Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Ally Financial Inc. | v200597_8k.htm |

| EX-99.1 - EXHIBIT 99.1 - Ally Financial Inc. | v200597_ex99-1.htm |

Ally Financial Inc.

3Q10 Earnings Review

November 3, 2010

Contact Ally Investor Relations at (866) 710-4623 or investor.relations@ally.com

Ally Financial Inc.

3Q10 Earnings Review

November 3, 2010

Contact Ally Investor Relations at (866) 710-4623 or investor.relations@ally.com

Forward-Looking Statements and Additional Information

The following should be read in conjunction with the financial statements, notes and other information contained in the Company’s 2009 Annual

Forward-Looking Statements and Additional Information

The following should be read in conjunction with the financial statements, notes and other information contained in the Company’s 2009 Annual

Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current

Reports on Form 8-K.

This information is preliminary and based on company data available at the time of the presentation

In the presentation that follows and related comments by Ally Financial Inc. (“Ally”) management, the use of the words “expect,” “anticipate,”

“estimate,” “forecast,”

“initiative,” “objective,” “plan,” “goal,” “project,” “outlook,” “priorities,” “target,” “intend,” “evaluate,” “pursue,” “seek,” “may,”

“would,” “could,” “should,” “believe,” “potential,” “continue,” or similar expressions is intended to identify forward-looking statements. All statements

herein and in related management comments,

other than statements of historical fact, including without limitation, statements about future events

and financial performance, are forward-looking statements that involve certain risks and uncertainties. While these statements represent our

current

judgment on what the future may hold, and we believe these judgments are reasonable, these statements are not guarantees of any

events or financial results, and Ally’s actual results may differ materially due to numerous important factors that are

described in the most recent

reports on SEC Forms 10-K and 10-Q for Ally, each of which may be revised or supplemented in subsequent reports on SEC Forms 10-Q and 8-

K. Such factors include, among others, the following: our inability to repay our outstanding

obligations to the U.S. Department of the Treasury, or to

do so in a timely fashion and without disruption to our business; uncertainty of Ally's ability to enter into transactions or execute strategic

alternatives to realize the value of its Residential

Capital, LLC (“ResCap”) operations; our inability to successfully accommodate the additional risk

exposure relating to providing wholesale and retail financing to Chrysler dealers and customers and the resulting impact to our financial stability;

uncertainty related to Chrysler’s and GM’s recent exits from bankruptcy; uncertainty related to the new financing arrangement between Ally and

Chrysler; securing low cost funding for Ally and ResCap and maintaining the mutually beneficial

relationship between Ally and GM, and Ally and

Chrysler; our ability to maintain an appropriate level of debt and capital; the profitability and financial condition of GM and Chrysler; our ability to

realize the anticipated benefits associated with

our conversion to a bank holding company, and the increased regulation and restrictions that we

are now subject to; continued challenges in the residential mortgage and capital markets; the potential for deterioration in the residual value of off-

lease

vehicles; the continuing negative impact on ResCap of the decline in the U.S. housing market; any impact resulting from delayed foreclosure

sales or related matters; changes in U.S. government-sponsored mortgage programs or disruptions in the markets in

which our mortgage

subsidiaries operate; disruptions in the market in which we fund Ally’s and ResCap’s operations, with resulting negative impact on our liquidity;

changes in our accounting assumptions that may require or that result from

changes in the accounting rules or their application, which could result

in an impact on earnings; changes in the credit ratings of ResCap, Ally, Chrysler or GM; changes in economic conditions, currency exchange rates

or political stability in the markets

in which we operate; and changes in the existing or the adoption of new laws, regulations, policies or other

activities of governments, agencies and similar organizations (including as a result of the recently enacted financial regulatory reform bill).

Investors

are cautioned not to place undue reliance on forward-looking statements. Ally undertakes no obligation to update publicly or otherwise

revise any forward-looking statements except where expressly required by law. Reconciliation of non-GAAP financial measures

included within

this presentation are provided in this presentation.

Use of the term “loans” describes products associated with direct and indirect lending activities of Ally’s global operations. The specific products

include retail installment sales

contracts, loans, lines of credit, leases or other financing products. The term “originate” refers to Ally’s purchase,

acquisition or direct origination of various “loan” products.

2

Third Quarter Highlights

Ally earned core pre-tax income(1) of $636 million and net income of $269 million in the

third quarter

Premier Auto

Third Quarter Highlights

Ally earned core pre-tax income(1) of $636 million and net income of $269 million in the

third quarter

Premier Auto

Finance

Provider

Access Capital

Markets

Improve Cost

Structure

Franchise momentum continues with 48% year-over-year growth in consumer originations

Maintained #1 position as leading U.S. new car lender

Named preferred lender for Fiat in the U.S.

Over $30 billion of new secured and unsecured funding transactions year-to-date

Quarterly controllable expenses declined $146 million year-over-year

Bank deposits grew $2.6 billion in the quarter and now comprise 29% of total funding

Ally Bank retail deposits grew 29% year-over-year with CD retention rate of 88%

Ally Bank is a leading franchise in the growing online banking market

(1) Core pre-tax income is a non-GAAP financial measure. Please refer to slide 11 for further details

De-Risk

Mortgage

Business

European operations sold, representing $11 billion of assets

Resort Finance portfolio ($1 billion UPB)

sold at a gain

Sold approximately $1.9 billion UPB of legacy mortgage assets at gains in 2010

Grow Deposits

3

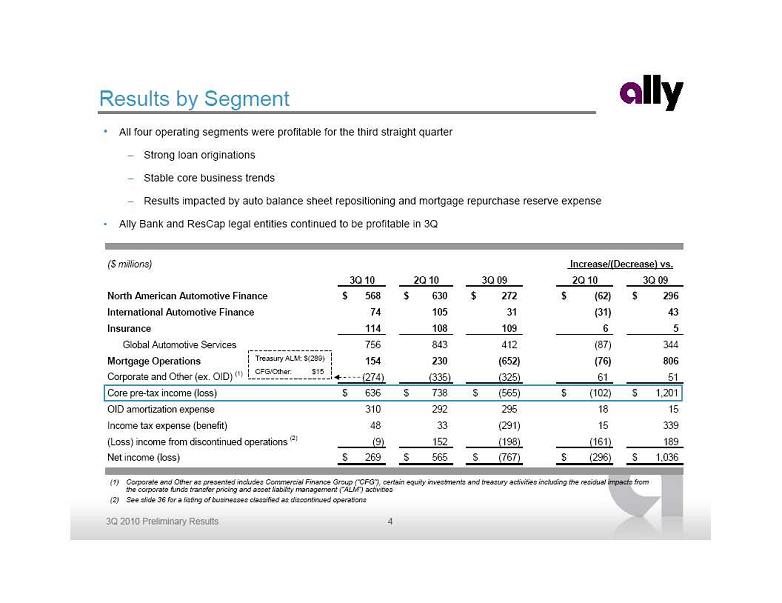

Results by Segment

All four operating segments were profitable for the third straight quarter

Strong loan originations

Stable core business trends

Results impacted by auto balance sheet repositioning and mortgage repurchase reserve expense

Ally Bank and ResCap legal entities continued to be profitable in 3Q

(1) Corporate and Other as presented includes Commercial Finance Group (“CFG”), certain equity investments and treasury activities including the residual impacts from

Results by Segment

All four operating segments were profitable for the third straight quarter

Strong loan originations

Stable core business trends

Results impacted by auto balance sheet repositioning and mortgage repurchase reserve expense

Ally Bank and ResCap legal entities continued to be profitable in 3Q

(1) Corporate and Other as presented includes Commercial Finance Group (“CFG”), certain equity investments and treasury activities including the residual impacts from

the corporate funds transfer pricing

and asset liability management (“ALM”) activities

(2) See slide 36 for a listing of businesses classified as discontinued operations

Treasury ALM: $(289)

CFG/Other: $15

($ millions)

3Q 10

2Q 10

3Q 09

2Q 10

3Q 09

North American Automotive Finance

568

$

630

$

272

$

(62)

$

296

$

International Automotive Finance

74

105

31

(31)

43

Insurance

114

108

109

6

5

Global Automotive Services

756

843

412

(87)

344

Mortgage Operations

154

230

(652)

(76)

806

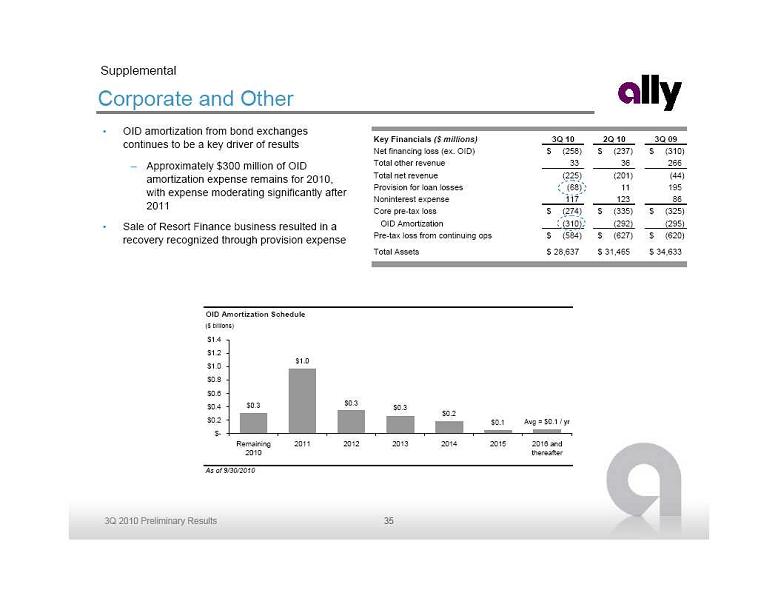

Corporate and Other (ex. OID)

(1)

(274)

(335)

(325)

61

51

Core pre-tax income (loss)

636

$

738

$

(565)

$

(102)

$

1,201

$

OID amortization expense

310

292

295

18

15

Income tax expense (benefit)

48

33

(291)

15

339

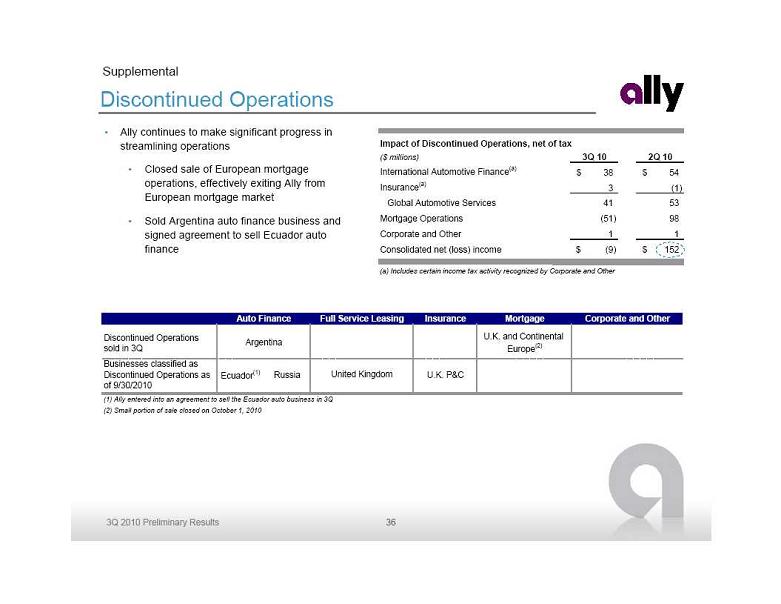

(Loss) income from discontinued operations

(2)

(9)

152

(198)

(161)

189

Net income (loss)

269

$

565

$

(767)

$

(296)

$

1,036

$

Increase/(Decrease) vs.

4

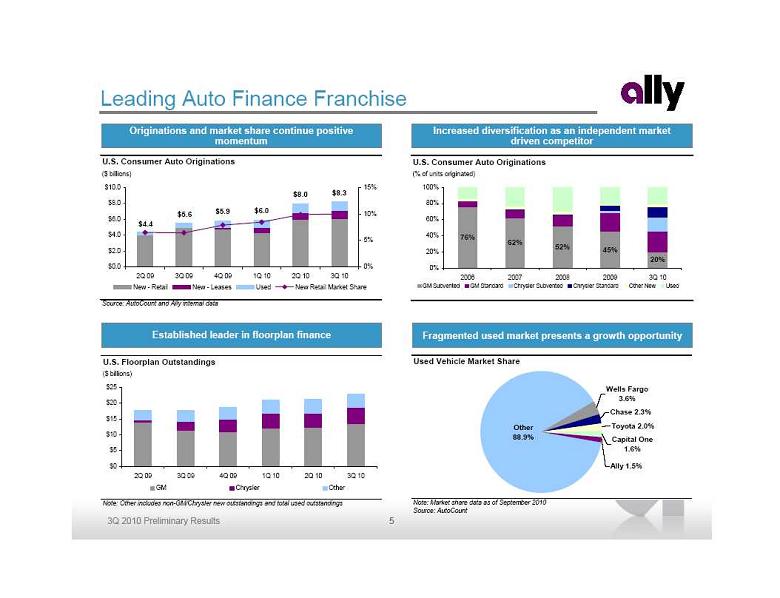

Leading Auto Finance Franchise

Established leader in floorplan finance

Increased diversification as an independent market

Leading Auto Finance Franchise

Established leader in floorplan finance

Increased diversification as an independent market

driven competitor

Originations and market share continue positive

momentum

Fragmented used market presents a growth opportunity

U.S. Consumer Auto Originations

($ billions)

Source: AutoCount and Ally internal data

$5.9

$6.0

$8.0

$8.3

$4.4

$5.6

$0.0

$2.0

$4.0

$6.0

$8.0

$10.0

2Q 09

3Q 09

4Q 09

1Q 10

2Q 10

3Q 10

0%

5%

10%

15%

New - Retail

New - Leases

Used

New Retail Market Share

U.S. Consumer Auto Originations

(% of units originated)

76%

62%

52%

45%

20%

0%

20%

40%

60%

80%

100%

2006

2007

2008

2009

3Q 10

GM Subvented

GM Standard

Chrysler Subvented

Chrysler Standard

Other New

Used

U.S. Floorplan Outstandings

($ billions)

Note: Other includes non-GM/Chrysler new outstandings and total used outstandings

