Attached files

| file | filename |

|---|---|

| EX-5.1 - OPINION AND CONSENT OF CLARK WILSON LLP - MAVERICK MINERALS CORP | exhibit5-1.htm |

| EX-23.1 - CONSENT OF BDO CANADA LLP - MAVERICK MINERALS CORP | exhibit23-1.htm |

| As filed with the Securities and Exchange Commission on October 8, 2010 |

| Registration No. ______________ |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

MAVERICK MINERALS

CORPORATION

(Exact name of registrant as specified in its

charter)

| Nevada | 5040 | 88-0410480 |

| State or other jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer |

| incorporation or organization | Classification Code Number) | Identification No.) |

2501 Lansdowne Ave.

Saskatoon, Saskatchewan S7J 1H3, Canada

(306)

343-5799

(Address and telephone number of principal executive

offices)

Michael J. Morrison, Chtd

1495 Ridgeview Dr Ste 220

Reno NV 89519

(775) 827-6300

(Name, address and telephone

number of agent for service)

Copy of communications to:

Clark Wilson LLP

800-885 W. Georgia St.

Vancouver, B.C. V6C 3H1

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: [x]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | [ ] | Accelerated filer | [ ] |

| Non-accelerated filer | [ ] | Smaller reporting company | [x] |

| (Do not check if a smaller reporting company) |

Calculation Of Registration Fee

| Title of Each Class of Securities to be Registered |

Amount to be Registered(1) |

Proposed Maximum Offering Price Per Share(2) |

Proposed Maximum Aggregate Offering Price |

Amount of Registration Fee(3) |

| Shares of Common Stock | 2,000,000 | $1.50 | $3,000,000 | $213.90 |

| (1) |

An indeterminate number of additional Shares of common stock shall be issuable pursuant to Rule 416 to prevent dilution resulting from stock splits, stock dividends or similar transactions and in such an event the number of shares registered shall automatically be increased to cover the additional shares in accordance with Rule 416 under the Securities Act of 1933. |

| (2) |

The offering price has been arbitrarily determined by us and bears no relationship to assets, earnings, or any other valuation criteria. No assurance can be given that the shares offered hereby will have a market value or that they may be sold at this, or at any price. |

| (3) |

Estimated solely for the purpose of calculating the registration fee based on Rule 457(o). |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion dated October 7, 2010

PROSPECTUS

2,000,000 SHARES

We propose to sell 2,000,000 shares of our common stock at a fixed price of $1.50 per share on a best efforts basis with no minimum purchase requirement. The aggregate offering price will be $3,000,000 and any funds raised from this offering will be immediately available to us for our use. There will be no refunds. The offering will be for a period of 90 days from the date of this prospectus and may be extended for an additional 90 days if we choose to do so.

This offer is not being underwritten. Robert J. Kinloch, our sole director and our Chief Executive Officer and Chief Financial Officer will be the only person offering or selling these shares on our behalf. Mr. Kinloch will not receive any compensation for offering or selling our shares. Except for Robert J. Kinloch, no brokers will sell these shares and no commission will be paid to anyone.

Our common stock is quoted on the Financial Industry Regulatory Authority’s OTC Bulletin Board under the symbol “MVRM.OB”. On October 6, 2010 the closing sale price for our common stock as reported by the OTC Bulletin Board was $1.60 per share.

Nevada law does not require that funds raised pursuant to the sale of securities be placed into an escrow account and the proceeds from this offering will not be placed in an escrow, trust or similar account.

Our business is subject to many risks and an investment in our shares of common stock will involve a high degree of risk. You should invest in our shares of common stock only if you can afford to lose your entire investment. You should carefully consider the various risks described in the section titled ‘Risk Factors’ beginning on page 6, below, before investing in our shares.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offence.

Please read this prospectus carefully. You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with different information.

The date of this prospectus is October 7, 2010.

2

TABLE OF CONTENTS

3

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information you should consider before investing in our shares of common stock. You should read this entire prospectus, including “Risk Factors” and the consolidated financial statements and related notes, before making an investment decision. This prospectus includes forward-looking statements that involve risks and uncertainties. See “Forward-Looking Statements” and “Risk Factors”. As used in this prospectus, the terms, “we,” “us,” “our,” the “Company” and “Maverick” refer to Maverick Minerals Corporation and our subsidiary, Eskota Energy Corporation, unless otherwise stated. All references in this prospectus to currency or dollar amounts refer to U.S. dollars unless otherwise specified.

Our Business

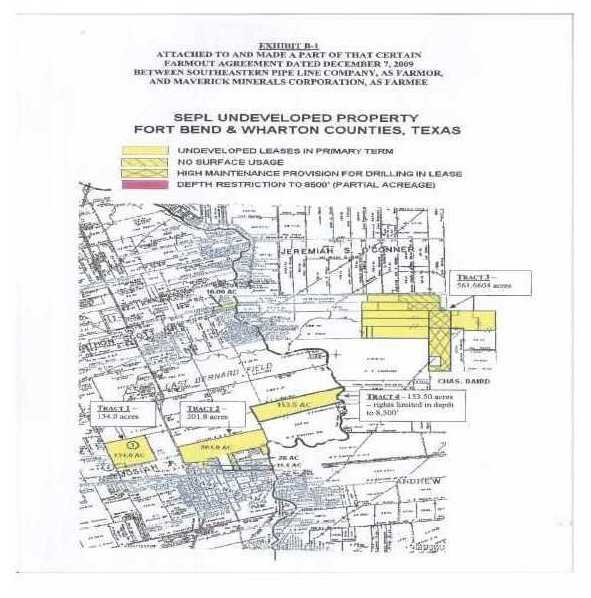

We are currently an exploration stage company engaged in the acquisition, exploration, and development of prospective oil and gas properties. Our current business focus is to implement the terms of the Farmout Agreement pursuant to which we intend to earn an interest in certain oil and gas mineral leases located in Fort Bend and Wharton Counties, Texas owned by Southeastern Pipe Line Company (“SEPL”). Our initial operations during the next quarter are to locate suitable locations to drill, drilling, and determining if an initial test well is viable. If the well is viable and we can develop the well, we intend to earn an interest in the mineral leases which are the subject of the Farmout Agreement. If the well is not viable, we intend to plug and abandon the well. Our anticipated 2010 drilling program has recently commenced and is expected to target the Wilcox Trend, a vast depositional sand zone with a history of natural gas and condensate production. The Wilcox Trend is articulated into the upper, middle, and lower Wilcox. We intend to target the middle Wilcox to a depth of between 12,500 and 13,500 feet.

Number of Shares being Offered

We propose to sell 2,000,000 shares of common stock at a fixed price of $1.50 per share on a best efforts basis with no minimum purchase requirement. This offer is not being underwritten. Robert J. Kinloch, our sole director and our Chief Executive Officer and Chief Financial Officer will be the only person offering or selling these shares on our behalf. Except for Robert J. Kinloch, no brokers will sell these shares and no commission will be paid to anyone.

