Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CNO Financial Group, Inc. | form8k.htm |

4Q10

Financial and operating results for the period ended December 31, 2010

Financial and operating results for the period ended December 31, 2010

February 23, 2011

Unless otherwise specified, comparisons in this presentation are between 4Q10 and 4Q09.

Exhibit 99.1

CNO Financial Group

2

Forward-Looking Statements

Cautionary Statement Regarding Forward-Looking Statements. Our statements, trend analyses and other information contained in this

press release relative to markets for CNO Financial’s products and trends in CNO Financial’s operations or financial results, as well as other

statements, contain forward-looking statements within the meaning of the federal securities laws and the Private Securities Litigation Reform

Act of 1995. Forward-looking statements typically are identified by the use of terms such as “anticipate,” “believe,” “plan,” “estimate,” “expect,”

“project,” “intend,” “may,” “will,” “would,” “contemplate,” “possible,” “attempt,” “seek,” “should,” “could,” “goal,” “target,” “on track,” “comfortable

with,” “optimistic” and similar words, although some forward-looking statements are expressed differently. You should consider statements that

contain these words carefully because they describe our expectations, plans, strategies and goals and our beliefs concerning future business

conditions, our results of operations, financial position, and our business outlook or they state other ‘‘forward-looking’’ information based on

currently available information. Assumptions and other important factors that could cause our actual results to differ materially from those

anticipated in our forward-looking statements include, among other things: (i) changes in or sustained low interest rates causing a reduction in

investment income, the margins of our fixed annuity and life insurance businesses and demand for our products; (ii) general economic, market

and political conditions, including the performance and fluctuations of the financial markets which may affect our ability to raise capital or

refinance existing indebtedness and the cost of doing so; (iii) the ultimate outcome of lawsuits filed against us and other legal and regulatory

proceedings to which we are subject; (iv) our ability to make changes to certain non-guaranteed elements of our life insurance products; (v) our

ability to obtain adequate and timely rate increases on our health products, including our long-term care business; (vi) the receipt of any

required regulatory approvals for dividend and surplus debenture interest payments from our insurance subsidiaries; (vii) mortality, morbidity,

the increased cost and usage of health care services, persistency, the adequacy of our previous reserve estimates and other factors which may

affect the profitability of our insurance products; (viii) changes in our assumptions related to deferred acquisition costs or the present value of

future profits; (ix) the recoverability of our deferred tax assets and the effect of potential ownership changes and tax rate changes on their

value; (x) our assumption that the positions we take on our tax return filings, including our position that our 7.0% convertible senior debentures

due 2016 will not be treated as stock for purposes of Section 382 of the Internal Revenue Code of 1986, as amended, and will not trigger an

ownership change, will not be successfully challenged by the Internal Revenue Service; (xi) changes in accounting principles and the

interpretation thereof; (xii) our ability to continue to satisfy the financial ratio and balance requirements and other covenants of our debt

agreements; (xiii) our ability to achieve anticipated expense reductions and levels of operational efficiencies including improvements in claims

adjudication and continued automation and rationalization of operating systems, (xiv) performance and valuation of our investments, including

the impact of realized losses (including other-than-temporary impairment charges); (xv) our ability to identify products and markets in which we

can compete effectively against competitors with greater market share, higher ratings, greater financial resources and stronger brand

recognition; (xvi) our ability to generate sufficient liquidity to meet our debt service obligations and other cash needs; (xvii) our ability to maintain

effective controls over financial reporting; (xviii) our ability to continue to recruit and retain productive agents and distribution partners and

customer response to new products, distribution channels and marketing initiatives; (xix) our ability to achieve eventual upgrades of the

financial strength ratings of CNO Financial and our insurance company subsidiaries as well as the impact of our ratings on our business, our

ability to access capital and the cost of capital; (xx) the risk factors or uncertainties listed from time to time in our filings with the Securities and

Exchange Commission; (xxi) regulatory changes or actions, including those relating to regulation of the financial affairs of our insurance

companies, such as the payment of dividends and surplus debenture interest to us, regulation of financial services affecting (among other

things) bank sales and underwriting of insurance products, regulation of the sale, underwriting and pricing of products, and health care

regulation affecting health insurance products; and (xxii) changes in the Federal income tax laws and regulations which may affect or eliminate

the relative tax advantages of some of our products. Other factors and assumptions not identified above are also relevant to the forward-

looking statements, and if they prove incorrect, could also cause actual results to differ materially from those projected. All forward-looking

statements are expressly qualified in their entirety by the foregoing cautionary statements. Our forward-looking statements speak only as of the

date made. We assume no obligation to update or to publicly announce the results of any revisions to any of the forward-looking statements to

reflect actual results, future events or developments, changes in assumptions or changes in other factors affecting the forward-looking

statements.

press release relative to markets for CNO Financial’s products and trends in CNO Financial’s operations or financial results, as well as other

statements, contain forward-looking statements within the meaning of the federal securities laws and the Private Securities Litigation Reform

Act of 1995. Forward-looking statements typically are identified by the use of terms such as “anticipate,” “believe,” “plan,” “estimate,” “expect,”

“project,” “intend,” “may,” “will,” “would,” “contemplate,” “possible,” “attempt,” “seek,” “should,” “could,” “goal,” “target,” “on track,” “comfortable

with,” “optimistic” and similar words, although some forward-looking statements are expressed differently. You should consider statements that

contain these words carefully because they describe our expectations, plans, strategies and goals and our beliefs concerning future business

conditions, our results of operations, financial position, and our business outlook or they state other ‘‘forward-looking’’ information based on

currently available information. Assumptions and other important factors that could cause our actual results to differ materially from those

anticipated in our forward-looking statements include, among other things: (i) changes in or sustained low interest rates causing a reduction in

investment income, the margins of our fixed annuity and life insurance businesses and demand for our products; (ii) general economic, market

and political conditions, including the performance and fluctuations of the financial markets which may affect our ability to raise capital or

refinance existing indebtedness and the cost of doing so; (iii) the ultimate outcome of lawsuits filed against us and other legal and regulatory

proceedings to which we are subject; (iv) our ability to make changes to certain non-guaranteed elements of our life insurance products; (v) our

ability to obtain adequate and timely rate increases on our health products, including our long-term care business; (vi) the receipt of any

required regulatory approvals for dividend and surplus debenture interest payments from our insurance subsidiaries; (vii) mortality, morbidity,

the increased cost and usage of health care services, persistency, the adequacy of our previous reserve estimates and other factors which may

affect the profitability of our insurance products; (viii) changes in our assumptions related to deferred acquisition costs or the present value of

future profits; (ix) the recoverability of our deferred tax assets and the effect of potential ownership changes and tax rate changes on their

value; (x) our assumption that the positions we take on our tax return filings, including our position that our 7.0% convertible senior debentures

due 2016 will not be treated as stock for purposes of Section 382 of the Internal Revenue Code of 1986, as amended, and will not trigger an

ownership change, will not be successfully challenged by the Internal Revenue Service; (xi) changes in accounting principles and the

interpretation thereof; (xii) our ability to continue to satisfy the financial ratio and balance requirements and other covenants of our debt

agreements; (xiii) our ability to achieve anticipated expense reductions and levels of operational efficiencies including improvements in claims

adjudication and continued automation and rationalization of operating systems, (xiv) performance and valuation of our investments, including

the impact of realized losses (including other-than-temporary impairment charges); (xv) our ability to identify products and markets in which we

can compete effectively against competitors with greater market share, higher ratings, greater financial resources and stronger brand

recognition; (xvi) our ability to generate sufficient liquidity to meet our debt service obligations and other cash needs; (xvii) our ability to maintain

effective controls over financial reporting; (xviii) our ability to continue to recruit and retain productive agents and distribution partners and

customer response to new products, distribution channels and marketing initiatives; (xix) our ability to achieve eventual upgrades of the

financial strength ratings of CNO Financial and our insurance company subsidiaries as well as the impact of our ratings on our business, our

ability to access capital and the cost of capital; (xx) the risk factors or uncertainties listed from time to time in our filings with the Securities and

Exchange Commission; (xxi) regulatory changes or actions, including those relating to regulation of the financial affairs of our insurance

companies, such as the payment of dividends and surplus debenture interest to us, regulation of financial services affecting (among other

things) bank sales and underwriting of insurance products, regulation of the sale, underwriting and pricing of products, and health care

regulation affecting health insurance products; and (xxii) changes in the Federal income tax laws and regulations which may affect or eliminate

the relative tax advantages of some of our products. Other factors and assumptions not identified above are also relevant to the forward-

looking statements, and if they prove incorrect, could also cause actual results to differ materially from those projected. All forward-looking

statements are expressly qualified in their entirety by the foregoing cautionary statements. Our forward-looking statements speak only as of the

date made. We assume no obligation to update or to publicly announce the results of any revisions to any of the forward-looking statements to

reflect actual results, future events or developments, changes in assumptions or changes in other factors affecting the forward-looking

statements.

CNO Financial Group

3

Non-GAAP Measures

This presentation contains the following financial measures that differ from the

comparable measures under Generally Accepted Accounting Principles (GAAP):

operating earnings measures; book value, excluding accumulated other comprehensive

income (loss) per share; operating return measures; earnings before net realized

investment gains (losses) and corporate interest and taxes; debt to capital ratios,

excluding accumulated other comprehensive income (loss); and interest-adjusted benefit

ratios. Reconciliations between those non-GAAP measures and the comparable GAAP

measures are included in the Appendix, or on the page such measure is presented.

comparable measures under Generally Accepted Accounting Principles (GAAP):

operating earnings measures; book value, excluding accumulated other comprehensive

income (loss) per share; operating return measures; earnings before net realized

investment gains (losses) and corporate interest and taxes; debt to capital ratios,

excluding accumulated other comprehensive income (loss); and interest-adjusted benefit

ratios. Reconciliations between those non-GAAP measures and the comparable GAAP

measures are included in the Appendix, or on the page such measure is presented.

While management believes these measures are useful to enhance understanding and

comparability of our financial results, these non-GAAP measures should not be

considered substitutes for the most directly comparable GAAP measures.

comparability of our financial results, these non-GAAP measures should not be

considered substitutes for the most directly comparable GAAP measures.

Additional information concerning non-GAAP measures is included in our periodic filings

with the Securities and Exchange Commission that are available in the “Investors - SEC

Filings” section of CNO’s website, www.CNOinc.com.

with the Securities and Exchange Commission that are available in the “Investors - SEC

Filings” section of CNO’s website, www.CNOinc.com.

CNO Financial Group

4

CNO Financial Group

5

4Q10: Summary

CNO

§ Net income of $168.2 million, compared to $18.2 million

§ Net operating income* of $51.7 million, up 62%, or 18 cents per

diluted share

diluted share

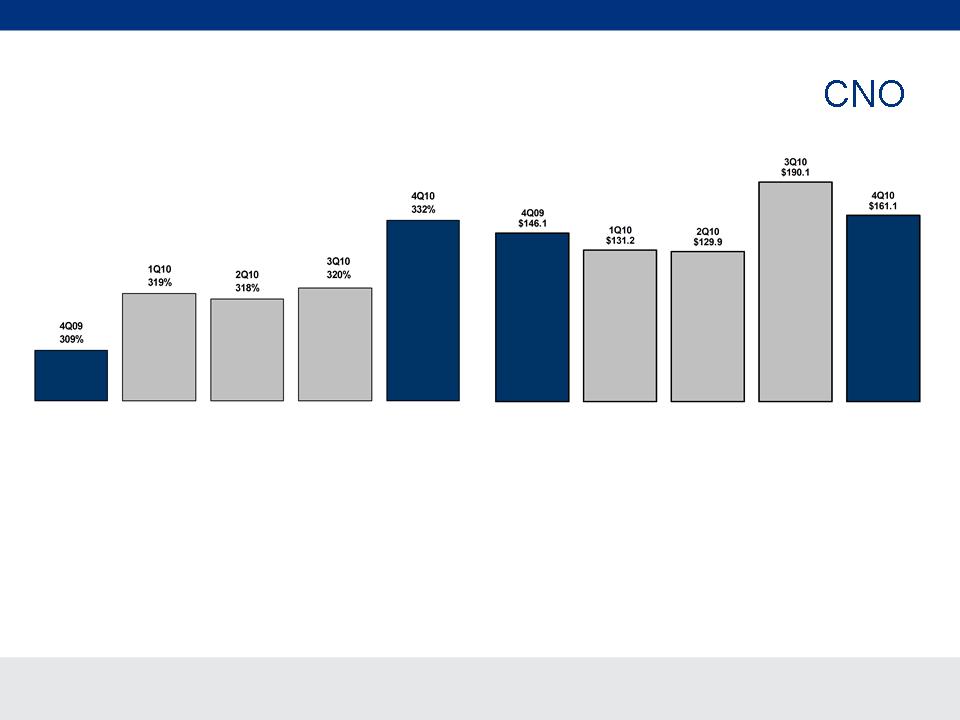

§ Consolidated RBC at 332%, up 12 percentage points from 9/30/10

§ Holding company liquidity at $161 million, down $29 million from

9/30/10 primarily reflecting the repayment of debt

9/30/10 primarily reflecting the repayment of debt

§ Debt to total capital ratio, as defined in our Senior Secured Credit

Agreement 19.99%, down from 21.17% at 9/30/10

Agreement 19.99%, down from 21.17% at 9/30/10

§ AOCI of $238 million at 12/31/10 vs. AOCI of $688 million at 9/30/10

§ Core sales** up 13% over 3Q10

*Management believes that an analysis of net income applicable to common stock before: (1) loss on extinguishment or modification of debt, net of income taxes; (2)

net realized investment gains or losses, net of related amortization and income taxes; and (3) increases or decreases in the valuation allowance related to deferred

tax assets (“Net operating income,” a non-GAAP financial measure) is important to evaluate the financial performance of the company, and is a key measure

commonly used in the life insurance industry. Management uses this measure to evaluate performance because such items can be affected by events that are

unrelated to the company’s underlying fundamentals. The table on page 8 reconciles the non-GAAP measure to the corresponding GAAP measure.

net realized investment gains or losses, net of related amortization and income taxes; and (3) increases or decreases in the valuation allowance related to deferred

tax assets (“Net operating income,” a non-GAAP financial measure) is important to evaluate the financial performance of the company, and is a key measure

commonly used in the life insurance industry. Management uses this measure to evaluate performance because such items can be affected by events that are

unrelated to the company’s underlying fundamentals. The table on page 8 reconciles the non-GAAP measure to the corresponding GAAP measure.

**Excludes PFFS and PDP.

CNO Financial Group

6

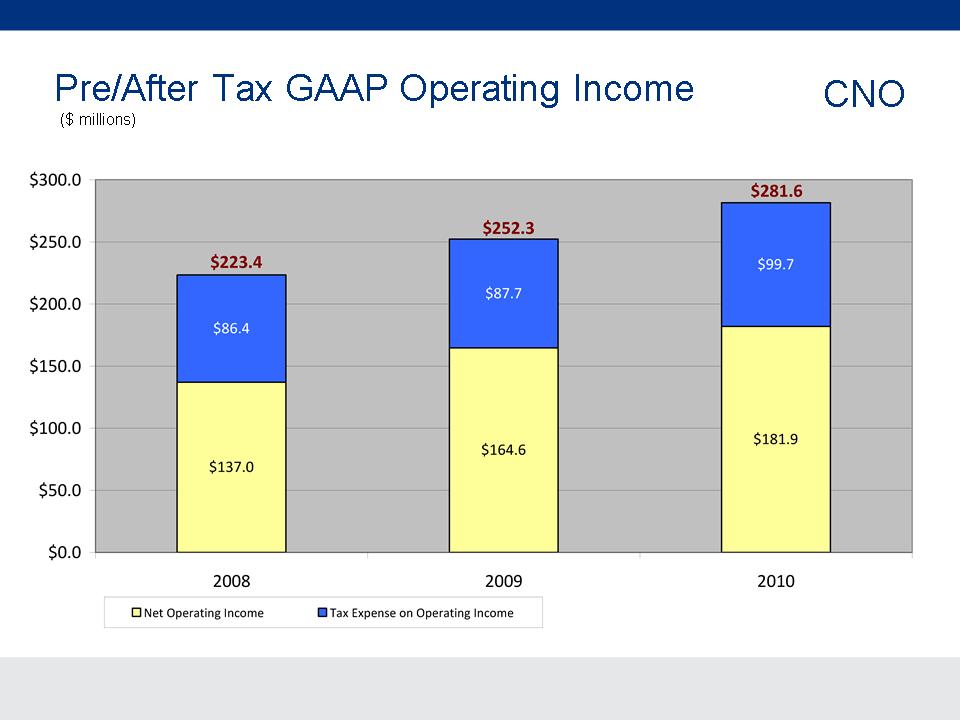

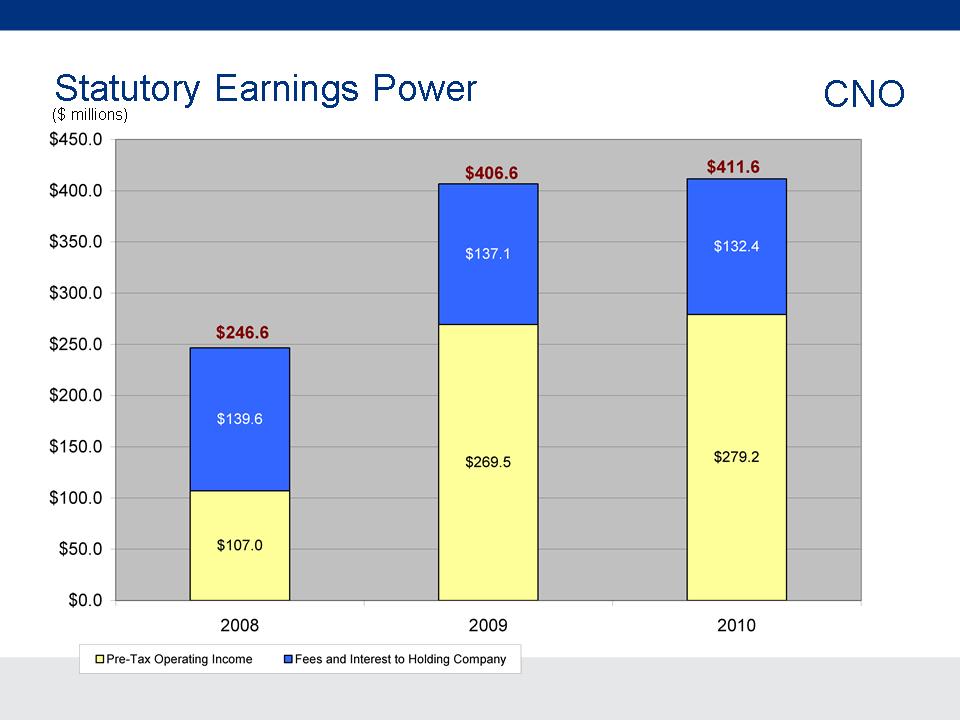

2010 vs. 2009 Summary

CNO

§ Net income of $284.6 million, compared to $85.7 million

§ Net operating income* of $181.9 million, up 11%, or 65 cents per

diluted share

diluted share

§ Consolidated RBC at 332%, up 23 percentage points for the year

§ Holding company liquidity at $161 million, up $15 million

§ Debt to total capital ratio, as defined in our Senior Secured Credit

Agreement 19.99%, down from 21.63% at 12/31/09

Agreement 19.99%, down from 21.63% at 12/31/09

§ AOCI of $238 million at 12/31/10 vs. AOCL of $(264) million at

12/31/09

12/31/09

§ Core sales** for the year down 5%

§ Material weakness has been remediated

*Management believes that an analysis of net income applicable to common stock before: (1) loss on extinguishment or modification of debt, net of income taxes; (2) net

realized investment gains or losses, net of related amortization and income taxes; and (3) increases or decreases in the valuation allowance related to deferred tax

assets (“Net operating income,” a non-GAAP financial measure) is important to evaluate the financial performance of the company, and is a key measure commonly

used in the life insurance industry. Management uses this measure to evaluate performance because such items can be affected by events that are unrelated to the

company’s underlying fundamentals. The table on page 8 reconciles the non-GAAP measure to the corresponding GAAP measure.

realized investment gains or losses, net of related amortization and income taxes; and (3) increases or decreases in the valuation allowance related to deferred tax

assets (“Net operating income,” a non-GAAP financial measure) is important to evaluate the financial performance of the company, and is a key measure commonly

used in the life insurance industry. Management uses this measure to evaluate performance because such items can be affected by events that are unrelated to the

company’s underlying fundamentals. The table on page 8 reconciles the non-GAAP measure to the corresponding GAAP measure.

