Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - GigPeak, Inc. | d8k.htm |

| EX-99.1 - PRESS RELEASE - GigPeak, Inc. | dex991.htm |

GigOptix

GigOptix

(GGOX.OB)

(GGOX.OB)

Corporate Presentation

Corporate Presentation

February 2011

February 2011

FILED BY GIGOPTIX, INC. AND ENDWAVE CORPORATION

PURSUANT TO RULE 425 UNDER THE

SECURITIES ACT OF 1933

SUBJECT COMPANY: GIGOPTIX, INC. AND ENDWAVE CORPORATION

Exhibit 99.2 |

©

2011 GigOptix, Inc. All Rights Reserved

2

2

2

Disclaimer

Disclaimer

Forward Looking Statements:

This

presentation

contains

statements

regarding

operating

trends,

future

results,

new

projects,

and

other

market,

business

and

product

trends

that

are forward-

looking.

We

undertake

no

obligation

to

update

or

revise

the

forward-looking

statements,

whether

as

a

result

of

new

information,

future

events

or

otherwise.

Additional

factors

that

could

cause

actual

results

to

differ

are

discussed

under

the

heading

"Risk

Factors"

and

in

other

sections

of

the

GigOptix

and

Endwave

filings

with

the

SEC,

and

in

GigOptix’s

and

Endwave’s

other

current

and

periodic

reports

filed

or

furnished

from

time

to

time

with

the

SEC.

Use of Non-GAAP and Adjusted EBITDA Financial Measures:

These

materials

include

references

to

non-GAAP

revenue,

non-GAAP

net

income/loss,

Adjusted

consolidated

non-GAAP

net

income/loss,

and

Adjusted

EBITDA.

GigOptix

believes

that

these

non-GAAP

financial

measures

are

important

indicators

of

the

ongoing

operations

of

its

business

and

provide

better

comparability

between

reporting

periods

and

provide

a

better

baseline

for

analyzing

trends

in

GigOptix’s

operations.

GigOptix

does

not,

nor

does

it

suggest

that

investors

should,

consider

such

non-GAAP

and

Adjusted

EBITDA

financial

measures

in

isolation

from,

or

as

a

substitute

for,

financial

information

prepared

in

accordance

with

GAAP.

GigOptix

believes

the

disclosure

of

the

effects

of

these

items

increases

the

reader’s

understanding

of

the

underlying

performance

of

the

business

and

that

such

non-GAAP

and

Adjusted

EBITDA

financial

measures

provide

investorswith

an

additional

tool

to

evaluate

our

financial

results

and

assess

our

prospects

for

future

performance.

Additional Information About This Transaction:

This presentation shall not constitute an offer of any securities for sale. In

connection with the proposed transaction, GigOptix will file with the

Securities and Exchange Commission a

Registration

Statement

on

Form

S-4

that

will

include

a

proxy

statement

of

Endwave

and

a

prospectus

of

GigOptix.

The

definitive

proxy

statement/prospectus

will

be

mailed

to

stockholders

of

Endwave.

GigOptix

and

Endwave

urge

investors

and

security

holders

to

read

the

proxy

statement/prospectus

regarding

the

proposed

transaction

when

it

becomes

available

because

it

will

contain

important

information

about

the

proposed

transaction.

You

may

obtain

a

free

copy

of

the

proxy

statement/prospectus

(when

available)

and

other

related

documents

filed

by

GigOptix

and

Endwave

with

the

SEC

at

the

SEC’s

web

site

at

www.sec.gov.

The

proxy

statement/prospectus

(when

it

is

available)

and

other

documents

filed

by

GigOptix

or

Endwave

with

the

SEC

relating

to

the

proposed

transaction

may

also

be

obtained

for

free

by

accessing

GigOptix’s

web

site

at

www.gigoptix.com

by

clicking

on

the

link

for

“Investor”,

then

clicking

on

the

link

for

“SEC

Filings”,

or

by

accessing

Endwave’s

web

site

at

www.endwave.com

and

clicking

on

the

“Company”

link

and

then

clicking

on

the

link

for

“SEC

Filings”

underneath

the

heading

“Investor

Relations”.

Participants in the Merger:

GigOptix,

Endwave

and

their

respective

directors,

executive

officers

and

certain

other

members

of

management

and

employees

may

be

deemed

to

be

participants

in

the

solicitation

of

proxies

from

Endwave

stockholders

in

connection

with

the

proposed

transaction.

