Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - TOWER BANCORP INC | d8k.htm |

Tower Bancorp, Inc.

Investor Presentation

First Quarter 2011

Exhibit 99.1 |

ABOUT

THIS PRESENTATION 2

Safe Harbor Regarding Forward-Looking Statements

This presentation contains forward-looking statements that are intended to be covered by the safe

harbor for forward- looking statements provided by the Private Securities Litigation Reform

Act of 1995. Forward-looking statements are not statements of historical fact, and can

be identified by the use of forward-looking terminology such as “believe,” “expect,”

“may,” “will,” “should,” “project,” “plan,”

“seek,” “target,” “intend” or “anticipate” or the negative thereof or comparable

terminology. Forward-looking statements include discussions of strategy, financial projections

and estimates and their underlying assumptions, statements regarding plans, objectives,

expectations or consequences of various transactions, and statements about the future

performance, operations, products and services of Tower and our subsidiaries. These

forward-looking statements are subject to various assumptions, risks, uncertainties and other

factors including, but not limited to: a continuation or worsening of the current disruption in

credit and other markets; the ineffectiveness of Tower’s business strategy due to

changes in current or future market conditions; the effects of competition, and of changes in laws

and regulations on competition, including industry consolidation and development of competing

financial products and services; interest rate movements; the performance of

Tower’s investment portfolio; changes in rates of deposit and loan growth; asset

quality and the impact on assets from adverse changes in the economy and in credit or other markets and

resulting effects on credit risk and asset values; inability to achieve merger-related

synergies; difficulties in integrating distinct business operations, including information

technology; capital and liquidity strategies; and deteriorating economic

conditions. The foregoing review of important factors should be read in conjunction with the risk factors and

other cautionary statements included in documents filed by Tower Bancorp, Inc. with the Securities and

Exchange Commission, including Tower’s Quarterly Report on Form 10-Q, Annual Report on

Form 10-K and other required filings. Because of these uncertainties, risks and the possibility of changes in these assumptions, actual

results could differ materially from those expressed in any forward-looking statements.

Investors are cautioned not to place undue reliance on these statements. Tower Bancorp,

Inc. assumes no duty or obligation to update any forward-looking statements made in this

presentation. Non-GAAP Financial Measures

This presentation contains the non-GAAP financial measure, ratio of tangible common equity to

tangible assets. In order to calculate tangible common equity and tangible assets,

Tower’s management subtracts intangible assets from both common equity and assets.

Reconciliations of these non-GAAP measures to the most directly comparable GAAP measures are

set forth in the Appendix. |

CORPORATE PROFILE

3

Corporate Overview

•

High growth community bank headquartered in

Harrisburg, PA

•

49 banking offices located primarily in central and

southeastern Pennsylvania

•

Major Business Lines

•

Small Business Banking

•

Retail Banking

•

Wealth Management

•

Not-for-profit Banking

Financial Highlights 12/31/2010 (unaudited)

Assets:

Deposits:

Loans:

TCE/TA (1)

Market Capitalization(2)

$2.7 billion

$2.3 billion

$2.1 billion

8.55%

$263 million

Source: Company Documents as of 12/31/2010

(1) This

measure is considered to be a Non-GAAP measure. Management uses

this ratio to assess the strength of the Tower Bancorp,

Inc.'s capital position. See the reconciliation of GAAP to Non-GAAP

measures in the appendix to this presentation. (2) Source: SNL Financial as

of January 28, 2011 |

MISSION, VISION AND VALUES

4

Mission Statement

Tower Bancorp, Inc. will positively impact lives by helping people achieve their

dreams. Vision Statement

Tower Bancorp, Inc. will be a high performing financial services

company that creates

financial success for consumer, business, and not for profit customers in the markets

we choose to serve.

