Attached files

| file | filename |

|---|---|

| 8-K - ATHENAHEALTH, INC. 8-K - ATHENAHEALTH INC | a6478388.htm |

| EX-99.1 - EXHIBIT 99.1 - ATHENAHEALTH INC | a6478388-ex991.htm |

Exhibit 99.2

|

Third Quarter Fiscal Year 2010 |

|

Prepared Remarks

Jonathan Bush, President, Chairman &

Chief Executive Officer

Tim Adams, Senior Vice President, Chief

Financial Officer

About These Remarks

The following commentary is

provided by management in conjunction with athenahealth’s third quarter

fiscal year 2010 earnings press release. These remarks represent

management’s current views on the Company’s financial and operational

performance and are provided to give investors and analysts more time to

analyze and understand our performance in advance of the earnings

conference call. These prepared remarks will not be read on the

conference call. A complete reconciliation between GAAP and non-GAAP

results as well as a summary of supplemental metrics and definitions is

provided in the tables following these prepared remarks.

Earnings Conference Call Information

As previously

announced, the Company’s third quarter 2010 earnings conference call

will be held on Friday, October 22nd at 8:00 a.m. ET and will

include only brief comments followed by questions and answers. To

participate in the Company's live conference call and webcast, please

dial 800-638-5495 (617-614-3946 for international calls) using

conference code No. 49182074 or visit the Investors section of the

Company's web site at www.athenahealth.com. A replay will be available

for one week following the conference call at 888-286-8010 (617-801-6888

for international calls) using conference code No. 95235326. A webcast

replay will also be archived on the Company's website.

Safe Harbor and Forward Looking Statements

These

remarks contain forward-looking statements, which are made pursuant to

the safe harbor provisions of the Private Securities Litigation Reform

Act of 1995, including statements reflecting management’s expectations

for future financial and operational performance and operating

expenditures, expected growth, including anticipated annual growth

rates, profitability and business outlook, increased sales and marketing

expenses, increased cross-selling efforts among the Company’s service

offerings, expected client implementations, expected certification and

regulatory approvals, the benefits of the Company's current service

offerings and research and development for new service offerings, the

benefits of current and expected strategic sales and marketing

relationships, and statements found under the Company’s Reconciliation

of Non-GAAP Financial Measures section of these remarks. The

forward-looking statements in these remarks do not constitute guarantees

of future performance. These statements are neither promises nor

guarantees, and are subject to a variety of risks and uncertainties,

many of which are beyond the Company’s control, which could cause actual

results to differ materially from those contemplated in these

forward-looking statements. In particular, the risks and uncertainties

include, among other things: the Company’s fluctuating operating

results; the Company’s variable sales and implementation cycles, which

may result in fluctuations in its quarterly results; risks associated

with its expectations regarding its ability to maintain profitability;

impact of increased sales and marketing expenditures, including whether

increased expansion in revenues is attained and whether impact on

margins and profitability is longer term than expected; changes in tax

rates or exposure to additional tax liabilities; the highly competitive

industry in which the Company operates and the relative immaturity of

the market for its service offerings; and the evolving and complex

governmental and regulatory compliance environment in which the Company

and its clients operate. Existing and prospective investors are

cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date hereof. The Company

undertakes no obligation to update or revise the information contained

in these remarks, whether as a result of new information, future events

or circumstances, or otherwise. For additional disclosure regarding

these and other risks faced by the Company, see the disclosures

contained in its public filings with the Securities and Exchange

Commission, available on the Investors section of the Company’s website

at http://www.athenahealth.com and on the SEC's website at

http://www.sec.gov.

Use of Non-GAAP Financial Measures

These remarks

contain non-GAAP financial measures as defined by SEC Regulation G. The

GAAP financial measure most directly comparable to each non-GAAP

financial measure used or discussed, and a reconciliation of the

differences between each non-GAAP financial measure and the comparable

GAAP financial measure, are included following these prepared remarks or

can be found within the Company’s third quarter 2010 earnings press

release on the Investors section of the Company’s web site at

http://www.athenahealth.com.

Opening Remarks

Athenahealth posted strong financial

results during the third quarter and expanded our industry leadership

position as a unique cloud-based service to medical groups. Growth in

our physician base was strong as existing clients expanded their

organizations and new clients joined the network. Growth within our

existing client base was influenced in part by the recent wave of

consolidation activity across medical groups. While our affiliation with

enterprise clients enables us to serve large employed and affiliated

physician communities and benefit from their expansion, the majority of

physicians in the U.S. (approximately 400,000) remain independent.1

We believe that our unique ability to rapidly onboard and service

physicians, no matter their employment status, will serve us well no

matter how the current consolidation trend plays out over time.

Looking ahead, maintaining rapid growth remains vitally important for athenahealth as we continue our journey from best biller in the cloud to the most trusted business service to medical groups across billing, medical records, patient communications, and soon, community health information management. We must address strong demand for new services and consolidation trends among medical groups and health systems. We must build and manage a diverse portfolio of sales channels while at the same time, develop unique reimbursement opportunities for our clients like the athenahealth-Humana Medical Home EHR Rewards Program. We must gain more awareness as a resource to members of a health care supply chain under unprecedented pressure to perform.

In the strategic waterfall model we have adhered to since our founding, investments in stability, performance, satisfaction and profitability have always come first:

Strategic Waterfall (presented at 2nd Annual Investor Summit on December 3, 2009)

Stability Leadership, culture, environment Performance Cash with us v. without us Satisfaction “Client listening”, issue resolution Profitability Reduction of operational costs Growth Bookings, client base expansion

This discipline has created an organization that engages employees, delivers high-performing services, retains clients, and expands scalability. Without these pillars in place, any growth in revenue and profit would be short-lived. This same investment hierarchy applies within the growth segment of the waterfall. Specifically, we have spent the last three years since Rob Cosinuke’s arrival as Chief Marketing Officer building a sophisticated, scalable growth organization. This work has consumed a meaningful percentage of our growth budget each year and was a prerequisite to sustainable expansion of our sales and marketing capability. Therefore, as we become a larger company and our overall growth budget expands, we expect that a greater proportion of that budget will be allocated to pure sales and in-market expense. This bodes well for our ability to sustain growth and achieve our vision of an information infrastructure that makes health care work as it should.