Information

regarding

the

persons

who

may,

under

the

rules

of

the

SEC,

be

considered

participants

in

the

solicitation

of

Endwave

stockholders

in

connection

with

the

proposed

transaction,

including

the

interests

of

such

participants

in

the

proposed

transaction,

will

be

set

forth

in

the

proxy

statement/prospectus

when

it

is

filed

with

the

SEC.

You

can

find

information

about

GigOptix’s

executive

officers

and

directors

in

GigOptix’s

definitive

proxy

statement

filed

with

the

SEC

on

October

28,

2010.

You

can

find

information

about

Endwave’s

executive

officers

and

directors

in

Endwave’s

definitive

proxy

statement

filed

with

the

SEC

on

June

11,

2010.

You

can

obtain

free

copies

of

these

documents

from

GigOptix

or

Endwave,

respectively,

using

the

contact

information

below. |

3

3

3

©

2011 GigOptix, Inc. All Rights Reserved

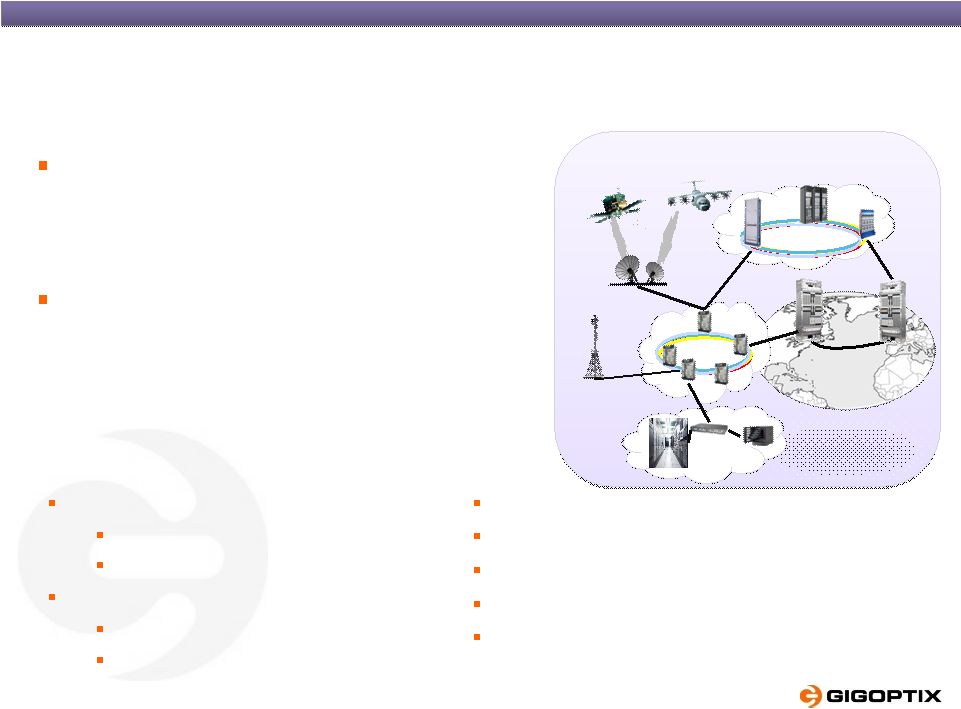

Leading supplier of network

interface devices enabling high

speed data communication

Solution portfolio spanning

communication spectrum from

fiber optics to high speed

wireless mobile backhaul

Core

DWDM

Core

Routers

Metro

Routers

Satellite

Ground Station

Satellite

Communication

Airborne

Communication

Base Station

Backhaul

Submarine

Networks

Access

Metro

Enterprise

&

Datacenter

GigOptix, Inc.

GigOptix, Inc.

Latest Development: Acquisition of Endwave

Latest Development: Acquisition of Endwave

(ENWV)

(ENWV)

Served Markets:

Optical Communications

Datacom

and Telecom Networks

Military/Aerospace

High Speed Wireless Communications

Point-to-Point radio for mobile back haul

Military/Aerospace/Automotive

Products:

High speed analog ICs

High frequency analog ICs

High speed optical modulators

High speed wireless front ends

Structured and Standard Cell ASICs

SLIDE

REFLECTS

GIGOPTIX,

INC.

