Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - OCCIDENTAL PETROLEUM CORP /DE/ | form8k-20110126.htm |

| EX-99.1 - EXHIBIT 99.1 - OCCIDENTAL PETROLEUM CORP /DE/ | ex99_1-20110126.htm |

| EX-99.2 - EXHIBIT 99.2 - OCCIDENTAL PETROLEUM CORP /DE/ | ex99_2-20110126.htm |

| EX-99.4 - EXHIBIT 99.4 - OCCIDENTAL PETROLEUM CORP /DE/ | ex99_4-20110126.htm |

| EX-99.5 - EXHIBIT 99.5 - OCCIDENTAL PETROLEUM CORP /DE/ | ex99_5-20110126.htm |

EXHIBIT 99.3

Investor Relations Supplemental Schedules

|

Investor Relations Supplemental Schedules

|

|||||||

|

Summary

|

|||||||

|

($ Millions)

|

|||||||

|

4Q 2010

|

4Q 2009

|

||||||

|

Reported Net Income

|

$1,212

|

$938

|

|||||

|

EPS - Diluted

|

$1.49

|

$1.15

|

|||||

|

Core Results

|

$1,287

|

$1,102

|

|||||

|

EPS - Diluted

|

$1.58

|

$1.35

|

|||||

|

Total Worldwide Sales Volumes (mboe/day)

|

751

|

722

|

|||||

|

Total Worldwide Crude Oil Realizations ($/BBL)

|

$79.96

|

$71.74

|

|||||

|

Domestic Natural Gas Realizations ($/MCF)

|

$4.13

|

$4.37

|

|||||

|

Wtd. Average Basic Shares O/S (mm)

|

812.6

|

811.8

|

|||||

|

Wtd. Average Diluted Shares O/S (mm)

|

813.7

|

813.5

|

|||||

|

YTD 2010

|

YTD 2009

|

||||||

|

Reported Net Income

|

$4,530

|

$2,915

|

|||||

|

EPS - Diluted

|

$5.56

|

$3.58

|

|||||

|

Core Results

|

$4,664

|

$3,192

|

|||||

|

EPS - Diluted

|

$5.72

|

$3.92

|

|||||

|

Total Worldwide Sales Volumes (mboe/day)

|

744

|

714

|

|||||

|

Total Worldwide Crude Oil Realizations ($/BBL)

|

$75.16

|

$57.31

|

|||||

|

Domestic Natural Gas Realizations ($/MCF)

|

$4.53

|

$3.46

|

|||||

|

Wtd. Average Basic Shares O/S (mm)

|

812.5

|

811.3

|

|||||

|

Wtd. Average Diluted Shares O/S (mm)

|

813.8

|

813.8

|

|||||

|

Shares Outstanding (mm)

|

812.8

|

811.9

|

|||||

|

Cash Flow from Operations

|

$

|

9,300

|

$

|

5,800

|

|||

1

Investor Relations Supplemental Schedules

|

OCCIDENTAL PETROLEUM

|

||||||||||||||

|

2010 Fourth Quarter

|

||||||||||||||

|

Net Income (Loss)

|

||||||||||||||

|

($ millions)

|

||||||||||||||

|

Reported

|

Core

|

|||||||||||||

|

Income

|

Significant Items Affecting Income

|

Results

|

||||||||||||

|

Oil & Gas

|

$

|

1,666

|

$

|

275

|

Asset Impairments

|

$

|

1,941

|

|||||||

|

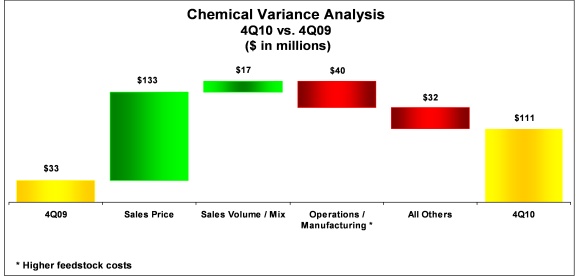

Chemical

|

111

|

111

|

||||||||||||

|

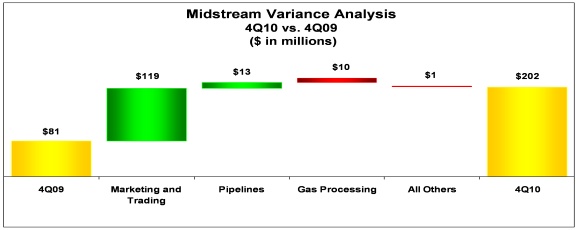

Midstream, marketing and other

|

202

|

202

|

||||||||||||

|

Corporate

|

||||||||||||||

|

Interest expense, net

|

(20

|

)

