Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - PERNIX THERAPEUTICS HOLDINGS, INC. | ptx_8k.htm |

Dated December 17, 2010

|

(1)

|

GAINE, INC

|

|

|

(2)

|

PERNIX THERAPEUTICS, LLC

|

|

|

(3)

|

BIOCOPEA LIMITED

|

|

|

(4)

|

KULIK INVESTMENTS (I) IC LIMITED

|

|

|

- and -

|

||

|

(5)

|

RESPICOPEA HOLDINGS LIMITED

|

|

JOINT VENTURE AGREEMENT

Beachcroft LLP

tel: +44 (0) 20 7242 1011 fax: +44 (0) 20 7831 6630

DX 45 London

106611059_11.DOC

|

Table of contents

Clause heading and number Page number

|

Page number

|

|||||

| 1. | INTERPRETATION | 2 | ||||

| 2. | COMPLETION | 8 | ||||

| 3. | APPLICATION OF SUMS SUBSCRIBED | 9 | ||||

| 4. | FINANCIAL PROVISIONS | 10 | ||||

| 5. | DIRECTORS AND MANAGEMENT | 14 | ||||

| 6. | CONDUCT OF THE COMPANY’S BUSINESS | 16 | ||||

| 7. | DIVIDENDS | 16 | ||||

| 8. | TRANSFER OF SHARES | 16 | ||||

| 9. | EXIT | 17 | ||||

| 10. | WARRANTIES | 17 | ||||

| 11. | RESTRICTIVE COVENANTS | 18 | ||||

| 12. | FORCE MAJEURE | 18 | ||||

| 13. | CONFLICT WITH ARTICLES | 19 | ||||

| 14. | NATURE OF AGREEMENT | 19 | ||||

| 15. | CONFIDENTIALITY | 20 | ||||

| 16. | DURATION AND TERMINATION | 21 | ||||

| 17. | EFFECTS OF TERMINATION | 23 | ||||

| 18. | ARBITRATION | 23 | ||||

| 19. | NOTICES AND SERVICE | 24 | ||||

| 20. | MISCELLANEOUS | 26 | ||||

| 21. | LAW AND JURISDICTION | 26 | ||||

| 22. | ADDRESS FOR SERVICE | 26 | ||||

| SCHEDULE 1 | 27 | |||||

| Part 1 | 27 | |||||

| Holding Company Details | 27 | |||||

| Part 2 | 28 | |||||

| Respicopea Ireland details | 28 | |||||

| Part 3 | 29 | |||||

| Respicopea US details | 29 | |||||

Page (1)

Beachcroft LLP

| SCHEDULE 2 | 30 | |||

| Part 1 | 30 | |||

| Matters reserved for an ordinary resolution by the Ordinary Shareholders | 30 | |||

| Part 2 | 32 | |||

| Matters reserved for a special resolution by the Ordinary Shareholders | 32 | |||

| SCHEDULE 3 | 33 | |||

| Deed of Adherence | 33 | |||

| SCHEDULE 4 | 35 | |||

| Formulae | 35 | |||

| Part A - Formula 1 | 35 | |||

| Part B - Formula 2 | 36 | |||

| Part C - Formula 3 | 37 | |||

| SIGNATURE PAGE | 38 |

Page (2)

Beachcroft LLP

| THIS AGREEMENT is made the | day of | 2010 |

BETWEEN:

|

(1)

|

GAINE, INC, a company incorporated under the laws of the State of Delaware and whose principal office is 6606 FM 1488, Ste. 148-165, Magnolia, TX 77354 and whose registered office is at The Company Corporation, 2711 Centerville Road, Wilmington, DE 19808 ("Gaine Investor");

|

|

(2)

|

PERNIX THERAPEUTICS, LLC, a company organised under the laws of the State of Louisiana and whose registered office is at 33219 Forest West Street, Magnolia, TX 77354 ("Pernix");

|

|

(3)

|

BIOCOPEA LIMITED, a company incorporated in England and Wales under company number 06704604 and whose registered office is at 100 Fetter Lane, London EC4A 1BN ("Biocopea");

|

|

(4)

|

KULIK INVESTMENTS (I) IC LIMITED of Suite 7, Provident House, Havilland Street, St Peter Port, Guernsey GY1 2QE ("Biocopea Investor"); and

|

|

(5)

|

RESPICOPEA HOLDINGS LIMITED, a company incorporated in England under company number 7448669 and whose registered office is at 100 Fetter Lane, London EC4A 1BN (the "Company ").

|

WHEREAS:

|

(A)

|

Gaine Investor, Pernix, Biocopea and Biocopea Investor have agreed to invest in the Company on and subject to the terms of this Agreement.

|

|

(B)

|

The Company (the details of which, after the issue of shares and appointment of directors contemplated by clauses 2.3 and 5.1 (respectively) below have been effected, are set out in Part 1 of Schedule 1) beneficially owns all the issued share capital of the Subsidiaries (as defined below).

|

|

(C)

|

The Ordinary Shareholders (as defined below) have agreed to fund the Company by way of a subscription for shares and agree that:

|

|

|

(i)

|

their subscriptions as detailed in clause 2.3 represent part of their total anticipated investment in the Company and the corresponding percentage of the entire issued shareholding in the capital of the Company (as represented by Ordinary Shares which they obtain under such clause) reflects the investments which may be requested under the Funds Notices (as defined below);

|

|

|

(ii)

|

the amount of the appropriate level of investment in the Company will be finalised when the Board (as defined below) is able to ascertain the regulatory funding requirements more accurately;

|

|

|

(iii)

|

upon finalisation of the investment requirements of the Company, the Ordinary Shareholders and the Company have agreed that if the Ordinary Shareholders do not provide the required funding in accordance with the principles set out in Clause 4 below the Ordinary Shareholders will transfer certain of their Ordinary Shares to other Ordinary Shareholders on the terms of this Agreement.

|

|

(D)

|

The Ordinary Shareholders (as defined below) have agreed that their respective rights as shareholders of the Company, the business of the Company and the Business shall be regulated in accordance with the provisions of this Agreement.

|

Page 1

Beachcroft LLP

NOW IT IS HEREBY AGREED as follows:

|

1.

|

INTERPRETATION

|

|

1.1

|

In this Agreement and its Recitals, the following words and expressions shall, unless the context otherwise requires, have the following meanings:

|

|

1.1.1

|

"A Share" means an A ordinary share of one penny in the capital of the Company;

|

|

1.1.2

|

"A Shareholders" means the holders of A Shares from time to time, each being an "A Shareholder";

|

|

1.1.3

|

"Agreed Form" means in the form agreed between the parties and signed or initialled for the purpose of identification by or on behalf of each of them;

|

|

1.1.4

|

"the Articles" means the articles of association of the Company as the same may be amended from time to time in accordance with the terms of this Agreement (and "Article" shall be construed accordingly);

|

|

1.1.5

|

"B Share" means a B ordinary share of one penny in the capital of the Company;

|

|

1.1.6

|

"B Shareholders" means the holders of B Shares from time to time, each being a "B Shareholder";

|

|

1.1.7

|

"Biocopea Intellectual Property" means the Intellectual Property Rights and any other products, methods, patents or technology using theobromine in a cough product developed by Biocopea prior to, on or after the date hereof;

|

|

1.1.8

|

"the Board" means the board of directors (as constituted from time to time) of the Company and/or any Subsidiary;

|

|

1.1.9

|

"the Board Minutes" means the minutes of a meeting of the Board of the Company in the Agreed Form;

|

|

1.1.10

|

"the Business" means acting as a holding company for the Subsidiaries involved in the development of medication and drugs for use in respiratory diseases including cough related diseases, the licensing of such medication and drugs to third parties and such other business activities as the Company and the Subsidiaries may conduct from time to time;

|

|

1.1.11

|

"Business Day" means a day (excluding Saturdays and Sundays) on which banks in the City of London are open for the transaction of normal banking business;

|

|

1.1.12

|

"Business Plan" means the exploitation of the Intellectual Property Rights owned or used by Respicopea Ireland for maximum commercial benefit;