UPON

COMPLETION

OF

MERGER

WITH

ENDWAVE |

©

2011 GigOptix, Inc. All Rights Reserved

4

4

4

Market Demand for More Bandwidth

Market Demand for More Bandwidth

2010 mobile data traffic was three times the size of the entire global Internet in 2000

(Cisco) 2014 mobile data traffic will be 40 times what it was in 2010

Movies

Online TV

Music

Online Games

Social Networking

Increasing use of data intense

services escalate bandwidth

demand

HD displays

Pictures

Increasing use of mobile infrastructure for

delivery of data

Source:Ovum |

©

2011 GigOptix, Inc. All Rights Reserved

5

5

5

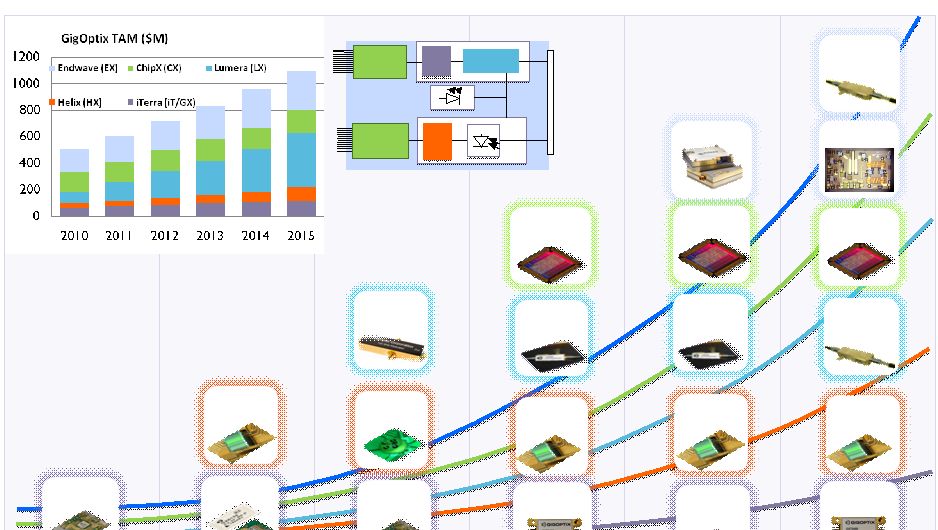

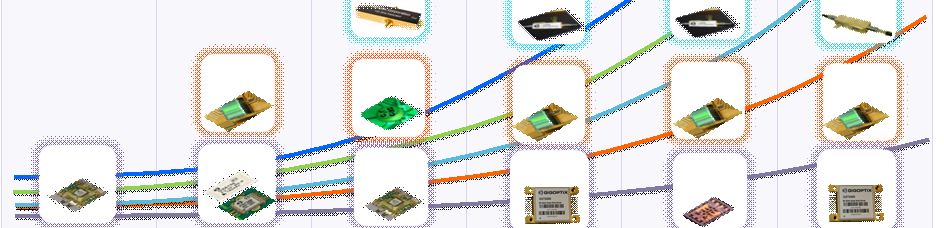

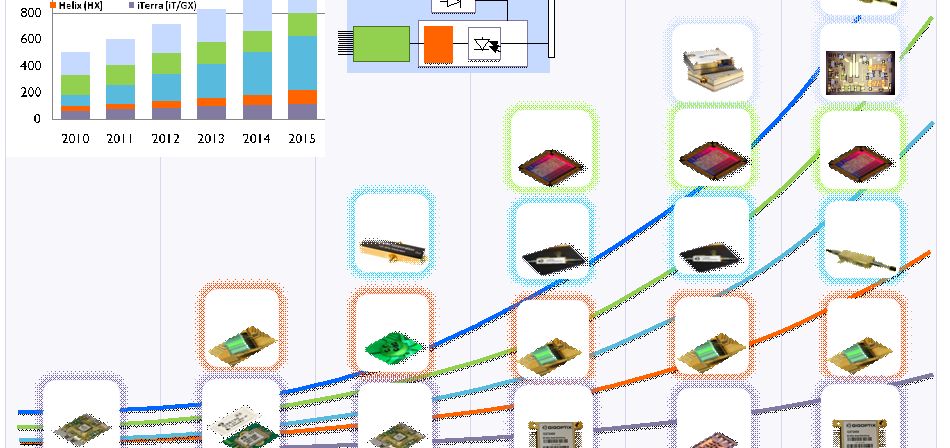

GigOptix Growth Strategy

GigOptix Growth Strategy

Since 2007 GigOptix has invested $15M in developing and acquiring assets that

leverage a prior investment of more than $300M.