|

(20

|

)

|

||||||||||

|

Other

|

(149

|

)

|

(149

|

)

|

||||||||||

|

Taxes

|

(618

|

)

|

(100

|

)

|

Tax effect of adjustments

|

(798

|

)

|

|||||||

|

(80

|

)

|

Benefit from foreign tax

|

||||||||||||

|

credit carry-forwards

|

||||||||||||||

|

Income from continuing operations

|

1,192

|

95

|

1,287

|

|||||||||||

|

Discontinued operations, net of tax

|

20

|

(20

|

)

|

Discontinued operations, net

|

-

|

|||||||||

|

Net Income

|

$

|

1,212

|

$

|

75

|

$

|

1,287

|

||||||||

|

Basic Earnings Per Common Share

|

||||||||||||||

|

Income from continuing operations

|

$

|

1.47

|

||||||||||||

|

Discontinued operations, net

|

0.02

|

|||||||||||||

|

Net Income

|

$

|

1.49

|

$

|

1.58

|

||||||||||

|

Diluted Earnings Per Common Share

|

||||||||||||||

|

Income from continuing operations

|

$

|

1.47

|

||||||||||||

|

Discontinued operations, net

|

0.02

|

|||||||||||||

|

Net Income

|

$

|

1.49

|

$

|

1.58

|

||||||||||

2

Investor Relations Supplemental Schedules

|

OCCIDENTAL PETROLEUM

|

||||||||||||||

|

2009 Fourth Quarter

|

||||||||||||||

|

Net Income (Loss)

|

||||||||||||||

|

($ millions)

|

||||||||||||||

|

Reported

|

Core

|

|||||||||||||

|

Income

|

Significant Items Affecting Income

|

Results

|

||||||||||||

|

Oil & Gas

|

$

|

1,869

|

$

|

1,869

|

||||||||||

|

Chemical

|

33

|

33

|

||||||||||||

|

Midstream, marketing and other

|

81

|

81

|

||||||||||||

|

Corporate

|

||||||||||||||

|

Interest expense, net

|

(31

|

)

|

(31

|

)

|

||||||||||

|

Other

|

(107

|

)

|

(107

|

)

|

||||||||||

|

Taxes

|

(743

|

)

|

(743

|

)

|

||||||||||

|

Income from continuing operations

|

1,102

|

-

|

1,102

|

|||||||||||

|

Discontinued operations, net of tax

|

(164

|

)

|

164

|

Discontinued operations, net

|

-

|

|||||||||

|

Net Income

|

$

|

938

|

$

|

164

|

$

|

1,102

|

||||||||

|

Basic Earnings Per Common Share

|

||||||||||||||

|

Income from continuing operations

|

$

|

1.35

|

||||||||||||

|

Discontinued operations, net

|

(0.20

|

)

|

||||||||||||

|

Net Income

|

$

|

1.15

|

$

|

1.36

|

||||||||||

|

Diluted Earnings Per Common Share

|

||||||||||||||

|

Income from continuing operations

|

$

|

1.35

|

||||||||||||

|

Discontinued operations, net

|

(0.20

|

)

|

||||||||||||

|

Net Income

|

$

|

1.15

|

$

|

1.35

|

||||||||||

3

Investor Relations Supplemental Schedules

|

OCCIDENTAL PETROLEUM

|

||||||||||||||

|

2010 Twelve Months

|

||||||||||||||

|

Net Income (Loss)

|

||||||||||||||

|

($ millions)

|

||||||||||||||

|

Reported

|

Core

|

|||||||||||||

|

Income

|

Significant Items Affecting Income

|

Results

|

||||||||||||

|

Oil & Gas

|

$

|

7,151

|

$

|

275

|

Asset Impairments

|

$

|

7,426

|

|||||||

|

Chemical

|

438

|

438

|

||||||||||||

|

Midstream, marketing and other

|

472

|

472

|

||||||||||||

|

Corporate

|

||||||||||||||

|

Interest expense, net

|

(93

|

)

|

(93

|

)

|

||||||||||

|

Other

|

(404

|

)

|

(404

|

)

|

||||||||||

|

Taxes

|

(2,995

|

)

|

(100

|

)

|

Tax effect of adjustments

|

(3,175

|

)

|

|||||||

|

(80

|

)

|

Benefit from foreign tax

|

||||||||||||

|

credit carry-forwards

|

||||||||||||||

|

Income from continuing operations

|

4,569

|

95

|

4,664

|

|||||||||||

|

Discontinued operations, net of tax

|

(39

|

)