**Excludes PFFS and PDP.

CNO Financial Group

7

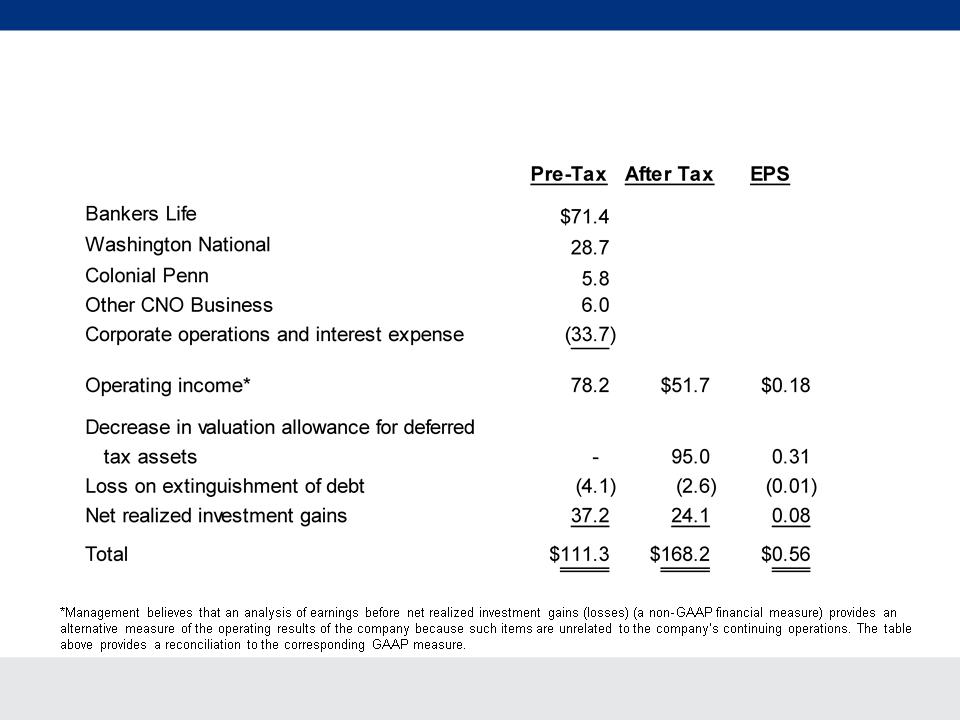

4Q10 Summary of Results

CNO

($ millions, except per-share amounts)

CNO Financial Group

8

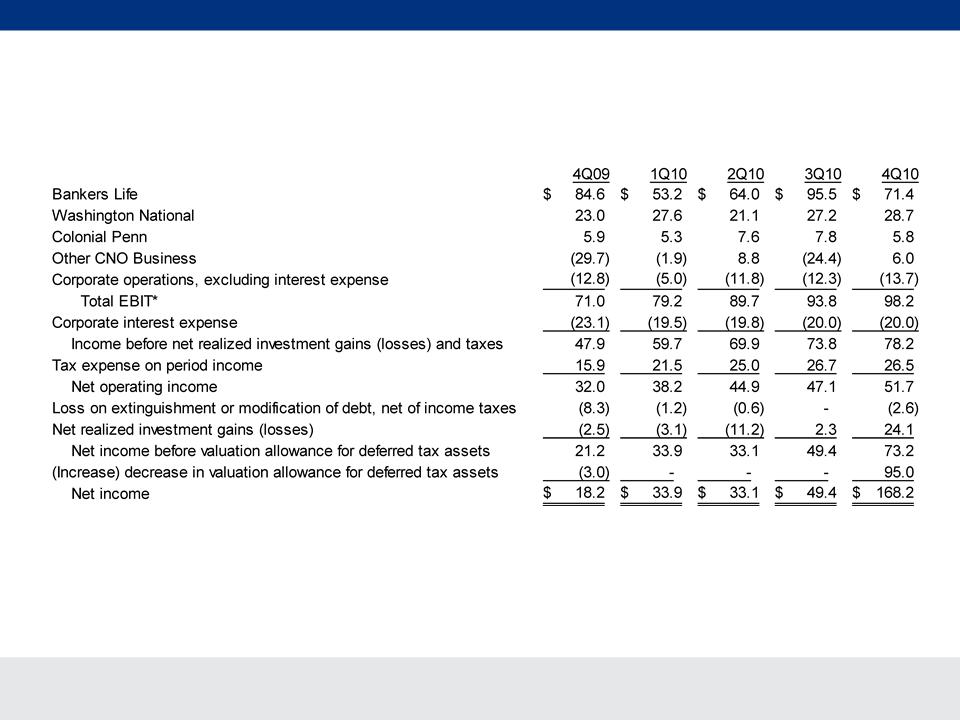

Quarterly Earnings

CNO

*Management believes that an analysis of earnings before net realized investment gains (losses), corporate interest, loss on extinguishment

or modification of debt and taxes (“EBIT,” a non-GAAP financial measure) provides a clearer comparison of the operating results of the

company quarter-over-quarter because it excludes: (1) corporate interest expense; (2) loss on extinguishment or modification of debt; and (3)

net realized investment gains (losses) that are unrelated to the company’s underlying fundamentals. The table above provides a reconciliation

of EBIT to net income.

or modification of debt and taxes (“EBIT,” a non-GAAP financial measure) provides a clearer comparison of the operating results of the

company quarter-over-quarter because it excludes: (1) corporate interest expense; (2) loss on extinguishment or modification of debt; and (3)

net realized investment gains (losses) that are unrelated to the company’s underlying fundamentals. The table above provides a reconciliation

of EBIT to net income.

($ millions)

CNO Financial Group

9

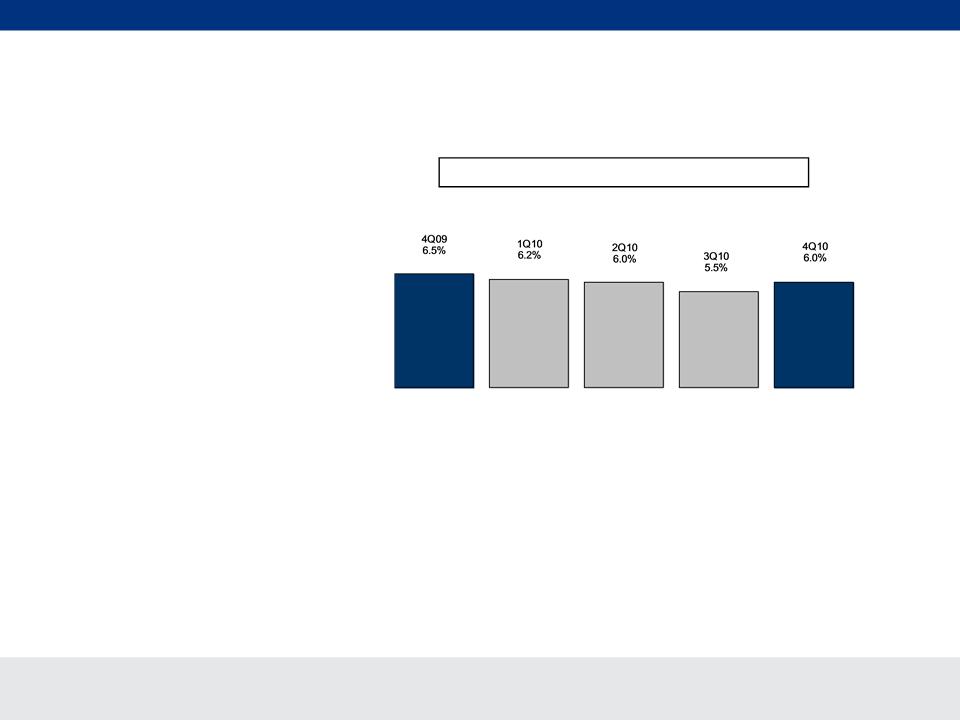

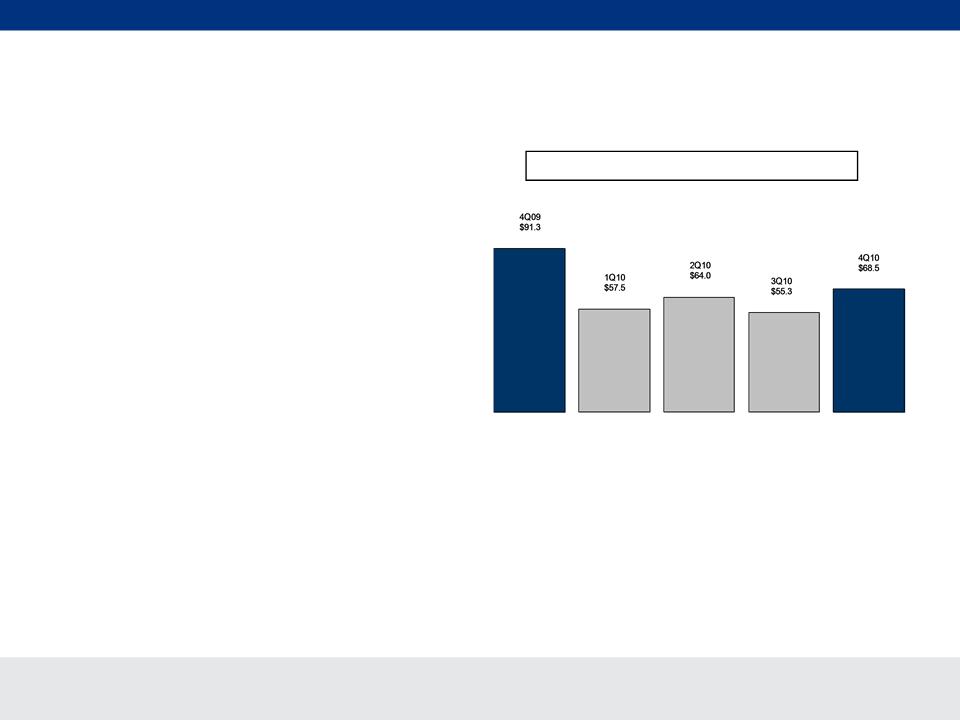

Operating ROE

CNO

Operating ROE*, Trailing 4 Quarters

*Operating return excludes loss on extinguishment or modification of debt, net realized investment gains (losses) and valuation

allowance related to deferred tax assets. Equity excludes accumulated other comprehensive income (loss) and the value of net

operating loss carryforwards. See Appendix for a reconciliation to the corresponding GAAP measure.

allowance related to deferred tax assets. Equity excludes accumulated other comprehensive income (loss) and the value of net

operating loss carryforwards. See Appendix for a reconciliation to the corresponding GAAP measure.

|

Average common shareholders’ equity,

excluding AOCI/L and net operating loss carryforwards, trailing 4 quarters: |

$2,551.1

|

$2,679.2

|

$2,808.3

|

$2,942.8

|

$3,048.5

|

($ millions)

CNO Financial Group

10

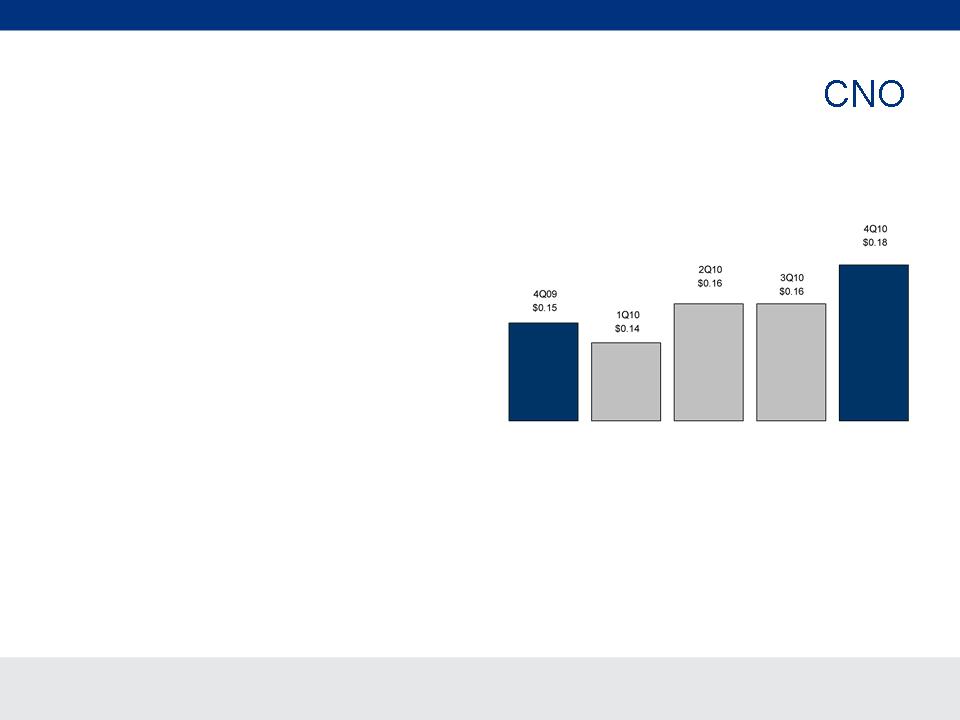

Operating EPS (Diluted)*

§ Increased EPS despite dilution

from recapitalization in 4Q09

from recapitalization in 4Q09

*Operating earnings per share exclude loss on extinguishment or modification of debt, net realized investment gains (losses) and

valuation allowance related to deferred tax assets. See Appendix for a reconciliation to the corresponding GAAP measure.

valuation allowance related to deferred tax assets. See Appendix for a reconciliation to the corresponding GAAP measure.

|

Weighted average diluted shares (in millions):

|

217.5

|

292.1

|

302.6

|

306.0

|

306.7

|

CNO Financial Group

11

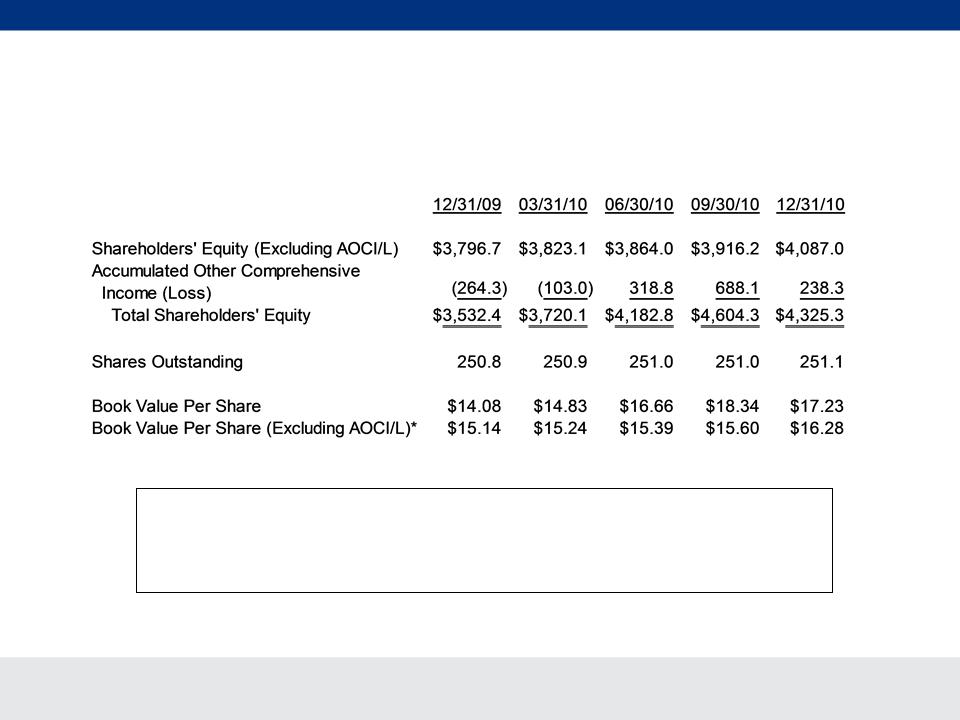

Book Value

CNO

*See Appendix for a reconciliation to the corresponding GAAP measure.

($ millions, except per-share amounts)

Book value per diluted share (excluding AOCI/L) as of December 31, 2010 was $14.23

– Includes dilutive impact of $293.0 million of 7.0% debentures

CNO Financial Group

12

CNO Financial Group

13

CNO Financial Group

14

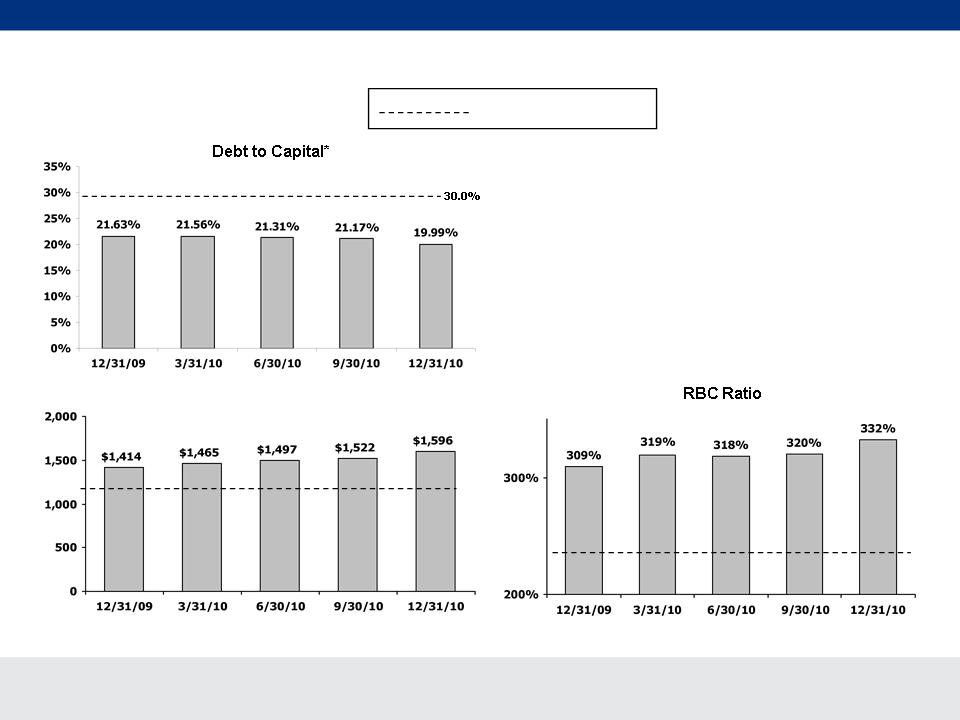

Financial Strength

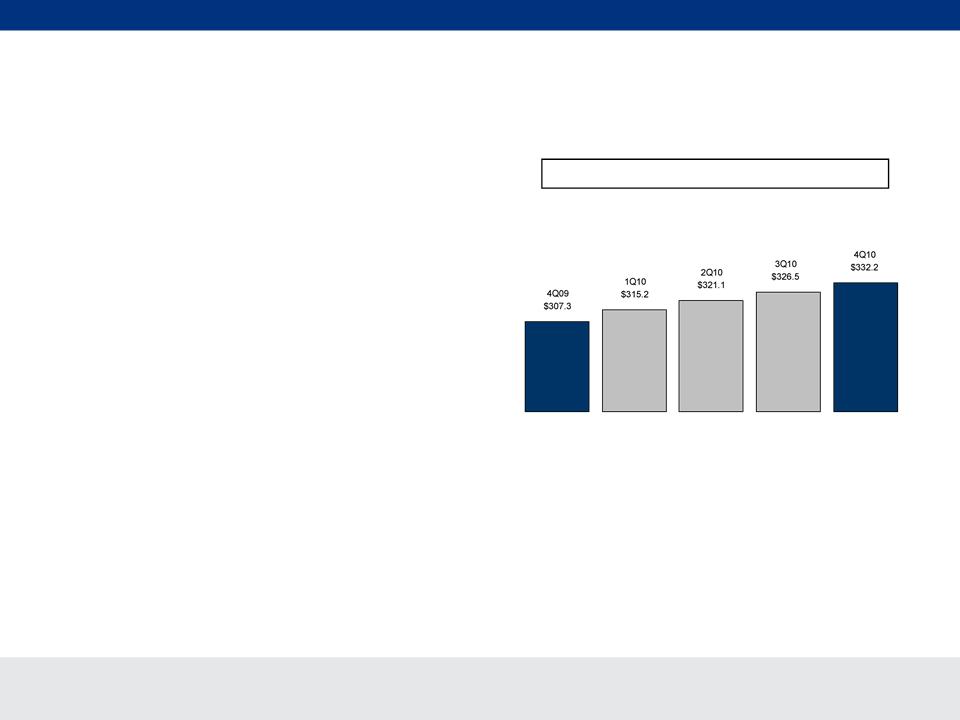

§ RBC increased to 332% in 4Q10

– Positive impact from statutory operating income

(+22 points)

(+22 points)

– Impact of WNIC merger (+8 points)

– Impact of capital losses (-7 points)

– Other impacts, including surplus debenture

interest and increase in total investments (-11

points)

interest and increase in total investments (-11

points)

*Risk-Based Capital (“RBC”) requirements provide a tool for insurance regulators to determine the

levels of statutory capital and surplus an insurer must maintain in relation to its insurance and

investment risks. The RBC ratio is the ratio of the statutory consolidated adjusted capital of our

insurance subsidiaries to RBC.

levels of statutory capital and surplus an insurer must maintain in relation to its insurance and

investment risks. The RBC ratio is the ratio of the statutory consolidated adjusted capital of our

insurance subsidiaries to RBC.