GigOptix is a fast growing fabless high-speed optical and high frequency wireless

semiconductor device company, leveraging prior investment in acquired companies

Over the last 3 years through internal development and building on our strategic efforts

we have built a portfolio of more than 90 products and 100 patents

April 2007

Inception of

GigOptix LLC.

July 2007

January 2008

December

2008

November

2009

1H 2011

GigOptix, Inc.

Products:

High speed

electro-optics:

Drivers

High speed

electro-optics:

Amplifiers &

Drivers

High speed

electro-optics:

Polymer

Modulators

High speed

electronics:

Mixed-Signal

ASIC

High Speed

electronics:

MMICs &

Transceivers

90+ analog

semiconductor

& High Speed

Wireless and

ASICs products

2007

2008

2009

2011 |

©

2011 GigOptix, Inc. All Rights Reserved

6

6

6

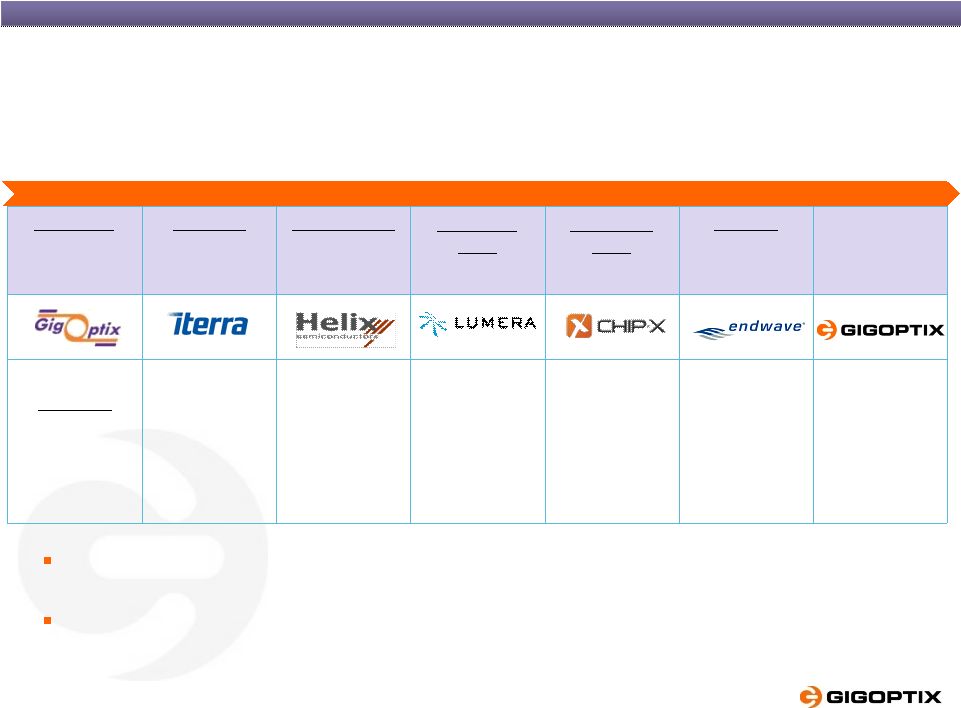

Company Overviews

Company Overviews

Description

a leading supplier of high

performance electronic and

electro-optic components that

enable next generation 40G and

100G optical networks

a leading provider of high-frequency

RF solutions and semiconductor

products for the wireless mobile

backhaul communications, satellite

communications, electronic

instruments and defense and security

markets

Products

High Speed Optical:

Drivers, Amplifiers, Modulators

ASIC

High Frequency RF:

MMIC, Modules/Transceivers

Target

Markets

Telecom, Datacom, Defense,

Instrumentation, Consumer,

Military, Aerospace

Point-to-Point Back-Haul Wireless

Communications, Military,

Aerospace, Automotive |

©

2011 GigOptix, Inc. All Rights Reserved

7

7

7

GigOptix

GigOptix

+ Endwave

+ Endwave

Combination

Combination

1.

