Attached files

| file | filename |

|---|---|

| 8-K - Protagenic Therapeutics, Inc.\new | v205143_8k.htm |

Investor Relations Presentation

December 2010

This presentation contains forward-looking statements within the meaning of the Private Securities Litigation

Reform Act of 1995, about Atrinsic (“ATRN”) and its affiliates. Forward-looking

statements are statements that are

not historical facts. Such forward-looking statements, based upon the current beliefs and expectations of ATRN's

management, are subject to risks and uncertainties, which could cause actual results to differ from the

forward-

looking statements. The following factors, among others, could cause actual results to differ from those set forth in

the forward-looking statements: general economic conditions; geopolitical events and regulatory changes;

requirements or

changes adversely affecting the businesses in which ATRN is engaged; demand for the products

and services that ATRN provides, as well as other relevant risks detailed in ATRN's filings with the Securities and

Exchange Commission. The information set

forth herein should be read in light of such risks. ATRN assumes no

obligation to update the information contained herein.

Adjusted EBITDA presented for all periods is a non-GAAP financial measure. Refer to “Supplemental Disclosure

regarding Non-GAAP Measures,” presented in the Company’s most recent quarterly earnings

release, available at

http://www.atrinsic.com/press/press-release/38, and filed with the Securities & Exchange Commission

on Form 8-

K, for additional information regarding Adjusted EBITDA and other non-GAAP financial measures presented

herein.

Forward Looking Statement

Atrinsic’s Business

We have a recurring revenue, subscription-

based direct-to-consumer business model

Recognizable and relevant entertainment

brand in Kazaa

We offer alternative billing capabilities

Our focus is on digital music in the rapidly

growing mobile space

Direct-to-Consumer Subscriptions:

Kazaa Entertainment

We are a top ten search agency according to

(2010)

We offer advertisers an integrated service offering

across paid search, SEO, display, affiliate marketing,

business intelligence and brand protection services

We work with all facets of advertisers, large and

small, to acquire customers and expand markets

Interactive Agency/Affiliate Network:

Atrinsic Interactive

We are a best-in-class search agency that

owns/operates a top-tier affiliate network

Focus

To build and sustain a large and profitable subscriber base and a growing and engaged

audience

Atrinsic Interactive’s Business Mission

To become the largest, independent search marketing agency

To become a top five affiliate network

To leverage our multi-channel marketing expertise and technology to drive advertisers’ results

Direct-to Consumer Subscriptions: Kazaa

Deliver entertainment content to our customers anywhere, anytime, and on any device in a

manner our customers choose

Atrinsic Snapshot

We currently have 217,000 paying subscribers

(3Q 2010) across our entertainment products

We have approximately 64,000 Kazaa

subscribers (3Q 2010)

Ticker: ATRN (ATRND until 1/3/10)

Exchange: Nasdaq Global Market

Average Daily Volume: 38,000 shares

Shares Outstanding: 6.3 million

Recent Market Cap: $11 million

Cash (3Q 2010): $4.2 million (additional

$2.7MM in cash tax refunds

after quarter end)

Working Capital: $6.0 million

Total Debt: $0

3Q 2010 Revenue: $9.2 million

2010 Revenue (YTD): $32 million

Auditors: KPMG LLP

We are a top ten search agency according to

(2010)

We will have approximately 60 employees,

transitioning to a single location in NY by 1Q

2011

As a result of restructuring and focus, we

expect to achieve fixed operating expense cost

savings of between 30% to 50%

ARPU of $5.74 across all of our subscription

products (3Q 2010)

Due to improvements in churn and higher rates

of subscriber acquisition, we expect 10%

month-over-month growth in Kazaa subs

Atrinsic Interactive

We are a top ten search agency according to

(2010).

We offer advertisers an integrated service offering

across paid search, SEO, display, affiliate marketing,

business intelligence and brand protection services.

We are focused on targeting and maintaining clients

that participate across the agency services, including

search and affiliate marketing.

