Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - TFS Financial CORP | d8k.htm |

Sandler O'Neill

East Coast Financial Services Conference

November 10-12, 2010

Exhibit 99.1 |

2

Forward-Looking Statements

This presentation contains forward-looking statements, which can be identified

by the use of such words as estimate, project, believe, intend, anticipate,

plan, seek, expect and similar expressions. These forward-looking statements

include:

Statements of our goals, intentions and expectations;

Statements regarding our business plans and prospects and growth and operating

strategies; Statements concerning trends in our provision for loan losses

and charge-offs; Statements regarding the asset quality of our loan

portfolio; and Estimates of our risks and future costs and benefits.

These

forward-looking

statements

are

subject

to

significant

risks,

assumptions

and

uncertainties,

including,

among

other things, the following important factors that could affect the actual outcome

of future events: Significantly increased competition among depository and

other financial institutions; Inflation and changes in the interest rate

environment that reduce our interest margins or reduce the fair value of financial instruments;

General

economic

conditions,

either

nationally

or

in

our

market

areas,

including

employment

prospects

and

conditions

that

are

worse

than

expected;

Decreased demand for our products and services and lower revenue and earnings

because of a recession; Adverse changes and volatility in credit

markets; Legislative or regulatory changes that adversely affect our

business; Changes in consumer spending, borrowing and savings habits;

Changes

in

accounting

policies

and

practices,

as

may

be

adopted

by

the

bank

regulatory

agencies,

the

Financial

Accounting

Standards

Board

and the Public Company Accounting Oversight Board;

Changes

in

laws

or

governmental

regulations

affecting

financial

institutions,

including

changes

in

regulatory

costs

and

capital

requirements;

The timing and the amount of revenue that we may recognize;

Changes

in

expense

trends

(including,

but

not

limited

to

trends

affecting

non-performing

assets,

charge

offs

and

provisions

for

loan

losses);

Changes in consumer spending, borrowing and spending habits;

The impact of the current governmental effort to restructure the U.S. Financial and

regulatory system; Inability of third-party providers to perform their

obligations to us; Adverse changes and volatility in real estate

markets; The strength or weakness of the real estate markets and of the

consumer and commercial credit sectors and its impact on the credit quality of

our loans and other assets.

Because of these and other uncertainties, our actual future results may be

materially different from the results indicated by these forward- looking

statements. |

3

Organized in 1997 as the mid-tier stock holding company for Third

Federal Savings & Loan Association of Cleveland (“Thrift”), which

was founded in 1938 by Ben and Gerome Stefanski

Completed first step IPO conversion in April 2007

TFSL (NASDAQ)

Financials at 9/30/2010:

Assets:

$11.1B

Deposits:

$ 8.9B

Equity:

$ 1.8B

Market Cap: $ 2.7B

As of September 30, 2010, there were 308.3 million shares

outstanding, of which 73.7% were held by the Mutual Holding

Company

Overview of TFS Financial Corporation |

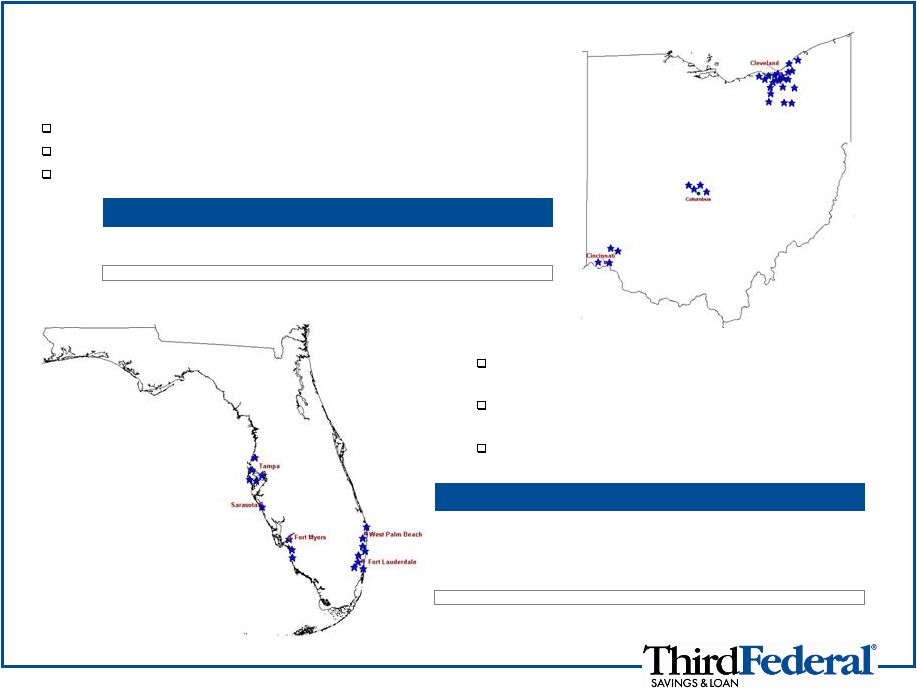

Ohio

22 full service branches in Northeast Ohio

4 loan production offices in the Columbus area (Central Ohio)

4 loan production offices in the Cincinnati area (Southwestern Ohio)

Markets of Operation

Florida

Organic, de novo expansion into Florida started in

2000

9 full service branches along the West Coast from

New Port Richey to Naples

8 full-service branches along the East Coast from

Palm Gardens to Hallandale

Source: SNL Financial

Deposits as of June 30, 2010

Deposits

Market

Market

MSA

Branches

($M)

Share (%)

Rank

Cleveland-Elyria-Mentor, OH

19

5,782

11.51

2

Akron, OH

3

499

4.33

8

Ohio Totals

22

6,281

2.79

9

Deposits

Market

Market

MSA

Branches

($M)

Share (%)

Rank

Tampa-St.Petersburg-Clearwater, FL

5

1,090

2.21

7

Miami-Fort Lauderdale, FL

8

1,064

0.68

26

Cape Coral-Fort Myers, FL

2

251

2.15

13

North Port-Bradenton-Sarasota, FL

1

248

1.47

15

Naples-Marco Island, FL

1

123

1.12

17

Florida Totals

17

2,776

0.69

23

4 |

5

Strategic Overview

Our business model is to originate and service first mortgage loans and continue to

service existing home equity loans and lines which we fund with core retail

deposits Thrift stopped accepting applications of new home equity

loans and lines in June 2010 Thrift introduced and is originating new

adjustable rate mortgages product to replace home equity lines

–

$1B in loan applications from 7/1/10 to 9/30/10 have been ARM products

The ARM will act as an interest-rate hedge for the balance sheet

First mortgage loans and retail deposits have been generated primarily from the

market areas defined by where we have full service branches and loan

production offices Large deposits per branch ($227 million at

9/30/10) helps keep us a low cost provider In generating mortgage loans and

home equity loans and lines, only non-commissioned Thrift associates

were used to gather applications, underwrite and process the requests First

mortgage originations continue to be made using stringent, conservative

lending standards

Historically, prudent capital management has supplemented shareholder

returns. Repurchased

24.1

million

of

TFSL

stock

(approximately

23%

of

the

public

float)

since

the

IPO

in April 2007

Dividends of $49 million paid to public common shareholders since IPO

|

6

Financial Highlights

(Dollars in Thousands)

At or for the year ended,

9/30/08

9/30/09

9/30/10

Balance Sheet

Assets ($)

10,786,451

10,598,840

11,076,027

Net Loans ($)

9,208,736

9,219,585

9,181,749

Deposits ($)

8,261,101

8,570,506

8,851,941

Common Equity ($)

1,843,652

1,745,865

1,752,897

Balance Sheet Ratios

Loans/ Deposits (%)

111.5

107.6

103.7

TCE / TA (%)

17.0

16.4

15.8

Thrift Only Ratios:

Core Capital Ratio (%)

12.1

12.5

12.1

Tier 1 Risk Based Ratio (%)

17.3

17.3

18.0

Total Risk Based Capital Ratio (%)

17.6

18.2

19.2

Profitability

Net Interest income ($)