Consolidated RBC Ratio*

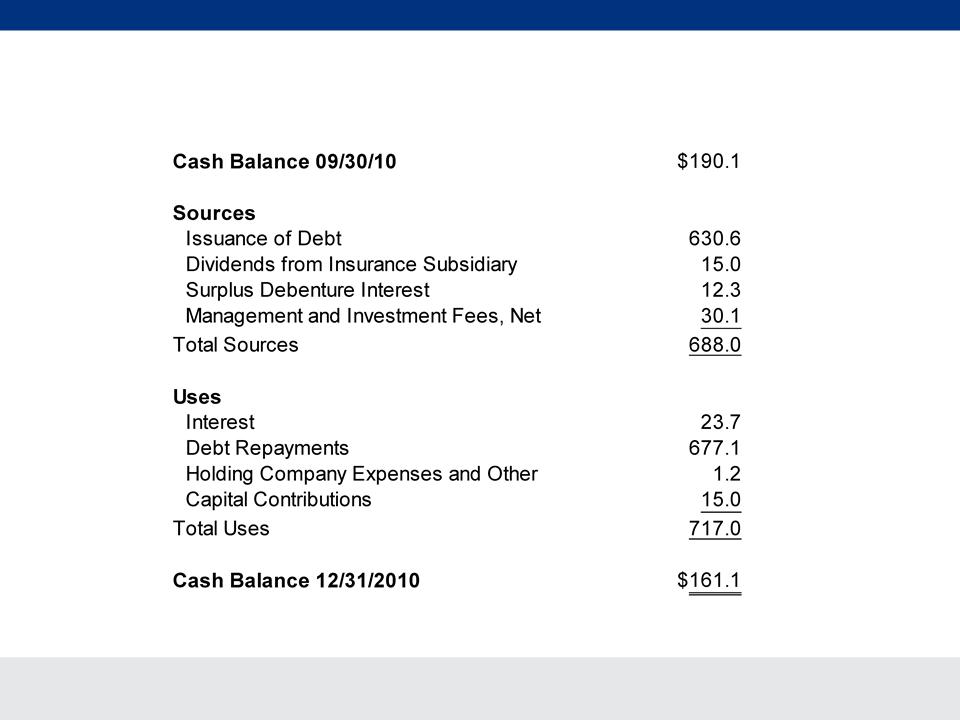

§ Unrestricted cash held at the holding

company decreased $29 million to $161

million during 4Q10 primarily reflecting

the repayment of debt

company decreased $29 million to $161

million during 4Q10 primarily reflecting

the repayment of debt

Liquidity

($ millions)

|

21.63%

|

21.56%

|

21.31%

|

21.17%

|

19.99%

|

|

Debt to Total Capital Ratio**

|

**as defined in our Senior Secured Credit Agreement. See appendix for reconciliation

to GAAP measure.

to GAAP measure.

CNO Financial Group

15

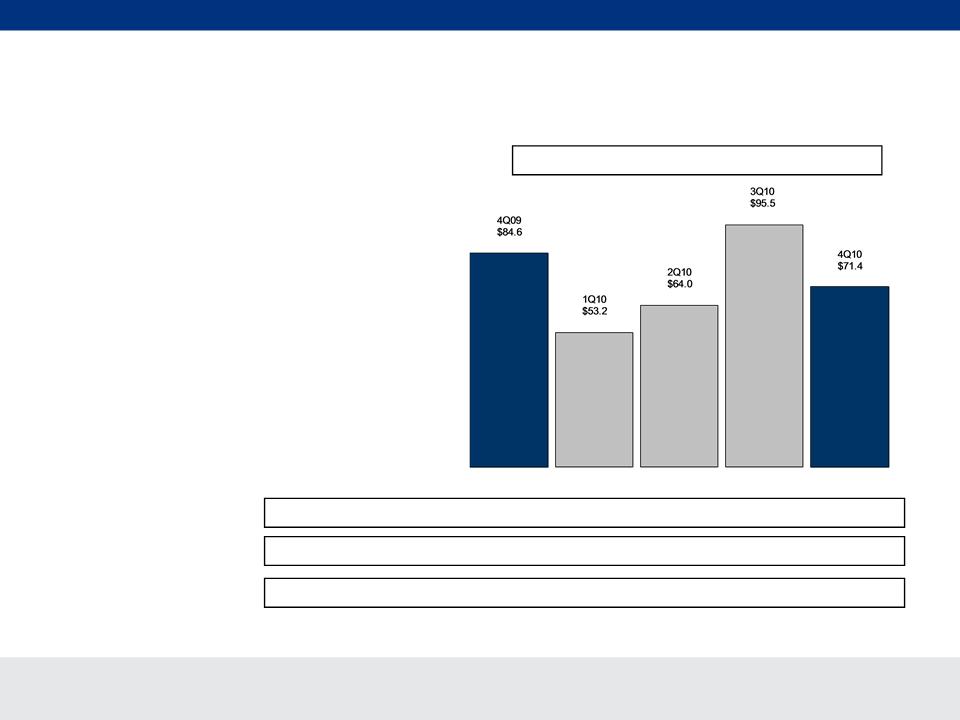

§ Earnings of $71.4 million, down 16%

– Results in 4Q10 were favorably impacted by $18 million from improved

spreads and growth in the annuity block

spreads and growth in the annuity block

– Results in 4Q10 were unfavorably impacted by:

• $4 million from unfavorable mortality

• $3 million from unfavorable Med Supp persistency

– Results in 4Q09 were favorably impacted by:

• $11 million from PFFS business we assumed from Coventry, the last of

which expired on January 1, 2010

which expired on January 1, 2010

• $10 million due to positive development of long-term care reserves and

the impact of policyholder actions following rate increases

the impact of policyholder actions following rate increases

• A $6 million out-of-period correction

4Q Summary

Bankers Life

CNO Financial Group

16

Sales and Distribution Results

§ Mixed sales results

– Med Supp sales 2nd highest in Bankers’

history

history

– Life and Annuity sales better than

industry results

industry results

• 16% increase in life sales

• 15% increase in annuity sales

– LTC sales in line with expectations

Bankers Life

Quarterly NAP*

*PFFS and PDP sales are not comparable and are excluded from NAP in all periods; in addition, we no longer assume any of the risks on

PFFS contracts through reinsurance.

PFFS contracts through reinsurance.

($ millions)

|

Med Supp policies issued (in thousands):

|

32.5

|

10.6

|

12.6

|

10.2

|

19.7

|

CNO Financial Group

17

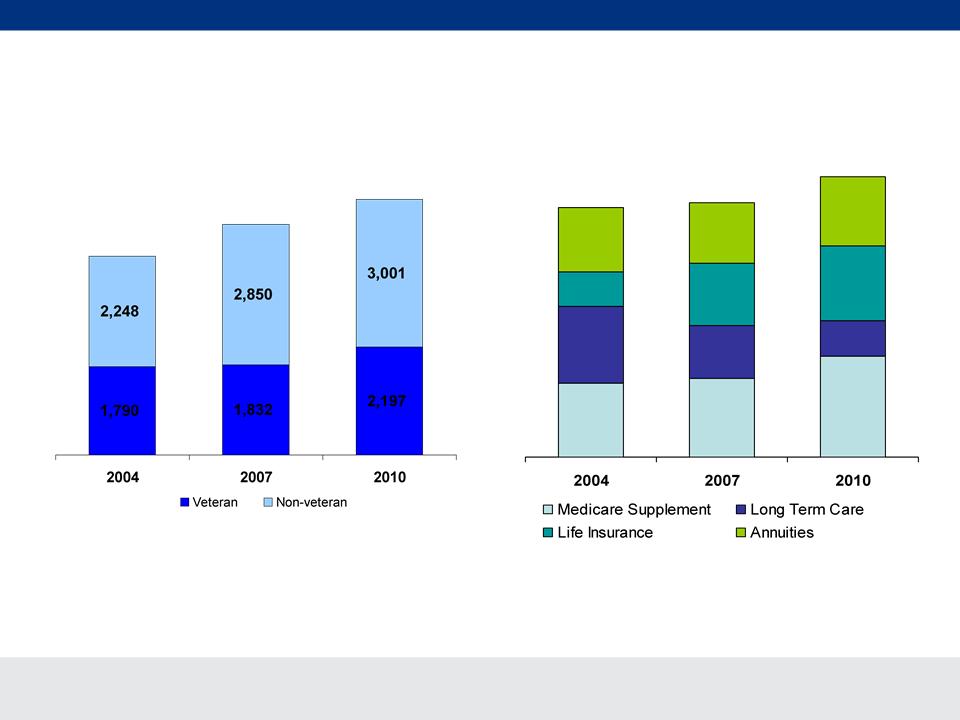

Distribution Value Proposition

Bankers Life

Average Agent Counts

Diversified Product Suite (Share of Sales*)

4,682

4,038

5,198

$218.5

$222.4

$245.4

30%

30%

14%

26%

24%

24%

21%

31%

36%

13%

26%

25%

NAP in millions

*Excluding PFFS & PDP

§ Needs based market focus able to reach middle market boomers and seniors with straightforward products

§ Nationwide footprint with localized presence in key target markets (75% of sales take place within 10 miles of an agent’s home)

§ Bankers “franchise” model - standardization and development of best practices in key activities (e.g. recruiting/sales leads/ training)

drives productivity, consistency and compliance

drives productivity, consistency and compliance

CNO Financial Group

18

Bankers Life

§ LTC is an important product that enables Bankers Life to meet the needs

of its customers

of its customers

§ Stable financial results

§ Bankers experience and strategy enable us to differentiate through:

– Stringent underwriting

– Low exposure to higher risk product benefits (i.e. “0” day elimination period,

“lifetime” benefits, high compound inflation, etc.)

“lifetime” benefits, high compound inflation, etc.)

– Successful proactive in-force rate actions over last five years

– Rigorous claim management

– New business priced for higher returns

– Career Distribution channel positively impacts underwriting and re-rate results

LTC Update

CNO Financial Group

19

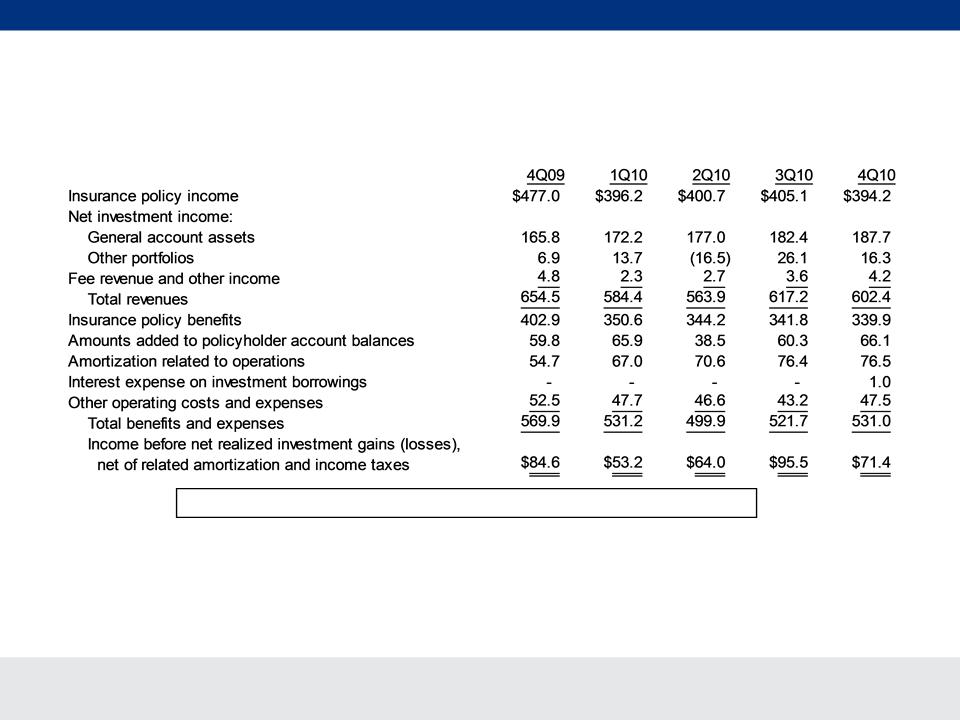

Quarterly Earnings

Management believes that an analysis of income before net realized investment gains (losses), net of related amortization (a non-GAAP

financial measure), is important to evaluate the financial performance of our business, and is a measure commonly used in the life insurance

industry. Management uses this measure to evaluate performance because realized gains or losses can be affected by events that are

unrelated to a company’s underlying fundamentals. The table on Page 8 reconciles the non-GAAP measure to the corresponding GAAP

measure. See Appendix for a reconciliation of the return on equity measure to the corresponding GAAP measure.

financial measure), is important to evaluate the financial performance of our business, and is a measure commonly used in the life insurance

industry. Management uses this measure to evaluate performance because realized gains or losses can be affected by events that are

unrelated to a company’s underlying fundamentals. The table on Page 8 reconciles the non-GAAP measure to the corresponding GAAP

measure. See Appendix for a reconciliation of the return on equity measure to the corresponding GAAP measure.

Trailing 4 Quarter Operating Return on Allocated Capital: 11.8%

Bankers Life

($ millions)

CNO Financial Group

20

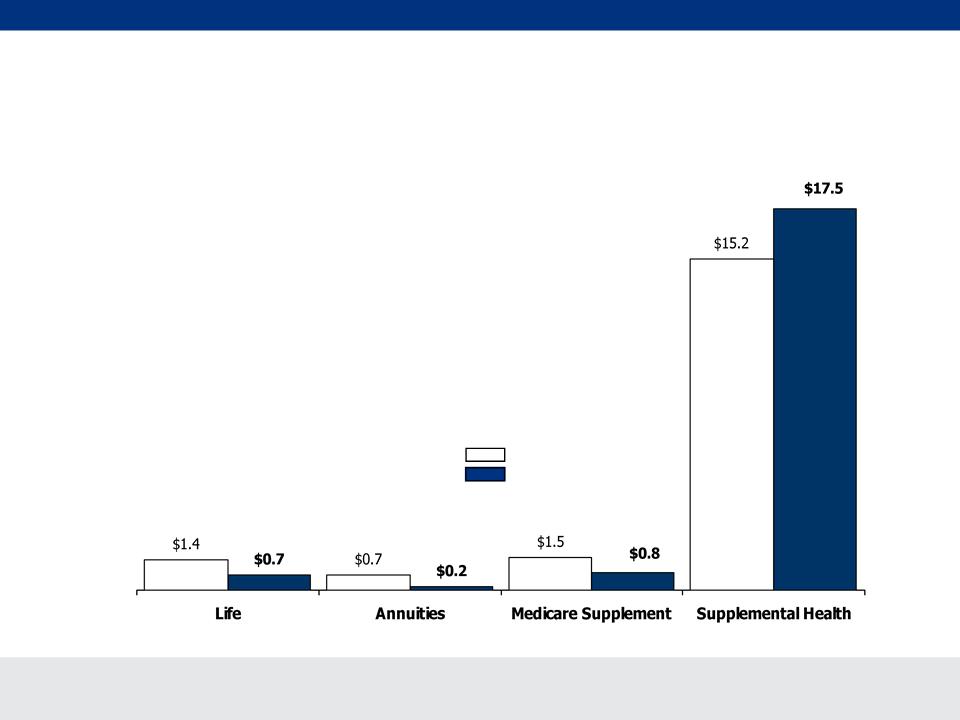

§ Earnings of $28.7 million, up 25%

– Reflects an increase in earnings from our supplemental health

products due to growth in this block of business and lower claims

products due to growth in this block of business and lower claims

§ Sales (NAP) of $19 million, up 3%

– Supplemental health NAP of $17.5 million, up 15%

§ Strong supplemental health sales growth in both WNIC

Independent and PMA channels

Independent and PMA channels

4Q Summary

Washington National

CNO Financial Group

21

Washington National

§ Supplemental health sales up 15%

– PMA up 18%

– WNIC Independent up 8%

§ Worksite sales* up 3%

– WNIC Independent up 20%

– PMA down 3%

4Q09 NAP

4Q10 NAP

4Q10 Sales Results

* Worksite sales include supplemental health and life

($ millions)

CNO Financial Group

22

Quarterly Earnings

Washington National

Management believes that an analysis of income (loss) before net realized investment gains (losses), net of related amortization (a non-

GAAP financial measure), is important to evaluate the financial performance of our business, and is a measure commonly used in the life

insurance industry. Management uses this measure to evaluate performance because realized gains or losses can be affected by events

that are unrelated to a company’s underlying fundamentals. The table on Page 8 reconciles the non-GAAP measure to the corresponding

GAAP measure.

GAAP financial measure), is important to evaluate the financial performance of our business, and is a measure commonly used in the life

insurance industry. Management uses this measure to evaluate performance because realized gains or losses can be affected by events

that are unrelated to a company’s underlying fundamentals. The table on Page 8 reconciles the non-GAAP measure to the corresponding

GAAP measure.

Trailing 4 Quarter Operating Return on Allocated Capital: 9.9%

($ millions)

CNO Financial Group

23

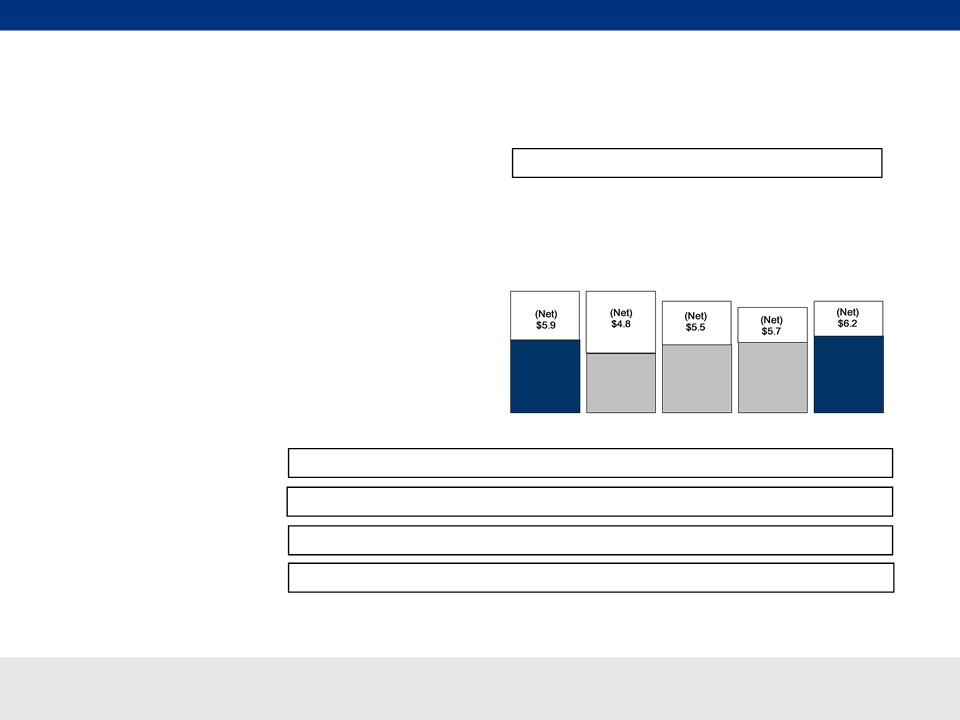

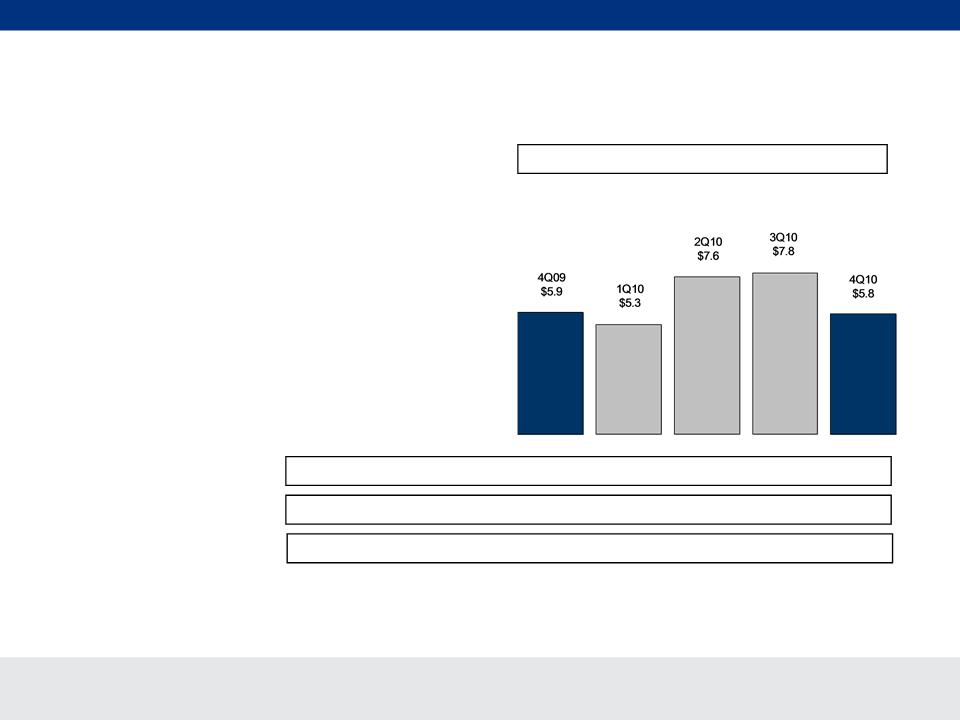

§ Earnings of $5.8 million, compared to $5.9 million

– Unfavorable mortality in life products

– Substantially offset by increased earnings in core life products due

to growth and higher investment yields

to growth and higher investment yields

§ Sales growth continues:

– NAP up 13%

– 2010 sales up 11%

– 2010 lead generation up 35%

Summary

Colonial Penn

CNO Financial Group

24

Quarterly Earnings

Colonial Penn

Management believes that an analysis of income before net realized investment gains (losses), net of related amortization (a non-GAAP

financial measure), is important to evaluate the financial performance of our business, and is a measure commonly used in the life

insurance industry. Management uses this measure to evaluate performance because realized gains or losses can be affected by events

that are unrelated to a company’s underlying fundamentals. The table on Page 8 reconciles the non-GAAP measure to the corresponding

GAAP measure. See Appendix for a reconciliation of the return on equity measure to the corresponding GAAP measure.

financial measure), is important to evaluate the financial performance of our business, and is a measure commonly used in the life

insurance industry. Management uses this measure to evaluate performance because realized gains or losses can be affected by events

that are unrelated to a company’s underlying fundamentals. The table on Page 8 reconciles the non-GAAP measure to the corresponding

GAAP measure. See Appendix for a reconciliation of the return on equity measure to the corresponding GAAP measure.

