Attached files

| file | filename |

|---|---|

| 8-K - FULTON FINANCIAL CORP | f8k.htm |

1

Fulton Financial

Corporation

-------------------------------------

Investor Presentation

Data as of September 30, 2010

2

n This presentation may contain forward-looking statements about Fulton Financial Corporation’s financial

condition, results of operations, business, strategies, products and services. You can identify forward-looking

statements by the use of words such as “may”, “should”, “will”, “could”, “estimates”, “predicts”, “potential”,

“continue”, “anticipates”, “believes”, “plans”, “expects”, “future” and “intends” and similar expressions

which are intended to identify forward-looking statements.

condition, results of operations, business, strategies, products and services. You can identify forward-looking

statements by the use of words such as “may”, “should”, “will”, “could”, “estimates”, “predicts”, “potential”,

“continue”, “anticipates”, “believes”, “plans”, “expects”, “future” and “intends” and similar expressions

which are intended to identify forward-looking statements.

n Such forward-looking statements reflect the current beliefs and expectations of the Corporation’s

management, are based on estimates, assumptions and projections about the Corporation’s business and its

industry, and involve significant risks and uncertainties, some of which are beyond our control and difficult to

predict. These statements are not guarantees of future performance and actual results may differ materially

from those expressed or forecasted in the forward-looking statements. The Corporation undertakes no

obligation to update or revise any forward-looking statements, whether as a result of new information, future

events or otherwise. Accordingly, investors and others are cautioned not to place undue reliance on such

forward-looking statements.

management, are based on estimates, assumptions and projections about the Corporation’s business and its

industry, and involve significant risks and uncertainties, some of which are beyond our control and difficult to

predict. These statements are not guarantees of future performance and actual results may differ materially

from those expressed or forecasted in the forward-looking statements. The Corporation undertakes no

obligation to update or revise any forward-looking statements, whether as a result of new information, future

events or otherwise. Accordingly, investors and others are cautioned not to place undue reliance on such

forward-looking statements.

n Many factors could affect future financial results including, without limitation, asset quality and the impact of

adverse changes in the economy and in credit or other markets and resulting effects on credit risk and asset

values; acquisition and growth strategies; market risk; changes or adverse developments in economic,

political or regulatory conditions; a continuation or worsening of the current disruption in credit and other

markets, including the lack of or reduced access to, and the abnormal functioning of markets for mortgages

and other asset-backed securities and for commercial paper and other short-term borrowings; changes in the

levels of Federal Deposit Insurance Corporation deposit insurance premiums and assessments; the effect of

competition and interest rates on net interest margin and net interest income; investment strategy and income

growth; investment securities gains and losses; declines in the value of securities which may result in charges

to earnings; changes in rates of deposit and loan growth or a decline in loans originated; balances of risk-

sensitive assets to risk-sensitive liabilities; salaries and employee benefits and other expenses; amortization

of intangible assets; goodwill impairment; capital and liquidity strategies; and other financial and business

matters for future periods.

adverse changes in the economy and in credit or other markets and resulting effects on credit risk and asset

values; acquisition and growth strategies; market risk; changes or adverse developments in economic,

political or regulatory conditions; a continuation or worsening of the current disruption in credit and other

markets, including the lack of or reduced access to, and the abnormal functioning of markets for mortgages

and other asset-backed securities and for commercial paper and other short-term borrowings; changes in the

levels of Federal Deposit Insurance Corporation deposit insurance premiums and assessments; the effect of

competition and interest rates on net interest margin and net interest income; investment strategy and income

growth; investment securities gains and losses; declines in the value of securities which may result in charges

to earnings; changes in rates of deposit and loan growth or a decline in loans originated; balances of risk-

sensitive assets to risk-sensitive liabilities; salaries and employee benefits and other expenses; amortization

of intangible assets; goodwill impairment; capital and liquidity strategies; and other financial and business

matters for future periods.

n For a more complete discussion of certain risks and uncertainties affecting the Corporation, please see the

sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and

Results of Operations” set forth in the Corporation’s filings with the Securities and Exchange Commission.

sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and

Results of Operations” set forth in the Corporation’s filings with the Securities and Exchange Commission.