_____________________________________

1 2010 SK&A survey

data

Results Overview

athenahealth’s top line results for

the third quarter of fiscal year 2010 reflect strong annual revenue

growth. This revenue growth was primarily driven by client base

expansion and as discussed within our Q2 2010 prepared remarks, includes

the recognition of approximately $1.0 million in revenue associated with

the June Medicare claims hold that shifted revenue out of Q2 2010.

- Total revenue of $63.1 million, representing 33% growth over $47.4 million in Q3 2009

Our bottom line results for Q3, consistent with our growth strategy, demonstrate strong sales and marketing investments and a focus on operating leverage:

- GAAP direct operating expense of $24.5 million, an increase of 23% over $19.9 million in Q3 2009

- Non-GAAP Adjusted Gross Margin of 62.8%, up nearly four points from 58.9% in Q3 2009

- GAAP sales and marketing expense of $13.2 million or 21.0% of total revenue, an increase of 48% over $9.0 million or 18.9% of total revenue in Q3 2009

- GAAP general and administrative expense of $10.4 million or 16.5% of total revenue, an increase of just 7% over $9.7 million or 20.5% of total revenue in Q3 2009

- Non-GAAP Adjusted EBITDA of $14.6 million or 23.0% of total revenue, an increase of 85% over $7.9 million or 16.6% of total revenue in Q3 2009

- Non-GAAP Adjusted Net Income of $6.4 million or $0.18 per diluted share, an increase of approximately 100% over $3.2 million or $0.09 per diluted share in Q3 2009

We believe that the Company’s underlying drivers of long-term success remain strong:

- Employee engagement remains high at 4.0 out of 5.0, flat with 4.0 in Q3 2009

- Client satisfaction remains strong at 85.7%, down slightly from 86.4% in Q3 2009

- Average Client Days in Accounts Receivable (DAR) was 38.8 days, an improvement of 1% or 0.5 days from 39.3 days in Q3 2009

athenahealth’s client base continues to expand while the adoption of new services grows rapidly. At September 30, 2010:

- 63% of all new athenaCollector® deals included athenaClinicals® during Q3 2010, up from 31% in Q3 2009

- 19% of all new athenaCollector deals included athenaClinicals and athenaCommunicatorSM during Q3 2010

- 124 new athenaCollector client accounts added in Q3 2010 for a total of 1,877, up 25% from 1,507 in Q3 2009

- 1,437 net new active physicians using athenaCollector for a total of 18,573, up 25% from 14,835 in Q3 2009

- 1,535 net new active providers using athenaCollector for a total of 26,317, up 19% from 22,100 in Q3 2009

- 444 net new active physicians using athenaClinicals for a total of 1,992, up 155% from 780 in Q3 2009

- 562 net new active providers using athenaClinicals for a total of 2,818, up 122% from 1,270 in Q3 2009

- 183 net new active physicians using athenaCommunicator for a total of 625

- 257 net new active providers using athenaCommunicator for a total of 946

athenaCollector network performance metrics were as follows for Q3 2010:

- $1,517,064,118 posted in total client collections, up 24% from Q3 2009

- 11,837,095 claims submitted, up 19% from Q3 2009

- 72.1% electronic remittance advice (ERA) rate, an improvement of approximately eight points from Q3 2009 and an all-time high for the Company

- 94.2% first pass resolution (FPR) rate, an improvement of nearly two points over Q3 2009 and an all-time high for the Company

Product Development Discussion

Product development at

athenahealth is organized around the mission of being the best in the

world at getting doctors paid for doing the right thing. In order to

fulfill this mission, we deliver services backed by web-native software,

proprietary knowledge and hard work.

During Q3, we continued to expand the scope of our core athenaCollector service by reconciling client bank statements to balances posted in athenaNet. Meanwhile, the rollout of Credit Card Plus (CCP) is progressing nicely. CCP is used at the point of service and provides front-desk staff with an estimate of patient self-pay balances due at a later date. Using this estimate, staff can obtain patient preauthorization to collect such balances via credit card when they are due. Enhancements like CCP and bank statement reconciliation are delivered to clients as part of our ongoing service commitment and help them to reduce administrative work and improve results.

We also achieved Level I Compliance for the new American National Standards Institute (ANSI) 5010 transaction format ahead of the December 31, 2010 Level I compliance deadline. ANSI 5010 is a prerequisite for the adoption of new International Classification of Diseases (ICD)-10 code sets, which must be adopted by October 1, 2013. Full migration to the ANSI 5010 standard is mandated by the U.S. Department of Health and Human Services by January 1, 2012. The migration to ANSI 5010 and in particular, ICD-10, will be very challenging for physician practices using software to tackle, requiring costly upgrades and more work for practice staff. This migration is further complicated by its overlap with the HITECH Act for adoption of EHR technology. However, due to our single-instance, web-based service model, athenahealth clients will not require any upgrades or pay any additional cost to achieve compliance and successfully submit claims using the new standards.

athenaClinicals continued to mature significantly during the third quarter and was among the first electronic health records (EHRs) to achieve Stage 1 Meaningful Use ONC-ATCB 2011/2012 Certification from the Certification Commission for Health Information Technology (CCHIT®) on September 30th. As a result of our ability to roll out rapid updates to our web-based application, all athenaClinicals clients are now using an EHR that has been certified under the latest Meaningful Use standards and at no additional charge. We do not believe that any other leading EHR provider can claim that 100% of their EHR customer base is now using a product with this certification.

