Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PUBLIC SERVICE ELECTRIC & GAS CO | d8k.htm |

| EX-99 - PRESS RELEASE - PUBLIC SERVICE ELECTRIC & GAS CO | dex99.htm |

Public Service Enterprise Group

PSEG Earnings Conference Call

4

th

Quarter and Year-end 2010

February 22, 2011

Exhibit 99.1 |

| 1

Forward-Looking Statement

Readers are cautioned that statements contained in this presentation about our and

our subsidiaries' future performance, including future revenues, earnings,

strategies, prospects, consequences and all other statements that are not purely

historical, are forward-looking statements for purposes of the safe harbor

provisions under The Private Securities Litigation Reform Act of

1995. When used herein, the words “anticipate”,

“intend”, “estimate”, “believe”, “expect”, “plan”,

“should”, “hypothetical”, “potential”,

“forecast”, “project”, variations of such words and similar expressions are intended to identify forward-looking statements.

Although we believe that our expectations are based on reasonable assumptions, they

are subject to risks and uncertainties and we can give no assurance they

will be achieved. The results or developments projected or predicted in these

statements may differ materially from what may actually occur. Factors which

could cause results or events to differ from current expectations include, but are

not limited to: •

adverse changes in energy industry law, policies and regulation, including market

structures and a potential shift away from competitive markets toward subsidized market

mechanisms, transmission planning and cost allocation rules, including rules

regarding how transmission is planned and who is permitted to build transmission going

forward, and reliability standards,

•

any inability of our transmission and distribution businesses to obtain adequate

and timely rate relief and regulatory approvals from federal and state regulators,

•

changes in federal and state environmental regulations that could increase our

costs or limit operations of our generating units, •

changes in nuclear regulation and/or developments in the nuclear power industry

generally that could limit operations of our nuclear generating units,

•

actions

or

activities

at

one

of

our

nuclear

units

located

on

a

multi-unit

site

that

might

adversely

affect

our

ability

to

continue

to

operate

that

unit

or

other

units

located

at

the

same site,

•

any inability to balance our energy obligations, available supply and trading

risks, •

any deterioration in our credit quality,

•

availability of capital and credit at commercially reasonable terms and conditions

and our ability to meet cash needs, •

any

inability

to

realize

anticipated

tax

benefits

or

retain

tax

credits,

•

changes in the cost of, or interruption in the supply of, fuel and other

commodities necessary to the operation of our generating units, •

delays in receipt of necessary permits and approvals for our construction and

development activities, •

delays or unforeseen cost escalations in our construction and development

activities, •

adverse changes in the demand for or price of the capacity and energy that we sell

into wholesale electricity markets, •

increase in competition in energy markets in which we compete,

•

adverse performance of our decommissioning and defined benefit plan trust fund

investments and changes in discount rates and funding requirements, and

•

changes in technology and customer usage patterns.

For further information, please refer to our Annual Report on Form 10-K,

including Item 1A. Risk Factors, and subsequent reports on Form 10-Q and Form 8-K

filed with the Securities and Exchange Commission. These documents address in

further detail our business, industry issues and other factors that could cause

actual

results

to

differ

materially

from

those

indicated

in

this

presentation.

In

addition,

any

forward-looking

statements

included

herein

represent

our

estimates

only as of today and should not be relied upon as representing our estimates as of

any subsequent date. While we may elect to update forward-looking

statements from time to time, we specifically disclaim any obligation to do so,

even if our internal estimates change, unless otherwise required by applicable

securities laws. |

| 2

GAAP Disclaimer

PSEG presents Operating Earnings in addition to its Net Income reported in

accordance with accounting principles generally accepted in the United

States (GAAP). Operating Earnings is a non-GAAP financial measure that

differs from Net Income because it excludes gains or losses associated with

Nuclear Decommissioning Trust (NDT), Mark-to-Market (MTM)

accounting, and other material one-time items. PSEG presents

Operating Earnings because management believes that it is appropriate for

investors to

consider results excluding these items in addition to the results reported in

accordance with GAAP. PSEG believes that the non-GAAP financial

measure of Operating Earnings provides a consistent and comparable

measure of performance of its businesses to help shareholders understand

performance trends. This information is not

intended to be viewed as an

alternative to GAAP information. The last slide in this presentation includes

a list of items excluded from Income from Continuing Operations to

reconcile to Operating Earnings, with a reference to that slide included on

each of the slides where the non-GAAP information appears.

