Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BANC OF CALIFORNIA, INC. | d8k.htm |

First PacTrust

Bancorp, Inc.

October 2010

Exhibit 99.1 |

2

Important Disclosures

Forward-Looking Statements

These materials contain various forward-looking statements that are based on assumptions and

describe our future plans and strategies and our expectations. These forward-looking

statements are generally identified by words such as “believe,” “expect,” “intend,” “anticipate,” “estimate,” “project,” or similar words. Our

ability to predict results or the actual effect of future plans or strategies is uncertain. Factors

which could cause actual results to differ materially from those estimated include, but are not

limited to the possibility that the potential private placement transaction referred to herein will not be completed within the time frame

anticipated or at all; continuation or worsening of current recessionary conditions, as well as

continued turmoil in the financial markets; our ability to implement our acquisition strategy

and the applicability of the FDIC Statement of Policy on Qualifications for Failed Bank Acquisitions to us; the credit risks of lending activities,

which may be affected by further deterioration in the real estate market, may lead to decreased loan

delinquencies, losses and nonperforming assets in our loan portfolios, and may result in our

allowance for loan losses not being adequate to cover actual losses, and require us to materially increase our reserves; changes

in general economic conditions, either nationally or in our market area; changes in the levels of

general interest rates, and the relative differences between short- and long-term

interest rates, deposit interest rates, our net interest margin and funding sources; fluctuations in the demand for loans, the number of unsold homes

and other properties and fluctuations in commercial and residential real estate values in our market

area; results of examinations of us by the Office of Thrift Supervision or by other regulatory

authorities, including our compliance with our Memorandum of Understanding and the possibility that any such regulatory

authority may, among other things, require us to increase our allowance for loan losses,

write-down asset values, increase our capital levels, or affect our ability to borrow funds

or maintain or increase deposits, which could adversely affect our liquidity and earnings; legislative or regulatory changes that adversely affect our

business, including changes in the interpretation of regulatory capital or other rules; our ability to

control operating costs and expenses; our ability to successfully integrate any assets,

liabilities, customers, systems, and management personnel we have acquired or may in the future acquire into our operations and our ability

to realize related revenue synergies and cost savings within expected time frames and any goodwill

charges related thereto; staffing fluctuations in response to product demand or the

implementation of corporate strategies that affect our work force and potential associated charges; errors in our estimates in determining

fair value of certain of our assets, which may result in significant declines in valuation; the

network and computer systems on which we depend could fail or experience a security breach; our

ability to retain key members of our senior management team; costs and effects of litigation, including settlements and

judgments; increased competitive pressures among financial services companies; changes in consumer

spending, borrowing and savings habits; adverse changes in the securities markets; earthquake,

fire or other natural disasters affecting the condition of real estate collateral; the availability of resources to address changes

in laws, rules, or regulations or to respond to regulatory actions; inability of key third-party

providers to perform their obligations to us; changes in accounting policies and practices, as

may be adopted by the financial institution regulatory agencies or the Financial Accounting Standards Board or their application to our

business or final audit adjustments, including additional guidance and interpretation on accounting

issues and details of the implementation of new accounting methods; war or terrorist

activities; other economic, competitive, governmental, regulatory, and technological factors affecting our operations, pricing, products,

and services and the other risks described as detailed in the Company’s reports filed with the

SEC, including our Annual Report on Form 10-K for the fiscal year ended December 31, 2009

and subsequently filed Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. |

3

Important Disclosures (Cont’d)

Financial Projections

This presentation contains projections of financial performance. Such projections are, by nature,

based on anticipating future events that cannot be predicted with accuracy and there is no

assurance that the projections can or will be achieved. Such projections are also based on certain assumptions made at the time such

projections were formulated and may not necessarily be updated for any subsequent developments.

Actual results will be dependent upon a number of factors that are beyond the control of the

Company and the Bank. Accordingly, the projections should not be viewed as an estimate, prediction or representation as to

future results and should not be relied on in making an investment decision. Actual results may differ

substantially from the projections. The information contained in this document is for

information purposes only and based solely on information and data supplied by the Company and other third party sources. While the

information contained in this document is based on sources believed to be reliable, neither the

Company nor its representatives have independently verified the facts, assumptions, and

estimates contained in this document. Accordingly, no representation or warranty, expressed or implied, is made to, and no reliance

should be placed on, the fairness, accuracy, completeness or correctness of the information and

opinions contained in this document. Investment results may vary substantially over time and

from period to period based on many factors and an investor could lose its entire investment. Past performance is not necessarily

indicative of future performance. Prospective investors should consult with their financial, legal,

and tax advisors before making any investment decisions. Additional Information

The potential private placement transaction referred to herein will involve the sale of securities of

the Company in a transaction that will not be registered under the Securities Act of 1933, as

amended, and will be subject to the resale restrictions thereunder. Such securities may not be offered or sold absent registration or an

applicable exemption from registration. This document does not constitute an offer to sell or a

solicitation of an offer to buy any securities, nor shall there be any sale of securities in any

state or jurisdiction in which such an offer, solicitation or sale would be unlawful prior to registration or qualification under the securities

laws of any such state or jurisdiction.