The following is a brief summary of this offering.

| Shares being offered | Up to 2,000,000 shares of common stock(1) | |

|

| ||

| Offering price per share |

$1.50 | |

|

| ||

| Maximum possible proceeds to us |

Up to $3,000,000 | |

|

| ||

| Offering period |

The offering will conclude when all 2,000,000 shares of common stock have been sold, or 90 days after the date of the prospectus. We may at our discretion extend the offering for an additional 90 days. | |

|

| ||

| Use of proceeds |

After deducting offering expenses of $100,000, we will use the proceeds of this offering mainly for expenses associated with our operations under our Farmout Agreement with Southeastern Pipe Line Company and working capital expenses | |

|

| ||

| Number of shares outstanding before the offering |

11,602,617 Shares of Common Stock | |

|

| ||

| Number of shares outstanding after the offering, assuming all of the offered shares are sold |

13,602,617 Shares of Common Stock |

4

| (1) |

We are authorized to issue up to 750,000,000 shares of common stock and 100,000,000 Preferred shares. As of October 7, 2010, there were 11,602,617 Shares of common stock outstanding and no Preferred shares outstanding. |

Summary of Financial Information

The summarized financial data presented below is derived from and should be read in conjunction with our audited financial statements for the years ended December 31, 2009 and 2008 and our unaudited financial statements for the six months ending June 30, 2010 and 2009, including the notes to those financial statements which are included elsewhere in this prospectus, and should also be read in conjunction with the section of this prospectus entitled “Management’s Discussion and Analysis” beginning on page 31 of this prospectus.

| Year Ended December 31,

2009 (Audited) |

Year Ended December 31,

2008 (Audited) | |

| Balance Sheet | ||

| Total assets | $577,219 | $0 |

| Cash and cash equivalents | $6,024 | $0 |

| Total liabilities | $1,197,501 | $1,238,134 |

| Total common stock and equity | $(620,282) | $(1,238,134) |

| Statement of Operations and Comprehensive Income (Loss) | ||

| Total revenue | $0 | $0 |

| Total SG&A expenses | $275,963 | $204,571 |

| Other income (expenses) | $(3,157,506) | $314,522 |

| Net income (loss) | $(3,433,469) | $109,951 |

| Net income (loss) per common share (basic & diluted) | $(0.38) | $0.04 |

| Total comprehensive income (loss) | $(3,433,469) | $109,951 |

| Six-Month Period Ended June 30, 2010 (Unaudited) |

Six-Month Period Ended June 30, 2009 (Unaudited) | |

| Balance Sheet | ||

| Total assets | $619,883 | $577,219 |

| Cash and cash equivalents | $0 | $6,024 |

| Total liabilities | $1,381,517 | $1,197,501 |

| Total common stock and equity | $(761,634) | $(620,282) |

| Statement of Operations and Comprehensive Income (Loss) | ||

| Total revenue | $0 | $0 |

| Total G&A expenses | $123,125 | $121,470 |

| Other income (expenses) | $(18,227) | $(3,135,847) |

| Net income (loss) | $(141,352) | $(3,257,317) |

| Net income (loss) per common share (basic and diluted) | $(0.01) | $(1.19) |

| Total comprehensive income (loss) | $(141,352) | $(3,257,317) |

5

Actual |

Pro forma before offering (1) |

Pro forma after offering (2) | |

| Balance Sheet Data: | |||

| Current assets | $17,654 | $17,654 | $2,917,654 |

| Current liabilities | $1,023,767 | $225,873 | $225,873 |

| Total assets | $619,883 | $987,383 | $3,887,383 |

| Long-term liabilities | $357,750 | $357,750 | $357,750 |

| Common stock | $10,477 | $11,603 | $13,603 |

| Total stockholders’ equity (capital deficit) | $(761,634) | $403,760 | $3,303,760 |

| Common shares issued | 10,476,721 | 11,602,617 | 13,602,617 |

| Notes | |

| (1) |

The pro forma as before offering gives effect to (i) a debt settlement with Art Brokerage, Inc. on September 7, 2010 pursuant to which the Company issued 725,971 shares of common stock of the Company at a deemed price of $1.05 per share in settlement of $762,269 of outstanding debt owed by the Company to Art Brokerage, Inc., (ii) a debt settlement with David Steiner Primary Trust (“Steiner”) on July 19, 2010 whereby we agreed to issue 49,925 shares of our common stock to Steiner in settlement of the Convertible Debenture dated December 11, 2009 in the principal amount of $35,625 and outstanding interest to July 19, 2010 of $1,778, and (iii) a data purchase agreement (the “Agreement”) with two individuals (collectively the “Vendors”), pursuant to which the Company agreed to purchase from the Vendors geologic data relating to certain oil and gas mineral leases located in Texas, including among other things: electric logs, seismic work, seismic reprocessing, data from the Texas Railroad Commission. In consideration for the acquisition of the geologic data from the Vendors the Company agreed to issue an aggregate of 350,000 shares of the common stock of the Company to the Vendors. |

| (2) |

The pro forma after offering gives effect to the 2,000,000 shares issued at $1.50 in connection with this Prospectus. |

RISK FACTORS

Much of the information included in this prospectus includes or is based upon estimates, projections or other “forward looking statements”. Such forward looking statements include any projections and estimates made by us and our management in connection with our business operations. While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested herein. Such estimates, projections or other “forward looking statements” involve various risks and uncertainties as outlined below. We caution the reader that important factors in some cases have affected and, in the future, could materially affect actual results and cause actual results to differ materially from the results expressed in any such estimates, projections or other “forward looking statements”.

We are an exploration stage company implementing a new business plan.

We are an exploration stage company with only a limited operating history upon which to base an evaluation of our current business and future prospects. If we do discover oil or gas resources in commercially exploitable quantities on any of our properties, we will be required to expend substantial sums of money to establish the extent of the resource, develop processes to extract it and develop extraction and processing facilities and infrastructure. If we discover a major reserve, there can be no assurance that such a reserve will be large enough to justify commercial operations, nor can there be any assurance that we will be able to raise the funds required for development on a timely basis. If we cannot raise the necessary capital or complete the necessary facilities and infrastructure, our business may fail. There is no assurance that we will be able to drill an initial test well on the property subject to the Farmout Agreement within the timeline set out in the agreement or at all. Failure to do so will result in the loss of all our interest in the Farmout Agreement with SEPL.

6

We have had negative cash flows from operations and if we are not able to obtain further financing, our business operations may fail.

We had a working capital deficit of $1,006,113 as of June 30, 2010. We do not expect to generate any revenues for the foreseeable future unless we are successful developing any wells that are the subject of the Farmout Agreement. Accordingly, we will require additional funds, either from equity or debt financing, to maintain our daily operations and to develop any further wells under the Farmout Agreement. Obtaining additional financing is subject to a number of factors, including market prices for oil and gas, investor acceptance of our interest pursuant to the Farmout Agreement, and investor sentiment. Financing, therefore, may not be available on acceptable terms, if at all. The most likely source of future funds presently available to us is through the sale of equity capital. Any sale of share capital, however, will result in dilution to existing shareholders. If we are unable to raise additional funds when required, we may be forced to delay our plan of operation and our entire business may fail.

We currently do not generate revenues, and as a result, we face a high risk of business failure.

The only interest in property we have is pursuant to the Farmout Agreement. From the date of our incorporation, we have primarily focused on the location and acquisition of mineral and oil and gas properties. We have not generated any material revenues to date. In order to generate revenues, we will incur substantial expenses in the evaluation and development of the Initial Well. We therefore expect to incur significant losses into the foreseeable future. We recognize that if we are unable to generate significant revenues from our activities, our entire business may fail. There is no history upon which to base any assumption as to the likelihood that we will be successful in our plan of operation, and we can provide no assurance to investors that we will generate any operating revenues or achieve profitable operations.