|

|

1.1.13

|

"C Share" means a C ordinary share of one penny in the capital of the Company;

|

|

1.1.14

|

"Capital Contributions" has the meaning ascribed to it in Clause 4.5;

|

|

1.1.15

|

"Completion" means performance by the Parties of their respective obligations under Clause 2;

|

Page 2

Beachcroft LLP

|

1.1.16

|

"Completion Date" means the date hereof;

|

|

1.1.17

|

"Connected" means connected as defined in section 839 of ICTA;

|

|

1.1.18

|

"Control" shall have the meaning ascribed to it in section 416(2) of ICTA and “change in Control” shall be deemed to have occurred with respect to any company if any person having previously controlled that company ceases to do so or if any person acquires control of it;

|

|

1.1.19

|

"Deficit" has the meaning ascribed to it in Clause 4.4;

|

|

1.1.20

|

"Deficit Funds Notice" has the meaning ascribed to it in Clause 4.4;

|

|

1.1.21

|

"Directors" means the directors of the Company or of any Subsidiary from time to time appointed in accordance with the terms of this Agreement;

|

|

1.1.22

|

"Encumbrance" means any interest or equity of any person (including any right to acquire, option or right of pre-emption) or any mortgage, charge, pledge, lien, restriction, assignment, hypothecation, security interest, title retention or any other security agreement or arrangement or any agreement or arrangement to create any of the same;

|

|

1.1.23

|

"the Estimated Budget" means the estimated consolidated budget for the Company and each Subsidiary during the Preliminary Funding Period, the initial copy of which has been seen by each of the Parties and shall be updated from time to time in accordance with Clause 4.2;

|

|

1.1.24

|

"Excess" means the amount transferred by an Overfunding A Shareholder to the Company in respect of a Funds Notice on or before the relevant Forty Day Deadline to the extent that such amount exceeds such Ordinary Shareholder's Pro Rata Share of the amount of funds requested by the Company under the relevant Funds Notice (and "Excesses" shall be interpreted accordingly);

|

|

1.1.25

|

"Excess Funds Requirement" has the meaning ascribed to it in Clause 4.7;

|

|

1.1.26

|

“Executive Directors” means Gregory Stoloff and Cooper Collins;

|

|

1.1.27

|

"Force Majeure" has the meaning given to that expression by Clause 12.1;

|

|

1.1.28

|

"Formula 1" means the formula set out in, and calculated in accordance with, Part A of Schedule 4;

|

|

1.1.29

|

"Formula 2" means the formula set out in, and calculated in accordance with, Part B of Schedule 4;

|

|

1.1.30

|

"Formula 3" means the formula set out in, and calculated in accordance with, Part C of Schedule 4;

|

|

1.1.31

|

"Formula 1 Shares" has the meaning ascribed to it in Clause 4.6.2;

|

|

1.1.32

|

"Forty Day Deadline" has the meaning ascribed to it in Clause 4.3;

|

|

1.1.33

|

"Funds Notice" has the meaning ascribed to it in Clause 4.3;

|

Page 3

Beachcroft LLP

|

1.1.34

|

"Group” means, in relation to any company, that company and any other company which, at the relevant time, is its holding company or subsidiary of any such holding company, and “member” of a Group shall be construed accordingly;

|

|

1.1.35

|

"holding company" and "subsidiary" have the meanings respectively given to them by section 1159 of the Companies Act 2006;

|

|

1.1.36

|

“ICTA” means the Income and Corporation Taxes Act 1988;

|

|

1.1.37

|

"Initial Subscription Monies" means the sum of $3,000,000 advanced by the Subscribers to the Company on or before the date hereof by way of subscription for Shares;

|

|

1.1.38

|

"Intellectual Property Assignments" means:

|

|

(a)

|

the agreement to be entered on or before Completion between Dr Dezso Korbonits, Mr István Jelinek, Dr Péter Aranyi, Dr Mikus Endre (the "Original Inventors") and Respicopea Ireland under which certain Intellectual Property Rights in relation to theobromine will be assigned by the Original Inventors to Respicopea Ireland; and

|

|

(b)

|

the agreement to be entered on or before Completion in the Agreed Form between Biocopea and Respicopea Ireland under which certain of the Biocopea Intellectual Property will be assigned by Biocopea to Respicopea Ireland;

|

|

1.1.39

|

"Intellectual Property Licences" means:

|

|

(a)

|

the patent licence agreement to be entered on or before Completion in the Agreed Form between Gaine Investor (1), Pernix (2) Respicopea Ireland (3) and Respicopea US (4) under which the Theobromine Intellectual Property will be licensed to Respicopea Ireland on the terms set out therein (the "Patent Licence");

|

|

(b)

|

the US patent agreement to be entered at Completion in the Agreed Form between Respicopea Ireland and Respicopea US under which the Theobromine Intellectual Property (at the date of Completion) will be licensed by Respicopea Ireland to Respicopea US; and

|

|

(c)

|

the development and distribution agreement to be entered at Completion in the Agreed Form between Respicopea US (1), Respicopea Ireland (2), Pernix (3) and the Company (4) under which certain Intellectual Property Rights will be licensed by Respicopea US to Pernix;

|

|

1.1.40

|

"Intellectual Property Rights" means any and all patents, trade marks, rights in designs, get-up, trade, business or domain names, websites, copyrights, and topography rights (whether registered or not and any applications to register or rights to apply for registration of any of the foregoing), rights in inventions, know-how, trade secrets and other confidential information, rights in computer software, including source code, operating systems and specifications, databases and all other intellectual property rights of a similar or corresponding character which subsist in any part of the world;

|

|

1.1.41

|

"Investment" means the investment by the Subscribers pursuant to clause 3;

|

Page 4

Beachcroft LLP

|

1.1.42

|

"Investors" means the Gaine Investor and the Biocopea Investor;

|

|

1.1.43

|

“Listing” means the unconditional granting of permission for the issued share capital of the Company or of any Subsidiary to be dealt on any recognised investment exchange (as defined in section 285 of the Financial Services and Markets Act 2000);

|

|

1.1.44

|

"Management" means Manfred Scheske, Gregory Stoloff, Robin Bannister and Cooper Collins;

|

|

1.1.45

|

"ordinary resolution" has the meaning ascribed to it in section 282 of the Companies Act 2006;

|

|

1.1.46

|

"Ordinary Shares" means the A Shares and B Shares;

|

|

1.1.47

|

"Ordinary Shareholders" means the holders of the Ordinary Shares from time to time, each being an "Ordinary Shareholder";

|

|

1.1.48

|

"Overfunding A Shareholder" means an A Shareholder who transfers to the Company more than his Pro Rata Share of the amount of funds requested by the Company under a Funds Notice on or before the relevant Forty Day Deadline;

|

|

1.1.49

|

"Parties" means the parties to this Agreement;

|

|

1.1.50

|

"Preliminary Funding Period" means the period between the date hereof and the earlier of the date:

|

|

|

(i)

|

of the relevant Forty Day Deadline (or Second Forty Day Deadline) in respect of a Funds Notice (or Deficit Funds Notice) in which the Company indicates that it is the last Funds Notice (or Deficit Funds Notice) to be issued by the Company; and

|

|

|

(ii)

|

of the first theobromine product (as developed by the Respicopea Holdings Group) to obtain a marketing authorisation for any country;

|

|

1.1.51

|

"Pro Rata Share" means in relation to:

|

|

|

(i)

|

an Ordinary Shareholder's holding of any Shares (e.g A Shares and/or B Shares), the number of Shares of the relevant class of Shares held by that Ordinary Shareholder when expressed as a proportion of the total number of issued Shares in such class; or

|

|

|

(ii)

|

a request for an amount of funds made by the Company to the A Shareholders under a Funds Notice, the proportion of funds requested from each A Shareholder which shall equate to the number of A Shares held by each A Shareholder as a proportion of the total number of A Shares in issue (and "A Shareholder's Pro Rata Share" shall be interpreted accordingly unless the context requires otherwise);