Value Statement

Tower Bancorp, Inc. is committed to attracting and retaining employees who are

passionate about providing uncompromising service to our customers with a sense of

warmth, integrity, friendliness, and company spirit. We value and

respect each other because we truly believe that our success only comes from

working together for our team’s success. |

5

CORPORATE LEADERSHIP TEAM

Deep and proven management team with average experience of 25 years

|

6

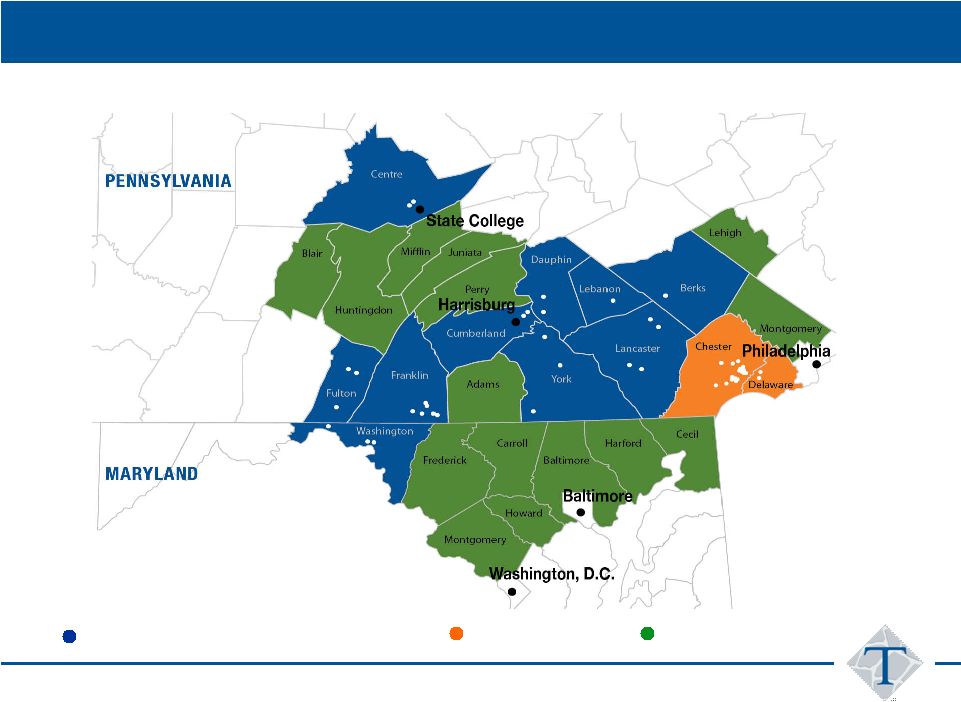

Potentially attractive growth and expansion opportunities

FOOTPRINT AND CURRENT GROWTH POTENTIAL

Note: Tower believes that a growth opportunity exists for the counties appropriately marked

above based on Tower’s close proximity to those counties, management’s

familiarity with the demographics and businesses and business leaders in those counties and Tower’s reputation in those counties.

1N Bank Division

Graystone Bank and Tower Bank Divisions

Growth Markets |

7

BUSINESS STRATEGIES

High touch relationship management and exceptional service supported by

technology |

8

ORGANIC GROWTH

Compelling

Organic

Growth

(1)

Source: FDIC Deposit Data as of 6/30/2010

(2)

Source: Company Documents- Growth % Year Ended 12/31/2010

Excludes $51.5 million participation purchased from First Chester and $24 million loan to First

Chester (both in 4th quarter of 2009). Also excludes loans and deposits acquired from

First Chester County Corporation. (3) Source: Company Documents–

Non-Interest Income Growth year ended 12/31/2010 vs. 12/31/2009 |

9

•

November

14,

2005

de

novo

Graystone

Bank

opened

with

three

branches

in

Central

Pennsylvania

•

Raised

approximately

$65

million

of

total

capital

via

private

placement

•

Reached

over

$600

million

of

assets

with

9

branches

in

less

than

3

years

•

Achieved

net

income

of

$2.1

million

in

third

full

year

of

operation

2005

-

2008

2009

2010

•

Graystone

completed

a

merger

of

equals

transaction

on

March

31,

2009

with

First

National

Bank

of

Greencastle,

forming

Graystone

Tower

Bank

as

a

subsidiary

of

Tower

Bancorp,

Inc.