$0

$5

$10

$15

$20

$25

2Q 09

3Q 09

4Q 09

1Q 10

2Q 10

3Q 10

GM

Chrysler

Other

Used Vehicle Market Share

Note: Market share data as of September 2010

Source: AutoCount

Other

88.9%

Wells Fargo

3.6%

Chase 2.3%

Toyota 2.0%

Capital One

1.6%

Ally 1.5%

5

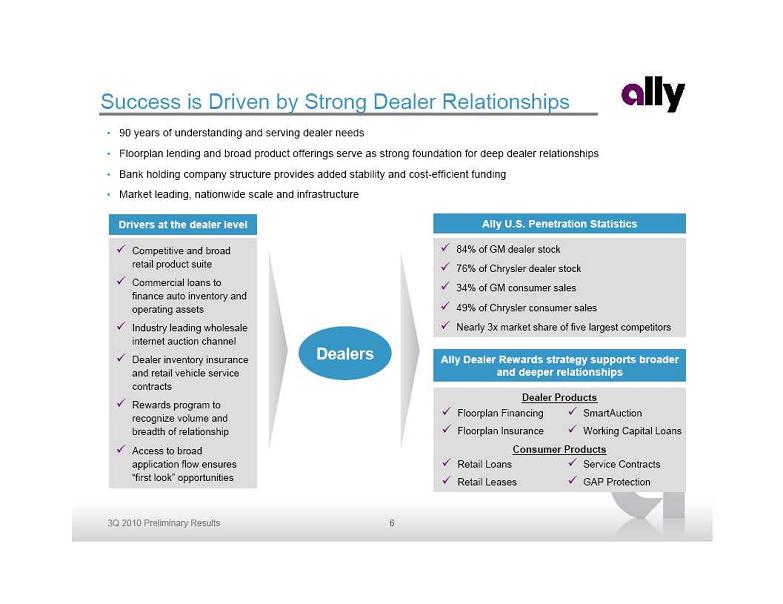

Success is Driven by Strong Dealer Relationships

90 years of understanding and serving dealer needs

Floorplan lending and broad product offerings serve as strong foundation for deep dealer relationships

Bank holding company structure provides added stability and cost-efficient funding

Market leading, nationwide scale and infrastructure

Drivers at the dealer level

84% of GM dealer stock

76% of Chrysler dealer stock

34% of GM consumer sales

49% of Chrysler consumer sales

Nearly 3x market share of five largest competitors

Ally U.S. Penetration Statistics

Dealers

Ally Dealer Rewards strategy supports broader

Success is Driven by Strong Dealer Relationships

90 years of understanding and serving dealer needs

Floorplan lending and broad product offerings serve as strong foundation for deep dealer relationships

Bank holding company structure provides added stability and cost-efficient funding

Market leading, nationwide scale and infrastructure

Drivers at the dealer level

84% of GM dealer stock

76% of Chrysler dealer stock

34% of GM consumer sales

49% of Chrysler consumer sales

Nearly 3x market share of five largest competitors

Ally U.S. Penetration Statistics

Dealers

Ally Dealer Rewards strategy supports broader

and deeper relationships

Competitive and broad

retail product suite

Commercial loans to

finance auto inventory and

operating assets

Industry leading wholesale

internet auction channel

Dealer inventory insurance

and retail vehicle service

contracts

Rewards program to

recognize volume and

breadth of relationship

Access to broad

application flow ensures

“first look” opportunities

Dealer Products

Consumer Products

Floorplan Financing

Floorplan Insurance

SmartAuction

Working Capital Loans

Retail Loans

Retail Leases

Service Contracts

GAP Protection

6

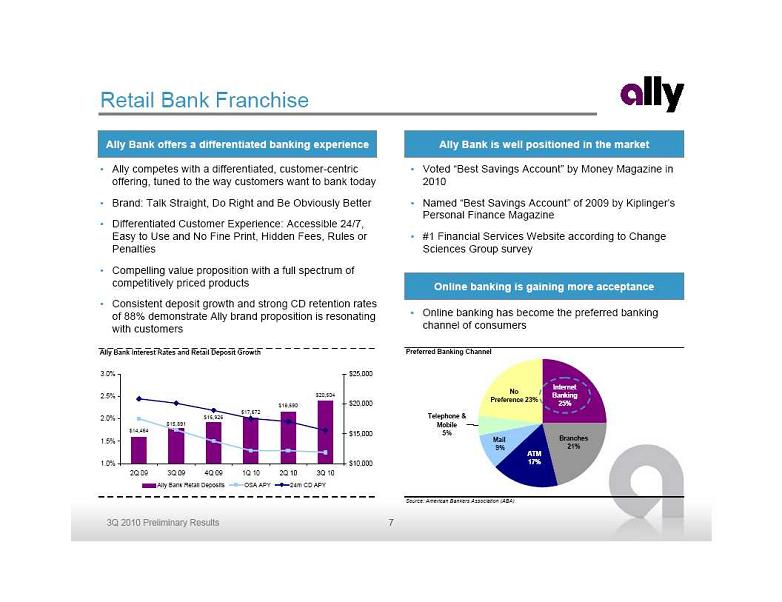

Retail Bank Franchise

Ally Bank offers a differentiated banking experience

Ally competes with a differentiated, customer-centric

Retail Bank Franchise

Ally Bank offers a differentiated banking experience

Ally competes with a differentiated, customer-centric

offering, tuned to the way customers want to bank today

Brand: Talk Straight, Do Right and Be Obviously Better

Differentiated Customer Experience: Accessible 24/7,

Easy to Use and No Fine Print, Hidden Fees, Rules or

Penalties

Compelling value proposition with a full spectrum of

competitively priced products

Consistent deposit growth and strong CD retention rates

of 88% demonstrate Ally brand proposition is resonating

with customers

Voted “Best Savings Account” by Money Magazine in

2010

Named “Best Savings Account” of 2009 by Kiplinger’s

Personal Finance Magazine

#1 Financial Services Website according to Change

Sciences Group survey

Ally Bank is well positioned in the market

Online banking has become the preferred banking

channel of consumers

Online banking is gaining more acceptance

Ally Bank Interest Rates and Retail Deposit Growth

$14,464

$17,672

$18,690

$20,504

$16,926

$15,891

1.0%

1.5%

2.0%

2.5%

3.0%

2Q 09

3Q 09

4Q 09

1Q 10

2Q 10

3Q 10

$10,000

$15,000

$20,000

$25,000

Ally Bank Retail Deposits

OSA APY

24m CD APY

Preferred Banking Channel

Source: American Bankers Association (ABA)

Telephone &

Mobile

5%

Mail

9%

ATM

17%

Branches

21%

No

Preference 23%

Internet

Banking

25%

7

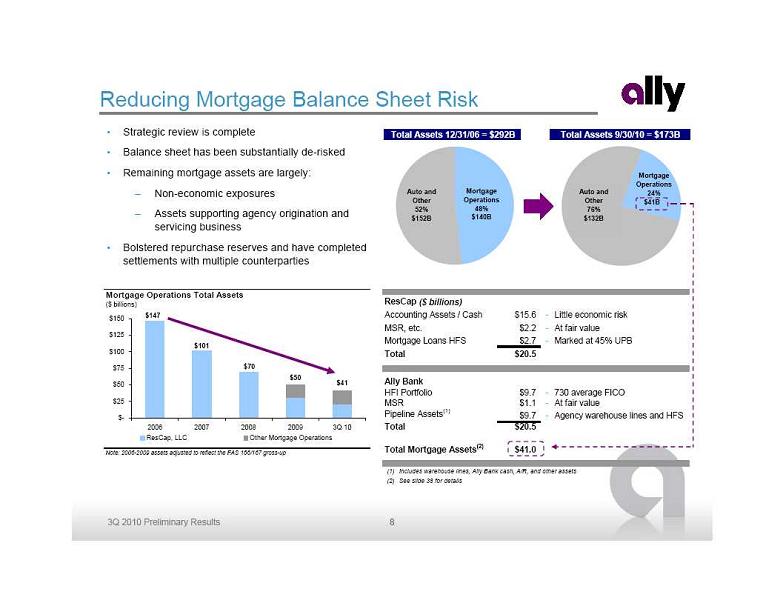

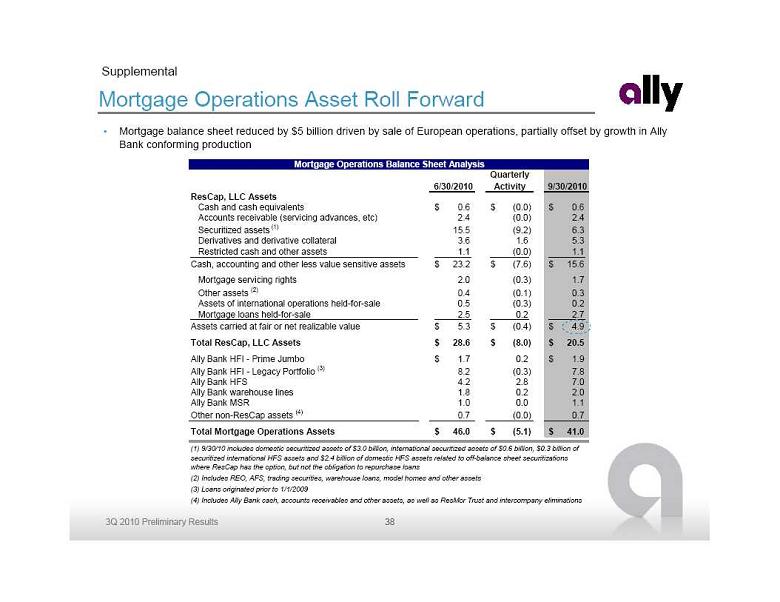

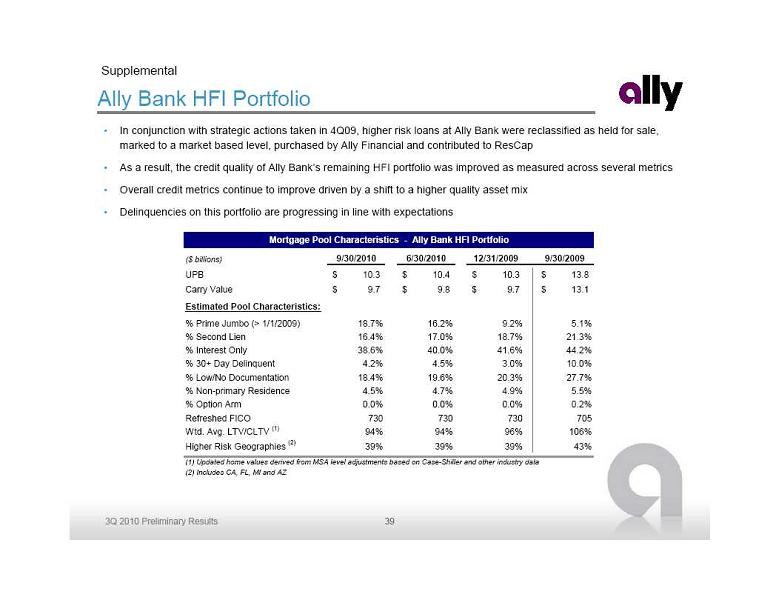

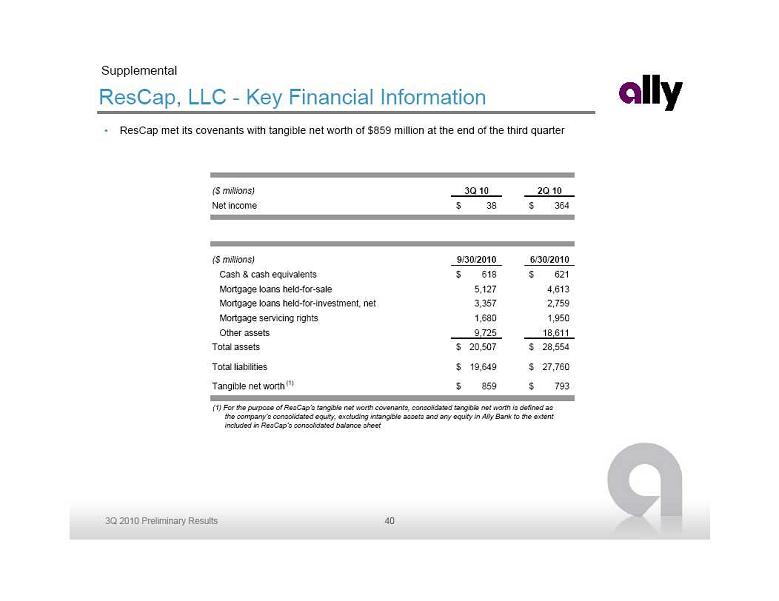

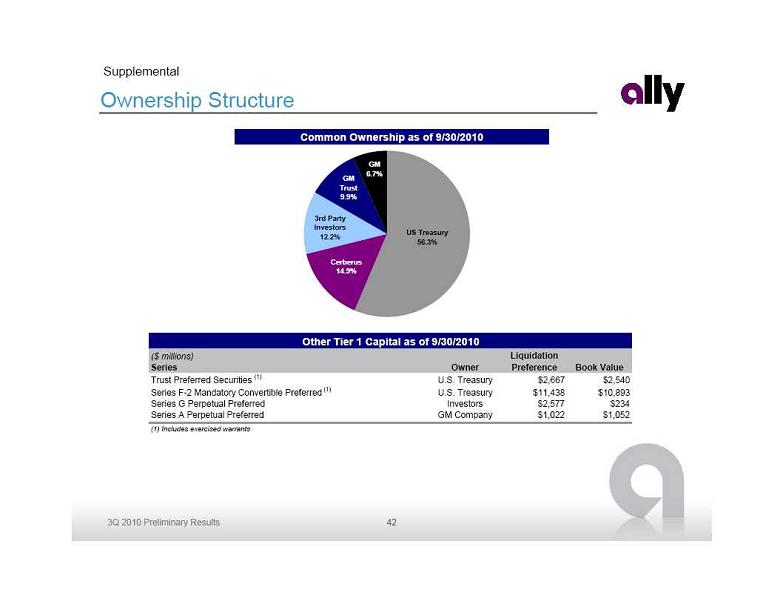

Reducing Mortgage Balance Sheet Risk

Strategic review is complete

Balance sheet has been substantially de-risked

Remaining mortgage assets are largely:

Non-economic exposures

Assets supporting agency origination and

Reducing Mortgage Balance Sheet Risk

Strategic review is complete

Balance sheet has been substantially de-risked

Remaining mortgage assets are largely:

Non-economic exposures

Assets supporting agency origination and

servicing business

Bolstered repurchase reserves and have completed

settlements with multiple counterparties

(1) Includes warehouse lines, Ally Bank cash, A/R, and other assets

(2) See slide 38 for details

Total Assets 12/31/06 = $292B

Total Assets 9/30/10 = $173B

Mortgage

Operations

48%

$140B

Auto and

Other

52%

$152B

Auto and

Other

76%

$132B

Mortgage

Operations

24%

$41B

ResCap

($ billions)

Accounting Assets / Cash

$15.6

-

Little economic risk

MSR, etc.