|

39

|

Discontinued operations, net

|

-

|

|||||||||

|

Net Income

|

$

|

4,530

|

$

|

134

|

$

|

4,664

|

||||||||

|

Basic Earnings Per Common Share

|

||||||||||||||

|

Income from continuing operations

|

$

|

5.62

|

||||||||||||

|

Discontinued operations, net

|

(0.05

|

)

|

||||||||||||

|

Net Income

|

$

|

5.57

|

$

|

5.73

|

||||||||||

|

Diluted Earnings Per Common Share

|

||||||||||||||

|

Income from continuing operations

|

$

|

5.61

|

||||||||||||

|

Discontinued operations, net

|

(0.05

|

)

|

||||||||||||

|

Net Income

|

$

|

5.56

|

$

|

5.72

|

||||||||||

4

Investor Relations Supplemental Schedules

|

OCCIDENTAL PETROLEUM

|

||||||||||||||

|

2009 Twelve Months

|

||||||||||||||

|

Net Income (Loss)

|

||||||||||||||

|

($ millions)

|

||||||||||||||

|

Reported

|

Core

|

|||||||||||||

|

Income

|

Significant Items Affecting Income

|

Results

|

||||||||||||

|

Oil & Gas

|

$

|

5,097

|

$

|

8

|

Rig contract terminations

|

$

|

5,105

|

|||||||

|

Chemical

|

389

|

389

|

||||||||||||

|

Midstream, marketing and other

|

235

|

235

|

||||||||||||

|

Corporate

|

||||||||||||||

|

Interest expense, net

|

(102

|

)

|

(102

|

)

|

||||||||||

|

Other

|

(405

|

)

|

40

|

Severance

|

(350

|

)

|

||||||||

|

15

|

Railcar leases

|

|||||||||||||

|

Taxes

|

(2,063

|

)

|

(22

|

)

|

Tax effect of adjustments

|

(2,085

|

)

|

|||||||

|

Income from continuing operations

|

3,151

|

41

|

3,192

|

|||||||||||

|

Discontinued operations, net of tax

|

(236

|

)

|

236

|

Discontinued operations, net

|

-

|

|||||||||

|

Net Income

|

$

|

2,915

|

$

|

277

|

$

|

3,192

|

||||||||

|

Basic Earnings Per Common Share

|

||||||||||||||

|

Income from continuing operations

|

$

|

3.88

|

||||||||||||

|

Discontinued operations, net

|

(0.29

|

)

|

||||||||||||

|

Net Income

|

$

|

3.59

|

$

|

3.93

|

||||||||||

|

Diluted Earnings Per Common Share

|

||||||||||||||

|

Income from continuing operations

|

$

|

3.87

|

||||||||||||

|

Discontinued operations, net

|

(0.29

|

)

|

||||||||||||

|

Net Income

|

$

|

3.58

|

$

|

3.92

|

||||||||||

5

Investor Relations Supplemental Schedules

|

OCCIDENTAL PETROLEUM

|

||||||||||||||

|

Worldwide Effective Tax Rate

|

||||||||||||||

|

QUARTERLY

|

YEAR-TO-DATE

|

|||||||||||||

|

2010

|

2010

|

2009

|

2010

|

2009

|

||||||||||

|

REPORTED INCOME

|

QTR 4

|

QTR 3

|

QTR 4

|

12 Months

|

12 Months

|

|||||||||

|

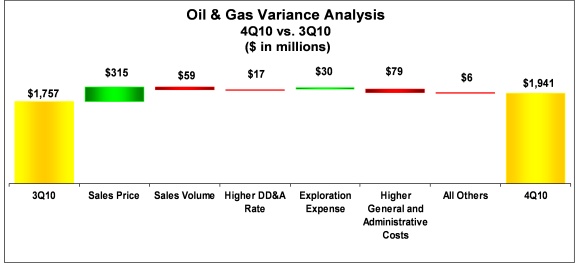

Oil & Gas

|

1,666

|

1,757

|

1,869

|

7,151

|

5,097

|

|||||||||

|

Chemicals

|

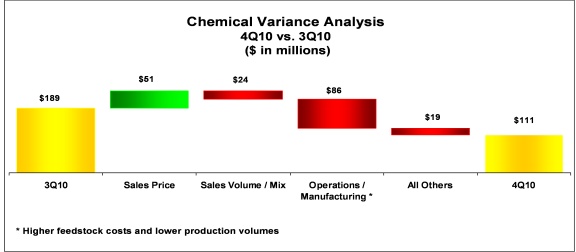

111

|

189

|

33

|

438

|

389

|

|||||||||

|

Midstream, marketing and other

|

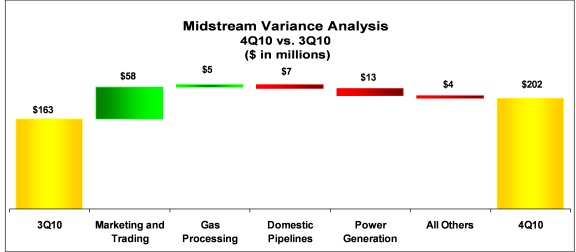

202

|

163

|

81

|

472

|

235

|

|||||||||

|

Corporate & other

|

(169

|

)