In addition to updating our athenaClinicals application to comply with the latest clinical standards, a key ongoing focus for athenaClinicals product development is to design the clinical workflow in such a way that eligible providers demonstrate meaningful use and adhere to evolving clinical requirements with minimal work effort. We also continue to expand the quality management capabilities of athenaClinicals, adding more transparency through tools like the Pay-for-Performance (P4P) Dashboard that monitor fulfillment of Meaningful Use measures, in addition to other P4P programs. Our model enables account managers to closely monitor clients and update practice administrators regarding their progress fulfilling any performance criteria that impact revenue. Furthermore, our 2011 HITECH Act Guarantee Program goes a step further by promising eligible providers that go live on athenaClinicals prior to June 30, 2011 that they will receive stimulus funds for 2011 Meaningful Use.

On the go-to-market front, we introduced a stand-alone option for athenaClinicals adoption during the third quarter. This option was aimed at offering athenahealth's channel partners and enterprise clients more flexibility as they execute on their affiliated and clinical community connectivity programs. The ability to adopt athenaClinicals without athenaCollector as a prerequisite will enable practices with existing practice management system commitments to rapidly adopt a Meaningful Use-certified EHR and migrate to athenaCollector at a later date. Stand-alone athenaClinicals utilizes the same core athenaNet application code as the integrated EHR solution and, as a result, qualifies eligible providers for Meaningful Use funds.

We believe that athenaClinicals is a truly differentiated medical record service in that unlike software-based medical records, athenaClinicals takes over the processing of inbound faxes to the physician office. In addition, athenaClinicals drives enrollment in and receipt of P4P program dollars. Large and small practices alike don’t need to worry about managing paper-based and electronic transactions with payers, the government or other supply chain partners because the athenaClinicals service takes care of that. The main barriers to traditional EHR adoption are high upfront cost, diminished productivity and lengthy implementation cycles – all of which add up to a universally negative return on investment. athenahealth offers a better way. We believe that our cloud-based service approach is the only one that actually breaks down these barriers and enables doctors to make money for doing the right thing.

Turning to athenaCommunicator, product enhancements during the third quarter included the delivery of radiology imaging via the patient portal and the availability of pay-by-phone credit card functionality via live operators. Going forward, development work will include the creation of OpenTable-like self-service scheduling functionality for patients. We are extremely pleased with the early success of this service offering since its launch in March.

Finally, our athenaCommunity pilot program continues to progress. We executed the first facilitated transaction for a clean, electronic patient referral between a primary care physician and a specialist during the third quarter. While the athenaCommunity initiative remains nascent, we believe that it is the foundation of a sustainable model for true health information exchange that will disrupt the flawed software-based vertical integration model that is currently being deployed. The logic behind this flawed software model is that the only way to have a complete picture of a patient is to have every participant in that patient’s care under one roof…we are proving this logic wrong. We are also demonstrating that in addition to aggregating information from different sources, relevance matters when it comes to distributing that information - getting the right information to the appropriate audience at the right time saves both parties time and money. In every other industry, customized information is exchanged to and from disparate sources, using the Internet as a common platform via an intelligent business model like that of athenaCommunity. We believe that U.S. health care will follow suit and that the creation of a sustainable mechanism for the efficient coordination of clinical information across the health care supply chain is a necessity. We believe that athenaCommunity fulfills this need and will position athenahealth to become the nation’s best platform for care coordination in the coming years.

Revenue Discussion

Our total revenue of $63.1 million

in Q3 2010 grew by 33% or $15.7 million over Q3 2009. This revenue

growth was primarily driven by client base expansion and includes the

recognition of approximately $1.0 million in revenue associated with the

June Medicare claims hold. As discussed within our Q2 2010 prepared

remarks, approximately $30.0 million in client collections and about

$1.0 million of athenahealth’s business services revenue was shifted

from Q2 2010 and recognized during Q3 2010.

Finally, a same store analysis of claims created, a proxy for physician office utilization, indicates that physician office activity in Q3 2010 was relatively flat with Q3 2009. However, flu inoculation activity is down on a year-over-year basis, suggesting a weaker flu season this year.

Client Base Discussion

Annual growth in total revenue

continues to outpace growth in our physician base. We believe this trend

will continue as athenaClinicals and athenaCommunicator are included in

a growing portion of new deals and as adoption of these services spreads

across our existing client base.

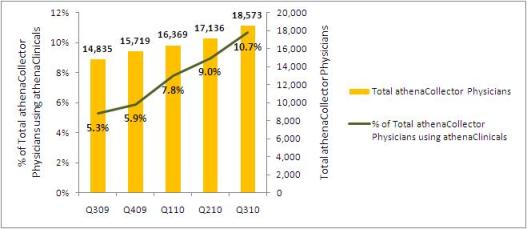

% of Total athenaCollector Physicians using athenaClinicals total athenaCollector Physicians Total AthenaCollector Physicians 0% 2% 4% 6% 8% 10% 12% 2,000 4,000 6,000 8,000 10,000 12,000 14,000 16,000 18,000 20,000 Q309 Q409 Q110 Q210 Q310 5.3% 5.9% 7.8% 9.0% 10.7% 14,835 15,719 16,369 17,136 18,573

During Q3 2010, total active physicians on athenaCollector grew by 25% year-over-year to 18,573. On a sequential basis, we added 1,437 net new active physicians to the network, up from 1,244 added in Q3 2009. Our quarterly net new physician additions may vary widely due to the number and size of larger clients that go live in a particular quarter. This quarter’s strong physician additions were impacted by expanded relationships with existing clients as well as implementations for new clients joining our network.

Turning to athenaClinicals, we continue to experience rapid growth in client adoption of this service. Total active physicians live on athenaClinicals grew by 155% year-over-year to 1,992. On a sequential basis, we added 444 net new active physicians on athenaClinicals, up from 156 added in Q3 2009. This equates to an overall adoption rate of nearly 11% of total athenaCollector physicians, up from approximately 5% in Q3 2009. In terms of new sales, during Q3 2010 63% of all new athenaCollector deals included athenaClinicals, up from 31% in Q3 2009. We expect the athenaClinicals client base to increase significantly over time due to cross-selling within our existing base and growth in the volume of combined deals.

