Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Manitex International, Inc. | d8k.htm |

| EX-99.2 - PRESS RELEASE - Manitex International, Inc. | dex992.htm |

“Focused

manufacturer of

engineered lifting

equipment “

Corporate Presentation

Exhibit 99.1

Manitex

International, Inc.

Corporate Presentation

(NASDAQ:MNTX)

March 2011 |

“Focused

manufacturer of

engineered lifting

equipment “

Corporate Presentation

Forward Looking Statements and Non-

GAAP Measures

2

Safe Harbor Statement under the U.S. Private Securities Litigation Reform Act of 1995: This

presentation contains statements that are forward-looking in nature which express

the beliefs and expectations of management including statements regarding the

Company’s expected results of operations or liquidity; statements concerning

projections, predictions, expectations, estimates or forecasts as to our business, financial

and operational results and future economic performance; and statements of

management’s goals and objectives and other similar expressions concerning matters

that are not historical facts. In some cases, you can identify forward-looking

statements by terminology such as “anticipate,”“estimate,”

“plan,” “project,” “continuing,” “ongoing,” “expect,”

“we believe,” “we intend,” “may,” “will,”

“should,” “could,” and similar expressions. Such statements are based on

current plans, estimates and expectations and involve a number of known and unknown risks,

uncertainties and other factors that could cause the Company's future results,

performance or achievements to differ significantly from the results, performance or

achievements expressed or implied by such forward looking statements. These factors and

additional information are discussed in the Company's filings with the Securities and Exchange

Commission and statements in this presentation should be evaluated in light of these important

factors. Although we believe that these statements are based upon reasonable

assumptions, we cannot guarantee future results. Forward looking statements speak only

as of the date on which they are made, and the Company undertakes no obligation to

update publicly or revise any forward-looking statement, whether as a result of new information,

future developments or otherwise. Non-GAAP

Measures: Manitex International from time to time refers to various non-GAAP (generally accepted

accounting principles) financial measures in this presentation. Manitex believes that this

information is useful to understanding its operating results without the impact of

special items. See Manitex’s earnings releases on the Investor Relations section of

our website www.manitexinternational.com for a description and/or reconciliation of

these measures.

|

“Focused

manufacturer of

engineered lifting

equipment “

Corporate Presentation

Company Snapshot

3

Company Description

Manitex International, Inc. provides engineered lifting

solutions. The company operates through two

segments, Lifting Equipment and Equipment

Distribution. The Lifting Equipment segment designs,

manufactures, and distributes boom trucks and crane

products. The Equipment Distribution segment sells,

services and distributes lifting equipment to end users.

The company was formerly known as Veri-Tek

International, Corp. and changed its name to Manitex

International, Inc. in May 2008. Manitex International

was founded in 1993 and is based in Bridgeview,

Illinois.