|

(84

|

)

|

(138

|

)

|

(497

|

)

|

(507

|

)

|

||||

|

Pre-tax income

|

1,810

|

2,025

|

1,845

|

7,564

|

5,214

|

|||||||||

|

Income tax expense

|

||||||||||||||

|

Federal and state

|

129

|

322

|

338

|

1,087

|

684

|

|||||||||

|

Foreign

|

489

|

500

|

405

|

1,908

|

1,379

|

|||||||||

|

Total

|

618

|

822

|

743

|

2,995

|

2,063

|

|||||||||

|

Income from continuing operations

|

1,192

|

1,203

|

1,102

|

4,569

|

3,151

|

|||||||||

|

Worldwide effective tax rate

|

34%

|

41%

|

40%

|

40%

|

40%

|

|||||||||

|

2010

|

2010

|

2009

|

2010

|

2009

|

||||||||||

|

CORE RESULTS

|

QTR 4

|

QTR 3

|

QTR 4

|

12 Months

|

12 Months

|

|||||||||

|

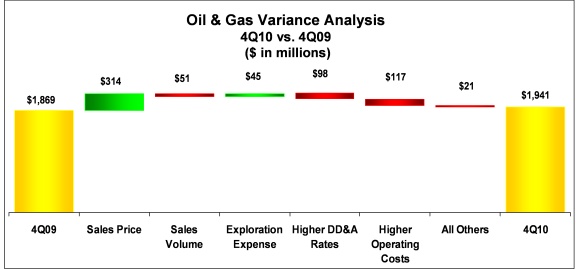

Oil & Gas

|

1,941

|

1,757

|

1,869

|

7,426

|

5,105

|

|||||||||

|

Chemicals

|

111

|

189

|

33

|

438

|

389

|

|||||||||

|

Midstream, marketing and other

|

202

|

163

|

81

|

472

|

235

|

|||||||||

|

Corporate & other

|

(169

|

)

|

(84

|

)

|

(138

|

)

|

(497

|

)

|

(452

|

)

|

||||

|

Pre-tax income

|

2,085

|

2,025

|

1,845

|

7,839

|

5,277

|

|||||||||

|

Income tax expense

|

||||||||||||||

|

Federal and state

|

309

|

322

|

338

|

1,267

|

706

|

|||||||||

|

Foreign

|

489

|

500

|

405

|

1,908

|

1,379

|

|||||||||

|

Total

|

798

|

822

|

743

|

3,175

|

2,085

|

|||||||||

|

Core results

|

1,287

|

1,203

|

1,102

|

4,664

|

3,192

|

|||||||||

|

Worldwide effective tax rate

|

38%

|

41%

|

40%

|

41%

|

40%

|

|||||||||

6

Investor Relations Supplemental Schedules

|

OCCIDENTAL PETROLEUM

|

||||||||||||

|

2010 Fourth Quarter Net Income (Loss)

|

||||||||||||

|

Reported Income Comparison

|

||||||||||||

|

Fourth

|

Third

|

|||||||||||

|

Quarter

|

Quarter

|

|||||||||||

|

2010

|

2010

|

B / (W)

|

||||||||||

|

Oil & Gas

|

$

|

1,666

|

$

|

1,757

|

$

|

(91

|

)

|

|||||

|

Chemical

|

111

|

189

|

(78

|

)

|

||||||||

|

Midstream, marketing and other

|

202

|

163

|

39

|

|||||||||

|

Corporate

|

||||||||||||

|

Interest expense, net

|

(20

|

)

|

(18

|

)

|

(2

|

)

|

||||||

|

Other

|

(149

|

)

|

(66

|

)

|

(83

|

)

|

||||||

|

Taxes

|

(618

|

)

|

(822

|

)

|

204

|

|||||||

|

Income from continuing operations

|

1,192

|

1,203

|

(11

|

)

|

||||||||

|

Discontinued operations, net

|

20

|

(12

|

)