FEATURED CLIENTS

CROSS CHANNEL REPORTING

The Atrinsic Affiliate Network uses state of the art

business intelligence tools for brand protection and to

identify common publisher violations.

The paid search team utilizes highly intelligent search

tools to drive sales at the lowest cost for advertisers.

Our multi-channel path to conversions enables us to see

the entire conversion funnel across any online marketing

channel. We have the ability to take the proverbial black

box out of the conversion

flow.

Atrinsic Affiliate Network

Representing an evolution in affiliate marketing platforms, our platform offers a

full- service solution while maintaining the highest level of brand protection.

Using our affiliate network, we create mutually beneficial, easy partnerships for

advertisers and publishers to drive website traffic and customer acquisition.

Our Network is low-risk, yet high-reward. Our software increases transparency

between publishers and advertisers, giving both parties access to higher

quality data.

Through the use of comprehensive reporting, trademark monitoring and

proprietary business intelligence tools, our team is able to identify

opportunities and flag potential issues before they become brand destructive.

ADVERTISERS

We hope that in the future, Kazaa will be one of our largest advertisers on the

Network.

On October 13, 2010, we amended our existing Kazaa marketing agreements with Brilliant Digital in exchange

for 4,161,430 shares of our common stock. We also entered into an agreement to acquire all of the assets of

Brilliant Digital that relate to the Kazaa digital music subscription business for an additional 7,125,665 shares.

In connection with our acquisition of the Kazaa assets, in November, 2010, we announced that we are

undertaking a restructuring of our existing operations, and of the Kazaa business that Brilliant Digital is engaged

in, to reduce certain operational expenditures and to improve efficiencies in product development and sales

and customer acquisition outcomes for the Kazaa digital music service. As a result of the restructuring, we

expect to be able to achieve fixed operating cost savings of between 30%-50%.

Acquisition of Kazaa

We are acquiring all of the assets associated with the Kazaa business, including the Kazaa trademark and

associated intellectual property (kazaa.com, etc.), as well as a content management system, a content delivery

platform and customer service platform, and licenses with rights’ holders. We are also assuming certain limited

working capital liabilities.

We expect that our special meeting, where stockholder will vote to approve the Kazaa acquisition will be in the

first quarter of 2011.

The Kazaa digital music service is our principal premium direct-to-

consumer subscription product.

Subscription Products

We currently have 217,000 paying subscribers across all of our products.

Because we are proficient in multiple billing platforms, we are able

to create subscriber acquisition efficiencies.

Ringtone.com, billed to a user’s mobile device, allows consumers to

download premium ringtones.

Our casual game subscription services have a broad selection of

popular digital games, including top-rated games Zuma™, Diner

Dash®, and World Series of Poker® Pro Challenge.