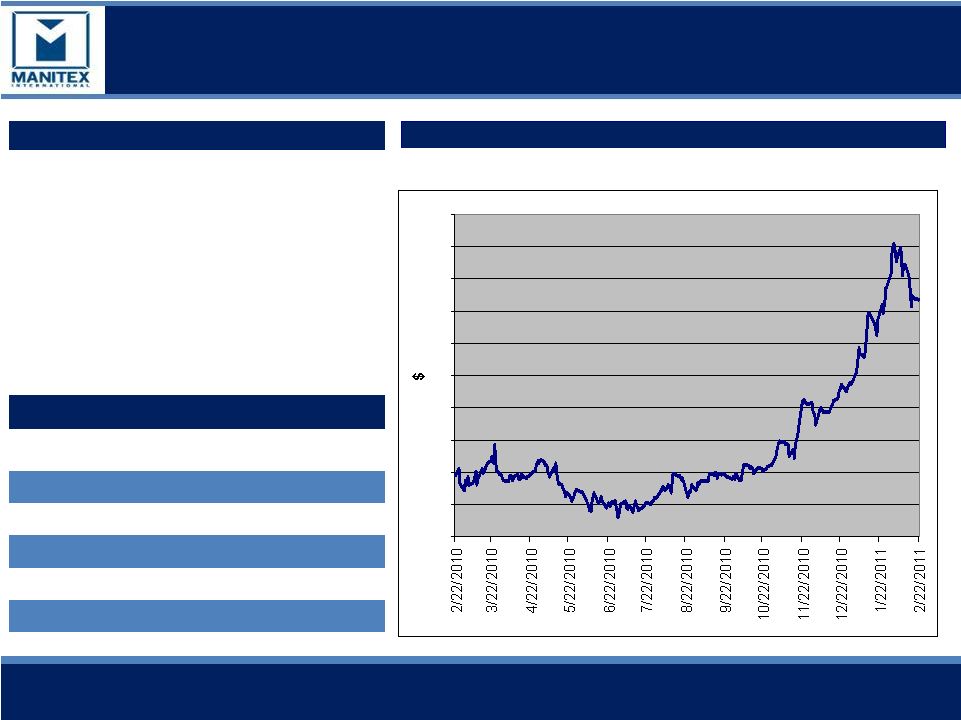

Financial Summary

Total Enterprise Value

(02/22/2011):

$92.7 million

Market Cap (02/22/2011):

$59.0 million

2010 est Total Revenue:

$91.2 million

2010 est Net Income:

$1.8 million

2010 est EBITDA:

$8.1 million

Stock Price (02/22/2011):

$5.18

Ticker / Exchange:

MNTX / NASDAQ

1.5

2

2.5

3

3.5

4

4.5

5

5.5

6

6.5

$5.18

LTM Share Price Performance (02/22/2010 – 02/22/2011) |

“Focused

manufacturer of

engineered lifting

equipment “

Corporate Presentation

•

Global provider of boom trucks, sign cranes, specialized

material handling equipment, and container handling

equipment primarily used in commercial, port, state, local

and international government, and military applications

•

Major industries served include energy (extraction and

processing), utilities, railroads, commercial building,

rental fleets, cargo transportation, infrastructure

development and port and inter-modal operations

•

Historically serving North American markets; recent

international diversification and growth

•

Business Model based in part on an aggressive program of

making accretive acquisitions of complementary

businesses

–

High margin niche markets

–

Including two in 2009 (Badger and Load King) and CVS

agreement in July 2010

–

Rely on seller financing (favorable terms, limited

covenants)

Corporate Overview

Manitex International

4

Manitex International

Businesses |

“Focused

manufacturer of

engineered lifting

equipment “

Corporate Presentation

5

Product Overview

Manitex, Manitex Liftking, Badger, Load King

•

Badger Equipment has

manufactured specialized

earthmoving, railroad and

material handling

equipment since 1945 and

has built over 10,000 units

during its existence.

