Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PIONEER ENERGY SERVICES CORP | d8k.htm |

Stephens Fall Investment Conference

November 16, 2010

(NYSE AMEX: PDC)

www.pioneerdrlg.com

Exhibit 99.1 |

2

Forward-looking Statements

This presentation contains various forward-looking statements and information that are based on

management’s current expectations and assumptions

about future events. Forward-looking statements are generally accompanied by words such as “estimate,” “project,”

“predict,” “expect,”

“anticipate,” “plan,”

“intend,” “seek,”

“will,” “should,”

“goal,” and

other words that convey the uncertainty of future events and outcomes. Forward-looking information

includes , among other matters, statements regarding the

Company’s anticipated growth, quality of assets, rig utilization rate, capital

spending by oil and gas companies, production rates, the Company's growth strategy, and the Company's

international operations. Although the Company believes that the expectations and assumptions

reflected in such forward-looking statements are reasonable, it can give no assurance that

such expectations and assumptions will prove to have been correct. Such statements are subject to

certain risks, uncertainties and assumptions, including, among others: general and regional

economic conditions and industry trends; the continued strength of the contract land drilling industry in

the geographic areas where the Company operates; decisions about onshore exploration and development

projects to be made by oil and gas companies; the highly competitive nature of the contract land

drilling business; the Company’s future financial

performance, including availability, terms and deployment of capital; the continued availability of

qualified personnel; changes in governmental regulations, including those relating to the environment;

the political, economic and other uncertainties encountered in the Company's international

operations and other risks, contingencies and uncertainties, most of which are difficult to

predict and many of which are beyond our control. Should one or more of these risks,

contingencies or uncertainties materialize, or should underlying assumptions prove incorrect, actual

results may vary materially from those expected. Many of these factors have been discussed in more

detail in the Company's annual report on Form 10-K for the fiscal year ended December 31,

2009 and Form 10-Q for the three months ended, March 31, 2010 and September 30, 2010.

Unpredictable or unknown factors that the Company has not discussed in this presentation or in

its filings with the Securities and Exchange Commission could also have material adverse effects

on actual results of matters that are the subject of the forward-looking statements. All forward-looking

statements speak only as the date on which they are made and the Company undertakes no duty to update or

revise any forward-looking statements. We advise our shareholders to use caution and common

sense when considering our forward looking statements. |

Overview

Ticker Symbol:

PDC

Market Cap:

$374 million (November 11, 2010)

Stock price:

$6.91 (November 11, 2010)

Average 3-month daily

trading volume:

452,000 shares

Public float:

Approximately 54 million shares

Employees:

2,444

Headquarters:

San Antonio, Texas

3 |

4

Pioneer Drilling Overview |

Investment Considerations

Rig fleet trading at a significant discount to replacement value

Focused on protecting cash flow from natural gas price uncertainty

Approximately 70% of working rigs on term contracts

(1)

Approximately 60% of working rigs in shale plays

(1)

Approximately

60%

of

our

working

drilling

rigs

and

workover

rigs

are

operating on wells targeting oil

(1)

Recent bond offering combined with credit facility provides ample

flexibility and liquidity

Continued growth opportunities in core businesses: land drilling, well

services and wireline

5

(1) Based on information provided in 3rd quarter 2010 conference call;

