Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - TELLURIAN INC. /DE/ | d8k.htm |

Annual General Meeting

8

th

December,

2010

Orlando

Exhibit 99.1 |

Non-GAAP Measures Disclosure

Forward

Looking

Statements

Statements in this presentation which are not historical in nature are intended

to be, and are hereby identified as, forward-looking statements for

purposes of the Private Securities Litigation Reform Act of 1995. These statements about Magellan and Magellan Petroleum Australia

Limited (“MPAL”) may relate to their businesses and prospects,

revenues, expenses, operating cash flows, and other matters that involve a

number of uncertainties that may cause actual results to differ materially from

expectations. Among these risks and uncertainties are the ability of

MPAL, with the assistance of the Company, to successfully and timely close the Evans Shoal acquisition, the likelihood and timing of the

receipt of proceeds from the Young Energy Prize S.A. private placement

transaction due to conditions stipulated in the Securities Purchase

Agreement dated August 6, 2010, the ability of the Company to successfully

develop a strategy for methanol development, pricing and production

levels from the properties in which Magellan and MPAL have interests, the extent of the recoverable reserves at those properties,

the profitable integration of acquired businesses, including Nautilus Poplar

LLC, the future outcome of the negotiations for gas sales contracts for

the remaining uncontracted reserves at both the Mereenie and Palm Valley gas fields in the Amadeus Basin, including the likelihood of

success of other potential suppliers of gas to the current customers of Mereenie

and Palm Valley production. In addition, MPAL has a large number of

exploration permits and faces the risk that any wells drilled may fail to encounter hydrocarbons in commercially recoverable

quantities. Any forward-looking information provided in this presentation

should be considered with these factors in mind. The Company assumes no

obligation to update any forward-looking statements contained in this presentation whether as a result of new information, future

events or otherwise.

Oil and gas issuers are required to include disclosure regarding proved oil and

gas reserves in certain filings made with the U.S. Securities and

Exchange Commission. Proved reserves are the estimated quantities of crude oil,

natural gas, and natural gas liquids which geological and engineering

data demonstrate with reasonable certainty to be recoverable in future years from known reservoirs under existing economic and

operating conditions, i.e., prices and costs as of the date the estimate is

made. The SEC also permits the disclosure of probable and possible

reserves which are additional reserves that are less certain to be recovered.

Investors are urged to consider closely the disclosures in Magellan’s

periodic filings with the SEC available from us at the company’s website

www.magellanpetroleum.com Management believes that EBITDA, the

non-GAAP (Generally Accepted Accounting Principles) measure indicated by an asterisk (*) used in

this presentation provides investors with important perspectives into the

company’s ongoing business performance. The company does not

intend for the information to be considered in isolation or as a substitute for

the related GAAP measures. Other companies may define the measure

differently. We define EBITDA as follows: earnings before the deduction of interest expenses, taxes, depreciation and amortization. |

NASDAQ:

MPET www.magellanpetroleum.com

AGM 2010 3

Magellan’s mission is to provide substantial growth and long-term value

to shareholders by acquiring, developing and producing oil and natural

gas resources using the following strategy:

1.

Acquire

and

develop

discovered,

but

“under-exploited”

natural

gas

and

oil

reserves

2.

Add value through unconventional commercial solutions

3.

Be unique while maintaining a strong balance sheet and financial

flexibility

Mission Statement

Mission and Strategy

Success in executing plans will provide “proof of concept”

Business Summary

Pacific

-

Develop

discovered/proven

natural

gas

fields

to

service

growing

vehicle

fuel

oxygenate

demand

in Asia; mainly China

North

America

-

Redevelop

overlooked

domestic

onshore

oil

fields

using

Enhanced

Oil

Recovery

(EOR)

techniques and new technologies |

NASDAQ:

MPET www.magellanpetroleum.com

AGM 2010 4

Change of Management

Evans Shoal

Announcement

Montana

Announcement

Share Performance History |

NASDAQ:

MPET www.magellanpetroleum.com

AGM 2010 5

Earnings Comparison

(in US$)

FY2010

FY2009

(yoy

%)

Oil sales

9,886,592

11,479,660

-14%

Gas sales

13,615,755

14,740,296

-8%

Other production related revenues

5,022,210

1,970,621

155%

Revenues

$28,524,557

$28,190,577

1%

Production costs

(10,116,320)

(8,153,263)

24%

Exploratory and dry hole costs

(1,273,268)

(3,475,937)

-63%

Salaries and employee benefits

(4,816,350)

(1,708,997)

182%

Auditing, accounting and legal services

(1,947,901)

(1,576,509)

24%

Shareholder communications

(551,408)

(633,112)

-13%

Other administrative expenses

(6,707,184)

(3,969,658)

69%

Total costs and expenses

(25,412,431)

(19,517,476)

30%

Adjusted EBITDA*

$3,112,126

$8,673,101

-64%

Margin

11%

31%

Depletion, depreciation and amortization

(4,680,240)

(6,785,952)

-31%

Accretion expense

(748,209)

(531,405)

41%

Gain (loss) on sale of assets

4,767,688

(75,812)

nm

Operating income

2,451,365

1,279,932

92%

Warrant expense

(4,276,471)