As used herein, the “Company,” “we,” “us” and “our” refer to

First PacTrust Bancorp, Inc. and the “Bank” refers to Pacific Trust Bank, a wholly owned subsidiary of

the Company. |

4

Ranking for Largest Community Bank Franchises in San Diego by Assets *

NAME (CHARTER TYPE)

12/31/2007

12/31/2008

12/31/2009

MOST

RECENT

California Bank & Trust (STATE)

1

1

1

1

Pacific Western Bank (STATE)

2

2

2

2

Imperial Capital Bank (STATE)

3

3

FAIL

FAIL

La Jolla Bank (FEDERAL)

4

4

3

FAIL

San Diego National Bank (FEDERAL)

5

5

FAIL

FAIL

Bank of Internet USA (FEDERAL)

6

6

4

3

PACIFIC TRUST BANK (FEDERAL)

7

7

6

5

Torrey Pines Bank (STATE)

8

8

5

4

1st Pacific Bank of California (STATE)

9

10

9

FAIL

Metro United Bank (STATE)

10

9

7

6

Regents Bank (FEDERAL)

11

12

10

7

Silvergate

Bank

(STATE)

12

11

8

8

Balboa Thrift and Loan Association (STATE)

13

13

12

11

Discovery Bank (STATE)

14

16

NA

NA

Security Business Bank of S.D. (STATE)

15

14

13

12

Home Bank of California (STATE)

16

17

14

15

California Community Bank (STATE)

17

15

11

10

Neighborhood National Bank (FEDERAL)

18

18

16

14

San Diego Trust Bank (STATE)

19

NA

15

13

Rancho Santa Fe Thrift & Loan (STATE)

20

20

NA

NA

Borrego Springs Bank (FEDERAL)

NA

19

20

16

San Diego Private Bank (STATE)

NA

NA

17

17

First Business Bank (FEDERAL)

NA

NA

18

18

Seacoast Commerce Bank (STATE)

NA

NA

19

19

Coronado First Bank (STATE)

NA

NA

NA

20

Deep Community Roots

Chartered by the U.S. Office of Thrift Supervision

Insured by the FDIC

Founded in 1941 with 69 years of continuous operations

(public since 2002)

Former credit union for Rohr, Inc.

99 employees and 18,000 depository relationships

Valuable Branch Network

9 banking locations, including 6 full service branches

Member of CU Service Center Network with over 4,100

shared branch locations throughout the U.S.

1.12% cost of deposits as of 9/30/10 with no brokered funds

Disciplined Credit Team

Average FICO score at origination of 739 (as of 12/31/09)

Average LTV at origination of 58% (as of 12/31/09)

No construction or subprime loans and limited land loans

Attractive Assets

84% of loan portfolio is 1-4 unit residential mortgages

Mortgages focused in beach cities throughout the San Diego

area (i.e., La Jolla, Coronado, Rancho Santa Fe, Del Mar

and Carlsbad)

Approximately 1,000 residential mortgage loans (Average

size $600,000) (as of 12/31/09)

6% home price appreciation in San Diego since 12/31/09

Positioned for Growth

Balance sheet is strong with capacity to originate meaningful

volumes of commercial real estate and small business (C&I)

loans

Growth plans are complimentary with regulatory goals

San Diego’s Largest Federally Chartered Community Bank

*Source: FDIC Website as of 6/30/2010. |

5

First PacTrust

Announced Transformational Private

Placement To Pursue Growth

Enhanced management team better enables the

Bank to pursue a robust commercial banking

strategy, expanding into more profitable loan

categories (i.e. CRE, C&I) and business lines (i.e.

small business banking, servicing, asset

management, secondary portfolio acquisitions)

Gregory Mitchell, former CEO of California National

Bank, to assume role as CEO of First PacTrust

following the closing of the private placement (Q4

2010)

Bank planning to hire following roles/positions:

chief retail officer, chief administrative officer, loan

and core deposit production personnel, a

commercial lending team, a risk officer, and capital

markets personnel

Through the infusion of $60 million at

$11.00 per share and the introduction of

additional management support, Pacific

Trust Bank should strengthen its market

position in San Diego and expand its

footprint throughout Southern California

Failures of San Diego National Bank,

Imperial Capital Bank, 1

Pacific Bank of

California and La Jolla Bank have

provided a significant void in the San

Diego community banking market while

failures and distress in Orange and Los

Angeles counties provide additional

growth opportunities

Distress and lack of core profitability

experienced by subscale community

banks in Southern California presents

attractive acquisition candidates

Proceeds of the recapitalization expected to be

used to repay TARP and pursue growth in the

Bank’s target markets

Strong regulatory capital ratios along with

enhanced management team better position the

Bank for robust organic growth and other strategic

opportunities, including acquisitions

Enhance Management Team

Growth Capital

The First PacTrust

Opportunity

Private Placement Overview

Offering Size:

$60 million

Price:

$11.00 / share (58.5% of current tangible book)

(78.5% of pro forma tangible book)

Lead Investors:

TCW Shared Opportunity Fund V, COR Capital LLC

Anticipated Completion:

4th

Quarter 2010

st |

6

First PacTrust

Has A Three-Part Growth Strategy

Strengthen management and

commence growth strategy within

the Bank’s primary footprint

Locate and open new retail

banking locations and staff

with well known community

bankers to attract core

deposits

Enhance loan and deposit

product set

Establish high quality C&I

and community banking

relationships

Diversify portfolio and prudently

deploy capital by originating high

quality commercial real estate and

C&I loans

Very high market demand

with limited supply of

lenders in Southern

California

Strengthens balance sheet

and reduces concentration

risk

1. Organic Growth

Selectively explore traditional

acquisitions

Focus on banks with the

following characteristics

Privately held or limited

trading liquidity

Subscale (< $1.5 billion

in assets)

Broken business

models

Strategic benefits to franchise

development

Markets

Products

People

2. Traditional M&A

Pursue strategic transactions

with FDIC assistance

FDIC will typically provide

downside protection for

approximately 80% of certain

loan losses

Right to assume or rescind all

contracts of the failed bank (i.e.

leases)

Focus on smaller banks (i.e.,

$500 million in assets and less)

in attractive markets

FDIC’s troubled list is currently

over 800 banks

3. FDIC-Assisted M&A |

7

•

$14.01 Tangible Common Equity per share

•

$135.9 million

Tangible

Common

Equity

(1)

•

20.29%

Tier

1

Risk-Based

(est)

(3)

•

21.54%

Total

Risk-Based

(est)

(3)

•

$107 million market cap ($11.00 stock price)

•

Growth targets emphasizing diversification into CRE

and C&I loans

•

Ability to secure performing loan portfolios from

distressed sellers

•

Pacific Trust Bank plans to expand its management

team to include a group led by Gregory Mitchell, a

former regulator, investment banker and most recently

CEO of California National Bank

•

4.5% target net interest margin from improving mix of

loans and deposits

•

Target after-tax 15% ROE and 1.5% ROA

•

Increase DDA and other core accounts through de

novo branching and hiring of skilled community

bankers focused on building out commercial banking

strategy

•

Enhance liquidity

ASSETS

CAPITAL

MANAGEMENT

•

$18.79

Tangible

Common

Equity

per

share

(1)

•

$78.4 million

Tangible

Common

Equity

(1)

•

12.90% Tier 1 Risk-Based

•

14.15% Total Risk-Based

•

$50 million market cap

•

$704.7 million loan portfolio

•

2.49% Reserves / Loans

•

2.9% NPL / Assets

(2)

•

84% of loans 1-4 unit residential mortgages

•

Since its formation in 1941 (and its 2002

conversion to a publicly traded thrift), Pacific Trust

Bank has maintained a solid and disciplined

approach to lending

•

Net interest margin 4.13% for the quarter ended

9/30/2010

•

2010 YTD core (pre-tax, pre-provision) earnings

estimate $15.8 million; est. core earnings ROE

19.8%, est. core earnings ROA 1.83%

(1)

•

1.8% dividend yield at price in private placement

•

$685 million retail deposits

•

No brokered deposits

•

1.12% cost of deposits

•

$111 million in cash and securities

As of 9/30/10

Pro Forma

Pacific Trust Bank’s CAMEL Summary

EARNINGS

LIQUIDITY

(1)

See “Non-GAAP Financial Information.” Core earnings projection per 8-K released on

July 27, 2010. (2)

Excluding TDRs.

