Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Pinnacle Foods Finance LLC | d8k.htm |

Pinnacle Foods

Wells Fargo 2010 Consumer

Conference

September 30, 2010

Exhibit 99.1 |

| 2

Forward-Looking Statements and GAAP Reconciliation

Forward-looking statements should not be read as a guarantee of future

performance or results, and will not necessarily be accurate indications of

the times at, or by which, such performance or results will be achieved or whether such

performance or results will ever be achieved. Forward-looking information

is based on information available at the time and management’s good

faith belief with respect to future events, and is subject to risks and uncertainties that could cause

actual performance or results to differ materially from those expressed in the

statements. Forward-looking statements speak only as of the date the

statements are made. Pinnacle Foods Finance LLC (“Pinnacle

Foods,”

“Pinnacle”

or the “Company”) assumes no obligation to update forward-looking

statements to reflect actual results, changes in assumptions or changes in

other factors affecting forward-looking information except to the extent required by

applicable securities laws. If the Company does update one or more

forward-looking statements, no inference should be drawn that the

Company will make additional updates with respect thereto or with respect to

other forward-looking statements.

SEC rules regulate the use of “non-GAAP financial measures”

in public disclosures, such as “EBITDA”

“Adjusted EBITDA”

and “Consolidated EBITDA”, that are derived on the basis of methodologies

other than in accordance with generally accepted accounting principles, or

“GAAP.” These rules govern the manner in which non-GAAP

financial measures may be publicly presented and prohibit in all filings

with the SEC, among other things: •

exclusion of charges or liabilities that require, or will require, cash settlement

or would have required cash settlement, absent an ability to settle in

another manner, from a non-GAAP financial measure; and •

adjustment of a non-GAAP financial measure to eliminate or smooth items

identified as non-recurring, infrequent or unusual, when the nature of

the charge or gain is such that it has occurred in the past two years or is reasonably likely to

recur within the next two years.

We have included non-GAAP financial measures in this presentation, including

EBITDA, Adjusted EBITDA and Consolidated EBITDA, that may not comply with

the SEC rules governing the presentation of non-GAAP financial

measures. In addition, the Company’s measurements of Consolidated EBITDA

are based on definitions of EBITDA included in certain of the Company’s

debt agreements and, as a result, may not be comparable to those of other

companies. |

3

To become a leading publicly-owned

food

company

by

creating

a

compelling

investment

opportunity

through

the

strength

of

our

brands

and

people. |

| 4

Key Investment Highlights

•

Brand strength

•

Pinnacle brands hold #1 or #2 market position in 8 of 12 major category segments in

which they compete

•

Limited private label penetration across most categories

•

Improved health and nutrition profile with Birds Eye acquisition

•

Successful history of brand innovation and renovation

|

5

Category Segments

Major Brands

Market

Position

IRI Market

Share

Frozen Vegetables

#1

26.6

Shelf-Stable Pickles, Peppers and Relish

#1

18.8

Baking Mixes and Frostings

#2

17.2

Frozen Waffles, Pancakes and French Toast¹

#2

15.1

Frozen Prepared Seafood²

#2

19.2

Frozen Complete Bagged Meals³

#2

23.7

Frozen Breakfast Entrées / Savory Handhelds

#2

8.7

Table Syrups²

#2

18.2

Canned Meat

2,4

#3

9.4

Bagels

#3

7.9

Single-Serve Frozen Dinners and

Entrées² #4

8.7

Frozen Pizza-for-One

#4

9.9

Iconic, Leading Brand Equities

(52-Weeks Ending August 2010)

Pinnacle holds the #1 or #2 market position in 8 of the 12 major

category segments

1. Aunt Jemima holds #1 share in frozen pancakes and French toast.

2. Combined market position among branded players.

3. Birds Eye Voila! holds the #1 market position in the value sub-segment of

frozen complete bagged meals. 4.

Armour

holds

#1

market

position

in

the

Vienna

sausage,

potted

meat

and

sliced

beef

segments.

Categories with above average private label penetration

|

6

Product Improvements

Seafood: Whole Fish Fillets

Log Cabin: No HFCS

Duncan Hines:

Whole Grain Muffins

Brand Renovation and Innovation are Important Growth

Drivers

Updated Packaging

New Products |

| 7

Key Investment Highlights

•

Brand strength

•

Pinnacle brands hold #1 or #2 market position in 8 of 12 major category segments in

