Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 3, 2011

Waxess Holdings, Inc.

(Exact name of registrant as specified in Charter)

|

Delaware

(State or other jurisdiction

of incorporation)

|

333-146478

(Commission

File Number)

|

20-8820679

(IRS Employer

Identification No.)

|

|

1401 Dove Street, Suite 220, Newport Beach, CA

|

92660

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: 949-825-6570

| International Vineyard, Inc. | ||

| 17309 Josie Circle | ||

| Bellflower, CA 90706 | ||

| (Former name or former address, if changed since last report) |

|

Copies to:

|

||

|

Harvey J. Kesner, Esq.

|

||

| Benjamin S. Reichel, Esq. | ||

| Sichenzia Ross Friedman Ference LLP | ||

| 61 Broadway, 32nd Floor | ||

| New York, New York 10006 | ||

| Telephone: (212) 930-9700 |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|_| Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|_| Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|_| Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|_| Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

1

CURRENT REPORT ON FORM 8-K

WAXESS HOLDINGS, INC.

TABLE OF CONTENTS

Page

2

| Item 2.01 |

Completion of Acquisition or Disposition of Assets

|

On February 3, 2011, we filed an Amended and Restated Certificate of Incorporation in order to, among other things, change our name from “International Vineyard, Inc.” to “Waxess Holdings, Inc.” (the “Company”), and to increase our authorized capital stock from 55,000,000 shares to 125,000,000 shares, which shall be divided into two classes as follows: 100,000,000 shares of Common Stock, par value $0.001 per share, and 25,000,000 shares of “blank check” preferred stock, par value $0.001 per share. Additionally, we amended and restated our bylaws to, among other things, increase the maximum number of directors to be appointed to our board.

On February 4, 2011, we entered into an Agreement of Merger and Plan of Reorganization (the “Merger Agreement”) with Waxess USA, Inc., a privately held California corporation (“Waxess USA”), and Waxess Acquisition Corp., our newly formed, wholly-owned Delaware subsidiary (“Acquisition Sub”). Upon closing of the transaction contemplated under the Merger Agreement (the “Merger”), Acquisition Sub merged with and into Waxess USA, and Waxess USA, as the surviving corporation, became a wholly-owned subsidiary of the Company.

Pursuant to the terms and conditions of the Merger Agreement:

|

·

|

At the closing of the Merger, each share of Waxess USA’s common stock issued and outstanding immediately prior to the closing of the Merger was exchanged for the right to receive 1.19883186 shares of our common stock. To the extent that there are fractional shares, such fractional shares will be rounded to the nearest whole share. Accordingly, an aggregate of 7,500,000 shares of our common stock were issued to the holders of Waxess USA’s common stock.

|

|

·

|

Upon the closing of the Merger, Robert DeMate resigned as our sole officer and director and simultaneously with the Merger a new board of directors and new officers were appointed. The new board of directors consists of Hideyuki Kanakubo, Larry Paulson, Dr. James Canton and J. Steven Roush. The new officers consist of Hideyuki Kanakubo, our President and Chief Executive Officer and Jerome Kaiser, our Chief Financial Officer and Secretary.

|

|

·

|

In connection with the Merger, our majority stockholder agreed to cancel 8,141,042 shares of our common stock (the “Stock Cancellation”), resulting in 1,083,333 shares of common stock held by persons who were stockholders of ours prior to the Merger remaining outstanding. These 1,083,333 shares constitute our “public float” and are our only shares of registered common stock and accordingly are our only shares available for resale without further registration.

|

The foregoing description of certain changes to our Certificate of Incorporation and the Merger does not purport to be complete and is qualified in its entirety by reference to the complete text of (i) the Amended and Restated Certificate of Incorporation, which is filed as Exhibit 3.1 hereto (ii) the Amended and Restated Bylaws, which is filed as Exhibit 3.2 hereto, and (iii) the Merger Agreement, which is filed as Exhibit 2.1 hereto, each of which is incorporated herein by reference.

Following (i) the closing of the Merger, and (ii) the cancellation of 8,141,042, there were 8,583,333 shares of common stock issued and outstanding. Approximately 87.4% of such issued and outstanding shares were held by the former stockholders of Waxess.

We did not have any outstanding options or warrants to purchase shares of capital stock immediately prior to the closing of the Merger. Upon closing of the Merger, we issued warrants to purchase 3,385,000 shares of common stock (not including warrants for accrued interest) to prior holders of the Bridge Notes (as defined and discussed herein) and warrants to purchase an aggregate of 130,250 shares of common stock to several placement agents in the Bridge Note financing. Prior to the Merger, we adopted the 2011 Equity Incentive Plan (the “2011 Plan”) and reserved 1,500,000 shares of common stock for issuance as awards to officers, directors, employees, consultants and others. Upon closing of the Merger, we issued options to purchase an aggregate of 651,754 shares of our common stock at an exercise price of $2.00 per share to certain of our post-Merger non-employee directors.

The shares of our common stock issued to former holders of Waxess USA’s stock in connection with the Merger were not registered under the Securities Act of 1933, as amended (the “Securities Act”), in reliance upon an exemption from registration provided by Section 4(2) under the Securities Act and Regulation D promulgated thereunder. These securities may not be transferred or sold absent registration under the Securities Act or an applicable exemption therefrom.

Changes to the Business. We intend to carry on the business of Waxess USA as our sole line of business. Upon closing of the Merger, we relocated our executive offices to 1401 Dove Street, Suite 220, Newport Beach, CA 92660 and our telephone number is (949) 825-6570.

The Merger was approved by written consent of the holders of a majority of the outstanding shares of Waxess USA’s common stock on February 4, 2011.

Under California law, Waxess USA’s stockholders who did not vote in favor of the Merger may under certain circumstances seek to be paid the fair value of their shares determined by judicial proceeding by exercising statutory rights reserved for dissenters of certain major actions. Determination of fair value is based on many relevant factors, except that a court may disregard any appreciation or depreciation resulting from the anticipation or accomplishment of an event such as the Merger. As of February 8, 2011, no holder of Waxess USA’s common stock had notified the company of their intention to seek to exercise the right to seek appraisal of their shares.

3

Changes to the Board of Directors and Executive Officers. Upon the closing of the Merger, each of the directors of the Company resigned and Hideyuki Kanakubo, Larry Paulson, Dr. James Canton and J. Steven Roush were appointed as directors of the Company. In addition, upon the closing of the Merger, each of the officers of the Company resigned and certain officers of Waxess USA prior to the Merger were appointed as the officers of the Company.

Our board of directors consists of between one and fifteen persons, fixed from time to time by the board or our stockholders. A vacancy on our board of directors may be filled by the vote of a majoprity of the directors holding office. All directors hold office for one-year terms until the election and qualification of their successors. Officers are appointed by the board of directors and serve at the discretion of the board.

Accounting Treatment. The Merger is being accounted for as a reverse-merger and recapitalization. Waxess USA is the acquirer for financial reporting purposes and the Company is the acquired company. Consequently, the assets and liabilities and the operations that will be reflected in the historical financial statements prior to the Merger will be those of Waxess USA and will be recorded at the historical cost basis of Waxess USA, and the consolidated financial statements after completion of the Merger will include the assets and liabilities of the Company and Waxess USA, historical operations of Waxess USA and operations of the Company from the closing date of the Merger.

Tax Treatment; Small Business Issuer. The Merger is intended to constitute a reorganization within the meaning of Section 368(a) of the Internal Revenue Code of 1986, as amended (the “Code”), or such other tax free reorganization exemptions that may be available under the Code.

