lawsuits; Unforeseen business interruptions; Volatility

in Questcor's

monthly

and

quarterly

Acthar

shipments

and

end-user

demand,

as

well

as

volatility

in

our

stock

price;

and

Other

risks

discussed in Questcor's

annual report on Form 10-K for the year ended December 31, 2010 and other documents

filed with the

Securities and Exchange Commission.

The risk factors and other information contained in these documents should be considered in

evaluating Questcor's prospects and

future financial performance.

Note: Except for the historical information contained herein, this press release contains

forward-looking statements that have been made pursuant to the Private Securities

Litigation Reform Act of 1995. These statements relate to future events or our future

financial performance. In some cases, you can identify forward-looking statements

by terminology such as “believes,” “continue,”

“could,”

“estimates,”

“expects,”

“growth,”

“may,”

“plans,”

“potential,”

“should,”

“substantial”

or “will”

or the negative of such terms and other

comparable terminology. These statements are only predictions. Actual events or results may

differ materially. Factors that could cause or contribute to such differences include,

but are not limited to, the following: Our reliance on Acthar for substantially all of

our net sales and profits; The complex nature of our manufacturing process and the

potential for supply disruptions or other business disruptions; The lack of patent

protection for Acthar; and the possible FDA approval and market introduction of competitive products;

Our ability to generate revenue from sales of Acthar

to treat on-label indications associated with NS, and our ability to develop

other

therapeutic uses for Acthar; Research and development risks, including risks associated with

Questcor's preliminary work in the area of

nephrotic

syndrome and our reliance on third-parties to conduct research and development and the

ability of research and development to generate successful results; Regulatory changes

or other policy actions by governmental authorities and other third parties as recently

adopted U.S. healthcare reform legislation is implemented; Our ability to receive high reimbursement levels from

third party payers; An increase in the proportion of our Acthar

unit sales comprised of Medicaid-eligible patients and government

entities; Our ability to estimate reserves required for Acthar

used by government entities and Medicaid-eligible patients and the

impact that unforeseen invoicing of historical Medicaid sales may have upon our results; Our

ability to operate within an industry that is highly regulated at both the Federal and

state level; Our ability to effectively manage our growth and our reliance on key personnel;

The impact to our business caused by economic conditions; Our ability to protect our

proprietary rights; Our ability to maintain effective controls over financial reporting;

The risk of product liability lawsuits; Unforeseen business interruptions; Volatility

in Questcor's

monthly

and

quarterly

Acthar

shipments

and

end-user

demand,

as

well

as

volatility

in

our

stock

price;

and

Other

risks

discussed in Questcor's

annual report on Form 10-K for the year ended December 31, 2010 and other documents

filed with the

Securities and Exchange Commission.

The risk factors and other information contained in these documents should be considered in

evaluating Questcor's prospects and

future financial performance. |

4

Questcor

Overview

A biopharmaceutical company

whose product helps patients with serious,

difficult-to-treat medical conditions

A biopharmaceutical company

whose product helps patients with serious,

difficult-to-treat medical conditions |

5

Questcor

Overview

Flagship Product:

Flagship Product:

•

Profitable, cash flow positive, $127M in cash, debt-free

•

Profitable, cash flow positive, $127M in cash, debt-free

•

19 approved indications

•

19 approved indications

Key Markets:

Key Markets:

•

Multiple

Sclerosis,

Infantile

Spasms,

Nephrotic

Syndrome

•

Combined markets opportunity exceeds $1.5 billion

•

Multiple

Sclerosis,

Infantile

Spasms,

Nephrotic

Syndrome

•

Combined markets opportunity exceeds $1.5 billion

Strategy:

Strategy:

•

Grow Acthar

sales in each key market

•

Grow Acthar

sales in each key market

Financials:

Financials: |

6

History of Acthar

1952

First

Approved

1968-1973

DESI Review

Label Expands

1950

1950

1978

MS Indication Added

2000

2000

2001

Questcor

Acquires

Acthar

2010

Label Modernized

19 Indications

2007

Questcor

Changes

Strategy

2010

2010 |

7

Significant Barriers to Entry |

8

Questcor

Growth Engine

Multiple Sclerosis (MS)

Multiple Sclerosis (MS)

Infantile Spasms (IS)

Infantile Spasms (IS)

Nephrotic

Nephrotic

Syndrome (NS)