|

32

|

||||||||

|

Net Income

|

$

|

1,212

|

$

|

1,191

|

$

|

21

|

||||||

|

Earnings Per Common Share

|

||||||||||||

|

Basic

|

$

|

1.49

|

$

|

1.46

|

$

|

0.03

|

||||||

|

Diluted

|

$

|

1.49

|

$

|

1.46

|

$

|

0.03

|

||||||

|

Worldwide Effective Tax Rate

|

34%

|

41%

|

7%

|

|||||||||

|

OCCIDENTAL PETROLEUM

|

||||||||||||

|

2010 Fourth Quarter Net Income (Loss)

|

||||||||||||

|

Core Results Comparison

|

||||||||||||

|

Fourth

|

Third

|

|||||||||||

|

Quarter

|

Quarter

|

|||||||||||

|

2010

|

2010

|

B / (W)

|

||||||||||

|

Oil & Gas

|

$

|

1,941

|

$

|

1,757

|

$

|

184

|

||||||

|

Chemical

|

111

|

189

|

(78

|

)

|

||||||||

|

Midstream, marketing and other

|

202

|

163

|

39

|

|||||||||

|

Corporate

|

||||||||||||

|

Interest expense, net

|

(20

|

)

|

(18

|

)

|

(2

|

)

|

||||||

|

Other

|

(149

|

)

|

(66

|

)

|

(83

|

)

|

||||||

|

Taxes

|

(798

|

)

|

(822

|

)

|

24

|

|||||||

|

Core Results

|

$

|

1,287

|

$

|

1,203

|

$

|

84

|

||||||

|

Core Results Per Common Share

|

||||||||||||

|

Basic

|

$

|

1.58

|

$

|

1.48

|

$

|

0.10

|

||||||

|

Diluted

|

$

|

1.58

|

$

|

1.48

|

$

|

0.10

|

||||||

|

Worldwide Effective Tax Rate

|

38%

|

41%

|

3%

|

|||||||||

7

Investor Relations Supplemental Schedules

8

Investor Relations Supplemental Schedules

|

OCCIDENTAL PETROLEUM

|

||||||||||||

|

2010 Fourth Quarter Net Income (Loss)

|

||||||||||||

|

Reported Income Comparison

|

||||||||||||

|

Fourth

|

Fourth

|

|||||||||||

|

Quarter

|

Quarter

|

|||||||||||

|

2010

|

2009

|

B / (W)

|

||||||||||

|

Oil & Gas

|

$

|

1,666

|

$

|

1,869

|

$

|

(203

|

)

|

|||||

|

Chemical

|

111

|

33

|

78

|

|||||||||

|

Midstream, marketing and other

|

202

|

81

|

121

|

|||||||||

|

Corporate

|

||||||||||||

|

Interest expense, net

|

(20

|

)

|

(31

|

)

|

11

|

|||||||

|

Other

|

(149

|

)

|

(107

|

)

|

(42

|

)

|

||||||

|

Taxes

|

(618

|

)

|

(743

|

)

|

125

|

|||||||

|

Income from continuing operations

|

1,192

|

1,102

|

90

|

|||||||||

|

Discontinued operations, net

|

20

|

(164

|

)

|

184

|

||||||||

|

Net Income

|

$

|

1,212

|

$

|

938

|

$

|

274

|

||||||

|

Earnings Per Common Share

|

||||||||||||

|

Basic

|

$

|

1.49

|

$

|

1.15

|

$

|

0.34

|

||||||

|

Diluted

|

$

|

1.49

|

$

|

1.15

|

$

|

0.34

|

||||||

|

Worldwide Effective Tax Rate

|

34%

|

40%

|

6%

|

|||||||||

|

OCCIDENTAL PETROLEUM

|

||||||||||||

|

2010 Fourth Quarter Net Income (Loss)

|

||||||||||||

|

Core Results Comparison

|

||||||||||||

|

Fourth

|

Fourth

|

|||||||||||

|

Quarter

|

Quarter

|

|||||||||||

|

2010

|

2009

|

B / (W)

|

||||||||||

|

Oil & Gas

|

$

|

1,941

|

$

|

1,869

|

$

|

72

|

||||||

|

Chemical

|

111

|

33

|

78

|

|||||||||

|

Midstream, marketing and other

|

202

|

81

|

121

|

|||||||||

|

Corporate

|

||||||||||||

|

Interest expense, net

|

(20

|

)

|

(31

|

)

|

11

|

|||||||

|

Other

|

(149

|

)

|

(107

|

)

|

(42

|

)

|

||||||

|

Taxes

|

(798

|

)

|

(743

|

)

|

(55

|

)