Following the Merger, the Company will continue to be a “smaller reporting company,” as defined in Item 10(f)(1) of Regulation S-K, as promulgated by the SEC.

The Company was incorporated as a Delaware corporation on April 2, 2007 for the purpose of developing a wholesale and distribution business that specializes in providing French and California sourced wines to the Chinese market. On February 3, 2011, we amended and restated our certificate of incorporation in order to, among other things, change our name to Waxess Holdings, Inc. and increase our authorized capital stock to 125,000,000 shares of which 100,000,000 are designated as common stock and 25,000,000 are designated as “blank check” preferred stock.

Waxess USA began operations in 2004, and was incorporated in California in 2008. Waxess USA is engaged in the development and marketing of phone terminals capable of converging traditional landline, cellular and data services based on its patent portfolio. The business was started by a group of ex-Uniden executives that observed the migration of landline subscribers to cellular and determined that the migration would continue and create a need for home cellular cordless phones. Waxess USA currently offers its DM1000 (cell@home) product through various channels, including several of the major US carriers, and is working to bring its higher performance, lower cost next generation DM1500 and MAT1000 products out to the market. To date, Waxess USA has not generated material revenues or earnings as a result of its activities. As a result of the Merger, Waxess USA became a wholly-owned subsidiary of the Company and the Company succeeded to the business of Waxess USA as its sole line of business.

As used in this Current Report on Form 8-K, all references to “we,” “our” and “us” for periods prior to the closing of the Merger refer to Waxess USA, as a privately owned company, and for periods subsequent to the closing of the Merger refer to the Company and its subsidiaries (including Waxess USA).

Overview

We are a technology firm, located in Newport Beach, CA, that was incorporated in 2008 and develops and markets phone terminals capable of converging traditional landline, cellular and data services based on its patent portfolio. The business was started in 2004 by a group of ex-Uniden executives that observed the migration of landline subscribers to cellular would continue and create a need for home cellular cordless phones. Waxess currently offers its DM1000 (cell@home) product through various channels, including several of the major US carriers, and is working to bring its higher performance, lower cost next generation DM1500 and MAT1000 products out to the market.

Our Industry

Consumers Migrate to Mobile

The US market is in the midst of a migration from landline to wireless communications. Former landline consumers are moving to mobile and voice over internet protocol (VoIP) for their telephone service. However, many of the current residential landline subscribers are in areas with poor cellular coverage. We believe that these subscribers are potential customers. Until the landline business has completely faded, our products offer these landline customers a way to seamlessly move from landline to wireless. Our products converge landline and cellular technology on the same phone. We plan to expand our products to work with additional technologies currently being developed, including Wi-Max, WiFi mesh networks, and LTE (Long-Term Evolution, a step towards 4G with 100Mbps download speeds that is being invested in by Verizon and AT&T).

4

The transition to wireless continues to increase at a rapid pace. The increase in the transition is primarily the result of the low cost to add another cellular line, such as a $10 per month family plan, compared to $40 to $70 per month landline plan, or a $15 to $45 per month plan for VoIP. The move to wireless also lowers expenses to businesses where many of the calls originated from offices are made to cellular numbers. Another hurdle that has been removed is the ability of the consumer to move their landline number to a cellular carrier at no cost.

Health Concerns

While many users migrate to wireless for the lower cost, a continuing concern is the potential health problems that may arise from the prolonged usage of holding microwave emitting devices (cell phones) to your ear. As a result, the FCC has mandated cellular phones can transmit only 300mW to 400mW, with a Specified Area Radiation (SAR) allowance of 1.6W/kg. The combination of the two has caused a deterioration of cell phone quality in home and office buildings. With 60% of cellular phone calls placed inside buildings, the desire for better internal signals is a leading concern for subscribers, with 27% citing it as the reason they switched to a different wireless carrier. Our products have the cellular module built into the base, which allows the base unit to transmit at 2W, or roughly five times more power than is allowed by cellular phones, with the handsets transmitting only 50mW. Through this setup, we have seen a 6dB to 10dB increase in reception quality.

Carriers Push to Increase ARPU

The increasing competition over wireless subscribers has led to price decreases in voice services, which has driven carriers to seek ways to increase Average Revenue Per User (ARPU). The move from landline to wireless has helped add customers; however the addition of a landline replacement to an existing subscriber significantly increases the profitability per customer. The other push of carriers is to increase the usage of higher priced data plans, which allows subscribers to use mobile phones to complement or supplement the home computer. Our current DM1000 can be equipped with a data kit to download data from the cellular network to the subscribers’ home computer, enabling the terminal to replace both the home phone and the internet service. Our DM1500 and MAT1000 models will also offer enhanced capabilities for data connection/replacement.

Wireless Local Loop

Our products can be used as a Fixed Wireless Terminal (FWT) in international markets and as a voice and data solution for the Wireless Local Loop (WLL) market. WLL is the last mile solution for communications, using wireless transmissions in lieu of building an expensive copper infrastructure. WLL differs from traditional cell phones in that it is used in a fixed point, which allows the terminal to use a directional antenna instead of an omni-directional antenna required to roam. The directional antenna allows significantly improved voice quality and data transmission with the only tradeoff being the lack of roaming capability. A 2008 report by the Global Industry Analysts called for the WLL market to reach $7 billion globally, with the Asia region growing the fastest through 2015 at nearly 20% annually. Sales of FWT units are expected to reach 250 million units worldwide annually

Our Products

DM1000

For cellular customers seeking a solution to poor voice quality for in-building calls at work and at home, we have developed our first home cellular cordless telephone, the Dual Mode Communication Terminal (D mode CT), which is sold under the cell@home brand name. The phone looks like a conventional cordless telephone with multiple handsets, but comes with an embedded wireless module built into the base and a RJ11 jack for conventional landline service. These modules enable the DM1000 to be the first terminal that can be manually switched between cellular (GSM and CDMA networks) and landline services. The increased signal strength of the terminal is due to the 2W of power transmitting the signal from the base unit, or roughly five times what is legally allowed from traditional handheld cellular phones, with only 50mW being sent from the handset. The reduced transmission power from the handset also reduces potential health risks resulting from the microwave emission. We believe this dual feature offering will allow customers to gradually migrate from landline to wireless without needing to change their phones. When finally switching to cellular service in-home, the subscriber can take advantage of traditional cell phone features, such as SMS messaging from each phone. The terminal is also equipped with a patent pending RF signal delivery method that allows the phone to use PC phone services, such as Skype. An accessory data kit can also be attached to the base unit and a computer that enables the subscriber to have internet capabilities on their computer at speeds faster than dial-up connections. To date, we have sold roughly 10,000 GSM DM1000 units.

5

Our second generation terminal, the DM1500, will offer more integrated features than the DM1000, but use about half the parts and be priced at approximately half the amount of the DM1000. The terminal will have access to all cellular phone features, data and internet access and other add-on services, such as SLIC/fax. The unit will also feature a rechargeable battery for backup, a removable antenna and a USB jack to enable internet connection on a computer. We expect carriers will offer the unit free to subscribers as a result of the low price and hardware subsidies granted by the carriers to new subscribers. We believe this should speed the adoption of dropping traditional landline service and using a cellular number for exclusive in-home use, as well as increasing broadband access to all of the U.S., a program the government is helping fund. For wireless subscribers purchasing an all-inclusive plan, the DM1500 will enable the user to replace its landline, cable TV and internet services, as well as speed the adoption of the international WLL market. We expect this unit to be ready for carrier certification in the third quarter of this year and be available for purchase by late fourth quarter.