|

| PSEG

2010 Q4 Review

Ralph Izzo

Chairman, President and Chief Executive Officer

*

*

*

*

*

*

* |

4

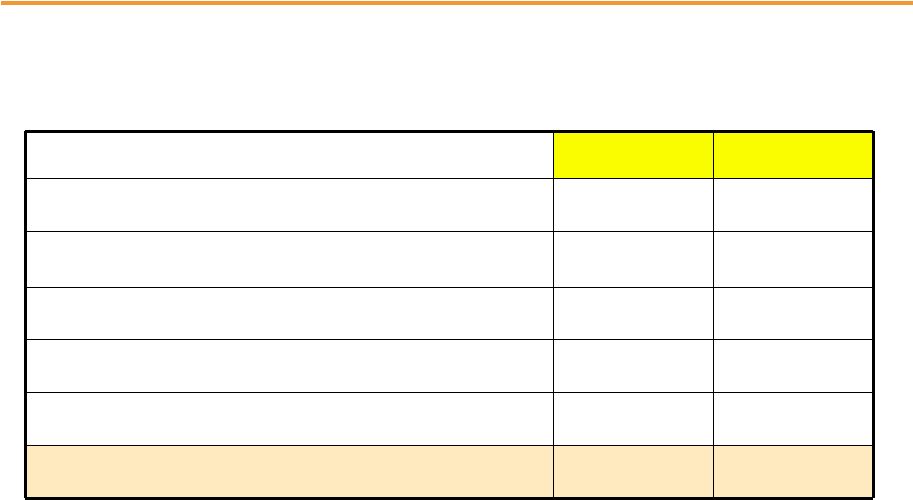

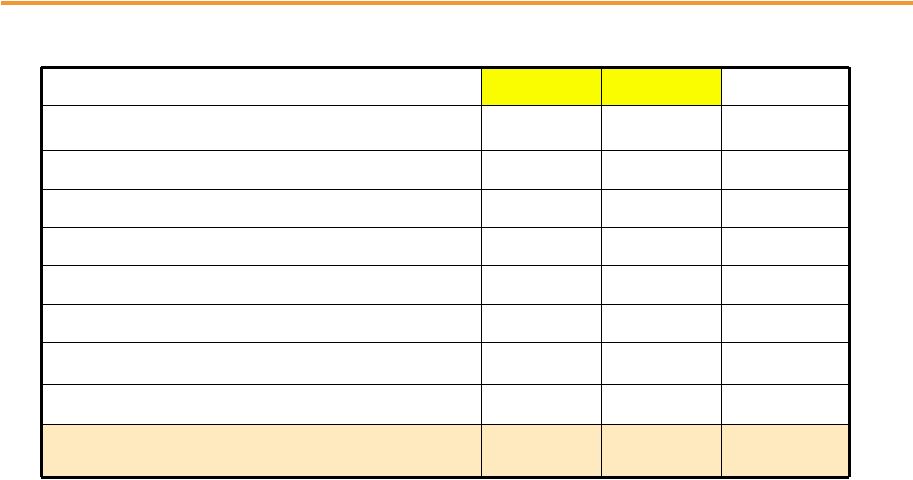

Q4 Earnings Summary

$ millions (except EPS)

2010

2009

Operating Earnings

$ 303

$ 334

Reconciling Items, Net of Tax

(13)

40

Income from Continuing Operations

290

374

Discontinued Operations, Net of Tax

(8)

(25)

Net Income

282

349

EPS from Operating Earnings*

$ 0.60

$ 0.66

Quarter ended December 31

* See page 34 for Items excluded from Income from Continuing Operations to

reconcile to Operating Earnings. |

5

Full-year Earnings Summary

$ millions (except EPS)

2010

2009

Operating Earnings

$ 1,584

$ 1,567

Reconciling Items, Net of Tax

(27)

27

Income from Continuing Operations

1,557

1,594

Discontinued Operations, Net of Tax

7

(2)

Net Income

1,564

1,592

EPS from Operating Earnings*

$ 3.12

$ 3.09

For the twelve months ended

December

31

* See page 34 for Items excluded from Income from Continuing Operations to

reconcile to Operating Earnings. |

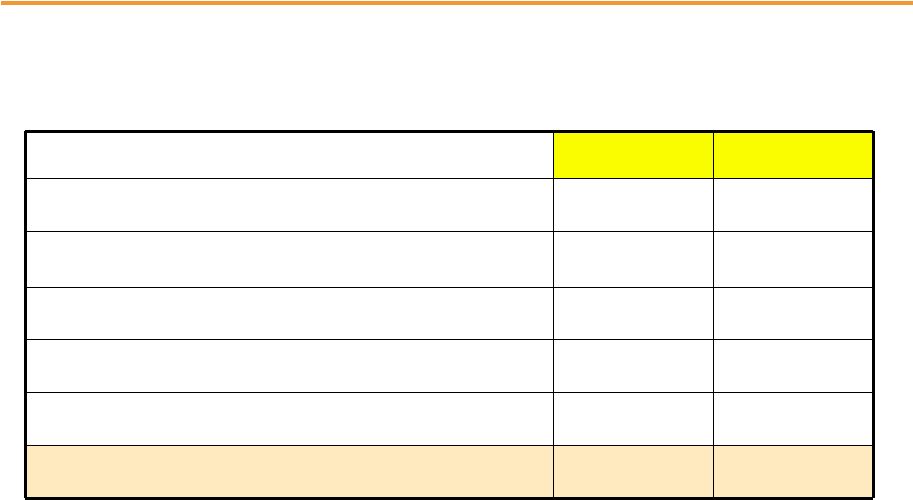

6

PSEG –

2010: Balanced asset mix met market’s challenges

2010 Earnings Within Guidance

Operating earnings of $3.12 compared with guidance of $3.00 -

$3.25

Results reflect the removal of Texas generating assets to discontinued

operations

A Year of Accomplishments

Completed installation of the Back-End Technology at NJ coal stations

Record year for generation for Power

Hope Creek received a 100 INPO rating

PSE&G won its 9

th

consecutive Reliability One Award

PSE&G’s

electric & gas distribution rate settlement supported improved returns

Holdings terminated all remaining international leveraged leases

O&M Growth Contained with Focus on Operating Efficiency

Balance Sheet Strengthened |

7

PSEG –

2011: Meeting market’s challenges

Providing

Operating

Earnings

Guidance

for

2011

of

$2.50

-

$2.75

per share

Power’s outlook influenced by lower prices and volume

PSE&G benefits from increased investment and full year of rate relief

Energy Holdings’