|

||||||

|

Core Results

|

$

|

1,287

|

$

|

1,102

|

$

|

185

|

||||||

|

Core Results Per Common Share

|

||||||||||||

|

Basic

|

$

|

1.58

|

$

|

1.36

|

$

|

0.22

|

||||||

|

Diluted

|

$

|

1.58

|

$

|

1.35

|

$

|

0.23

|

||||||

|

Worldwide Effective Tax Rate

|

38%

|

40%

|

2%

|

|||||||||

9

Investor Relations Supplemental Schedules

10

Investor Relations Supplemental Schedules

|

SUMMARY OF OPERATING STATISTICS

|

||||||||||||||

|

Fourth Quarter

|

Twelve Months

|

|||||||||||||

|

2010

|

2009

|

2010

|

2009

|

|||||||||||

|

NET SALES VOLUMES PER DAY:

|

||||||||||||||

|

United States

|

||||||||||||||

|

Crude Oil and Liquids (MBBL)

|

||||||||||||||

|

California

|

90

|

92

|

92

|

93

|

||||||||||

|

Permian

|

163

|

164

|

161

|

164

|

||||||||||

|

Midcontinent Gas

|

19

|

15

|

18

|

14

|

||||||||||

|

Total

|

272

|

271

|

271

|

271

|

||||||||||

|

Natural Gas (MMCF)

|

||||||||||||||

|

California

|

259

|

282

|

280

|

250

|

||||||||||

|

Permian

|

154

|

122

|

133

|

125

|

||||||||||

|

Midcontinent Gas

|

286

|

241

|

264

|

260

|

||||||||||

|

Total

|

699

|

645

|

677

|

635

|

||||||||||

|

Latin America

|

||||||||||||||

|

Crude Oil (MBBL)

|

Colombia

|

31

|

36

|

32

|

39

|

|||||||||

|

Natural Gas (MMCF)

|

Bolivia

|

18

|

12

|

16

|

16

|

|||||||||

|

Middle East / North Africa

|

||||||||||||||

|

Crude Oil and Liquids (MBBL)

|

||||||||||||||

|

Bahrain

|

3

|

1

|

3

|

-

|

||||||||||

|

Dolphin

|

23

|

26

|

24

|

25

|

||||||||||

|

Libya

|

12

|

15

|

13

|

12

|

||||||||||

|

Oman

|

63

|

54

|

61

|

50

|

||||||||||

|

Qatar

|

74

|

80

|

76

|

79

|

||||||||||

|

Yemen

|

27

|

32

|

30

|

35

|

||||||||||

|

Total

|

202

|

208

|

207

|

201

|

||||||||||

|

Natural Gas (MMCF)

|

||||||||||||||

|

Bahrain

|

170

|

40

|

169

|

10

|

||||||||||

|

Dolphin

|

232

|

256

|

236

|

257

|

||||||||||

|

Oman

|

47

|

42

|

48

|

49

|

||||||||||

|

Total

|

449

|

338

|

453

|

316

|

||||||||||

|

Continuing operations

|

||||||||||||||

|

Barrels of Oil Equivalent (MBOE)

|

699

|

680

|

701

|

672

|

||||||||||

|

Discontinued operations

|

||||||||||||||

|

Crude Oil (MBBL)

|

46

|

37

|

37

|

37

|

||||||||||

|

Natural Gas (MMCF)

|

36

|

30

|

34

|

30

|

||||||||||

|

Total Sales - MBOE

|

751

|

722

|

744

|

714

|

||||||||||

11

Investor Relations Supplemental Schedules

|

OCCIDENTAL PETROLEUM

|

||||||||||||||

|

SUMMARY OF OPERATING STATISTICS

|

||||||||||||||

|

Fourth Quarter

|

Twelve Months

|

|||||||||||||

|

2010

|

2009

|

2010

|

2009

|

|||||||||||

|

NET PRODUCTION PER DAY:

|

||||||||||||||

|

United States

|

||||||||||||||

|

Crude Oil and Liquids (MBBL)

|

272

|

271

|

271

|

271

|

||||||||||

|

Natural Gas (MMCF)

|

699

|

645

|

677

|

635

|

||||||||||

|

Latin America

|

||||||||||||||

|

Crude Oil (MBBL)

|

Colombia

|

30

|

36

|

32

|

39

|

|||||||||

|

Natural Gas (MMCF)

|

18

|

12

|

16

|

16

|

||||||||||

|

Middle East / North Africa

|

||||||||||||||

|

Crude Oil and Liquids (MBBL)

|

||||||||||||||

|

Bahrain

|

3

|

1

|

3

|

-

|

||||||||||

|

Dolphin

|

23

|

26

|

24

|

26

|

||||||||||

|

Iraq

|

11

|

-

|

3

|

-

|

||||||||||

|

Libya

|

12

|

11

|

13

|

11

|

||||||||||

|

Oman

|

67

|

56

|

62

|

50

|

||||||||||

|

Qatar

|

75

|

78

|

76

|

79

|

||||||||||

|

Yemen

|

27

|

31

|

31

|

34

|

||||||||||

|

Total

|

218

|

203

|

212

|

200

|

||||||||||

|

Natural Gas (MMCF)