Kazaa Screenshots

Kazaa Screenshots

Kazaa Digital Music Service

Potential to become one of the premier music subscription services

by revenue and subscribers

Unlimited access to millions of CD quality tracks

Pay one monthly fee to download unlimited music files and play that

music on up to five computers/devices

Download unlimited ringtones to a mobile phone

Subscribers are billed through a credit card, landline or mobile device

Royalties are paid to the rights’ holders for licenses to the music utilized

by this digital service

Access to streaming, unlimited downloads

With expansion, we have an opportunity to extend into other

entertainment related products and services

We are also developing a multi-tiered pricing strategy based on variable

features and access

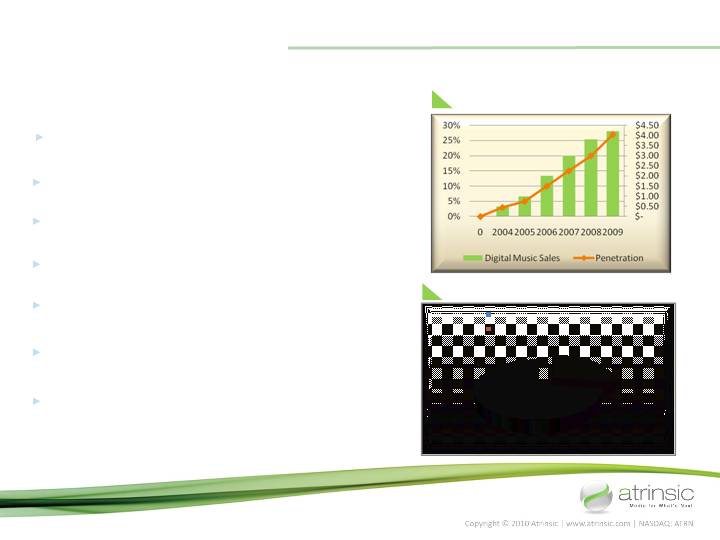

2009 Worldwide Digital Music Sales of $4.2 billion

2009

Worldwide Digital Music Revenue &

Penetration (in billions)

Large and growing market for digital music. Digital music represents

about 27% of total market and is growing at double digits (IFPI).

In the U.S., digital music adoption is even greater, accounting for

40% of music sales (IFPI).

Digital Music Market

Subscriptions and mobile business models are key growth sectors

within the market. These sectors correspond to the focus of Kazaa.

Overall U.S. music sales hit 1.5 billion units in 2009 – the second

year above 1.5 billion (Nielsen SoundScan).

In 2009 there were 1.2 billion digital track downloads in the U.S.

(Nielsen SoundScan).

Mobile Internet usage is expected to eclipse desktop Internet usage

within three years (Morgan Stanley Research).

Music subscriptions grew rapidly in 2009 and accounted for more

than 5% of all digital sales (IFPI).

27%

73%

Revenue from digital channels

Revenue from traditional channels

Mobile Internet Penetration

Mobile devices are rapidly beginning to dominate the Internet. It is expected that the Internet will be mostly

accessed via mobile devices by 2014 (Morgan Stanley Research).

Mobile Devices to Dominate the Internet

The convergence of Internet usage and mobile devices is expected to expand the market for on demand

streaming music.

2008

2009

2010

2011

2012

2013

2014

33%

35%

40%

44%

46%

47%

51%

67%

65%

60%

56%

54%

53%

49%

How Will the Internet be Accessed?

Mobile

Desktop

The Final (Efficient) Frontier

There is no one correct answer, rather there is a frontier of efficient marketing spending – described as the

highest life time value LTV that can be achieved for a given subscriber acquisition cost (SAC)

Solving an Optimization Problem: What should we pay for a subscriber?

By improving the product, modifying pricing, billing efficiently, reducing churn and increasing utilization, we

can maximize LTV, given a level of SAC

By validating leads, monitoring our marketing channels, engaging in SEO and better SEM practices, and

utilizing alternative marketing approaches, we can minimize SAC, given a level of LTV

L

T

V

eCPA

LTV Optimization

You are here

You are here

We are focused on cost-effectively acquiring customers through multiple

online distribution channels: Affiliate marketing, search, social media,

display, email/SMS and organic/SEO.

A Disciplined Approach to Marketing

Multi Channel, Disciplined Approach. Focused on ROI

We also have a network of our own media, consisting of music, games

and lifestyle web sites and proprietary content to attract consumers.

We are disciplined marketers. We are constantly optimizing marketing

spend with respect to number of subscribers, revenue and costs.

We employ a comprehensive data strategy to validate and enhance our data

using a highly advanced data validation platform to improves targeting and

billability.

Merchandizing and Content

Kazaa is a fully licensed digital music subscription service. We pay rights’ holders royalties on tracks

downloaded or streamed. Our subscribers have access to millions of tracks.

In conjunction with our product roadmap, we are continually enhancing and improving Kazaa to offer users

improved functionality and better search capabilities.

As subscribers browse, search and listen to music, Kazaa provides users with detailed information on

tracks or albums, along with popular rankings and music charts and other rankings.

We are implementing a comprehensive communications strategy, including employing email and SMS to

communicate with our users in a relevant way to improve retention and to encourage utilization.

