Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CONCEPTUS INC | d8k.htm |

| EX-99.1 - PRESS RELEASE - CONCEPTUS INC | dex991.htm |

Conceptus Inc.

Quarterly Results

Fourth Quarter 2010

©

2011 Conceptus, Inc. All rights reserved.

February 24, 2011

Exhibit 99.2 |

-

2 -

Safe Harbor

Except for the historical information contained herein, the matters discussed in

this presentation include forward-looking statements, the accuracy of

which is subject to risks and uncertainties. These forward-looking

statements include discussions regarding: projected net sales and earnings

before interest, taxes, depreciation, amortization and equity-based

compensation (“EBITDA”) for the full year 2011, and the expected

impact of the economy on consumer spending on non-urgent medical procedures

such as Essure®, trends in and market share related to competitive trialing,

growth in physician metrics, our ability to increase utilization of Essure

through the promotion of a compatible

endometrial ablation product, and the expected attainment of strategic initiatives

intended to grow the business.

These discussions and other forward-looking statements included herein may

differ significantly from actual results. Such differences may be based upon

factors such as changes in strategic planning decisions by management,

re-allocation of internal resources, changes in the impact of

recessionary pressures, decisions by insurance companies, scientific advances by

third parties, litigation risks, effect of regulations promulgated pursuant

to the Health Care Reform Act, and the introduction of competitive products,

as well as those factors set forth in the Company's most recent Annual

Report on Form 10-K and most recent Quarterly Report on Form 10-Q, and other

filings with the Securities and Exchange Commission. These

forward-looking statements speak only as to the date on which the

statements were made. We undertake no obligation to update or revise

publicly any forward-looking statements, whether as a result of new information, future

events, or otherwise.

©

2011 Conceptus, Inc. All rights reserved. |

2010 Highlights

Mark Sieczkarek

President and Chief Executive Officer

©

2011 Conceptus, Inc. All rights reserved. |

-

4 -

Key Challenges…

©

2011 Conceptus, Inc. All rights reserved.

Macro-economic

pressures = fewer

OB/GYN office visits and

elective procedures

Growth moderated in

U.S. transcervical

sterilization market

Competitor trialing

reduced physician

metric growth |

-

5 -

…Drove Strategic Initiatives

©

2011 Conceptus, Inc. All rights reserved.

Expanded sales force

coverage by 50% to minimize

competitive impact

Provided GYNs value-add

services to facilitate Essure

®

adoption and utilization

Leveraged in-office channel

strength: promote GYNECARE

THERMACHOICE

®(1)

(1)

Global endometrial ablation (GEA) product manufactured for and marketed by

ETHICON™

Women’s Health & Urology, a division of Ethicon, Inc.