•

Manufacturer of a complete

line of RT Forklifts, Special

Mission Oriented Vehicles,

Carriers, Heavy Material

Handling Transporters and

Steel Mill Equipment

•

Manitex specializes in

engineered lifting

equipment and its

product family includes

Manitex Boom Trucks,

SkyCrane Aerial Platforms

and Sign Cranes

•

Manufacturer of container

handling equipment for the

global port and inter-modal

sectors. Products include reach

stackers, laden and unladen

container forklifts and straddle

carriers |

“Focused

manufacturer of

engineered lifting

equipment “

Corporate Presentation

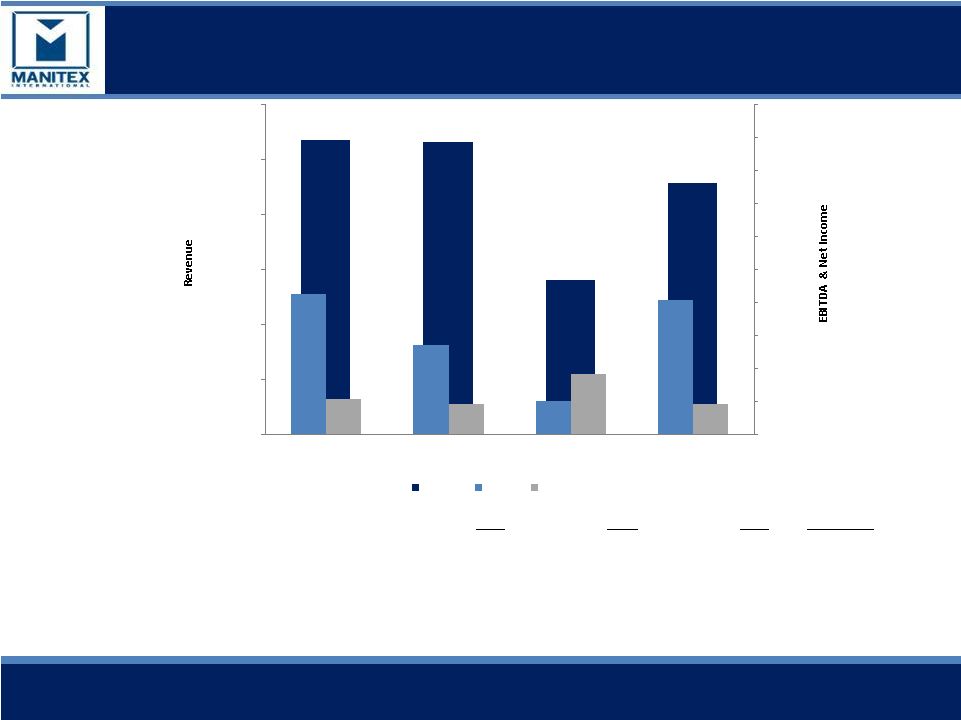

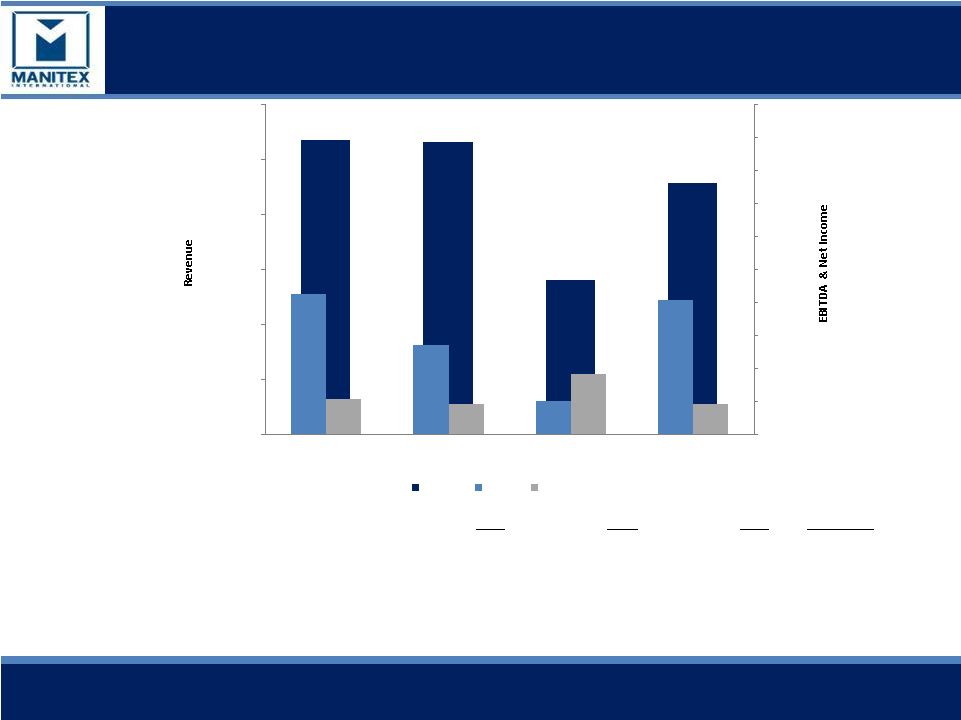

Select Financial Data

Note: Includes continuing operations only.

•Includes gain on bargain purchase of $3,815

•**2010 est, based on 2010 nine months ytd

plus estimated Q4 based on repeating Q3

revenue, gross profit, EBITDA and net income

6

(USD in thousands)

$ in thousands, except percentages

2007

2008

2009

2010 est**

Revenue

$

106,946

$

106,341

$

55,887 $

91,200 Gross Margin

18.6%

16.4%

20.0%

23.6%

EBITDA

8,461

5,416

1,982

8,100

EBITDA Margin (%)

7.9%

5.1%

3.5%

8.9%

Net Income

2126

1,799

3,639 *

1834

$106,946

$106,341

$55,887

$91,200

$8,461

$5,416

$1,982

$8,100

$1,799

$3,639

$1,834

$2,126

$0

$20,000

$40,000

$60,000

$80,000

$100,000

$120,000

2007

2008

2009

2010 est**

$0

$2,000

$4,000

$6,000

$8,000

$10,000

$12,000

$14,000

$16,000

$18,000

$20,000

Revenue

EBITDA

Net Income |

“Focused

manufacturer of

engineered lifting

equipment “

Corporate Presentation

Key Management

Name & Title

Experience

David Langevin

Chairman & CEO

20+ years principally with Terex

Andrew Rooke

President &COO

20+ years principally with Rolls Royce, GKN Sinter Metals, Off-

Highway & Auto Divisions

David Gransee

CFO & Treasurer

Formerly with Arthur Andersen, 15+ years with Eon Labs

(formerly listed)