(3)

Pro forma capital ratios shown above represent levels if all proceeds are downstreamed to the Bank;

however, current plans include $11.0 million in proceeds to be downstreamed to the Bank upon

close of the transaction with the remaining proceeds to stay at the holding company. The additional

proceeds will be downstreamed to the Bank as necessary. |

8

Third Quarter Highlights

Company reported net income of $3.0 million and

EPS of $0.66

Net interest margin increased to 4.13%, up from

3.45% in the second quarter

Cost of deposits down to 1.12%

Loan loss provision for the quarter decreased to

$781k from $5.6 million the previous quarter

Core earnings of $12.9 million YTD

Efficiency ratio of 44.8%

Return on average assets of 1.40%

Tangible book value per share increased to

$18.79 / share

Net REO balance decreased to $7.8 million from

$8.3 million the preceding quarter

Non-performing loans have decreased to $25.4

million from $29.3 million the preceding quarter

Reserve levels as a % of loans increased to

2.49% despite significant decrease in the loan

loss provision

Income

Assets |

9

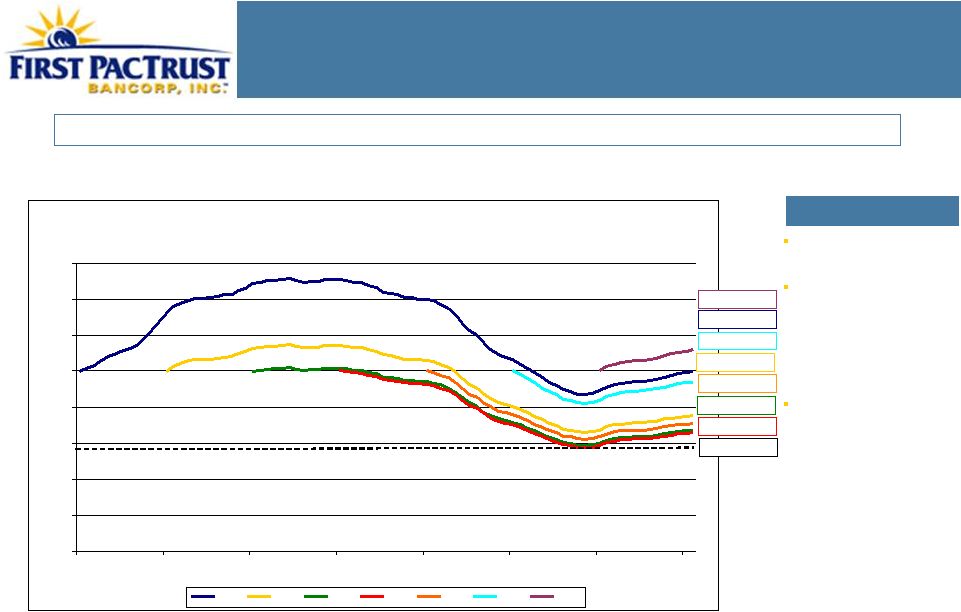

Bank’s Primary Market Area Recovering

(1)

Source: S&P Case Shiller

Home Price Index for San Diego County.

First

PacTrust’s

primary

market

area

of

San

Diego

has

exhibited

strong

recovery

rates

in

home

prices.

Leading Southern

California recovery

3

highest home

price increase (14%)

since 2009 as

measured by S&P

Case Shiller

Home

Price index

Stable economy with

vast and growing

military presence and

robust tech industry

San Diego Market

San Diego County Home Prices

(1)

0%

20%

40%

60%

80%

100%

120%

140%

160%

2003

2004

2005

2006

2007

2008

2009

2010

2003

2004

2005

2006

2007

2008

2009

58% Avg

LTV

2009: 112%

2003: 100%

2008: 94%

2004: 76%

2007: 71%

2005: 67%

2006: 66%

rd |

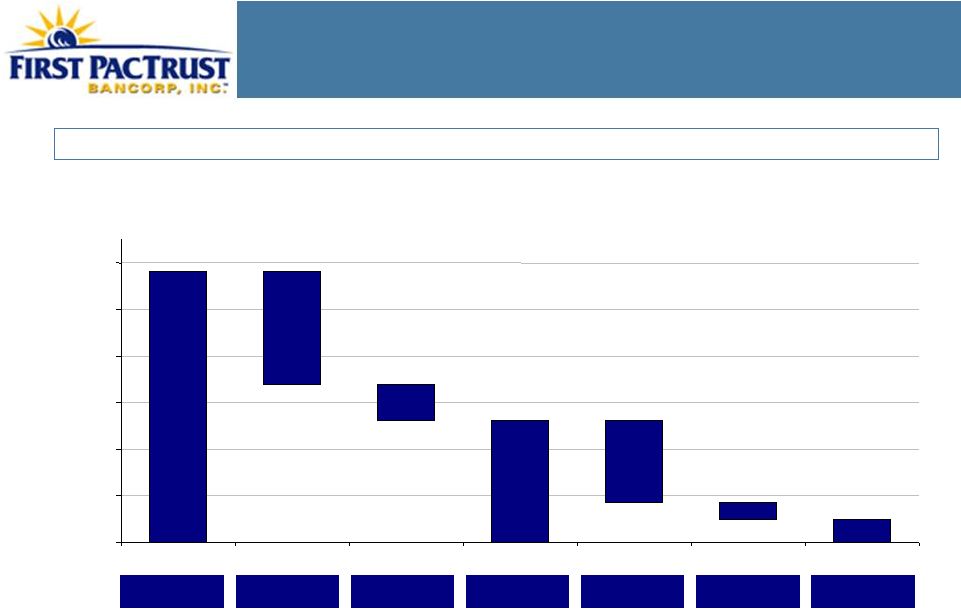

10

Current Stock Price Relative to Peers

FPTB’s

offering price is at a significant discount to peers at 3.0x core earnings and 59%

of current tangible book value.