|

-

6 -

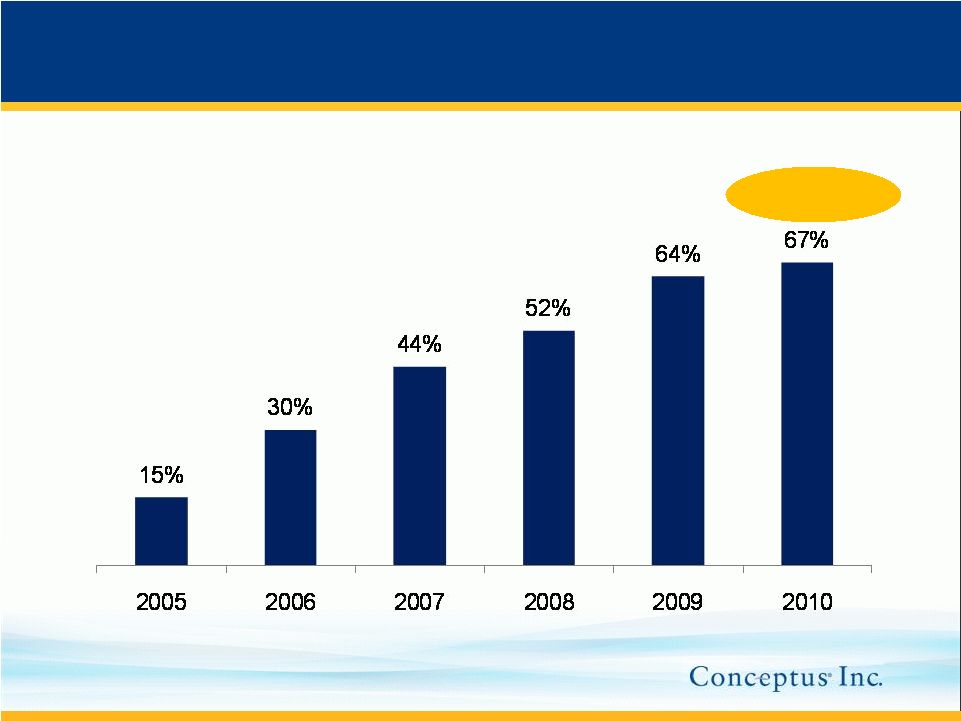

In-Office Channel Strength

Core competency: have successfully

developed physician office as the

preferred site-of-service for Essure

Office-based procedures as % of total volume

70% in Q4’10

©

2011 Conceptus, Inc. All rights reserved. |

-

7 -

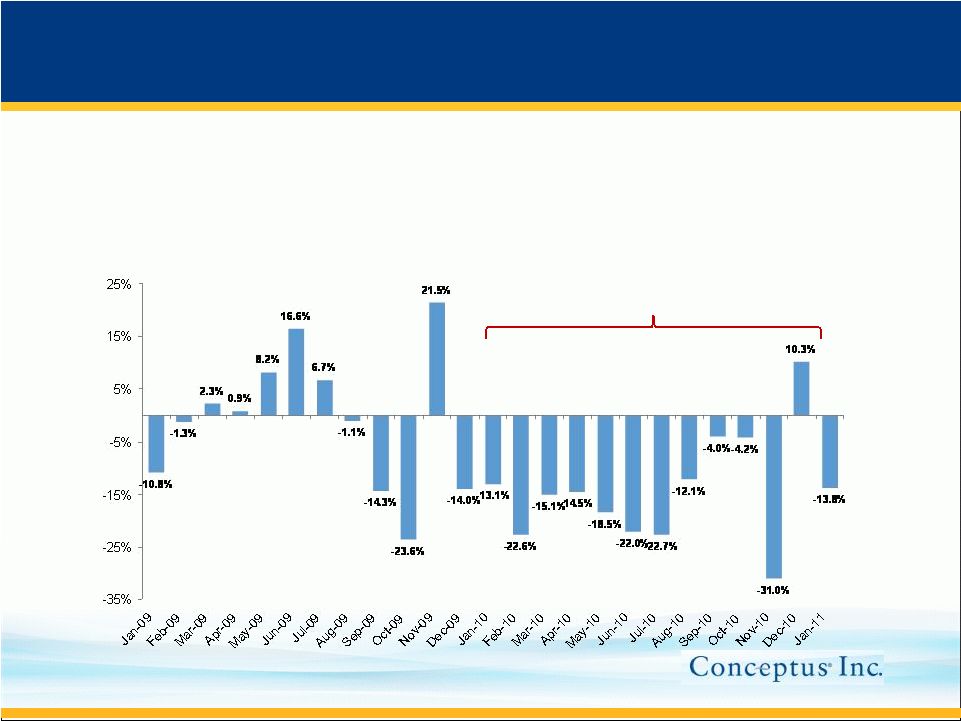

Challenge: Reduced Office Visits

(1) IMS Data provided by Credit Suisse Healthcare Team

Monthly

Y/Y

Change:

Domestic

OB/GYN

office

visits

(1)

2010: Average Y/Y decrease = -14%

Macro-economic trends contributed to the Y/Y decrease in

domestic OB/GYN office visits in 2010 |

-

8 -

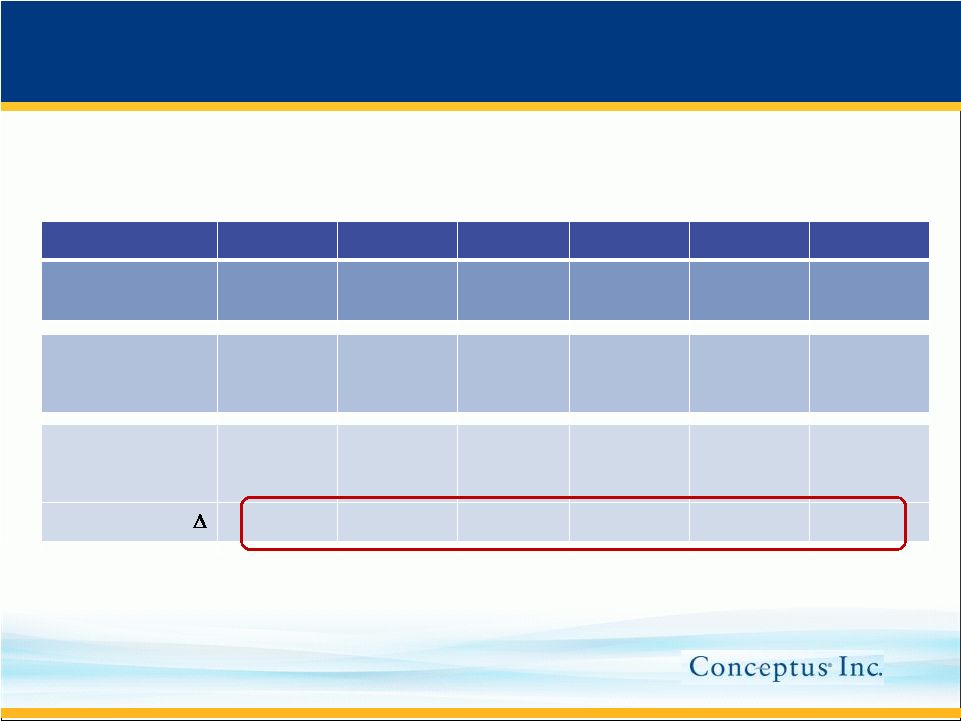

Challenge: Moderating Growth

U.S. hysteroscopic sterilization market

In $ millions

Q3 09

Q4 09

Q1 10

Q2 10

(1)

Q3 10

Q4 10

U.S. Essure

Sales

$28.0

$28.8

$25.4

$28.0

$27.3

$28.6

Competitor’s

Estimated

Sales

(2)

$0.6

$1.5

$2.1

$3.8

$5.2

$5.3

Transcervical

Sterilization

Market

$28.6

$30.3

$27.5

$31.8

$32.5

$33.9

Y/Y

35%

34%

30%

22%

14%

12%

©

2011 Conceptus, Inc. All rights reserved.

(1)

Competitor’s national sales launch in April 2010

(2)

Competitor’s estimated net sales includes data from third party research

|

-

9 -

2010 Accomplishments

©

2011 Conceptus, Inc. All rights reserved.

Expanded field sales coverage

Achieved 1-3 year account agreements

Improved physician metric growth in Q3 and Q4

Provided physicians innovative training and marketing

Secured new strategic opportunity to promote

GYNECARE THERMACHOICE®

to physician offices

Gained state Medicaid wins for in-office

reimbursement |

-

10 -

Expanded sales coverage and increased sales territories

to

better

align

resources:

160

sales

personnel

in

the

field,

with

120

in

direct

sales

Focus on competitive defense, physician metric growth,

and increased Essure utilization

Emphasis on increased productivity and territory growth

We are one of the industry’s largest medical device

sales teams dedicated to OB/GYN physicians

Expanded Field Sales Coverage

©

2011 Conceptus, Inc. All rights reserved. |

-

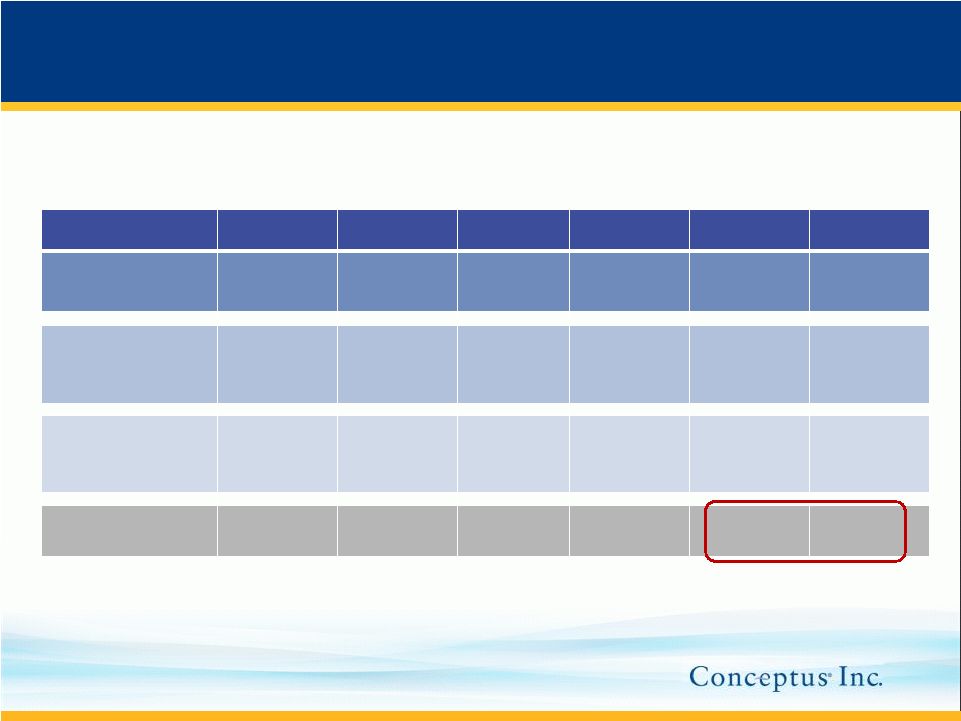

11 -

In $ millions

Q3 09

Q4 09

Q1 10

Q2 10

(1)

Q3 10

Q4 10

U.S. Essure

Sales

$28.0

$28.8

$25.4

$28.0

$27.3

$28.6

Competitor’s

Estimated

Sales

(2)

$0.6

$1.5

$2.1

$3.8

$5.2

$5.3

Transcervical

Sterilization

Market

$28.6

$30.3

$27.5

$31.8

$32.5

$33.9

Competitor’s

Share

2.1%

5.0%

7.6%

11.9%

16.0%

15.6%

Competitor Market Share Flattened

U.S. hysteroscopic sterilization market

©

2011 Conceptus, Inc. All rights reserved.

(1)

Competitor’s national sales launch in April 2010

(2)

Competitor’s estimated net sales includes data from third party research

|

-

12 -

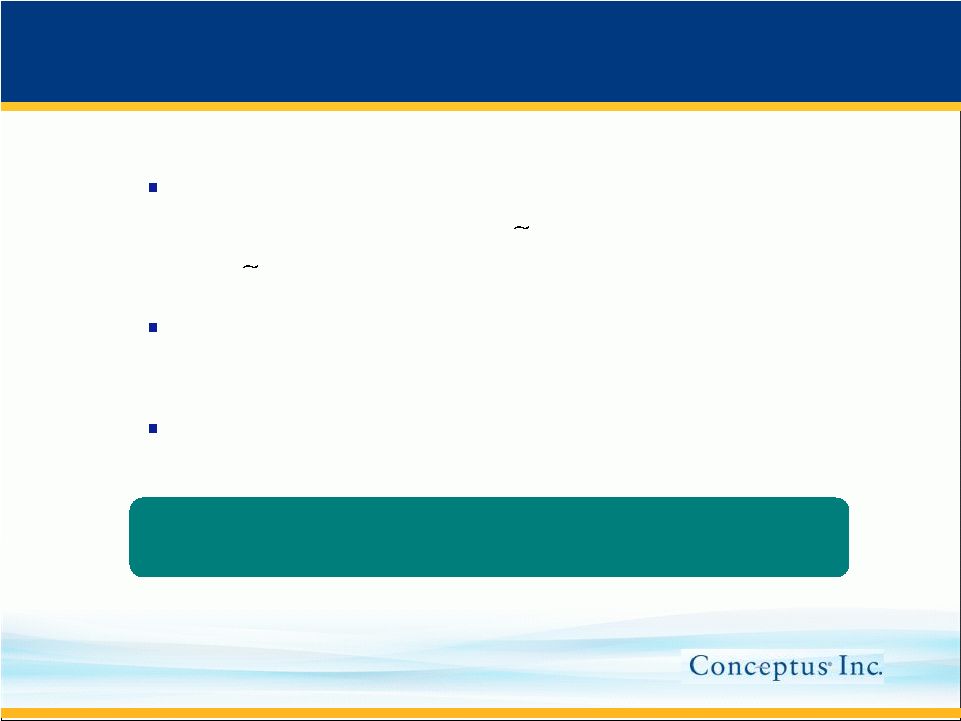

Status of Competitive Trialing

©

2011 Conceptus, Inc. All rights reserved.

1,000

accounts

have

trialed

to

date

out

of

1,500

to

2,000

accounts anticipated to trial

Pace has slowed: The number of accounts entering trialing

and the number of competitor cases has decelerated in

recent months

Trialing expected to last

12 to

15 months at a rate of

200

accounts entering trialing per quarter + one year to trial

300+ accounts signed 1-3 year agreements by the end of

Q4’10 |

-

13 -

Physician Metric Growth Improved

Q4’10

Q3’10

Q2’10

Q1’09

Q4’09

Current Period Activity:

Physicians entering preceptorship

413

375

387

423

401

Physicians becoming certified

458

324

335

406

409

Physicians transitioning to office

202

185

163

243

464

Physician Base:

12,530

12,117

11,742

11,355

10,932

©

2011 Conceptus, Inc. All rights reserved.

U.S. physician metrics grew in Q4’10 |

-

14 -

Provided Innovative Physician Services

VirtaMed’s state-of-the-art

EssureSim

(TM)

simulates

the Essure hysteroscopic

procedure

©

2011 Conceptus, Inc. All rights reserved.

Value-add services drive Essure adoption and utilization

Assist individual physicians in

building their Essure practice

Educate physician office support

personnel on Essure’s benefits

Test new ways to identify

potential Essure candidates for

physicians

Training

Marketing |

-

15 -

Secured Strategic Partnership

Essure and GYNECARE THERMACHOICE®

are compatible in-

office procedures

Patients are strongly advised not to get pregnant if they have a

GEA procedure, making Essure medically necessary

An estimated 50% of GEA patients do not have permanent birth

control

We began promoting

GYNECARE THERMACHOICE®

in U.S.

physician offices in early 2011

Goal: Leverage our in-office channel strength to

increase physician utilization of Essure

©

2011 Conceptus, Inc. All rights reserved. |

-

16 -

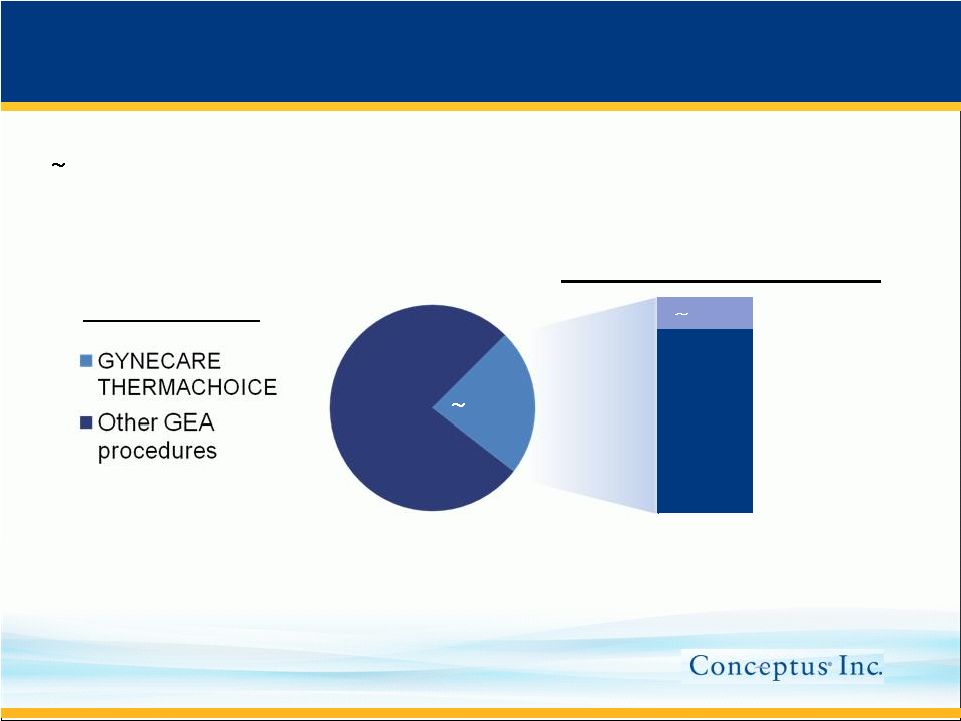

GEA In-Office Opportunity

GYNECARE THERMACHOICE

procedures by site-of-service

In-office

procedures

Hospital

procedures

$400 million annual GEA market in U.S.

©

2011 Conceptus, Inc. All rights reserved.

Based on company estimates

15%

All GEA brands

18% |

-

17 -

Partnership Synergies

Benefits for Ethicon: Increase in-office procedures

–

Establish larger in-office market share by leveraging Conceptus

in-office channel strength

Benefits for Conceptus: Increase utilization of Essure

–

Accounts

perform

3

to

4

GEA

procedures

per

month

–

Opportunity

is

50%

of

patients

who

do

not

already

have

permanent birth control: utilization of Essure could increase

from

1

to

2

procedure(s)