Our independent auditors have expressed substantial doubt about our ability to continue as a going concern, which may hinder our ability to obtain future financing.

At June 30, 2010, we had an accumulated deficit of $5,377,439 and a working capital deficit of $1,006,113. These circumstances raise substantial doubt about our ability to continue as a going concern, as described in the explanatory paragraph to our independent auditors’ report on our consolidated financial statements for the year ended December 31, 2009. Although our consolidated financial statements raise substantial doubt about our ability to continue as a going concern, they do not reflect any adjustments that might result if we are unable to continue our business.

If we are required for any reason to repay our outstanding secured loans or any other indebtedness, we would be required to deplete our working capital, if available, or raise additional funds.

If we are required to repay the secured loans or any other indebtedness for any reason, we would be required to use our working capital and raise additional funds. If we are unable to repay the secured loans or any other indebtedness when required, we may be required to sell substantial assets of our company. In addition, the lenders could commence legal action against our company and foreclose on all of our assets to recover the amounts due. Any such sale or legal action would require our company to curtail or possibly cease our operations.

Market conditions or operation impediments may hinder our access to oil and gas markets or delay our potential production.

Our ability to develop the farmout acreage depends in part upon the availability, proximity and capacity of pipelines, natural gas gathering systems and processing facilities. This dependence is heightened where this infrastructure is less developed. Therefore, even if drilling results are positive in certain areas of our oil and gas properties, a new gathering system may need to be built to handle the potential volume of oil and gas produced. We might be required to shut in wells, at least temporarily, for lack of a market or because of the inadequacy or unavailability of transportation facilities. If that were to occur, we would be unable to realize revenue from those wells until arrangements were made to deliver production to market.

7

Even if we are able to establish any oil or gas reserves on the farmout acreage, our ability to produce and market oil and gas is affected and also may be harmed by:

- inadequate pipeline transmission facilities or carrying capacity;

- government regulation of natural gas and oil production;

- government transportation, tax and energy policies;

- changes in supply and demand; and

- general economic conditions.

The potential profitability of oil and gas ventures depends upon factors beyond the control of our company.

The potential profitability of oil and gas properties is dependent upon many factors beyond our control. For instance, world prices and markets for oil and gas are unpredictable, highly volatile, potentially subject to governmental fixing, pegging, controls, or any combination of these and other factors, and respond to changes in domestic, international, political, social, and economic environments. Additionally, due to worldwide economic uncertainty, the availability and cost of funds for production and other expenses have become increasingly difficult, if not impossible, to project. These changes and events may materially affect our financial performance.

Adverse weather conditions can also hinder drilling operations. A productive well may become uneconomic in the event water or other deleterious substances are encountered which impair or prevent the production of oil and/or gas from the well. In addition, production from any well may be unmarketable if it is impregnated with water or other deleterious substances. The marketability of oil and gas, which may be acquired or discovered, will be affected by numerous factors beyond our control. These factors include the proximity and capacity of oil and gas pipelines and processing equipment, market fluctuations of prices, taxes, royalties, land tenure, allowable production and environmental protection. These factors cannot be accurately predicted and the combination of these factors may result in our company not receiving an adequate return on invested capital.

Oil and gas operations are subject to comprehensive regulation, which may cause substantial delays or require capital outlays in excess of those anticipated causing an adverse effect on our company.

Oil and gas operations are subject to federal, state, and local laws relating to the protection of the environment, including laws regulating removal of natural resources from the ground and the discharge of materials into the environment. Oil and gas operations are also subject to federal, state, and local laws and regulations, which seek to maintain health and safety standards by regulating the design and use of drilling methods and equipment. Various permits from government bodies are required for drilling operations to be conducted; no assurance can be given that such permits will be received. Environmental standards imposed by federal, provincial, or local authorities may be changed and any such changes may have material adverse effects on our activities. Moreover, compliance with such laws may cause substantial delays or require capital outlays in excess of those anticipated, thus causing an adverse effect on us. Additionally, we may be subject to liability for pollution or other environmental damages, which it may elect not to insure against due to prohibitive premium costs and other reasons. To date we have not been required to spend any material amount on compliance with environmental regulations. However, we may be required to do so in future and this may affect our ability to expand or maintain our operations.

Exploratory drilling involves many risks and we may become liable for pollution or other liabilities, which may have an adverse effect on our financial position.

Drilling operations generally involve a high degree of risk. Hazards such as unusual or unexpected geological formations, power outages, labor disruptions, blow-outs, sour gas leakage, fire, inability to obtain suitable or adequate machinery, equipment or labour, and other risks are involved. We may become subject to liability for pollution or hazards against which we cannot adequately insure or which we may elect not to insure. Incurring any such liability may have a material adverse effect on our financial position and operations.

8

Shortages of rigs, equipment, supplies and personnel could delay or otherwise adversely affect our cost of operations or our ability to operate according to our business plans.

If drilling activity increases worldwide, a shortage of drilling and completion rigs, field equipment and qualified personnel could develop. These costs have recently increased sharply and could continue to do so. The demand for and wage rates of qualified drilling rig crews generally rise in response to the increasing number of active rigs in service and could increase sharply in the event of a shortage. Shortages of drilling and completion rigs, field equipment or qualified personnel could delay, restrict or curtail our exploration and development operations, which could in turn harm our operating results.

The geographic concentration of all of our properties in Texas subjects us to an increased risk of loss of revenue or curtailment of production from factors affecting those areas.

The geographic concentration of all of our leasehold interests in Texas means that our properties could be affected by the same event should the regions experience:

- severe weather;

- delays or decreases in production, the availability of equipment, facilities or services;

- delays or decreases in the availability of capacity to transport, gather or process production; or

- changes in the regulatory environment.

The oil and gas exploration and production industry is historically a cyclical industry and market fluctuations in the prices of oil and gas could adversely affect our business.

Prices for oil and gas tend to fluctuate significantly in response to factors beyond our control. These factors include:

- weather conditions in the United States and wherever our property interests are located;

- economic conditions, including demand for petroleum-based products, in the United States and the rest of the world;

- actions by OPEC, the Organization of Petroleum Exporting Countries;

- political instability in the Middle East and other major oil and gas producing regions;

- governmental regulations, both domestic and foreign;

- domestic and foreign tax policy;

- the pace adopted by foreign governments for the exploration, development, and production of their national reserves;

- the price of foreign imports of oil and gas;

- the cost of exploring for, producing and delivering oil and gas;

- the discovery rate of new oil and gas reserves;

- the rate of decline of existing and new oil and gas reserves;

- available pipeline and other oil and gas transportation capacity;

- the ability of oil and gas companies to raise capital;

- the overall supply and demand for oil and gas; and

- the availability of alternate fuel sources.

Changes in commodity prices may significantly affect our capital resources, liquidity and expected operating results. Price changes will directly affect revenues and can indirectly impact expected production by changing the amount of funds available to reinvest in exploration and development activities. Reductions in oil and gas prices not only reduce revenues and profits, but could also reduce the quantities of reserves that are commercially recoverable. Significant declines in prices could result in non-cash charges to earnings due to impairment.