|

|

|

(iii)

|

an A Shareholder, the number of A Shares held by such A Shareholder when expressed as a proportion of the total number of A Shares in issue;

|

|

|

(iv)

|

a transfer of funds by an A Shareholder or B Shareholder to the Company pursuant to a Funds Notice (or Deficit Funds Notice), the amount of funds provided by such Ordinary Shareholder when expressed as a proportion of the total amount of funds provided by the A Shareholders or B Shareholders (respectively) to the Company;

|

|

|

(v)

|

the Excess transferred to the Company by an Overfunding A Shareholder, the amount of such Excess when expressed as a proportion of the total Excesses transferred by Overfunding A Shareholders to the Company in respect of a Funds Notice;

|

Page 5

Beachcroft LLP

|

1.1.52

|

"Respicopea Ireland" means Respicopea Limited, details of which are set out in Part 2 of Schedule 1;

|

|

1.1.53

|

"Respicopea US" means Respicopea Inc, details of which are set out in Part 3 of Schedule 1;

|

|

1.1.54

|

"Restricted Information" has the meaning given to that expression by Clause 15;

|

|

1.1.55

|

"Second Forty Day Deadline" has the meaning ascribed to it in Clause 4.4;

|

|

1.1.56

|

"Shares" means Ordinary Shares and C Shares in the capital of the Company issued from time to time, and includes the beneficial interest therein and the term “Shareholder” shall be construed accordingly;

|

|

1.1.57

|

"the Share Transfer Provisions" means the provisions of the Articles relating to the transfer of Shares and expressions defined in those provisions have the same meaning in this Agreement;

|

|

1.1.58

|

"special resolution" has the meaning ascribed to it in section 283 of the Companies Act 2006;

|

|

1.1.59

|

“Subscribers” means together Gaine Investor, Pernix, Biocopea and Biocopea Investor, each being a "Subscriber";

|

|

1.1.60

|

"Subsidiaries" means the subsidiary undertakings of the Company from time to time which, at the date hereof are Respicopea Ireland and Respicopea US, each being a "Subsidiary";

|

|

1.1.61

|

"Taxation Statutes" means any directive, statute, enactment, law or regulation, wheresoever enacted or issued, coming into force or entered into providing for or imposing any Taxation and shall include orders, regulations, instruments, bye-laws or other subordinate legislation made under the relevant statute or statutory provision and any directive, statute, enactment, law, order, regulation or provision which amends, extends, consolidates or replaces the same or which has been amended, extended, consolidated or replaced by the same;

|

|

1.1.62

|

"Theobromine Intellectual Property" means:

|

|

(a)

|

all the Intellectual Property Rights under U.S. patent No. 6,348,470 relating to the use of theobromine in cough, together with all re-issues and extensions of such granted patent; and

|

|

(b)

|

any other Intellectual Property Rights acquired by Respicopea Ireland under the Intellectual Property Assignments and/or Intellectual Property Licences and/or developed by a member of the Respicopea Holdings Group pertaining to the use of theobromine in cough;

|

|

1.1.63

|

"Transaction Documents" means this Agreement, the Articles, the Intellectual Property Assignments and the Intellectual Property Licences;

|

Page 6

Beachcroft LLP

|

1.1.64

|

"Underfunding A Shareholders" has the meaning ascribed to it in Clause 4.6.2;

|

|

1.1.65

|

"Warranties" means the warranties by the Company set out in Clause 10;

|

|

1.1.66

|

"the Written Resolutions" means the written resolutions of the Company in the Agreed Form.

|

|

1.2

|

In this Agreement, unless the context otherwise requires, any reference to:

|

|

1.2.1

|

Clause, schedule and paragraph headings do not affect the interpretation of this Agreement;

|

|

1.2.2

|

a reference to a Clause or a Schedule is a reference to a clause of, or schedule to, this Agreement. A reference to a Paragraph is to a paragraph of the relevant Schedule;

|

|

1.2.3

|

a person includes a natural person, a corporate or unincorporated body (whether or not having a separate legal personality);

|

|

1.2.4

|

words in the singular include the plural and in the plural include the singular;

|

|

1.2.5

|

a reference to one gender includes a reference to the other genders;

|

|

1.2.6

|

a reference to a particular statute, statutory provision or subordinate legislation is a reference to it as it is in force from time to time taking account of any amendment or re-enactment and includes any statute, statutory provision or subordinate legislation which it amends or re-enacts and subordinate legislation for the time being in force made under it provided that, as between the parties, no such amendment or re-enactment shall apply for the purposes of this Agreement to the extent that it would impose any new or extended obligation, liability or restriction on, or otherwise adversely affect the rights of, any party;

|

|

1.2.7

|

a reference to writing or written includes faxes and email but no other electronic form, save for the purposes of Clause 5, where a reference to writing or written includes electronic forms and the sending or supply of notices in electronic form;

|

|

1.2.8

|

a reference in this Agreement to a document is a reference to the document whether in paper or electronic form;

|

|

1.2.9

|

where the words include(s), including or in particular are used in this Agreement, they are deemed to have the words "without limitation" following them;

|

|

1.2.10

|

any obligation in this Agreement on a person not to do something includes an obligation not to agree or allow that thing to be done;

|

|

1.2.11

|

where the context permits, other and otherwise are illustrative and shall not limit the sense of the words preceding them;

|

Page 7

Beachcroft LLP

|

1.2.12

|

references to times of day are, unless the context requires otherwise, to London time and references to a day are to a period of 24 hours running from midnight on the previous day;

|

|

1.2.13

|

any obligation in this Agreement on a person to procure something happens means that person will use all reasonable endeavours to procure that it happens to the extent that it is reasonably within his control; and

|

|

1.2.14

|

any reference to $ means United States dollars.

|

|

2.

|

COMPLETION

|

|

2.1

|

Forthwith upon the execution of this Agreement, the parties shall comply with their respective obligations under Clause 2.3.

|

|

2.2

|

Completion shall take place at the offices of Respicopea Ireland.

|

|

2.3

|

At Completion:

|

|

2.3.1

|

the Company and the Ordinary Shareholders shall procure that the Board Minutes and the Written Resolutions are passed and the matters contained therein are effected;

|

|

2.3.2

|

Gaine Investor shall subscribe £1,800 in cash in payment for, and the Company shall allot to it, 180,000 A Shares, comprising approximately 18% of the Shares in issue as at the Completion Date and shall initially have voting rights of approximately 20% of the entire voting rights attached to the share capital of the Company;

|

|

2.3.3

|

Pernix shall subscribe $1,500,000 in cash in payment for, and the Company shall allot to it, 280,000 B Shares, comprising approximately 28% of the Shares in issue as at the Completion Date and shall initially have voting rights of approximately 30% of the entire voting rights attached to the share capital of the Company;

|

|

2.3.4

|

Biocopea Investor shall subscribe $1,500,000 in cash in payment for, and the Company shall allot to it, 180,000 A Shares, comprising approximately 18% of the Shares in issue as at the Completion Date and shall initially have voting rights of approximately 20% of the entire voting rights attached to the share capital of the Company;

|

|

2.3.5

|

Biocopea shall subscribe £2,799 in cash in payment for, and the Company shall allot, 279,900 B Shares, comprising approximately 28% of the Shares in issue as at the Completion Date and shall initially have voting rights of approximately 30% of the entire voting rights attached to the share capital of the Company;

|

|

2.3.6

|

the Company will procure that Manfred Scheske shall subscribe £700 in cash in payment for, and the Company shall allot to Manfred Scheske, 70,000 C Shares, comprising approximately 7% of the Shares in issue at the Completion Date;

|

|

2.3.7

|

1% of the total share capital of the Company (which at the date of Completion is intended to be issued by the Company to a future employee or employees) shall be left unissued.

|

|

2.4

|

The Directors are hereby authorised generally and unconditionally to allot the Shares referred to in Clause 2.3 above to the Subscribers.