$2.2

-

At fair value

Mortgage Loans HFS

$2.7

-

Marked at 45% UPB

Total

$20.5

Ally Bank

HFI Portfolio

$9.7

-

730 average FICO

MSR

$1.1

-

At fair value

Pipeline Assets

(1)

$9.7

-

Agency warehouse lines and HFS

Total

$20.5

Total Mortgage Assets

(2)

$41.0

Mortgage Operations Total Assets

($ billions)

Note: 2006-2009 assets adjusted to reflect the FAS 166/167 gross-up

$101

$70

$50

$41

$-

$25

$50

$75

$100

$125

$150

2006

2007

2008

2009

3Q 10

ResCap, LLC

Other Mortgage Operations

#REF!

#REF!

#REF!

#REF!

#REF!

#REF!

#REF!

#REF!

#REF!

#REF!

#REF!

#REF!

#REF!

$147

8

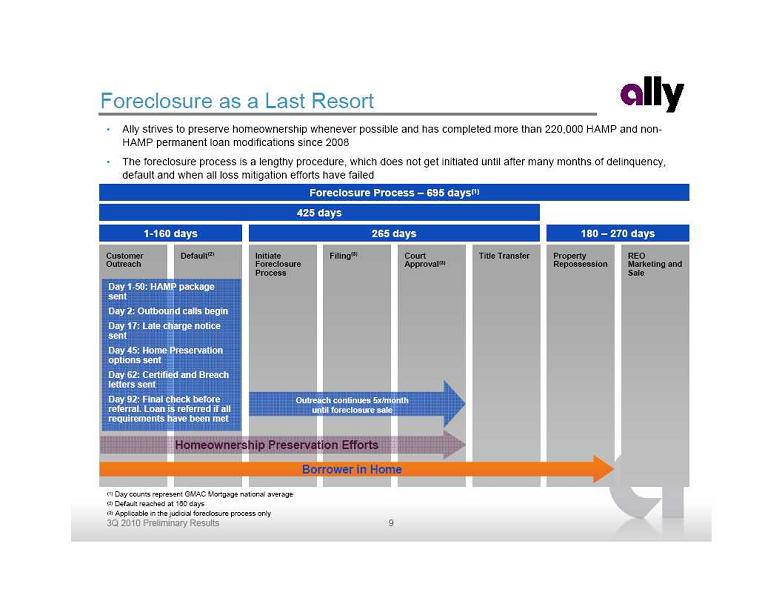

Default(2)

Initiate

Foreclosure

Process

Filing(3)

Court

Default(2)

Initiate

Foreclosure

Process

Filing(3)

Court

Approval(3)

Title Transfer

Property

Repossession

REO

Marketing and

Sale

Customer

Outreach

Borrower in Home

Homeownership Preservation Efforts

265 days

180 – 270 days

(1) Day counts represent GMAC Mortgage national average

(2) Default reached at 160 days

(3) Applicable in the judicial foreclosure process only

425 days

1-160 days

Foreclosure Process – 695 days(1)

Outreach continues 5x/month

until foreclosure sale

Day 1-50: HAMP package

sent

Day 2: Outbound calls begin

Day 17: Late charge notice

sent

Day 45: Home Preservation

options sent

Day 62: Certified and Breach

letters sent

Day 92: Final check before

referral. Loan is referred if all

requirements have been met

Foreclosure as a Last Resort

Ally strives to preserve homeownership whenever possible and has completed more than 220,000 HAMP and non-

HAMP permanent loan modifications since 2008

The foreclosure process is a lengthy procedure, which does not get initiated until after many months of delinquency,

default and when all loss mitigation efforts have failed

9

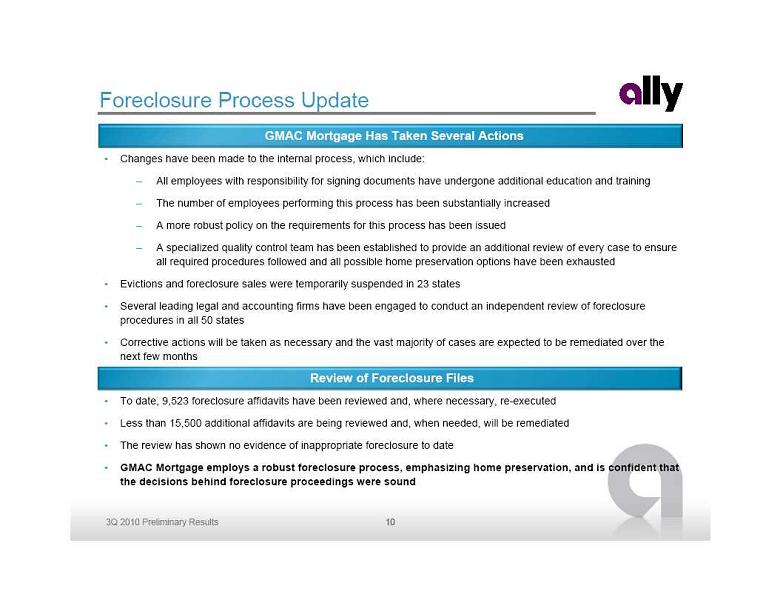

Foreclosure Process Update

Changes have been made to the internal process, which include:

All employees with responsibility for signing documents have undergone additional education and training

The number of employees performing this process has been substantially increased

A more robust policy on the requirements for this process has been issued

A specialized quality control team has been established to provide an additional review of every case to ensure

Foreclosure Process Update

Changes have been made to the internal process, which include:

All employees with responsibility for signing documents have undergone additional education and training

The number of employees performing this process has been substantially increased

A more robust policy on the requirements for this process has been issued

A specialized quality control team has been established to provide an additional review of every case to ensure

all required procedures followed and all possible home preservation options have been exhausted

Evictions and foreclosure sales were temporarily suspended in 23 states

Several leading legal and accounting firms have been engaged to conduct an independent review of foreclosure

procedures in all 50 states

Corrective actions will be taken as necessary and the vast majority of cases are expected to be remediated over the

next few months

To date, 9,523 foreclosure affidavits have been reviewed and, where necessary, re-executed

Less than 15,500 additional affidavits are being reviewed and, when needed, will be remediated

The review has shown no evidence of inappropriate foreclosure to date

GMAC Mortgage employs a robust foreclosure process, emphasizing home preservation, and is confident that

the decisions behind foreclosure proceedings were sound

GMAC Mortgage Has Taken Several Actions

Review of Foreclosure Files

10

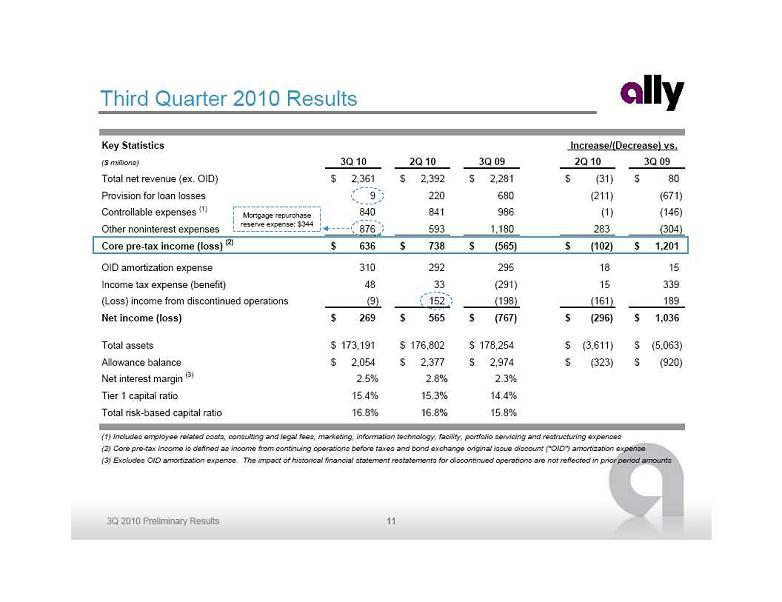

Third Quarter 2010 Results

Mortgage repurchase

Third Quarter 2010 Results

Mortgage repurchase

reserve expense: $344

Key Statistics

($ millions)

3Q 10

2Q 10

3Q 09

2Q 10

3Q 09

Total net revenue (ex. OID)

2,361

$

2,392

$

2,281

$

(31)

$

80

$

Provision for loan losses

9

220

680

(211)

(671)

Controllable expenses

(1)

840

841

986

(1)

(146)

Other noninterest expenses

876

593

1,180

283

(304)

Core pre-tax income (loss)

(2)

636

$

738

$

(565)

$

(102)

$

1,201

$

OID amortization expense

310

292

295

18

15

Income tax expense (benefit)

48

33

(291)

15

339

(Loss) income from discontinued operations

(9)

152

(198)

(161)

189

Net income (loss)

269

$

565

$

(767)

$

(296)

$

1,036

$

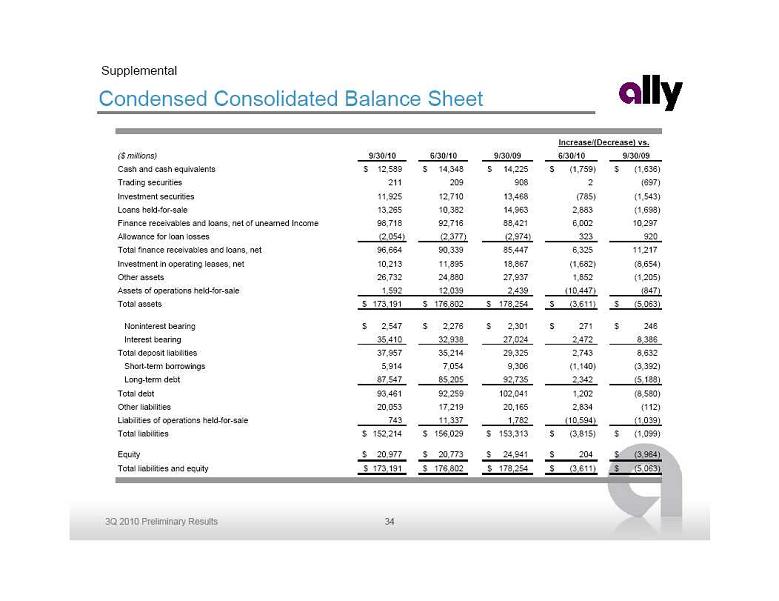

Total assets

173,191

$

176,802

$

178,254

$

(3,611)

$

(5,063)

$

Allowance balance

2,054

$

2,377

$

2,974

$

(323)

$

(920)

$

Net interest margin

(3)

2.5%

2.8%

2.3%

Tier 1 capital ratio

15.4%

15.3%

14.4%

Total risk-based capital ratio

16.8%

16.8%

15.8%

(1) Includes employee related costs, consulting and legal fees, marketing, information technology, facility, portfolio servicing and restructuring expenses

(2) Core pre-tax income is defined as income from continuing operations before taxes and bond exchange original issue discount ("OID") amortization expense

(3) Excludes OID amortization expense. The impact of historical financial statement restatements for discontinued operations are not reflected in prior period amounts

Increase/(Decrease) vs.

11

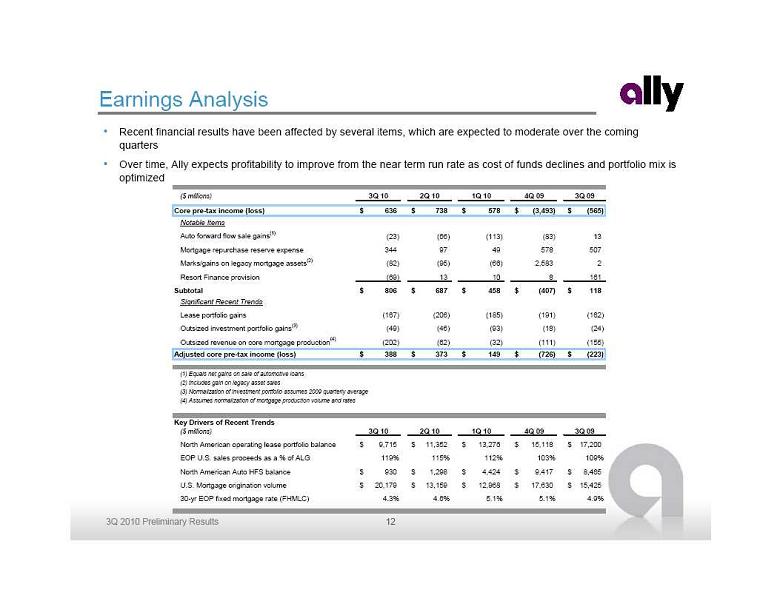

Earnings Analysis

Recent financial results have been affected by several items, which are expected to moderate over the coming

Earnings Analysis

Recent financial results have been affected by several items, which are expected to moderate over the coming

quarters

Over time, Ally expects profitability to improve from the near term run rate as cost of funds declines and portfolio mix is

optimized

($ millions)

3Q 10

2Q 10

1Q 10

4Q 09

3Q 09

Core pre-tax income (loss)

636

$

738

$

578

$

(3,493)

$

(565)

$

Notable Items

Auto forward flow sale gains

(1)

(23)

(66)

(113)

(83)

13

Mortgage repurchase reserve expense

344

97

49

578

507

Marks/gains on legacy mortgage assets

(2)

(82)

(95)

(66)

2,583

2

Resort Finance provision

(69)

13

10

8

161

Subtotal

806

$

687

$

458

$

(407)

$

118

$

Significant Recent Trends

Lease portfolio gains

(167)

(206)

(185)

(191)

(162)

Outsized investment portfolio gains

(3)

(49)

(46)

(93)

(18)

(24)

Outsized revenue on core mortgage production

(4)

(202)

(62)

(32)

(111)

(155)

Adjusted core pre-tax income (loss)

388

$

373

$

149

$

(726)

$

(223)

$

(1) Equals net gains on sale of automotive loans

(2) Includes gain on legacy asset sales

(3) Normalization of investment portfolio assumes 2009 quarterly average

(4) Assumes normalization of mortgage production volume and rates

Key Drivers of Recent Trends

($ millions)

3Q 10

2Q 10

1Q 10

4Q 09

3Q 09

North American operating lease portfolio balance

9,715

$

11,352

$

13,276

$

15,118

$

17,200

$

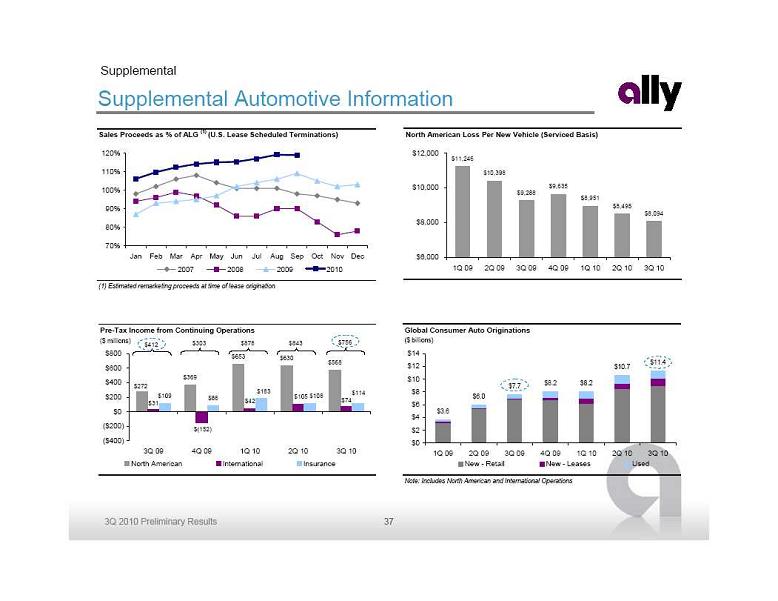

EOP U.S. sales proceeds as a % of ALG

119%

115%

112%

103%

109%

North American Auto HFS balance

930

$

1,298

$

4,424

$

9,417

$

8,465

$

U.S. Mortgage origination volume

20,179

$

13,159

$

12,968

$

17,630

$

15,425

$

30-yr EOP fixed mortgage rate (FHMLC)

