Attached files

| file | filename |

|---|---|

| EX-21 - EX-21 - SUREWEST COMMUNICATIONS | a2202166zex-21.htm |

| EX-10.9 - EX-10.9 - SUREWEST COMMUNICATIONS | a2202166zex-10_9.htm |

| EX-10.8 - EX-10.8 - SUREWEST COMMUNICATIONS | a2202166zex-10_8.htm |

| EX-10.10 - EX-10.10 - SUREWEST COMMUNICATIONS | a2202166zex-10_10.htm |

| EX-10.12 - EX-10.12 - SUREWEST COMMUNICATIONS | a2202166zex-10_12.htm |

| EX-10.13 - EX-10.13 - SUREWEST COMMUNICATIONS | a2202166zex-10_13.htm |

| EX-10.11 - EX-10.11 - SUREWEST COMMUNICATIONS | a2202166zex-10_11.htm |

| EX-10.16 - EX-10.16 - SUREWEST COMMUNICATIONS | a2202166zex-10_16.htm |

| EX-23 - EX-23 - SUREWEST COMMUNICATIONS | a2202166zex-23.htm |

| EX-32.2 - EX-32.2 - SUREWEST COMMUNICATIONS | a2202166zex-32_2.htm |

| EX-31.2 - EX-31.2 - SUREWEST COMMUNICATIONS | a2202166zex-31_2.htm |

| EX-31.1 - EX-31.1 - SUREWEST COMMUNICATIONS | a2202166zex-31_1.htm |

| EX-32.1 - EX-32.1 - SUREWEST COMMUNICATIONS | a2202166zex-32_1.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

Item 8. Financial Statements and Supplementary Data.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended December 31, 2010 |

||

or |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

Commission File Number 000-29660 |

|

||

| SUREWEST COMMUNICATIONS (Exact name of registrant as specified in its charter) |

||

California (State or other jurisdiction of incorporation or organization) |

68-0365195 (I.R.S. Employer Identification No.) |

|

8150 Industrial Avenue, Building A, Roseville, California (Address of principal executive offices) |

95678 (Zip Code) |

|

Registrant's telephone number, including area code (916) 786-6141 |

||

Securities registered pursuant to Section 12(b) of the Act: |

||

Title of each class Common Stock–Without Par Value Common Stock Purchase Rights |

Name of each exchange on which registered The NASDAQ Stock Market LLC The NASDAQ Stock Market LLC |

|

Securities registered pursuant to Section 12 (g) of the Act: None |

||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a small reporting company. See definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer ý | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes o No ý

As of June 30, 2010, the aggregate market value of the shares held by non-affiliates of the registrant's common stock was $79,101,169 based on the closing price as reported on the NASDAQ Stock Market LLC. The market value calculations exclude shares held on the stated date by registrant's employee benefit plans, directors and officers on the assumption such shares may be shares owned by affiliates. Exclusion from these public market value calculations does not necessarily conclude affiliate status for any other purpose.

On February 9, 2011, the registrant had 14,091,342 shares of Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant's Proxy Statement to be delivered to shareholders in connection with the Annual Meeting of Shareholders to be held on May 25, 2011 are incorporated herein by reference in Part II and Part III of this Annual Report on Form 10-K. Such proxy statement will be filed with the Securities and Exchange Commission within 120 days of the Registrant's fiscal year ended December 31, 2010.

Note About Forward-Looking Statements

Certain statements in this report, including that which relates to the impact on future revenue sources and potential sharing obligations of pending and future regulatory orders, continued expansion of the telecommunications network and expected changes in the sources of our revenue and cost structure resulting from our entrance into new communications markets, are forward-looking statements and are made pursuant to the safe harbor provisions of the Securities Litigation Reform Act of 1995. These forward looking statements generally are identified by the words "believe", "expect", "anticipate", "estimate", "intend", "should", "may", "will", "would", "will be", "will continue" or similar expressions. Such forward looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements of SureWest Communications to be different from those expressed or implied in the forward-looking statements. A detailed discussion of these and other risks and uncertainties that could cause actual results and events to differ materially from such forward–looking statements is included in the section entitled "Risk Factors" (refer to Part I, Item 1A). We disclaim any intention or obligation to update or revise publicly any forward-looking statements.

Item 1. Business. (Dollars in thousands, except per share amounts)

General Development of Business

SureWest Communications (the "Company", "we" or "our") is a California holding company with operating subsidiaries that provide a wide range of telecommunications, digital video, Internet, data and other facilities-based communications services in Northern California, primarily in the greater Sacramento region ("Sacramento region"), and in the greater Kansas City, Kansas and Missouri areas ("Kansas City area"). We were incorporated under the laws of the State of California in 1995, and through our predecessor we have operated in the telecommunications business since 1914.

As of December 31, 2010, our operating subsidiaries included SureWest Broadband, SureWest TeleVideo, SureWest Kansas, Inc. (with its various direct and indirect subsidiaries, "SureWest Kansas" or the "Kansas City operations"), SureWest Telephone and SureWest Long Distance. SureWest Telephone has a competitive local exchange carrier division (the "SureWest CLEC") which was authorized by the California Public Utilities Commission ("CPUC") in 1998 to provide telecommunications services in areas outside the telephone service area of SureWest Telephone, but it is not a separate subsidiary. The SureWest CLEC is reported in the Broadband segment.

Our strategy is to be the first choice as an integrated communications provider in the Sacramento region and Kansas City area. We seek to achieve this position by leveraging our existing advanced fiber network to extend our operations throughout Sacramento, Placer and adjacent counties in California and by providing superior customer service and integrating our systems, products and operating functions in the Kansas City area.

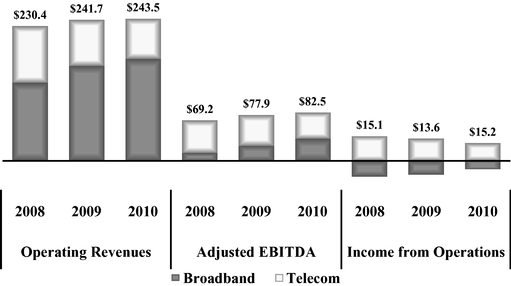

We have two reportable business segments: Broadband and Telecommunications ("Telecom"). The Telecom segment includes the Incumbent Local Exchange Carrier ("ILEC") operations of SureWest Telephone and SureWest Long Distance. The Broadband segment includes substantially all of the rest of

1

our operations. The table that follows reflects the percentage of total operating revenues generated by each of our two business segments for the last three fiscal years:

| |

% of Total Operating Revenues | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reporting Segment | 2010 | 2009 | 2008 | |||||||

Broadband |

72% | 67% | 59% | |||||||

Telecom |

28% | 33% | 41% | |||||||

Total operating revenues |

100% | 100% | 100% | |||||||

All telecommunications providers continue to face increased competition. As a result of technology changes and industry, legislative and regulatory developments, we too continue to face new competitive challenges. In recent years, changes in the legislative and regulatory environment have provided us with significant growth opportunities in our Broadband segment. As indicated by the table above, our Broadband segment has grown to contribute the majority of our total operating revenues. We anticipate Broadband revenues will continue to increase and will offset the anticipated decline of Telecom segment revenues.