Enhances revenue growth and strengthens balance sheet with substantial

cost savings

2.

Addresses customers’

growing needs for high speed solutions in optical

networks and wireless mobile backhaul

Same

customer

base,

same

technology

–

new

application

Jointly capitalizes on the increasing network bandwidth demands

3.

Leverages

highly

complementary

product

and

technology

portfolios

in

high

speed fiber and wireless communications

Further increases the level of integration, functionality and cost reductions for

products

targeting

microwave/millimeter

wave

and

broadband

fiber

optic

applications

Strengthens IC design capabilities in both GaAs

and SiGe

processes

4.

Expands penetration of targeted and new markets

Increases penetration of commercial and military applications

Potential for expansion into the high speed instrumentation market

|

©

2011 GigOptix, Inc. All Rights Reserved

8

8

8

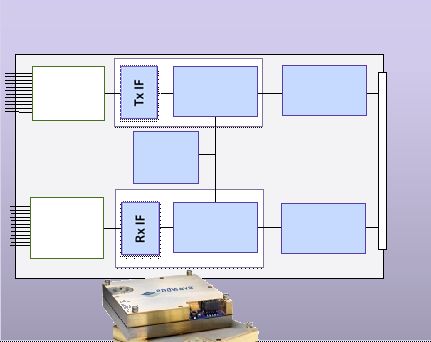

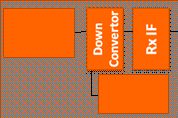

Optical & High Speed Wireless Technology

Optical & High Speed Wireless Technology

Many similarities between Optical and High Speed Wireless solutions exist:

Operate in the same microwave and millimeter wave frequencies

Utilize the same semiconductor process technologies and design expertise

Next generation optical transceiver will employ the same proven wireless

communication techniques to increase channel capacity

Optical Transceiver Module

Wireless Transceiver Module

Modem

Rx

Tx

Upconv

Modem

Tx

Local

Osc

Rx

Downconv

Low Noise

Amplifier

Power

Amplifier

DEMUX

PD

MUX

Optical

Modulator |

©

2011 GigOptix, Inc. All Rights Reserved

9

9

9

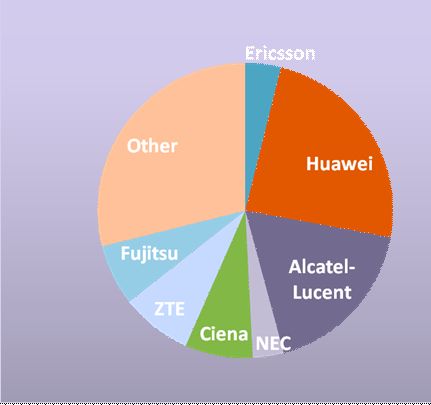

Optical & High Speed Wireless Customers

Optical & High Speed Wireless Customers

Increases business with current and targeted customers

High Speed Wireless

Optical Network Equipment Market

Source: Ovum, Jan 2011

Source: Maravedis Research, Oct 2010 |

©

2011 GigOptix, Inc. All Rights Reserved

10

10

10

GigOptix’s

GigOptix’s

High Speed Network End to End Solutions

High Speed Network End to End Solutions

TODAY:

Fiber

Optics

Networks:

10Gb/s

to

100Gb/s

and

beyond

GigOptix

components upon

completion of merger

GigOptix

potential extension

Included after the completion of merger:

High

Speed

Wireless

Mobile

Backhaul:

100Mb/s

to

2.5Gb/s

MUX

Up

Convertor

Low

Noise

Amplifier

Power

Amplifier

DEMUX

Local

Oscillato

r

Local

Oscillato

r

PD

MUX

Optical

Modulato

r

Optical

Amplifier

Optical

Amplifier

Optical

Amplifier

Optical

Amplifier

DEMUX |

11

11

11

©

2011 GigOptix, Inc. All Rights Reserved

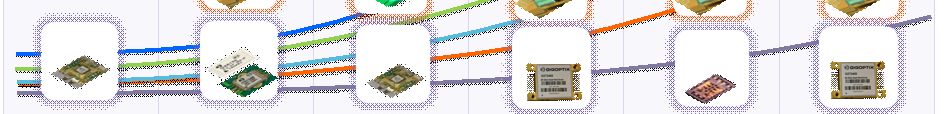

2007

2008

2009

2010

2011

2012

10G ULH

Drivers

100G RZ

Polymer

Modulator

10G Ultralow

Power VCSEL

Driver//TIAs

25G CDR

65nm Hybrid

4 &12ch 5G

Parallel Driver &

Receiver

4 &12ch 14G

Parallel Driver &

Receiver

40G DQPSK

MZ Driver

100G DPQPSK

Driver

100G DPQPSK

Polymer

Modulator

100G ETH

Driver

25G VCSEL

Driver/TIAs

High Speed

Mixed-Signal

Platform

MUX/Modem

100G DPQPSK

Integrated

Driver/

Modulator

10G LH & Metro

Drivers

Family of 10G &

20G TIAs

40G DPSK

Polymer

Modulator

E-Band T/R

E-Band MMIC

400G DPQPSK

Driver

Optical

Front End

Transceiver Module

GigOptix’s Product Portfolio

GigOptix’s Product Portfolio |

12

12

12

©

2011 GigOptix, Inc. All Rights Reserved

Building a Valuable Global Channel

Building a Valuable Global Channel |

13

13

13

©

2011 GigOptix, Inc. All Rights Reserved

Leveraging a Global Supply Chain

Leveraging a Global Supply Chain

GigOptix’s fabless business model utilizes industry

leading semiconductor foundries and packaging

contract manufacturers

Efficient technology transfer from in-house

prototype fab to contract manufacturers

ISO 9000 and 14001 standard compliance;

AS-9100, RoHS, Telcordia |

14

14

14

©

2011 GigOptix, Inc. All Rights Reserved

GigOptix

GigOptix

Senior Management –

Senior Management –

Post Merger

Post Merger

Dr. Avi

Katz: Chairman & Chief Executive Officer

Ms.

Julie

Tipton:

Chief

Operations

Officer

Mr.

Andrea

Betti-Berutto:

Chief

Technical

Officer

Mr. Curt Sacks: Chief Financial Officer |

15

15

15

©

2011 GigOptix, Inc. All Rights Reserved

GigOptix, Inc. Financial Performance

GigOptix, Inc. Financial Performance

Financials provided are expected 2010 financial results and are in millions. Final numbers

will be provided on or about March 2nd in GigOptix’s SEC Form 10-K.

Adjusted EBITA is defined as income or loss from operations net of depreciation,

amortization, stock-based compensation expense and restructuring expenses

|

16

16

16

GigOptix, Inc. Consolidated Balance Sheet Q410

GigOptix, Inc. Consolidated Balance Sheet Q410

(in thousands)

(in thousands)

December 31,

December 31,

2010

2009

$

%

ASSETS

Current assets:

Cash and cash equivalents

4,502

$

3,583

$

919

$

26%

Accounts receivable, net

5,366

3,750

1,616

43%

Inventories

1,609

1,457

152

10%

Prepaid and other current assets

405

816

(411)

(50%)

Total current assets

11,882

9,606

2,276

24%

Property and equipment, net

3,718

4,334

(616)

(14%)

Intangible assets, net

3,861

4,716

(855)

(18%)

Goodwill

7,407

7,307

100

1%

Restricted cash

356

601

(245)

(41%)

Other assets

652

758

(106)

(14%)

Total assets

27,876

$

27,322

$

554

$

2%

LIABILITIES AND STOCKHOLDERS' EQUITY

Current liabilities:

Accounts payable

2,960

$

4,376

$

(1,416)

$

(32%)

Accrued and other current liabilities

4,301

5,403

(1,102)

(20%)

Line of credit

3,226

1,324

1,902

144%

Total current liabilities

10,487

11,103

(616)

(6%)

Pension liabilities

211

186

25

13%

Other long-term liabilities

1,788

2,035

(247)

(12%)

Total liabilities

12,486

13,324

(838)

(6%)

Stockholders' Equity

Common stock, $0.001 par value; 50,000,000 shares authorized as of December 31, 2010;

12,210,264 and 9,289,682 issued and outstanding as of December 31, 2010 and

December 31, 2009, respectively.