per

month

©

2011 Conceptus, Inc. All rights reserved. |

-

18 -

Gained Additional Medicaid Wins

©

2011 Conceptus, Inc. All rights reserved.

33 states provided Essure Medicaid fee-for-service office

reimbursement of at least $1,700 as of 12/31/10

9 states improved Medicaid reimbursement in 2010: Colorado, Connecticut,

Illinois, Indiana, North Dakota, Ohio, Texas, Utah and Wisconsin

AK

WA

OR

CA

NV

ID

MT

WY

UT

CO

AZ

NM

TX

OK

KS

NE

SD

ND

MN

IA

MO

AR

LA

MS

WI

IN

MI

OH

KY

TN

AL

GA

FL

SC

NC

VA

WV

PA

NY

ME

IL

NH

VT

MD

DE

NJ

MA

CT

RI

HI |

Fourth Quarter 2010 Financials

Greg Lichtwardt

Executive Vice President, Operations and

Chief Financial Officer

©

2011 Conceptus, Inc. All rights reserved. |

-

20 -

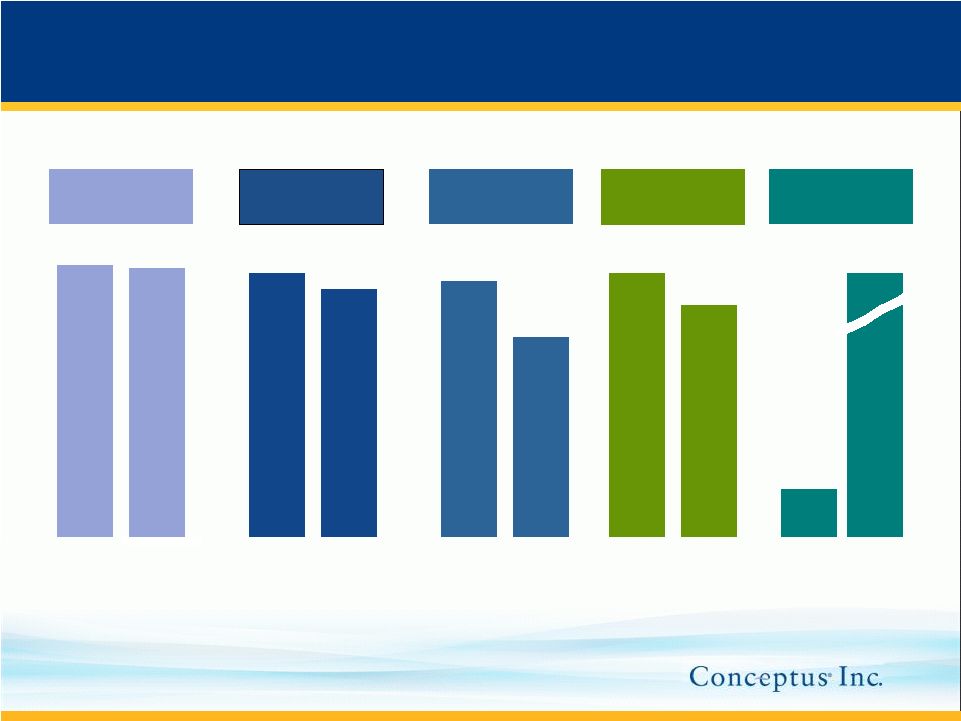

Q4’10 Snapshot

Net Sales

($mm)

Gross Margin

(%)

Diluted GAAP

EPS

Operating

Margin (%)

Q4’09

Q4’10

Q4’09

Q4’10

Q4’09

Q4’10

Q4’09

Q4’10

Q4’09

Q4’10

$37.0

82.2%

81.9%

$36.6

22.2%

16.8%

$0.21

$2.66

(2)

$11.9

EBITDA

(1)

($mm)

(1)

Earnings before interest, taxes, depreciation, amortization and equity-

based compensation. See reconciliation in Appendix

(2)

Includes benefit of $2.52 primarily due to the release of the

Company's deferred tax valuation allowance

©

2011 Conceptus, Inc. All rights reserved.

$10.1 |

-

21 -

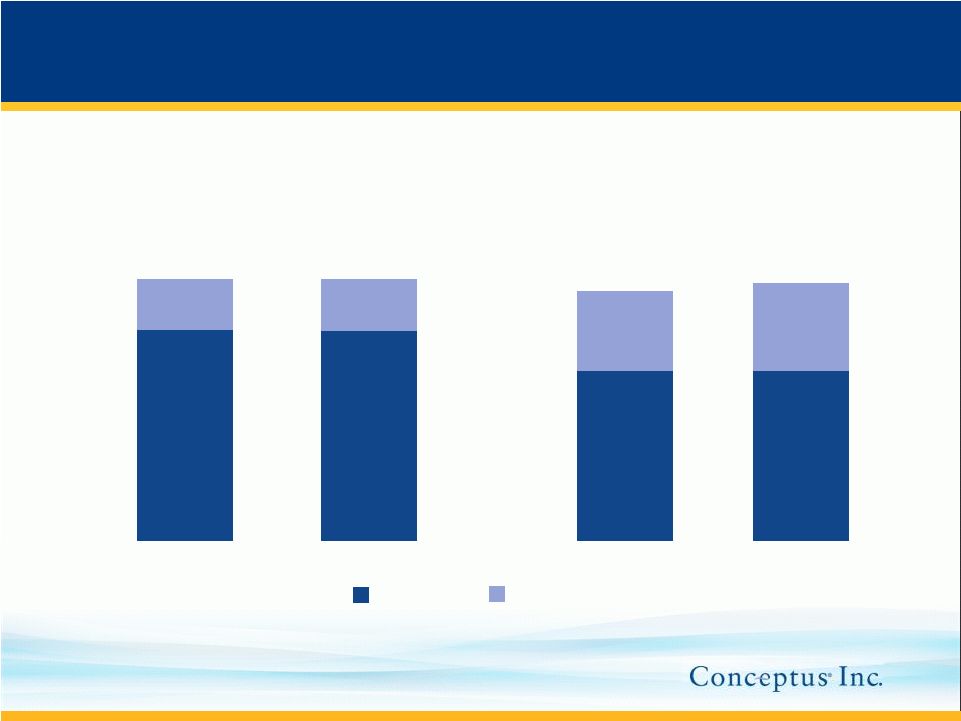

Worldwide Sales

Q4’10 Net Sales (in million $)

Q4’10 Units (in

thousands): $37.0

Q4’09

Q4’10

$28.8

(78%)

$36.6

$28.6

(78%)

31.9

Q4’09

Q4’10

20.9

(66%)

11.0

(34%)

32.4

21.0

(65%)

11.4

(35%)

Domestic

International

$8.0

(22%)

$8.2

(22%)