company research as of November 4, 2010 |

6

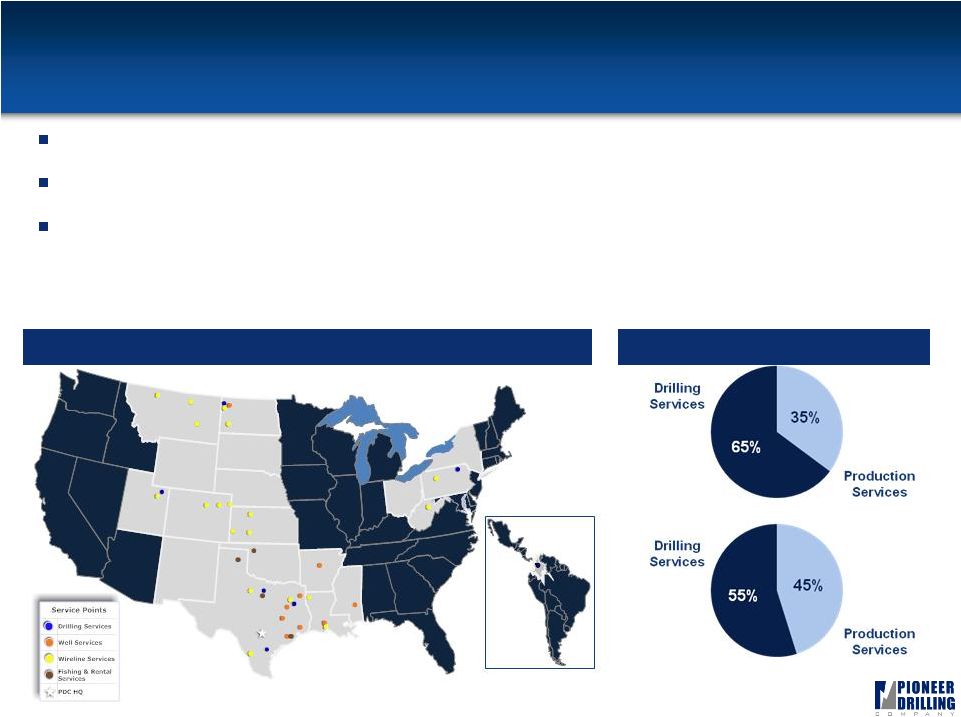

Overview of Pioneer

71 land drilling rigs (approximately 9

largest contract driller)

74 well service rigs (approximately 6

largest well service provider)

82 wireline

units (65 cased hole, 17 open hole)

Diversified Energy Services Provider

TTM September 30, 2010

Total Revenue: $420 million

Total Segment Margin: $125 million

6

Colombia

th

th |

Corporate Strategy

Focused on value-added organic growth in core businesses: land

drilling, well services and wireline

Maintaining emphasis on new-build equipment and state-of-the-art

technology

Continuing to pursue further international expansion

Maintain leadership position in accident-free work environment

7 |

Recent Developments

8

Locking in drilling rig utilization with term contracts

Increased term contracts from 4 to 32 since beginning of year, including

All seven rigs drilling in the Marcellus,

Eight rigs drilling in Bakken,

Six rigs drilling in Eagle Ford,

One rig drilling in South Texas,

Two rigs drilling in Uintah Basin, and

All eight rigs drilling in Colombia |

Drilling Services-Segment Overview

9

Historical Fleet Growth

Locations

Current Rig Fleet Mix

Note:

Rig

counts

for

2004,

2005

and

2006

represent

fiscal

years

ended

March

31,

2004,

2005

and

2006

while

2007,

2008

and

2009

represent

fiscal

years

ended

December

31,

2007,

2008

and

2009.