•

Immediately

following

the

merger,

Graystone

Tower

Bank

had

25

branches

and

over

$1.2

billion

in

assets

•

NASDAQ

Listed,

Symbol

TOBC

•

Successfully

raised

$57

million

in

public

common

stock

in

August

2009

•

Announced

acquisition

of

First

Chester

County

Corporation

on

December

28,

2009

•

Raised

$21

million

of

subordinated

debt

with

local

investors

in

2009

-

2010

•

Closed

the

First

Chester

County

Corporation

acquisition

on

December

10,

2010

•

Following

the

acquisition,

Graystone

Tower

Bank

has

49

branches,

$2.7

billion

of

assets

and

approximately

$550

million

of

assets

under

administration

•

Completed

$51.2

million

follow-on

common

equity

offering

in

December

2010

TIMELINE OF SIGNIFICANT CORPORATE EVENTS |

10

BUILDING SHAREHOLDER VALUE |

11

STRATEGIC GROWTH

•Focused on in-market and contiguous market opportunities

•Disciplined strategic initiative process

•Acquisition Factors

Accretive to EPS in the first year

Meets management IRR parameters

Single digit TBV dilution

Equal or better market demographics |

12

ASSET GROWTH ($000) (1) (2)

Source: Company Documents as of 12/31/2010

(1)

All

financial

information

for

periods

prior

to

March

31,

2009

represents

historical

financials

for

Graystone

Financial

Corp.,

as

the

accounting

acquirer in the reverse merger with Tower Bancorp Inc.

(2) 2005 financial data reflects the period from September 2, 2005 (inception date)

to December 31, 2005 * unaudited |

13

DEPOSIT GROWTH ($000) (1) (2)

Source: Company Documents as of 12/31/2010

(1)

All

financial

information

for

periods

prior

to

March

31,

2009

represents

historical

financials

for

Graystone

Financial

Corp.,

as

the

accounting

acquirer in the reverse merger with Tower Bancorp Inc.

(2) 2005 financial data reflects the period from September 2, 2005 (inception date)

to December 31, 2005 * unaudited |

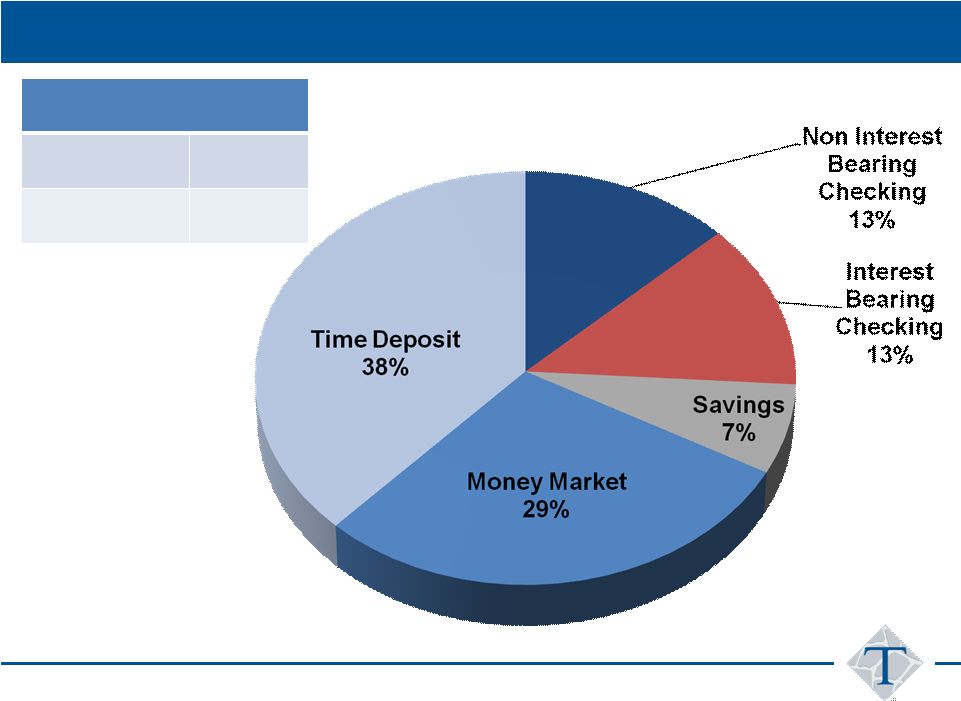

14

DEPOSIT COMPOSITION

Average Cost of Deposits

2009

2.07%

2010

1.46%

Source: Company Documents as of 12/31/2010 |

15

DEPOSIT MARKET SHARE

Total

Total

Y/o/Y

Deposits

Market

Growth

Branch

in Market

Share

Rate

Rank

Institution

Count

($000)

(%)

(%)

1

Wells Fargo & Co.