Trailing 4 Quarter Operating Return on Allocated Capital: 7.6%

($ millions)

CNO Financial Group

25

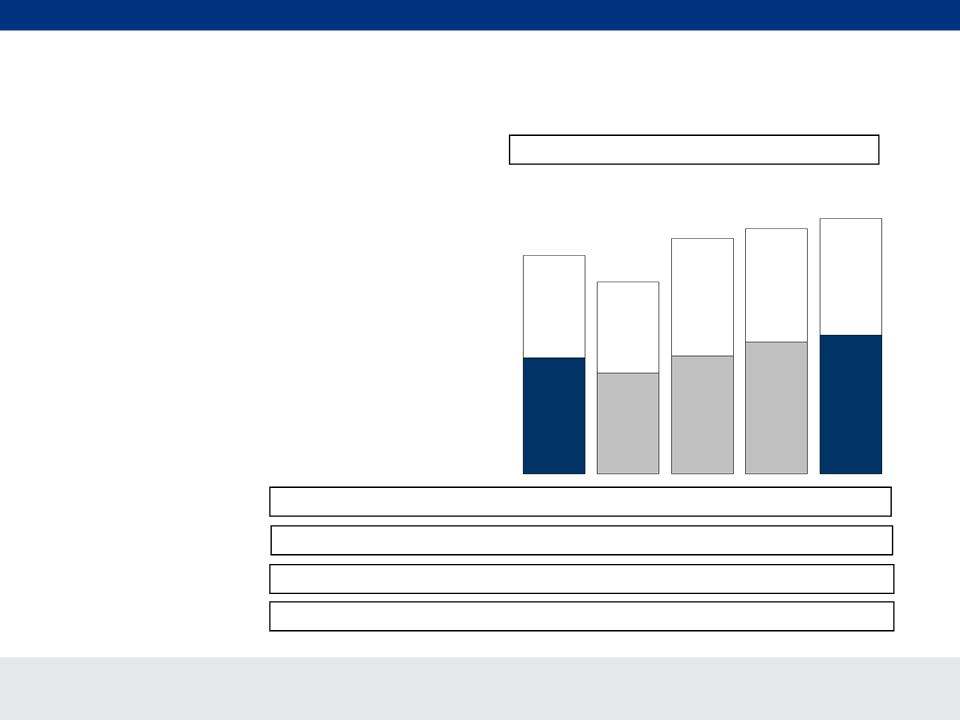

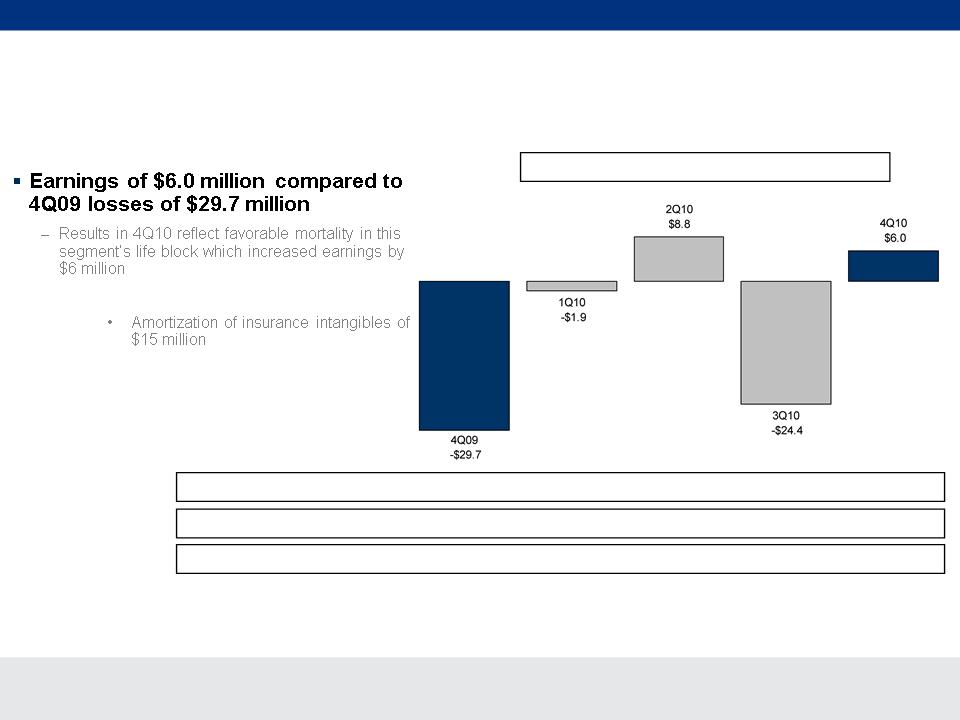

§ Earnings of $6.0 million, compared to loss of $29.7 million

– Results in 4Q10 reflect favorable mortality in this segment’s life block

which increased earnings by $6 million

which increased earnings by $6 million

– Results in 4Q09 were unfavorably impacted by:

• Amortization of insurance intangibles of $15 million

• Regulatory and legal settlements of $14 million

4Q Summary

Other CNO Business

CNO Financial Group

26

Sharpened Focus

§ Continued focus on:

– Non-Guaranteed Element Management

– Expense Management

– Risk Mitigation

§ Near-term results expected to continue to be volatile

– Portions of the business are in loss recognition

– Present value impact of some assumption changes

– NGE changes require a methodical approach

§ Yue vs. Conseco Life Litigation

– Rate increase in question had been previously withdrawn

– Appealing court’s declaratory judgment as to what items could be considered in future cost of insurance (COI) rate

increases on these ValueLife/ValueTerm policies

increases on these ValueLife/ValueTerm policies

– Conseco Life is preparing COI rate increases consistent with court decision and regulatory settlement agreement

– No reserve increase or intangible write-off resulted from court’s decision

Other CNO Business

CNO Financial Group

27

Quarterly Earnings (Losses)

Other CNO Business

Management believes that an analysis of income (loss) before net realized investment gains (losses), net of related amortization (a non-

GAAP financial measure), is important to evaluate the financial performance of our business, and is a measure commonly used in the life

insurance industry. Management uses this measure to evaluate performance because realized gains or losses can be affected by events

that are unrelated to a company’s underlying fundamentals. The table on Page 8 reconciles the non-GAAP measure to the corresponding

GAAP measure.

GAAP financial measure), is important to evaluate the financial performance of our business, and is a measure commonly used in the life

insurance industry. Management uses this measure to evaluate performance because realized gains or losses can be affected by events

that are unrelated to a company’s underlying fundamentals. The table on Page 8 reconciles the non-GAAP measure to the corresponding

GAAP measure.

($ millions)

CNO Financial Group

28

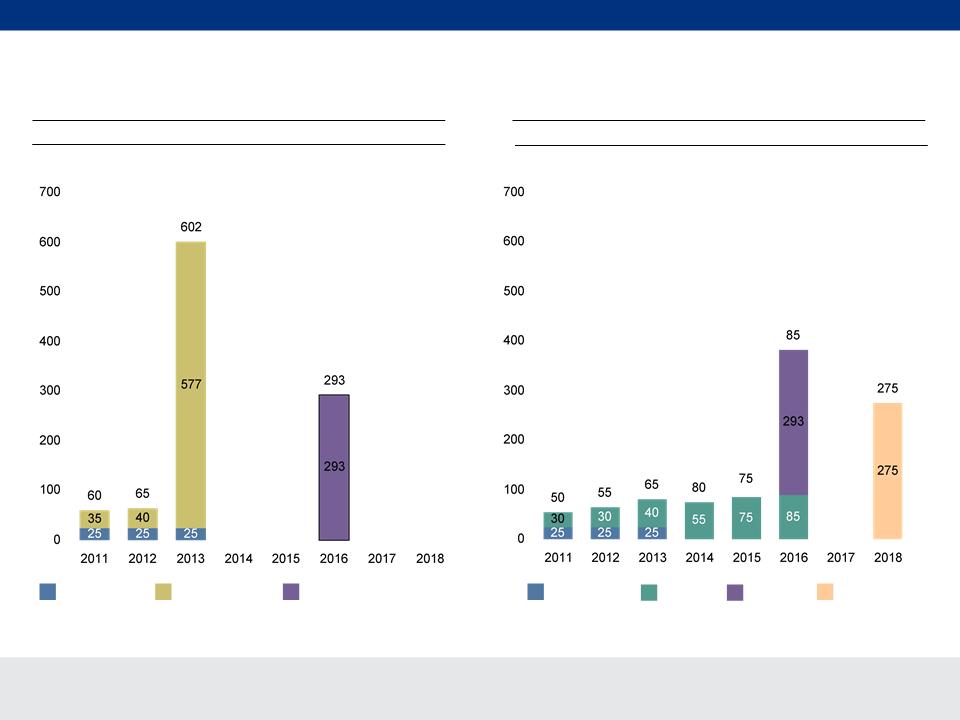

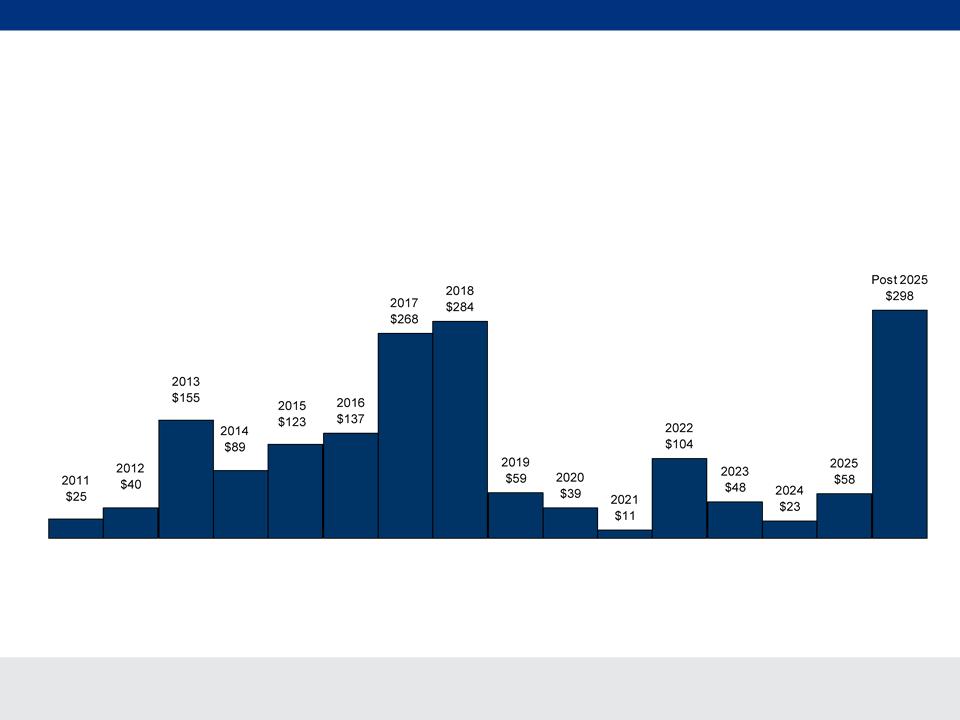

2010 Refinancing

§ $650 million of new financing

– $275 million 9.0% senior secured notes due January 2018

– $375 million senior secured credit facility amortizing through

September 2016

September 2016

§ Proceeds used to extinguish the previous senior secured credit facility of

$652 million

$652 million

§ Extended debt maturity profile by over 3 years

§ Diversified sources of financing

§ Increased financial flexibility

CNO Financial Group

29

2011 - 2018

2011 - 2018

Term Loan

Sr. Health Note

Convertible

9% Notes

Sr. Health Note

Convertible Debentures

Sr. Credit Facility

(1) Conversion price is $5.49. CNO can force conversion after 6/30/13 if CNO stock trades above $7.69 for 20 or more days in a consecutive 30 day trading

period. On 12/31/2010, CNO’s stock closed at $6.78.

period. On 12/31/2010, CNO’s stock closed at $6.78.

(1)

Prior Maturity Profile

Current Maturity Profile

($ millions)

$

$

Debt Maturity Profile

CNO Financial Group

30

Net Investment Income

CNO

§ Increase in investment income due

principally to growth in average assets

principally to growth in average assets

§ 4Q10 decline in realized yield due primarily to

expansion of FHLB loans

expansion of FHLB loans

– Floating rate

– Matched

§ Full year portfolio yield increase due

primarily to investments at yields exceeding

portfolio rate

primarily to investments at yields exceeding

portfolio rate

General Account Investment Income

|

Yield:

|

5.63%

|

5.76%

|

5.83%

|

5.86%

|

5.77%

|

($ millions)

CNO Financial Group

31

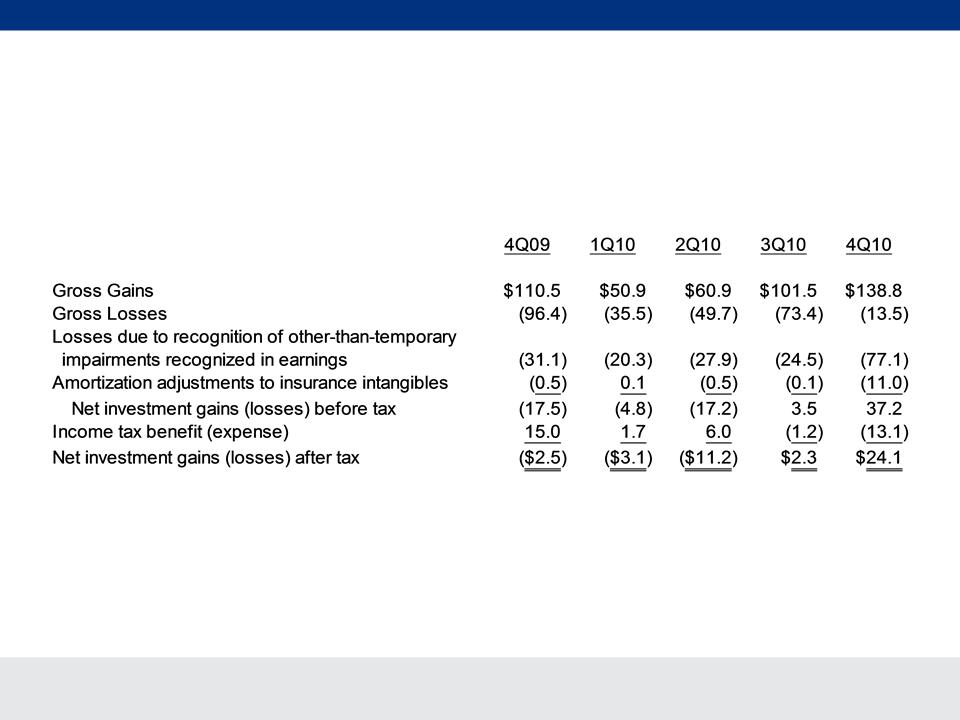

Realized Gains/Losses Recognized

through Net Income

CNO

($ millions)

CNO Financial Group

32

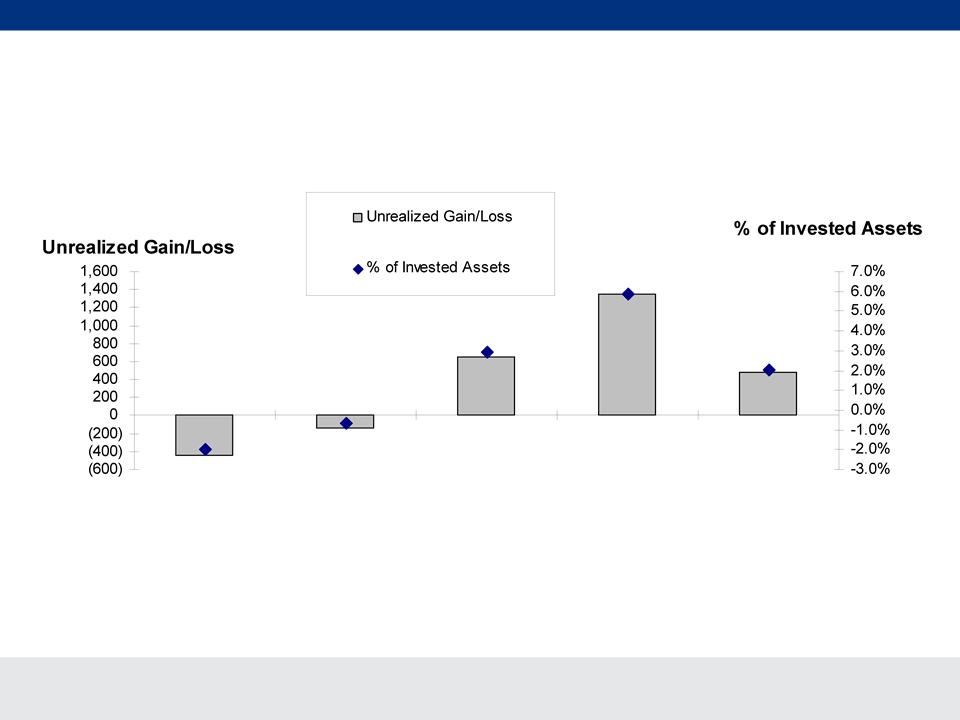

Unrealized Gain/Loss*

CNO

($ millions)

*Includes debt and equity securities classified as available for sale. Excludes investments from variable interest entities which we

consolidate under GAAP.

consolidate under GAAP.

4Q09

1Q10

2Q10

3Q10

4Q10

$

CNO Financial Group

33

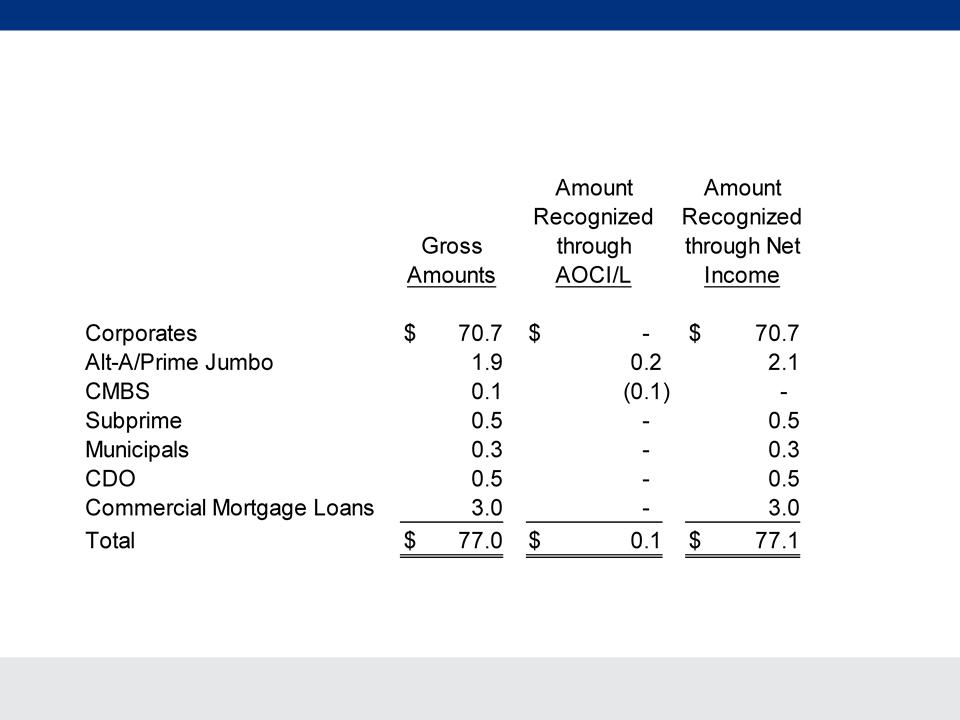

4Q10 Impairments

CNO

($ millions)

CNO Financial Group

34

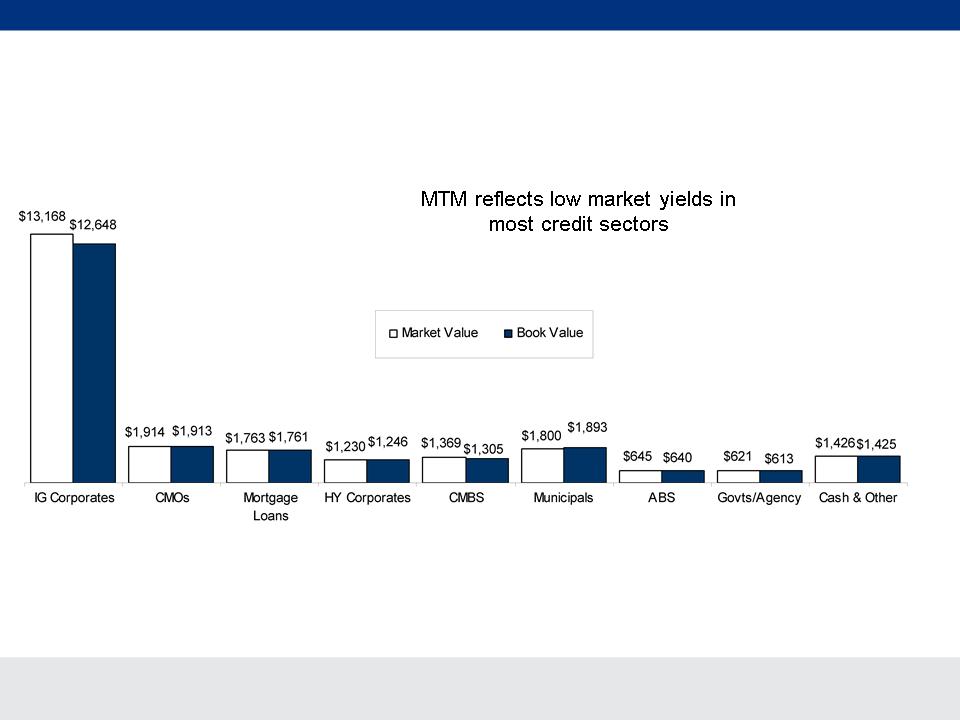

Asset Allocation at 12/31/10*

CNO

*Excludes investments from variable interest entities which we consolidate under GAAP (the related liabilities are non-recourse to CNO).