Our athenaCommunicator client base is growing rapidly as well. Total active physicians live on athenaCommunicator rose to 625 during the quarter. On a sequential basis, we added 183 net new active physicians on athenaCommunicator. This equates to an overall adoption rate of over 3% of total athenaCollector physicians. athenaCommunicator is also being adopted by new clients at a growing rate. During Q3 2010, 19% of new athenaCollector deals included athenaCommunicator as well as athenaClinicals.

In terms of new deals, we are pleased to confirm that CVS MinuteClinic has extended its agreement with athenahealth for revenue cycle services. MinuteClinic is the largest retail health care clinic provider in the U.S. with more than 500 locations across the country. athenahealth has served MinuteClinic since 2008, and with this agreement, looks forward to supporting their growth strategy.

In addition, we are pleased to announce that Holy Cross Hospital of Taos, New Mexico will implement its owned physician group of over 40 medical providers on athenaCollector and athenaClinicals during the coming months. In addition, Holy Cross will provide financial assistance for the adoption of athenahealth’s services to its broader affiliated community of approximately 30 medical providers in an effort to better connect doctors and patients. Holy Cross is a regional care delivery organization serving northern New Mexico and faced a difficult challenge in rolling out health care technology to rural medical clinics. They selected athenahealth’s web-based service model due to our scalable, low cost approach and our ability to seamlessly unite their rural clinics on a scalable platform.

On the implementation front, we brought Vohra Wound Physicians’ network of 100 providers live on athenaCollector during Q3. athenaClinicals implementations continue to progress for Caritas Christi (500 providers), Vanguard Health Systems (250 providers) and Capella Healthcare (130 providers). Finally, implementations of all three services are in progress for CHRISTUS Health (150 providers) and Southwest Kidney Institute (50 providers).

Non-GAAP Adjusted Gross Margin Discussion

Our Non-GAAP

Adjusted Gross Margin came in at 62.8% for Q3 2010, up from 58.9% in Q3

2009. This year-over-year expansion was supported by revenue growth as

well as improvements in network performance and operating cost

efficiencies.

Sales and Marketing Expense Discussion

|

|

GAAP sales and marketing expense increased by 48% to $13.2 million or 21.0% of total revenue in Q3 2010, up from $9.0 million or 18.9% of revenue in Q3 2009. We continued to expand our sales force and executed marketing initiatives such as regional flywheel campaigns across the country. During August, we also launched a new advertising campaign featuring a giant octopus, also known as the “Beast”, to illustrate the administrative and financial challenges gripping physician practices today. Our position as a physician advocate and service partner continues to differentiate athenahealth in an industry plagued by rising costs and complexity. |

In terms of growth infrastructure, we are pleased to report that our entire sales and marketing team is now live on Salesforce CRM. This tool will enable us to execute sales and marketing campaigns with a greater level of insight, accuracy and intelligence. We will be able to better target campaigns and understand more about what is working – and what is not – in terms of our sales and marketing efforts. This level of sophistication is a big step in forming the groundwork for a best-in-class growth organization, a process that began nearly three years ago with Rob Cosinuke’s arrival as Chief Marketing Officer. With the Salesforce CRM solution as well as solid content, communications, sales support and sales operations staff now in place, more of each incremental investment dollar will be allocated to awareness and lead generation activities, the most direct drivers of growth. Congratulations to Rob and his team on building this solid foundation for our sales and marketing organization.

On the channel front, the most significant development during the third quarter – and a strategic milestone for athenahealth overall – was the formation of our partnership with Humana Inc. As new Medicare payment quartiles are phased in during the next several years, Medicare Advantage payment rates will decline. As a result, Humana, like other health plans with significant Medicare member populations, has launched a campaign to drive higher care quality for its members while lowering the cost of their care. The athenahealth-Humana Medical Home EHR Rewards Program forms one element of Humana’s strategy to accomplish this. Through this program, approximately 500 eligible primary care practices and about 20,000 physicians will have the opportunity to qualify for implementation fee subsidization and up to 20% more in reimbursement above fee-for-service levels if they adopt athenaCollector and athenaClinicals. Ordinarily, Humana requires physicians to obtain National Committee for Quality Assurance (NCQA) PPC®-PCMH™ certification in order to qualify for Medical Home incentives. However, because Humana is so confident in athenahealth’s ability to surface gaps in compliance with Humana’s quality measures throughout the clinical workflow, they are equating athenaCollector and athenaClinicals adoption with NCQA certification. We believe this partnership is the first of its kind and emphasizes the power of our web-based service model in enabling physician practices and payers alike to optimize care quality and financial and operational outcomes.

In addition, we made strong progress in building relationships with regional extensions centers (RECs) during the third quarter. The RECs that have announced interest in our services include:

- Indiana: Indiana Health Information Technology Extension Center (I-HITEC)

- Massachusetts: Massachusetts Technology Collaborative

- Nevada/Utah: HealthInsight

- Rhode Island: Rhode Island Quality Institute (RIQI)

- Vermont: Vermont Information Technology Leaders (VITL)

- Virginia: Virginia HIT

Finally, in addition to recommending athenaCollector as the preferred revenue cycle service to its members, the Medical Society of the State of New York (MSSNY) will now recommend athenahealth as a preferred vendor for EHR services. MSSNY conducted a thorough evaluation of EHR technologies to help its network of more than 30,000 licensed physicians, medical residents and medical students achieve compliance with Meaningful Use. We believe that regional partnerships such as that with MSSNY will help to expand awareness of athenahealth as a trusted business service to physician practices.

Balance Sheet and Cash Flow Highlights

Our cash, cash

equivalents and short-term investments totaled $97.6 million at

September 30, 2010 and our debt totaled $10.1 million. Operating cash

flow was $10.1 million in Q3 2010, up 6% from $9.5 million in Q3 2009.

Our capital expenditures, including capitalized software development,

were $5.1 million or 8.0% of total revenue in the third quarter.