-

Investment and other income

3,012,831

1,583,065

90%

Income before income taxes

1,187,725

2,862,997

-59%

Income tax expense

(2,645,763)

(2,198,422)

20%

Net (loss) income

(1,458,038)

664,575

-319%

Net (loss) attributable to non-controlling interest in

subsidiaries (10,766)

-

Net (Loss) income attributable to MPC

($1,468,804)

$664,575

-321%

EPS (basic and diluted)

(0.03)

0.02

Operational Data:

Oil sales (bbls)

139,409

153,297

-9%

Australia

97,392

153,297

Nautilus

42,017

-

Gas sales (bcf)

3.43

5.16

-34%

Net realized price (A$ / mcf)

5.07

3.54

43%

Notes:

*Adjusted EBITDA represents EBITDA adjusted for non cash and none recurring

items |

NASDAQ:

MPET www.magellanpetroleum.com

AGM 2010 6

Cash Flow Overview

(in US$)

FY2010

FY2009

Operating Activities:

Net (loss) income

($1,458,038)

$664,575

Depletion, depreciation and amortization

4,680,240

6,785,952

Accretion expense and Deferred Income Tax

1,670,143

(1,086,628)

(Gain)/loss from disposal of assets

(4,767,688)

12,072

Gain from sale of investments

(1,975,286)

-

Stock-based compensation and change in warrant valuation

6,582,223

94,932

Exploration and dry hole costs and writeoffs

-

365,236

Changes in working capital

(1,511,172)

2,402,913

Net cash provided by operating activities

$ 3,220,422

$ 9,239,052

Investing Activities:

Additions to property and equipment

(2,276,128)

(2,430,184)

Proceeds from sale of assets

7,280,402

27,728

Oil and gas exploration activities

(567,343)

(491,490)

Net proceeds from sale of securities

2,821,137

(559,850)

Marketable securities matured or sold

997,306

710,916

Deposit for purchase of Evans Shoal

(13,751,850)

-

Purchase of interest in Nautilus / Poplar

(11,084,556)

-

Increase in restricted cash

(75,444)

-

Net cash (used) in investing activities

$ (16,656,476)

$ (2,742,880)

Financing Activities:

Debt principal payments

(845,147)

-

Proceeds from borrowings

570,000

-

Proceeds from issuance of stock and warrants

10,000,000

-

Equity issuance costs

-

(259,879)

Net Cash provided by (used in) financing activities

$ 9,724,853

$ (259,879)

Effect of exchange rate changes on cash and cash equivalents

2,613,893

(6,162,679)

Cash at beginning of period

34,688,842

34,615,228

Change in Cash Position

$ (1,097,308)

$ 73,614

Cash at end of period

$ 33,591,534

$ 34,688,842 |

Cash Forecasts

MAGELLAN’S CASH FORECASTS

“CERTAIN”

ESTIMATED

Magellan’s cash position by end of June 2012 is

expected to be US$27m

This reflects Magellan’s budgeted current

financial commitments and head office

expenses

Magellan’s discretionary CAPEX at the US Poplar

fields is expected to be partially financed via farm-

out

This will have a positive cash impact in an

amount to be negotiated

In addition, the Company is negotiating a new

borrowing base facility of approx. US$30m

The borrowing base will be secured by the

Company’s existing reserves

The size of the facility could be materially

increased when Mereenie

enters into a new gas

sales contract and/or significant additional

reserves were proven at Poplar

Magellan is actively seeking to market the gas

from the Mereenie

field in Australia

Potential renewal with LNG developer in

Darwin could add US$20-30m

per annum

TBD

NASDAQ: MPET

www.magellanpetroleum.com

AGM 2010 7 |

NASDAQ:

MPET www.magellanpetroleum.com

AGM 2010 8

Portfolio Overview

Evans Shoal

Up to 8 Tcf

(gross) planned methanol development offshore Australia

Payment due to Santos on Dec. 25

th

, moving toward closing

Ongoing discussions with Industry and Financial partners

Poplar

Current proved reserve base of 9.5 mmbbl

in the Charles Formation only (1.75 mmbbls

in

PDP, 0.77 mmbbls

in PDNP, and 6.96 mmbbls

in PUD)

Current production capacity of 290 bbls/d

Significant new PUD bookings show current and future drilling

Palm Valley/

Mereenie

Mereenie

gas

sales

contract

expired

in

Sept.