©

2011 Conceptus, Inc. All rights reserved. |

-

22 -

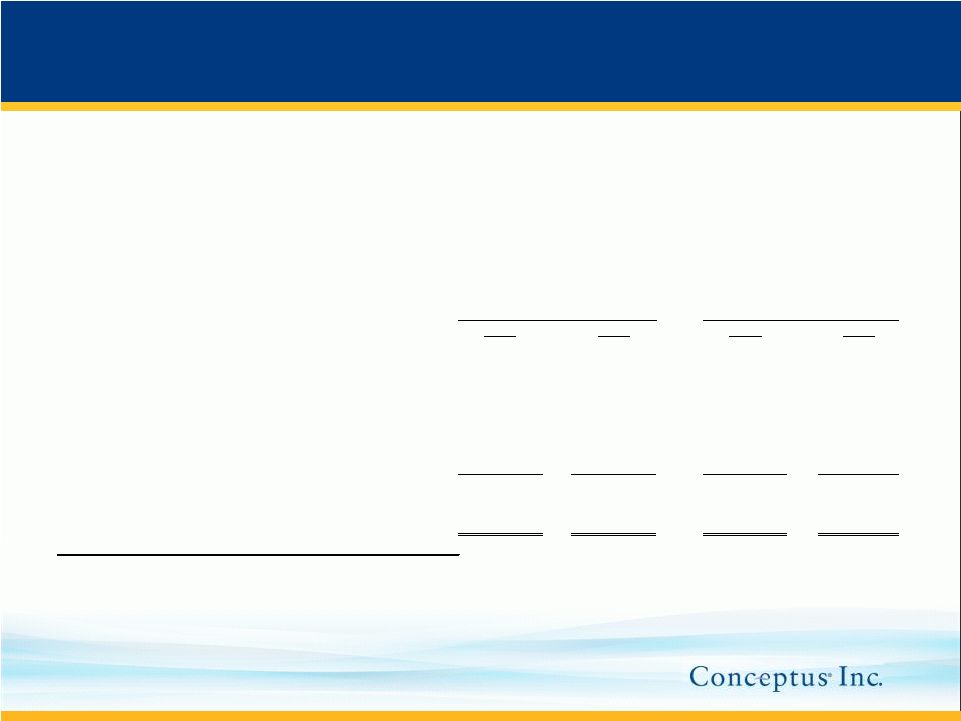

Q4’10

Q4’09

Y/Y

Change

Q3’10

Q/Q

Change

Net Sales

$36.6

$37.0

(1.1 %)

$33.9

8.0%

Gross Profit Margin

81.9%

82.2%

nm

80.6%

nm

Operating Expenses

$23.8

$22.2

7.2%

$24.6

(3.3%)

EBITDA

(1)

$10.1

$11.9

(15.1%)

$6.6

53.0%

Other Income / (Expense)

($1.6)

($1.6)

nm

($1.6)

nm

Tax Provision (benefit)

($79.2)

($0.15)

nm

$0.2

nm

NEAT

$83.7

(2)

$6.6

nm

$1.0

nm

GAAP EPS (diluted)

$2.66

(3)

$0.21

nm

$0.03

nm

Q4’10 Results

In million $ except for EPS

(1)

Earnings before interest, taxes, depreciation, amortization and equity-based

compensation. See appendix.

(2)

Net earnings after taxes includes a net income tax benefit of $79.2 million

primarily due to the release of the Company's deferred tax valuation

allowance (3)

Diluted GAAP EPS includes a net income tax benefit of $2.52 primarily due to the

release of the Company's deferred tax valuation allowance

©

2011 Conceptus, Inc. All rights reserved. |

-

23 -

Q4’10 EBITDA

EBITDA

$10.1

Amortization

of intangibles

Equity-based

compensation

$1.3

$0.8

$1.8

$6.2

Operating

income

See reconciliation in appendix

©

2011 Conceptus, Inc. All rights reserved.

Depreciation

expense

$ millions |

-

24 -

2010 EBITDA

EBITDA

$24.8

Amortization

of intangibles

Equity-based

compensation

$4.7

$3.3

$7.3

$9.5

Operating

income

See reconciliation in appendix

©

2011 Conceptus, Inc. All rights reserved.

Depreciation

expense

$ millions |

-

25 -

Balance Sheet

Cash & cash equivalents

Investments

and

put

option

(1)

A/R, inventories & other

current assets

PP&E

Intangible and other assets

Goodwill

Deferred tax asset

Total assets

ASSETS

18.4

72.5

29.7

10.1

25.2

16.0

78.8

250.7

61.7

43.5

25.7

9.8

29.1

17.3

0.0

187.1

12/31/10

A/P & other accrued ST

liabilities

Notes payable

(2)

Line

of

credit

(3)

Other accrued LT liabilities

Total Equity

Total liabilities & equity

LIABILITIES &

EQUITY

12/31/09

18.1

76.5

29.2

2.4

60.9

187.1

12/31/10

12/31/09

15.8

81.0

0.0

2.4

151.5

250.7

$ millions

(1)

Put option for 12/31/09 only

(2)

Notes payable is a current liability as of 12/31/10

(3)