Fiscal Year 2010 Outlook

Looking ahead, we expect that

revenue growth for the full year 2010 will be approximately 29% over

full year 2009. In terms of Q4 2010, we expect that Adjusted Gross

Margin, Adjusted EBITDA Margin and Adjusted Operating Margin should be

roughly in line with the margin levels we achieved in Q4 2009. Finally,

we continue to expect that our GAAP sales and marketing expense will be

approximately 21% of total revenue for the full year of 2010.

Closing Remarks

As 2010 draws to a close, athenahealth

is poised to enter 2011 as a stronger organization equipped to sustain

rapid growth. We look forward to providing more detailed information on

our strategic plans for 2011 and beyond during our 3rd Annual

Investor Summit on December 16, 2010.

Stock-Based Compensation Expense and Reconciliation of Non-GAAP Financial Measures

athenahealth, Inc.

STOCK-BASED COMPENSATION EXPENSE

(Unaudited,

in thousands)

Set forth below is a breakout of stock-based compensation expense for the three and nine months ended September 30, 2010 and 2009:

| (unaudited, in thousands) | Three Months Ended | Nine Months Ended | |||||||||

| September 30, | September 30, | ||||||||||

| 2010 | 2009 | 2010 | 2009 | ||||||||

| Stock-based compensation charged to: | |||||||||||

| Direct operating | $ | 601 | $ | 400 | $ | 1,721 | $ | 1,175 | |||

| Selling and marketing | 962 | 535 | 2,540 | 1,578 | |||||||

| Research and development | 524 | 255 | 1,527 | 749 | |||||||

| General and administrative | 1,674 | 933 | 4,667 | 2,613 | |||||||

| Total | $ | 3,761 | $ | 2,123 | $ | 10,455 | $ | 6,115 | |||

athenahealth, Inc.

RECONCILIATION OF NON-GAAP FINANCIAL

MEASURES

TO COMPARABLE GAAP MEASURES

(Unaudited, in

thousands, except per share amounts)

The following is a reconciliation of the non-GAAP financial measures used by the Company to describe the Company’s financial results determined in accordance with United States generally accepted accounting principles (GAAP). An explanation of these measures is also included below under the heading “Explanation of Non-GAAP Financial Measures”. While management believes that these non-GAAP financial measures provide useful supplemental information to investors regarding the underlying performance of the Company’s business operations, investors are reminded to consider these non-GAAP measures in addition to, and not as a substitute for, financial performance measures prepared in accordance with GAAP. In addition, it should be noted that these non-GAAP financial measures may be different from non-GAAP measures used by other companies, and management may utilize other measures to illustrate performance in the future. Non-GAAP measures have limitations in that they do not reflect all of the amounts associated with the Company’s results of operations as determined in accordance with GAAP.

Non-GAAP Adjusted Gross Margin

Set forth below is a

presentation of the Company’s “Non-GAAP Adjusted Gross Profit” and

“Non-GAAP Adjusted Gross Margin,” which represents Non-GAAP Adjusted

Gross Profit as a percentage of total revenue.

| (unaudited, in thousands) | Three Months Ended | Nine Months Ended | |||||||||||||

| September 30, | September 30, | ||||||||||||||

| 2010 | 2009 | 2010 | 2009 | ||||||||||||

| (As Restated) | (As Restated) | ||||||||||||||

| Total revenue | $ | 63,143 | $ | 47,405 | $ | 176,172 | $ | 134,081 | |||||||

| Direct operating expense | 24,543 | 19,942 | 72,163 | 57,900 | |||||||||||

| Total revenue less direct | |||||||||||||||

| operating expense | 38,600 | 27,463 | 104,009 | 76,181 | |||||||||||

| Add: Stock-based compensation expense | |||||||||||||||

| allocated to direct operating expense | 601 | 400 | 1,721 | 1,175 | |||||||||||

| Add: Amortization of purchased intangibles | 460 | 80 | 1,380 | 240 | |||||||||||

| Non-GAAP Adjusted Gross Profit | $ | 39,661 | $ | 27,943 | $ | 107,110 | $ | 77,596 | |||||||

| Non-GAAP Adjusted Gross Margin | 62.8 | % | 58.9 | % | 60.8 | % | 57.9 | % | |||||||

Non-GAAP Adjusted EBITDA Margin

Set forth below is a

reconciliation of the Company’s “Non-GAAP Adjusted EBITDA” and “Non-GAAP

Adjusted EBITDA Margin,” which represents Non-GAAP Adjusted EBITDA as a

percentage of total revenue.

| (unaudited, in thousands) | Three Months Ended | Nine Months Ended | |||||||||||||

| September 30, | September 30, | ||||||||||||||

| 2010 | 2009 | 2010 | 2009 | ||||||||||||

| (As Restated) | (As Restated) | ||||||||||||||

| Total Revenue | $ | 63,143 | $ | 47,405 | $ | 176,172 | $ | 134,081 | |||||||

| GAAP net income | 3,826 | 1,166 | 5,401 | 4,948 | |||||||||||

| Add: Provision for income taxes | 3,532 | 1,673 | 5,066 | 4,950 | |||||||||||

| Add: Acquisition-related expenses | - | 651 | - | 651 | |||||||||||

| Add (less): Total other (income) expense | 105 | 83 | 597 | (797 | ) | ||||||||||

| Add: Stock-based compensation expense | 3,761 | 2,123 | 10,455 | 6,115 | |||||||||||

| Add: Depreciation and amortization | 2,869 | 2,098 | 7,946 | 5,535 | |||||||||||

| Add: Amortization of purchased intangibles | 460 | 80 | 1,380 | 240 | |||||||||||

| Non-GAAP Adjusted EBITDA | $ | 14,553 | $ | 7,874 | $ | 30,845 | $ | 21,642 | |||||||

| Non-GAAP Adjusted EBITDA Margin | 23.0 | % | 16.6 | % | 17.5 | % | 16.1 | % | |||||||