|

Page 8

Beachcroft LLP

|

2.5

|

Upon Completion the parties shall enter into, or shall procure the entry into the following documents (as the case may be) to the extent they have not been executed prior to Completion:

|

|

2.5.1

|

the Intellectual Property Assignments;

|

|

2.5.2

|

the Intellectual Property Licences;

|

|

2.5.3

|

the Written Resolutions.

|

|

2.6

|

As soon as practicable after Completion, the Parties shall (to the extent that it is reasonably within their control having regard to their ability to appoint and control directors on the boards of each of the Company and the Subsidiaries) use their reasonable endeavours to register at the United States Patent and Trademarks Office (and any other appropriate registry) in respect of US Patent No 6,348,470:

|

|

2.6.1

|

a continuing security interest in the Agreed Form to protect Respicopea Ireland's contingent contractual right under the Patent Licence (as defined under the definition of "Intellectual Property Licences") to acquire the US patent licensed thereunder (and, in addition, to file such continuing security interest under the Uniform Commercial Code of the United States with the Delaware Secretary of State's office);

|

|

2.6.2

|

the Patent Licence itself; and

|

|

2.6.3

|

the agreement described in paragraph (b) of the definition of Intellectual Property Licences.

|

|

2.7

|

Upon Completion each of the Gaine Investor and Pernix shall deliver to the other Parties, a copy (certified as being a true and complete copy by a qualified attorney) of the minutes (in the Agreed Form) of the respective board meetings which each of the Gaine Investor and Pernix has held to:

|

|

2.7.1

|

approve the terms of this Agreement and, to the extent that such entity is a party to them, the documents contemplated by this Agreement;

|

|

2.7.2

|

authorise the entry into this Agreement and such documents; and

|

|

2.7.3

|

confer the necessary authority on the relevant officers of such entity.

|

|

3.

|

APPLICATION OF SUMS SUBSCRIBED

|

|

3.1

|

The sums subscribed by the Subscribers at Completion pursuant to Clause 2.3 and, subject to Clauses 4.1 and 4.2, any additional funding provided by the Shareholders pursuant to Clause 4, shall be applied by the Company in accordance with the Estimated Budget subject to:

|

|

3.1.1

|

the Executive Directors having a discretion to vary the sums to be applied to any particular category of activity and shift it to another category of activity provided that:

|

|

(a)

|

the aggregate expenditure under the Estimated Budget will not be exceeded; and

|

|

(b)

|

that each of the tasks within the Estimated Budget will be completed; and

|

Page 9

Beachcroft LLP

|

3.1.2

|

the Board being able to apply sums to be applied to any particular category of activity in the Estimated Budget to any other category of activity (whether in the Estimated Budget or not) if there is a simple majority vote of the Board to approve such variation.

|

|

3.2

|

The Company shall provide to the Subscribers:

|

|

3.2.1

|

in the Preliminary Funding Period, by no later than the 20th Business Day following the end of the month to which they relate, monthly management unaudited accounts for the Company containing cash flow for the month with comparison to budget and projected cash flows to the end of the Preliminary Funding Period; and

|

|

3.2.2

|

annually during the Preliminary Funding Period, an unaudited profit and loss account and an unaudited balance sheet; and

|

|

3.2.3

|

thereafter:

|

|

(a)

|

management accounting information as determined by the Board from time to time;

|

|

(b)

|

draft annual accounts for the Company in a form substantially approved by the Auditors, within 6 weeks from the end of the period to which they relate; and

|

|

(c)

|

annual audited accounts for the Company, within 10 weeks from the end of the period to which they relate.

|

|

4.

|

FINANCIAL PROVISIONS

Consideration of Funding Requirements

|

|

4.1

|

Not later than three months after the date hereof, the Company shall procure that a meeting of Directors shall be convened at which Directors shall consider the financial position of the Company, the status of the Business and the Subsidiaries’ ongoing requirements for further funding with a view to resolving whether and on what basis additional funding shall be sought by the Company and on what the additional funding should be spent.

|

|

4.2

|

Regard being had to the matters to be considered under Clause 4.1, the Board shall, when it decides that it is appropriate, consider and, if thought fit, pass a resolution (the “Resolution”) to approve the proposal for the ongoing funding of the Company, the Subsidiaries and the Business and the updated Estimated Budget which the Directors shall consider to be in the best interests of the Company. The passing of the Resolution shall require a simple majority of the Board.

|

|

|

Funds Notices

|

|

4.3

|

Where the proposal adopted by the Company by virtue of the passing of the Resolution provides for the provision of additional funding, quarterly meetings of the Board shall be held at which the financial requirements of the Company shall be monitored and when, from time to time in the Preliminary Funding Period, the Board resolves that the funding is actually required, the Company shall serve notice (a "Funds Notice") to that effect upon each of the A Shareholders which notice shall request the A Shareholders, on or before the date which is 40 days after the date of the Funds Notice (the "Forty Day Deadline") to transfer or procure the transfer to the Company in cleared funds of each A Shareholder's Pro Rata Share of the required funding provided that:

|

Page 10

Beachcroft LLP

|

4.3.1

|

each A Shareholder shall notify the Company of the amount it intends to transfer as soon as possible after receipt of the Funds Notice; and

|

|

4.3.2

|

in the event that any A Shareholder indicates that it will transfer an amount which is less than its Pro Rata Share, each of the other A Shareholders who wish to transfer additional funds to the Company shall act in good faith to transfer the balance of funds in their Pro Rata Shares (such Pro Rata Shares being calculated without including the number of A Shares held by the Underfunding A Shareholder when determining the total number of A shares held by the A Shareholders as a class for this purpose) or such other proportions as may be agreed between them.

|

|

|

Deficit Funds Notices

|

|

4.4

|

In the event that the aggregate amount of funds requested by the Company under any Funds Notice is not received in cleared funds by or on behalf of the A Shareholders on or before the relevant Forty Day Deadline the Investors shall cease to have the right to satisfy the request in the relevant Funds Notice by transferring funds to the Company and the Company shall send to the B Shareholders a notice in the form of a Funds Notice (a "Deficit Funds Notice") which shall request each of the B Shareholders to transfer, or procure the transfer of, on or before the date which is forty days after the date of the relevant Deficit Funds Notice (the "Second Forty Day Deadline") in their Pro Rata Shares, the amount of funds (the "Deficit") which was not so received by the Company and:

|

|

4.4.1

|

each B Shareholder shall notify the Company of the amount it intends to transfer as soon as possible after receipt of the Deficit Funds Notice; and

|

|

4.4.2

|

in the event that any B Shareholder indicates that it will transfer an amount which is less than its Pro Rata Share of the Deficit, each of the other B Shareholders who wish to transfer additional funds to the Company shall act in good faith to transfer the balance of funds in their Pro Rata Shares (such Pro Rata Shares being calculated without including the number of A Shares held by the underfunding B Shareholders when determining the total number of B Shares held by the B Shareholders as a class for this purpose) or such other proportions as may be agreed between them.

|

|

|

Capital Contributions

|

|

4.5

|

Each transfer of funds to the Company by an Ordinary Shareholder whether in accordance with Clauses 4.3 and 4.4 or otherwise shall be treated as a capital contribution by way of an additional subscription by the relevant A Shareholder or B Shareholder which shall be divided equally between the Shares of the relevant class which it holds at the time ("Capital Contributions") and, to the extent possible, as an increase to the share premium account of the Company in respect of those Shares.

|

|

|

Threshold Funds and Shareholdings

|

|

4.6

|

In relation to a request by the Company for an aggregate amount of $12,000,000 or less contained in a Funds Notice and, to the extent that, when aggregated with the amounts requested under previous Fund Notices, the amount requested under such Funds Notice does not exceed $12,000,000, in the event that:

Requirement satisfied by all A Shareholders Pro Rata

|

|

4.6.1

|

each A Shareholder transfers its Pro Rata Share requested in such Funds Notice to the Company on or before the relevant Forty Day Deadline, the A Shareholders' holdings of A Shares shall remain the same;

|

|

|

Requirement satisfied by A Shareholders but not Pro Rata

|

|

4.6.2

|

the A Shareholders collectively transfer the funds requested in such Funds Notice but one or more of the A Shareholders (the "Underfunding A Shareholders") do not transfer their Pro Rata Share of the funds requested in such Funds Notice, upon the earlier of (a) the relevant Forty Day Deadline for such Funds Notice and (b) the date upon which the relevant A Shareholder(s) indicate that it will not transfer its Pro Rata Share but the A Shareholder(s) have collectively transferred the funds requested in such Funds Notice, the Parties shall take steps to procure that the number of A Shares represented by "A" (the "Formula 1 Shares") in, and calculated in accordance with, Formula 1 is transferred by the Underfunding A Shareholder(s) as soon as practicable to the Overfunding A Shareholder(s) in the latter's Pro Rata Shares of the total Excesses; or

|

|

|

Requirement not fully satisfied by A Shareholders but satisfied in whole or in part by B Shareholders

|

|

4.6.3

|

the A Shareholders do not transfer to the Company the full amount of the funds requested in such Funds Notice on or before the relevant Forty Day Deadline, the Parties shall procure that the Formula 1 Shares are transferred by the Underfunding A Shareholders to:

|

|

(a)

|

any Overfunding A Shareholder provided that:

|

|

(i)

|

the Overfunding A Shareholders shall only be entitled to receive that percentage of the Formula 1 Shares which equates to the total Excesses when expressed as a percentage of the aggregate difference between (a) the Underfunding A Shareholders' Pro Rata Share of the amount of funds required under such Funds Notice and (b) the amount of funds that such Underfunding A Shareholders transferred to the Company on or before the relevant Forty Day Deadline;

|

|

(ii)

|

each Overfunding A Shareholder shall only be entitled to such proportion of the Formula 1 Shares to which the Overfunding A Shareholders are entitled under Clause 4.6.3(a)(i) above as equates to such Overfunding A Shareholder's Pro Rata Share of the total Excesses;

|

|

(b)

|

any B Shareholder who transfers funds to the Company in relation to the relevant Deficit Funds Notice in accordance with Clause 4.4 to the extent that such B Shareholder has an entitlement to additional B Shares (which, for the avoidance of doubt, will mean that the Formula 1 Shares transferred by the Underfunding A Shareholder hereunder will convert from A Shares to B Shares upon such transfer to the B Shareholder being completed) as represented by "B" in, and calculated in accordance with, Formula 2; and/or

|

|

(c)

|

each of the Ordinary Shareholders save for any Underfunding A Shareholders (after the transfers of A Shares in Clauses 4.6.3 (a) and/or (b) have been made and only if the A Shareholders and/or B Shareholders have not transferred to the Company the full amount of the funds requested in such Funds Notice and there is a Deficit) in proportion to the number of Shares they hold when expressed as a percentage of the total issued Shares in the capital of the Company (excluding any Underfunding A Shareholder's Shares);

|

provided that, for the avoidance of doubt, the Company shall procure that, upon any transfer of Formula 1 Shares to the B Shareholders, such shares shall convert to B Shares respectively in accordance with the procedure under Article 7.3 of the Articles.

Page 11

Beachcroft LLP

Additional Funds and Shareholdings

|

4.7

|

In relation to a request for funds by the Company for any amount contained in a Funds Notice and to the extent that, when aggregated with the amounts requested under previous Funds Notices, such amount exceeds $12,000,000 (the excess over $12,000,000 being referred to as the "Excess Fund Requirement"), in the event that:

|

Excess Fund Requirement satisfied by A Shareholders

|

4.7.1

|

the A Shareholders collectively transfer the Excess Fund Requirement requested under the relevant Funds Notice to the Company on or before the relevant Forty Day Deadline, each Shareholder's (i.e. for the avoidance of doubt, the Ordinary Shareholders and holders of C Shares) new holding of Shares (when expressed as a percentage of the entire issued share capital of the Company) shall be represented by "W" in, and calculated in accordance with, Formula 3 and the Parties shall procure that, immediately before the earlier of the relevant Forty Day Deadline and the date upon which all the A Shareholders' relevant transfers of funds are finalised, any necessary issue of Shares (including, without limitation, the disapplication of statutory pre-emption rights) shall be effected to ensure that each Shareholder has the correct holdings of Shares as specified in the calculation of Formula 3 for each of such Shareholders; or

|

Excess Fund Requirement not satisfied by A Shareholders but satisfied in whole or in part by B Shareholders

|

4.7.2

|

the A Shareholders do not transfer to the Company the full amount of the Excess Fund Requirement requested in such Funds Notice on or before the relevant Forty Day Deadline but a B Shareholder transfers funds to the Company in respect of the such Excess Fund Requirement on or before the Second Forty Day Deadline, each Shareholder's (i.e. for the avoidance of doubt, the Ordinary Shareholders and holders of C Shares) new holding of Shares (when expressed as a percentage of the entire issued share capital of the Company) shall be represented by "W" in, and calculated in accordance with, Formula 3 and the Parties shall procure that any necessary issue of Shares (including, without limitation, the disapplication of statutory pre-emption rights) shall be effected to ensure that each Shareholder has the correct holdings of Shares as specified in the calculation of Formula 3.

|

|

4.8

|

For the avoidance of doubt, if, where a request for funds by the Company is made in any one or more Funds Notice(s) and exceeds $12,000,000:

|

|

4.8.1

|

Clause 4.6 shall apply in relation to the first $12,000,000 of such Funds Notice(s) to calculate the new shareholdings of the each Ordinary Shareholder; and

|

|

4.8.2

|

Clause 4.7 shall apply in relation to any amount in excess of $12,000,000 to calculate the new shareholdings of each Shareholder after the calculation in referred to in Clause 4.8.1 has been carried out.

|

Page 12

Beachcroft LLP

External Investment

|

4.9

|

In the event that there is a Deficit after the provisions of Clause 4.4 have been applied in relation to any Funds Notice, subject to the provisions of this Agreement and the Articles, the Company may seek the funds represented by the Deficit from persons who are not existing shareholders in the capital of the Company and if shares in the capital of the Company are issued to such persons it is acknowledged and agreed that the shareholdings of all shareholders in the capital of the Company will be diluted by such issue.

|

Pre-emption on Transfer

|

4.10

|

In the event that an Ordinary Shareholder is required to transfer its Shares to another Ordinary Shareholder pursuant to this Clause 4, the Parties agree that Article 39.2 of the Articles (the "Pre-emption Transfer Provisions") shall not apply and the Directors shall be entitled to give notice to each Ordinary Shareholder that Pre-emption Transfer Provisions have been disapplied for the purposes of any transfer of Shares pursuant to this clause 4. For the avoidance of doubt, the Directors shall not have the right to disapply the Pre-emption Transfer Provisions on any transfer of shares (notwithstanding any such right in the Articles) which is made other than pursuant to this clause 4 and clause 8.7.

|

General

|

4.11

|

Where the number of Shares to be transferred or issued pursuant to this Clause 4 as calculated in accordance with:

|

|

4.11.1

|

Formula 1 includes a fraction of a share such number of shares shall be rounded up to the next whole number; and/or

|

|

4.11.2

|

Formula 2 and/or Formula 3 includes a fraction of a Share, such number of Shares shall be rounded to the nearest whole number and, if the fraction is one half exactly, it shall be rounded up to the next whole number.

|

|

4.12

|

Each of the holders of A Shares and B Shares to be transferred pursuant to this Clause 4 hereby with effect from the determination of the number of Shares to be transferred irrevocably:

|

|

4.12.1

|

agrees to transfer the legal and beneficial interest it holds in the Shares to the relevant transferee with all rights attaching or accruing to them free from any Encumbrance; and

|

|

4.12.2

|

appoints the Company as its attorney with full power in relation to such Shares to exercise all rights which are capable of exercise by it in its capacity as registered holder of the Shares including, without limitation, to transfer the Shares by signing and delivering a stock transfer form to the relevant transferee.