2010

–

optimistic

for

future

monetization

Currently producing approximately 500bbls/d (gross)

Production cost reductions have been effective

Palm Valley local gas sales contract expires in Jan 2012

Contingent resource base of 190+ BCF (gross)

United

Kingdom

Markwells

Wood -1 well current drilling to offset existing oil production

Some licenses offset the large Wytch

Farm field

Deep Gas and Shale potential (farm-out discussions now)

Four distinct portfolio segments |

NASDAQ:

MPET www.magellanpetroleum.com

AGM 2010 9

Bakken

(Possible

Carry)

$7.0

Charles

Infill

$5.0

Tyler

Nisku

$1.5

Red River

$2.4

Greenhorn

$0.5

NT09-1 $0.5

UK , $0.7

Evans Shoal

(carried)

$12.0

Future Capital Plan

FY2011

FY2012

J

F

M

A

M

J

J

A

S

O

N

D

Bakken

Development (possible carry)

Charles Infill

Tyler / Nisku

Duperow

/ Red River

Greenhorn Shale Core/Shallow Gas

UK Follow Up

Evans Shoal Delineation

NT09-1 Reprocessing

–

Total CAPEX for

2011 is $29.6 mln

–

Less carries Total

CAPEX for

FY2011 is $11

mln

–

Bakken

development will be

determined with

partner entry

–

Charles Infill is in

preparation for

CO2

pilot

Bakken

Number of wells

Cost per well

2

$3.5 mln

(carried)

Charles

Number of wells

Cost per well

5

$1 mln

Tyler / Nisku

Number of wells

Cost per well

1

$1.5 mln

Greenhorn Shale

Shallow Gas

Number of wells

Cost per well

1

$0.5 mln

Duperow

Red River

Number of wells

Cost per well

1

$2.4 mln

UK Follow Up

Number of wells

Cost per well

0

$0.7 mln

ES Delineation

Number of wells

Cost per well

1

$12 mln

(carried)

NT09-1

Seismic

$0.5 mln

Total Costs: $29.6mln

Less Carries: $11 mln |

NASDAQ:

MPET www.magellanpetroleum.com

AGM 2010 10

General and Administrative Trends

Human

Resources

New Ventures will necessitate the addition of new people

Operations Staff

Development expertise

Government Relations

Admin

Administratively we will reorganize

Centralized office near assets and field co-owners

Rationalization of dual operator position in the Amadeus Basin

Development

Recent emphasis has been on execution and “proof of concept”

Future efforts will begin to move toward further new development

This will necessitate capital structuring work; including new share issues

targeted at premiums to current prices for significant, value add

developments Substantial value can be achieved through business combination

with undervalued small cap energy companies

|

AGM 2010

NASDAQ: MPET

www.magellanpetroleum.com

Evans Shoal |

NASDAQ:

MPET www.magellanpetroleum.com

AGM 2010 12

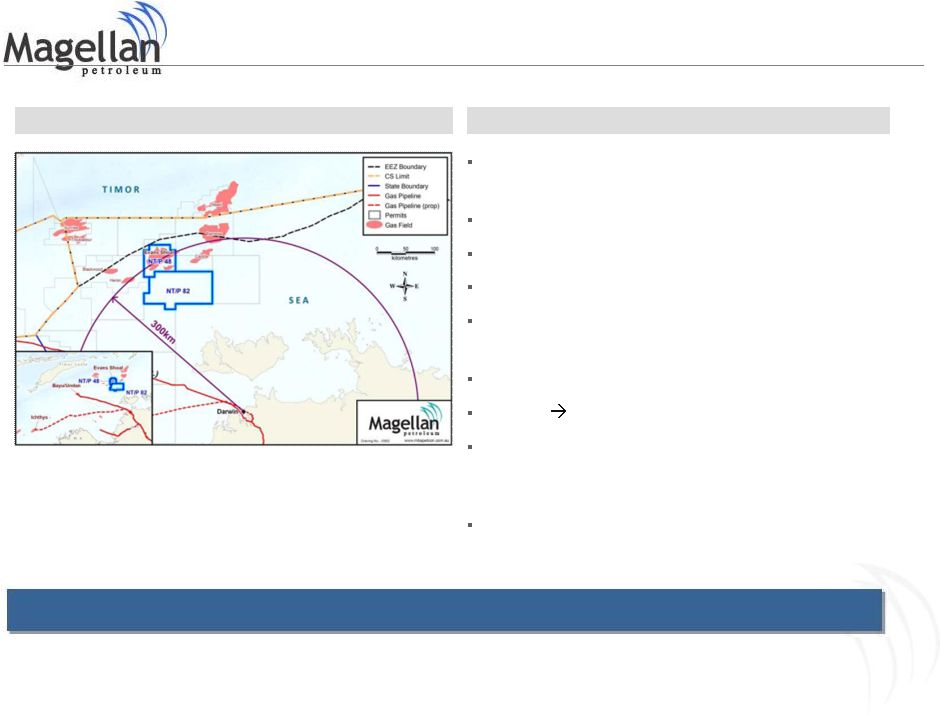

Contract to acquire 40% interest in field

•

Partners are Shell (25%), Petronas

(25%), Osaka Gas (10%)

Gross

reserves

of

up

to

8TCF

(including

CO

2

)

Hub Location (up to 80 TCF in Bonaparte Basin)

Also awarded NT09-1

Field is in relatively shallow water (50 feet to 475 feet)

•

Lower cost jack-up rigs capable at depths to 400 feet

Full 3D seismic coverage done over 215 sq mile structure

Darwin

deepwater port & existing facilities

Magellan will continue to conduct operations in an

environmentally responsible manner and work in

partnership with the indigenous community

North East Asia methanol market Annual Growth Rates

for consumption is expected to be 11%; likewise, imports

are

expected

to

grow

at

8%

annual

rates

(CMAI

1

)