Changes in commodity prices may also significantly affect our ability to estimate the value of producing properties for acquisition and divestiture and often cause disruption in the market for oil and gas producing properties, as buyers and sellers have difficulty agreeing on the value of the properties. Price volatility also makes it difficult to budget for and project the return on acquisitions and the development and exploitation of projects. We expect that commodity prices will continue to fluctuate significantly in the future.

9

Our interests are held in the form of leases that we may be unable to retain.

The interest in our property are held under leases and working interests in leases. If we or the holder of a lease fails to meet the specific requirements of the lease regarding delay or non-payment of rental payments or we or the holder of the lease fail to meet the minimum level of evaluation some or all of our leases may terminate or expire. There can be no assurance that any of the obligations required to maintain each lease will be met. The termination or expiration of our leases or the working interests relating to leases may reduce our opportunity to exploit a given prospect for oil production and thus have a material adverse effect on our business, results of operation and financial condition.

Any change to government regulation/administrative practices may have a negative impact on our ability to operate and our profitability.

The laws, regulations, policies or current administrative practices of any government body, organization or regulatory agency in the United States, Canada, or any other jurisdiction, may be changed, applied or interpreted in a manner which will fundamentally alter the ability of our company to carry on our business. The actions, policies or regulations, or changes thereto, of any government body or regulatory agency, or other special interest groups, may have a detrimental effect on us. Any or all of these situations may have a negative impact on our ability to operate and/or our profitability.

If we are unable to hire and retain key personnel, we may not be able to implement our plan of operation and our business may fail.

Our success will be largely dependent on our ability to hire and retain highly qualified personnel. This is particularly true in the highly technical businesses of mineral and oil and gas exploration. These individuals may be in high demand and we may not be able to attract the staff we need. In addition, we may not be able to afford the high salaries and fees demanded by qualified personnel, or we may fail to retain such employees after they are hired. At present, we have not hired any key personnel. Our failure to hire key personnel when needed will have a significant negative effect on our business.

Our executive officers have other business interests, and as a result, they may not be willing or able to devote a sufficient amount of time to our business operations, thereby limiting the success of our company.

Robert Kinloch and Donald Kinloch presently spend approximately 60% and 20% of their business time, respectively on business management services for our company. At present, both Robert and Donald Kinloch spend a reasonable amount of time in pursuit of our company’s interests. Due to the time commitments from Robert and Donald Kinloch’s other business interests, however, they may not be able to provide sufficient time to the management of our business in the future and our business may be periodically interrupted or delayed as a result of their other business interests.

Risks Relating to Our Common Stock

If we issue additional shares in the future, it will result in the dilution of our existing shareholders.

Our articles of incorporation authorize the issuance of up to 750,000,000 shares of common stock with a par value of $0.001 per share. Our board of directors may choose to issue some or all of such shares to acquire one or more businesses or to provide additional financing in the future. The issuance of any such shares will reduce the book value and market price of the outstanding shares of our common stock. If we issue any such additional shares, such issuance will reduce the proportionate ownership and voting power of all current shareholders. Further, such issuance may result in a change of control of our corporation.

Our common stock is illiquid and shareholders may be unable to sell their shares.

There is currently a limited market for our common stock and we can provide no assurance to investors that a market will develop. If a market for our common stock does not develop, our shareholders may not be able to re-sell the shares of our common stock that they have purchased and they may lose all of their investment. Public announcements regarding our company, changes in government regulations, conditions in our market segment or changes in earnings estimates by analysts may cause the price of our common shares to fluctuate substantially. In addition, stock prices for junior oil and gas companies fluctuate widely for reasons that may be unrelated to their operating results. These fluctuations may adversely affect the trading price of our common shares.

10

Penny stock rules will limit the ability of our stockholders to sell their stock.

The Securities and Exchange Commission has adopted regulations which generally define “penny stock” to be any equity security that has a market price (as defined) less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and “accredited investors”. The term “accredited investor” refers generally to institutions with assets in excess of $5,000,000 or individuals with a net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouse. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the Securities and Exchange Commission which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer’s confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in and limit the marketability of our common stock.

The Financial Industry Regulatory Authority, or FINRA, has adopted sales practice requirements which may also limit a shareholder’s ability to buy and sell our stock.

In addition to the “penny stock” rules described above, FINRA has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock and have an adverse effect on the market for its shares.

Because of the early stage of development and the nature of our business, our securities are considered highly speculative.

Our securities must be considered highly speculative, generally because of the nature of our business and the early stage of our development. We are engaged in the business of identifying, acquiring, exploring and developing commercial reserves of oil and gas. Our properties are in the exploration stage only and are without known reserves of oil and gas. Accordingly, we have not generated any material revenues nor have we realized a profit from our operations to date and there is little likelihood that we will generate any revenues or realize any profits in the short term. Any profitability in the future from our business will be dependent upon locating and developing economic reserves of oil and gas, which itself is subject to numerous risk factors as set forth herein. Since we have not generated any revenues, we will have to raise additional monies through the sale of our equity securities or debt in order to continue our business operations.

11

We do not intend to pay dividends on any investment in the shares of stock of our company.

We have never paid any cash dividends and currently do not intend to pay any dividends for the foreseeable future. To the extent that we require additional funding currently not provided for in our financing plan, our funding sources may prohibit the payment of a dividend. Because we do not intend to declare dividends, any gain on an investment in our company will need to come through an increase in the stock’s price. This may never happen and investors may lose all of their investment in our company.

Risks Related to Our Company

Our by-laws contain provisions indemnifying our officers and directors.

Our by-laws provide the indemnification of our directors and officers to the fullest extent legally permissible under the Nevada corporate law against all expenses, liability and loss reasonably incurred or suffered by him in connection with any action, suit or proceeding. Furthermore, our by-laws provide that our board of directors may cause our company to purchase and maintain insurance for our directors and officers, and we have implemented director and officer insurance coverage.

Our by-laws do not contain anti-takeover provisions and thus our management and directors may change if there is a take-over of our company.

We do not currently have a shareholder rights plan or any anti-takeover provisions in our by-laws. Without any anti-takeover provisions, there is no deterrent for a take-over of our company. If there is a take-over of our company, our management and directors may change.

Because most of our directors and officers are residents of other countries other than the United States, investors may find it difficult to enforce, within the United States, any judgments obtained against our directors and officers.

Most of our directors and officers are nationals and/or residents of countries other than the United States, and all or a substantial portion of such persons’ assets are located outside the United States. As a result, it may be difficult for investors to enforce within the United States any judgments obtained against our officers or directors, including judgments predicated upon the civil liability provisions of the securities laws of the United States or any state thereof.

USE OF PROCEEDS

Our offering is being made on a self-underwritten basis: no minimum number of shares must be sold in order for the offering to proceed. The offering price per share is $1.50. The following table sets forth the uses of proceeds assuming the sale of 15%, 25%, 50%, 75% and 100%, respectively, of the securities offered for sale by us.

Our plan of operation for the next 12 months will remain fundamentally unchanged whether we raise the maximum amount of $3,000,000 or some lesser amount. However, if we raise less than the maximum, we may be required to reduce the amount we can spend. If we raise less than the maximum, we intend to focus our spending on drilling and production costs associated with the Farmout Agreement with SEPL and/or possible acquisitions of further oil and gas leases.