Robert Litchev

President –

Material Handling & SVP

International Distribution

10+ years principally with Terex

Scott Rolston

SVP Sales & Marketing –

Manitex

International

13+ years principally with Manitowoc

7 |

“Focused

manufacturer of

engineered lifting

equipment “

Corporate Presentation

1)

2010 Solid return to Operating and Net profitability

–

Sales rebound of approx 63%

–

Gross margin expansion

–

Continued emphasis on cost control

2)

Experienced senior management

–

Senior management has over 70 years of collective experience from well-known industrial

leaders such as Terex, Manitowoc, Rolls Royce, GKN Sinter Metals, Off-Highway and

Auto Divisions and Genie 3)

The Company has a global presence with more than 20,000 units operating

worldwide spanning equipment dealerships throughout the country

–

High recurring revenue stream: approximately 20% of total sales (average 40% margin)

4)

Growing market share

–

Increased penetration in oil and gas, power grid and rail

–

Rebounding commercial sales

–

Expanding international sales

5)

Focused on earnings, cash flow and working capital management

8

Investment Highlights |

“Focused

manufacturer of

engineered lifting

equipment “

Corporate Presentation

9

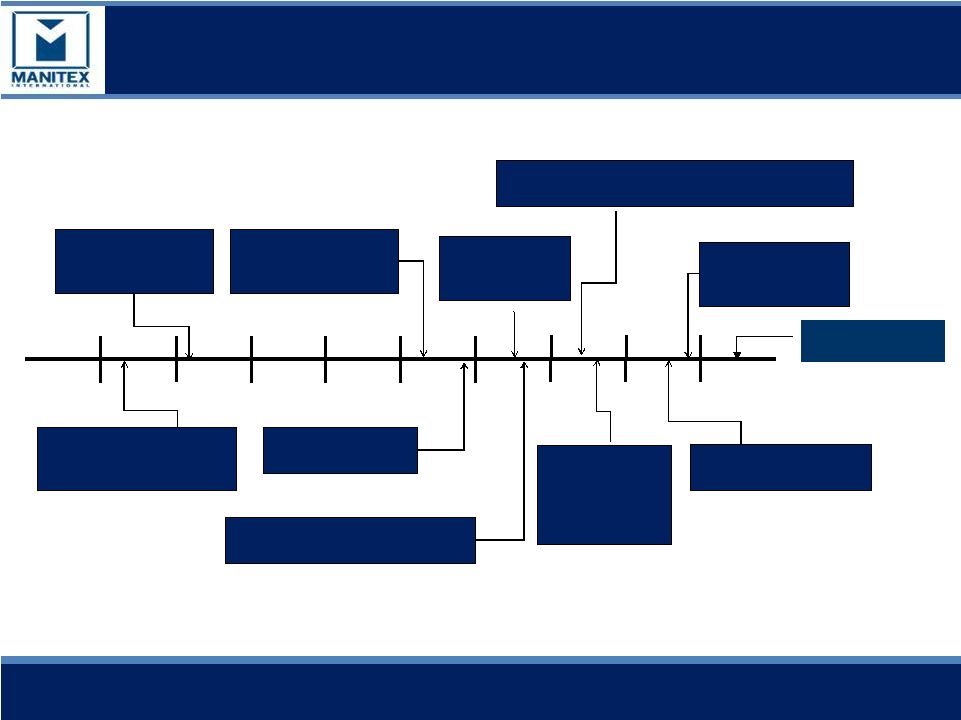

Company Timeline

March 2002:

Manitowoc (NYSE:MTW)

acquires Grove.