Kazaa presents its content in a variety of customized and personalized formats, including allowing users to flag

and access favorite tracks, build and edit playlists and also to see recently played tracks.

Utilizing proprietary preference and rankings technology, Kazaa offers radio features, which are automatically

generated playlists generated around individual tracks, and provides intelligent recommendations based on

listener habits and user preferences.

Our merchandizing strategy is geared towards improving customer retention and increasing LTVs.

We are employing social media to advertise to other Facebook users what a Kazaa user is listening to and are

developing off site streaming .

Product Roadmap

Other short term product development includes optimizing Kazaa for

mobile viewing and usage, providing a download player with side loading

and greater merchandizing capability.

On an ongoing basis, we continue to enhance and improve the user

experience through preference engine improvements and search

capabilities and GUI modifications.

Our product strategy is focused on increasing retention and LTVs and reducing churn

As a result of these ongoing improvements, we already see increased

utilization and access.

Medium term product development initiatives include mobile applications to

enable subscribers to stream and download music on the iPhone and iPad

and on mobile devices with Android, Blackberry and Windows Mobile 7

operating systems.

Proficiency in Multiple Billing Platforms

Billing & Pricing

We create customer acquisition efficiencies relative to traditional

direct marketers, who may only offer a single billing modality –

credit cards. Thus, we are able to expand our potential customer

base, attracting consumers who prefer not to use a credit card.

We own 36% of The Billing Resource, LLC (“TBR”), one of only a

handful of local exchange carrier fixed-line billing aggregators in

the United States.

In addition to agreements with multiple aggregators who have

access to U.S. carriers – both wireless and landline – for billing,

we also have an agreement in place with AT&T Wireless to distribute

and bill for our services directly to subscribers on its network.

BILLING PARTNERS

Pricing Strategy

In conjunction with the rollout of our Kazaa mobile product and

mobile apps, we are constantly testing and incorporating alternative

price points to maximize retention and LTV

Kazaa now offers a mobile phone-billed $9.99 per month product and

is developing multi-tiered pricing to deliver different value

propositions for all market segments.

Billing Alternatives

We have approximately 217,000 subscribers and today

subscriptions represents approximately 50% of our

revenues. Approximately 35% of subscribers billed on

mobile, 41% billed on telephone land lines and 24% billed

by credit card.

41%

24%

35%

3Q 2010 Billing Breakdown

LEC

CC

Mobile

Operating Leverage

High variable cost structure and relatively low fixed costs, allows us to respond to market

conditions

Significant variable cost component in our business model improves operating leverage (increasing predictability

and transparency). Cost of media, or subscriber acquisition expense, as a percentage of revenue, is expected to

fall over time.

57%

43%

Expenses YTD 2010

Variable

Fixed

Long Tails

Long subscriber tails are a benefit of our recurring revenue business model

Initial “investment” in new subscribers results in short term loss, but then the recurring revenue

stream turns profitable and then continues to pay back.

$(20)

$(15)

$(10)

$(5)

$

-

$5

$10

$15

$20

Month 1

Month 2

Month 3

Month 4

Month 5

Cumulative Subscriber Gross Profit

See For Yourself

Check it out yourself and monitor our

progress. And download unlimited

tracks for a low monthly fee.

Go to Kazaa.com and subscribe to our digital music service

Did I mention we are a top-ten

search agency according to

(2010)?

Quarterly Financial Highlights

(in millions)

For the Quarter

1Q '10

2Q '10

3Q '10

Total Net Revenue

12,200

$

10,814

$

9,180

$

Cost of Sales

(7,344)

(6,009)

(4,589)

Gross Profit

4,856

4,805

4,591

Operating Expenses

(7,422)

(8,662)

(7,706)

EBITDA

(2,566)

(3,857)

(3,115)

At Quarter End

1Q '10

2Q '10

3Q '10

Cash and cash equivalents

12,475

$

7,268

$

4,249

$

Working Capital

12,597

8,609

5,964

Total Debt

-

-

-