Forward-Looking Statement

3

Presentation Outline

u Corporate Profile

u Franchise and Markets

u Overview of the 3rd Quarter

u Capital

u Earnings/Peer Group

u Financial Performance

u Supplemental Credit Information

u Investment Portfolio

4

Fulton Financial Profile (as of 9/30/10)

n Mid-Atlantic regional financial holding company

n A family of 8 community banks in 5 states

n Fulton Financial Advisors

n Fulton Mortgage Company

n 272 community banking offices

n Asset size: $ 16.3 billion

n 3,800 Team Members

n Market capitalization: $ 1.8 billion

n Book value per common share: $ 9.43

n Tangible book value per common share: $6.67

n Shares outstanding: 198.9 million

5

A Valuable Geographic Franchise

6

Superior Customer Experience

WE WILL CARE, LISTEN,

UNDERSTAND, AND DELIVER

UNDERSTAND, AND DELIVER

7

Our Brand

COMMUNITY BANKING

SMALL BUSINESS

HIGH NET WORTH

RETAIL BANKING

8

Overview of the 3rd Quarter

n TARP redeemed in full on July 14th

n Repurchased associated warrant on September 8th

n Strong mortgage activity and related sale gains

n Net interest margin expansion

n Continued core deposit growth / highly liquid

n Regulation E overdraft guidelines implemented

n Announced merger of Delaware affiliate into Fulton

Bank

Bank

n Expenses well controlled

9

Overview of the 3rd Quarter / Credit

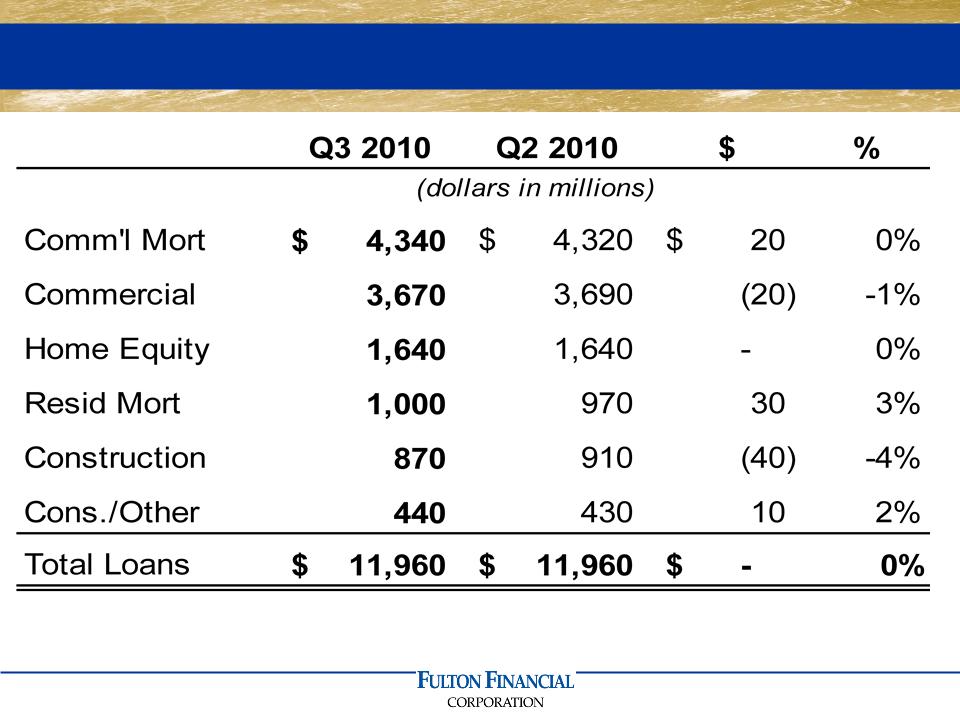

n Loan balances stable / growth offset

runoff and charge-offs

runoff and charge-offs

n Earning asset growth a challenge

n Economic recovery slower than

anticipated

anticipated

n Non-performing assets and overall

delinquency increased linked quarter

delinquency increased linked quarter

n Further reduction in construction

exposure

exposure

n Provision unchanged from prior quarter

10

n 52 relationships with commitments to lend

of $20 million or more

n Maximum individual commitment: $33 million

n Maximum commitment land development:

$25 million

Ø Maximum commitment any one development

project: $15 million

project: $15 million

n Average commercial lending relationship size is

$459,711

$459,711

n Loans and corresponding relationships are

within Fulton’s geographic market area

within Fulton’s geographic market area

Summary of Larger Loans 9/30/10

11

Basel Capital Guidelines

n Corporation’s current capital levels

exceed preliminary guidelines

exceed preliminary guidelines

n Possible further definition and

clarification from U. S. Regulatory

Authorities

clarification from U. S. Regulatory

Authorities

12

Capital 9/30/10

|

GAAP Capital

|

$1.88 billion

|

|

Total Risk-Based Capital

|

$1.77 billion

|

|

Total Risk-Based Capital Ratio

|

13.90%

|

|

Tier 1 Risk-Based Capital Ratio

|

11.40%

|

|

Leverage Capital Ratio

|

9.20%

|

|

Tangible Common Equity Ratio

|

8.40%

|

|

Tangible Common Equity

to Risk-Weighted Assets

|

10.45%

|

13

Dodd Frank Act

n Established organizational structure

to address each applicable Title

to address each applicable Title

n Expect market opportunities with

appropriate planning and strategizing

appropriate planning and strategizing

n Believe we are in a better position to

absorb increased costs than smaller

competitors

absorb increased costs than smaller

competitors

14

Mortgage Foreclosures

n Media focus is largely on high volume

servicing/ foreclosure operations

servicing/ foreclosure operations

n Each customer viewed on case-by-case basis

n Strive to keep borrowers in their homes

n Approximately 300 residential foreclosure

actions initiated during first nine months of

this year

actions initiated during first nine months of

this year

n Currently conducting review of our foreclosure

requirements, foreclosure procedures and law

firms we use

requirements, foreclosure procedures and law

firms we use

n The impact of any deficiencies which may be

discovered is not expected to be material

discovered is not expected to be material

15

Financial Performance

16

17

Income Statement Summary

18

Income Statement Summary (YTD September)

19

International Bancshares Corporation

Old National Bancorp

South Financial Group, Inc.

Susquehanna Bancshares, Inc.

TCF Financial Corporation

Trustmark Corporation

UMB Financial Corporation

United Bankshares, Inc.

Valley National Bancorp

Whitney Holding Corporation

Wilmington Trust Corporation

*Fulton’s peer group as of September 30, 2010

Associated Banc-Corp

BancorpSouth, Inc.

Bank of Hawaii Corporation

BOK Financial Corporation

Citizens Republic Bancorp

City National Corporation

Commerce Bancshares, Inc.

Cullen/Frost Bankers, Inc.

First Citizens BancShares, Inc.

First Midwest Bancorp, Inc.