78

6,513,295

11.7

8.0

2

PNC Financial Services Group Inc.

107

5,666,891

10.1

9.6

3

Fulton Financial Corp.

90

4,841,048

8.7

10.8

4

M&T Bank Corp.

110

4,434,564

7.9

6.8

5

Susquehanna Bancshares Inc.

97

4,063,957

7.3

8.5

6

Royal Bank of Scotland Group Plc

73

3,751,832

6.7

(3.4)

7

Banco Santander SA

76

2,690,507

4.8

(8.7)

8

Tower Bancorp Inc.

49

2,304,356

4.1

12.7

9

Toronto-Dominion Bank

26

2,264,615

4.1

5.9

10

Metro Bancorp Inc.

28

1,656,459

3.0

6.1

11

National Penn Bancshares Inc.

29

1,606,095

2.9

(0.3)

12

Orrstown Financial Services Inc.

16

989,223

1.8

42.0

13

Citigroup Inc.

4

901,480

1.6

(16.0)

14

Codorus Valley Bancorp Inc.

21

737,574

1.3

9.2

15

Franklin Financial Services Corp.

27

719,704

1.3

3.1

Total (1-15)

831

43,141,600

77.2

Total (1-85)

1,176

55,870,422

100.0

o

Tower Ranks:

o

8th overall in deposit market share in its counties of operation

o

3rd in total deposit market share, excluding companies with greater than $20

billion in assets o

Significant

opportunities

exist

to

gain

share

within

our

current

markets

Source: SNL Financial

Deposits as of June 30, 2010; Tower deposits and branches pro forma for First

Chester County Corporation acquisition. All other companies pro forma

for pending acquisitions. |

16

LOAN GROWTH ($000) (1) (2)

Source: Company Documents as of 12/31/2010

(1)

All

financial

information

for

periods

prior

to

March

31,

2009

represents

historical

financials

for

Graystone

Financial

Corp.,

as

the

accounting

acquirer in the reverse merger with Tower Bancorp Inc.

(2) 2005 financial data reflects the period from September 2, 2005 (inception date)

to December 31, 2005 * unaudited |

17

LOAN COMPOSITION

Loan Detail

Balance ($000)

% of Portfolio

Commercial:

Industrial

$916,360

44%

Real Estate

$441,243

21%

Construction

$185,424

9%

Consumer:

Home Equity

$196,498

9%

Other

$52,412

3%

Residential Mortgage

$279,944

14%

Total Loans

$2,071,881

Source: Company Documents as of 12/31/2010 |

18

STRONG CREDIT METRICS

Source: Company Documents as of 12/31/2010 and SNL Financial

Note:

Peer

Group

LTM

ended

9/30/2010

and

Tower

Bancorp

LTM

ended

12/31/2010

(unaudited).

Peer

group

companies

are

set

forth

in

the Appendix to this presentation |

19

STRONG CREDIT METRICS

Source: Company Documents as of 12/31/2010 and SNL Financial

Note:

Peer

Group

LTM

ended

9/30/2010

and

Tower

Bancorp

LTM

ended

12/31/2010

(unaudited).

Peer

group

companies

are

set

forth

in

the

Appendix to this presentation |

20

NON-INTEREST INCOME

($000) (1) (2)

Source: Company Documents as of 12/31/2010

(1)

All

financial

information

for

periods

prior

to

March

31,

2009

represents

historical

financials

for

Graystone

Financial

Corp.,

as

the

accounting

acquirer in the reverse merger with Tower Bancorp Inc.