($ millions)

CNO Financial Group

35

§ 91% investment grade

Fixed Maturities, available for sale, by Rating

at 12/31/10 (Market Value)

at 12/31/10 (Market Value)

|

% of Bonds which are Investment Grade:

|

12/31/09

93%

|

3/31/10

93%

|

6/30/10

92%

|

9/30/10

92%

|

12/31/10

91%

|

*Excludes investments from variable interest entities which we consolidate under GAAP (the related liabilities are non-recourse to CNO).

AAA

14%

AA

10%

A

23%

BBB

44%

<BBB

9%

CNO Financial Group

36

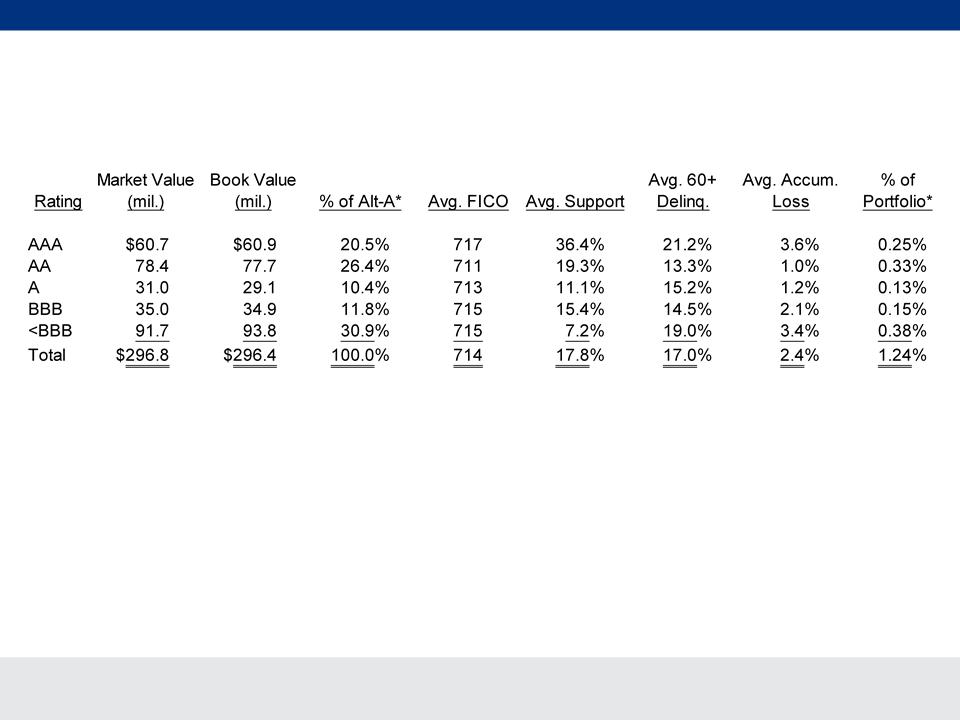

Alt-A at 12/31/10

CNO

§ 1.2% of total invested assets

§ 100% NAIC 1 classification

§ Substantial proportion of investments purchased at discounts reflective of current market

expectations for cash flows from collateral

expectations for cash flows from collateral

§ Collateral performing better than overall Alt-A collateral universe in terms of delinquency and

accumulated loss trends

accumulated loss trends

§ All securities evaluated using market-consistent estimates of future collateral performance

*Market value.

($ millions)

CNO Financial Group

37

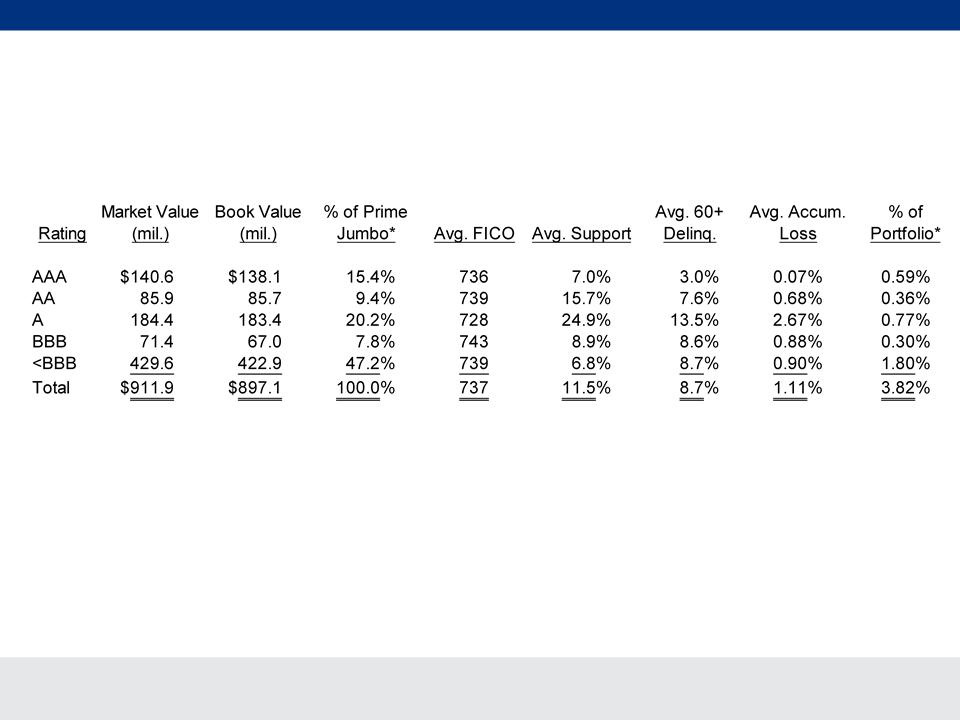

Prime Jumbo at 12/31/10

CNO

§ 3.8% of total invested assets

§ 98% NAIC 1 classification

§ Substantial proportion of investments purchased at discounts reflective of current

market expectations for cash flows from collateral

market expectations for cash flows from collateral

§ All securities evaluated using market-consistent estimates of collateral performance

§ Credit support remains substantial relative to anticipated cumulative losses

*Market value.

($ millions)

CNO Financial Group

38

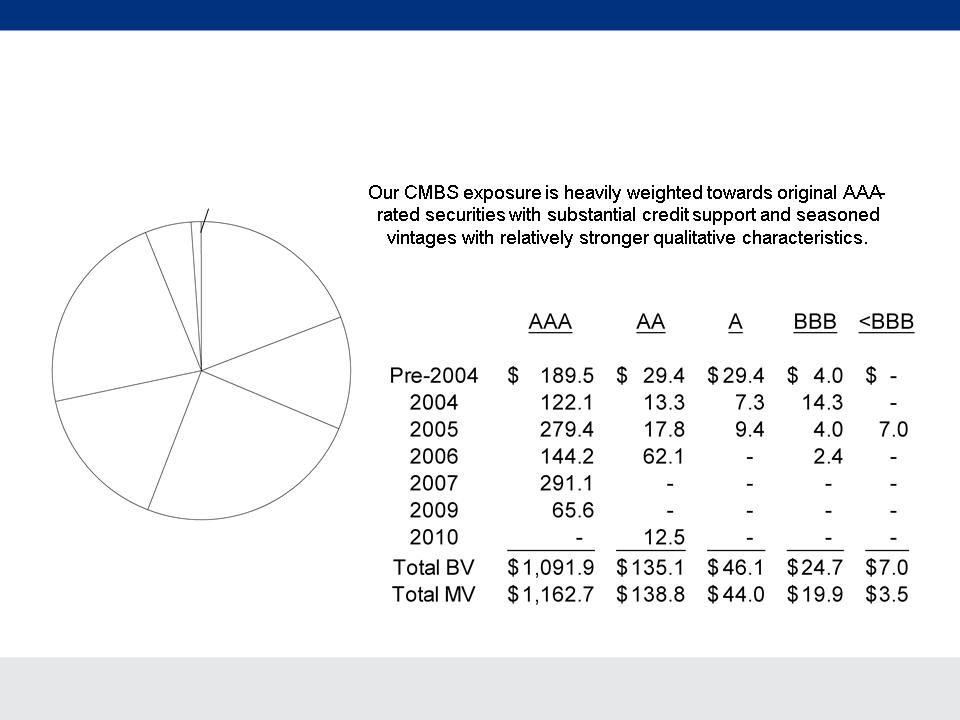

CMBS at 12/31/10

CNO

Pre-2004

19.3%

2004

12.0%

2005

24.4%

2006

16.0%

2007

22.3%

2009

5.0%

($ millions)

2010

1.0%

CNO Financial Group

39

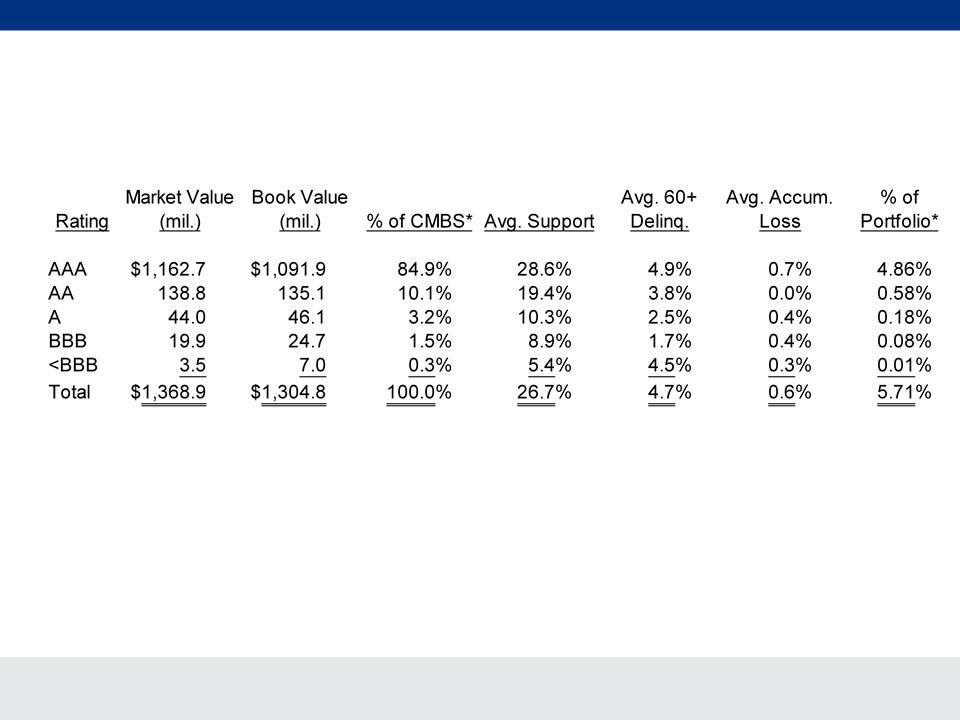

CMBS at 12/31/10

CNO

§ 5.7% of invested assets

§ 99.5% NAIC 1 classification

§ Negligible effect from Blackrock/NAIC rating process

§ Collateral performing materially better than overall CMBS collateral universe in terms of delinquency

and cumulative loss

and cumulative loss

§ All securities evaluated using market-consistent estimates of collateral performance

§ Substantial credit support inherent in structures relative to expected cumulative losses

*% of market value

($ millions)

CNO Financial Group

40

Commercial Mortgage Loans at 12/31/10

CNO

By Property Type

§ Current LTV of approximately 60.1%

§ Trailing debt service coverage ratio (DSCR) stable at approximately 1.41

§ As of 12/31/10, 1 delinquent loan ($.1mm unpaid balance)

2010

4.7%

4.7%

2009

0.4%

0.4%

2008

18.7%

18.7%

2007

20.4%

20.4%

2006

18.9%

18.9%

2005

9.4%

9.4%

2004 and Prior

27.5%

27.5%

Office

37.2%

37.2%

Indus.

17.9%

17.9%

Other

0.2%

0.2%

Retail

39.8%

39.8%

Multi-

Family

4.9%

Family

4.9%

CNO Financial Group

41

Summary

§ Solid earnings continued in Q4

§ Refinanced debt in Q4, provides more flexibility going

forward

forward

§ Improvements being recognized

– Credit rating upgrades

– Reduction in tax valuation allowance

§ Continued emphasis on profitable growth

– 2011 first year of baby boomers turning 65

– Adding 15 new locations for Bankers Life in 2011

– Expanding PMA’s recruiting capacity and sales

management team

management team

CNO

CNO Financial Group

42

Questions and Answers

CNO Financial Group

43

Appendix

CNO Financial Group

44

Covenant Metrics

Interest Coverage Ratio

Statutory Surplus ($ millions)

*Excludes Accumulated Other Comprehensive Income (Loss), as defined by the senior credit facility

$1,200

CNO

225%

Levels reflect covenants per

new agreement

new agreement

§ The ratio of available cash flow to interest

expense must equal or exceed 2.0

expense must equal or exceed 2.0

§ Covenant requirement begins 3/31/2011

CNO Financial Group

45

4Q10 Liquidity

CNO

($ millions)

CNO Financial Group

46

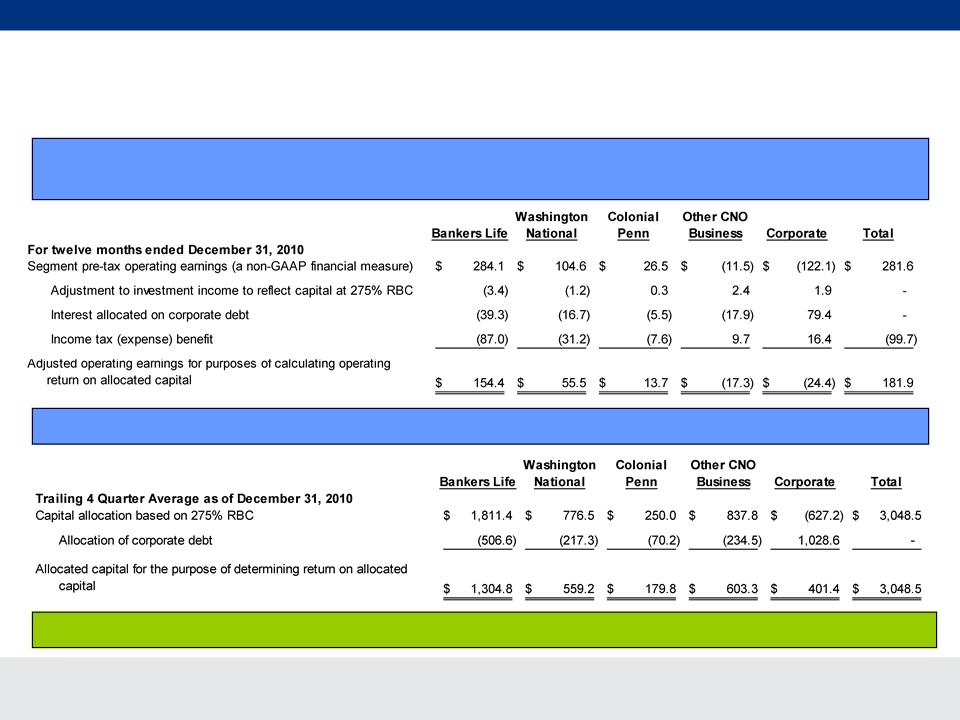

Operating Return on Allocated Capital Computation*

Adjusted operating earnings for the purpose of calculating operating return on allocated

capital is determined as follows:

capital is determined as follows:

Allocated capital is calculated as follows:

* A non-GAAP financial measure. Refer to the Appendix for a reconciliation to the corresponding GAAP measure.

Operating Return on Allocated Capital: 11.8% 9.9% 7.6% -2.9% -6.1% 6.0%

($ millions)

CNO Financial Group

47

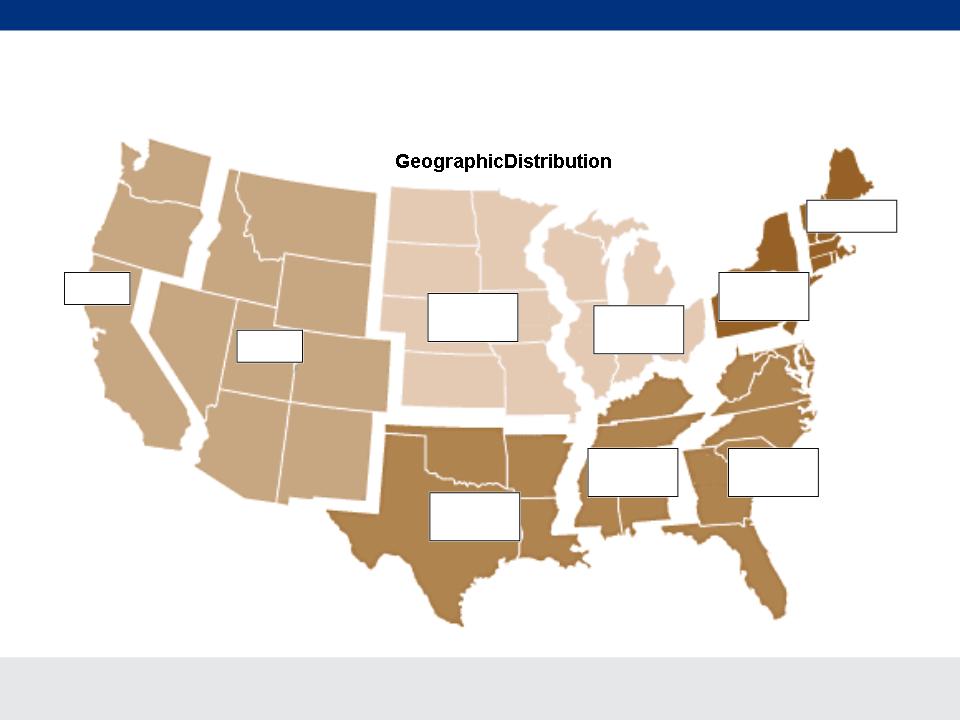

Commercial Mortgage Loans at 12/31/10

CNO

Pacific

10.1%

Mountain

10.2%

West North

Central

Central

14.0%

West South

Central

Central

6.5%

East North

Central

Central

15.6%

East South

Central

Central

3.1%

New England

9.0%

Middle

Atlantic

Atlantic

8.5%

South

Atlantic

Atlantic

23.0%

CNO Financial Group

48

Commercial Mortgage Loans at 12/31/10

By Maturity

CNO

($ millions)

CNO Financial Group

49

Collected Premiums

CNO

§ Trailing 4 quarters down 13%

– Decline at Bankers Life due

primarily to termination of

PFFS reinsurance contracts

primarily to termination of

PFFS reinsurance contracts

– Stable results at Colonial

Penn

Penn

– Slight decline at Washington

National primarily due to

Wilton Re transaction in

3Q09

National primarily due to

Wilton Re transaction in

3Q09

– Decline at OCB primarily

due to Wilton Re transaction

in 3Q09 and continued run-

off of inforce blocks, as

expected

due to Wilton Re transaction

in 3Q09 and continued run-

off of inforce blocks, as

expected

CP

Washington

National

National

Collected Premiums -Trailing 4 Quarters

4Q09

$4,114.8

1Q10

$3,937.2

BLC OTHER

2Q10

$3,819.6

BLC PFFS

3Q10

$3,651.1

4Q10

$3,590.1

OCB

($ millions)

CNO Financial Group

50

Segment Performance

Bankers Life

*Operating earnings exclude net realized gains (losses). See Appendix for corresponding GAAP measure of our consolidated results of

operations.

operations.

§ Earnings of $71.4 million, down

16%

16%

– Results in 4Q10 were favorably impacted by $18 million

increase from improved spreads and growth in the annuity

block

increase from improved spreads and growth in the annuity

block

– Results in 4Q10 were unfavorably impacted by:

• $4 million from unfavorable mortality

• $3 million from unfavorable Med Supp persistency

– Results in 4Q09 were favorably impacted by:

• $11 million from PFFS business we assumed from

Coventry, the last of which expired on January 1, 2010

Coventry, the last of which expired on January 1, 2010

• $10 million due to positive development of long-term

care reserves and the impact of policyholder actions

following rate increases

care reserves and the impact of policyholder actions

following rate increases

• A $6 million out-of-period correction

PTOI-Trailing 4 Quarters: $278.0 $286.5 $287.2 $297.3 $284.1

Revenues-Quarterly: $654.5 $584.4 $563.9 $617.2 $602.4

Pre-Tax Operating Income*

Revenues -Tr. 4 Quarters: $2,647.5 $2,596.8 $2,497.9 $2,420.0 $2,367.9

($ millions)

CNO Financial Group

51

Premiums - Med Supp

§ First-year premiums up 8%

Med Supp - First-Year Premiums

Bankers Life

($ millions)

Policies issued and not included in NAP (net of chargebacks, in thousands):

|

PFFS policies issued:

|

-1.0

|

22.8

|

-0.4

|

0.1

|

0.4

|

|

PDP policies issued:

|

1.3

|

8.0

|

0.3

|

1.0

|

0.4

|

|

Med Supp First-Year Prems.-Tr. 4 Qtrs:

|

$91.7

|

$99.2

|

$107.5

|

$114.1

|

$116.4

|

|

Med Supp Total Premiums-Quarterly:

|

$173.8

|

$176.6

|

$168.8

|

$170.1

|

$182.3

|

|

Med Supp NAP-Quarterly:

|

$56.8

|

$19.4

|

$21.0

|

$16.0

|

$31.8

|

|

Med Supp NAP-Trailing 4 Quarters:

|

$114.3

|

$115.3

|

$117.1

|

$113.2

|

$88.2

|

CNO Financial Group

52

Premiums - Long-Term Care

§ Net first-year premiums* up 5%,

reflecting reduction in new

business reinsurance

reflecting reduction in new

business reinsurance

First-Year Prems.-Tr. 4 Qtrs: $17.7 $18.3 $19.1 $21.9 $22.2

Total Premiums-Quarterly: $149.5 $149.5 $146.6 $145.0 $143.5

Long-Term Care - First-Year Premiums*

NAP-Quarterly: $8.3 $8.6 $8.7 $7.2 $6.7

NAP-Trailing 4 Quarters: $35.4 $36.5 $35.4 $32.8 $31.2

*Includes $3.4 million in 4Q09, $4.3 million in 1Q10, $3.7 million in 2Q10, $2.8 million in 3Q10 and $2.0 million in 4Q10 of premiums

ceded under business reinsurance agreement.

ceded under business reinsurance agreement.