First Merit Corporation

Peer Group*

20

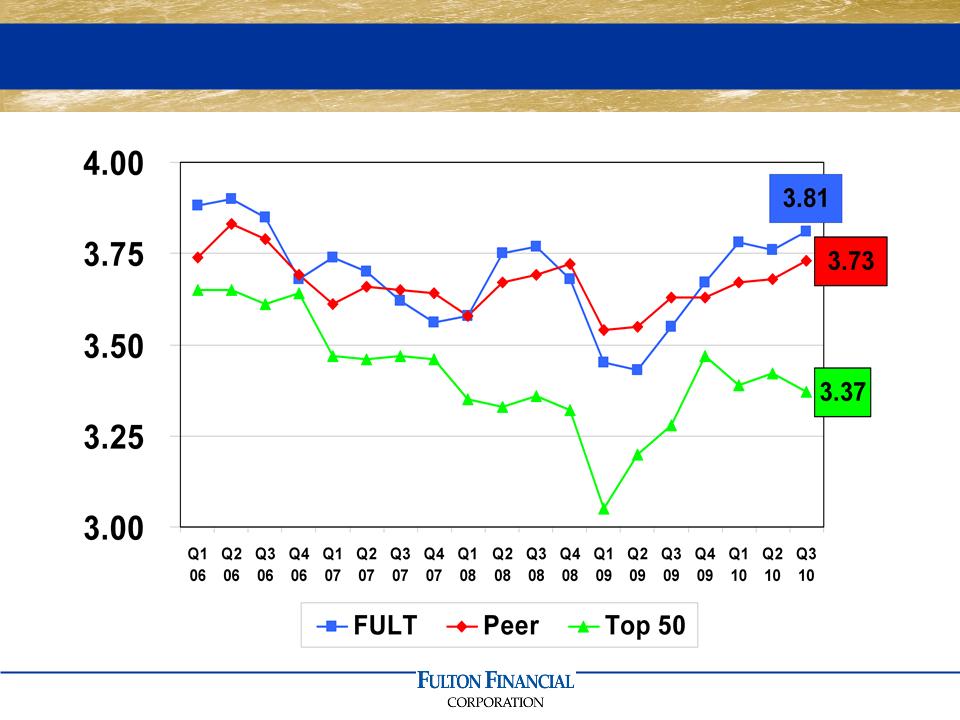

Net Interest Margin

21

Average Loans (Q3 2010 vs. Q2 2010)

22

Average Loans (September 30th - Year to Date)