Evans Shoal

EVANS SHOAL

STRATEGIC LOCATION

Notes:

(1) CAGR figures provided by CMAI, see slide 11

Evans Shoal reserves targeted (with CO

2

content)

as Methanol feedstock |

NASDAQ:

MPET www.magellanpetroleum.com

AGM 2010 13

China Methanol Market

Coastal

•

Most of Chinese demand is and will remain coastal

•

>50% of Chinese demand in East China and South

China allowing for competition from imports

Inland

•

Majority of coal-based producers in Northern and

Western China are small-scale and inefficient (less

than 130,000 tons)

•

Inability to compete with low-cost coastal imports

ANALYSIS BY REGION

MTO (METHANOL-TO-OLEFINS)

TRANSPORTATION FUEL

Methanol-based production effectively competing with

naphtha (becoming expensive with rising oil price)

Ability for coal producers to forward-integrate into the

petrochemical chain, where value is generally derived

from methanol to olefins, with polyolefins

as a means

to monetize olefins production

Integrated and captive market with limited impact on

price. Seen as price-taker where naphtha is setting

prices

Independence, diversification and security of Chinese fuel

supply

Regulation will be required to support growth and

related infrastructures

“Green fuel”

allowing cleaner and more efficient

combustion

Methanol to play an important part in price setting with

fuel applications expected to increase in a high oil price

environment

CHINA METHANOL MARKET

MMTPA

2010

2020

Capacity

34.4

53.2

Production

12.8

39.9

Operating Rate

37%

75%

Consumption

19.5

55.2

Net Imports

(6.8)

(15.3) |

Evans Shoal

Structural Discussion Moving Forward

AGM 2010

NASDAQ: MPET

www.magellanpetroleum.com |

NASDAQ:

MPET www.magellanpetroleum.com

AGM 2010 15

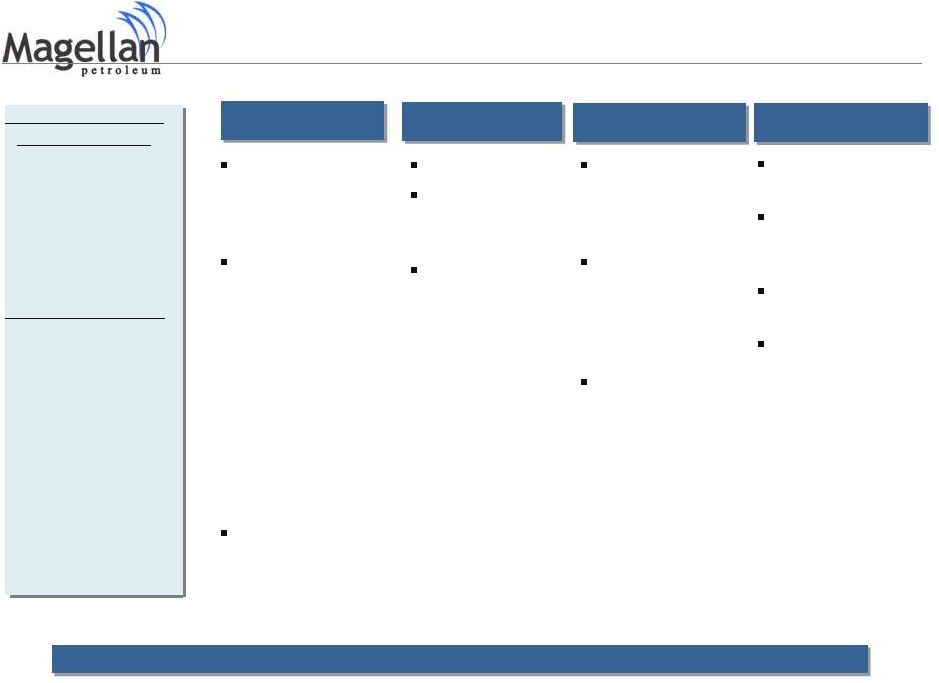

Near term signing of

MoU

Work with co-owners

of the field on a “go

forward”

plan

Gain all necessary

approval

Evaluate capital

restructuring plan

-Begin strategic

discussions regarding

placement of debt or

equity at appropriate

prices.

-Place standby debt

facility

Strategic Partner

Historically

supportive

shareholder

Assessed

independently

through special

committee

Provides an

industrial plan with

off take agreement

that can be financed

Elements of an MoU

received

-Downstream

partners and project

management

-Upstream equity

interest

-Volume

-Timing

-Pricing Structure

Initiate Darwin site

award

Various third party

interests were

evaluated at

different stages

Challenge to bring

in a comparable

process, especially

with regard to

timing

Interest from Asian

players is being

considered: Korea,

China

Two over-arching

considerations

–

Main decision factor

is the certainty of

proceeds

–

Enhance

Shareholder value

Mid

term

strategy

–

Implement near-term

financial structure

with plan to issue

new shares or debt

longer-term.