(1) Source: SNL. Core earnings defined as pre-tax,

pre-provision earnings and 2010 projection is per 8-k released on July 27, 2010. Stock prices as of 10/22/10.

Market

Valuation

of

Comparable

Banks

(1)

Dividend Paying Banks, < $2.5b in Assets, Raised > $30m since 1/2009

Company Name

Ticker

State

Stock

Price

TBV

Price /

TBV

2010E Core

Earn's ($mm)

Core P/E

Tower Bancorp, Inc.

TOBC

PA

22.19

$21.06

105%

$19.2

8.2x

Orrstown Financial Services, Inc.

ORRF

PA

25.00

17.20

145%

32.7

6.1

Univest Corporation of Pennsylvania

UVSP

PA

19.09

12.99

147%

NA

NA

First of Long Island Corporation

FLIC

NY

25.13

17.61

143%

26.2

8.3

CNB Financial Corporation

CCNE

PA

13.77

8.75

157%

19.9

8.4

Lakeland Financial Corporation

LKFN

IN

19.12

14.99

128%

61.3

5.0

Sterling Bancorp

STL

NY

9.26

6.17

150%

41.4

6.0

MidSouth Bancorp, Inc.

MSL

LA

13.61

11.00

124%

11.1

11.9

Bank of Commerce Holdings

BOCH

CA

3.81

4.71

81%

18.3

3.5

Pacific Continental Corporation

PCBK

OR

8.80

8.15

108%

23.2

7.0

Washington Banking Company

WBCO

WA

13.74

8.98

153%

29.1

7.2

CenterState Banks, Inc.

CSFL

FL

8.60

7.64

113%

18.4

14.0

Cardinal Financial Corporation

CFNL

VA

10.18

7.33

139%

41.2

7.1

Average

130%

7.7x

Median

139%

7.2

First Pacific Trust (Offering Price)

Status Quo TBV

FPTB

CA

$11.00

$18.79

59%

$15.8

3.0x

Pro Forma TBV

11.00

14.01

79% |

11

Transaction Improves Bank’s Capital Markets Exposure

PRE RECAPITALIZATION

1. Limited Information to Investor Community

No analyst coverage

No earnings conference calls

2. Limited Trading Liquidity

Limited trading liquidity which reduces the Bank’s

appeal to larger investors

Stock trades at a liquidity discount

Limited capital markets activities

3. Limited Growth Capital and Capabilities

With its historical capital levels and strategic focus,

the Bank has not been perceived as a high growth

institution or market consolidator

Absence of robust commercial real estate or C&I

lending capabilities has created market perception of

Bank as an SFR portfolio lender, unable to take

advantage of lending opportunities

First PacTrust

is addressing each of these issues and seeks to narrow its valuation gap from its

peers evidenced by the enhanced trading volume and information to the

investor community to-date. POST RECAPITALIZATION

1. Enhanced Information to Investor Community

Pursue sell-side analyst coverage and increase

investor communications. For instance, analyst

research coverage initiated by Baird & Co. (OW, $15

PT)

2. Enhanced Trading Liquidity

Recap will more than double the Bank’s share count

and increase liquidity. For instance, month-to-date

average daily volume is over 70,000 shares

compared to 5,900 shares traded YTD preceding

announcement of transaction

3. Enhanced Growth Capital and Capabilities

With an over-capitalized balance sheet and an

enhanced management team, the Bank is in a better

position to take advantage of market opportunities

It is expected that the new management personnel

will bring significant CRE and C&I lending and risk

management capabilities |

Appendix

12 |

Franchise Map and Branches

Chula Vista Main Branch

Chula Vista Admin Center

El Cajon Branch

Balboa Branch

Rancho Bernardo Branch

Temecula Branch

Riverside Branch

Chula Vista

Riverside

Mini Branches

13 |

Pacific Trust Bank Loan Composition

Pacific Trust Bank’s loan portfolio consists predominantly of 1-4 family

loans making up 84% of the Bank’s gross loans.

Loan Locations

Loan Breakdown as of 9/30/10

Construction

0.0%

Consumer

1.6%

C&I

0.1%

1-4 Family

83.7%

Multi Family

4.8%

Commercial RE

7.4%

Land

2.5%

14 |

15

Strong Capital Position

First

PacTrust’s

capital

ratios

exceed

“well-capitalized”

levels

and

will

be

further

enhanced

due

to

the

private placement.