6

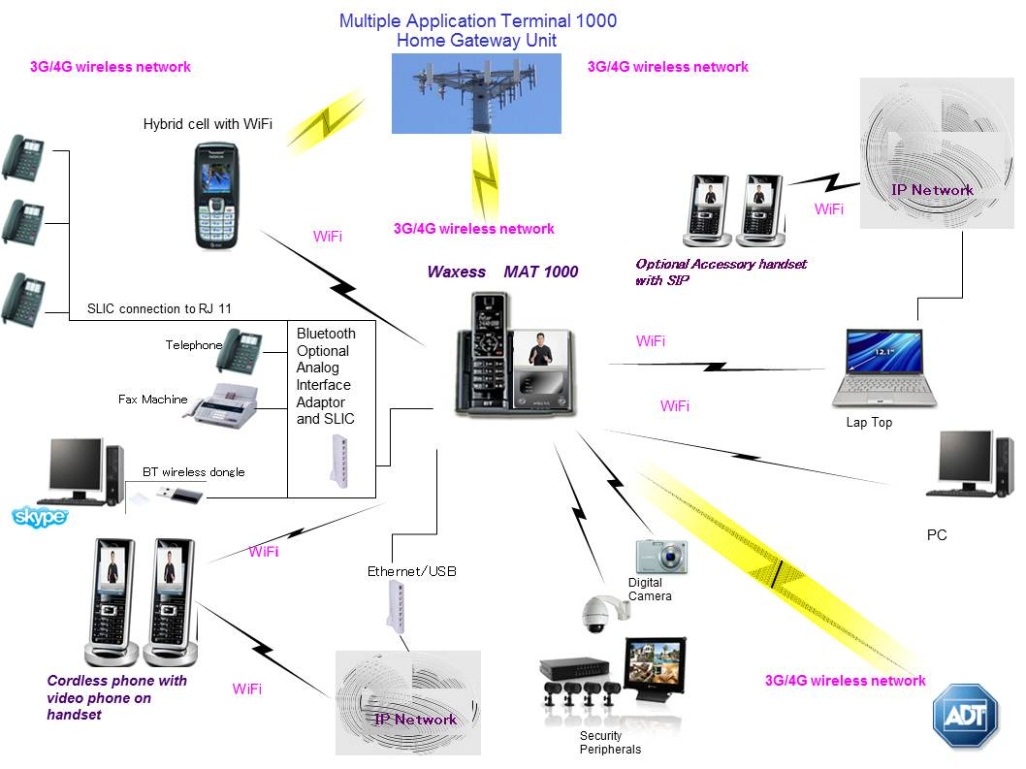

MAT1000

The next product we intend to develop is the Multiple Application High Speed Stationary Terminal (Home Gateway Terminal MAT1000). The MAT1000 is a high speed multiple services access terminal with WiFi technology that utilizes our patent pending wireless/VoIP data/voice bridge technology. In essence, the terminal will converge all of the products and services within a home, including appliances, televisions and security systems, and act as a data delivery hub to each wireless/cellular phone connected to it. For example, a cellular phone linked to the MAT1000 could dial the in-home terminal to take advantage of VoIP services that would currently be available only in the home. The unit will feature a touch screen with a QWERTY keyboard, video phone capabilities, and an amplified WiFi platform to enhance cordless handset voice and data quality. We are currently in discussion with a number of very large cellular companies for the MAT1000. We believe the MAT1000 will expand our customer base from cellular subscribers to VoIP carriers, LTE/WiMax 4G carriers, content and ISP providers and security companies. We are planning to have the MAT1000 ready for carrier certification in the first quarter of 2012 and available for purchase in third quarter of that year; however this timeline will depend in part on the speed of LTE/WiMax network buildup.

7

Manufacturing

We outsource our manufacturing to TCL Communication Equipment Co., Ltd. Due to carrier/customer demand, we are in the process of adding a second manufacturer. Waxess is currently in discussion with one of the world’s largest electronic manufacturing services (EMS) companies. We have also entered into a series of agreements with Olympus Business Creation America, Inc. (“Olympus”), pursuant to which Olympus finances purchases of inventory on our behalf based upon approved customer orders. We are then invoiced by Olympus for such purchases and required to remit payments in accordance with the terms of the agreement. Olympus receives a 5% trade commission on all inventory purchases. We have granted Olympus a security interest in certain of our intellectual property to secure such inventory purchases. In addition, our founder has given Olympus a personal guaranty with respect to the payment for such purchases. This arrangement with Olympus allows us to focus our working capital on supporting channel development efforts, with management expecting to keep four to six weeks of product on hand for immediate delivery needs. It also enables us to place our focus and capital on research and development, which should allow us to continue to develop new products that converge various types of telecomm products and services.

Customers

We are offering the DM1000 to carriers such as Verizon Wireless (VW), Sprint, AT&T, and other distributors primarily in the USA. The primary drive of our growth is expected to come from sales of our next generation telecommunication device, the DM1500, outside the USA. We are in discussions with significant telecommunications companies in China, South America, Brazil, Canada, and Africa. The success of the DM1500 is based on its anticipated competitive pricing, its uniqueness as a fixed wireless terminal with the world’s first multiple cordless cellular telephone handsets, and the cell-only features like SMS (“texting”). The Fixed Wireless terminal market resides everywhere in the country where conventional landline infrastructure is too expensive or the terrain of the location prohibits hardwire copper or fiber optics installation for communication service. The DM1500 can offer both voice and data service to these hard to get to areas of the country.

We believe our product slate will be well positioned to take advantage of this developing demand. The DM1500 will have the ability to download data from wireless networks and redistribute that data to PCs within the home and office environment. We believe the DM1500 will also address DSL and ADSL markets and assist wireless carriers in gaining additional subscribers through a landline replacement strategy and thereby increase ARPU.

In 2006, we signed a distribution agreement with Brightpoint, Inc. ("Brightpoint"), one of the world’s largest cellular distribution companies. Brightpoint offers activation services to distributors in various US channels, which will enable us to offer our products to customers including Best Buy, RadioShack, Walmart, QVC and HSN.

In March 2009, the DM1000 received certification from AT&T as part of their Choice Program. The DM1000 is currently being evaluated for AT&T’s Demo Equipment Program (DEP), which would allow AT&T to offer this product to groups such as the Federal Emergency Management Agency (FEMA) for emergency response.

In July 2010, we signed a Global Master Distribution and Services Agreement with Brightpoint. This agreement grants Brightpoint an exclusive right to distribute Waxess products globally. The agreement also provides for Brightpoint to support Waxess in the areas of logistics, financing and marketing. Brightpoint has also agreed to invest $1.5 million in Waxess.

We applied for VW Open Development Certification Program in March 2009 and received certification that our DM1000 is now network ready. We are shipping the newly certified DM1000 to VW indirect agents in July 2010. We are also in discussions with VW to promote their 4G service LTE in conjunction with the introduction of the DM1500 and our next generation device, the MAT1000.

We executed a Technical Partner Program Agreement with Sprint in 2009. Our DM1000 received network certification in March 2010. We are now able to market our cell@home terminals to our customers as a co-branded product such as “Waxess powered by Sprint PCS.” Because Sprint is a wireless service only carrier and has no affiliation with landline carriers, we believe they will be an ideal partner to promote porting landline numbers to Sprint wireless numbers for home communication.

We have begun the network certification process with T-Mobile’s Machine-to-Machine (M2M) group. Similar to Sprint PCS, T-Mobile has no landline business.