Non-GAAP Adjusted Operating Income

Set forth below is a

reconciliation of the Company’s “Non-GAAP Adjusted Operating Income” and

“Non-GAAP Adjusted Operating Income Margin.” Non-GAAP Adjusted Operating

Income Margin represents Non-GAAP Adjusted Operating Income as a

percentage of total revenue.

| (unaudited, in thousands) | Three Months Ended | Nine Months Ended | |||||||||||||

| September 30, | September 30, | ||||||||||||||

| 2010 | 2009 | 2010 | 2009 | ||||||||||||

| (As Restated) | (As Restated) | ||||||||||||||

| Total revenue | $ | 63,143 | $ | 47,405 | $ | 176,172 | $ | 134,081 | |||||||

| GAAP net income | 3,826 | 1,166 | 5,401 | 4,948 | |||||||||||

| Add: Provision for income taxes | 3,532 | 1,673 | 5,066 | 4,950 | |||||||||||

| Add: Acquisition-related expenses | - | 651 | - | 651 | |||||||||||

| Add (less): Total other (income) expense | 105 | 83 | 597 | (797 | ) | ||||||||||

| Add: Stock-based compensation expense | 3,761 | 2,123 | 10,455 | 6,115 | |||||||||||

| Add: Amortization of purchased intangibles | 460 | 80 | 1,380 | 240 | |||||||||||

| Non-GAAP Adjusted Operating Income | $ | 11,684 | $ | 5,776 | $ | 22,899 | $ | 16,107 | |||||||

| Non-GAAP Adjusted Operating Income Margin | 18.5 | % | 12.2 | % | 13.0 | % | 12.0 | % | |||||||

Non-GAAP Adjusted Net Income

Set forth below is a

reconciliation of the Company’s “Non-GAAP Adjusted Net Income” and

“Non-GAAP Adjusted Net Income per Diluted Share.”

| (unaudited, in thousands except per share amounts) | Three Months Ended | Nine Months Ended | |||||||||||||

| September 30, | September 30, | ||||||||||||||

| 2010 | 2009 | 2010 | 2009 | ||||||||||||

| (As Restated) | (As Restated) | ||||||||||||||

| GAAP net income | $ | 3,826 | $ | 1,166 | $ | 5,401 | $ | 4,948 | |||||||

| (Less) Add: (Gain) loss on interest rate derivative | 111 | 125 | 475 | (375 | ) | ||||||||||

| Add: Stock-based compensation expense | 3,761 | 2,123 | 10,455 | 6,115 | |||||||||||

| Add: Amortization of purchased intangibles | 460 | 80 | 1,380 | 240 | |||||||||||

| Sub-total of tax deductible items | 4,332 | 2,328 | 12,310 | 5,980 | |||||||||||

| (Less): Tax impact of tax deductible items (1) | (1,733 | ) | (931 | ) | (4,924 | ) | (2,392 | ) | |||||||

| Add: Acquisition-related expenses | - | 651 | - | 651 | |||||||||||

| Non-GAAP Adjusted Net Income | $ | 6,425 | $ | 3,214 | $ | 12,787 | $ | 9,187 | |||||||

| Weighted average shares - diluted | 35,156 | 34,900 | 35,179 | 34,707 | |||||||||||

| Non-GAAP Adjusted Net Income per Diluted Share | $ | 0.18 | $ | 0.09 | $ | 0.36 | $ | 0.26 | |||||||

| (1) - Tax impact calculated using federal statutory tax rate of 34% and a blended state tax rate of 6% | |||||||||||||||

| *Note that Other (income) expense is no longer excluded per revised non-GAAP methodology as discussed in our Current Report on Form 8-K filed with the SEC on February 4, 2010 | |||||||||||||||

| (unaudited, in thousands except per share amounts) | Three Months Ended | Nine Months Ended | |||||||||||||

| September 30, | September 30, | ||||||||||||||

| 2010 | 2009 | 2010 | 2009 | ||||||||||||

| (As Restated) | (As Restated) | ||||||||||||||

| GAAP net income per share - diluted | $ | 0.11 | $ | 0.03 | $ | 0.15 | $ | 0.14 | |||||||

| (Less) Add: (Gain) loss on interest rate derivative | - | 0.01 | 0.01 | (0.01 | ) | ||||||||||

| Add: Stock-based compensation expense | 0.11 | 0.06 | 0.30 | 0.17 | |||||||||||

| Add: Amortization of purchased intangibles | 0.01 | - | 0.04 | 0.01 | |||||||||||

| Sub-total of tax deductible items | 0.12 | 0.07 | 0.35 | 0.17 | |||||||||||

| (Less): Tax impact of tax deductible items (1) | (0.05 | ) | (0.03 | ) | (0.14 | ) | (0.07 | ) | |||||||

| Add: Acquisition-related expenses | - | 0.02 | - | 0.02 | |||||||||||

| Non-GAAP Adjusted Net Income per Diluted Share | $ | 0.18 | $ | 0.09 | $ | 0.36 | $ | 0.26 | |||||||

| Weighted average shares - diluted | 35,156 | 34,900 | 35,179 | 34,707 | |||||||||||

| (1) - Tax impact calculated using federal statutory tax rate of 34% and a blended state tax rate of 6% | |||||||||||||||

| *Note that Other (income) expense is no longer excluded per revised non-GAAP methodology as discussed in our Current Report on Form 8-K filed with the SEC on February 4, 2010 | |||||||||||||||

Explanation of Non-GAAP Financial Measures

The Company

reports its financial results in accordance with United States generally

accepted accounting principles, or GAAP. However, management believes

that in order to properly understand the Company's short-term and

long-term financial and operational trends, investors may wish to

consider the impact of certain non-cash or non-recurring items, when

used as a supplement to financial performance measures in accordance

with GAAP. These items result from facts and circumstances that vary in

frequency and/or impact on continuing operations. Management also uses

results of operations before such items to evaluate the operating

performance of the Company and compare it against past periods, make

operating decisions, and serve as a basis for strategic planning. These

non-GAAP financial measures provide management with additional means to

understand and evaluate the operating results and trends in the

Company’s ongoing business by eliminating certain non-cash expenses and

other items that management believes might otherwise make comparisons of

the Company’s ongoing business with prior periods more difficult,

obscure trends in ongoing operations, or reduce management’s ability to

make useful forecasts. Management believes that these non-GAAP financial

measures provide additional means of evaluating period-over-period

operating performance. In addition, management understands that some

investors and financial analysts find this information helpful in

analyzing the Company’s financial and operational performance and

comparing this performance to its peers and competitors.