Regulatory Ratios

5.00%

6.00%

10.00%

9.24%

9.80%

12.90%

14.15%

14.59%

20.29%

21.54%

15.10%

0.0%

2.5%

5.0%

7.5%

10.0%

12.5%

15.0%

17.5%

20.0%

22.5%

25.0%

Tier 1 Leverage Ratio

Tier 1 Risk-Based Capital

Total Risk-Based Captial

TCE Ratio

Well Capitalized Min

Status Quo

Pro Forma

Note: Ratios as of 9/30/10. Pro forma capital ratios shown above represent levels if all

proceeds are downstreamed to the Bank; however, current plans include $11.0 million in

proceeds to be downstreamed to the Bank upon close of the transaction with remaining proceeds to stay

at the holding company. The additional proceeds will be downstreamed to the Bank as

necessary. |

16

Non-Performing Asset Overview

(1)

Non-performing Assets (NPA) = Non-performing Loans (NPLs) + OREOs.

(2)

Net NPL Exposure is NPLs

net of loan loss reserves and tax adjustment.

Of the

$58.1

million

in

NPAs,

nearly

43%

are

TDRs

and

the

$7.8

million

in

REOs

consist

of

6

properties.

(1)

Non-Performing Asset Analysis

Current Non-

Non-

Loan Loss

Tax

Net NPL

Perf Assets

TDRs

OREOs

Perf Loans

Reserves

Adjustment

Exposure

(2)

$5.0m

($3.6m)

($17.6m)

(2.01%)

$25.4m

3.34%

($7.8m)

(0.94%)

($24.9m)

(2.75%)

$58.1m

7.02%

$0.0

$10.0

$20.0

$30.0

$40.0

$50.0

$60.0 |

17

Non-Performing Loans (NPLs)

Pacific Trust Bank has 37 credits that

are currently non-performing for a total

balance of $25.4 million

Pacific Trust Bank completes an

impairment analysis on all non-

performing loans and establishes

reserves or completes charge-offs to

reduce the net carrying value of each

asset to no more than 90% of the most

recent value

Non-Performing Loans (NPLs)

Loan Type

# of

Loans

Book Value

Average Loan

Size

1-4 Family Subtotal

25

15,536,740

621,470

Multi-Family Subtotal

6

1,976,639

329,440

CRE Subtotal

1

1,392,107

1,392,107

C&I Subtotal

-

-

-

Land Subtotal

3

6,461,700

2,153,900

Other Subtotal

2

6,364

3,182

Total

37

25,373,550

685,772

Note: Troubled debt restructurings not included, however, see next slide for

breakdown. |

Troubled Debt Restructurings (TDRs)

Pacific Trust Bank has completed

troubled debt restructurings (TDRs)

for 28 properties valued at $24.9

million

Most

TDRs

are

performing

as

agreed, however, they must do so

for 6-12 consecutive months in

order to be removed from the NPA

category

All

TDRs

have

been

recently

appraised with net loan balance

(net of specific reserves or charge-

offs) of no more than 90% of

appraised value

Non-Performing Loans (NPLs)

Loan Type

# of

Loans

Book Value

Average Loan

Size

1-4 Family Subtotal

20

10,309,914

515,496

Multi-Family Subtotal

2

8,501,677

4,250,839

CRE Subtotal

-

-

-

C&I Subtotal

-

-

-

Land Subtotal

3

5,948,400

1,982,800

Other Subtotal

3

150,256

50,086

Total

28

24,910,247

889,652

18 |

OREOs

Pacific Trust Bank holds 6 OREO assets with a net value

of $7.8 million

5 REO assets are for SFR (all have been appraised in

2010)

4 SFR are located in San Diego and 1 is located in

Rancho Santa Fe

2 SFR are currently in escrow to be sold, an

another one is leased through May 2011

1 REO asset is a construction loan

Asset has been charged-off / reserved to a level

equal to 36% of the bank’s initial loan amount

All OREO is carried at

levels no more than 90% of

the most recent appraised

value.