Since completing the development of our CDMA version of the DM1000 (DM1000C), we have begun promoting this product to CDMA carriers. We are also in discussions with certain carriers to sell the DM1000 product as a post-paid option for in-home use.

In April 2009, we signed a three-year purchase agreement with Ibratele in Brazil. This agreement grants Ibratele the exclusive right to market and sell our products in Brazil subject to certain conditions.

The Chinese government has provided certain carriers with large subsidies to provide communication services to Central and Western China. The Chinese government has announced that it is phasing out the Personal Handyphone System (PHS) by 2011. We believe that the DM1500 would be a viable replacement for the PHS used in the home.

Many African countries have limited landline infrastructure, which creates a high demand for battery backed wireless communication and data systems. In November 2009, Waxess signed a best efforts purchase agreement with Akwasoft in Ghana to sell 100,000 units of the DM1000 or DM1500.

8

Competition

|

Company

|

Product

|

Price

|

Product Type

|

Description

|

||||

| GE, Uniden, Panasonic, V Tech, RCA, Cell Socket, |

Bluetooth cordless telephone and Docking station

|

Varies from US$149.99 to $249.99

|

Docking cradle or docking interface connection for audio or Bluetooth profiling to BT enabled cellular phone

|

Audio transfer of cellular communication to home telephone or other communication equipment. It is only an accessory and no subsidy is involved and it does not help wireless carrier get another subscriber

|

||||

| Tellular and other fixed wireless terminal products such as Westech and Axesstel |

Fixed wireless phone or black box

|

$149 for the most inexpensive SLIC unit to $300 in price range |

Either black box with SLIC to feed wireless signals to home landline infrastructure or FTW with wired phone

|

It has a wireless module and so it is a net acquisition getter but it has to rely on home tel line and it can create a nightmare for service other than your own equipment. You have to program existing wired or cordless telephone or switch off tel line power outside home before use. No automatic switching from landline to cellular signals

|

||||

|

D link, Link System

|

VoIP adaptor and WiFi router etc

|

$49.99 for hardware, $39 to $49 for VoIP service and $10 a month plan and $300 or more for hybrid cellular phone with WiFi

|

Combination of existing available adaptor, router, and WiFi hybrid products |

A combination of different product from various manufacturer Customer service will be a nightmare without knowing exactly who is causing the problem.

|

||||

|

Samsung

|

Ubicell products

|

$245.00

|

Femtocell. A in home cellular booster and connectivity to internet VoIP |

Used for Sprint Airave and Verizon Wireless new Femtocell.

|

Femtocells

Femtocells use a broadband connection to create a small cellular base station that provides better indoor voice quality from mobile phones. The chief difference between femtocells and our products are that femtocells require a broadband connection while our products can bring in “free” internet service to the user.

Tellular - Offers several products that enable in-home voice and data applications through wireless networks. Its products allow traditional telephones to be connected to the wireless network and can be connected to a computer to access the cellular data service.

Sprint AIRAVE - Femtocell that works with Sprint CDMA handsets. The AIRAVE is available to Sprint customers at a price of $99.99.

Samsung Ubicell - This femtocell picks up mobile calls within 300 feet and seamlessly routes mobile calls to the cellular network via the internet, and transfers the calls back to the wireless network once the handset moves out of range from the unit. The Ubicell is available on Verizon CDMA and WCDMA networks, marketed as the Network Extender and sold for $199.99.

AT&T 3G Microcell - This femtocell picks up mobile calls within 5,000 square feet of the unit and seamlessly routes mobile calls to the cellular network via the internet, call to network when outside the Microcell range. The Microcell is available on AT&T networks at a price of $149.99.

T-Mobile@Home - Enables a standard home phone to be connected to the T-Mobile wireless router, which connects in-home calls through a broadband connection. The router allows for two SIM cards to be installed, thereby allowing two mobile lines to be added. The router is sold for $149.99 and requires a $10 per month line to be added to your mobile plan.

MagicJack - Broadband-based plug-in that allows traditional telephones to be connected to a computer with broadband service. The VoIP system costs $40, plus $20 per year for unlimited phone calls.

Mobile Broadband

Mobile broadband plans are available through all major cellular carriers, with the majority of the offerings being a USB plug-in or PC Card. The attachments provide mobile broadband to computers using each carrier’s 3G/4G networks. Each unit retails between $129.99 and $349.99, with most available to new subscribers at no cost to $99.99, with the signing of a two-year plan. The monthly charge for mobile broadband ranges from $39.99 to $59.99 for 5GB of monthly data. With the addition of a data plan on a mobile phone, broadband service can be used on a laptop or desktop computer at no additional charge and can be used wherever wireless service is available .

9

Government Regulation

Pursuant to its authority under the Communications Act of 1934, as amended (the “Communications Act”), the FCC regulates the licensing, construction, modification, operation, ownership, sale and interconnection of wireless communications systems, as do some state and local regulatory agencies. Congress also periodically revises or enacts laws affecting the telecommunications industry, as do state legislatures. Decisions by these bodies could have a significant impact on the competitive market structure among wireless providers and on the relationships between wireless providers and other carriers. These mandates may also impose significant financial, operational or service obligations on us and other wireless providers. We are unable to predict the scope, pace or financial impact of legal or policy changes that could be adopted in these proceedings.

Intellectual Property

We own or are applying for the following patents:

|

US Patent No./ Application No.

|

Issue Date / Application Date

|

Title

|

Description

|

|

|

6,766,175

|

Issued: 07/20/04

|

Cordless and Wireless Telephone Docking Station

|

This patent describes a method to combine wireless (cellular) telephone and a cordless telephone in one system without complex wiring or embedded into a larger system.

|

|

|

6,987,988

|

Issued: 01/17/06

|

Cordless and Wireless Telephone Interface and Switching Mode

|

A system that combines wireless (cellular) phone, cordless telephone and PSTN landline telephone system in one integrated system which allows connectivity to each system and how the electric switching is performed.

|

|

|

7,072,675

|

Issued: 07/04/06

|

Wireless System and Method for Multiple Handset Cordless Telephone System

|

This is a method outlined to combine a wireless (cellular) phone and a multiple handset cordless telephone system. This system receives voice and data from the wireless telephone. A control unit manages the interconnectivity of the TX/RX units and speakerphone. The TX/RX units communicate with multiple cordless handsets.

|

|

|

11/141.819

|

Filed: 06/01/05

|

Dual Mode Communication and Method

|

A full description of D mode CT products where cellular signal is received from wireless carrier and how its AT Commands for all functionality are transformed to a cordless telephone CPU to perform as a cellular cordless telephone. It also teaches how an automatic switching is done between PSTN and wireless service and how they are combined to perform as a full two line system.

|

|

|

11/234.297

|

Filed: 09/23/05

|

Cordless Telephone with Internet Connectivity

|

Describes how the paging function of a cordless telephone is used to transfer audio from an internet phone (such as Skype) from a PC to cordless telephone handsets and how dialing out and call receiving is performed on a cordless handset.

|

|

|

11/542.804

|

Filed: 10/04/06

|

Internet Telephone Bridge and its Method

|

Describes how voice and data from one service is transported in its full capacity to another service. This function enables (Waxess) hardware to perform as a home relay device and thereby making cellular connection seamlessly transported to VoIP and vice versa. This bridging renders and cellular telephone and cellular coverage and extension of the subscribers VoIP service and subscribers

|

|

|

11/593.725

|

Filed: 11/07/06

|

Wireless, Cordless, Internet Telephone Method

|

Further details how cellular, VoIP and other methods of delivery are intertwined within hardware and how the traffic is performed among those services.