12

Our plan, at different share sales levels is as follows (in order of priority):

Percent of maximum offering |

If 15% of Shares Sold |

If 25% of Shares Sold |

If 50% of Shares Sold |

If 75% of Shares Sold |

If 100% of Shares Sold |

| Amount raised | $450,000 | $750,000 | $1,500,000 | $2,250,000 | $3,000,000 |

| Allocation | |||||

| Offering expenses | $100,000 | $100,000 | $100,000 | $100,000 | $100,000 |

| Drilling and Production Costs | $350,000 | $650,000 | $1,100,000 | $1,850,000 | $2,600,000 |

| Working capital | $0 | $0 | $300,000 | $300,000 | $300,000 |

In the table provided above, the categories of expenditures consist of the following:

Offering Expenses

This expenditure item refers to the costs and expenses payable by our company in connection with the issuance and distribution of the securities being registered hereunder and the preparation of the registration statement.

Drilling and Production Costs

This expenditure item refers to costs and expenses relating to the drilling of an initial test well in connection with our Farmout Agreement with Southeastern Pipe Line Company.

Acquisition Costs

This expenditure item refers to costs and expenses relating to possible acquisitions of further oil and gas leases.

Working Capital

This expenditure item refers to the following:

| (1) |

accounting and auditing costs associated with our continuing reporting obligations under the Securities Exchange Act of 1934, including the cost of bookkeeping and audit and reviews; | |

| (2) |

legal costs associated with preparing and filing our periodic reports, in negotiating contracts on our behalf and in performing similar services on an as-needed basis; and, | |

| (3) |

The costs related to operating our office including rent, telephone, office supplies, personnel, printing fees, registration fees, transfer agent fees and similar expenses, including small miscellaneous costs that have not otherwise been listed, such as bank service charges and sundry items. |

Our allocation of the net proceeds of this offering is only an estimate and is based on our current plans, our understanding of the industry and current economic conditions, as well as assumptions about our future revenues and expenditures.

Warrants, Rights and Convertible Securities

Other than as disclosed below, there are no outstanding warrants, rights or convertible securities as of October 7, 2010.

13

-

In August, 2009, we granted an aggregate of 145,000 non-qualified options to acquire shares of our common stock at an exercise price of $0.40 per share to certain of our officers, employees and consultants under the 2009 Stock Option Plan.

-

On November 26, 2009, we entered into a subscription agreement with Robert Kinloch pursuant to which Mr. Kinloch purchased one convertible debenture (the “Debenture”) in the aggregate principal amount of $100,000 in settlement of $100,000 of outstanding debt owed by the Company to Mr. Kinloch. The Debenture is convertible into shares of the Company’s common stock at a deemed conversion price per share of $0.30 for an aggregate purchase price of $100,000. The Debenture is payable on demand, and bears interest at the rate of 8% per annum, payable on the date of conversion of the Debenture. Interest is calculated on the basis of a 360-day year and accrues daily commencing on the date the Debenture is issued until payment in full of the principal amount, together with all accrued and unpaid interest and other amounts which may become due have been made.

-

On September 23, 2010 we made the following grants of stock options: Robert Kinloch, our sole director and an executive officer of the Company, received an option to acquire 700,000 shares of our common stock at a price of $1.05 until August 20, 2015, and Donald Kinloch, an executive officer of the Company, received an option to acquire 400,000 shares of our common stock at a price of $1.05 until August 20, 2015.

DETERMINATION OF OFFERING PRICE

Common Equity

The price of $1.50 per share of common stock is not based on past earnings, nor is the price of our shares indicative of the current market value of the assets owned by us. No valuation or appraisal has been prepared for our business. The offering price of $1.50 per share was arbitrarily determined by us based on our assessment of what the market would support in order for us to raise proceeds, of $3,000,000. Among the factors considered were:

-

our business plan and stage of development;

-

the cash requirements associated with our operations under the Farmout Agreement with Southeastern Pipelines Inc.;

-

our relative working capital requirements.

The offering price of the shares of our common stock does not necessarily bear any relationship to our assets, book value, past operating results, financial condition or any other established criteria of value. The offering price should not be regarded as an indicator of the future market price of the shares.

Our common stock is quoted on the Financial Industry Regulatory Authority’s OTC Bulletin Board under the symbol “MVRM.OB”. On October 6, 2010 the closing sale price for our common stock as reported by the OTC Bulletin Board was $1.60 per share.

DILUTION

“Dilution” represents the difference between the offering price and the net tangible book value per share immediately after completion of this offering. “Net tangible book value” is the amount that results from subtracting total liabilities and intangible assets from total assets. Dilution arises mainly as a result of our arbitrary determination of the offering price of the shares being offered.

We are offering our shares of common stock at a price per share that is significantly more than the price per share paid by our current shareholders for our common stock. We are offering for sale up to 2,000,000 shares of common stock. Because we have arbitrarily set the price higher than the book value of the existing shares, the net tangible book value of all the shares after the distribution of shares pursuant to this offering will be lower than the price of the shares pursuant to this offering. As a result, if you purchase shares in this offering, you will experience immediate and substantial dilution.

14

Donna Rose beneficially owns 9,713,071 shares of our common stock or 83.7% of our issued and outstanding common stock as of the date of this prospectus through her affiliated companies Senergy Partners LLC and Art Brokerage, Inc. Since 2005, Donna Rose, has been a principal investor in the Company. During 2005 and 2006 we endured a period where for various reasons we were unable to complete a number of business acquisitions and subsequently lost our quotation on the FINRA over-the-counter bulletin board. During this time Donna Rose emerged as the principal financier that was willing to fund the Company until we had a successful venture. Because of her history of funding the Company since 2005 and due to the Company’s need for additional funding, the Company agreed, pursuant to the recent agreements outlined below, to allow Donna Rose to become a major stockholder in Maverick provided she agreed to release us from debts owing to her affiliates and provided us with funds which we intend to use to fund the drilling of our initial test well and/or operating expenses. Over the past two years we have entered into the following transactions with Donna Rose and/or her affiliated companies Art Brokerage, Inc. and Senergy Partners LLC:

-

On February 13, 2009, we issued 8,900,000 (post-split) shares of our common stock at a deemed price of $0.05 per share in settlement of a $447,500 debt owed to Senergy Partners LLC. Also on February 13, 2009, we entered into a loan agreement with Senergy pursuant to which we received a revolving loan of up to $1,000,000 (the “Credit Facility”). In connection with our entry into the Credit Facility and Debt Settlement Agreement with Senergy, on February 13, 2009 we entered into an Assignment and Assumption Agreement with Senergy and Art Brokerage, Inc. pursuant to which Art Brokerage assigned to Senergy all its right, title and interest to a debt (the “Assigned Debt”) of $447,500 owed by the Company to Art Brokerage. In February, 2009, prior to the entry into the Credit Facility and the Debt Settlement Agreement, and in connection with the negotiation of these agreements, a majority shareholder of Maverick agreed to return to treasury 2,000,000 post-split shares of Maverick’s issued and outstanding common stock held by him. As a result of these transactions Senergy acquired 8,950,000 post-split shares of common stock.

-

On September 24, 2009, we entered into a Debt Settlement and Subscription Agreement with Art Brokerage, Inc. pursuant to which we issued Art Brokerage 436,000 restricted post-split shares of the Company’s common stock at a deemed value of $0.50 per share in settlement of outstanding debt owed to Art Brokerage in the amount of $218,000.

-

On September 7, 2010, we entered into a debt settlement and subscription agreement with Art Brokerage, Inc. pursuant to which the Company issued 725,971 shares of common stock of the Company at a deemed price of $1.05 per share in settlement of $762,269 of outstanding debt owed by the Company to Art Brokerage, Inc.