4Q09

(Direct)

$9.3

1Q10

(Direct)

$9.1

2Q10

(Direct)

$9.2

3Q10

(Direct)

$8.5

4Q10

(Direct)

$8.2

Bankers Life

($ millions)

CNO Financial Group

53

Premiums - Life Insurance

§ First year premiums up 17%

First-Year Prems.-Tr. 4 Qtrs: $82.6 $86.0 $91.4 $93.8 $97.7

Total Premiums-Quarterly: $61.4 $46.5 $52.1 $54.8 $56.2

Life - First-Year Premiums

NAP-Quarterly: $13.7 $15.8 $17.3 $16.3 $15.9

NAP-Trailing 4 Quarters: $57.7 $60.9 $62.6 $63.1 $65.3

SPWL

Non-

SPWL

4Q09

$23.0

$10.8

$12.2

1Q10

$20.2

$9.6

$10.6

2Q10

$24.8

$12.4

$12.4

3Q10

$25.8

$11.9

$13.9

4Q10

$26.9

$12.3

$14.6

Bankers Life

($ millions)

CNO Financial Group

54

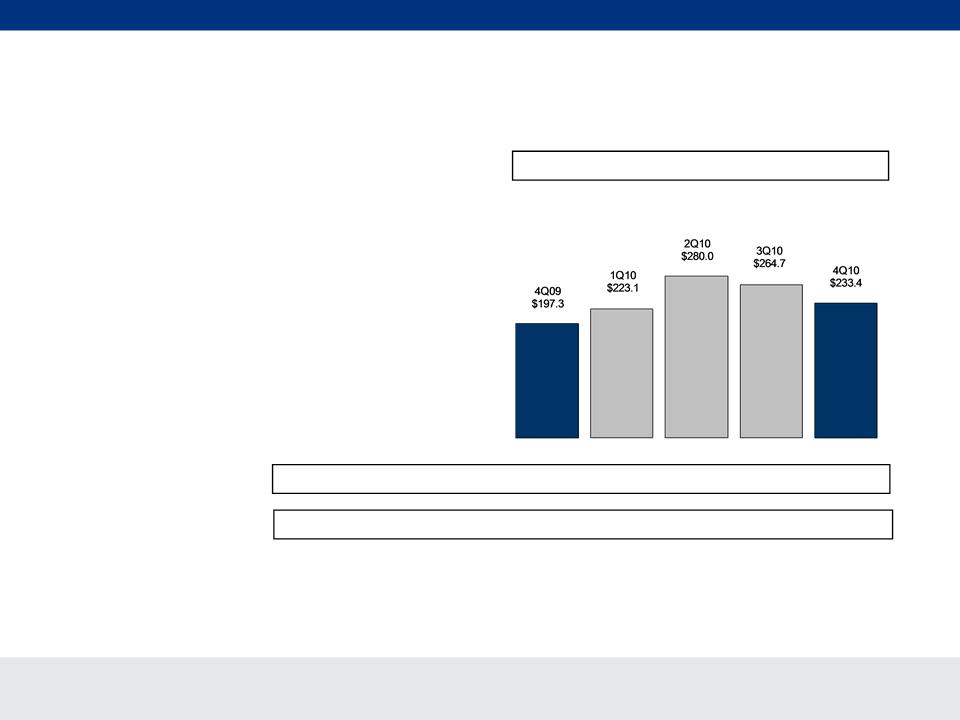

Premiums - Annuity

§ First-year premiums up 18%

First-Year Prems.-Tr. 4 Qtrs: $1,057.1 $979.1 $984.4 $965.1 $1,001.2

Total Premiums-Quarterly: $198.2 $224.4 $281.1 $265.8 $234.4

Annuity - First-Year Premiums

Bankers Life

($ millions)

CNO Financial Group

55

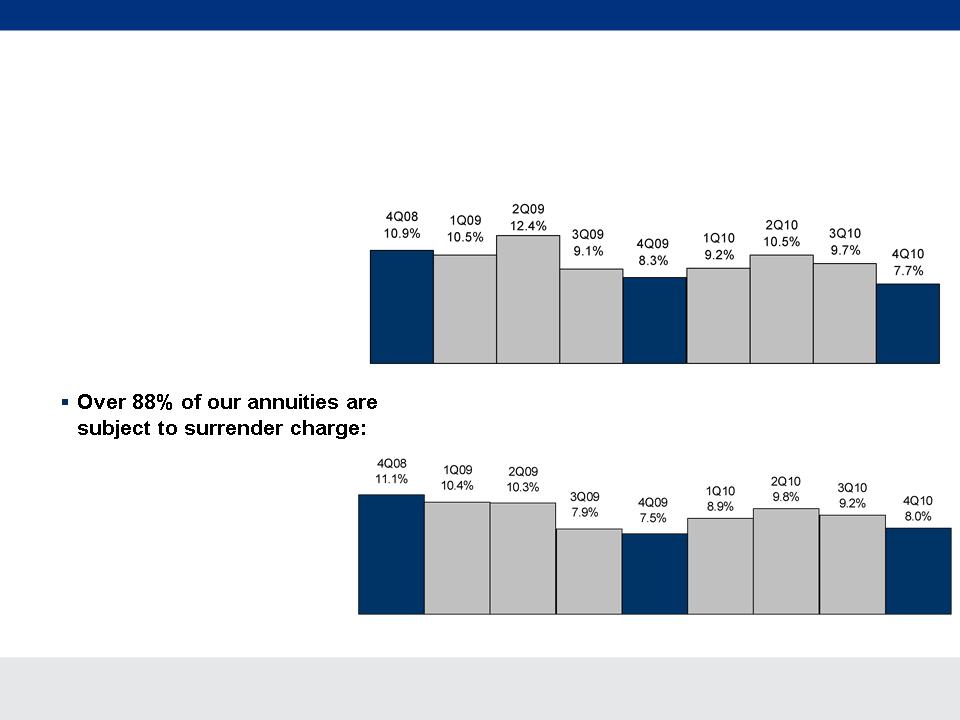

§ Total account value:

– IAs - $1.9 billion

– Non-IAs - $4.5 billion

§ Average account value:

– IAs - $1.9 billion

– Non-IAs - $4.7 billion

– IAs - 96%

– Non-IAs - 85%

Annuity Surrenders

IA Surrenders

(annualized quarterly rate)

Non-IA Surrenders

(annualized quarterly rate)

Bankers Life

CNO Financial Group

56

Benefit Ratio* - PDP

§ Down 7.7 points, impacted by

improved pricing and plan design

changes

improved pricing and plan design

changes

*We calculate benefit ratios by dividing insurance policy benefits by insurance policy income.

Bankers Life

CNO Financial Group

57

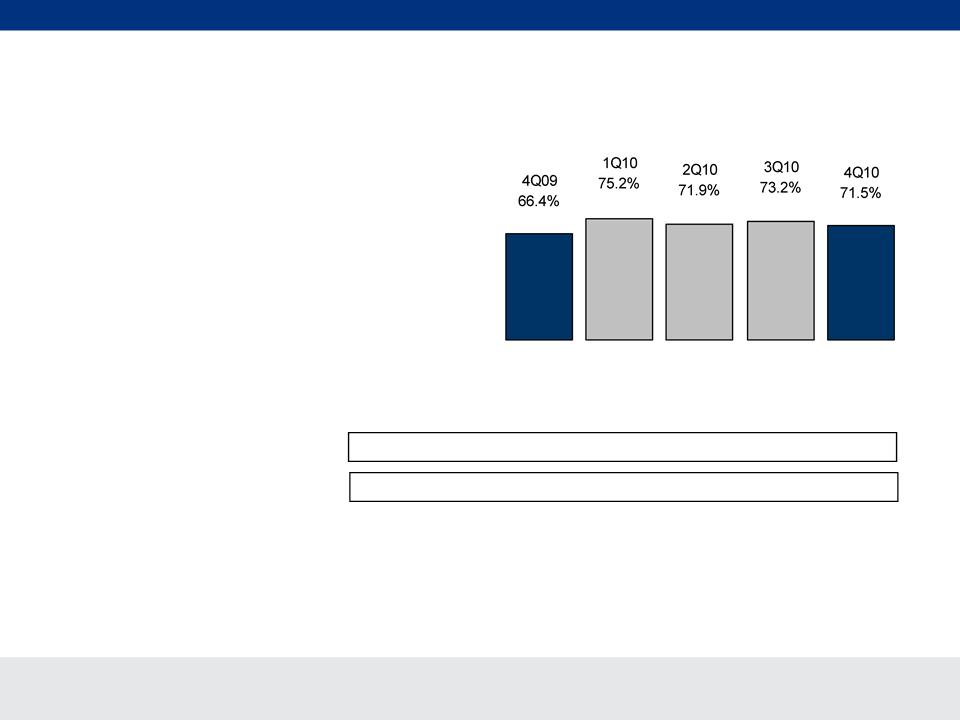

Benefit Ratio* - Med Supp

§ 4Q10 impacted by favorable

claims experience

claims experience

*We calculate benefit ratios by dividing insurance policy benefits by insurance policy income.

Bankers Life

CNO Financial Group

58

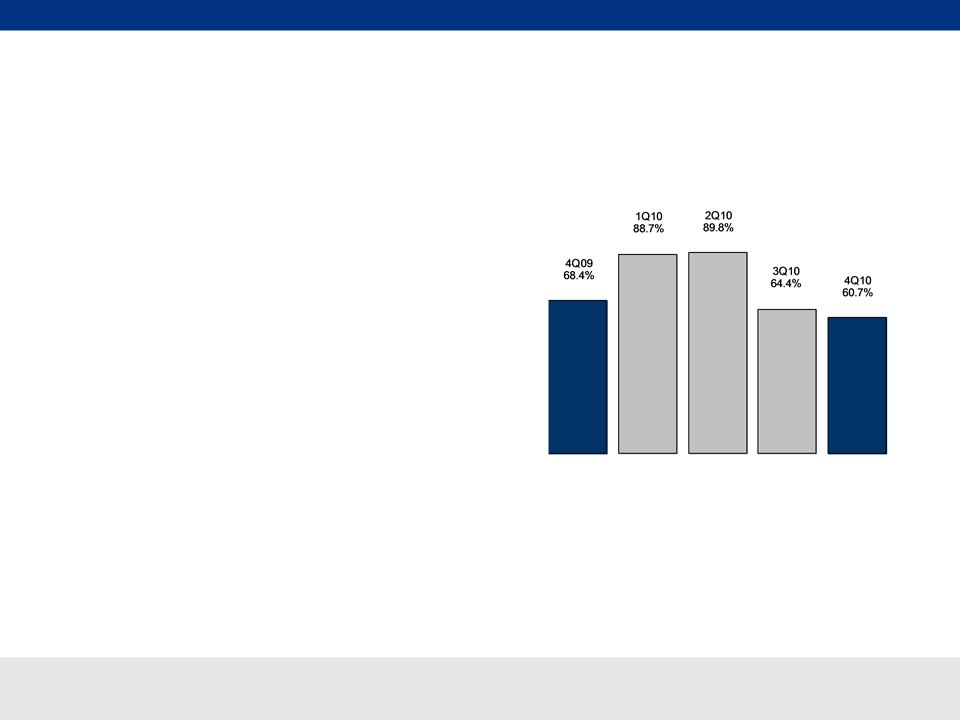

Interest-Adjusted Benefit

Ratio* - LTC

Ratio* - LTC

*We calculate interest-adjusted benefit ratios by dividing insurance policy benefits less interest income on the accumulated assets

backing the insurance liabilities by insurance policy income.

backing the insurance liabilities by insurance policy income.

§ 4Q09 reflects a reserve release

due to positive development of

reserves and the impact of

policyholder actions following

rate increases in 2009

due to positive development of

reserves and the impact of

policyholder actions following

rate increases in 2009

Trailing 4 Quarter Avg.: 67.9% 69.6% 71.0% 71.7% 73.0%

Qtrly. non-int. adjusted: 104.3% 114.4% 113.0% 114.2% 113.3%

Bankers Life

CNO Financial Group

59

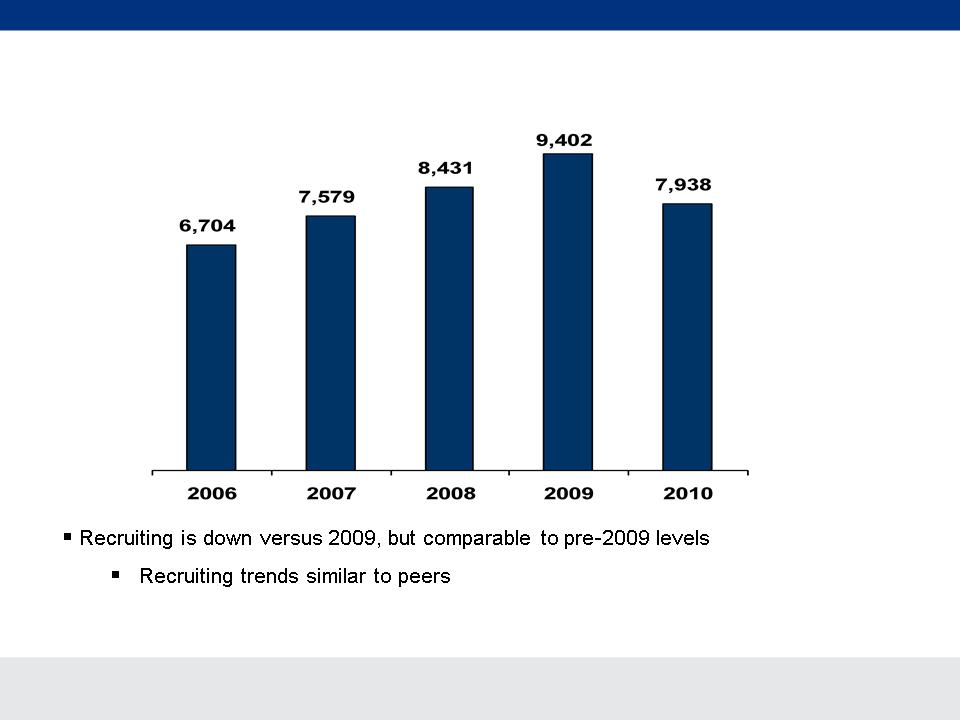

New Agent Contracts

Bankers Life

§ 15 new locations planned in 2011

CNO Financial Group

60

LTC Rate Increase

Bankers Life

§ We are filing for an additional increase on almost all plans sold between

2002 and 2005.

2002 and 2005.

§ For plans generally sold between 1992-2003, we are filing for an additional

increase ONLY on policies with inflation protection.

increase ONLY on policies with inflation protection.

§ For these two blocks, premium increase filings are in progress:

– We expect to implement rate increases of about $35 million after all

states have approved, of which approximately $5.5 million of approvals

had been received as of 12/31/10.

states have approved, of which approximately $5.5 million of approvals

had been received as of 12/31/10.

Additional rate increase filings commenced on our LTC portfolio in

October

October

CNO Financial Group

61

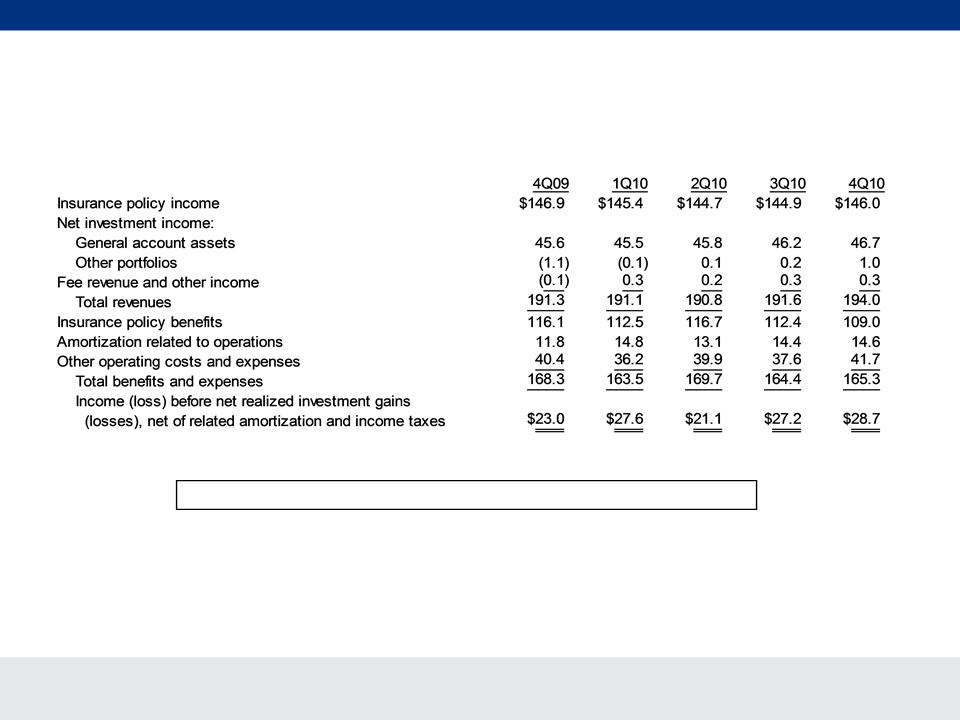

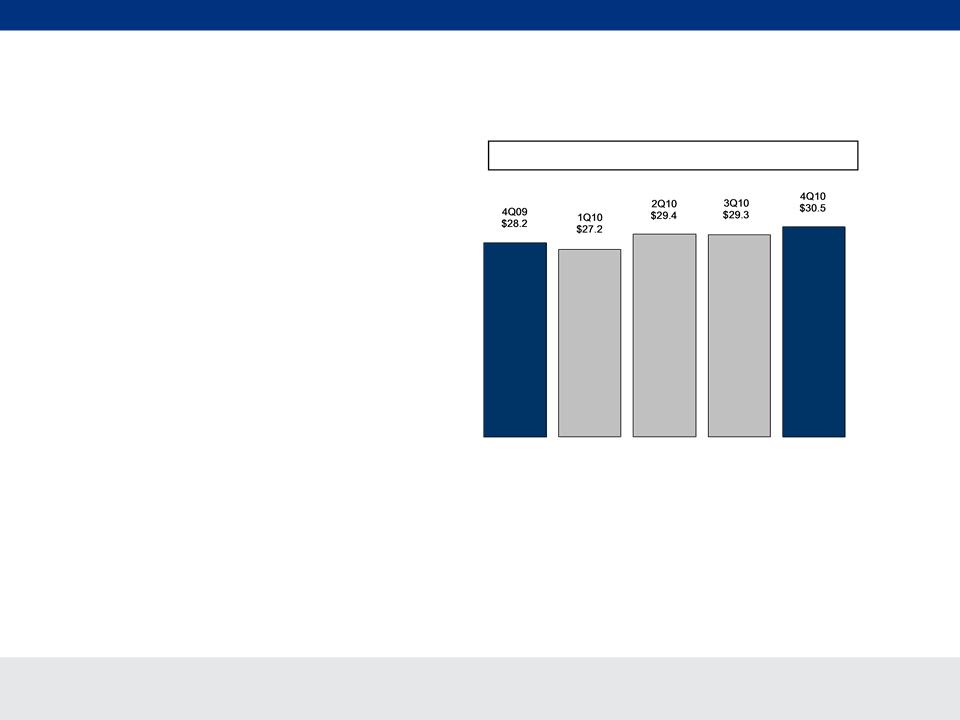

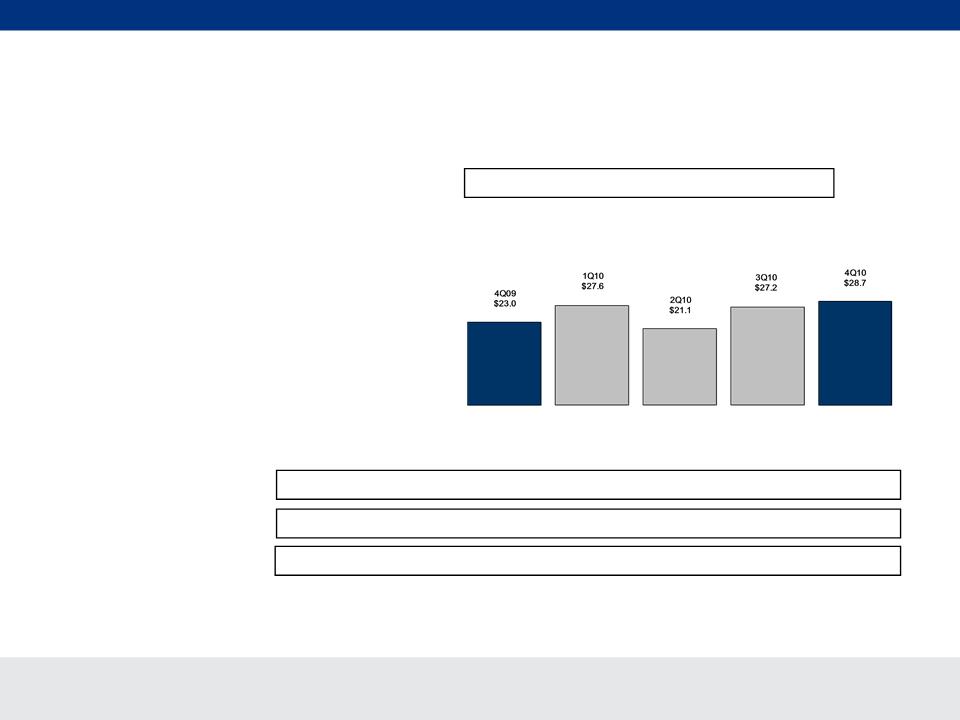

Segment Performance

Washington National

*Operating earnings exclude net realized gains (losses). See Appendix for corresponding GAAP measure of our consolidated results of

operations.

operations.