* Cold-stacked

19 rigs

Avg

HP: 1,084

South Texas

16 rigs

Avg

HP: 931

East Texas

58%

42%

49%

31%

20%

Electric

Mechanical

550-999

HP

1,000-1,499

HP

1,500-2,000

HP

9 rigs

Avg

HP: 1,222

North Dakota

3 rigs

Avg

HP: 850

North Texas

3 rigs

Avg

HP: 1000

Utah

7 rigs

Avg

HP: 1,000

Appalachia

8 rigs

Avg

HP: 1,375

Colombia

6 rigs

Avg

HP: 600

Oklahoma*

40

52

61

66

70

71

0

20

40

60

80

2004

2005

2006

2007

2008

2009 |

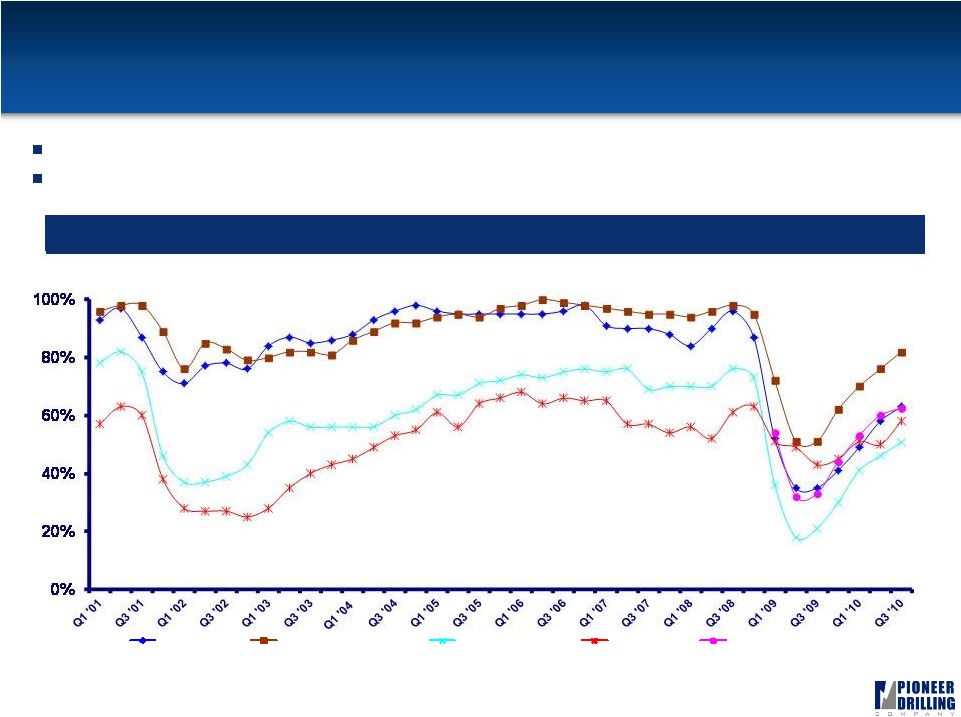

10

Strong Utilization Through the Cycles

Averaged 85% utilization through cycles since 2001, comparing favorably to

peers Utilization has rebounded from a monthly low of 33% in June 2009

to 63% currently

(1)

Comparable Utilization Rates

Pioneer

Helmerich

& Payne

Patterson-UTI

Nabors

Precision (U.S.)

Source: Helmerich & Payne, Patterson-UTI, & Precision Drilling data consists of U.S.

domestic utilization rates derived from Form 10-K, Form 10-Q reports, & press releases. Nabors utilization rates for

worldwide land fleet obtained from public documents and industry analysts. Helmerich & Payne

Q3 2010 only estimated based on analyst reports. Pioneer Drilling utilization rates include Colombian

operations beginning Q3 2007.

(1) PDC utilization for Q3 2010.