23

Average Loan Growth

24

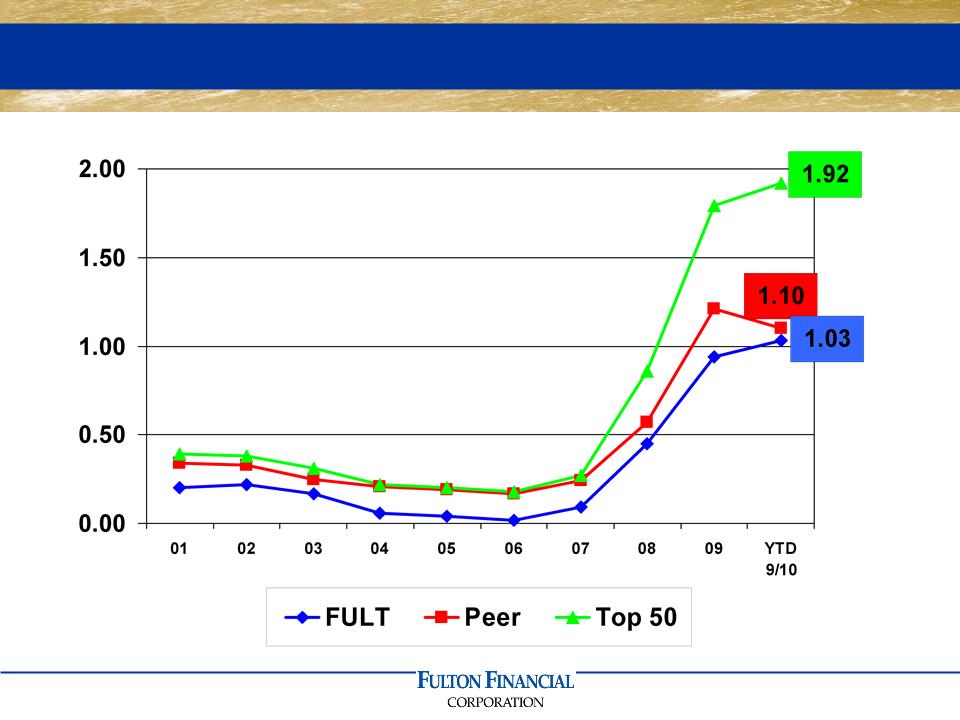

Net Charge-Offs To Average Loans

25

Non-performing Loans to Loans

26

Allowance to Loans

27

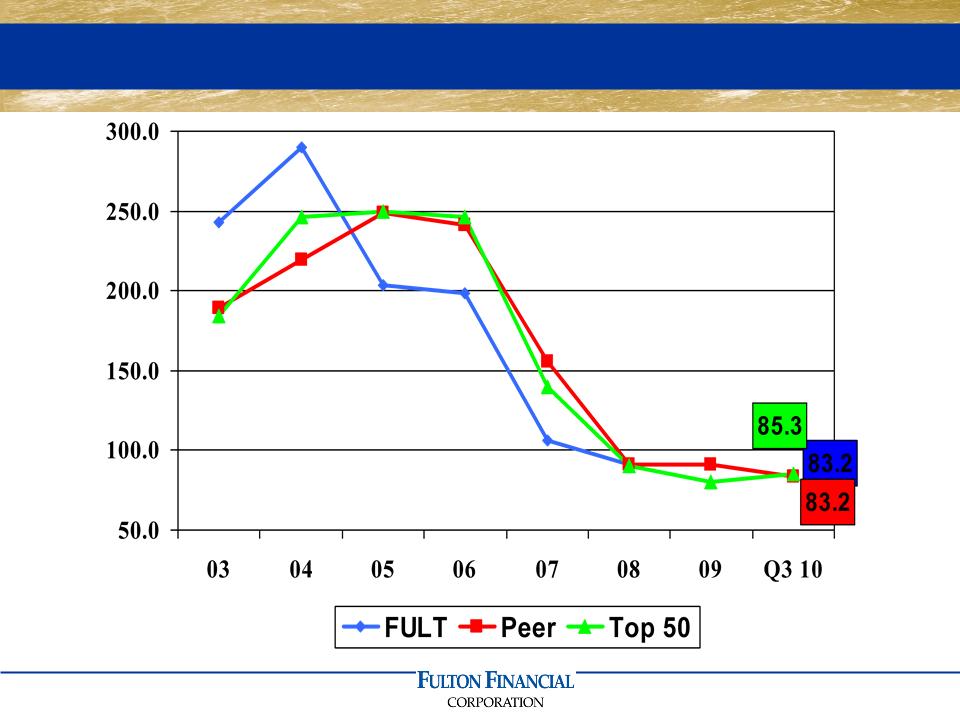

Allowance to Non-performing Loans

28

Average Deposits (Q3 2010 vs. Q2 2010)

29

Average Deposits (September 30th - Year to Date)

30

Average Deposit Growth

31

32

Other Income (Q3 2010 vs. Q2 2010)

33

Other Income (September 30th - Year to Date)