outlook influenced by absence of lease termination gains

Responding to Market Challenges

Complaint filed at FERC in response to NJ’s LCAPP Legislation

U.S District Court action challenging constitutionality under Supremacy

and Commerce clauses

Foundation for Future

Committed to $6.7 billion Capital Program over 2011-2013

Balance Sheet strong

2011 Represents 104

th

Year of Paying an Annual Dividend on an

Uninterrupted Basis

Indicated annual rate of $1.37 per share for 2011 |

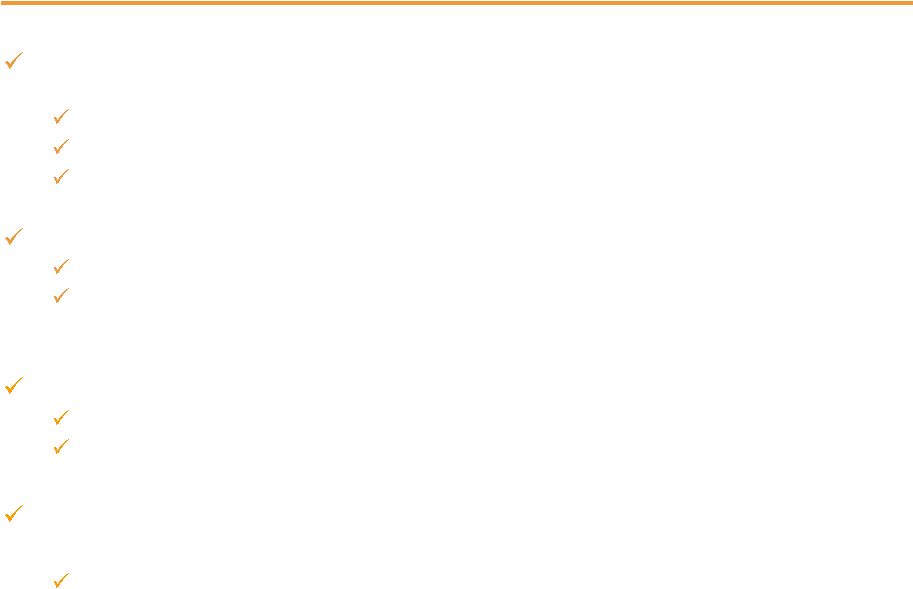

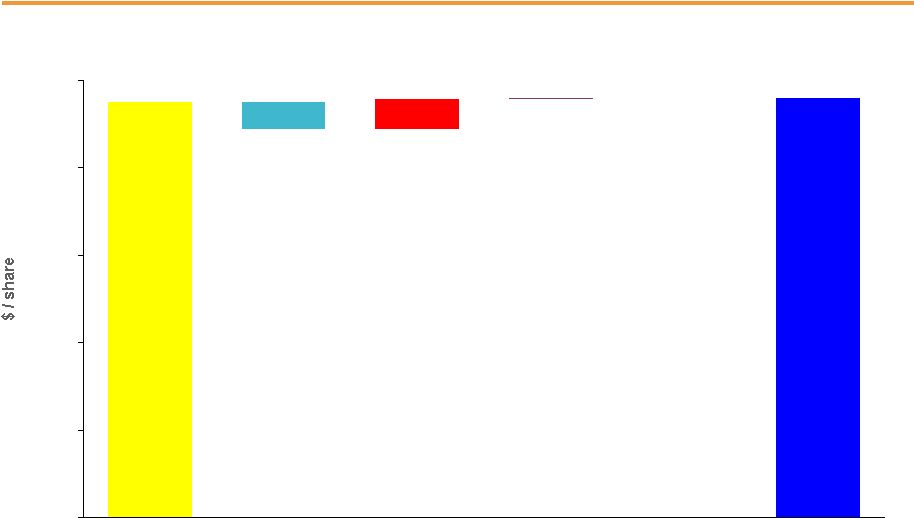

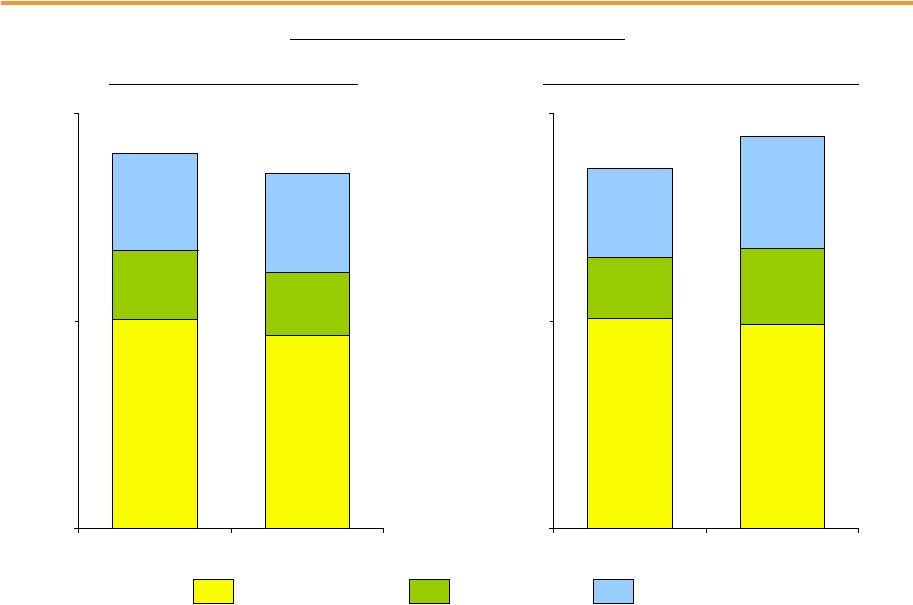

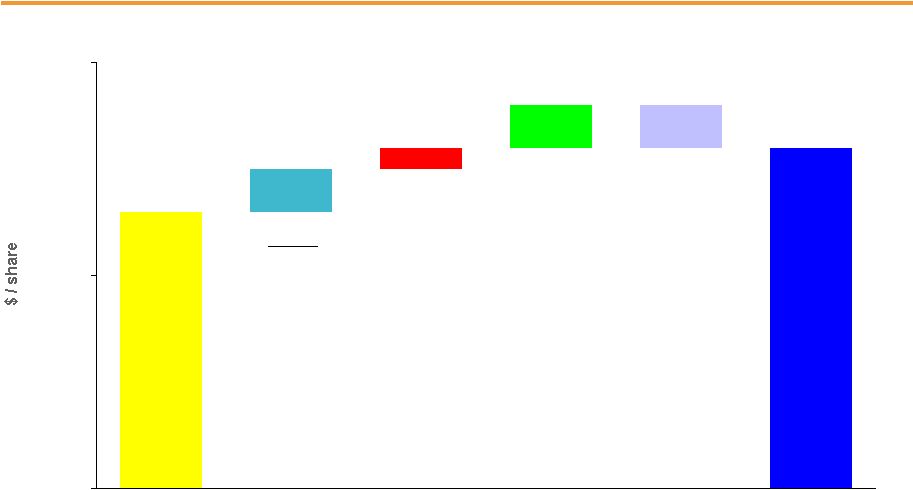

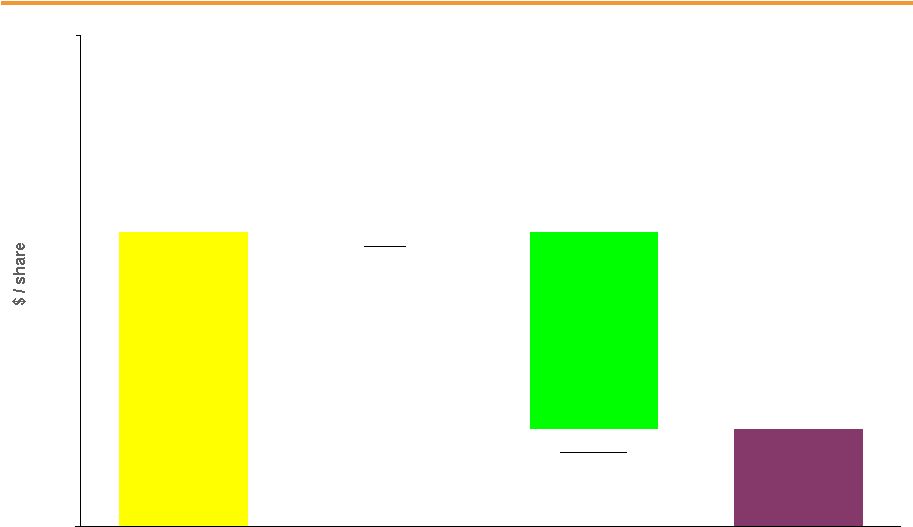

8

2009 Operating Earnings*

2010 Operating Earnings*

2011 Guidance

$2.50 -

$2.75E

PSEG –

Introducing 2011 Guidance

$3.09