19 |

20

Securities Overview

Investment Portfolio @ 09/30/2010

Lowest

Maturity

Est. Avg

Original

Coupon

Par/Principal

Purchase

Book

Current

CUSIP #

Investment

Rating

Date

Life

Face Value

Rate

Value

Price

Yield

Book Value

Pacific Trust Bank Security Portfolio (Bank)

Government/Agency Securities:

3128X7MN1

FHLMC Note

AAA

05/05/2011

0.6 Years

5,000,000

3.500%

5,000,000

104.2180

1.372%

5,062,747

Total Government/Agency Notes

5,000,000

3.500%

5,000,000

1.372%

5,062,747

Mortgage-Backed Securities:

22944BDK1

CSMC 2007-5 7A2

BBB

10/25/2024

3.5 Years

2,300,000

5.000%

1,223,668

97.0000

5.943%

1,186,958

02640CAE5

AGFMT 2009-1 A5

AA

09/25/2048

2.8 Years

5,000,000

5.750%

5,000,000

102.0000

5.001%

5,094,478

76110HTX7

RALI 2004-QS7 A3

AAA

05/25/2034

2.7 Years

2,000,000

5.500%

1,152,685

100.6250

5.208%

1,159,322

05948KCR8

BOAA 2003-5 2A1

A

07/25/2018

3.0 Years

3,800,000

5.000%

1,027,453

100.6250

4.730%

1,033,491

12667FU45

CWALT 2005-J1 4A1

B+

08/25/2017

2.2 Years

20,000,000

6.000%

2,364,034

100.9063

5.474%

2,384,827

74958EAA4

RFMSI 2006-S12 1A1

B+

12/25/2021

2.8 Years

5,160,000

5.500%

1,483,021

102.1563

4.093%

1,514,337

12643CCA7

CSMC 2010-1R 17A1

AAA

06/27/2036

0.7 Years

3,758,000

4.750%

2,749,287

101.2500

1.928%

2,767,931

2254W0PE9

CSFB 2005-11 8A1

B

12/25/2035

1.4 Years

3,000,000

5.250%

1,463,863

97.5000

6.322%

1,432,647

12643CGA3

CSMC 2010-1R 49A1

AAA

07/27/2036

1.2 Years

2,559,000

4.750%

2,118,160

101.3750

2.508%

2,136,766

46633PAJ1

JPMRR 2009-7 5A1

AAA

02/27/2037

2.0 Years

3,335,000

6.000%

2,652,886

98.1406

6.547%

2,607,553

74928QAT3

RBSSP 2009-9 8A4

AAA

10/26/2037

2.7 Years

1,296,444

6.000%

1,115,909

95.1875

7.812%

1,066,740

12642JCG0

CSMC 2009-11R 3A1

AAA

10/26/2037

2.6 Years

4,990,000

6.500%

3,962,975

96.9375

7.778%

3,848,657

92922F4A3

WAMU 2005-AR14 1A1

BB-

12/25/2035

0.7 Years

4,050,000

4.771%

977,351

81.5000

13.401%

853,451

07384YMB9

BSABS 2003-AC5 A2

AAA

10/25/2033

4.8 Years

11,460,000

5.000%

2,522,618

83.2500

8.382%

2,114,770

05955EAK9

BAFC 2009-R4A 2A4

AAA

07/26/2035

1.4 Years

2,910,438

5.250%

1,342,058

87.5000

9.757%

1,214,191

74928FAD2

RBSSP 2009-3 1A4

AAA

11/26/2035

1.2 Years

3,000,000

5.500%

1,607,486

86.7500

9.482%

1,434,188

74928EAC7

RBSSP 2009-2 2A1

AAA

05/26/2036

1.4 Years

5,000,000

5.500%

3,133,116

89.2500

11.453%

2,822,240

12667GQS5

CWALT 2005-20CB 4A1

B-

07/25/2020

3.3 Years

12,000,000

5.250%

4,432,339

81.5000

12.044%

3,670,692

743873BK6

PFMLT 2005-2 1A1A

BB-

10/25/2035

6.3 Years

9,000,000

2.820%

2,347,782

78.7500

10.142%

1,851,873

74928DAG0

RBSSP 2009-1 4A1

AAA

10/26/2035

1.1 Years

2,500,000

5.500%

1,218,327

90.5000

10.683%

1,135,481

12669D2Z0

CWHL 2003-HYB2 2A1

AAA

07/19/2033

2.0 Years

20,000,000

3.964%

1,664,899

81.0000

10.535%

1,350,411

05954XAJ1

BAFC 2008-R3 3A4

AAA

01/25/2037

2.1 Years

6,000,000

6.000%

4,309,242

87.8125

10.455%

3,864,017

32051GFV2

FHAMS 2005-FA1 2A1

B+

02/25/2020

3.5 Years

22,376,000

5.000%

8,355,534

81.8750

11.212%

6,989,137

863576CE2

SASC 2005-6 4A1

B

05/25/2035

3.6 Years

6,595,000

5.000%

2,514,862

69.5000

13.633%

1,761,574

Total Non-Agency CMOs/REMICs

162,089,882

5.296%

60,739,555

8.262%

55,295,731

38374VQ77

GNR 2009-50 A

AAA

08/20/2036

1.2 Years

9,950,000

5.500%

6,051,177

104.5625

2.400%

6,298,346

31358LV94

FNMA REMIC 1992-30 F

AAA

03/25/2022

3.4 Years

2,000,000

0.781%

3,144

99.9688

0.786%

3,144

362095HK0

GNMA 62334

AAA

07/15/2013

0.8 Years

100,000

12.000%

379

100.0000

12.000%

379

Total Agency MBS/CMO/REMICs

12,050,000

5.498%

6,054,699

2.400%

6,301,869

Total Mortgage Backed Securities

5.314%

66,794,254

7.662%

61,597,600

Total Negotiable Securities

5.188%

71,794,254

7.185%

66,660,347

First Pactrust Bancorp Securities Portfolio (Holding Company)