–

Complete off take

agreement pursuant

to MoU

–

Gain “Major Project”

status in Darwin

Rationale

Evaluation of other options

YEP most attractive option, after careful review of funding alternatives

INDUSTRIAL

PARTNER

YEP

OTHER

NEXT STEPS |

NASDAQ:

MPET www.magellanpetroleum.com

AGM 2010 16

Current Company Structure

CURRENT AUSTRALIAN ORGANISATION

Other Assets

27%

(1)

73%

100%

(1)

Fully diluted with warrants

•

Mereenie

•

Palm Valley

•

Dingo

•

UK

•

Other

Evans Shoal

Asset Sale

Deed

YEP

FREE FLOAT

MAGELLAN

MPAL

/ MGT |

NASDAQ:

MPET www.magellanpetroleum.com

AGM 2010 17

Loan

US$85m

Acquisition Structure

AT COMPLETION

ECONOMICS FOLLOWING CONVERSION

YEP

MAGELLAN

YEP

FREE FLOAT /

MGT

MPAL (Old) -

Properties

33%

(1)

67%

Evans Shoal

Permit

Loan

US$70m +/-

MPAL (New) -

Group

Convertible

post PIPE

US$15m

(1)

Includes exercise of 4.4m warrant shares and issuance of 5.2m PIPE#2

shares SHAREHOLDER VALUE

Economic

interest in

first 3 Tcf

Economic

interest

beyond first

3Tcf

51%

5%

49%

95%

Call option to increase economic

interest to 51%, at discount to NPV

Significant value creation at attractive cost to

Magellan

$13.8m

deposit

and

5.2

mln

shares

@$3

to

acquire approximately 110mmBOE

Carried through first $26m FEED costs

Option to increase economic interest to 51% in

reserves beyond 3 Tcf

at discount

Enables the project to move forward

Monetise major stranded gas assets in Australia

YEP

MAGELLAN |

North American Activities

AGM 2010

NASDAQ: MPET

www.magellanpetroleum.com |

NASDAQ:

MPET www.magellanpetroleum.com

AGM 2010 19

Currently holds 9.5 mmbbls

of Proven net oil reserves

(based on SEC rules) in the Charles formation

Left relatively dormant for the last several decades, Poplar

is a strong candidate for an aggressive infill program and

CO

2

flood in order to maximize recovery

Recent drilling results and existing wells show other pay

zones exist within this acreage and include:

•

Shallow Gas in the Judith River Fm

•

Greenhorn Oil Shale

Niobrara stratigraphic

equivalent and Eagle Ford analog

•

Charles

•

Mission Canyon

•

Lodgepole

•

Bakken/Three Forks

•

Duperow

•

Red

River

Poplar Oil Fields

POPLAR, MT

STRATEGIC LOCATION

EPU#119

The

Poplar

complex

is

a

candidate

for

Tertiary

CO

2

flooding.

The

success

case

with

this

EOR

program is a 10% + incremental oil recovery profile |

NASDAQ:

MPET www.magellanpetroleum.com

AGM 2010 20

Cased to the Nisku

(7132 ft) on 11/12/2010. Well results as

of today are as follows:

•

Shallow Judith River gas pressure seen

•

New Greenhorn Oil Shale (2282’) (Niobrara stratigraphic

equivalent) is oil saturated and contains positive development

characteristics. Core planned in 2011

•

Tyler testing impractical due to high mud weights maintained

through the Dakota. New well needed to test at lower mud

weights.

•

Charles core completed and is currently under analysis. Logs

showed excellent porosity and permeability in the B and C.

Recompletion planned post-Nisku

work.

•

Nisku

formation penetrated but with high weight water-based

mud. Relative permeability has been affected. Currently

producing high water cut but are attempting to draw down

pressure and place packers to isolate water and improve oil cut.

Next move up to recomplete Charles.

Montana Results: EPU #119 Well

Magellan -

EPU #119 Poplar MT

EPU #119 WELL RESULTS

BAKKEN FORMATION

•

Bakken

and Three Forks core successfully obtained and analyzed

1.Gas as high as 9000 units seen in the Lodgepole 2.Substantial

fracturing and fair to good porosity

3.Permeability was higher than that of Elm-Coulee 4.Middle Bakken is over

pressured and mature 5.Core analysis indicates oil

and gas saturation 6.Three Forks results

were better than expected. Seven distinct, yet independent, stacked

development intervals |

NASDAQ:

MPET www.magellanpetroleum.com

AGM 2010 21

Poplar Development Strategy

Proven Reserves

Optimize production from the existing PDP reserve base, and execute work program

to bring the PDNP reserve base online

Drill PUD locations starting in 2011

Additional Infill

Move

down

to

40

or

80

acre

spacing

in

the

Charles

reservoir

in

preparation

for

CO

2

flood

CO

2

Pilot

Initiate “Huff-n-Puff”

CO

2

EOR pilot in 2Q 2012, including one injector and 4 producers.

Full CO

2

Flood

A full CO

2

flood would be implemented at the Field after successful pilot

A successful CO

2

flood could result in additional recovery of 10% or 80 mmbbl

Bakken

Shale

Various well penetrations and logs confirm the presence of the Bakken

The recent EPU#119 well cored 61’

of Bakken/Three Forks formation.