Syndrome (NS) |

9

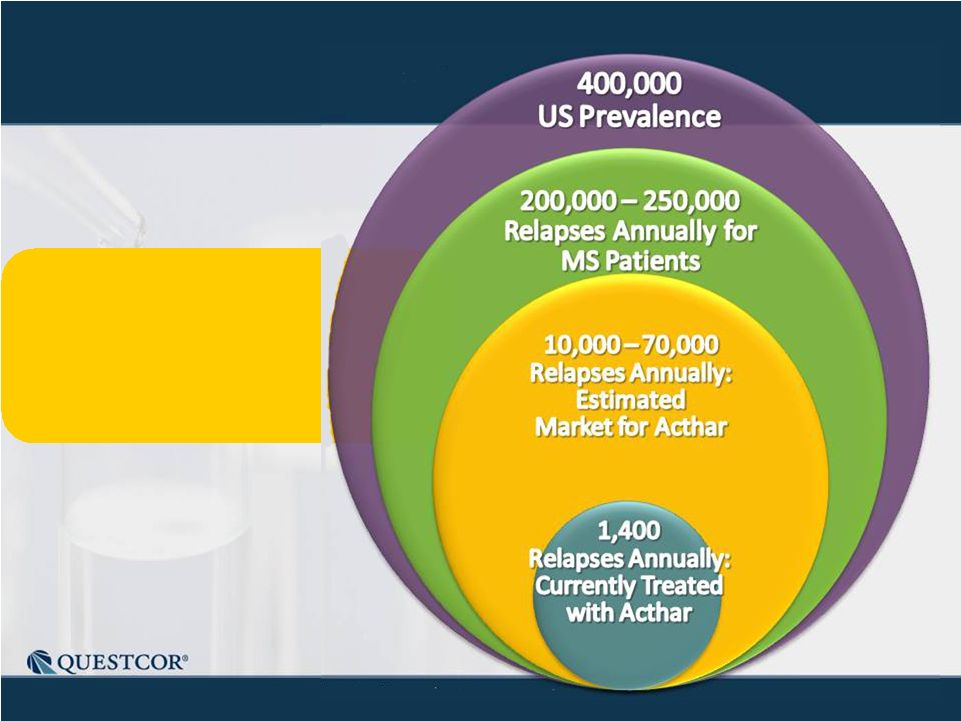

Large Market Opportunity

~$65M

~$65M

~$40M

~$40M

~$3M

~$3M

~$5M

~$5M

$1B+

MS Sales

IS Sales

NS Sales

$500M to $2B+

$100M

$1B+

Other Sales

Current**

Market*

*Represents estimated net sales market opportunity based on internal company estimates

** Represents approximate current net sales annualized run rate

based on internal company estimates |

10

Acthar

and MS

•

Neurodegenerative

disorder

•

Acute treatment for

relapses

•

Dosing period is 1-2

weeks*

•

$40K-$50K/Rx

Acthar

Acthar

when

when

“Steroids are

“Steroids are

not suitable”

not suitable”

*Based on prescription data |

11

MS Sales -

Record of Consistent Growth

New Paid Rxs

New Paid Rxs

Notes: Historical trend information is not necessarily indicative of future results.

Chart includes "Related Conditions" - diagnoses that are

either alternative descriptions of the condition or are closely related to the medical

condition which is the focus of the table. Numbers in the bars show

the number of sales people making calls at the end of the quarter.

|

12

$500M to $2B+

Potential Market

Multiple Sclerosis

*Data on this slide is based on US only. Based on internal company estimates.

|

13

•

Q4-2010 results

–

Q4-10 new paid Rxs

up 66% vs. Q409

–

MS sales over 50% of QCOR sales

–

Over $65M annualized run rate

–

Approximately one in six Rxs

is a repeat patient

•

Growing number of Acthar

prescribers

–

But only ~400 out of 8,000 neurologists

•

Speakers bureau growing

•

Q4-2010 results

–

Q4-10 new paid Rxs

up 66% vs. Q409

–

MS sales over 50% of QCOR sales

–

Over $65M annualized run rate

–

Approximately one in six Rxs

is a repeat patient

•

Growing number of Acthar

prescribers

–

But only ~400 out of 8,000 neurologists

•

Speakers bureau growing

MS Trends |

14

MS Sales Calls vs. Paid New Rxs

*MS call data approximate |

15

Sales Force Expansion

•

Doubled sales force: hiring/training Aug-Oct 2010

(38 to 77 sales reps)

•

Newly expanded sales force began call activity Nov 1

–

Significant increase in MS-treating neurologists targeted for sales calls

–

Now also targeting child neurologists for IS sales calls

•

MS paid Rxs increasing since November 1

–

November matched previous monthly record

–

December set new record

–

January near previous record level

–

February set new record

•

Doubled sales force: hiring/training Aug-Oct 2010

(38 to 77 sales reps)