|

We also license the following patents from one of our shareholders:

|

US Patent No./ Application No.

|

Issue Date / Application Date

|

Title

|

Description

|

|||

|

7,010,311

|

Issued: 03/07/06

|

Wireless Node Multiple Handset Cordless Telephone

|

A wireless and cordless telephone node system. The system includes a node with a wireless transceiver that communicates wireless signals with a wireless network and a cordless transceiver that communicates cordless signals with multiple cordless terminal units. A switch routes calls between the wireless network and the multiple cordless terminals. A variety of cordless terminals are provided that emulate conventional corded telephones, cordless telephones and wireless telephones. The wireless node is designed for both fixed and portable operation.

|

|||

|

7,146,180

|

Issued: 12/05/06

|

Wireless Node Multiple Handset Cordless Telephone

|

A wireless and cordless telephone node system. The system includes a node with a wireless transceiver that communicates wireless signals with a wireless network, a cordless transceiver that communicates cordless signals with multiple cordless terminal units, and one or more landline interfaces that couple metallically with the PSTN. A switch routes calls between the landlines, wireless network and the multiple cordless terminals. A subscriber identity module and card interface is provided for control of wireless account user data. A variety of cordless terminals are provided that emulate conventional corded telephones, cordless telephones and wireless telephones. The wireless node is designed for both fixed and portable operation.

|

10

We believe that our patent portfolio covers our technology, including the use of AC electricity to power a wireless-cellular base station, the use of wireless modules in a base unit that broadcasts on a regular cordless module, and the convergence of VoIP onto a wireless-cellular phone. The two patents above, licensed from Frank Liu, call for us to pay a 2% license fee on each terminal sold.

We are working with a third party on an exclusive purchase agreement for a data access chip, which may provide a barrier to entry of this market.

Research & Development

The Company outsources a majority of its research and development to IDY Corporation in Japan, which focuses on integrating various products and services onto to one wireless-based platform. The remaining research and development work is done internally primarily to develop the software and modules. Research and development costs for 2009 and 2008 totaled $79,084 and $109,579, respectively.

Properties

The Company leases 2,238 square feet of office space at 1401 Dove Street, Suite 220, Newport Beach, CA 92660 for $4,118 per month. The lease expires on June 30, 2012. The Company believes the facilities to be adequate for its needs in the near future.

Employees

As of February 4, 2011, we employed approximately 11 full-time employees, none of which are represented by labor unions. We believe that our relationship with our employees is satisfactory, but there can be no assurances that we will not experience labor strikes or disturbances in the future.

Legal Proceedings

We are not involved in any pending legal proceeding or litigations and, to the best of our knowledge, no governmental authority is contemplating any proceeding to which we are a party or to which any of our properties is subject, which would reasonably be likely to have a material adverse effect on the Company.

This Current Report on Form 8-K and other written and oral statements made from time to time by us may contain so-called “forward-looking statements,” all of which are subject to risks and uncertainties. Forward-looking statements can be identified by the use of words such as “expects,” “plans,” “will,” “forecasts,” “projects,” “intends,” “estimates,” and other words of similar meaning. One can identify them by the fact that they do not relate strictly to historical or current facts. These statements are likely to address our growth strategy, financial results and product and development programs. One must carefully consider any such statement and should understand that many factors could cause actual results to differ from our forward looking statements. These factors may include inaccurate assumptions and a broad variety of other risks and uncertainties, including some that are known and some that are not. No forward looking statement can be guaranteed and actual future results may vary materially.

Information regarding market and industry statistics contained in this Report is included based on information available to us that we believe is accurate. It is generally based on industry and other publications that are not produced for purposes of securities offerings or economic analysis. We have not reviewed or included data from all sources, and cannot assure investors of the accuracy or completeness of the data included in this Report. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and the additional uncertainties accompanying any estimates of future market size, revenue and market acceptance of products and services. We do not assume any obligation to update any forward-looking statement. As a result, investors should not place undue reliance on these forward-looking statements.

11

This discussion should be read in conjunction with the other sections of this Current Report on Form 8-K, including “Risk Factors,” “Description of Our Business” and the Financial Statements attached hereto as Item 9.01 and the related exhibits. The various sections of this discussion contain a number of forward-looking statements, all of which are based on our current expectations and could be affected by the uncertainties and risk factors described throughout this Report as well as other matters over which we have no control. See “Forward-Looking Statements.” Our actual results may differ materially.

Overview

We are a technology firm, located in Newport Beach, CA, that was incorporated in 2008 and develops and markets phone terminals capable of converging traditional landline, cellular and data services based on its patent portfolio. The business was started in 2004 by a group of ex-Uniden executives that observed the migration of landline subscribers to cellular would continue and create a need for home cellular cordless phones. Waxess currently offers its DM1000 (cell@home) product through various channels, including several of the major US carriers, and is working to bring its higher performance, lower cost next generation DM1500 and MAT1000 products out to the market.

Results of Operations

Three Months Ended September 30, 2010 Compared to the Three Months Ended September 30, 2009

Gross revenues for the three months ended September 30, 2010 were $303,063, compared to $139,419 for the three months ended September 30, 2009. The increase of $163,644 or 54% was primarily due to the introduction of the CDMA version of the DM1000 during September 2010.

Gross margin as a percentage of sales during the three months ended September 30, 2010 was 3% of sales, compared to 17% of sales for the three months ended September 30, 2009. The decrease was primarily due to product returns from two customers for software reprogramming. The reprogrammed product is currently being resold. The Company also incurred higher than normal freight charges resulting from air shipping product into the United States from China to meet customer shipping requirements.

Operating expenses for the three months ended September 30, 2010 were $748,836, compared to $198,935 for the three months ended September 30, 2009. The increase of $549,901 or 73% was primarily due to an increase in research and development spending as the Company commenced development of its second generation product, the DM1500, increased labor costs associated with new hires, and costs attributable to the Merger and the associated fundraising activities including travel, agent fees, legal and accounting. The resulting net loss for the three months ended September 30, 2010 was $778,316, compared with a loss of $175,427 for the three months ended September 30, 2009, a $602,889 or 77% increase in loss.

Nine Months Ended September 30, 2010 Compared to Nine Months Ended September 30, 2009

Gross revenues for the nine months ended September 30, 2010 were $306,997, compared to $145,699 for the nine months ended September 30, 2009. The increase of $161,298 or 111% was primarily due to the introduction of the CDMA version of the DM1000 during September.

Gross margin as a percentage of sales during the nine months ended September 30, 2010 was 3%, compared to 20% for the nine months ended September 30, 2009. The decrease was primarily due to product returns from two customers for software reprogramming. The reprogrammed product is currently being resold. The Company also incurred higher than normal charges from air shipping product from China to meet customer shipping requirements.

Operating expenses for the nine months ended September 30, 2010 were $2,586,712, compared to $750,339 for the nine months ended September 30, 2009. The increase of $1,836,373 or 245% was primarily due to an increase in research and development spending as the Company commenced development of its second generation product, the DM1500, increased labor costs associated with new hires, and costs attributable to the Merger and the associated fundraising activities including travel, agent fees, legal and accounting. The resulting net loss for the nine months ended September 30, 2010 was $2,743,200 compared to a net loss of $720,551 for the nine months ended September 30, 2009, an increase in loss of $2,022,649 or 281%.

Year Ended December 31, 2009 Compared to the Year Ended December 31, 2008

Gross revenues for the years ended December 31, 2009 and December 31, 2008 approximated $148,000. Gross margins as a percentage of revenue the year ended December 31, 2009 were 21%, compared to 23% for the year ended December 31, 2008 resulting from offering higher product discounts.