The Telecom segment provides wholesale access services through the use of its network to the Broadband segment, which enables the Broadband segment to offer high-speed Internet, Voice-over-Internet-Protocol ("VoIP") services and video services to those customers within SureWest Telephone's service area. These wholesale services are included as intersegment revenues and expenses in each of the respective segments and eliminated in the consolidated statements of income.

No customer accounted for more than 10% of our consolidated operating revenues during the years ended December 31, 2010, 2009 and 2008.

Our products or services that generated 10% or more of our total operating revenues in any of the last three years are as follows:

| |

Total Operating Revenues | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

2010 | 2009 | 2008 | |||||||

Broadband residential data service |

$ | 48,878 | $ | 45,061 | $ | 39,966 | ||||

Broadband residential video service |

$ | 49,139 | $ | 47,522 | $ | 38,520 | ||||

Broadband residential voice service |

$ | 26,461 | $ | 25,897 | $ | 20,619 | ||||

Broadband business service |

$ | 46,209 | $ | 39,554 | $ | 33,077 | ||||

Telecom residential service |

$ | 17,276 | $ | 24,504 | $ | 32,464 | ||||

Telecom business service |

$ | 34,160 | $ | 35,457 | $ | 38,066 | ||||

Telecom access service |

$ | 16,895 | $ | 19,727 | $ | 23,732 | ||||

A summary of net operating revenues from external customers, income from continuing operations, assets and capital expenditures for each of the business segments can be found in Note 12 in the Notes to Consolidated Financial Statements, in Item 8, which is incorporated herein by reference. A discussion of factors potentially affecting our operations is set forth in "Risk Factors" in Item 1A, which is incorporated herein by reference.

As of December 31, 2010, we employed approximately 818 employees, an approximate 8% decline compared to December 31, 2009. The year-over-year decrease in the number of employees was primarily due to a workforce reduction initiative that eliminated approximately 60 positions during 2010. None of our employees are represented by a union. We believe our employee relations are positive.

2

Broadband

General

The Broadband segment includes SureWest Broadband, SureWest TeleVideo, SureWest Kansas and the SureWest CLEC. As of December 31, 2010, the Broadband segment had 104,100 residential subscribers and 236,100 Revenue-generating units ("RGUs").

The Broadband segment utilizes fiber-to-the-home ("FTTH") and fiber-to-the-node ("FTTN") networks in portions of the Sacramento region and Kansas City area to offer bundled residential and commercial services that include Internet protocol ("IP")-based digital and high-definition television, high-speed Internet, VoIP and local and long distance telephone. We continue to expand the use of optical fiber in our networks.

Our advanced telecommunications network gives us a competitive edge that enables us to provide our customers with high data speeds for Internet service and to deploy multiple services of superior quality. Technology changes have fostered the development of a wide range of alternatives to traditional telephone and cable television services. Our advanced telecommunications network gives us the ability to respond to the emerging trends and evolution of our customers' expectations for voice communications and the distribution and viewing of video programming.

In February 2008 we acquired 100% of the issued and outstanding stock of Everest Broadband, Inc. ("Everest" or "SureWest Kansas" or the "Kansas City Operations") for a total purchase price of $181,459, including transaction costs. Subsequent to the acquisition, the Kansas City operations have been included in our Broadband segment and consolidated results of operations. SureWest Kansas is a competitive provider of high-speed data, video and voice services in the Kansas City area. The addition of our Kansas City operations accelerates our growth strategy and has positioned us as a premier provider of network services to residential and business customers in the markets we serve there, as well as in California.

During 2008, SureWest TeleVideo possessed authorizations to serve areas of Sacramento and Placer counties and the cities of Roseville and Lincoln, California. SureWest TeleVideo has expanded its services into previously licensed areas of Elk Grove and Natomas, California as well as to other areas within its service area footprint. We are authorized to provide video programming to substantially all of the residents in the SureWest Telephone service area.

In 2006, the California legislature adopted California Assembly Bill No. 2987, the Digital Infrastructure and Video Competition Act of 2006 ("DIVCA"), which requires providers of multichannel video services to obtain a state franchise instead of a local franchise, and to replace local franchises with state franchises as they expire. DIVCA also accommodates video service delivery in areas that are smaller than an entire municipality. On January 1, 2009, the various local cable television franchises of our subsidiaries in California were replaced with a single California state video franchise that covers our currently served areas plus areas in which we have considered future network expansion.

Our Kansas City operations possess local or state cable television and/or telecommunications franchises covering the cities of Lenexa, Merriam, Olathe, Overland Park, Prairie Village and Shawnee, in Kansas; and they also hold a Federal Communications Commission ("FCC") Open Video System certification for parts of Kansas City, Missouri.

SureWest Broadband procures digital transport capability through a wholesale access agreement with its affiliate, SureWest Telephone, and also through agreements with other carriers. With SureWest TeleVideo, it has developed an advanced method of delivering video services to subscribers in the Sacramento region using IP, or IP-video capability.

3

Competition

All of the businesses in the Broadband segment are subject to extensive competition. Competition has grown dramatically in recent years. Except for the multichannel video delivery business, which requires significant capital investment to serve customers, the barriers to entry are not high, and technology changes force rapid competitive adjustments.

We compete against AT&T, Comcast, Frontier, Wave Broadband, DirecTV, Dish and other companies in the Sacramento region. We compete against Comcast, Time Warner Cable, AT&T, DirecTV, Dish and a number of smaller companies in the Kansas City area.

Numerous wireless carriers also compete against our subsidiaries in the telecommunications business. Most of our wireless competitors now offer Internet and data connectivity, and they are increasing their capabilities in delivering video.

We have found that we can be successful against these competitors by constantly seeking out new sales opportunities in attractive geographic locations and market segments, by maintaining a highly reliable network that is accessible to new customers and by focusing on the provision of excellent service to our customers. To the extent permitted by law and regulatory requirements, we seek to operate our business across the Broadband segment in an integrated manner and to run our network as a single integrated facility in each region. The operating units in this segment benefit within the Sacramento region from the name recognition and reputation of SureWest, and from the active participation of our executives and employees in civic and other groups.

In most cases, we have entered the cable television service markets as the operator of a second (or subsequent) cable system. While we will benefit from the somewhat reduced regulation that such entrants enjoy, we nevertheless face the challenge of drawing customers away from the incumbent cable service provider. The provision of cable television over a closed transmission path has been recognized as possessing certain monopoly characteristics and, therefore, the ability of a second or subsequent provider to succeed in the marketplace is not assured. Similarly, the possession of comparatively greater size and scale can give an incumbent cable competitor an advantage in both access to and pricing of the program content needed to operate a cable television business. Comcast (in California and in parts of the Kansas City area) and Time Warner (in the Kansas City area) each possess significantly greater size and scale than the Company.

Regulation

We operate businesses that are regulated on the Federal, state and local levels.