January 2003:

Manitowoc divests

Manitex

December 2009:

Acquire Load King

Trailers

July 2009 Acquire Badger

Equipment Co

November 2006: Veri-

Tek Acquires LiftKing

July 2007: VCC

acquires Noble

forklift

August 2007: Sale of assets and

closure of legacy VCC business

May 2008: Name changed to Manitex International

and listed on Nasdaq (MNTX)

October 2008:

Crane &

Machinery and

Schaeff Forklift

acquired

July 2006: Manitex

merges into Veri-Tek,

Intl. (VCC)

2002

2003

2004

2005

2006

2007

2008

2009

2010

July 2010 :CVS Ferrari

Operating Agreement |

“Focused

manufacturer of

engineered lifting

equipment “

Corporate Presentation

•

Load King Trailers, an Elk Point, South

Dakota-based manufacturer of

specialized custom trailers and hauling

systems typically used for transporting

heavy equipment

•

Consideration of $3 million; Load King’s

last five years average annual revenues

were approximately $23 million

•

Niche product line, well-recognized

quality brand name and accomplished

management team

Recent Acquisitions

Highlights

10

•

Badger Equipment Co, a Winona,

Minnesota based manufacturer of

specialized rough terrain cranes and

material handling products

•

Stock purchase with consideration of

$5.1m: Badgers last five years average

annual revenues were approximately

$8m

•

Developing new rough terrain crane line

targeted for railroad, refinery and

construction markets

•

Long standing brand recognition and

crane legacy, with established railroad

and municipality relationships |

“Focused

manufacturer of

engineered lifting

equipment “

Corporate Presentation

Recent

Acquisitions

(subject

to

approval)

CVS

11

•

June 30 2010 MNTX entered into an agreement to operate, on an

exclusive rental

basis,

the

business

of

CVS

SPA,

commencing

July

1

2010

•

CVS

SPA

is

located

near

Milan

Italy

and

designs

and

manufactures

a

range

of reach stackers and associated lifting equipment for the global container

handling market

•

CVS had 2008 annual sales of $106m prior to the global downturn

•

The rental agreement has been filed with the Italian Court and includes an

offer to purchase the business at the conclusion of the Italian insolvency

process (“Concordato Preventivo”) Rental period could extend for up to

two years

•

Sales and profits are consolidated into Manitex International from July

2010.

No

debt

or

liabilities

of

“old

CVS”

were

assumed.

As

at

July

1,

CVS

has a backlog of orders of approximately $10m

•

Acquisition is transformational:

•

Adds global product offering

•

European manufacturing and design

•

Adds scale

•

Above average growth profile sectors of containers / ports / inter-

modal |

Replacement

Parts & Service Consistent Recurring Revenue

•

Recurring revenue of approximately 20% of total sales

•

Spares relate to swing drives, rotating components, and booms among others, many of