•

Newly expanded sales force began call activity Nov 1

–

Significant increase in MS-treating neurologists targeted for sales calls

–

Now also targeting child neurologists for IS sales calls

•

MS paid Rxs increasing since November 1

–

November matched previous monthly record

–

December set new record

–

January near previous record level

–

February set new record |

16

•

Devastating, refractory form of childhood epilepsy

–

Very poor developmental outcome if inadequately treated

•

Not responsive to standard anti-epileptic drugs

•

Ultra-rare orphan disorder

–

1,500 to 2,000 patients annually

•

Typically occurs in children less than 2 years old

•

Characterized by

–

“spasms”

--

a specific type of seizure

–

“hypsarrhythmia”

--

abnormal EEG pattern

•

Devastating, refractory form of childhood epilepsy

–

Very poor developmental outcome if inadequately treated

•

Not responsive to standard anti-epileptic drugs

•

Ultra-rare orphan disorder

–

1,500 to 2,000 patients annually

•

Typically occurs in children less than 2 years old

•

Characterized by

–

“spasms”

--

a specific type of seizure

–

“hypsarrhythmia”

--

abnormal EEG pattern

Infantile Spasms |

17

•

Used by over half of child neurologists

•

FDA approval 10/15/10

–

7 year orphan exclusivity for IS indication

•

Crisis therapy

•

Treatment for 2-4 weeks*

•

In a randomized, single-blinded, controlled study, 87% of

patients achieved overall response (no spasms and no

hypsarrhythmia) at two weeks versus 29% on prednisone

•

$100K-$125K/Rx

–

About half of patients receive drug for free

•

Used by over half of child neurologists

•

FDA approval 10/15/10

–

7 year orphan exclusivity for IS indication

•

Crisis therapy

•

Treatment for 2-4 weeks*

•

In a randomized, single-blinded, controlled study, 87% of

patients achieved overall response (no spasms and no

hypsarrhythmia) at two weeks versus 29% on prednisone

•

$100K-$125K/Rx

–

About half of patients receive drug for free

Acthar

and IS

*Based on prescription data |

18

•

Significant variability in quarterly prescriptions

•

Q4-2010 sales within historic range

•

Promotion effort began 11/1/10

•

Potential to increase IS revenue

–

Acthar

currently used to treat 30-50% of IS patients

•

Significant variability in quarterly prescriptions

•

Q4-2010 sales within historic range

•

Promotion effort began 11/1/10

•

Potential to increase IS revenue

–

Acthar

currently used to treat 30-50% of IS patients

IS Sales Plan |

19

•

Characterized by excessive spilling of protein from the

kidney into the urine (proteinuria)

•

Can result in end-stage renal disease (ESRD), dialysis,

transplant

•

Significant unmet need

–

Few treatment options

•

Characterized by excessive spilling of protein from the

kidney into the urine (proteinuria)

•

Can result in end-stage renal disease (ESRD), dialysis,

transplant

•

Significant unmet need

–

Few treatment options

Nephrotic

Syndrome |

20

•

FDA-approved on label indication for reduction of

proteinuria

in:

–

Idiopathic types of nephrotic

syndrome

•

Idiopathic membranous nephropathy

•

Focal

segmental

glomerular

sclerosis

(FSGS)

•

IgA

nephropathy

–

Lupus nephritis

•

Treatment for 4-6 months*

•

$150K-250K/Rx

•

FDA-approved on label indication for reduction of

proteinuria

in:

–

Idiopathic types of nephrotic

syndrome

•

Idiopathic membranous nephropathy

•

Focal

segmental

glomerular

sclerosis

(FSGS)

•

IgA

nephropathy

–

Lupus nephritis

•

Treatment for 4-6 months*

•

$150K-250K/Rx

Acthar

and NS

*Based on prescription data |

21

•

Available November 2010

•

Case series showed response from Acthar

in refractory

idiopathic membranous nephropathy (on-label)

–

9 of 11 patients met response criteria

•

Positive signal received in diabetic nephropathy

investigator initiated trial (not on-label)

–

9 of 15 patients on Acthar

met response criteria and none have

required dialysis

•

Available November 2010

•

Case series showed response from Acthar

in refractory

idiopathic membranous nephropathy (on-label)

–

9 of 11 patients met response criteria

•

Positive signal received in diabetic nephropathy

investigator initiated trial (not on-label)

–

9 of 15 patients on Acthar

met response criteria and none have

required dialysis

Proof of Concept Data |

22

•

Dose response trial for idiopathic membranous

nephropathy (on-label)