34

More Efficient Than Peers

35

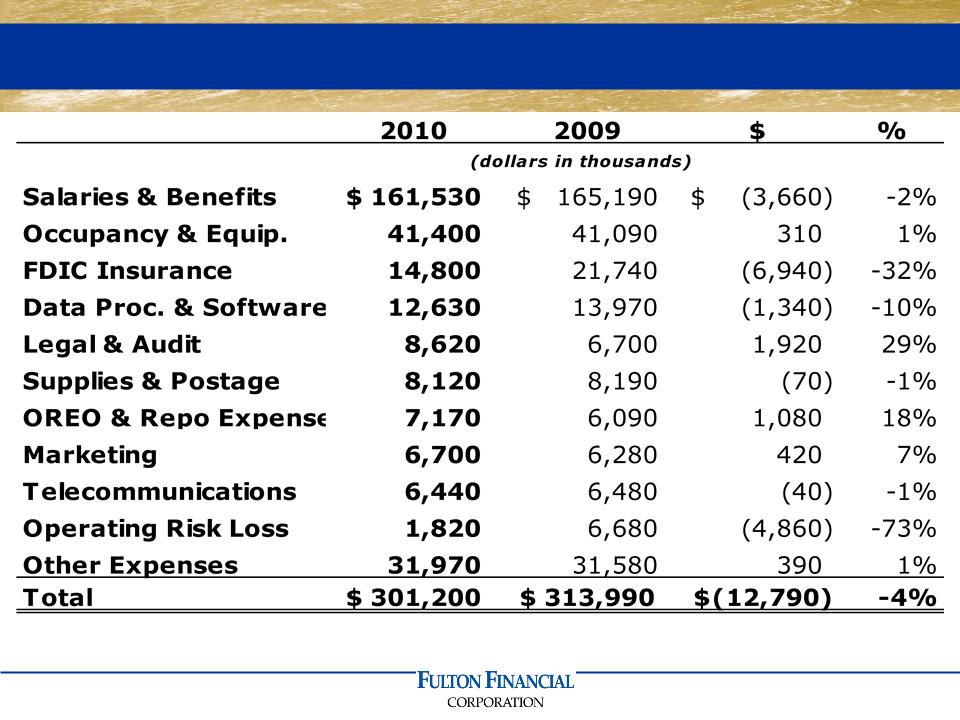

Other Expense (Q3 2010 vs. Q2 2010)

36

Other Expense (September 30th - Year to Date)

37

Corporate Priorities

n EPS growth to improve total shareholder return

n Reduce credit costs and construction exposure

n Aggressively seek quality loans / protect current

relationships

relationships

n Pricing to reward, retain and enhance retail

customer relationships

customer relationships

n Leverage our brand and Forbes recognition

n Consistent superior customer experience

n Continue to align funding costs with protracted low

rate environment

rate environment

n Offset impact of Regulation E changes / focus on

non-interest income

non-interest income

38

Fulton Financial Corporation

One Penn Square

Lancaster, PA 17602

www.fult.com

39

Supplemental Credit

Information

Information

40

Commercial Loans by Industry (Sept. 30, 2010)

41

Loan Distribution by State (Q3 2010)

42

Provision and Net Charge-Offs

Provision

Net Charge-Offs / Average Loans

($ in millions)

43

Net Charge-offs (Recoveries) (Q3 2010)

44

Loan Delinquency (Key Sectors)

|

Category

|

Total (%)

9/30/10

|

90-Days

9/30/10

|

Total (%)

9/30/09

|

90-Days

9/30/09

|

|

Commercial

Loans |

3.08

|

2.31

|

2.26

|

1.65

|

|

Consumer

Direct |

1.54

|

0.71

|

1.69

|

0.65

|

|

Commercial

Mortgage |

2.85

|

2.29

|

1.84

|

1.31

|

|

Residential

Mortgage |

9.19

|

5.26

|

9.28

|

5.14

|

|

Construction

|

12.02

|

10.98

|

11.37

|

10.12

|

|

Total

Portfolio |

3.86

|

2.87

|

3.34

|

2.34

|

45

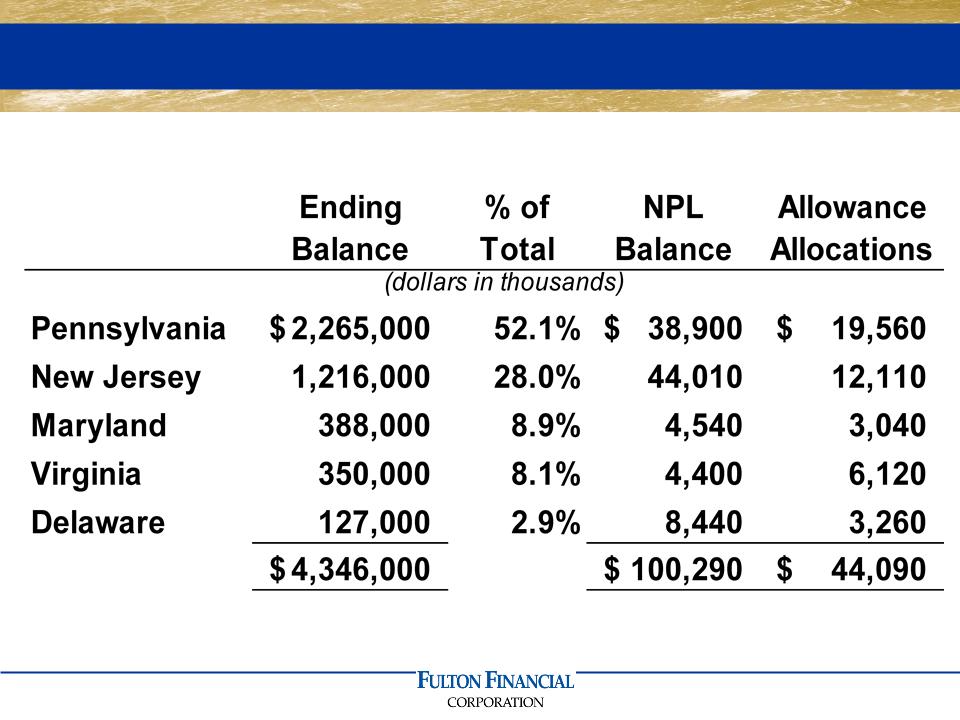

Non-performing Loans* (September 30, 2010)