|

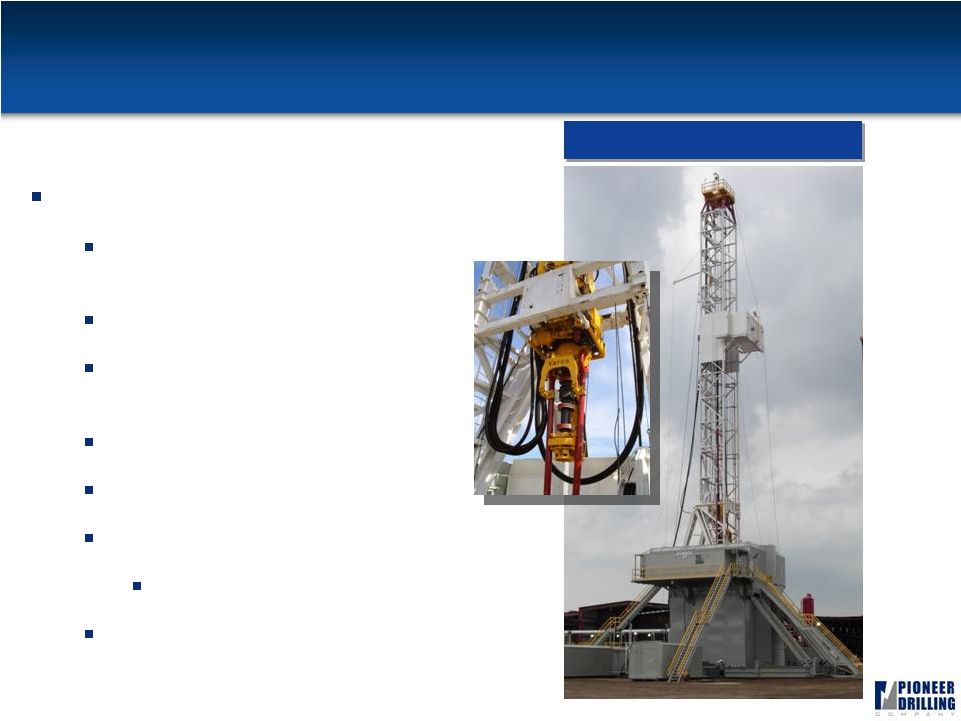

11

Modern, Efficient Drilling Fleet

Over 75% of fleet is shale capable

31 new builds (44%) since 2001 with

most

constructed

during

2004

-

2006

69%

with

1,000

HP

-

2,000 HP

35 rigs working with top drives (49%

of fleet)