The most recent comprehensive revision of the nation's primary law governing telecommunications and cable television occurred in 1996, when the Telecommunications Act of 1996 was enacted. This law amended the Communications Act of 1934 and significantly altered the regulatory structure for telecommunications providers. It also has directly and indirectly changed the environment for cable television and Internet providers. Current state and Federal laws and regulations that are applicable to our subsidiaries actively promote competition, but in most cases, maintain varying degrees of regulation as well.

Some level of regulation also is exerted over our subsidiaries by agencies other than the FCC and the state commissions. For example, the Federal Trade Commission ("FTC") has asserted jurisdiction over certain aspects of Internet sales and marketing and the use and misuse of customer information by providers of goods and services.

The FCC was directed by Congress to develop a National Broadband Plan ("NBP") as part of the American Recovery and Reinvestment Act of 2009. In March 2010, after taking extensive public comment, the FCC released the full text of its NBP, which contains policy recommendations on a variety of issues that

4

the FCC has linked to expanded broadband deployment. The policy recommendations include guiding principles to foster competition in broadband, telephone, wireless and cable services over the next decade, including recommendations related to universal service fund ("USF") reform, intercarrier compensation, cable set-top boxes and spectrum reallocation, among others. The NBP recommendations most relevant to the Company include shifting the current USF mechanisms that support universal voice telephone services to support of universal broadband deployment and the phased reduction of intercarrier access compensation levels, with a potential phase-out of all such compensation within ten years. Some of these recommendations only restate pre-existing FCC proposals in current rulemakings while others raise new issues. The FCC has begun some proceedings to implement aspects of the NBP.

In an April 6, 2010 decision, a Federal appeals court found that the FCC lacked authority over certain Internet-related practices of Comcast. This decision came during a proceeding that had been initiated by the FCC to adopt rules related to the conduct of providers of retail Internet services. Notwithstanding the Federal appeals court decision, on December 21, 2010, the FCC adopted rules requiring that such providers honor certain operating principles, including principles of (i) transparency, (ii) no blocking, (iii) no unreasonable discrimination and (iv) reasonable network management in connection with their Internet services. The FCC order has already been appealed.

In addition, the FCC initiated action on February 8, 2011 to again consider reform of the current structure for intercarrier compensation and to consider rules for transitioning the current universal service fund to support broadband deployment. The FCC's actions in these and future proceedings could significantly alter the structure of these arrangements, and affect the costs and sources or revenue for affected service providers. Action in any of these proceedings could have a material impact on us. We will continue to monitor these matters, participate in them as we deem appropriate, and assess the potential impact on our consolidated financial position and results of operations.

The following narrative summarizes the primary regulatory issues affecting the telecommunications, video services and Internet services of our subsidiaries in the Broadband segment:

Telecommunications

Our subsidiaries that provide telecommunications services are subject to varying degrees of Federal and state regulation. They are also subject to local government regulation in some cases.

The FCC has jurisdiction over services and facilities that are interstate in nature, and it can also regulate in other circumstances where it has been given statutory authority to act, including through preemption. State commissions have jurisdiction over most matters that are exclusively intrastate in nature, except for certain matters preempted by the FCC. Telecommunications regulation by local governmental units is generally limited to matters involving the use of local streets and rights of way. Our Kansas City operations hold certain local telecommunications franchises, for example.

The FCC and the state commissions do not regulate all providers that come under their jurisdiction in the same way. Incumbent Local Exchange Carriers ("ILECs") remain more highly regulated. While some regulation of ILECs has eased as competition has increased, that regulation remains more burdensome than the regulation of other telecommunications providers.

Almost all other providers of regulated services, including local competitors to ILECs, are typically subjected to lighter regulation. This lighter regulation is sometimes characterized as "non-dominant" regulation. The basis for this asymmetric form of regulation lies in the determination that these other firms do not possess market power in the provision of services, and as a result will be regulated effectively by market forces. SureWest Telephone is regulated as an ILEC, but our subsidiaries in the Broadband segment are all regulated as non-dominant providers of telecommunications services.

The nature and extent of regulation by the FCC and by state commissions is constantly evolving as a result of ongoing events, changes in public policy, initiatives by carriers and customer interest groups, judicial

5

decisions and other factors. The application of some rules that were once reserved for comprehensively regulated providers alone has now been expanded in some cases to cover lightly regulated companies as well. Examples include the expansion of 911 access obligations, network outage reporting, protection of customer privacy and compliance with the Communications Assistance for Law Enforcement Act.

Among our subsidiaries in the Broadband segment, the following addresses the nature of their regulation:

SureWest CLEC, SureWest TeleVideo, and SureWest Kansas each offer telecommunications services, and when engaged in providing telecommunications, each is subjected to a lighter form of regulation than ILECs face. In addition, regulations that are intended to promote the growth of competition and that are restrictive when applied to ILECs may actually be of benefit to these subsidiaries. For example, a mandatory resale requirement applied to AT&T in California and/or Kansas allows the SureWest CLEC and our Kansas City operations to gain access to special access services and other connections that can be used in the provision of services to our customers.

Ongoing proceedings at the FCC and at the state level are addressing a number of critical telecommunications issues within their respective jurisdictions. A number of these proceedings have been active for many years. Others were newly instituted in 2010. Some of the issues being addressed include the nature of interconnection between different types of networks; the pricing of access and interconnection; the regulation of special access services; the interrelationship between traditional circuit switched telephone services and newer services that use IP and other advanced technologies and standards; the treatment of VoIP; the manner in which broadband services can be made more widely available; the nature and extent of any rules and regulations dealing with the provision of Internet access services, including rules requiring nondiscrimination in the treatment of applications providers; the future of the various Federal and state universal service support funds and the mechanisms that support them; the structure of intercarrier compensation and the future direction and organization of the agency itself. During calendar year 2009, Congress passed legislation making funding available for the expanded deployment of broadband services in certain areas of the country. Some of that funding may be made available to our competitors, allowing them to invest in facilities in defined underserved areas, and helping them to directly or indirectly finance competitive activities. Even if the areas are not areas in which we do business, the availability of Federal funding can free up other capital funds for use in areas in which we compete. The implementation of the broadband program by the FCC and the National Telecommunications and Information Administration is ongoing. The impact of some of these proceedings on the ILEC is separately discussed below under Telecom–Regulation.

Common carriers activities are generally exempt by law from direct FTC regulation, but carriers can be subject to FTC regulation to the extent that they offer non-common carrier services. The FTC's interest in telecommunications and related issues appears to have increased recently, particularly in areas related to privacy.

Video Services

Our cable television subsidiaries each require a state or local franchise or other authorization in order to provide cable service to customers. Each of these subsidiaries is subject to regulation under a framework first added to the Communications Act as Title VI in 1984, substantially amended in 1992 and further amended by the Telecommunications Act of 1996.

Under this framework, the responsibilities and obligations of franchising bodies and cable operators have been carefully defined. The law addresses such issues as the use of local streets and rights of way; the carriage of public, educational and governmental channels; the provision of channel space for leased commercial access; the amount and payment of franchise fees; consumer protection; the enforcement and/or termination of a franchise; and similar issues. In addition, Federal laws place limits on the common ownership of cable systems and competing multichannel video distribution systems, and on the common ownership of cable systems and local telephone systems in the same geographic area. Many provisions of

6

the Federal law have been implemented through FCC regulations. These matters are subject to ongoing oversight by the FCC. The FCC has expanded its oversight and regulation of the cable television-related matters recently. In some cases, FCC action has created opportunities for the Company against incumbent cable operators.