|

449

|

338

|

453

|

316

|

||||||||||

|

Continuing operations

|

||||||||||||||

|

Barrels of Oil Equivalent (MBOE)

|

714

|

676

|

706

|

671

|

||||||||||

|

Discontinued operations

|

||||||||||||||

|

Crude Oil (MBBL)

|

33

|

36

|

36

|

36

|

||||||||||

|

Natural Gas (MMCF)

|

36

|

30

|

34

|

30

|

||||||||||

|

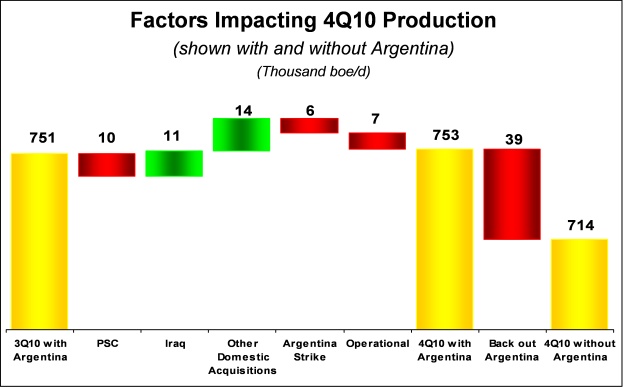

Total Worldwide Production - MBOE

|

753

|

717

|

748

|

712

|

||||||||||

12

Investor Relations Supplemental Schedules

|

OCCIDENTAL PETROLEUM

|

|||||||||||||||||

|

SUMMARY OF OPERATING STATISTICS

|

|||||||||||||||||

|

Fourth Quarter

|

Twelve Months

|

||||||||||||||||

|

2010

|

2009

|

2010

|

2009

|

||||||||||||||

|

OIL & GAS:

|

|||||||||||||||||

|

PRICES

|

|||||||||||||||||

|

United States

|

|||||||||||||||||

|

Crude Oil ($/BBL)

|

79.20

|

70.90

|

73.79

|

56.74

|

|||||||||||||

|

Natural gas ($/MCF)

|

4.13

|

4.37

|

4.53

|

3.46

|

|||||||||||||

|

Latin America

|

|||||||||||||||||

|

Crude Oil ($/BBL)

|

81.05

|

71.69

|

75.29

|

55.89

|

|||||||||||||

|

Natural Gas ($/MCF)

|

7.76

|

5.73

|

7.73

|

5.70

|

|||||||||||||

|

Middle East / North Africa

|

|||||||||||||||||

|

Crude Oil ($/BBL)

|

80.65

|

73.11

|

76.67

|

58.75

|

|||||||||||||

|

Total Worldwide

|

|||||||||||||||||

|

Crude Oil ($/BBL)

|

79.96

|

71.74

|

75.16

|

57.31

|

|||||||||||||

|

Natural Gas ($/MCF)

|

2.91

|

3.42

|

3.11

|

2.83

|

|||||||||||||

|

Fourth Quarter

|

Twelve Months

|

||||||||||||||||

|

2010

|

2009

|

2010

|

2009

|

||||||||||||||

|

Exploration Expense

|

|||||||||||||||||

|

United States

|

$

|

27

|

$

|

53

|

$

|

162

|

$

|

160

|

|||||||||

|

Latin America

|

6

|

12

|

7

|

14

|

|||||||||||||

|

Middle East / North Africa

|

21

|

33

|

93

|

80

|

|||||||||||||

|

TOTAL REPORTED

|

$

|

54

|

$

|

98

|

$

|

262

|

$

|

254

|

|||||||||

13

Investor Relations Supplemental Schedules

|

OCCIDENTAL PETROLEUM

|

||||||||||||||||

|

SUMMARY OF OPERATING STATISTICS

|

||||||||||||||||

|

Fourth Quarter

|

Twelve Months

|

|||||||||||||||

|

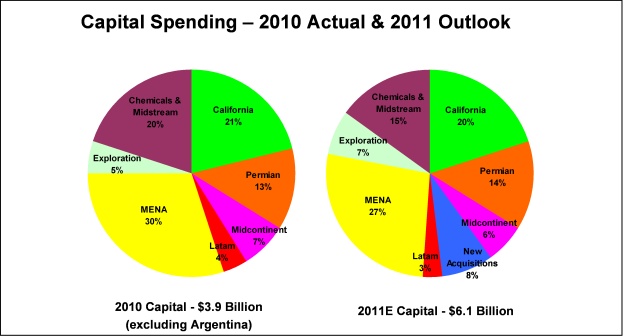

Capital Expenditures ($MM)