Operating expenses for the year ended December 31, 2009 were $993,356 compared to $675,847 for the year ended December 31, 2008. The increase of $317,509 or 47% was primarily attributable to share based compensation provided to the Company’s founder. The resulting net loss for the year ended December 31, 2009 was $1,025,951, compared to $810,470 for the year ended December 31, 2008, an increase in loss of $215,481 or 27%.

Liquidity and Capital Resources

As of September 30, 2010, cash was $133,310, an increase of $37,388 from September 30, 2009. For the nine months ended September 30, 2010, cash from operations decreased $2,819,299. The decrease was primarily due to operating losses and an increase in inventory levels. During the nine months ended September 30, 2010, we sold convertible notes of varying denominations, which resulted in proceeds totaling $2,510,000. During the nine months ended September 30, 2010 we sold 316,230 shares of common stock for $650,055. These proceeds were used to fund the development and commercialization of our first and second generation products. In July, we retired a note payable to the founder for $120,000.

12

Off-Balance Sheet Arrangements

Since our inception, except for standard operating leases, we have not engaged in any off-balance sheet arrangements, including the use of structured finance, special purpose entities or variable interest entities.

Critical Accounting Policies and Estimates

Those material accounting policies that we believe are the most critical to an investor’s understanding of our financial results and condition are discussed below.

Revenue Recognition. We derive revenue from sale of wireless communication devices. Revenue is generally recognized at the time of shipment; however, the timing of revenue recognition and the amount of revenue actually recognized depends upon a variety of factors, including the specific terms of each arrangement and the nature of our deliverables and obligations. Determination of the appropriate amount of revenue recognized involves judgments and estimates that we believe are reasonable, but actual results may differ from our estimates. We record reductions to revenue for customer incentive programs and other volume-related rebate programs.

Valuation of Intangible Assets. At September 30, 2010 and 2009, we had intangible assets, net of accumulated amortization, of $182,238. The determination of the value of such intangible assets requires management to make estimates and assumptions that affect our financial statements. Valuation techniques consistent with the market approach, income approach and/or cost approach are used to measure fair value. An estimate of fair value can be affected by many assumptions which require significant judgment. Our estimate of the fair value of certain assets may differ materially from that determined by others who use different assumptions or utilize different business models. New information may arise in the future that affects our fair value estimates and could result in adjustments to our estimates in the future, which could have an adverse impact on our results of operations.

We assess potential impairments to intangible assets when there is evidence that events or changes in circumstances indicate that the carrying amount of an asset or asset group may not be recoverable. Our judgments regarding the existence of impairment indicators and future cash flows related to intangible assets are based on operational performance of our businesses, market conditions and other factors. Although there are inherent uncertainties in this assessment process, the estimates and assumptions we use, including estimates of future cash flows, volumes, market penetration and discount rates, are consistent with our internal planning. If these estimates or their related assumptions change in the future, we may be required to record an impairment charge on all or a portion of our intangible assets.

Share-Based Compensation. Share-based compensation expense recognized during the nine months ended 2010 and 2009 was $243,501 and 304,746, respectively. Share-based compensation is measured at the grant date based on the fair value of the award and is recognized as expense over the requisite service period. We generally estimate the value of stock option awards using a lattice binomial option-pricing model. Accordingly, the fair value of an option award as determined using an option-pricing model is affected by our stock price on the date of grant as well as assumptions regarding a number of complex and subjective variables. These variables include, but are not limited to, our expected stock price volatility over the term of the awards, actual and projected employee stock option exercise behaviors, risk-free interest rates and expected dividends. For purposes of estimating the fair value of stock options, we used the implied volatility of market-traded options in our stock for the expected volatility assumption input to the binomial model. The assumption inputs related to employee exercise behavior include estimates of the post-vest forfeiture rate and suboptimal exercise factors, which are based on historical experience. In addition, judgment is required in estimating the amount of share-based awards that are expected to be forfeited. We estimate the forfeiture rate based on historical experience. To the extent our actual forfeiture rate is different from our estimate, share-based compensation expense is adjusted accordingly.

Income Taxes. The Company periodically evaluates the likelihood of the realization of deferred tax assets, and adjusts the carrying amount of the deferred tax assets by a valuation allowance to the extent the future realization of the deferred tax assets is not judged to be more likely than not. The Company considers many factors when assessing the likelihood of future realization of our deferred tax assets, including recent cumulative earnings experience by taxing jurisdiction, expectations of future taxable income or loss, the carry-forward periods available to us for tax reporting purposes, and other relevant factors. At September 30, 2010, based on the weight of available evidence, including cumulative losses in recent years and expectations of future taxable income, the Company determined that it was more likely than not that its deferred tax assets would not be realized. Accordingly, the Company has recorded a valuation allowance equivalent to 100% of its cumulative deferred tax assets. Future changes in uncertain tax positions are not expected to have an impact on the effective tax rate due to the existence of the valuation allowance. The Company will continue to classify income tax penalties and interest, if any, as part of interest and other expenses in its statements of operations. The Company has incurred no interest or penalties as of September 30, 2010.

Recently Issued Accounting Pronouncements

Accounting standards promulgated by the FASB change periodically. Changes in such standards may have an impact on the Company’s future financial statements. For the Company’s analysis and impact of these accounting standards please see Note 1: Summary of Significant Accounting Policies in our September 30, 2010 and December 31, 2009 and 2008 financial statements.

13

There are numerous and varied risks, known and unknown, that may prevent us from achieving our goals. If any of these risks actually occur, our business, financial condition or results of operation may be materially adversely affected. In such case, the trading price of our common stock could decline and investors could lose all or part of their investment.

Risks Relating to Our Business

Since we have a limited operating history, it is difficult for potential investors to evaluate our business.

Our founders commenced our current business in August 2004 and incorporated in 2008. Our limited operating history makes it difficult for potential investors to evaluate our business or prospective operations. Since our formation, we have generated only limited and sporadic revenues. As an early stage company, we are subject to all the risks inherent in the initial organization, financing, expenditures, complications and delays inherent in a new business. Investors should evaluate an investment in us in light of the uncertainties encountered by developing companies in a competitive environment. Our business is dependent upon the implementation of our business plan. There can be no assurance that our efforts will be successful or that we will ultimately be able to attain profitability.

We may need additional financing to execute our business plan and fund operations, which additional financing may not be available on reasonable terms or at all.

We have limited funds even with proceeds from the sale of the Bridge Notes and may not be able to execute our current business plan and fund business operations long enough to achieve profitability. Our ultimate success may depend upon our ability to raise additional capital. There can be no assurance that additional funds will be available when needed from any source or, if available, will be available on terms that are acceptable to us.

We may be required to pursue sources of additional capital through various means, including joint venture projects and debt or equity financings. Future financings through equity investments are likely to be dilutive to existing stockholders. Also, the terms of securities we may issue in future capital transactions may be more favorable for our new investors. Newly issued securities may include preferences, superior voting rights, the issuance of warrants or other derivative securities, and the issuances of incentive awards under equity employee incentive plans, which may have additional dilutive effects. Further, we may incur substantial costs in pursuing future capital and/or financing, including investment banking fees, legal fees, accounting fees, printing and distribution expenses and other costs. We may also be required to recognize non-cash expenses in connection with certain securities we may issue, such as convertible notes and warrants, which will adversely impact our financial condition.