PTOI-Trailing 4 Quarters: $110.9 $104.9 $100.8 $98.9 $104.6

Revenues-Quarterly: $191.3 $191.1 $190.8 $191.6 $194.0

Pre-Tax Operating Income*

Revenues-Tr. 4 Quarters: $788.3 $780.2 $771.4 $764.8 $767.5

($ millions)

§ Earnings of $28.7 million, up 25%

– Reflects an increase in earnings

from our supplemental health

products due to growth in this block

of business and lower claims

from our supplemental health

products due to growth in this block

of business and lower claims

CNO Financial Group

62

Premiums -

Supplemental Health

Washington National

§ NAP up 15%

– Increased focus on supplemental

health products

health products

– Momentum increasing in Worksite

market

market

First-Year Prems.-Tr. 4 Qtrs: $45.4 $47.7 $49.7 $50.9 $52.0

Total Premiums-Quarterly: $99.0 $99.6 $100.2 $101.5 $104.2

Supplemental Health - First-Year Premiums

NAP-Quarterly: $15.2 $14.6 $17.5 $18.0 $17.5

NAP-Trailing 4 Quarters: $57.5 $60.6 $63.4 $65.3 $67.6

($ millions)

CNO Financial Group

63

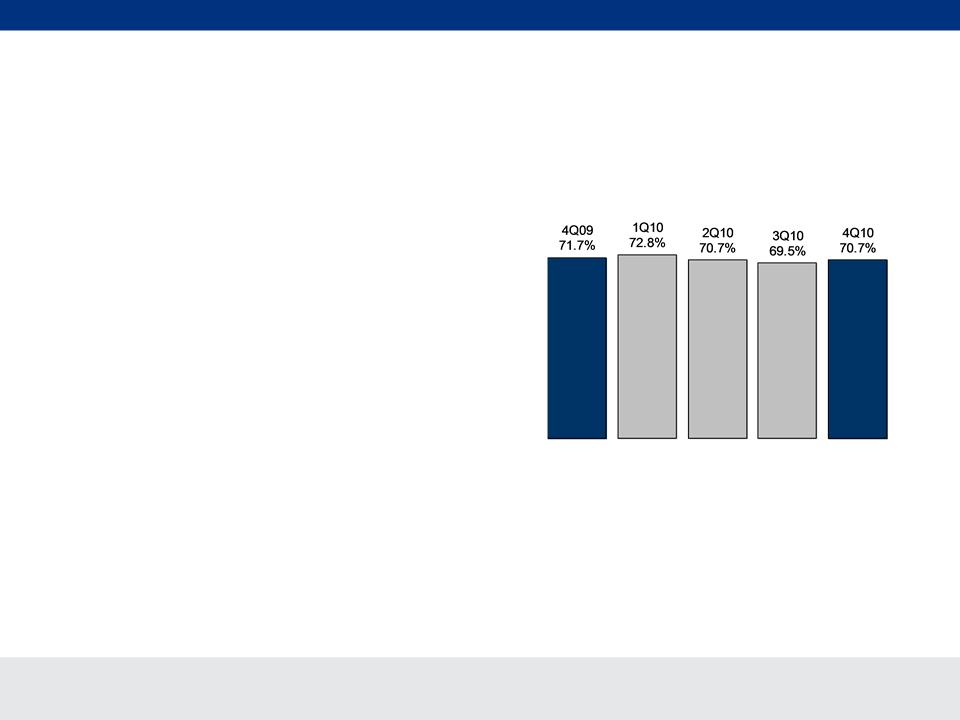

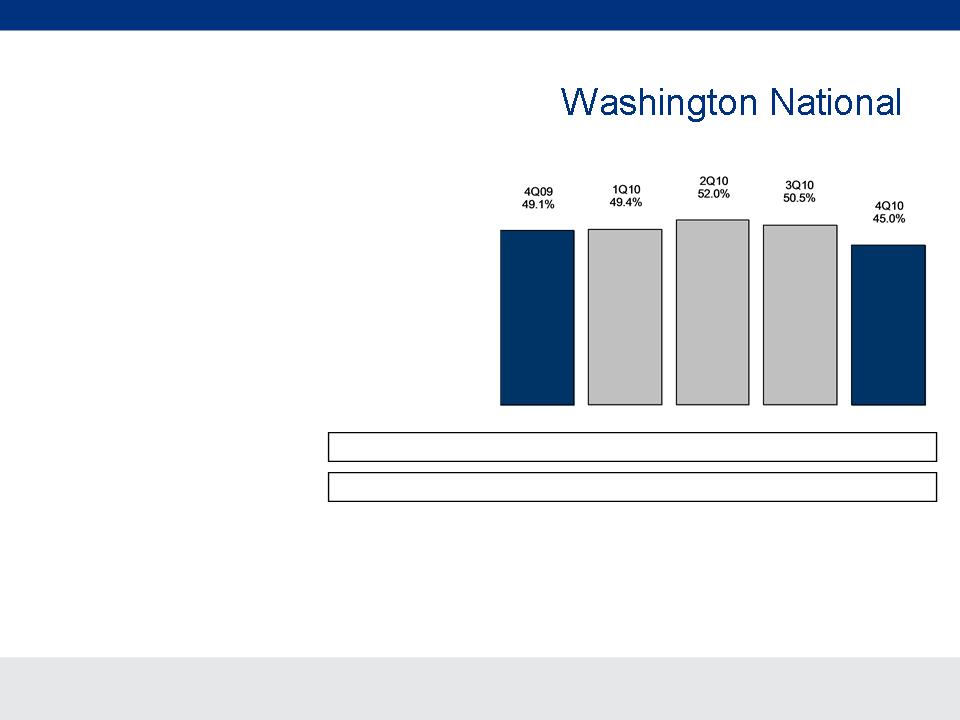

Interest-Adjusted Benefit Ratio* -

Supplemental Health Insurance

Trailing 4 Quarter Avg.: 46.0% 47.8% 48.4% 50.3% 49.2%

Qtrly. non-int. adjusted: 82.0% 82.3% 83.2% 81.3% 75.0%

*We calculate interest-adjusted benefit ratios by dividing insurance policy benefits, less interest income on the accumulated assets backing

the insurance liabilities, by insurance policy income.

the insurance liabilities, by insurance policy income.

§ Down 4.1 points vs. 4Q09 due

to favorable claim experience

to favorable claim experience

§ Non-interest adjusted ratio

75.0% vs. 4Q09 82.0%

75.0% vs. 4Q09 82.0%

CNO Financial Group

64

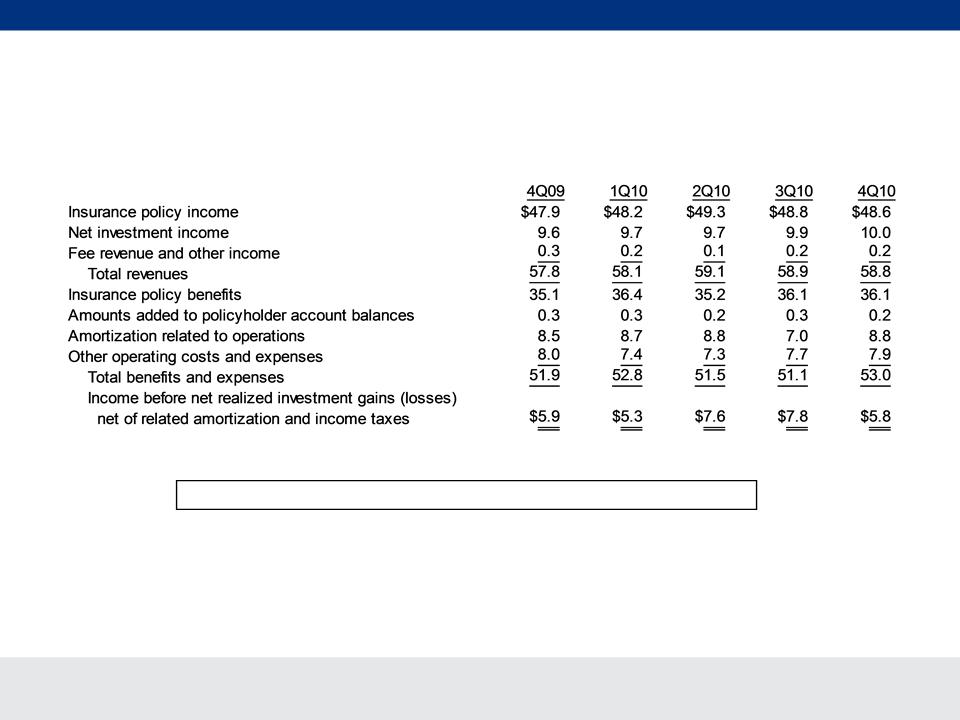

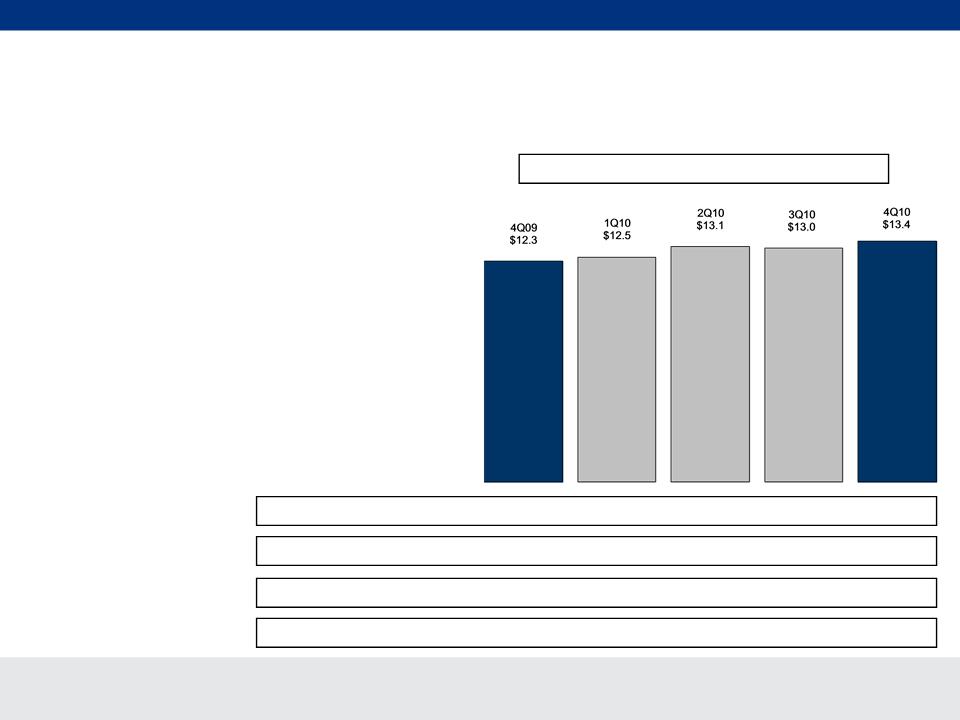

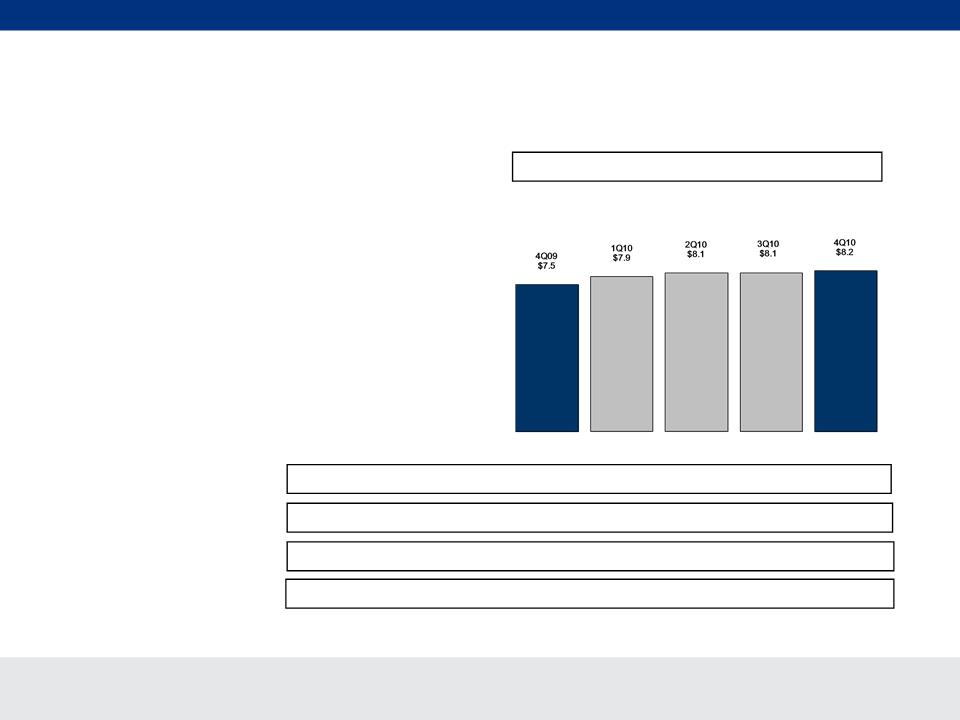

Segment Performance

Colonial Penn

*Operating earnings exclude net realized gains (losses). See Appendix for corresponding GAAP measure of our consolidated results of

operations.

operations.

§ Earnings of $5.8 million, down

1.7%

1.7%

– Unfavorable mortality in life

products

products

– Substantially offset by increased

earnings in core life products due

to growth and higher investment

yields

earnings in core life products due

to growth and higher investment

yields

PTOI-Trailing 4 Quarters: $29.4 $29.6 $26.2 $26.6 $26.5

Revenues-Quarterly: $57.8 $58.1 $59.1 $58.9 $58.8

Pre-Tax Operating Income*

Revenues -Tr. 4 Quarters: $235.7 $236.7 $233.1 $233.9 $234.9

($ millions)

CNO Financial Group

65

Premiums - Life Insurance

Colonial Penn

§ Sales (NAP) up 13%

§ YTD sales up 11%

§ YTD lead generation up 35%

First-Year Prems.-Tr. 4 Qtrs: $33.0 $31.7 $31.4 $31.6 $32.3

Total Premiums-Quarterly: $48.9 $47.3 $46.7 $46.9 $46.8

Life - First-Year Premiums

NAP-Quarterly: $8.4 $13.1 $12.2 $11.5 $9.5

NAP-Trailing 4 Quarters: $41.9 $42.7 $44.3 $45.2 $46.3

($ millions)

CNO Financial Group

66

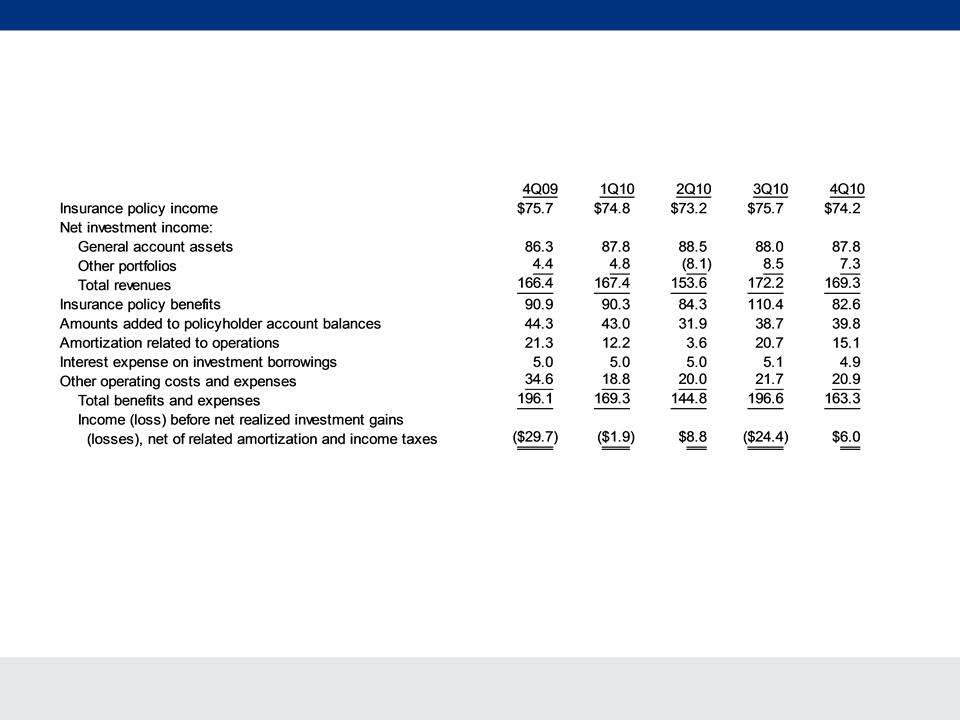

Segment Performance

Other CNO Business

*Operating earnings exclude net realized gains (losses). See Appendix for corresponding GAAP measure of our consolidated results of

operations.

operations.

– Results in 4Q09 were unfavorably impacted by:

• Regulatory and legal settlements of

$14 million

$14 million

PTOI-Trailing 4 Quarters: $(43.6) $(43.1) $(30.3) $(47.2) $(11.5)

Revenues-Quarterly: $166.4 $167.4 $153.6 $172.2 $169.3

Pre-Tax Operating Income (Loss)*

Revenues-Tr. 4 Quarters: : $712.3 $699.7 $670.4 $659.6 $662.5

($ millions)

CNO Financial Group

67

Information Related to Certain Non-GAAP Financial Measures

The following provides additional information regarding certain non-GAAP measures used in this presentation. A non-GAAP

measure is a numerical measure of a company’s performance, financial position, or cash flows that excludes or includes amounts

that are normally excluded or included in the most directly comparable measure calculated and presented in accordance with

GAAP. While management believes these measures are useful to enhance understanding and comparability of our financial

results, these non-GAAP measures should not be considered as substitutes for the most directly comparable GAAP measures.

Additional information concerning non-GAAP measures is included in our periodic filings with the Securities and Exchange

Commission that are available in the “Investors - SEC Filings” section of CNO’s website, www.CNOinc.com.

measure is a numerical measure of a company’s performance, financial position, or cash flows that excludes or includes amounts

that are normally excluded or included in the most directly comparable measure calculated and presented in accordance with

GAAP. While management believes these measures are useful to enhance understanding and comparability of our financial

results, these non-GAAP measures should not be considered as substitutes for the most directly comparable GAAP measures.

Additional information concerning non-GAAP measures is included in our periodic filings with the Securities and Exchange

Commission that are available in the “Investors - SEC Filings” section of CNO’s website, www.CNOinc.com.

Operating earnings measures

Management believes that an analysis of net income applicable to common stock before loss on extinguishment or modification of

debt, net realized gains or losses and increases or decreases to our valuation allowance for deferred tax assets (“net operating

income,” a non-GAAP financial measure) is important to evaluate the performance of the Company and is a key measure

commonly used in the life insurance industry. Management uses this measure to evaluate performance because loss on

extinguishment or modification of debt, realized investment gains or losses and increases or decreases to our valuation allowance

for deferred tax assets are unrelated to the Company’s continuing operations.

Management believes that an analysis of net income applicable to common stock before loss on extinguishment or modification of

debt, net realized gains or losses and increases or decreases to our valuation allowance for deferred tax assets (“net operating

income,” a non-GAAP financial measure) is important to evaluate the performance of the Company and is a key measure

commonly used in the life insurance industry. Management uses this measure to evaluate performance because loss on

extinguishment or modification of debt, realized investment gains or losses and increases or decreases to our valuation allowance

for deferred tax assets are unrelated to the Company’s continuing operations.