|

2010

|

2009

|

2010

|

2009

|

||||||||||||

|

Oil & Gas

|

||||||||||||||||

|

California

|

$

|

297

|

$

|

152

|

$

|

841

|

$

|

554

|

||||||||

|

Permian

|

212

|

85

|

502

|

413

|

||||||||||||

|

Midcontinent Gas

|

131

|

41

|

269

|

118

|

||||||||||||

|

Latin America

|

56

|

40

|

163

|

210

|

||||||||||||

|

Middle East / North Africa

|

344

|

253

|

1,199

|

1,021

|

||||||||||||

|

Exploration

|

62

|

50

|

192

|

132

|

||||||||||||

|

Chemicals

|

108

|

91

|

237

|

205

|

||||||||||||

|

Midstream, marketing and other

|

144

|

124

|

501

|

554

|

||||||||||||

|

Corporate

|

6

|

4

|

36

|

38

|

||||||||||||

|

TOTAL

|

$

|

1,360

|

$

|

840

|

$

|

3,940

|

$

|

3,245

|

||||||||

|

Depreciation, Depletion &

|

Fourth Quarter

|

Twelve Months

|

||||||||||||||

|

Amortization of Assets ($MM)

|

2010

|

2009

|

2010

|

2009

|

||||||||||||

|

Oil & Gas

|

||||||||||||||||

|

Domestic

|

$

|

365

|

$

|

305

|

$

|

1,412

|

$

|

1,237

|

||||||||

|

Latin America

|

31

|

48

|

122

|

198

|

||||||||||||

|

Middle East / North Africa

|

282

|

237

|

1,134

|

823

|

||||||||||||

|

Chemicals

|

78

|

76

|

321

|

298

|

||||||||||||

|

Midstream, marketing and other

|

38

|

31

|

142

|

110

|

||||||||||||

|

Corporate

|

5

|

6

|

22

|

21

|

||||||||||||

|

TOTAL

|

$

|

799

|

$

|

703

|

$

|

3,153

|

$

|

2,687

|

||||||||

14

Investor Relations Supplemental Schedules

|

OCCIDENTAL PETROLEUM

|

||||||||||||

|

CORPORATE

|

||||||||||||

|

($ millions)

|

||||||||||||

|

31-Dec-10

|

31-Dec-09

|

|||||||||||

|

CAPITALIZATION

|

||||||||||||

|

Long-Term Debt (including current maturities)

|

$

|

5,111

|

$

|

2,796

|

||||||||

|

Others

|

-

|

25

|

||||||||||

|

Total Debt

|

$

|

5,111

|

$

|

2,821

|

||||||||

|

EQUITY

|

$

|

32,484

|

$

|

29,159

|

||||||||

|

Total Debt To Total Capitalization

|

14%

|

9%

|

||||||||||

15

Investor Relations Supplemental Schedules

|

Investor Relations Supplemental Schedules

|

|||||||||

|

Argentina Summary

|

|||||||||

|

($ Millions)

|

|||||||||

|

2008

|

2009

|

2010

|

|||||||

|

Net Production (MBOE/Day)

|

38

|

41

|

42

|

||||||

|

Results pre-tax

|

(591

|

)

|

(369

|

)

|

(33

|

)

|

|||

|

Results after-tax

|

(344

|

)

|

(224

|

)

|

(18

|

)

|

|||

|

Depreciation, Depletion &

Amortization of Assets

|

314

|

430

|

350

|

||||||

|

Capital Expenditures

|

538

|

336

|

415

|

*

|

|||||

|

*Includes $105 million contract extension bonus.

|

|||||||||

16

Investor Relations Supplemental Schedules

|

Investor Relations Supplemental Schedules

|

||||||||||||||

|

Argentina Summary

|

||||||||||||||

|

($ Millions)

|

||||||||||||||

|

2010

|

||||||||||||||

|

1st Q

|

2nd Q

|

3rd Q

|

4th Q

|

TY

|

||||||||||

|

Net Production (MBOE/Day)

|

42

|

42

|

45

|

39

|

42

|

|||||||||

|

Results pre-tax

|

(43

|

)

|

(17

|

)

|

(13

|

)

|

40

|

(33

|

)

|

|||||

|

Results after-tax

|

(26

|

)

|

(8

|

)

|

(7

|

)

|

23

|

(18

|

)

|

|||||

17

Investor Relations Supplemental Schedules

18