|

|

4.13

|

The holders of A Shares and B Shares to be converted pursuant to this Clause 4 shall deliver the certificate(s) for those of their Shares to be converted (or an indemnity in lieu thereof) to the Company as soon as practicable, whereupon the Company shall issue to the persons entitled thereto certificates for the new Shares.

|

|

4.14

|

For the avoidance of doubt:

|

|

4.14.1

|

in the event that a Shareholder fails to transfer to the Company an amount equal to its Pro Rata Share of the funding requested under a Funds Notice (or any part of such amount), such failure shall not, of itself, cause such Shareholder to be in breach of this Agreement;

|

Page 13

Beachcroft LLP

|

4.14.2

|

no Shareholder is obliged to make such a transfer of funds;

|

|

4.14.3

|

if a Shareholder does not satisfy such a funding request, where relevant its percentage shareholding shall be decreased in accordance with the terms of this Agreement.

|

|

5.

|

DIRECTORS AND MANAGEMENT

|

|

5.1

|

Pernix shall (for so long as it remains a B Shareholder) be entitled by notice to the Company and each Subsidiary to appoint a maximum of one Director to the Board and, by notice in writing to the Company and the relevant Subsidiary to remove and replace any such Director. The initial Director to be so appointed is Tracy Clifford.

|

|

5.2

|

Gaine Investor shall (for so long as it remains an A Shareholder) be entitled by notice to the Company and each Subsidiary to appoint a maximum of one Director to the Board and, by notice in writing to the Company and the relevant Subsidiary to remove and replace any such Director. The initial Director to be so appointed is Cooper Collins.

|

|

5.3

|

Biocopea shall (for so long as it remains a B Shareholder) be entitled by notice to the Company and each Subsidiary to appoint a maximum of one Director to the Board and, by notice in writing to the Company and the relevant Subsidiary to remove and replace any such Director. The initial Director to be so appointed is Gregory Stoloff.

|

|

5.4

|

Biocopea Investor shall (for so long as it remains an A Shareholder) be entitled by notice to the Company and each Subsidiary to appoint a maximum of one Director to the Board and, by notice in writing to the Company and the relevant Subsidiary to remove and replace any such Director. The initial Director to be so appointed is Kim Duncan.

|

|

5.5

|

The Chief Executive Officer of the Company and the Subsidiaries shall be Manfred Scheske until he is replaced in accordance with the relevant provisions set out in this Agreement and/or the Articles. For the avoidance of doubt, the Chief Executive Officer shall not be a de jure director of such companies.

|

|

5.6

|

Each Ordinary Shareholder shall procure that its respective appointee to the Board devotes all necessary time and effort to the general management of the Company and the Subsidiaries and shall use all reasonable endeavours to ensure that at all properly convened meetings of the Board the requisite quorum is present.

|

|

5.7

|

Each Ordinary Shareholder shall be responsible for and shall indemnify the other Ordinary Shareholders, the Company and each Subsidiary against any loss, liability or cost sustained by any of them as a result of any claim by any Director appointed by it for unfair or wrongful dismissal or otherwise arising out of his removal from the Board.

|

|

5.8

|

Any Director may, by giving notice in writing to the Company or the relevant Subsidiary, appoint an alternate and may, in the same way, remove an alternate so appointed by him. An alternate shall be entitled to receive notice of all meetings of the Board and attend and vote as such at any meeting at which the Director appointing him is not personally present, and generally in the absence of his appointor to do all the things which his appointor is authorised or empowered to do. A Director who is also an alternate shall be entitled, in the absence of his appointor:

|

|

5.8.1

|

to a separate vote on behalf of his appointor in addition to his own vote; and

|

|

5.8.2

|

to be counted as part of the quorum of the Board on his own account and in respect of the Director for whom he is the alternate.

|

Page 14

Beachcroft LLP

|

5.9

|

The Chairman at meetings of the Board and committee of the Directors shall not where the Board or committee is deadlocked, have a second or casting vote.

|

|

5.10

|

The quorum necessary to constitute a meeting of the Board shall, without prejudice to Article 10.2, be a simple majority of the Directors or their alternates. Where a quorum is not present within half an hour from the time appointed for the meeting, or if during a meeting a quorum ceases to be present, the meeting shall stand adjourned to the same day in the next week at the same time and place, or to such time and place as the directors may determine. Notice shall be given of the adjourned meeting and the quorum for the adjourned meeting shall be four Directors or their alternates.

|

|

5.11

|

Meetings of the Board shall take place at such time or times as the Board shall determine, PROVIDED THAT, unless otherwise agreed by the Directors, a meeting of the Board of the Company and of each Subsidiary shall be held at least once every three calendar months. Unless otherwise agreed in writing by all the Directors, at least 28 clear Business Days’ notice in writing shall be given of each meeting of the Board, which notice shall specify in as much detail as is practicable the business to be considered at the meeting, and unless all the Directors (or their duly appointed alternates) agree otherwise no matters shall be resolved at any meeting of the Board except those specified in the notice of the meeting.

|

|

5.12

|

Board meetings may be convened by an Ordinary Shareholder or Director giving not less than 48 hours' notice if the interests of the Company or any Subsidiary would in the opinion of that Ordinary Shareholder or Director be likely to be adversely affected to a material extent if the business to be transacted at such Board meeting were not dealt with as a matter of urgency, or if all the Directors or the Ordinary Shareholders agree.

|

|

5.13

|

Subject to clause 5.12 all relevant Board papers for Board meetings shall be sent to all Directors not less than five Business Days prior to the relevant Board meeting. This is without prejudice to the ability of any Director at such meeting to raise an urgent matter for which no prior notice has been given. Minutes shall be sent to the Directors as soon as practicable after the holding of the relevant meeting.

|

|

5.14

|

All decisions of the Board of the Company and of each Subsidiary shall be determined by a simple majority of votes cast by the Directors (or their alternates). At meetings of the Board, resolutions shall be validly passed by votes by the Directors on a show of hands of all those present.

|

|

5.15

|

Subject to Clause 5.16, the Ordinary Shareholders acknowledge and agree that the decisions of the Board of the Company and of each Subsidiary shall be delegated such that day-to-day management decisions shall be determined by the Management and decisions ordinarily taken by the directors of the Company (e.g. the issue of Shares by the Company) shall, subject to any ordinary resolution or special resolution required under clause 5.16, be effected by a simple majority vote of the Board.

|

|

5.16

|

The Ordinary Shareholders and the Company shall procure that neither the Company nor any Subsidiary may enter into any of the transactions or effect any of the matters specified in:-

|

|

5.16.1

|

Part 1 of Schedule 2 unless the Ordinary Shareholders vote (whether in person or by proxy) by passing an ordinary resolution in favour of such transaction or matter (as the case may be); or

|

|

5.16.2

|

Part 2 of Schedule 2 unless the Ordinary Shareholders vote (whether in person or by proxy) by passing a special resolution in favour of such transaction or matter (as the case may be).

|

Page 15

Beachcroft LLP

|

5.17

|

The Board shall, not later than 30 days before the beginning of each financial period of the Company, consider and seek to approve an annual business plan for the Company.

|

|

5.18

|

Subject to Clause 15, each Director shall be entitled to make full disclosure to the Shareholder appointing him of any information relating to the Company which that Director may acquire in the course of his appointment.

|

|

5.19

|

PepTcell Limited or its associates shall provide appropriate management services, (including, without limitation accounting, finance, tax returns and day-to-day management operations and administration such as contract negotiations and ordering goods) to the Company and each Subsidiary sufficient for the operation of the business of the Company and the Business. These services will be subject to a service agreement between PepTcell Limited, the Company and each Subsidiary and invoiced monthly at rates stipulated in the Estimated Budget (as updated from time to time in accordance with Clause 4.2).

|

|

5.20

|

As at the date hereof, the Board consists of the directors identified in Clauses 5.1 to 5.4 (inclusive) and any amendment to the number of directors shall be effected in accordance with Clause 5.16.1 and paragraph 12 of Part 1 of Schedule 2.

|

|

6.