4.3%

4.6%

5.1%

5.1%

4.9%

12

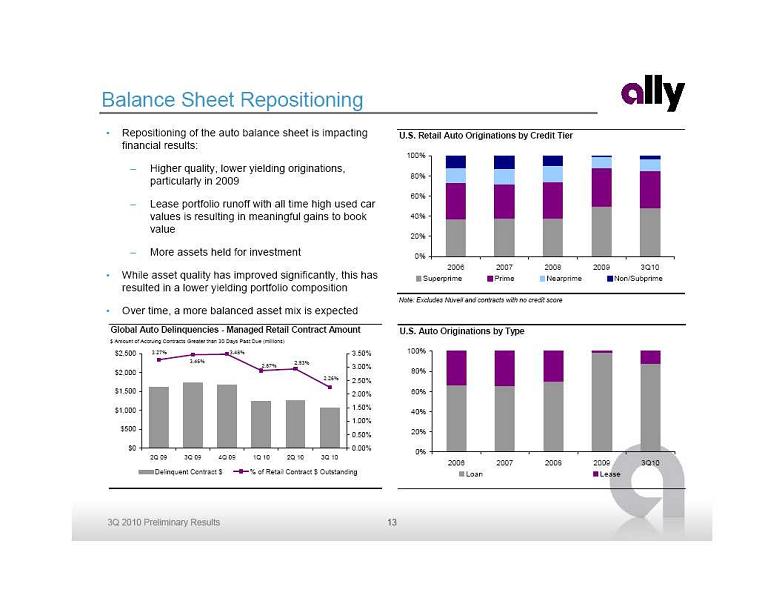

Balance Sheet Repositioning

Repositioning of the auto balance sheet is impacting

Balance Sheet Repositioning

Repositioning of the auto balance sheet is impacting

financial results:

Higher quality, lower yielding originations,

particularly in 2009

Lease portfolio runoff with all time high used car

values is resulting in meaningful gains to book

value

More assets held for investment

While asset quality has improved significantly, this has

resulted in a lower yielding portfolio composition

Over time, a more balanced asset mix is expected

Global Auto Delinquencies - Managed Retail Contract Amount

$ Amount of Accruing Contracts Greater than 30 Days Past Due (millions)

3.27%

3.46%

3.48%

2.87%

2.93%

2.26%

$0

$500

$1,000

$1,500

$2,000

$2,500

2Q 09

3Q 09

4Q 09

1Q 10

2Q 10

3Q 10

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

Delinquent Contract $

% of Retail Contract $ Outstanding

U.S. Auto Originations by Type

0%

20%

40%

60%

80%

100%

2006

2007

2008

2009

3Q10

Loan

Lease

U.S. Retail Auto Originations by Credit Tier

Note: Excludes Nuvell and contracts with no credit score

0%

20%

40%

60%

80%

100%

2006

2007

2008

2009

3Q10

Superprime

Prime

Nearprime

Non/Subprime

13

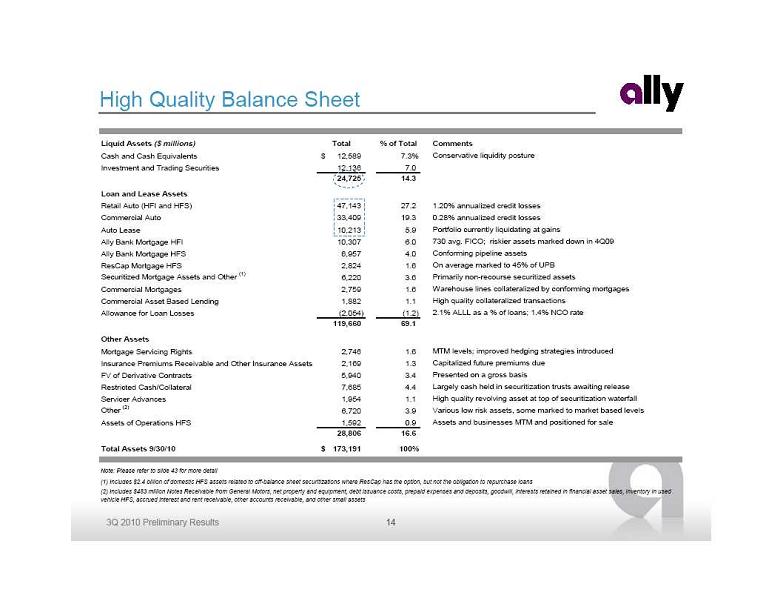

High Quality Balance Sheet

Liquid Assets

($ millions)

Total

% of Total

Comments

Cash and Cash Equivalents

12,589

$

7.3%

Conservative liquidity posture

Investment and Trading Securities

12,136

7.0

24,725

14.3

Loan and Lease Assets

Retail Auto (HFI and HFS)

47,143

27.2

1.20% annualized credit losses

Commercial Auto

33,409

19.3

0.28% annualized credit losses

Auto Lease

10,213

5.9

Portfolio currently liquidating at gains

Ally Bank Mortgage HFI

10,307

6.0

730 avg. FICO; riskier assets marked down in 4Q09

Ally Bank Mortgage HFS

6,957

4.0

Conforming pipeline assets

ResCap Mortgage HFS

2,824

1.6

On average marked to 45% of UPB

Securitized Mortgage Assets and Other

(1)

6,220

3.6

Primarily non-recourse securitized assets

Commercial Mortgages

2,759

1.6

Warehouse lines collateralized by conforming mortgages

Commercial Asset Based Lending

1,882

1.1

High quality collateralized transactions

Allowance for Loan Losses

(2,054)

(1.2)

2.1% ALLL as a % of loans; 1.4% NCO rate

119,660

69.1

Other Assets

Mortgage Servicing Rights

2,746

1.6

MTM levels; improved hedging strategies introduced

Insurance Premiums Receivable and Other Insurance Assets

2,169

1.3

Capitalized future premiums due

FV of Derivative Contracts

5,940

3.4

Presented on a gross basis

Restricted Cash/Collateral

7,685

4.4

Largely cash held in securitization trusts awaiting release

Servicer Advances

1,954

1.1

High quality revolving asset at top of securitization waterfall

Other

(2)

6,720

3.9

Various low risk assets, some marked to market based levels

Assets of Operations HFS

1,592

0.9

Assets and businesses MTM and positioned for sale

28,806

16.6

Total Assets 9/30/10

173,191

$

100%

(1) Includes $2.4 billion of domestic HFS assets related to off-balance sheet securitizations where ResCap has the option, but not the obligation to repurchase loans

(2) Includes $483 million Notes Receivable from General Motors, net property and equipment, debt issuance costs, prepaid expenses and deposits, goodwill, interests retained in financial asset sales, inventory

in used

vehicle HFS, accrued interest and rent receivable, other accounts receivable, and other small assets

Note: Please refer to slide 43 for more detail

14

High Quality Balance Sheet

Liquid Assets

($ millions)

Total

% of Total

Comments

Cash and Cash Equivalents

12,589

$

7.3%

Conservative liquidity posture

Investment and Trading Securities

12,136

7.0

24,725

14.3

Loan and Lease Assets

Retail Auto (HFI and HFS)

47,143

27.2

1.20% annualized credit losses

Commercial Auto

33,409

19.3

0.28% annualized credit losses

Auto Lease

10,213

5.9

Portfolio currently liquidating at gains

Ally Bank Mortgage HFI

10,307

6.0

730 avg. FICO; riskier assets marked down in 4Q09

Ally Bank Mortgage HFS

6,957

4.0

Conforming pipeline assets

ResCap Mortgage HFS

2,824

1.6

On average marked to 45% of UPB

Securitized Mortgage Assets and Other

(1)

6,220

3.6

Primarily non-recourse securitized assets

Commercial Mortgages

2,759

1.6

Warehouse lines collateralized by conforming mortgages

Commercial Asset Based Lending

1,882

1.1

High quality collateralized transactions

Allowance for Loan Losses

(2,054)

(1.2)

2.1% ALLL as a % of loans; 1.4% NCO rate

119,660

69.1

Other Assets

Mortgage Servicing Rights

2,746

1.6

MTM levels; improved hedging strategies introduced

Insurance Premiums Receivable and Other Insurance Assets

2,169

1.3

Capitalized future premiums due

FV of Derivative Contracts

5,940

3.4

Presented on a gross basis

Restricted Cash/Collateral

7,685

4.4

Largely cash held in securitization trusts awaiting release

Servicer Advances

1,954

1.1

High quality revolving asset at top of securitization waterfall

Other

(2)

6,720

3.9

Various low risk assets, some marked to market based levels

Assets of Operations HFS

1,592

0.9

Assets and businesses MTM and positioned for sale

28,806

16.6

Total Assets 9/30/10

173,191

$

100%

(1) Includes $2.4 billion of domestic HFS assets related to off-balance sheet securitizations where ResCap has the option, but not the obligation to repurchase loans

(2) Includes $483 million Notes Receivable from General Motors, net property and equipment, debt issuance costs, prepaid expenses and deposits, goodwill, interests retained in financial asset sales, inventory

in used

vehicle HFS, accrued interest and rent receivable, other accounts receivable, and other small assets

Note: Please refer to slide 43 for more detail

14

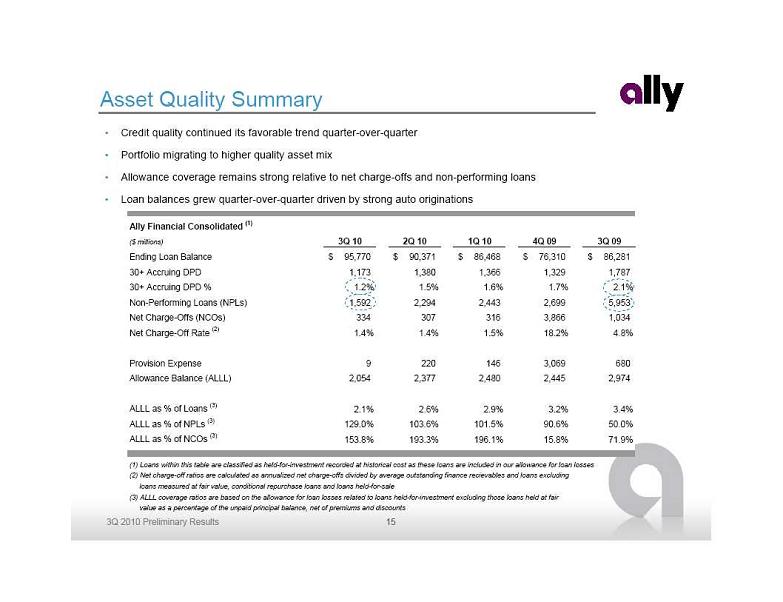

Asset Quality Summary

Credit quality continued its favorable trend quarter-over-quarter

Portfolio migrating to higher quality asset mix

Allowance coverage remains strong relative to net charge-offs and non-performing loans

Loan balances grew quarter-over-quarter driven by strong auto originations

Ally Financial Consolidated

(1)

($ millions)

3Q 10

2Q 10

1Q 10

4Q 09

3Q 09

Ending Loan Balance

95,770

$

90,371

$

86,468

$

76,310

$

86,281

$

30+ Accruing DPD

1,173

1,380

1,366

1,329

1,787

30+ Accruing DPD %

1.2%

1.5%

1.6%

1.7%

2.1%

Non-Performing Loans (NPLs)

1,592

2,294

2,443

2,699

5,953

Net Charge-Offs (NCOs)

334

307

316

3,866

1,034

Net Charge-Off Rate

(2)

1.4%

1.4%

1.5%

18.2%

4.8%

Provision Expense

9

220

146

3,069

680

Allowance Balance (ALLL)

2,054

2,377

2,480

2,445

2,974

ALLL as % of Loans

(3)

2.1%

2.6%

2.9%

3.2%

3.4%

ALLL as % of NPLs

(3)

129.0%

103.6%

101.5%

90.6%

50.0%

ALLL as % of NCOs

(3)

153.8%

193.3%

196.1%

15.8%

71.9%

(1) Loans within this table are classified as held-for-investment recorded at historical cost as these loans are included in our allowance for loan losses

(2) Net charge-off ratios are calculated as annualized net charge-offs divided by average outstanding finance recievables and loans excluding

loans measured at fair value, conditional repurchase loans and loans held-for-sale

(3) ALLL coverage ratios are based on the allowance for loan losses related to loans held-for-investment excluding those loans held at fair

value as a percentage of the unpaid principal balance, net of premiums and discounts

15

Asset Quality Summary

Credit quality continued its favorable trend quarter-over-quarter

Portfolio migrating to higher quality asset mix

Allowance coverage remains strong relative to net charge-offs and non-performing loans

Loan balances grew quarter-over-quarter driven by strong auto originations

Ally Financial Consolidated

(1)

($ millions)

3Q 10

2Q 10

1Q 10

4Q 09

3Q 09

Ending Loan Balance

95,770

$

90,371

$

86,468

$

76,310

$

86,281

$

30+ Accruing DPD

1,173

1,380

1,366

1,329

1,787

30+ Accruing DPD %

1.2%

1.5%

1.6%

1.7%

2.1%

Non-Performing Loans (NPLs)

1,592

2,294

2,443

2,699

5,953

Net Charge-Offs (NCOs)

334

307

316

3,866

1,034

Net Charge-Off Rate

(2)

1.4%

1.4%

1.5%

18.2%

4.8%

Provision Expense

9

220

146

3,069

680

Allowance Balance (ALLL)

2,054

2,377

2,480

2,445

2,974

ALLL as % of Loans

(3)

2.1%

2.6%

2.9%

3.2%

3.4%

ALLL as % of NPLs

(3)

129.0%

103.6%

101.5%

90.6%

50.0%

ALLL as % of NCOs

(3)

153.8%

193.3%

196.1%

15.8%

71.9%

(1) Loans within this table are classified as held-for-investment recorded at historical cost as these loans are included in our allowance for loan losses