* See page 34 for Items excluded from Income from Continuing Operations to

reconcile to Operating Earnings.

$3.12 |

| PSEG

2010 Q4 Operating Company Review

Caroline Dorsa

EVP and Chief Financial Officer

*

*

*

*

*

*

* |

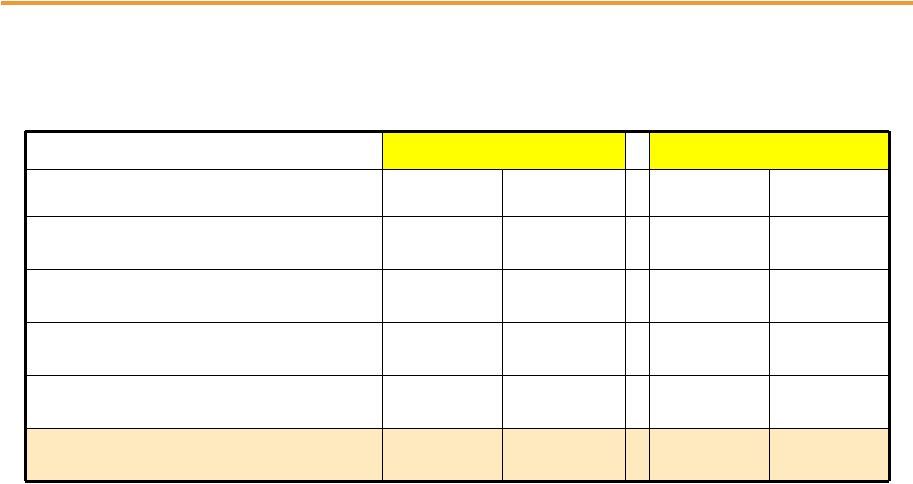

10

Q4 Operating Earnings by Subsidiary

Operating Earnings

Earnings per Share

$ millions (except EPS)

2010

2009

2010

2009

PSEG Power

$ 212

$ 260

$ 0.42

$ 0.51

PSE&G

83

68

0.16

0.13

PSEG Energy Holdings

5

12

0.01

0.03

Enterprise

3

(6)

0.01

(0.01)

Operating Earnings*

$ 303

$ 334

$ 0.60

$ 0.66

Quarter ended December 31

* See page 34 for Items excluded from Income from Continuing Operations to

reconcile to Operating Earnings. |

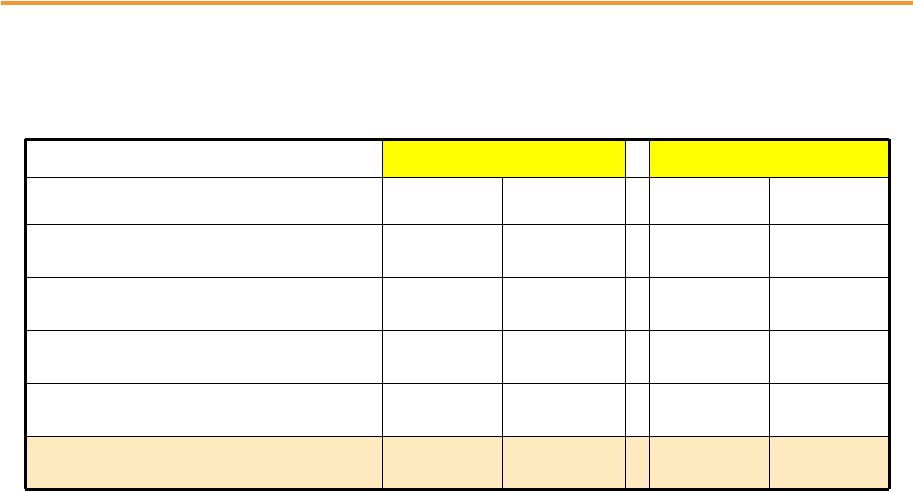

11

Full-year Operating Earnings by Subsidiary

Operating Earnings

Earnings per Share

$ millions (except EPS)