-

On September 20, 2010, we entered into a loan agreement (the “Loan Agreement”) with Art Brokerage, Inc. (“Art Brokerage”), pursuant to which Art Brokerage provided the Company with a non-revolving term loan in the principal amount of $2,400,000 having an interest rate of 5% per annum. The loan matures on April 1, 2015. As a condition of the Loan Agreement, the Company agreed to enter into a general security agreement dated September 20, 2010 creating a security over the Company’s present and after-acquired personal property and over the Company’s real property and other assets. In addition and as further security of the Company’s indebtedness under the Loan Agreement, the Company and Art Brokerage entered into a pledge and security agreement dated September 20, 2010, pursuant to which the Company agreed to pledge to Art Brokerage a first priority security interest in all of the shares of capital stock of Eskota Energy Corporation, the wholly owned subsidiary of the Company, and all proceeds with respect to such stock.

-

In connection with the negotiation of the Loan Agreement with Art Brokerage, we were required to enter into an amendment to our existing loan with Senergy Partners LLC. Under the terms of the amendment agreement dated September 15, 2010, entered into by the Company with Senergy Partners LLC, the parties agreed that if Art Brokerage entered into a loan agreement with the Company with respect to a loan of $2,400,000, the existing loan agreement between the parties dated February 13, 2009 providing for up to $1,000,000 in principal to the Company would be amended to provide that upon entry into the Loan Agreement the outstanding balance of principal and accrued interest under the Senergy loan could not exceed a maximum limit of $500,000.

15

Our sole director holds beneficially owns 773,623 shares of our common stock or 6.2% of our issued and outstanding common stock as of the date of this prospectus. This consists of 73,623 shares held by him directly and options to acquire an additional 700,000 shares of our common stock at a price of $1.05. On November 26, 2009, we entered into a subscription agreement with Robert Kinloch pursuant to which Mr. Kinloch purchased a convertible debenture in the aggregate principal amount of $100,000 in settlement of $100,000 of outstanding debt owed by the Company to Mr. Kinloch. The Debenture is convertible into shares of the Company’s common stock at a deemed conversion price per share of $0.30. The Debenture may only be converted into shares on 61 days notice to the Company.

If you purchase our shares of common stock in this offering, you will suffer an immediate dilution in the value of shares that you purchase. As at June 30, 2010 the net tangible book value deficit of our company was $0.07 per share of common stock based upon 10,476,721 shares of common stock outstanding. The net tangible book value of our company is calculated by dividing the total capital deficit of $761,634 as at June 30, 2010 by the outstanding shares of common stock of 10,476,721 as at June 30, 2010. As adjusted for share transactions which have occurred subsequent to June 30, 2010 through the date of this prospectus, the pro forma net tangible book value of our company before the offering was $0.04 per share of common stock based upon 11,602,617 shares of common stock outstanding. The pro forma net tangible book value of our company before the Offering is calculated by dividing the total pro forma stockholders’ equity of $403,760 by the pro-forma outstanding shares of common stock of 11,602,617. If we are successful in selling all of the 2,000,000 shares of common stock that we are offering to sell in this offering, the pro forma net tangible book value of our company would be $3,303,760, or approximately $0.24 per share of common stock, which would represent an immediate increase of $0.20 in net tangible book value per share of common stock.

Comparative Data

| If 25% of Shares Sold | If 50% of Shares Sold | If 75% of Shares Sold | If 100% of Shares Sold | |

| Shares Sold | 500,000 | 1,000,000 | 1,500,000 | 2,000,000 |

| Net Proceeds | $650,000 | $1,400,000 | $2,150,000 | $2,900,000 |

| Total Shares Outstanding | 12,102,617 | 12,602,617 | 13,102,617 | 13,602,617 |

| Offering price(1) | $1.50 | $1.50 | $1.50 | $1.50 |

| Historical net tangible book value (deficit) per share at June 30, 2010, before subsequent share issuances and before this offering(2) | ($0.07) | ($0.07) | ($0.07) | ($0.07) |

| Pro forma effect of subsequent share issuances on historical net tangible book value at June 30, 2010 before this offering(3) | $ 0.11 | $ 0.11 | $ 0.11 | $ 0.11 |

| Pro forma historical net tangible book value at June 30, 2010, before this offering(4) | $0.04 | $0.04 | $ 0.04 | $ 0.04 |

16

| If 25% of Shares Sold | If 50% of Shares Sold | If 75% of Shares Sold | If 100% of Shares Sold | |

| Increase in net tangible book value per share at June 30, 2010 attributable to new investors(5) | $0.06 | $ 0.11 | $ 0.16 | $ 0.20 |

| Adjusted net tangible book value per share at June 30, 2010 after this offering(6) | $0.10 | $0.15 | $0.20 | $0.24 |

| Dilution per share to new investors in this offering (7) | $ 1.40 | $ 1.35 | $ 1.30 | $ 1.26 |

| (1) |

Offering price per share of common stock. |

| (2) |

The historical net tangible book value per share at June 30, 2010, before subsequent share issuances is determined by dividing the number of shares of common stock outstanding on June 30, 2010 into the net tangible book value (deficit) of our company on June 30, 2010. |

| (3) |

The pro forma historical net tangible book value at June 30, 2010, before this offering is determined by deducting the historical net tangible book value (deficit) per share at June 30, 2010, before subsequent share issuances (see note 2) and before this offering from the pro forma historical net tangible book value at June 30, 2010, before this offering (see note 4). |

| (4) |

The pro forma historical net tangible book value at June 30, 2010, before this offering is determined by dividing the pro forma adjusted before the offering number of shares of common stock that will be outstanding before into the pro forma adjusted before the offering net tangible book value before the offering adjusted for the effect of subsequent share issuances. |

| (5) |

The increase in net tangible book value per share attributable to new investors is derived by taking the adjusted net tangible book value per share at June 30, 2010 after this offering (see note 6), and subtracting from it the pro forma historical net tangible book value at June 30, 2010, before this offering (see note 4). |

| (6) |

The adjusted net tangible book value per share at June 30, 2010 after this offering is determined by taking the pro forma adjusted after the offering net tangible book value divided by the number of shares of common stock outstanding after the offering. |

| (7) |

The dilution to new investors in this offering is determined by subtracting the adjusted net tangible book value per share at June 30, 2010 after this offering (see note 6) by the offering price. |

CAPITALIZATION

The following table sets for the capitalization of the Company as of June 30, 2010, (i) on a historical basis, (ii) on a pro forma before offering basis, adjusted to give effect to (a) a debt settlement with Art Brokerage, Inc. on September 7, 2010 pursuant to which the Company issued 725,971 shares of common stock of the Company at a deemed price of $1.05 per share in settlement of $762,269 of outstanding debt owed by the Company to Art Brokerage, Inc., (b) a debt settlement with David Steiner Primary Trust (“Steiner”) on July 19, 2010 whereby we agreed to issue 49,925 shares of our common stock to Steiner in settlement of the Convertible Debenture dated December 11, 2009 in the principal amount of $35,625 and outstanding interest to July 19, 2010 of $1,778, and (c) a data purchase agreement (the “Agreement”) with two individuals (collectively the “Vendors”), pursuant to which the Company agreed to purchase from the Vendors geologic data relating to certain oil and gas mineral leases located in Texas, including among other things: electric logs, seismic work, seismic reprocessing, data from the Texas Railroad Commission. In consideration for the acquisition of the geologic data from the Vendors the Company agreed to issue an aggregate of 350,000 shares of the common stock of the Company to the Vendors and (iii) on a pro forma basis after offering basis, to give effect to (a) the 2,000,000 shares issued at $1.50 in connection with this Prospectus.