Management defines “Non-GAAP Adjusted Gross Profit” as total revenue, less direct operating expense, plus stock-based compensation expense allocated to direct operating expense and amortization of purchased intangibles, and “Non-GAAP Adjusted Gross Margin” as non-GAAP Adjusted Gross Profit as a percentage of total revenue. Management considers these non-GAAP financial measures to be important indicators of the Company’s operational strength and performance of its business and a good measure of its historical operating trends. Moreover, management believes that these measures enable investors and financial analysts to closely monitor and understand changes in the Company’s ability to generate income from ongoing business operations.

Management defines “Non-GAAP Adjusted EBITDA” as the sum of GAAP net income before provision for income taxes, total other (income) expense, stock-based compensation expense, depreciation and amortization, acquisition-related expenses and amortization of purchased intangibles and “Non-GAAP Adjusted EBITDA Margin” as Non-GAAP Adjusted EBITDA as a percentage of total revenue. Management defines “Non-GAAP Adjusted Operating Income” as the sum of GAAP net income before provision for income taxes, total other (income) expense, stock-based compensation expense, acquisition-related expenses and amortization of purchased intangibles and “Non-GAAP Adjusted Operating Income Margin” as Non-GAAP Adjusted Operating Income as a percentage of total revenue. Management defines “Non-GAAP Adjusted Net Income” as the sum of GAAP net income before (gain) loss on interest rate derivative, stock-based compensation expense, acquisition-related expenses, amortization of purchased intangibles, and any tax impact related to these items, and “Non-GAAP Adjusted Net Income per Diluted Share” as Non-GAAP Adjusted Net Income divided by weighted average diluted shares outstanding. Management considers these non-GAAP financial measures to be important indicators of the Company’s operational strength and performance of its business and a good measure of its historical operating trends, in particular the extent to which ongoing operations impact the Company’s overall financial performance.

Management excludes each of the items identified below from the applicable non-GAAP financial measure referenced above for the reasons set forth with respect to that excluded item:

- Stock-based compensation expense — excluded because these are non-cash expenses that management does not consider part of ongoing operating results when assessing the performance of the Company’s business, and also because the total amount of expense is partially outside of the Company’s control because it is based on factors such as stock price volatility and interest rates, which may be unrelated to our performance during the period in which the expense is incurred.

- Acquisition-related expenses and amortization of purchased intangibles — acquisition-related expenses are reported at the time acquisition costs are incurred, and purchased intangibles are amortized over a period of several years after the acquisition and generally cannot be changed or influenced by management after the acquisition. Accordingly, these items are not considered by management in making operating decisions, and management believes that such expenses do not have a direct correlation to future business operations. Thus, including such charges does not accurately reflect the performance of the Company’s ongoing operations for the period in which such charges are incurred.

- Gains and losses on interest rate derivative — excluded because until they are realized, to the extent these gains or losses impact a period presented, management does not believe that they reflect the underlying performance of ongoing business operations for such period.

Supplemental Metrics and Definitions

| Supplemental Metrics (unaudited) |

| Last Updated: September 30, 2010 |

|

|

|||||||||

| Fiscal Year 2009 |

Fiscal Year 2010 |

||||||||

| Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | Q3 | |||

|

Client Base |

|||||||||

| Total Accounts | 1,333 | 1,406 | 1,507 | 1,592 | 1,684 | 1,753 | 1,877 | ||

| Total Physicians on athenaCollector | 13,196 | 13,591 | 14,835 | 15,719 | 16,369 | 17,136 | 18,573 | ||

| Total Providers on athenaCollector | 19,739 | 20,323 | 22,100 | 23,366 | 23,978 | 24,782 | 26,317 | ||

| Total Physicians on athenaClinicals | 574 | 624 | 780 | 920 | 1,275 | 1,548 | 1,992 | ||

| Total Providers on athenaClinicals | 949 | 1,043 | 1,270 | 1,471 | 1,867 | 2,256 | 2,818 | ||

| Total Physicians on athenaCommunicator | n/a | n/a | n/a | n/a | n/a | 442 | 625 | ||

| Total Providers on athenaCommunicator | n/a | n/a | n/a | n/a | n/a | 689 | 946 | ||

|

Client Performance |

|||||||||

| Client Satisfaction | 82.4% | 86.7% | 86.4% | 88.7% | 86.6% | 86.1% | 85.7% | ||

| Client Days in Accounts Receivable (DAR) | 44.3 | 40.2 | 39.3 | 38.5 | 40.0 | 38.8 | 38.8 | ||

| First Pass Resolution (FPR) Rate | 91.4% | 92.3% | 92.5% | 93.5% | 93.1% | 93.4% | 94.2% | ||

| Electronic Remittance Advice (ERA) Rate | 55.5% | 58.5% | 64.2% | 68.0% | 68.9% | 68.8% | 72.1% | ||

| Total Claims Submitted | 9,073,155 | 9,414,482 | 9,970,800 | 11,582,674 | 11,175,099 | 11,312,806 | 11,837,095 | ||

| Total Client Collections | $ 1,085,652,593 | $ 1,208,859,985 | $ 1,223,100,008 | $ 1,355,616,378 | $ 1,312,820,931 | $ 1,421,347,731 | $ 1,517,064,118 | ||