The Telecommunications Act of 1996 also added to the Communications Act a number of provisions addressing the implementation and operation of open video systems ("OVS"). An OVS is a form of multichannel video delivery that is distinct from a traditional cable television delivery system and Congress identified a distinct regulatory structure to be applied to it. OVS were intended to accommodate unaffiliated providers of video programming on the same network. The OVS regulatory structure also offered a means for a single provider to serve less than an entire community. Our Kansas City operations in Missouri utilize an OVS that allows us to operate in only a part of Kansas City.

A number of state and local provisions also affect the operation of our cable systems. The enactment of DIVCA in California sought to encourage further the entrance of telephone companies and other new cable operators to compete against the large incumbent cable operators. DIVCA changed preexisting California law to require new franchise applicants to obtain franchise authorizations on the state level. In addition, DIVCA established a general set of state-defined terms and conditions to replace numerous terms and conditions that had applied uniquely in local municipalities, and it repealed a state law that had prohibited local governments from adopting terms for new competitive franchises that differed in any material way from the incumbent's franchise, even if competitive circumstances were very different. Some portions of this law are also available to incumbent cable operators with existing local franchises who compete against us.

A state franchising law also has been enacted in Kansas. While these laws have reduced franchise burdens on our subsidiaries, and have made it easier for them to seek out and enter new markets, they also have reduced the entry barriers for others who may want to enter our cable television markets.

Federal law and regulation also affects numerous issues related to video programming and other content.

Under Federal law, certain local television broadcast stations (both commercial and non-commercial) can elect, every three years, to take advantage of rules that require a cable operator to distribute the station's content to the cable system's customers without charge, or to forego this "must-carry" obligation and to negotiate for carriage on an arm's length contractual basis, which typically involves the payment of a fee by the cable operator, and sometimes involves other consideration as well.

If the station and the cable operator can come to an agreement, the station grants "retransmission consent" for the term of the agreement, typically for the entire three year period. The current three-year cycle commenced on January 1, 2009. Fees under retransmission consent agreements generally underwent marked increases for the 2009-2011 period. New three-year elections will occur in late 2011 and would generally apply for the 2012-2014 period. We expect stations again to seek significantly higher fees for retransmission consent rights covering this period.

Federal law and regulation regulate access to certain programming content that is delivered by satellite. The 1992 amendment to the Communications Act put in place a ban on exclusive contracts between cable operators and certain affiliated satellite programmers. The ban has been extended by the FCC until October 5, 2012. It will expire at that time unless it is extended again. The FCC recently adopted an order banning exclusive contracts between affiliates where the programming is sent via terrestrial media, and banning certain other unfair acts, making it clear that the withholding of regional sports programming and high definition television programming by content affiliates of incumbent cable operators would receive special attention. Unlike the satellite provisions, the new rules would not expire. The FCC's order is under appeal and a decision in this matter is anticipated during 2011.

In connection with the FCC's approval of a cable transaction involving Comcast and Time Warner in July 2006, the parties' regional sports networks also remain subject to certain program access rules until July

7

2012. In early 2010, Comcast proposed to enter into a joint venture with NBC Universal, through which it would acquire control of numerous NBC properties, including both broadcast and cable television programming operations of NBC. In early 2011, the FCC and the Department of Justice ("DOJ") approved the transaction, with a significant number of conditions related to program access and carriage, non-discrimination, bundling and the relationship of the joint venture to emerging on-line competition. Most of the conditions will have a duration of seven years. A few of the conditions are marginally favorable for the Company's cable operations, in part because they would qualify as small cable operators. The FCC and DOJ conditions may give the Company additional options in bargaining for video programming content licenses with the joint venture, and promote more equal treatment in comparison with larger cable competitors. Other conditions relate to the continued independence of the NBC operations from Comcast in dealing with cable operators on certain issues, as well as the expansion of content alternatives in a number of areas that may ultimately become available to the Company.

The contractual relationships between cable operators and most providers of content who are not television broadcast stations generally are not subject to FCC oversight or other regulation. The majority of providers of content to our subsidiaries, including content providers affiliated with incumbent cable operators such as Comcast, but who are not subject to any FCC or DOJ conditions, do so through arm's length contracts where the parties have mutually agreed upon the terms of carriage and the applicable fees.

The transition to digital television ("DTV") has led the FCC to adopt and implement new rules designed to ease the shift. These rules can be expected to make broadcast content more accessible over the air to smartphones, personal computers and other non-television devices. Local television broadcast stations will also be able to offer more content over their assigned digital spectrum after the DTV transition, including additional channels. The FCC is considering whether it should modify its must carry rules to cover any new digital channels offered by local television broadcast stations entitled to must carry treatment. This could cause additional costs and compliance burdens for cable operators, including our cable subsidiaries.

The Company continues to monitor the emergence of video content options for customers that have become available over the Internet, and that may be made available free, by individual subscription or in conjunction with a separate cable service agreement. In some cases, this involves the ability to watch episodes of desirable network television programming and to procure additional content related to programs carried on linear cable channels. These options have increased significantly, and can lead cable television customers to terminate or reduce their level of services. At this time, these "over-the-top" programming options do not purport to duplicate the nature or extent of desirable programming carried by cable systems, and the market is still comparatively nascent, but in light of changing technology and events such as the Comcast-NBC transaction, the "over-the-top" market will continue to grow and evolve rapidly.

Cable operators depend to some degree upon their ability to utilize the poles (and conduit) of electric and telephone utilities. The terms and conditions under which such attachments can be made were established in the Federal Pole Attachment Act of 1978, as amended. The Pole Attachment Act outlined the formula for calculating the fee to be charged for the use of utility poles, a formula that assesses fees based on the proportionate amount of space assigned for use and an allocation of certain qualified costs of the pole owner. The FCC has put in place a structure for pole attachment regulation that has covered cable operators and other types of providers. A proceeding is currently pending in which the FCC proposes to examine its current formula and to determine whether a single rate should apply equally to all providers who use poles, whether they are cable operators, telecommunications providers, or Internet providers, even if they use the attachment to offer more than one service. States have the option to opt out of the Federal formula and to regulate pole attachments independently. Kansas and Missouri follow the FCC pole attachment framework. California has elected to separately regulate pole attachments and pole attachment rates. FCC action may affect the rates paid for pole attachments by our Kansas City operations, and may indirectly affect the way in which the state of California regulates pole attachments. It also could increase our costs for such attachments.

8

Cable operators are subject to longstanding cable copyright obligations where they pay copyright fees for some types of programming that are considered secondary retransmissions. The copyright fees are updated from time to time, and are paid into a pool administered by the United States Copyright Office for distribution to qualifying recipients.