(2) Net charge-off ratios are calculated as annualized net charge-offs divided by average outstanding finance recievables and loans excluding

loans measured at fair value, conditional repurchase loans and loans held-for-sale

(3) ALLL coverage ratios are based on the allowance for loan losses related to loans held-for-investment excluding those loans held at fair

value as a percentage of the unpaid principal balance, net of premiums and discounts

15

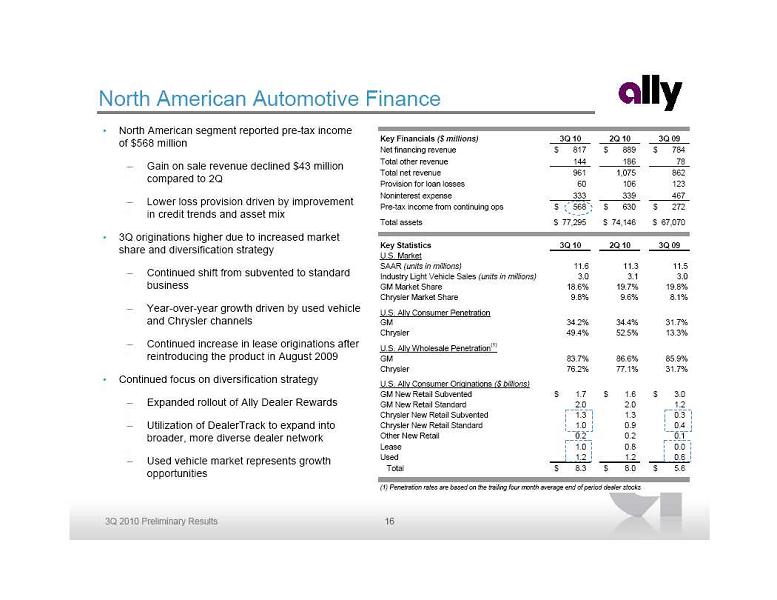

North American segment reported pre-tax income

North American segment reported pre-tax income

of $568 million

Gain on sale revenue declined $43 million

compared to 2Q

Lower loss provision driven by improvement

in credit trends and asset mix

3Q originations higher due to increased market

share and diversification strategy

Continued shift from subvented to standard

business

Year-over-year growth driven by used vehicle

and Chrysler channels

Continued increase in lease originations after

reintroducing the product in August 2009

Continued focus on diversification strategy

Expanded rollout of Ally Dealer Rewards

Utilization of DealerTrack to expand into

broader, more diverse dealer network

Used vehicle market represents growth

opportunities

North American Automotive Finance

Key Financials

($ millions)

3Q 10

2Q 10

3Q 09

Net financing revenue

817

$

889

$

784

$

Total other revenue

144

186

78

Total net revenue

961

1,075

862

Provision for loan losses

60

106

123

Noninterest expense

333

339

467

Pre-tax income from continuing ops

568

$

630

$

272

$

Total assets

77,295

$

74,146

$

67,070

$

Key Statistics

3Q 10

2Q 10

3Q 09

U.S. Market

SAAR

(units in millions)

11.6

11.3

11.5

Industry Light Vehicle Sales

(units in millions)

3.0

3.1

3.0

GM Market Share

18.6%

19.7%

19.8%

Chrysler Market Share

9.8%

9.6%

8.1%

U.S. Ally Consumer Penetration

GM

34.2%

34.4%

31.7%

Chrysler

49.4%

52.5%

13.3%

U.S. Ally Wholesale Penetration

(1)

GM

83.7%

86.6%

85.9%

Chrysler

76.2%

77.1%

31.7%

U.S. Ally Consumer Originations

($ billions)

GM New Retail Subvented

1.7

$

1.6

$

3.0

$

GM New Retail Standard

2.0

2.0

1.2

Chrysler New Retail Subvented

1.3

1.3

0.3

Chrysler New Retail Standard

1.0

0.9

0.4

Other New Retail

0.2

0.2

0.1

Lease

1.0

0.8

0.0

Used

1.2

1.2

0.6

Total

8.3

$

8.0

$

5.6

$

(1) Penetration rates are based on the trailing four month average end of period dealer stocks

16

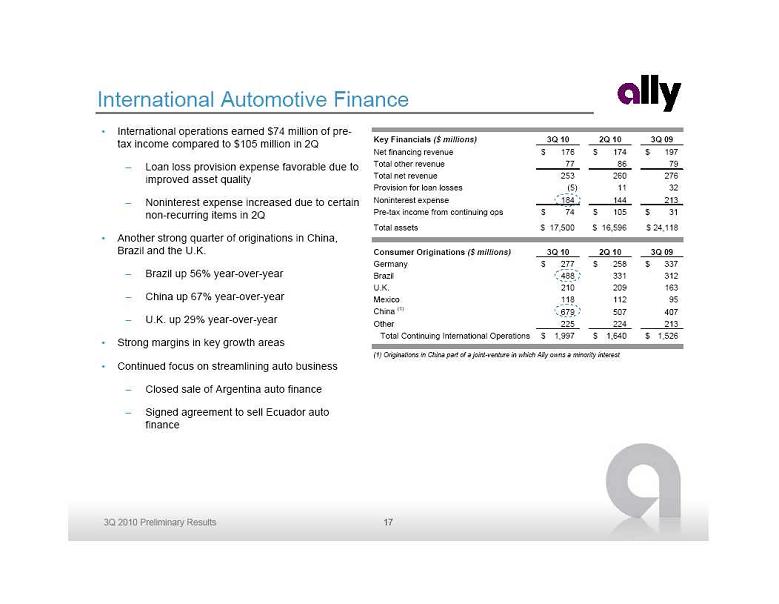

International operations earned $74 million of pre-

International operations earned $74 million of pre-

tax income compared to $105 million in 2Q

Loan loss provision expense favorable due to

improved asset quality

Noninterest expense increased due to certain

non-recurring items in 2Q

Another strong quarter of originations in China,

Brazil and the U.K.

Brazil up 56% year-over-year

China up 67% year-over-year

U.K. up 29% year-over-year

Strong margins in key growth areas

Continued focus on streamlining auto business

Closed sale of Argentina auto finance

Signed agreement to sell Ecuador auto

finance

International Automotive Finance

Key Financials

($ millions)

3Q 10

2Q 10

3Q 09

Net financing revenue

176

$

174

$

197

$

Total other revenue

77

86

79

Total net revenue

253

260

276

Provision for loan losses

(5)

11

32

Noninterest expense

184

144

213

Pre-tax income from continuing ops

74

$

105

$

31

$

Total assets

17,500

$

16,596

$

24,118

$

Consumer Originations

($ millions)

3Q 10

2Q 10

3Q 09

Germany

277

$

258

$

337

$

Brazil

488

331

312

U.K.

210

209

163

Mexico

118

112

95

China

(1)

679

507

407

Other

225

224

213

Total Continuing International Operations

1,997

$

1,640

$

1,526

$

(1) Originations in China part of a joint-venture in which Ally owns a minority interest

17

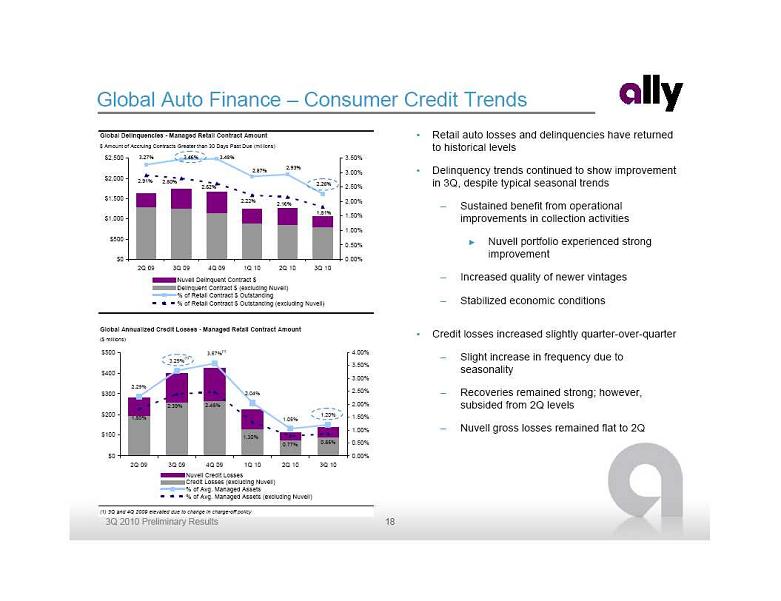

Global Auto Finance – Consumer Credit Trends

Retail auto losses and delinquencies have returned

Global Auto Finance – Consumer Credit Trends

Retail auto losses and delinquencies have returned

to historical levels

Delinquency trends continued to show improvement

in 3Q, despite typical seasonal trends

Sustained benefit from operational

improvements in collection activities

Nuvell portfolio experienced strong

improvement

Increased quality of newer vintages

Stabilized economic conditions

Credit losses increased slightly quarter-over-quarter

Slight increase in frequency due to

seasonality

Recoveries remained strong; however,

subsided from 2Q levels

Nuvell gross losses remained flat to 2Q

Global Delinquencies - Managed

Retail Contract Amount

$ Amount of Accruing Contracts Greater than 30 Days Past Due (millions)

2.91%

2.80%

2.62%

2.22%

2.16%

1.81%

2.26%

2.93%

2.87%

3.48%

3.46%

3.27%

$0

$500

$1,000

$1,500

$2,000

$2,500

2Q 09

3Q 09

4Q 09

1Q 10

2Q 10

3Q 10

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

Nuvell Delinquent Contract $

Delinquent Contract $ (excluding Nuvell)

% of Retail Contract $ Outstanding

% of Retail Contract $ Outstanding (excluding Nuvell)

Global Annualized Credit Losses - Managed Retail Contract Amount

($ millions)

(1) 3Q and 4Q 2009 elevated due to change in charge-off policy

2.29%

3.29%

3.57%

2.04%

1.05%

1.20%

0.85%

0.77%

1.30%

2.48%

2.39%

1.80%

$0

$100

$200

$300

$400

$500

2Q 09

3Q 09

4Q 09

1Q 10

2Q 10

3Q 10

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

4.00%

Nuvell Credit Losses

Credit Losses (excluding Nuvell)

% of Avg. Managed Assets

% of Avg. Managed Assets (excluding Nuvell)

(1)

(1)

18

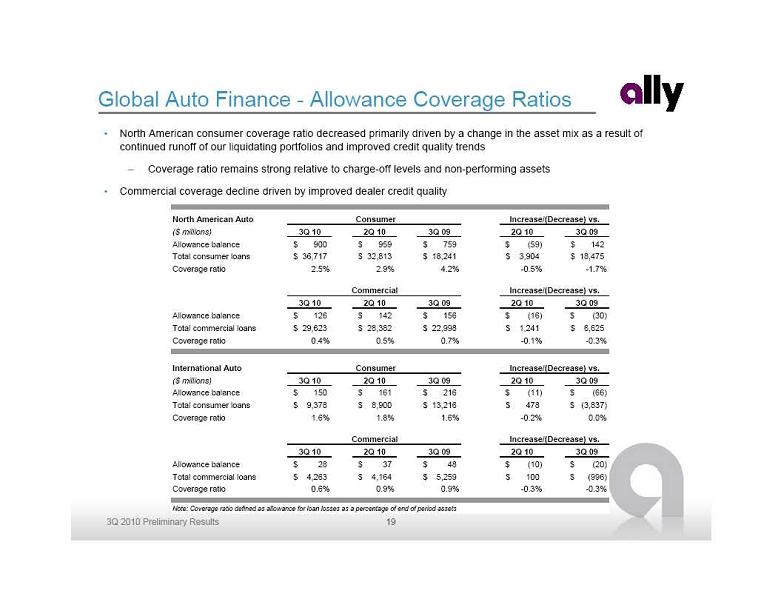

Global Auto Finance - Allowance Coverage Ratios

North American consumer coverage ratio decreased primarily driven by a change in the asset mix as a result of

Global Auto Finance - Allowance Coverage Ratios

North American consumer coverage ratio decreased primarily driven by a change in the asset mix as a result of

continued runoff of our liquidating portfolios and improved credit quality trends

Coverage ratio remains strong relative to charge-off levels and non-performing assets

Commercial coverage decline driven by improved dealer credit quality

North American Auto

Consumer

($ millions)

3Q 10

2Q 10

3Q 09

2Q 10

3Q 09

Allowance balance

900

$

959

$

759

$

(59)

$

142

$

Total consumer loans

36,717

$

32,813

$

18,241

$

3,904

$

18,475

$

Coverage ratio

2.5%

2.9%

4.2%

-0.5%

-1.7%

Commercial

3Q 10

2Q 10

3Q 09

2Q 10

3Q 09

Allowance balance

126

$

142

$

156

$

(16)

$

(30)

$

Total commercial loans

29,623

$

28,382

$

22,998

$

1,241

$

6,625

$

Coverage ratio

0.4%

0.5%

0.7%

-0.1%

-0.3%

International Auto

Consumer

($ millions)

3Q 10

2Q 10

3Q 09

2Q 10

3Q 09

Allowance balance

150

$

161

$

216

$

(11)

$

(66)

$

Total consumer loans

9,378

$

8,900

$

13,216

$

478

$

(3,837)

$

Coverage ratio

1.6%

1.8%

1.6%

-0.2%

0.0%

Commercial

3Q 10

2Q 10

3Q 09

2Q 10

3Q 09

Allowance balance

28

$

37

$

48

$

(10)

$

(20)

$

Total commercial loans

4,263

$

4,164

$

5,259

$

100

$

(996)

$

Coverage ratio

0.6%

0.9%

0.9%

-0.3%

-0.3%

Note: Coverage ratio defined as allowance for loan losses as a percentage of end of period assets

Increase/(Decrease) vs.

Increase/(Decrease) vs.

Increase/(Decrease) vs.

Increase/(Decrease) vs.