46

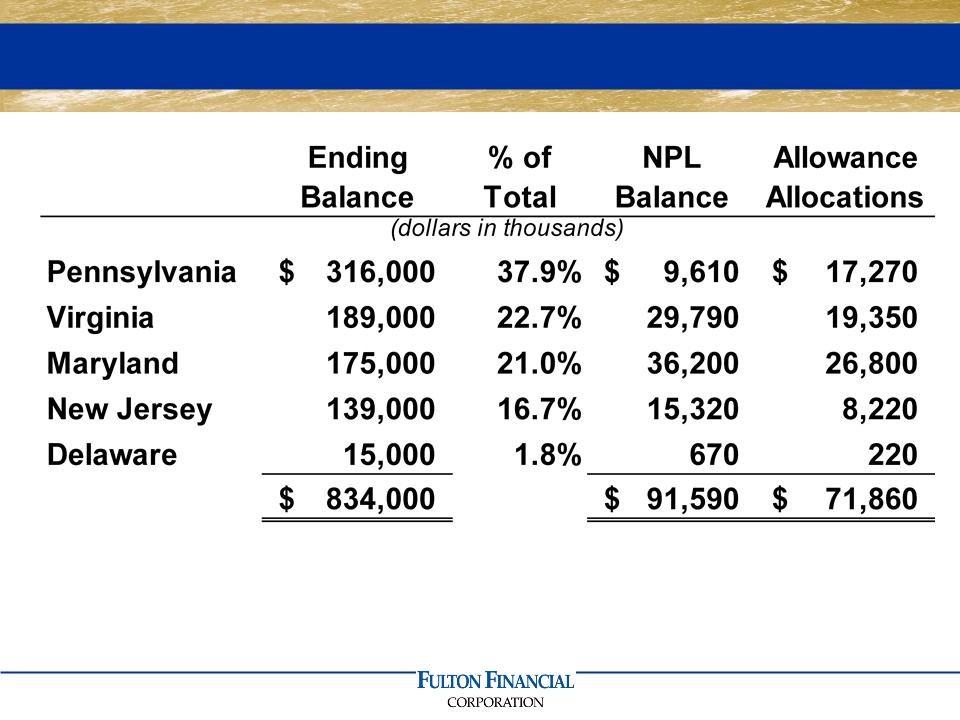

Residential Mtg by State (September 30, 2010)

47

C&I Loans by State (September 30, 2010)

48

Construction Loans (September 30, 2010)

