Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PROVIDENT FINANCIAL SERVICES INC | d8k.htm |

Sandler O’Neill & Partners

East Coast Financial Services Conference

November 11, 2010

Exhibit 99.1 |

Forward Looking Statements

2

Certain statements contained herein are "forward-looking statements" within the meaning of

Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of

1934. Such forward-looking statements may be identified by reference to a future period or

periods, or by the use of forward-looking terminology, such as "may," "will,"

"believe," "expect," "estimate," "anticipate," "continue,"

or similar terms or variations on those terms, or the negative of those terms.

Forward-looking statements are subject to numerous risks and uncertainties, including, but

not limited to, those related to the economic environment, particularly in the market areas in

which Provident Financial Services, Inc. (the “Company”) operates, competitive products

and pricing, fiscal and monetary policies of the U.S. Government, changes in government

regulations affecting financial institutions, including regulatory fees and capital requirements,

changes in prevailing interest rates, acquisitions and the integration of acquired businesses,

credit risk management, asset-liability management, the financial and securities markets and

the availability of and costs associated with sources of liquidity. The Company cautions readers not to place undue reliance on any such forward-looking

statements which speak only as of the date made. The Company also advises readers that the

factors listed above could affect the Company's financial performance and could cause the

Company's actual results for future periods to differ materially from any opinions or statements

expressed with respect to future periods in any current statements. The Company does not

undertake and specifically declines any obligation to publicly release the result of any revisions

which may be made to any forward-looking statements to reflect events or circumstances after

the date of such statements or to reflect the occurrence of anticipated or unanticipated

events. |

3

Christopher Martin

Christopher Martin

Chairman, President &

Chief Executive Officer |

NYSE

Symbol - PFS

$6.8 billion in assets

Headquartered in Jersey City, NJ

Holding company for The Provident Bank

Oldest NJ bank chartered in 1839

Converted from mutual form in 2003

81 branch locations throughout northern and central NJ

3 Loan Production Offices in NJ

Moving / Consolidating administrative operations to Metro Park (Iselin)

in March 2011 from 3 locations to 1

No TARP, No TRUPS, No dilution with a secondary offering

CORPORATE PROFILE

4 |

Senior management team has, on average, over 25 years of

banking experience with large commercial banks & thrifts in

our primary markets

Extremely knowledgeable and results-oriented

Culture of accountability, efficiency and integrity

Majority of officers have been with publicly-traded

organizations

360°

leadership development program to assure management

succession

Executive Leadership Team

5 |

Current Retail Franchise

6 |

Market

Demographics (as of 6/30/10) Source: FDIC-Summary of

Deposit & SNL County

Market

Rank

Number

of

Branches

Company

Deposits

in Market

($000)

Deposit

Market

Share

(%)

Total

Population

2010

(Actual)

Median

HH

Income

2010

($)

Middlesex

5

24

1,596,006

7.46

794,605

78,561

Hudson

4

15

915,698

3.81

607,650

52,525

Morris

10

10

712,897

3.80

496,157

104,165

Essex

13

7

479,095

2.28

783,531

55,914

Monmouth

9

10

459,179

2.63

649,429

82,974

Bergen

26

3

223,296

0.58

910,386

84,344

Somerset

9

4

178,191

2.11

333,075

101,044

Ocean

13

4

163,070

1.27

578,728

60,936

Union

20

3

139,796

0.80

531,112

73,602

Mercer

20

1

53,031

0.47

371,697

75,009

Passaic

25

1

7,990

0.08

500,140

62,332

NJ Totals

82

4,928,249

6,556,510

7 |

Challenge: Increase revenue in difficult environment

Community Bank with commercial emphasis

SBA Initiative

Reduce marginally accretive asset classes

Expand non-interest income with concentration on Wealth

Management

Aggressively manage credit quality

Branch rationalization

Healthcare Lending Group established in 2010

Acquisitions where accretive & improve franchise value

Seeking Out Strategic Growth & Opportunities

8 |

Market

Capitalization: $740.6 million 59,922,431 Shares Outstanding

5,879 Registered Stockholders

15.90% Insider Ownership (includes 7.76% held by ESOP)

61.34% Institutional Ownership

3.56% Current Dividend Yield

130.8% Price/TBV

80.4% Price/BV

14.0x

P/E

(as

of

10/26/10)

12.1x

Price/2011

Est.