|

CONDUCT OF THE COMPANY’S BUSINESS

|

|

6.1

|

Each of the Executive Directors, undertakes to the Company (on its own behalf and on behalf of each Subsidiary) and each Subsidiary and the Subscribers that he will procure to the full extent of his respective rights and powers from time to time both as a Shareholder and/or Director, as appropriate, of the Company and/or any Subsidiary that the Executive Directors shall:

|

|

6.1.1

|

use all reasonable endeavours to efficiently and properly manage the Business and to achieve the Business Plan;

|

|

6.1.2

|

act at all times in good faith in their dealings on behalf of the Company and each Subsidiary and use all reasonable endeavours not to do anything or cause anything to be done which adversely affects or may adversely affect the goodwill of the Business or of the Company or the Subsidiaries;

|

|

6.1.3

|

devote his time and attention during normal business hours and such hours as may be required of him to the Business and the affairs of the Company and each Subsidiary;

|

|

6.1.4

|

not enter into any transaction, agreement or other arrangement with the Company or any Subsidiary or any other person Connected with the Company or any Subsidiary other than on a bona fide arm’s length basis or as agreed by the Board where interested parties are unable to vote; and

|

|

6.1.5

|

not have any interest in any contract (other than his own service agreement) entered into by the Company or any Subsidiary unless on a bona fide arm’s length basis and agreed by the Board where interested parties are unable to vote.

|

|

7.

|

DIVIDENDS

|

|

7.1

|

Subject to the provisions of Part 23 of the Companies Act 2006, there shall be distributed by way of dividend such proportion of the distributable profits of the Company for each accounting period as shall be recommended by the Directors and approved by an ordinary resolution of the Ordinary Shareholders.

|

|

7.2

|

If so required by any Shareholder, by notice in writing to the Company, the Company shall enter into a group income election under section 247(1) of ICTA in respect of dividends paid to that Shareholder, and the Company shall not subsequently revoke any such election (unless required to do so by notice in writing given to it by the Shareholder in question) or (unless so required) give to the Collector of Taxes a notice pursuant to section 247(3) of ICTA in relation to that election.

|

|

8.

|

TRANSFER OF SHARES

|

|

8.1

|

No Shareholder shall sell, transfer, mortgage, charge, encumber or otherwise dispose of any Share or any interest therein except in accordance with the provisions of this Clause 8.

|

|

8.2

|

The Directors shall not approve for registration any person becoming entitled to a Share or Shares in consequence of the death or bankruptcy of a Shareholder, or any nominee of such person, unless and until such person has entered into a deed of adherence to this Agreement in the form set out in Schedule 3 to this Agreement, subject to such amendment thereto as shall be required to ensure such adherence.

|

|

8.3

|

If a deed of adherence has not been entered into in accordance with Clause 8.2 by such person within 90 days of him becoming entitled to such Share or Shares (or such longer period as the Directors may determine), then a Transfer Notice (as defined in the Articles) shall be deemed to have been given pursuant to the Share Transfer Provisions by the deceased Shareholder in respect of all Shares held by him.

|

|

8.4

|

An Ordinary Shareholder may transfer some or all of his Ordinary Shares provided that:

|

|

8.4.1

|

the transfer is made in accordance with the Share Transfer Provisions;

|

|

8.4.2

|

except in the case of a transfer from one Ordinary Shareholder to another, the proposed transferee has executed a deed of adherence in the form set out in Schedule 3, subject to such amendment thereto as shall be required to reflect the terms agreed with the proposed transferee; and

|

|

8.4.3

|

any necessary consent has been obtained for the transfer.

|

|

8.5

|

The Ordinary Shareholders shall procure that the Directors approve for registration any transfer of Shares which complies with the provisions of this Clause 8, and decline to approve for registration any other transfer of Shares.

|

|

8.6

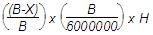

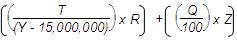

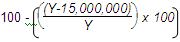

|

Upon any Shareholder ceasing to hold any Shares, subject to compliance with the provisions of Clause 8.2:

|

|

8.6.1

|

all future obligations of that Shareholder and, except where the Shares are transferred to another Member of its Group, any obligations assumed by any other Member of its Group shall cease; and

|

|

8.6.2

|

the Shareholders and the Company shall use their best endeavours to procure the termination, in relation to any future obligation thereunder, of any guarantee given to a third party for the benefit of the Company:

|

Page 16

Beachcroft LLP

|

(a)

|

by that Shareholder; and

|

|

(b)

|

where those Shares are not transferred to another Member of that Shareholder’s Group, by any other Member of that Group.

|

|

8.7

|

In the event that any person (including without limitation, Manfred Scheske) ceases to be engaged in the Business (whether or not he is employed by the Company, the Subsidiaries or a third party), the Ordinary Shareholders shall procure (subject to the determination of the Board as to whether such person's C Shares are to be (a) "warehoused" with PepTcell Limited, Biocopea Limited or some other person(s) approved by the Board pending transfer of such C Shares to a person engaged in the Business; or (b) transferred to the Ordinary Shareholders in accordance with the Articles) whether the Ordinary Shareholders act in their capacity as Shareholders or as persons who control the composition of the Board, that the transfer of the relevant person's C Shares (as determined by the Board in accordance with the options (a) and (b) specified in this sub-clause) is approved by the Board pursuant to Article 39.3 of the Articles and effected as soon as practicable after the relevant date of such cessation.

|

|

9.

|

EXIT

|

Notwithstanding the provisions of the Articles, on a voluntary winding up of the Company immediately following a disposal of the whole (or substantially all) of the business and assets of the Company, the surplus assets available for the Shareholders, shall first be applied to return to the Gaine Investor the balance of the sum of $2,800,000 due and payable by the Company to the Gaine Investor pursuant to clause 8.1 of the Patent Licence to the extent that it has not already been paid, and, thereafter, any balance shall be distributed amongst the Shareholders in accordance with the provisions of the Articles.

|

10.

|

WARRANTIES

|

|

10.1

|

In consideration of the Subscribers making the Investment, the Company warrants to the Subscribers (on terms that each of them is entering into this Agreement and subscribing for Ordinary Shares in reliance on the Warranties) that, as at the date of this Agreement:

|

|

10.1.1

|

the details of the Company and each Subsidiary set out in Schedule 1 (after the provisions of Clauses 2.3 and 2.5 have been effected) will be, true and accurate;

|

|

10.1.2

|

the Company is duly constituted and incorporated under the laws of England;

|

|

10.1.3

|

compliance has been made with all legal requirements in connection with the formation of the Company and each Subsidiary and all issues and grants of shares or other securities of the Company and each Subsidiary; and

|

|

10.1.4

|

the Company has the necessary power, authority and capacity to enter into and perform this Agreement and this Agreement will constitute valid and binding obligations on it.

|

|

10.2

|

Each of the Parties warrants (on behalf of itself only) to the other Parties that it:

|

|

10.2.1

|

is a limited company or corporation duly incorporated and validly existing under the laws of its jurisdiction and has been in continuous existence since its incorporation; and

|

|

10.2.2

|

has full capacity, power and authority to enter into, and exercise its rights and perform its obligations under, this Agreement and each document to be entered pursuant to this Agreement, and this Agreement and such documents shall be binding upon, and enforceable against, it;

|

and each of the Parties acknowledges that the other Parties are relying on such warranties in entering into this Agreement.