63% with iron roughnecks

42% electric

12 walking/skidding systems on rigs

3 more installed in Q4

33 pairs of 1300/1600 HP mud pumps

50 Series Rig |

60

Series Rig 12

Mast

Traveling

Equipment

Mud Tanks

Handling

Equipment

Drawworks

Mud Pumps

Mud Cleaning

Equipment

Pipe Racks

Accumulator

Gas Buster

Choke

Manifold

SCR House

Fuel-Water

Tank

Power

Package

Suitcases |

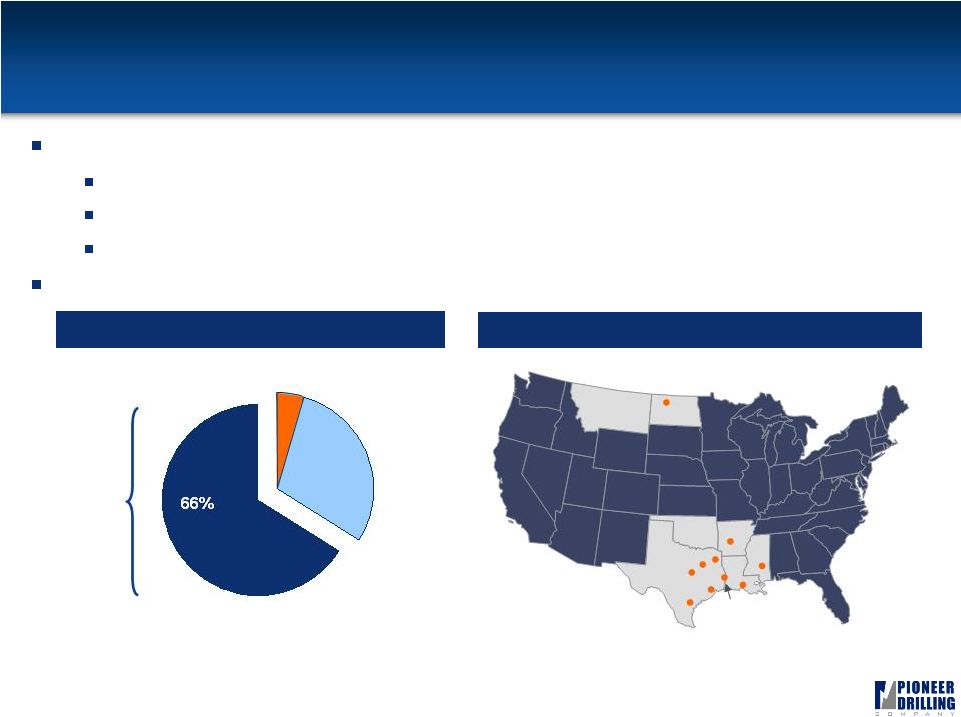

Well Service Fleet Overview

13

One of the newest and most highly capable well service fleets in

the industry

Sixty-nine 550 HP rigs

Four 600 HP rigs

One 400 HP rig

Established in the Bakken, Fayetteville, Haynesville and Eagle Ford shales

Well Service Fleet Age

Well Service Locations

Average year in service: 2007

66%

2007 or

newer

31%

3%

Williston

Bryan

Palestine

Longview

New Iberia

El Campo

Liberty

Kenedy

Conway

Laurel

2005-2006

2002-2004 |

Wireline

and Fishing & Rental Overview

14

Wireline

Services

Open

and

cased-hole

wireline

services

82 wireline

units with an average age

of less than 5 years

Established in the Bakken, Barnett,

Marcellus, Haynesville, Niobrara and

Eagle Ford shales

Fishing & Rental Services

Range of specialized services and

equipment that are utilized on a non-

routine basis for both drilling and well