2010

2009

2010

2009

PSEG Power

$ 1,091

$ 1,193

$ 2.15

$ 2.35

PSE&G

430

321

0.85

0.63

PSEG Energy Holdings

49

43

0.10

0.09

Enterprise

14

10

0.02

0.02

Operating Earnings*

$ 1,584

$ 1,567

$ 3.12

$ 3.09

For the year ended December 31

* See page 34 for Items excluded from Income from Continuing Operations to

reconcile to Operating Earnings. |

12

$.66

(.09)

.03

(.02)

.02

$.60

0.00

0.35

0.70

PSEG EPS Reconciliation –

Q4 2010 versus Q4 2009

Q4 2010

operating

earnings*

Q4 2009

operating

earnings*

Higher Prices

partially offset by

Lower Volume .01

WPT (.03)

Migration (.01)

O&M (.02)

Taxes (.04)

PSEG Power

Electric & Gas

Margins

(including Rate

Increases) .03

O&M .02

D&A (.02)

PSE&G

PSEG Energy

Holdings

Enterprise

Lower Lease

Sales (.03)

Other .01

* See page 34 for Items excluded from Income from Continuing Operations to

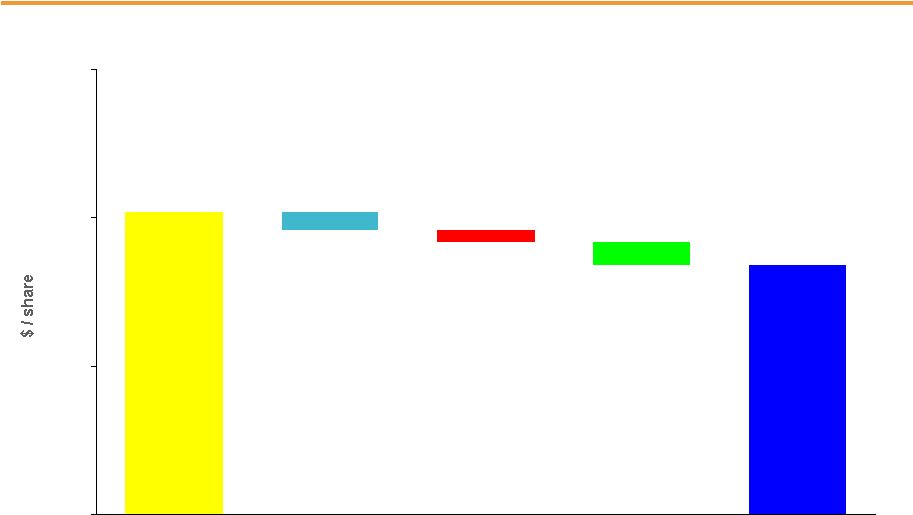

reconcile to Operating Earnings. Interest |

13

$3.09

(.20)

.22

.01

.00

$3.12

0.00

0.65

1.30

1.95

2.60

3.25

PSEG EPS Reconciliation –

Full-year 2010 versus Full-

year 2009

2010

operating

earnings*

2009

operating

earnings*

2009 Debt

Exchange

Benefit

(Eliminated in

Consolidation) (.04)

Interest .04

Higher Volume

offset by Lower

Prices .00

WPT (.10)

Migration (.04)

Nuclear (.03)

O&M (.01)

Taxes (.04)

Other .02

PSEG Power

Electric & Gas

Margin

(including Rate

Increases) .12

Transmission

Margin .04

O&M .04

Weather .02

D&A (.03)

Other .03

PSE&G

PSEG Energy

Holdings

Enterprise

Lower Lease

Sales and

Impairment (.09)

2009 Debt

Exchange

Costs

(Eliminated in

Consolidation) .04

Interest .03

Other .03

* See page 34 for Items excluded from Income from Continuing Operations to

reconcile to Operating Earnings. |

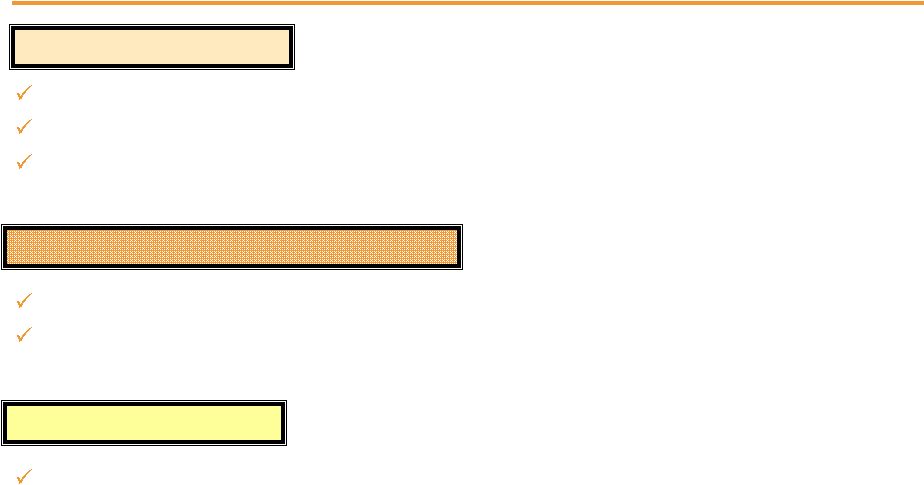

14

PSEG –

Meeting Challenges by:

Delivering superior results on our fleet of well positioned

assets

Achieving earnings targets with focus on attaining top

quartile performance across the enterprise

Investing in areas with attractive risk-adjusted returns

Maintaining a strong balance sheet |

| PSEG

Power 2010 Q4 Review

*

*

*

*

*

*

* |

16

PSEG Power –

Q4 2010 EPS Summary

$ millions (except EPS)

Q4 2010

Q4 2009

Variance

Operating Revenues

$ 1,575

$ 1,678

($ 103)

Operating Earnings

212

260

(48)

NDT Funds Related

Activity,

Net of Tax

15

8

7

Mark-to-Market, Net of Tax

(28)

3

(31)

Income from Continuing Operations

199

271

(72)

Discontinued Operations, Net of Tax

(8)

(25)

17

Net Income

191

246

(55)

EPS from Operating Earnings*

$ 0.42

$ 0.51

($ 0.09)

* See page 34 for Items excluded from Income from Continuing Operations to

reconcile to Operating Earnings. |

17

$.42

(.02)

(.03)

(.04)

$.51

0.00

0.25

0.50

0.75

Higher Prices

partially offset by

Lower Volume .01

WPT (.03)

Migration (.01)

PSEG Power EPS Reconciliation –

Q4 2010 versus Q4 2009

Q4 2010

operating

earnings*

Q4 2009

operating

earnings*

O&M (.02)

* See page 34 for Items excluded from Income from Continuing Operations to

reconcile to Operating Earnings. Taxes (.04) |

18

30,283

29,571

8,899

10,932

12,982

16,224

0

30,000

60,000

2009

2010

PSEG Power –

Generation Measures

7,531

6,993

2,509

2,286

3,547

3,532

0

7,500

15,000

2009

2010

Quarter

ended

December

31

Total Nuclear

Total Coal*

Oil & Natural Gas

–

excluding

Texas

* Includes figures for Pumped Storage

PSEG

Power

–

Generation

(GWh)

13,587

12,811

Twelve

months

ended

December

31

52,164

56,727 |

19

PSEG Power –

Fuel Costs

Quarter ended December 31

($ millions)

2009

2010

Coal

97

82

Oil & Gas

172

160

Total Fossil

269

242

Nuclear

40

41

Total Fuel Cost

309

283

Total Generation

(GWh)

13,587

12,811

$ / MWh

23

22

PSEG Power –

Fuel Costs*

Twelve months ended

December 31

($ millions)

2009

2010

Coal

336

418

Oil & Gas

625

763

Total Fossil

961

1,181

Nuclear

150

164

Total Fuel Cost

1,111

1,345

Total Generation

(GWh)

52,164

56,727

$ / MWh

21

24

*Excludes Texas. |

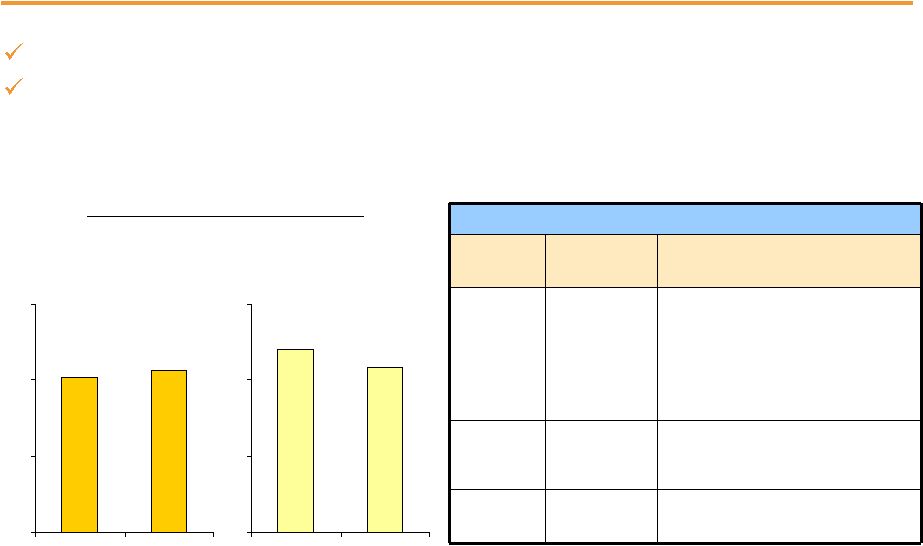

20

PSEG Power –

Gross Margin Performance

$0

$25

$50

$75

2009

2010

$0

$25

$50

$75

2009

2010

$51

$53

Quarter ended

December 31

Twelve months ended

December 31

$60

$54

4Q aided by improvement in higher wholesale prices

Hope Creek 26-day refueling outage, and planned testing for BET

Regional Performance

Region

2010 Gross

Margin ($M)

2010 Performance

PJM

$2,953

2010 contribution to gross margin

($M) declined by 1.1% versus year

ago; strong production from fossil

units combined with weather related

summer demand helped to offset the

impact of lower prices and customer

migration.

New

England

$79

Bridgeport Harbor hurt by low

contract prices.

New York

$48

Low contract prices partially offset by

an increase in generation.