which are proprietary

–

Serve additional brands

–

Service team for crane equipment

12

“Focused

manufacturer of

engineered lifting

equipment “

Corporate Presentation |

“Focused

manufacturer of

engineered lifting

equipment “

Corporate Presentation

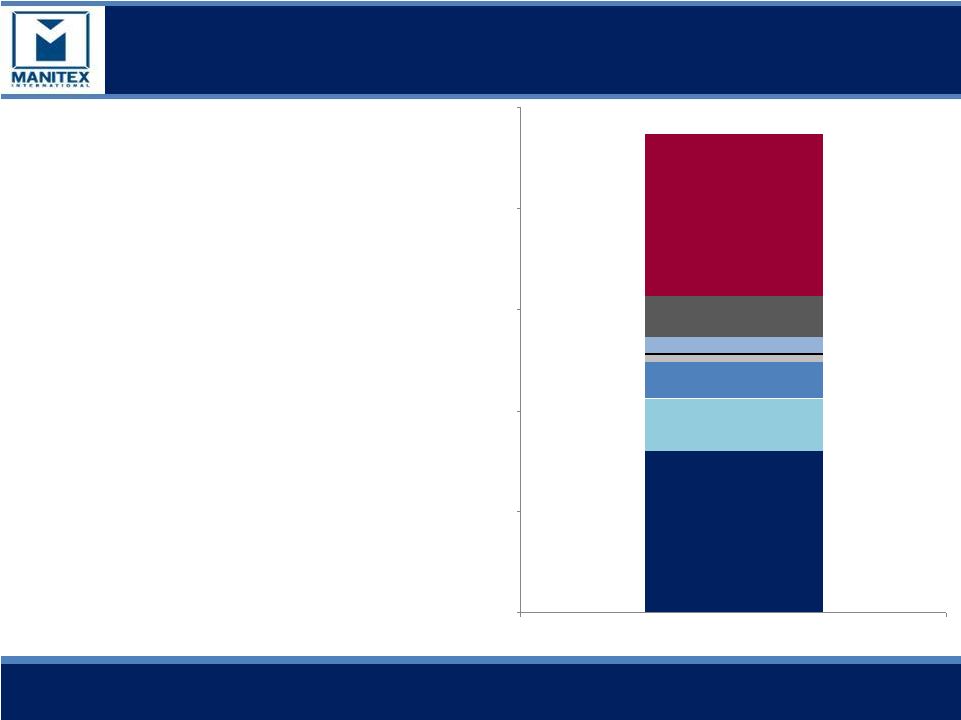

Pro-forma Revenues

•

Pro-forma revenues are based on 2007

revenue numbers for each respective

business, regardless of date of acquisition by

Manitex International

•

We believe Pro-forma revenues are more

representative of revenue opportunity than

revenues in the current phase of the

economic cycle

13

Manitex, $80.0

Liftking, $26.0

Crane & Machinery, $18.1

Schaeff, $3.3

Noble, $1.1

Badger, $8.0

LoadKing, $20.0

CVS Ferrari, $80.0

$0.0

$50.0

$100.0

$150.0

$200.0

$250.0

Pro-forma Annual Revenue |

“Focused

manufacturer of

engineered lifting

equipment “

Corporate Presentation

14

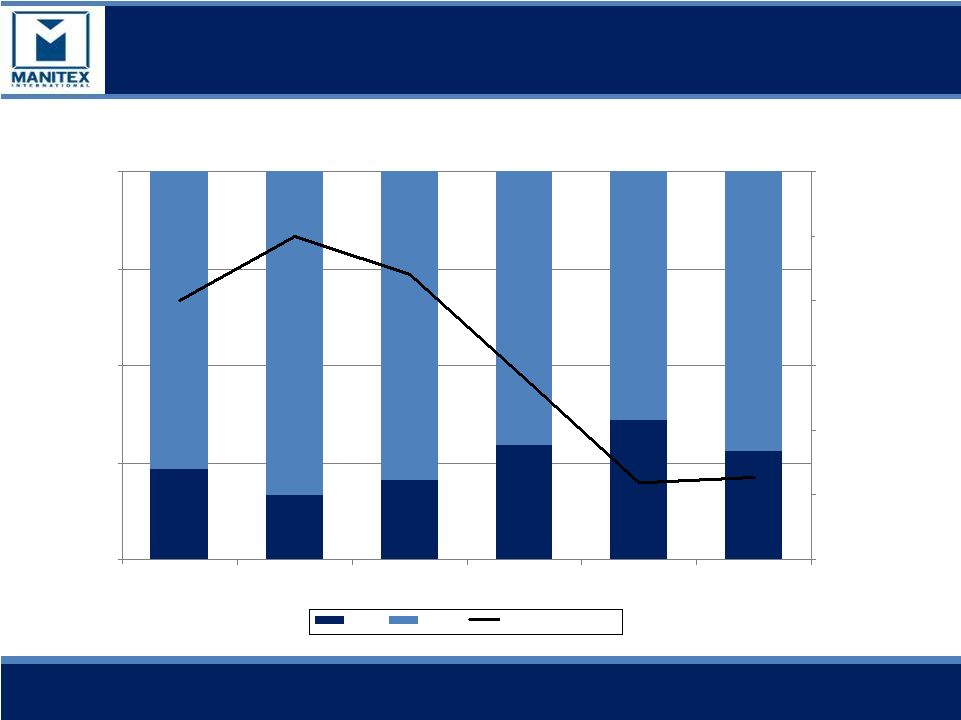

Increased Market Share as Market Declined

Boom Truck Crane Market

23.4%

16.7%

20.8%

29.6%

36.1%

28.0%

76.6%

83.3%

79.2%

70.4%

63.9%

72.0%

0.0%

25.0%

50.0%

75.0%

100.0%

2005

2006

2007

2008

2009

2010

Market Share

0

500

1000

1500

2000

2500

3000

Units Shipped

MNTX

Others

Total Units Shipped |

“Focused

manufacturer of

engineered lifting

equipment “

Corporate Presentation

•

Management saw the state of the world as an opportunity to cut costs and

grow the business through acquisition at a very modest cost, notwithstanding

reductions in its core markets

•

$12.4 m reduction in costs in 2009 compared to 2008

•

Management was successful in lowering costs to match decreases in sales; revenue decreased

47% from 2008-2009

•

With outside financing unavailable our model of negotiating seller financing fit

circumstances perfectly

•

1

st

nine months 2010 gross margin 23.6%, $4.3m increase in EBITDA, revenue

62% higher

•

1

st

nine months 2010 EBITDA margin of 8.8% was the best since 2007

15

2009/2010 Highlights

Opportunistic Cost Cutting |

“Focused

manufacturer of

engineered lifting

equipment “

Corporate Presentation

Select Financial Data

Note: Includes continuing operations only.