19

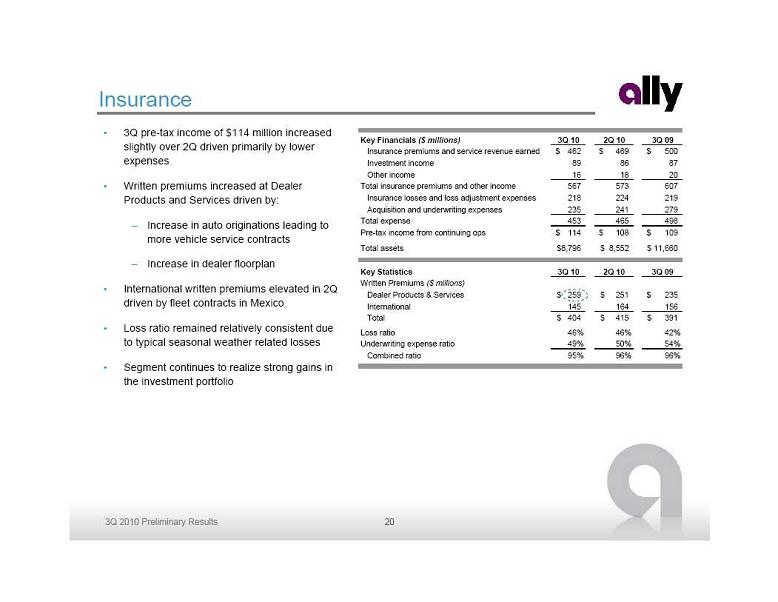

Insurance

3Q pre-tax income of $114 million increased

Insurance

3Q pre-tax income of $114 million increased

slightly over 2Q driven primarily by lower

expenses

Written premiums increased at Dealer

Products and Services driven by:

Increase in auto originations leading to

more vehicle service contracts

Increase in dealer floorplan

International written premiums elevated in 2Q

driven by fleet contracts in Mexico

Loss ratio remained relatively consistent due

to typical seasonal weather related losses

Segment continues to realize strong gains in

the investment portfolio

Key Financials

($ millions)

3Q 10

2Q 10

3Q 09

Insurance premiums and service revenue earned

462

$

469

$

500

$

Investment income

89

86

87

Other income

16

18

20

Total insurance premiums and other income

567

573

607

Insurance losses and loss adjustment expenses

218

224

219

Acquisition and underwriting expenses

235

241

279

Total expense

453

465

498

Pre-tax income from continuing ops

114

$

108

$

109

$

Total assets

8,796

$

8,552

$

11,660

$

Key Statistics

3Q 10

2Q 10

3Q 09

Written Premiums

($ millions)

Dealer Products & Services

259

$

251

$

235

$

International

145

164

156

Total

404

$

415

$

391

$

Loss ratio

46%

46%

42%

Underwriting expense ratio

49%

50%

54%

Combined ratio

95%

96%

96%

20

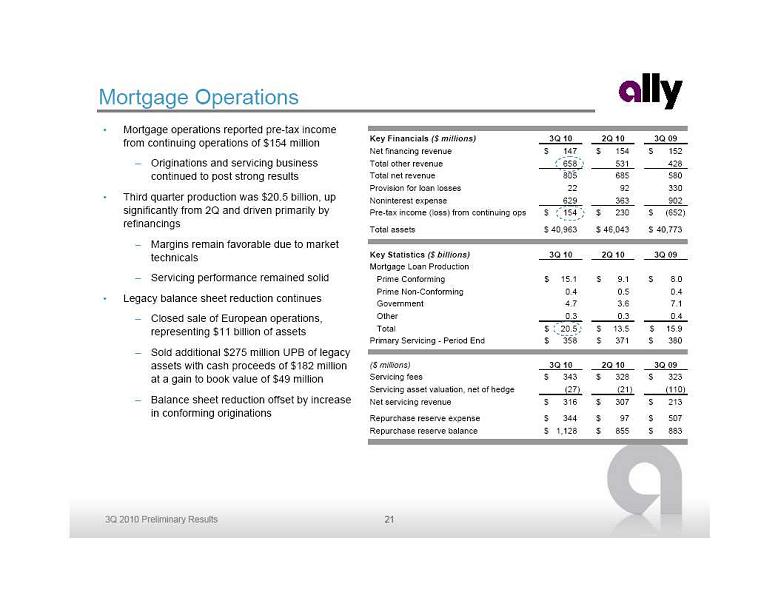

Mortgage Operations

Mortgage operations reported pre-tax income

Mortgage Operations

Mortgage operations reported pre-tax income

from continuing operations of $154 million

Originations and servicing business

continued to post strong results

Third quarter production was $20.5 billion, up

significantly from 2Q and driven primarily by

refinancings

Margins remain favorable due to market

technicals

Servicing performance remained solid

Legacy balance sheet reduction continues

Closed sale of European operations,

representing $11 billion of assets

Sold additional $275 million UPB of legacy

assets with cash proceeds of $182 million

at a gain to book value of $49 million

Balance sheet reduction offset by increase

in conforming originations

Key Financials

($ millions)

3Q 10

2Q 10

3Q 09

Net financing revenue

147

$

154

$

152

$

Total other revenue

658

531

428

Total net revenue

805

685

580

Provision for loan losses

22

92

330

Noninterest expense

629

363

902

Pre-tax income (loss) from continuing ops

154

$

230

$

(652)

$

Total assets

40,963

$

46,043

$

40,773

$

Key Statistics

($ billions)

3Q 10

2Q 10

3Q 09

Mortgage Loan Production

Prime Conforming

15.1

$

9.1

$

8.0

$

Prime Non-Conforming

0.4

0.5

0.4

Government

4.7

3.6

7.1

Other

0.3

0.3

0.4

Total

20.5

$

13.5

$

15.9

$

Primary Servicing - Period End

358

$

371

$

380

$

($ millions)

3Q 10

2Q 10

3Q 09

Servicing fees

343

$

328

$

323

$

Servicing asset valuation, net of hedge

(27)

(21)

(110)

Net servicing revenue

316

$

307

$

213

$

Repurchase reserve expense

344

$

97

$

507

$

Repurchase reserve balance

1,128

$

855

$

883

$

21

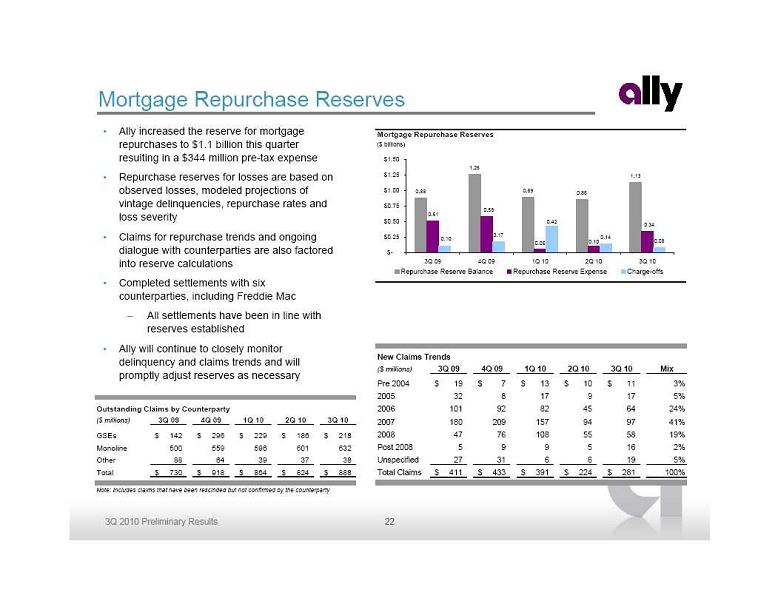

Mortgage Repurchase Reserves

Ally increased the reserve for mortgage

Mortgage Repurchase Reserves

Ally increased the reserve for mortgage

repurchases to $1.1 billion this quarter

resulting in a $344 million pre-tax expense

Repurchase reserves for losses are based on

observed losses, modeled projections of

vintage delinquencies, repurchase rates and

loss severity

Claims for repurchase trends and ongoing

dialogue with counterparties are also factored

into reserve calculations

Completed settlements with six

counterparties, including Freddie Mac

All settlements have been in line with

reserves established

Ally will continue to closely monitor

delinquency and claims trends and will

promptly adjust reserves as necessary

Mortgage Repurchase Reserves

($ billions)

0.88

1.26

0.89

0.86

1.13

0.05

0.17

0.14

0.08

0.34

0.10

0.58

0.51

0.42

0.10

$-

$0.25

$0.50

$0.75

$1.00

$1.25

$1.50

3Q 09

4Q 09

1Q 10

2Q 10

3Q 10

Repurchase Reserve Balance

Repurchase Reserve Expense

Charge-offs

New Claims Trends

($ millions)

3Q 09

4Q 09

1Q 10

2Q 10

3Q 10

Mix

Pre 2004

19

$

7

$

13

$

10

$

11

$

3%

2005

32

8

17

9

17

5%

2006

101

92

82

45

64

24%

2007

180

209

157

94

97

41%

2008

47

76

108

55

58

19%

Post 2008

5

9

9

5

16

2%

Unspecified

27

31

6

6

19

5%

Total Claims

411

$

433

$

391

$

224

$

281

$

100%

Outstanding Claims by Counterparty

($ millions)

3Q 09

4Q 09

1Q 10

2Q 10

3Q 10

GSEs

142

$

296

$

229

$

186

$

218

$

Monoline

500

559

596

601

632

Other

88

64

39

37

38

Total

730

$

918

$

864

$

824

$

888

$

Note: Includes claims that have been rescinded but not confirmed by the counterparty

22

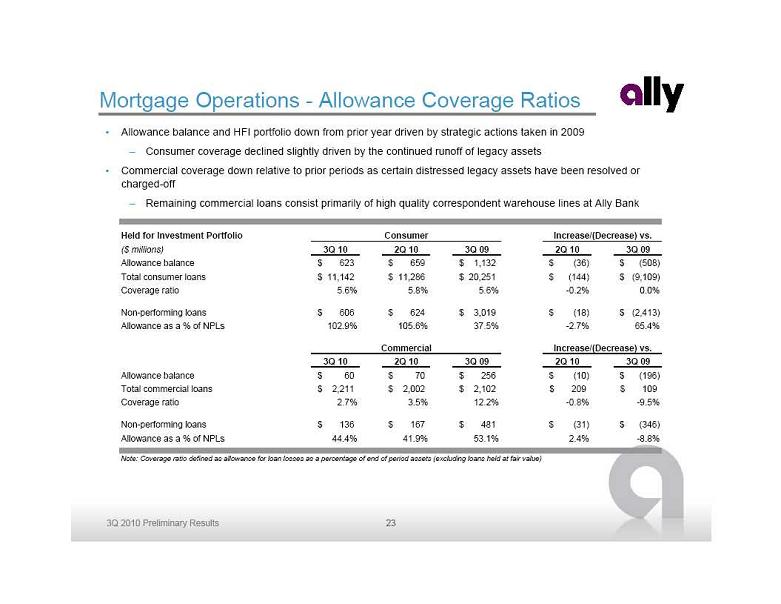

Mortgage Operations - Allowance Coverage Ratios

Allowance balance and HFI portfolio down from prior year driven by strategic actions taken in 2009

Consumer coverage declined slightly driven by the continued runoff of legacy assets

Commercial coverage down relative to prior periods as certain distressed legacy assets have been resolved or

Mortgage Operations - Allowance Coverage Ratios

Allowance balance and HFI portfolio down from prior year driven by strategic actions taken in 2009

Consumer coverage declined slightly driven by the continued runoff of legacy assets

Commercial coverage down relative to prior periods as certain distressed legacy assets have been resolved or

charged-off

Remaining commercial loans consist primarily of high quality correspondent warehouse lines at Ally Bank

Held for Investment Portfolio

Consumer

($ millions)

3Q 10

2Q 10

3Q 09

2Q 10

3Q 09

Allowance balance

623

$

659

$

1,132

$

(36)

$

(508)

$

Total consumer loans

11,142

$

11,286

$

20,251

$

(144)

$

(9,109)

$

Coverage ratio

5.6%

5.8%

5.6%

-0.2%

0.0%

Non-performing loans

606

$

624

$

3,019

$

(18)

$

(2,413)

$

Allowance as a % of NPLs

102.9%

105.6%

37.5%

-2.7%

65.4%

Commercial

3Q 10

2Q 10

3Q 09

2Q 10

3Q 09

Allowance balance

60

$

70

$

256

$

(10)

$

(196)

$

Total commercial loans

2,211

$

2,002

$

2,102

$

209

$

109

$

Coverage ratio

2.7%

3.5%

12.2%

-0.8%

-9.5%

Non-performing loans

136

$

167

$

481

$

(31)

$

(346)

$

Allowance as a % of NPLs

44.4%

41.9%

53.1%

2.4%

-8.8%

Note: Coverage ratio defined as allowance for loan losses as a percentage of end of period assets (excluding loans held at fair value)

Increase/(Decrease) vs.

Increase/(Decrease) vs.

23

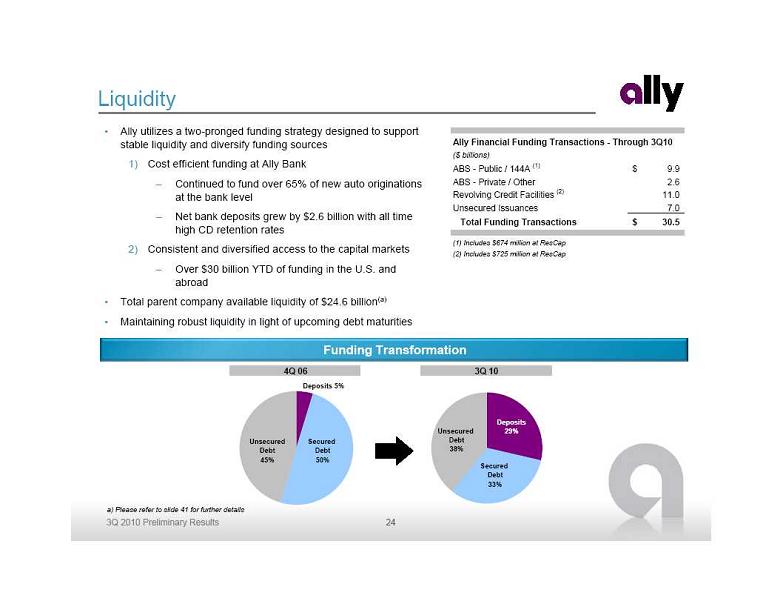

Liquidity

Ally utilizes a two-pronged funding strategy designed to support

Liquidity

Ally utilizes a two-pronged funding strategy designed to support

stable liquidity and diversify funding sources

1) Cost efficient funding at Ally Bank

Continued to fund over 65% of new auto originations

at the bank level

Net bank deposits grew by $2.6 billion with all time

high CD retention rates

2) Consistent and diversified access to the capital markets

Over $30 billion YTD of funding in the U.S. and

abroad

Total parent company available liquidity of $24.6 billion(a)

Maintaining robust liquidity in light of upcoming debt maturities

Funding Transformation

a) Please refer to slide 41 for further details

Ally Financial Funding Transactions - Through 3Q10

($ billions)

ABS - Public / 144A

(1)

9.9

$

ABS - Private / Other

2.6

Revolving Credit Facilities

(2)