servicing operations

Overview

Locations

Williston

Dickinson

Cut Bank

Billings

Havre

Tyler

Bossier City

Broussard

Graham

Alvarado

Roosevelt

Pratt

Liberal

Hays

Casper

Buckhannon

Punxsutawney

Ft. Morgan

Brighton

Wray

Woodward

Pampa

Springtown

El Campo

Wireline

Fishing & Rental

Laredo |

15

Industry and Market Conditions |

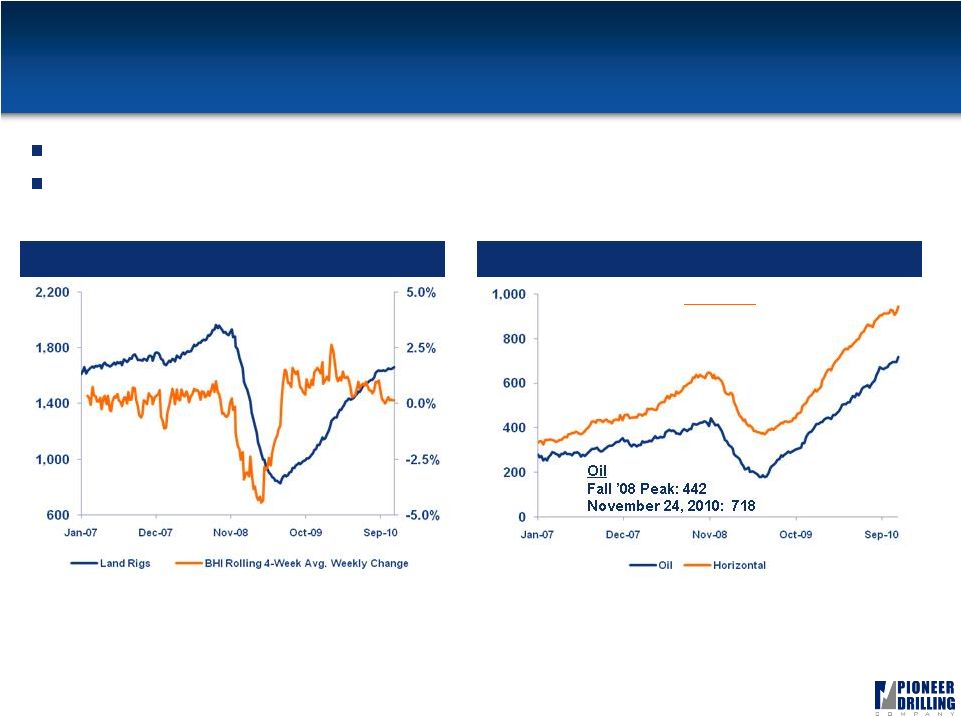

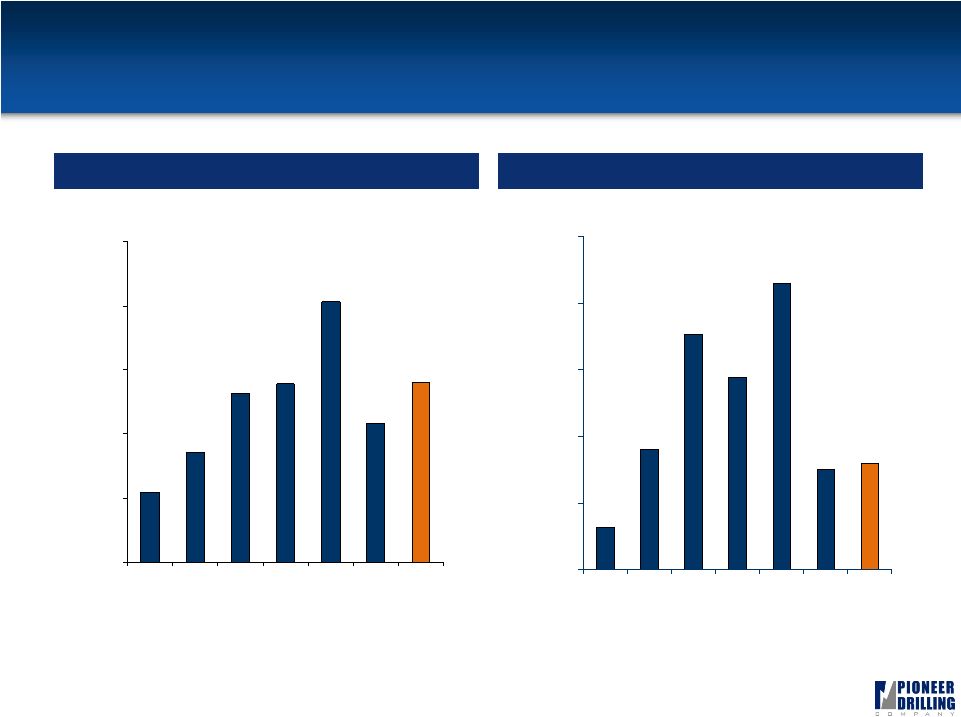

Recovery in U.S. Land Rig Count

1

16

Steady rig count improvement during the second half of 2009 and 2010 YTD

Horizontal and oil rig counts have surpassed Fall 2008 peak levels

Land Rig Count

Horizontal & Oil Rig Count

Source: Baker Hughes.

Source: Baker Hughes.

Horizontal

Fall ’08 Peak: 650

November 5, 2010: 943

16 |

30

35

40

45

50

55

60

65

70

Base Production (all sources)

Unconventional

Alaska

LNG imports

Benefits of Growing Shale Plays

1

17

Oilfield service companies stand to benefit from shale production due to its

lower risk development and increased service intensity (up to 3 -

5x

conventional)

Reintroduction

of

the

Majors

in

the

U.S.

market

should

result

in

greater

activity levels

Recent U.S. Shale Investments

Source:

Base

production,

Alaska,

and

LNG

import

data

–

EIA

AEO

2010.

