Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SmartStop Self Storage, Inc. | d8k.htm |

hosted by:

H. Michael Schwartz

Chairman and CEO

Exhibit 99.1 |

Agenda

Portfolio Update

Acquisition Update

Branding Update

Technology Update |

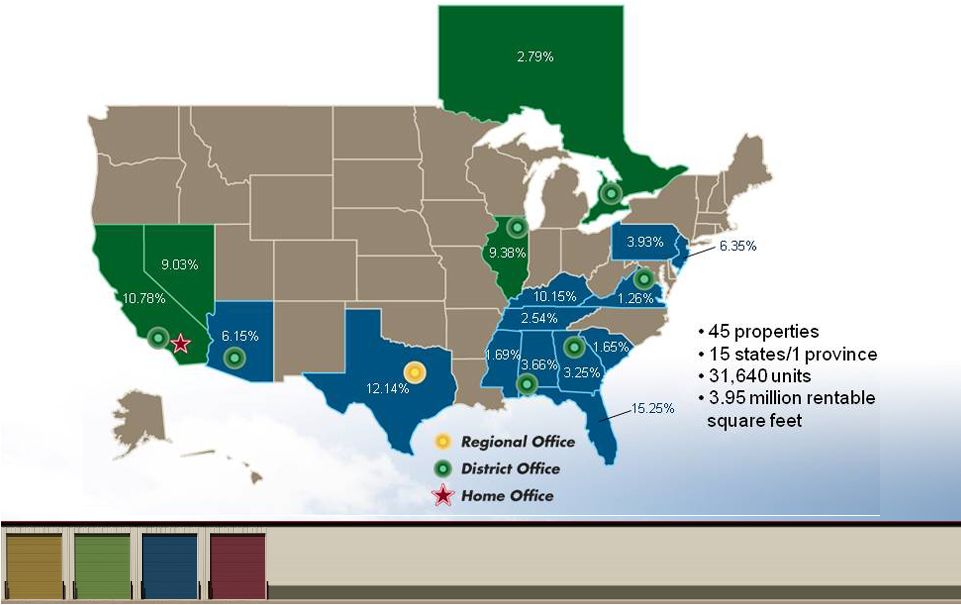

Portfolio Update

Properties:

45

Number of Tenants:

23,576

Net Rentable:

3,949,500 square feet

Total Units:

31,640

Portfolio Update

(as of 12/31/2010) |

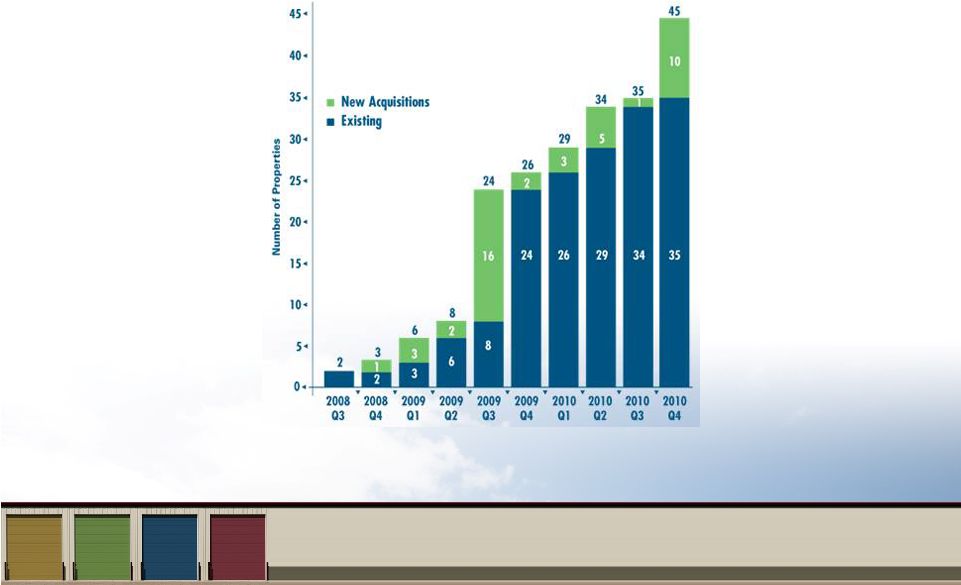

Wholly Owned Properties by Quarter

Portfolio Update |

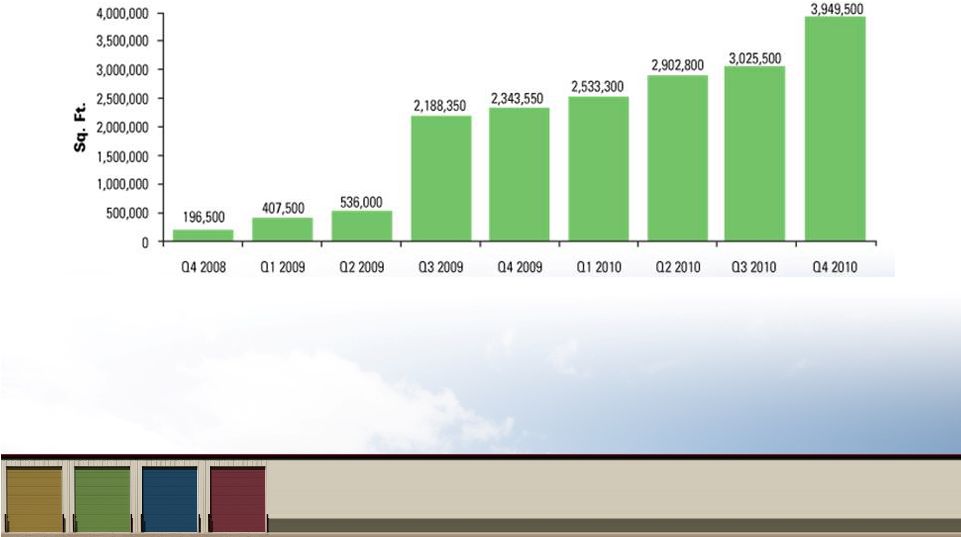

Net

Rentable Square Feet by Quarter Portfolio Update

|

Property

Acquisition

Price

Approx. Units

Approx. Rentable Sq. Ft. (net)

1

Chicago –

95th St. –

IL

$6,300,000

690

72,000

2

Chicago –

Western Ave. –

IL

$1,400,000

590

59,000

3

Chicago –

Ogden Ave. –

IL

$4,000,000

750

194,400

4

Chicago –

Roosevelt Rd. –

IL

$1,800,000

445

45,000

5

Toronto –

Ontario –

Canada

$14,150,000

1,060

110,000

6

La Cienega

–

Los Angeles –

CA

$13,100,000

770

87,000

7

Long Beach –

CA

$12,900,000

830

87,000

8

Las Vegas III –

NV

$4,275,000

700

94,000

9

Las Vegas –

Downtown –

NV

$6,875,000

540

81,600

10

Las Vegas –

Rancho –

NV

$4,000,000

740

94,000

Total

$68,800,000

7,115

924,000

Fourth Quarter Acquisitions

Acquisition Update

(1) Includes 85,000 rentable square feet of industrial

warehouse/office space. (1) |

Potential Acquisitions

(1)

Amount

of

units

and

square

footage

when

construction

is

completed.

(2)

Approximate

price

based

on

Canadian/US

conversion

rate

(excludes

estimated

construction

costs).