Earnings

(as

of

10/26/10)

Market Data as 9/30/10

9 |

Asset

Composition 9/30/10

9/30/10

12/31/08

12/31/08

10 |

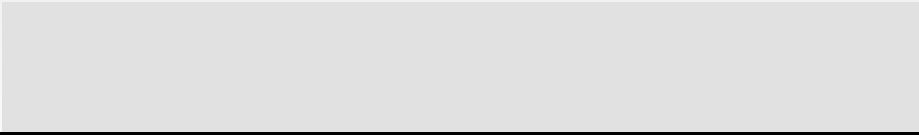

Loan

Originations 11 |

Loan

Portfolio Net total of $6.8MM representing premiums, discounts & deferred

fees, has not been included in the outstanding loan totals Total Loans =

$4,337 MM Total Loans = $4,337 MM

12

(as of 9/30/10)

(in thousands) |

CRE

Portfolio by Industry Total CRE Loans = $1,480 MM

Total CRE Loans = $1,480 MM

13

(as of 9/30/10)

(in thousands) |

Construction Loan Portfolio

Total Construction Loans = $134 MM

Total Construction Loans = $134 MM

Construction loan balance does not reflect unfunded commitments of $75MM. No

loans are located outside of NJ/NY/PA

14

(as of 9/30/10)

(in thousands) |

Portfolio Performance

(in thousands)

CRE/CONST

C & I

CONSUMER

1-4

FAMILY

TOTAL

LOAN PORTFOLIO BALANCE

1,614,071

$

741,367

$

568,533

$

1,413,877

$

4,337,848

$

NON-PERFORMING LOANS

29,575

$

28,515

$

7,123

$

38,297

$

103,510

$

% OF PORTFOLIO

1.83%

3.85%

1.25%

2.71%

2.39%

% OF TOTAL LOANS

0.68%

0.66%

0.16%

0.88%

2.39%

NET CHARGE-OFFS

7,134

$

6,824

$

3,131

$

1,491

$

18,580

$

ANNUALIZED NET CHARGE-

OFFS AS % OF AVG. O/S

0.61%

1.24%

0.73%

0.14%

0.57%

15

(as of 9/30/10)

Net total of $6.8MM representing premiums, discounts & deferred fees, has not

been included in the outstanding loan totals |

Asset

Quality PFS

PEER*

Non-performing Loans/Loans (%)

2.39

2.41

Loan Loss Reserves/ Loans (%)

1.58

1.67

Loan Loss Reserves/ Non-performing Loans (%)

66.4

89.0

Net Charge-offs / Avg Loans (%)

0.57

1.22

Non-Performing Assets / Assets (%)

1.61

1.87

Source: SNL

16

(as of 9/30/10)

*Peer Group : BNCL, CBU, FNB, FCF, FFIC, INDB, ISBC, NPBC, NBTB, NAL, NWBI,

STBA, SASR, SUSQ, UBSI, VLY, WSBC, WSFS |

NPAs

& 90+ day Delinquencies / Loans & REO (%)