There are numerous other regulations applicable to cable operators and/or to cable systems that apply in diverse ways. For example, the FCC has adopted a rule that governs the disposition of inside wiring installed by a cable operator in multiple dwelling units when another cable provider seeks to serve a customer there. The FCC also has invalidated exclusivity provisions in agreements between multiple dwelling unit owners and cable providers (the FCC is still considering proposals to prohibit related exclusive marketing agreements and bulk billing arrangements altogether). The FCC also has adopted rules to promote the use of plug-and-play televisions and to eliminate the need for set top boxes, but is reassessing its policies in light of rapid changes in technology and the emergence of broadband access to video content through the Internet.

The FCC has so far declined to require that cable operators allow unaffiliated Internet service providers to gain access to customers by using the network of the operator's cable system. The FCC also has considered the benefits of a requirement that cable operators offer programming on their systems on an a la carte or themed basis, but to date has not adopted regulations requiring such action. These matters may resurface in the future, particularly as the "over-the-top" market grows. In light of the fact that programming is increasingly being made available through Internet connections, some cable operators have considered their own a la carte alternatives. Content owners with linear channels also are moving toward greater "on demand" programming, offerings that maintain the value of their linear channels for customers.

The outcome of pending matters cannot be determined at this time but can lead to increased costs for the Company in connection with our provision of cable services, and can affect our ability to compete in the markets we serve.

Internet Services

During 2010, SureWest TeleVideo, SureWest CLEC and our Kansas City operations provided retail Internet services, and/or facilities for the transport of Internet services.

The provision of Internet access services is not significantly regulated by either the FCC or the state commissions. However, the FCC has been moving toward the imposition of some controls on the provision of Internet access. In 2002, in part to place cable modem service and Digital Subscriber Line ("DSL") service on an equal competitive footing, the FCC asserted jurisdiction over these services as "information services" under Title I of the Communications Act, and removed them from treatment under Title II of the Act, but to date it has not determined what regulatory framework, if any, is appropriate for Internet services under Title I.

The FCC has also adopted policy principles to signal its objectives with respect to high speed Internet and related services. These principles are intended to encourage broad customer access to the content and applications of their choice, to promote the unrestricted use of lawful equipment by users of Internet services and to promote competition among providers. Some parties have sought action by the FCC to convert these policy principles to formal rules.

The FCC has used its authority in individual Internet-related situations through ad hoc decision making. For example, it has fined providers who have engaged in network management practices that affect, and in some cases restrict, customers' use of the Internet or their access to content. In 2009, the FCC proposed to enact rules related to Internet access services, relying in part on the policy principles that it had earlier adopted, but expanding their reach and adding additional provisions. The adoption of the rules as they have been proposed would prohibit discrimination with respect to applications providers, among other things, subject to reasonable network management by an Internet access service provider.

9

The Federal appeals court decision in April 2010 reassessed the FCC's authority over Internet services under the Communications Act, and invalidated action taken by the FCC that was based on authority that the FCC thought it possessed. The FCC continues to evaluate its jurisdictional options in light of this decision, and it has continued to assert jurisdictional authority in some areas related to the promotion of an open Internet. Its adoption of rules in this regard in December 2010, has been appealed to a Federal appeals court. The extent of the FCC's jurisdiction in connection with the Internet will not be resolved for some time. The Company is unable to predict the outcome of current proceedings.

The FTC is currently assessing certain advertising and marketing practices of Internet-related companies. A recent FTC report encourages disclosure by providers about the way in which search-related information of a consumer may be used for targeted marketing of goods and services, and further encourages these providers to obtain prior consent from consumers for such use. It also has issued a report promoting options for Internet users to prohibit the tracking of their usage. It is currently unclear whether the FTC initiatives will lead to new rules or new law.

The outcome of pending matters cannot be determined at this time but can lead to increased costs for the Company in connection with our provision of Internet services, and can affect our ability to compete in the markets we serve.

Telecom

General

The Telecom segment includes SureWest Telephone and SureWest Long Distance, which provide landline telecommunications services, wholesale access services, domestic and international long distance services and certain non-regulated services. The services provided by the subsidiaries in this segment are available only in the Sacramento region. SureWest Telephone, which is the principal operating subsidiary of the Telecom segment, provides local services, regional toll telephone services, network access services and certain non-regulated services. Some services are provided through connections with other carriers serving adjacent areas, including AT&T, and also through service agreements with numerous interexchange carriers, including national interexchange carriers. SureWest Long Distance provides long distance services. Revenues from this segment have decreased as a percentage of our consolidated revenues from continuing operations over the past several years due to declining voice RGUs (and a corresponding reduction in the use of services) and most recently, the acquisition of Everest, which is included in the Broadband segment. In addition, many customers are choosing to subscribe to our Broadband Digital Phone offering instead of the traditional circuit-switched phone service offered by SureWest Telephone. Despite these events, we expect this segment to continue to provide a large proportion of our earnings in 2011.

The Telecom segment will continue to experience decreases in access revenues through 2011 due to scheduled reductions in California High Cost Fund ("CHCF") subsidies and the elimination of transport interconnection revenue effective January 1, 2011. We anticipate Telecom revenue declines to slow over the next several years with the completion of the phased subsidy reductions. Despite these events, during 2011 we expect this segment to continue to generate the majority of our income from continuing operations.

SureWest Telephone continues to benefit from past investments to enhance the copper network and build an advanced fiber network, creating a next-generation platform. Through our network, we offer services such as fiber-optics-based high-speed Internet, customized data and Ethernet transport services, data center and disaster recovery solutions, traditional landline and scalable IP communications platform. As a result, declines in business revenues have slowed as the climate for small and medium sized businesses begins to stabilize. Additionally, we supply wholesale access and DSL services through our network to the Broadband segment, enabling them to offer high-speed Internet, VoIP, video and wireless backhaul

10

services to customers within the Telecom service territory. The expansion of the Broadband segment customer base and backhaul services has caused wholesale revenues to grow over the past three years.

SureWest Telephone operates as an ILEC with a service area of approximately 83 square miles, covering Roseville and Citrus Heights, California, and adjacent areas in Placer and Sacramento Counties. We hold a non-exclusive perpetual franchise granted by Section 7901 of the California Public Utilities Code. The area served by SureWest Telephone has been one of the most rapidly growing areas in California during the past two decades causing it to attract new competitors, but the pace of growth has slowed in recent years as the area has become more developed and as the economy has moved through a recession.

SureWest Telephone provides services to residential, business and carrier customers, and continues to be subject to the competitive and regulatory challenges faced by ILECs both nationally and in California. As a result of competitive pressures, SureWest Telephone experienced a 25% decrease in voice RGUs and a 7% decline in business customers from December 31, 2009 to December 31, 2010. As of December 31, 2010, SureWest Telephone served approximately 28,900 voice RGUs and approximately 7,900 business customers. We believe that the economic downturn in the area in recent years, expanding competition and service substitution have impacted, and will continue to reduce, the number of voice RGUs and business customers.

SureWest Long Distance offers intrastate, interstate and international long distance services, including calling card and 800 services. SureWest Long Distance is a resale business that utilizes other national and international carriers for wholesale transport, switching and other capabilities. SureWest Long Distance maintains agreements with Sprint Communications Company L.P. and Level 3 Communications, LLC to diversify its risks related to its wholesale providers. The rates offered to SureWest Long Distance by these companies are competitive; however, changes in the wholesale marketplace in the recent past have provided recurring opportunities to long distance resellers to further reduce their costs.