(2) 2005 financial data reflects the period from September 2, 2005 (inception date)

to December 31, 2005 * unaudited |

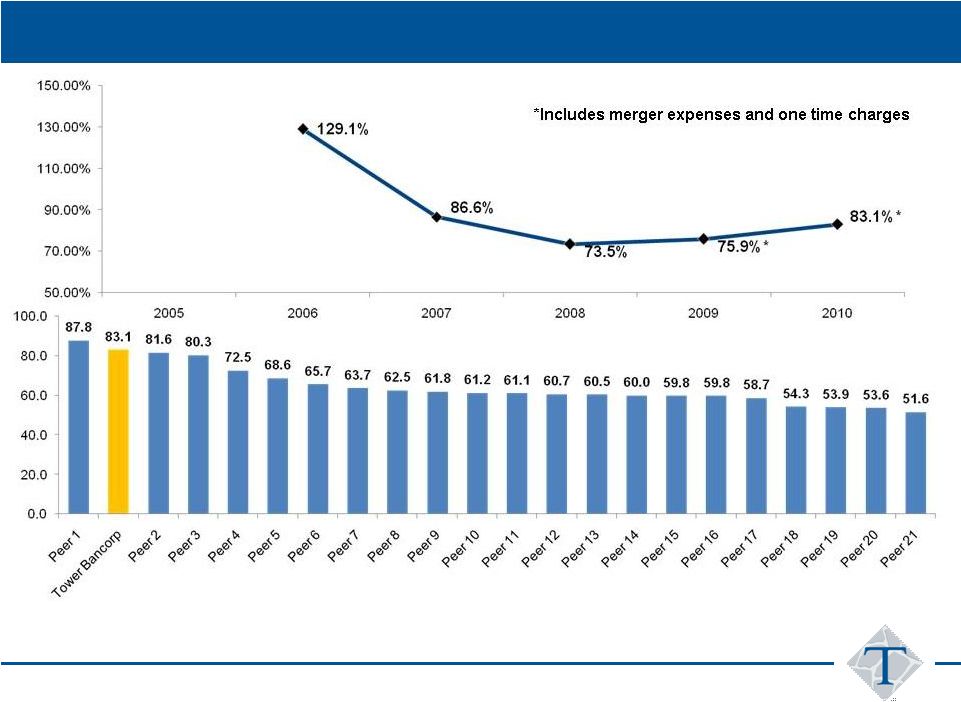

21

FUTURE EFFICIENCY IMPROVEMENT

Source: Company Documents as of 12/31/2010 and SNL Financial

(1) All financial information for periods prior to March 31, 2009 represents historical financials for

Graystone Financial Corp., as the accounting acquirer in the reverse merger (2) Efficiency ratio

is calculated as total non-interest expense divided by the total of net interest income and non-interest income.

Note: Peer Group LTM ended 9/30/2010 and Tower Bancorp LTM ended 12/31/2010 (unaudited). Peer

group companies are set forth in the Appendix to this presentation |

22

NET INTEREST MARGIN (1) (2)

Source: Company Documents as of 12/31/2010

(1)

All

financial

information

for

periods

prior

to

March

31,

2009

represents

historical

financials

for

Graystone

Financial

Corp.,

as

the

accounting

acquirer in the reverse merger

(2) 2005 financial data reflects the period from September 2, 2005 (inception date)

to December 31, 2005 * unaudited |

23

FIVE QUARTER REVENUE TREND ($000,000)

4Q09

1Q10

2Q10

3Q10

4Q10

% Chg.

4Q10/

3Q10

%Chg.