| Total Working Days | 61 | 64 | 64 | 62 | 61 | 64 | 64 | ||

|

Employees |

|||||||||

| Direct | 547 | 565 | 570 | 582 | 630 | 675 | 690 | ||

| Sales & Marketing | 99 | 101 | 110 | 123 | 157 | 168 | 186 | ||

| Research & Development | 128 | 150 | 162 | 177 | 172 | 187 | 197 | ||

| General & Administrative | 112 | 126 | 129 | 133 | 130 | 136 | 140 | ||

| Total Employees* | 886 | 942 | 970 | 1,014 | 1,087 | 1,166 | 1,213 | ||

|

Quota Carrying Sales Force |

|||||||||

| Small Practice | 18 | 17 | 20 | 22 | 25 | 27 | 34 | ||

| Group Practice | 16 | 17 | 18 | 18 | 20 | 23 | 22 | ||

| Enterprise Segment | 5 | 5 | 5 | 5 | 5 | 6 | 7 | ||

| Cross-Sell | 4 | 4 | 5 | 5 | 5 | 6 | 7 | ||

| Total Quota Carrying Sales Representatives | 43 | 43 | 48 | 50 | 55 | 62 | 70 | ||

| *Headcount for Q409 has been adjusted to reflect full-time equivalent (FTE) methodology versus individual headcount methodology as reported in the Company's 2009 Annual Report on Form 10-K | |||||||||

| Supplemental Metrics Definitions |

| Last Updated: September 30, 2010 |

| Client Base | |

|

Total Accounts |

The number of discrete clients that are actively invoiced by athenahealth during the last 91 days. |

|

Total Physicians on athenaCollector |

The number of physicians that have rendered a service which generated a medical claim that was billed during the last 91 days on the athenaCollector platform. Examples of physicians include Medical Doctors (MD) and Doctor of Osteopathic Medicine (DO). |

|

Total Providers on athenaCollector |

The number of providers, including physicians, that have rendered a service which generated a medical claim that was billed during the last 91 days on the athenaCollector platform. Examples of non-physician providers are Nurse Practitioners (NP) and Registered Nurses (RN). |

| Total Physicians on athenaClinicals | The number of physicians that have rendered a service through the athenaClinicals platform which generated a medical claim that was billed during the last 91 days on the athenaCollector platform. Examples of physicians include Medical Doctors (MD) and Doctor of Osteopathic Medicine (DO). |

|

Total Providers on athenaClinicals |

The number of providers, including physicians, that have rendered a service through the athenaClinicals platform which generated a medical claim that was billed during the last 91 days on the athenaCollector platform. Examples of non-physicians are Nurse Practitioners (NP) and Registered Nurses (RN). |

| Total Physicians on athenaCommunicator | The number of physicians that have rendered a service which generated a medical claim that was billed during the last 91 days on the athenaCollector platform and whose practice is actively using athenaCommunicator. |

| Total Providers on athenaCommunicator | The number of providers, including physicians, that have rendered a service which generated a medical claim that was billed during the last 91 days on the athenaCollector platform and whose practice is actively using athenaCommunicator. |

| Client Performance | |

| Client Satisfaction | The percentage of athenaCollector clients who chose 4 or 5 on a scale of 1 to 5 when asked if they would recommend athenahealth to a trusted friend or colleague. These responses are generated from a "client listening" survey that the company conducts for two segments of its client base twice per year. |

| Client Days in Accounts Receivable (DAR) | The average number of days that it takes outstanding balances on claims to be resolved, e.g. paid, for clients on athenaCollector. Clients that have been live less than 90 days are excluded, as well as clients who are terminating services. |

| First Pass Resolution (FPR) Rate | Approximates the percentage of primary claims that are favorably adjudicated and closed after a single submission during the period. Currently, the FPR rate is calculated on a monthly basis, and certain practices are excluded (e.g. those that have been live for less than 90 days). |

| Electronic Remittance Advice (ERA) Rate | Remittance refers to the information about payments (a/k/a explanations of benefits) received from insurance companies during the period. The ERA rate reflects the percentage of total charges that were posted using electronic remittance. |

| Total Claims Submitted | The number of claims billed through athenaNet during the period. |

| Total Client Collections | The dollar value of collections posted on behalf of clients during the period. |

| Total Working Days | The total number of days during the quarter minus weekends and U.S. Post Office holidays. |

| Employees | |

| Direct | The total number of full time equivalent individuals (FTEs) employed by the Company to support its service operations as of quarter end. This team includes production systems, enrollment services, paper claim submission, claim resolution, clinical operations, professional services, account management, and client services. |

| Sales & Marketing | The total number of FTEs employed by the Company to support its sales and marketing efforts as of quarter end. This team includes sales representatives, business development staff and the marketing team. |

| Research & Development | The total number of FTEs employed by the Company to support its research and development efforts as of quarter end. This team includes product development and product management. |

| General & Administrative | The total number of FTEs employed by the Company to support its general and administrative functions as of quarter end. This team includes finance, human resources, compliance, learning and development, internal audit, corporate technology, recruiting, facilities, and legal. |

| Total Employees | The total number of FTEs employed by the Company as of quarter end. This number excludes interns and seasonal employees. |

| Quota-Carrying Sales Force | |

| Small Practice | Quota-carrying sales representatives assigned to bring in net new annual recurring revenue from the small practice segment (organizations with 1-3 physicians) as of quarter end. |

| Group Practice | Quota-carrying sales representatives assigned to bring in net new annual recurring revenue from the group practice segment (organizations with 4-150 physicians) as of quarter end. |

| Enterprise Segment | Quota-carrying sales representatives assigned to bring in net new annual recurring revenue from the enterprise market segment (organizations with150+ physicians) as of quarter end. |

| Cross-Sell | Quota-carrying sales representatives assigned to bring in net new annual recurring revenue from the sale of additional services to existing athenaCollector clients as of quarter end. |

| Total Quota Carrying Sales Representatives | The total number of sales representatives who carry quota for net new annual recurring revenue as of quarter end. |

15