219,862

230,075

227,506

Provision for loan losses ($)

(34,500)

(115,000)

(106,000)

Net Interest income after provision for loan losses ($)

185,362

115,075

121,506

Non-interest income ($)

47,780

67,384

58,638

Non-interest expense ($)

(151,447)

(162,388)

(161,929)

Income before income taxes ($)

81,695

20,071

18,215

Income tax expense ($)

(27,205)

(5,676)

(6,877)

Net income ($)

54,490

14,395

11,338

Net interest margin (%)

2.18

2.20

2.16

Efficiency Ratio (%)

56.6

54.6

56.6

Asset Quality

NPAs/ Assets (%)

1.7

2.6

2.7

NCOs/ Avg

Loans (%)

0.2

0.7

0.7

Reserves/ Loans (%)

0.5

1.0

1.4

Texas Ratio (NPAs

& TDRs

/ TCE & LLR) (%)

10.0

17.4

21.0 |

7

Loan and Deposit Balances

*About

Home

Today:

An

affordable

housing

program

targeted

toward

low

and

moderate

income

home

buyers

that

is

designed to

teach the essential skills needed for successful homeownership. Most loans

supported by PMI. Cumulative loan originations under this

program

have

been

less

than

$20

million

over

the

last

three

years.

(negligible)

80% of 1-4 family in Ohio

Also service $7B in loans for others

No brokered deposits

Deposits increased 3.3% from prior year

Deposit Data 9/30/10

71%

11%

18%

0%

Certificates of Deposit

Negotiable Order of

Withdrawal

Savings

Accrued Interest

Gross Loan Balances 9/30/10

66%

3%

30%

1%

Residential non-Home

Today

Residential Home

Today

Equity loans and lines

of credit

Other |

8

Capital Position as of September 30, 2010*

15.75%

12.14%

18.00%

19.17%

10.92%

9.68%

16.20%

17.46%

0.00%

5.00%

10.00%

15.00%

20.00%

Tangible Common

Equity Ratio (TFSL)

Core Capital Ratio

(Thrift)

Tier 1 Risk-based Ratio

(Thrift)

Total Risk-Based

Capital Ratio (Thrift)

Well Capitalized

Source: SNL Financial

Peers include: ISBC, CFFN, BNCL, KRNY, NFBK, WSBF, EBSB and RCKB

6.00%

10.00%

5.00%

Peers

TFSL/Thrift

* Peer data is as of 6/30/10 |

9

Loan Delinquencies and Charge-offs

Dollars in millions

Loan

Delinquencies

Net Charge-offs for FYE

Balances

9/30/2009

9/30/2010

9/30/2009

9/30/2010

Residential non-Home Today

Ohio and Kentucky

$4,970

1.8%

1.8%

Florida

1,168

3.8%

5.1%

Total

$6,138

2.2%

2.5%

$7

$12

Residential Home Today

Ohio and Kentucky

$270

38.3%

34.7%

Florida

11

30.2%

32.1%

Total

$281

37.9%

34.6%

$4

$5

Home Equity Loans and Lines of Credit

Ohio

$1,146

2.5%

2.0%

Florida

798

4.0%

4.1%

California

325

1.8%

1.5%

Other

580

2.7%

2.4%

Total

$2,849

2.9%

2.6%

$51

$49

Overall Total

$9,375

3.6%

3.5%

$64

$68

$5

2

$5

7

$4

-0-

$5

-0-

$6

35

5

5

$7

33

4

5

Other

$107

12.9%

$2

$2

3.9% |

10

Memorandum of Understanding

On August 16, 2010, the Thrift received a Memorandum of Understanding from

the OTS. Key elements of the MOU:

Provide the OTS a written report from a consulting firm assessing the home

equity lending portfolio

Develop a plan to reduce the concentration limits for home equity loans and lines

relative to tier 1 core capital and ALLL

Enhance policies and procedures with respect to home equity lending and credit

risk management

Submit an updated business plan addressing all corrective actions

Monitor the Thrift’s performance against the business plan

|

11

Promontory Financial Group (“PFG”)