4Q10/

4Q09

Net Interest Income

11.26

12.05

12.90

13.37

16.35

22.3

45.2

Total Noninterest

Income

3.32

2.00

2.49

3.08

4.01

30.2

20.8

Total Revenue

14.59

14.05

15.40

16.45

20.36

23.8

39.6

Net Interest Margin (%)

3.53

3.62

3.73

3.64

3.83

19 bps

30 bps

Source: Company Documents as of 12/31/2010 |

STRONG CAPITAL STRUCTURE

No TARP Funding

24

Source: Company Documents as of 12/31/2010 |

25

INVESTMENT MERITS

•

Deep and broad management team with extensive in-market experience

•

Successful and proven growth strategy

•

Diversified

credit

portfolio

with

a

conservative

focus

on

credit

quality

•

Significant franchise value

•

First Chester acquisition offers significant anticipated EPS accretion

|

THANK YOU! |

APPENDIX |

28

REGIONAL PEER GROUP COMPANIES

First Financial Bancorp

First Commonwealth Financial Corporation

NBT Bancorp Inc.

Community Bank System, Inc.

S&T Bancorp, Inc.

Sandy Spring Bancorp, Inc.

TowneBank

Sun Bancorp, Inc.

Carter Bank & Trust

Tompkins Financial Corporation

StellarOne Corporation

Hampton Roads Bankshares, Inc.

Virginia Commerce Bancorp, Inc.

Lakeland Bancorp, Inc.

Hudson Valley Holding Corp.

Union First Market Bankshares Corporation

First Community Bancshares, Inc.

Sterling Bancorp

Metro Bancorp, Inc.

Univest Corporation of Pennsylvania

Financial Institutions, Inc. |

29

FINANCIAL HIGHLIGHTS ($000)

Source: Company Documents as of 12/31/2010

(1) 4Q 2010 was a merger quarter which included purchase accounting adjustments as

well as merger expenses, restructuring charges and operating losses

associated with discontinuing the operations of the American Home Bank

Division. (2) Does not include the impact of purchase accounting loan

marks 4Q

2009

1Q

2010

2Q

2010

3Q

2010

4Q

2010(1)

Year End

2010

Assets

$1,470,583

$1,542,172

$1,588,079

$1,618,841

$2,747,161

$2,747,161

Loans Receivable

$1,138,460

$1,162,212

$1,216,335

$1,321,647

$2,071,881

$2,071,881

Deposits

$1,216,469

$1,276,501

$1,322,342

$1,355,717

$2,299,898

$2,299,898

Shareholder’s Equity

$163,877

$164,387

$165,343

$165,794

$256,664

$256,664

Net Income

$2,056

$1,905

$1,177

$2,502

$(4,512)

$1,072

EPS

$0.29

$0.27

$0.17

$0.35

$(0.56)

$0.15

Net Interest Margin

3.53%

3.62%

3.73%

3.64%

3.83%

3.71%

NPA/Assets

0.53%

0.85%

0.83%

1.00%

0.86%

0.86%

Loan Loss Reserve/Gross Loans

(2)

0.85%

0.94%

0.95%

0.96%

0.65%

0.65%

Total Risk Based Capital Ratio

14.53%

15.41%

14.49%

13.18%

13.29%

13.29% |

30

NON-GAAP FINANCIAL RECONCILIATION

Tower believes the presentation of these non-GAAP financial measures provide

useful supplemental information that is essential to an investor’s

proper understanding of the operating results of Tower’s core businesses. Our management

uses these non-GAAP financial measures in their analysis of our

performance. These non-GAAP disclosures should not be viewed as a

substitute for financial measures determined in accordance with GAAP, nor are they necessarily

comparable to non-GAAP performance measures that may be presented by other

companies. Reconciliations of GAAP to non-GAAP measures are included in

the table below. Source: Company Documents as of 12/31/2010

December 31,

2010

Reconciliation of Non-GAAP Balance Sheet Data:

Total assets - GAAP

2,747,161

$

Less:

Goodwill and other intangible assets 23,679

Total tangible assets - Non-GAAP

2,723,482

$

Total

Stockholders' equity - GAAP 256,664

$

Less: Goodwill and other intangible assets

23,679

Tangible equity - Non-GAAP

232,985

$

Tower Bancorp, Inc. and Subsidiary

Reconciliation of GAAP to Non-GAAP Measures

(Dollars in thousands, except share data and ratios)

(Unaudited)

December 31,

2010

Capital Ratios:

Total equity to total assets - GAAP

9.34%

Effect of intangible assets

-0.79%

Tangible common equity to tangible assets -Non-GAAP

8.55% |