Re-REMIC Accural Tranches:

05955EAJ2

BAFC 2009-R4 2A3

NR

07/26/2035

3.0 Years

359,718

5.250%

390,812

0.5000

0.000%

0

74928FAC4

RBSSP 2009-3 1A3

NR

11/26/2035

3.3 Years

409,090

5.500%

444,187

0.5000

0.000%

0

74928EAD5

RBSSP 2009-2 2A2

NR

05/26/2036

3.7 Years

1,896,551

5.500%

2,077,977

0.5000

0.000%

0

74928DAH8

RBSSP 2009-1 4A2

NR

10/26/2035

2.7 Years

277,777

5.500%

305,768

0.5000

0.000%

0

05954XAN2

BFAC 2008-R3 3A3

NR

01/25/2037

10.4 Years

3,230,769

6.000%

3,605,405

0.5000

0.000%

0

Total Re-REMIC Z Tranches

6,173,905

5.750%

6,824,148

0.000%

0

Total Mortgage Backed Securities

5.750%

6,824,148

0.000%

0

Total Negotiable Securities

5.750%

6,824,148

0.000%

0 |

21

Non-GAAP Financial Information

This presentation contains certain financial information determined by methods

other than in accordance with accounting principles generally accepted in

the United States (“GAAP”). These non-GAAP financial measures include tangible

common equity, tangible common equity per share and core (pre-tax,

pre-provision) earnings. Tangible common equity and tangible common

equity per share are calculated by excluding preferred equity from

stockholders’

equity and excluding any intangible assets (of which we currently have none) from

assets. We believe that this is consistent with the treatment by the

Office of Thrift Supervision, our regulatory agency, which excludes any

intangible assets from the calculation of risk-based capital ratios.

Accordingly, management believes that these non-GAAP financial measures

provide information to investors that is useful in understanding the basis of our risk-based capital ratios.

Core (pre-tax, pre-provision) earnings are calculated by adding provision

for loan losses to income before income taxes. Management believes that

presenting core (pre-tax, pre-provision) earnings is useful in assessing our core performance

and trends, particularly during periods of economic stress.

Reconciliations of the non-GAAP measures to the comparable GAAP measures are

provided below. The

following

table

presents

a

reconciliation

of

tangible

common

equity

to

stockholders’

equity

(dollars

in

thousands):

As of 9/30/10

Pro Forma

(1)

Stockholders’

equity:

$

98,867

$

135,869

Less: Intangible assets

0

0

Tangible equity

98,867

135,869

Less: Preferred equity

(19,123)

0

Tangible common equity

$

79,744

$

135,869

Non-GAAP Financial Information

(1)

Giving effect to estimated net proceeds from private placement of $56.15

million. Assumes net proceeds used in part to redeem TARP preferred stock. |

The

following

table

presents

a

reconciliation

of

tangible

common

equity

per

share

to

stockholders’

equity

per

share:

As of 9/30/10

Pro Forma

(1)

Stockholders’

equity per share:

$

23.29

$

14.01

Less: Effect of intangible assets

0.00

0.00

Tangible equity per share

23.29

14.01

Less: Preferred equity

(4.50)

0.00

Tangible common equity per share

$

18.79

$

14.01

Non-GAAP Financial Information (Cont.)

(1)

Giving effect to estimated net proceeds from private placement of $56.15

million. Assumes net proceeds are used in part to redeem TARP preferred stock.

22 |

The following table presents the derivation of the estimated return on equity (ROE)

utilizing the estimated 2010 core earnings and the September 30, 2010 equity

balance: 2010

projected

core

earnings

(1)

$15.765m

Equity as of September 30, 2010

$79.7m

Core Earnings ROE

19.8%

The following table presents the derivation of the estimated return on assets (ROA)

utilizing the 2010 estimated core earnings and the September 30, 2010

asset balance: 2010

projected

core

earnings

(1)

$15.765m

Assets as of September 30, 2010

$862.7m

Core Earnings ROA

1.83%

Non-GAAP Financial Information (Cont.)

(1)

Core earnings projection per 8-K released on July 27, 2010. See footnote 2 on

prior page. 23 |