Used proceeds from redemption of all outstanding

auction rate securities to pay down line of credit in full

©

2011 Conceptus, Inc. All rights reserved. |

-

26 -

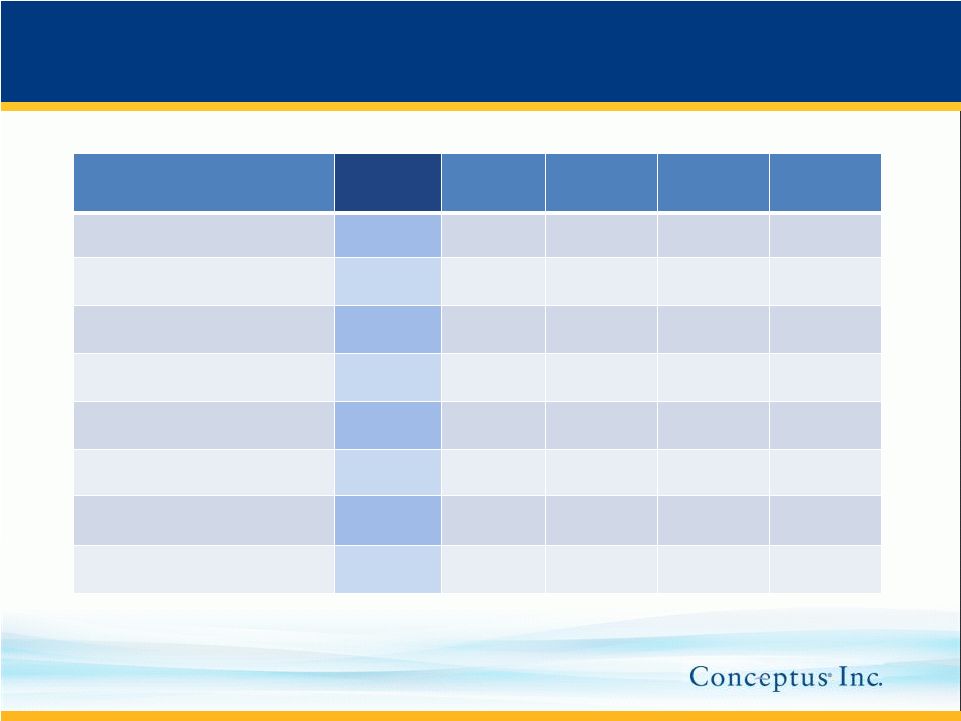

Guidance

FY’11E

FY’10A

Net Sales

$135mm to

$150mm

$140.7mm

Gross Profit Margin

82.0% to

82.5%

80.9%

Operating Expenses

$102mm to

$105mm

$104.3mm

EBITDA

(1)

$24.7mm to

$34.7mm

$24.8mm

(1)

See appendix

©

2011 Conceptus, Inc. All rights reserved. |

2011:

Vision, Strategy and Growth Drivers

Mark Sieczkarek

President and Chief Executive Officer

©

2011 Conceptus, Inc. All rights reserved. |

-

28 -

Who We Are

Mission:

Revolutionizing women’s healthcare

with innovative solutions

Vision:

Make Essure standard of care in

permanent birth control market

©

2011 Conceptus, Inc. All rights reserved. |

-

29 -

Our Approach in 2011

1.

Successfully

navigate

the

“new

normal”

economy

–

Assume continued high unemployment

–

Assume high deductible insurance plans remain

popular and patient utilization rates remain low,

especially for non-urgent procedures like Essure

2.

Minimize impact of competition

–

Continue to educate physicians on Essure’s superior

efficacy

©

2011 Conceptus, Inc. All rights reserved. |

-

30 -

Our Approach in 2011

3.

Accelerate Essure sales by leveraging GEA in-

office synergy

4.

Drive market awareness and adoption of Essure

through cost effective direct-to-consumer marketing

initiatives

–

Online, digital, viral

–

Patient education

©

2011 Conceptus, Inc. All rights reserved. |

-

31 -

Our Approach in 2011

5.

Expand our presence in international markets

–

France: Age 40+ market

–

China and India

–

WomanCare Global to distribute Essure in Ghana,

Kenya, Mexico, Puerto Rico, and Turkey

6.

Washington DC focus and reimbursement issues

–

Inclusion of contraception in the Preventative Services

for Women’s healthcare package

–

Medicaid reimbursement and cost savings issues

–

ACOG recognition of hysteroscopic sterilization as

“standard of care”

©

2011 Conceptus, Inc. All rights reserved. |

-

32 -

Our Approach in 2011

7.

Create a pipeline of women’s health products and

services that accelerate adoption of Essure

–

Therapeutic

–

Prefer office site-of-service

8.