17

| June 30, 2010 | |||

Actual |

Pro forma before offering (1) |

Pro forma after offering (2) | |

| Current portion of long-term debt | $751,069 | $- | $- |

| Convertible debt | $135,625 | $100,000 | $100,000 |

| Long-term debt, less current portion | $357,750 | $357,750 | $357,750 |

| Shareholders’ Equity | |||

| Shares of Common Stock authorized: | |||

| 750,000,000 common shares

at $0.001 par Issued and fully paid 10,476,721 (pro forma before offering – 11,602,617) and (pro forma after offering – 13,602,617) |

$10,477 |

$11,603 |

$13,603 |

| Additional paid-in-capital | $4,604,455 | $6,039,566 | $8,937,566 |

| Deficit, accumulated during the exploration stage | $(5,377,439) | $(5,648,282) | $(5,648,282) |

| Accumulated Other Comprehensive Income | $873 | $873 | $873 |

| Total Shareholders’ Equity (Capital Deficit) | $(761,634) | $403,760 | $3,303,760 |

| Total Capitalization | $(403,884) | $761,510 | $3,661,510 |

PLAN OF DISTRIBUTION

We are offering up to 2,000,000 shares of common stock of our company on a best efforts basis. The offering price is $1.50 per share. There is no minimum number of shares that we have to sell in this offering. All money we receive from the offering will be immediately appropriated by us for the uses set forth in the Use of Proceeds section of this prospectus. No funds will be placed in an escrow account during the offering period and no money will be returned once the subscription has been accepted by us. The offering will be for a period of 90 days from the date of this prospectus and may be extended for an additional 90 days if we choose to do so.

Only after the Securities and Exchange Commission declares our registration statement effective, do we intend to advertise and hold investment meetings in various states where the offering will be registered. We will also distribute the prospectus to potential investors at the meetings and to our friends and relatives who are interested in our company and in a possible investment in the offering.

We intend to sell the shares in this offering through Robert J. Kinloch, one of our executive officers and sole director. Mr. Kinloch will not be paid any commissions for his efforts to offer and sell these shares on our behalf. To date, we have sold the shares primarily through the efforts of Mr Kinloch.

We have not utilized the Internet to advertise our offering, however, prospective investors may visit our website, www.maverickminerals.com, to learn more about our business.

Offering Period and Expiration Date

This offering will commence on the date of this prospectus and continue for 90 days. We may at our option extend the offering period for additional 90 days, or unless the offering is completed or otherwise terminated by us.

Procedures for Subscribing

If you decide to subscribe for any shares in this offering, you must:

-

Execute and deliver a subscription agreement; and,

-

Deliver a check or certified funds to us for acceptance or rejection.

18

All checks for subscriptions must be made payable to “Maverick Minerals Corporation.”

Right to Reject Subscriptions

We have the right to accept or reject subscriptions in whole or in part, for any reason or for no reason. All monies from rejected subscriptions will be returned immediately by us to the subscriber, without interest or deductions. Subscriptions for securities will be accepted or rejected within 48 hours after we receive them.

Regulation M

Our officers and directors and the employees of Maverick Minerals Corporation will not be purchasing any of the shares of common stock offered by us in this offering. They will comply with the provisions of Regulation M. Other than the foregoing, no consideration has been given to the compliance of Regulation M of the Securities Exchange Act of 1934. Regulation M is intended to preclude manipulative conduct by persons with an interest in the outcome of an offering, while easing regulatory burdens on offering participants.

DESCRIPTION OF SECURITIES TO BE REGISTERED

Common and Preferred Shares

Our authorized capital stock consists of 850,000,000 shares designated as follows: 750,000,000 Shares of common stock and 100,000,000 Preferred shares.

Voting Rights

Each share of common stock entitles the holder to one vote on all matters submitted to a vote of the stockholders including the election of directors. Except as otherwise required by law the holders of our common stock possess all voting power. According to our bylaws, in general, each director is to be elected by a majority of the votes cast with respect to the directors at any meeting of our stockholders for the election of directors at which a quorum is present. According to our bylaws, in general, the affirmative vote of a majority of the shares represented at the meeting and entitled to vote on any matter (which shares voting affirmatively also constitute at least a majority of the required quorum), except for the election of directors, is to be the act of our stockholders. Our bylaws provide that stockholders holding at least 10% of the shares entitled to vote, represented in person or by proxy, constitute a quorum at the meeting of our stockholders. Our bylaws also provide that any action which may be taken at any annual or special meeting of our stockholders may be taken without a meeting and without prior notice if a consent in writing, setting forth the action so taken, is signed by the holders of outstanding shares having not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present and voted.

Our articles of incorporation and bylaws do not provide for cumulative voting in the election of directors. Because the holders of our common stock do not have cumulative voting rights and directors are generally to be elected by a majority of the votes casts with respect to the directors at any meeting of our stockholders for the election of directors, holders of more than fifty percent, and in some cases less than 50%, of the issued and outstanding shares of our common stock can elect all of our directors.

Dividends

The holders of our common stock are entitled to receive the dividends as may be declared by our board of directors out of funds legally available for dividends. Our board of directors is not obligated to declare a dividend. Any future dividends will be subject to the discretion of our board of directors and will depend upon, among other things, future earnings, the operating and financial condition of our company, its capital requirements, general business conditions and other pertinent factors. We do not anticipate that dividends will be paid in the foreseeable future.

As of the date of this prospectus, we have not paid any dividends to shareholders. The declaration of any future dividend will be at the discretion of our board of directors and will depend upon our earnings, if any, our capital requirements and financial position, our general economic conditions, and other pertinent conditions. It is our present intention not to pay any dividends in the foreseeable future, but rather to reinvest earnings, if any, in our business operations.

19

Miscellaneous Rights and Provisions

In the event of our liquidation or dissolution, whether voluntary or involuntary, each share of our common stock is entitled to share ratably in any assets available for distribution to holders of our common stock after satisfaction of all liabilities.

Our common stock is not convertible or redeemable and has no preemptive, subscription or conversion rights. There are no conversions, redemption, sinking fund or similar provisions regarding our common stock. Our common stock, after the fixed consideration thereof has been paid or performed, are not subject to assessment, and the holders of our common stock are not individually liable for the debts and liabilities of our company.

Our bylaws provide that our board of directors may amend our bylaws by a majority vote of our board of directors including any bylaws adopted by our stockholders, but our stockholders may from time to time specify particular provisions of these bylaws, which must not be amended by our board of directors. Our current bylaws were adopted by our board of directors. Therefore, our board of directors can amend our bylaws to make changes to the provisions relating to the quorum requirement and votes requirements to the extent permitted by the Nevada Revised Statutes.

Anti-Takeover Provisions

Some features of the Nevada Revised Statutes, which are further described below, may have the effect of deterring third parties from making takeover bids for control of our company or may be used to hinder or delay a takeover bid. This would decrease the chance that our stockholders would realize a premium over market price for their shares of common stock as a result of a takeover bid. Our articles of incorporation and bylaws exempt our common stock from these provisions.