PFG (a premier financial consulting group made up primarily of former regulators)

was engaged to provide an assessment of the home equity portfolio and

lending practices Report was completed and submitted to the OTS in September

2010 The report had several key findings:

Thrift has controlled credit risk through selection of higher quality of

borrowers Thrift has employed generally conservative underwriting

practices Thrift capital position can withstand significant economic stress,

and maintains a substantive

cushion

over

statutory

“well-capitalized”

standards

Thrift should actively manage home equity lending exposure down

Thrift has opportunities to enhance risk management and to mitigate home equity

concentrations including line cancellations/suspensions and improved

programs, policies and practices |

12

Summary of Home Equity Portfolio

(charts available in appendix)

The

ratio

of

home

equity

portfolio

and

open

commitments

relative

to

Tier

1

(Core)

Capital

plus

ALLL,

has

ranged

between

288%

to

544%

over

the

past

seven

years.

Balance

at

September

2010

is

350%,

with

a

plan

to

reduce

to

260%

by

December,

2011

Customers have maintained strong credit scores with 85% of existing credit limits

associated with current credit scores over 700

Loans seriously delinquent (either >90 days past due or in bankruptcy or

foreclosure) is under 3% –

very little delinquency occurs in credit scores over 700

While CLTVs

(combined loan to value) have slipped from origination, the portion of

loans with >100% CLTV have delinquencies under 5%

72% of customers with negative equity have credit scores of 700 or better

70% of customers have used the same or less of their credit line, regardless of

change in property value, indicating they are not using their equity lines

to stay current on their obligations. |

13

The Reduction plan effectively began with the suspension of all new home equity

loan and line originations, increases and extensions beginning in June

2010. The

formal

plan

submitted

to

the

OTS

in

September

2010,

included

3

key

elements:

Line Reduction

–

From June 30, 2010, through December 2011, a reduction of $1

billion of commitments including $300 million in outstanding balances

–

The

plan

does

not

include

selling

any

existing

home

equity

loans

or

lines

Process

and

Procedure

Management

-

Implementation

of

expanded

line

management, account management and collection processes recommended by PFG

–

These procedures will assist in the ongoing management of the risk in our current

portfolio as individual customer situations change and as larger economic

trends evolve Down streaming of Capital

–

Down stream $150 million into the Thrift from the

holding company in October 2010.

–

Holding

Company

has

approximately

$400

million

of

equity

capital

separate

from

the

Thrift

at

9/30/10

Home Equity Lending Reduction Plan |

14

Current Status of Plan:

The Thrift believes the requirements of the MOU for the submission of

documents have been met. However the OTS has neither approved nor

disapproved the plan, and therefore the plan is subject to revision. The OTS

has the ultimate authority as to how long the MOU will remain in

effect.

Reduction is being accomplished in a variety of ways:

The Thrift is asking customers to voluntarily close their lines of credit and/or

close their second mortgage as a part of a refinance

In early October, the Thrift began suspending lines of credit for customers with a

significant decline in equity

As of September 30, 2010:

Home equity balances have been reduced $47 million from June 30,

2010

Commitments have been reduced $102 million from June 30, 2010

Home Equity Lending Reduction Plan |

15

Cash Dividends and Stock Repurchases

TFS Financial must provide the OTS 45 days prior written notice of

the Company’s intent to declare and pay dividends to its

stockholders or repurchase any of its outstanding stock.

The Company understands and shares the view of the importance to

shareholders of dividends and stock repurchases, however, the

Company does not intend to declare or pay a dividend, or to

repurchase any of its outstanding common stock until the OTS’

concerns are resolved. |

16

Summary

Working diligently to resolve the MOU with the OTS

Focus on our core competency of originating high credit quality 1-4 family

residential mortgages in our banking footprint including the introduction of

new products like our new ARM loans

TFSL has a strong capital position and flexibility at the holding company

We have many means at our disposal by which to achieve our desired

reduction in home equity loans and commitments

Focused on returning to shareholder enhancing activities

Dividends

Share Buybacks |

Appendix: Home Equity Lines of Credit |

18

Home Equity Lines of Credit

History of Equity Portfolio Exposure

Calculations include only capital at Thrift level and excludes additional capital

maintained at TFSL Home Equity Portfolio and Open Commitments Relative to Thrift Tier 1 (Core)