Competition

In recent years, competition to serve customers in the SureWest Telephone service area has increased significantly. SureWest Telephone competes against AT&T and a number of other certificated carriers, Comcast and numerous other companies in both the business and residential telecommunications and information transport markets in its telephone service area. Its competitors offer traditional telecommunications services as well as IP-based services and other emerging data-based services. Some competitors have extended their own network facilities in the SureWest Telephone service area. Changes in technology have made it possible for customers to receive services in new ways at competitive rates. To meet the competition, SureWest Telephone has responded in part by introducing new services and service "bundles", offering services in convenient groupings with package discounts and billing advantages and by investing in its network and business operations. Changing technology requires that we continue to adapt our network and the manner in which we provide service. Within our telephone service area, services are provided over an integrated network making extensive use of optical fiber. SureWest Telephone deploys fiber optic facilities to broaden the reach and capacity of our services requiring additional bandwidth. In some instances, fiber optics is deployed directly to a customer's premises. Because bandwidth is limited by distance when utilizing copper facilities, we are also deploying equipment throughout our service area to enable the improved provision of services over copper. Certain of our facilities take advantage of IP, which allows for more efficient use of bandwidth.

See Item 7–"Management's Discussion and Analysis of Financial Condition and Results of Operations" for further discussion regarding SureWest Telephone's revenues that are subject to the competitive environment in which SureWest Telephone operates.

We anticipate that our businesses will continue to experience competition and that the nature and extent of such competition will increase. Competitors to the SureWest Telephone business include competitive local exchange carriers, interexchange carriers (including interexchange carriers which serve customers directly

11

without using facilities of local exchange carriers), traditional video providers expanding into voice and data services, wireless service providers, providers of IP-based calling services (including SureWest Broadband), customers which are telecommunications self-providers and a range of other providers that specialize in certain niche areas of telecommunications. Technology change has accelerated the pressure on established carriers, including SureWest Telephone, by virtue of software-defined businesses and innovations related to packet switching and the use of the Internet and IP capabilities.

Regulation

Some of the general aspects of telecommunications regulation on the Federal and state levels are outlined above in the discussion of regulation as it applies to the Broadband segment. SureWest Telephone, as an ILEC, is subject to significant regulation by both the CPUC and the FCC. In particular, SureWest Telephone's revenues are influenced greatly by the actions of the CPUC and the FCC. However, since SureWest Telephone is not a retail provider of Internet access service, the FCC's actions to regulate certain aspects of how Internet service is made available are expected to have little direct impact on it.

Intrastate telecommunications service rates of SureWest Telephone are subject to regulation by the CPUC. The provision of access to the networks of interexchange carriers for long distance calling is governed by access tariffs and by intercarrier agreements, which are subject to the jurisdiction of the CPUC or FCC, or both, depending upon the nature of the transmissions. SureWest Telephone has a tariff on file with the FCC for all elements of interstate access services except carrier common line charges, for which SureWest Telephone concurs with the tariff of the National Exchange Carrier Association.

The characterization of traffic as interstate or intrastate, and as a telecommunications or information service has been a significant source of dispute among carriers and others in recent years, as those characterizations can impact the regulatory treatment of the traffic and the payment obligations of the providers which are involved. The characterization of: (i) traffic involved in intercarrier interconnection, (ii) Internet traffic and (iii) traffic that utilizes IP and other transmission technologies are examples of issues that are currently subject to analysis on the state and federal levels, and that are expected to be subject to regulatory action in the future. Both the FCC and CPUC have initiated proceedings to evaluate the appropriate level of regulation for providers of telecommunications services and for IP-enabled services. In addition, various proceedings at the FCC are pending that could lead to significant alteration of the existing compensation arrangements among providers of telecommunications services, and that could adversely impact the amount of the payments we receive from carriers and others for use of our network.

The FCC monitors SureWest Telephone's interstate earnings through the use of annual cost separation studies prepared by SureWest Telephone, which utilize estimated cost information and projected demand usage. The FCC establishes rules that carriers must follow in the preparation of the annual studies. Additionally, under current FCC rules governing rate making, SureWest Telephone is required to establish interstate rates based on projected demand usage for its various services and determine the actual earnings from these rates once actual volumes and costs are known.

With respect to its regulatory authority over SureWest Telephone's rates, the CPUC also has the power, among other things, to establish terms and conditions of intrastate service, to prescribe uniform systems of accounts and to regulate the mortgaging or disposition of public utility properties.

A CPUC decision in August 2005 allowed SureWest Telephone to continue receiving our $11,500 annual interim draw from the CHCF. The CHCF was previously authorized by the CPUC to offset SureWest Telephone's intrastate regulated operating expenses on an interim basis. In August 2006, we requested permission from the CPUC to implement a graduated phase-down of our annual $11,500 interim draw. In September 2007, the CPUC issued Decision 07-09-002 which provides for SureWest Telephone to phase-down its interim annual CHCF draw over a five-year period. The phase-down of the interim draw

12

began in January 2007, initially reducing the annual $11,500 interim draw to $10,200, and in each subsequent year will be incrementally reduced by $2,040.

In an ongoing proceeding relating to the New Regulatory Framework (under which SureWest Telephone has been regulated since 1996), the CPUC adopted Decision 06-08-030 in 2006, which grants carriers broader pricing freedom in the provision of telecommunications services, bundling of services, promotions and customer contracts. This decision adopted a new regulatory framework, the Uniform Regulatory Framework ("URF"), which among other things (i) eliminates price regulation and allows full pricing flexibility for all new and retail services except basic residential services, which could only be raised up to $3.25 per year for 2009 and 2010 as described below, (ii) allows new forms of bundles and promotional packages of telecommunication services, (iii) allocates all gains and losses from the sale of assets to shareholders and (iv) eliminates almost all elements of rate of return regulation, including the calculation of shareable earnings. On September 18, 2008, the CPUC adopted Decision 08-09-042, which allows URF ILECs to increase their basic residential rate by up to $3.25 per year over the next two years. Beginning January 1, 2011, the URF ILECs are allowed full pricing flexibility for the basic residential rate. On December 31, 2010, the CPUC issued a ruling to initiate a new phase to assess whether, or to what extent, the level of competition in the telecommunications industry is sufficient to control prices for the four largest ILECs in the state, including SureWest Telephone. The CPUC's actions in this and future proceedings could lead to new rules and an increase in government regulation.

In December 2007, the CPUC issued a final decision in a proceeding investigating the continued need for an intrastate access element called the transport interconnection charge ("TIC"). The final decision capped SureWest Telephone's intrastate access charges through 2010 and the TIC was eliminated effective January 1, 2011. SureWest Telephone will have an opportunity to recover all or part of our lost TIC revenue elsewhere, including residential rate adjustments, as well as through growth of our Broadband segment. We anticipate a reduction in our 2011 intrastate access revenues of approximately $2,050.