Our ability to obtain needed financing may be impaired by such factors as the capital markets, both generally and specifically in our industry, and the fact that we are not profitable, which could impact the availability or cost of future financings. If the amount of capital we are able to raise from financing activities, together with our revenues from operations, is not sufficient to satisfy our capital needs, even to the extent that we reduce our operations accordingly, we may be required to cease operations.

It may be costly and difficult to enforce our intellectual property rights.

Our success will depend on our ability to: (i) obtain patents for product technologies and manufacturing methodologies; (ii) defend patents once applied for and obtained; (iii) maintain trade secrets; and (iv) operate without infringing the intellectual property rights of others, both in the United States and foreign countries. Patent positions can be uncertain and involve complex legal and factual issues for which the legal principles remain largely unresolved. We cannot promise that our patents will not be challenged, invalidated, or circumvented. Potential competitors have filed patents in areas related to our research. We may need to expend funds to litigate to defend or enforce our patents against others. It may be difficult for us to obtain and enforce worldwide patent protection because of the cost and legal issues attendant with obtaining patents in each country. Changes in the laws pertaining to the life of a patent may also have an adverse effect on our intellectual property rights.

Our industry is subject to rapid technological change, and we must make substantial investments in new products, services and technologies to compete successfully.

New technological innovations generally require a substantial investment before they are commercially viable. We intend to continue to make substantial investments in developing new products and technologies, and it is possible that our development efforts will not be successful and that our new technologies will not result in meaningful revenues. Our future success will depend on our ability to continue to develop and introduce new products, technologies and enhancements on a timely basis. Our future success will also depend on our ability to keep pace with technological developments, protect our intellectual property, satisfy customer requirements, meet consumer expectations, price our products and services competitively and achieve market acceptance. The introduction of products embodying new technologies and the emergence of new industry standards could render our existing products and technologies, and products and technologies currently under development, obsolete and unmarketable. If we fail to anticipate or respond adequately to technological developments or customer requirements, or experience any significant delays in development, introduction or shipment of our products and technologies in commercial quantities, demand for our products and our customers’ and licensees’ products that use our technologies could decrease, and our competitive position could be damaged.

Competitive pricing could adversely affect our profits.

Profits suggested by our business plan will attract competitive attention. We already face competition in the consumer electronics space from companies that probably have lower fixed and marginal costs than we have. We expect competitors to challenge our patent estate, invent similar products, and introduce product substitutes. There is no assurance that our competitors will not develop more effective or affordable technology in an earlier or more efficient manner. The possibility exists that others may develop more cost effective products and/or processes without effective products. To the extent that our products threaten competitor’s offerings, these competitors can be expected to engage in price-cutting to protect traditional markets. Many of our potential competitors have significantly greater financial and technical resources, and established sales and marketing teams than we do.

14

Defects or errors in our products and services or in products made by our suppliers could harm our relations with our customers and expose us to liability. If we experience product recalls, we may incur significant expenses and experience decreased demand for our products.

Our products are inherently complex and may contain defects and errors that are detected only when the products are in use. The design process interface issues are more complex as we enter into new domains of technology, which adds risk to yields and reliability. Because our products are used for both personal and business purposes, such defects or errors could have a serious impact on our end customers, which could damage our reputation, harm our customer relationships and expose us to liability. Defects or impurities in our components, materials or software, equipment failures or other difficulties could adversely affect our ability, and that of our customers, to ship products on a timely basis as well as customer or licensee demand for our products. Any such shipment delays or declines in demand could reduce our revenues and harm our ability to achieve or sustain desired levels of profitability. We and our customers may also experience component or software failures or defects that could require significant product recalls, rework and/or repairs that are not covered by warranty reserves.

If we are unable to attract and retain qualified employees, it would adversely impact our business.

Our future success depends largely upon the continued service of our board members, executive officers and other key management and technical personnel. Our success also depends on our ability to continue to attract, retain and motivate qualified personnel. In addition, implementing our product and business strategy requires specialized engineering and other talent, and our revenues are highly dependent on technological and product innovations. The market for such specialized engineering and other talented employees in our industry is extremely competitive. In addition, existing immigration laws make it more difficult for us to recruit and retain highly skilled foreign national graduates of U.S. universities, making the pool of available talent even smaller. Key employees represent a significant asset, and the competition for these employees is intense in the wireless communications industry. In the event of a labor shortage, or in the event of an unfavorable change in prevailing labor and/or immigration laws, we could experience difficulty attracting and retaining qualified employees. We continue to anticipate increases in human resource needs, particularly in engineering. If we are unable to attract and retain the qualified employees that we need, our business may be harmed. We may have particular difficulty attracting and retaining key personnel in periods of poor operating performance given the significant use of incentive compensation by our competitors. Although we intend to in the near future, we currently do not have employment agreements with our key management personnel and do not maintain key person life insurance on any of our personnel. To the extent that new regulations make it less attractive to grant share-based awards to employees or if stockholders do not authorize shares for the continuation of equity compensation programs in the future, we may incur increased compensation costs, change our equity compensation strategy or find it difficult to attract, retain and motivate employees, each of which could materially and adversely affect our business.

We depend upon a limited number of third-party suppliers to manufacture and test component parts, subassemblies and finished goods for our products. If these third-party suppliers do not allocate adequate manufacturing and test capacity in their facilities to produce products on our behalf, or if there are any disruptions in the operations, or the loss, of any of these third parties, it could harm our ability to meet our delivery obligations to our customers, reduce our revenues, increase our cost of sales and harm our business.

A supplier’s ability to meet our product manufacturing demand is limited mainly by its overall capacity and current capacity availability. Our ability to meet customer demand depends, in part, on our ability to obtain timely and adequate delivery of parts and components from our suppliers. A reduction or interruption in our product supply source, an inability of our suppliers to react to shifts in product demand or an increase in component prices could have a material adverse effect on our business or profitability. Component shortages could adversely affect our ability and that of our customers to ship products on a timely basis and, as a result, our customers’ demand for our products. Any such shipment delays or declines in demand could reduce our revenues and harm our ability to achieve or sustain desired levels of profitability. Additionally, failure to meet customer demand in a timely manner could damage our reputation and harm our customer relationships. Our operations may also be harmed by lengthy or recurring disruptions at any of our suppliers’ manufacturing facilities and by disruptions in the distribution channels from our suppliers and to our customers. Any such disruptions could cause significant delays in shipments until we are able to shift the products from an affected manufacturer to another manufacturer. If the affected supplier was a sole-source supplier, we may not be able to obtain the product without significant cost and delay. The loss of a significant third-party supplier or the inability of a third-party supplier to meet performance and quality specifications or delivery schedules could harm our ability to meet our delivery obligations to our customers and negatively impact our revenues and business operations.

Our suppliers may place us on raw material allocation in the event that there are limited supplies of the raw materials that we use in our products.

Our contract manufacturers may place us on an allocation due to limited availability of raw materials. In this event, the supplier could elect to allocate raw materials and manufacturing capacity to others and reduce deliveries to us to our detriment. We cannot guarantee that the actions of our suppliers will not cause disruptions in our operations that could harm our ability to meet our delivery obligations to our customers or increase our cost of sales.

We may engage in acquisitions or strategic transactions or make investments that could result in significant changes or management disruption and fail to enhance stockholder value.