–

$5-7M multi-center trial, n~100

–

Reduction of proteinuria

is endpoint

•

Presently designing a well controlled study in

collaboration with FDA for diabetic nephropathy (off-

label)

–

Proof-of-concept study with different dosing regimens and a

placebo

–

Objectives will be to determine if Acthar

is efficacious and safe in a

placebo controlled study

–

If successful, next step will be a larger Phase II trial

•

Dose response trial for idiopathic membranous

nephropathy (on-label)

–

$5-7M multi-center trial, n~100

–

Reduction of proteinuria

is endpoint

•

Presently designing a well controlled study in

collaboration with FDA for diabetic nephropathy (off-

label)

–

Proof-of-concept study with different dosing regimens and a

placebo

–

Objectives will be to determine if Acthar

is efficacious and safe in a

placebo controlled study

–

If successful, next step will be a larger Phase II trial

R&D Effort in NS |

23

•

Nov 2010 ASN meeting

–

First meeting with commercial team presence

–

Data presented via podium/posters

–

30+ doctor advisory board meeting

•

Hired

5

reps

to

sell

Acthar

to

nephrologists

–

Develop selling process and generate sales

–

Initiate sales efforts in early March 2011

–

Expand sales force if sales increase

•

Peer review publication of case series in March 2011

•

Nov 2010 ASN meeting

–

First meeting with commercial team presence

–

Data presented via podium/posters

–

30+ doctor advisory board meeting

•

Hired

5

reps

to

sell

Acthar

to

nephrologists

–

Develop selling process and generate sales

–

Initiate sales efforts in early March 2011

–

Expand sales force if sales increase

•

Peer review publication of case series in March 2011

NS Business Plan |

24

•

MS -

Build on sales momentum,

lots of market headroom

•

IS -

Incremental market

share growth

•

NS -

Establish Acthar

as a therapeutic alternative

in this sizeable market

•

MS -

Build on sales momentum,

lots of market headroom

•

IS -

Incremental market

share growth

•

NS -

Establish Acthar

as a therapeutic alternative

in this sizeable market

Immediate Acthar

Growth Opportunities

*

Represents estimated net sales market opportunity based on internal company estimates

** Represents approximate current net sales annualized run rate

based on internal company estimates |

25

Financials

Profitable

Profitable

Debt Free

Debt Free

Cash Flow Positive

Cash Flow Positive |

26

2010 Financial Results

Record Sales (up 30%) and Solid Earnings (EPS up 35%)

Record Sales (up 30%) and Solid Earnings (EPS up 35%)

Net Sales ($M)

Net Sales ($M)

Gross Margin

Gross Margin

Operating Inc ($M)

Operating Inc ($M)

EPS

EPS

$115.1

$115.1

93%

93%

$53.8

$53.8

$0.54

$0.54

$

$

92%

92%

$41.2

$41.2

$0.40

$0.40

2010

2009

88.3

88.3 |

27

Questcor

is Cash Flow Positive

Debt-free balance sheet

Debt-free balance sheet

*After return of $67 million of cash to shareholders through share

repurchases.

Cash / ST Investment

Cash / ST Investment

Accounts Receivable

Accounts Receivable

$127M*

$127M*

$17M

$17M

2/18/11 |

28

•

Expanded sales force to pursue MS/IS

•

Dedicated pilot NS sales team starting March 2011

•

Develop other markets for Acthar

–

Acthar

is its own pipeline with 15 other on-label

and many possible other therapeutic uses

–

Further defining and developing the unique

characteristics of Acthar

•

No business development

efforts

planned

•

Expanded sales force to pursue MS/IS

•

Dedicated pilot NS sales team starting March 2011

•

Develop other markets for Acthar

–

Acthar

is its own pipeline with 15 other on-label

and many possible other therapeutic uses

–

Further defining and developing the unique

characteristics of Acthar

•

No business development

efforts

planned

Go Forward Plan -

Sell More Acthar |

29

•

Questcor

is streamlined, focused &

profitable

•

Acthar

has sustainable competitive

advantages

•

Focus on substantial growth in MS sales

•

Recent IS approval/label modernization

•

Possible upside with NS

•

Market sizes have good growth potential

•

Cash flow positive/no debt

•

Questcor

is streamlined, focused &

profitable

•

Acthar

has sustainable competitive

advantages

•

Focus on substantial growth in MS sales

•

Recent IS approval/label modernization

•

Possible upside with NS

•

Market sizes have good growth potential

•

Cash flow positive/no debt

Investment Highlights |

30

30

NASDAQ:

QCOR

NASDAQ:

QCOR

March 2011

March 2011 |

31

|