Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CenterState Bank Corp | d8k.htm |

Investor Presentation

December 2010 |

This presentation contains forward-looking statements, as defined by Federal

Securities Laws, relating to present or future trends or factors affecting

the operations, markets and products of CenterState

Banks, Inc. (CSFL). These statements are provided to assist in the

understanding of future financial performance. Any such statements are based on

current expectations and involve a number of risks and uncertainties. For a

discussion of factors that may cause such forward-looking statements to

differ materially from actual results, please refer to CSFL’s

most recent Form 10-Q and Form 10-K filed with the Securities

Exchange Commission. CSFL undertakes no obligation to release revisions to these

forward-looking statements or reflect events or circumstances after the

date of this presentation.

Forward Looking Statement

2 |

Birmingham

Atlanta

Winston-Salem

Tampa

Winter Haven

Corporate Overview

Headquartered in Davenport, FL

$2.1 billion in assets

$1.7 billion in deposits

Company formed: June 2000

2 Subsidiary Banks; 54 locations

6 of 14 counties of operation rank in the

top 15 fastest growing counties in Florida

3

Correspondent banking market |

4

Merger and Corporate Structure

Merger of three national bank subsidiaries completed 12/10/10

Lead bank approximates $1.9 billion of combined total assets and

approximately 8%

Tier 1 leverage capital ratio

Remaining Corporate subsidiaries: Valrico State Bank and R4ALL,

Inc. R4ALL subsidiary presently warehousing approximately $29

million classified assets.

Carried at 80% of appraised values

Approximately 22% of classified loans are current

Benefits of new structure includes use of capital, cost efficiency, and

development of specialists.

Newly consolidated special asset group comprised of 25 professionals

focused on disposition of Legacy Bank assets, and FDIC covered

assets. |

Source: Raymond James

Carson Medlin

Florida Credit Environment

Florida economy

11.7% unemployment

Florida Real Estate Market

25% of mortgages in Florida are delinquent or in some stage of

foreclosure Florida real estate values continue to decrease.

Median price decreased 6% y/y in

September.

Florida’s total NPAs

increased in 3Q10; 5 of the 7 Florida regions had

increased NPAs.

Liquidation Approaches

Orderly liquidation

Note sales in wholesale debt market

Repossessed real estate auctions

Negotiated bulk sale

5 |

Florida Economic Environment

6

Florida’s April 1 Population

United States and Florida Unemployment Rates

(seasonally adjusted)

Median Sales Price of Existing Homes

Source:

The

Florida

Legislature

Office

of

Economic

and

Demographic

Research

Economy Slowly Recovering

Florida growth rates are beginning an expected slow return to more

typical levels. But, drags are more persistent than past

events, and it will take years to climb out of the hole left by

the recession.

Overall…

The subsequent turnaround in Florida housing will be led by:

Low home prices that begin to attract buyers and clear the

inventory Long-run

sustainable

demand

caused

by

continued

population

growth

and

household

formation.