Common stock, $0.001 par value

12

9

3

33%

Additional paid-in capital

89,554

82,814

6,740

8%

Accumulated deficit

(73,353)

(68,993)

(4,360)

6%

Accumulated other comprehensive income

177

168

9

5%

Total stockholders' equity

16,390

13,998

2,392

17%

Total liabilities and stockholders' equity

28,876

$

27,322

$

1,554

$

6%

Net Change |

17

17

17

GigOptix, Inc. Consolidated Statement of Operations

GigOptix, Inc. Consolidated Statement of Operations

Q410

Q410 (in thousands)

(in thousands)

December 31,

December 31,

Revenue

2010

2009

Product

6,580

$

81%

3,708

$

118%

Government contract

1,520

19%

703

22%

-

0%

(1,275)

-41%

Total revenue

8,100

100%

3,136

100%

Cost of revenue

Product

3,301

41%

2,896

92%

Government Contract

365

5%

372

12%

Total cost of revenue

3,666

45%

3,268

104%

Gross profit (loss)

4,434

55%

(132)

-4%

Research and development expense

2,603

32%

2,345

75%

Selling, general and administrative expense

1,928

24%

3,752

120%

Restructuring expense

-

0%

884

28%

Total operating expenses

4,531

56%

6,981

223%

Loss from operations

(97)

-1%

(7,113)

-227%

Interest income (expense)

(115)

-1%

(66)

-2%

Other income (expense)

(115)

-1%

(3)

0%

Loss before provision for (benefit from) income taxes

(327)

-4%

(7,182)

-229%

Provision for (benefit from) income taxes

28

0%

38

1%

Net loss

(355)

-4%

(7,220)

-230%

Net loss per share -

basic and diluted

(0.03)

$

(0.98)

$

Weighted average number of shares used in per share

calculations -

basic and diluted

12,203

7,391

Effect of change in estimated billing

rates under government contracts

%

%

Three months ended |

18

18

18

©

2011 GigOptix, Inc. All Rights Reserved

Summary

Summary

The combination of GigOptix

and Endwave

creates a leading supplier of high speed and high

frequency

analog

semiconductors,

modulators

and

wireless

mobile

backhaul

World class high speed product portfolio:

High speed analog ICs

High frequency analog ICs

High speed optical modulators

High speed wireless front ends

Structured and Standard Cell ASICs

Trusted supplier to Tier-1 OEMs for critical high performance communication devices

Successful history of generating value for investors and customers through strategic plan of

growing both organically and through synergistic acquisitions and mergers

Highly

scalable

fabless

manufacturing

model

partnering

with

best

in

class

contract

manufacturers

Strong IP portfolio with more than 100 patents granted and over 40 applications on file

Solid revenue growth in 2010 with good revenue growth opportunities for 2011

Strong balance sheet with solid cash position and no long term debt

Leading supplier of high performance network interface devices, enabling high

speed optical and wireless networks for Tier-1 Telecom and Datacom

OEMs |

©

2011 GigOptix, Inc. All Rights Reserved

19

19

19

Transaction Overview

Transaction Overview

What will be the conversion ratio be for ENWV to GGOX common stock?

The actual conversion ratio in the merger cannot be determined until immediately before the

consummation of the merger. However, if the merger were consummated on February

7, 2011, each outstanding share of Endwave common stock would convert into

approximately 0.89 shares of GGOX common stock. How many shares will the combined

company have? Approximately 21 million outstanding shares

What is the status of GigOptix

being listed on a Major Exchange?

We will continue our best efforts to list GigOptix

common stock on NYSE Amex or another national securities

exchange, with the intent to receive conditional listing approval so we may be able to

commence trading concurrent with the merger closing.

The Press Release (dated 2/7/2011) noted the combined company had approximately $28M

in

cash

and

investments

at

12/31/2010

but

that

cash

at

the

close

of

the

transaction

would

be approx. $16M. What are the factors behind the $12M reduction?

The cash and investment balance will be reduced by transaction related fees, restructuring

related payments, the pay down of GGOX AR line and cash used in operations during the

period between 12/31/10 and the close of the deal. We will continue to work hard

to reduce our cash usage during the period. The Press Release (dated 2/7/2011) noted the

combined company would see savings of approx. $1M/quarter in 2012. What are the items

that make up these savings? The

savings

will

come

from

a

number

of

different

areas

including

public

company

related

expenses,

the consolidation

of personnel, facilities and the reduction of overhead.

The Answers to your Questions |

20

20

20

©

2011 GigOptix, Inc. All Rights Reserved

Thank you!

Thank you! |