Plus ALLL 350%

387%

375%

288%

414%

449%

544%

0%

100%

200%

300%

400%

500%

600%

September 30, 2004

September 30, 2005

September 30, 2006

September 30, 2007

September 30, 2008

September 30, 2009

September 30, 2010 |

19

*

Seriously

delinquent:

Lines

90

days

or

more

past

due,

or

are

reported

either

in

bankruptcy

or

foreclosure

regardless

of

payment

status.

Where

credit

is

not

available,

balances

are

included

in

the

<600

category

Credit Extended is the credit limit on any lines open to draw and the principal

balance on lines suspended or in repayment. 0.00%

74%

58%

1%

60%

70%

750 and higher %

of total

0.14%

94%

79%

4%

81%

85%

700 and higher %

of total

2.88%

$2,198

$2,748

$79

$2,668

$4,946

Total

0.03%

$953

$379

$0

$379

$1,332

800-850

0.03%

$908

$1,215

$0

$1,215

$2,123

750-799

0.46%

$200

$565

$3

$563

$766

700-749

6.02%

$91

$384

$23

$361

$475

600-699

25.87%

$45

$205

$53

$152

$250

< 600

% Seriously

Delinquent

Unused

Balances

Total

Balances

Seriously

Delinquent*

Current

Credit

Extended

Credit

Score

Home Equity Lines of Credit

Credit

Extended, Balances and Delinquencies by Credit Score

As of July 2010, dollars in millions |

20

2.86%

$79

$2,676

$4,976

$4,977

Total

4.72%

$37

$739

$1,188

$8

>100

2.47%

$7

$277

$482

$6

90-100

1.96%

$7

$355

$657

$1,459

81-89%

1.67%

$18

$1,051

$2,171

$3,321

<=80%

3.90%

$10

$254

$478

$183

Not Available

% Seriously

Delinquent

Seriously

Delinquent*

Current

Extended $s

as of June

2010

Extended $s

at Origination

CLTV

Home Equity Lines of Credit

Credit

Extended and Balances by Refreshed Property Values

As of June 2010, dollars in millions

*

Seriously delinquent: Lines 90 days or more past due, or are reported either in

bankruptcy or foreclosure regardless of payment status.

|

21

Home Equity Lines of Credit

Customers not Using Lines to Maintain Credit Score

Data as of June 2010

0%

100%

0%

100%

81-100%

22%

78%

20%

80%

61-80%

27%

73%

23%

77%

41-60%

26%

74%

23%

77%

21-40%

21%

79%

22%

78%

1-20%

17%

83%

15%

85%

0%

Utilization Percent as

of June 2010 is

Higher than

Oct. 2009

Utilization Percent as

of June 2010 is the

Same or Lower

than Oct. 2009

Utilization Percent as

of June 2010 is

Higher than

Oct. 2009

Utilization Percent as

of June 2010 is the

Same or Lower

than Oct. 2009

Utilization as of

Oct. 2009

Accounts in a Negative Equity Position

All Accounts

Customers who've maintained a 700 Credit Score

More than 70% of customers have used the same or less of their credit line,

regardless of change in property value |

22

Home Equity Lines of Credit

Negative Equity by Credit Score

As of July 2010, dollars in millions

Negative equity is the

updated property value,

less the original senior lien

balance, less the credit

exposure

72% of customers with

negative equity have credit

scores 700 or better.

4.57%

$35

$737

$744

Total

0.00%

$0

$68

$106

800-850

0.03%

$0

$303

$282

750-799

0.52%

$1

$174

$150

700-749

7.54%

$11

$130

$128

600-699

27.49%

$24

$63

$78

< 600

% Seriously

Delinquent

Seriously

Delinquent*

Current

Negative

Equity $s

*

Seriously delinquent: Lines 90 days or more past due, or are reported either in

bankruptcy or foreclosure regardless of payment status.

|