Page 17

Beachcroft LLP

|

11.

|

RESTRICTIVE COVENANTS

|

|

11.1

|

To assure to each Ordinary Shareholder, the Company and each Subsidiary the value of the Business and the full benefit of the goodwill of the Business, each Ordinary Shareholder undertakes and covenants with each other Ordinary Shareholder, the Company and each Subsidiary that it shall not, and shall procure that each other member of its Group will not, during the period it holds Ordinary Shares and for the calendar year after it disposes of such Ordinary Shares, without the prior written consent of each other Ordinary Shareholder (whether directly or indirectly) as principal, shareholder, consultant, agent or in any other way and whether on its own behalf or on behalf of or in conjunction with any other person be engaged, concerned or interested in any business or activities anywhere in the world which compete or seeks to compete with any business or activities carried on, or to be carried on, by the Subsidiaries in connection with, or arising out of, the Business or otherwise that relates to the treatment of cough indication that theobromine, or its derivatives, address or seek to address.

|

|

11.2

|

Nothing in Clause 11.1 shall prevent a Subscriber or any other member of its Group from being engaged, concerned or interested in any business or activities anywhere in the world to the extent that such business or activities relate to the treatment of cough indication but do not use in any way (whether directly or indirectly) theobromine or derivatives thereof.

|

|

11.3

|

Nothing in Clause 11.1 prevents any Ordinary Shareholder or Subscriber or any other member of its Group from holding for investment purposes only in entities that are competing with the Company:

|

|

11.3.1

|

any units of any authorised unit trust; or

|

|

11.3.2

|

not more than 5% of any class of shares or securities of any company traded on any recognised investment exchange (as defined in Section 285 of the Financial Services and Markets Act 2000) or any national securities exchange.

|

|

11.4

|

The covenant in Clause 11.1 is considered fair and reasonable by the parties, but if any such restriction is found to be unenforceable and would be valid if any part of it were deleted or the period or area of application reduced, the restriction shall apply with such modifications as may be necessary to make it valid and effective.

|

|

12.

|

FORCE MAJEURE

|

|

12.1

|

For the purpose of this Agreement, “Force Majeure” means any circumstances beyond the reasonable control of either party (including, without limitation, any strike, lock-out or other form of industrial action).

|

|

12.2

|

If any party is affected by Force Majeure which affects or may affect the performance of any of its obligations under this Agreement, it shall forthwith notify the other parties of its nature and extent.

|

Page 18

Beachcroft LLP

|

12.3

|

No party shall be deemed to be in breach of this Agreement, or otherwise be liable to any other party, by reason of any delay in performance, or the non-performance, of any of its obligations hereunder, to the extent that the delay or non-performance is due to any Force Majeure of which it has notified the other parties, and the time for performance of that obligation shall be extended accordingly.

|

|

12.4

|

If the performance by any party of any of its obligations under this Agreement is affected by Force Majeure for a continuous period in excess of 6 months, the parties shall enter into a bona fide discussions with a view to alleviating its effects, or to agreeing upon such alternative arrangements as may be fair and reasonable.

|

|

13.

|

CONFLICT WITH ARTICLES

If during the continuance of this Agreement there shall be any conflict between any provision of this Agreement and any provision of the Articles (as the same may be amended or replaced from time to time) then the provisions of this Agreement shall prevail.

|

|

14.

|

NATURE OF AGREEMENT

|

|

14.1

|

This Agreement is personal to the parties and none of them may assign, mortgage, charge (otherwise than by floating charge) or sub-licence any of its rights hereunder, or sub-contract or otherwise delegate any of its obligations hereunder, except with the written consent of the other parties.

|

|

14.2

|

Nothing in this Agreement shall create, or be deemed to create, a partnership, or the relationship of principal and agent, between the parties or any of them.

|

|

14.3

|

This Agreement and the other Transaction Documents contain the entire agreement between the parties with respect to the subject matter of such documents and may not be modified except by an instrument in writing signed by the duly authorised representative of the parties.

|

|

14.4

|

Each party acknowledges that, in entering into this Agreement and the other Transaction Documents, it does not do so in consideration of or in reliance on any representation, warranty or other provision except as expressly provided in this Agreement or the other Transaction Documents, and all conditions, warranties or other terms implied by statute or common law are excluded to the fullest extent permitted by law.

|

|

14.5

|

If any provision of this Agreement is held by any court or other competent authority to be invalid or unenforceable in whole or in part, this Agreement shall continue to be valid as to its other provisions and the remainder of the affected provision.

|

|

14.6

|

No failure or delay by any party in exercising any of its rights under this Agreement shall be deemed to be a waiver thereof and no waiver of a breach of any provision of this Agreement shall be deemed to be a waiver of any subsequent breach of the same or any other provision.

|

|

14.7

|

Where any provision of this Agreement applies expressly or by implication to the Company or any Subsidiary, the Shareholders shall procure that the Company and each relevant Subsidiary complies with that provision.

|

|

14.8

|

The Company is excluded from any obligation contained in this agreement to the extent that such obligation would constitute an unlawful fetter on the Company's statutory powers.

|

Page 19

Beachcroft LLP

|

15.

|

CONFIDENTIALITY

|

|

15.1

|

For the purposes of this Agreement “Restricted Information” means, in relation to each party to this Agreement (the "Recipient”) any information which is disclosed to that party by another party (the "Informant”) pursuant to or in connection with this Agreement, whether orally or in writing or any other medium, and whether the information is expressly stated to be confidential or marked as such.

|

|

15.2

|

The Recipient undertakes with the Informant that, except as provided by Clause 15.3 or as authorised in writing by the Informant, it shall, at all times both during the continuance of this Agreement and after its termination:

|

|

15.2.1

|

use its best endeavours to keep confidential all Restricted Information;

|

|

15.2.2

|

not disclose any Restricted Information to any other person;

|

|

15.2.3

|

not use any Restricted Information for any purpose otherwise than as contemplated by and subject to the terms of this Agreement;

|

|

15.2.4

|

not make any copies of, record in any way or part with possession of any Restricted Information; and

|

|

15.2.5

|

ensure (if a company) that none of its directors, officers, employees, agents or advisers does any act which, if done by that party, would be a breach of the provisions of Clauses 15.2.1, 15.2.2, 15.2.3 or 15.2.4 above.

|

|

15.3

|

The Recipient may:

|

|

15.3.1

|

disclose any Restricted Information to:

|

|

(a)

|

any sub-contractor, supplier or licensee of the Recipient;

|

|

(b)

|

any bona fide transferee of the Recipient’s Shares;

|

|

(c)

|

any governmental or other authority or regulatory body (including without limitation, the United States Securities and Exchange Commission); or

|

|

(d)

|

any employees of that party or of any of the aforementioned persons;

|

| to such an extent only as is necessary for the purposes contemplated by this Agreement, or as required by law, and in each case (except where the disclosure is to any such body as is mentioned in Clause 15.3.1(c) above or any employees of any such body) subject to the Recipient first obtaining a written undertaking in favour of the Informant from the person in question, as nearly as practicable in the terms of this clause, to keep the Restricted Information confidential and to use it only for the purposes for which the disclosure is made, and submitting to the same to the Informant; or |

|

15.3.2

|

use any Restricted Information for any purpose, or disclose it to any other person, to the extent only that the Recipient can demonstrate from its written records that it was known to the Recipient at the time when it was disclosed by the Informant; or

|

Page 20

Beachcroft LLP

|

15.3.3

|

it is at the date of this Agreement, or at any time after that date becomes, public knowledge through no fault of the Recipient, provided that in doing so the Recipient does not disclose any part of that Restricted Information which is not public knowledge.

|

|

15.4

|

The provisions of this Clause 15 shall continue in force in accordance with their terms, notwithstanding the termination of this Agreement for any reason.

|

|

16.

|

DURATION AND TERMINATION

|

|

16.1

|

Subject as provided in the following provisions of this clause, this Agreement shall continue in force for a period of five years from its date, and shall continue thereafter from year to year unless terminated in accordance with its terms.

|

|

16.2

|

If:

|

|

16.2.1

|

a Shareholder proposes an individual voluntary arrangement within the meaning of section 253 Insolvency Act 1986, or an interim order is made in relation to the party under section 252 Insolvency Act 1986, or any other steps are taken or negotiations commenced by the party or any of its creditors with a view to proposing any kind of composition, compromise or arrangement involving the other party and any of its creditors;

|

|

16.2.2

|

a Shareholder has any distress or execution levied on its assets which is not paid out within seven days of its being levied;

|

|

16.2.3

|

a Shareholder is deemed to be unable to pay his debts within the meaning of section 267(2)(c) Insolvency Act 1986, or the party presents, or has presented, a petition for a Bankruptcy Order;

|

|