11.0

Unsecured Issuances

7.0

Total Funding Transactions

30.5

$

(1) Includes $674 million at ResCap

(2) Includes $725 million at ResCap

4Q 06

3Q 10

Deposits 5%

Secured

Debt

50%

Unsecured

Debt

45%

Unsecured

Debt

38%

Secured

Debt

33%

Deposits

29%

24

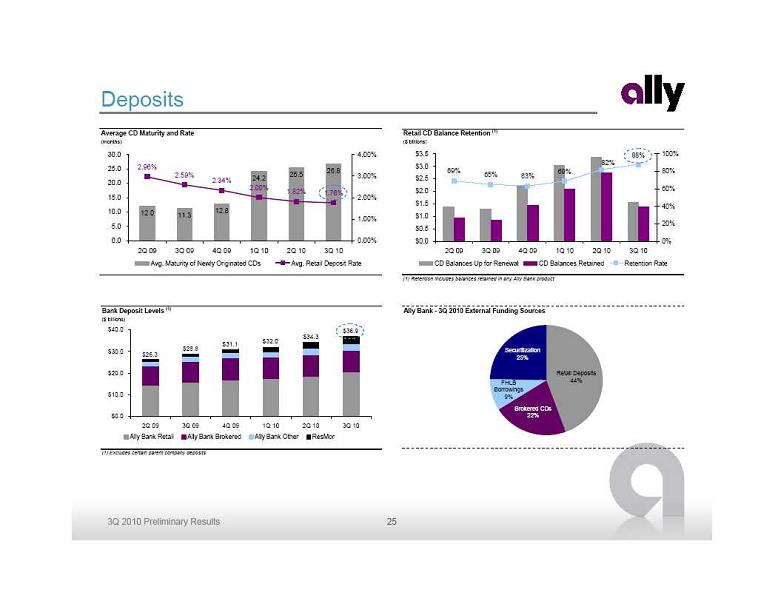

Deposits

Average CD Maturity and Rate

(months)

12.0

11.3

12.8

24.2

25.5

26.8

2.96%

2.59%

2.34%

2.00%

1.82%

1.76%

0.0

5.0

10.0

15.0

20.0

25.0

30.0

2Q 09

3Q 09

4Q 09

1Q 10

2Q 10

3Q 10

0.00%

1.00%

2.00%

3.00%

4.00%

Avg. Maturity of Newly Originated CDs

Avg. Retail Deposit Rate

Retail CD Balance Retention

(1)

($ billions)

(1) Retention includes balances retained in any Ally Bank product

69%

65%

63%

69%

88%

82%

$0.0

$0.5

$1.0

$1.5

$2.0

$2.5

$3.0

$3.5

2Q 09

3Q 09

4Q 09

1Q 10

2Q 10

3Q 10

0%

20%

40%

60%

80%

100%

CD Balances Up for Renewal

CD Balances Retained

Retention Rate

Bank Deposit Levels

(1)

($ billions)

(1) Excludes certain parent company deposits

$36.9

$34.3

$32.0

$31.1

$28.8

$26.3

$0.0

$10.0

$20.0

$30.0

$40.0

2Q 09

3Q 09

4Q 09

1Q 10

2Q 10

3Q 10

Ally Bank Retail

Ally Bank Brokered

Ally Bank Other

ResMor

Ally Bank - 3Q 2010 External Funding Sources

Securitization

25%

Brokered CDs

22%

Retail Deposits

44%

FHLB

Borrowings

9%

25

Deposits

Average CD Maturity and Rate

(months)

12.0

11.3

12.8

24.2

25.5

26.8

2.96%

2.59%

2.34%

2.00%

1.82%

1.76%

0.0

5.0

10.0

15.0

20.0

25.0

30.0

2Q 09

3Q 09

4Q 09

1Q 10

2Q 10

3Q 10

0.00%

1.00%

2.00%

3.00%

4.00%

Avg. Maturity of Newly Originated CDs

Avg. Retail Deposit Rate

Retail CD Balance Retention

(1)

($ billions)

(1) Retention includes balances retained in any Ally Bank product

69%

65%

63%

69%

88%

82%

$0.0

$0.5

$1.0

$1.5

$2.0

$2.5

$3.0

$3.5

2Q 09

3Q 09

4Q 09

1Q 10

2Q 10

3Q 10

0%

20%

40%

60%

80%

100%

CD Balances Up for Renewal

CD Balances Retained

Retention Rate

Bank Deposit Levels

(1)

($ billions)

(1) Excludes certain parent company deposits

$36.9

$34.3

$32.0

$31.1

$28.8

$26.3

$0.0

$10.0

$20.0

$30.0

$40.0

2Q 09

3Q 09

4Q 09

1Q 10

2Q 10

3Q 10

Ally Bank Retail

Ally Bank Brokered

Ally Bank Other

ResMor

Ally Bank - 3Q 2010 External Funding Sources

Securitization

25%

Brokered CDs

22%

Retail Deposits

44%

FHLB

Borrowings

9%

25

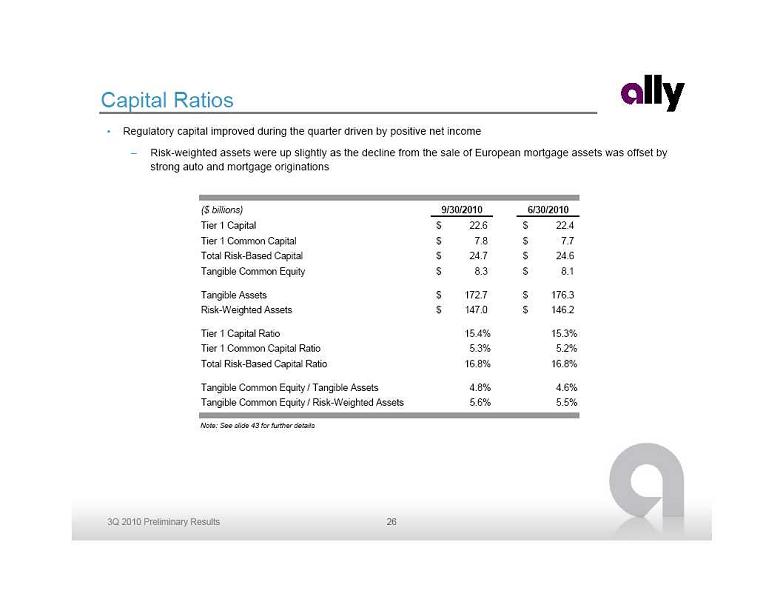

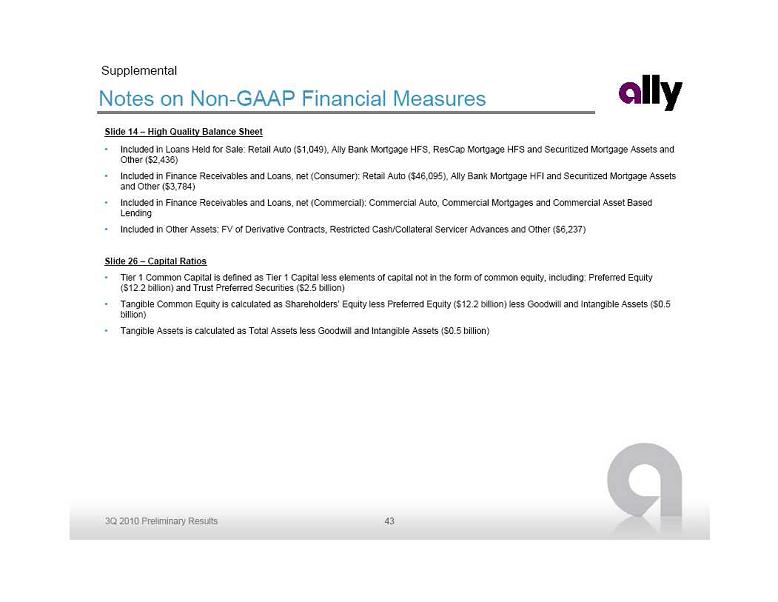

Capital Ratios

Note: See slide 43 for further details

Regulatory capital improved during the quarter driven by positive net income

Risk-weighted assets were up slightly as the decline from the sale of European mortgage assets was offset by

Capital Ratios

Note: See slide 43 for further details

Regulatory capital improved during the quarter driven by positive net income

Risk-weighted assets were up slightly as the decline from the sale of European mortgage assets was offset by

strong auto and mortgage originations

($ billions)

9/30/2010

6/30/2010

Tier 1 Capital

22.6

$

22.4

$

Tier 1 Common Capital

7.8

$

7.7

$

Total Risk-Based Capital

24.7

$

24.6

$

Tangible Common Equity

8.3

$

8.1

$

Tangible Assets

172.7

$

176.3

$

Risk-Weighted Assets

147.0

$

146.2

$

Tier 1 Capital Ratio

15.4%

15.3%

Tier 1 Common Capital Ratio

5.3%

5.2%

Total Risk-Based Capital Ratio

16.8%

16.8%

Tangible Common Equity / Tangible Assets

4.8%

4.6%

Tangible Common Equity / Risk-Weighted Assets

5.6%

5.5%

26

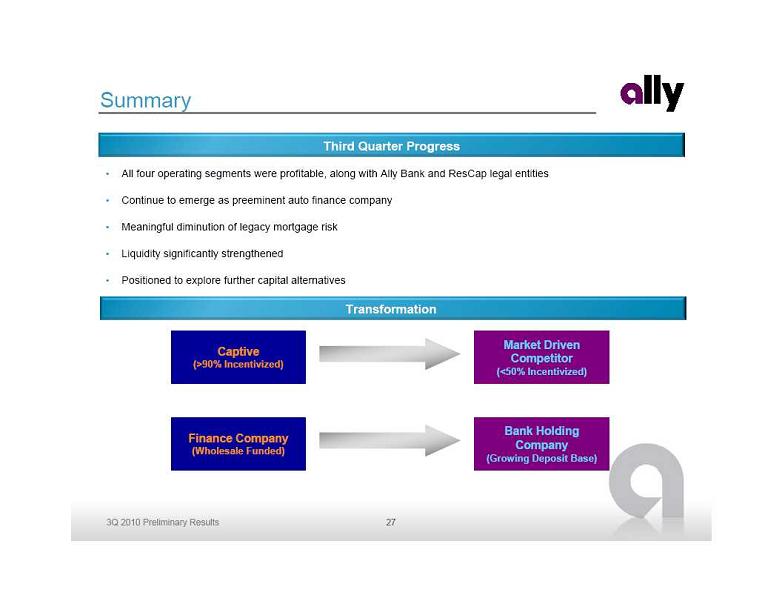

Summary

All four operating segments were profitable, along with Ally Bank and ResCap legal entities

Continue to emerge as preeminent auto finance company

Meaningful diminution of legacy mortgage risk

Liquidity significantly strengthened

Positioned to explore further capital alternatives

Third Quarter Progress

Captive

(>90% Incentivized)

Finance Company

(Wholesale Funded)

Market Driven

Summary

All four operating segments were profitable, along with Ally Bank and ResCap legal entities

Continue to emerge as preeminent auto finance company

Meaningful diminution of legacy mortgage risk

Liquidity significantly strengthened

Positioned to explore further capital alternatives

Third Quarter Progress

Captive

(>90% Incentivized)

Finance Company

(Wholesale Funded)

Market Driven

Competitor

(<50% Incentivized)

Bank Holding

Company

(Growing Deposit Base)

Transformation

27

Supplemental Charts

Supplemental Charts

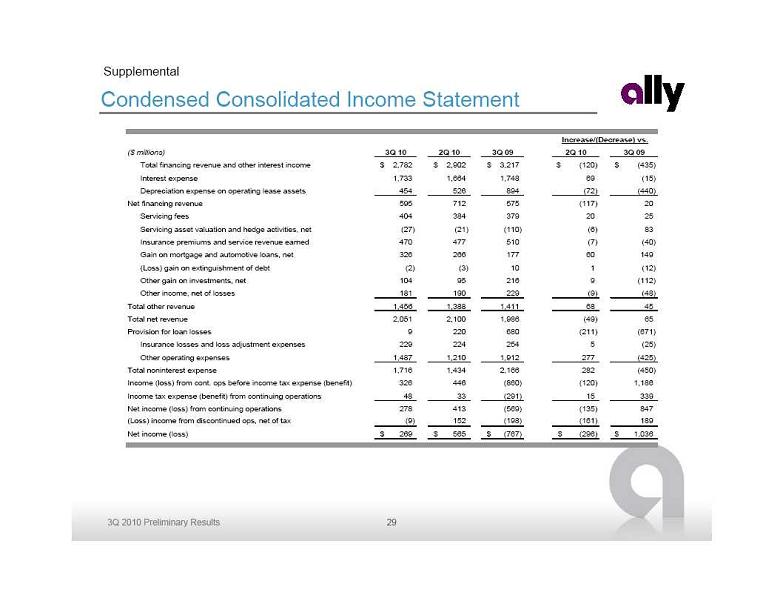

Condensed Consolidated Income Statement

Supplemental

($ millions)

3Q 10

2Q 10

3Q 09

2Q 10

3Q 09

Total financing revenue and other interest income

2,782

$

2,902

$

3,217

$

(120)

$

(435)

$

Interest expense

1,733

1,664

1,748

69

(15)

Depreciation expense on operating lease assets

454

526

894

(72)

(440)

Net financing revenue

595

712

575

(117)

20

Servicing fees

404

384

379

20

25

Servicing asset valuation and hedge activities, net

(27)

(21)

(110)

(6)

83

Insurance premiums and service revenue earned

470

477

510

(7)

(40)

Gain on mortgage and automotive loans, net

326

266

177

60

149

(Loss) gain on extinguishment of debt

(2)

(3)

10

1

(12)

Other gain on investments, net

104

95

216

9

(112)

Other income, net of losses

181

190

229

(9)

(48)

Total other revenue

1,456

1,388

1,411

68

45

Total net revenue

2,051

2,100

1,986

(49)

65

Provision for loan losses

9

220

680

(211)

(671)

Insurance losses and loss adjustment expenses

229

224

254

5

(25)

Other operating expenses

1,487

1,210

1,912

277

(425)

Total noninterest expense

1,716

1,434

2,166

282

(450)

Income (loss) from cont. ops before income tax expense (benefit)

326

446

(860)

(120)

1,186

Income tax expense (benefit) from continuing operations

48

33

(291)

15

339

Net income (loss) from continuing operations

278

413

(569)

(135)

847

(Loss) income from discontinued ops, net of tax

(9)

152

(198)

(161)

189

Net income (loss)

269

$

565

$

(767)

$

(296)

$

1,036

$

Increase/(Decrease) vs.