These actions of the CPUC and of the FCC, as noted above, can affect the rates charged for access and interconnection, and, as a result, the revenues we derive from access and related services. SureWest Telephone's future operations also may be impacted by other proceedings at the FCC and CPUC, including proceedings that address interstate access and other rates and charges, the nature of interconnection between ILEC carriers and others, the collection and distribution of support payments required to assure universal access to basic telephone services, the charges that can be assessed for new forms of service that directly or indirectly utilize carrier networks, the expansion of broadband services, the treatment of Internet access and VoIP services as telecommunications or information services under the Communications Act and the promotion of Internet openness (sometimes characterized as network neutrality). The general nature of regulation of telecommunications companies, including SureWest Telephone, is also addressed above in the section captioned Broadband–Regulation.

The long distance business is recognized as being fully competitive and there are many providers of long distance services. Because of the level of competition, regulation of this area of the telecommunications business is light or has been removed altogether. Where it exists, regulation is focused on specific public policy concerns, such as customer account slamming and other consumer protection issues, rather than the rates, terms and conditions of service.

The FCC has opened a number of investigative proceedings to establish policies and/or rules to maintain and promote universal service, to reform the structure of intercarrier compensation and to address the provision of broadband services. Further regulatory actions with respect to these matters may have a material impact on us. We will continue to monitor these matters and the potential effects on our consolidated financial position and results of operations.

13

Current Business Developments

Sale of Communication Tower Assets

In February 2009, we sold our fifty-two wireless communications towers ("Tower Assets") owned by our subsidiary West Coast PCS, LLC ("West Coast PCS") to Global Tower Partners. West Coast PCS was a component of our Broadband segment. The sale was completed for an aggregate cash purchase price of $9,222, resulting in a gain of $2,525, net of tax. Proceeds from the sale of the Tower Assets were used to repay a portion of outstanding long-term debt.

Sale of Wireless Assets

In May 2008, we completed the sale of the operating assets of our Wireless business, SureWest Wireless, to Verizon Wireless ("Verizon") for an aggregate cash purchase price of $69,746, resulting in a gain of $18,864, net of tax. Under the agreement, Verizon acquired the spectrum licenses and operating assets of SureWest Wireless, excluding our owned communication towers. SureWest Wireless was previously reported as a separate reportable segment.

Acquisition of Everest Broadband, Inc.

In February 2008, we acquired 100% of the issued and outstanding stock of SureWest Kansas Inc., formerly Everest Broadband, Inc. for a total purchase price of $181,459, including transaction costs. Subsequent to the acquisition, the Kansas City operations have been included in our Broadband segment and consolidated results of operations. SureWest Kansas is a competitive provider of high-speed data, video and voice services in the Kansas City area. The addition of our Kansas City operations accelerates our growth strategy and has positioned us as a premier provider of network services to residential and business customers in the markets we serve.

Executive Officers of the Registrant

Our executive officers are appointed by, and serve at the discretion of, our board of directors. Each executive officer is a full-time employee. There is no family relationship between any of our executive officers or directors. Our executive officers as of February 1, 2011 were as follows:

Steven C. Oldham; age 60; President and Chief Executive Officer

Mr. Oldham has served as President and Chief Executive Officer since January 2006 and as a member of the Board of Directors since 2004. Prior to joining the Company, Mr. Oldham served from 2002 to 2005 as a Senior Advisor for The Brattle Group, which provides consulting services in economics, finance and regulation. He also served as Senior Vice President, Energy Supply for Sierra Pacific Resources, where he worked for 27 years in various positions of increasing responsibility.

Fred A. Arcuri; age 58; Senior Vice President and Chief Operating Officer

Mr. Arcuri has served as Senior Vice President and Chief Operating Officer since January 2006. From 2002 to 2005, he served as Senior Vice President and Chief Operating Officer of SureWest Broadband, after being elected a Vice President in 2000.

L. Scott Sommers; age 53; Senior Vice President, Finance and Corporate Development

Mr. Sommers has served as Senior Vice President, Finance and Corporate Development since March 2008. Prior to his appointment to Senior Vice President, he served as Vice President, Treasurer since he joined the Company in 2006. Prior to joining the Company, Mr. Sommers served from 2005 to 2006 as Managing Director of Investment Banking for Cantor Fitzgerald. Before joining Cantor Fitzgerald, Mr. Sommers served as First Vice President for Mellon Financial from 1998 to 2005.

14

Scott K. Barber; age 50; Vice President and General Manager of Operations, California

Mr. Barber has served as Vice President and General Manager of Operations, California since March 2008. Prior to his appointment to General Manager of Operations, California, he served as Vice President, Network Operations from 2003 to 2008 and as Executive Director, Network Services from 2000 to 2003.

Dan T. Bessey; age 45; Vice President and Chief Financial Officer

Mr. Bessey has served as Chief Financial Officer since March 2008 after being appointed to Vice President, Finance in 2007. Prior to his appointment to Vice President, he served as Controller from 2003 to 2007 and as Director of Corporate Finance from 2000 to 2003.

Edwin B. Butler; age 47, Vice President, Sales

Mr. Butler was named Vice President, Sales in December 2009. Prior to his appointment to Vice President, he served as Executive Director, Business Sales Kansas since he joined the company in 2008 as part of our acquisition of Everest. Prior to joining the Company, Mr. Butler served as the Vice President, Business Solutions for Everest from 2002 to 2008.

Timothy J. Dotson; age 50; Vice President and Chief Information Officer

Mr. Dotson has served as Vice President, Chief Information Officer since March 2007. Prior to his appointment to Vice President, he served in various leadership roles with increasing responsibilities in Information Technology for over sixteen years with the Company. He served as Chief Information Officer from 2006 to 2007, Executive Director Information Technology Solutions from 2004 to 2006 and Information Technology Director from 2002 to 2004.

Peter C. Drozdoff; age 55; Vice President, Marketing

Mr. Drozdoff has served as Vice President, Marketing since 2002. From 2000 to 2002, he served as Executive Director, Corporate Marketing.

Kenneth E. Johnson; age 47; Vice President and Chief Technology Officer

Mr. Johnson was named Chief Technology Officer in November 2010. Prior to his appointment as Chief Technology Officer, he served as Vice President, General Manager of Operations, Kansas since February of 2008. Mr. Johnson joined the Company as part of our acquisition of Everest in 2008. Prior to joining the Company, Mr. Johnson served as the Chief Technology Officer for Everest from 2003 to 2008.

Karlyn S. Oberg; age 51; Vice President, Administration

Ms. Oberg has served as Vice President, Administration since September 2008. Prior to her appointment as Vice President, she served as Executive Director, Enterprise Initiatives from 2006 to 2008. She also served as Director of Investor Relations from 2005 to 2006 and as Director, ITS Program Office from 2003 to 2005.

Darla J. Yetter; age 50; Corporate Secretary

Ms. Yetter was elected Corporate Secretary in 2003. Since 1994, she has served as Assistant to the President.