Product enhancements

–

Begin clinical trials of fifth generation Essure

–

Seek FDA approval of transvaginal ultrasound (TVU) for

Essure confirmation instead of HSG

©

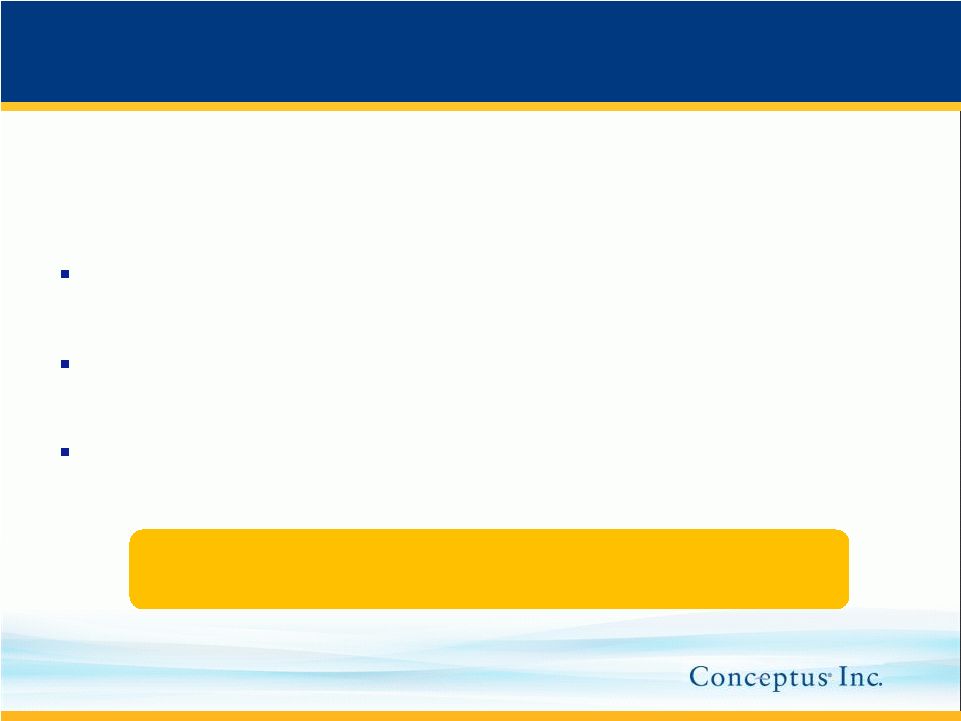

2011 Conceptus, Inc. All rights reserved. |

-

33 -

Growth Drivers

Increasing sales force productivity

Competitive trialing slowdown

Increase utilization of Essure through the promotion

of ThermaChoice in U.S. physician offices

Leverage marketing synergies between physician

and consumer audiences

Continue to build relationships with OB/GYN

communities

©

2011 Conceptus, Inc. All rights reserved. |

Appendix

©

2011 Conceptus, Inc. All rights reserved. |

-

35 -

Use of Non-GAAP Financial Measures

©

2011 Conceptus, Inc. All rights reserved.

The Company has supplemented its GAAP operating income with a non-GAAP

measure of earnings before interest, taxes, depreciation, amortization and

equity-based compensation (“EBITDA”). Management believes that this

non- GAAP financial measure provides useful supplemental information to

management and investors regarding the performance of the Company’s

business operations, facilitates a better comparison of results for current

periods with the Company’s previous operating results, and assists

management in analyzing future trends, making strategic and business

decisions and establishing internal budgets and forecasts. A reconciliation of

non-GAAP EBITDA to GAAP net income in the most directly comparable GAAP

measure, is provided in the below schedule.

There are limitations in using these non-GAAP financial measures because

they are not prepared in accordance with GAAP and may be different from

non- GAAP financial measures used by other companies. These

non-GAAP financial measures should not be considered in isolation or as a

substitute for GAAP financial measures. Investors and potential investors

should consider non- GAAP financial measures only in conjunction with the

Company’s consolidated financial statements prepared in accordance with

GAAP and the reconciliations of the non-GAAP financial measures provided

in the below schedules. |

-

36 -

GAAP to Non-GAAP Reconciliation

©

2011 Conceptus, Inc. All rights reserved.

2010

2009

2010

2009

Operating income, as reported

6,148

$

8,195

$

9,549

$

14,643

$

Adjustments to net income:

Amortization of intangibles (a)

817

829

3,254

1,387

Equity-based compensation (b)

1,833

1,726

7,246

6,282

Depreciation expense (c)

1,283

1,124

4,701

4,101

Adjustments to operating income

3,933

3,679

15,201

11,770

Non-GAAP EBITDA

10,081

$

11,874

$

24,750

$

26,413

$

(a) Consists of amortization of intangible assets, primarily licenses and customer relationships

(b) Consists of equity-based compensation in accordance with ASC 718

(c) Consists of depreciation, primarily on property, plant and equipment

(In thousands)

Conceptus, Inc.

December 31,

Three Months Ended

Twelve Months Ended

December 31,

Reconciliation of Operating Income to Earnings Before Interest, Taxes, Depreciation, Amortization

and Equity-Based Compensation

(EBITDA) (Unaudited) |

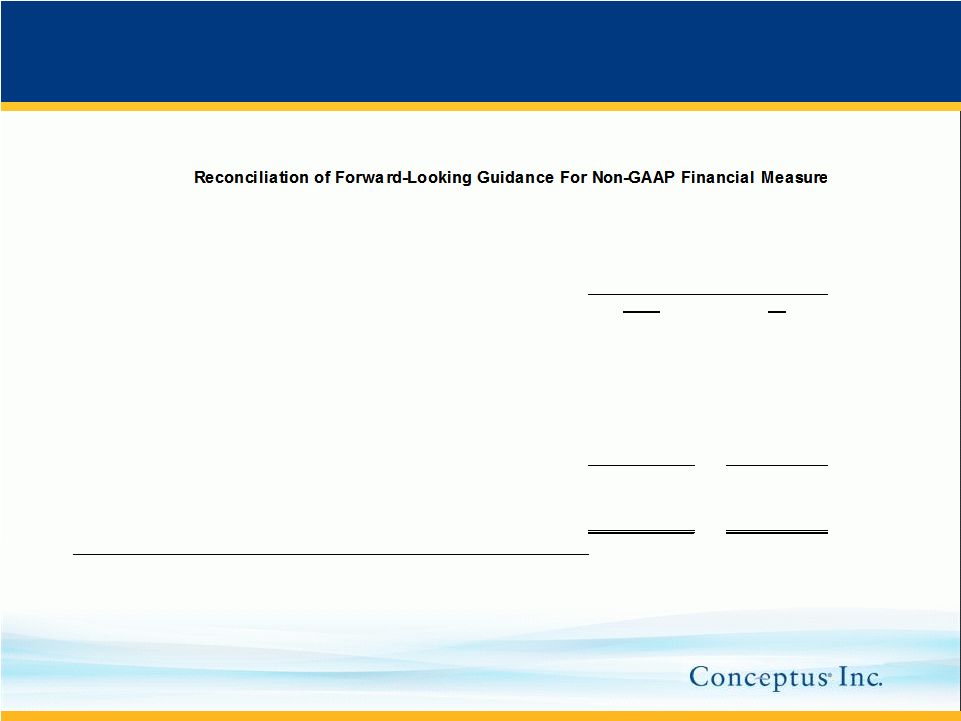

-

37 -

©

2011 Conceptus, Inc. All rights reserved.

GAAP to Non-GAAP Reconciliation

From

To

Operating Income Guidance

8,592

$

18,592

$

Estimated Non-GAAP Guidance

Amortization of intangibles (a)

3,261

$

3,261

$

Equity-based compensation (b)

7,571

$

7,571

$

Depreciation expense (c)

5,250

$

5,250

$

Adjustments to operating income

16,082

$

16,082

$

Non-GAAP EBITDA Guidance

24,674

$

34,674

$

(a) Consists of amortization of intangible assets, primarily licenses and customer relationships

(b) Consists of equity-based compensation in accordance with ASC 718

(c) Consists of depreciation, primarily on property, plant and equipment

December 31, 2011

Conceptus, Inc.

To Projected GAAP Operating Income

(Unaudited)

Twelve Months Ending |

Thank You

©

2011 Conceptus, Inc. All rights reserved.

CC-2642 24FEB11F |