•Includes gain on bargain purchase of $3,815

•**2010 est, based on 2010 nine months ytd

plus estimated Q4 based on repeating Q3

revenue, gross profit, EBITDA and net income

16

(USD in thousands)

$ in thousands, except percentages

2007

2008

2009

2010 est**

Revenue

$

106,946

$

106,341

$

55,887 $

91,200 Gross Margin

18.6%

16.4%

20.0%

23.6%

EBITDA

8,461

5,416

1,982

8,100

EBITDA Margin (%)

7.9%

5.1%

3.5%

8.9%

Net Income

2126

1,799

3,639 *

1834

$106,946

$106,341

$55,887

$91,200

$8,461

$5,416

$1,982

$8,100

$1,799

$3,639

$1,834

$2,126

$0

$20,000

$40,000

$60,000

$80,000

$100,000

$120,000

2007

2008

2009

2010 est**

$0

$2,000

$4,000

$6,000

$8,000

$10,000

$12,000

$14,000

$16,000

$18,000

$20,000

Revenue

EBITDA

Net Income |

“Focused

manufacturer of

engineered lifting

equipment “

Corporate Presentation

Growth Drivers –

2010 and Beyond

•

World wide improvements in GDP, economic recovery

•

Increased market penetration with product developments and innovative

distribution

•

Leverage synergy with railroad industry

•

Developed products specifically for the following industries: Oil & Gas,

Railroads, Power Grid & Wind Power

•

Any significant governmental infrastructure spending will be a potential

spark to recovery for Manitex

•

International expansion

–

New

dealership

agreements

reached

in

Middle

East,

Russia,

&

with

Caterpillar

Global

Distribution Network

–

Achieved European CE Certification for 50 Ton Cranes in 2009.

–

Manitex

International

made

its

first

international

sales

in

2008

and

has

identified

new

markets

to

accelerate

future

growth

(Russian

market

potential

is

estimated

to

be

double

that

of North America)

–

2010

non

-

US

sales

were

over

38%

of

revenue

•

CVS Ferrari is additive to the Company results

17 |

“Focused

manufacturer of

engineered lifting

equipment “

Corporate Presentation

Summary

Delivering sound operational and financial performance despite the historic

economic and industry-specific challenges.

Poised For Growth

•

Growing market share

•

Increased penetration in oil and gas, power grid and rail

•

Rebound in commercial sales

•

Coordinated distribution of our products worldwide

•

Continued expansion into international markets

•

In the recent past we have scaled our business to match demand and we now

look forward to long term growth

•

Focused on earnings, cash flow and working capital management

18 |

“Focused

manufacturer of

engineered lifting

equipment “

Corporate Presentation

Appendix

19

Manitex International, Inc.