Prospective

Zones

Work program for other pay zones documented in the field: Shallow Gas in the

Judith River Fm, Greenhorn Oil Shale, Mission Canyon, Lodgepole, Duperow,

and Red River Seven distinct, yet independent, stacked development

intervals |

AGM 2010

NASDAQ: MPET

www.magellanpetroleum.com |

NASDAQ:

MPET www.magellanpetroleum.com

AGM 2010 23

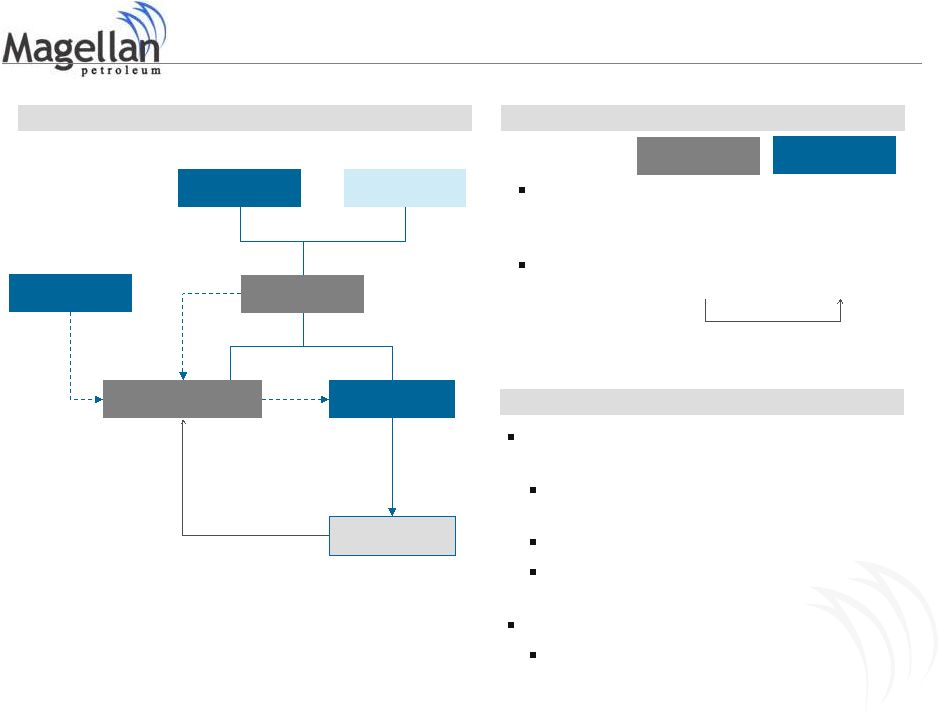

United Kingdom drilling development

•

Offset drilling to existing oil production

•

Some licenses offset the large Wytch

Farm field

•

Deep Gas and Shale potential (farm-out discussions now)

Onshore UK & Australia

AUSTRALIA

UNITED KINGDOM

Mereenie

Oil Field, onshore Australia

•

Magellan is 35%

•

Sales contract expired in September 2010

•

Contingent resources of 150 BCF and 2 mmbbls

(gross)

Palm Valley Gas Field, onshore Australia

•

Magellan is 52% and operator

•

Contingent resources of 40 BCF (gross)

•

Discussing new gas sales contract for remaining life of

reserves |

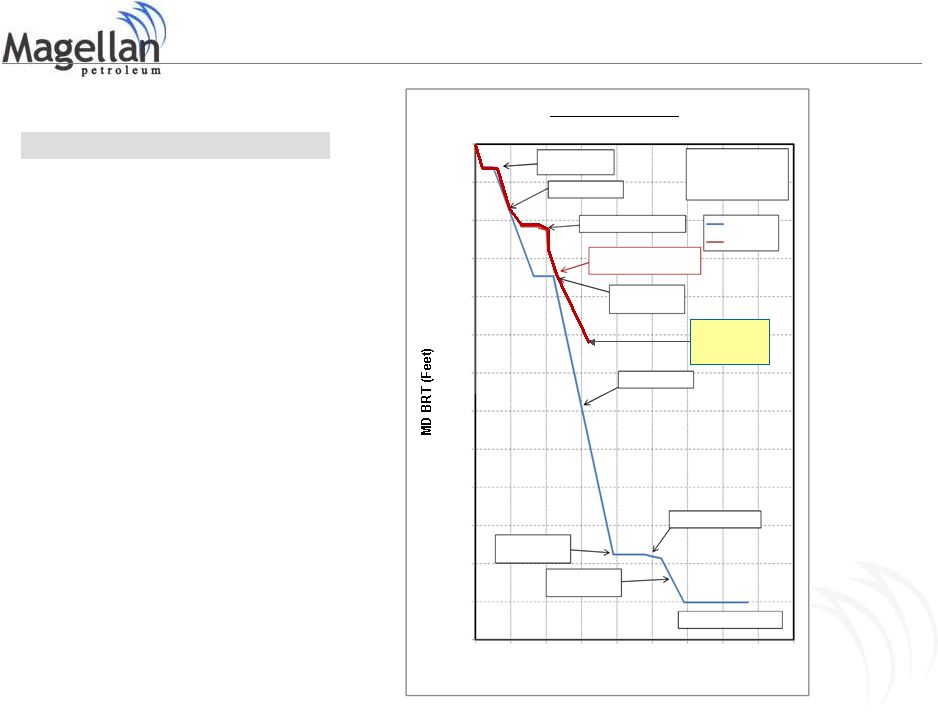

NASDAQ:

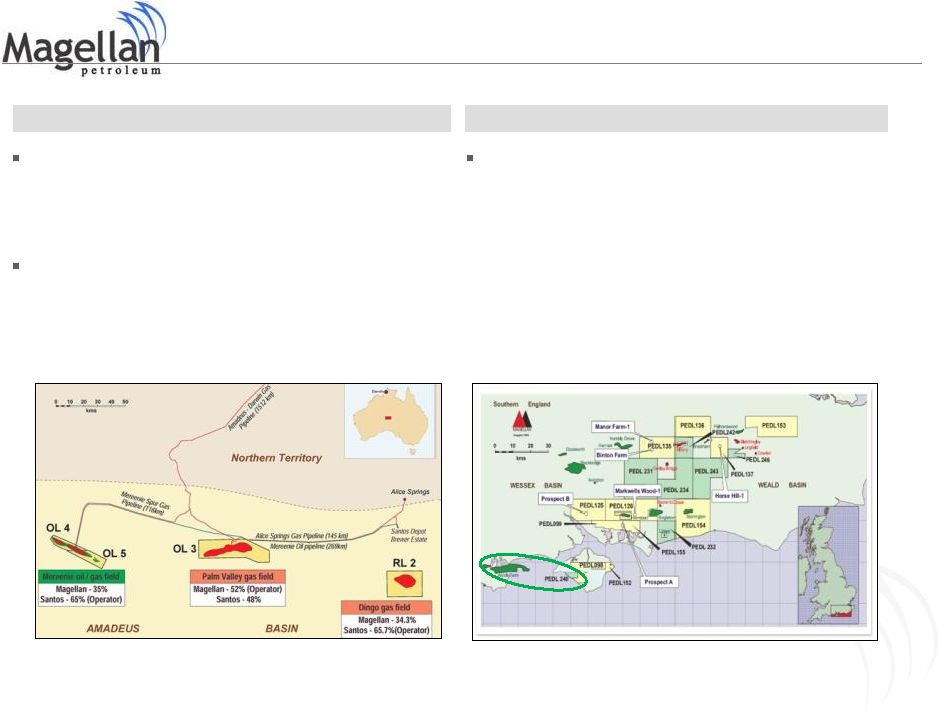

MPET AGM 2010 24

0

500

1000

1500

2000

2500

3000

3500

4000

4500

5000

5500

6000

6500

Markwells Wood 1

Time Vs

Depth

Set 18?" Casing Location:

PEDL 126

00°55'14.46"W

310 ft

50°54'31.59"N Drill

17½" hole

Spuded:

21-Nov-2010

Cement off loss zones

Prognosed

Actual

Day 11 Rpt: Depth 1682 ft

02-Dec

06:-0 hr GMT

Set 13?" Casing

1730 ft

Drill 12¼" hole

Core 30 ft 8½" hole

Set 9?" Casing

5381 ft

Drill 8½" hole

Well TD 6009 ft

Log, Complete, Demob

0

5

10

15

20

25

30

35

40

45

DAYS

UK Development Update

Current

Position

–

Spud Date November 21, 2010

–

Late December logging, evaluation and

completion

–

Structure drilled at significant angle to avoid

area faulting

–

Subsequent testing without rig planned.

Dependent on flow characteristics

–

Expected well cost of $4.4 million equivalent.

Magellan held a 50% interest initially. 10% of

that ownership has been farmed-out in return

for payment of 20% of drilling costs.

Magellan’s net cost is expected to be $1.3

million prior to initiation of testing.