29

Condensed Consolidated Income Statement

Supplemental

($ millions)

3Q 10

2Q 10

3Q 09

2Q 10

3Q 09

Total financing revenue and other interest income

2,782

$

2,902

$

3,217

$

(120)

$

(435)

$

Interest expense

1,733

1,664

1,748

69

(15)

Depreciation expense on operating lease assets

454

526

894

(72)

(440)

Net financing revenue

595

712

575

(117)

20

Servicing fees

404

384

379

20

25

Servicing asset valuation and hedge activities, net

(27)

(21)

(110)

(6)

83

Insurance premiums and service revenue earned

470

477

510

(7)

(40)

Gain on mortgage and automotive loans, net

326

266

177

60

149

(Loss) gain on extinguishment of debt

(2)

(3)

10

1

(12)

Other gain on investments, net

104

95

216

9

(112)

Other income, net of losses

181

190

229

(9)

(48)

Total other revenue

1,456

1,388

1,411

68

45

Total net revenue

2,051

2,100

1,986

(49)

65

Provision for loan losses

9

220

680

(211)

(671)

Insurance losses and loss adjustment expenses

229

224

254

5

(25)

Other operating expenses

1,487

1,210

1,912

277

(425)

Total noninterest expense

1,716

1,434

2,166

282

(450)

Income (loss) from cont. ops before income tax expense (benefit)

326

446

(860)

(120)

1,186

Income tax expense (benefit) from continuing operations

48

33

(291)

15

339

Net income (loss) from continuing operations

278

413

(569)

(135)

847

(Loss) income from discontinued ops, net of tax

(9)

152

(198)

(161)

189

Net income (loss)

269

$

565

$

(767)

$

(296)

$

1,036

$

Increase/(Decrease) vs.

29

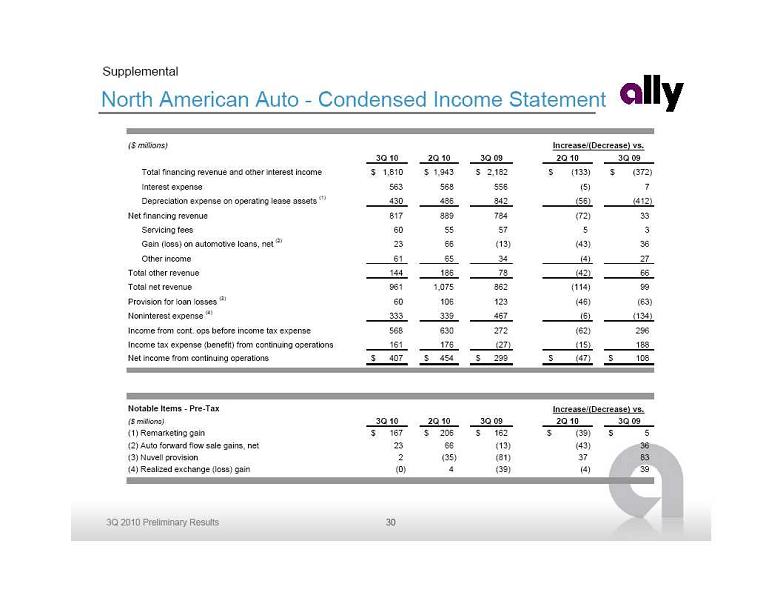

North American Auto - Condensed Income Statement

Supplemental

($ millions)

3Q 10

2Q 10

3Q 09

2Q 10

3Q 09

Total financing revenue and other interest income

1,810

$

1,943

$

2,182

$

(133)

$

(372)

$

Interest expense

563

568

556

(5)

7

Depreciation expense on operating lease assets

(1)

430

486

842

(56)

(412)

Net financing revenue

817

889

784

(72)

33

Servicing fees

60

55

57

5

3

Gain (loss) on automotive loans, net

(2)

23

66

(13)

(43)

36

Other income

61

65

34

(4)

27

Total other revenue

144

186

78

(42)

66

Total net revenue

961

1,075

862

(114)

99

Provision for loan losses

(3)

60

106

123

(46)

(63)

Noninterest expense

(4)

333

339

467

(6)

(134)

Income from cont. ops before income tax expense

568

630

272

(62)

296

Income tax expense (benefit) from continuing operations

161

176

(27)

(15)

188

Net income from continuing operations

407

$

454

$

299

$

(47)

$

108

$

Notable Items - Pre-Tax

($ millions)

3Q 10

2Q 10

3Q 09

2Q 10

3Q 09

(1) Remarketing gain

167

$

206

$

162

$

(39)

$

5

$

(2) Auto forward flow sale gains, net

23

66

(13)

(43)

36

(3) Nuvell provision

2

(35)

(81)

37

83

(4) Realized exchange (loss) gain

(0)

4

(39)

(4)

39

Increase/(Decrease) vs.

Increase/(Decrease) vs.

30

North American Auto - Condensed Income Statement

Supplemental

($ millions)

3Q 10

2Q 10

3Q 09

2Q 10

3Q 09

Total financing revenue and other interest income

1,810

$

1,943

$

2,182

$

(133)

$

(372)

$

Interest expense

563

568

556

(5)

7

Depreciation expense on operating lease assets

(1)

430

486

842

(56)

(412)

Net financing revenue

817

889

784

(72)

33

Servicing fees

60

55

57

5

3

Gain (loss) on automotive loans, net

(2)

23

66

(13)

(43)

36

Other income

61

65

34

(4)

27

Total other revenue

144

186

78

(42)

66

Total net revenue

961

1,075

862

(114)

99

Provision for loan losses

(3)

60

106

123

(46)

(63)

Noninterest expense

(4)

333

339

467

(6)

(134)

Income from cont. ops before income tax expense

568

630

272

(62)

296

Income tax expense (benefit) from continuing operations

161

176

(27)

(15)

188

Net income from continuing operations

407

$

454

$

299

$

(47)

$

108

$

Notable Items - Pre-Tax

($ millions)

3Q 10

2Q 10

3Q 09

2Q 10

3Q 09

(1) Remarketing gain

167

$

206

$

162

$

(39)

$

5

$

(2) Auto forward flow sale gains, net

23

66

(13)

(43)

36

(3) Nuvell provision

2

(35)

(81)

37

83

(4) Realized exchange (loss) gain

(0)

4

(39)

(4)

39

Increase/(Decrease) vs.

Increase/(Decrease) vs.

30

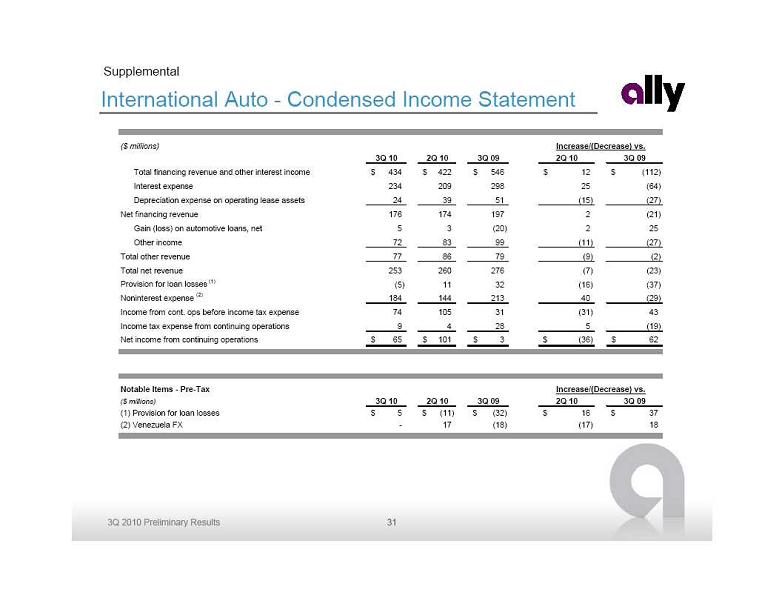

International Auto - Condensed Income Statement

Supplemental

($ millions)

3Q 10

2Q 10

3Q 09

2Q 10

3Q 09

Total financing revenue and other interest income

434

$

422

$

546

$

12

$

(112)

$

Interest expense

234

209

298

25

(64)

Depreciation expense on operating lease assets

24

39

51

(15)

(27)

Net financing revenue

176

174

197

2

(21)

Gain (loss) on automotive loans, net

5

3

(20)

2

25

Other income

72

83

99

(11)

(27)

Total other revenue

77

86

79

(9)

(2)

Total net revenue

253

260

276

(7)

(23)

Provision for loan losses

(1)

(5)

11

32

(16)

(37)

Noninterest expense

(2)

184

144

213

40

(29)

Income from cont. ops before income tax expense

74

105

31

(31)

43

Income tax expense from continuing operations

9

4

28

5

(19)

Net income from continuing operations

65

$

101

$

3

$

(36)

$

62

$

Notable Items - Pre-Tax

($ millions)

3Q 10

2Q 10

3Q 09

2Q 10

3Q 09

(1) Provision for loan losses

5

$

(11)

$

(32)

$

16

$

37

$

(2) Venezuela FX

-

17

(18)

(17)

18

Increase/(Decrease) vs.

Increase/(Decrease) vs.

31

International Auto - Condensed Income Statement

Supplemental

($ millions)

3Q 10

2Q 10

3Q 09

2Q 10

3Q 09

Total financing revenue and other interest income

434

$

422

$

546

$

12

$

(112)

$

Interest expense

234

209

298

25

(64)

Depreciation expense on operating lease assets

24

39

51

(15)

(27)

Net financing revenue

176

174

197

2

(21)

Gain (loss) on automotive loans, net

5

3

(20)

2

25

Other income

72

83

99

(11)

(27)

Total other revenue

77

86

79

(9)

(2)

Total net revenue

253

260

276

(7)

(23)

Provision for loan losses

(1)

(5)

11

32

(16)

(37)

Noninterest expense

(2)

184

144

213

40

(29)

Income from cont. ops before income tax expense

74

105

31

(31)

43

Income tax expense from continuing operations

9

4

28

5

(19)

Net income from continuing operations

65

$

101

$

3

$

(36)

$

62

$

Notable Items - Pre-Tax

($ millions)

3Q 10

2Q 10

3Q 09

2Q 10

3Q 09

(1) Provision for loan losses

5

$

(11)

$

(32)

$

16

$

37

$

(2) Venezuela FX

-

17

(18)

(17)

18

Increase/(Decrease) vs.

Increase/(Decrease) vs.

31

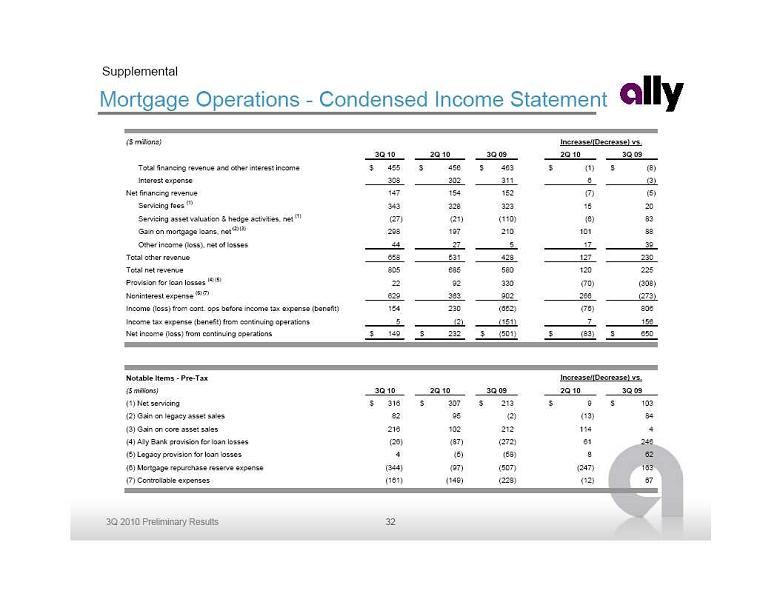

Mortgage Operations - Condensed Income Statement

Supplemental

($ millions)

3Q 10

2Q 10

3Q 09

2Q 10

3Q 09

Total financing revenue and other interest income

455

$

456

$

463

$

(1)

$

(8)

$

Interest expense

308

302

311

6

(3)

Net financing revenue

147

154

152

(7)

(5)

Servicing fees

(1)

343

328

323

15

20

Servicing asset valuation & hedge activities, net

(1)

(27)

(21)

(110)

(6)

83

Gain on mortgage loans, net

(2) (3)

298

197

210

101

88

Other income (loss), net of losses

44

27

5

17

39

Total other revenue

658

531

428

127

230

Total net revenue

805

685

580

120

225

Provision for loan losses

(4) (5)

22

92

330

(70)

(308)

Noninterest expense

(6) (7)

629

363

902

266

(273)

Income (loss) from cont. ops before income tax expense (benefit)

154

230

(652)

(76)

806

Income tax expense (benefit) from continuing operations

5

(2)

(151)

7

156

Net income (loss) from continuing operations

149

$

232

$

(501)

$

(83)

$

650

$

Notable Items - Pre-Tax

($ millions)

3Q 10

2Q 10

3Q 09

2Q 10

3Q 09

(1) Net servicing

316

$

307

$

213

$

9

$

103

$

(2) Gain on legacy asset sales

82

95

(2)

(13)

84

(3) Gain on core asset sales

216

102

212

114

4

(4) Ally Bank provision for loan losses

(26)

(87)

(272)

61

246

(5) Legacy provision for loan losses

4

(5)

(58)

8

62

(6) Mortgage repurchase reserve expense

(344)

(97)

(507)

(247)

163

(7) Controllable expenses

(161)

(149)

(228)

(12)

67

Increase/(Decrease) vs.

Increase/(Decrease) vs.

32

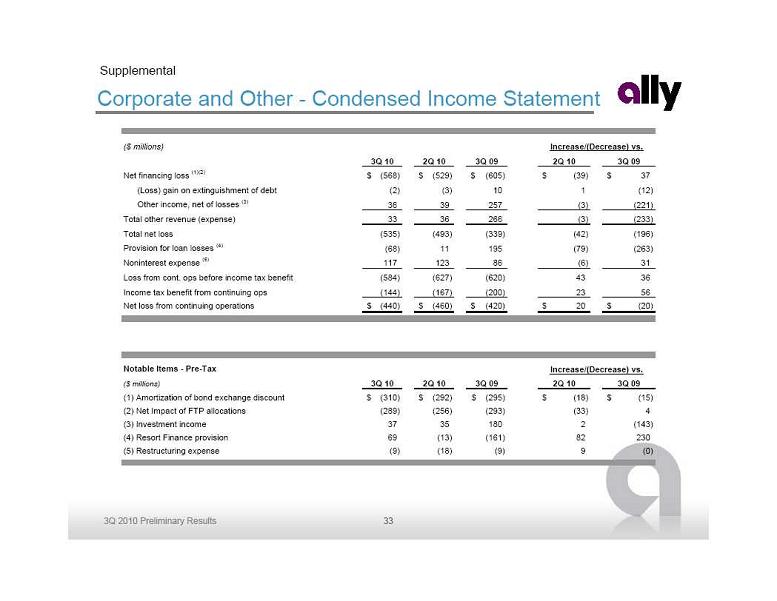

Mortgage Operations - Condensed Income Statement

Supplemental

($ millions)

3Q 10

2Q 10

3Q 09

2Q 10