Growing Importance of Shale

$Millions

$40,991

12/14/2009

$4,700

5/28/2010

$3,375

11/11/2008

$3,200

11/9/2010

$2,250

12/30/2009

$1,900

9/2/2008

$1,050

6/30/2009 |

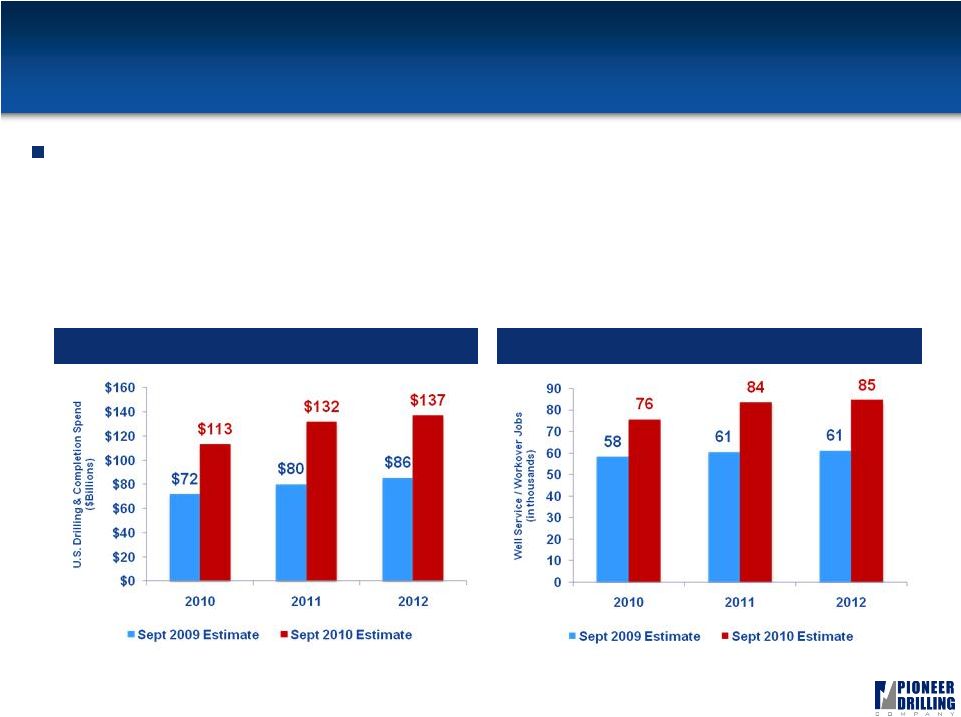

Conclusion: Improving Oil Service Outlook

1

18

North American capital spending outlook much improved

Upstream Spending Outlook

Well Service / Workover

Jobs Outlook

Source: Spears & Associates.

Source: Spears & Associates.