CNO Financial Group

68

Information Related to Certain Non-GAAP Financial Measures

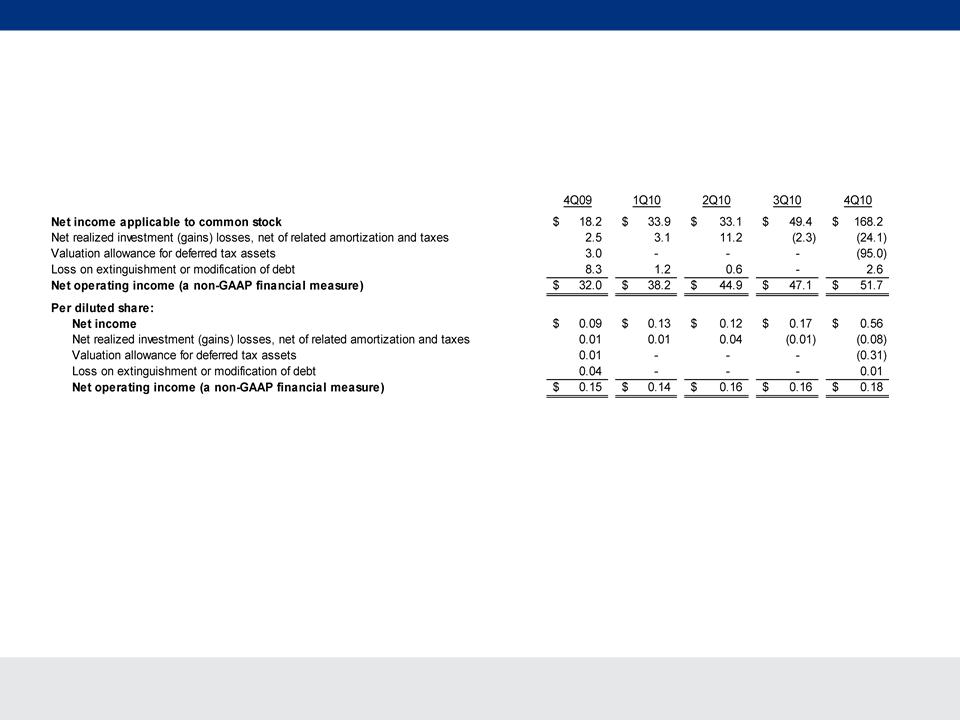

A reconciliation of net income applicable to common stock to net operating income (and related per-share amounts) is as follows

(dollars in millions, except per-share amounts):

(dollars in millions, except per-share amounts):

CNO Financial Group

69

Information Related to Certain Non-GAAP Financial Measures

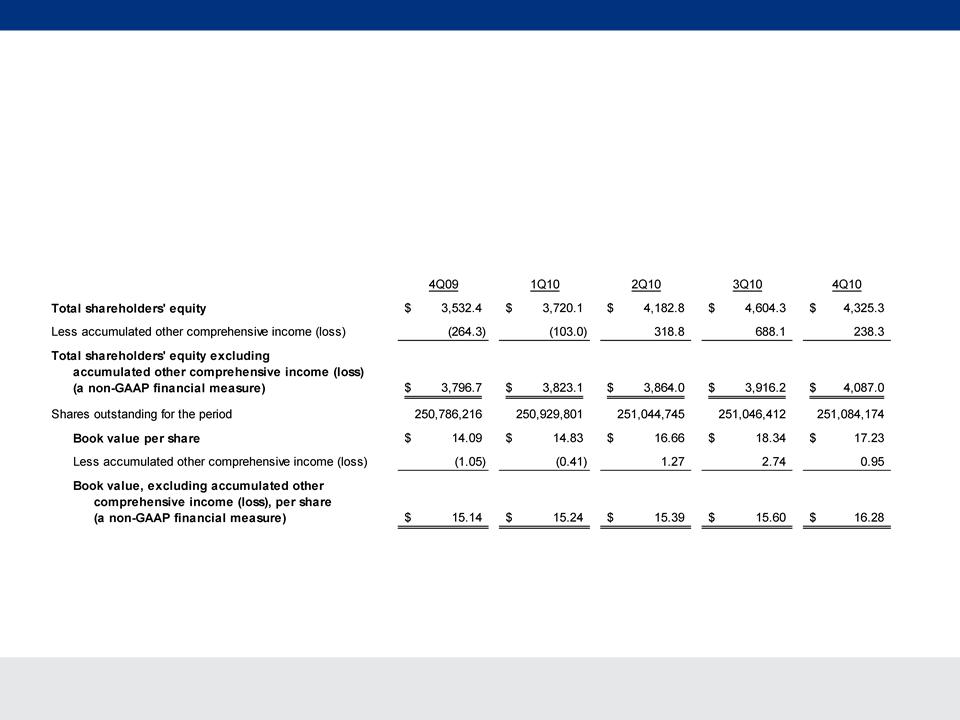

Book value, excluding accumulated other comprehensive income (loss), per share

This non-GAAP financial measure differs from book value per share because accumulated other comprehensive income (loss) has been

excluded from the book value used to determine the measure. Management believes this non-GAAP financial measure is useful because it

removes the volatility that arises from changes in accumulated other comprehensive income (loss). Such volatility is often caused by changes in

the estimated fair value of our investment portfolio resulting from changes in general market interest rates rather than the business decisions

made by management.

This non-GAAP financial measure differs from book value per share because accumulated other comprehensive income (loss) has been

excluded from the book value used to determine the measure. Management believes this non-GAAP financial measure is useful because it

removes the volatility that arises from changes in accumulated other comprehensive income (loss). Such volatility is often caused by changes in

the estimated fair value of our investment portfolio resulting from changes in general market interest rates rather than the business decisions

made by management.

A reconciliation from book value per share to book value per share, excluding accumulated other comprehensive income (loss) is as follows

(dollars in millions, except per share amounts):

(dollars in millions, except per share amounts):

CNO Financial Group

70

Information Related to Certain Non-GAAP Financial Measures

Operating return measures

Management believes that an analysis of return before loss on extinguishment or modification of debt, net realized gains or losses, and

increases or decreases to our valuation allowance for deferred tax assets (“net operating income,” a non-GAAP financial measure) is important

to evaluate the performance of the Company and is a key measure commonly used in the life insurance industry. Management uses this

measure to evaluate performance because loss on extinguishment or modification of debt, realized investment gains or losses, and increases to

our valuation allowance for deferred tax assets are unrelated to the Company’s continued operations.

increases or decreases to our valuation allowance for deferred tax assets (“net operating income,” a non-GAAP financial measure) is important

to evaluate the performance of the Company and is a key measure commonly used in the life insurance industry. Management uses this

measure to evaluate performance because loss on extinguishment or modification of debt, realized investment gains or losses, and increases to

our valuation allowance for deferred tax assets are unrelated to the Company’s continued operations.

This non-GAAP financial measure also differs from return on equity because accumulated other comprehensive income (loss) has been

excluded from the value of equity used to determine this ratio. Management believes this non-GAAP financial measure is useful because it

removes the volatility that arises from changes in accumulated other comprehensive income (loss). Such volatility is often caused by changes in

the estimated fair value of our investment portfolio resulting from changes in general market interest rates rather than the business decisions

made by management.

excluded from the value of equity used to determine this ratio. Management believes this non-GAAP financial measure is useful because it

removes the volatility that arises from changes in accumulated other comprehensive income (loss). Such volatility is often caused by changes in

the estimated fair value of our investment portfolio resulting from changes in general market interest rates rather than the business decisions

made by management.

In addition, our equity includes the value of significant net operating loss carryforwards (included in income tax assets). In accordance with

GAAP, these assets are not discounted, and accordingly will not provide a return to shareholders (until after it is realized as a reduction to taxes

that would otherwise be paid). Management believes that excluding this value from the equity component of this measure enhances the

understanding of the effect these non-discounted assets have on operating returns and the comparability of these measures from period-to-

period. Operating return measures are used in measuring the performance of our business units and are used as a basis for incentive

compensation.

GAAP, these assets are not discounted, and accordingly will not provide a return to shareholders (until after it is realized as a reduction to taxes

that would otherwise be paid). Management believes that excluding this value from the equity component of this measure enhances the

understanding of the effect these non-discounted assets have on operating returns and the comparability of these measures from period-to-

period. Operating return measures are used in measuring the performance of our business units and are used as a basis for incentive

compensation.

All references to return on allocated capital measures assume a capital allocation based on a 275% targeted risk-based capital at the segment

level. Additionally, corporate debt has been allocated to the segments.

level. Additionally, corporate debt has been allocated to the segments.

CNO Financial Group

71

Information Related to Certain Non-GAAP Financial Measures

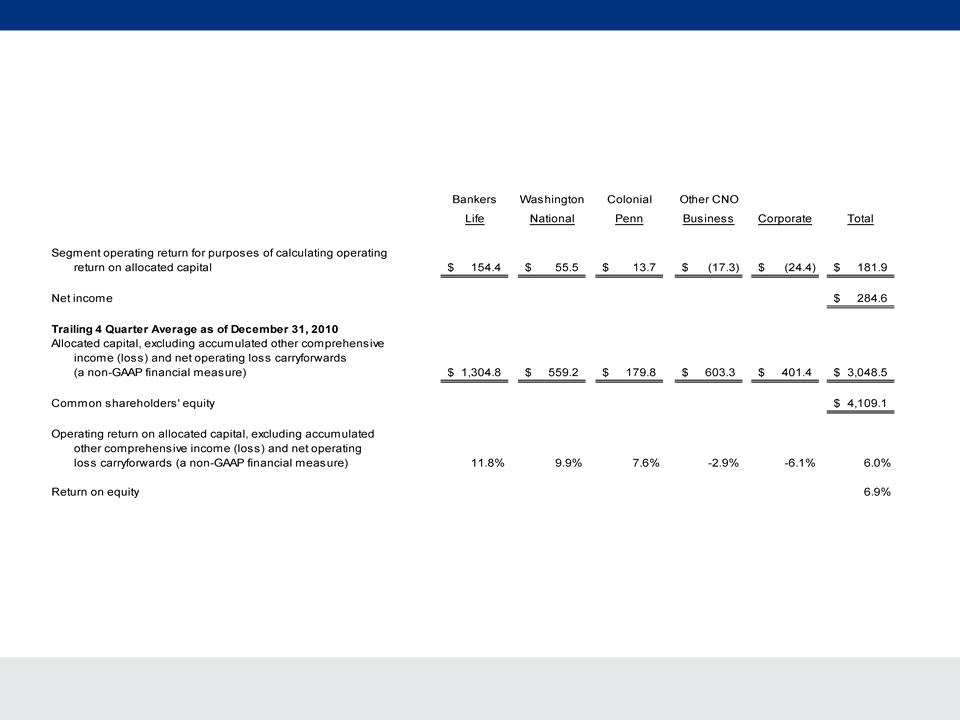

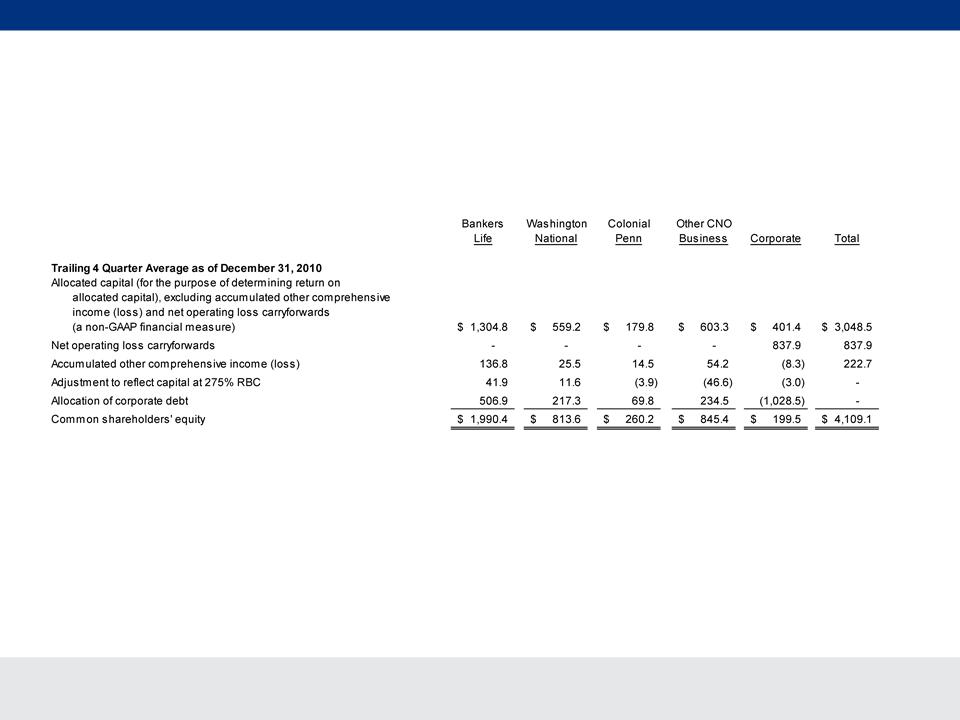

The calculations of: (i) operating return on allocated capital, excluding accumulated other comprehensive income (loss) and net operating

loss carryforwards (a non-GAAP financial measure); and (ii) return on equity, for the twelve months ended December 31, 2010, are as

follows (dollars in millions):

loss carryforwards (a non-GAAP financial measure); and (ii) return on equity, for the twelve months ended December 31, 2010, are as

follows (dollars in millions):

(Continued on next page)

CNO Financial Group

72

Information Related to Certain Non-GAAP Financial Measures

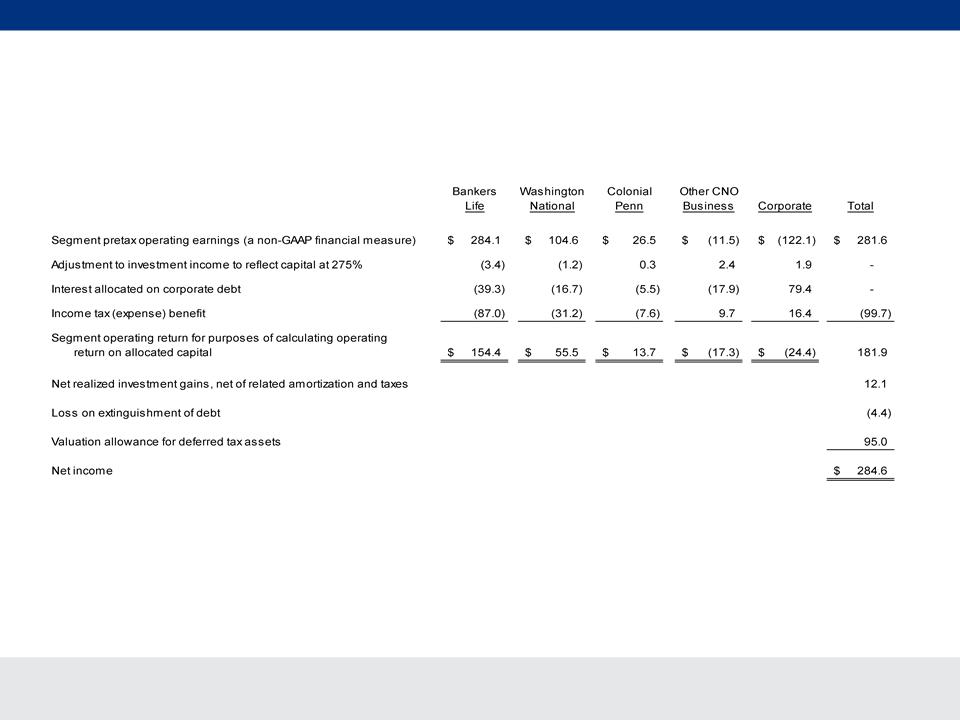

A reconciliation of pretax operating earnings (a non-GAAP financial measure) to segment operating return (loss) and consolidated net income

(loss) for the year ended December 31, 2010, is as follows (dollars in millions):

(loss) for the year ended December 31, 2010, is as follows (dollars in millions):

(Continued on next page)

CNO Financial Group

73

Information Related to Certain Non-GAAP Financial Measures

A reconciliation of average allocated capital (for the purpose of determining return on allocated capital), excluding accumulated other

comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure) to average common shareholders’ equity, is

as follows (dollars in millions):

comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure) to average common shareholders’ equity, is

as follows (dollars in millions):

(Continued on next page)

(Continued from previous page)

CNO Financial Group

74

Information Related to Certain Non-GAAP Financial Measures

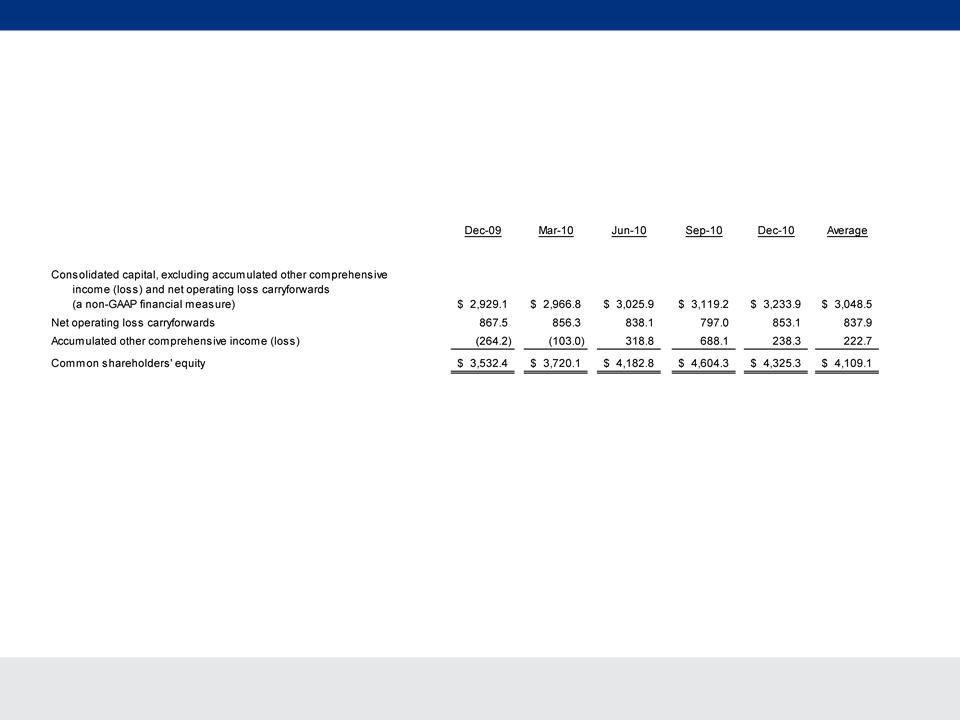

A reconciliation of consolidated capital, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-

GAAP financial measure) to common shareholders’ equity, is as follows (dollars in millions):

GAAP financial measure) to common shareholders’ equity, is as follows (dollars in millions):

(Continued from previous page)

CNO Financial Group

75

Information Related to Certain Non-GAAP Financial Measures

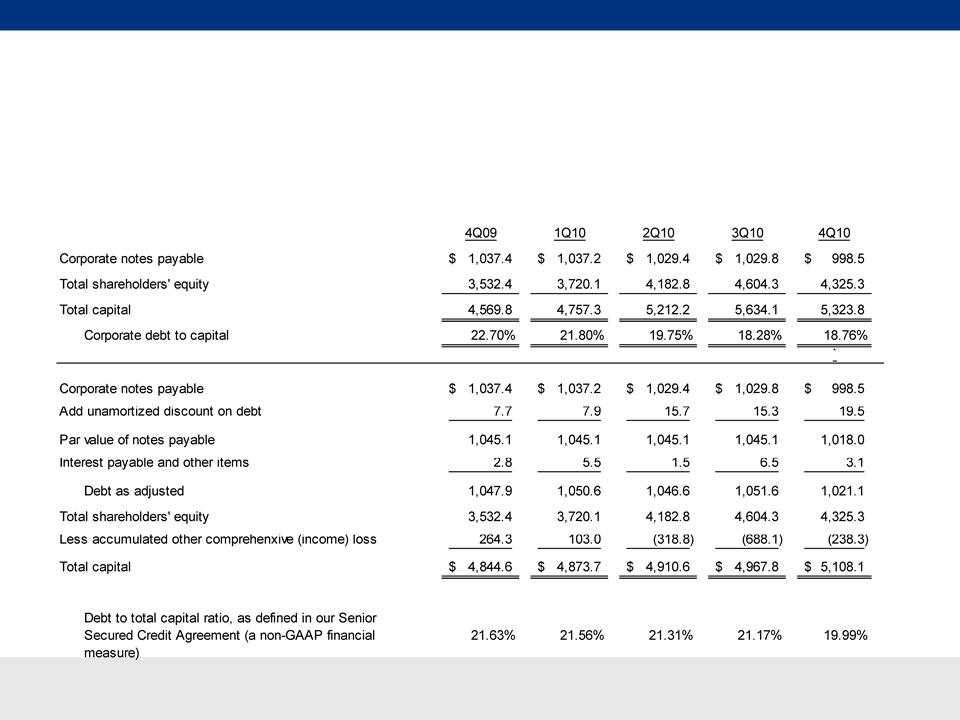

A reconciliation of the debt to capital ratio to debt to capital, as defined in our Senior Secured Agreement is as follows (dollars in millions)

Debt to capital ratio, excluding accumulated other comprehensive income (loss)

This non-GAAP financial measure differs from the debt to capital ratio because accumulated other comprehensive (income) loss has been

excluded from the value of capital used to determine this measure. In addition, debt is defined as par value plus accrued interest and certain

other items. Management believes this non-GAAP financial measure is useful as the level of such ratio impacts certain provisions in our Senior

Secured Credit Agreement.

excluded from the value of capital used to determine this measure. In addition, debt is defined as par value plus accrued interest and certain

other items. Management believes this non-GAAP financial measure is useful as the level of such ratio impacts certain provisions in our Senior

Secured Credit Agreement.