17

*Peer Group : BNCL, CBU, FNB, FCF, FFIC, INDB, ISBC, NPBC, NBTB, NAL, NWBI,

STBA, SASR, SUSQ, UBSI, VLY, WSBC, WSFS Source: SNL

|

Aaa

Aa1

Baa2

Baa3

B1

B3

Caa1

55%

9%

4%

6%

3%

4%

19%

Aa1

Aa2

Aa3

A1

A2

A3

Baa1

B1

5%

22%

3%

19%

41%

4%

3%

3%

Aaa

Aa1

Aa2

Aa3

A1

A2

Baa1

NR

5%

9%

47%

23%

10%

2%

2%

2%

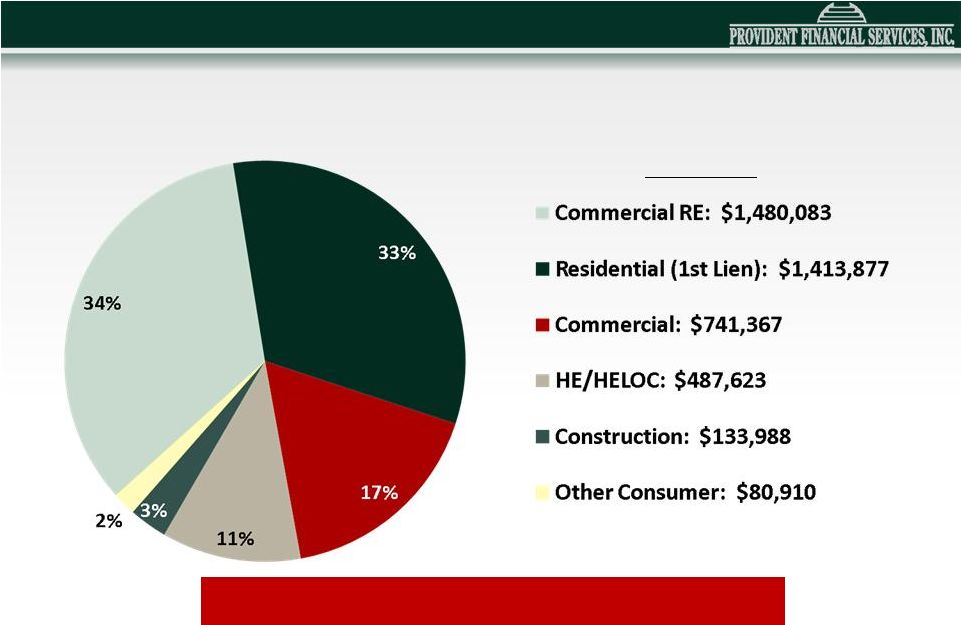

Municipal

Corporate Notes

Private Label CMO

18

Note: 80% are Available for Sale.

(as of 9/30/10)

Investment Securities

(in thousands) |

Deposit Composition

At 9/30/10

At 9/30/10

At 12/31/08

At 12/31/08

Total Cost of Deposits: 1.91%

Total Cost of Deposits: 1.91%

Total Cost of Deposits: 1.15%

Total Cost of Deposits: 1.15%

19 |

Average Deposits

20 |

Time

Deposit Maturities 1.00%*

1.17%*

2.13%*

3.58%*

2.96%*

*Weighted Average Cost

21

(as of 9/30/10) |

Borrowings

4.26%*

3.81%*

3.76%*

2.99%*

3.00%*

*Weighted Average Cost

22

(as of 9/30/10) |

Thomas M. Lyons

Thomas M. Lyons

Senior Vice President &

Chief Financial Officer

23 |

Financial

Highlights 24

(Dollars in thousands)

BALANCE SHEET:

9/30/10

12/31/09

Total assets

$6,782,295

$6,836,172

Total loans

4,344,657

4,384,194

Total deposits

4,904,556

4,899,177

Total investments

1,744,815

1,702,513

Total borrowed funds

903,610

999,233

Total stockholders' equity

921,048

884,555 |

Financial Highlights

(Dollars in thousands except

Earnings per Share)

INCOME STATEMENT:

9/30/10

9/30/09*

Operating Income *

$37,590

$23,904

Operating Diluted Earnings per Share

$0.66

$0.43

Operating ROAE

5.55%

3.46%

Operating ROAA

0.74%

0.48%

Net Interest Margin

3.45%

3.02%

Operating Efficiency Ratio

57.18%

68.50%

Nine Months Ended

*Excludes impact of goodwill impairment charge in 2009

25 |

Return on Average Assets

Source: SNL

26

*Peer Group : BNCL, CBU, FNB, FCF, FFIC, INDB, ISBC, NPBC, NBTB, NAL, NWBI,

STBA, SASR, SUSQ, UBSI, VLY, WSBC, WSFS |

Net

Interest Rate Margin 27

Source: SNL

*Peer Group : BNCL, CBU, FNB, FCF, FFIC, INDB, ISBC, NPBC, NBTB, NAL, NWBI,

STBA, SASR, SUSQ, UBSI, VLY, WSBC, WSFS |

Interest Cost: Total Deposits

Source: SNL

28

*Peer Group : BNCL, CBU, FNB, FCF, FFIC, INDB, ISBC, NPBC, NBTB, NAL, NWBI,

STBA, SASR, SUSQ, UBSI, VLY, WSBC, WSFS |

Cost

of Funds Source: SNL

29

*Peer Group : BNCL, CBU, FNB, FCF, FFIC, INDB, ISBC, NPBC, NBTB, NAL, NWBI,

STBA, SASR, SUSQ, UBSI, VLY, WSBC, WSFS [Total Interest Expense

/ (Average Interest Bearing Liabilities + Average Noninterest

Bearing Deposits)]. |

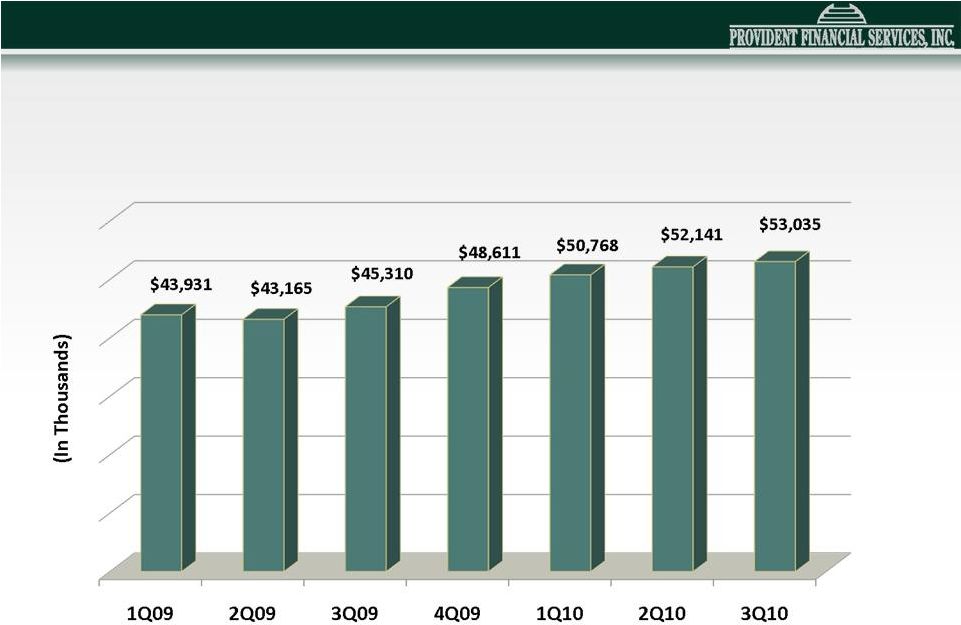

Pre-Provision Net Interest Income

30 |

(Total

noninterest

expense

-

(foreclosed

property

expense + amortization of intangibles expense +

total noninterest income)) as a percentage of average

assets. (Annualized)

Net Operating Exp / Avg

Assets (%)

Source: SNL

31

*Peer Group : BNCL, CBU, FNB, FCF, FFIC, INDB, ISBC, NPBC, NBTB, NAL, NWBI,

STBA, SASR, SUSQ, UBSI, VLY, WSBC, WSFS |

Quarterly Cash Dividend since IPO

Current Dividend

Yield = 3.56%

32 |

Capital

The Company continues to exceed all current regulatory

The Company continues to exceed all current regulatory

requirements and is “well capitalized.”

requirements and is “well capitalized.”

33

(as of 9/30/10)

Amount

Ratio

Amount

Ratio

Regulatory Tier 1 leverage capital

256,613

$

4.00%

545,017

$

8.50%

Tier 1 risk-based capital

168,832

$

4.00%

545,017

$

12.91%

Total risk-based capital

337,664

$

8.00%

597,975

$

14.17%

REQUIRED

ACTUAL

(Dollars in thousands) |

Looking Forward

Clear Strategy and Effective Execution

Expand relationships while regional and national banks remain dislocated

Cultivate and reward existing relationships to defend from competition

Implement process improvements to achieve efficiency target and achieve Line of

Business profitability targets

Continue to enhance branch franchise

Adapt to new regulations from Dodd-Frank and SEC

Improve net interest income while managing risk

Maintain appropriate capital levels while assessing opportunities

Provide tax-efficient return to stockholders

34 |