Acquisition of Controlling Interest

The Nevada Revised Statutes contain provisions governing acquisition of controlling interest of a Nevada corporation. These provisions provide generally that any person or entity that acquires certain percentage of the outstanding voting shares of a Nevada corporation may be denied voting rights with respect to the acquired shares, unless the holders of a majority of the voting power of the corporation, excluding shares as to which any of such acquiring person or entity, an officer or a director of the corporation, and an employee of the corporation exercises voting rights, elect to restore such voting rights in whole or in part. These provisions apply whenever a person or entity acquires shares that, but for the operation of these provisions, would bring voting power of such person or entity in the election of directors within any of the following three ranges:

-

20% or more but less than 33 1/3%;

-

33 1/3% or more but less than or equal to 50%; or

-

more than 50%.

The stockholders or board of directors of a corporation may elect to exempt the stock of the corporation from these provisions through adoption of a provision to that effect in the articles of incorporation or bylaws of the corporation. Our articles of incorporation and bylaws exempt us from these provisions.

Articles of Incorporation and Bylaws

There are no provisions in our articles of incorporation or our bylaws that would delay, defer or prevent a change in control of our company and that would operate only with respect to an extraordinary corporate transaction involving our company or any of our subsidiaries, such as merger, reorganization, tender offer, sale or transfer of substantially all of its assets, or liquidation.

20

Holders of our Common Stock

As of October 7, 2010 there were approximately 146 registered holders of record of our common stock. As of such date there were 11,602,617 shares issued and outstanding.

Stock Transfer Agent

The transfer agent for our common stock is Pacific Stock Transfer Company. Its address is 4045 South Spencer Street, Las Vegas, NV Suite 403, 89119.

EXPERTS & COUNSEL

The consolidated financial statements as of December 31, 2009 and 2008 and for each of the two years in the period ended December 31, 2009 and for the period from inception (April 23, 2003) to December 31, 2009 included in this Prospectus and in the Registration Statement have been so included in reliance on the report of BDO Canada LLP, an independent registered public accounting firm (the report on the financial statements contains an explanatory paragraph regarding the Company’s ability to continue as a going concern) appearing elsewhere herein and in the Registration Statement, given on the authority of said firm as experts in auditing and accounting. Clark Wilson LLP has provided an opinion on the validity of the shares of our common stock being offered pursuant to this prospectus.

INTERESTS OF NAMED EXPERTS & COUNSEL

No expert or counsel named in this prospectus as having prepared or certified any part of this prospectus or having given an opinion upon the validity of shares of common stock being registered or upon other legal matters in connection with the registration or offering of the shares of common stock was employed on a contingency basis or had, or is to receive, in connection with the offering, a substantial interest, directly or indirectly, in our company or any of our subsidiaries. Nor was any such person connected with our company, or any of our subsidiaries as a promoter, managing or principal underwriter, voting trustee, director, officer or employee.

Description of Business

Corporate History

We were incorporated in the State of Nevada on August 27, 1998 under the name “Pacific Cart Services Ltd.” Following our incorporation, we pursued opportunities in the business of franchising fast food distributor systems.

We were not successful in implementing our business plan as a fast food distributor systems business. As management of our company investigated opportunities and challenges in the business of being a fast food distributor systems company, management realized that the business did not present the best opportunity for our company to realize value for our shareholders. Accordingly, we abandoned our previous business plan.

On March 22, 2002, we changed our name to Maverick Minerals Corporation to reflect our change in focus to holding and developing mineral and resource projects. We are an exploration stage company that has not yet generated or realized any revenues from our business operations.

From November 2001 until February 2003, we held a 100% interest in the Silver, Lead, Zinc, Keno Hill mining camp in Yukon, Canada through our then subsidiary, Gretna Capital Corporation. Despite a tenure marked by historic maintenance cost reductions and extensive research into a new hydrometallurgical approach to production and environmental remediation at the mine site, the project endured through a period of low commodity prices. On January 1, 2003 we defaulted on a payment of CDN$1,050,000 required under an agreement of purchase and sale for the acquisition of an interest in the project. Due to the default, the Company was divested of its claims by its creditors by way of court action which culminated on February 14, 2003.

21

On April 21, 2003 we closed a transaction, as set out in the Purchase Agreement with UCO Energy Limited to purchase the outstanding equity of UCO Energy Corporation (“UCO”). To facilitate the transaction, we issued 3,758,040 shares of common stock (post 10 for 1 reverse split) in exchange for all the issued and outstanding common shares of UCO. As a result of the transaction, the former shareholders of UCO held approximately 90% of the issued and outstanding common shares of Maverick. A net distribution of $944,889 was recorded in connection with the common stock of Maverick for the acquisition of UCO in respect of the Company’s net liabilities at the acquisition date. UCO was in the business of pursuing opportunities in the coal mining industry. From July 7, 2003 until March 5, 2004, we were engaged in the waste coal recovery business by way of a lease agreement at the Old Ben Mine near Sesser, Illinois. We extracted coal fines from holding ponds with a leased dredge and subsequently dried them in a fines plant and sold the dried product to an electrical utility. The operation was conducted in our wholly owned subsidiary UCO.

Effective March 5, 2004, we were in default of our lease agreement that granted access to the waste coal. The default was a function of an equipment malfunction and an equipment lease default. Extensive efforts to refinance our coal recovery activities were undertaken post default in an effort to return to production. These efforts proved unsuccessful. In April, 2004 Maverick instituted new management at the annual meeting of its wholly-owned subsidiary, UCO Energy Corp. Subsequent to these events, our subsidiary reached a settlement agreement with the lessor of the coal lands and the lessor of our dredging equipment. The settlement provided for a mutual release between our subsidiary and each lessor independently.

Maverick incorporated a wholly-owned subsidiary, Eskota Energy Corporation, Inc. (“Eskota”) a Texas company, in August, 2005. Eskota entered into an Assignment Agreement with Veneto Exploration LLC of Plano, Texas (“Veneto”) on August 18, 2005 pursuant to which we acquired certain petroleum and natural gas rights and leases, known as the S. Neill Unitized lease (the “Eskota Leases”) comprising a 100% working interest in a 75%+/- NRI in approximately 6,000 acres in central Texas approximately 9 miles east of the town of Sweetwater, in exchange for a $1,400,000 note payable. An additional $375,000 cash was paid by the Company for the acquisition of the Eskota Leases.

Eskota was to receive all revenue earned under the above noted leases. Eskota agreed to contribute not less than $400,000 towards capital improvements on the said lease and equipment during the first twelve months after closing. The parties agreed to negotiate a reasonable covenant to ensure these expenditures were made. A note payable was signed on August 31, 2005 between Eskota and Veneto whereby Eskota promised to pay Veneto $700,000 before August 31, 2006, and $700,000 by May 31, 2007. In light of the above deadlines and the fact that the purchase price was predicated partially on down hole success from the initial re-works, management determined that it was not prudent to proceed with further investment on the property and that settlement discussions should begin with Veneto for a mutual release and return of the property and retirement of the promissory note of $1,400,000 issued by the Company. The effect of the initial failure to increase production from the first two attempts to restore the existing wells was reflected in an asset impairment charge taken by the Company of $419,959 on its fiscal year end financial statements dated December 31, 2005.