PSEG Power Gross Margin ($/MWh)*

* Excludes Texas. |

21

PSEG Power –

Q4 2010 Operating Highlights

Q4 output down 5.7%; full-year increase of 8.7%

2010 capacity factor for PS share of nuclear fleet at 91.2%

Fossil output for the year at record level

Availability of fleet in 4Q allowed Power to take advantage of higher spark

spreads Operations

Regulatory and Market

Environment

Financial

2011 BGS auction priced at $94.30/MWh versus $111.50/MWh for expiring

contract

Approximately 95% of 2011 anticipated coal and nuclear output hedged at

average price of $68/MWh

PSEG Power considering options as part of NJ procurement process

Customer migration expanded to approximately 30% at year-end 2010

BET in service on schedule at year-end 2010 meeting all Consent Decree

requirements

Texas asset sales for approximately $687 million, $343 per KW

|

| PSE&G

2010 Q4 Review

*

*

*

*

*

*

* |

23

PSE&G –

Q4 Earnings Summary

$ millions (except EPS)

Q4 2010

Q4 2009

Variance

Operating Revenues

$ 1,882

$ 1,922

($ 40)

Operating Expenses

Energy Costs

1,083

1,165

(82)

Operation & Maintenance

358

384

(26)

Depreciation & Amortization

187

146

41

Taxes Other than Income Taxes

35

33

2

Total Operating Expenses

1,663

1,728

(65)

Operating Earnings / Net Income

83

68

15

EPS from Operating Earnings*

$ 0.16

$ 0.13

$ 0.03

* See page 34 for Items excluded from Income from Continuing Operations to

reconcile to Operating Earnings. |

24

$.16

(.02)

.02

.01

.02

$.13

0.00

0.10

0.20

PSE&G EPS Reconciliation –

Q4 2010

versus Q4 2009

Q4 2010

operating

earnings*

Q4 2009

operating

earnings*

Margins

Electric, Gas &

Transmission

D&A

* See page 34 for Items excluded from Income from Continuing Operations to

reconcile to Operating Earnings. O&M

Rate Increase |

25

PSE&G –

Q4 Operating Highlights

Annual transmission revenue increase of $45 million effective on

January 1, 2011

Resolved Societal Benefits Clause with NJ BPU

PSE&G’s distribution operations earned a 9.7% return on equity in

2010 Operations

Regulatory and Market

Environment

Financial

Economic recovery remains slow but commercial sales up slightly in Q4

O&M remains under control

Focused on maintaining reliability |

| PSEG

Energy Holdings 2010 Q4 Review

*

*

*

*

*

*

* |

27

PSEG Energy Holdings –

Q4 2010 Earnings Summary

$ millions (except EPS)

Q4 2010

Q4 2009

Variance

Operating Earnings

$ 5

$ 12

($ 7)

Net Reversal of Lease Transaction

Reserves

-

29

(29)

Net Income (Loss)

$ 5

$ 41

($ 36)

EPS from Operating Earnings*

$ 0.01

$ 0.03

($ 0.02)

* See page 34 for Items excluded from Income from Continuing Operations to

reconcile to Operating Earnings. |

28

$.01

(.02)

.00

$.03

0.00

0.05

PSEG Energy Holdings EPS Reconciliation –

Q4 2010 versus

Q4 2009

Q4 2010

operating

earnings*

Q4 2009

operating

earnings*

2009 Lease

Sales

* See page 34 for Items excluded from Income from Continuing Operations to

reconcile to Operating Earnings. Resources

Lower Lease

Sales (.03)

Other .01

Global

GWF

(Impairment)

(.01)

Taxes & Other

.01 |

29

PSEG Energy Holdings –

Q4 Operating Highlights

Financial

All 18 international leveraged leases have been terminated,

reducing potential cash tax liability at year-end to $260 million

$320 million on deposit with IRS to meet potential tax liability

Redeemed all outstanding recourse debt at Holdings’

level |

| PSEG

*

*

*

*

*

*

* |

31

PSEG Financial Highlights

2011

operating

earnings

guidance

of

$2.50

-

$2.75

per

share

Guidance by operating company

Financial risk associated with international lease investments

eliminated

Financial position strengthened

All

Holdings’

long-term,

recourse

debt

eliminated

at

year-end

2010

Debt

:

capital

ratio

remained

strong

at

45%

at

year-end

2010 |

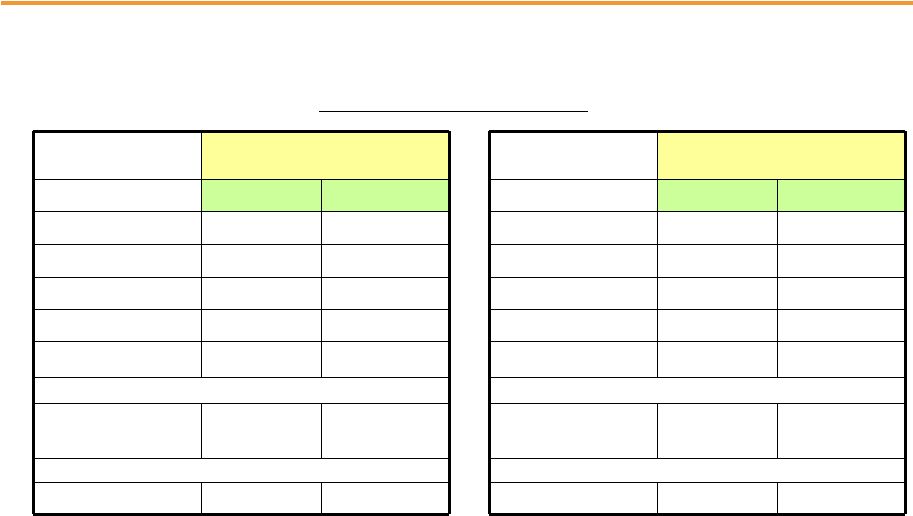

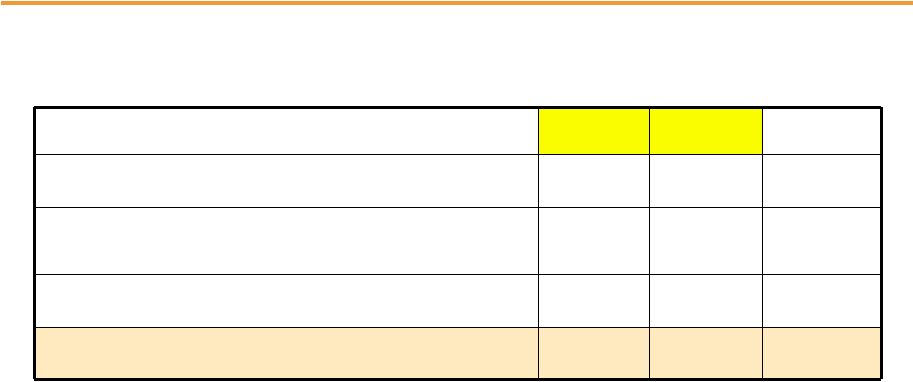

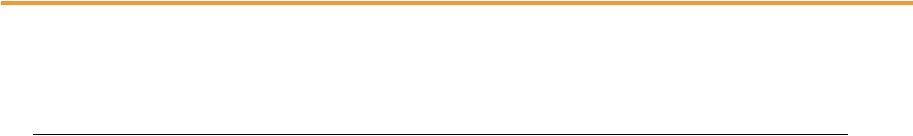

32

PSEG 2011 Operating Earnings Guidance -

PSEG 2011 Operating Earnings Guidance -

By Subsidiary

By Subsidiary

$ millions (except EPS)

2011E

2010A

PSEG Power

$ 765 –

$ 855

$ 1,091

PSE&G

$ 495 –

$ 520

$ 430

PSEG Energy Holdings

$ 0 –

$ 5

$ 49

Enterprise

$ 5 –

$ 15

$ 14

Operating Earnings*

$ 1,265 –

$ 1,395

$ 1,584

Earnings per Share

$ 2.50 –

$ 2.75

$ 3.12

* See Page 34 for Items excluded from Income from Continuing Operations to

reconcile to Operating Earnings. |

33

PSEG Liquidity as of January 31, 2011

Expiration

Total

Available

Company

Facility

Date

Facility

Usage

Liquidity

5-Year Credit Facility (Power)

Dec-12

$1,600

1

$144

$1,456

5-Year Credit Facility (PSEG)

Dec-12

$1,000

2

$14

$986

5-Year Bilateral Facility (Power)

Sep-15

$100

$100

$0

2-Year Credit Facility (Power)

Jul-11

$350

$0

$350

PSE&G

5-Year Credit Facility

Jun-12

$600

3

$0

$600

Total

$3,650

$3,392

1

Power Facility reduces by $75 million in 12/2011

2

PSEG Facility reduces by $47 million in 12/2011

3

PSE&G Facility reduces by $28 million in 6/2011

PSEG /

Power

($Millions) |

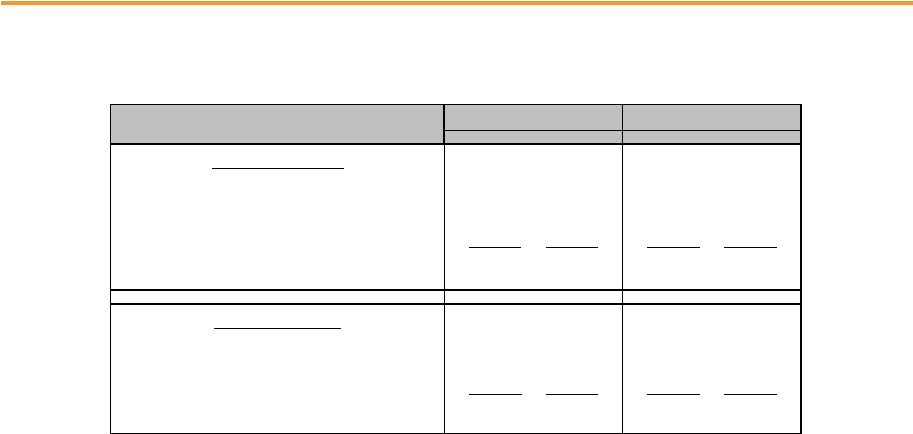

34

Items Excluded from Income from Continuing Operations to

Reconcile to Operating Earnings

Please see Page 2 for an explanation of PSEG’s use of Operating Earnings as a

non-GAAP financial measure and how it differs from Net Income.

Pro-forma Adjustments, net of tax

2010

2009

2010

2009

Earnings Impact ($ Millions)

Gain (Loss) on Nuclear Decommissioning Trust (NDT)

Fund Related Activity (PSEG Power)

15

$

8

$

46

$

9

$

Gain (Loss) on Mark-to-Market (MTM) (PSEG Power)

(28)

3

(1)

(11)

Net Reversal of Lease Transaction Reserves (Energy Holdings)

-

29

-

29

Market Transition Charge Refund (PSE&G)

-

-

(72)

-

Total Pro-forma adjustments

(13)

$

40

$

(27)

$

27

$

Fully Diluted Average Shares Outstanding (in Millions)

507

507

507

507

Per Share Impact (Diluted)

Gain (Loss) on NDT Fund Related Activity (PSEG Power)

0.03

$

0.02

$

0.09

$

0.02

$

Gain (Loss) on MTM (PSEG Power)

(0.06)

0.01

-

(0.02)

Net Reversal of Lease Transaction Reserves (Energy Holdings)

-

0.05

-

0.05

Market Transition Charge Refund (PSE&G)

-

-

(0.14)

-

Total Pro-forma adjustments

(0.03)

$

0.08

$

(0.05)

$

0.05

$

For the Three Months Ended

For the Twelve Months Ended

December 31,

December 31,

PUBLIC SERVICE ENTERPRISE GROUP INCORPORATED

Reconciling Items Excluded from Continuing Operations to Compute Operating Earnings

(Unaudited) |