which they compete

•

Limited private label penetration across most categories

•

Improved health and nutrition profile with Birds Eye acquisition

•

Successful history of brand innovation and renovation

•

Portfolio diversification

•

Participation in a broad set of categories

•

Limited input cost concentration

•

Scale where needed –

5

th

largest frozen food company |

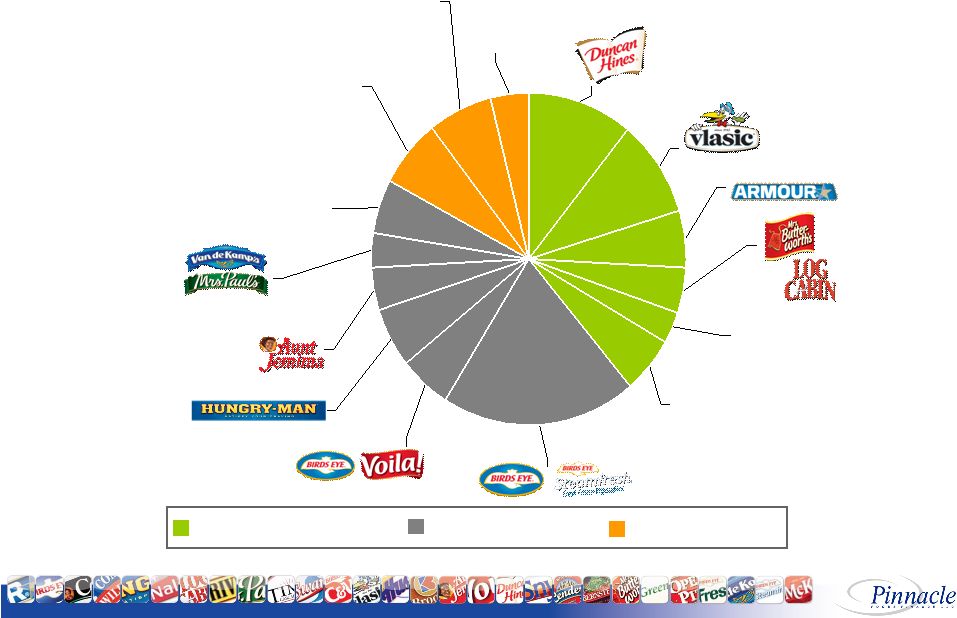

8

Participation in a Broad Set of Categories

Snacks 4%

3%

Private Label

7%

4%

6%

5%

20%

Canada 3%

Other 5%

5%

6%

9%

11%

Other 5%

Foodservice 7%

___________________________

Note: LTM as of 6/27/10.

Duncan Hines Grocery Division

Birds Eye Frozen Division

Specialty Foods Division |

9

Pinnacle Now Ranks Fifth in Frozen

$ Share

16.9

5.3

4.9

4.6

4.1

3.8

2.9

2.4

2.0

1.7

$ Retail

Sales

$5,405MM

$1,706MM

$1,551MM

$1,467MM

$1,321MM

$1,219MM

$938MM

$769MM

$633MM

$542MM

Source:

Symphony

IRI

InfoScan

Reviews:

Total

Frozen

Categories;

Total

US

Food;

52

weeks

ending

June

13,

2010 |

| 10

Key Investment Highlights

•

Brand strength

•

Pinnacle brands hold #1 or #2 market position in 8 of 12 major category segments in

which they compete

•

Limited private label penetration across most categories

•

Improved health and nutrition profile with Birds Eye acquisition

•

Successful history of brand innovation and renovation

•

Portfolio diversification

•

Participation in a broad set of categories

•

Limited input cost concentration

•

Scale where needed –

5

th

largest frozen food company

•

Nimble, responsive organization

•

Experienced senior team

•

Management alignment to value creation

•

Speed –

Birds Eye integration |

Birds Eye Integration |

12

Ideal Addition to the

Pinnacle Portfolio

Iconic brand with #1 market

position in $2.3B frozen

vegetable category

Products well aligned with

current consumer

preferences: health &

nutrition, quality and

convenience

Successful history of

innovation and new product

development

Improves Operating

Capabilities of

Both Businesses

Combination results in

diversified scale player with

leading EBITDA

margins…Pinnacle is now

the 5th largest manufacturer

in frozen food

Combined portfolio

enhances retail coverage,

especially within frozen food

segment

Achievable

Integration / Synergies

The combination will deliver

strong synergies

Similar business lines, sales

coverage, and information

systems enhance integration

Birds Eye Acquisition |

13

Pinnacle Named Frozen Food Processor of the Year |

| 14

Birds Eye Integration Complete; Synergies

Continue Ahead of Plan

•

Management has increased estimated synergies as a result of the Birds Eye

acquisition to $50 million, up from $45 million

•

Substantially all of the actions have been implemented to achieve full synergy

amount during FY 2011

•

Half of the annual savings will be realized in FY 2010 and the full annual savings

to be realized in FY 2011

•

The closing of Birds Eye’s Rochester Headquarters substantially completed in

Q3 2010 •

The Company has fully deployed the One Order, One Invoice, One Truck combined

distribution strategy in both the dry and frozen categories

•

Procurement functions have been integrated and are leveraging the

business’ combined scale

•

Administrative functions have been successfully integrated into the Company’s

new Cherry Hill, NJ facility |

Financial Performance |

| 16

1

st

Half (1H) 2010 Business Update

•

Strong

1H

results

with

Management

EBITDA

up

19%

y-o-y

to

$222

million

(1)

•

Cash

Flow

from

operations

of

$153

million

generated

in

the

first

6

months

of

2010

•

Gross Margin +330 bps from favorable product mix, beneficial movement in

commodity prices and productivity initiatives

(2)

