Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PREMIERWEST BANCORP | prwtf8kcov.htm |

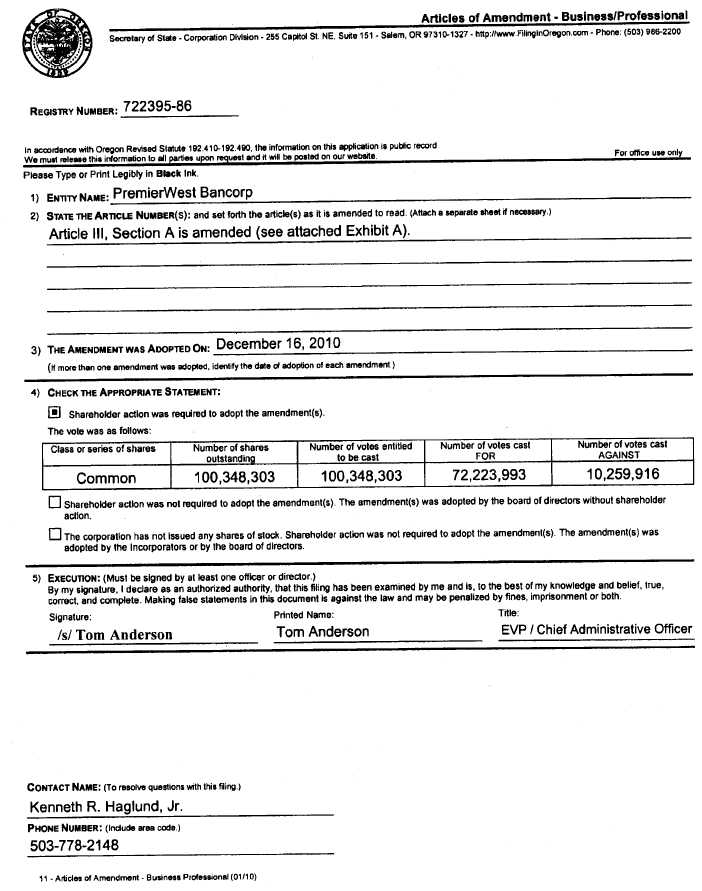

EXHIBIT 3.1

Exhibit A

Article III, Section A of the Articles of Incorporation of PremierWest Bancorp is hereby amended and restated in its entirety as follows:

“A. Authorized Classes of Shares.

(i) Immediately upon the filing of this Amendment to Articles of Incorporation (the “Effective Time”) by the Secretary of State of the State of Oregon, each ten outstanding shares of the Corporation’s common stock will be exchanged and combined, automatically, without further action, into one share of common stock (the “Reverse Split”). Any fractional shares resulting from that exchange and combination will not be issued, but will be paid out in cash (without interest or deduction) in the amount equal to the number of shares exchanged and combined into such fractional share multiplied by the closing trading price of the Corporation’s common stock on The NASDAQ Capital Market on the trading day immediately before the Effective Time. Each stock certificate that immediately prior to the Effective Time represented shares of common stock (the “Old Certificates”) shall thereafter represent that number of whole shares of common stock into which the shares of common stock represented by the Old Certificate shall have been exchanged and combined, and the right to receive payment for resulting fractional shares. Each person holding of record an Old Certificate shall receive, upon surrender of such certificate or certificates, a new certificate or certificates evidencing and representing the number of whole shares of common stock to which such person is entitled, or, at the discretion of the Corporation and unless otherwise instructed by such holder, book-entry shares in lieu of a new certificate or certificates evidencing and representing the number of whole shares of common stock to which such person is entitled, under the foregoing exchange and combination.

(ii) Immediately after the Reverse Split, the Corporation is authorized to issue 151,000,000 shares of stock, divided into two classes as follows:

1,000,000 shares of preferred stock, no par value (“Preferred Stock”). The Preferred Stock may be further divided into one or more series of Preferred Stock. Each series of Preferred Stock will have the preferences, limitations and relative rights as may be set forth for such series either in these Articles or in an amendment to these Articles (“Preferred Stock Designation”). A Preferred Stock Designation may be adopted either by action of the Board of Directors of the Corporation pursuant to Section G of Article III or by action of the shareholders of the Corporation; and

150,000,000 shares of common stock, no par value (“Common Stock”).

Except as may otherwise be provided in a Preferred Stock Designation, all shares of a class will have preferences, limitations and relative rights identical to those of all other shares of the same class. All shares of a series of Preferred Stock will have preferences, limitations and relative rights identical to those of all other shares of that series of Preferred Stock.”