Available Information

Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to reports filed pursuant to Sections 13(a) or 15(d) of the Securities Exchange Act of 1934, as

15

amended, are available free of charge on our web site at www.surw.com/ir/, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the Securities and Exchange Commission ("SEC"). Our website also contains copies of our Code of Ethics and charter of each committee of our Board of Directors. Copies are also available free of charge upon request to SureWest Communications, P.O. Box 969, Roseville, CA 95678, Attn: Investor Relations Manager. The information found on our web site is not part of this or any other report we file with or furnish to the SEC. The public may read and copy any materials we file with the SEC at the SEC's Public Reference Room at 100 F Street, NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding our filings at http://www.sec.gov.

Our operations and financial results are subject to various risks and uncertainties, including but not limited to those described below, that could adversely affect our business, financial condition, results of operations, cash flows and the trading price of our common stock.

We expect to continue to face significant competition in all parts of our business and the level of competition is expected to intensify. The telecommunications, Internet and digital video businesses are highly competitive. We face actual or potential competition from many existing and emerging companies, including other incumbent and competitive local telephone companies, long-distance carriers and resellers, wireless companies, Internet service providers, satellite companies, cable television companies and in some cases by new forms of providers who are able to offer competitive services through software applications, requiring a comparatively small initial investment. The wireless business has expanded significantly and has caused many subscribers to traditional telephone services and land-based Internet access services to give up those services and to rely exclusively on wireless service. Consumers are finding individual television shows of interest to them through the Internet and are watching content that is downloaded to their computers. Some providers, including television and cable television content owners, have initiated what are called "over-the-top" services that deliver video content to televisions and computers over the Internet. Over-the-top services can include episodes of highly-rated television series in their current broadcast seasons. They also can include content that is related to broadcast or sports content that the Company carries, but that is distinct and may be available only through the alternative source. Finally, the transition to digital broadcast television has allowed many consumers to obtain high definition local broadcast television signals (including many network affiliates) over-the-air, using a simple antenna. Consumers can pursue each of these options without foregoing any of the other options. We may not be able to successfully anticipate and respond to many of these various competitive factors affecting the industry, including regulatory changes that may affect our competitors and us differently, new technologies, services and applications that may be introduced, changes in consumer preferences, demographic trends and discount or bundled pricing strategies by competitors. The incumbent telephone carrier in the markets we serve (AT&T in both Sacramento and in the Kansas City area) enjoys certain business advantages, including size, financial resources, favorable regulatory position, a more diverse product mix, brand recognition and connection to virtually all of our customers and potential customers. The largest cable operators (Comcast in the Sacramento region and Time Warner in the Kansas City area) also enjoy certain business advantages, including size, financial resources, ownership of or superior access to desirable programming and other content, a more diverse product mix, brand recognition and first-in-the-field advantages with a customer base that generates positive cash flow for its operations. Both Comcast and Time Warner also actively offer telephone services and Internet services to business and residential customers. Our competitors continue to add features and adopt aggressive pricing and packaging for services comparable to the services we offer. Their success in selling some services competitive with ours can lead to revenue erosion in other related areas. We face intense

16

competition in our markets for long-distance, Internet access and other ancillary services that are important to our business and to our growth strategy. Our business and results of operations may be adversely affected if we do not compete effectively.

We must adapt to rapid technological change. If we are unable to take advantage of technological developments, or if we adopt and implement them more slowly than our competitors, we may experience a decline in the demand for our services. Our industry operates in a technologically complex environment. New technologies are continually developed and products and services undergo constant improvement. These offer consumers a variety of choices for their communication needs. To remain competitive, we will need to adapt to future changes in technology to enhance our existing offerings and to introduce new or improved offerings that anticipate and respond to the varied and continually changing demands of our customers. If we are unable to match the benefits offered by competing technologies on a timely basis or at an acceptable cost, if we fail to employ technologies desired by our customers before our competitors do so, or if we do not successfully execute on our technology initiatives, our business and results of operations could be adversely affected.

In addition, evolving technologies can reduce the costs of entry for others, resulting in greater competition and give competitors significant new advantages. Technological developments could require us to make a significant new capital investment in order to remain competitive with other service providers. If we do not replace or upgrade our network and its technology once it becomes obsolete, we will be unable to compete effectively and will likely lose customers. We also may be placed at a cost disadvantage in offering our services. Technology changes are also allowing individuals to bypass telephone companies and cable operators entirely to make and receive calls, and to provide for the distribution and viewing of video programming without the need to subscribe to traditional voice and video products and services. Increasingly, this can be done over wireless facilities and other emerging mobile technologies as well as traditional wired networks. Although we use fiber optics in parts of our networks, including in some residential areas, we continue to rely on coaxial cable and copper transport media to serve customers in many areas. The facilities we use to offer our video services, including the interfaces with customers, are undergoing a rapid evolution, and depend in part on the products, expertise and capabilities of third parties. If we cannot develop new services and products to keep pace with technological advances, or if such services and products are not widely embraced by our customer, our results of operations could be adversely impacted.

Current and future economic conditions could impact our results of operations and the availability of financing. The past few years have been characterized by weak global economic conditions, tightening of credit markets and instability in the financial markets. Although these conditions are improving in some areas, if these conditions worsen, customers may delay, reduce or forego subscribing to advanced or premium services to which they subscribe, or may discontinue subscribing to one or more of our services, or may delay purchasing decisions or delay full implementation of service offerings. Further, volatility or deteriorating economic conditions, in the California economy in particular, could adversely affect our customers and their ability to pay amounts owed to us. Any of these events would likely harm our business, results of operations and financial condition.

In addition, adverse changes in the credit markets, including increases in interest rates and borrowing spreads, could increase our cost of borrowing and negatively impact our operating results as well as our ability to expand our network. A sustained decline in the current economic environment could affect our access to financing and could have an adverse effect on our ability to execute future strategic initiatives, including potential future acquisitions or divestitures.

Unfavorable changes in the financial markets could adversely affect our pension plan investments resulting in a material funding requirement to meet future pension obligations. The cost to maintain our frozen defined benefit Pension Plan (the "Pension Plan") and future funding requirements for the Pension Plan are affected by several factors including the expected return on investment of the assets held by

17

the Pension Plan, changes in the discount rate used to calculate pension expense and the amortization of unrecognized gains and losses. Returns generated on Pension Plan assets have historically funded a significant portion of the benefits paid under the Pension Plan. We estimate the long-term rate of return of Pension Plan assets will be 8.0%. The Pension Plan invests in marketable equity securities which are exposed to changes in the financial markets. If the financial markets experience a downturn and returns fall below our estimate, as seen in recent years, we could be required to make a material contribution to the Pension Plan, which could adversely affect our cash flows from operations.

Our operations and those of our customers may be adversely affected by the impact of California economic conditions and California's budget deficit. As of December 31, 2010, a significant portion of our operations are located in California. The continuing economic crisis has particularly affected the economy of California. The State of California began its fiscal year on July 1, 2010 with a significant reported deficit, which continues to impact and aggravate current recessionary conditions within the State. Given the budgetary situation in California, there is also the possibility that the California State Legislature could enact new tax legislation, increasing tax rates in California. The economic and legislative environment within the State could have an adverse impact on businesses operating in California, including us and our customers. Any of these factors would likely harm our business, results of operations and financial condition.