•

Net

Leverage

has

declined

from

6.0x

at

the

time

of

the

Birds

Eye

transaction

to

5.6x

as

of

Q2

2010

•

Net Sales decline of 3.6% in 1H 2010 vs. 1H 2009 was driven by the Company’s

continued efforts to deemphasize Private Label and Foodservice offerings,

its announced discontinuation of Birds Eye's Steamfresh Meals, and a tough

trading environment •

North American Retail sales were approximately flat in 1H 2010 vs. 1H 2009

•

At

the

end

of

1H

the

Company

had

$143

million

of

cash

which

will

be

partially

used

to

fund

typical

seasonal working capital needs in the third quarter

•

Given its strong cash position, the Company does not anticipate any revolver draw

in 2010 •

Refinanced debt (replaced Term Loan C with $442MM Term Loan D and $400MM 8.25%

Senior Notes)

•

Leverage neutral transaction with reduction in overall cost of capital

•

Term Loan D applicable margin 150bps lower than Term Loan C

•

Enhanced current debt maturity profile (New Senior Notes due September 2017)

___________________________

1.

Before variable product contribution from exited businesses of $3.8mm and estimated

synergies associated with the Birds Eye Acquisition of $18.1mm. 2.

After

adjusting

actual

results

for

adjustments

per

Senior

Credit

Facility

and

Bond

Indenture |

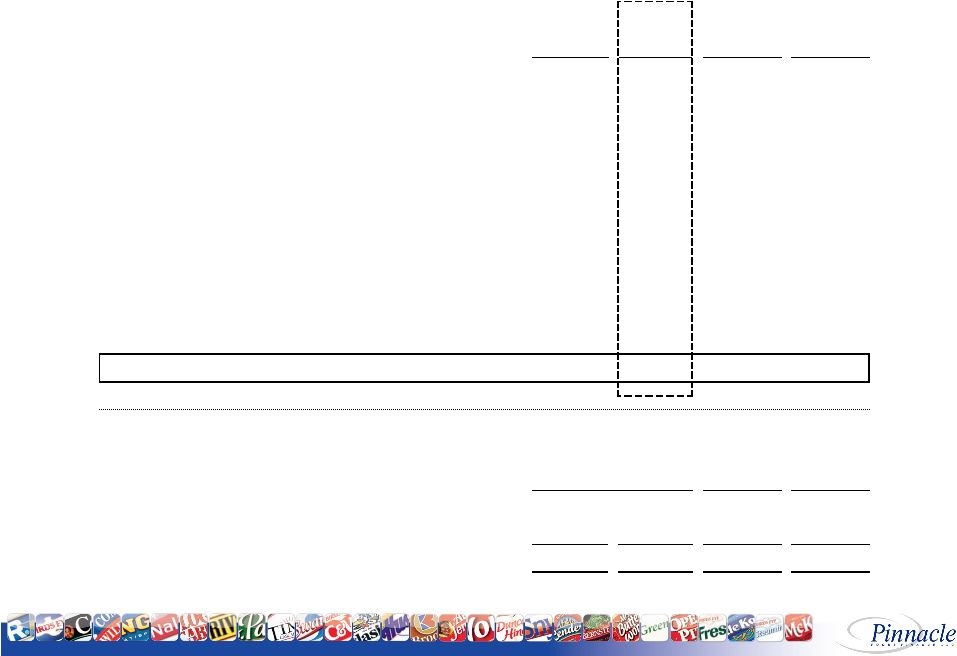

17

1H Financial Summary

___________________________

1.

Pro forma for Birds Eye acquisition.

Actual

Actual

H1

H1

($s in millions)

2009

(1)

2010

(2)

$

%

Net Sales

1,278

$

1,233

$

(46)

$

-3.6%

% Growth

COPS

982

935

47

4.8%

% Net Sales

76.8%

75.9%

Advertising and Consumer

45

37

8

17.3%

% Net Sales

3.5%

3.0%

SG&A and other

113

128

(15)

-13.3%

% Net Sales

8.9%

10.4%

EBIT

138

133

(6)

-4.1%

% Net Sales

10.8%

10.8%

Depreciation & Amortization

44

39

(5)

-11.6%

Reported EBITDA

182

171

(11)

-5.9%

% Net Sales

14.2%

13.9%

Adjusted EBITDA

187

222

35

18.5%

% Net Sales

14.7%

18.0%

Reported EBITDA

182

171

Adjustments per Senior Credit Facility and Bond Indentures

Non-cash items

1

28

Non-recurring items

4

20

Other adjustment items

1

2

Subtotal - Adjusted EBITDA

187

222

35

$

18.5%

Variable product contribution from exited businesses

10

3

Estimated synergies associated with the Birds Eye acquisition

-

18

Consolidated EBITDA (per Senior Credit Facility and Bond Indentures)

197

$

243

$

46

$

23.6%

Variance to Prior Year |

18

Key Investment Highlights

Successful History

of Brand

Renovation and

Product

Innovation

Proven

Management

Team

Continued

Strong

Financial

Performance

Strong

Customer

Relationships

Increase in

Estimated

Synergies to

$50mm

Proven Brand

Equities

Birds Eye

Integration

Successfully

Completed

High Recurring

Cash Flow |