Property

Acquisition Price

Approx. Units

Approx. Rentable

Sq. Ft. (net)

1

El Paso –

TX

$1,250,000

290

40,800

2

SF Bay Area –

Morgan Hill –

CA

$6,290,000

480

61,000

3

SF Bay Area –

Vallejo –

CA

$7,800,000

860

75,000

4

SF Bay Area –

San Lorenzo –

CA

$2,850,000

640

62,000

5

SF Bay Area –

Gilroy –

CA

$6,560,000

610

63,500

6

Las Vegas –

Pecos –

NV

$4,600,000

790

69,000

7

Mavis –

Ontario –

Canada

$5,500,000

1,070

104,500

8

London I –

Ontario –

Canada

$8,100,000

660

68,000

9

London II –

Ontario –

Canada

$7,580,000

610

57,000

Total

$50,530,000

6,010

600,800

(1)

(1)

Acquisition Update

(1)

(1)

(2)

(2)

(2) |

Acquisition Update

Square Footage by State (as of 12/31/2010)

|

Acquisition Update

Square Footage by State (as of 12/31/2010)

|

Chicago, Illinois (95

th

St.)

Year Converted: 2002

Total Units: 690

Net Rentable: 72,000 sq. ft.

Acres: 4.6

Fourth Quarter Acquisitions

Acquisition Update |

Chicago, Illinois (Western Ave.)

Year Converted: 2004

Total Units: 590

Net Rentable: 59,000 sq. ft.

Acres: 2.7

Fourth Quarter Acquisitions

Acquisition Update |

Cicero, Illinois (Ogden Ave.)

Year Converted: 2002

Total Units: 750

Net Rentable: 194,400 sq. ft. (1)

Acres: 10.4

Fourth Quarter Acquisitions

Acquisition Update

(1)

Includes

85,000

rentable

square

feet

of

industrial

warehouse/office

space. |

Cicero, Illinois (Roosevelt Rd.)

Year Converted: 2004

Total Units: 445

Net Rentable: 45,000 sq. ft.

Acres: 6.4

Fourth Quarter Acquisitions

Acquisition Update |

Toronto, Canada (Dufferin

St.)

Year Converted: 2008

Total Units: 1,060

Net Rentable: 110,000 sq. ft.

Acres: 4.7

Fourth Quarter Acquisitions

Acquisition Update |

Los

Angeles, CA (La Cienega) Year Built: 2004

Total Units: 770

Net Rentable: 87,000 sq. ft.

Acres: 1.7

Fourth Quarter Acquisitions

Acquisition Update |

Long Beach, California

Year Built: 1999

Total Units: 830

Net Rentable: 87,000 sq. ft.

Acres: 3.7

Fourth Quarter Acquisitions

Acquisition Update |

Las

Vegas, Nevada (Ann Rd.) Year Built: 2005

Total Units: 700

Net Rentable: 94,000 sq. ft.

Acres: 3.2

Fourth Quarter Acquisitions

Acquisition Update |

Las

Vegas, Nevada (Downtown) Year Built: 1996

Total Units: 540

Net Rentable: 81,600 sq. ft.

Acres: 1.7

Fourth Quarter Acquisitions

Acquisition Update |

Las

Vegas, Nevada (Rancho) Year Built: 2006

Total Units: 740

Net Rentable: 94,000 sq. ft.

Acres: 3.2

Fourth Quarter Acquisitions

Acquisition Update |

Branding Update |

Branding Update

Branding Update

18

Properties

are

now

SmartStop

SM

branded

3 more

properties are scheduled to be

completed by 2/14/11

9 additional

properties have permits, of these

5 already have temporary signage

2 properties

in production are on hold, due to

inclement weather |

Technology Update

Technology Update

New

“print”

yellow page and “internet”

yellow

page campaign

Investing more than $500K annually

Better

online

exposure,

influencing

credibility and spiking organic searches

Enhancing relevance with Google and

search engine optimization (SEO) |

Technology Update

OpenTech

Alliance

selected

to

handle

growing call center operations and extend

business hours

Superior

knowledge

of

the

self

storage

business, the most advanced technology

and the highest quality of agents

Technology Update |

hosted by:

H. Michael Schwartz

Chairman and CEO |