49

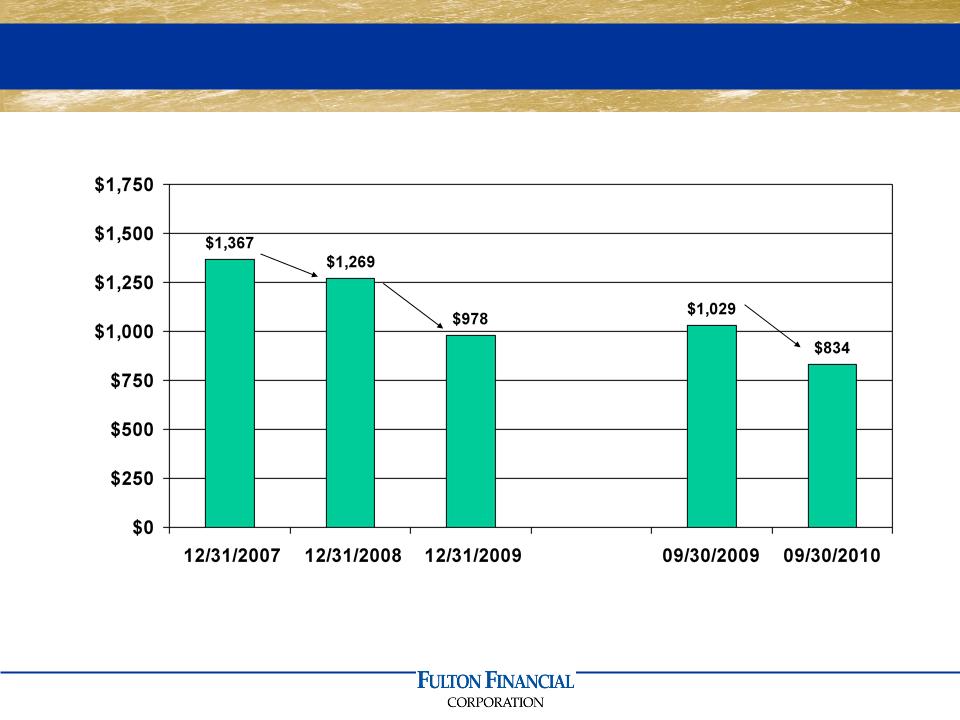

Declining Construction Exposure

(7%)

(23%)

(19%)

($ in millions)

Construction Loans /

Total Loans

Total Loans

12.2%

10.5%

8.2%

8.6%

7.0%

50

Construction Loans by Type 9/30/10

51

CRE Loans by State (September 30, 2010)

52

Shared National Credits (September 30, 2010)

53

54

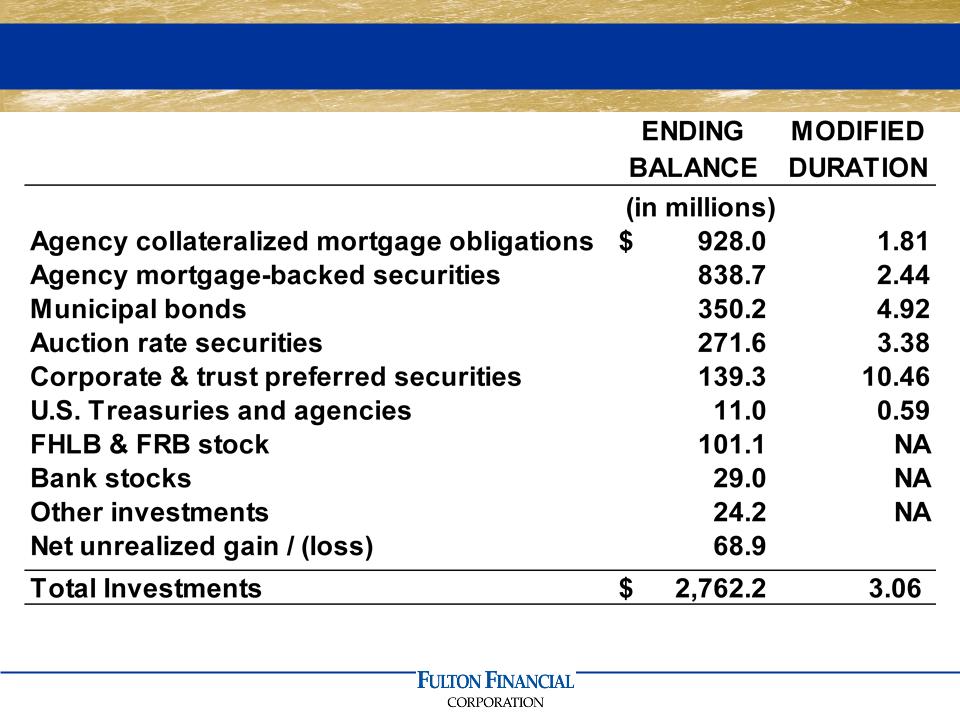

Investment Portfolio Detail

55

Investment Portfolio (September 30, 2010)

56

Fulton Financial Corporation

One Penn Square

Lancaster, PA 17602

www.fult.com

Version 2010-11-24