Corporate Presentation

March 2011 |

“Focused

manufacturer of

engineered lifting

equipment “

Corporate Presentation

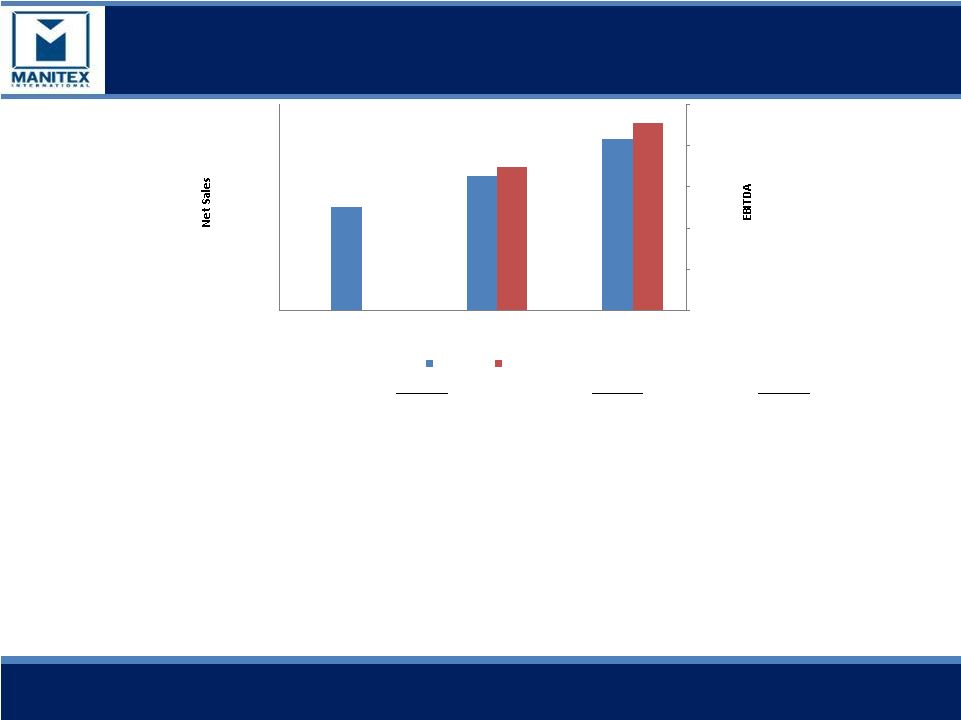

Key Figures -

Quarterly

20

USD thousands

Q3-2009

Q2-2010

Q3-2010

Net sales

$15,063

$19,502

$24,859

% change in Q3-2010 to

prior period

65%

27%

Gross profit

2,208

4,607

5,855

Gross margin %

14.7%

23.6%

23.6%

Operating expenses

2946*

3,658

4,365

Net (loss) Income

(147)

213

657

EBITDA

-80

1,732

2,271

EBITDA % of Sales

-0.5%

8.9%

9.1%

Backlog ($ million)

22.3

24.9

32.8

* excludes bargain purchase gain of $0.9m

$15,063

$19,502

$24,859

$1,732

$2,271

$0

$5,000

$10,000

$15,000

$20,000

$25,000

$30,000

Q3-2009

Q2-2010

Q3-2010

$0

$500

$1,000

$1,500

$2,000

$2,500

Net Sales

EBITDA |

“Focused

manufacturer of

engineered lifting

equipment “

Corporate Presentation

Summarized Balance Sheet

21

Current assets

$47,496

$40,147

$40,685

Fixed assets

10,955

11,804

5,878

Other long term assets

41,198

42,734

39,665

Total Assets

$99,649

$94,685

$86,228

Current liabilities

17,875

14,569

17,062

Long term liabilities

39,749

39,688

34,152

Total Liabilities

$57,624

$54,257

$51,214

Shareholders equity

42,025

40,428

35,014

Total liabilities & Shareholders equity

$99,649

$94,685

$86,228

31-Dec-08

31-Dec-09

30-Sep-10 |

“Focused

manufacturer of

engineered lifting

equipment “

Corporate Presentation

Debt and Liquidity

$000

Q3-2010

Q4-2009

Total Cash

217

287

Total Debt

33,745

33,511

Total Equity

42,025

40,428

Net capitalization

75,553

73,652

Net debt / capitalization

44.4%

45.1%

Quarterly EBITDA

2,271

426

Quarterly EBITDA % of sales

9.1%

2.9%

•Ebitda for Q3-2010 at 9.1% of sales is best performance

by the Company •Debt reduction in Q3-2010 of

$1.2m: •Revolver facility, based on available collateral at

September 30, 2010 was $22.3m •Revolver availability at September 30,

2010 $3.2m •Net capitalization is the sum of debt plus equity minus

cash. •Net debt is total debt less cash |

“Focused

manufacturer of

engineered lifting

equipment “

Corporate Presentation

Working Capital

$000

Q3 2010

Q4 2009

Working Capital

$29,621

$25,578

Days sales outstanding

62

67

Days payable outstanding

53

73

Inventory turns

2.7

1.7

Current ratio

2.7

2.8

•Increase in working capital Q3-2010 v Q4-2009 principally from

increased accounts receivable ($6.0m) and inventory ($1.2m) and offset by

increased accounts payable, accruals & other liabilities ($3.4)

•Inventory increase from new businesses of CVS and NAEE

•Continued strength of current ratio |