From time to time, we may engage in acquisitions or strategic transactions or make investments with the goal of maximizing stockholder value. We may acquire businesses; enter into joint ventures or other strategic transactions and purchase equity and debt securities, including minority interests in publicly-traded and private companies, non-investment-grade debt securities, equity and debt mutual and exchange-traded funds, and corporate bonds/notes. Some of our strategic investments may entail a high degree of risk and will not become liquid until more than one year from the date of investment, if at all. Our acquisitions or strategic investments (either those we have completed or may undertake in the future) may not generate financial returns or result in increased adoption or continued use of our technologies. In addition, our other investments may not generate financial returns or may result in losses due to market volatility, the general level of interest rates and inflation expectations. In some cases, we may be required to consolidate or record our share of the earnings or losses of those companies. Our share of any losses will adversely affect our financial results until we exit from or reduce our exposure to these investments. Achieving the anticipated benefits of acquisitions depends in part upon our ability to integrate the acquired businesses in an efficient and effective manner. The integration of companies that have previously operated independently may result in significant challenges, and we may be unable to accomplish the integration smoothly or successfully. We cannot assure you that the integration of acquired businesses with our business will result in the realization of the full benefits anticipated by us to result from the acquisition. We may not derive any commercial value from the acquired technology, products and intellectual property or from future technologies and products based on the acquired technology and/or intellectual property, and we may be subject to liabilities that are not covered by indemnification protection we may obtain.

15

If we are unable to manage future expansion effectively, our business, operations and financial condition may suffer significantly, resulting in decreased productivity.

If our products prove to be commercially valuable, it is likely that we will experience a rapid growth phase that could place a significant strain on our managerial, administrative, technical, operational and financial resources. Our organization, procedures and management may not be adequate to fully support the expansion of our operations or the efficient execution of our business strategy. If we are unable to manage future expansion effectively, our business, operations and financial condition may suffer significantly, resulting in decreased productivity.

We are subject to the risks of conducting business outside the United States.

A significant part of our strategy involves our continued pursuit of growth opportunities in a number of international market locations. We market, sell and service our products internationally. We expect to continue to expand our international sales operations and to sell products in additional countries and locations. This expansion will require significant management attention and financial resources to successfully develop direct and indirect international sales and support channels, and we cannot assure you that we will be successful or that our expenditures in this effort will not exceed the amount of any resulting revenues. If we are not able to maintain or increase international market demand for our products and technologies, we may not be able to maintain a desired rate of growth in our business. We believe that the wireless markets in China and India, among others, represent growth opportunities for us. If wireless operators in China or India, or the governments of China or India, make technology deployment or other decisions that result in actions that are adverse to the expansion of our technologies, our business could be harmed. We are subject to risks in certain global markets in which wireless operators provide subsidies on wireless device sales to their customers. Increases in device prices that negatively impact device sales can result from changes in regulatory policies related to device subsidies.

Our earnings are subject to substantial quarterly and annual fluctuations and to market downturns.

Our revenues and earnings may fluctuate significantly in the future. General economic or other political conditions may cause a downturn in the market for our products or technology. Despite the recent improvements in market conditions, a future downturn in the market for our products or technology could adversely affect our operating results and increase the risk of substantial quarterly and annual fluctuations in our earnings. Any prolonged credit crisis or currency crisis may result in the insolvency of key suppliers resulting in product delays; delays in reporting and/or payments from our distributors; the inability of our customers to obtain credit to finance purchases of our products; customer insolvencies that impact our customers’ ability to pay us and cause our customers to change delivery schedules, cancel committed purchase orders or reduce purchase order commitment projections; uncertainty in global economies, which could impact demand for our products in various regions; counterparty failures negatively impacting our treasury operations; and the inability to utilize federal and/or state capital loss carryovers. Our future operating results may be affected by many factors, including, but not limited to: our ability to retain existing or secure anticipated customers, both domestically and internationally; our ability to develop, introduce and market new products and services on a timely basis; management of inventory by us and our customers and their customers in response to shifts in market demand; changes in the mix of products developed, produced and sold; seasonal customer demand; and disputes with our customers. These factors affecting our future earnings are difficult to forecast and could harm our quarterly and/or annual operating results.

Compliance with changing regulation of corporate governance and public disclosure may result in additional expenses.

Changing laws, regulations and standards relating to corporate governance and public disclosure may create uncertainty regarding compliance matters. New or changed laws, regulations and standards are subject to varying interpretations in many cases. As a result, their application in practice may evolve over time. We are committed to maintaining high standards of corporate governance and public disclosure. Complying with evolving interpretations of new or changed legal requirements may cause us to incur higher costs as we revise current practices, policies and procedures, and may divert management time and attention from revenue generating to compliance activities. If our efforts to comply with new or changed laws, regulations and standards differ from the activities intended by regulatory or governing bodies due to ambiguities related to practice, our reputation might also be harmed.

|

Risks Relating to Our Industry

|

Government regulation and policies of industry standards bodies may adversely affect our business.

Our products are subject to various regulations, including FCC regulations in the United States and other international regulations, as well as the specifications of national, regional and international standards bodies. Changes in the regulation of our activities, including changes in the allocation of available spectrum by the United States government and other governments, or exclusion or limitation of our technology or products by a government or standards body, could have a material adverse effect on our business, operating results, liquidity and financial position.

If wireless devices pose safety risks, we may be subject to new regulations, and demand for our products and those of our licensees and customers may decrease.

Concerns over the effects of radio frequency emissions, even if unfounded, may have the effect of discouraging the use of wireless devices, which may decrease demand for our products and those of our licensees and customers. In recent years, the FCC and foreign regulatory agencies have updated the guidelines and methods they use for evaluating radio frequency emissions from radio equipment, including wireless phones and other wireless devices. In addition, interest groups have requested that the FCC investigate claims that wireless communications technologies pose health concerns and cause interference with airbags, hearing aids and medical devices. Concerns have also been expressed over the possibility of safety risks due to a lack of attention associated with the use of wireless devices while driving. Any legislation that may be adopted in response to these expressions of concern could reduce demand for our products and those of our licensees and customers in the United States as well as foreign countries.

16

Global economic conditions that impact the wireless communications industry could negatively affect our revenues and operating results.

Despite the recent improvements in market conditions, a future decline in global economic conditions could have adverse, wide-ranging effects on demand for our products and for the products of our customers. We cannot predict other negative events that may have adverse effects on the economy, on demand for wireless device products or on wireless device inventories and wireless operators. Inflation and/or deflation and economic recessions that adversely affect the global economy and capital markets also adversely affect our customers and our end consumers. For example, our customers’ ability to purchase or pay for our products and services, obtain financing and upgrade wireless networks could be adversely affected, leading to cancellation or delay of orders for our products. Also, our end consumers’ standards of living could be lowered, and their ability to purchase wireless devices based on our technology could be diminished. Inflation could also increase our costs of raw materials and operating expenses and harm our business in other ways, and deflation could reduce our revenues if product prices fall. Any of these results from worsening global economic conditions could negatively affect our revenues and operating results. Because we intend to continue to make significant investments in research and development and to maintain extensive ongoing customer service and support capability, any decline in the rate of growth of our revenues will have a significant adverse impact on our operating results.

Risks Relating to our Organization and our Common Stock

As a result of the Merger, Waxess USA became a subsidiary of ours and since we are subject to the reporting requirements of federal securities laws, this can be expensive and may divert resources from other projects, thus impairing its ability grow.

As a result of the Merger, Waxess USA became a subsidiary of ours and, accordingly, is subject to the information and reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and other federal securities laws, including compliance with the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”). The costs of preparing and filing annual and quarterly reports, proxy statements and other information with the SEC (including reporting of the Merger) and furnishing audited reports to stockholders will cause our expenses to be higher than they would have been if Waxess USA had remained privately held and did not consummate the Merger.