MARKWELLS WOOD 1 |

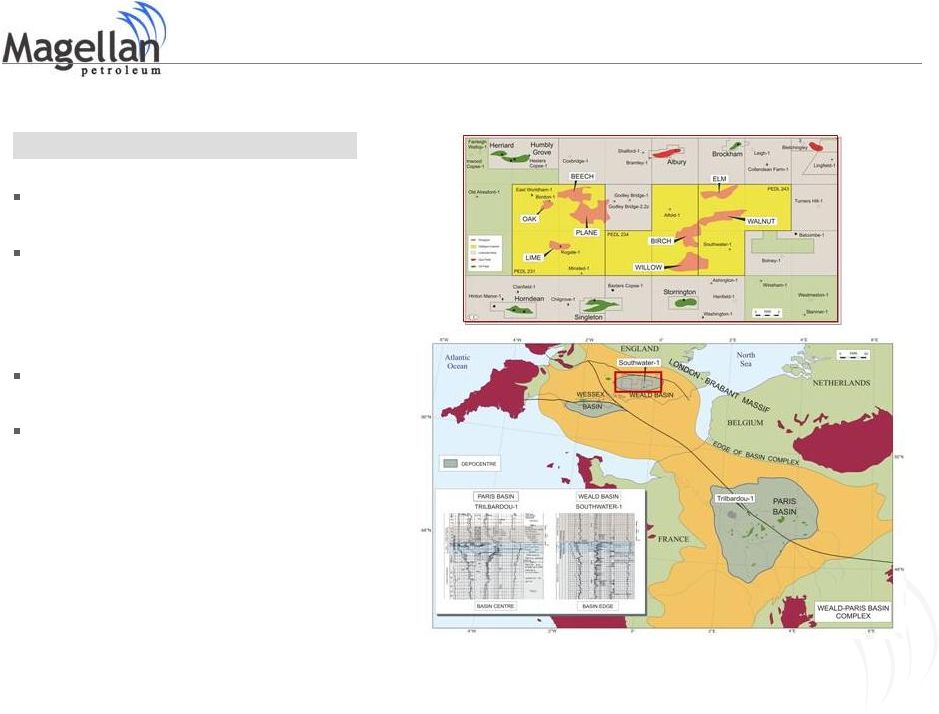

NASDAQ:

MPET www.magellanpetroleum.com

AGM 2010 25

The acreage is held by Celtique

(50%,

Operator) and Magellan (50%)

The Weald Basin area is located in

countryside south west of London, close to

the large south east UK energy market and

proximal to major gas trunk lines and

refineries

Licences cover contiguous 1,000 sq kms

(247,000 acres)

Actively marketing shale development farm

in, likely will need to gain further data

UK Shale Acreage Update

SHALE POSITION |

New Opportunities and Shareholder Value

AGM 2010

NASDAQ: MPET

www.magellanpetroleum.com |

NASDAQ:

MPET www.magellanpetroleum.com

AGM 2010 27

New Opportunities

Pacific

Methanol

Several over-looked gas fields have been identified as the next major fields

for methanol development in the Pacific

North American

Oil & Gas

Augment acreage in Montana

Match under-valued gas purchasing companies with existing Upstream

development opportunities

Undervalued

Small-Cap

Energy Cos

Consolidate

smaller,

yet

valuable,

energy

companies

via

issuance

of

new

share

CO2

Sourcing

Improve

value

proposition

from

CO

2

tertiary

flooding

via

control

of

CO

2

sources

No shortage of opportunity once current work is done

|

NASDAQ:

MPET www.magellanpetroleum.com

AGM 2010 28

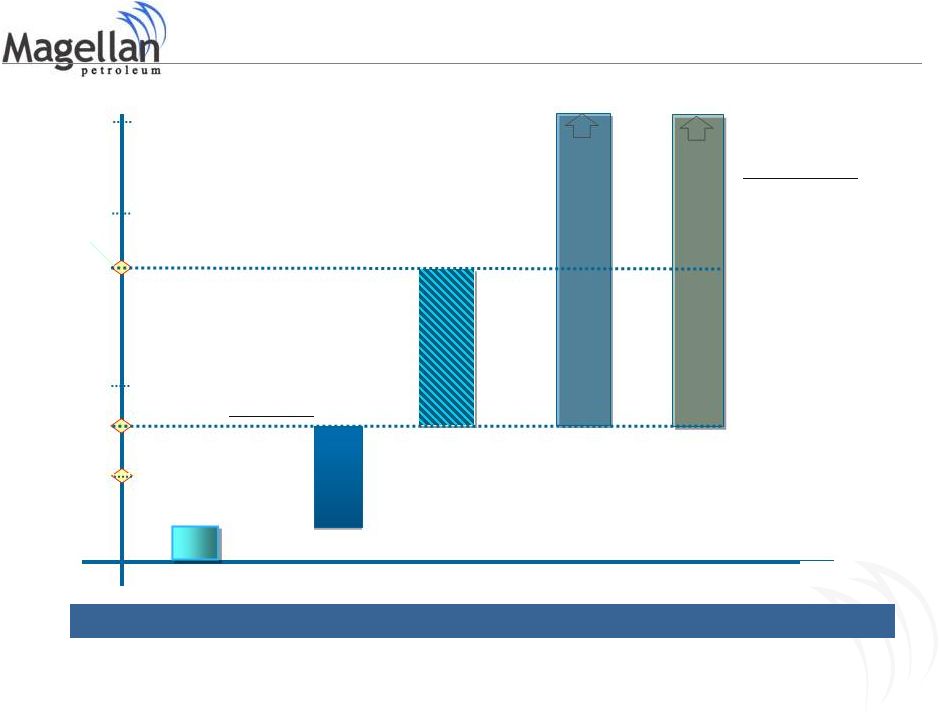

100

200

300

400

US$ millions

(net to Magellan)

500

Market Cap

Liquidation (no gas value)

Sale of Mereenie

Gas

Cash

Note : Each module represents results of Excel economic

evaluation Evans Shoal

Methanol Value

Future growth

•

Evans Shoal Gas

Development

•Montana Infill/Tertiary

Work

•Mereenie

West-end

Drilling

•

Potential UK Discovery

•Undervalued Smallcap

Acquisition

Poplar Redevelopment

Value

Cash Position and Value

PIPE2 @ $3

Magellan remains substantially undervalued pending “proof of

concept” |

AGM 2010

NASDAQ: MPET

www.magellanpetroleum.com |