Florida’s unique

demographics and the aging of the baby-boom generation. |

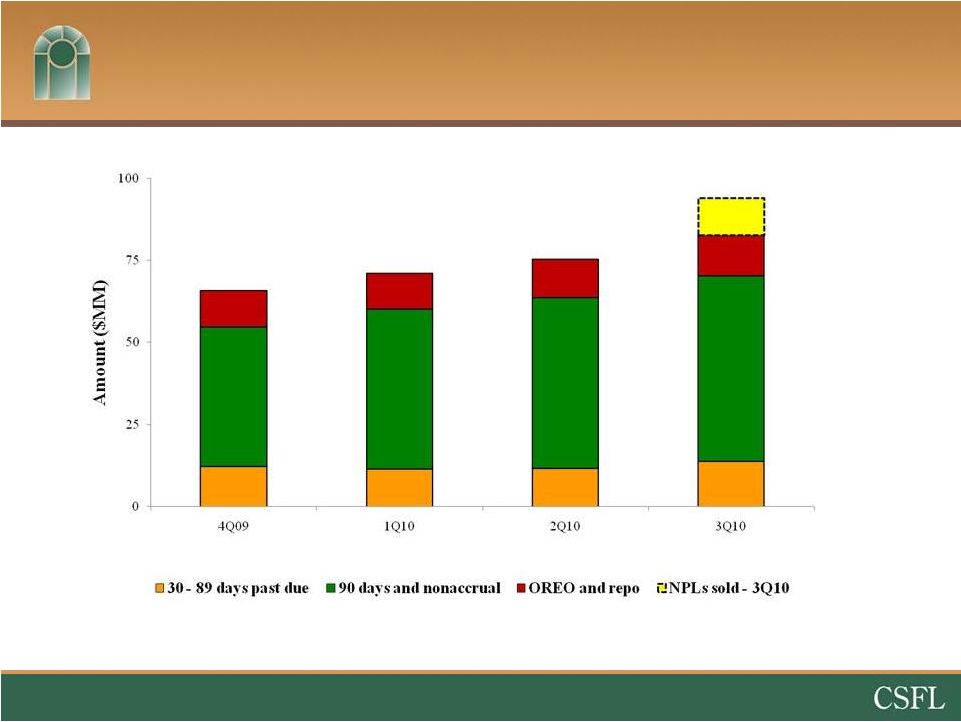

Credit Trends

7 |

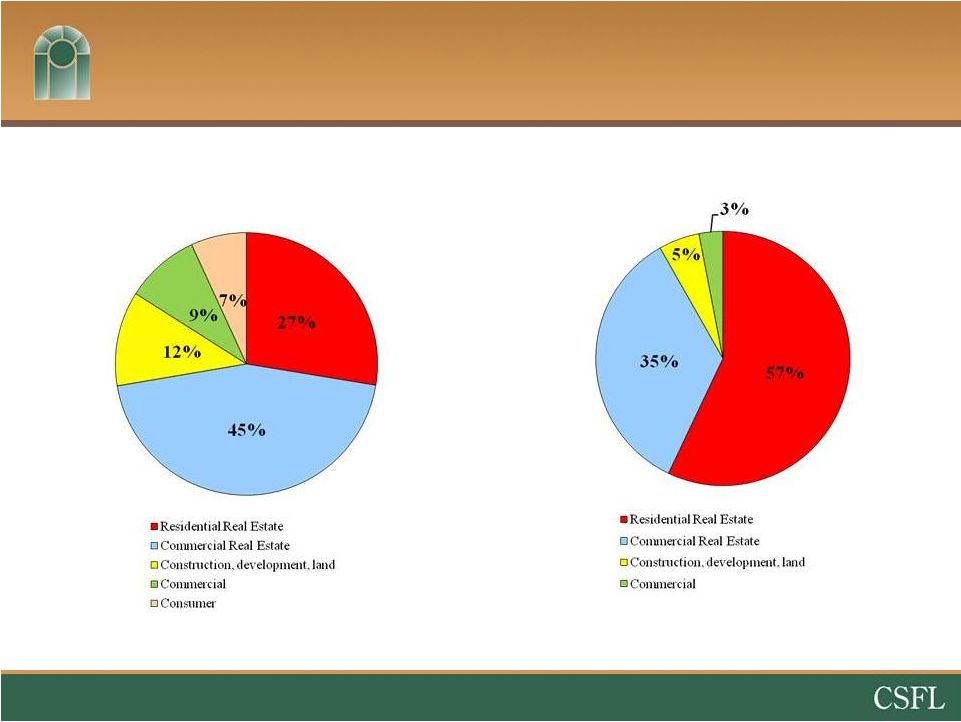

Loan Portfolio Composition

As of September 30, 2010

Excluding Covered Loans

$920 Million

8

*After

credit

mark

-

80%

FDIC

loss

share

first

dollar

loss.

Covered Loans*

$210 Million |

Non-Performing Loans

Other Real Estate Owned

$56,399,000 (6.13% of total loans, excluding covered loans)

30% of NPLs

are current

76% of legal unpaid loan balance, net of specific reserves

$11,861,000

58% of legal unpaid loan balance at

repossession date

Residential

Real Estate

$16,729K

(102 loans)

Commercial

Real Estate

$26,259K

(52 loans)

Construction,

A&D, & Land

$12,421K

(52 loans)

Commercial

$440K

(17 loans)

Consumer / Other

$550K

(24 loans)

Commercial

Real Estate

(18)

$5,737K

Mobile Homes

w/ Land

(6)

$151K

Vacant Land

( various acreages)

$1,796K

Single Family Homes

(29)

$3,037K

Residential Lots

(48)

$1,140K

Data as of 9/30/10

Non Performing Loans and OREO

(excluding covered loans and OREO)

9 |

FDIC Investments –

Consolidation Story

July 16, 2010 –

Olde

Cypress Community Bank, Clewiston, Florida

August 20, 2010 –

Independent National Bank, Ocala, Florida

August 20, 2010 –

Community National Bank, Bartow, Florida

1Q 2011 –

TD transaction, Palatka, Florida

10

Capital required to

support acquired

assets at 8%

$12.5 M

$12.4 M

$5.2 M

$9.0M

$39.1 M

July 27, 2010 Capital Raise, net $32.8 M

Total

January 30, 2009 –

Ocala National Bank, Ocala, Florida |

11

Ocala National Bank

Conversion completed 2009, core deposits growing; efficiencies

obtained. Independent National Bank, Ocala

Conversion scheduled for 5/2011; core deposit base stable; efficiencies

expected to be realized in 2Q11.

Olde

Cypress Community Bank, Clewiston

Conversion scheduled for 7/2011; core deposit base stable; efficiencies

expected to be realized 3Q11

Community National Bank, Bartow

Conversion scheduled for 9/2011; core deposit base stable; efficiencies

expected to be realized 4Q11

The efficiencies gained from the last three FDIC acquisitions should be

approximately $3million annually compared to present run rate

but will not be fully realized until 4Q11 FDIC Investment

Performance |

TD Bank transaction

Expected to close in 1Q 2011

4 Branches in Putnam County, Florida

$113 Million deposits

Purchase $125 Million of hand-picked

performing loans

Purchase price of performing loans equal to

90% of legal unpaid balance

Loans have a two-year put back period for any loan that becomes

30 days past due or becomes classified pursuant to

applicable regulatory guidelines.

IRR anticipated to exceed 20%

Capital required to support acquired assets at 8%: $9 million

12 |

Current Events

$75 million of AFS securities sold during 4Q10; pre-tax gain of

$3.4 million. Modest profit anticipated 4Q10; PTPP income

continues to be healthy Correspondent

Banking

Division

–

expected

4Q

earnings

in

line

with

1Q

and

2Q

Modest

increase

in

NPAs

expected

in

4Q10.

OREO auction held in 4Q10; approximately $2.4 million sold; recognized

loss on sale of approximately $500K.

The

Bank

continues

to

evaluate

a

number

of

FDIC

transactions

and

anticipates

to

be

an

active

bidder in 2011. A larger transaction may require a contingent

capital raise. Three largest subsidiary banks combined into one

bank during December creating cost efficiencies and better

utilization of capital. In uncertain times, management’s

approach is to maintain a Tier 1 leverage ratio approximating

10% at the company level. As the economy and real estate markets

improve, and we enter into a more

normal

environment,

we

would

expect

to

reduce

this

ratio

to

approximately

8%.

13 |