18 |

19

Financials |

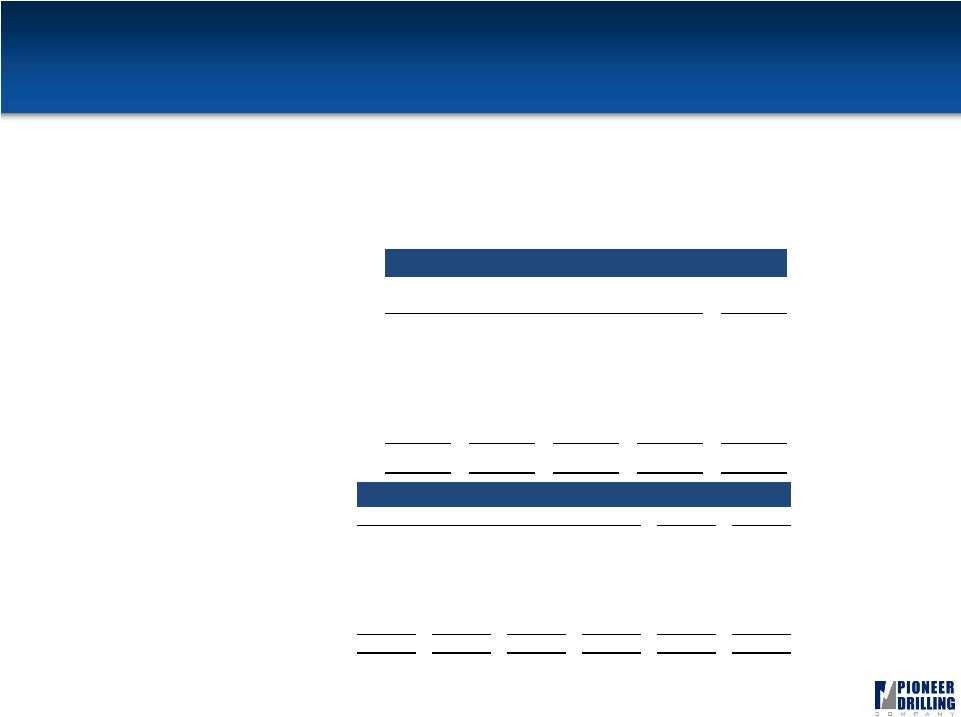

Capitalization

20

($ in millions)

September 30, 2010

Cash

$

16.9

Revolving Credit Facility ($225)

(1)

39.8

Sr. Unsecured Notes

239.9

Other

3.3

Total Debt

$

283.0

Stockholders' Equity

398.6

Total Capitalization

$

681.6

LTM EBITDA

$

79.5

Debt / LTM EBITDA

(2)

3.44x

Debt / Total Book Capitalization

41.5%

(1) Excludes $9.2 million of LCs

outstanding.

(2) Total consolidated leverage ratio as reported in form 10Q for the third

quarter 2010. |

21

$163

$257

$396

$417

$610

$326

$420

$0

$150

$300

$450

$600

$750

2004

2005

2006

2007

2008

2009

TTM

$32

$90

$177

$145

$215

$75

$80

$0

$50

$100

$150

$200

$250

2004

2005

2006

2007

2008

2009

TTM

Consolidated Revenue & EBITDA

Revenue ($ millions)

EBITDA ($ millions)

(1)

(1)

Note: Fiscal year end was changed from March 31 to December 31 effective on December 31, 2007; all data

points reflect calendar year and trailing twelve months information derived from 10K and 10Q

filings. (1) As of September 30, 2010. |

Capital Expenditures

22 |

23

Appendix |

24

Reconciliation of EBITDA to Net Income

Year ended December 31,

($ in millions)

2004

2005

2006

2007

2008

2009

EBITDA

31.7

90.3

176.6

144.5

214.8

74.9

Depreciation & Amortization

(20.6)

(30.8)

(47.6)

(63.6)

(88.1)

(106.2)

Net Interest

(1.9)

0.8

3.6

3.3

(11.8)

(8.9)

Impairment Expense

-

-

-

-

(171.5)

-

Income Tax (Expense) Benefit

(3.4)

(22.1)

(47.7)

(27.3)

(6.1)

17.0

Net Income (Loss)

5.7

38.1

84.8

56.9

(62.7)

(23.2)

TTM

($ in millions)

Q4

2009

Q1

2010

Q2

2010

Q3

2010

TTM

EBITDA

14.1

9.2

22.0

34.2

79.5

Depreciation & Amortization

(27.7)

(28.9)

(29.6)

(30.8)

(117.0)

Net Interest

(3.6)

(4.1)

(7.1)

(7.6)

(22.3)

Impairment Expense

-

-

-

-

-

Income Tax (Expense) Benefit

8.8

9.2

4.5

1.6

24.1

Net Income (Loss)

(8.4)

(14.5)

(10.1)

(2.6)

(35.7)

We define EBITDA as earnings (loss) before interest income (expense), taxes, depreciation,

amortization and impairments. Although not prescribed under GAAP, we believe the presentation

of EBITDA is relevant and useful because it helps our investors understand our operating

performance and makes it easier to compare our results with those of other companies that have

different financing, capital or tax structures. EBITDA should not be considered in isolation

from or as a substitute for net earnings (loss) as an indication of operating performance or cash

flows from operating activities or as a measure of liquidity. A reconciliation of net earnings (loss)

to EBITDA is included in the table below. EBITDA, as we calculate it, may not be comparable to

EBITDA measures reported by other companies. In addition, EBITDA does not represent funds

available for discretionary use. |

25 |